Pardon Our Interruption

As you were browsing something about your browser made us think you were a bot. There are a few reasons this might happen:

- You've disabled JavaScript in your web browser.

- You're a power user moving through this website with super-human speed.

- You've disabled cookies in your web browser.

- A third-party browser plugin, such as Ghostery or NoScript, is preventing JavaScript from running. Additional information is available in this support article .

To regain access, please make sure that cookies and JavaScript are enabled before reloading the page.

5.3 Explain and Compute Equivalent Units and Total Cost of Production in an Initial Processing Stage

As described previously, process costing can have more than one work in process account. Determining the value of the work in process inventory accounts is challenging because each product is at varying stages of completion and the computation needs to be done for each department. Trying to determine the value of those partial stages of completion requires application of the equivalent unit computation. The equivalent unit computation determines the number of units if each is manufactured in its entirety before manufacturing the next unit. For example, forty units that are 25% complete would be ten (40 × 25%) units that are totally complete.

Direct material is added in stages, such as the beginning, middle, or end of the process, while conversion costs are expensed evenly over the process. Often there is a different percentage of completion for materials than there is for labor. For example, if material is added at the beginning of the process, the forty units that are 100% complete with respect to material and 25% complete with respect to conversion costs would be the same as forty units of material and ten units (40 × 25%) completed with conversion costs.

For example, during the month of July, Rock City Percussion purchased raw material inventory of $25,000 for the shaping department. Although each department tracks the direct material it uses in its own department, all material is held in the material storeroom. The inventory will be requisitioned for each department as needed.

During the month, Rock City Percussion’s shaping department requested $10,179 in direct material and started into production 8,700 hickory drumsticks of size 5A. There was no beginning inventory in the shaping department, and 7,500 drumsticks were completed in that department and transferred to the finishing department. Wood is the only direct material in the shaping department, and it is added at the beginning of the process, so the work in process (WIP) is considered to be 100% complete with respect to direct materials. At the end of the month, the drumsticks still in the shaping department were estimated to be 35% complete with respect to conversion costs. All materials are added at the beginning of the shaping process. While beginning the size 5A drumsticks, the shaping department incurred these costs in July:

These costs are then used to calculate the equivalent units and total production costs in a four-step process.

Step One: Determining the Units to Which Costs Will Be Assigned

In addition to the equivalent units, it is necessary to track the units completed as well as the units remaining in ending inventory. A similar process is used to account for the costs completed and transferred. Reconciling the number of units and the costs is part of the process costing system. The reconciliation involves the total of beginning inventory and units started into production. This total is called “units to account for,” while the total of beginning inventory costs and costs added to production is called “costs to be accounted for.” Knowing the total units or costs to account for is helpful since it also equals the units or costs transferred out plus the amount remaining in ending inventory.

When the new batch of hickory sticks was started on July 1, Rock City Percussion did not have any beginning inventory and started 8,700 units, so the total number of units to account for in the reconciliation is 8,700:

The shaping department completed 7,500 units and transferred them to the testing and sorting department. No units were lost to spoilage , which consists of any units that are not fit for sale due to breakage or other imperfections. Since the maximum number of units that could possibly be completed is 8,700, the number of units in the shaping department’s ending inventory must be 1,200. The total of the 7,500 units completed and transferred out and the 1,200 units in ending inventory equal the 8,700 possible units in the shaping department.

Step Two: Computing the Equivalent Units of Production

All of the materials have been added to the shaping department, but all of the conversion elements have not; the numbers of equivalent units for material costs and for conversion costs remaining in ending inventory are different. All of the units transferred to the next department must be 100% complete with regard to that department’s cost or they would not be transferred. So the number of units transferred is the same for material units and for conversion units. The process cost system must calculate the equivalent units of production for units completed (with respect to materials and conversion) and for ending work in process with respect to materials and conversion.

For the shaping department, the materials are 100% complete with regard to materials costs and 35% complete with regard to conversion costs. The 7,500 units completed and transferred out to the finishing department must be 100% complete with regard to materials and conversion, so they make up 7,500 (7,500 × 100%) units. The 1,200 ending work in process units are 100% complete with regard to material and have 1,200 (1,200 × 100%) equivalent units for material. The 1,200 ending work in process units are only 35% complete with regard to conversion costs and represent 420 (1,200 × 35%) equivalent units.

Step Three: Determining the Cost per Equivalent Unit

Once the equivalent units for materials and conversion are known, the cost per equivalent unit is computed in a similar manner as the units accounted for. The costs for material and conversion need to reconcile with the total beginning inventory and the costs incurred for the department during that month.

The total materials costs for the period (including any beginning inventory costs) is computed and divided by the equivalent units for materials. The same process is then completed for the total conversion costs. The total of the cost per unit for material ($1.17) and for conversion costs ($2.80) is the total cost of each unit transferred to the finishing department ($3.97).

Step Four: Allocating the Costs to the Units Transferred Out and Partially Completed in the Shaping Department

Now you can determine the cost of the units transferred out and the cost of the units still in process in the shaping department. To calculate the goods transferred out, simply take the units transferred out times the sum of the two equivalent unit costs (materials and conversion) because all items transferred to the next department are complete with respect to materials and conversion, so each unit brings all its costs. But the ending WIP value is determined by taking the product of the work in process material units and the cost per equivalent unit for materials plus the product of the work in process conversion units and the cost per equivalent unit for conversion.

This information is accumulated in a production cost report . This report shows the costs used in the preparation of a product, including the cost per unit for materials and conversion costs, and the amount of work in process and finished goods inventory. A complete production cost report for the shaping department is illustrated in Figure 5.6 .

Calculating Inventory Transferred and Work in Process Costs

Kyler Industries started a new batch of paint on October 1. The new batch consists of 8,700 cans of paint, of which 7,500 was completed and transferred to finished goods. During October, the manufacturing process recorded the following expenses: direct materials of $10,353; direct labor of $17,970; and applied overhead of $9,000. The inventory still in process is 100% complete with respect to materials and 30% complete with respect to conversion. What is the cost of inventory transferred out and work in process? Assume that there is no beginning work in process inventory.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 2: Managerial Accounting

- Publication date: Feb 14, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-managerial-accounting/pages/5-3-explain-and-compute-equivalent-units-and-total-cost-of-production-in-an-initial-processing-stage

© Jul 16, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Learning Materials

- Business Studies

- Combined Science

- Computer Science

- Engineering

- English Literature

- Environmental Science

- Human Geography

- Macroeconomics

- Microeconomics

- Costs of Production

What are the costs of production of a firm and why are they so important? Take, for example, a keyboard manufacturing company. To produce their keyboards, this company would consider the prices of materials such as paint, metal, and electronic parts. It would also have to consider the necessary labour and the supply chain distribution to produce these keyboards. All of these are the costs of production of the keyboards. If there was an increase in the electronic parts prices, the company would have to increase the price of the keyboards to achieve the appropriate margin and maintain the same level of profit . That is why knowing their productions costs as well as the difference between fixed costs, variable costs, average costs, and total costs is fundamental for any firm.

Millions of flashcards designed to help you ace your studies

- Cell Biology

_______ production in microeconomic theory is when at least one of the factors of production is fixed.

Long-run production in microeconomic theory is the period where the scale of all factors of production is ________.

Choose the fixed costs.

Select examples of variable costs.

If a company increases its output in the short run, its total variable costs will rise.

Review generated flashcards

to start learning or create your own AI flashcards

Start learning or create your own AI flashcards

- Asymmetric Information

- Consumer Choice

- Economic Principles

- Factor Markets

- Imperfect Competition

- Labour Market

- Market Efficiency

- Microeconomics Examples

- Perfect Competition

- Political Economy

- Poverty and Inequality

- Production Cost

- Average Cost

- Constant Returns to Scale

- Cost Accounting

- Cost Curves

- Cost Minimization

- Decreasing Returns to Scale

- Diseconomies of Scale

- Economic Cost

- Economic Profit vs Accounting Profit

- Economies of Scale

- Economies of Scope

- Fixed Costs

- Increasing Returns to Scale

- Isocost Line

- Long Run Entry and Exit Decisions

- Long Run Production Cost

- Marginal Cost

- Marginal Revenue

- Opportunity Cost of Capital

- Production Function

- Productivity

- Profit Maximization

- Returns to Scale

- Revenue Vs Profit

- Short Run Production Cost

- Short Run Production Decision

- Specialisation and Division of Labour

- Technological Change

- The Law of Diminishing Returns

- Total Cost Curve

- Types of Profit

- User Cost of Capital

- Supply and Demand

Costs of production definition

Costs of production refer to all the expenses incurred in the process of creating and delivering a product or service. These expenses can include raw materials, labour, equipment, rent, and marketing costs. In simple terms, it is the sum of all expenses necessary to produce and sell a product or service.

The costs of production are the costs that a company incurs when it produces goods or services, sells those goods or services, and delivers them to its customers.

Costs of production overview

The costs of production overview will explain the different types of costs that firms incur when producing goods or services and how they can be categorized into fixed and variable costs in both short-run and long-run production.

What is short-run production?

Short-run production in microeconomic theory is when at least one of the factors of production (land, labour, capital, or technology) is fixed and can’t be changed.

The company can produce more output in the short run by adding more variable factors to the fixed factors of production.

Consider a hockey stick manufacturer. They require materials such as lumber, labour, machinery, and a factory. If the demand for hockey sticks increased, the company would start producing more hockey sticks to meet the demand.

They would order the necessary raw materials (lumber, for example) with little delay thus increasing their stock of those materials. In addition, the company would require a larger workforce. To guarantee a larger workforce, the company could hire more workers or give extra shifts and night shifts to its current workers.

In this case, both of these factors (the raw materials and the labour force) would be considered variable inputs.

On the other hand, an additional factory can’t be a variable input. A new factory would be a fixed input, as the company wouldn’t be able to build a new one in a short time. Furthermore, machinery could also be a fixed input since producing it and installing it might take the firm a long time.

What is long-run production?

Long-run production in microeconomic theory is the period where the scale of all factors of production is variable and can be changed.

In the long run, the company can benefit from economies of scale as the scale and capacity of production can increase. For example, a company can increase the quantity of its labour force while simultaneously increasing the quantity of capital.

In the hockey stick manufacturer example, all the inputs (lumber, labour, machinery, and the factory) are variable in the long run.

This means that the firm could change all of them so that it wouldn’t have fixed factors that prevented an increase in production output.

In the hockey stick industry, it means that existing firms are not constrained and can change the size of the company and the number of factories they own.

Types of production costs

There are many types of production costs:

- variable cost

- total costs

- average cost

- marginal cost

Fixed costs

Fixed costs are the costs that don’t change when production output changes.

A company has to pay fixed costs whether the output level increases or decreases. Fixed costs are also costs that a company incurs when the output level is zero. The higher the fixed costs are in a company, the higher the output must be for the business to break even.

Capital can be a fixed factor of production that can make a company incur consistent amounts of fixed costs in the short run.

Other examples of fixed costs include:

1. Maintenance costs of a factory or an office building.

3. Interest on loans.

4. Advertising.

5. Business rates.

Variable costs

Variable costs are the costs that change when production output changes.

Variable costs relate directly to the production or sale of a product. The marginal cost of an extra output unit determines the variable cost as more variable inputs are integrated into production. If a company increases its output in the short run, its total variable costs will rise.

If a firm increases the production of its products, which it also needs to package, its variable costs will rise. This is because the firm will require a higher amount of packaging for the increased production output.

Other examples of variable costs include:

2. Basic raw materials (such as wood, metal, iron.)

3. Energy costs.

4. Fuel costs.

5. Packaging costs.

Total costs

A company’s total costs are made up of the fixed costs and variable costs added together, as shown in this formula:

\(\hbox{Total Costs (TC) = Fixed Costs (FC) = Variable Costs (VC)}\)

Total cost is the aggregate cost incurred by a company of producing a given output level.

When a company produces more and increases its output, the company’s total cost of production will increase.

Costs of production example

Consider this simple table to understand a basic costs overview and their calculation process.

Output | Fixed costs | Variable costs | Total costs |

Units | $ | $ | $ |

50 | 10,000 | 15,000 | 25,000 |

100 | 10,000 | 20,000 | 30,000 |

150 | 10,000 | 25,000 | 35,000 |

200 | 10,000 | 30,000 | 40,000 |

250 | 10,000 | 35,000 | 45,000 |

Table 1. Total costs calculation - Vaia.

In Table 1 you can see we have a certain set of units labeled as ‘Output’ as well as fixed costs and variable costs in ‘$.’

As we now know, the fixed costs remain constant. Hence, for every unit produced the fixed costs are $10,000.

As we said before, the variable costs change for every unit of output produced.

To calculate the total costs of production we can follow the formula that we discussed above. We simply add the fixed and variable costs. The sum of each total for every unit produced is illustrated in the fourth column.

Average cost of production

We calculate the average cost of production (also known as the unit cost) by dividing the firm’s total cost of production by the quantity of output it produced.

\(\hbox{Average Cost (AC)}=\frac{\hbox{Total Costs (TC)}}{\hbox{Level of Output (Q)}}\)

Let’s calculate the average costs with an example from Table 2 below. Consider the following units:

Output | Fixed costs | Variable costs | Total costs | Average cost |

Units | $ | $ | $ | $ |

50 | 10,000 | 15,000 | 25,000 | 500 |

100 | 10,000 | 20,000 | 30,000 | 300 |

150 | 10,000 | 25,000 | 35,000 | 233 |

200 | 10,000 | 30,000 | 40,000 | 200 |

250 | 10,000 | 35,000 | 45,000 | 180 |

Table 2. Average costs calculation - Vaia.

We can also illustrate the average costs for each output level on an average total cost curve as in the figure below.

In Figure 1 the cost of production is depicted on the y axis and the level of produced output is depicted on the x axis.

We can conclude that when initially the company’s costs of production (C) fall, the number of units of output produced (Q) increases. When the company produces at Q1, the average output cost is at C1. However, if for some reason the company increases its output from Q1 to Q2, we can see that the average cost per unit falls from C1 to C2. For higher output levels, the average costs the company incurs usually rise. You can see that when output increases from Q2 to Q3 and the average cost rises from C2 to C3.

In microeconomic theory, the average total cost curves in the short run are U-shaped. They initially show unit costs falling and then rising as output increases.

At low output levels, the average costs are high because there are more average fixed and variable costs. As the output level increases, the average costs fall due to the combined effect of declining average fixed and variable costs resulting from the internal economies of scale . However, as the output level continues to increase and the average cost continues to decline it eventually reaches a minimum.

This minimum point is the average-cost-minimising output level and the productively efficient output level or the optimum output level a firm can produce at the given cost. On the graph above, it is the lowest point of the average cost curve, at the intersection of C2 and Q2.

Once a firm reaches the optimum level and continues to produce more output, the average costs will start rising again. This can happen if the company decides to increase the quantities of variable factors such as machinery. This would lead to diseconomies of scale in production and diminishing returns causing the average costs to rise rapidly.

We can divide average production costs or average total costs into average fixed costs and average variable costs.

\(\hbox{Average Total Costs (ATC)}=\hbox{Average Fixed Costs (AFC)}+\hbox{Average Variable Costs (AVC)}\)

Average fixed costs curve

The average fixed cost curve is a negatively sloped curve that illustrates the relationship between the average fixed cost incurred by a company when producing goods and services of a certain output level in the short run. The curve shows the relation between the average fixed cost and the output level while keeping other variables like technology or capital constant.

We can illustrate the average fixed costs for each output level on an average fixed cost curve as in the figure below.

As you can see in Figure 2, the average fixed cost is relatively high at C1 and a low output level at Q1. However, as the production of output of the company starts to increase from Q1 to Q2, the average cost gradually declines from C1 to C2. This is because the fixed costs are spread over an increasingly larger quantity of output.

Average variable costs curve

The average variable cost curve is a U-shaped curve that illustrates the relationship between the average variable cost incurred by a firm producing goods and services at a certain output level in the short run.

Figure 3 below shows a firm’s variable cost curve of the production of labour factor.

As you can see in Figure 3, labour becomes more productive as more workers are employed. Labour reaches its highest productivity, thereby minimising the average costs for the firm, at cost C and output level Q. However, if employment within the firm increased further, labour would eventually become less productive and the average cost would start rising again.

Average total costs curve

The average total cost curve illustrates the relationship between the average total cost incurred by a firm producing goods and services at a certain output level in the short run. The curve shows us the relation between the average total cost and output level while keeping production factors like technology and labour constant.

The average total cost curve is U-shaped and is usually illustrated alongside the average fixed cost curve and average variable cost curve.

Figure 4 below depicts the three curves alongside each other.

We obtain the average total cost curve by adding together the average fixed cost and the average variable cost at each output level.

These are the formulae:

\(\hbox{Average Total Costs (ATC)}=\frac{\hbox{Total Costs (TC)}}{\hbox{Level of Output (Q)}}\)

The average total cost is high for small quantities of output, but as production increases, the average total cost starts to decline until it reaches a minimum value and then starts rising again.

The U-shape of the average total cost curve is a result of the underlying averages of both the average fixed and average variable costs. At low levels of output, both average fixed cost and average variable cost curves decline, which causes the average total cost curve to decline as well.

However, due to the law of diminishing marginal returns , the average variable cost curve eventually starts rising, outweighing the continued decline of the average fixed cost. This causes the average total cost to rise as well.

Long-run average costs

In the long run, the firm can change the size and scale of the factors of production it utilises. It can add or even subtract the assets such as factories or machinery to its production factors. In the long run, the costs are illustrated in the long-run average cost curve.

Figure 5 below depicts a long-run average cost curve:

The long-run average cost is essentially the long-run cost divided by the output level. The curve is U-shaped because the long-run average costs initially fall due to economies of scale as the firm expands its operations. Economies of scale is a phenomenon that occurs when a firm’s output increases whilst its long-run average costs decrease.

However, after the firm hits a certain point in its production process (illustrated at the intersection of C and Q in Figure 5 above), it starts experiencing diseconomies of scale . Diseconomies of scale is a phenomenon that occurs when a firm’s output increases whilst its long run average costs increase.

Let's take a look at examples of costs of production for different types of companies.

Manufacturing company

Examples of production costs for a manufacturing company are:

- Fixed Cost: rent or lease of the factory, insurance premiums, salaries of administrative staff, wages of production workers

- Variable Cost: raw materials, electricity bills, cost of maintenance and repairs

Delivery service:

Costs of production examples for a delivery service company are:

- Fixed Cost: salaries of administrative staff, office rent or lease, phone and internet bills

- Variable Cost: gas for delivery cars, maintenance and repairs of vehicles, cost of packaging

Restaurant:

Here are examples of production costs for a restaurant:

- Fixed Cost: rent for the restaurant building, salaries of administrative staff, utilities (electricity, gas, water), fixed wages of kitchen and service staff

- Variable Cost: f ood ingredients, cost of beverages, cost of cleaning supplies and other operational expenses.

How can a firm reduce its costs of production?

There are several ways in which a firm can reduce its costs of production.

One way to reduce the costs of production would be to reduce direct costs as they make up a large portion of the total manufacturing costs. One technique is to use quotations from as many suppliers as possible. Another technique would be to offer cash payments in return for a cash discount. Many suppliers may be willing to trade off the discount for immediate payment.

A second way to decrease production costs would be to increase employees’ efficiency. A firm can do this by offering efficient training programs and by helping labour utilise cost-reducing techniques. It can also offer incentives to workers, such as a pay rise or a bonus premium.

Finally, tasks should be handed out to those that are specialised. In other words, if there is someone specialised in one field, the worker should be allocated to working in that particular field.

Costs of production - Key takeaways

The total cost is the aggregate cost incurred by a company of producing a given output level. We calculate it by adding the fixed costs and variable costs.

We calculate the average cost, or unit cost, by dividing the firm’s total cost of production by the quantity of output produced.

We can divide average costs of production or average total costs into average fixed costs and average variable costs.

The average fixed cost curve is a negatively sloped curve that illustrates the relationship between the average fixed cost incurred by a company when producing goods and services of a certain output level in the short run.

The average total cost curve illustrates the relationship between the average total cost incurred by a firm producing goods and services at a certain output level in the short run.

The long run average cost is essentially the long run cost divided by the ooutput level. The curve is U-shaped due to economies and diseconomies of scale.

Flashcards in Costs of Production 5

Learn with 5 Costs of Production flashcards in the free Vaia app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Costs of Production

What are examples of production costs?

Some examples of production costs are labour costs, raw material costs, capital goods (such as machinery or technology) costs.

What is cost of production?

The costs of production are the costs that a company incurs when it is going through the process of producing goods or services, selling those goods or services, and delivering them to its customers.

What is unit cost of production?

The unit cost of production is the total expenditure incurred by a company to produce, store, and sell one unit of a particular product.

Why do we need to compute the cost of production?

It helps firms estimate the revenues, profits, and losses that it has made. It also enables businesses to set the right prices for the products they sell.

Test your knowledge with multiple choice flashcards

Join the Vaia App and learn efficiently with millions of flashcards and more!

Keep learning, you are doing great.

Discover learning materials with the free Vaia app

Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Vaia Editorial Team

Team Microeconomics Teachers

- 16 minutes reading time

- Checked by Vaia Editorial Team

Study anywhere. Anytime.Across all devices.

Create a free account to save this explanation..

Save explanations to your personalised space and access them anytime, anywhere!

By signing up, you agree to the Terms and Conditions and the Privacy Policy of Vaia.

Sign up to highlight and take notes. It’s 100% free.

Join over 22 million students in learning with our Vaia App

The first learning app that truly has everything you need to ace your exams in one place

- Flashcards & Quizzes

- AI Study Assistant

- Study Planner

- Smart Note-Taking

Privacy Overview

What is Cost Allocation?

Types of costs, cost allocation mechanism, what is a cost driver, benefits of cost allocation, additional resources, cost allocation.

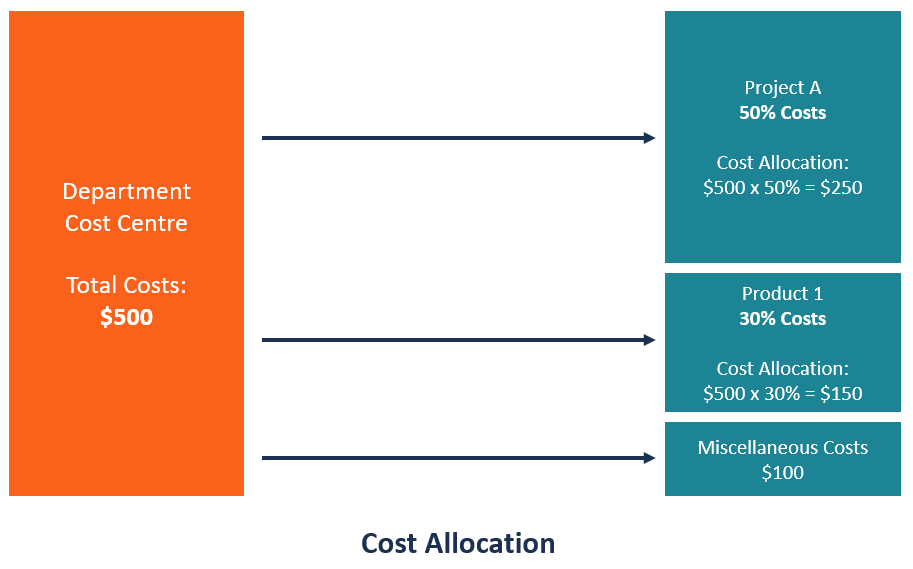

The process of identifying, accumulating, and assigning costs to costs objects

Cost allocation is the process of identifying, accumulating, and assigning costs to costs objects such as departments, products, programs, or a branch of a company. It involves identifying the cost objects in a company, identifying the costs incurred by the cost objects, and then assigning the costs to the cost objects based on specific criteria.

When costs are allocated in the right way, the business is able to trace the specific cost objects that are making profits or losses for the company. If costs are allocated to the wrong cost objects, the company may be assigning resources to cost objects that do not yield as much profits as expected.

There are several types of costs that an organization must define before allocating costs to their specific cost objects. These costs include:

1. Direct costs

Direct costs are costs that can be attributed to a specific product or service, and they do not need to be allocated to the specific cost object. It is because the organization knows what expenses go to the specific departments that generate profits and the costs incurred in producing specific products or services . For example, the salaries paid to factory workers assigned to a specific division is known and does not need to be allocated again to that division.

2. Indirect costs

Indirect costs are costs that are not directly related to a specific cost object like a function, product, or department. They are costs that are needed for the sake of the company’s operations and health. Some common examples of indirect costs include security costs, administration costs, etc. The costs are first identified, pooled, and then allocated to specific cost objects within the organization.

Indirect costs can be divided into fixed and variable costs. Fixed costs are costs that are fixed for a specific product or department. An example of a fixed cost is the remuneration of a project supervisor assigned to a specific division. The other category of indirect cost is variable costs, which vary with the level of output. Indirect costs increase or decrease with changes in the level of output.

3. Overhead costs

Overhead costs are indirect costs that are not part of manufacturing costs. They are not related to the labor or material costs that are incurred in the production of goods or services. They support the production or selling processes of the goods or services. Overhead costs are charged to the expense account, and they must be continually paid regardless of whether the company is selling goods or not.

Some common examples of overhead costs are rental expenses, utilities, insurance, postage and printing, administrative and legal expenses , and research and development costs.

The following are the main steps involved when allocating costs to cost objects:

1. Identify cost objects

The first step when allocating costs is to identify the cost objects for which the organization needs to separately estimate the associated cost. Identifying specific cost objects is important because they are the drivers of the business, and decisions are made with them in mind.

The cost object can be a brand , project, product line, division/department, or a branch of the company. The company should also determine the cost allocation base, which is the basis that it uses to allocate the costs to cost objects.

2. Accumulate costs into a cost pool

After identifying the cost objects, the next step is to accumulate the costs into a cost pool, pending allocation to the cost objects. When accumulating costs, you can create several categories where the costs will be pooled based on the cost allocation base used. Some examples of cost pools include electricity usage, water usage, square footage, insurance, rent expenses , fuel consumption, and motor vehicle maintenance.

A cost driver causes a change in the cost associated with an activity. Some examples of cost drivers include the number of machine-hours, the number of direct labor hours worked, the number of payments processed, the number of purchase orders, and the number of invoices sent to customers.

The following are some of the reasons why cost allocation is important to an organization:

1. Assists in the decision-making process

Cost allocation provides the management with important data about cost utilization that they can use in making decisions. It shows the cost objects that take up most of the costs and helps determine if the departments or products are profitable enough to justify the costs allocated. For unprofitable cost objects, the company’s management can cut the costs allocated and divert the money to other more profitable cost objects.

2. Helps evaluate and motivate staff

Cost allocation helps determine if specific departments are profitable or not. If the cost object is not profitable, the company can evaluate the performance of the staff members to determine if a decline in productivity is the cause of the non-profitability of the cost objects.

On the other hand, if the company recognizes and rewards a specific department for achieving the highest profitability in the company, the employees assigned to that department will be motivated to work hard and continue with their good performance.

Thank you for reading CFI’s guide to Cost Allocation. In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful:

- Break-Even Analysis

- Cost of Production

- Fixed Costs

- Fixed and Variable Costs

- Projecting Income Statement Line Items

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Costs Of Production

Cost of production refers to an enterprise’s overall cost of manufacturing a given quantity of a commodity or of delivering a service. The costs of manufacturing products at a factory can be divided into the costs of recruiting inputs also called production factors. Costs of production may involve items like labor, raw materials, or consumable products. Typically the two main inputs are divided into labor, such as salaries, wages, contractor fees, distribution fees, and resources, either purchasing or renting machinery, equipment, houses, land, etc.

Types of costs of Production: There are different types of costs of production that companies may incur when producing a product or delivering a service. They include the following:

- Fixed costs – These costs that don’t vary with output. This implies the expenses stay unaltered in any event, when there is zero creation or when the business has arrived at its most extreme creation limit.

- Variable costs – These costs relate to how much (e.g. raw materials) is generated. That is, they are increasing as the level of output rises and decreases as the volume of production goes down. If the amount of output is zero so no variable costs will be incurred.

- Total cost – Such costs include both variable and fixed costs. It takes into account all costs incurred during the manufacturing process or when delivering a service.

- Average cost – The average cost alludes to the absolute expense of creation isolated by the quantity of units delivered. It can likewise be gotten by adding the average variable expenses and the average fixed expenses.

- Marginal Cost – That is the cost of an extra unit being made. A company’s management relies on marginal costs to make resource allocation decisions, trying to distribute capital from the output in a way that is optimally profitable.

- Short-run costs – A firm will have fixed capital (it takes some effort to expand the size of processing plants), and the firm can shift the amount of work. Notwithstanding, temporarily, a firm is probably going to encounter lessening minimal returns.

- Long-run costs – A firm can shift all components of creation, for example, capital and work. Thusly, the firm won’t face consistent losses. Be that as it may, as the measure of capital can shift, the firm may encounter economies or diseconomies of scale.

Traditionally, constructing or purchasing capital costs are seen as examples of fixed costs, while hiring or dismissing staff or contractors costs are considered examples of variable costs. The profit that a company makes on its goods is determined by subtracting the overall cost of production from the overall revenue that the company takes in (which is largely from selling its products).

Determining the fixed costs is the first step when determining the costs involved in producing a product. The next move is to define the variable costs incurred during the manufacturing process. Add the fixed costs and variable costs, and divide the overall costs by the number of goods sold to get the average cost per product.

Average Cost Per Unit = Fixed Costs + Variable Costs / Total No. of Items Produce

On the off chance that the organization or company decides not to raise costs for its items, it can keep up (or increment) its degree of benefit just on the off chance that it can keep consistent (or decline) the expenses of creation. For the organization or company to make a benefit, the selling cost must be higher than the expense per unit. The more an organization can bring down its expenses of creation while simultaneously expanding its income (through expanded quantities of deals), the more beneficial the organization or company will be. Setting a value that is underneath the expense per unit will bring about misfortunes. It is, hence, fundamentally significant that the organization or company has the option to precisely survey the entirety of its expenses.

Above all, a company will set a profit-making price on a product if it knows how much it costs to manufacture the product. Understanding the cost of production also helps one to assess which part of the overall cost of, for example, an enterprise, a manufacturing process, or a building lease is associated with a specific product. Furthermore, understanding the assembly costs it possible to identify costs that are too high and to form comparisons between the prices of various activities within the company.

Information Sources:

- economicshelp.org

- corporatefinanceinstitute.com

- encyclopedia.com

Limitations of Law of Substitution

Cost of Production Theory of Value

Variance Inflation Factor (VIF)

Concept of Social Accounting

The Hour And The Man

Debt Collection Agency

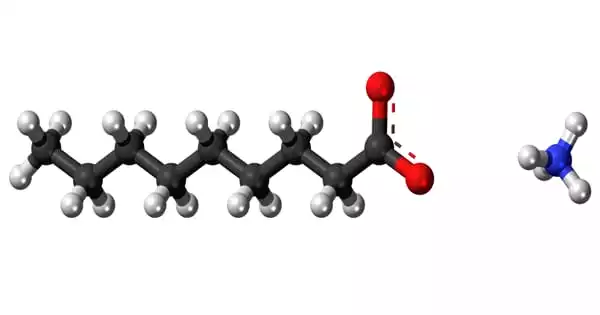

Ammonium Nonanoate – a Soap Salt

Agronomy Definition

The Global Capital Market

Nubank’s IPO Filing Gives us a Peek Into Nubank Economics

Latest post.

Silver Laurate – an inorganic compound

Potassium Laurate – a metal-organic compound

New Vaccination against Cervical Cancer combines Preventive and Therapeutic Activity

Precision Treatment improves Survival in Metastatic Prostate Cancer

Manganese Laurate – a metal-organic compound

Magnesium Laurate – a metal-organic compound

Cost Assignment at Production Enterprises

- Published: 19 April 2022

- Volume 42 , pages 426–429, ( 2022 )

Cite this article

- A. N. Genova 1

59 Accesses

2 Citations

Explore all metrics

An approach to calculating production costs is outlined. The specifics of calculation are considered for costs of different type. Methods of cost assignment are described.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Analysis and Cost Estimation Algorithm as a Tool for Industrial Enterprise Management

The Role of Production Indicators in Optimizing the Production Activity of a Company

Cost-Efficiency Indicators

Chaika, N.K., Formation of development strategy for industrial enterprise quality, J. Manage. Syst ., 2021, vol. 22, no. 180, pp. 20–26.

Google Scholar

Danilina, M.V., Trifonov, P.V., Surkova, E.V., et al., Managing business in the regions of Russia: Threats’ analysis, Int. J. Econ. Res ., 2017, vol. 14, no. 4, pp. 55–67.

Drury, C., Management and Cost Accounting , Cengage Learning, 2012, 8th ed.

Kulikova, A.N., Building a management accounting system at industrial enterprises, Vseross. Zh. Nauchn. Publ ., 2012, no. 2 (12), pp. 29–31.

Download references

Author information

Authors and affiliations.

Moscow Aviation Institute, Moscow, Russia

A. N. Genova

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to A. N. Genova .

Additional information

Translated by B. Gilbert

About this article

Genova, A.N. Cost Assignment at Production Enterprises. Russ. Engin. Res. 42 , 426–429 (2022). https://doi.org/10.3103/S1068798X22040074

Download citation

Received : 01 October 2021

Revised : 01 October 2021

Accepted : 01 October 2021

Published : 19 April 2022

Issue Date : April 2022

DOI : https://doi.org/10.3103/S1068798X22040074

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- production costs

- cost calculation

- cost assignment

- cost management

- corporate governance

- Find a journal

- Publish with us

- Track your research

Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 01 | Checking Account | 150,000 | |

| Owner’s Capital | 150,000 | ||

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 03 | Factory Overhead | 2,500 | |

| Checking Account | 2,500 | ||

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

IMAGES

VIDEO

COMMENTS

Suppose this firm can hire workers at a wage rate of $10 per hour to work in its factory which has a rental cost of $100. Use the production function to derive the cost function. 2. First compute the variable cost for Q = 0 through Q = 5. 3. Next compute the fixed cost for Q = 0 through Q = 5. 4. Then compute the total cost for Q = 0 through Q = 5.

Table 8-1 and Figure 8-1 give monthly cost data for your latest venture: Radical Rollerblades. To keep things simple, labor is your only variable input. Each worker is paid $2,000 a month, so your variable costs equal the wage rate (w) of $2,000 multiplied by the number of workers (L) you hire (TVC = w × L). Table 8-1.

the cost of flour for a baker. An example of an implicit cost of production is: the income an entrepreneur could have earned working for someone else. Economic profits will take into account: both implicit and explicit costs. Assume Brad worked as a contractor for a year and had revenues of $120,000 and explicit cost of $70,000.

production function. the relationship between the quantity of inputs used to make a good and the quantity of output of that good. marginal product. the increase in output that arises from an additional unit of input. diminishing marginal product. the property whereby the marginal product of an input declines as the quantity of the input increases.

Module 7 Assignment: Problem Set—Production and Costs. Click on the following link to download the problem set for this module: Production and Costs Problem Set.

The production function. In the production process, inputs are used to make outputs. The costs incurred by the firm are very closely linked to the level of inputs used in the production process. In the example of the cookie selling firm owned by Carmen, the inputs are: sugar, flour, chocolate chips and the oven.

Draw a graph of the marginal product curve using the numbers you computed. Suppose this firm can hire workers at a wage rate of $10 per hour to work in its factory which has a rental cost of $100. Use the production function to derive the cost function. 2. First compute the variable cost for Q = 0 through Q = 5. 3.

Assignment: Production and Costs. Step 1: To view this assignment, click on Assignment: Production and Costs. Step 2: Follow the instructions in the assignment and submit your completed assignment into the LMS.

9.1: Learn By Doing- Average Costs and Curves. 9.2: Lessons From Alternative Measures of Cost. 9.3: Introduction to Production and Costs in the Long Run. 9.4: Production in the Long Run. 9.5: Long Run Costs and Production Technology. 9.6: Economies of Scale. 9.7: The Size and Number of Firms in an Industry.

ASSIGNMENT TWO Analyzing Supply: Production, Inputs, and Costs In this assignment, you will work with production, inputs, and costs of supply analysis. Instructions: Answer the following questions using the knowledge you gained in this course. Explain your answers thoroughly. 1. Peter picks a peck of pickled peppers using 10 units of labor and two pepper-picking machines.

8.1: Production Choices and Costs: The Short Run; 8.2: Production Choices and Costs: The Long Run; 8.3: Review and Practice; This page titled 8: Production and Cost is shared under a CC BY-NC-SA 3.0 license and was authored, remixed, and/or curated by Anonymous via source content that was edited to the style and standards of the LibreTexts ...

This information is accumulated in a production cost report. This report shows the costs used in the preparation of a product, including the cost per unit for materials and conversion costs, and the amount of work in process and finished goods inventory. A complete production cost report for the shaping department is illustrated in Figure 5.6.

Costs of production - Key takeaways. The costs of production are the costs that a company incurs when it produces goods or services, sells those goods or services, and delivers them to its customers. Fixed costs are the costs that don't change when production output changes. Variable costs are the costs that change when production output changes.

4. Average cost. The average cost refers to the total cost of production divided by the number of units produced. It can also be obtained by summing the average variable costs and the average fixed costs. Management uses average costs to make decisions about pricing its products for maximum revenue or profit.

The LibreTexts libraries are Powered by NICE CXone Expert and are supported by the Department of Education Open Textbook Pilot Project, the UC Davis Office of the Provost, the UC Davis Library, the California State University Affordable Learning Solutions Program, and Merlot. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, and 1413739.

Cost allocation is the process of identifying, accumulating, and assigning costs to costs objects such as departments, products, programs, or a branch of a company. It involves identifying the cost objects in a company, identifying the costs incurred by the cost objects, and then assigning the costs to the cost objects based on specific criteria.

Question: The results of the four key steps are typically presented in a production cost report.The production cost report 8 summarizes the production and cost activity within a department for a reporting period. It is simply a formal summary of the four steps performed to assign costs to units transferred out and units in ending work-in-process (WIP) inventory.

Costs Of Production. Cost of production refers to an enterprise's overall cost of manufacturing a given quantity of a commodity or of delivering a service. The costs of manufacturing products at a factory can be divided into the costs of recruiting inputs also called production factors. Costs of production may involve items like labor, raw ...

Step 1: To view this assignment, click on Assignment: Problem Set — Production and Costs. Step 2: Follow the instructions in the assignment and submit your completed assignment into the LMS.

Methods of cost assignment are described. Keywords: production costs, cost calculation, cost assignment, cost management, corporate governance DOI: 10.3103/S1068798X22040074 Because markets are oversaturated and highly competitive today, we must constantly improve man-agement methods and consequently systems for calcu-lating production costs [1 ...

In cost assignment, the direct and indirect costs associated with production and the provision of work or services are allocated to specific objects (products or contracts). The following methods may be used. 1. Direct assignment: the cost is included directly in the cost of the object on the basis of information regarding the volume and unit ...

The prep department. And then for baking, we'll say that it's $3,000 of raw materials. And then we've got $12,000 for the packaging. And then we'll just credit raw materials. I'll just abbreviate here raw mats. And that adds up to $120,000. So this is our journal entry.

Efficient warehouse management is essential for optimizing inventory, minimizing transportation costs, and enhancing overall performance. This research introduces a novel Mixed-Integer Nonlinear Programming (MINLP) model to address the Storage Location Assignment Problem (SLAP) in warehouse management. Integrating multi-criteria decision-making with strategic production planning, our model ...

What you will learn to do: assign costs to jobs. Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item. ... Because her entire facility is devoted to production, she determines that ...