- Browse All Articles

- Newsletter Sign-Up

Investment →

- 17 Aug 2023

- Research & Ideas

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 06 Jun 2023

- Cold Call Podcast

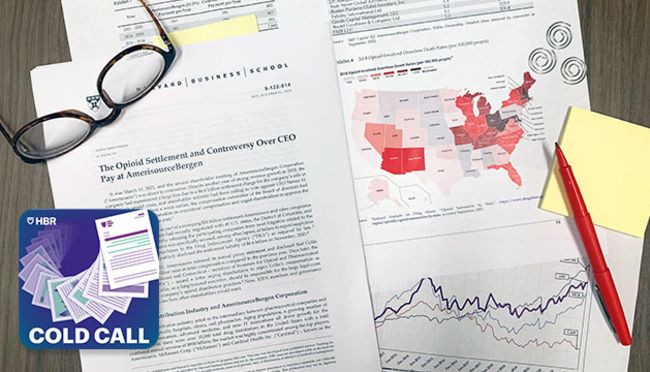

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 11 Apr 2023

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 23 Mar 2023

As Climate Fears Mount, More Investors Turn to 'ESG' Funds Despite Few Rules

Regulations and ratings remain murky, but that's not deterring climate-conscious investors from paying more for funds with an ESG label. Research by Mark Egan and Malcolm Baker sizes up the premium these funds command. Is it time for more standards in impact investing?

- 16 Feb 2023

ESG Activists Met the Moment at ExxonMobil, But Did They Succeed?

Engine No. 1, a small hedge fund on a mission to confront climate change, managed to do the impossible: Get dissident members on ExxonMobil's board. But lasting social impact has proved more elusive. Case studies by Mark Kramer, Shawn Cole, and Vikram Gandhi look at the complexities of shareholder activism.

- 20 Sep 2022

Larry Fink at BlackRock: Linking Purpose to Profit

In 2014, Larry Fink started writing letters to the leaders of some of the largest publicly listed companies, urging them to consider the importance of environmental, social, and governance (ESG) issues. Fink is the chairman and CEO of BlackRock, one of the largest asset management houses in the world. The firm’s success was rooted in its cost-effective, passive investment products that rely more on tracking indices and funds. But Fink wanted his firm to engage with the companies in which they invest and hold them accountable for their social and environmental impacts. What role should investors play in urging business leaders to take environmental, social, and governance issues more seriously and enforcing compliance? Harvard Business School professor George Serafeim discusses the merits of Fink’s approach, the importance of corporate investments in ESG themes, and how to lead a company driven by purpose and profit in his case, “BlackRock: Linking Purpose to Profit,” and his new book Purpose and Profit: How Business Can Lift Up The World.

- 21 Jul 2022

Did Pandemic Stimulus Funds Spur the Rise of 'Meme Stocks'?

Remember the GameStop stock frenzy? Research by Robin Greenwood and colleagues shows how market speculation can flare up when you combine stimulus funds, trading platforms, and plain old boredom.

- 18 Jul 2022

After the 'Crypto Crash,' What's Next for Digital Currencies?

After soaring to dizzying levels, Bitcoin and other cryptocurrencies have lost more than half of their value in recent months. Scott Duke Kominers discusses crypto's volatility, potential for regulation, and why these digital assets are likely here to stay.

- 13 Oct 2020

- Working Paper Summaries

Fencing Off Silicon Valley: Cross-Border Venture Capital and Technology Spillovers

This study of foreign corporate investment transactions from 32 countries between 1976 and 2015 finds these investments pose a trade-off: While they support young firms in pursuing innovations they could not otherwise afford, they also generate knowledge for the foreign investors.

- 20 Aug 2020

The “best ideas” in investment managers’ portfolios generate statistically and economically significant risk-adjusted returns over time, and they systematically outperform other positions in the portfolios. Investors can gain substantially if managers choose less-diversified portfolios that tilt more towards their best ideas.

- 12 Aug 2020

Why Investors Often Lose When They Sue Their Financial Adviser

Forty percent of American investors rely on financial advisers, but the COVID-19 market rollercoaster may have highlighted a weakness when disputes arise. The system favors the financial industry, says Mark Egan. Open for comment; 0 Comments.

- 29 Jul 2020

Two Case Studies on the Financing of Forest Conservation

Case studies about The Conservation Fund and Sonen Capital highlight three broad lessons about fresh approaches to the ownership and management of forestland.

- 07 Jul 2020

Market Investors Pay More for Resilient Companies

During a market collapse, investors will pay up for companies considered resilient in their response, according to George Serafeim. Open for comment; 0 Comments.

- 12 Jun 2020

Corporate Resilience and Response During COVID-19

Investors look for evidence during a market crisis that a company is resilient. This study includes findings that challenge the notion that companies need to adopt practices that hurt their employees because investors want them to do so.

- 05 Jun 2020

How Anchor Investors Help Impact Funds Succeed

3Questions A startup fund's ability to attract a major first investor is a signal to others that the investment pool is just fine for entering. Shawn Cole and Rob Zochowski answer questions about anchor investors. Open for comment; 0 Comments.

- 09 Apr 2020

How Social Entrepreneurs Can Increase Their Investment Impact

Grants or investments? Philanthropic organizations have multiple funding tools available, but choosing the wrong one can dilute the benefits, according to research by Benjamin N. Roth. Open for comment; 0 Comments.

- 09 Mar 2020

Impact Investing: A Theory of Financing Social Entrepreneurship

The author provides a formal definition of organizational sustainability and characterizes the situations in which a social enterprise should be sustainable. The analysis then delineates when an investment in a social enterprise delivers superior impact to a grant.

- 18 Feb 2020

A Preliminary Framework for Product Impact-Weighted Accounts

Although there is growing interest in environmental, social, and governance measurement, the impact of company operations is emphasized over product use. A framework like this one that captures a product’s reach, accessibility, quality, optionality, environmental use emissions, and end of life recyclability allows for a systematic methodology that can be applied to companies across many industries.

- 03 Dec 2019

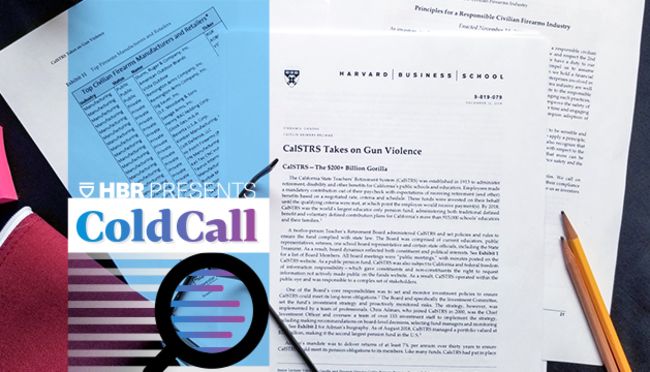

Why CalSTRS Chooses to Engage with the Gun Industry

Should large institutional investors divest or engage if they have an issue with a company? In a recent case study, Vikram Gandhi discusses how CalSTRS, the $200 billion pension plan for California public school teachers, chose to engage with gun makers and retailers. Open for comment; 0 Comments.

IMAGES

VIDEO

COMMENTS

This study of foreign corporate investment transactions from 32 countries between 1976 and 2015 finds these investments pose a trade-off: While they support young firms in pursuing innovations they could not otherwise afford, they also generate knowledge for the foreign investors. 20 Aug 2020. Working Paper Summaries.

Portfolio Management in Theory and Practice. Risk Management in Theory and Practice. Quantitative Finance. Regulation, Taxation, Governance, and Compliance. Economics and Financial History. Asset Classes. Browse our content by topic to discover expertise. We deliver more than 11,000 articles covering 60 investment disciplines.

Abstract. The Financial Analysts Journal is a leading forum for sharing knowledge about investment management. It often features academic research, but its focus has consistently been on practice and how new knowledge can support one of society’s most important endeavors: preserving and growing assets for our collective economic future.