Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Lease option: definition, how it works, pros and cons.

Many people might question whether it’s better to rent or buy your own property. The path to homeownership is not set in stone, and there are many options and approaches to consider if you want to buy a home.

A lease option might be one of the ways you transition to homeownership, giving you something in between renting and buying . This might be an especially appealing option if your down payment or credit score still needs some work. Let’s learn more about what a lease option is, how it works, and explore some potential benefits and drawbacks for tenants and landlords.

What is a lease option?

A lease option, also called a “lease with the option to buy,” is a type of rent-to-own contract. This agreement allows one to rent a home for a certain period and an opportunity to buy it at the end of the lease period. You may have the ability to switch to this contract as a current tenant, or you could potentially offer a home seller to sign a lease option instead of a conventional purchase agreement .

You might want to consider this approach if you’ve got your heart set on a specific home but need some extra time to work on your credit or down payment before applying for a mortgage . With a lease option in place, it is generally much more difficult for the current homeowner to sell the house to someone else during the lease term. The exceptions might occur if the renter fails to qualify for the mortgage or if the contract contains any specific clauses allowing the sale, among others.

Difference between a lease option and a lease purchase

Rent-to-own agreements usually come in two forms: lease option and lease purchase. A lease option gives the tenant a choice to buy the home later, while a lease-purchase obliges them to do so. A lease option is typically more flexible since the tenant isn't obligated to buy the property and may potentially opt out at the end of their lease. By contrast, a lease purchase contract is more rigid and usually does not give a choice to walk away from a deal.

How does a lease with option to buy work?

Knowing what a lease option entails, let’s go into more detail on what the process looks like. Here are some general steps potential buyers might take if they want to purchase a home with a lease option:

- Sign a contract: A lease option integrates additional terms into a regular lease agreement. At this point, potential homebuyers may want to confirm that they're not signing a lease purchase and understand all the provisions included in the contract. Both parties might also want to consult a lawyer beforehand to reduce the chance of potential misunderstandings or issues.

- Pay fees: Upon signing the contract, a future buyer will typically be expected to pay an option fee (sometimes called an option consideration). This is a non-refundable upfront fee a current homeowner might require in exchange for the right to buy the house when the lease term expires.

- Pay rent: As with any standard lease, a tenant will need to pay rent every month. However, under a lease option, they’ll also pay a monthly premium (also called a rent credit) on top, which is determined by the landlord and tenant during the contract phase. This can be a flat fee or a percentage of the rent and is often applied to the eventual down payment.

- Buy out the property: Before the end of your lease, a potential buyer should decide whether they want to purchase the property. It’s important to know that even if they signed a lease option contract, they will likely still need to qualify for a mortgage (unless buying entirely in cash).

How to structure a lease option to buy

Generally, it’s highly recommended to turn to a tax professional and a real estate attorney to construct a lease with an option to buy. There are many things to consider, and it’s best to have a professional guiding you along the way. That said, tenants and landlords may want to brush up on some of the common points included in most lease option agreements:

- Purchase price: A lease option contract should clearly include the property’s agreed-upon purchase price, or clearly state how to determine this price at the end of the leasing term. Consider engaging with a real estate professional to help you determine an accurate and fair purchase price.

- Length of agreement: Another requirement for a lease option is establishing the lease term between the property owner and the tenant. There are no strict rules about its length, but you could potentially expect it to be between one and three years.

- Option fee: An option fee is one of the standard elements of a lease option agreement. Its size is typically decided between the parties and may amount to a few percent of the total purchase price. Some agreements may have clauses that allow for an option fee to go toward a down payment; however, it's not a common practice.

- Monthly premium: As you learned above, a monthly premium is the extra amount a tenant pays every month in addition to rent. Similar to the option fee, it could be put toward the down payment, but it’s non-refundable if the tenant doesn’t go through with the purchase.

- Responsibilities: Your lease option agreement should cover what you and the current homeowner will each be responsible for. Since the lines of ownership tend to blur with a lease option, you may want to agree ahead of time on who’s responsible for the maintenance, paying homeowners association (HOA) fees , paying for utilities and more.

Lease option pros and cons for a buyer

Are you an aspiring homebuyer wondering if a lease option is the right move in your situation? Like other homeownership journeys, lease option agreements have their advantages and disadvantages to consider.

Pros of lease options as a buyer

- Flexible path to buying a home: A lease option could be a suitable alternative if you aspire to become a homeowner but can’t quite afford it just yet. Using this type of contract, you get a little more time to potentially save toward the down payment or work to improve your credit .

- Lock-in purchase price: The housing market can be potentially unpredictable, making it hard to foresee what prices will look like a year from now. With a lease option, you don’t have to worry about market fluctuations as your agreed-upon price is locked in the moment you and the seller or landlord sign a lease option contract. However, you may want to factor in that this does not apply to the mortgage interest rates, which may change significantly throughout your renting.

- Test drive the property: When buying a home, you usually don’t have the luxury of living in it beforehand. Thanks to a lease with the option to buy, however, you can learn all the ins and outs of your potential home and really get to know the area and your neighbors.

Cons of lease options as a buyer

- Market changes: In the event of negative housing market fluctuations, it’s possible you might end up paying more for the house than its current value, as you’ve locked in the price from a year ago. What’s more, there may be a chance that mortgage rates could go up during this period as well.

- Additional costs: Lease options typically come with extra charges, such as the option fee and rent credit. Thus, you may be paying over market price for your rental as a tenant. Additionally, you stand to lose any money put toward the purchase price if you decide to pull out of the deal.

- Added responsibilities: Depending on your agreement with the homeowner, you may be fully or partially responsible for maintenance, repairs and paying HOA fees, among other things.

Lease option pros and cons for a seller

The advantages and disadvantages of committing to the lease option look different for homeowners who want to sell. If you want to consider putting your house on the market using a lease option, it may help to weigh the pros and cons:

Pros of lease options as a seller

- May help you sell in a down market: If you decide to go with a lease option, you may be able to widen your pool of potential buyers, since you can now include people who aren’t ready to commit to buying a house in a traditional sense.

- Opportunity to make passive income: Lease option agreements might provide a stable source of additional income for the lease duration. Plus, tenants usually pay above market average rent in a lease option.

- Potential for higher selling price: A lease option may be something to consider if you want to sell in the next few years but suspect the market might go down. This way, you can lock in the price at the current level.

Cons of lease options as a seller

- Delayed sale: Lease option agreements can potentially last anywhere from one to several years. So, they might not be the go-to choice for those looking to sell their property on a shortened timeline and walk away with money.

- Limited control over property: Although the landlord continues to be a property owner throughout the length of the lease, they might have less say in tending the property. Depending on the specifics of the contract, the tenant could be responsible for maintenance and minor renovation projects. This could result in changes to the property you disapprove of and cause disputes, especially if the sale doesn't go through.

- Potential for no sale: The difference between a lease with an option to buy and other rent-to-own agreements is that in the former, a tenant is not legally obligated to go through with the purchase. Thus, there’s a chance you may not be able to sell your house at the end of the lease, though you would keep the option fee and any rental income (including premiums) that you made during the lease.

- Market volatility: If the value of the property fluctuates during the rental period, the owner could either end up selling at a lower price or make a smaller profit than originally planned.

The lease option is one of the more untraditional approaches toward homeownership. It can potentially buy you some time and move you a little closer to ownership, even if you feel like your credit score needs work or you don’t have enough funds for the down payment. However, keep in mind that the lease option also has its drawbacks to consider. It’s typically a good idea to speak to a real estate attorney before signing a lease with the option to buy to fully understand your terms and explore potential alternatives.

Lease option FAQs

1. how can you find lease option homes.

You have a few options to consider if you want to find a lease option home. First, you could turn to real estate agents or brokers in your area, as they might have some houses in mind. Also, you could try looking for homes listed as “for sale by owner,” as those sellers might be more amenable to considering a lease option.

2. Can a property owner or a tenant breach a lease option contract?

The answer depends on the specifics of the contract you’ve signed with the other party. In some cases, if you’re a tenant and decide not to go through with the purchase, you might lose the option fee and rent credit. For property owners, lease options usually offer a little less flexibility in the event of a breach, much like many other purchase agreements . Still, you could back out if the tenant breaks certain clauses. To have a comprehensive view of your options, you might want to start by carefully reading your agreement and reaching out to a lawyer if you have any questions or concerns.

3. Does a lease with option to buy help build credit?

A lease option will not necessarily help you build credit, but there are scenarios where it could be used for that purpose. To do so, you’ll need to ask your landlord to report your rent payments to the three major credit bureaus. It may be helpful to officialize this requirement in your lease option contract, after which, of course, you’ll need to do your best to make all payments on time. Over the course of your lease, this may be a way to help boost your credit before it’s time to apply for a mortgage to make the final purchase.

Take the first step and get preapproved.

Have questions connect with a home lending expert today, what to read next, finding a home desert homes: a homebuyer's guide.

Desert homes offer stunning natural views and a warm climate. Read more to learn what a desert house is and evaluate the pros and cons of living in the desert.

finding a home SOFR: what is it and how does it work?

SOFR serves as a benchmark interest rate for loans. Keep reading to learn why SOFR exists, how it works, and its direct impact on mortgage rates.

finding a home Pocket listings, explained

Pocket listings are a way for sellers to market and sell their home quietly. Learn more about how they work, who they benefit how to find one, and more.

finding a home What is an art deco house?

An art deco house offers a unique architectural design with asymmetry and color. Learn about different art deco-style homes and what to consider when buying.

- REALTOR® Store

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency. Close

- Social Media

- Sales Tips & Techniques

- MLS & Online Listings

- Starting Your Career

- Being a Broker

- Being an Agent

- Condominiums

- Smart Growth

- Vacation, Resort, & 2nd Homes

- FHA Programs

- Home Inspections

- Arbitration & Dispute Resolution

- Fair Housing

- All Membership Benefits

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®. Close

- Directories Complete listing of state and local associations, MLSs, members, and more. Close

- Dues Information & Payment

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed. Close

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms. Close

- Your Membership Account Review your membership preferences and Code of Ethics training status. Close

- Highlights & News Get the latest top line research, news, and popular reports. Close

- Housing Statistics National, regional, and metro-market level housing statistics where data is available. Close

- Research Reports Research on a wide range of topics of interest to real estate practitioners. Close

- Presentation Slides Access recent presentations from NAR economists and researchers. Close

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work. Close

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends. Close

- Statistical News Release Schedule

- Advocacy Issues & News

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you. Close

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States. Close

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party. Close

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment. Close

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice. Close

- All Education & Professional Development

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base. Close

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members. Close

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license. Close

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates. Close

- Library & Archives Offering research services and thousands of print and digital resources. Close

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism. Close

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees. Close

- Latest News

- NAR Newsroom Official news releases from NAR. Close

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools. Close

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends. Close

- Newsletters Stay informed on the most important real estate business news and business specialty updates. Close

- NAR NXT, The REALTOR® Experience

- REALTORS® Legislative Meetings

- AE Institute

- Leadership Week

- Sustainability Summit

- Mission, Vision, and Diversity & Inclusion

- Code of Ethics

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more. Close

- Committee & Liaisons

- History Founded as the National Association of Real Estate Exchanges in 1908. Close

- Affiliated Organizations

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan. Close

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations. Close

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation. Close

- NAR's Consumer Outreach

- Find a Member

- Browse All Directories

- Find an Office

- Find an Association

- NAR Group and Team Directory

- Committees and Directors

- Association Executive

- State & Local Volunteer Leader

- Buyer's Rep

- Senior Market

- Short Sales & Foreclosures

- Infographics

- First-Time Buyer

- Window to the Law

- Next Up: Commercial

- New AE Webinar & Video Series

- Drive With NAR

- Real Estate Today

- Center for REALTOR® Development

- Leading with Diversity

- Good Neighbor

- NAR HR Solutions

- Fostering Consumer-Friendly Real Estate Marketplaces Local broker marketplaces ensure equity and transparency.

- Marketing Social Media Sales Tips & Techniques MLS & Online Listings View More

- Being a Real Estate Professional Starting Your Career Being a Broker Being an Agent View More

- Residential Real Estate Condominiums Smart Growth Vacation, Resort, & 2nd Homes FHA Programs View More Home Inspections

- Legal Arbitration & Dispute Resolution Fair Housing Copyright View More

- Commercial Real Estate

- Right Tools, Right Now

- NAR REALTOR Benefits® Bringing you savings and unique offers on products and services just for REALTORS®.

- Directories Complete listing of state and local associations, MLSs, members, and more.

- Become a Member As a member, you are the voice for NAR – it is your association and it exists to help you succeed.

- Logos and Trademark Rules Only members of NAR can call themselves a REALTOR®. Learn how to properly use the logo and terms.

- Your Membership Account Review your membership preferences and Code of Ethics training status.

- Highlights & News Get the latest top line research, news, and popular reports.

- Housing Statistics National, regional, and metro-market level housing statistics where data is available.

- Research Reports Research on a wide range of topics of interest to real estate practitioners.

- Presentation Slides Access recent presentations from NAR economists and researchers.

- State & Metro Area Data Affordability, economic, and buyer & seller profile data for areas in which you live and work.

- Commercial Research Analysis of commercial market sectors and commercial-focused issues and trends.

- Federal Advocacy From its building located steps away from the U.S. Capitol, NAR advocates for you.

- REALTORS® Political Action Committee (RPAC) Promoting the election of pro-REALTOR® candidates across the United States.

- State & Local Advocacy Resources to foster and harness the grassroots strength of the REALTOR® Party.

- REALTOR® Party A powerful alliance working to protect and promote homeownership and property investment.

- Get Involved Now more than ever, it is critical for REALTORS® across America to come together and speak with one voice.

- All NAR & Affiliate Courses Continuing education and specialty knowledge can help boost your salary and client base.

- Code of Ethics Training Fulfill your COE training requirement with free courses for new and existing members.

- Continuing Education (CE) Meet the continuing education (CE) requirement in state(s) where you hold a license.

- Designations & Certifications Acknowledging experience and expertise in various real estate specialties, awarded by NAR and its affiliates.

- Library & Archives Offering research services and thousands of print and digital resources.

- Commitment to Excellence (C2EX) Empowers REALTORS® to evaluate, enhance and showcase their highest levels of professionalism.

- NAR Academy at Columbia College Academic opportunities for certificates, associates, bachelor’s, and master’s degrees.

- NAR Newsroom Official news releases from NAR.

- REALTOR® Magazine Advancing best practices, bringing insight to trends, and providing timely decision-making tools.

- Blogs Commentary from NAR experts on technology, staging, placemaking, and real estate trends.

- Newsletters Stay informed on the most important real estate business news and business specialty updates.

- Leadership & Staff National, state & local leadership, staff directories, leadership opportunities, and more.

- History Founded as the National Association of Real Estate Exchanges in 1908.

- Strategic Plan NAR’s operating values, long-term goals, and DEI strategic plan.

- Governing Documents Code of Ethics, NAR's Constitution & Bylaws, and model bylaws for state & local associations.

- Awards & Grants Member recognition and special funding, including the REALTORS® Relief Foundation.

- Top Directories Find a Member Browse All Directories Find an Office Find an Association NAR Group and Team Directory Committees and Directors

- By Role Broker Association Executive New Member Student Appraiser State & Local Volunteer Leader

- By Specialty Commercial Global Buyer's Rep Senior Market Short Sales & Foreclosures Land Green

- Multimedia Infographics Videos Quizzes

- Video Series First-Time Buyer Level Up Window to the Law Next Up: Commercial New AE Webinar & Video Series

- Podcasts Drive With NAR Real Estate Today Center for REALTOR® Development

- Programs Fair Housing Safety Leading with Diversity Good Neighbor NAR HR Solutions

- Lease-Option Purchases

Quick Takeaways

- “A lease option is a contract in which a landlord and tenant agree that, at the end of a specified period, the renter can buy the property at a specified price. The tenant pays an up-front option fee and an additional amount each month that goes toward the eventual down payment.”

- Lease option contracts are referred to by many names, such as a “rent to own” agreement, but they all mean the same thing!

- Make sure to get details on the structure of the deal, including the agreement length, the option fee, and whether you or the landlord are responsible for maitenance and home repairs

Source: What to Know About “Lease Option to Buy” or Rent to Own Homes ( Yahoo! Finance , Feb. 10, 2023)

Lease-Option purchases are a unique way to achieve homeownership. In a Lease-option purchase, often called “lease-to-buy” or “lease-to-own,” a renter enters into a legal contract with the owner of the property stating that a percentage of the rent will go toward purchasing the unit. Often, the purchase price and length of agreement are pre-determined. This method is great for those who need extra time to build up credit and savings or who simply want to test out an area before committing.

With record high home prices and record low inventory, would-be buyers are looking for creative ways to purchase homes, lease-option purchases included. Multiple startups have gotten in on the action, including Pathway Homes, which just spent $750 million dollars on lease-to-own options. This method can be used successfully in commercial real estate as well, especially for smaller, family-owned businesses.

Lease-Option purchases do come with a variety of tax and contract considerations. Make sure you familiarize yourself with IRS write-offs, property tax law, and IRS reclassification. The government has a variety of sources, listed above, to help you understand the ins and outs of lease-option purchases!

See References for more information.

Latest on this topic

NAR Library & Archives has already done the research for you. References (formerly Field Guides) offer links to articles, eBooks, websites, statistics, and more to provide a comprehensive overview of perspectives. EBSCO articles ( E ) are available only to NAR members and require the member's nar.realtor login.

Lease to Own: The Basics

Everything You Need to Know About Rent-To-Own Homes ( Rocket Mortgage , Jan. 31, 2024)

With a rent-to-own property, a buyer may pay an option fee, also called “option money” or “option consideration.” It’s an upfront, nonrefundable fee paid to the seller. While the fee amount is negotiable, it’s usually 2% – 7% of the property's value.

The fee gives the buyer the exclusive right to buy the property later. If the buyer doesn’t buy the property, they don’t get the option fee back. If the buyer decides to purchase the property, the option fee is typically credited toward the final purchase price.

How Does Rent-to-Own Work? ( NerdWallet , Nov. 27, 2023)

Simply put: You pay a little extra to help yourself save for a down payment. In a rent-to-own agreement, this happens in two ways:

Rent credits (paid monthly): Sometimes called rent premiums, these are extra payments you make in addition to rent.

An option fee (paid once, upfront): This nonrefundable deposit is typically 1% to 7% of the purchase price. For a $200,000 home, that’s $2,000 to $14,000.

Rent-to Own Homes: How the Process Works ( Investopedia , Mar. 28, 2023)

Rent-to-Own contracts have many important clauses that buyers need to be aware of. Depending on the contract, renters may be responsible for purchasing the house even if they can no longer afford it. Buyers also need to make sure they pay close attention to taxes, home maintenance, and how much principle will be applied to your future home.

Lease Purchase Agreements: Benefits for Buyers and Owners ( Forbes , Feb. 16, 2023)

“A lease purchase agreement—also known as a rent-to-own or lease-to-own agreement—lets someone rent a property for a specified period of time with the promise to purchase it at the end of the lease term. The owner is contractually obligated to sell the property to the renter when the end of the term hits. Likewise, it also obligates the renter to buy the property from the owner.”

Case Studies & Examples

Rent-to-Own Contracts Offer Kansans Low Barrier Path to Homeownership – at a Higher Risk of Fraud ( KMUW , Jan. 22, 2024)

Rent-to-own buyers often spend time and money fixing a property, said Jason Roach, the chief attorney for the Sedgwick County District Attorney’s Consumer Protection Division. That’s risky because those investments – as well as any up-front cash payment – could be lost if the buyers don’t end up getting title to the home.

In rent-to-own contracts, the buyers typically don’t get the title to the house until they’ve completed all the payments.

These Rent-to-Own Homes Programs Can Help You Get into That House ( HomeLight , Jan. 16, 2024)

Well, here’s some good news: there are multiple rent-to-own programs and lease-to-own options available to prospective homeowners. We’ve reviewed a variety of programs and sought advice from an experienced agent to help you understand your options.

Ahead, we compare four of the most reputable rent-to-own programs to help you answer the question, “Is rent to own a good idea?”

A Lehigh Valley Landlord Gives His Renters a Chance to Buy Their Home. Now a Lawmaker Wants to Help ( Morning Call , Feb. 2, 2024) E

To help streamline the process, Freeman proposed House Bill 1922 to help potential homebuyers, especially those with lower incomes, have a chance to own instead of permanently renting.

“It’s for people of lesser means who are looking for a way to get homeownership but to do so in a more easily navigable way,” Freeman said.

The program would be administered by the Pennsylvania Housing Finance Agency, Freeman said, and would have built-in safeguards for the tenant.

In this program, under the lease-to-purchase agreement, a portion of the rent would go toward an escrow account to pay for closing and down payment costs. When there are enough funds in the account, the tenant would then obtain a mortgage and take ownership of the property.

The Pennsylvania Association of Realtors said it was aware of the legislation and is studying it.

Divvy Wants to Make Rent-to-Own Deals Easy. Many Customers Find Them Hard ( The New York Times , Aug. 1, 2023)

Approximately 10 million Americans have entered into a rent-to-own deal at some point in their adult lives, according to estimates by the Pew Charitable Trusts. People who sign up for such deals typically have little if any savings and are often evicted from their homes after falling behind on rent. Others are forced to walk away because no bank will write a mortgage for a house that’s in bad shape.

Out-of-State Phoenix Developers Plan Thousands of Build-to-Rent Units In Phoenix Metro ( Phoenix Business Journal , Mar. 1, 2023)

“Two out-of-state developers plan to build nearly 2,000 build-to-rent units across metro Phoenix — bringing a unique approach to the wildly popular niche that originated in Arizona and is taking the country by storm. Palm Desert, California-based Family Development currently has nearly 1,000 units at some level of construction, while Atlanta-based Trilogy Investment Co. has plans to match that number.”

Las Vegas Start Up Helps Clients Buy a Home, One Month at a Time ( Las Vegas-Review Journal , Jan. 31, 2023)

“Las Vegas-based startup Roots Homes wants to help millennials and Gen Z purchase a home by offering more flexibility than the years it takes to save money toward a down payment — using a method known as fractional homeownership. Its first customer moved into a home in November, and the company said its 10th client is scheduled to move into a home this week. And last month, the company announced it raised $2.2 million in pre-seed funding to help fuel its growth.”

Tax Implications

“The renter doesn't get the usual tax breaks associated with home ownership: He can't deduct mortgage interest or claim any of the other tax breaks he'd get as a homeowner. Depending on your income and the state in which you live, however, you may be eligible for a renter's tax deduction. For example, in Massachusetts, renters can deduct up to $3,000. The owner of the rent-to-own arrangement, on the other hand, can deduct rental expenses -- repairs, maintenance, mortgage interest, travel to the house -- from the rental income the house brings in.”

eBooks & Other Resources

The following eBooks and digital audiobooks are available to NAR members:

eBooks.realtor.org

Smart Guide to Real Estate: Step by Step Rent to Own (eBook)

Investing in Rent-to-Own Property (eBook)

Investing in Real Estate With Lease Options and “Subject to” Deals (eBook)

Books, Videos, Research Reports & More

As a member benefit, the following resources and more are available for loan through the NAR Library. Items will be mailed directly to you or made available for pickup at the REALTOR® Building in Chicago.

Who Says You Can’t Buy a Home! HG 2040.5 R25w (2006)

Have an idea for a real estate topic? Send us your suggestions .

The inclusion of links on this page does not imply endorsement by the National Association of REALTORS®. NAR makes no representations about whether the content of any external sites which may be linked in this page complies with state or federal laws or regulations or with applicable NAR policies. These links are provided for your convenience only and you rely on them at your own risk.

5. Is it ethical

Now that we got the “ legal ” question out of the way…

What about “How ethical is it to wholesale”.

Type that into the web and you’ll get thrown into a black hole of comments and forums chatter you won’t ever be able to get out of.

Here’s the bottom line of why it gets so much controversy and what it has to do with assignment fees…

Wholesalers are going around marketing “We buy houses CASH” when in reality, they aren’t buying it cash… they’re assigning the contract for a fee.

This is where everyone gets their tights all tied up in a bunch (did I just make up a word?! Yes! I did). Because if you say you’re going to close it with cash, but you have to walk away from the seller because you can’t find a buyer… how would you feel leaving a seller (who seriously needed to close yesterday), hanging)?

Some with a conscious would feel pretty bad… others don’t care.

So it’s up to you how you feel about the ethics side of things.

Can you close the deal yourself if you can’t find a cash buyer , via a hard money lender or partner? Or will you feel comfortable walking away from the deal? Or will you be confident enough to go up to the seller and tell her the truth, that you intended on selling the contract to a cash buyer but it seems that your priced it too high, can we renegotiate?

The underlying problem with “walking away” from a buyer is not pricing it right.

If you have a good deal, cash buyers will be all over it and be HAPPY to pay you an assignment fee.

Here’s a video on ethical wholesaling:

6. How much should a fee be?

New wholesalers typically aren’t sure what they should charge. But it’s going to vary from deal-to-deal, and market to market.

A decent wholesaling fee can range from $10,000 to $30,000.

There are occasions when you hear about $100,000 assignment fees. And they do happen. It’s just a matter of negotiating a good deal.

While there isn’t a “set fee” that wholesalers should charge, it all depends on how good of a deal you can negotiate, and how high you can mark up the contract for an end buyer.

So there are two components that determine how much you can get paid for an assignment fee:

- Seller’s price.

- End buyers price.

Later, in another section, I talk about how you can increase your assignment fee… for now, let’s just cover how much your can charge.

Earlier I mentioned that your market might have an influence on how much you can charge. And that has more to do with how low of a discount, sellers are willing to take AND how competitive it is in your market.

Here’s an example:

If a seller talks to three wholesalers, one offers $200,000 while the others offer $180,000, she most likely will go with the higher offer. Well, now those wholesalers might enter into bidding wars in the market, by creeping up their MAOP (Max allowable offer price).

When wholesalers start raising their Max offers (because the market is demanding it), AND if the end buying price (what cash buyers are willing to pay for that deal) does move up with it…

Then you start seeing wholesalers’ assignment fees start shrinking down. We’ll go over later some techniques for helping with this natural occurrence in the market.

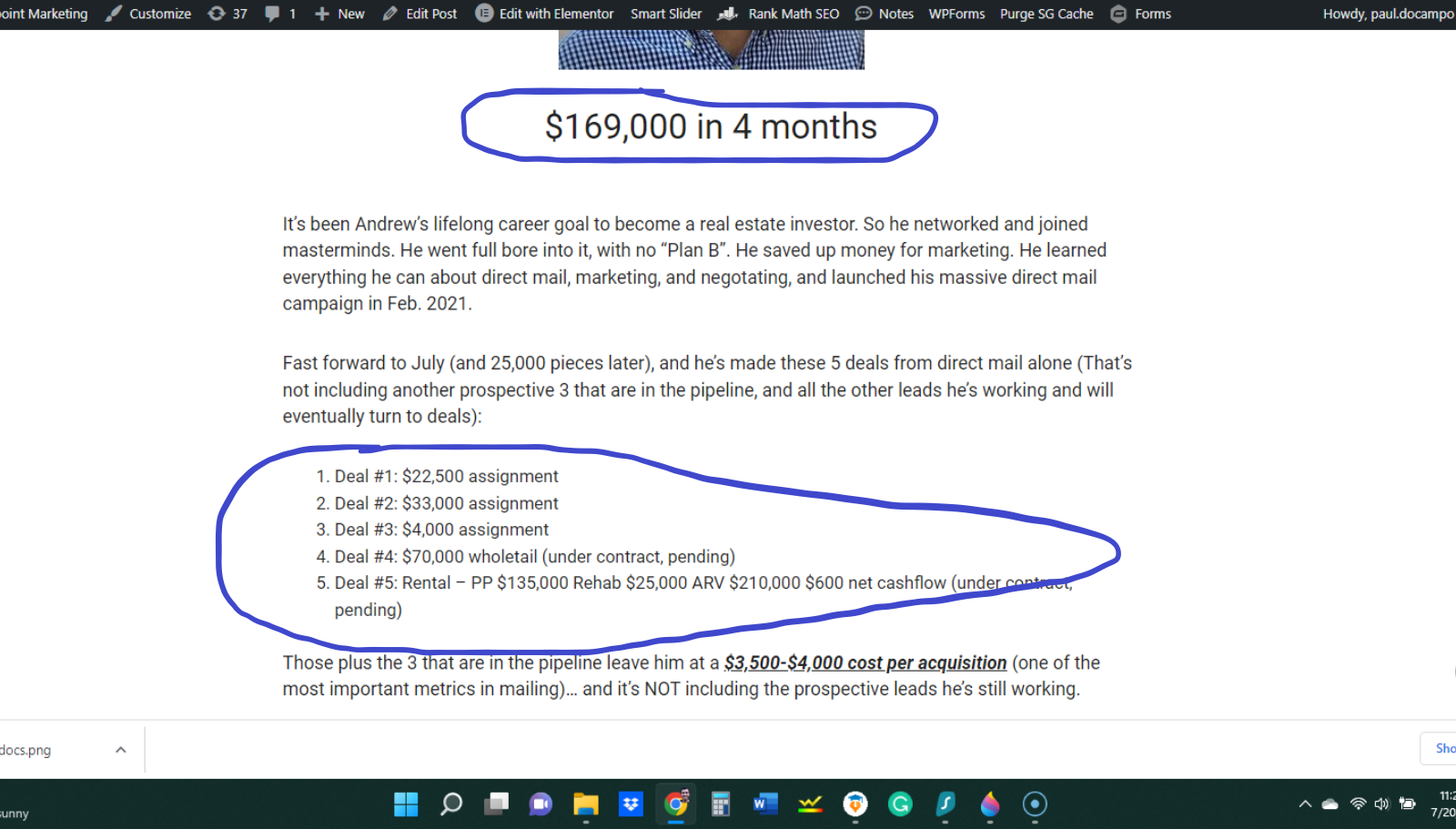

Here’s an example of a real wholesaler using our handwritten mailers, in a case study where he made anywhere from $4k fees to $22,500

7. Who pays for it?

Typically, in a traditional real estate wholesaling model, the end buyer (the cash buyer) is paying for your assignment fee.

For example: You negotiate with the seller to buy the property for $100,000. And the end buyer agrees to buy this deal for $120,000. He enters into escrow and pays the $120,000. You get the difference between the seller price and the end buyer price.

8. Does the seller or buyer see the fee?

In a typical assignment transfer, yes your assignment fee will be inside the closing statements.

After a property closes escrow, every party involved will get “closing statements” that look might look like this (depending on your state and the companies you use):

One of the line items may show up as “Assignment Fee” (or something similar), and show the amount.

Buyers will see these, as well as sellers.

However, a cash buyer (usually) understands that wholesaling is A LOT of work and that you should get paid for it. A good cash buyer understands that.

Sellers, most likely, won’t understand what an “assignment fee” is when they see this doc (they most likely won’t even read it).

On the rare occasion that they actually do ask what that line item is, you can tell the truth like this: “We work with partners and lenders all the time, and sometimes we end up selling the property during escrow to these partners, instead of keeping it ourselves. In this case we ended up selling to them”.

There’s a way to circumvent this potential problem of an assignment fee showing up on the closing documents…

And that’s by doing a double close instead of an assignment.

Let me explain in the next section…

9. Alternatives to an assignment?

As mentioned in the previous section, an assignment fee can have some cons to it. The primary being that sellers AND buyers can see how much you’re getting paid.

However, there is another “tool” you can use that hides this from both parties, and that’s called the “double close” (sometimes referred to as a “simultaneous closing” or “back to back” closing. As the name implies, there are 2 separate closings, not 1 (like our assignment fee transaction).

Here’s an explanation:

- The homeowner (party A) agrees to sell to a wholesaler (Party B) for $100,000

- They enter escrow

- While in escrow, Party B finds a cash buyer (Party C)

- Party C agrees to buy that property for $150,000

- They enter a second escrow agreement (different from the first)

- Party C funds the escrow account to buy the property at $150,000

- Party B uses those funds (minus his “assignment fee”) to pay the purchase from Party A

A little confusing?

Maybe this infographic helps:

We won’t go into too much detail about this as this is an article on the assignment fee… But just know that there is an alternative to hiding your fee but using a double close.

The con to this is that you pay a little more because you’re in fact doing 2 closes, not 1. So the times you might want to a double close vs an assignment fee is when you negotiated a very good deal and want to conceal the big check you’ll be getting.

10. Assignment fees and agents?

Anyone can get paid an assignment fee for this kind of “wholesaling” transaction. There’s no law that says agents can’t. However, that agent/broker needs to pay careful attention to their State RE commission laws as they’re put under serious scrutiny if they walk any fine lines.

For instance, if you’re buying the property and wholesaling it AND you’re licensed… in most states, you have to express to the seller that you are a licensed real estate agent but you are NOT representing them, and instead the principle of the transaction.

If you’re an agent wondering if you can (or should) do this, first contact your broker or RE Commission office to find out more.

Secondly, you might want to reconsider doing this as in some markets agent commission fees are higher than typical wholesaling fees. This is rare, but there are some hot markets where wholesalers have to keep raising their prices to win the deal, and therefore lower their assignment fee.

11. How to increase your assignment fees?

As mentioned in a previous section, your fee is greatly dependent on the kind of deal you negotiate.

So if you get a deal at $100,000 and another investor (cash buyer) is willing to pay $150,000 for it, you walk with a $50,000 assignment fee (assuming no closing costs are removed from this).

There are 4 factors to increasing your assignment fees…

- Become a better marketer If you improve your knowledge and skill set in marketing, you can essentially get to motivated sellers before anyone else.In the next section, we cover how to find these properties, which has everything to do with marketing, but one way (that we specialize in) is using handwritten mail to gain the best response rates from sellers.

- Become a better negotiator If you study and practice good salesmanship you can effectively win deals even if you’re offer is “low” . If you have no experience in sales, this will take time, but there are loads of resources available online (free and paid) that you can take advantage of. But, if you’re planning to stay in this entrepreneurship game for the long haul I HIGHLY suggest you study sales on a regular basis.

- Know you numbers Getting better and better at knowing what your market demands in terms of prices, rehab costs , etc… will help determine a more accurate price at a faster rate. Why does this matter to getting paid a higher assignment fee? It’s 2 reasons: First, if you know that cash buyers are willing to pay X, you can raise your asking price from end buyers, or on the flip side of that if, you know that a house needs some major repairs you can use that negotiated a lower price with the seller…Secondly, if you are really good with numbers, you can give an offer faster than your competition who has to take 1-2 days to send an offer in. In competitive markets “ Speed to lead ” wins and the person who can act fastest is usually the one who takes the trophy.

- Build a thriving buyers list The second component of the assignment fee and wholesaling business is selling the contract to a cash buyer.And, if you can build a list of buyers who will pay more for a good deal than most of the other “bottom of the barrel” buyers who demand very steep prices.Where do find buyers willing to pay more? It’s usually among high w-2 earners (doctors, lawyers, etc) who like to flip houses on the side. Or high-income business owners looking to park their cash somewhere to earn 15%+ annual ROI by doing so occasional flips.If you can find them, network with them, and add them to your list you can essentially raise your property raise to increase your assignment fee

12. How to find discounted properties to wholesale?

Finally our last section in this article which is probably at the top of some people’s minds:

“ Assignments sound great, but how do you FIND discounted properties!?!?”

Wholesaling is probably one of the toughest occupations in real estate.

You have to be well-rounded in almost every aspect of the industry. And you have to be top-notch in your selling and marketing capabilities.

But with that, there are foundational techniques to help you find these properties on your own. I’m going to give you 2 resources to start below.

First, is our article “ 8 ways to find 100 sellers for under $500”

Second is our eBook on Direct mail

You can get the Ebook for free by subscribing below to our newsletter, where we give lessons, stories, and value every week to real estate investors like you…

Spread the Word. Share this post!

Subscribe to our Newsletter

Sign up for news, updates, and more from BPM. It’s time to ZAG!

- Coaching Team

- Investor Tools

- Student Success

Real Estate Investing Strategies

- Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

A Beginner’s Guide To A Lease Option Agreement

What is a lease option?

Lease option requirements

Lease option example

Using lease option for real estate

Lease options are investing tools that advanced real estate investors can use to sell properties in their portfolios. Renters can use a lease option to temporarily rent a property before deciding whether to buy it. In other words, a lease option is a unique tool that provides both property owners and renters some flexibility. To use lease options successfully, you must understand how they work and what their limitations are. Keep reading to find out how lease options work, their requirements, and whether or not they may be a good fit for you.

What is a Lease Option?

A lease option, also called a lease with the option to purchase, is a type of lease contract that lets a renter purchase their rented property either during or at the end of their lease period. Furthermore, a lease option prevents an owner from putting the property up for sale or selling it to another person during the lease’s term. After the lease’s term expires, the renter must either forfeit the option to purchase the property or exercise the option and purchase the property.

How Does a Lease Option Work?

In a nutshell, a lease option lets a potential property buyer flexibly rent a property from an investor/owner without having to buy it at the end of the lease period. Unlike the terms of a regular lease-purchase agreement, a lease option allows the renter to forfeit the option to purchase the property if they want to move on. A property’s price is typically agreed upon upfront by the renter/prospective buyer and property owner at the start of the lease option arrangement. Prices are also usually at the current market value for the home or property. This can be beneficial for the prospective buyer, as it means they may purchase the home for less than the current market rate by the end of their lease term. However, to exercise the lease option, renters are often charged fees by the owners, such as up to 1% of the home’s total sale price.

Lease Option Requirements

On their face, lease options are trade-offs for property owners or investors. They may end up being required to sell the property to the renter at a lower price than they’d be able to secure if they sold the property to another buyer when the lease term ends. In exchange, tenants must pay more rent than they would normally. Additionally, lease options have several requirements for a tenant to qualify. A lease optioned property owner will charge a premium in addition to regular monthly rent. This can either be a percentage added to the normal rent price or another type of fee. However, this premium, called the rent credit, usually becomes part of the down payment for the property if the tenant exercises the option to buy the home from the property owner.

Some banks may not let the above premium or rent credit be used for the down payment if the tenant purchases the lease optioned home. This normally occurs if the rent was charged at the at-market rate. Buyers should therefore check with multiple banks when leasing a home with the intent to enter a lease option agreement. Lease option terms are typically between one and three years, although they can be whatever timeframe the property owner and renter agree upon. The lease option contract must state the property’s eventual prospective purchase price. This purchase price will stay the same regardless of how at-market rates may rise or fall in the interim.

Why Use a Lease Option?

Naturally, lease options are excellent deals for tenants who don’t mind paying a little extra rent in exchange for the option to purchase the home at the end of their lease agreement. The lease option also gives them flexibility in that they aren’t forced to purchase the home at the end of the lease term – they can walk away if they find another option or life circumstances force them to reconsider. Furthermore, renters may enter a lease option arrangement if they don’t have enough money to make a down payment at the moment. By renting, they can save enough money to make the down payment while benefiting from the premium credit (which will hypothetically lower the down payment required to purchase the property).

Renters benefit even more because they can buy the property in the future at earlier market prices. They will not have to worry about the market rate increasing in the future. Owners may also decide to enter into a lease option for separate reasons. For example, a property owner could have difficulty selling a house outright but could easily secure renters. In this way, they can still get income from the house and still have the possibility of a full sale later down the road. Additionally, property owners get to charge rent at a premium (or rent at a price above the current market rate) to their tenants. This results in more short-term profits. If the renter doesn’t buy the house, they get to keep the premium funds since they aren’t put toward the down payment for the house. Entering a lease option agreement could also be strategic on the property owner’s part. For example, if there are tax problems involved with selling the property at the moment, they can wait for the tax issues to clear up and potentially sell the property later.

Lease Option Variables to Consider

Be sure to consider renter’s insurance and homeowner’s insurance. Renter’s insurance should be held by the renter and protects any loss of value for personal belongings and furnishings. The homeowner should have their own separate insurance policy to protect the home value in case anything adverse happens during the lease term, such as a fire or water damage.

Example of a Lease Option

Suppose that there’s a landlord with a home valued at $400,000. It already has a tenant looking to buy a home in the future. Since both parties find the current real estate market grim, the landlord offers the tenant a lease option.

In this case, the buyer-tenant pays an extra 3% of the total house price as a fee for the lease option. They also pay a premium on their monthly rent . They then have the option to buy the house they currently live in two years in the future at current market prices. The premium credit rent goes toward the eventual down payment.

How to Use a Lease Option to Invest in Real Estate

There are several ways in which you can use a lease option to creatively invest in real estate. You could offer a straight lease option. In this scenario, you will become the owner or lessor of a property. You’ll find a tenant-buyer, enter the lease option agreement with them, then either sell the property eventually or cycle through more tenant-buyers until you find one who eventually makes the sale. You can also be a lessee, in which case you will still act as the investor. In this scenario, you’ll sign the lease option agreement with the property owner intending to sublet the property to another person.

The property owner, meanwhile, charges you the lowest rent possible. You and the property owner can split the difference in cash you get from your subletting tenant. More advanced investors can potentially try a “lease option sandwich” strategy, in which the investor acts as a lessee and finds the property where they can secure a lease option from an owner. Then the investor finds an excellent tenant looking for a rent-to-own arrangement. The investor signs the potential tenant with a lease option for the same property, keeping the difference in cash.

As you can see, lease options are a viable means of getting into the real estate investing market and good options to pay for a home if you don’t currently have enough cash for a down payment. Consider the above strategies carefully and always remember that a lease option can also be risky – if you’re the lessor, you’re on the hook for selling your property to your tenant if they exercise the option to buy it at the end of their lease’s term!

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

What is an STR in Real Estate?

Wholetailing: a guide for real estate investors, what is chain of title in real estate investing, what is a real estate fund of funds (fof), reits vs real estate: which is the better investment, multi-family vs. single-family property investments: a comprehensive guide.

Norada Real Estate Investments

Investment Properties For Sale

A Premier Turnkey Investment Marketplace For Investors

Newly Listed Investment Properties For Sale In Affordable Growth Markets

Join our Real Estate Investment Group (FREE)

Popular Blogs

- Housing Market News 2024: Today's Market Update

- Home Sales Decline Amidst Rising Prices and Interest Rates

- Housing Market Predictions 2024: Will Real Estate Crash?

- Is It a Good Time to Buy a House or Should I Wait Until 2025?

- Housing Market Predictions for Next 5 Years (2024-2028)

- Will the Housing Market Crash in 2025?

- Mortgage Rates Predictions 2024: Will Rates Go Down?

- Economic Forecast for the Next 5 Years

- Florida Housing Market Predictions 2024 & Next 5 Years: Will it Crash?

- Where Are Housing Prices Falling 2022?

- Hottest Housing Markets Predicted for 2024

- Housing Market Crash: What Happens to Homeowners if it Crashes?

- If The Housing Market Crashes What Happens To Interest Rates?

- Texas Housing Market 2024: Trends and Forecast

- Worst Real Estate Markets in the US

Related Posts

- High Interest Rates: Will Fed’s Decision Crash the Housing Market?

- Is the Housing Market on the Brink in 2024: The Forecast

- Fed Warns of High Risks in US Real Estate Market

- Housing Market Predictions for 2024 & 2025 Remain Critical

- 10 Worst Cities in California: Worst Places to Live in CA 2024

- Housing Market Alert: Mortgage Demand Dips, Will Prices Crash?

- California Housing Market: Trends & Predictions for 2024

- Will Miami’s Housing Market Crash Due to Rising Mortgage Rates

- Will Mortgage Rates Hit 8% in 2024? Prediction Says No

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions for Next 2 Years

- Los Angeles Housing Market Trends And Forecast for 2024

- 30-Year Mortgage Rates on the Rise: Will It Affect Your Dream Home?

- Forget 2008: Why Today’s Housing Market in 2024 is Different?

- Housing Market Predictions for the Next 2 Years: Find Out!

- Mortgage Rate Predictions: Are 7% Rates Here to Stay, Lock in Now or Wait?

- Projected Interest Rates in 5 Years: A Look at the Forecasts

- Ranked: WORST Places to Live in Florida Cities for Families in 2024

- Canada Interest Rate Forecast for Next 10 Years

- New Home Sales Surprise with March Surge Despite Rising Mortgage Rates

- 1031 Exchange (3)

- Asset Protection (16)

- Banking (19)

- Best Places (19)

- Book Reviews (4)

- Economy (228)

- Financing (153)

- Flipping (4)

- Foreclosures (27)

- General Real Estate (58)

- Getting Started (75)

- Growth Markets (219)

- Housing Market (609)

- Making Money Online (17)

- Mortgage (61)

- Passive Income (26)

- Personal Development (21)

- Podcast (6)

- Property Management (27)

- Real Estate (153)

- Real Estate Investing (108)

- Real Estate Investing (450)

- Real Estate Investments (89)

- Real Estate Market (152)

- Real-Estate-Investments (1)

- Rehabbing (6)

- Self-Directed IRA Investing (5)

- Selling Real Estate (29)

- Stock Market (4)

- Trending News (42)

Lease with an Option to Buy House: What You Need to Know

February 21, 2024 by Marco Santarelli

If you're looking to buy a house but aren't quite ready to make the commitment, a lease with an option to buy might be a good option for you. A lease with an option to buy, also known as a lease option, is a real estate agreement that allows a tenant to rent a property for a specified period with the option to purchase the property at the end of the lease term. This type of agreement typically involves two separate contracts: a lease agreement and an option agreement.

The lease agreement outlines the terms of the rental, including the monthly rent payment, the length of the lease term, and any other conditions of the rental. The option agreement gives the tenant the right to purchase the property at a predetermined price at the end of the lease term.

Lease with an option to buy agreements can be beneficial for both buyers and sellers. For buyers, it allows them to move into a property they are interested in without having to commit to purchasing it right away. For sellers, it provides a steady stream of rental income and the potential for a sale at the end of the lease term. However, it's important to understand the key components of the lease option agreement and the potential pitfalls to avoid before entering into this type of agreement.

Key Takeaways

- A lease with an option to buy is a type of agreement that allows you to rent a property with the option to purchase it at the end of the lease term.

- This type of agreement can be beneficial for both buyers and sellers, but it's important to understand the key components of the lease option agreement and the potential pitfalls to avoid.

- The process of entering a lease option agreement involves negotiating the terms of the lease, setting a purchase price, and determining the length of the lease term.

How Does It Work?

The lease with an option to buy agreement encompasses several crucial aspects:

- Lease term: The duration during which the renter evaluates their choice to exercise the option to purchase.

- Purchase price: The specified price at which the property can be bought if the renter opts for the purchase.

- Option fee: A non-refundable upfront fee securing the right to purchase the property.

- Monthly rent: The regular payment made by the renter, part of which contributes towards the property's purchase price.

At the end of the lease term, the renter has the option to buy the property at the agreed purchase price. If they decide to proceed, they must pay the remaining balance of the purchase price. However, if they choose not to purchase the property, they forfeit the option fee and any portion of the monthly rent allocated toward the purchase price.

Benefits and Drawbacks of Lease with an Option to Buy

There are several advantages to a lease with an option to buy. One of the main benefits is that it allows the tenant to try out the property before committing to a purchase. This can be particularly beneficial for those who are unsure if they want to own a home, or who are not yet financially ready to make a purchase.

Another advantage is that a portion of the monthly rent payment can be applied toward the purchase price of the property. This is known as a rent credit and can help the tenant build up equity in the property over time.

However, there are also some disadvantages to consider. One potential downside is that the tenant may end up paying more for the property than it is worth, particularly if the option price is set too high. Additionally, if the tenant decides not to purchase the property at the end of the lease term, they may lose the option fee and any rent credits they have accumulated.

Types of Leases with Options to Buy

Lease-purchase agreement.

A lease-purchase agreement outlines critical terms:

- Lease term: The duration before the tenant can exercise the option to purchase the property.

- Purchase price: The agreed price for purchasing the property.

- Option fee: A non-refundable upfront fee securing the purchase right.

- Monthly rent: The monthly payment, part of which contributes to the property's purchase price.

At the lease term's conclusion, the tenant can buy the property at the agreed price or forfeit the option fee and relevant rent portions.

Rent-to-Own Agreement

Similar to a lease-purchase agreement but usually with a shorter term and a higher option fee. Often suitable for individuals with poor credit or facing challenges in obtaining a traditional mortgage.

Seller-Financing

Seller-financing involves the property seller providing the financing for the buyer, eliminating the need for a traditional mortgage. It's an alternative for individuals with poor credit or facing mortgage qualification difficulties.

Key Components of the Lease Option Agreement

A lease option agreement is a contract that allows a tenant to rent a property with the option to buy it at a later date. This type of agreement can be a great way to get into a home when you don't have the funds for a down payment or if you're not sure if you want to commit to buying a home just yet. Here are the key components of a lease option agreement that you need to know:

Lease Terms

The lease terms of a lease option agreement are similar to a standard lease. This includes the rental amount, payment schedule, and the duration of the lease. It's important to read the lease terms carefully to ensure that you understand your obligations as a tenant.

Option to Purchase Details

The option to purchase details are the most important part of a lease option agreement. This outlines the terms of the option, including the option fee, the duration of the option period, and the price for which you can purchase the property in the future. It's important to negotiate these terms carefully to ensure that you're getting a fair deal.

Financial Considerations

There are several financial considerations that you need to take into account when signing a lease option agreement. These include the option fee, which is typically 2-5% of the purchase price, and the rental amount, which is usually higher than a standard lease. Additionally, you'll need to consider your ability to secure financing when the option period ends. It's important to work with a qualified real estate agent or attorney to ensure that you understand all of the financial implications of a lease option agreement.

Process of Entering a Lease Option Agreement

Entering a lease option agreement involves several steps. Here are the key considerations to keep in mind:

Negotiation Strategies

Once you find a property that you are interested in, it is time to negotiate the terms of the lease option agreement with the landlord/seller. Before you start negotiations, it is important to determine what you are looking for in the agreement. For example, you should consider the length of the lease, the sales price of the home, and the option fee.

During negotiations, it is important to be clear about your expectations and to be willing to compromise. Remember that the landlord/seller is also looking for a favorable deal. Try to find common ground and work towards a mutually beneficial agreement.

Legal Considerations

Before signing a lease option agreement, it is important to consult with a real estate attorney. A real estate attorney can review the agreement and ensure that it is legally binding and enforceable.

The lease option agreement should clearly outline the rights and responsibilities of both parties. It should also specify the consequences of default or breach of the agreement. Make sure that you fully understand the terms of the agreement before signing it.

Due Diligence

Before entering a lease option agreement, it is important to conduct due diligence on the property. This includes inspecting the property, reviewing the title, and researching the neighborhood.

Inspecting the property can help you identify any issues that need to be addressed before moving in. Reviewing the title can help you ensure that the landlord/seller has the legal right to sell the property. Researching the neighborhood can help you determine whether the property is located in a desirable area.

By following these steps, you can enter a lease option agreement with confidence and ensure that you are getting a fair deal.

Overall, lease with an option to buy can be a great way to get into a home if you cannot afford to buy one outright. However, it is important to carefully consider the potential pitfalls and to take steps to avoid them. By working with a reputable lender, carefully reviewing the lease agreement, and inspecting the property before entering into the agreement, you can help ensure that your lease with an option to buy is a success.

1. What is a lease option?

A lease option grants the right to purchase the property rented at the end of the lease term.

2. How does a lease option work?

You pay an option fee and higher monthly rent, with a portion contributing to the property's purchase. At the lease term's end, you can choose to buy the property or forfeit the option fee and relevant rent.

3. What are the benefits of a lease option?

– Enables faster move-in to a home – Allows time to enhance credit and save for a down payment – Provides a trial period to try out a home

4. What are the drawbacks of a lease option?

– Potential higher long-term costs – No guarantee of mortgage qualification at the lease term's end – Risk of forfeiting fees and rent if not choosing to buy

5. Is a lease option right for me?

Depends on your individual circumstances; consider your financial situation and goals before deciding.

6. How much is the option fee for a lease option?

The option fee typically ranges from 1-5% of the property's purchase price.

7. What is the lease term for a lease option?

The lease term usually varies from 1-3 years.

8. Can I assign my lease option to someone else?

Assignment possibilities depend on the lease option agreement terms.

9. What happens if I don't exercise my option to buy at the end of the lease term?

If you opt not to purchase, you forfeit the option fee and relevant rent portions designated for the purchase price.

About Marco Santarelli

Marco Santarelli is an investor, author, Inc. 5000 entrepreneur, and the founder of Norada Real Estate Investments – a nationwide provider of turnkey cash-flow investment property. His mission is to help 1 million people create wealth and passive income and put them on the path to financial freedom with real estate. He’s also the host of the top-rated podcast – Passive Real Estate Investing.

Recommended Articles:

Join 100,000+ Fellow Investors.

Subscribe to get our top real estate investing content.

Real Estate

Quick links.

- High Interest Rates: Will Fed’s Decision Crash the Housing Market? April 24, 2024 Marco Santarelli

- Is the Housing Market on the Brink in 2024: The Forecast April 24, 2024 Marco Santarelli

- Fed Warns of High Risks in US Real Estate Market April 24, 2024 Marco Santarelli

Norada Real Estate Investments 30251 Golden Lantern, Suite E-261 Laguna Niguel, CA 92677

(949) 218-6668

(800) 611-3060.

- Search Search Please fill out this field.

What Is a Lease Option?

- How It Works

- Requirements

Industries With Lease Options

Reasons to use a lease option.

- Right of First Offer

- Right of First Refusal

Special Considerations

- Frequently Asked Questions (FAQs)

The Bottom Line

- Home Ownership

What Is a Lease Option? Requirements, Benefits, and Example

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

Brandon is a professor of finance and financial planning. CFP, RICP, and EA, and a doctorate in finance from Hampton University.

:max_bytes(150000):strip_icc():format(webp)/headshot-BrandonRenfro-3aeca9d98f2247669f3412aa144e9990.jpg)

A lease option is an agreement that gives a renter a choice to purchase the rented property during or at the end of the rental period. It also precludes the owner from offering the property for sale to anyone else. When the term expires, the renter must either exercise the option or forfeit it. A lease option is also known as a lease with the option to purchase.

Key Takeaways

- A lease option is an agreement that gives a renter a choice to purchase the rented property during or at the end of the rental period.

- A lease option also precludes the owner from offering the property for sale to anyone else.

- A renter usually pays some percentage above the standard monthly rental amount, which goes to the downpayment for buying the home.

- Leasing options may last for any period of time, but they commonly expire after two to three years.

- Depending on the contract, the buyer-tenant may be responsible for maintenance and repairs which are normally the landlord's responsibility.

How a Lease Option Works

A lease option gives a potential buyer more flexibility than a standard lease-purchase agreement, which requires the renter to buy the home when the lease ends. The price of the home is agreed to upfront by the buyer (the renter) and the owner. The price is typically at the current market value of the home, allowing the renter to buy the home in the future at today's price.

For that option, the renter is usually charged an upfront fee by the owner, which might be 1% of the home's sale price. The fee goes to the downpayment if the renter decides to buy the home at the end of the lease. The lease option is especially helpful to those who might be building their credit or don't have enough saved for a downpayment. However, there are several features of lease options to consider.

Requirements for a Lease Option

Leasing options come with a tradeoff for property owners, since they may lose the chance to sell the property for a higher price. In exchange, tenants pay more to rent with a leasing option than they would pay otherwise.

Rental Payments

The owner charges a premium in addition to the standard monthly rent for the option to buy at today's price when the lease ends. The premium might be a percentage added to the current rent, such as a 10% surcharge of the standard monthly rent for a home of that size.

The premium, which is often called rent credit, becomes part of the downpayment for the home if the option is exercised to buy the home by the renter. However, the renter forfeits the extra money paid above the standard rent if the home is not purchased at the end of the lease.

Some owners might take a one-time cash payment, often called "valuable consideration," which is similar to the premium paid for an option in the financial markets. This is not a deposit on the purchase of the property, meaning it's not refundable. The amount ranges from a token fee to 5% of the expected purchase price.

Bank Financing With a Lease Option

The good news for renters is that typically, banks will allow the total funds of the premium above the rental payments to go to the downpayment for purchasing the home. However, if the rent charged was an at-market rate, the bank may not allow any of the funds to be applied to the purchase price. It's important that buyers check with multiple banks to determine their policies regarding financing a mortgage for a home with a lease option.

The Term of a Lease Option

The term of the option may be any period on which the property owner and renter agree, but is commonly one to three years. The lease option contract also stipulates the property's purchase price at the start of the lease or how that price will be determined at the end of the option. More specifics on the lease option terms are in the following section.

Lease Option Terms

There are a number of lease option characteristics or terms starting with the actual lease term. This defines the period during which the tenant will occupy the property. The purchase option price is also a critical component of the lease agreement, determining the price at which the tenant can buy the property if they choose to exercise their option. In some cases, an exact dollar may not be given but instead a method of calculating the value (i.e. the Official Kelley Blue Book value at the date of lease termination).

The option fee, also known as option consideration, is a non-refundable upfront payment made by the tenant to the landlord to secure the right to purchase the property during the lease term. Rent credits, if applicable, are additional financial incentives in some lease option agreements that may sometimes be used to offset fees or the purchase price.

Lease options often have an exercise period that defines the specific timeframe within which the tenant must notify the landlord of their intent to exercise the purchase option. It is crucial for the tenant to adhere to this timeframe to avoid losing the right to buy the property.

Lease options usually have default and termination clauses. Default and termination provisions should outline what happens if either party fails to meet their obligations. Some lease option agreements may include an option for the tenant to extend the lease term or exercise period if they need more time to decide on exercising the purchase option. In some cases, this extension may incur a fee.

Last, the lease option may require an appraisal and inspection. This is to determine the property's current value and condition at the time of exercising the purchase option. In many ways, this protects the buyer from not overpaying for a less-than-valuable good.

This article primarily focuses on real estate; however, there are a variety of industries that often bake lease options into contract agreements. These industries include but are not limited to:

- Real estate: In real estate, lease options enable prospective homebuyers to rent a house with the opportunity to buy it later. This is the primary context of this article.

- Automobiles: Lease options are frequently employed for cars. Customers have the choice to lease an automobile for a predetermined time, often two to three years, with the option to purchase the car at the conclusion of the lease term for a predetermined cost.

- Equipment: Companies frequently rely on expensive equipment in a variety of industries, including manufacturing, construction, and healthcare. They can rent the equipment for a certain time period so they can evaluate its performance and suitability for their purposes by using equipment lease options. After the equipment has a diminished useful life (but still holds value), the company may have the option to buy the equipment.

- Technology: Software licenses, computer hardware, and other types of technological equipment can all be leased via technology lease options. In some cases, these services may then be permanently downloaded or owned in perpetuity (often because they may have been superseded by newer versions).

- Agriculture: Leasing farms is one use of lease options in the agriculture industry . Farmers who lack the funds to buy land might lease it with the possibility of buying it later if they produce profitable crops.

- Aviation: When leasing aircraft, airlines or private parties may employ lease options. It gives them more financial freedom by allowing them to use airplanes for a certain amount of time without having to pay the entire purchase price.

Consider making a proposal for the right to buy other assets you lease that are not included on this list. After a good has been used, the owner may recognize that its useful life has diminished and, if you're satisfied with the product, you may end up guiding an easy sale.

There are several reasons why the renter and the owner might enter into a lease option. It's important to consider whether the benefits outweigh any drawbacks for entering into the agreement.

Why Renters Enter Into a Lease Option

A potential buyer may have many reasons to use a lease option rather than buy the property outright at the start. A major consideration is not having enough money or credit to make the purchase. Renting can allow the potential buyer to save money for the purchase and at the same time, build their credit by making regular, on-time payments.

The renter has a chance to buy a property in the future at today's prices. If the renter doesn't have the money saved today to buy the home but is worried the home's value will increase in the next few years, the lease option is a good choice. Also, if the renter loves the home, the school district, or the neighborhood, the lease option takes the home off the market—allowing the renter to save enough to buy it when the lease ends.

Even if the potential buyer has the means to purchase the property, they may not want to commit to it right away. For example, if the potential buyer is from another place, they might want to live in the new town before committing to the purchase. Or, they may still have their old property to sell before being able to buy the new property.

Finally, the property may not qualify for certain loans, including a VA loan , due to needed repairs or upgrades. By renting first, the potential buyer can make those improvements in order to qualify for the loan later.

Why Owners Enter Into a Lease Option

A property owner may enter into a lease option agreement because they had trouble selling the house outright. The option can make the property more attractive to different types of potential buyers.

Also, if a homeowner is thinking of selling the home in a few years, the lease option allows the owner to collect a premium above the current market for rent. The worst-case scenario is that the renter doesn't buy the house; the owner places it on the market to sell and keeps the extra funds paid above the standard monthly rent.