Best Practices for Creating a Top-Notch Investment Presentation

Raising venture capital is difficult. On top of having a business or product that a VC finds “fundable,” you need to have a system in place to raise capital. This includes everything from identifying the right investors to pitching investors to nurturing investors.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Inevitably, you will have to present or pitch to investors over the course of a fundraise (typically using a pitch deck ). To learn more about how to best pitch and present to your potential investors, check out our tips below:

What is the purpose of an investment presentation?

An investment presentation or pitch is a tool to help founders share their company story and vision with investors. An investor presentation is a visual representation of your company narrative and includes things like metrics, roadmaps, team members, etc.

Kristian Andersen of High Alpha breaks down how founders should think about crafting their pitch deck and story below:

Related Resource: Tips for Creating an Investor Pitch Deck

How long should an investment presentation be?

There is no exact answer when it comes to determining the length of your pitch deck. Different businesses and pitches will require different pitch decks, but we have found that as a rule of thumb founders should shoot for a pitch deck that is 12 slides or less.

We studied our own data from our pitch deck sharing tool and found that the average number of slides in a pitch deck (where 100% of slides were viewed) was 12.2 slides.

Related Resource: Pitch Deck 101: How Many Slides Should My Pitch Deck Have?

Many investors agree with somewhere between the 10 to 15 slide range as well. Alex Iskold of 2048 recommends a short pitch deck that should be 10 or fewer slides.

What your pitch deck should look like for your investment presentation

As we mentioned previously, every business is different. The needs for different slides and narratives will differ from business to business. However, there are a few slides that are typically used regardless of the business. Check out a few popular pitch deck slides below:

1) Discuss the company overview

First things first, clearly present your company and what you do. This should be easy to digest and understand for the investors you are pitching.

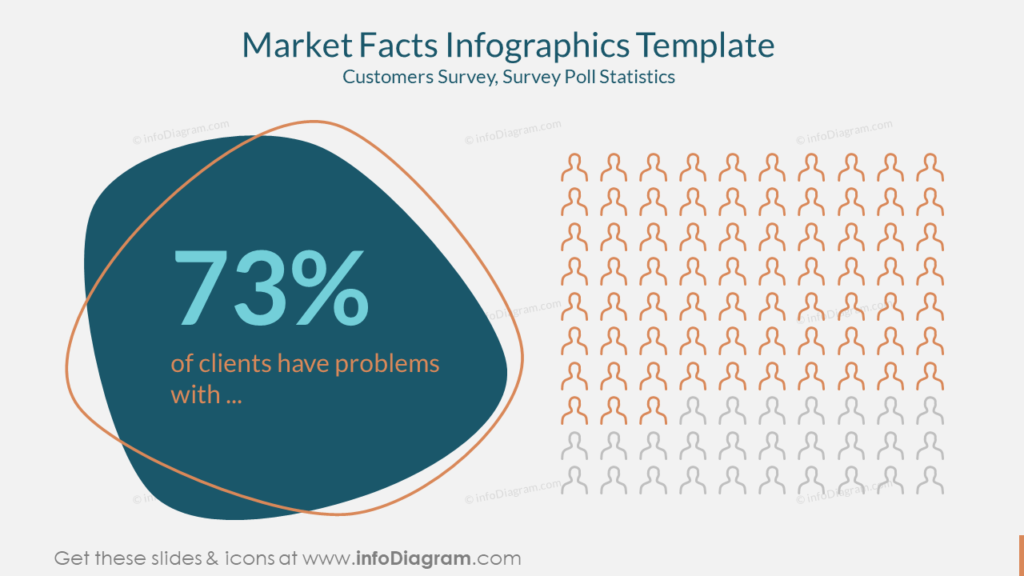

2) Present the problem

Use data, stories, or a compelling way to present the problem you are solving. Ideally, you’d like your audience to feel the problem or have a good grasp of others experiencing the problem.

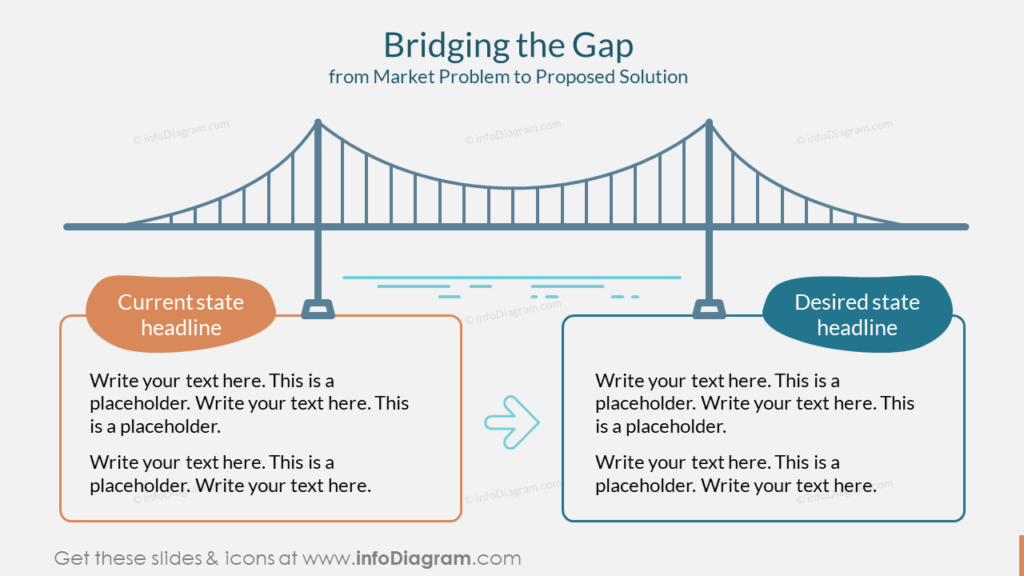

3) Present your solution

Once investors understand the problem you are tackling, you need to lay out how your solution solves the problem. Make the case why you and your solution are the ones to solve the problem.

4) Highlight the target market

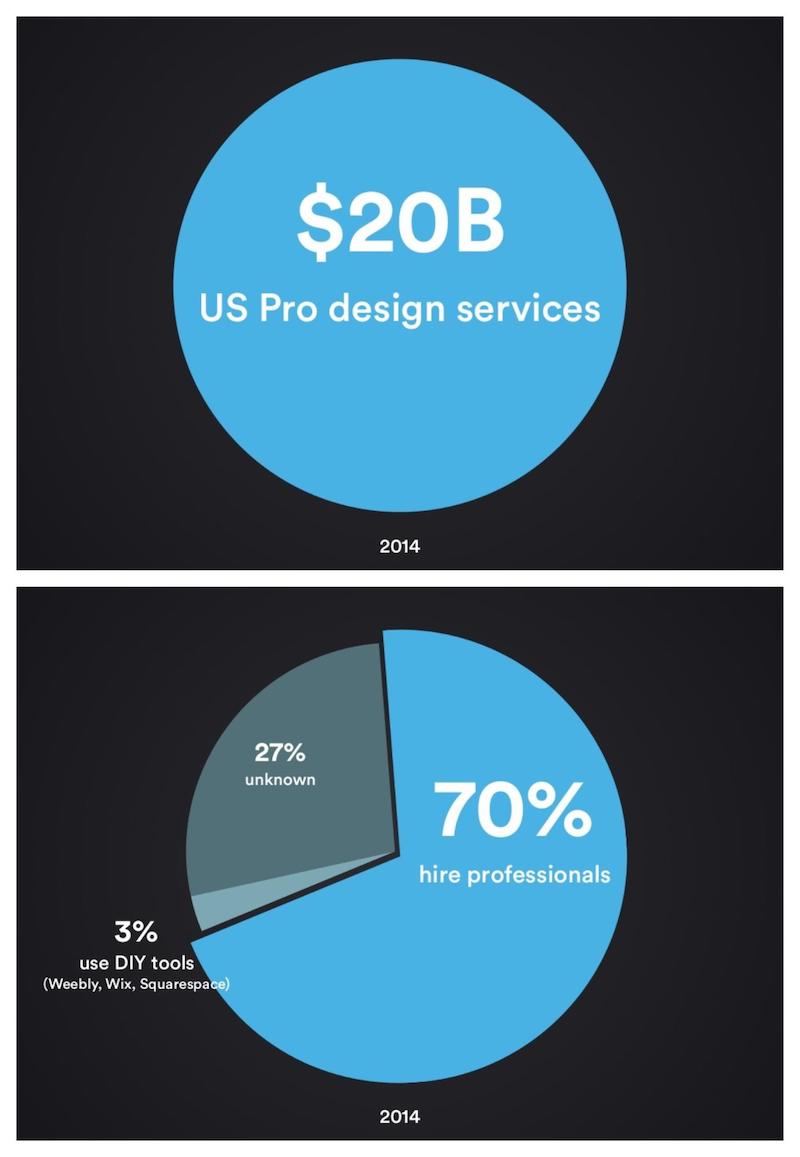

Next, lay out the target market and what your ideal customer looks like. This can help investors answer the “why now?” question.

5) Illustrate the market opportunity

At the end of the day, investors want to invest in companies that can turn into huge companies. Demonstrate the market and how it is (or has the opportunity) to become a large market.

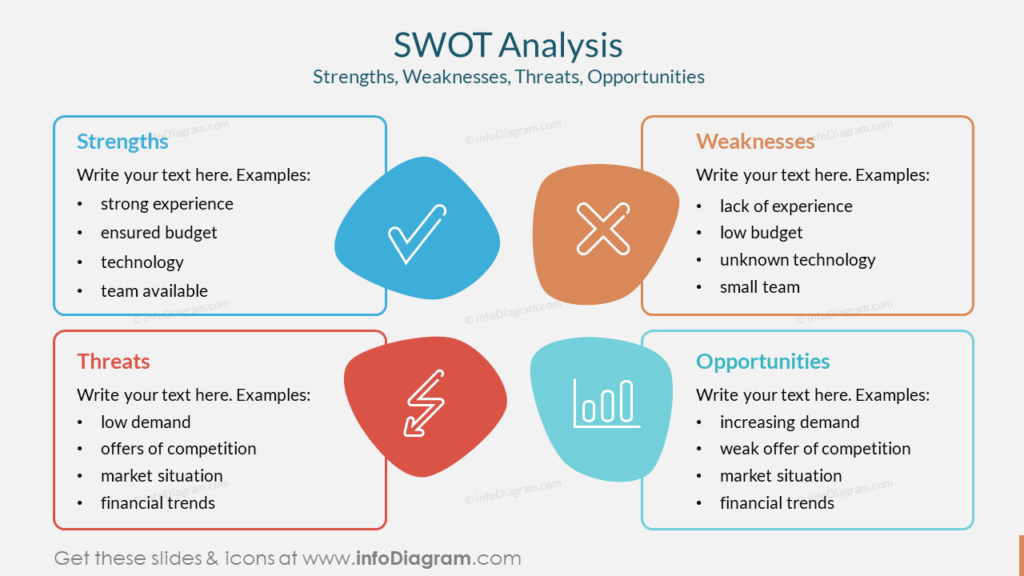

6) Identify the competition

Investors will want to understand the space. Lay out your competitors and explain how you are different and better than them.

7) Showcase your product

Next, showcase the status of your product and future plans. Use data or customer stories to share how awesome your product is.

8) Share why your team is the one to solve the problem

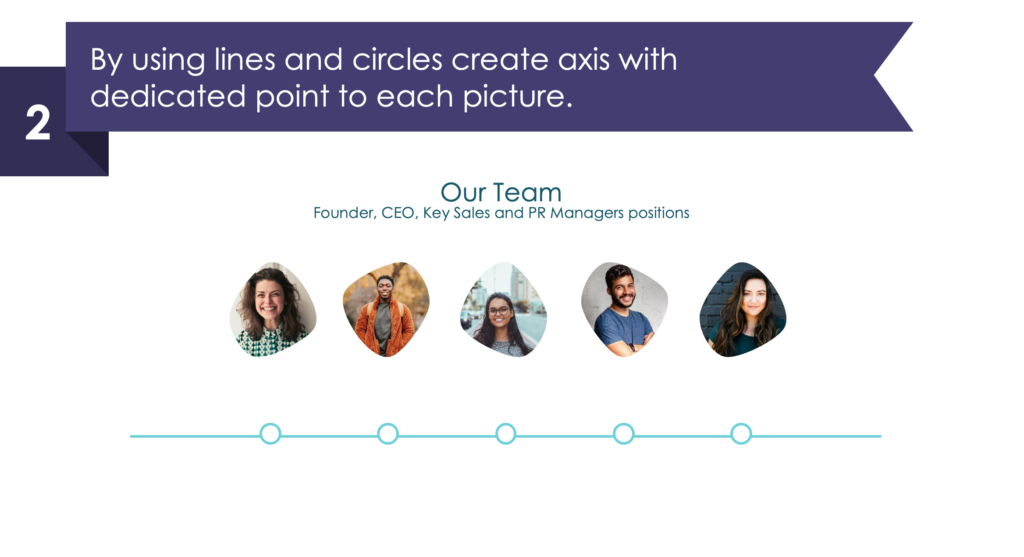

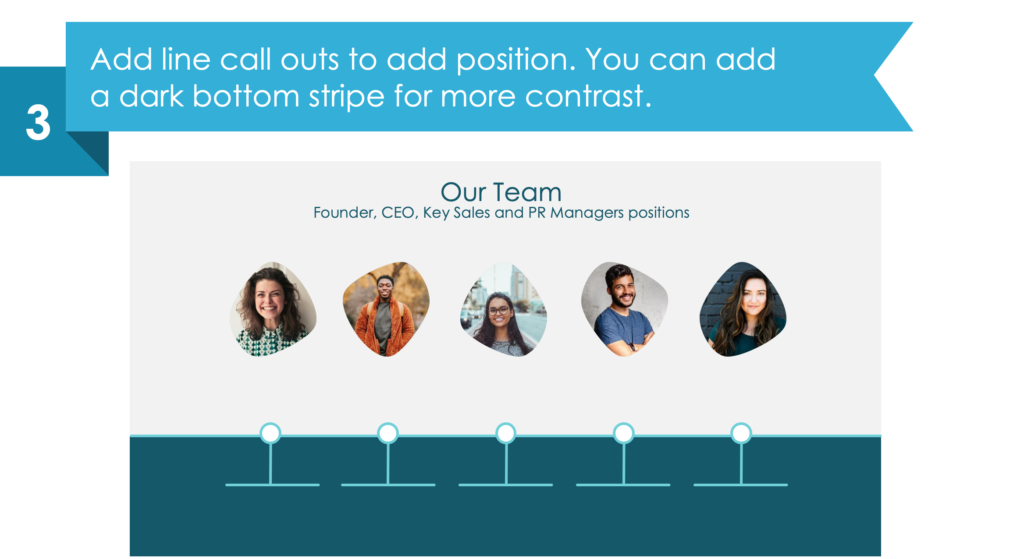

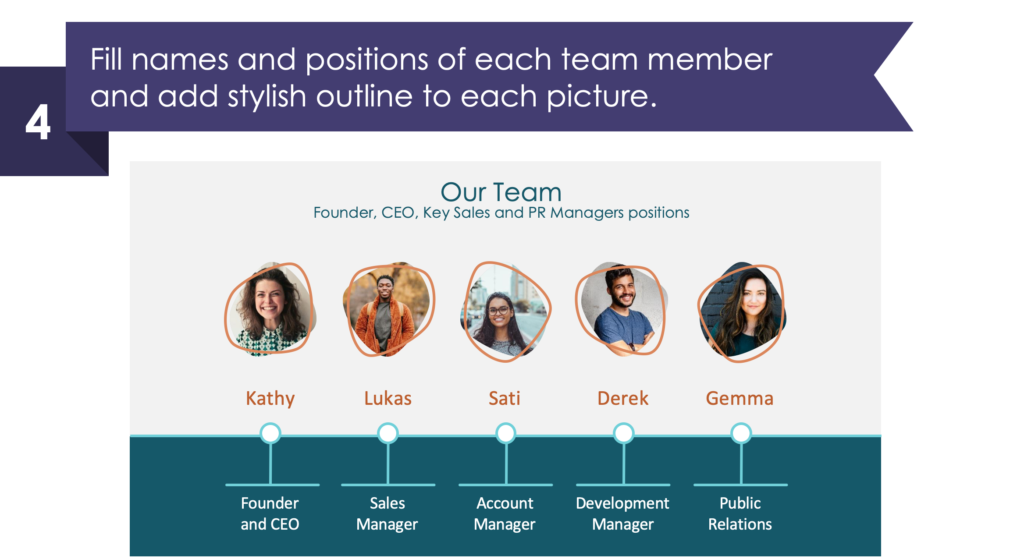

Show your executive team members and share their relevant experience and skills so investors understand why your team is fit to execute the problem and the solution.

9) Explain your business model and marketing strategies

Investors want to know that your business has a clear plan and strategy to generate revenue. Clearly lay out your acquisition strategy and sales & marketing efforts to date so investors can understand how your business will attract and close new customers.

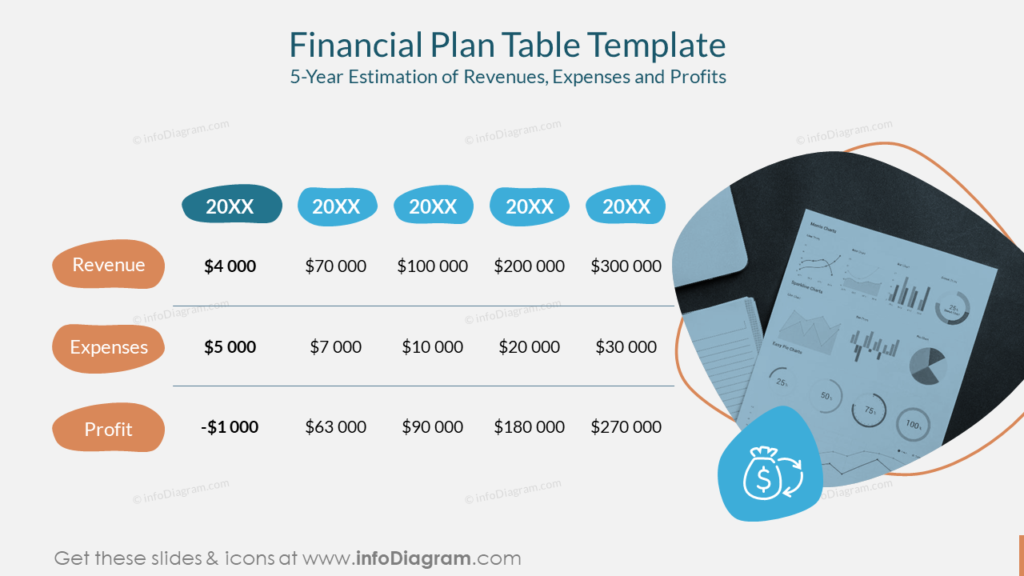

10) Present financial data and metrics

Of course, investors want to see the data and metrics behind your business. Lay out key financial and core metrics so investors know the status of your business.

Qualities investors want to see

An investor’s job is to generate returns for their investors (limited partners, LPs). What investors look for in a potential investment will vary from firm to firm but we laid out a few of the common attributes investors want to see in a founder and their business below:

- Large market

- Clear customer acquisition strategy

- Experienced team

- Strong leadership

- Traction and growth

- Coachability

Of course, those are just a few of the traits investors will look for in a founder or startup. Different investors will place a different level of importance on different attributes. It is important to understand what an investor looks for in an investment and tailor your pitch to them.

Related Resource: Startup Metrics You Need to Monitor

Best practices for a top-notch investor presentation

As we’ve mentioned, different investors will look for different attributes in a presentation. However, most things investors look for can be boiled down to a few key areas. Below we lay out a few best practices for putting together a top-notch investor presentation.

Practice your pitch

This should go without saying but make sure you practice your pitch. You should know the ins and outs of your presentation and business. Of course, practicing in front of a mirror or friend can only go so far.

Some founders and investors recommend “ranking” your investors before approaching investors. E.g. Tier 1 investors are the best fit, Tier 3 are less of a fit for your business. If you rank your investors you’ll be able to spend some of your earliest pitches on “Tier 3” (or lower fit) investors to dial in your pitch and prepare for your pitches with better fit investors later on in your fundraise.

Related Resource: How to Pitch a Perfect Series B Round (With Deck Template)

Keep your message simple and clear

Investors see hundreds or thousands of pitches over a given year. Being able to clearly articulate your message and pitch is a surefire way to remove any confusion. By keeping your message simple and clear, you’ll remove any back-and-forth wasted on small details and be able to spend time on what matters most — having a conversation about your business.

Find ways to connect with the investors

At the end of the day, a founder is selling their company to potential investors. Like a good sales process, a good investor pitch starts by building a relationship and trust. When pitching potential investors, find ways to connect with them in advance of the pitch. This could be everything from following and interacting with them on Twitter to going to in-person events where they are present.

Highlight early successes and wins

Get potential investors excited about your business by sharing early successes and wins. This will get the presentation off on the right foot and allow everyone to build excitement around your business. Of course, try to back up your early successes and wins with data when possible.

Know your metrics

Inevitably, investors will want to dig into the metrics and data behind your business. For most investors, this is used to evaluate your business and could be considered the best predictor of success for your business.

However, metrics can also be a barometer for how well you know your business. You don’t need to remember every data point behind your business but need to know how different metrics are calculated and what causes any major fluctuations.

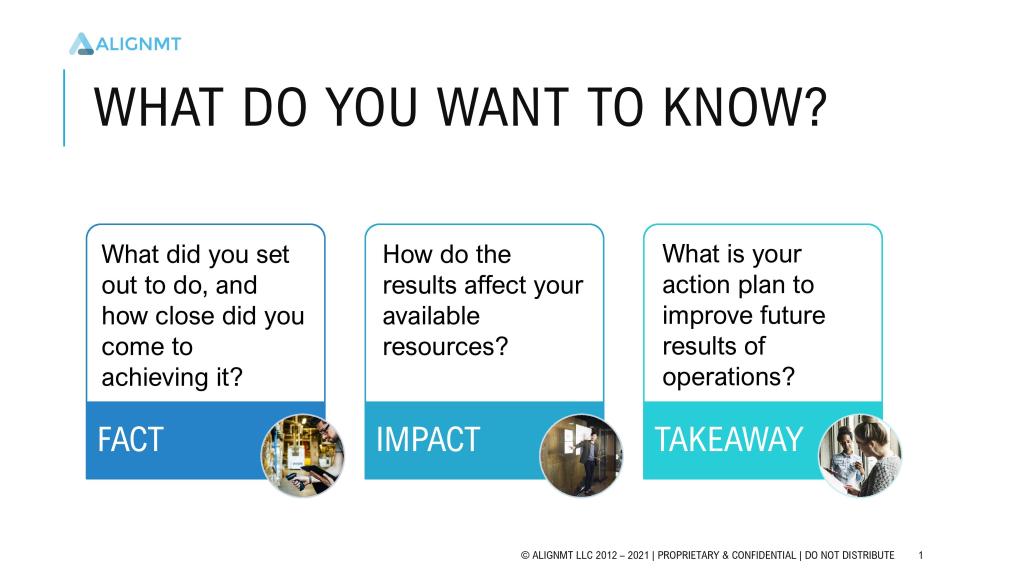

Include engaging visuals and graphics

An investor presentation is a tool used to pitch your business. In order to best engage with your audience, you should aim to have engaging visuals and graphics throughout your presentation. Of course, the underlying data is what is most important but having engaging and easy-to-understand visuals and graphics is a great way to support and improve your pitch.

Leave time for questions

The best pitches and presentations tend to be more conversational. You’ll want to balance feeding your investors with the material they need and also be able to have a constructive conversation about your business. By coming prepared, having a clear and simple presentation, and engaging with your investors beforehand is a surefire way to have a conversation about your business.

Communicate before your presentation

Investors need months of data and interactions to make a decision about a potential investment. In order to best help investors build conviction and have more meaningful conversations, make sure you are engaging with potential investors on a regular basis. This can be in the form of your monthly investor updates or sharing your pitch deck in advance before a meeting.

Sharing your pitch deck in advance of a meeting is a hot topic. Some investors will say you should and some will say the opposite. At the end of the day, it is important for you to feel out the investor and do what you believe is best for you and your business.

Related Resource: 18 Pitch Deck Examples for Any Startup

In-person vs remote investment presentations

Before 2020, investment presentations were generally in-person. However, since the way we work has shifted so have investment presentations. Investors are largely open to receiving pitches and making investment decisions via a remote presentation. Learn more about the pros and cons of both in-person and remote presentations below:

In-person presentation

Before 2020, in-person presentations were the go-to for investment presentations. In-person presentations come with both pros and cons. On the positive side, in-person presentations are typically a better way to build relationships and will make sure an investor’s time is undivided.

On the other hand, in-person presentations can be expensive (both financially and time-wise) for an early-stage startup founder that might not have the resources to travel across the country. This will likely limit the number of potential investors that a founder can meet with over the course of a fundraise.

Remote presentation

Remote presentations and investor pitches have risen in popularity since COVID. Many investors are becoming comfortable with investing in companies remotely and is largely accepted by most investors. Like in-person presentations, remote presentations come with their own unique set of pros and cons.

On the positive side, remote presentations allow founders to meet with more investors as it is more viable financially (and time-wise) to meet with investors remotely. On the flip side, some individuals might find that developing a relationship remotely is more difficult and can take more meetings and a different style of communication to build trust.

Share your pitch deck with Visible

With our suite of fundraising tools, you can easily find investors , share your pitch deck, and track your fundraising funnel. Learn more about our pitch deck sharing tool and give it a free try here .

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Graphic Design 30+ Best Pitch Deck Examples, Tips & Templates

30+ Best Pitch Deck Examples, Tips & Templates

Written by: Ryan McCready Jul 04, 2023

A startup is, by definition, a fast-growing company. And to grow you need funding.

Enter the pitch deck.

In this post, we’ll look at the best startup pitch deck templates from heavy-hitters such as Guy Kawasaki, Airbnb, Uber and Facebook. We’ll also uncover the secrets of their successful startup pitch decks, and how you can leverage them to attract investor dollars, bring on new business partners and win new client contracts.

Haven’t created a winning pitch deck before? Then, use Venngage’s Presentation Maker to easily edit the templates — no technical expertise required.

Table of contents (click to jump ahead):

- What is a pitch deck?

30 pitch deck examples for businesses

What makes a good pitch deck, what is the difference between a pitch deck vs business plan, pitch deck faq, create a pitch deck in 4 easy steps, what is a pitch deck .

A pitch deck is a presentation created to raise venture capital for your business. In order to gain buy-in and drum up financial support from potential investors, these presentations outline everything from why your business exists, to your business model, progress or milestones , your team, and a call-to-action.

The best startup pitch decks can help you:

- Prove the value of your business

- Simplify complex ideas so your audience can understand them (and get on board)

- Differentiate your business from competitors

- Tell the story behind your company to your target audience (and make that story exciting)

What is a pitch deck presentation?

A pitch deck presentation is a slideshow that introduces a business idea, product, or service to investors. Typically consisting of 10–20 slides, a pitch deck is used to persuade potential investors to provide funding for a business. It serves as a comprehensive overview of your company, outlining your business model, the problem you solve, the market opportunity you address, your key team members, and your financial projections.

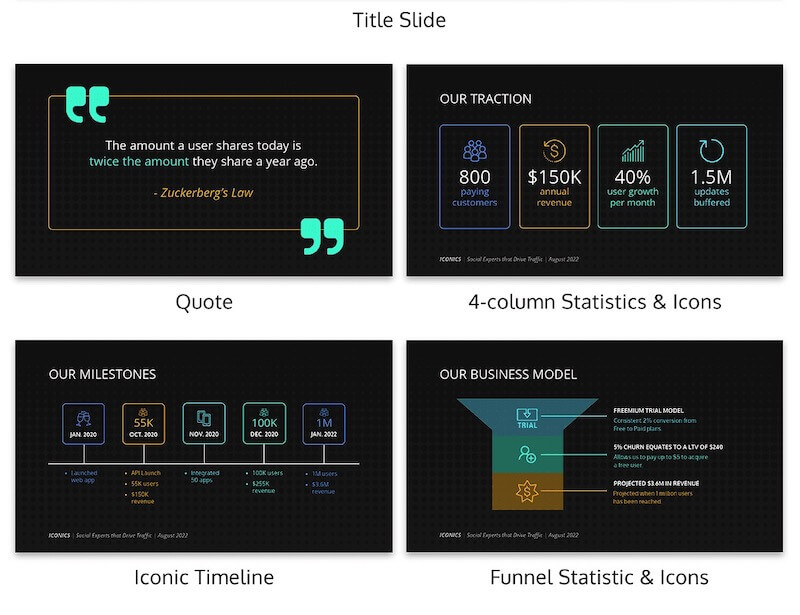

1. Buffer pitch deck

Industry: Social Media Management

Business model: Subscription-based SaaS (Software as a Service)

Amount raised: $500k, according to Buffer’s co-founder Leo Widrich .

Location: San Francisco, California, USA

Website: Buffer.com

Key takeaway : The traction slide was key for Buffer: it showed they had a great product/market fit. If you have great traction, it’s much easier to raise funding.

What’s interesting about Buffer’s pitching process was the issue of competition, as that’s where many talks stalled. Investors became confused, since the social media landscape looked crowded and no one was sure how Buffer differed.

Eventually, they created this slide to clear the air:

To be frank, I’m still confused by this addition to the Buffer pitch deck, but perhaps their presentation would have cleared things up.

In any case, we’ve recreated Buffer’s pitch deck with its own traction, timeline and competitor slides, plus a clean new layout and some easy-to-customize icons:

Design tip : don’t forget to add a contact slide at the end of your pitch deck, like in the business pitch example below.

Because sometimes you’re going to pitch to a small room of investors. Other times, it will be to an auditorium full of random people in your industry. And I can guarantee that not everyone is going to know your brand off the top of their head.

You should make it extremely easy for people to find out more info or contact your team with any questions. I would recommend adding this to the last slide, as shown below.

Alternatively, you could add it to the slide that will be seen the longest in your pitch deck, like the title slide. This will help anyone interested write down your information as event organizers get things ready.

Related: Creating a Pitch Deck? 5 Ways to Design a Winner

2. Airbnb pitch deck

Industry: Hospitality, Travel, and Technology

Business model: Online marketplace (peer-to-peer) for lodging and travel experiences

Amount raised: $20k at three months and $600k at eight months (seed), according to Vator .

Website: airbnb.com

Key takeaway: A large marketplace, impressive rate of traction and a market ready for a new competitor are the factors which made Airbnb stand out early on, says Fast Company. The organization’s slide deck clearly demonstrates these points.

Your pitch deck should explain the core information in your business plan in a simple and straightforward way. Few startups have done this as well as Airbnb.

We’ve re-designed Airbnb’s famous deck as two light and airy sample pitch deck templates. The focus here is on engaging visuals, with minimal text used.

Airbnb fundraising slide deck

This type of deck is also called a demo day presentation . Since its going to be viewed from a distance by investors while you present, you don’t need lots of text to get your message across. The point is to complement your speech, not distract from it.

Another great thing about Airbnb’s fundraising slide deck format is that every slide has a maximum of three sections of information:

As one of the most popular presentation layouts , the rule of three design principle has been drilled into my head. And for good reason!

Here’s one of the slides that demonstrates why this pitch deck design tip works:

VIDEO TUTORIAL: Learn how to customize this pitch deck template by watching this quick 8-minute video.

Minimalist Airbnb pitch deck template

This simple sample pitch deck template is clean and incredibly easy to customize, making it perfect for presentation newbies.

Don’t forget to insert your own tagline instead of the famous “Book rooms with locals, rather than hotels” slogan. Hint: your tagline should similarly convey what your business offers. Airbnb’s pitch deck offers up tantalizing benefits: cost savings, an insider’s perspective on a location and new possibilities.

Design tip : Click the text boxes in our online editor and add your own words to the pitch decks. Duplicate slides you like, or delete the ones you don’t.

Related: How to Create an Effective Pitch Deck Design [+Examples]

3. Uber pitch deck

Industry: Transportation, Technology, and Logistics

Business model: On-demand transportation network and logistics platform

Amount raised: $1.57M in seed funding in 2010, reports Business Insider .

Website: uber.com

Key takeaway : Successful pitch decks clearly highlight the key pain point (the inefficiency of cabs) and a tantalizing solution (fast, convenient 1-click ordering).

Uber co-founder Garrett Camp shared the company’s very first pitch deck from 2008 via a Medium post .

While there’s a surprising amount of text, it still manages to hit on every major part of their business plan succinctly — including key differentiators, use cases and best/worst-case scenarios.

Want something similar? We’ve updated the classic Uber pitch deck template with a sharp layout:

Uber investor deck

Many of the best pitch deck presentations out there are rather brief, only covering a few main points across a handful of slides. But sometimes your deck needs to provide more information.

There’s nothing wrong with having a longer investor pitch deck, as long as you switch up the slide layouts throughout — no one wants to see basically the same slide (just with different metrics or points) 25 times over.

This sample pitch deck template we created based on the infamous Uber deck has 20 or more slides and a diversity of layout options:

Design tip : Replace the photos with your own or browse our in-editor library with thousands of free professional stock images. To do so, double click any image to open our “replace” feature. Then, search for photos by keyword.

Blue Uber slide deck

In this navy version of the Uber pitch deck template, we’ve added bright colors and creative layouts.

Again, it’s easy to swap out the icons in our online editor. Choose from thousands of free icons in our in-editor library to make it your own.

Related : 9 Tips for Improving Your Presentation Skills For Your Next Meeting

4. Guy Kawasaki pitch deck

How much did they raise? Guy Kawasaki’s Garage Capital raised more than $315 million dollars for its clients, according to one estimate .

Key takeaway : Avoid in-depth technical discussions in your pitch deck. Focus on the pain point you’re solving, how you’ll solve it, how you’ll make money and how you’ll reach custvomers.

Guy Kawasaki’s 10 slide outline is famous for its laser focus. He’s renowned for coining the 10/20/30 rule : 10 slides, 20 minutes and no fonts smaller than 30 point.

While you may be tempted to include as much of your business plan as possible in your pitch deck, his outline forces you to tease out your most important content and engage investors or clients within a short time span.

We’re recreated his famous outline in two winning templates you can adapt and make your own:

Gradient Guy Kawasaki pitch deck

This clean pitch deck template has all the sections you need and nothing you don’t.

Kawasaki’s format steers you towards what venture capitalists really care about : problem/solution, technology, competition, marketing plan, your team, financial projections and timeline.

Read our blog post on persuasive presentations for more design and speaking tips.

Design tip : Quickly add in charts and graphs with our in-editor chart maker. You can even import data from Excel or Google sheets.

Blue Guy Kawasaki pitch deck

This more conservative pitch deck template design keeps all the focus on the core information.

Remember: opt for a 30-point font or larger. This will force you to stick to your key points and explain them clearly. Anything smaller, and you’ll risk losing your audience — especially if they’re busy reading while tuning out what you’re actually saying.

5. Sequoia capital pitch deck

How much did they raise? Sequoia Capital is actually a Venture Capital firm. According to TechCrunch , they’ve raised almost $1B for later-stage U.S. investments.

Key takeaway : “If you can’t tell the story of the company in five minutes, then you’re either overthinking it or you haven’t simplified it down enough.” – Mike Vernal, Sequoia Capital

VC firm Sequoia Capital has its own 10-slide pitch deck format to rival Guy Kawasaki’s famous example that we’ll take a look at a little later on. Its highly-curated, clarified format shines a spotlight on innovative ideas.

As the video above suggests, effectively communicating your mission, not just listing features, is key. Below is our take on the Sequoia Capital pitch deck example; you’ll find it clean, clear and easy to create.

Design tip : Click the blue background and select a new color from our color wheel (or one of your own brand colors via My Brand Kit, available with Venngage for Business ) to create a pitch deck with your branding.

Related: How to Make Successful Financial Pitch Decks For Startups

Blue and pink iconics pitch deck

Ready to try it for yourself? Add a pop of color to your version of the Sequoia pitch deck template with this pink and blue slide deck. The contrasting colors will make your information stand out.

6. Facebook pitch deck

How much did they raise? $500K in angel funding from venture capitalist Peter Thiel (first round).

Key takeaway : If you don’t have revenue traction yet, lean heavily on other metrics , like customer base, user engagement and growth. Use a timeline to tell a story about your company.

The best pitch decks tell the real story about your company or brand. You should not only want to sell the audience on your product but also on the hard work you’ve done building it from the ground up.

Design tip: Try data visualizations to relay a company or product timeline . Since people are familiar with the format and know how to read them quickly, you can convey the information impactfully and save room while you’re at it.

Here, Facebook’s classic pitch deck shows the incredible schools that’ve already signed on and describe when future launches will happen.

The sample pitch deck template featured below shows another example of a company or product timeline . This would have been a great fit in the Facebook pitch deck, don’t you think?

Plus you can summarize a ton of information about your brand on a single slide. Check out how well the timeline fits into this pitch deck template below:

If the designer wouldn’t have used a timeline, the same information could have been spread over five or six extra slides! Luckily, Venngage’s timeline maker can help you visualize progress across a period of time without any design experience required.

7. TikTok Pitch Deck

How much did they raise? $150.4M in funding in 2014 (back when TikTok was called Musical.ly), says Crunchbase .

Key takeaway : Use icons as visual anchors for written information.

(The full slide deck is available to Digiday subscribers , though you can view some of the key slides in this Medium post . Keep in mind: this TikTok pitch deck was created for potential advertisers, not investors. No other TikTok pitch decks are publicly available.)

What TikTok does really well in the above example is use icons as visual anchors for their stats. (I could write a whole article about using icons in your presentations correctly. There are so many ways you can use them to upgrade your slides.)

If you’re not sure what I’m talking about, just look at the slide deck template below.

Each of the main points has an icon that gives instant visual context about what the stat is about to the audience. These icons draw the eye immediately to these important facts and figures as well.

Design tip: Remember to use icons that have a similar style and color palette. Otherwise, you run the risk of them becoming a distraction.

8. Y Combinator pitch deck

How much did they raise? This startup accelerator has invested in over 3,500 startups to date, according to the company website . They state their combined valuation nears $1 trillion.

Key takeaway : Create clear, concise pitch deck slides that tell a story investors can understand in seconds.

The classic Y Combinator pitch deck is incredibly simple, and for good reason. Seed stage companies can’t provide much detail, so they should focus on telling a story about their company.

That means your slides should tell a story investors can immediately understand in a glance.

Note that one of Y Combinator’s key components is the problem (above) and solution (below) slides.

Explaining how your startup is going to solve a pain point is a vital part of any slide deck. According to Y Combinator , startups should use the problem slide to show the problem your business solves, and how this problem currently affects businesses and/or people. Additionally, if you’re starting a new startup, forming an LLC could be a great choice to launch your business in the right direction, especially if you are focused on asset protection .

Without that information, investors are going to be left with more questions than answers.

The solution slide should show the real-world benefits of your product/service. I recommend using data visualization to show traction, like the chart above, with a couple of notes for context.

To ensure your problem and solutions slides are easily understood, use a similar layout for both, as shown below.

This will help the audience quickly recall the main problem you want to solve, and connect it to your solution (even if the slides are separated by a few other points or ideas).

9. Front pitch deck

How much did they raise ? $10M in Series A funding

Key takeaway : Use a simple flowchart to visualize a problem your product/service solves.

Not everyone is going to be able to explain their problem and solution as succinctly as the previous examples. Some will need to take a unique approach to get their point across.

That’s why I want to highlight how Front masterfully communicated the problem to be solved. They likely realized it would be a lot easier (and cleaner) to create a flow chart that visualizes the problem instead of text. (Did I mention you can make your own flowcharts with Venngage?)

Also, I really like how they distilled each down to a single phrase. That approach, combined with the visuals, will help it stick in investors’ minds as one of the best pitch decks.

Here’s another example pitch deck that uses a chart to convey their problem/solution:

It splits the competition slide right down the middle to illustrate the differences. It also shows exactly how the processes differ between the two entities using mini flowcharts.

Helping the audience make the right conclusions about your company should be an important part of your pitch deck strategy. Without saying a word, the visual choices you make can greatly impact your message.

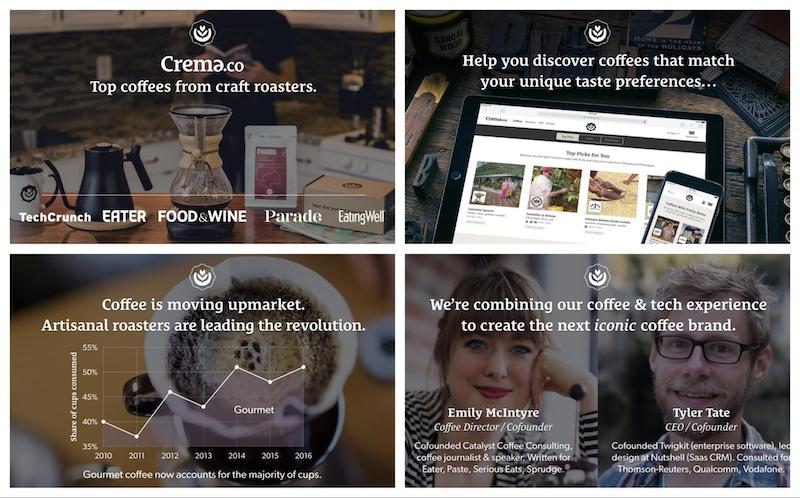

10. Crema pitch deck

How much did they raise? $175K in seed funding .

Key takeaway : Choose background images carefully — making sure they have a similar color palette.

The best pitch decks keep things consistent, mainly because there are so many moving parts in any presentation. You want each of your slides to feel like they’re connected by a singular feeling or theme. An out-of-place presentation background image can throw that off.

Keeping things consistent when you use a solid background color or pattern isn’t hard. But things can get tricky if you want to use different photos for your backgrounds.

However, if you pick presentation background images that have a similar color palette, you’ll be fine. Check out the images Crema used in their startup pitch deck below:

If you’re struggling to find exactly the same colored photos, you can use a color filter to make things more uniform.

11. WeWork pitch deck

How much did they raise? $6.9M in seed funding in 2011, says Crunchbase .

Key takeaway : Put your metrics on display.

The behemoths at WeWork still have one of the best software pitch decks, despite recent troubles (layoffs, and a valuation that dropped from $47 billion to $2.9 billion).

In fact, this investor pitch deck actually helped them raise money at a $5 billion valuation.

My favorite thing from this is how their key metrics are on the second slide. They waste no time getting down to business!

A lot of the time brands hide these metrics at the end of their presentation, but WeWork made sure to put it front and center in their slide deck.

This approach puts the audience in a positive state of mind, helping them be more receptive to the pitch.

12. Crew (Dribble) pitch deck

How much did they raise? $2M in seed funding

Key takeaway : Start your presentation with a simple statement to set the tone.

Sometimes you have to set the mood of the room before you jump into your slide deck. A simple way to do this is by adding a powerful statement or famous quote at the beginning of your slides.

This may sound cliche, but the creatives over at Crew (now Dribbble ) used this approach well in their pitch presentation.

By claiming that every business is an online business, they instantly change the way that people think about the business sector.

Additionally, the designers used this straightforward statement to set up the rest of the presentation. In the next few slides, the potential market is explained. Without the statement, I don’t think these numbers would be as impactful.

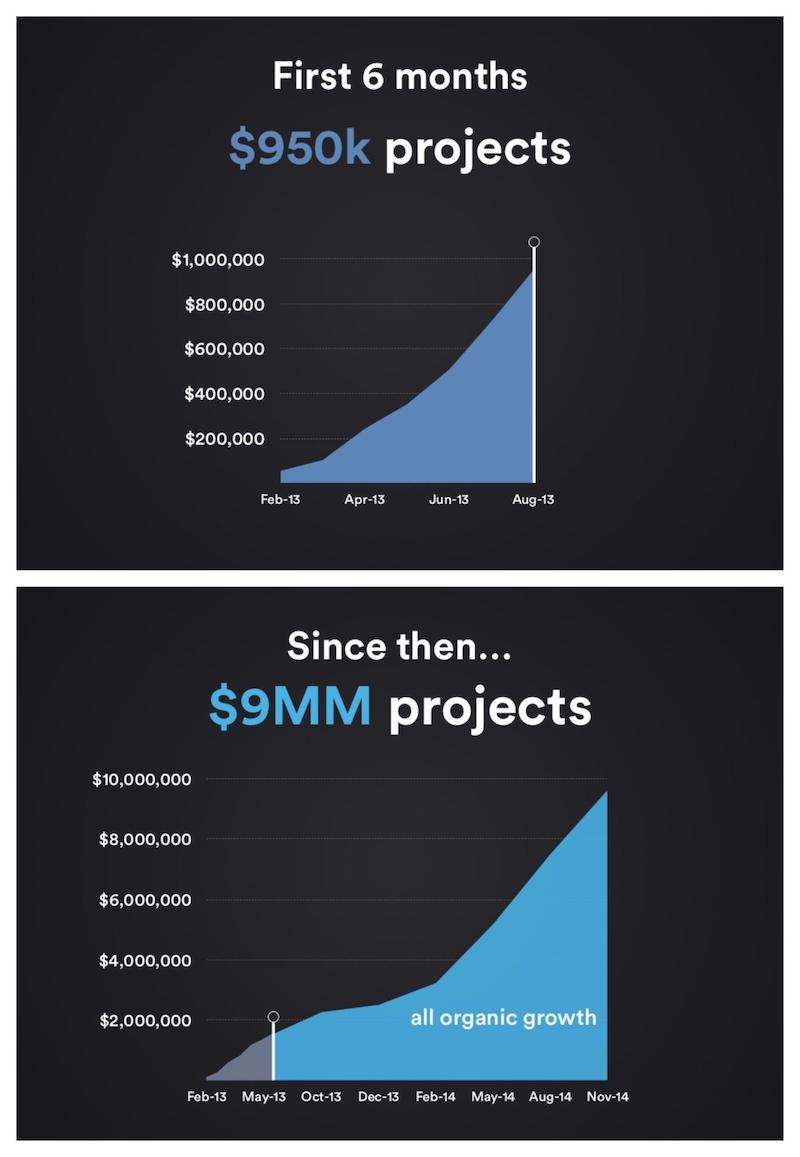

Let’s take a look at the graphs and charts the Dribble team used in their slide deck. In the below business pitch example, you can see that the line charts use the same color palette, size, and typography.

One of my favorite tips from my presentation ideas roundup article states you should never make the audience do the math.

You can also use this mantra when you’re adding data visualizations to your slides. Make each slide extra easy to consume, as well as, easy to compare to other visualizations.

Below the pie charts use the exact same color palette, size, and typography as well:

If the designers would have used a different example, the audience would be distracted trying to decipher the information.

But consistent design across multiple visualizations will ensure your audience can make comparisons that lead to the right conclusions.

Pro Tip: You can use a comparison infographic to summarize key points you’re comparing.

13. Aspire Food Group pitch deck

How much did they raise? $1M from the Hult Prize in 2013 to scale their project.

Key takeaway : Simple graphics clearly illustrate the problem (food security), the size of the market and Aspire’s unique farming project (spoiler alert: it’s insects).

Nonprofits pitching donors or social enterprises pitching for funding have a slightly different challenge than other organizations. They need to present a unique solution and make an emotional connection to their audience.

Aspire’s simple pitch deck graphics allow investors to grasp their unique business idea at a glance. Plus, by introducing the audience to one of their customers and describing how insect farming has impacted her food budget, the concept is made relatable to many.

Another simple design hack is to choose a unique background for your nonprofit or social enterprise pick deck. Take this sample pitch deck template:

There are millions of stock photos out there for you to pick from, so finding one that will work shouldn’t be too hard.

However, when you’re picking your presentation background images , it’s important to make sure it matches your message or brand.

In the above example, the pitch deck’s slightly crumpled paper background fits an eco-friendly startup well. Especially because eco-friendly living and minimalism share similar tenants.

Another great example is this sponsorship pitch deck above. It elevates the message by opting for a simplistic background choice.

With a beautiful yet minimalistic slide deck like this, who wouldn’t want to donate?

Most of the time your pitch deck background images are supposed to be used in a supporting role. However, you can also design your presentation around the background images to create some of the best pitch decks out there.

As you can see in this pitch deck template, we added written content to the white space in each of the stock photos:

Plus no one can really copy your pitch deck layout, so you will instantly stand out from other companies.

Be sure to pick photos that share the same color palette and theme. Otherwise, the benefits of using these presentation backgrounds will be lost.

14. Mattermark pitch deck

How much did they raise? A total of $17.2M so far, says Crunchbase .

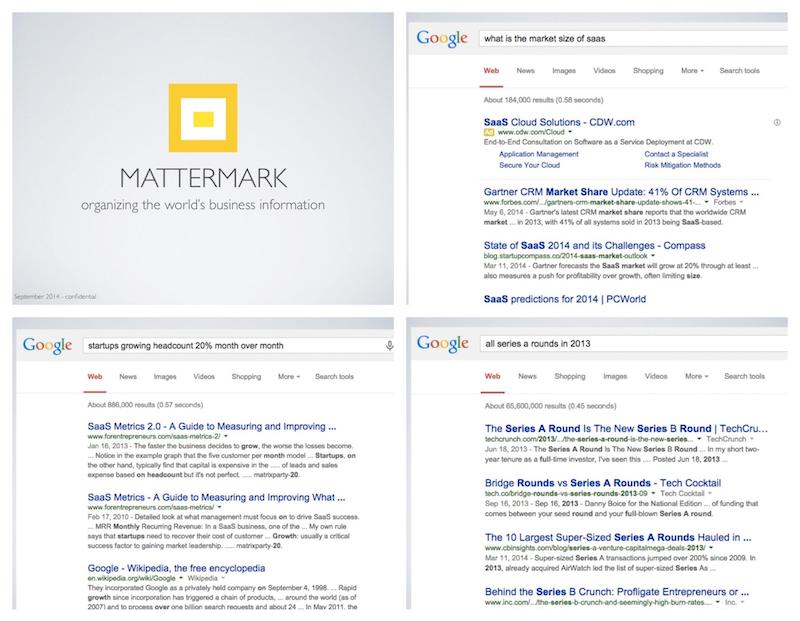

Key takeaway : Use screenshots in your pitch deck to show the problem you’re solving.

Highlighting digital problems is tough when you have limited space and time…like when you’re pitching your new digital product to a room full of investors.

That’s why some of the best pitch decks include screenshots of the problem being solved.

As you can see above, the people from Mattermark used screenshots to show how unorganized SAAS reporting was. At that time it was spread over a ton of different sites, with different reporting standards and values.

It would be difficult to sell an investor on their product just by talking about the market. Mainly because not a lot of people have experience in that specific niche.

But with a handful of screenshots, they were able to highlight the product potential almost instantly.

In terms of design, the team at Mattermark stuck to the rule of three (see slide below). This rule will help you keep your team from overwhelming the audience with a flood of stats or figures.

They also decided to make these figures easier to consume by highlighting them in different colors

Compared to a boring list of figures, it’s a lot easier to remember three distinct colored numbers. Plus because the background colors darken as they go, it naturally guides the reader’s eyes down the slide.

15. Dwolla pitch deck

How much did they raise? $12M in funding as of 2018.

Key takeaway : Give the reason your company was founded in one quick sentence.

In many of our own presentations, we talk about how Venngage started from humble beginnings before undergoing tremendous growth in just a few years.

That’s because people love origin stories — they help your audience connect with your brand and appreciate all the work put into it.

Take a look at the pitch deck slide from Dwolla above. In a single sentence, they outline their reason for doing business, and what they hope to solve.

Just be sure to talk about your company founding in the first few slides of your pitch. Otherwise, it won’t have the same impact.

On another note, as a design company, we always love to see people create great visualizations in their pitch decks — particularly when these visuals communicate key information well….like when it comes to your ideal users!

I have seen a lot of brands just talk about their users, but I recommend creating visual user personas instead. Our persona guides can help you with this!

As you can see above, Dwolla visualized their user personas for each use case.

These visual user personas allow audiences to put a “real” face to your user base. And if you have many ideal users (like Dwolla), it helps keep each group organized.

16. Kickfolio (App.io) pitch deck

How much did they raise? $1M in seed funding.

Key takeaway : Go for huge graphs! The bigger, the better.

Be proud of your brand’s growth and metrics in your slide deck.

You worked hard to grow a company from nothing, and that’s a big achievement! So why would you want to make that growth hard to see?

However, I’ve seen a lot of people inadvertently hide their key metrics by using small graphs or charts.

The only solution to this problem is…get bigger with your graphs! And I mean huge, like the ones App.io deployed in the pitch deck above. Their graph is so large and imposing, every audience member could see it clearly.

Venngage’s graph maker can help you do this for your own pitch decks too.

17. Yalochat pitch deck

How much did they raise? $15M in Series B funding, says TechCrunch.

Key takeaway : Use icons as illustrations to add instant context.

Icons have been making a comeback in the design world over the past few years. According to recent reports on graphic design trends , they’ll continue to be popular.

This presentation from Yalochat is one of the best examples of how to use illustrated icons correctly.

Each icon perfectly illustrates the point being made on each slide, giving instant context. They will definitely catch the eyes of any audience member.

Just remember to follow their lead and use consistently designed icons !

18. Brex pitch deck

How much did they raise? $1.5 billion to date.

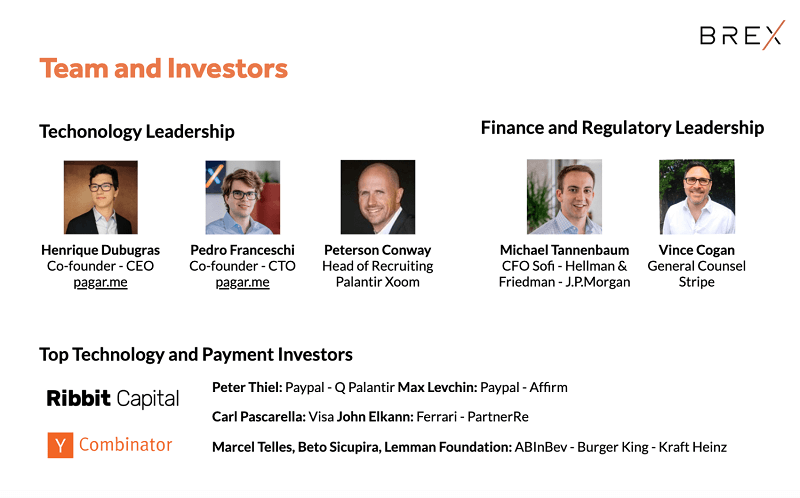

Key takeaway : Include a single slide about your team and highlight what makes them truly exceptional.

Another important part of your story is the people who helped you build your company. These people are the lifeblood of your brand, and what helps it stand out from the competitors.

Corporate card startup Brex does this well by using team member photos, and including their titles and company affiliations to build credibility. You can download the Brex slides for free, thanks to Business Insider .

Let’s tale a look at a sample pitch deck that employs a similar philosophy.

I’m guessing you already planned on adding something similar to your pitch deck. Again, I would recommend using only a single team slide like they did.

You can use a team photo if you want to talk about the whole team, or add an organizational chart instead. Alternatively, like Brex, you can highlight the most important individuals, like this business pitch example:

Whatever you choose to do, don’t forget to talk about your team on a team slide, and highlight the people who make your company truly great.

Read More: 12+ Organizational Chart Examples and Templates

19. Purple Go pitch deck

How much did they raise? Undisclosed.

Key takeaway : Use a contrasting hue to draw your audience’s attention to key information.

Color isn’t just about making your designs look good — it can also draw your audience’s attention to important information.

For example, take a look at this simple pitch deck from Purple Go . They contrast deep purple with white to help certain sentences pop.

This is a simple way to make your slides have a lot of impact; pick colors that contrast boldly with each other.

20. Mint pitch deck

How much did they raise? $31M to date, according to Mint.

Key takeaway : Add visual cues, such as illustrations and icons, to help explain your brand to investors.

I’m guessing your pitch deck is already going to touch on how you stand out from the competition. But just listing a few things that set you apart may not be enough on your slide deck!

You may need to add some visual cues to help the audience out.

We decided to redesign Mint’s original deck for a contemporary take on this.

In this minimalist pitch deck template, our designers used visuals to make the main company stand out even more. And best of all, it doesn’t distract from the minimalist theme.

This simple addition to your slides will help your information jump off the page, providing a rewarding visual break from related companies.

21. Park Evergreen (Plot) pitch deck

How much did they raise? $400k in seed funding.

Key takeaway : Give each metric its own slide.

Generally, slide decks are full of important metrics that you’re supposed to remember. But not all of those numbers are presented in a way that would make them easy to.

Some are hidden in long paragraphs, while others are smashed together with less important findings.

That’s why I’m a huge fan of how Park Evergreen (now called Plot ) included important numbers in this slide deck. As you can see below, each metric is given its own slide:

With this approach, the audience members place their full attention on that number. And they’ll be able to recall the information a lot quicker.

It may look overly simple to some, but the best pitch decks use this tactic a lot.

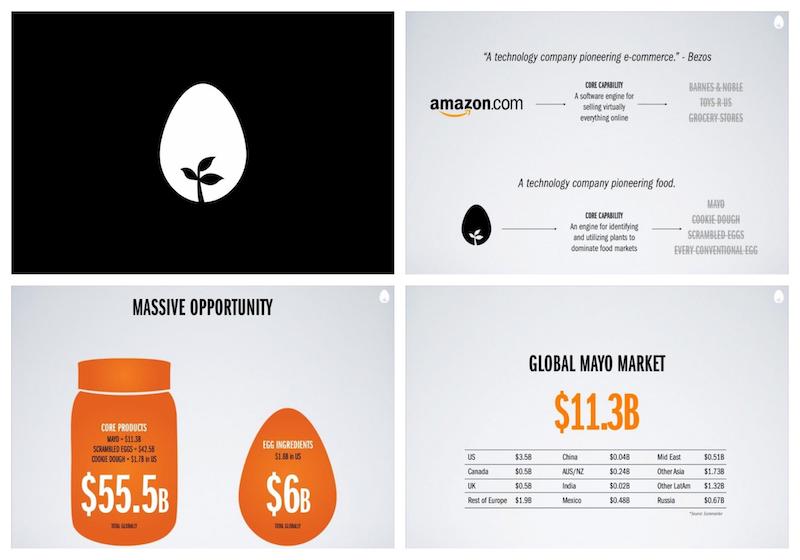

22. Hampton Creek (Eat Just) pitch deck

How much did they raise? $1.5M in Series A.

Key takeaway : Create a minimalist title slide to build anticipation for your presentation.

You probably know that presentations don’t always run as smoothly as planned. With long breaks and technical problems, the time between presentations can end up running rather long.

Translation: you might spend more time looking at the title slide than the actual presentation itself.

So if you really want to build some anticipation for your pitch, create a minimalist (some might even say, mysterious) title slide. As you can see, the team at Eat Just (once known as Hampton Creek) did just that.

The lack of information makes spectators want to learn more about your brand, effortlessly engaging them.

The only negative is that no one is going to know the name of your company — yet.

23. Sickweather pitch deck

How much did they raise? $2.6M to date, according to Crunchbase.

Key takeaway : Pull out the main metrics from your graphs and charts to make your slide a snap to understand.

Remember when I said: “Don’t make your audience do the math”?

Yeah. That’s because people hate doing math — so you never want to make investors try to calculate your data themselves. Especially when dealing with millions of dollars, tiny percent changes or other complicated numbers.

Out of all the tips in this article, this one might be the most important. Mainly because forgetting this idea all but guarantees your failure.

That’s why I recommend you “do the math” on every slide where you include a graph or chart — like how Sickweather did above.

By pulling out the main growth metrics from the graph, they made this slide a lot more consumable, and showed the audience exactly what they should pay attention to.

24. Dutchie pitch deck

How much did they raise? $35M in 2020, according to TechCrunch .

Key takeaway : Set the tone by putting your most impressive stat(s) in the introduction.

Dutchie, an all-in-one technology platform for eCommerce, POS and payments, wastes no time coming out the gates with one impressive insight: “10% of all legal cannabis in the world” is purchased through their product.

Now I don’t know about you, but that’s pretty tantalizing.

So it makes perfect sense they would pull it out from their market share figures and feature it in their introduction. By doing so, investors get an idea how successful and established Dutchie is right off the bat.

25. Studysmarter pitch deck

How much did they raise? $15M according to TechCrunch .

Key takeaway : Illustrate your vision over several slides.

Rather than dedicate one slide to their vision for the company, digital learning company Studysmarter continuously brings up how their product will be understood in the future — as “the world’s central hub” for “lifelong” learning, becoming the “largest learning platform in Europe” by 2021.

While this visionary sentiment is not new to the pitch deck industry, it makes sense Studysmarter would want to focus much of their presentation slide deck on this idea: the idea of an unlimited target market and use cases.

Design wise, their illustrations are consistent, using visuals to illustrate their message and various target demographics.

These graphics build off the sleek, modern interface Studysmarter’s brand image invokes. It also illustrates what they want investors to envision for the future of the brand.

26. Clearbanc (Clearco) Pitch Deck

How much did they raise? $70M in series A funding, according to TechCrunch.

Key takeaway : Use flow charts to communicate complicated processes.

As a company that offers startups “growth capital for the new economy” through non-dilutive revenue-share agreements, Clearco (previously known as Clearbanc) wins big by communicating how the process works in less than a slide’s time.

That’s right: the company uses a flowchart .

For complicated business processes that would normally take several slides of text to communicate, a flowchart is a smart way to visualize a process while saving space and keeping your audience engaged.

Particularly for a company like Clearco, this is key for getting investors up to speed. Then you can move on to the other facts and figures they’ll surely want to hear.

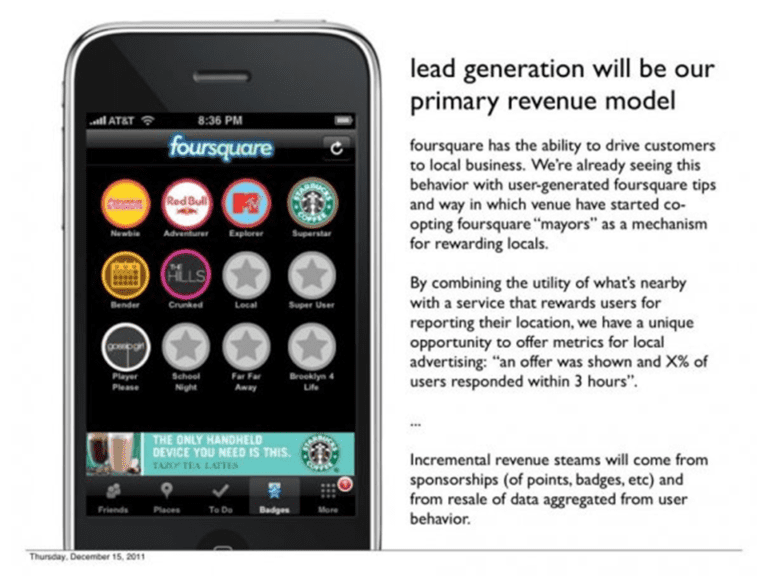

27. Foursquare Pitch Deck

Key takeaway : Show how the end-product looks in your presentation.

Okay look, I get it. This slide deck from 2009 is certainly behind on times when it comes to design tips in this current day and age…

BUT take it back to more than a decade ago, and you’ll see why Foursquare’s pitch deck won big with investors.

As one of the first businesses to employ gamification, the company lets this selling proposition shine by using an iPhone graphic to show how the app’s points and badges look to the end-user. These visuals communicate the appeal by showcasing exactly how consumers will interact with, and understand, the product.

In essence, it takes the guesswork out of their pitch.

So while the text-heavy aspect of this sample pitch deck isn’t exactly ideal, their use of visuals can teach us a lesson.

28. TalentBase pitch deck

How much did they raise? $330K to date.

Key takeaway : Let the numbers do the talking.

Rather than take up a ton of slide space in this pitch deck example, TalentBase, an affordable payroll solution , focused their real estate on the real deal-closers: the numbers.

While this won’t work for every business, as you may need to add more slides to truly explain the environment your organization exists in and your processes, TalentBase uses their positioning to drive forward a captivating narrative.

And this narrative utilizes only numbers to connect the dots in the mind of potential investors about the value TalentBase offers, in terms of market capture.

29. Peloton pitch deck

Key takeaway : Discuss both the tangible and intangible benefits your product offers.

In 2018, back before the real pandemic hey-day of this tech unicorn, Peloton dazzled in a funding round and managed to capture in $550M funding.

Part of this can be attributed to Peloton’s emphasis on the benefits it brings customers.

Across multiple slides, the exercise equipment and media company highlights how customers’ lives are improved in various emotional and functional ways. Since this connection lays the groundwork for long-term B2C relationships, investors can immediately identify the value encompassed by this modern fitness tool.

Looking to try something similar? Check out the below Peloton sample pitch deck, reimagined by our Venngage design team.

30. Ledgy pitch deck

How much did they raise? $ 10M in September 2021.

Key takeaway : Cut down on space with text and graphics that follow a clear logical narrative.

In just seven slides, the equity management and investor relations platform, Ledgy, was able to convince their audience that their product was worth investing in.

By putting their mission first, and following it up with engaging visuals, the company tells a story despite using minimal text.

Yoko Spirig, CEO and co-founder of Ledgy, echoed this sentiment in an interview : “Starting with the ‘why’ lets you build the business case for the product, and create a logical narrative that investors can follow.”

That’s why, design-wise, this is one of the cleanest pitch deck examples in the bunch. It’s one of the shortest too.

I also appreciate how their brand colors are used in conjunction with white to keep everything consistent (something that Venngage’s automated branding feature My Brand Kit can help you out with).

To summarize, some of my favorite pitch deck design tips include:

- Adding icon headers to your most important insights

- Use similar charts and graphs for easy comparisons across slides

- For longer pitch decks, switch up the slide layouts

- Pick a consistent theme for your presentation background images

- Don’t just list your ideal users, create visual personas

- Use a timeline to show how your company has grown

- Always do the math for your audience

Now let’s take a look at what’s the difference between a pitch deck and a business plan.

A pitch deck and a business plan serve different purposes in the world of entrepreneurship, each playing a crucial role in showcasing and strategizing a business venture. The main distinction lies in their format, level of detail and intended audience.

Pitch decks typically consists of a series of carefully crafted slides, highlighting key aspects of the business such as the value proposition, target market, revenue model, competitive advantage and team expertise.

The goal is to pique interest, generate excitement and secure further engagement or funding opportunities. A pitch deck emphasizes storytelling, persuasive visuals, and concise messaging to create an impactful impression.

On the other hand, a business plan is a comprehensive and detailed document that provides an in-depth roadmap for the entire business venture. It outlines the company’s mission, vision, goals, market analysis, marketing strategies, operational details, financial projections and risk assessment.

A business plan serves as a strategic blueprint, guiding the entrepreneur and internal stakeholders in executing the business idea effectively. It tends to be more exhaustive, often spanning several pages or even chapters, and is typically presented in a written format.

What should a pitch deck contain?

A well-crafted pitch deck should contain key information that effectively communicates your business concept, value proposition, and growth potential. While the specific content may vary depending on your industry and target audience, here are the essential elements that a pitch deck should typically include:

- Problem statement

- Market opportunity

- Business model

- Competitive analysis

- Marketing and sales strategy

- Team members

- Financial projections

- Milestones and timeline

- Investment opportunity

Not a graphic designer? No sweat — creating your own pitch deck is a breeze using Venngage’s Presentation Maker . (We’ll go over the basics here; for a more in-depth look, check out this article .)

Step 1: Sign up on Venngage for free using your email, Gmail or Facebook account. If you already have an account, log in to access the platform.

Step 2: Browse through our selection of professionally designed pitch deck templates and select one that suits your needs and preferences.

Step 3: Once you’ve selected a template, start customizing it to match your branding and content. Venngage’s drag-and-drop editor allows you to easily modify every aspect of the template, including colors, fonts, images and layout. Replace the placeholder text with your own content, such as your company information, product or service details, market analysis and financial projections.

Note: there are hundreds of templates available that you can design and share for free. If you want to access certain designs, take advantage of in-editor features like My Brand Kit/Team collaboration .

Step 4: Once you’re satisfied with your design, you can download it in various formats such as PDF or PNG. Alternatively, you can use also Venngage’s sharing options to present your pitch deck directly from the platform or share it with others via a generated link.

To leave a lasting impression on your audience, consider transforming your slides into an interactive presentation. Here are 15 interactive presentation ideas to enhance interactivity and engagement.

Now that you know how to create the best pitch decks to communicate your ideas, present your startup or raise venture capital, take action and start designing your own pitch deck today!

And if you want to learn more, there are a ton of other presentation design resources you can take a look at next:

- 20+ Business Pitch Deck Templates and Design Best Practices

- 120+ Best Presentation Ideas, Design Tips & Examples

- 15 Presentation Design Statistics to Know For 2019

- 7 Tips for Designing a Persuasive Presentation [Presentation Design Guide + Templates]

- 20+ Consulting Proposal Templates

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

Unsupported browser

This site was designed for modern browsers and tested with Internet Explorer version 10 and later.

It may not look or work correctly on your browser.

- Presentations

- Pitch Decks

The 10+ PPT Slides Every Investor (Startup) Pitch Deck Needs

Pitch decks are used to present your business in person. Today’s startup environment is more crowded and competitive than ever. So, it’s up to you to make your new company stand out.

Not only are you trying to sell potential customers on your idea, you’re in search of investors and venture capital funding as well. Your pitch deck might well be the most important presentation you ever deliver.

Let’s explore the ten essential slides every startup pitch deck needs to get your business off of the ground. If you’re asking yourself, “what does a pitch deck look like,” you’ve come to the right place. We'll answer the question of what should a pitch deck include and discuss how to properly use pitch decks. I'll also share some excellent sources for professionally-designed pitch deck templates .

How to Use Pitch Deck Presentation Templates

Before we get started, let’s explore the world of pre-built pitch deck presentation templates. You might not be a professional graphic designer, or have a lot of presentation experience. But that shouldn’t stop you from delivering a powerful and dynamic pitch deck presentation. Thanks to Envato, it doesn’t have to.

Envato offers two incredible platforms to access these amazing templates. Envato Elements is an all-you-can-download service you can join for a low monthly fee. Envato Market takes the pay-as-you-go approach, offering individual templates for purchase. What they share is a deep catalog of professionally-designed pitch deck templates.

In every download, you’ll find all the slides you need to get started building your investor pitch deck. Instead of spending valuable time designing slides from scratch, you can simply pick a stylish template and then drop in your own content. It saves time, and delivers a refined result on par with the most advanced professional presentations.

Make sure to check out this round-up of pitch deck templates:

The Purpose of a Pitch Deck

Pitch decks really have a few main goals. Keep these in mind to ensure your success:

Explain your purpose. As you build an investor or startup pitch deck, you’re really selling an idea. This idea should demonstrate your vision for future success. You’ll need details to illustrate how you’ll get there. To keep attention and interest, your purpose should be clear, and the means of reaching it understandable.

Attract interest. You may have the best concept in the world, but it isn’t worth much if investors don’t buy in. The first step is to introduce your idea. But the second step is where you close the deal; where you convince investors you’re worth their time and money. To do this, you’ll need both a strong concept and detailed financial models to showcase your path to profit.

Close the deal. Once you’ve made your pitch, you need to enlist customers and get investor checks signed. To do this, you must conclude a strong, detail-oriented presentation with an inspiring, yet logical close. This inspires confidence through both numerical detail and your own passion.

To build a pitch deck you need to be clear and also concise. Successful investors may hear dozens of pitches a week, and if you spend too long, they’ll simply no longer pay attention. Plus, the best ideas are easily explained.

10 Essential PowerPoint Investor Pitch Deck Slides

Now that you've got the major concepts of a pitch deck presentation in mind, it’s time to look at the key slides featured in individual pitch decks.

1. About Your Firm

Before getting into details, introductions are key. The about slides should highlight a few critical elements about your upstart. Among these should be your name, a brief history, contact details, and other basic information.

About slides are the presentation equivalents of resume top lines. They essentially announce who you are, and how to find you. If you've got strong branding, such as a powerful logo or online presence, this is the time to roll it out.

Check out the complete round-up of PowerPoint Pitch deck templates for examples that include "About" slides.

2. Introduce Your Mission

Once you’ve introduced your presentation, it’s time to outline your mission. Intros should include a brief opener, with everything else reserved for the body of the presentation. The first key element is to state your mission. In other words, you've got to tell your audience exactly what you’re about. This may be a problem you intend to solve. It could be a market you intend to capture, or perhaps a new idea you want to bring to reality.

Whatever your startup solves, your mission is the big idea that makes your project tick. Thus, it's featured with prime importance. Mission slides should include a series of bullets that outline your purpose. You should always include graphics as well. Charts are ideal if you've got specific data to illustrate. Otherwise, be sure to include an image or two to capture attention.

3. Highlight Your Specialization

Now that you’ve outlined your mission, it’s time to introduce how you fit into the larger picture. Many missions address problems or ideas anyone could address. The key here is to show what makes you special. Specialization slides are used to demonstrate your services.

For example, if you want to build a new way to connect with rural customers, this is where you show it off. On these slides, you should show off your specific skills and areas of expertise. This might be done with images of past projects, or sliding-scale graphics that rank your knowledge. These slides should be image-heavy, and a testimonial quote would be helpful, if available.

4. Prove Your Differentiation

You’ve highlighted your mission and specialization, but you still need to show how you’re different. In this crowded marketplace, many other firms might be doing exactly what you’re doing. To convince customers to spend and investors to pitch in cash, it's absolutely critical to demonstrate your absolute uniqueness.

Others may compete in the same sphere, but it’s up to you to show how only you can truly compete and win. For these slides, you need to illustrate a clear plan while clearly showing how you're superior to the competition. Data-driven elements are crucial here. Market charts and models transcend words to numerically demonstrate your prowess.

5. Showcase Your Services

Services are your specific offerings. These slides should showcase your products, services, or anything else you provide in exchange for client funds. The first three categories build your case of belonging in a given market. These service slides then show exactly how you'll fit into that market.

In many ways, these are the most important element of any winning investor or startup pitch deck. Investors provide funds to enable you to provide your services. In return, you should expect your own return, strong enough to then repay to investors. Consider these carefully, and ensure they're vibrant, bold, and concise value offerings. Images are a must. Simplicity is similarly key—who really wants to buy a complicated product to solve a simple problem?

6. Mock Up Your Offerings

This category is specific to app and software-based pitch decks, but it’s too important to ignore. Suppose you’ve built the next killer app. Or perhaps you just want to show off your new website. Either way, simple screenshots don’t cut it.

A professional device mockup actually replicates your favorite devices right inside your presentation. Whether you want to use a computer, notebook, tablet, watch, or phone, you can use device mockups to show how your software product looks on an actual device.

This is relatable to your audience, and provides an uber-realistic portrayal of the real world. Pre-built pitch deck templates from Envato include mockups built just for you. All you need is a screenshot to get started.

7. Recall Your Milestones

Over the past few categories, you’ve built a case for market space and then shown what you offer to compete. Marketing pitch deck presentations are very much about the future. They capture a vision of reality, and then a plan to get there. But investors are very much driven by past performance.

Wherever applicable, you should always include milestone slides. These are essentially a short history of your firm. Any past successes—captured sales, funding, hires, and more—should be prominently showcased. Investors are naturally inspired if they feel they’re jumping aboard an already-successful bandwagon. It’s your job to take your history and convert it into an actionable message. Timeline slides and brief history bullets accomplish this task perfectly.

8. Introduce Your Team

Before investors are willing to spend, you need to introduce your team. This puts a face with your name, and shows them who they’ll be working with. These slides can be pretty brief. Most important is a professional headshot for each key member of your team. Follow this with their name and a brief biography.

Since it’s short, the bio should include only basic background information while largely focusing on each individual’s role in the venture. Use this approach for your main leaders. But it also pays to have a group shot of the balance of your team. This showcases their involvement and illustrates how much you care about each and every person on your team. After all, if you don’t believe in them, how can any potential investor believe in you?

9. Present Your Pricing

Okay. You’ve introduced your team, outlined your history, mission, and product offerings. Now it’s time to get to the key point. Any worthwhile investor will expect a return on her investment. The pricing slides are where you demonstrate where it comes from. Pricing is truly your value proposition in the market. Here, you can outline your pricing model for your offering.

Combined with market share models and projections, together this can provide you with an estimate of revenue and profitability. As a general rule, pricing models should be simple and straightforward. If customers cannot easily understand them, they'll likely cross over to your competition. Your pricing slides should be similarly open and readable. After you establish your offerings, assign a clear valuation to them here. Charts and infographics are especially helpful in this case to show off gaps and your means of filling them.

10. The Funding Ask

The final element of any successful business deck is the funding ask. You’ve built your case, shown off your mission, built a revenue model, and introduced your team. Now it’s time to bring investors onboard. The funding ask is the ultimate culmination of your investor pitch deck.

Here, you ask investors to trust and believe in you. This is best accomplished by wrapping a successful presentation with a quick recap and summary. Focus on highlights, both of past triumphs and future ambitions. Don’t be too pushy, but also set realistic expectations. Be accurate about the level of funding you need, and when investors can expect a return. The key is openness and transparency. If you're fair with potential investors, chances are they’ll be fair to you as well.

Depending on your individual business, you may want to add, delete, or rearrange these. But they’re likely to be featured prominently in every successful pitch deck.

Other Tips for a Winning Pitch Deck

The section above covers general slides that every startup or investor pitch deck should include, but these aren't the only tips you need to deliver a successful presentation. And remember, Envato Elements offers a convenient way to produce professional-looking investor pitch decks quickly. Keep these three key tips in mind as well:

1. Specialize Your Slides

The above ideas are general-purpose concepts that fit a wide variety of pitch decks. But remember, each and every pitch deck should be tailored to your own mission. You’ll want to include new slide designs that fit your individual purpose.

For example, a photography business will want a series of demonstration slides to display its work. A software firm should build out slides with an in-depth dive into content and code. Funding pitch decks on a large scale should include slides with more detailed financial models and projections.

2. Keep a PDF Copy Handy

Slides, however, aren’t all it takes to deliver a winning pitch deck presentation. The ultimate theme is preparation. But you also have to be prepared to answer questions from a skeptical audience. If investors are convinced solely by a slide deck, they’re probably not fully engaged.

The type of funding you want to attract comes from those who ask the tough questions and expect detailed answers. Start by keeping a PDF copy of your slides to share. And be sure to do your homework—remember that every data point you share could prompt any one of a dozen follow-up questions.

Use this tip to export your presentation: as a PDF:

3. Leave Room to Connect

Knowing your pitch inside and out makes you appear competent, and it helps you resolve questions in a breeze. Be ready to answer in person, via call, email, or even text. If you prepare carefully, you’ll ace the presentation and the follow-up questions as well. Make sure to leave contact details so that your audience can continue the conversation.

Get Started on Your Next PowerPoint Investor or Startup Pitch Deck

Now it’s up to you. Remember to dress well, speak clearly, and project confidence to your audience. The backing slide deck is covered thanks to these templates. All you need to do is be yourself, so go forth and deliver an unforgettable, profitable pitch deck presentation!

You’ve seen the key steps to building a powerful pitch deck presentation. We’ve discussed the importance of preparation. And with spectacular templates from Envato Elements and Envato Market , building a winning pitch deck has never been easier.

How To Pitch Investors in Investor Meetings – An Expert Guide

March 14, 2023

Will you soon be meeting investors? Are you feeling a little nervous? Don’t worry – it’s perfectly normal. Here, we’ll guide you through how to pitch to investors, from making a great first impression to delivering a winning pitch presentation.

When you pitch investors, you want to be successful. But how do you pitch to investors convincingly? What do investors look for in a pitch?

Pitching to investors is a hard-won skill. The greatest challenge most people face is that they only present to investors a few times in their career. Whereas we’ve been helping firms improve their investor pitches for over 15 years. We help private companies, private equity-owned businesses, fund managers and public companies improve their investor presentations. We know how to pitch to investors. We’ve seen what works. And we can help you too

First. An investor pitch is more than the pitch deck.

When we say ‘ investor pitch ’ we mean your investor story, your pitch deck and how the team comes across in investor pitch meetings – the whole package. Every element needs to be right to win the investment you want.

Whether you are pitching your business to a trade buyer or you are raising money from an external investor, you need to be compelling when you pitch to investors. We’ve been creating investor pitch decks and coaching teams to pitch investors for over 15 years. These are some of our top tips:

How to pitch investors in investor meeting – 10 top tips

Now, let’s review each of these pitch presentation tips in more detail:

1. Understand your investor

Before you start crafting your pitch, it’s crucial you understand who you’ll be presenting to. Research the investment firm: what industries do they typically invest in? What deals have they done recently? What have they said publicly? Who are the key decision-makers? What’s their investment process like? Knowing this will help you tailor your pitch to their specific interests.

To be really persuasive, you need to know why an investor should be interested . You may think an investor wants to make money. But making money is often not enough. After all, there are many ways to make money.

Instead, you want to uncover what else your investor is looking for. For example, What is their risk appetite? How important are ESG concerns to them? Does this investment confer some sort of status by association with other investors?

Because every investor is different, there is no single, cookie-cutter approach to this. So you need to run your investor pitch meetings in a way that you can discover what your investor is really looking for. And when you understand your investor’s motivation, you’ll find it much easier to persuade them because you will be talking to their concerns.

However, the most effective pitches go one step further. These pitches are based on extensive research about the people on the other side of the table:

- What are their investment goals?

- What are their backgrounds?

- Why might they want to buy into your investment?

If your entire investor pitch is oriented around these questions, you’ll have a much greater chance of success.

How do you achieve this? One powerful techniques is to ask questions. For example:

- ‘Have you seen this before?’

- ‘Does that make sense?’

- ‘What are your thoughts on what we’ve shown you so far?’

2. Put your investor at the centre of attention

When you pitch for investment, what role do you take? And what role does your investor take? Get this right in your investment pitch, and you have a much better chance of success.

Shakespeare wrote that “all the world’s a stage”, and on that stage, you want your investor, not you, to take the starring role. Perhaps it’s not surprising that one of the most common complaints we hear from investors is that those pitching haven’t tailored what they’re saying to the people in the room. Typically, investors don’t want to be ‘taken through’ a generic presentation . Your pitch should be tailored. For example, you can ask investors what they’d like to focus on, then build your presentation around that.

Of course, adapting your pitch on the fly is not as easy as performing a pre-prepared monologue. It requires that you know your material inside-out. It demands additional preparation and rehearsal. You’ll need a coach to help you get there.

3. Describe what’s special about your investment opportunity

You need to explain what’s different and specific about your investment opportunity. What do I mean by this?

For example: Imagine you have invented an improved mouse trap. What is it about your mouse trap business that makes it special?

- Is it cheaper?

- Does it capture mice unharmed?

- Does it catch more mice?

- Is it more reliable?

- Are you selling a service rather than a product?

All of these may be true, but to explain your idea – and get the investors you want – you need to be clear about the one big idea that makes your pitch special.

For example, recently we helped a large SaaS business that provides services to banks. They save banks money, save time, and are highly scalable. All of these are relevant problems for banks. But with our client, we worked out that their service gave a bank a competitive advantage. This was because the service also created a much, much better customer experience. And this was the “killer” difference, not those other benefits.

To transform your investor pitch , make sure you have uncovered what makes your idea really special. If you have not yet worked out the one brilliant idea underpinning your pitch, speak to our team and ask about our Cracker Programme that will uncover it for you.

Learn how we can help – schedule a free consultation now

4. Make an impression that sticks

An essential strategy you want to deploy when pitching investors is to be more memorable. If you have a memorable investor pitch you increase your chances of progressing beyond “just a first meeting”.

It’s a real challenge to make a memorable investor pitch. Investors see countless pitches and have more investment opportunities than ever. So, if you are pitching to investors, it’s much harder to stand out.

Here’s how to make a strong first impression:

- Build Rapport: When you Introduce yourself, aim for a connection. Find common ground with your investor to build rapport. Perhaps you know people in common, perhaps you went to the same school, perhaps you used to work in the same city. Any connection can help.

- Show Passion: Your enthusiasm for your business is contagious. Let your passion for your idea, team, and industry shine through.

- Be Yourself: Authenticity is key. Investors are looking to back people they believe in, so it’s important they see you as genuine and sincere in your presentation.

Much of the work we do at BBA is to help funds and businesses craft their investment propositions so that they are memorable and therefore more investable. For example, one technique is DON’T BE BORING. If your pitch sounds just like everyone else’s, you’ll be forgotten quickly. Instead, intrigue us and appeal to our natural curiosity. Is there something counter-intuitive about your approach? Get investors thinking (but not too hard) and they are more likely to remember you.

5. Craft your pitch carefully

Your pitch should be clear, concise, and engaging. Here are some key elements of your investor pitch to work on:

- Elevator Pitch: Perfect your elevator pitch, a 10-30 second summary of your business that can grab an investor’s attention. Explain the problem you solve, your solution, and your target market. Make this compelling.