5-Step Guide on How to Prepare a Convincing Annual Budget Presentation

Michelle Harris - Guest Contributor

- Reevaluate company and departmental goals

- Gather budgeting information

- Set up the annual budget

- Create a convincing budget presentation

- Present your budget and win!

Learn how to present your departmental budget and gain the approval of decision-makers.

Every year, leaders are responsible for creating an annual budget for their department. It’s one thing to grapple with the numbers, but presenting the budget can be a more challenging task.

If your annual budget isn’t convincing enough, chances are you won’t get everything you require to run your department the way it needs to. Anything less than what is required and you’ll have a rough time getting through the coming year.

We’ve put together a list of five steps designed to help you prepare an exceptional annual budget presentation that cannot go unnoticed. Using this step-by-step approach will help you convince executive leaders that every component of your budget is absolutely necessary to run your department and meet company goals.

1. Reevaluate company and departmental goals

Before determining your annual budget, go back and review your company’s and department’s goals . Note anything that’s changed from previous years. This is particularly important in the case of a changing economy and market or disruptions in business due to the pandemic and other unexpected events. As goals change, so must the budget—pay close attention to all historical data. As you develop your departmental budget, you want to ensure that it aligns with your department and the company’s overall goals and objectives.

2. Gather budgeting information

Allow plenty of time to gather all of the intel needed to create a detailed and accurate budget. Don’t merely go by the departmental expenses and payments made during the previous year. Your previous year's budget is important, but also pay attention to the actual records to identify shortfalls or a surplus in the budgeted items.

When creating a budget, you have different options on how you approach it and especially when presenting it. Of course, this can all depend on your industry, company, and specific department. Following are the different types of budgets that companies most often use:

Also, discuss budgeting with team members and other stakeholders to ensure that you cover all of your bases. However, every piece of budgeting information should be based on facts rather than opinions. That way, you’ll be sure to have a budget that’s appropriately allocated.

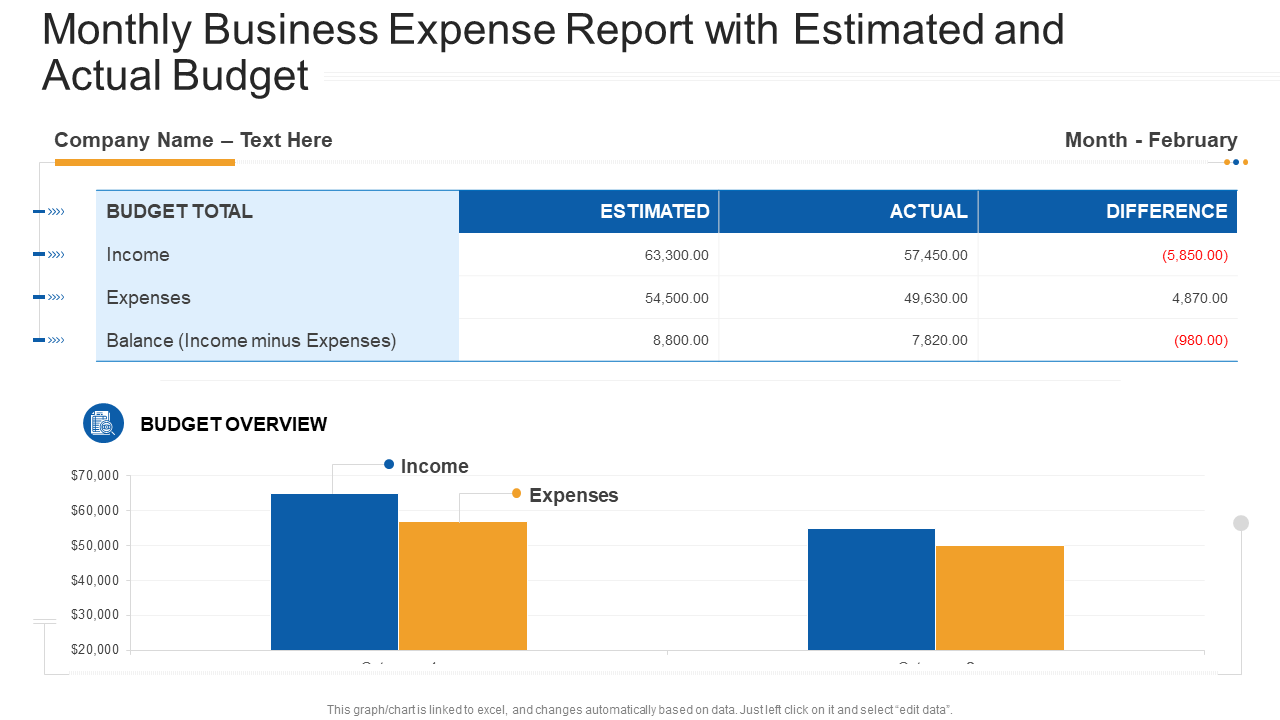

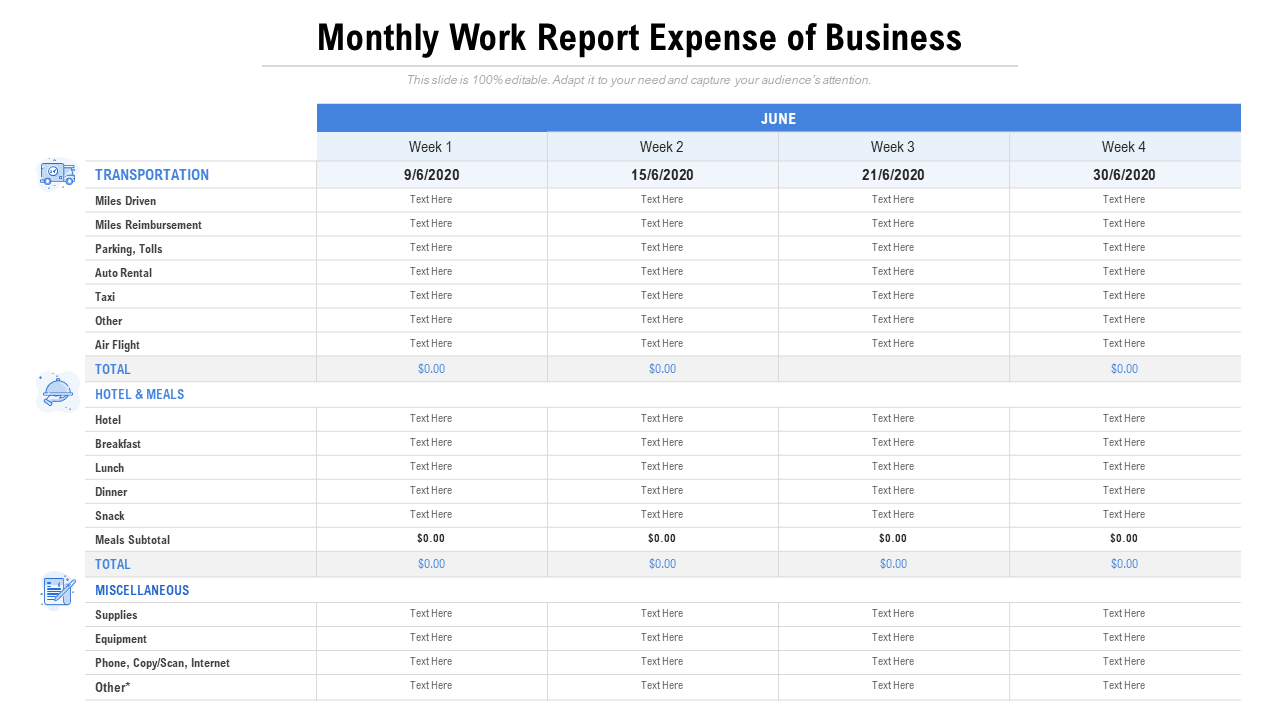

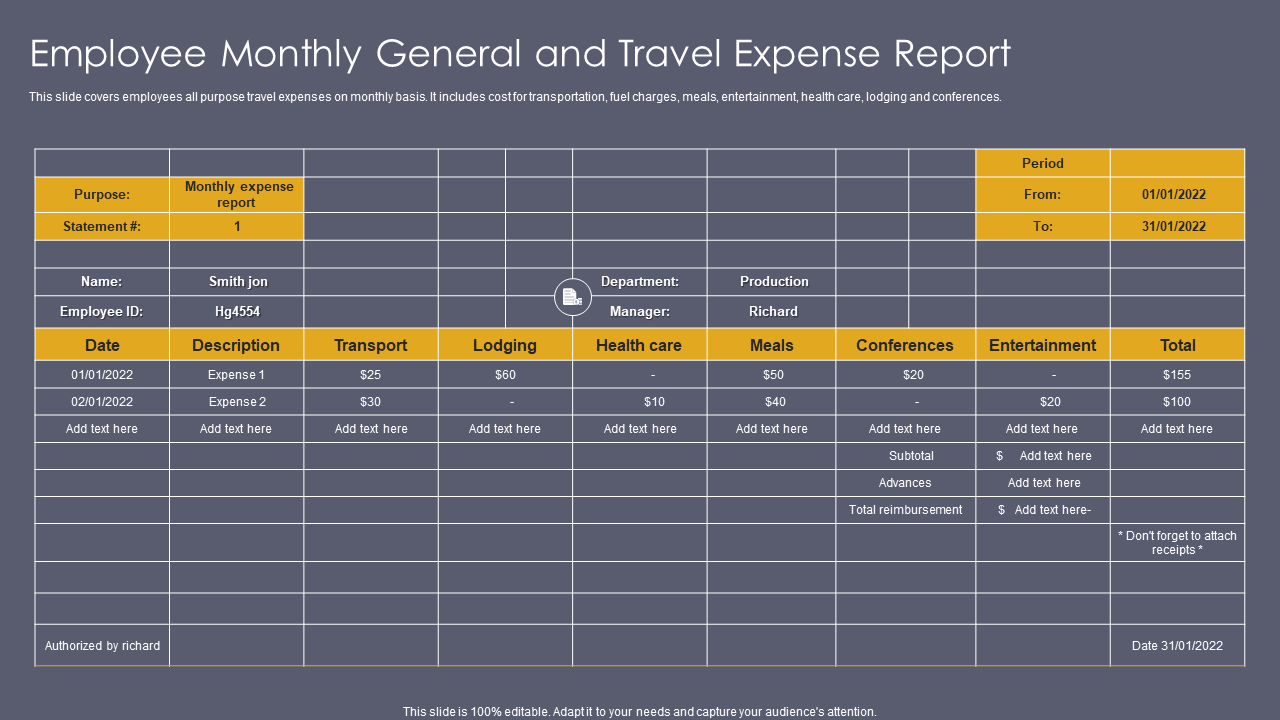

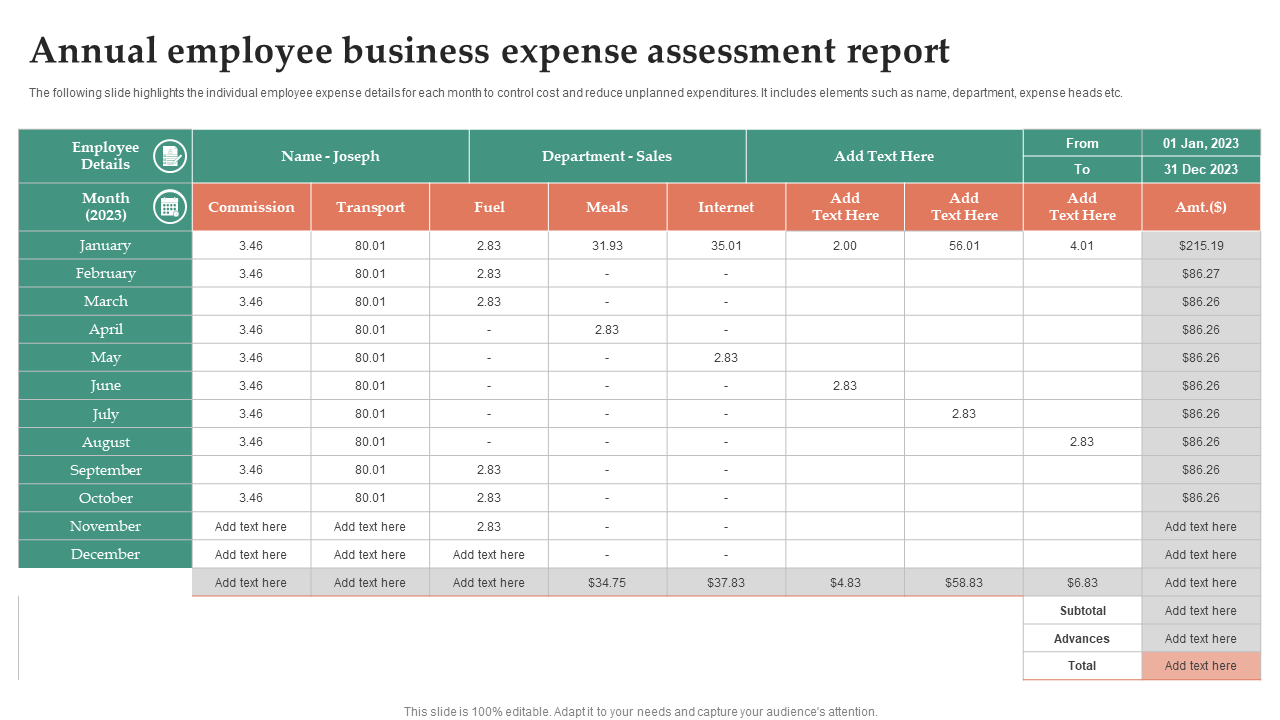

3. Set up the annual budget

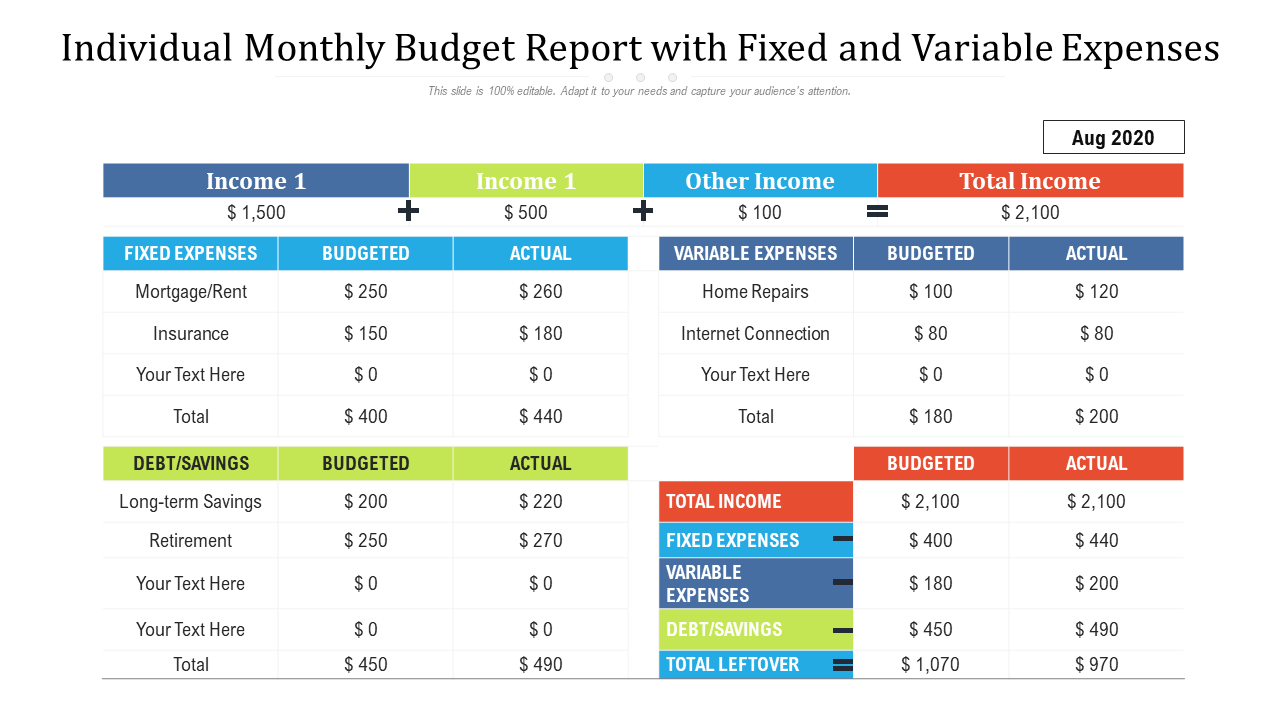

Next, sit down to create the actual budget. Depending on your preferred method, or that of your company, you can use spreadsheets or budgeting software. Each budget typically includes the following basic elements:

In addition to the basic items, you may also want to consider additional and unexpected expenses that may occur. You may think of different scenarios that could arise and determine how they might impact your business and affect your budget. You may then tweak the budget as you see fit. This allows you to plan ahead and be well-prepared for any adversity that may surface.

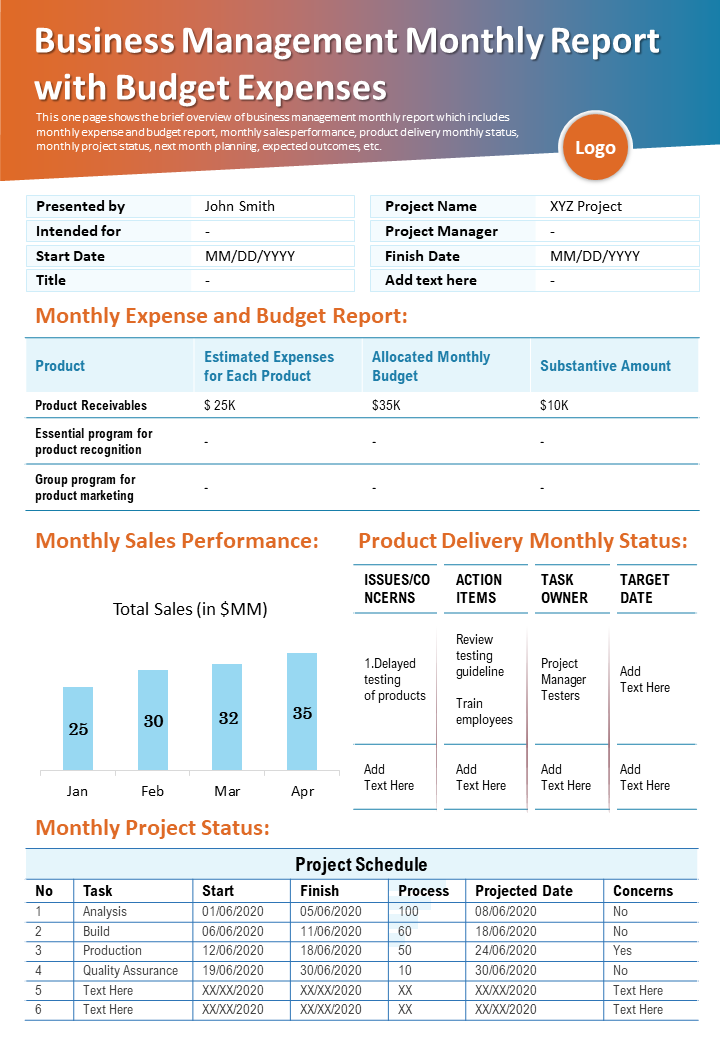

4. Create a convincing budget presentation

Carefully setting up your annual budget and aligning it to your company’s and department’s goals will make the following creative bit easier. The worst thing to do is try to throw together a budget while creating the presentation. You must have your budgeting ducks lined up in a row first.

presentation tips

As you plan out your presentation, consider including the following to help you convince the decision-makers:

Budget presentation title

Budget presentation agenda

Executive summary

Company SWOT analysis

Business challenges

Budget plan and allocation

Budget process and timeline

Departmental deliverables

Steps following budget approval

There are many ways to make an effective and impactful presentation. It can be anything from a simple printed booklet to an interactive multimedia presentation. It doesn’t have to be over-the-top but should show that your budget is well organized, thorough, and fact-based.

5. Present your budget and win!

It doesn't matter how you choose to present your budget—you can use PowerPoint or other media—but it should include graphics and other information to make your case. Here are a few tips to keep in mind:

Keep it brief (not more than 10 slides).

Include charts, diagrams, graphs, etc. for better data visualization.

Showcase your problem-solving skills by giving solutions.

Show enthusiasm, but don't deliver a long speech.

Enhance your annual budget presentation

Unless you’re an experienced accountant or a natural penny pincher, you probably cringe at the thought of creating an annual budget. Even more so, it can be frustrating trying to get your boss to accept your budget. That’s why it’s critical to know how to create an impressive and convincing annual budget presentation that wins the approval of business stakeholders.

There are plenty of options available to help you enhance your presentations to showcase an annual budget that will garner a “yay” rather than a “nay.” At Capterra, we’ve done all the dirty work to compile a list of presentation software for you to easily compare and choose from. Our shortlist gives you the top-ranked suggestions, so you can see which software ranks the highest.

If you need help getting your numbers in order before you’re ready to present, take a look at the available budgeting software , including the best free budgeting software for small businesses .

Was this article helpful?

About the author.

Michelle Harris is a strategist residing on Florida’s beautiful Gulf Coast. Providing global clients with solutions to head-banging problems is her passion at Shel-Shok, LLC. She is a Ph.D. candidate researching finance decision-making and holds graduate degrees in management and marketing. Her background includes art, education, medicine and conservation (she is a glorified bug hugger!). When not strategizing, you will find her motorcycling, belly dancing, roller derbying and beach bumming.

Related Reading

5 key financial reporting software features with top products that offer them, important financial ratios for businesses, how to keep books for a small business, capterra value report: a price comparison guide for accounting software, 6 accounting tasks that can be fully automated, how to establish your accounting department structure, how data analytics is changing the way accountants work, maximize your tax refunds: 6 smart tax planning tips for small businesses, what is financial accounting types and examples.

- Search Search Please fill out this field.

How to Create a Monthly Budget

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-1d1189bf85d0470eb415291cb149a744.jpg)

- The 50/30/20 Rule

Calculate Your Income

List all your expenses, create and track your budget.

Ziga Plahutar / Getty Images

Regardless of your income and financial situation, a budget is one of the most important tools at your disposal. You can be alerted to trends you might not have noticed when you track your money habits, like spending nearly $70 a month on lunch-break coffees. Noticing those trends is an essential step in identifying your behaviors, and accepting a change is needed.

“A budget simply tells us how much money is coming in, how much is going out, and where it’s going—and this is essential information for everyone,” Jonathan P. Bednar II, CFP at Paradigm Wealth Partners in Knoxville, Tennessee, told The Balance in an email.

As many as 80% of Americans say they are following a budget, according to a 2021 budgeting survey conducted by Debt.com. The two most common reasons for budgeting, according to the survey, include wanting to increase wealth or savings, or being prompted by debt, according to the survey. Learn what steps you should take to create an efficient and useful budget, ultimately leading to a financially stable future.

The 50/30/20 Rule

When it comes to budgeting, the simpler the better is usually the motto, as you’re less likely to be consistent with a complex budgeting process. One popular budgeting strategy is the 50/30/20 rule , which separates your spending by category: must-haves, wants, and savings or debt payoff, respectively, using net income.

A full 50% of your income should be budgeted for essential expenses, according to the rule. “This includes housing, utilities, auto payments, groceries, gas, minimum monthly debt payments, insurance premiums, etc.,” Bednar said. And ideally, according to Bednar, no more than 30% of this amount should go toward your housing payment.

The next portion of your net income, 30%, should be allocated for personal expenses, or things you really want but do not need. “These are items that you could cut if you had to, like dining out, hobbies, entertainment, gym memberships, and fun, monthly subscription boxes,” Bednar said.

The final 20% is the most essential part of your budget, according to Bednar, because what you do with it will largely determine whether you’re financially successful or not. “This portion of your budget goes toward your financial goals—things like paying off debt, saving for an emergency fund , saving for a home, and investing.”

While it’s tempting to make minimum payments on debt and put whatever’s left at the end of the month in savings, Bednar warns against this approach. “What usually happens is that there is nothing leftover, so if you don’t deliberately budget for those things, they’re unlikely to happen,” Bednar said.

If you have high-interest debt, you may want to consider flipping the wants and savings portions of your budget. “When those high-interest debts are dragging you down, it’s impossible to make any progress on your other financial goals,” Bednar said. Devoting that extra 10% of your income to paying off debt could save you thousands of dollars in interest.

After deciding on a budgeting strategy , the next step is to determine your monthly income. “If you work for an employer as a W-2 employee, they will take care of all of the tax withholding, so you can use your after-tax income amount to create your budget,” Dave Henderson, CFP, ChFC, CLU, a self-employed advisor at Colorado-based Jenkins Wealth, said in an email to The Balance. If you’re self-employed, you’ll need to subtract your self-employment tax before calculating your net monthly income.

When calculating your income, be sure to include all sources. If you have multiple jobs, take part in a side hustle, or receive child support or government benefits, those values should be included in your monthly income.

After you determine what’s coming into your bank account, determine what’s going out. “You can do this by reviewing your credit card statements, as well as your bank statements for the last two-to-three months to determine where your money has been going,” Henderson said.

Some expenses are fixed, staying the same from month to month, and others are variable and change often, such as groceries and entertainment. With variable expenses, it’s helpful to look back at your receipts from the previous few weeks or months and calculate an average.

Consider starting a daily log of your expenses to see what you’re really spending your money on. Often, those small expenses, like running out for coffee or grabbing a snack on your way home from work, can be overlooked, so it’s best to keep track of them in the moment.

Now that you know the information you need for a budget, it’s time to actually create a budget.

While you can easily track your monthly spending habits by hand using pen and paper, there are several budgeting apps and software programs that make this process easier.

One popular budgeting app is Mint, which is Bednar’s favorite, because it is accessible and free. With Mint, as well as most others, you will need to gather details on your financial accounts, like credit cards and investments. These will be connected to the app and visible all in one place, ensuring all of the tracked information is accurate and up to date. According to Bednar, Mint recommends a budget based on the information you provide, but you also have the option of customizing it.

Here’s a sample of how the 50/30/20 rule might look, based on a net monthly income of $5,000, according to Bednar.

Once your budget is made, whether through an online platform or on paper, track your progress. “You will quickly see that there are some categories in the budget where adjustments need to be made,” Henderson said. “You may find out that you are spending way too much money on entertainment, for example, and not putting enough money into savings.”

If you’d rather use a simpler solution, the Federal Trade Commission also offers a budget worksheet .

By reviewing these gaps in spending, you can make adjustments accordingly. It’s also key to remember that even though you have a budget, it will only be useful if you periodically track and update it to reflect any changes to your income and expenses.

Debt.com. " Americans Are Budgeting More Than Ever ."

:max_bytes(150000):strip_icc():format(webp)/1-11-23controloffinances-2d5ac066ba3c4e959d29f92a54b4713a.jpeg)

How to make a monthly budget in 5 simple steps

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Personal finance

- • Savings accounts

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. Here is a list of our banking partners .

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU — the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

While few people would say they actually enjoy budgeting , that doesn’t make the task any less important. Making a budget helps you plan for expenses, and it can provide insight into your spending habits, allowing you to curb spending more easily.

The current high-inflation environment may have many people feeling especially strained when it comes to affording monthly expenses — and trying to save at the same time . While it won’t beat inflation altogether, establishing a budget will help you get by and lower the stress of covering upcoming expenses.

If you’re looking to build your first monthly budget, or want to revise one you already have, here are some tips.

Key takeaways

- A budget is a tool that helps you manage your finances, from paying bills to building up your savings.

- Having a budget helps you meet financial obligations as well as handle any unplanned expenses that come your way.

- Budgeting can help you boost your emergency fund or save for goals such as a down payment on a home, a new car or your dream vacation.

What is a monthly budget?

A monthly budget is a plan for how you’ll spend your money each month. Monthly budgets are popular because many recurring expenses occur on a monthly basis, such as rent, utilities, credit card payments and other loan payments.

Ideally, your budget will involve spending less than you make each month, allowing you to save money. Also, when your expenses don’t exceed your earnings, you won’t need to tap into savings or borrow money to make ends meet.

A budget helps you plan for expenses before they happen, rather than hoping you have enough money to cover essential costs or emergencies. Budgets can also make you more mindful of your spending, as you prioritize your spending on things that are important to you over what’s less important.

Why budgeting is important

Regular budgeting carries many tangible benefits, which often include:

- Bills that are paid on time

- More money in your online high-yield savings account

- The means to cover unplanned expenses

- Better ability to avoid overspending

- Peace of mind from knowing your finances are in order

What’s more, checking in regularly with your finances helps ensure you’ll catch any bank errors or fraudulent transactions.

Key statistics on spending and savings

- On average, American households spent $72,967 in 2022. ( Bureau of Labor Statistics )

- Housing, the largest expense, accounted for about 33 percent ($24,298) of the average household expenditure reported in 2022. (Bureau of Labor Statistics)

- The cost of housing is increasing, too — the median existing home sales price went up 2.8 percent from September 2022 to September 2023. ( National Association of Realtors )

- Only 48 percent of U.S. adults say they have enough savings to cover at least three months of living expenses. ( Bankrate )

- More than half of Americans (57 percent) are uncomfortable with the amount of emergency savings they have. (Bankrate)

- More than half of adults (53 percent) have delayed financial milestones because of economic conditions, while 53 percent have opted out of events or activities due to the economy. ( Bankrate )

How to make a monthly budget: 5 steps

1. calculate your monthly income.

The first step is to determine how much money you earn each month. This will determine how much you can spend (and save) each month.

When calculating your monthly earnings, look at consistent sources of income. You should include your paycheck from your day job, but should probably exclude less consistent sources of money, such as selling old items you no longer need.

Make sure you calculate your earnings using your net income , also known as your take-home pay. This is the money you have left over after taxes and payroll deductions.

2. Track your spending for a month or two

One of the best ways to get a sense of how much you should budget for is to track your actual spending over the course of a few months. Various budgeting apps can help you track spending by linking to your bank account, or you could track spending manually by saving receipts and adding up expenses yourself.

As you track your spending, you may find that you spend more or less than you expected in different categories. This is important because it is a good lead-in to the next step in the process.

Don’t forget to budget for expenses that may occur annually instead of monthly. You should account for expenditures such as property taxes, car insurance payments , doctor or veterinary visits and vacation costs.

3. Think about your financial priorities

Once you’ve spent time tracking your spending, it’s time to review your spending history and how it aligns with your financial priorities.

Everyone has expenses they can’t avoid, such as housing, food and transportation. However, if you aren’t keeping an eye on your spending, it’s easy to overspend on nonessential things. For example, you may find that you’re spending hundreds of dollars each month on takeout meals or have an array of monthly subscriptions you rarely use, from streaming services to gym and club memberships.

Building a budget isn’t about limiting yourself to only spending money on essentials. Instead, it’s about allocating your money in the way that makes sense for you. Once you see how much you’re spending on certain things, you might want to try adjusting your spending habits to increase your savings or put more money toward fulfilling hobbies or activities.

4. Design your budget

To design a budget, list the line items that correspond to each spending category . It’s smart to pay yourself first, so be sure to include a line item for savings, whether it be for an emergency fund , a new car, a down payment on a home or other purposes. When it comes to savings advice, take the words of the Oracle of Omaha, investing guru Warren Buffett who said, “Do not save what is left after spending, but spend what is left after saving.”

Common expense categories in a budget include:

- Rent or mortgage payment

- Property taxes

- Car payment

- Insurance premiums

- Student loan payment

- Medical bills

- Tuition fees

- Home and car maintenance

- Gym membership

- Entertainment and hobbies

- Clothing and personal care

Next, look at your spending habits and see how they line up with your priorities. If your actual spending is already aligned with your goals, you can use your spending history as a guide for your budget. If you want to completely overhaul your spending habits, you’ll want to build your budget from the ground up instead.

50/30/20 rule: One popular rule of thumb for building a budget is the 50/30/20 budget rule , which states that you should allocate 50 percent of your income toward needs, 30 percent toward wants and 20 percent for savings. How you allocate spending within these categories is up to you.

There aren’t any strict rules when it comes to budgeting, though, as long as you spend in a way that’s satisfying and helps you reach your financial goals. The one truly important guideline is to spend less than you earn each month. Even if you can’t save 20 percent of your income, get into the habit of saving as much as possible.

5. Track your spending and refine your budget as needed

A budget is a living document that can be changed over time, as needed. Once you’ve built your budget, you should continue to track your spending and follow your spending plan.

As time passes, your priorities and life circumstances may change. For example, you take on a new loan or you receive a pay raise. Review your budget periodically to see if it needs revising based on any such changes.

Monthly budget example

Using the steps outlined above, let’s consider how someone might make a budget for a net income of $4,000 a month. Remember that net income is the money you have for a budget after subtracting taxes and deductions. The net income can include earnings from a full-time job as well as any passive income or side gigs.

It might be helpful to organize each line item by priority. The first priority in this budget is savings, which is followed by needs or essentials, and then by wants or nonessentials.

After making the budget, you’ll want to track your spending to see how actual expenses line up with predicted expenses. Then, adjust the budget accordingly to make up for any differences.

Budgeting resources

- Budget apps : These can help with some of the monotonous work associated with budgeting. Budgeting apps such as Mint and EveryDollar come with digital tools that can monitor your spending, track savings goals and provide insight into where you can save on certain expenses.

- Savings accounts : One of the most important line items of a budget is savings, so a savings account is a must. Find an account that earns a competitive annual percentage yield (APY) and that either doesn’t charge a service fee or makes this fee easy to avoid.

- Checking accounts : While money in a savings account is for various savings goals or emergencies, a checking account is where money for daily spending is kept. If you’re looking to open a new account, you may also be able to take advantage of a bank account bonus .

- Budget calculator : Bankrate’s home budget calculator does the work of figuring out what your net income is after you account for each expense category . It also suggests ways you can save more money.

- Microsoft Office template : This budget template is an option for those who prefer manually making a budget over digital services, and it’s free with Microsoft 365. It outlines the various spending categories for a single household — you just fill in the cells with each expense amount.

Bottom line

As prices continue to rise , the importance of tracking where your money goes rings truer than ever. Making a budget is an effective way to keep up with your spending, gain a better understanding of your financial habits and incentivize saving.

Before creating a monthly budget, track your spending for a month, noting necessary expenses, unnecessary expenses and where there’s room for savings. You’ll calculate your expenses against your available income, with the goal of spending less than you earn . To help save on time and menial work, consider using a budgeting app or calculator to establish your budget.

Bankrate’s René Bennett and writer TJ Porter contributed to earlier versions of this story.

Related Articles

What are examples of monthly expenses?

13 ways to save money on a tight budget

How to create a biweekly budget in just 4 easy steps

How to budget: 5 tips to get started

- Presentations

Budget Presentation

Used 4,920 times

Use premade budget presentation slides to produce comprehensive reports fast with our free budget presentation template.

e-Sign with PandaDoc

Prepared by:

[Sender.FirstName] [Sender.LastName] [Sender.Company]

Current State

Table of contents, business challenges, initiatives, budget allocation, budget timeline, expected roi, deliverables.

Existing budget:

Yearly revenue:

Compared to last year’s budget:

+25% / -25%

The main factors and tendencies influencing and hindering the budget:

Declining demand

Growing niche competition

Constant TA stimulation

Local economy fluctuations

Ideas and actions to streamline and boost budgeting:

Implement smart tech for improved revenue and budget analysis and forecasting

Streamline budget tracking tools to get more control over budgeting

Add new budget planning scenarios

Rethink cash flow and profit goals

How the budget is distributed at the moment:

General budget

Technology and tools

Marketing and promotion

Maintenance and administration

Workflow management

Backup budget

The timeline of budgeting highlights and events January-April 2022:

Jan 2022:

Major budget reallocation

Funds raised during the [event.name]

Investment secured from (investor.name)

Feb 2022:

Major project expense

Investment opportunity gained from (investor.name)

(Highlight)

March 2022:

April 2022:

Specify budget consumption percentages by specific aspects:

Return on Investment rates you expect to see in future fiscal periods:

Q 1 – $0.00

Q 2 – $0.00

Q 3 – $0.00

What budget initiatives are expected to bring to the table:

Budgeting predictions, revenue forecasts, and more profit opportunities.

Integration of AI, Big Data, and Machine Learning tools (PM and Software Team):

Acquisition of new data tracking solutions (PM and Software Team):

Better control over budgeting and optimized budget allocation.

Creation of new budget planning scenarios (Top Manager, Budget Specialist, Finance Department):

Financial resilience and competitive edge in the market.

Setting of new cash flow and budgeting goals (Top Manager, Budget Specialist, Finance Department):

Optimized budgeting and new market outreach opportunities.

Specify parts of the budget that should cover summarized budgeting milestones

Specialists to wield new tools

Acquisition of new tech licenses

Financial research and planning

Maintenance of new tech solutions

Thank you for your attention, and have a rich fiscal period.

Care to rate this template?

Your rating will help others.

Thanks for your rate!

Useful resources

- Featured templates

- Sales proposals

- NDA agreements

- Operating agreements

- Service agreements

- Sales documents

- Marketing proposals

- Rental and lease agreement

- Quote templates

Think Outside The Slide

Presenting Financial Information Visually in PowerPoint

Why does it seem to be so difficult to effectively present financial statements, results or analysis? Executives, management, and stakeholders get confused by the slides full of spreadsheets and ask a lot of questions. In my surveys of audiences, they tell me that they want visuals instead of tables of numbers so the key messages are clear.

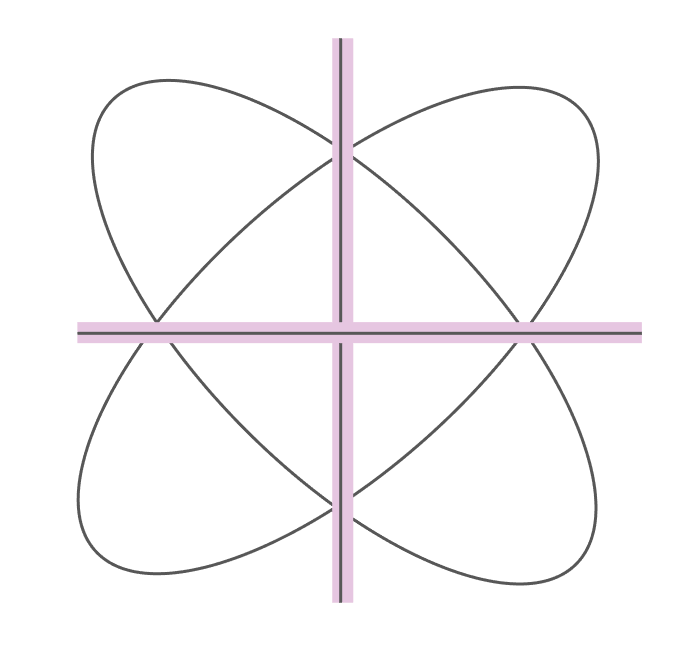

Here is an example of how to visually present the Net Income in an Income or P&L statement.

Here is an example of visually showing the assets or liabilities and the year over year change from the Balance Sheet.

And here is an example of showing a walk of budget and variance amounts for expense categories from the Income or P&L statement.

See, it is possible to effectively present financial statements, results, or analysis. If you want to see more examples of visuals, here’s a whole page of examples for financial topics organized by type of message you want to communicate . I also have articles on each of the three key financial statements: Income/P&L , Balance Sheet , and Cash Flow .

If you want to learn how to present financial statements, results or analysis more effectively, follow these links to jump to the topic that is most important to you right now. Why presenting financial information is difficult and what audiences want in financial presentations Use the GPS approach to create a clear message for your presentation while reducing information overload How to select graphs and visuals based on the message they communicate Save time by learning how to create graphs and visuals faster in Excel and PowerPoint

Why presenting financial information is difficult and what audiences want in financial presentations

Why does it seem so difficult to effectively present financial information? You may regularly present financial information such as monthly results, weekly performance against goals, or financial analysis. Your slides are full of spreadsheets and complex graphs you have copied in from Excel because that is what you have seen other financial professionals do.

But it doesn’t seem to be all that effective. Your audience, whether they are executives, management, or stakeholders, are overwhelmed with the information you present. They seem confused and end up asking lots of questions. You usually have to do more analysis before they will make a decision.

You figure there has to be a better way to present financial information so it is easily understood and acted on. There is.

First we need to understand why it seems so difficult. In my work with hundreds of financial professionals, it seems that there are three beliefs that hold them back from creating and delivering effective presentations.

“Everyone should love numbers as much as I do.”

Too many analysts mistakenly think that their audiences want every number they have and all the details behind the analysis. This is simply not true. Most people don’t have a great love of numbers, but they do need to know what the numbers mean to their department, area, or life.

“All the numbers need to be presented in case someone has a question.”

Copying spreadsheets of numbers onto slides has two negative reactions from most audiences. First, they get overwhelmed and they mentally check out, leaving the room without understanding the key messages the presenter needs them to understand. If they don’t check out, the second reaction is to find an obscure number on the slide (one that has nothing to do with the key message) and ask numerous questions to prove to others that they were paying attention. The presentation goes off track and the key messages get missed.

“I have to prove I can do my job well by presenting every calculation, all the analysis, and every detail I considered.”

If your boss has a problem with your job performance, they will set up a separate meeting with you one-on-one. The quality of your conclusion is more important than the quantity of the work. Executives can tell how well you did your work by how insightful your conclusion is and how it helps them make strategic decisions that benefit the business.

So what do audiences of financial presentations want to see? I asked them in a survey in March 2016 ( full survey results are here ). Let’s start with what they don’t want. They don’t want an overload of information. Unfortunately, that is what they get when financial professionals cling to the three beliefs listed above.

What do they want instead? Their responses were in three key themes:

- “Start with the message, not the data.” was the sage advice of one respondent. Financial professionals should determine the key message and then find the support for the messages, not start with the data and hope the audience figures out the messages.

- The presentation must be relevant to the particular audience, using terms they understand and making it clear what the analysis means to their area, project, or life.

- The slides should have easy to understand graphs and other visuals, not large tables of numbers. Adding callouts to explain key points in the visuals is also helpful.

Use the GPS approach to create a clear message for your presentation while reducing information overload

If you want your next presentation of financial or operational information to clear and focused, I suggest you start with planning your presentation.

Create a clear message for your presentation

Presenting financial information should not just be a data dump. Don’t start preparing for your presentation using the Grab & Hope method where you just grab slides from previous presentations and hope they come together into a coherent message. This article explains more about why this method is not effective and wastes time.

Use a GPS system as an analogy when planning your presentation. Start with the goal of the presentation (like the destination of a trip), evaluate the present situation (like the current location with a GPS), then determine the steps necessary to move the audience from where they are to where you want them to be (like the best route when taking a trip). This article explains more about the GPS system.

Declutter your slides

Putting spreadsheets on slides is the top annoyance in financial presentations according to the people who responded to my survey ( full results here ), so don’t just copy a table of numbers onto a slide. Many presenters feel they need all the data on their slides in case a question gets asked. In fact, you have three additional opportunities to share information with your audience: before the presentation in a pre-read, after the presentation in supplemental files, or behind your slides with hyperlinks to source files or hidden slides. This article explains this idea and when you move information to these other places, you can focus your message on the key points you need the audience to understand.

You may have heard the phrase “Less is More” and think that is what I am suggesting here. Not at all. I don’t believe that phrase makes sense at all, as I explain in this article . Your goal should be clarity of your message, and all that extra detail confuses the message for your audience.

Make sure you are giving executives what they need. Leaders need actionable insights on what needs to be done next. Insights that consider the context of the results, the relationships between the data and other factors. Spreadsheets only give them measurement results that answer what happened or performance results that answer how the results compare to a previous period or goal.

If you want a structured approach to planning your presentations so they have a clear message and focused content, get my book GPS for Presentations .

How to select graphs and visuals based on the message they communicate

This is the step that is the biggest roadblock for many financial professionals: How to select the right visual for each slide. The key is to not start by looking at the data. Remember that the presentation is communicating key messages to the audience. Start with what message you are trying to communicate when you select a visual. Write your key message as a headline at the top of the slide, like a newspaper writes a headline for every story ( use this template to write a headline that summarizes the result from your analysis).

Don’t select a visual just because it looks cool, select a visual that clearly communicates your message to the audience. I have an entire page of example visuals organized into the nine categories that I see professionals use most often in financial presentations . For each message you want to communicate, identify the category and then look through the examples in that category to select a visual that will effectively communicate that message.

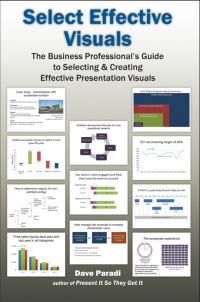

As a business professional, how can you select the best visual for each message? Follow the approach in my book Select Effective Visuals . I break down almost every message a business professional will need to communicate into six categories. I break those down into 30 groups and sub-groups and 66 individual visuals. The book contains 192 color examples of visual and tips on how to create the visuals using Excel and PowerPoint, the tools you already have on your computer.

Save time by learning how to create graphs and visuals faster in Excel and PowerPoint

A large barrier to using visuals in presentations is the time it takes to create the slides if you don’t know the quick and easy ways to create visuals in PowerPoint. You could use Google to try to find tutorials but you never know whether the video or article you found is created by someone who is an expert and will show you the best technique. The best site for free PowerPoint tutorials is www.indezine.com , which is run by a recognized PowerPoint expert. They have tutorials for almost every feature in every version of PowerPoint. Some of the best tutorials for using Excel come from recognized experts Jon Peltier , Bill Jelen , and Chandoo .

When you are creating graphs, make sure they are clean and not cluttered. This article gives tips on cleaning up the default graphs in Excel/PowerPoint, this article gives tips on labeling graphs, this article explains when gridlines are helpful on line graphs, and this article shows how to replace the default legend with more effective labels. I also offer some calculators and tutorials for creating some non-standard graphs, such as waterfall graphs, diverging stacked bar charts, and treemaps.

If you prefer to create tables or graphs in Excel and copy them on to a PowerPoint slide, you need to be aware of the potential advantages/disadvantages of each method. Along with Glenna Shaw of www.visualology.net , I created a table of every copy/paste method as of Office 2013. If you want to link a table of cells from Excel to a PowerPoint slide, read this article . If you want to link a graph from Excel to a PowerPoint slide, read this article . In each article you will also learn why linking may not give you what you really need, and why creating the table or graph in PowerPoint might be better. I have an e-course that goes into depth on this topic with videos of each of the key methods for using Excel content in PowerPoint.

The information above and the articles, makeovers, and resources above will be very helpful. But the best way for you and your colleagues to make a step change improvement in the way you present financial information is to set up a customized on-site workshop. My two-day sessions include in-depth discussion of the GPS approach to planning your message and focusing the content. We go through the HVF approach to create effective slides, learning how to select the correct visual and I show many makeovers of your actual slides so you can see the ideas applied to the information you present. The second day is hands-on practice creating the visuals, including ways to set up your Excel and PowerPoint files so weekly or monthly updating is quick and simple. You can learn more about my customized workshops here.

I also offer in-person training workshops to improve a team’s skills in using Excel to create effective graphs . In mid-2019 I will be releasing a new ecourse that shares expert-level techniques for advanced Excel graphing without using plug-ins, add-ins, or VBA programming. You can get on the priority notification list if you are interested.

You can also spend less time creating visuals when you start with something that is already partially done. This page on my site allows you to download 77 pre-made visuals for communicating a message that is time based, such as a timeline or calendar. This article shows you sites to get free vector icons for use on your slides. And this article shows you how to use a site that has over 4,000 professional sequence and relationship diagrams.

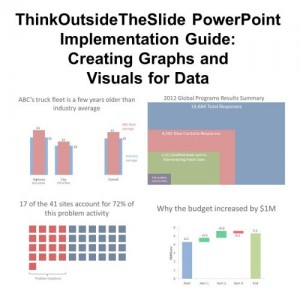

Getting tips on the functions of PowerPoint or Excel is good, but not as good as learning the exact steps to create the visuals you want. That is why I have created my Implementation Guides . These are the handouts I use in my customized workshops to give step-by-step instructions that the participants can follow to create many of the effective visuals I show them. If you want to create graphs in PowerPoint that are clear and impactful, these guides will save you hours of time. I also cover the specific methods for copying or linking Excel cells or graphs to PowerPoint.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Budgeting 101: How to Budget Money

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If I have take-home pay of, say, $3,000 a month, how can I pay for housing, food, insurance, health care, debt repayment and fun without running out of money? That’s a lot to cover with a limited amount, and this is a zero-sum game.

The answer is to make a budget.

What is a budget? A budget is a plan for every dollar you have. It’s not magic, but it represents more financial freedom and a life with much less stress. Here’s how to set up and then manage your budget.

Get a custom financial plan and unlimited access to a Certified Financial Planner™

NerdWallet Advisory LLC

How to budget money

Calculate your monthly income, pick a budgeting method and monitor your progress.

Try the 50/30/20 rule as a simple budgeting framework.

Allow up to 50% of your income for needs, including debt minimums.

Leave 30% of your income for wants.

Commit 20% of your income to savings and debt repayment beyond minimums.

Track and manage your budget through regular check-ins.

Understand the budgeting process

Figure out your after-tax income : If you get a regular paycheck, the amount you receive is probably it, but if you have automatic deductions for a 401(k), savings, and health and life insurance, add those back in to give yourself a true picture of your savings and expenditures. If you have other types of income — perhaps you make money from side gigs — subtract anything that reduces it, such as taxes and business expenses.

Choose a budgeting plan: Any budget must cover all of your needs, some of your wants and — this is key — savings for emergencies and the future. Budgeting plan examples include the envelope system and the zero-based budget.

Track your progress: Record your spending or use online budgeting and savings tools .

Automate your savings: Automate as much as possible so the money you’ve allocated for a specific purpose gets there with minimal effort on your part. An accountability partner or online support group can help, so that you're held accountable for choices that blow the budget.

Practice budget management: Your income, expenses and priorities will change over time, so actively manage your budget by revisiting it regularly, perhaps once a quarter. If you're struggling to stick with your plan, try these budgeting tips .

Start by determining your take-home (net) income, then take a pulse on your current spending. Finally, apply the 50/30/20 budget principles : 50% toward needs, 30% toward wants and 20% toward savings and debt repayment.

The key to keeping a budget is to track your spending on a regular basis so you can get an accurate picture of where your money is going and where you’d like it to go instead. Here’s how to get started: 1. Check your account statements. 2. Categorize your expenses. 3. Keep your tracking consistent. 4. Explore other options. 5. Identify room for change. Free online spreadsheets and templates can make budgeting easier.

Start with a financial self-assessment. Once you know where you stand and what you hope to accomplish, pick a budgeting system that works for you. We recommend the 50/30/20 system, which splits your income across three major categories: 50% goes to necessities, 30% to wants and 20% to savings and debt repayment.

Start by determining your take-home (net) income, then take a pulse on your current spending. Finally, apply the 50/30/20

budget principles

: 50% toward needs, 30% toward wants and 20% toward savings and debt repayment.

The key to keeping a budget is to

track your spending

on a regular basis so you can get an accurate picture of where your money is going and where you’d like it to go instead. Here’s how to get started: 1. Check your account statements. 2. Categorize your expenses. 3. Keep your tracking consistent. 4. Explore other options. 5. Identify room for change. Free

online spreadsheets and templates

can make budgeting easier.

Start with a financial self-assessment. Once you know where you stand and what you hope to accomplish, pick a

budgeting system

that works for you. We recommend the 50/30/20 system, which splits your income across three major categories: 50% goes to necessities, 30% to wants and 20% to savings and debt repayment.

Try a simple budgeting plan

We recommend the popular 50/30/20 budget to maximize your money . In it, you spend roughly 50% of your after-tax dollars on necessities, including debt minimum payments. No more than 30% goes to wants, and at least 20% goes to savings and additional debt payments beyond minimums.

We like the simplicity of this plan. Over the long term, someone who follows these guidelines will have manageable debt, room to indulge occasionally, and savings to pay irregular or unexpected expenses and retire comfortably.

The 50/30/20 budget

Find out how this budgeting approach applies to your money.

Your 50/30/20 numbers:

Necessities

Savings and debt repayment

Do you know your “want” categories?

Become a NerdWallet member to track your monthly spending trends, including how much you're allocating to needs and wants.

Allow up to 50% of your income for needs

Your needs — about 50% of your after-tax income — should include:

Basic utilities.

Transportation.

Minimum loan and credit card payments. Anything beyond the minimum goes into the savings and debt repayment category.

Child care or other expenses you need so you can work.

If your absolute essentials overshoot the 50% mark, you may need to dip into the “wants” portion of your budget for a while. It’s not the end of the world, but you'll have to adjust your spending.

Even if your necessities fall under the 50% cap, revisiting these fixed expenses occasionally is smart. You may find a better cell phone plan , an opportunity to refinance your mortgage or an opportunity for less expensive car insurance . That leaves you more to work with elsewhere.

Leave 30% of your income for wants

Separating wants from needs can be difficult. In general, though, needs are essential for you to live and work. Typical wants include dinners out, gifts, travel and entertainment.

It’s not always easy to decide. Are restorative spa visits (including tips for a massage ) a want or a need? How about organic groceries? Decisions vary from person to person.

If you're eager to get out of debt as fast as you can, you may decide your wants can wait until you have some savings or your debts are under control. But your budget shouldn't be so austere that you can never buy anything just for fun.

Every budget needs wiggle room — maybe you forgot about an expense or one was bigger than you anticipated — and some money to spend as you wish. If there's no money for fun, you'll be less likely to stick with your budget.

Commit 20% of your income to savings and debt paydown

Use 20% of your after-tax income to put something away for the unexpected, save for the future and pay off debt balances (paying more than minimums). Make sure you think of the bigger financial picture; that may mean two-stepping between savings and debt repayment to accomplish your most pressing goals.

Many experts recommend you try to build up several months of bare-bones living expenses. We suggest you start with an emergency fund of at least $500 — enough to cover small emergencies and repairs — and build from there.

You can’t get out of debt without a way to avoid more debt every time something unexpected happens. And you’ll sleep better knowing you have a financial cushion.

Get the easy money first. For most people, that means tax-advantaged accounts such as a 401(k). If your employer offers a match, contribute at least enough to grab the maximum. It's free money.

Why do we make capturing an employer match a higher priority than debts? Because you won’t get another chance this big at free money, tax breaks and compound interest. Ultimately, you have a better shot at building wealth by getting in the habit of regular long-term savings.

You don’t get a second chance at capturing the power of compound interest . Every $1,000 you don’t put away when you’re in your 20s could be $20,000 less you have at retirement .

Once you’ve snagged a match on a 401(k), if available, go after the toxic debt in your life: high-interest credit card debt, personal and payday loans, title loans and rent-to-own payments. All carry interest rates so high that you end up repaying two or three times what you borrowed.

If either of the following situations applies to you, investigate options for debt relief , which can include bankruptcy or debt management plans :

You can't repay your unsecured debt — credit cards, medical bills, personal loans — within five years, even with drastic spending cuts.

Your total unsecured debt equals half or more of your gross income.

Once you’ve knocked off any toxic debt, the next task is to get yourself on track for retirement. Aim to save 15% of your gross income; that includes your company match, if there is one.

If you’re young, consider funding a Roth individual retirement account after you capture the company match. Once you hit the contribution limit on the IRA, return to your 401(k) and maximize your contribution there.

Regular contributions can help you build up three to six months' worth of essential living expenses — not your full budget, just the must-pay basics. You shouldn’t expect steady progress because emergencies happen, and that's when you should pull money from this fund. Just focus on replacing what you use and building higher over time.

These are payments beyond the minimum required to pay off your remaining debt .

If you’ve already paid off your most toxic debt, what’s left is probably lower-rate, often tax-deductible debt (such as your mortgage). Tackle these when the more-basic goals listed above are covered.

Any wiggle room you have here comes from the money available for wants or from saving on your necessities, not your emergency fund and retirement savings.

Congratulations! You’re in a great position — a really great position — if you’ve built an emergency fund, paid off toxic debt and are socking away 15% toward a retirement nest egg. You’ve built a habit of saving that gives you immense financial flexibility. Don’t give up now.

Consider saving for irregular expenses that aren’t emergencies, such as a new roof or your next car. Those expenses will come no matter what, and it’s better to save for them than borrow.

WATCH TO LEARN MORE ABOUT BUDGETING

» LEARN: Tips for Canadians on how to budget

on Capitalize's website

Get a custom financial plan and unlimited access to a Certified Financial Planner™ for just $49/month.

- Google Slides Presentation Design

- Pitch Deck Design

- Powerpoint Redesign

- Other Design Services

- Business Slides

- Design Tips

Creating a budget presentation in PowerPoint (+ 12 bonus tips from our best experts)

Investors, lenders, and all the company’s stakeholders are primarily interested in the revenue they get, so they tend to rely on exact numbers before real investments and other contributions. They have many different opportunities to invest in and consequently choose the one that is more likely to win. And that’s precisely when a budget presentation comes in handy as the most effective way to provide a compelling, professional, and differentiated description of the capital they could get after several investments.

If you are wondering how to present budget in PowerPoint, here is a quick guide for you.

How to make a budget for a project in a PowerPoint presentation

First and foremost, a budget presentation PowerPoint has to be clearly targeted toward equity investors and lenders with a lot of appropriate and suitable information. The budget plan presentation should be clear and concise to catch a person’s attention. They are looking for a high-quality project for their portfolio, so you should show you value their time and can fit all necessary info in a couple of sentences, diagrams, graphs, or tables.

Remember, you are the one looking for investors, so your budget presentation PowerPoint slides need to be credible and concise. You can design them on your own using budget presentation PowerPoint templates or opt for the services of a professional presentation agency to save time and sleep.

The main mistakes happen on the statistics and strategy slides of the budget PowerPoint presentation since few of them are easy to follow. Commonly, they are bland, boring, and not able to keep the audience’s attention. It would be frustrating to come up with such a budget planning presentation people worked on for a year.

Numbers. Numbers. Numbers.

But nothing really stands out.

Here’s how to do a good budget presentation:

- Research for previous budget planning PowerPoint presentations to have a confident database to rely on.

- Have a 10-minute conversation with the current team, ask critical questions, try to pull out a story, and incorporate that story in the investment presentation.

- Create a branded company look that resonates with investors. If you are new to presentation design, a pitch deck design service can help develop truly effective budget presentation slides.

- No matter what industry you are in, make a ‘Highlights’ slide that answers all why questions, demonstrates value drivers (+ threats to them), and calls to action.

- Create 3 or 4 different investment options for every investor to find the most affordable asset and proceed to cooperate with you.

- Make your credibility pop out from the proposed budget PowerPoint presentation and leave no questions to potential investors.

Whether you are trying to be compelling, sell assets, or increase your capital – concentrate on the important data and don’t delve into much detail on every budget PowerPoint slide. You would not prefer yawning, attention loss, or refusals from stakeholders, would you?

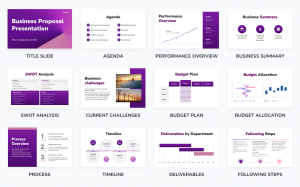

Some potential budget presentation PowerPoint slides include:

- Performance overview.

- Business summary.

- SWOT analysis.

- Current challenges.

- Budget plan.

- Budget allocation.

- Deliverables.

- Following steps.

To make the most out of each PowerPoint budget slide from the list, double-check every number for accuracy, use illustrative diagrams and charts, and, most importantly, keep the entire budget presentation ppt brief. Bear in mind that ten slides are more than enough to outline the problem, the proposed budget, and the exact ways the invested capital will provide a solution.

12 bonus tips on how to show budget in PowerPoint

Below are the top tips from our best experts to help you design a PowerPoint presentation that your investors will definitely remember, so read on!

Tip #1. Put yourself in the shoes of your investor

Before you dive into your PowerPoint budget presentation, take the time to understand your investors, their concerns, and expectations, and tailor your content accordingly.

Tip #2. Key financial metrics are important

These include revenue growth, profitability, revenue forecasts, etc. Clearly demonstrate how their investment will contribute to the success of your company.

Tip #3. Provide detailed financial projections

Be sure to present income and financial statements and visualize complex information with charts and diagrams for easy understanding.

Tip #4. Identify risk factors

Accept potential risks and uncertainties. Describe how your team plans to mitigate these risks and present contingency plans.

Tip #5. Display your budget breakdown

Investors value a clear understanding of spending, so take the time to display your budget breakdown, emphasizing major expenses and capital allocation.

Tip #6. Ensure your ppt is compelling

Structure your budgeting PowerPoint presentation as a narrative, and be sure to detail past successes, current accomplishments, and future potential for the company.

Tip #7. Focus on the ROI

Clearly communicate potential returns on investments to investors. Demonstrate how their investment will contribute to the overall growth and profitability of the company.

Tip #8. Be transparent about your estimates

Being transparent builds confidence and ensures that investors understand the basis for your calculations, so clearly articulate the assumptions underpinning your financial forecasts.

Tip #9. Practice as much as you can

Rehearse your presentation until you feel confident and comfortable delivering it. Anticipate possible questions and prepare thoughtful answers.

Tip #10. Emphasize key milestones and accomplishments

Highlight specific milestones and key accomplishments that the budget aims to achieve. Remember, investors want to see a roadmap to success.

Tip #11. Maintain clarity throughout your slides

In your company budget presentation, be clear about what you are asking from investors, whether it is funding for a specific project, expansion, or any other business need.

Tip #12. Encourage questions and discussion

Encourage investors to ask questions and participate in discussions. This will show that you are open and willing to address your concerns.

By following these tips on how to present a budget, you can create a persuasive presentation that not only effectively presents financial information but also matches the expectations and interests of your potential investors.

Still confused about how to design a budget presentation in PowerPoint?

Don’t hesitate to contact us any time of the day or night! Our design experts are online 24/7 to help take your presentation project to the next level.

#ezw_tco-2 .ez-toc-widget-container ul.ez-toc-list li.active::before { background-color: #ededed; } Table of contents

- Presenting techniques

50 tips on how to improve PowerPoint presentations in 2022-2023 [Updated]

- Keynote VS PowerPoint

Types of presentations

- Present financial information visually in PowerPoint to drive results

PM diary part 2: creating an effective kick off meeting presentation

- Guide & How to's

![how to budget monthly expenses presentation 50 tips on how to improve PowerPoint presentations in 2022-2023 [Updated]](https://slidepeak.com/wp-content/uploads/2021/09/2-1170x372.png)

Got any suggestions?

We want to hear from you! Send us a message and help improve Slidesgo

Top searches

Trending searches

teacher appreciation

11 templates

17 templates

el salvador

32 templates

summer vacation

19 templates

27 templates

Budget Infographics

Free google slides theme, powerpoint template, and canva presentation template.

There are many ways to represent budgets—as many as the amount of infographics we’re bringing to you today! Use them in your business or marketing presentations and make the most of the various designs, including circular charts, text blocks, timelines and pyramids. Everything will make sense!

Features of these infographics

- 100% editable and easy to modify

- 30 different infographics to boost your presentations

- Include icons and Flaticon’s extension for further customization

- Designed to be used in Google Slides, Canva, and Microsoft PowerPoint and Keynote

- 16:9 widescreen format suitable for all types of screens

- Include information about how to edit and customize your infographics

How can I use the infographics?

Am I free to use the templates?

How to attribute the infographics?

Attribution required If you are a free user, you must attribute Slidesgo by keeping the slide where the credits appear. How to attribute?

Related posts on our blog.

How to Add, Duplicate, Move, Delete or Hide Slides in Google Slides

How to Change Layouts in PowerPoint

How to Change the Slide Size in Google Slides

Related presentations.

Premium template

Unlock this template and gain unlimited access

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Prepare a Budget for an Organization: 4 Steps

- 16 Nov 2021

An organization’s budget dictates how it leverages capital to work toward goals. For this reason, the ability to prepare a budget is one of the most crucial skills for any business leader —whether a current or aspiring entrepreneur, executive, functional lead, or manager.

Before preparing your first organizational budget, it’s important to understand what goes into a budget and the key steps involved in creating one.

What Is a Budget?

A budget is a document businesses use to track income and expenses in a detailed enough way to make operational decisions.

Budgets are typically forward-looking in nature. Income is based on projections and estimates for the periods they cover, as are expenses. For this reason, organizations often create both short- (monthly or quarterly) and long-term (annual) budgets, where the short-term budget is regularly adjusted to ensure the long-term budget stays on track.

Access your free e-book today.

Most organizations also prepare what’s known as an “actual budget” or “actual report” to compare estimates against reality following the period covered by the budget. This allows an organization to understand where it went wrong in the budgeting process and adjust estimates moving forward.

Budget vs. Cash Flow Statement

If the definition above sounds similar to a cash flow statement , you’re right: Your organization’s budget and cash flow statement are similar in that they both monitor the flow of money into and out of your business. Yet, they differ in key ways.

First, a budget typically offers more granular details about how money is spent than a cash flow statement does. This provides greater context for making tactical business decisions, such as considering where to trim business expenses.

Related: The Beginner’s Guide to Reading & Understanding Financial Statements

Second, a budget is, quite literally, a tool used to direct work done within an organization. The cash flow statement plays a different role by offering a higher-level overview of how money moves into, throughout, and out of an organization.

Instead of thinking of the two documents as competing, view them as complementary, with each playing a role in driving your business’s performance.

Steps to Prepare a Budget for Your Organization

The steps below can be followed whether creating a budget for a project, initiative, department, or entire organization.

1. Understand Your Organization’s Goals

Before you compile your budget, it’s important to have a firm understanding of the goals your organization is working toward in the period covered by it. By understanding those goals, you can prepare a budget that aligns with and facilitates them.

Related: The Advantages of Data-Driven Decision-Making

For example, consider a business that regularly experiences year-over-year revenue growth that’s offset by rising expenses. That organization might benefit from focusing efforts on better controlling expenses during the budgeting process.

Alternatively, consider a company launching a new product or service. The company may invest more heavily in the fledgling business line to grow it. With this goal, the company may need to trim expenses or growth initiatives elsewhere in its budget.

2. Estimate Your Income for the Period Covered by the Budget

To allocate funds for business expenses, you first need to determine your income and cash flow for the period to the best of your ability.

Depending on the nature of your organization, this can be a simple or complicated process. For example, a business that sells products or services to known clients locked in with contracts will likely have an easier time estimating income than a business that depends on active sales activity. In the second case, it would be important to reference historical sales and marketing data to understand whether the market is changing in a way that might cause you to miss or exceed historical trends.

Related: How to Read & Understand an Income Statement

Beyond income from sales activity, you should include other income sources, such as returns on investments, asset sales, and bond or share offerings.

3. Identify Your Expenses

Once you understand your projected income for the period, you need to estimate your expenses. This process involves three main categories: fixed costs, variable expenses, and one-time expenses.

Fixed costs are any expenses that remain constant over time and don’t dramatically vary from week to week or month to month. In many cases, those expenses are locked in by some form of contract, making it easy to anticipate and account for them. This category usually includes expenses related to overhead, such as rent payments and utilities. Phone, data, and software subscriptions can also fall into this category, along with debt payments. Any expense that’s regular and expected should be included.

Related: 6 Budgeting Tips for Managers

Variable expenses are those your business incurs, which vary over time depending on several factors, including sales activities. Your shipping and distribution costs, for example, are likely to be higher during a period when you sell more product than one when you sell less product. Likewise, utilities such as water, gas, and electricity will be higher during periods of increased use. This is especially true for businesses that manufacture their own products. Sales commissions, materials costs, and labor costs are other examples of variable expenses.

Both fixed expenses and variable expenses are recurring in nature, making it easy to account for them (even if variable expenses must be projected). One-time expenses , also called “one-time spends,” don’t recur and happen more rarely. Purchasing equipment or facilities, developing a new product or service, hiring a consultant, and handling a security breach are all examples of one-time expenses. Understanding major initiatives—and what it will take to accomplish them—and what you’ve spent in previous years on similar expenses can help account for them in your budget, even if you’re unsure of their exact values.

4. Determine Your Budget Surplus or Deficit

After you’ve accounted for all your income and expenses, you can apply them to your budget. This is where you determine whether you have enough projected income to cover all your expenses.

If you have more than enough income to cover your expenses, you have a budget surplus. Knowing this, you should determine how to use additional funds best. You may, for example, move the money into a rainy day fund you can access should your actual income fall short of projections. Alternatively, you may deploy the funds to grow your business.

On the other hand, if your expenses exceed your income, you have a budget deficit. At this point, you must identify the best path forward to close the gap. Can you bring in additional funds by selling more aggressively? Can you lower your fixed or variable expenses? Would you consider selling bonds or shares of company stock to infuse the business with additional capital?

An Important Financial Statement

The person responsible for generating a budget varies depending on an organization’s nature and its budgetary goals. An entrepreneur or small business owner, for example, is likely to prepare an organizational budget on their own. Meanwhile, a larger organization may rely on a member of the accounting department to generate a budget for the entire business. Individual department heads or functional leads might also be called on to submit budget proposals for their teams.

With this in mind, anyone who aspires to start their own business or move into an organizational leadership position can benefit from learning how to prepare a budget.

Do you want to take your career to the next level? Consider enrolling in our eight-week Financial Accounting course or three-course Credential of Readiness (CORe) program to learn financial concepts that can enable you to unlock critical insights into business performance and potential. Not sure which course is right for you? Download our free flowchart .

About the Author

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories