- See all articles

- Business tips

- Inventory management

- Manufacturing

- Product updates

Product costing methods for business success

Have you ever opened your banking app and been struck with a wave of panic? Or found yourself staring at your phone screen in utter bewilderment, wondering where all your money went? These are all-too-common experiences that can be easily remedied with a well-implemented product costing system.

While personal finance can be daunting, the stakes are even higher when it comes to running a successful business. Without a solid understanding of where your expenses are going, you risk losing money and valuable resources.

That’s why product costing is a vital component of any thriving business. This article delves into the intricacies of product costing to help you gain a deeper understanding of its importance.

Table of contents

What is product costing, importance of product costing, product costing methods, how to find product cost, activity-based costing vs. product costing, accounting for product cost, how katana helps with product costing.

Product costing is the process of calculating the comprehensive expenses associated with creating or acquiring a product, including direct costs like raw materials and labor, as well as indirect costs such as overhead and administrative expenses. By meticulously accounting for all cost components, product costing provides a holistic understanding of the true production expenses, allowing companies to set appropriate prices that cover costs and generate a profit.

Having precise and up-to-date product costing information empowers companies to make well-informed decisions about pricing strategies, production quantities, and resource allocation. With this valuable insight, businesses can determine the most cost-effective ways to produce goods, identify areas for cost reduction, and optimize their operations to drive profitability and competitiveness in the market.

Additionally, product costing plays a crucial role in budgeting, financial forecasting, and assessing the financial viability of product lines or projects, giving businesses a comprehensive view of their financial health and aiding in long-term planning.

Let’s take a closer look at the importance of product costing and the benefits it brings.

Product costing plays a pivotal role in the success and financial health of any business, regardless of its size or industry. It serves as a critical tool that enables companies to make informed and strategic decisions that can directly impact profitability and overall business performance. Here are some key reasons why product costing is of paramount importance:

- Accurate pricing — Product costing allows businesses to determine the true cost of manufacturing or acquiring a product. With precise cost data, companies can set appropriate prices that cover production expenses and provide a reasonable profit margin. This prevents underpricing, which can lead to losses, or overpricing, which may deter potential customers.

- Cost control and efficiency — By analyzing the detailed costs involved in the production process , companies can identify areas of inefficiency and take measures to control expenses. Whether it’s optimizing raw material usage, streamlining production processes, or reducing overhead costs, product costing provides insights that drive cost-saving initiatives and boost overall efficiency.

- Resource allocation — Understanding the cost breakdown of each product helps companies allocate their resources wisely. They can focus on high-margin products or those with strong market demand while phasing out less profitable ones. This strategic allocation ensures that resources are channeled where they can yield the highest returns, maximizing the company’s profitability.

- Budgeting and financial planning — Product costing provides a solid foundation for creating budgets and forecasting financial performance. Accurate cost estimates help businesses set realistic revenue targets, plan investments, and assess the financial feasibility of new product developments or business expansions.

- Competitive advantage — In a highly competitive market, having a comprehensive understanding of product costs can be a significant differentiator. Businesses that are adept at managing costs can offer competitive prices while maintaining healthy profit margins, positioning themselves favorably in the market.

- Decision-making — Product costing empowers management with valuable insights when making critical decisions. Whether it’s choosing between in-house production and outsourcing , introducing new product lines, or discontinuing unprofitable ones, the data-driven decision-making facilitated by product costing ensures well-considered choices that align with business objectives.

- Performance evaluation — Comparing actual costs to estimated costs helps in evaluating the performance of different product lines or production processes. Businesses can identify areas that need improvement, set performance benchmarks, and incentivize teams to achieve cost-saving goals.

- Financial transparency — Accurate product costing enhances financial transparency within the organization. It enables stakeholders, investors, and lenders to have a clear picture of the company’s financial health, fostering trust and confidence in the business.

In conclusion, product costing is not merely a financial exercise but a fundamental business practice that guides sound decision-making, cost control, and resource optimization.

It empowers companies to stay competitive, achieve sustainable growth, and navigate the complexities of the market with confidence, all while ensuring the efficient and profitable delivery of products to customers. By investing in robust product costing practices, businesses position themselves for success and create a strong foundation for long-term prosperity.

Want to see Katana in action?

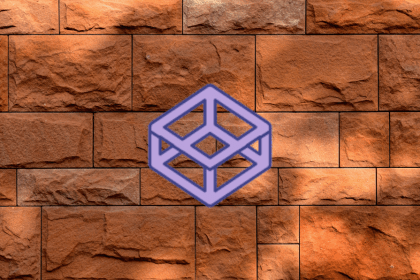

Businesses of all shapes and sizes aim to produce high-quality products that meet customer needs while ensuring profitability. In this quest for success, product costing plays a vital role. It helps determine the cost of goods sold , which eventually determines the price of a product . While there are various types of product costing , we will delve into the four main categories that businesses typically use to categorize their expenses.

Job costing

Job costing is used to calculate the cost of producing a specific product or service. This method takes into account the labor, material, and overhead costs associated with the job. It’s commonly used in industries such as construction, where each project is unique and requires custom pricing.

Process costing

Process costing is used to calculate the cost of producing a large number of identical products. This method is typically used in manufacturing environments where products are made in large batches . The total cost of production is divided by the number of units produced to arrive at the cost per unit.

Activity-based costing

Activity-based costing, or ABC costing, allocates indirect costs to specific products or services based on the activities involved in producing them. This method is useful when many indirect costs are associated with a product, and it’s difficult to determine how to allocate those costs. By identifying the activities involved in producing a product, it becomes easier to determine how much of the indirect costs should be allocated to that product.

Standard costing

Standard costing uses predetermined standard costs for materials, labor, and overhead. The actual costs are then compared to the predetermined costs to identify variances and make adjustments. This method is useful when a company wants to identify areas of inefficiency and reduce costs.

Wondering how to calculate product cost? Finding out the product cost of your business is as simple as applying a quick product cost formula. All you have to do is add up the costs associated with the item’s production and divide them by the total number of units.

The following formula can be used to calculate the product unit cost of your business:

Product unit cost = (Direct labor + direct materials + consumable production supplies + factory overhead) / number of units produced

Product costing examples

Now that you know the formula, let’s take a look at some practical examples of what a product cost analysis looks like:

- A company manufactures 2,000 chairs, and the total cost of producing them is $20,000 . This means that each chair has a product unit cost of $10 ( $20,000/2,000 ).

- A toy manufacturer produces 2,500 toys, and the total cost for materials and labor is $50,000 . Thus, the result is a product unit cost of $20 ( $50,000/2,500 ).

It’s important to include all related costs of manufacturing the product when you calculate product cost. For the chair example, this would include the wood, nails, glue, and labor, among other costs. If these costs exceed the selling price of the chair, then your business is undoubtedly making a loss and needs to re-evaluate the product costing system immediately.

A more intricate way of calculating your costs is known as activity-based costing. It’s a step deeper into understanding your costs. Activity-based costing looks at the activities that go into making a product and assigns costs to those activities rather than the product itself.

For example, let’s say you manufacture computers as your main product. Your activity-based cost analysis might consider the following activities: design, assembly, testing, and shipping. Each of these activities has its own associated cost, which is then added together for an accurate total unit cost for each computer produced.

Nevertheless, every company should at least know their product cost as a bare minimum, as this knowledge alone can be used to make effective pricing decisions. When combined with activity-based costing, product costing can be a powerful tool for running an even more efficient business.

This wasn’t meant to be a pun, but product costs are also accounted for in accounting. They are essentially categorized as inventory on the balance sheet and can be tracked in the inventory account (which is often referred to as a current asset).

The total product costs you have incurred for any given period should be reported on the income statement only when sold. This will give you an accurate view of your cost structure, and it’s also essential information when calculating taxes owed or other financial statements.

Managing the financial aspect of your business can be daunting, but with Katana’s cloud inventory platform , you can say goodbye to the hassle and embrace seamless product cost accounting. The software provides an array of tools that simplify the cost-tracking process and allow you to focus on what really matters — your business.

One of the standout features of Katana is the automated production orders system. From the moment an order is placed, the system tracks all costs associated with each product. This ensures that you have access to real-time cost data, enabling you to make informed decisions about pricing and other financial matters quickly and with ease.

With the inventory management feature, you can monitor your stock levels in real time. At the same time, Katana provides accurate information on how much it will cost to produce or purchase more products if needed. This feature helps you to optimize your inventory levels and improve your cash flow.

Katana’s reporting tools offer insights into your company’s financial performance, giving you a clear picture of where your money is heading and where it should be heading in the future. With this information, you can make data-driven decisions about your product costing and confidently take your business to new heights. Book a demo with Katana today!

Product costing FAQs

Product costing is a system used by businesses to determine the total expenses associated with manufacturing a product, which includes direct costs (like materials and labor) and indirect costs (such as overhead and administrative expenses). This information helps in setting appropriate prices and making informed business decisions.

Product cost can be calculated by summing up all the direct costs (materials, labor) and indirect costs (overhead, administrative expenses) incurred in manufacturing a product.

What are product costing examples?

Examples of product costing include determining the total expenses to produce a smartphone (materials, assembly labor, factory overhead) or calculating the cost of producing a handmade artisanal chair (wood, varnish, craftsman’s labor).

What are the four types of costing?

The four types of costing are

- Job costing — Used for customized products or services

- Process costing — For mass-produced items

- Activity-based costing — Allocating costs based on activities

- Standard costing — Compares actual costs to predetermined standards

How is product costing done?

Product costing involves identifying and accumulating all costs associated with producing a specific product, usually through cost accounting systems, allocation methods, and cost allocation bases to ensure accurate cost calculations.

- Accounting Guide

- 1.1. WIP manufacturing

- 1.2. Inventory accounting

- 1.3. Inventory costing

- 1.4. Costing methods

- 1.5. Job order costing

- 1.6. Process costing

- 1.7. Product costing methods

- 2.1. QuickBooks Online inventory limitations

- 2.2. QuickBooks raw materials inventory woes

- 2.3. QuickBooks Online serial number tracking

- 2.4. QuickBooks bill of materials

- 2.5. QuickBooks inventory scanner

- 2.6. QuickBooks inventory asset

- 3.1. Xero bill of materials (BOM)

- 3.2. Xero raw materials

- 3.3. Xero barcode inventory system

- 3.4. Xero inventory add-ons

- 4. E-commerce accounting

- 5. QuickBooks vs. Xero: which is best?

- 6. Best accounting software for manufacturing

Readers also liked

What is Product Costing? A Comprehensive Guide with example for Business Owners and Managers

Welcome to our comprehensive guide on product and food costing, specifically tailored for restaurant owners and managers. In this blog post, we will delve into the essential components of costing, including labor, materials, and overhead. We will provide practical example of costing a delectable Baked Dijon Salmon. So, let’s dive in and explore the world of product and food costing!

I. Understanding Product Costing

Definition of product costing:.

Product costing refers to the process of determining and allocating the costs associated with producing a specific product or service. It involves analyzing and breaking down the various cost components involved in the production or provision of the product, such as labor, materials, and overhead expenses. By accurately calculating these costs, businesses can make informed decisions regarding pricing, profitability, budgeting, and resource allocation.

The definition of product costing can vary slightly depending on the context. In manufacturing industries, product costing typically focuses on determining the costs associated with producing goods. This includes direct costs, such as raw materials and labor, as well as indirect costs, such as factory overhead, utilities, and depreciation of production equipment. The goal is to calculate the cost per unit of the product, which helps businesses set appropriate prices, evaluate profitability, and make strategic decisions about production volumes and pricing strategies.

In the context of service-based businesses, product costing can also apply to the costs associated with providing a specific service. For example, in the restaurant industry, product costing involves analyzing the costs of ingredients, labor, and overhead expenses required to prepare a menu item. This helps determine the cost of goods sold (COGS) and enables businesses to set menu prices that cover their expenses while remaining competitive.

Accurate product costing provides several benefits for businesses. It helps control costs by identifying areas of inefficiency, reducing waste, and optimizing resource utilization. It allows businesses to make informed pricing decisions based on a thorough understanding of the costs involved. Additionally, product costing aids in financial planning, budgeting, and forecasting, ensuring that businesses have a realistic understanding of their costs and can allocate resources effectively. Ultimately, product costing provides businesses with the necessary insights to improve profitability, make strategic decisions, and maintain a competitive edge in the market.

Key Components:

The key components of product costing are the fundamental elements that make up the total cost of a product or service. These components help businesses understand and analyze the cost structure associated with the production or provision of a specific item. The primary key components of product costing include labor, materials, and overhead expenses. By understanding and calculating these key components, businesses can determine the total cost of a product or service. This information is crucial for setting appropriate prices, evaluating profitability, making informed decisions about resource allocation, and identifying areas where cost optimization measures can be implemented. Analyzing each component individually provides insights into cost drivers and enables businesses to effectively control costs, enhance competitiveness, and maximize profitability.

Labor Costs:

Labor costs refer to the expenses associated with the workforce involved in the production or provision of a product or service. This includes wages, salaries, benefits, and other compensation provided to employees directly involved in the production process. Calculating labor costs involves determining the time spent on various tasks, such as manufacturing, assembly, packaging, or service delivery, and multiplying it by the applicable labor rates.

Materials Costs:

Materials costs encompass the expenses incurred for the raw materials, components, or ingredients required to manufacture or create a product. These costs can include the cost of purchasing or acquiring materials, as well as any transportation or storage expenses associated with them. Calculating materials costs involves considering the quantity and cost of each material used in the production process.

Overhead Expenses:

Overhead expenses, also known as indirect costs, are the expenses incurred in the production process that cannot be directly attributed to a specific product or service. They include costs associated with facility maintenance, utilities, depreciation of machinery, administrative expenses, and other general expenses necessary for the overall operation of the business. Allocating overhead expenses to specific products or services often involves using predetermined allocation methods, such as allocating based on labor hours, machine usage, or square footage.

Importance of Accurate Costing:

Accurate costing is of utmost importance for businesses for several reasons. accurate costing is vital for businesses as it facilitates profitability analysis, informed decision-making, effective budgeting, cost control, pricing strategies, and supplier management. It provides businesses with the necessary insights to optimize costs, maximize profitability, and make strategic decisions that drive long-term success. Let’s explore the key reasons why accurate costing is crucial:

Profitability Analysis:

Accurate costing provides a clear understanding of the costs associated with producing or providing a product or service. By knowing the true costs, businesses can accurately determine the profitability of each product or service offering. This information is essential for making informed pricing decisions and ensuring that prices are set at a level that covers costs and generates a reasonable profit margin.

Informed Decision-Making:

Accurate costing data enables businesses to make informed decisions regarding resource allocation, production planning, and investment. With a thorough understanding of costs, businesses can identify areas for cost optimization, allocate resources effectively, and make strategic decisions that align with their financial goals. This helps businesses avoid unnecessary expenses and maximize their return on investment.

Budgeting and Financial Planning:

Accurate costing is crucial for creating realistic budgets and conducting effective financial planning. By knowing the true costs of production, businesses can set appropriate targets, forecast revenues and expenses accurately, and allocate resources efficiently. This ensures that financial resources are managed effectively and that the business operates within its financial means.

Cost Control and Waste Reduction:

Accurate costing provides businesses with insights into cost drivers and areas of inefficiency. With this knowledge, businesses can implement cost control measures, identify waste and inefficiencies in the production process, and take steps to reduce them. This leads to improved operational efficiency, cost savings, and enhanced profitability.

Pricing Strategy:

Accurate costing information allows businesses to develop effective pricing strategies. By understanding the true costs involved in producing a product or providing a service, businesses can set prices that are competitive in the market while still ensuring profitability. Accurate costing enables businesses to avoid underpricing, which can lead to financial losses, and overpricing, which can result in reduced demand and lost sales opportunities.

Negotiation and Supplier Management:

Accurate costing information is essential when negotiating with suppliers or seeking cost-saving opportunities. It provides businesses with a clear understanding of the costs associated with raw materials or inputs, allowing them to negotiate better terms, identify alternative suppliers, or implement cost-saving measures within the supply chain.

II. Product Costing Example: Baked Dijon Salmon

Recipe Overview: Presenting the recipe for Baked Dijon Salmon (Serving Size 4) and detailing the required ingredients using Costbucket Inventory Management Software

Ingredients

¼ cup butter, melted

3 tablespoons Dijon mustard

1 ½ tablespoons honey

¼ cup dry bread crumbs

¼ cup finely chopped pecans

4 teaspoons chopped fresh parsley

4 (4 ounce) fillets salmon

salt and pepper to taste

1 lemon, for garnish

Labor Cost Calculation:

Calculating the labor cost involved in preparing the salmon dish requires a breakdown of the time spent on various tasks and applying the appropriate labor rates. Let’s demonstrate the process step-by-step:

Identify the Tasks:

Start by identifying the specific tasks involved in preparing the salmon dish. This may include activities such as prepping the ingredients, cooking the salmon, plating the dish, and cleaning up.

Determine the Time Spent:

Next, estimate the time spent on each task. This can be done by observing the process or consulting with the individuals responsible for performing the tasks. For example, let’s assume the following estimated times for our Baked Dijon Salmon recipe:

Prepping the ingredients: 15 minutes

Cooking the salmon: 20 minutes

Plating the dish: 5 minutes

Cleaning up: 10 minutes

Calculate the Labor Hours:

Convert the estimated times into labor hours. Divide the time spent on each task by 60 to convert it from minutes to hours. Using our example:

Prepping the ingredients: 15 minutes ÷ 60 = 0.25 hours

Cooking the salmon: 20 minutes ÷ 60 = 0.33 hours

Plating the dish: 5 minutes ÷ 60 = 0.08 hours

Cleaning up: 10 minutes ÷ 60 = 0.17 hours

Determine the Labor Rates:

Next, determine the labor rates for the individuals involved in the tasks. This may vary depending on factors such as job roles, experience levels, and local labor laws. Consult your business’s payroll or human resources department for the applicable labor rates. For simplicity, let’s assume a flat labor rate of $15 per hour for all tasks.

Calculate the Labor Cost:

Multiply the labor hours for each task by the corresponding labor rate to calculate the labor cost. Using our example labor rates:

Prepping the ingredients: 0.25 hours × $15/hour = $3.75

Cooking the salmon: 0.33 hours × $15/hour = $4.95

Plating the dish: 0.08 hours × $15/hour = $1.20

Cleaning up: 0.17 hours × $15/hour = $2.55

Sum up the Labor Costs:

Finally, sum up the labor costs for all the tasks to determine the total labor cost involved in preparing the salmon dish. In our example: $3.75 + $4.95 + $1.20 + $2.55 = $12.45 . For a serving size of 4 people, this would be $12.45 divided by 4 = $3.11. Please note that the larger number of servings the lower the labor cost per meal. So for the same prep time, if the serving size is 10 people it would bring the labor cost per meal down to $1.25.

Materials Cost Calculation:

Calculating the materials cost involves breaking down the cost of each ingredient used in the recipe. Here’s a step-by-step process for calculating the materials cost shown in Costbucket:

Identify the Ingredients:

Start by identifying all the ingredients used in the recipe. For the Baked Dijon Salmon, the ingredients include salmon, bread crumbs, pecans, seasonings, and any other components required for the dish.

Determine the Quantity:

Next, determine the quantity of each ingredient required for the recipe. This information can be obtained from the recipe itself or by referring to standard portion sizes. For example, if the recipe calls for 4 units (4 ounce per unit) fillets of salmon, you know you’ll need 4 units of salmon.

Obtain Ingredient Prices:

To accurately calculate the materials cost, you need reliable sourcing information for ingredient prices. This can be obtained from suppliers, grocery stores, or online marketplaces. It’s important to ensure that the prices you use are up to date and reflect the quality and quantity of the ingredients required.

Calculate the Cost per Unit:

For each ingredient, multiply the quantity required by the unit price to calculate the cost per unit. For example, if a pound (16 ounces) fillet of salmon costs $10.99 and you need 4 fillets, the cost per unit of salmon would be $5 × 4 = $20.

Determine Total Material Costs:

Continue this process for each ingredient and calculate the cost per unit for each one. Then, sum up the costs of all the ingredients to determine the total material cost. For instance, if the bread crumbs cost $2, pecans cost $3, and the seasonings cost $1, the total material cost would be $20 (salmon) + $2 (bread crumbs) + $3 (pecans) + $1 (seasonings) = $26.

It’s important to note that the accuracy of the materials cost calculation depends on obtaining reliable sourcing information for ingredient prices. Consider factors such as seasonality, market fluctuations, and bulk purchasing discounts when determining ingredient costs.

By following these steps and using accurate ingredient pricing, you can calculate the materials cost for the Baked Dijon Salmon recipe. This information is valuable for understanding the direct cost of the ingredients and pricing the dish appropriately to cover expenses and ensure profitability.

Overhead Cost Calculation:

Calculating overhead costs involves allocating indirect expenses to the salmon dish. These expenses include costs such as electricity, water, kitchen supplies, and other overhead expenses incurred during the production process. Here’s a step-by-step process for allocating overhead costs:

Identify Overhead Expenses: Start by identifying the overhead expenses associated with the production process of the salmon dish. This may include electricity used for cooking, lighting, and equipment operation, water consumed during cooking and cleaning, kitchen supplies like utensils and cookware, and any other indirect expenses specific to your business.

Determine Allocation Basis: Next, determine an appropriate allocation basis to allocate the overhead expenses to the salmon dish. Common allocation bases include labor hours, machine usage, square footage, or a specific percentage of total overhead costs. Choose an allocation basis that reflects the usage or consumption of resources by the salmon dish.

Calculate Overhead Rate: To calculate the overhead rate, divide the total overhead expenses by the chosen allocation basis. For example, if the total overhead expenses for a month are $2,000 and the allocation basis is labor hours, with a total of 400 labor hours in that month, the overhead rate would be $2,000 / 400 = $5 per labor hour.

Determine Allocation for the Salmon Dish: Based on the allocation basis chosen, determine the usage or consumption of resources by the salmon dish. For instance, if the salmon dish takes 1 hour to prepare and the overhead rate is $5 per labor hour, the overhead allocation for the salmon dish would be $5.

Repeat for Other Overhead Expenses: Repeat the process for each overhead expense. Determine the appropriate allocation basis for each expense and calculate the allocation accordingly. For example, if kitchen supplies cost $100 for the month and the allocation basis is the number of salmon dishes produced (e.g., 10 dishes), the overhead allocation for kitchen supplies would be $100 / 10 = $10 per dish.

Sum up the Overhead Allocations: Finally, sum up the overhead allocations for all the expenses to determine the total overhead cost allocated to the salmon dish. In our example, if the overhead allocation for electricity is $5 and for kitchen supplies is $10, the total overhead cost allocated to the salmon dish would be $5 + $10 = $15.

By following these steps, you can allocate the overhead costs, such as electricity, water, and kitchen supplies, to the salmon dish. This helps in accurately determining the total cost of the dish, considering both direct and indirect expenses and aids in setting appropriate prices and evaluating profitability.

Total Cost Calculation:

Calculating the total cost per serving of Baked Dijon Salmon involves summing up the labor, materials, and overhead costs. Let’s break down the process step-by-step:

Calculate Direct Labor Cost : Using the labor cost calculation method discussed earlier, determine the labor cost involved in preparing the Baked Dijon Salmon dish. For example, if the labor cost is $12.45 per preparation (as calculated previously), this cost remains constant regardless of the number of servings.

Calculate Direct Materials Cost: Using the materials cost calculation method discussed earlier, determine the cost of ingredients for the Baked Dijon Salmon recipe. Let’s assume the materials cost is $26 for the entire recipe.

Calculate Overhead Costs : Using the overhead cost calculation method discussed earlier, determine the overhead cost allocated to the Baked Dijon Salmon dish. For example, if the overhead cost is $15 per dish (as calculated previously), this cost remains constant per serving.

Sum Up the Costs : To determine the total cost per serving, add up the labor cost, materials cost, and overhead cost. Using the values from the previous calculations: Total Cost per Serving = Labor Cost per Preparation + Materials Cost / Number of Servings + Overhead Cost per Dish

Let’s assume the recipe serves 4 people: Total Cost per Serving = $12.45 + ($26 / 4) + $15 Total Cost per Serving = $12.45 + $6.50 + $15 Total Cost per Serving = $33.95

Therefore, the total cost per serving of Baked Dijon Salmon is $33.95.

Calculating the total cost per serving allows you to understand the direct and indirect costs associated with the dish. This information is vital for pricing decisions, profitability analysis, and determining the overall financial performance of the recipe.

Pricing Considerations:

Setting an appropriate selling price for the Baked Dijon Salmon dish requires considering various factors, including the calculated cost, market demand, competition, perceived value, and profit margin goals. Here are some key pricing considerations:

Cost Markup and selling price:

Consider applying a cost markup to the total cost per serving to ensure you cover your expenses and generate a reasonable profit margin. The markup percentage depends on your business’s financial goals, industry standards, and market conditions. For example, if you want to achieve a 30% profit margin, you would add 30% of the total cost per serving to arrive at the selling price.

Market Analysis:

Analyze the market demand and competition for similar dishes. Research the prices of comparable salmon dishes in your area or the industry to understand the price range customers are willing to pay. This information helps you position your dish competitively and avoid overpricing or underpricing.

Perceived Value:

Consider the perceived value of your Baked Dijon Salmon dish. Factors such as the quality of ingredients, unique flavors, presentation, and overall dining experience contribute to the perceived value. If customers perceive your dish as high-quality and worth the price, you may be able to set a slightly higher price.

Menu Strategy:

Take into account your overall menu strategy and pricing structure. Consider the profitability and popularity of other menu items. If the Baked Dijon Salmon is a signature dish or a customer favorite, you might price it slightly higher compared to other menu items to reflect its special status and unique ingredients.

Pricing Psychology:

Understand pricing psychology techniques to influence customer perceptions. For example, using $X.99 instead of rounding up to the nearest whole dollar can create the perception of a lower price. Experiment with different pricing strategies to determine what resonates best with your target market.

Evaluate the impact of the calculated cost and pricing on your profitability. Consider the volume of sales you expect for the Baked Dijon Salmon dish and calculate the projected revenue based on the selling price. Ensure that the projected revenue, when subtracting the costs, yields a desirable profit margin.

Flexibility and Adjustments:

Be prepared to adjust the pricing if necessary. Monitor customer feedback, sales data, and overall market conditions. If the dish is not selling as expected or there are significant cost fluctuations, you may need to revisit and adjust the pricing accordingly.

It’s important to strike a balance between covering costs, meeting profit goals, and appealing to your target market’s price sensitivity. Regularly review and analyze your pricing strategy to ensure it remains competitive, profitable, and aligned with your business objectives.

III. Benefits and Value-Add of Product Costing for Businesses

Cost control and profitability:.

Accurate product costing enables businesses to have better control over costs, identify cost-saving opportunities, and improve overall profitability. By understanding the individual cost components, such as labor and materials, businesses can make informed decisions to optimize expenses and maximize profit margins.

Informed Pricing Decisions:

Product costing provides businesses with valuable insights into the true cost of their products. Armed with this information, they can set appropriate prices that cover their expenses while remaining competitive in the market. Precise pricing helps businesses avoid underpricing, ensuring they generate adequate revenue to sustain operations and invest in growth.

A thorough understanding of product costs allows businesses to create realistic budgets and develop accurate financial projections. With a clear picture of their costs, they can allocate resources effectively, make informed investment decisions, and plan for future growth and expansion.

Performance Evaluation:

Product costing provides a basis for evaluating the performance of products and identifying areas for improvement. By comparing actual costs with expected costs, businesses can pinpoint inefficiencies, streamline operations, and enhance overall productivity.

Inventory Management:

Accurate product costing is vital for effective inventory management. It helps businesses determine optimal inventory levels, reduce waste and spoilage, and prevent overstocking or understocking of products. By aligning inventory levels with demand and cost considerations, businesses can improve cash flow and minimize holding costs.

Competitive Advantage:

Properly understanding and managing product costs gives businesses a competitive edge in the marketplace. They can offer competitive pricing, maintain profitability, and build a reputation for delivering value to customers. Additionally, cost transparency enables businesses to respond swiftly to market changes and adjust their pricing strategies accordingly.

Strategic Decision-Making:

With reliable product costing data, businesses can make strategic decisions regarding product mix, production processes, sourcing options, and resource allocation. This empowers them to adapt to changing market dynamics, identify growth opportunities, and optimize their operations for long-term success.

Frequently Asked Questions

How to track menu pricing effect on sales.

Successful restaurants track their menu prices and sells and continuously adjust their prices when prices fluctuate. Johnny’s price of the Johnny Burger has risen from 14.40 to 14.40. Price rises also have a negative impact on food sales elsewhere.

What to do before you start food costing?

Budget planning plays an important role in running a business. The process is not just a part of a business plan, but a process to keep restaurants profitable and restaurant food cost-efficient. Reviewing your budget regularly can be helpful in determining how your money is spent and in making decisions to improve it. Although some people are worried about numbers they do not need. Monitoring your cash flow and managing your restaurant’s budget is easy to accomplish and will ensure that all of this is happening at hand.

How to calculate food cost percentage?

Food costs percentage consists of dividing the price of goods sold and the profit/sale generated by these products. The costs in goods sold total food sales are the amount of money a customer has spent to purchase ingredients and inventory over a period. We can help with this calculation. If a particular product makes profit, it can make sense based upon its profitability. But you need information to make sure that everything you do in your business succeeds. Take a glance at your daily inventory. 3. List all the items that have arrived in your mailbox for the first time in a month.

Why is food cost percentage important?

For real-time knowledge of restaurant operations, a person should know the percentages of the food cost. A grasp of food costs helps you make decisions about dish prices, dish rentability, and overall cost. The more you understand what your restaurant food costs and prices are, the more equipped you are to choose your menu.

How are product costs related to production costs?

Production costs refer to the cost of materials, labor, or overhead. Cost relates to the purchase of or the production of products for sale. Product costs cover all direct costs for the production of the products. Product prices may be fixed or variable according to the products made. The fixed expenses are constant regardless of quantity and the variable charges are variable. There’s a close link between product cost and manufacturing cost because of the direct impact of manufacturing overhead costs because of product expense.

Should product cost influence product price?

Yes, product costs will affect product prices as compared to other products in the market. The prices of products are usually based on the costs of the item, and market demand, competition, and other factors are also important to determine the prices. A company with lowered prices may be forced to cut costs or lose their business altogether. A firm that raises the price too high might lose revenue to competitors or fail to meet the demand. The price of a business should be determined by examining its product costs. Upon determination of food cost control the total cost to produce the product, the company must also calculate the margin of the product to determine the final price.

What is the difference between actual food cost percentage and ideal food cost?

Actual food cost percentage refers to the actual cost of ingredients and materials used in a dish, divided by the selling price, expressed as a percentage. It helps determine the profitability of a menu item.

Ideal food cost, on the other hand, is the target percentage that businesses aim to achieve for food costs, considering factors like pricing strategies, profit margins, and industry benchmarks. It represents the optimal cost structure that maximizes profits while maintaining quality.

How can I maximize profits through effective cost management?

Effective cost management involves closely monitoring and controlling labor, materials, and overhead expenses. By accurately calculating and tracking these costs, you can identify areas for improvement, optimize pricing strategies, minimize waste, and make informed decisions to maximize profitability.

Can product costs be affected by the manufacturing process?

Yes, the manufacturing process can have a direct impact on product costs. Factors such as production efficiency, equipment utilization, waste reduction, and quality control measures can influence the labor and materials costs associated with manufacturing a product.

What is product unit cost?

Product unit cost refers to the cost incurred to produce or acquire a single unit of a product. It includes the costs of labor, materials, and overhead allocated to each unit. Understanding the product unit cost is essential for pricing decisions and determining the profitability of individual products.

What is the difference between product costs and period costs?

Product costs are the costs directly associated with manufacturing or acquiring a product. They include the cost of labor, materials, and overhead. Product costs are typically incurred in the production process and are considered part of the cost of goods sold.

Period costs, on the other hand, are not directly related to the production process. They are incurred over a specific period and are usually associated with administrative, selling, and general operating expenses.

How can I set competitive prices while considering costs?

Setting competitive prices requires considering both your costs and the market demand. By accurately calculating your costs, including labor, materials, and overhead, you can determine your desired profit margins. Market research and analysis of competitors’ pricing can then help you position your offerings competitively while ensuring profitability.

Advisory boards aren’t only for executives. Join the LogRocket Content Advisory Board today →

- Product Management

- Solve User-Reported Issues

- Find Issues Faster

- Optimize Conversion and Adoption

What is product cost and how to calculate (with example)

Whether it’s a one-off product or a SaaS subscription, understanding product cost is crucial for any business to succeed. Breaking down your costs into materials, labor, overhead, and other expenses reveals insights into where your money is going.

In this guide, we’ll show you how to calculate product cost and how doing so can help you make informed decisions about crowdfunding, refine your pricing strategy, and improve profitability.

What is product cost?

Product cost refers to the total expenses incurred during the development, production, and maintenance of a software product or technology solution. It encompasses a wide range of costs, including research, design, development, testing, deployment, and ongoing support and maintenance.

Product cost plays a crucial role in determining the pricing strategy and overall profitability of a product or service.

Product cost vs. period cost

While product costs are directly tied to the creation and development of a software product or technology solution. Period costs are the expenses that a company incurs during a specific accounting period but aren’t directly related to the product’s development.

Product costs include direct materials, direct labor, and overhead expenses. These costs are capitalized as inventory and become part of the cost of goods sold when the product is sold.

Period costs, on the other hand, are typically associated with selling, general, and administrative (SG&A) expenses, such as marketing, rent, salaries for non-production staff, and other administrative costs. Period costs are expensed in the period they are incurred and appear on the income statement as operating expenses.

Understanding how to properly categorize these costs helps you optimize your spending, prioritize investments, and ultimately, drive the company’s growth and success.

Why product cost is important for product managers

Put simply, understanding the costs of developing a product, feature, or update helps you make more informed decisions throughout the product lifecycle.

But it’s not just about knowing the costs. It’s also about knowing the value a project will bring to the product. This not only helps you determine the next project to prioritize but also maximizes your profits.

Over 200k developers and product managers use LogRocket to create better digital experiences

When it comes to pricing, many stakeholders have a say in how much a customer should pay for a product. It should be a collaborative effort from executives, marketing, sales, product managers, and finance. Depending on the company, product managers may or may not determine the pricing strategy for the product. Either way, you should at least participate in the conversation.

How to calculate product cost

Calculating product costs can be a difficult task, especially when it comes to determining the development costs of SaaS. However, there are some basic formulas to help calculate the product cost.

But first, let’s go over the few variables that affect product costs. These include:

- Direct material — Raw materials that are easily measurable and used to directly manufacture products

- Direct labor — Wages, payroll taxes, benefits, and insurance of employees who directly work on the product

- Indirect material — Materials used in the manufacturing process but aren’t classified as direct material. Examples include office supplies

- Indirect labor — Wages, payroll taxes, benefits, and insurance of employees who aren’t directly manufacturing the product, but are crucial for a smooth manufacturing process. One example is managerial roles

- Other overhead — Overhead costs that aren’t classified as material or labor but are part of the overall expenses. An example is the electricity bill

To calculate product costs, you’ll use the following equation:

Direct labor + direct material + overhead = Product costs

To break this down into a per-unit cost, then use this formula:

Product costs (the answer from the previous equation) divided by the number of units produced = Per-unit cost

Let’s apply this formula using a practical example. Suppose you’re developing a new mobile application. The following costs are associated with the development of the app:

- Direct material — $5,000 (licensing fees for software libraries)

- Direct labor — $50,000 (salary and benefits for developers)

- Overhead — $20,000

Using the formula, we can calculate the product cost as follows:

$5,000 (direct material) + $50,000 (direct labor) + $20,000 (overhead) = $75,000 (product costs)

Now, let’s say the company expects to develop and sell 500 units (subscriptions) of the mobile application. To determine the per-unit cost, we’ll use the following formula:

$75,000 (product costs) / 500 (number of units produced) = $150 (per-unit cost)

With this information, you can make informed decisions about pricing strategies, potential profitability, and areas to optimize costs during the development process.

Factors that affect product cost

Various factors can influence the overall cost of developing and maintaining a software product or technology solution. By understanding these factors, product managers can better manage their resources, anticipate potential challenges, and make informed decisions that ultimately impact the product’s success. The following are some key factors to consider when evaluating product cost:

Scope of product

Developer costs, team structure, equipment and software purchases, other costs.

You may be envisioning a SaaS product with several features and components. It can be costly to fully build out this level of complex software and maintain it. You’ll also need to consider quality assurance processes and maintenance.

An excellent developer usually also comes at a high costs. However, it may pay off in the long run if they deliver high-quality code. Some cost-saving measures, like hiring junior developers, may result in several issues later on in the development process.

Are you going to hire employees, an agency, or freelancers to build your product? Each option has varying costs.

For example, an in-house employee will expect benefits like paid time off, workspaces, and equipment. Meanwhile, a freelancer wouldn’t expect any of those benefits. In some cases, this is a more affordable option.

You may need to buy state-of-the-art equipment for your developers and other team members. You may also face development expenses such as external APIs. These are variables that can impact your product costs.

It’s not enough to just build a great product. You also need to invest in marketing, sales, customer support, legal, and more to ensure your product reaches the hands of the customers you want to serve.

A bit harder to calculate, time is a crucial factor to consider nevertheless. The software development lifecycle is time-consuming, and you may face obstacles that could lengthen your timeline.

Time is money in this scenario, so you’ll want to consider how long you expect the development process to take and keep track of the actual timeline of events.

Strategies to reduce product cost

You may find yourself in a situation where you determine your production costs are more than you desire. Or, maybe your customers aren’t willing to pay that much for your product. In this case, you may want to consider strategies to reduce product costs.

But reducing product costs can come with an unexpected price that doesn’t involve money: if you’re not careful, it could end up lowering the quality of the product. It’s a delicate balancing act to minimize product costs without compromising on quality.

Here are some strategies to consider if you want to reduce your product cost without dropping your standards:

Do your customer research correctly

Create a minimal viable product (mvp), analyze your current tech, understand the scope of the project, don’t skimp on quality assurance.

Customer research may be the most important step in building and maintaining any product. Many product managers and stakeholders think they know what the customer wants . Sometimes they’re right, but when they’re wrong, the consequences could be disastrous.

Backing up your assumptions with data can bolster your confidence that you are building a product that actually meets the needs of your customers. Alternatively, customer research can show that you are on the wrong path and need to pivot. This is an essential step, and it shouldn’t be skipped over.

A minimal viable product (MVP) is an app or product that is just functional enough to serve early adopters’ bare-minimum needs.

By aiming to create a useful product with minimal features, you can avoid spending too much time and money on features that may or may not resonate with your target market.

Your tech stack can have an impact on your budget. For example, you may be using several SaaS applications that have overlapping features. You may also be maintaining your own servers, but using cloud servers could help lower costs.

Evaluating your expenses can help you determine whether you’re getting the most value out of them or need to consider alternatives.

Before you even begin developing a product, you need a clear plan for what you’re building. Without a project plan or product roadmap , it’s hard to make sure all stakeholders and teams are on the same page.

You’ll need to have the following to reduce labor and costs:

- Technical specifications

- Wireframes or a design vision

- Detailed development plan

This may seem like an additional cost at first, but quality assurance (QA) is crucial to spotting errors and bugs. Without QA, your development costs could increase and your timeline can extend further than originally anticipated.

An investment in QA can go a long way toward protecting your budget and preventing your project from becoming overdue.

Knowing the true costs of development can help you determine what features to build, whether for an MVP or for your next major update.

With a solid financial plan in place, you can identify which components are driving up your product costs and adjust accordingly. This way, you can optimize your resources and maximize profits.

Featured image source: IconScout

LogRocket generates product insights that lead to meaningful action

Get your teams on the same page — try LogRocket today.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Facebook (Opens in new window)

- #product strategy

Stop guessing about your digital experience with LogRocket

Recent posts:.

Leader Spotlight: Enabling and leveraging live video commerce, with Andrew Chen

Andrew Chen, Chief Product Officer at CommentSold, discusses how live video is transforming ecommerce opportunities for brands.

A guide to success metrics

Success metrics are measurable parameters used to measure progress, effectiveness, and ultimately, success.

Leader Spotlight: Leveraging data to understand buying behavior, with Chris Baltusnik

Chris Baltusni talks about the difference between adopting an omnichannel approach versus a multichannel one.

A guide to the V2MOM framework

The V2MOM framework encourages continuous communication and updates, making it a dynamic tool for managing progress towards goals.

Leave a Reply Cancel reply

- HR & Payroll

Costing Methods: A Complete Guide

Every company has a unique nature and set of traits. It must thus use a variety of costing methods to determine the price of its items. For any manufacturer, choosing the appropriate price for a product is crucial.

If you overcharge for your product, you risk losing potential clients to your rivals. However, if you underprice the item, your accountant can get nervous when they see the balance sheet. There are numerous costs methods that organizations can use to increase their profit margin .

You may provide the best value for both yourself and your customers while relieving your accountant's burden by using the costing method that is most appropriate for your firm.

With this approach, you begin with the sale price in mind since you already know what it should be. In this post, we'll look at the concept of costing methods and the several types of costing you might employ to keep tabs on expenses in your business. Following are the topics covered:

What Is Costing?

Methods of costing, what is the importance of the costing method, what costing method should manufacturers choose, how to calculate overheads, key takeaways.

A system for determining out a company's cost of production is called costing, or cost accounting. This method of accounting examines both variable and fixed costs incurred over the course of manufacturing. Costing data is used by businesses to verify that every aspect of production is profitable and effective.

Contrary to other types of accounting, costing operations are carried out by an organization's internal management. This internal management is not visible to clients or institutions from the outside.

Cost accounting has more latitude than other types of accounting because there are no rigid requirements it must follow.

What Is a Costing Method?

A costing method is a way for figuring out how much something will cost. In order to assign a cost to a manufactured good, product costing techniques are used.

The cost of producing a good or providing a service is simply the sum of all the costs associated with that good or service. Each of these approaches can be used in various production and decision-making situations.

Be careful to use the information just for its intended purpose. For instance, a costing method designed for incremental pricing decisions may not be acceptable for long-term decision making. The type of costing method employed can lead to significant variances in costs.

Short-Term vs Long-Term Pricing Decisions

Manufacturers will prioritize direct costs, or expenses directly related to manufacturing. They will make short-term pricing decisions. In contrast, businesses must take indirect expenses and/or overhead costs into account when making long-term pricing and profitability decisions.

In general, the term " manufacturing overhead " is used to describe indirect expenditures that originate from manufacturing processes (such as plant maintenance, rent, etc.).

Administrative overhead is the term used to describe indirect expenditures that are connected to non-manufacturing operations (such as office supplies, G&A wages, telephone, rent, heat, admin related depreciation , etc.).

To ensure the long-term viability of a company, it is crucial to comprehend how these factors affect pricing. This is crucial when analyzing long-term pricing.

Types of Costing

Marginal Costing: Only the variable costs, such as direct materials, direct expenses, direct labor, and variable overheads, are allotted to production using this method. The variable overheads are allotted to production using this method.

- The fixed cost of production is not included. Costs are classified as constant or variable under marginal costing.

- Variable costs often vary in a directly proportionate manner based on changes in the volume of output. Fixed costs typically remain stable or constant.

- Dealing with the effects of changes in output volume or range on a company concern's costs or profit is the major goal of marginal costing.

- Divide the variation in production costs by the variation in quantity to determine marginal cost.

- Finding the point at which an organization can realize economies of scale to improve production and overall operations is the goal of marginal cost analysis.

- The manufacturer may make money if the marginal cost of producing one extra unit is less than the price per unit.

Standard Costing: Standard costing refers to the process of predetermining costs based on preset standards. This is done under specific operating conditions. Historical costing is the process of determining and recording costs after they have been incurred. It acts as a postmortem of the actual expenditures and gives the management a record of what actually occurred.

This method is referred to as conventional costing or actual costing because it is conventional. There are two methods for determining actual costs: post costing and continuous costing.

Historical Costing: You register a company asset at its purchase price using the cost principle. Keep track of assets on the balance sheet at the cash value they had at the time of purchase.

The price of an asset is not altered to reflect market fluctuations. Liabilities can be recorded using the historical cost concept as well. It doesn't matter how small your business is; your assets are important. You must be able to effectively manage and account for them.

- Asset tracking may be done easily and accurately using the cost principle.

- The historical cost principle ensures that an objective cost was documented by displaying the real price you paid for an asset.

- The price tenet is based on previous exchanges. The cost principle may not always be the best method for determining an asset's worth.

- The price principle may not accurately reflect the value of some goods.

- You might need to consider an asset's fair market value if its market is one that fluctuates regularly.

- With long-term assets, historical cost accounting is typically more challenging.

- Long-term assets are valuable possessions that you do not anticipate selling for cash in the near future. Long-term assets include things like buildings, land, cars, and other machinery.

- When selling long-term assets, the cost principle might be challenging to understand. Between the time you made the initial purchase and the time you sell the item, the market value may have altered.

- It may be more difficult to assess the financial health of your firm due to the diverse values. The various values in your financial statements must be explained.

Long-term assets typically lose value over time. After so many years, the cost principle might no longer accurately reflect the current worth of long-term property. A building's value today could be different from what it was fifty years ago, for instance.

On the other side, you don't own short-term assets for a long enough period of time for their value to drastically fluctuate. The value of short-term assets like inventory shouldn't be significantly impacted by market value.

Absorption Costing: The method of absorbing production's fixed and variable costs is called absorption costing . This method involves adding all costs, including fixed and variable costs , to the production.

Absorption costing is described as "the practice of charging all expenses, whether variable and fixed, to operations, processes, or products". It is a practice of the Institute of Cost and Management Accountants.

There is no distinction between fixed costs and variable costs when using absorption costing. To calculate the cost of production, both fixed and variable costs are taken into account. Full costing is another name for absorption costing.

Uniform Costing: The adoption of the same costing principles and procedures by many undertakings is known as uniform costing.

In order to provide cost data that are as comparable as possible, it is a strategy or method of costing. Several firms within a field or industry use a similar costing system. Through mutual comparison, standard costs can be established and cost management is secured in the company.

It is also possible to advise appropriate actions to regulate and lower costs. Uniform costing aims to standardize accounting practices and provide assistance in establishing reasonable prices for the goods produced by businesses that use this approach.

Thus, the objectives of a uniform costing system are:

- It guarantees that the product prices are established using accurate costing information.

- It offers trustworthy data for comparing cost performances amongst units.

- It offers information to compare the production costs and efficiencies of various companies.

- It is beneficial to determine the industry's overall cost of production on a basis that all individual units or firms may accept.

Uniform costing is not a separate or different method of cost accounting. Only members of the industry or trade association may use this technique of cost accounting. The industry members adopt the same costing ideas, processes, and procedures in order to compare firms.

Lean costing: Lean accounting, also known as lean costing, aids in improving an organization's financial management procedures. Instead of using conventional or traditional historical costing methods, lean costing assigns value-based pricing to the expenses of production. Lean costing is a method of estimating the costs of production.

Based on lean performance measures, this gives the organization an idea of where waste may be reduced. This is done to maximize efficiency in the production process.

Categories of Business Expenses

Variable Cost: A variable cost is a type of business expense whose amount varies according to how much a company produces or sells. Depending on a company's production or sales volume, variable costs grow or fall. They increase with rising production and decline with falling production.

A manufacturing company's raw material and packaging costs, or a retail business' credit card transaction fees or shipping costs, which increase or decrease with sales, are examples of variable costs. A fixed cost and a variable cost can be compared.

Fixed cost: Fixed costs are expenses that would not change regardless of changes in output. They would still be incurred even if no output were produced. For instance, rent, interest charges, real estate taxes, and employee wages.

However, fixed costs are limited to a set time period because they can fluctuate over the long term. A manufacturer, for instance, can opt to raise capacity in response to the rise in demand for its product. This necessitates a larger level of investment in plant and equipment.

Total Cost: Total cost is determined by adding up fixed, variable, and semi-variable expenses. It is often expressed as the sum of all costs that are both fixed (such as the cost of a building lease and the cost of large machinery) and variable (such as the cost of labor and raw materials), which change depending on the level of output.

Long-term rate of increase in variable costs with increasing output will be progressively greater if fixed costs are not changed. For example, by purchasing a larger building or more heavy gear.

This is because extra units of output have diminishing returns. Or, to put it another way, over time, increasing inputs of variable costs will result in progressively fewer units of output.

Direct and Indirect cost : Costs incurred directly include labor used to produce the items. The cost of the items is also reflected in the main materials used in their manufacture. Prime expenses and direct costs are both used interchangeably.

The costs associated with the entire plant, such as those brought on by the usage of energy and fixed assets, fall under indirect costs. Overhead is another name for indirect expenditures.

Indirect Costs in Manufacturing

The common misconception regarding production costs is that they only include direct expenses like labor and raw materials. New manufacturers frequently overlook indirect expenses. These must be considered when determining product prices.

The various expenses required to keep your firm operating that aren't directly tied to the production process are known as indirect costs. These may incorporate:

- Utilities such as electricity, water, and gas

- Mortgage or rent payments

- Marketing and advertising expenses

- Equipment upkeep and repairs

- Administrative expenditures such as payroll and accounting

You can see your manufacturing costs more clearly after calculating indirect costs. But doing so can be difficult and time-consuming. The advantages of accuracy must be weighed against the expense of devoting a lot of time and resources to this task.

It could not be worth the expense, for instance, if one technique of figuring out your costs is 7% more accurate than the other. It would take your cost accountants ten times longer to complete.

Incremental cost: This is mostly the incremental expense incurred while producing one more unit of production. Additionally known as differential cost. Managers in businesses are considerably more concerned with the additional costs associated with producing a product than they are with the allocated cost of overhead.

They just care about the expenditures that are incurred when one more unit is generated. They only want to make sure that a profit margin is being made with each incremental product sale.

This category's primary product costing techniques include:

- Direct costing: This is an accounting of all expenses that are directly related to the manufacture and sale of a good. These expenses include direct materials, piece-rate labor, and commissions. The cost that results can be used to determine the lowest price that a product can be sold for and still make a profit.

- Throughput costing: This analysis examines the effects that one extra unit flowing through the bottleneck operation will have on the business's overall throughput (revenue minus entirely variable costs). The throughput produced per minute of manufacturing time at the bottleneck operation is the main focus of product costing.

Opportunity Cost: It is described as the price of giving up an alternative (benefit, profit, or value) in order to take a specific course of action. The value or advantage forfeited by engaging in a specific activity in comparison to engaging in an alternative activity is known as the opportunity cost of that activity.

Simply put, it means that if you choose one activity, you forfeit the chance to do another. The difference between the anticipated returns of each alternative is all that needs to be considered when estimating an opportunity cost.

Sunk Cost: An investment that has already been made but cannot be recovered is referred to as a sunk cost, also known as a retrospective cost. Sunk costs in company include things like marketing, research, installing new software or equipment, and paying for workers and benefits. Sunk also pays for facilities.

Inventory Costing

Companies assign costs to products during inventory costing. This is also known as inventory cost accounting. Incidental expenses like storage, administration, and market fluctuations are also included in these expenditures. In order to prevent corporations from overstating these costs, generally accepted accounting standards (GAAP) adopt standardized accounting guidelines.

Inventory costing is a component of inventory management. A supply chain's proper inventory management lowers overall inventory costs and aids in deciding how much of a product a company should hold. All of this data aids businesses in determining the necessary margins to allocate to each product or product category.

Materials that have been purchased and materials that are Made-to-Stock (MTS) are priced based on inventory costs. The majority of businesses will use one of the following inventory costing methodologies:

- First-In, First-Out (FIFO)

- Last-In, First-Out (LIFO)

- Average or Weighted Average Cost

- Specific Identification

These costing approaches specify how inventory is valued and costed each time it is added to a pool of inventory. When inventory items are sold or used in production, the cost of the sale or WIP (Work In Progress) assigned to the transaction is calculated by multiplying the quantity of inventory items from one inventory layer by the inventory layer's unit price in order to meet the needs of the sale or manufacturing.

Each approach establishes the cost of the inventory that is allocated to Cost of Goods Sold (CGS)/Work in Progress (WIP).

FIFO: The oldest layers of inventory are used first (based on the date of receipt or the date of manufacture), according to FIFO. The majority of businesses use this technique because it typically provides a better connection of the material costs related to a sale. The cost of a sale is typically lower than the material costs related to a sale.

LIFO: According to LIFO, the newest layers of inventory are those based on the date they were manufactured or received. The newest layers are depleted before the oldest layers. Few manufacturers use this technique. Additionally, it can no longer be used in industries where manufacturers file their financial statements in line with IFRS.

- When the price of a manufacturer's most recent inventory is mixed together with current inventory and neither is obvious. It does offer some validity, though.

- As an example, consider a coal mining corporation that transports inventory from various mines to a single storage pit.

- Regardless of the mine from which it originated, each load from each truck arrival is stacked one on top of the other. When the business makes a sale, they use the coal from the "top" of the pit (i.e. newest coal first – or last in, first out).

- Since the top (newer) layers of coal in this scenario will be sold before the older layers, LIFO would be a more realistic costing analysis.

Average or Weighted Average: In essence, the average or weighted average proves that there is only one inventory layer in the stock. The "average cost" of all the things that are currently available in the inventory pool makes up that tier.

A new "per unit output price" is calculated each time an additional layer of inventory is added. It is then applied to every outbound inventory transaction until the next time the item is bought and received into inventory. A new "outbound unit price" will then need to be calculated.

Specific Identification: Each inventory item is given a specific cost according to the concept of specific identification. When an item is sold or used in production, its specific cost is appropriately assigned as COGS or WIP.

Even if you are purchasing a group of the same thing, each item in the group bears a specific cost that should not be allocated (shared) throughout the group, this practice makes sense if you are purchasing pricey, separately purchased items.

Keeping this level of particular cost detail in inventory is unnecessary. There aren't any items with high price tags or distinctive cost structures.

Production Costing

There are several different production costing techniques available. Each has advantages and disadvantages of its own. All of the direct and indirect costs firms incur when producing a good or rendering a service are referred to as production costs.

Various expenditures, including labor, raw materials, consumable manufacturing supplies, and general overhead, might be included in production costs. The following are the main production costing techniques used:

- Product Costing- Job Costing, Process Costing

Standard Costing

Multiple Costing

- ABC Costing

Unit Costing

Direct Costing

Batch Costing

Operation Costing

Target Costing

Product Costing

The process of calculating the costs associated with producing a specific product is called product costing. The consumption of components and raw materials, labor costs, and overhead expenses specific to one unit are included in this overall cost.

Product costing is crucial for accountants in order to value inventory and determine the cost of products sold. However, managers start with product costing when determining which things to produce and how much to charge for those that are.

You can use a variety of pricing techniques to get the product's ideal selling price after computing the cost per unit. A manufacturing performance statistic that aids in monitoring production costs is the cost per unit.

The following are the primary techniques for determining product costs:

Job Costing: This approach determines expenses for each work order independently. Because they each have their own specifications and scope. This kind of costing also applies to custom-made goods.

To manufacture an item(s) for sale, MTS to be sold later, or to be used in future production. Job costing (variable costing) includes taking materials, labor, and overhead and adding them to a production process. Costs are accrued through transactions that take place for:

- The amount of manufacturing and office expenses allocated to the product being produced

- Stock purchases and WIP inventory assignments

- Specialized work charged at employee rates

Production settings that use Make-To-Order (MTO) are the main users of this sort of costing. Job costing has the benefit of enabling manufacturers to track the exact costs associated with producing one or more items. It also enables manufacturers to add a markup to achieve the targeted profit margin for the product.

- If a factory has good control over their variable and overhead costs, it may produce very accurate quoting and pricing in this context. Direct expenses are directly related to a product.

- One drawback of job costing is that it typically leads to a lot of transaction level activity that is needed to track all the various charges that are continuously assigned to the manufacturing process. This is in order to arrive at correct costing for a product.

- Not to mention, managing and updating manufacturing costs appropriately requires quite complex software systems. Additionally, it may be difficult to absorb overhead into productive activities.

If you are an MTO manufacturer, it is crucial for your environment to be able to track real-time costs per unit of production as well as the ability to establish/manipulate overhead absorption as frequently as necessary without a lot of manual intervention, especially if you hope to accurately price products as they are being produced.

Example: Repair of buildings, Painting etc.

Contract costing: Terminal costing is another name for it. In essence, this approach is comparable to job costing. It is utilised, nonetheless, when a large and lengthy task is involved. The task is completed in accordance with the client's requirements.