- Youth Program

- Wharton Online

Ethics & Legal Studies

Wharton’s phd program in ethics and legal studies is unique: the only doctoral program in the world to focus on ethical and legal norms relevant to individual and organizational decision-making within business..

The Ethics & Legal Studies Doctoral Program at Wharton trains students in the fields of ethics and law in business. Students are encouraged to combine this work with investigation of related fields, including Philosophy, Law, Psychology, Management, Finance, and Marketing. Students take a core set of courses in the area of ethics and law in business, together with courses in an additional disciplinary concentration such as management, philosophy/ethical theory, finance, marketing, or accounting. Our program size and flexibility allow students to tailor their program to their individualized research interests and to pursue joint degrees with other departments across Wharton and Penn. Resources for current Ph.D. students can be found at http://www.wharton.upenn.edu/doctoral-inside/ .

Our world-class faculty take seriously the responsibility of training graduate students for the academic profession. Faculty work closely with students to help them develop their own distinctive academic interests. Our curriculum crosses many disciplinary boundaries. Faculty and student intellectual interests include a range of topics such as:

- Philosophy & Ethics : • philosophical business ethics • normative political philosophy • rights theory • theory of the firm • philosophy of law • philosophy of punishment & coercion • philosophy of deception and fraud • philosophy of blame and complicity • climate change ethics • effective altruism • integrative social contracts theory • corporate moral agency

- Law & Legal Studies : • law and economics • corporate penal theory • constitutional law • bankruptcy • corporate governance • corporate law • financial regulation • administrative law • empirical legal studies • blockchain and law • antitrust law • environmental law and policy • corporate criminal law • corruption • negotiations.

- Behavioral Ethics : • neuroscience and business ethics • moral psychology • moral beliefs and identity • moral deliberation • perceptions of corporate identity

Our program prepares graduates for tenure-track careers in university teaching and research at leading business schools and law schools. We have an excellent record of tenure-track placements, including Carnegie Mellon University, Notre Dame University, and George Washington University. Click here to see our placements .

Sample Schedule

Core courses.

In addition to the Wharton Doctoral course requirements, the student’s four-course unit core in the Legal Studies and Business Ethics Department consists of two required doctoral seminars, LGST 9200 Ethics in Business and Economics, and LGST 9210 Foundations of Business Law. The remaining two LGST courses may be selected from a list of LGST courses that the faculty coordinator has approved.

Students without basic law courses will be required to take LGST 1010 in their first semester. Students will take LGST courses, other than Ph.D. seminars, under an independent study number, meet with the instructor periodically outside class, and write a paper. These requirements should be satisfied through courses taught by members of the LGST standing faculty, though exceptions will be made in special circumstances. The requirements may be adjusted for students with law degrees.

Ethics and Law in Business Courses

Students must take four LGST courses, including these two core course seminars:

- Ethics in Business and Economics (LGST 9200)

- Foundations of Business Law (LGST 9210)

Major Disciplinary Cluster

The purpose of the cluster is to ground students in a single academic specialty other than Business Ethics. Clusters include the following:

Students must choose a disciplinary cluster during the first year, in consultation with a faculty advisor. Required courses may not be double-counted. For example, a student choosing Philosophy as the cluster may not use the two required courses in ethical theory as part of the five course cluster requirement.

Get the Details.

Visit the Ethics & Legal Studies website for details on program requirements and courses. Read faculty and student research and bios to see what you can do with an Ethics & Legal Studies PhD.

Ethics & Legal Studies Doctoral Coordinator Brian Berkey Associate Professor of Legal Studies & Business Ethics

Academic & Business Administrator Tamara English Legal Studies and Business Ethics Department Email: [email protected]

- Harvard Business School →

- Faculty & Research →

corporategovernance →

No results found in faculty profiles.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Corporate Governance: Essentials for a New Business Era

Program overview.

Today’s corporate boards face historic and unprecedented challenges. Boards of directors must navigate these sources of unexpected enterprise risk while capably monitoring their firms’ financial performance. For those responsible for filling board seats, the push toward making boards more diverse and inclusive adds complexity. Meanwhile, new opportunities are emerging for those seeking board service.

Corporate Governance: Essentials for a New Business Era provides critical tools for aspiring, newly appointed, and veteran board members, and for executives working with their board or other boards. Participants will gain insight into the duties and nuances of board service and learn to forge partnerships with company officers to strengthen financial return, enterprise risk management, and governance diversity.

Date, Location, & Fees

If you are unable to access the application form, please email Client Relations at [email protected] .

April 22 – 25, 2024 Philadelphia, PA $9,850

April 22 – 25, 2025 Philadelphia, PA $9,850

Drag for more

Program Experience

Former guest speakers, who should attend, highlights and key outcomes.

In Corporate Governance: Essentials for a New Business Era , you will:

- Explore board opportunities for C-suite officers in areas including technology, human resources, and sustainability

- Grasp how a director’s role is changing in today’s social, legal, and business environment

- Learn to present yourself as an attractive candidate for boards

- Look inside the process for nominating, selecting, and onboarding directors

Experience and Impact

Traditional board governance is a thing of the past. Today’s directors must be ready and able to handle a wide range of enterprise risks that could impact a large company. Led by top Wharton management faculty, Corporate Governance: Essentials for a New Business Era offers those aspiring to be on boards, recently appointed to a board, or experienced directors and company executives a wide-ranging look at what constitutes successful board service in the current environment. The specific content of the program will also be informed by the most pressing issues facing corporate boards. The focus will include company and legal issues related to diversity and inclusion; environmental, social, and governance (ESG) metrics; and leading in the boardroom.

Participants will explore how to present themselves as candidates for boards against the backdrop of social and legislative efforts to make boards more ethnically diverse and gender inclusive. You will also learn about the functional capabilities that are valued on boards, including strategy, technology, human resources, sustainability, and international experience. You will acquire strategies for marketing yourself to recruiters and come to recognize the value you can bring to a boardroom setting.

Individuals already on boards will gain new insights into managing emerging sources of enterprise risk and how best to diversify their board to address new regulations and investor expectations.

In addition to the outstanding faculty, selected guest speakers will enhance the program’s practical, real-world approach. Speakers may include veteran board chairs and lead directors; a federal prosecutor who has conducted internal investigations for major telecommunications and financial firms; and an executive-search partner experienced in board recruitment and onboarding.

A valuable benefit of this program is the substantial networking opportunity. You will have time to interact with seasoned and board-ready individuals from a wide variety of backgrounds and experience, providing for an expanded peer group. The need has never been greater for board members with new perspectives and experience. Timely and unique, Corporate Governance helps you take full advantage of the rapidly changing environment for both board selection and director responsibilities.

Session topics include:

- Overview of board structure, committees and emerging best practices

- Enterprise challenges and risks including climate change, job displacement, global trade, disease epidemics, and social responsibility

- Creating opportunities for those who have been underrepresented in the boardroom

- Characteristics of successful board leaders

- Overseeing management

- Building diversity, equity, and inclusion in the boardroom

- Leading boards through legal issues and other crises

- Succession planning

- Bringing environmental and social issues into the boardroom

- Designing political and social strategies

- Shareholder activism

Convince Your Supervisor

Here’s a justification letter you can edit and send to your supervisor to help you make the case for attending this Wharton program.

Due to our application review period, applications submitted after 12:00 p.m. ET on Friday for programs beginning the following Monday may not be processed in time to grant admission. Applicants will be contacted by a member of our Client Relations Team to discuss options for future programs and dates.

Janet Foutty

Executive Chair of the Board, Deloitte

Janet Foutty is executive chair of the board, Deloitte. She leads the board in providing governance and oversight on critical business matters including strategy, brand positioning, risk mitigation, talent development, and leadership succession. Janet is also a member of Deloitte’s Global Board of Directors, and chair of Deloitte Foundation, the 90-year old not-for-profit organization that helps develop future talent and promote excellence in teaching, research, and curriculum innovation.

Janet’s leadership experience includes most recently serving as chair and chief executive officer for Deloitte Consulting LLP where she led a $10B business comprised of over 50,000 professionals in helping Fortune 500 companies and government agencies translate complex issues into opportunity.

She previously led Deloitte’s federal practice dedicated to improving the efficacy and efficiency of US government agencies; as well as Deloitte Consulting LLP’s technology practice, which achieved exponential growth through acquisitions and the launch of businesses including Deloitte Digital. She has also held leadership roles on client programs that span retail, technology, government, energy, and financial services industries. Janet is a frequent author and popular public speaker. She regularly communicates with executive-level audiences about the changing business landscape, technology disruption, and leadership. Janet is a passionate advocate for inclusion in the workplace; women in technology; and the need for science, technology, engineering, and mathematics (STEM) education. She has founded Women in Technology groups in India and the United States. Janet serves on the board of directors of Bright Pink, a nonprofit dedicated to women’s health, and Catalyst, a global nonprofit working to build more inclusive workplaces. She serves on the advisory boards of NYU Stern’s Tech MBA program, Columbia Law School’s Millstein Center for Global Markets and Corporate Ownership, and the executive committee for the Council on Competitiveness.

Janet holds a Bachelor of Science from Indiana University, and a Masters of Business Administration in finance from the Kelley School of Business at Indiana University. She is an inductee of the Kelley School of Business Academy of Alumni Fellows, and a member of the Kelley School of Business Dean’s Council.

Watch the Video: Janet Foutty, Chair of the Board for Deloitte, talks about the key principles of board agility.

Katina Dorton

Chief Financial Officer; Board Director

Katina Dorton is a recognized and internationally experienced financial executive, corporate director, and public company CFO. Dorton's strategic insights, expert perspective, and financial acumen are informed by earlier career experience as a Wall Street investment banker and corporate transactions attorney. Dorton's industry expertise includes health care and life sciences, industrial services, and financial services.

Throughout her career, Dorton has advised executive leaders and boards of directors on capital markets, fund raising, mergers and acquisitions, and other strategic transactions, collectively valued at more than $50 billion. As CFO, Dorton has built financial, legal, and operational functions to support companies through aggressive growth and transition including IPO preparation. Dorton has served on several public company boards and has demonstrated strong leadership as lead director, audit chair and governance committee chair. She meets the qualifications of an SEC financial expert, is a National Association of Corporate Directors (NACD) Corporate Governance Fellow, and serves on the NACD Lead Director Steering Committee. Dorton was named as one of Women Inc's 2019 Most Influential Corporate Directors and a 2020 NACD Directorship 100 Honoree.

William McNabb

Former Chairman and Chief Executive Officer, Vanguard; Senior Fellow, Center for Leadership and Change Management, The Wharton School

F. William McNabb III is the former chairman and chief executive officer of Vanguard. He joined Vanguard in 1986. In 2008, he became chief executive officer; in 2010, he became chairman of the board of directors and the board of trustees. He stepped down as chief executive officer at the end of 2017 and as chairman at the end of 2018. Earlier in his career, he led each of Vanguard’s client-facing business divisions.

McNabb is active in the investment management industry and served as the chairman of the Investment Company Institute’s board of governors from 2013 to 2016. A board member of UnitedHealth Group and the chairman of Ernst & Young’s Independent Audit Committee, he is also chairman of the board of the Zoological Society of Philadelphia, a board member of CECP: The CEO Force for Good, and a board member of the Philadelphia School Partnership.

In addition, McNabb is the executive in residence at the Raj & Kamla Gupta Governance Institute at the Le Bow College of Business and a member of the Advisory Board of the Ira M. Millstein Center for Global Markets and Corporate Ownership at Columbia Law School. He is a member of the Wharton Leadership Advisory Board of the Wharton Center for Leadership and Change Management and a member of the Wharton School’s Graduate Executive Board. He also serves on the Dartmouth Athletic Advisory Board.

McNabb earned an AB at Dartmouth College and an MBA from the Wharton School of the University of Pennsylvania.

Paula Price

Public and Private Company Independent Board Director and Strategic Advisor

Paula A. Price was EVP and chief financial officer of Macy’s Inc. from July 2018 to May 2020, and served as advisor to the renowned retailer until the end of 2020. As CFO, she was also a principal architect of Macy’s transformation journey and, during the COVID-19 pandemic, led its financial restructuring, including raising $4.5 billion to recapitalize and sustain the company.

Price has been a visiting executive with Harvard Business School since July 2018, and was a full-time senior lecturer of business administration in the Accounting and Management Unit, having joined the faculty in July 2014. Until January 2014, Price was executive vice president and chief financial officer of Ahold USA, which she joined in 2009. At Ahold, Price was responsible for finance, accounting, and shared services; strategy and planning; real estate development and construction; and information technology. Price transformed the finance function, delivered a $1 billion cost savings program to fund strategic growth initiatives, and led a team of over 1,000.

Prior to joining Ahold, Price was senior vice president, controller, and chief accounting officer for CVS Caremark Corporation, and a key player in the $26 billion CVS/Caremark merger transaction. Price began her career as an intern in public accounting at Arthur Andersen & Co. before joining full time with clients that spanned financial services, consumer packaged goods, and health care.

Price currently serves as an independent director for public, private, and not-for profit companies. Today, she serves on the boards of the following publicly traded companies: Accenture, chairing its Audit Committee; Bristol Myers Squibb; Western Digital; and Davita, chairing its Audit Committee. She is a qualified audit committee financial expert as defined by the SEC and a certified public accountant.

Price’s career includes senior-level finance, general management, and strategy roles based in New York, Boston, London, and Chicago in the retail, financial services, health care, and consumer packaged goods industries.

Price earned her MBA in Finance and Strategy from the University of Chicago and her BSc in Accountancy from DePaul University.

Price and her family live in Manhattan and on Martha’s Vineyard, where she enjoys painting and outdoor activities.

Mark Turner

President, Chief Executive Officer and Director of WSFS Financial Corporation and WSFS Bank

Mark A. Turner, has been President, Chief Executive Officer and a Director of WSFS Financial Corporation and WSFS Bank since 2007. Mr. Turner was previously both the Chief Operating Officer and the Chief Financial Officer of WSFS. Prior to joining WSFS in 1996, he worked at CoreStates Bank, Meridian Bancorp and at the international professional services firm of KPMG, LLP. WSFS is a multi-billion dollar, publicly-traded financial organization (NASDAQ:WSFS), the largest bank and trust company headquartered in Delaware and the Delaware Valley, and the 7th oldest bank in the U.S. Mr. Turner is privileged to be leading a Company that has been named by an independent survey as a “Top Workplace” in Delaware for the last 11 years in a row (with special recognitions for the Company’s leadership, ethics, and career development), and has also been voted as the “#1 Bank” in Delaware for six years in a row.

Mr. Turner received his MBA from the Wharton School of the University of Pennsylvania, his Master’s Degree in Executive Leadership from the University of Nebraska-Lincoln, and his Bachelor’s Degree in Accounting and Management from LaSalle University (Philadelphia). Among other executive leadership programs, Mr. Turner has studied at National Training Labs, Aspen Institute, Gallup University, Toyota University, Center for Creative Leadership, UC Berkeley, and Buckley School for Public Speaking.

Mr. Turner is an active leader in his community. He has served as: Chairman of the Board of Delaware Business Roundtable (DBRT); a member of U.S. Federal Reserve Board’s Advisory Council; Chairman of the Board of Delaware Bankers Association (DBA); a member of Executive Committee of the Board of Delaware State Chamber of Commerce (DSCC); a member of the Board of Trustees of Delaware State University (DSU); a member of the Board of Directors of Delaware Alliance for Non-Profit Advancement (DANA); a member of the Board of Advisors of Teach for America (TFA), Delaware; and a founding member of both Delaware Talent Live (DTL) and Wilmington Leaders Alliance (WLA).

Corporate Governance: Essentials for a New Business Era prepares executives with diverse backgrounds who aspire to join a board or wish to enhance their knowledge for ongoing board service. This program offers a wide-ranging look at what constitutes successful board service in the current climate with a focus on the fiduciary duties of directors, strategies for filling and seeking board seats, and navigating the politics of board service.

This program is ideal for:

- Senior-level women or minority executives who aspire to board service or have recently joined a board

- C-suite executives including general counsels, chief technology officers, chief financial officers, chief human resource officers, chief risk officers, and chief sustainability officers

- Partner-level attorneys in law firms with experience in corporate investigations, mergers/acquisitions, and compliance

- Leaders of major nonprofit organizations and academic institutions

- Board members who wish to become better informed and more productive in their role

- Members of governance and nominations committees seeking to diversify their boards

- Corporate secretaries

- Institutional investors

Fluency in English, written and spoken, is required for participation in Wharton Executive Education programs.

Group Enrollment

To further leverage the value and impact of this program, we encourage companies to send cross-functional teams of executives to Wharton. We offer group-enrollment benefits to companies sending four or more participants.

Michael Useem, PhD See Faculty Bio

Academic Director

William and Jacalyn Egan Professor Emeritus of Management; Faculty Director, Center for Leadership and McNulty Leadership Program, Wharton School, University of Pennsylvania

Research Interests: Catastrophic and enterprise risk management, corporate change and restructuring, leadership, decision making, governance

Mary-Hunter McDonnell, JD, PhD See Faculty Bio

Associate Professor of Management; Faculty Co-Director, Zicklin Center for Governance and Business Ethics, The Wharton School

Research Interests: Organizational theory (political sociology, institutional theory); nonmarket strategy; corporate governance; corporate misconduct and punishment

Peter Cappelli, DPhil See Faculty Bio

George W. Taylor Professor of Management; Director, Center for Human Resources, The Wharton School

Research Interests: Human-resource practices, public policy related to employment, talent and performance management

Emilie Feldman, PhD See Faculty Bio

Michael L. Tarnopol Professor; Professor of Management, The Wharton School

Research Interests: Corporate governance, corporate strategy, diversification, divestitures, firm scope, spinoffs, mergers and acquisitions

Witold Henisz, PhD See Faculty Bio

Vice Dean and Faculty Director, ESG Initiative; Deloitte & Touche Professor of Management in Honor of Russell E. Palmer, former Managing Partner

Research Interests: Political and social risk management; project management; ESG integration; stakeholder engagement

Nancy Rothbard, PhD See Faculty Bio

Deputy Dean; David Pottruck Professor; Professor of Management, The Wharton School

Research Interests: Emotion and identity, work motivation and engagement, work-life and career development

How does a diverse board of directors help increase organizational performance?

Companies with diverse boards (in terms of race, ethnicity, gender, age, professional experience, and other factors) — and who work to benefit from that diversity — have been shown to have higher than average ROI, have better than average growth, and pay higher dividends to stockholders. They can better monitor senior leaders, challenge the status quo, be more innovative, and provide more agile leadership in the face of change and disruptions. Diverse boards tend to be more aware of market trends and take steps to improve the company’s brand and overall reputation. They also tend to acknowledge a wider variety of risks and thus are more risk-averse.

How do you measure board diversity? Are there different methods that different companies use to measure it?

Diversity laws that mandate a specific number or percentage of women directors were first passed in Europe (Norway was first in 2003). By 2018, they extended to the United States: California and Illinois have diversity laws, and Hawaii, Massachusetts, Michigan, and New Jersey are currently drafting them. Most of these laws, like those in Europe, focus solely on gender diversity.

Companies are also now facing pressure from institutional and activist investors, as well as social movements, to improve board diversity, but standards for measuring that diversity range widely. Most firms must define and benchmark progress toward diversity for themselves.

What are the qualities of a good board member?

A good board member should bring unique perspectives and sources of information and be willing to share them. They are honest and ethical, exercise discretion, and are cooperative with and respectful of their fellow directors. Good directors are also forward thinking, actively considering new issues to monitor that could become problematic for the firm in the future.

What skills do you need to be a board member?

Directors must be knowledgeable about and able to participate meaningfully in the duties their board is charged with. Those include making strategic decisions about mergers and acquisitions, CEO succession, executive compensation, and other high-level issues. Board members should possess strong critical thinking skills, awareness of the industry and positioning the company within it, and leadership experience. Business acumen in areas such as finance, operations, technology, and marketing is required of the board as a whole, but not every member needs expertise in each area.

What role does the board of directors play in corporate governance?

Corporate governance makes managers accountable to the best interests of their firm. The board acts as the intermediary, monitoring and guiding the firms’ senior leaders. In the United States, because shareholders typically do not own a very large block of shares in a company, the board plays a crucial role in representing those shareholders’ interests by actively working on their behalf.

How does corporate governance affect the image of the company?

Boards that actively monitor senior leadership and that maintain a level of independence can help safeguard a firm’s reputation by preventing or rectifying potentially disastrous situations. Many well-known company failures, such as Enron’s and recent #MeToo-related debacles, can be linked to failures in corporate governance.

Why is board composition important in corporate governance?

A board has to effectively decide on and implement a number of critical, diverse strategic tasks. Those include hostile takeovers, capital allocation strategy, and executive compensation and succession. To perform optimally, the board's composition must match the skill sets needed.

Download the program schedule , including session details and format.

Hotel Information

Fees for on-campus programs include accommodations and meals. Prices are subject to change.

Read COVID-19 Safety Policy »

Related Programs

- Shareholder Activism: Activating Change for Value Creation

- Women on Boards: Building Exceptional Leaders

Schedule a personalized consultation to discuss your professional goals:

+1.215.898.1776

Still considering your options? View programs within Leadership and Management or:

Find a new program

Undergraduate

Executive education, faculty & research, aacsb accreditation, cliftonstrengths.

Overview Accounting Business Information Systems Finance Global Management Human Resources Management Marketing Supply Chain Management

Student Career Development

Career development conferences, mentoring match, professional academies, tafel internship program, career development resources, recruiter career services, alumni career services, study abroad, international programs, study abroad resources, international blog, ambassadors program, student life, residential life, student organizations, pitt business outside the classroom, take a virtual tour of pitt business, prospective freshmen, transfer students, current pitt students, international students, diversity students, tuition and financial aid, advanced placement credit, student ambassadors, visit pitt business, strategic roadmap, stats & rankings, board of visitors, equity, diversity, and inclusion, student life & organizations our campus, life in pittsburgh, media inquiries, social media, information technology, staff directory, wellness and safety resource hub, info by program, joint & dual degree requirements, interact with us, attend an event, visit campus, tuition & aid, start your application, admitted students, executive mba, master of pharmacy business administration, executive dba, micro-credentials application, graduate certificate in business analytics application, stats & rankings, request transcripts, refer students, regional representatives, get involved, boards & councils, student scholarships, continue your education, pitt business magazine, alumni newsletter, faculty by area, business analytics & operations, information systems & technology management, marketing & business economics, organizations & entrepreneurship, david berg center for ethics and leadership, center for branding, center for executive education, center for healthcare management, center for integrated learning, center for supply chain management, business of humanity project, center for sustainable business, katz international center for conflict resolution.

- Job Placements

Info Systems & Tech Management

Org behavior & hr management, strategic management, alumni testimonials, executive mba in healthcare, healthcare leadership and business fundamentals, doctor of business administration.

DBA Course of Study

DBA Frequently Asked Questions

Academic Calendar

Academic courses, real-world learning, career management, global learning, you belong at katz, signature mba, part-time mba, accelerated mba, joint degree mba, dual degree mba/ms, mba with business analytics, master of science, business analytics, management information systems, marketing science, supply chain management, supply chain management and industrial engineering, credentials, micro-credentials, graduate certificates, international applicant admission and faq, pitt2pittbusiness, phd in finance.

- Academics Overview

- Collaborative Research

The Katz PhD Program in Finance focuses on research in financial economics, and most recently has studied phenomena such as corporate governance, restructurings, mergers and acquisitions, initial public offerings, corporate valuations, corporate diversification, corporate disclosures, equity-based compensation, and issues related to international corporate finance. The finance group mentors students with an apprenticeship model, providing an early start in research projects both by and with faculty.

Over successive five-year periods between 1980 and 2014, graduates of the Katz PhD in Finance Program ranked between 28th and 49th among doctoral programs worldwide depending on the specific time interval over which productivity was measured. Most recently, our graduates ranked as the 17th most productive among finance graduates of U.S. public universities the 39th most productive among all programs worldwide. This is especially impressive given that the rankings do not make adjustments for differences in the number of graduates across programs.

Considering we are a relatively small program, our graduates have had an outsized impact in terms of producing high-impact research published in the leading finance academic journals.The upside of our small program size is that it allows for frequent interactions and collaborations among our faculty and our PhD students.

We have an excellent history of doctoral student/faculty collaboration, which often results in articles that are published in top journals. Our faculty members develop relationships with our students that result in research collaboration that often lasts well beyond the doctoral program experience.

Our goal is for students to join finance faculties at top research universities and to make significant scholarly contributions to the field of financial economics. We usually accept two or three new students per year so that we are able to give students a great deal of faculty attention.

Some of our alumni are now full or chaired professors at research-oriented schools including:

- University of Alabama

- Hong Kong University of Science and Technology

- Chinese University of Hong Kong

- University of Missouri

- Georgia Institute of Technology

- North Carolina State University

Year 1 Curriculum: Fall Term (12 credits)

Admitted students begin the PhD program with an intensive math class that meets daily for three weeks prior to the start of fall classes. Katz Finance PhD Students are expected to arrive on campus by August 1.

An exploration of critical thinking.

Year 1 Curriculum: Spring Term

A thorough examination of research methods.

Year 1 Curriculum: Summer Term (3 credits)

Research paper with faculty guidance.

Year 2 Curriculum: Fall Term

A continued study in critical thinking and research methods.

Year 2 Curriculum: Spring Term

A further dive into major concentrations, critical thinking, and research methods.

Year 2 Curriculum: Summer Term

A comprehensive independent study.

Year 3 Curriculum: Fall, Spring, and Summer Terms

Fully concentrated work on dissertation and service as teaching assistant.

Curriculum: Years 4 and 5

Teach and enter the job market to defend your dissertation.

STUDENT SPOTLIGHT

Pitt has spectacular faculty and staff members. One can work with world-class scholars on rigor and relevant topics in business fields. I’m fortunate to work with possibly the best mentors one could ask for – they respect your own research interests, always inspire you, and they encourage curiosity, discovery, and blazing your own trail. They support and help me evolve as an independent researcher and a future educator.

PhD, Information Systems and Technology Management

I chose Pitt over other schools for the exceptional faculty at Katz and for the flexibility and freedom it provides. The faculty, who are world-class researchers, genuinely care for my growth and are always open to discuss and collaborate on new research ideas. The flexible course of study allows me to draw from a vast array of courses offered across different schools, helping me choose only those which best fit my needs. I am lucky to be part of the Katz community, which inspires me to do better every day!

PhD, Marketing

Ph.D. in Planning, Governance, and Globalization (PGG)

Global events have fueled a growing demand for social scientists with truly global perspectives on government, corporate and non-profit sectors. Globalization has restructured our society, resulting in a need to redefine and redirect governance strategies in areas like the workplace, the neighborhood, municipal or state government, nation-states or non-governmental organizations. Likewise, problems of urbanization, democratization, and non-sustainable practices in land and resource use have not been resolved and there is impetus to transform domestic and global trends toward more sustainable economic development, environmental protection, and social equity.

The doctoral program in Planning, Governance & Globalization (PGG) takes a multidisciplinary approach to pursuing these areas of inquiry, utilizing two tracks rooted in different disciplines: Urban & Environmental Design & Planning (PGG-UEDP) supported by faculty in Urban Affairs & Planning (UAP) and Governance & Globalization (PGG-GG) supported by faculty in Government & International Affairs (GIA). Applicants to the program should have master’s degrees in closely allied fields, such as Planning, Political Science, Sociology, International Relations, Geography and Economics among others.

- --> General Item PGG Ph.D.: Urban & Environmental Design & Planning -->

- --> General Item PGG Ph.D.: Governance and Globalization Track -->

PGG TRACKS AND THEIR THEMATIC AREAS

Governance & Globalization track, supported by faculty in Governance and International Affairs (GG):

- Governance, Institutions & Civil Society

- Globalization, Identities, Security, & Economies

Urban & Environmental Design & Planning track, supported by faculty in Urban Affairs and Planning (UEDP):

- Metropolitan Development

- Community & Economic Development Planning

- International Development Planning

- Environmental Planning & Sustainability

- Landscape Planning & Analysis

- Transportation Planning

- Physical Planning & Urban Design

PGG welcomes full- and part-time students to either track at both the Blacksburg and the Washington, D.C. campuses.

Test Drive this Degree

Are you uncertain about enrolling in this program but would be interested in trying a class?

Many of our doctoral students, especially part-time students who are working professionals in the Washington, D.C. area, start the PGG program as a non-degree Commonwealth Campus student.

Commonwealth Campus status is open to an applicant who holds an earned bachelors or higher degree from a regionally accredited U.S. university. Examples of students who seek admission into the Commonwealth Campus program include those who may qualify for regular admission but do not currently wish apply immediately for a graduate degree or need to update their academic credentials after several years of professional experience.

If students perform well in the courses they take, they can build a case for admission into the PGG degree. Students can take up to twelve credit hours (typically four classes) as a non-degree Commonwealth Campus student.

PGG has established a highly selective Ph.D. program drawing students in the 60th percentile or higher of peer institutions based on GRE scores, GPA, and other measures. Applicants should have master’s degrees in closely allied fields, such as Planning, Landscape Architecture, Political Science, Sociology, International Relations, Geography, and Economics, among others. Applicants without a conferred master’s degree will be directed to apply for one of our master’s degree programs.

Admission to PGG program is based on a combination of four criteria:

- Performance in Master’s program/Academic Transcript

- Letters of recommendation

- Statement of purpose/interest in program

- Professional background and experience

The PGG degree has a ‘rolling admissions’ policy. Application deadlines are in the table below.

A limited number of Graduate Teaching Assistantships are available each year. Students wishing to be considered for one of these assistantships should apply by February 1st.

Students can be admitted to the PGG degree program in the Fall, Spring, and Summer. However, it is recommended that students enter in the Fall or Spring semesters as our foundational courses are taught face to face during the Fall and Spring semesters

The graduate admissions committee will carefully screen all applications, and all admissions decisions will be made by consensus of the faculty. At least one faculty member from this program must agree to supervise any applicant whose record meets admissions requirements before they will receive a formal offer of admission. All incoming students will be assigned a “provisional” advisor who will work with the student until the student establishes a formal advisory committee of four members.

Information about the tracks and their thematic areas, process for transfer courses, and more, can be found in the current PGG Handbook.

APPLICATION PROCESS

Students apply online through the Graduate School website. If applying online is not an option for you, you may request paper application materials through their site as well.

What to Prepare

- Prospective student need to prepare a statement of interest, detailing their proposed area of research, their professional background and experience (if applicable) and their interest in pursuing a doctorate at Virginia Tech. They should include a professional resume.

- Academic Transcripts – Master’s and undergraduate

- Three letters of recommendation from a mix of former professors and others who have had the opportunity to observe the applicant in an academic and professional capacity.

SUBMIT THE APPLICATION AND FOLLOWING MATERIALS ONLINE:

- Report of the TOEFL test (if applicable); Virginia Tech’s code is #005859. The Graduate School requires official test scores sent directly from ETS.

- Because we require that students have an awarded master’s degree before beginning their studies in PGG, we do NOT require GRE scores.

- Transcripts: see more important information about providing transcripts on the Graduate School’s application site.While completing your online application and prior to submitting it, you will be required to upload one copy of your scanned official transcript from each institution from which you have earned or will earn an undergraduate or graduate degree. Do not send transcripts for community college attendance or from any institution where you enrolled in classes but did not earn a degree.Please do not mail your official transcripts to us until you have received an offer of admission from Virginia Tech. Please note that non-legible scans will not be accepted. Make sure your scanned documents are legible before uploading, as non-legible documents will result in processing delays.You may scan a copy of your official paper or electronic transcript provided to you from your institution’s Registrar. Do NOT upload your institution’s web-based academic record or a document stating it is not an official transcript. Make sure that all critical and identifying marks have been scanned and are legible.

- Three letters of recommendation (these may also be submitted online).

- Resume and Personal Statement (see below for items to include in the statement).

Whether you’re applying to the Blacksburg or the Arlington campus, please direct any questions you have to:

Kelly Crist Manager of SPIA Faculty and Student Affairs Planning, Governance, and Globalization Ph.D. Program School of Public and International Affairs (0113) 140 Otey Street SW / Room 110 Virginia Tech Blacksburg, Virginia 24061 telephone: 540-231-2291 email: [email protected]

You may also direct questions to the Graduate School:

Graduate School Graduate Life Center at Donaldson Brown (0325) Virginia Tech Blacksburg, VA 24061

Graduate School – Graduate School admissions, application, and other information.

Applicants may use the space provided in the online application for their resume and personal statement. The online application form will ask you to state your reasons for pursuing a graduate degree; this section may be used as the personal statement.

PERSONAL STATEMENT

Items to include in your statement:

- Indicate which track (UEDP or GG) and the theme within the track you are interested in pursuing. Information about the tracks and themes can be found in the PGG Handbook.

- Include a brief research proposal.

- Identify faculty you would like to serve as your major professor and why.

ACADEMIC STANDARDS

Students applying to the PGG program should meet the following academic standards:

- A “B” overall grade point average (3.1 on a 4 point scale)

- TOEFL: minimums internet-based: 100; computer-based: 250; paper-based: 600. OR IELTS: minimum 6.5 (Neither TOEFL nor IELTS is required of US permanent residents or US naturalized citizens; can be waived by the Graduate School if student attended a university where English is the language of instruction.)

The PGG Admissions Committee begins reviewing applications in early February, so students who wish to be considered for graduate assistantships should have a complete application submitted by February 1 for the upcoming fall term. Graduate Assistantship decisions are made by the end of March.

The following application and decision deadlines have been established for the upcoming entry terms:

*Students seeking departmental funding should submit all required admissions materials by February 1st for full consideration. Funding decisions are generally made by the end of March. We will continue to welcome applications after this date on a rolling basis and these applicants will be considered for any funding that may still be available after the first round of decisions.

* Please also see the Graduate School’s site for other available funding .

International Students

Please allow plenty of time for the review of your application based on deadlines above. Any decisions made after these time frames need to be approved in advance and on a case-by-case basis, by the Graduate School’s International Graduate Student Services staff. The contact email for those applying to the Blacksburg campus is [email protected] . The contact email for those applying to the Arlington campus is [email protected] .

Evidence of English Proficiency: International applicants are exempt from demonstrating English proficiency if they have graduated from an accredited university where English is the language of instruction or if they are U.S. permanent residents (“green card” holders).

International applicants may demonstrate English proficiency by submitting scores from the Test of English as a Foreign Language (TOEFL) or the International English Language Testing System (IELTS) using the minimums listed under Academic Standards above.

International students in F-1 or J-1 status who obtained admission into a degree program are eligible for consideration by the academic departments for assistantships and in-state tuition scholarships.

APPLY TO THE GRADUATE SCHOOL

PGG Handbook

Download the PGG Handbook

All information can be found in the current student handbook. All forms must be submitted to Colleen Malley for processing.

Forms internal to PGG are below. Other forms may be found on the Graduate School ‘s website.

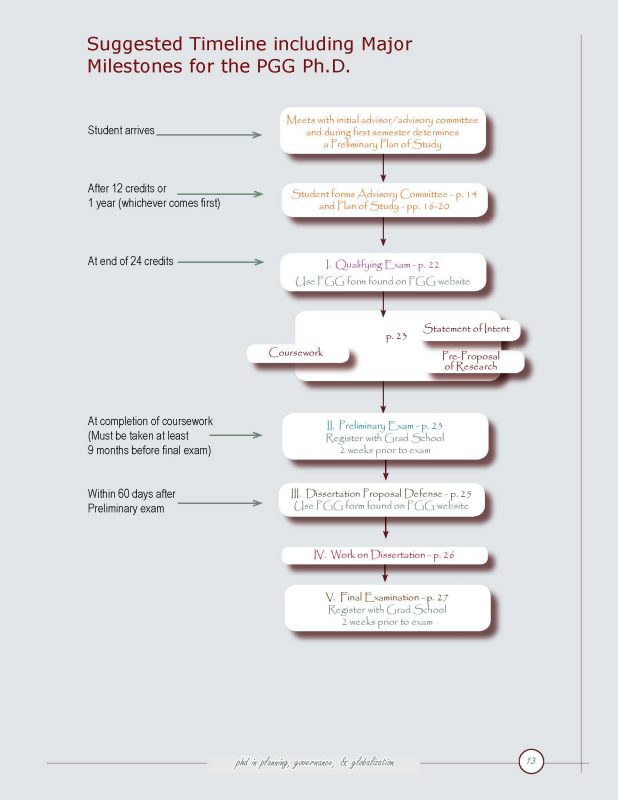

Suggested Milestone Timeline

Here is a suggested timeline of the major milestones that can also be found on page 9 of the handbook. Milestones are touched on briefly on pages 7-8 and in-depth descriptions begin on page 26 of the handbook.

Forms & Links

Sample Plan of Study

Submit your plan of study with signature page (see next item immediately following) to Colleen Malley once complete. Information about the plan can be found in the handbook beginning on page 16 and the sample plan is on pages 19 and 20. Students create their plans based on the sample. Courses listed on the plan should match those on your transcript*: * be sure you list the correct term on the plan as well as the correct department and course number (be careful of cross-listed courses). Note: if you don’t have items for a particular section you don’t need to include that section on your plan.

Plan of Study Signature Page

Signature page must be submitted with your plan. You can create your signature page when creating your Plan of Study or print this form.

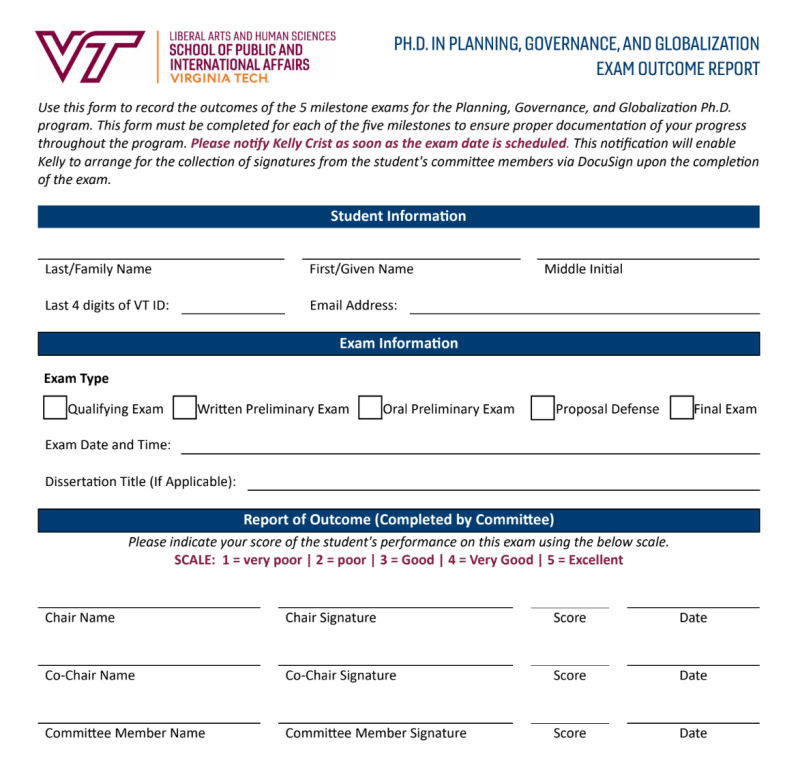

PGG Exam Outcome Report Form

Use this form to record the results of each of your milestone exams (Qualifying Exam, Written Preliminary Exam, Oral Preliminary Exam, Proposal Defense, Final Exam).

History of the PGG PhD

The PGG doctoral program is a spin-off from the Environmental Design and Planning (EDP) Ph.D. Program in the College of Architecture and Urban Studies. Initiated in 1975, the EDP program has grown not only in enrollment but also in specializations or streams as the College has become more diverse through restructuring. Effective spring 2007, EDP spun off two separate Ph.D. degrees, Planning, Governance & Globalization (PGG) in the School of Public & International Affairs and Architecture Design Research (ADR) in the School of Architecture + Design.

Kelly Crist Manager, Faculty and Student Affairs [email protected]

Ariel Ahram GG-track Director [email protected]

Todd Schenk UEDP-track Director [email protected]

Blacksburg 140 Otey St. Blacksburg, VA 24061 Mail Code 0113

Washington D.C. 900 N. Glebe Rd., 6th Floor, VTRC Arlington, VA 22203

Program on Corporate Governance

Courses taught at Harvard Law School on topics related to corporate governance include the following:

- Business Valuation and Analysis

- Conceptions of Legal Entities

- Corporations

- Drafting and Negotiating Complex Cross-Border M&A Transactions

- Failed Corporations: A Post-Mortem

- Law and Economics

- Valuing and Modeling M&A and LBOs

- Securities Regulation

- Mergers and Acquisitions Workshop: Boardroom Strategies and Deal Tactics

- A Comparative Perspective on Corporations, Ownership, and Capital Access

- Corporate and Capital Markets Law and Policy

- Corporate Criminal Investigations

- Corporate Finance

- Corporate Governance: Corporate Purpose

- Critical Corporate Theory Lab

- Empirical Law and Finance

- Empirical Methods and Data Analysis for Lawyers

- Law, Business, and the Public Good

- M&A Litigation

- Nuts and Bolts of Forming a Venture Capital Fund

- Regulation of Financial Institutions

- Research Seminar in Law, Economics, and Organizations

- Stakeholder Capitalism

- Venture Law and Finance

- Advanced Corporate Transactions

- Corporate Reorganization

- Hedge and Private Equity Funds: Law and Policy

- Investments Workshop: Public and Private Equity

- Mergers and Acquisitions

- Mergers and Acquisitions: Boardroom Strategies and Deal Tactics Workshop

- Comparative Corporate Governance

- Emiliano Catan

- Holger Spamann

- ESG: Corporate Ethics in the 21st Century

- Law and Economics Seminar

- Business Strategy for Lawyers

- Corporate Governance

- Cross Border M&A: Drafting, Negotiation & the Auction Process

- Law and Finance of Venture Capital and Start-ups

- Shareholder Activism

- Taxation of Business Corporations

- The Rise of ESG in Corporate Law & Governance

- Analytical Methods for Lawyers

- Professor Jesse Fried

- Professor Reinier Kraakman

- Professor Holger Spamann

- Professor J. Mark Ramseyer

- Current Issues in Securities Regulation

- Investment Management Law: Private Funds and Other Issues

- Professor Michal Barzuza

- Professor Jon Hanson

- Entrepreneurial Agreements and Startup Decisions

- Comparative Corporate Governance and Finance

- Mergers and Acquisitions in the Technology Sector

- Controlling Shareholders

- Corporate Governance: The Short-Termism Problem

- Corporations from a Comparative Perspective

- Empirical Law and Economics

- The Corporation as a Citizen

- Corporate Governance: Short-Termism and Current Controversies

- Professor Anthony Casey

- Professor Robert Clark

- Index Funds and the Concentration of Corporate Ownership

- Institutional Investors and Alternative Investment Forms: Private Equity, Venture Capital, and Hedge Funds

- International Investment Arbitration: Policies, Issues and Challenges

- Financial Analysis and Business Valuation

- Structuring Venture Capital, Private Equity, and Entrepreneurial Transactions

- Comparative Corporate Law, Finance and Governance

- Professor Jennifer Taub

- Current Issues in Corporate Governance

- International Investment Arbitration

- Introduction to Finance Concepts

- Investing in VC Funds

- Law and Business

- Legal History: History of American Economic Regulation

- Securities Regulation: Law and Policy

- Advisor Liability in M&A

- Bankruptcy: Current Issues

- Entrepreneurship and Venture Capital

- Executive and Board Turnover in the S&P 500: Research Seminar

- Anatomy of Deal Litigation in Practice

- The Art and Science of Financial Regulation

- Corporate Tax B: Mergers, Acquisitions and Divisions

- Advanced Topics in Financial Regulation

- Capital Markets Regulation

- Professor Holger Spamann

- Professor Guhan Subramanian

- Hedge and Private Equity Funds: Law & Policy

- Topics in Mergers and Acquisitions

- Capstone Seminar for the LL.M. Concentration in Comparative Law, Finance, and Corporate Governance

- Challenges of a General Counsel

- Professor John Coates

- Corporate Boards and Governance

- Professor Guhan Subramanian

- Drafting and Negotiating Cross-Border Merger & Acquisition Transactions

- Hedge Fund Law and Policy

- Mergers and Acquisitions Processes and Structures

- Globalization: Business, Legal and Public Policy Issues

- Introduction to Empirical Methods

- Securities Litigation

- Boards of Directors and Corporate Governance

- Investment Management Law: Private Funds, Money Market Funds and Other Issues

- Antitrust Law

- Corporate Governance and Finance of the Public Firm

- Professor Ryan Bubb

- Empirical Methods in Corporate, Securities and Capital Markets Law

- International Corporate Debt Solutions and Cross-Border Insolvency

- International Finance

- Introduction to Securities Regulation

- Law and Economics

- Law and Finance of Start-Up Companies

- Research Seminar: Management Turnover in the S&P 500

- Professor Andrew Gold

- Insider Share Ownership, Management Compensation, and CEO Turnover in U.S. Public Corporations

- Mergers, Acquisitions, and Split-Ups

- The Law and Finance of the Japanese Firm

- Professor David Skeel

- Governance of U.S. Public Corporations

- Topics in Financial Regulation: Consumer and Investor Protection

Fall/Spring

- Laws, Markets, and Religions

- Bankruptcy Deal-Making

- Hedge Fund Law and Regulation

- Current Issues in Executive Compensation and Corporate Governance

- Law, Economics, and Organizations Research

- Mergers and Acquisitions Law

- Comparative Corporate Governance: USA, Western Europe, Asia

- Corporate Finance: Advanced

- Assistant Professor Holger Spamann

- Professor Vikramaditya Khanna

- The 2007-2009 Financial Crisis

- European Securities Regulation

- Financial Statement Analysis and Valuation

- Derivatives Regulation

- Introduction to Accounting and Corporate Financial Reports

- Readings and Empirical Investigation in Managerial Turnover and Corporate Acquisitions

Knowledge Partners

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

Program Advisory Board

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

Corporate Governance: Maximize Your Effectiveness in the Boardroom

Drive strategic directions and succeed as a board member

Get Your Brochure

By clicking the button below, you agree to receive communications via Email/Call/WhatsApp/SMS from Wharton & Emeritus about this program and other relevant programs. Privacy Policy

Develop Future-Ready Skills Today

Emeritus is collaborating with Wharton Executive Education to help you build future-ready skills. Enroll before April 26, 2024 at 05:29 AM and get up to 11% tuition assistance to set yourself up for professional success.

Who is this program for?

The Corporate Governance: Maximize Your Effectiveness in the Boardroom program is designed to give participants a deeper understanding of corporate governance and help boost their effectiveness on a corporate board.

The program is ideal for:

Current board members and senior executives interested in joining a board who want to understand the various aspects of proactive governance and help drive strategic direction, risk oversight and the establishment of compensation.

C-suite executives looking to explore the duties and nuances of board service, help strengthen their company's financial return, enterprise risk management and governance diversity, and learn to effectively take on existing and emerging issues.

Attorneys engaged in legal services who are seeking to learn the fundamentals of corporate governance from a variety of angles and how to assess the effectiveness and execution of governance roles and responsibilities.

Key Takeaways

Wharton’s Corporate Governance program explores the role, structure, and responsibilities of corporate governance to help you succeed as a board member. This program will enable you to:

Define the board’s role and responsibilities as well as characteristics of successful board leaders

Ensure proactive governance and learn how to prepare for potential risks

Recognize key considerations of compensation and succession planning

Define strategies for board members, executives, and other environmental, social, and governance (ESG) integrators to respond to conflicting demands and societal challenges to their organization

Plan for how to manage the competing interests of stakeholders and shareholders

Program Modules

Program experience.

Discussion Boards

Reflections

Industry Examples

Assignments

Live Office Hours

Try-it Activities

Self-Study Quizzes

This online program provides real-world learning examples to help you understand the realities of corporate governance in practice through the experiential lens of leading global brands.

Analyze Apple’s board demographics to understand the value of diversity in background, experience, and skill sets.

Understand the importance of board accountability and how a captive board can reduce oversight in governance via this example of Disney’s board being comprised of friends and acquaintances of its president, Michael Ovitz.

Understand the impact of non-market factors through this example of the pharmaceutical organization, Mylan.

See how some companies (Starbucks,in this case) take diversity to heart and the influence that a diverse board can have.

Recognize the impact of diversity in background, experience, and skill sets through an analysis of Wells Fargo’s board composition.

Corporate Governance Handbook

This program enables you to explore the processes and responsibilities that drive corporate governance. It also includes a handbook where you can reflect on the program content and how it can help you succeed in a board member role. Topics addressed in the handbook include:

Laying the groundwork: Begin by drafting your director bio and exploring the importance of marketing yourself.

Conducting a personal skills audit: Assess your professional background to help you understand your strengths and any critical gaps in your knowledge or experience for board positions you’re seeking.

Finding your director doppelganger: Focus on strategically networking with directors who possess experience/characteristic profiles that are similar to yours, as they can help point you toward boards that are looking for a candidate with your profile.

Demonstrating your grit: Be able to persuasively articulate your experience in crisis/adversity situations.

Completing a leadership style assessment: Consider how your style informs the way you would manage various stakeholders, as well as which stakeholders you’re most comfortable interacting with and/or advocating for in the boardroom.

Putting the pieces together: Define and characterize your personal guiding principles via a concise and effective board value statement.

Associate Professor of Management, Organizational Behavior, The Wharton School

Mary-Hunter McDonnell studies organizational behavior within challenging institutional contexts, such as contentious social environments and uncertain regulatory environments....

Guest Speaker

Partner, Mayer Brown

Sean McDonnell is a partner in Mayer Brown's Washington D.C. office and a member of the global Litigation & Dispute Resolution practice. Previously, Sean was an Assistant Unit...

Testimonials

Certificate

Upon successful completion of the program, you will earn a digital certificate of completion from the Wharton School.

Note: After successful completion of the online program, your verified digital certificate will be emailed to you in the name you used when registering for the program. All certificate images are for illustrative purposes only and may be subject to change at the discretion of the Wharton School.

Didn't find what you were looking for? Write to us at [email protected] or Schedule a call with one of our Academic Advisors or call us at +1 680 205 5118 (US) / +44 185 845 9995 (UK) / +65 3135 1422 (SG)

Early registrations are encouraged. seats fill up quickly.

Flexible payment options available. View payment plans

25,000+ students realised their study abroad dream with us. Take the first step today

Meet top uk universities from the comfort of your home, here’s your new year gift, one app for all your, study abroad needs, start your journey, track your progress, grow with the community and so much more.

Verification Code

An OTP has been sent to your registered mobile no. Please verify

Thanks for your comment !

Our team will review it before it's shown to our readers.

- Study Abroad /

PhD in Corporate Governance: Top Universities, Course Fees, Scope

- Updated on

- Jun 2, 2023

PhD in Corporate Governance is a 3 years research-based doctoral degree where the learner gains deep knowledge about all the aspects related to the field of business which includes risk assessment, regulations, and sustainability. It also involves balancing the interest of stakeholders like regulators, suppliers, shareholders, etc. This can be a rewarding study program for students who have a bend towards corporate laws , business management, and a perfect degree after post-graduation to study abroad and gain global recognition.

This Blog Includes:

Why study phd in corporate governance, major topics in phd corporate governance, eligibility criteria, application process for phd in corporate governance, salary and job scope.

A PhD in Corporate Governance allows you to explore various aspects of corporate governance in depth and contribute new knowledge to the field. It can also prepare you for a career in academia, consulting, policy-making, or corporate leadership. Additionally, here are some benefits we have listed below related to this study program:

- You can develop advanced skills such as research analysis, communication, and critical thinking.

- You can gain expertise in a relevant topic that affects businesses and society.

- Creating original and impactful research can work in a positive way and may influence corporate governance practices and policies.

- You can build a network of peers, mentors, and experts in this field.

- This can also enhance your career and open more opportunities for you in various sectors and industries.

Also, Read- PhD in Commerce

Here are a few important topics that are related to the PhD in Corporate Governance:

Top Universities

Here is a list of world-renowned Universities that are well-recognized due to their modern education and innovative teaching methods.

You can easily enrol yourself in any of the Universities listed below without worrying about the quality of education:

Here are the top 5 colleges in India best for PhD in Corporate governance:

- Indian Institute of Management

- Indian School of Business

- Institute of Management Studies

- Lovely Professional University

Relevant Read – PhD in Management

Here are the basic eligibility criteria that you need to fulfil to pursue a PhD in Corporate Governance:

- You need to have a master’s degree or equivalent qualification in business management, law, or economics. Example- MBA

- You need to maintain a strong academic record and have the potential for research

- You should have a minimum aggregated score of 55%

- For International Students, A Letter of Recommendation ( LOR ) and Statement of Purpose ( SOP ) are required.

- It is also mandatory to prove your proficiency in the English language by qualifying for exams like SAT , IELTS , and TOEFL . To prepare for your English Proficiency test you can check Leverage Live .

- You may also need to clear the National level entrance exam like the NET

Here are some steps to make your application process a bit easier:

Step 1: Research and find a suitable university

You need to find out the best suitable university and program according to your liking and then cross-check other fees like tuition fee breakup, accommodation, etc. After that, you can head over to the official website of the desired university to apply for your study program.

Step 2: Collect documental proof related to proficiency exams and other documents

As mentioned earlier, it is mandatory to prove your proficiency in the English language by qualifying for exams like IELTS , and TOEFL . Other documents like LOR , SOP , updated resume , and previous academic transcripts like undergraduate and postgraduate are also necessary. So keep those documental proofs handy because you will need them while filling out the form.

Step 3- Submit your application and wait for the offer letter

Once you got all the required documents in one place you are ready to fill out the application form. Make sure you are entering all your personal details correctly. After the application is submitted you may need to wait for a few weeks for your offer letter as the university needs to evaluate your application properly. Once you received your offer letter you now need to apply for a Student Visa for your Study abroad dream to come true.

Must Read: An Ultimate Guide to PhD Courses

A PhD in Corporate Governance as mentioned earlier can easily provide you with diverse job opportunities and its demand is also anticipated to see a growth spike of 5% in the coming days, so here are a few job profiles with their yearly salary:

Teaching as a professor of PhD in Corporate Governance can be a good career option as you can get more time to spend with your family and better job security. Additionally, you will also get more respect in society as teaching is considered one of the noble professions across the globe.

The key skills or areas required in the field of corporate governance are: Risk Oversight Corporate Strategy Critical Thinking Skills Communication Skills Leadership Skills Executive Compensation

Corporate governance is all about protecting the company’s brand value, and assets, and maintaining corporate affairs whereas corporate management is all about the growth of the company and improvising new strategies.

This was everything related to PhD in Corporate Governance. As we all know how hectic and overwhelming the whole process of studying abroad can be so if you are searching for a top university and planning for studying abroad, you can reach us at 1800 57 2000 and contact our Leverage Edu experts also for much more amazing blogs you can always stay updated by following Leverage Edu Blogs . Additionally, you can also connect with us through our socials like Facebook , Instagram , Twitter , and LinkedIn .

Team Leverage Edu

Leave a Reply Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Contact no. *

Connect With Us

25,000+ students realised their study abroad dream with us. take the first step today..

Resend OTP in

Need help with?

Study abroad.

UK, Canada, US & More

IELTS, GRE, GMAT & More

Scholarship, Loans & Forex

Country Preference

New Zealand

Which English test are you planning to take?

Which academic test are you planning to take.

Not Sure yet

When are you planning to take the exam?

Already booked my exam slot

Within 2 Months

Want to learn about the test

Which Degree do you wish to pursue?

When do you want to start studying abroad.

January 2024

September 2024

What is your budget to study abroad?

How would you describe this article ?

Please rate this article

We would like to hear more.

Have something on your mind?

Make your study abroad dream a reality in January 2022 with

India's Biggest Virtual University Fair

Essex Direct Admission Day

Why attend .

Don't Miss Out

Corporate Governance in the United States

The sources of corporate governance law and regulation in the United States are varied and interrelated. There are four key sources: state corporate law (predominantly Delaware, in which over half of all US publicly traded corporations are incorporated); the federal 1933 Securities Act and 1934 Securities Exchange Act, and the regulations of the Securities and Exchange Commission (SEC) under those Acts; stock exchange listing rules (predominantly the New York Stock Exchange (NYSE) and the NASDAQ); and federal statutes in regard to particular areas of corporate practice (e.g., regulations promulgated by the Federal Reserve and other federal and state agencies with respect to banks and other financial institutions, and by other similar regulatory bodies in respect of communications, transportation and other regulated fields). Because of the federal system of US law, different sources of law are not always harmonised, and corporations are often subject to different obligations to federal and state governments, regulators at each level of government and demands of other relevant bodies, such as the applicable stock exchange. This mosaic of rules and regulations, and the mechanisms by which they are implemented and enforced, make for an environment of frequent change and evolution.

In addition, of increasing importance to the US corporate governance regime are the proxy advisory firms (predominantly Institutional Shareholder Services (ISS) and, with lower market share, Glass, Lewis & Co (Glass Lewis)) and the influence those proxy advisers have on the institutional investor community, and the related prevailing and evolving views of the institutional investor community. That community's views have become particularly influential as the shareholder base of the vast majority of US publicly traded corporations consists of an overwhelming majority of institutional shareholders, including index funds, pension funds and mutual funds. As a result, major institutional investors are increasingly developing their own independent views on preferred governance practices.

Securities laws and regulations are civilly enforced by the SEC, and the SEC must also grant clearance to certain important corporate disclosure documents (such as proxy statements and certain securities registration statements). Larger and older corporations with a history of securities law compliance are subject to fewer such pre-clearance requirements and may in certain cases file abbreviated forms of disclosure. Private investors may also bring actions under many provisions of the securities laws to recover damages for misstatements or omissions in public statements and in certain other circumstances. The Department of Justice prosecutes criminal violations of federal securities laws and SEC rules.

State law fiduciary duties of directors and officers are predominantly enforced by private actions led by plaintiffs' lawyers. These private actions generally fall into one of two categories: class-action suits on behalf of a particular group of the corporation's shareholders (typically all shareholders who bought or sold during a particular period or all unaffiliated shareholders), and derivative suits purportedly on behalf of the corporation itself. Putative class-action suits must satisfy the criteria under the Federal Rules of Civil Procedure or analogous provisions of state law before being permitted to proceed as a class action, including the numerousness of the class members, the commonality of legal and factual issues among members of the class, the typicality of the claims or defences of the representative parties to the class, and the fairness and adequacy of the representative parties' protection of the class interests. Derivative suits, creatures of state corporate law, provide a mechanism by which shareholder plaintiffs can in theory represent the corporation in suing the corporation's own board of directors or management, sometimes after complying with a 'demand' procedure in which the plaintiff must request that the corporation file suit and be rebuffed. In certain circumstances, especially when it can be shown that the board of directors is for some reason conflicted with respect to the alleged breach of duty, this demand requirement is excused and the shareholder will be permitted to pursue a claim in the corporation's name without further enquiry.

The two primary US stock exchanges, the NYSE and the NASDAQ, each make rules with which corporations must comply as a condition to being listed on these exchanges. These listing rules address all aspects of corporate governance, including topics such as director independence, the composition of various board committees, requirements to submit certain matters to a vote of shareholders, regulation of dual-class stock structures and other special voting rights, publication of and topics covered by corporate governance guidelines, and even requirements related to the corporation's public website. These rules are enforced by the threat of public reprimand from the exchanges, temporary suspension of trading for repeat offences and permanent delisting for perennially or egregiously non-compliant companies.

While proxy advisory firms are not a source of law, their guidelines figure significantly in the corporate governance landscape. ISS has been estimated to control approximately 61 per cent of the proxy advisory market, with Glass Lewis estimated to control approximately 36 per cent. These advisory firms exert pressure on corporations to conform to governance standards they promulgate by issuing director election voting recommendations to each publicly traded corporation's shareholders based on the corporation's compliance with the advisory firm's published standards. Perhaps because of the problem of rational apathy – that is, because an individual shareholder bears all of the costs of becoming an informed voter but shares the benefits with all other shareholders, shareholders have little incentive to inform themselves – proxy advisory firms wield outsized influence on corporate elections, especially among institutional investors such as pension funds. 2 One study found that a recommendation from ISS to withhold a favourable vote in an uncontested director election correlates with a 20.9 per cent decline in favourable voting. 3 In addition, a 2013 study sponsored by Stanford University found that companies were altering their compensation programmes to comply with proxy advisory firms' ever-evolving policies. 4 The US Congress, the US Department of Labor and the SEC have raised questions regarding fiduciary responsibility in the context of the outsourcing of proxy voting decisions to proxy advisory firms. Significantly, certain major institutional investors, such as BlackRock Inc (which invests over US$6.3 trillion in client assets) and the Vanguard Group (which invests over US$5.1 trillion in client assets) have stated that they reach proxy voting decisions on the basis of their own internally developed guidelines, independent of proxy advisory firms, and have sought to engage directly and pragmatically with companies. These major institutions are uniquely positioned to use their influence to recalibrate the system to reduce reliance on proxy advisory firms.

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), signed into law in July 2010, was passed in response to corporate governance practices perceived by some to have contributed to the 2008–2010 economic crisis. The Dodd-Frank Act requires additional disclosure in corporate proxies and non-binding shareholder votes on various questions of corporate governance (notably, related to executive compensation), and contemplates greater access for shareholder-proposed director nominees to the company proxy. More recently, in response to increasing company compliance costs, in 2018 the SEC adopted rule amendments to streamline disclosure requirements and reduce duplicative or overlapping disclosure obligations .

For further information on corporate governance in the United States consult https://thelawreviews.co.uk/edition/the-corporate-governance-review-edition-9/1189471/united-states

Commonsense Principles 2.0