How to Obtain a Confirmation Letter for an Assigned EIN Number

by Mariel Loveland

Published on 21 Nov 2018

When you sign up for a federal Employer Identification Number (EIN), also known as a federal tax ID number, the government makes a real point to remind you to never misplace your number. Let's be totally real, though. Some of us are pretty forgetful regardless of how successful our budding businesses may be. Losing your EIN number and the IRS confirmation happens. Don't worry – it's not gone forever.

Why Do I Need An EIN?

An Employer Identification Number is like a Social Security number for a business. You'll need your EIN to file taxes, apply for business licenses, open business bank accounts, obtain loans and new lines of credit and fill out various forms such as 1099-MISCs for contracting work. If you're working as a sole proprietor, you may wish to register for a federal tax ID number to avoid using your Social Security number for business purposes.

Sometimes, a bank or vendor may require a confirmation of your EIN from the IRS. Before you get nervous and start tearing apart your office looking for that pesky letter, don't worry. You can easily request a new confirmation letter instead.

Call The IRS And Request A Replacement Confirmation Letter

Getting a replacement confirmation letter for your Tax ID Number is as simple as calling up the IRS. Dial (800) 829-4933 if you're in the U.S. and (267) 941-1099 if you're abroad. Ask the IRS for a replacement 147C letter – that's what the letter is called. If you remember your EIN number, you can have the form faxed directly to you. If you don't remember your number, you'll have to wait for the letter to be sent by mail because the IRS will not give you the number over the phone.

Be Prepared To Answer Questions About Your Business

The IRS can't just give out EIN information to anyone. They can only send a 147C letter to an authorized individual like a corporate officer or partner. In order to confirm that you're authorized to get the form, you're going to need to answer some questions including telling the IRS your title in the business.

What Happens If I Lost My EIN Number?

If you don't need your confirmation letter and simply lost your EIN number, you can avoid calling the IRS by digging a bit into your company's records. Your EIN can be found on an old tax return. If you've set up a business account with a bank or applied for a license, you can call the bank or agency to get your EIN. If all else fails, call the IRS.

NorthOne is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A., Member FDIC.

How to Find Your EIN Verification Letter From The IRS

Table of Contents

Get your business banking done 90% faster with North One

Get started for free. 1

1 Minimum $50 deposit required. See your Deposit Account Agreement for more details.

North One is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A., Member FDIC.

One of the many steps involved in starting a business is obtaining an employer identification number (EIN), which is also known as a federal tax identification number. This unique nine-digit number is used for all sorts of things required to run a legitimate business. After applying for your EIN, you’ll receive an EIN verification letter from the IRS.

You should hold onto this letter for as long as you own your business. But thankfully, if you lose it, you’re not totally out of luck. This article will cover everything you need to know about EINs and what to do if you lose your EIN confirmation letter from the IRS.

The basics of employer identification numbers

You can think of an EIN as being the equivalent of a Social Security number for your business. It allows your business to pay state and federal taxes—which is why the IRS sends verification letters—along with other essential aspects of your daily business.

In addition to paying taxes, you need an EIN to hire employees, open a bank account, and to apply for a business license. Of course, not all businesses need employees, but a business owner can get in a ton of trouble for operating without a license or not paying taxes. Additionally, having a business bank account is a smart way to help ensure you run a successful organization.

How to apply for an EIN

The IRS has taken a number of steps to make EIN applications easy for business owners. These are the options you have when applying for your EIN:

- Apply online: Filling out the online application is the easiest way to get an EIN. The information is validated upon completion of the application, so you receive your EIN immediately. However, keep in mind that you won’t get the confirmation letter until it arrives in the mail. This application process is available for entities with principal locations in the U.S. or U.S. Territories.

- Apply by fax: If you’re a taxpayer with access to a fax machine, you can fill out Form SS-4 and fax it back to the IRS. You’ll just want to ensure that all of the information is correct, as this option doesn’t have instantaneous confirmation like the online application. If your application is approved and you provide your fax number, the IRS will fax you back within four business days with your confirmation.

- Apply by mail: You can also submit Form SS-4 through the mail. However, the mail can be a bit slow at times, so this method of EIN processing takes around four weeks to complete. Again, you’ll want to double-check that every field is filled out correctly on your SS-4 form.

- Apply by telephone: International applicants can also apply by telephone Monday through Friday from 6:00 a.m. to 11:00 p.m. Eastern Time. This method simply involves telling an IRS agent all of your answers to the questions on Form SS-4. Applicants calling in must be authorized to receive EINs (which we’ll cover in the next section).

What is an EIN confirmation letter from the IRS?

The EIN verification letter from the IRS is a document that’s sent to business owners upon receiving their EIN. If you know your EIN off the top of your head, this letter will likely only be needed one time. You’ll just need to present a physical copy to open your business bank account.

However, that nine-digit number isn’t always easy to remember, so it’s not a bad idea to keep the verification letter in a safe place. Plus, you’ll need it if you need to open up a new business bank account.

How do I get my EIN confirmation letter?

Keeping your EIN verification letter from the IRS in a secure location (like a safe deposit box) is the best way to ensure you never lose it. But with so many documents to keep track of, it’s not out of the ordinary for these confirmation letters to go missing.

Although you don’t want to find yourself in bad standing with the IRS, the agency is fairly understanding when it comes to needing a new copy of your EIN confirmation letter, so they make it easy to get a new copy. Here are the steps to take if you misplace your IRS EIN confirmation letter:

- Call the IRS: If you need to contact the IRS, it’ll have to be over the phone. To get a copy of your verification letter, you can call them toll-free at 1-800-829-4933. This is the “business and specialty tax line.”

- Speak to an agent: Once you’re on the phone with an IRS agent, tell them you need a 147c letter—the document number for a new copy of your EIN verification letter from the IRS—and give them your EIN.

- Confirm your identity: Only authorized individuals can request a 147c letter. Even if you know your EIN, the agent will need to ask some questions to verify your identity. Examples of people who can request a 147c letter are business owners, partners in an LLC, corporate officers or anyone who has power of attorney over a company. In addition to providing your EIN, you’ll need to tell the agent your name, business address and the type of tax return you file.

- Choose how you’d like to receive your letter: Even though it’s the fastest way to receive documents, the IRS will never email you any sensitive information, so your only two options for receiving your 147c letter are through the mail or via fax. It’s not uncommon for mail from the IRS to take several weeks to arrive, so we recommend choosing the fax option if you need your 147c letter sooner rather than later.

What if my address has changed?

Getting a 147c letter is a bit more complicated if either your business address or personal address has changed since you started your company. If your business address changed, you’ll need to file Form 8822-B. And if your personal address changed, you’ll need to file Form 8822. You can download both of these forms online, but you’ll need to print them and mail them back to the IRS.

Can I get a copy of my EIN letter from the bank?

We get it—calling the IRS or waiting by the mailbox for your EIN verification letter from the IRS can be tedious. Thankfully, your bank often can help you out! Although they can only provide you with a scan of your letter, this may be enough to accomplish whatever task you initially needed the document for.

Of course, you’ll want to verify that a scanned copy of the letter will suffice, but only waiting for a few minutes to get the document compared to several weeks is obviously preferable.

North One does not require customers to upload their EIN letters for verification and therefore does not have them available to provide back to customers.

Get the small business banking help you need

The options are nearly limitless when you need to open up a small business bank account , but for a seamless banking experience, be sure to choose North One. We’re committed to helping small businesses succeed and making life easier for business owners. Apply for an account today to start taking advantage of our innovative financial and organizational tools. Just be sure to submit your EIN verification letter from the IRS when you apply!

Try North One Connected Banking for free 1

Eytan Bensoussan

Related posts, how to find your articles of organization easily, what is a c corporation and how to start one, 10 small business ideas to start from home in 2024, how to start a cleaning business in 5 steps, how to choose the right business structure, how to come up with a catchy business name in 7 steps.

Username or Email Address

Remember Me

Registration is closed.

- Open an Account

How to Get EIN Verification Letter (IRS 147C) for an LLC

By Matt Horwitz

Updated May 22, 2024

Need to save time?

Hire a company to form your LLC: Northwest ($39 + state fee) LegalZoom ($149 + state fee)

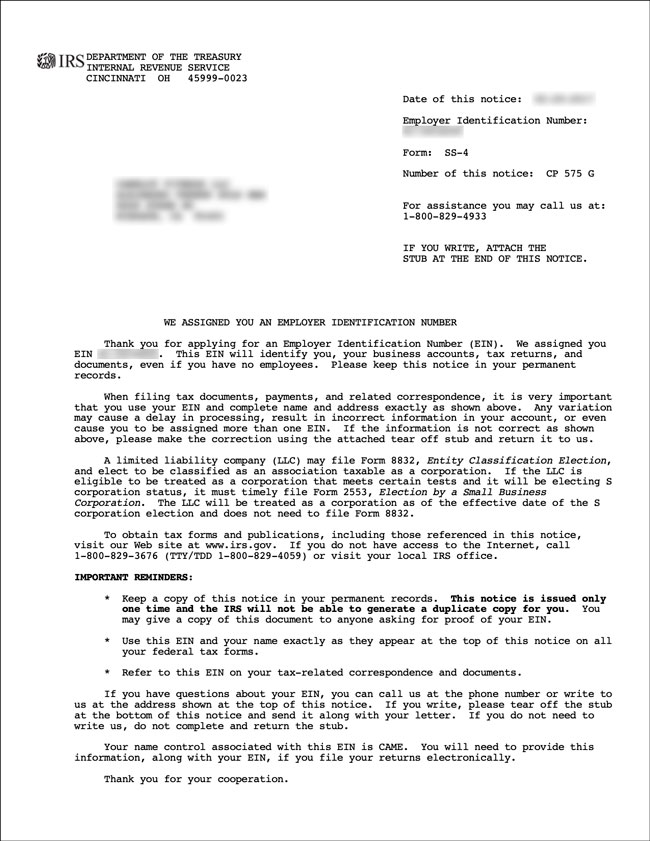

Here is what an EIN Confirmation Letter (CP 575) looks like:

Here is what an ein verification letter (147c) looks like:, how to get a 147c ein verification letter from the irs.

- Here's how to call the IRS and get a 147C Letter

- Here's how to write to the IRS and get a 147C Letter

How will the IRS send me EIN Verification Letter 147C?

When you first get an EIN Number , the IRS sends you an EIN Confirmation Letter (CP 575).

- If you got your EIN Number online, you can download the CP 575 online

- If you got your EIN Number by mail or fax, the IRS will mail you a CP 575 (it’s mailed to the address you listed on 4a and 4b of Form SS-4; takes 4-6 weeks to arrive)

Note: If you are a Third Party Designee, you cannot download the CP 575 if applying online. The CP 575 will be mailed to the EIN Responsible Party.

The IRS only issues the EIN Confirmation Letter (CP 575) one time. You can’t get this letter again. In fact, “CP” means the letter was auto-generated by a computer. So even if you call the IRS, no one there can recreate the CP 575.

However, there is good news . You can still get an official “EIN Letter” from the IRS. It’s just not called an EIN Confirmation Letter (CP 575).

Instead, it’s called an EIN Verification Letter (147C) .

Note: The full name of the 147C is actually EIN Verification Letter 147C, EIN Previously Assigned.

The CP 575 and 147C are technically different letters, however, they are both official letters from the IRS and can be used for all business matters.

The only two ways to get an EIN Verification Letter (147C) is to call the IRS at 1-800-829-4933, or to mail the IRS a written request.

Recommendation: We recommend calling the IRS between 7am and 10am or between 3pm and 7pm. And don’t call on Monday (the busiest day).

An EIN Verification Letter 147C can be requested by phone or by mail. But you can’t request it by fax.

It’s also important to note that requesting this letter by mail takes longer than requesting it by phone. Said another way, requesting 147C by mail may take 4-6 weeks to arrive. If you’d like to get your EIN verification letter faster, we recommend requesting the letter by phone.

Here’s how to call the IRS and get a 147C Letter

- Call the IRS at 1-800-829-4933 (the “business and specialty tax line”).

- Press option 1 for English.

- Press option 1 for Employer Identification Numbers.

- Press option 3 for “If you already have an EIN, but you can’t remember it, etc.”

- Tell the IRS agent that you have an LLC and need an EIN Verification Letter (147C).

- The IRS agent will ask a few security questions to confirm you own your LLC.

- Tell the IRS agent whether you’d like to receive the 147C Letter by mail or fax.

Tip: Only an owner of your LLC can request a 147C Letter. No one else can call for you, unless they have a Power of Attorney on file with the IRS. If you have a Single-Member LLC, refer to yourself as the “owner” (instead of Member). If you have a Multi-Member LLC, refer to yourself as a “partner” (instead of a Member).

Here’s how to write to the IRS and get a 147C Letter

You can also request an EIN verification letter 147C by mail.

What should I include in my IRS 147C request?

To request IRS Form 147C by mail, you’ll need to write the IRS a letter that contains:

- your LLC’s name,

- your LLC’s EIN number, and

- a general request for Form 147C.

We’ve created a letter for you, so all you have to do is fill in the blanks with your LLC information.

IRS – Request for EIN Verification Letter (147C) (Word) IRS – Request for EIN Verification Letter (147C) (PDF) IRS – Request for EIN Verification Letter (147C) (Google Doc)

As long as the information you submit in the letter is correct, the IRS will fulfill your written request.

Where do I mail my written request for an EIN verification letter?

The address you mail your written request to is state-dependent. Said another way, the address you submit your letter to depends on where your LLC is located.

That said, you’ll need to mail your request to 1 of 2 addresses:

Internal Revenue Service 333 West Pershing Rd. Mail Stop 6055 S-2 Kansas City, MO 64108

Internal Revenue Service Stop 6273 Ogden, UT 84201

Which address should I use to request my 147C by mail?

You should mail your written request to the Kansas City, Missouri office if your LLC is located in and does business in any of the following states:

Connecticut Delaware District of Columbia Florida Georgia Illinois Indiana Kentucky Maine Maryland Massachusetts Michigan New Hampshire

New Jersey New York North Carolina Ohio Pennsylvania Rhode Island South Carolina Tennessee Vermont Virginia West Virginia Wisconsin

You should mail your written request to the Ogden, Utah office if your LLC is located in and does business in any of the following states (or anywhere outside of the US):

Alabama Alaska Arizona Arkansas California Colorado Hawaii Idaho Iowa Kansas Louisiana Minnesota Mississippi

Missouri Montana Nebraska Nevada New Mexico North Dakota Oklahoma Oregon South Dakota Texas Utah Washington Wyoming

For security reasons, the IRS will never send you anything by email. Instead, the IRS will send you an EIN Verification Letter (147C) two ways:

- by fax (you can use an actual fax or a digital/online fax)

147C by mail

If you choose to receive your 147C by mail, it can take 4-6 weeks before your EIN Verification Letter (147C) arrives.

The IRS will mail your 147C Letter to the mailing address they have on file for your LLC. You’ll be able to confirm this address when you’re on the phone with the IRS agent.

147C by fax

If you choose fax, the IRS will fax you the 147C Letter while you’re on the phone.

Tip: The IRS agent will ask, “Do you have a private and secure fax next to you?” If you are using a digital/online fax, say yes .

Congratulations! You have successfully requested a 147C, EIN Verification Letter for your LLC. We recommend making a few copies and keeping them with your business records.

IRS: Lost or Misplaced Your EIN IRS: Telephone Assistance Contacts for Business Customers IRS: About Form SS-4, Application for Employer Identification Number (EIN) IRS: Internal Revenue Manuals 21.7.1 BMF/NMF Miscellaneous Information IRS: Internal Revenue Manuals 21.7.13 Assigning Employer Identification Numbers (EINs)

Want our free email course?

Get simple LLC lessons sent right to your inbox.

94 comments on “EIN Verification Letter (147C) for an LLC”

Disclaimer: Nothing on this page shall be interpreted as legal or tax advice. Rules and regulations vary by location. They also change over time and are specific to your situation. Furthermore, this comment section is provided so people can share their thoughts and experience. Please consult a licensed professional if you have legal or tax questions.

What happens if my session timed out before I could select the “confirmation letter” option?

You’ll get the EIN Confirmation Letter (CP 575) in the mail (I’d allow 6-8 weeks). If you need some “proof” sooner than that, then you can call the IRS (instructions above on this page) and request an EIN Verification Letter (147C).

WHAT IF I CAN’T REMEMBER THE ADDRESS I USED WHEN I APPLIED FOR EIN OR TELEPHONE NUMBER? I JUST CALLED THEM AND THEY SAID THEY COULDN’T AUNTHENTICATE MY IDENTITY BECAUSE IT’S BEEN SEVERAL YEARS AND I DID NOT HAVE A PERMANENT ADDRESS AT THAT TIME. I GAVE THEM MY SSN, DOB, I MEAN THAT’S PERSONAL INFO NO ONE ELSE SHOULD KNOW. I DON’T SEE ANY OTHER WAY TO GET MY REPLACEMENT EIN CERTIFICATION.

Hi Abel, I’m not sure. You could try calling again and asking if maybe you sending in a letter containing certain information could help. Otherwise, maybe try digging up old records to find that info. I’m really not sure.

Hi Matt… hope you are doing great.. Was wondering how do i get CP 575 notice if i am a Non Usa resident and dont have an SSN or ITIN…i received the EIN when i called the IRS. When i asked for the Cp575 notice they said they would send it to my mailing address which would typically take around 20 days. But previously i had taken a service from someone for EIN…he gave me the EIN and cp575notice PDF in 2 days… how is this possible? How did he manage to get the PDF of CP575 notice in 2 days?

Hi Cheryl, I’m doing well, thanks :) You were told correctly by the IRS. Even though non-US residents get the EIN number over fax, they later get the EIN Confirmation Letter (CP 575) by mail. There is a chance the person who got your EIN in 2 days likely didn’t list you as the EIN Responsible Party .

Said another way, the only way to get an EIN that fast is to apply online. And you can’t apply online if the EIN Responsible Party doesn’t have an SSN or ITIN. So what we sometimes see is someone (that person hired) lists themselves as the EIN Responsible Party. And while you can change the EIN Responsible Party for an LLC , we recommend just doing it correctly from the start. Hope that helps.

Hello Matt, I have my small business as a DBA and have had my EIN for a couple of years. In March I applied in the state of Texas for an LLC with the same company name. I was certified and I sent the SS-4 application for my LLC to the IRS. 3 months passed and I did not receive anything. I made the application by fax. I called and they said my DBA EIN was the same for my LLC. Is this correct?

Hi Yadira, that doesn’t sound correct to me. First, DBAs themselves don’t have EINs. It’s the owner “behind” the DBA that has the EIN. Aka, you, or your LLC. So the first EIN you have is for your Sole Proprietorship. You want a new LLC, owned by your LLC.

Hello Matt, I received my Ein number by fax six weeks ago. CP 575 letter not received. I called the IRS number. After 20 days they sent a 147C letter. My LLC name was misspelled. I’m trying to call customer service, but there’s no answer. I checked my SS4 form, I sent my LLC name correctly. Should I write them a letter? What can I do in this case?

Hi Silvia, I’d mail the IRS a letter and let them know they made a mistake. Please see change LLC name with IRS . We have a template letter on that page you can use.

I called the number listed here for the business and specialty tax line and waited for 45 minutes to be told it was the wrong department to call for a 147C. The correct department is at 1800-829-4933. Thanks for wasting my time.

I apologize, the number was correct. The IRS is just the worst.

Thanks Kaitlyn, totally cool. The IRS can be really frustrating to deal with. Glad you got it sorted though :)

Hi, many people are saying that you can get an EIN for your DBA, calling to IRS. Have you already heard anything about that? Or, is it just for LLC or INC? Because, i faxed an SS4 form to IRS 3 weeks ago, and then, I’ve called them this week and they are saying that they don’t have anything in the system about my DBA! I talked to 3 differents representatives and all of them were saying the same thing, i guess, they don’t know how to explain what’s going on. If you ask them something, they never know, actually. Thanks for your help!

Hi Emerson, let me back up a step first. A DBA is simply “nickname” for a business entity (like an LLC or Corporation) or a person(s). If you don’t have an LLC, then your DBA is for yourself (aka your Sole Proprietorship ). If you had a business partner, the DBA would be for your General Partnership .

So… no, you can’t get an EIN for a DBA. But you can get an EIN for a Sole Proprietorship (that has a DBA). Which is what I’m guessing you have. In that case, you should wait longer than 3 weeks and then call again. It’s likely not in the system yet. I wouldn’t apply again as that can cause issues. Hope that helps.

Thanks for helping. Yes, I’m gonna wait for sure. I already have my Sole Proprietorship registered with the County Clerk and the next step I’d like to get an EIN from the IRS. But, unfortunately, they are taking too long to issue that number. They say, “we are so busy, sorry but, you can’t solve it in person, you have to wait and that’s it”. It’s ridiculous to expect a basic EIN within a month or two. It should be easy and fast!

I know, it’s really frustrating. Many people are dealing with the same issue.

Do you know what questions, they ask you to get a new copy of the cover letter?

I forget exactly, but they are just confirming you are who you say you are, and that that matches their records.

Hi. I need help, i want to verify someone else’s EIN number. How can I do it? Other than calling or Visiting IRS. Are there any possibility to do it online?

There is no such service that we’re aware of.

Legal zoom did not include my suite #, and my original EIN cert letter reflects this. I can’t open a bank account until it is rectified.I’ve been trying since October. Is there any other way to get this done? Can I go to an office?

Hi Robert, sorry to hear that. You’ll need to keep trying. This is the only way to get a 147C EIN Verification Letter. There is no office to go to.

I am a foreign national, I created an LLC on 11/09/2022 and got my EIN approved, and received it in the Fax form IRS stating EIN on the Form SS-4. its been 6 weeks and i have been waiting on CP575. can you shed a light why is it taking so long from IRS to mail the document

The IRS has been really backed up. It will eventually arrive, but for many foreign nationals, it can take 2-4 months. Hope that helps!

I am a foreign national, I created an LLC on 11/22/2022 and got same day approval. Then I applied for EIN using SS-4 and followed the method you stated for foreigners. Today I got my EIN approved and I received a fax from IRS stating EIN on the form SS-4. The quality of the document is not good (EIN is visible but most of the form is unreadable) How can I get Letter 147C and CP575? Should I follow the process listed in this blog or should I wait a few days? By the way you are doing an extraordinary job of educating ordinary people like us. Thanks

Hi Waseem, you’re very welcome! The IRS should have mailed you a CP575, which should much more clear. Those faxes can sometimes be really hard to read lol!

Is it the same process when trying to get a verification letter for an estate?

Hi Nina, yes, it is.

We need a 147C from IRS. We’ve callled this number 1-800-829-4933 many, many times, and after choosing 1, 1 and 3 options, we always got a voice mail saying they are busy and call back at different time. After several weeks of not being able to contact IRS by phone, the only option left is to request it by mail, even if it takes 4 to 6 weeks. My questin is which department of IRS and which location of IRS should we send our request for 147C letter. The IRS.gov website does not have this info. Thank you very much for your help.

Hi Justin, I feel you on this. Thousands of people are dealing with the same issue. The IRS is extremely back up right now. Some readers are getting through by trying multiple times per day and multiple days per week (sounds like you’ve been doing the same though). As of right now, we only know about obtaining a 147C via phone, however, we’ll see if we can find anything out. If so, I’ll reply back here (and we’ll update this page). It may take us a couple weeks if we do find something. Thank you for your understanding. We’re hoping things return to normal soon.

Hi Justin, we just got through to the IRS (after trying for a few days). We added a new note at the top of this page. But in short, a 147C can only be requested by phone. It can’t be requested by mail or fax. And 1-800-829-4933 is the only number to request a 147C. So you’ll need to just keep trying. I know it’s super annoying. But check the note at the top of this page for some additional tips.

Cannot get thru to them by phone. Can I request via faxing to them? what #?

Hi James, not that we’re aware of. The IRS is extremely back up right now, however, readers are getting through by calling multiple times per day and multiple days per week. Hopefully things return to normal shortly.

Hi Whenever i call it hangs up because there arent any people to answer. ANy advice on how to go about it now?

Hi Mary, the IRS is still a bit backed up. We recommend calling shortly after they open in order to get through. Hope that helps!

No that doesn’t work either. I called at 7am and then again at 7:01 am and was hung up on. The instructions are accurate. Just no one is wanting to do their job or they refuse to take calls for 2 weeks now. I DID get to an agent on the “Forms” option. She told me to try between 5 and 5:30pm however that proven to be fruitless.

I am going on week 3 now. This is a government department that just got approved to hire over 85k workers and they cannot answer the bloody phone. America’s finest.

Oh my! That is really bad. I totally hear you. Thanks for the update and letting us know. I hope things get better in the coming months :)

Thank you so much for the easy to follow instruction on how to get 147C.

You’re very welcome Maribel :)

Thank you for sharing! This was very helpful!

You’re very welcome Rebecca :)

Thanks for your article. It is very helpful. I tried to obtain an EIN verification letter on behalf a client by calling in and faxing them a Form 2848. On line 3 of the form, I listed “EIN and EIN Verification Letter” “SS-4 and 147C” and “2021”. They rejected the form (after an hour and half hold to get to them and advised that line 3 needs to be totally blank when checking line 4 (specific use not recorded on CAF). Does this sound right? When I read the Instructions, I am even more confused. The person I spoke with was stuttering and referring to incorrect line numbers at first, so I worry that if I send blank line 3, I’m going to get rejected again.

Hi Jeff, we are not sure as we don’t deal with Form 2848 filings. However, anytime we get “unconfident” information from an IRS representative, we always call back a few more times and ask the exact same question to someone else. The phones are busy right now, so calling between 7am and 8am is best. Hope that helps.

Hey Matt AT LAST I GOT MY EIN. :) It was mailed CP575. But now I have few question that I want to clear it up.

1. The first SS4 form was sent on 5th of November. When I tried to talk to representative from IRS after 45 business days I still had no EIN assigned and they told me to resend SS4 form again. So than I found Third Party Designee. They faxed it for me few times. Now, can i find out from IRS which SS4 form did they use? Mine or my Third Party Designee?

2. It appress that the Name of my LLC is correct My business address is correct My first name is correct and written in full My Last Name is correct and written in full However, my middle name has only “One alphabet letter”. I can’t find an information if it is ok for middle name or not. When I faxed them I had everything written in full. I need help on this, please?

Hey Rocky, that is wonderful news :) You can call the IRS to check, or you can just do this: Use the current EIN you have. If you get another EIN in the future, just cancel/deactivate the EIN . If your name is Rocky John Smith and it’s entered as Rocky J Smith, that is totally okay. Hope that helps.

I’ve had my EIN for 20 years and just need a copy of the letter… it seems someone applying for a new EIN has the convenience of downloading theirs after the application but I have to call the IRS and then try to find one of these FAX machines to receive it. (we aren’t in the 90’s anymore so my oversized phone-printer isn’t here anymore). Why does acquiring a new letter need to be so difficult for those who already have an EIN?

Enter my EIN, something personal and download.. ??

Hi Herbert, we don’t disagree ;) However, this (or sending in a written request) is the only way to get a copy of your EIN.

Hi, Good Day, My EIN Number was received by phone on November 2nd but up to this moment, CP575 Letter not yet received in my USA LLC Mail address.

1- Do You know if clients in similar situations have already received their letter? 2- To get 147C by fax, is it required to send to IRS a consent letter asking IRS to send to You mentioned letter via fax? (is there a template for that?).

Tks and have a nice weekend. Ps. You have no idea how Your Videos and messages have already helped me in my journey!! Thanks a lot!! You rock!!

Hello After getting EIN what else we have to do for IRS like for taxes. Do you have any idea. thanks

Hi Giren, unfortunately, there isn’t a simple and short answer to this. Taxes depend on how the money is made, where the business makes money, where actives are, and what the tax status is of the LLC owner(s). We recommend working with an accountant .

Hi Daniel, thanks so much! You’re very welcome :) If you are the owner of the LLC, you can just call the IRS. You don’t need a consent form. Yes, the CP 575 can take a while to arrive due to the current situation. Sometimes it’s taking 3 months. You can call the IRS and request an EIN Confirmation Letter 147C in the meantime. Hope that helps.

I was issued my EIN on Dec. 15, 2020 by computer and as I opened it my system crashed. I managed to get the number before it went blue. My problem is I have been calling every single business day since then and get a recording that they are busy and to call back later or try again tomorrow. I cannot set the woocommerce portion of my ecommerce site up without verification and cannot get verification. I am running out of money while trying to get the one piece of paper I need from the IRS to allow me to open my business. I have customers waiting but they won’t wait forever…

Hi Stephen, I feel you man. Thousands and thousands of people are in the same situation. The IRS opens at 7am (local time; based off the incoming phone number’s area code). We recommend calling at 7am or 8am, or as early as you can. We’ve called the IRS ourselves about 5 times this week. We’ve had to wait each time, but we’ve gotten through each time. When calling, please follow the prompts/option number as mentioned above on this page to speak to a representative. Hope that helps :)

I got the EIN number only but my agent is saying that foreigners dont get CP 575 is that true? My question is after EIN approval do IRS send EIN verification letter or CP 575 letter to the respective mailing address or not(agent address)?

Hi Giren, if the SS-4 application was faxed, the first approval from the IRS is the SS-4 returned with the EIN written on it. Then the CP 575 arrives in the mail. Usually that is a few weeks after the EIN is issued, however, due to current delays, that can take a couple months. The CP 575 is sent to the mailing address that was listed on the SS-4. However, if you get an EIN Verification Letter (147C) it does the same thing and has the same power as the EIN Confirmation Letter (CP 575).

Thank you for your reply

After the EIN approval through fax will IRS send EIN verification letter automatically to the mailing address or we have to inform IRS for the mail.

Hi Giren, the EIN Confirmation Letter (CP 575) is automatically mailed after your EIN number is faxed back to you. You don’t have to contact the IRS to request it.

If I apply for an EIN online ( https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online ), it provides me with the EIN instantly. Where do I then go to download my CP575 instantly?

Hi Emily, the CP 575 (EIN Confirmation Letter) is provided in the very last step of the EIN online application. It’s a PDF form that you can download. If you didn’t download it and closed out of the EIN online application, you can call the IRS to get an EIN Verification Letter (147C) in the meantime. The CP 575 will eventually arrive in the mail, but that can take a few weeks to a couple months due to the delays the IRS is currently facing. Hope that helps.

Is that Step 5. EIN Confirmation? I don’t see where to download. It says “Congratulations! The EIN has been successfully assigned.” Then, under the EIN, it says “The confirmation letter will be mailed to the applicant.” The only links/buttons from this page is a “Continue” button to get additional information about using the new EIN, and a Help Topic link “Can the EIN be used before the confirmation letter is received?”

Hi Emily, yes, that is Step 5. EIN Confirmation. There should be a link that says “CLICK HERE for Your EIN Confirmation Letter”. We’ve never heard of that link not being there. That’s very strange. While the EIN Confirmation Letter (CP 575) will be mailed to you, we recommend calling the IRS for an EIN Verification Letter (147C) in the meantime. We recommend calling early in the morning for the shortest hold time.

You only have the option to print the CP 575 if you the responsible party. Third party registers obtaining an EIN on behalf of another entity do not have the option to print the CP 575 and it will be mailed to the client. You may want to update the article so everyone knows.

Hi Hugh, this is very helpful, thank you. We’ve updated the page.

I figured out why the link was not there. I usually put in that I am a Third Party applying for the EIN on behalf of the entity (as I am). To get the link to the letter, you have to click you are one of the owners, members, etc. of the entity. I was instructed to try it that way, and sure enough, the link comes up on Step 5. Thanks!!

Hi Emily, that makes sense. While that works, you don’t want to submit false information if you’re not an LLC Member or LLC Manager. The EIN Confirmation Letter (CP 575) will be mailed to the EIN Responsible Party if you’re applying as a Third Party Designee.

Thanks a lot, Matt, super helpful. One question remains, I already got a CP 575 but my name on it wasn’t full when I registered and this causes me trouble while registering as an Amazon seller. Is it possible to amend, extend my name while asking for the (147C) ?

Thanks a lot Antoine

Hi Antoine, you can ask while you call (I’m not 100% sure). If it doesn’t work, you can change the EIN Responsible Party for an LLC via Form 8822-B

Matt, buenos días Conoce algún número para pedir el 147Co ver si se ha emitido mi EIN que atiendan en inglés? Dado que sólo el titular puede llamar, es dificil comunicarse cuando sólo dan la opción en inglés en el número que mencionas. Llevo 9 semanas desde que envié mi SS-4 por FAX Gracias

Hola Nata, puedes llamar al 1-800-829-4933 y presionar la opción 2 para español.

Gracias Matt. Te cuento que intenté eso en Diciembre pero al parecer ese tipo de información sólo la brindan en inglés y te piden que vuelvas a comunicarte con un intérprete. Sin embargo, hoy llamé y la contestadora dice que el IRS se encuentra cerrado. Tienes idea a qué se debe este cierre o cuánto podría durar? Llevo 9 semanas de enviado el SS-4 por fax, sin ningún tipo de novedades aún.

Gracias eternas por tu ayuda.

Hola Nata, el IRS está abierto de lunes a viernes. A qué día y a qué hora llamaste? Intente llamarlos nuevamente esta semana y avíseme.

Hi, Thanks for your very informative documents. I have already received 147C but I changed my business name in that period and Should I change EIN number? How I can change my EIN number for changed business name company?

Hi Ersin, you’re very welcome. No, you would not change the EIN number if you change your LLC name (it’s still the same LLC). Instead, you just update the IRS with the new LLC name. We have instructions here: How to change my LLC name with the IRS . Hope that helps.

Can I apply for a new EIN # if I misplaced the one that I applied for recently?

Hi Christina, yes, you can do that. If you go that route, you can cancel the first EIN (see how to cancel an EIN with the IRS ). Alternatively, you can call the IRS and request an EIN Verification Letter (147C) as mentioned above on this page.

Hi, I received my EIN number by phone, 1 month ago, but up to this moment, I have not received the confirmation letter… Do you know if due to Corona Virus, is it taking longer than 4 to 6 weeks?? Tks and have a wonderful week ahead!!

Hi Daniel, yes, it’s taking much longer than 4-6 weeks right now. Sometimes 2 months or a bit longer. The EIN Verification Letter (147C) can serve as the official EIN approval though, in place of the EIN Confirmation Letter (CP 575)… or until it arrives by mail.

Thank you for this post. Exactly what I needed to know.

You’re welcome Lisa!

I received my EIN but I can’t find the letter I Know my number but I need the letter to open a bank account t what can I do? Please help me

Hi Efraín, the instructions on how to get your EIN Verification Letter (147C) are above on this page :) If you can’t find your EIN Confirmation Letter, the 147C is the only kind of “proof” you can get from the IRS. You can also call the bank and see if they’ll just take your word on the EIN, however, most banks want a copy of the EIN Confirmation Letter (CP 575) or EIN Verification Letter (147C). Hope that helps.

They didn’t accept, they want a copy. Thank you so much for your help I really appreciate.🙏🏼🙏🏼

I figured that was the case ;) You’re welcome Efraín!

Do foreign application having EIN can request for CP 575. (Non US citizen nor resident)

Hi Giren, yes, non-US residents/foreigners can get an EIN for an LLC. We have instructions here: How non-US residents can get EIN for LLC .

Hi Matt, I have been trying to get through to the IRS using option 1-1-3. It keeps telling saying they are experiencing higher than normal call volume and to try back. This has gone on for weeks. Any suggestions?

Hi Jennifer, the IRS has been horrible with phone support recently. Many people are having a hard time getting through. We recommend calling early in the morning, and if that doesn’t work, try multiple times per day. Some readers have gotten through, but only after trying for multiple days. Apologies, I wish there was something we could do or another way to solve this, but all we’ve been told by the IRS when we inquired was “keep trying”. Hopefully this doesn’t last too long and things soon return to normal. Thanks for your understanding.

Thanks for the article! It helped me a lot!. Btw, I faxed my EIN application 2 months ago. Now I still has not received any EIN/response from IRS? What should I do now?

Hi Thanh, it’s best to wait. The IRS has been delayed due to covid. You can call the IRS though at the number on this page to see if your EIN has been issued.

Thanks for the article! How long after receiving my EIN can I call the IRS to request a verification letter by fax?

Hi Momen, you don’t have to wait at all. You can request an EIN Verification Letter right after your EIN is issued.

Hello Matt, just wanted to see if you knew how to get my EIN letter because SWYFT Fillings sent it to the wrong address on file? I have tried calling the number but it keeps saying the office is closed. I started my business last August 2022 and i cant even do payroll or open a business account or anything without this letter..

Hi William, we posted an update at the top of this page. You’ll need to keep trying until you get through. There’s no other way to get the 147C letter.

Leave a comment or question

Comments are temporarily disabled.

How To Obtain Your EIN Verification Letter From The IRS

When you apply for an EIN , one of the most important documents for your EIN confirmation is your verification letter from the IRS. This unique nine-digit number is crucial for numerous aspects of running a legitimate business. Once you’ve applied for an EIN, the IRS sends you an EIN verification letter, and it’s vital to keep this letter safe.

However, if you happen to misplace it, don’t worry—this guide will walk you through the process of obtaining a copy of your EIN verification letter from the IRS.

What is an EIN confirmation letter?

The verification letter, often in the form of Form CP 575, is sent by the IRS upon approval of your EIN application, which you can fill out online. It serves as proof of your business’s tax identification and is required for tasks like opening a business bank account, hiring employees, and applying for specific business licenses.

Steps to Obtain a Copy of Your EIN Letter from the IRS

If you have lost or misplaced this confirmation letter, or simply did not receive one, then there are several steps you can take to ensure you get a copy of one. Below are some of the methods you can use to get your hands on a copy of your IRS EIN confirmation letter.

Contacting the IRS for a Verification Letter

Losing your EIN confirmation letter is not uncommon, and the IRS understands this. If you find yourself in need of a new copy, the process is relatively straightforward. Call the IRS at 1-800-829-4933 and speak to a representative on the “business and specialty tax line.” Request a 147c letter, which is essentially a new copy of your EIN verification letter. Be prepared to provide your EIN, business name, address, and other verification details.

For the process to run as smoothly as possible, you should make sure that all of the information you provide to the operator matches the information registered on their records before you make the call. As a heads up, the IRS receives many calls on a daily basis, so you should also be prepared to spend a bit of time on hold before being put through to someone who can help you.

Necessary Information for Verification

Authorized individuals, such as business owners, partners, or those with power of attorney, can request a 147c letter. The IRS agent will likely ask questions to confirm your identity, including details like your business address as per IRS records and the type of tax return your business files. If you are not authorized to obtain an EIN or relevant information on behalf of your company, then you will not be able to request an EIN verification letter.

Process for Requesting a 147c Letter

Once your identity is confirmed, you can choose how to receive your letter—either through mail or fax. While the IRS doesn’t email sensitive information, opting for fax can expedite the process compared to waiting for mail. In either format, the letter remains an official government document and will be accepted by any bank or licensing center should they require EIN confirmation.

Alternative Ways to Retrieve Your EIN Letter

If you don’t have the means of requesting your EIN directly from the IRS, then there are other methods you can follow to get a hold of this important document. Below are some of the alternative ways you can try to get your verification letter.

Getting a Copy from Your Bank

If you submitted a copy of your EIN verification letter when you applied for an account or loan, your bank might be able to help. Although they can’t provide an official copy, a scanned version of your EIN confirmation letter from your initial submission upon opening the account may be sufficient for certain tasks, depending on what they are. Before you request a copy of this document from your bank, it’s advised you confirm with the receiving party if a scanned copy will meet their requirements. Some organizations may need original documentation.

Contacting Your Accountant or Agency

If you enlisted the help of an external accountant or agency for your EIN application, they may have a copy of your confirmation letter. Reach out to them for assistance and they may be able to provide you with the document you require.

Checking for IRS Email Confirmations

If you applied for your EIN through the IRS website, check your email for confirmation. The IRS typically sends an email that can serve as proof in some respects. Remember, when you apply for an EIN online, it takes about 2 weeks for the IRS to register that EIN with your business. You should therefore check this before proceeding with any tasks that require EIN confirmation.

Keeping track of your EIN confirmation letter is crucial for the smooth operation of your business. Losing it is not the end of the world, as the IRS provides accessible ways to obtain a new copy. By promptly addressing the situation and maintaining accurate records, you ensure that your business functions seamlessly without any downtime or disruptions caused by administrative oversight. Whether through direct IRS contact, banking assistance, or support from professionals, the process is designed to be manageable. Always prioritize the safekeeping of your EIN documentation to avoid unnecessary hassles in the future.

If you require confirmation of your EIN but do not necessarily need an official letter, then you can also make use of lookup services like EINSearch . Our services offer a quick and easy way for you to obtain your EIN, or even another company’s if necessary. Get in touch with us today to see how we may be able to assist in locating your business’ EIN.

Want to stay in the know for all things EIN Search & TIN Matching?

Enter Your Name *

Enter Your Email *

Example: Yes, I would like to receive emails from EINSearch. (You can unsubscribe anytime)

Related Posts

What to do if you’re assigned an ein you did not request, ein vs. itin vs. ssn: the differences business owners must know, do i need to be registered as a business to obtain an ein.

Privacy Policy | Terms of Use

147C Letter – IRS EIN Verification

Searching for your misplaced EIN verification letter, also known as the IRS 147c letter? You’re not alone. Many business owners and tax professionals need to request a replacement EIN confirmation document. Thankfully, retrieving your 147c letter from the IRS is a straightforward process.

This comprehensive guide will simplify everything you need to rapidly get a replacement 147c letter. We’ll explain what the EIN verification letter contains, why you may need it, who can request it, and detail the fastest options to obtain your personalized 147c letter from the IRS.

So if you’ve lost your original Employee Identification Number (EIN) confirmation notice from the IRS and need another copy, you’re in the right place. Let’s dive in and demystify the entire 147c letter request process.

What is a 147c Letter?

An IRS 147c letter, also referred to as an EIN verification letter, is an official document sent from the Internal Revenue Service. It displays your business’s assigned nine-digit federal Employer Identification Number (EIN).

This EIN confirmation notice also includes your business entity’s complete registered legal name and address listed in the IRS database.

Essentially, whenever you successfully receive a federal EIN for tax and identification purposes, the IRS automatically mails your business this 147c verification letter. It serves as formal proof and acknowledgment from the IRS that your corporation, LLC, partnership or other business structure secured an official EIN.

Why do you need an IRS 147c Letter?

There are several important reasons you may need to acquire an EIN verification letter (147c) for your business:

- Opening a Business Bank Account – Most financial institutions require IRS confirmation of your EIN before opening a business bank or credit account under your company’s name and tax ID number. The 147c letter satisfies this prerequisite.

- Applying for Business Licenses – Local, state and federal licensing bureaus commonly mandate verified EIN documentation when processing applications for company licenses, permits or registrations.

- Proof of EIN for Tax Filings – Both the IRS and state taxing agencies can request your 147c letter to validate the legal business name and EIN matching their records when processing company tax documents.

- Legal Verification of Business Entity – Courts, government institutions and third parties frequently require formal IRS verification when confirming the legitimate existence of an organization’s tax identification.

In other words, despite having an EIN, many agencies and businesses will not formally recognize the legal status of your corporation or LLC without IRS-stamped validation. Whether opening a bank account, registering your company vehicle or simply proving your business life, expect to routinely provide a copy your 147c letter.

Who can request a 147c Letter?

Only authorized owners or representatives can retrieve a replacement EIN verification notice from the IRS. Typically, this means:

- A principal owning at least 20% equity share in the business

- An officer, member or partner listed in the company’s formal registration

- A designated Power of Attorney (POA) or Third Party Designee officially affiliated with the business

Minority shareholders, unofficial LLC members, employees, contractors or associates generally cannot request EIN confirmation directly from the IRS. However, with proper permissions, these informal affiliations can still obtain the 147c letter through an authorized representative listed above.

If no principal owner or officer remains active in the company, registered POAs may still qualify to receive a 147c notice on its behalf. Either way, the IRS will only issue replacement EIN letters to verified identities authorized under the business’s official registration.

How to get IRS 147c Letter (3 fast options)

Now that you understand what the form contains and why you need it, let’s explore the fastest ways to get your hands on an EIN verification letter (147c) from the IRS.

The IRS provides three reliable methods to quickly obtain your replacement 147c notice: call them directly, utilize a POA, or request through a professional tax service provider.

Option 1: Call the IRS directly

Calling the IRS Business and Specialty Tax line is the simplest way owners and principal officers can directly request a new 147c letter:

- Verify your government ID and personal details are available (SSN, ITIN, EIN, address etc.)

- Prepare answers to all potential IRS identity confirmation questions

- Call 800-829-4933, then press 1 for English or 2 for Spanish, followed by pressing 3 for all other questions

- Clarify the reason for your call is to request an updated 147c EIN verification letter

- Provide your fax number or verify mailing address for fastest IRS letter delivery

As long as you pass the standard security checks, the agent can instantly fax your new 147c letter or place a mail request to your registered business address. Just inform them of your preferred method to receive the refreshed EIN confirmation notice.

Expect a faxed 147c letter within minutes or mailed verification within 5-7 business days. Remember, only owners or partners can directly call the IRS through this process.

Option 2: Utilize an IRS Power of Attorney

If you cannot or prefer not to call the IRS directly, authorizing a Power of Attorney (POA) provides another path to securing your necessary 147c letter. Here are the step-by-step instructions when using an IRS-approved POA representative:

- Identify an appropriate POA for your business (tax preparer, lawyer, trusted affiliate etc.)

- Fully complete IRS Form 2848 Power of Attorney with your POA

- Write “147c letter” next to Tax Form Number on section 3 of your 2848 POA form

- Provide your POA with access to all required identity verification details

- Call the IRS together at 1-800-829-4933, select language option, then press 3

- Your POA informs the agent they will speak on your behalf with POA form ready

- Fax your Form 2848 during the call when requested

- Answer all IRS security checks through your representative POA

- Request your updated 147c EIN verification letter delivery method

- Receive your refreshed letter instantly via fax or in 5-7 days by mail

This approach allows someone to securely obtain your 147c confirmation on your behalf. Make sure to fully prepare your chosen POA representative in advance.

IRS 147c letter sample

Option 3: Retain Professional Tax Services

Finally, specialized tax preparation firms frequently provide 147c letter retrieval services for businesses nationwide. Their IRS connections and specialized staff simplify the entire EIN verification process.

Although paid services can seem inconvenient, this hands-off approach requires no effort from you. Reputable providers like H&S Accounting & Tax Services can swiftly procure your refreshed IRS notice containing up-to-date legal business details.

Professional tax services also help correctly update any changed information with the IRS, guaranteeing your new 147c letter contains current company data. Their expertise ensures you receive a valid 147c suitable for all legal and institutional purposes.

In certain cases, tax experts may directly expedite letter requests through dedicated IRS processing channels not available elsewhere. This yields the fastest and most reliable 147c letter turnaround.

While costs vary between providers, paying reliable tax professionals removes all hassle getting your urgently needed EIN verification letter reissued correctly.

147c Letter request turnaround times

Outside of professional services, how long does it take to receive your EIN confirmation after placing a 147c letter request?

The good news is the IRS can instantly fax your refreshed letter minutes after approving an owner’s call or POA request. This electronic copy usually satisfies most needs requiring the EIN notice.

For a physical mailed copy, expect your official 147c envelope from the IRS within 5-7 business days after successful telephone or POA requests.

So if you need fast verification, request fax delivery and receive IRS confirmation of your EIN almost instantly. Otherwise, standard mail provides you an official document for more stringent bureaucratic demands.

Bottom Line: Verifying your business EIN is simple

Obtaining a replacement copy of your critical IRS 147c EIN verification letter is a quick and easy process. Now that you understand what this notice contains, why you need it, and how to request it, you can confidently prove and validate your registered business identification at any time.

Whether you handle the straightforward phone call directly or use a specialized service for convenience, the IRS makes retrieving your 147c confirmation simple and fast. With this guide’s help getting a refreshed letter, you can keep your company compliance and financial operations running smoothly.

- Meet the Team

- Event Speaking

- Testimonials

- Bookkeeping

- S-Corp Formation

- Virtual CFO

How can I get a copy of my EIN Verification Letter (147C) from the IRS?

If you have lost your federal employer identification number , you can contact the IRS to request a copy of the EIN confirmation letter.

To request a copy of the EIN Verification Letter (147C), complete the following steps:

- Call the IRS Business & Specialty Tax Line toll-free at 1-800-829-4933 between the hours of 7 am and 7 pm in your local time zone.

- When the call is answered, press 1 for English

- Next, you will be asked to press 1 for information related to your FEIN or EIN

- Next, select option 3 – You have a FEIN or EIN but need a confirmation number

- You will need to have the FEIN or EIN number, name, and address you have been using on your 941 forms, W‐2 forms, and or 1099 forms.

- Once your information has been verified, the IRS agent will offer to fax the letter to you immediately or snail mail you a copy of the letter.

Only an owner or a Power of Attorney (POA) can request a 147C Letter. If you would like a POA to request your EIN Verification Letter (147C), both you and your POA will need to complete the IRS Form 2848 and have it ready to send to the IRS via fax during the phone call with the IRS.

For more information on how to retrieve your EIN Verification Letter, visit this IRS resource .

- Understanding Accountable Plans: A Guide for S-Corp Owners

- Reinstate Your Business in Texas: A Step-by-Step Guide

Amy Northard, CPA

Founder of The Accountant for Creatives® + taxes + bookkeeping + consulting + Hang out with me over on Instagram !

Comments are closed.

We’re not your parent’s accountant. When you hire us, you will be treated with care during every step of the process.

- Find out more about us.

- Invite us to speak at your event.

- Sign up for free tax tips and advice.

News & Tax Tips

- 3 Big Tax Changes in 2024

- Passive Business Owners: Tax Risks and Rewards

- Should My Business Be an LLC or an S-Corporation?

- Know Your Worth® Course

- S-Corp Reasonable Compensation

© 2024 The Accountants for Creatives®. Privacy and Terms .

S corps and partnership extension deadline Sept. 16

Customer login

Tax Pro login

Business tips

Obtaining Your EIN Verification Letter (Form 147C) from the IRS

8 minute read

Copy Article URL

Obtaining Your EIN Verification Letter From the IRS Form 147C: Request an EIN, Copy of EIN By Using IRS Letter 147C

Kristal Sepulveda, CPA

November 14, 2023

An Employer Identification Number (EIN) Verification Letter or EIN confirmation letter, also known as Form 147C, is a document issued by the Internal Revenue Service (IRS) to confirm the validity of your EIN. It is essential proof of your business's identity to conduct various financial and tax-related activities. This article will guide you through obtaining your EIN Verification Letter and help you understand its significance.

What is an EIN Verification IRS Letter 147C?

An EIN Verification Letter is an official document provided by the IRS that serves as confirmation of your business's EIN - a unique nine-digit number assigned to business entities for tax filing and reporting purposes. The letter includes important details such as the legal name of the business and its EIN, which are crucial for interacting with the IRS and other entities.

Understanding the purpose of an EIN Number Verification Letter

An EIN Verification Letter's primary purpose is to authenticate a business entity's existence and legitimacy. It provides third parties, such as financial institutions, vendors, and government agencies, with assurance regarding the accuracy of the EIN and the associated business entity.

Why do you need an EIN Verification Letter?

Businesses often require an EIN Verification Letter when opening bank accounts, applying for business loans, obtaining permits and licenses, or engaging in certain types of financial transactions. It is a vital piece of documentation that ensures smooth business operations and compliance with legal and regulatory requirements.

How does the IRS use the EIN Verification Letter?

From the IRS's perspective, the EIN Verification Letter is a means of validating the accuracy of the information provided by business entities . It helps the IRS confirm the identity of businesses and ensures that they are fulfilling their tax obligations in a lawful manner.

Want To Organize Your Business's Finances? Download A Free Balance Sheet Excel Template Here

How to request an ein verification letter.

If you need to request an EIN Verification Letter, the process involves contacting the IRS and submitting the necessary documentation to obtain the letter. Here are the steps for requesting an EIN Verification Letter:

Steps for requesting an EIN Verification Letter

To request your EIN Verification Letter, you'll need to complete Form SS-4, Application for Employer Identification Number, which is available on the IRS website or through their office. Once completed, you can submit the form to the IRS either online, by mail, fax, or in person.

Where to submit the request for an EIN Verification Letter?

The submission of Form SS-4 and the request for an EIN Verification Letter should be directed to the IRS Business and Specialty Tax Line or the appropriate IRS office, based on your business's location and the method of submission chosen.

Timeframe for receiving the EIN Verification Letter

Once the IRS processes your request, you can expect to receive your EIN Verification Letter within a reasonable timeframe. It's important to plan ahead and consider the time required for the IRS to review and respond to your request.

Want To Stay On Top Of Your Business's Accounts? Download A Free Chart Of Accounts Excel Template Here

When do you need to request a 147c letter need a 147c letter.

There are specific situations and events that may necessitate the need for a 147C Letter from the IRS. Understanding when you require this document is crucial to ensuring your business operations remain compliant and unhindered.

Events that require a 147C Letter from the IRS

Several circumstances, such as changes in business structure, tax audits, opening new business accounts, or interactions with government agencies, may require a 147C Letter from the IRS as part of the verification process.

How to identify if you need a 147C letter?

If you are unsure whether a particular situation or transaction requires a 147C Letter, it is advisable to consult with tax professionals, legal advisors, or directly with the IRS to determine the appropriate course of action. Proactively understanding the circumstances that warrant a 147C Letter can prevent potential disruptions in business activities .

Consequences of not having a 147C Letter when required

Failing to obtain a 147C Letter when needed can lead to delays in crucial business processes , denials of important applications, or even legal and financial repercussions. It is essential to be aware of the instances where a 147C Letter is mandatory and ensure timely compliance.

How to Contact the IRS for EIN Verification Letter?

When reaching out to the IRS to request an EIN Verification Letter or address related issues, it is important to understand the available options for communication and the information required for effective correspondence.

Options for contacting the IRS

You can contact the IRS through various channels, including phone, mail, online inquiries, or in-person visits to IRS offices. Each communication method has its own procedures and requirements, so selecting the most suitable option based on your specific needs is essential. The most common method is applying online via irs.gov.

Information required when calling the IRS for EIN Verification Letter

When contacting the IRS, you'll need to provide specific details such as your EIN, business name, contact information, and the purpose of your request. This information helps IRS agents process your request efficiently and accurately.

Resolving issues related to the EIN Verification Letter

In the event of errors, delays, or discrepancies related to your EIN Verification Letter, it's important to engage with the IRS promptly to address and resolve the issues. Working closely with IRS agents can help expedite the resolution process and prevent potential complications.

Common Errors and Issues when Requesting an EIN Verification Letter

While requesting an EIN Verification Letter, it's essential to be mindful of common errors and issues that may arise during the process. Being aware of these potential pitfalls can help you navigate the process more effectively.

Typical mistakes made when requesting an EIN Verification Letter

Errors such as incorrect information on the Form SS-4, incomplete documentation, or inaccuracies in the application details can lead to delays or rejections in issuing the EIN Verification Letter. Reviewing your submission thoroughly can help mitigate these issues.

Dealing with errors on the EIN Verification Letter

If you encounter errors or discrepancies on the EIN Verification Letter you receive, it's crucial to address them promptly by contacting the IRS. Providing clear explanations and supporting documentation can aid in rectifying any inaccuracies present in the letter.

Appealing a decision regarding the EIN Verification Letter

In situations where you disagree with the IRS's decision regarding your EIN Verification Letter, you have the right to appeal the decision through established procedures. Seeking professional guidance and understanding the appeals process can help effectively present your case.

Key Takeaways: Understanding Your Employer Identification Number Verification Letter

| Businesses Should Know About Filing Form 147C for Their EIN | Details |

|---|---|

| Purpose of Form 147C | To request a verification of your Employer Identification Number (EIN) from the Internal Revenue Service (IRS) |

| Who should file Form 147C | Businesses that have lost or misplaced their EIN |

| How to file Form 147C | Form 147C can be filed online, by fax, or by mail |

| What information is required on Form 147C | Business name, address, telephone number, EIN (if known), and business type |

| Processing time for Form 147C | The IRS typically processes Form 147C within 60 days |

| Cost to file Form 147C | There is no fee to file Form 147C |

| What to do with the IRS verification letter | Keep the IRS verification letter in a safe place for your records |

| Penalties for not responding to Form 147C | The IRS may assess penalties if you do not respond to Form 147C |

- CP 575 and 147C Letter : The CP 575 is the initial notice you receive from the IRS when you are assigned an EIN. If you need a copy, you can request a 147C letter, also known as an EIN Verification Letter.

- Getting a Copy of Your EIN : If you already have an EIN but require proof of your EIN, you can contact the IRS Business and Specialty Tax Line to request a copy of your EIN, specifically the CP 575 or 147C letter.

- EIN Verification Letter 147C : The IRS 147C letter is a document that serves as official proof of your EIN. If you need your 147C letter, you can request one from the IRS.

- Applying for an EIN : The way to get an EIN is through the IRS, and you can apply for an EIN if you don't remember your EIN or need a new one.

- Requesting EIN Confirmation Letter : If you need to provide your EIN to a third party or for official purposes, request an EIN confirmation letter, which the IRS will mail to you.

- Contact the IRS for EIN Issues : To receive your 147C letter or any documentation of your EIN, contact the IRS to request it. The IRS support team can guide you through the process.

- Form 2848 and EIN Representation : To allow someone else to request a copy of your EIN, you can use IRS Form 2848, which grants power of attorney.

- Understanding Your IRS Correspondence : The IRS send EIN Verification Letter as a way to provide official proof of your EIN. Remember, the IRS will never email 147C letters for security reasons.

- EIN Verification for Business Needs : If you need to prove your EIN for tax forms with the IRS or for business verification, the 147C letter or a copy of your CP 575 notice serves as a replacement for the original EIN notice.

- Receiving and Using Your EIN Documentation : Once you receive your verification letter, it's crucial to keep it for records as it is essential for maintaining good standing with the IRS and for various business needs.

- IRS Agent Communication : When you contact the IRS to request a copy or clarification, the IRS agent will ask for specific information to verify your identity and business details.

- Ensuring Compliance and Proof of Identity : It's important to recall your EIN or have a copy from the IRS for various transactions and interactions, as most financial institutions in the US accept 147C letters as well as other forms like Form 8821 or Form 2848.

How can Taxfyle help?

Finding an accountant to file your taxes is a big decision . Luckily, you don't have to handle the search on your own.

At Taxfyle , we connect individuals and small businesses with licensed, experienced CPAs or EAs in the US. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will handle filing taxes for you.

Get started with Taxfyle today , and see how filing taxes can be simplified.

Legal Disclaimer

Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

Was this post helpful?

Did you know business owners can spend over 100 hours filing taxes, it’s time to focus on what matters..

With Taxfyle, the work is done for you. You can connect with a licensed CPA or EA who can file your business tax returns. Get $30 off off today.

Want to put your taxes in an expert’s hands?

Taxes are best done by an expert. Here’s a $30 coupon to access to a licensed CPA or EA who can do all the work for you.

Is this article answering your questions?

Thanks for letting us know.

Whatever your questions are, Taxfyle’s got you covered. If you have any further questions, why not talk to a Pro? Get $30 off today.

Our apologies.

Taxes are incredibly complex, so we may not have been able to answer your question in the article. Fortunately, the Pros do have answers. Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have.

Do you do your own bookkeeping?

There’s an easier way to do bookkeeping..

Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands. Get $30 off today.

Why not upgrade to a licensed, vetted Professional?

When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle. Get $30 off today.

Are you filing your own taxes?

Do you know if you’re missing out on ways to reduce your tax liability.

Knowing the right forms and documents to claim each credit and deduction is daunting. Luckily, you can get $30 off your tax job.

Get $30 off your tax filing job today and access an affordable, licensed Tax Professional. With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle.

How is your work-life balance?

Why not spend some of that free time with taxfyle.

When you’re a Pro, you’re able to pick up tax filing, consultation, and bookkeeping jobs on our platform while maintaining your flexibility.

Why not try something new?

Increase your desired income on your desired schedule by using Taxfyle’s platform to pick up tax filing, consultation, and bookkeeping jobs.

Is your firm falling behind during the busy season?

Need an extra hand.

With Taxfyle, your firm can access licensed CPAs and EAs who can prepare and review tax returns for your clients.

Perhaps it’s time to scale up.

We love to hear from firms that have made the busy season work for them–why not use this opportunity to scale up your business and take on more returns using Taxfyle’s network?

by this author

Share this article

Subscribe to taxfyle.

Sign up to hear Taxfye's latest tips.

By clicking subscribe, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

Get our FREE Tax Guide for Individuals

Looking for something else? Check out our other guides here .

By clicking download, I agree to Taxfyle's Terms of Service , Privacy Policy , and am opting in to receive marketing emails.

File simpler.

File smarter.

File with Taxfyle.

2899 Grand Avenue, Coconut Grove, FL 33133

Copyright © 2024 Tickmark, Inc.

- Corporations

- Definitions

EIN Letter (What It Is And How To Get A Copy: Explained)

What is EIN Letter ?

What is an example of an EIN verification letter?

How do you get a new one?

In this article, I will break down the EIN Letter so you know all there is to know about it!

Keep reading as I have gathered exactly the information that you need!

Let me explain to you what is an EIN letter from IRS and why it’s important!

Are you ready?

Let’s get started!

Table of Contents

What Is An EIN Letter

An EIN letter can either refer to the Form CP 575 which is a letter sent by the IRS shortly after having assigned an EIN number to your or your business or it can refer to an EIN Verification Letter which is a letter sent by the IRS when Form CP 575 is misplaced.

Companies and some individuals get an EIN number (Employment Identification Number) representing a nine-digit number assigned to them by the IRS.

The EIN number is used to identify your company or sole proprietorship with the tax authorities, government agencies, banks, and other stakeholders.

The EIN letter (whether we are referring to CP 575 or the EIN Verification Letter) is a document that officially confirms your company’s EIN number.

At some point in time in your business, you may need to present this official EIN letter to banks, financial institutions, investors, suppliers, vendors, or others.

How EIN Letters Work

Now that we know what is an EIN letter, let’s see how it works.

Original EIN Letter

When you first apply for an Employer Identification Number, the IRS will send you an official confirmation of the EIN letter assigned to your company in a document called CP 575.

The CP 575 document is sent to you within 8 to 10 weeks following the approval of your EIN application.

It’s crucial to keep the CP 575 document in a safe place as the IRS will only mail this to you once.

If you lose or misplace your CP 575 , you will need to ask for a replacement EIN letter but this letter will no longer be a CP 575 but an EIN Verification Letter.

Replacement EIN Letter

No matter how careful we are, it’s possible that we lose paperwork from time to time.

The same is true for your EIN letter.

If you happen to lose your original EIN letter, you’ll need to ask the IRS for a replacement copy.

However, the IRS will not replace your original EIN letter by issuing once more the same CP 575 Form.

Instead, the IRS will issue an EIN Verification Letter in the form of a 147C Letter .

This letter is essentially the official substitute of the CP 575 form allowing you to officially confirm your company’s EIN letter should banks and lenders ask.

Why Is An EIN Letter Important

An EIN letter is an important document that is issued to your company by the IRS.

When the IRS assigns a tax identification number to your company (an EIN), it will officially confirm that assignment by sending a letter (an EIN letter).

The confirmation of your company’s EIN in a letter is like getting the confirmation of Social Security Number for individuals.

In the same way that an SSN is a crucial number for individuals, EIN is a crucial number for companies.