Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Accounts Payable Resume Guide & Examples

Accounts Receivable Resume Examples: Proven To Get You Hired In 2024

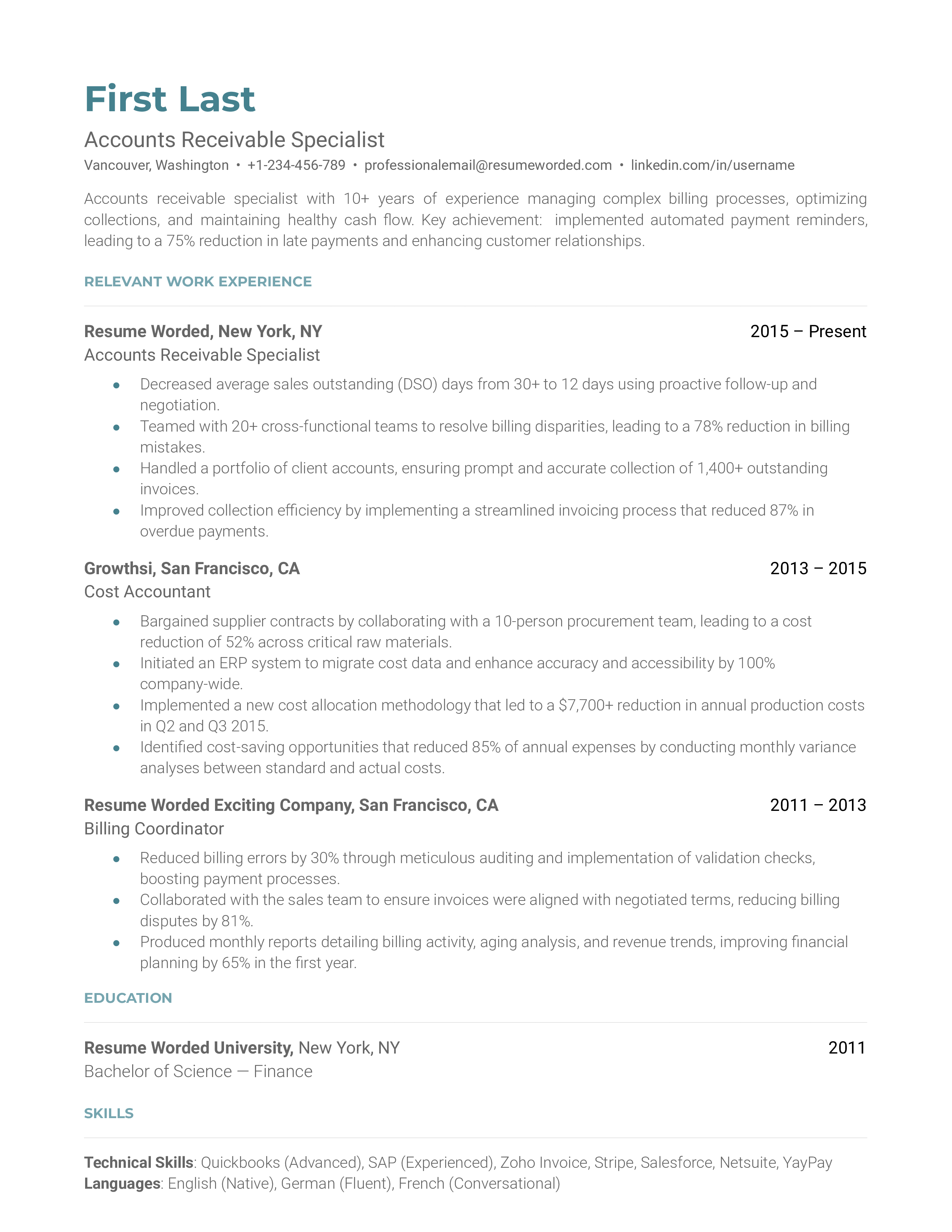

Accounts Receivable Resume Template

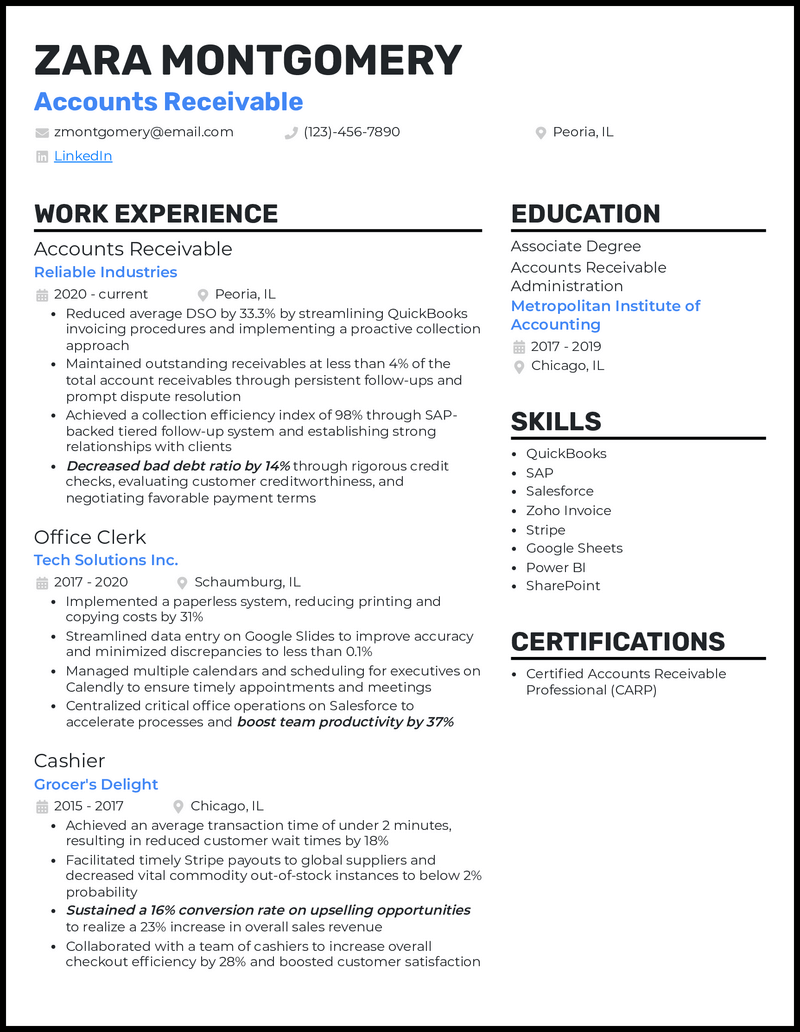

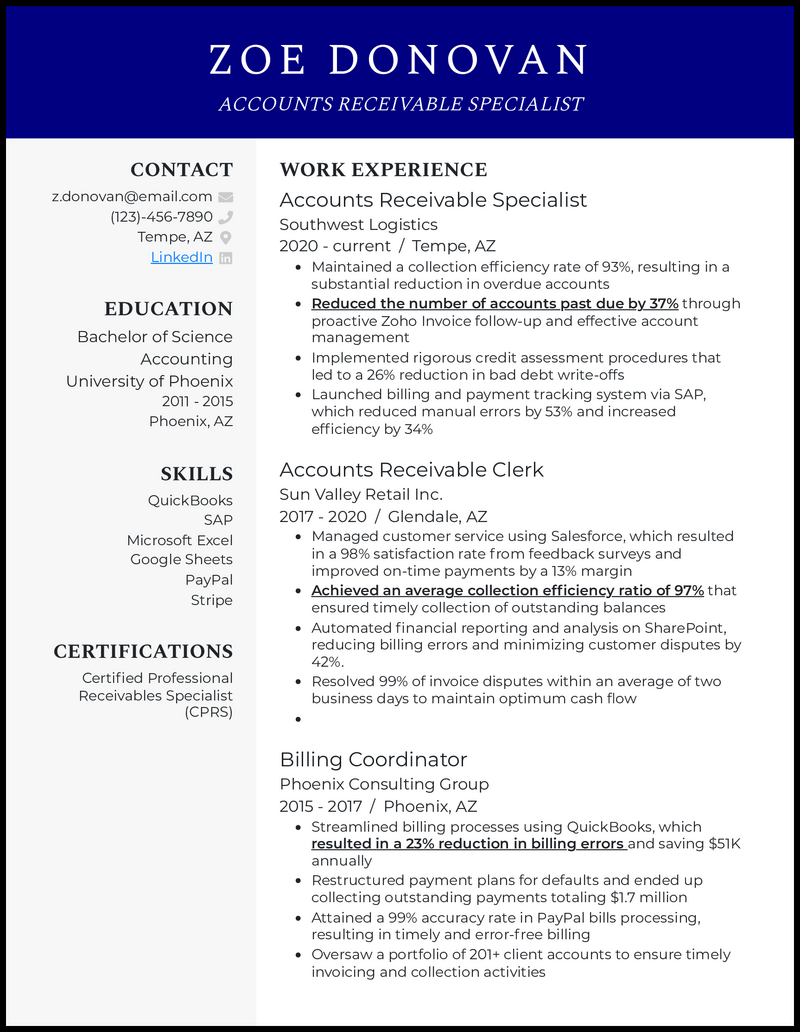

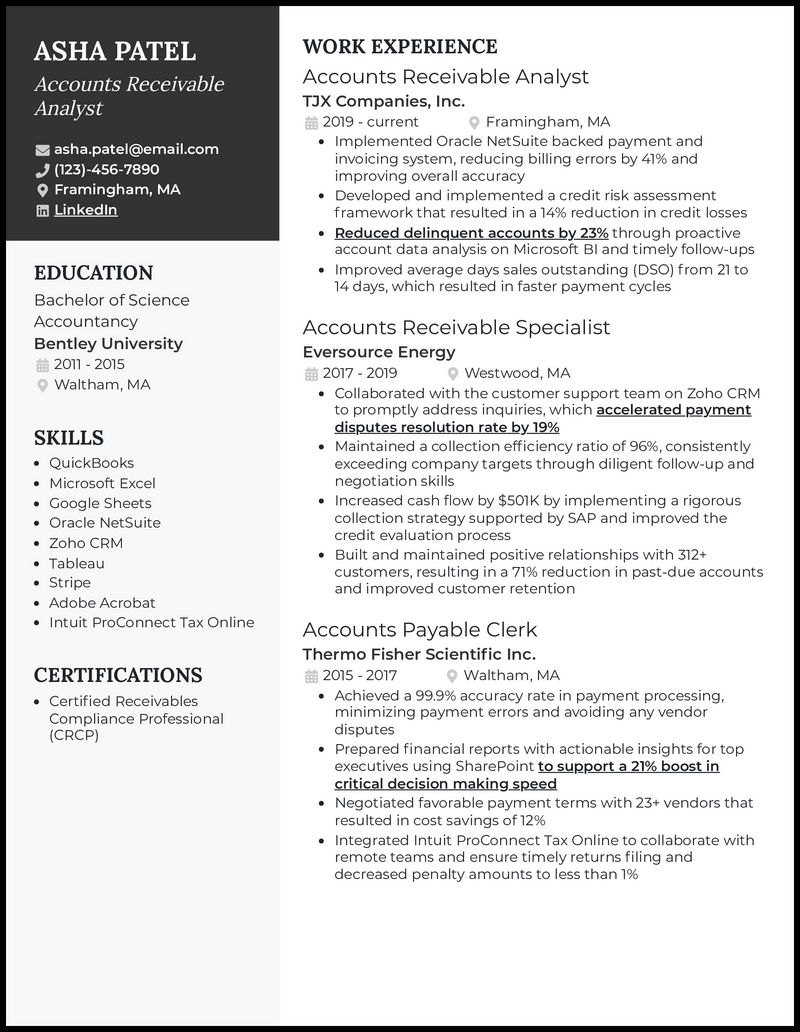

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., accounts receivable resume sample.

An accounts receivable role is integral to a company's financial health. You're the gatekeeper of incoming funds, and your management skills directly impact the company's cash flow. While the industry is becoming increasingly digital, speed and accuracy remain paramount, so resume-wise, you need to portray a blend of technical skill and precision thinking. The market for accounts receivable roles is competitive. Today, companies typically look for candidates with a mix of traditional accounting skills, familiarity with modern financial software, and data-analysis abilities. When drafting your resume, keep these requirements and trends in mind and frame your skills and experience accordingly.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

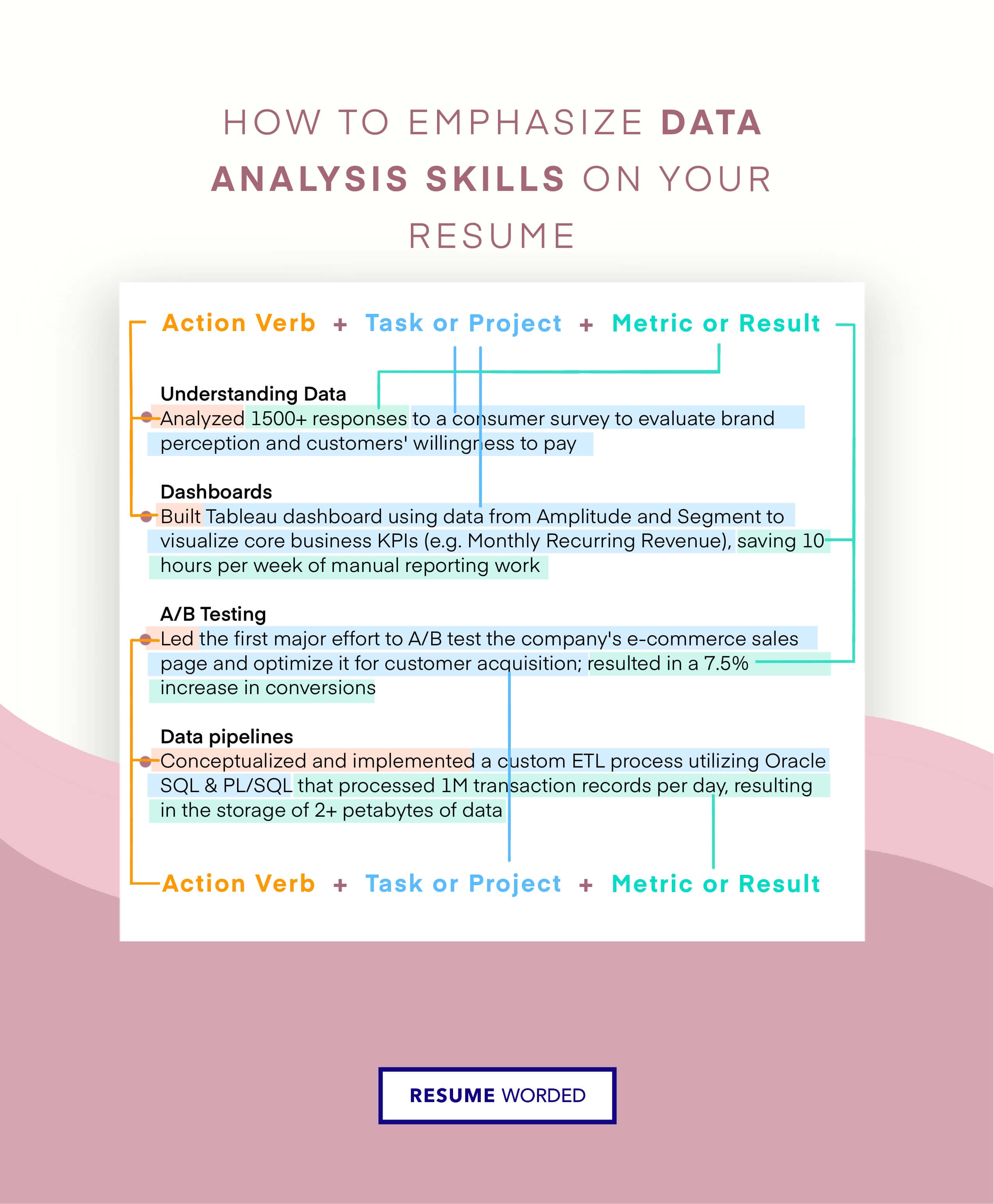

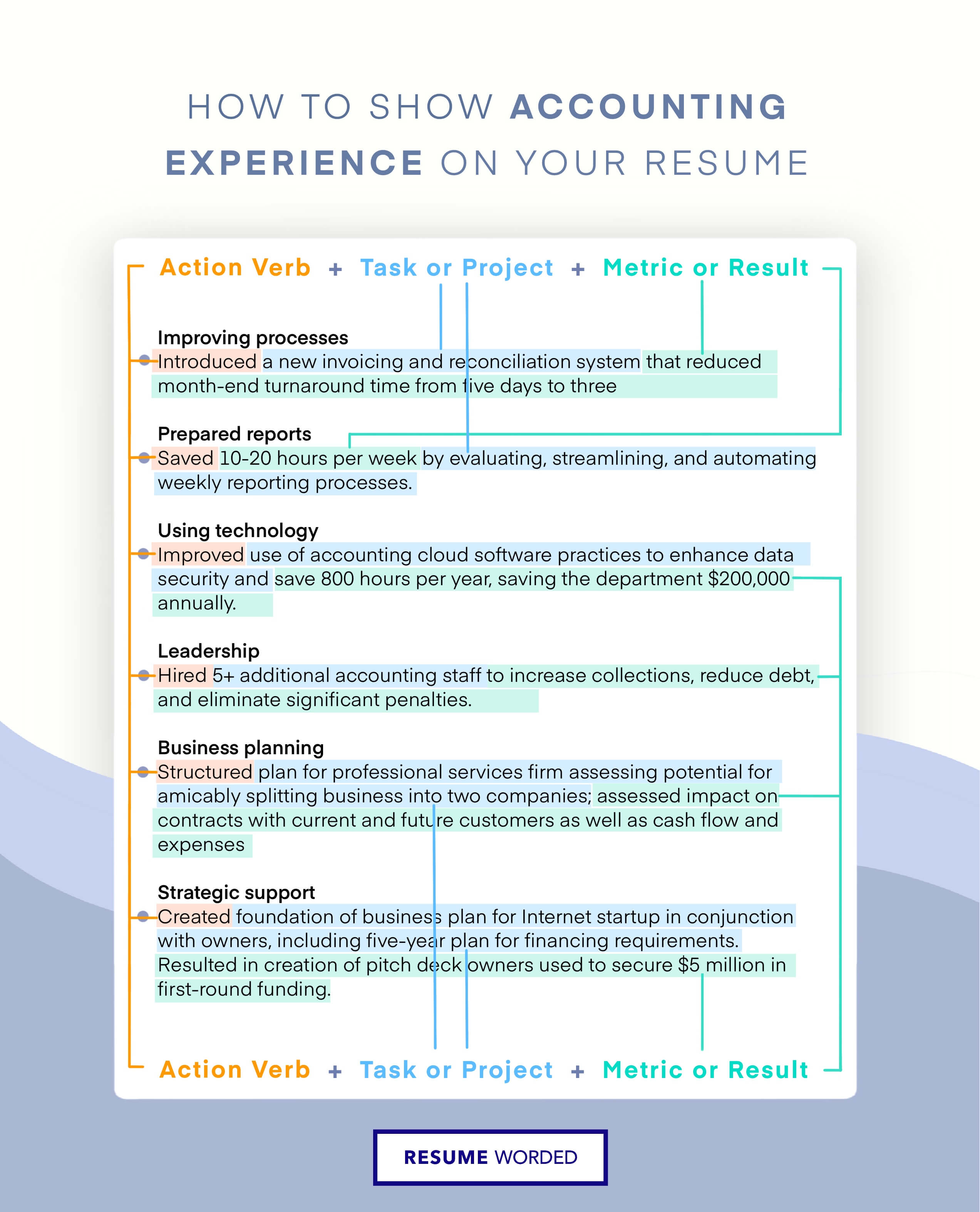

Tips to help you write your accounts receivable resume in 2024, emphasize your data proficiency.

Since the domain is increasingly data-driven, make sure to mention your familiarity with financial software like Quickbooks or Excel. Include any tangible achievements using these tools, like improving collection time or identifying revenue patterns.

Detail your collection strategies

In accounts receivable roles, your ability to collect payment is a crucial skill. You should showcase your strategies for timely collection, such as maintaining positive customer relationships or negotiating payment plans, and their success rates on your resume.

In the world of finance and accounting, Accounts Receivable (AR) is the key role that ensures the company's incoming cash flow. As an AR specialist, you're the one holding the strings to the company's collections, effectively making you an integral part of the firm's financial strength. Recently, there has been a strong desire for individuals who can utilize cutting-edge accounting software and have a keen eye for detail. When you're preparing your resume, remember, hiring managers are looking for someone who can seamlessly handle financial data, build strong relationships with clients, and contribute to the company's healthy cash flow.

Show proficiency in accounting software

As an Accounts Receivable specialist, you need to display your proficiency in accounting software like QuickBooks or SAP. This demonstrates that you can effortlessly navigate through different platforms, thus ensuring efficiency and accuracy in your work.

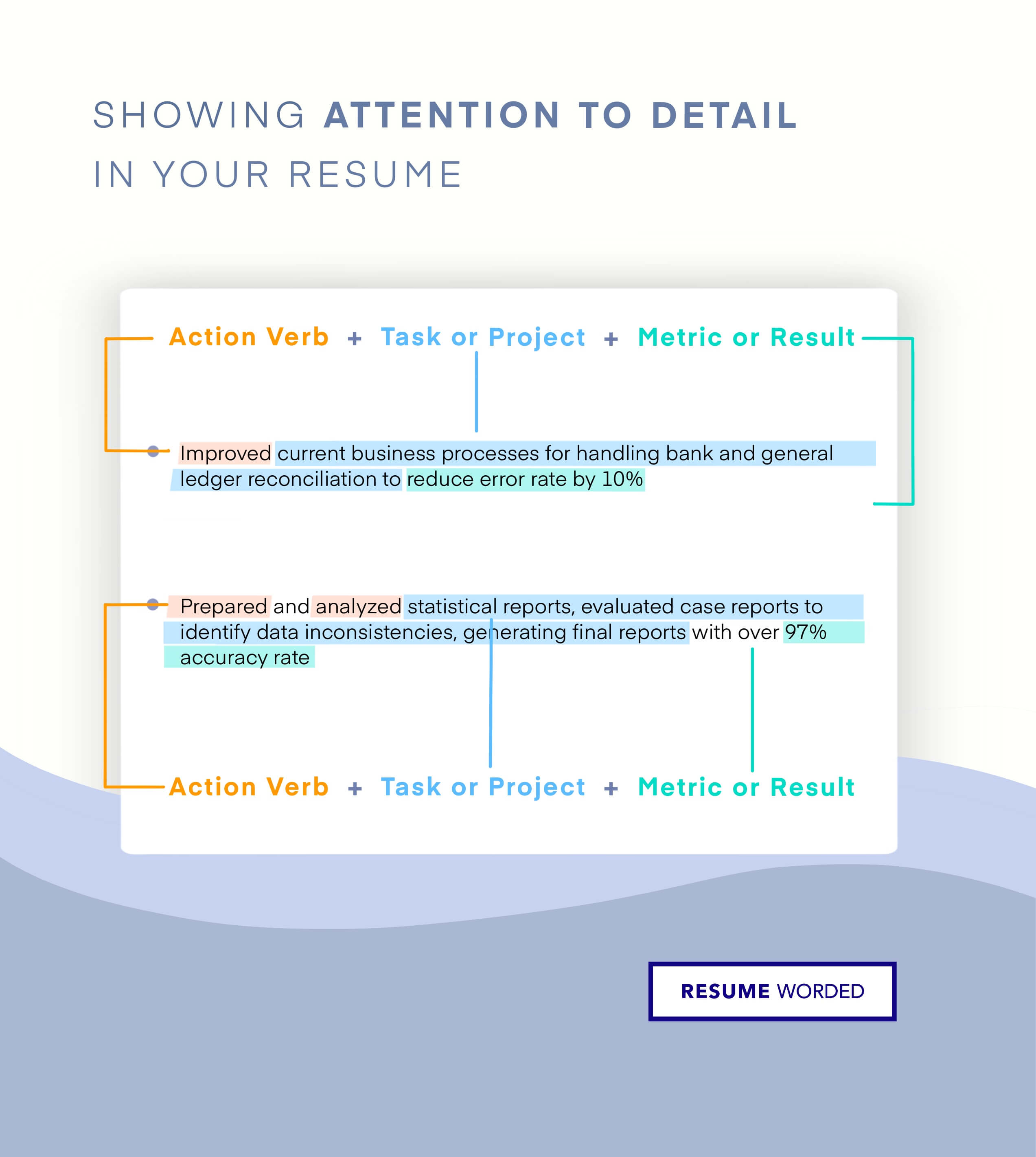

Emphasize your strong attention to detail

An Accounts Receivable role means dealing with a plethora of numbers daily. You should emphasize your strong attention to detail on your resume. Indicate past situations where your keen observation prevented financial mishaps or led to process improvements.

Accounts Payable Specialist Resume Sample

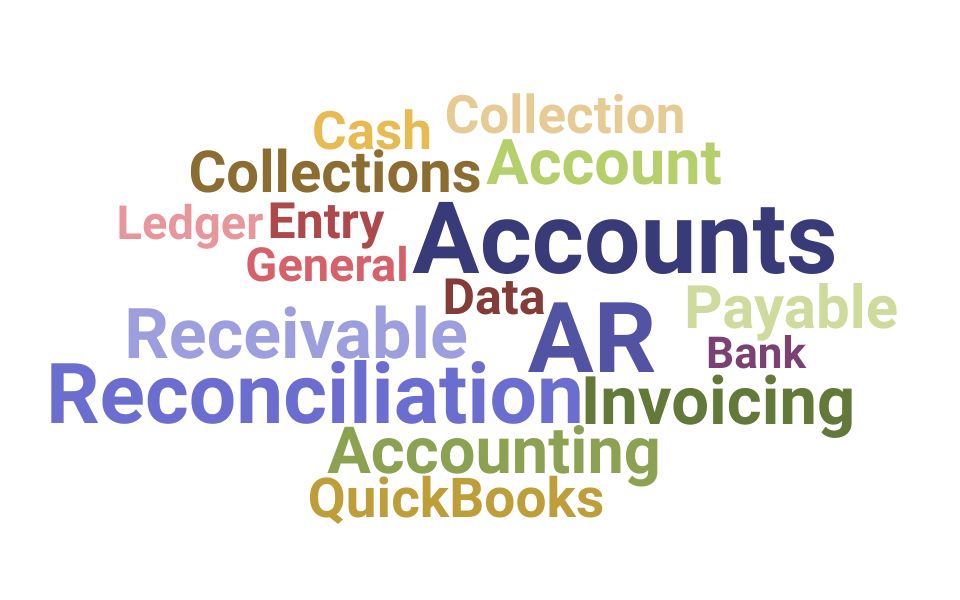

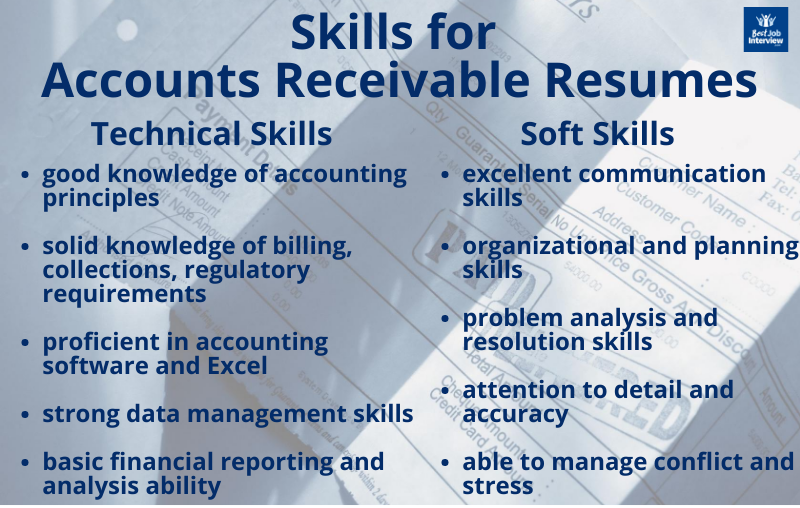

Skills for accounts receivable resumes.

Here are examples of popular skills from Accounts Receivable job descriptions that you can include on your resume.

Skills Word Cloud For Accounts Receivable Resumes

This word cloud highlights the important keywords that appear on Accounts Receivable job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

Similar resume templates, accounts payable.

- C-Level and Executive Resume Guide

- Finance Director Resume Guide

- Claims Adjuster Resume Guide

- Accounts Payable Resume Guide

- Collections Specialist Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Accounts Payable Resume Guide & Examples for 2022

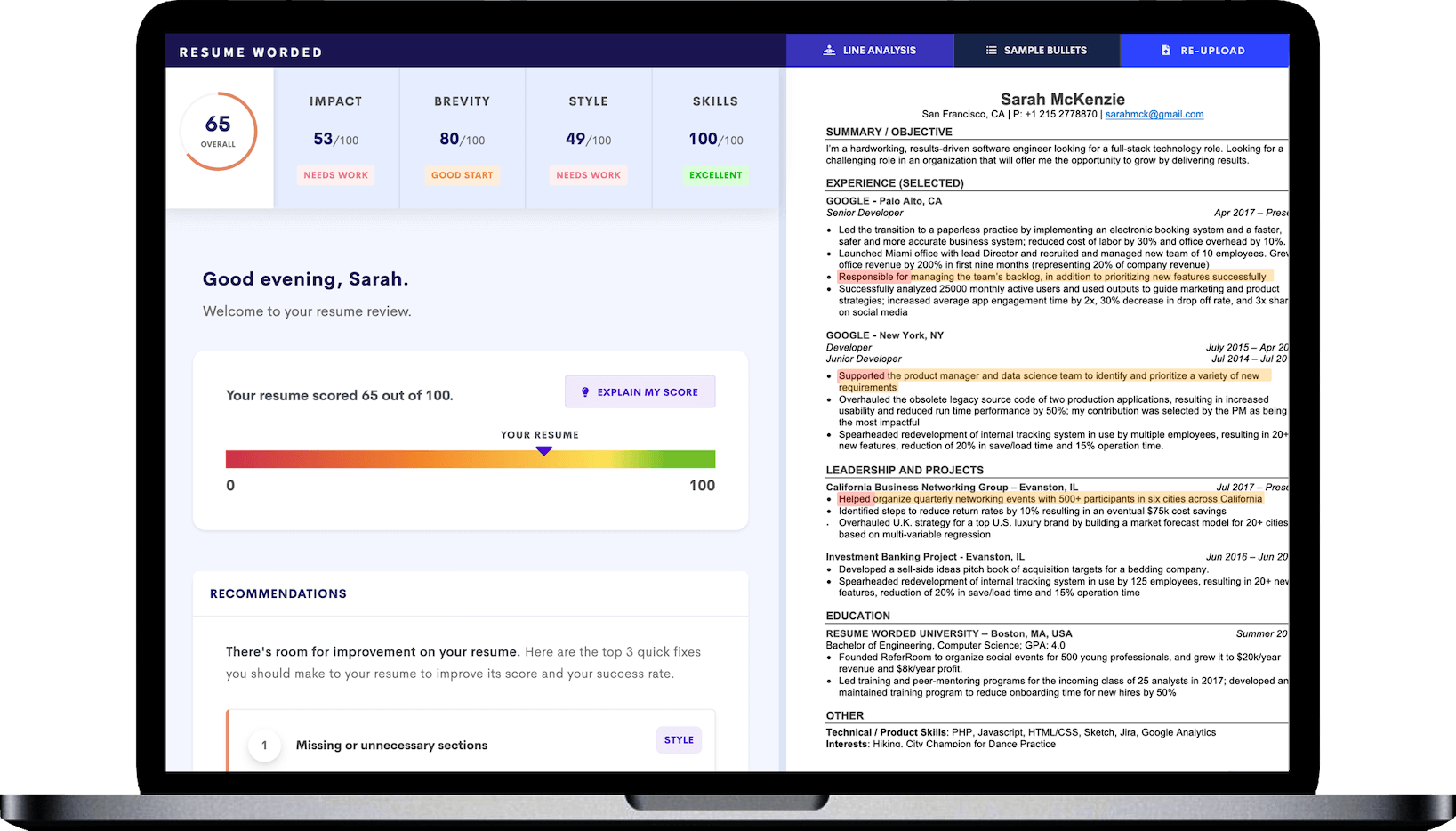

Improve your Accounts Receivable resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Accounts Receivable resumes in your industry.

• Fix all your resume's mistakes.

• Find the Accounts Receivable skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Accounts Receivable Resumes

- Template #1: Accounts Receivable

- Template #2: Accounts Receivable

- Template #3: Accounts Payable Specialist

- Skills for Accounts Receivable Resumes

- Free Accounts Receivable Resume Review

- Similar Accounts Payable Resume Templates

- Other Finance Resumes

- Accounts Receivable Interview Guide

- Accounts Receivable Sample Cover Letters

- Accounts Payable - 2024 Resume Guide

- Alternative Careers to a Accounts Receivable

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 5 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 5 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Accounts Receivable Resume Examples Built for 2024

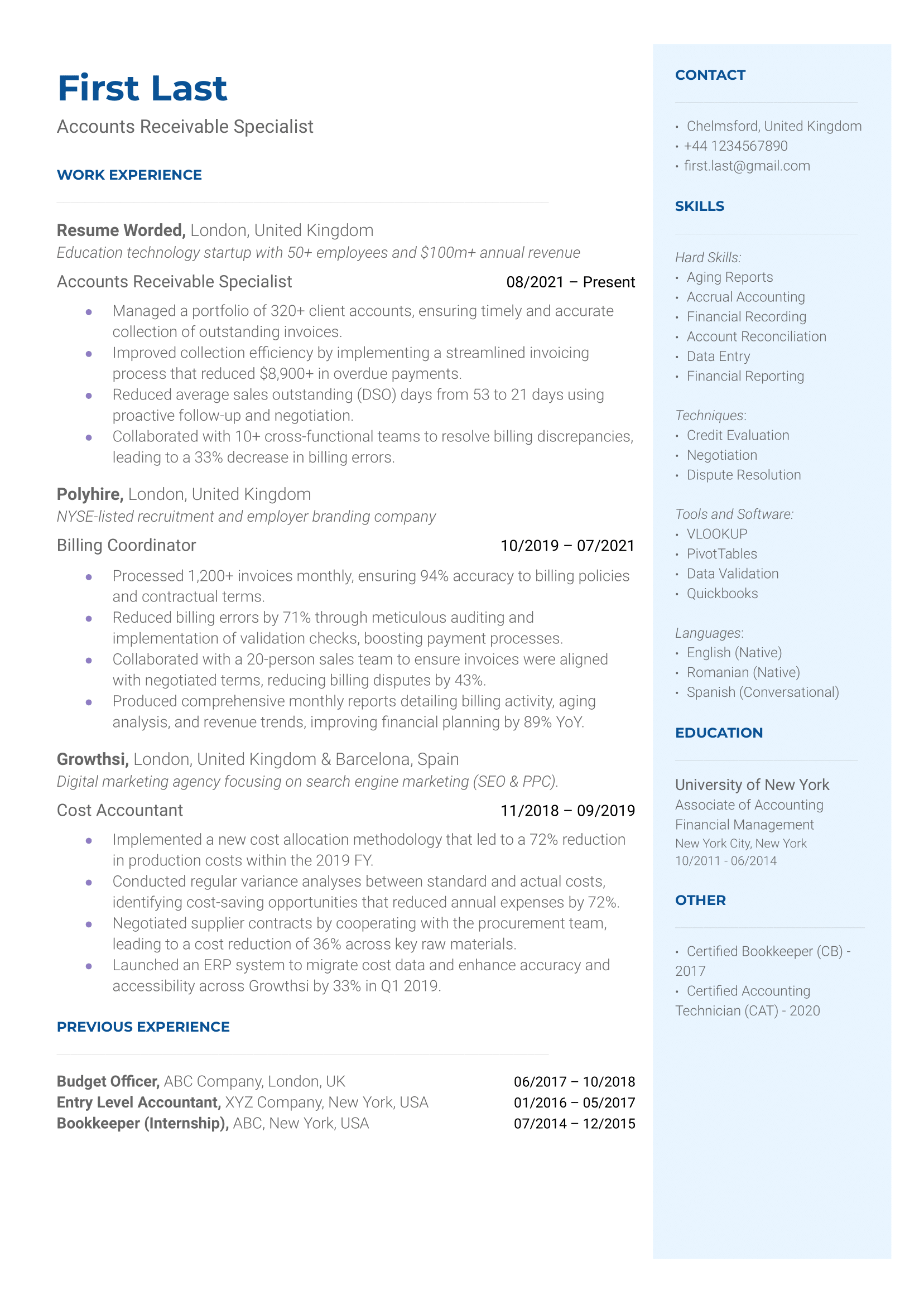

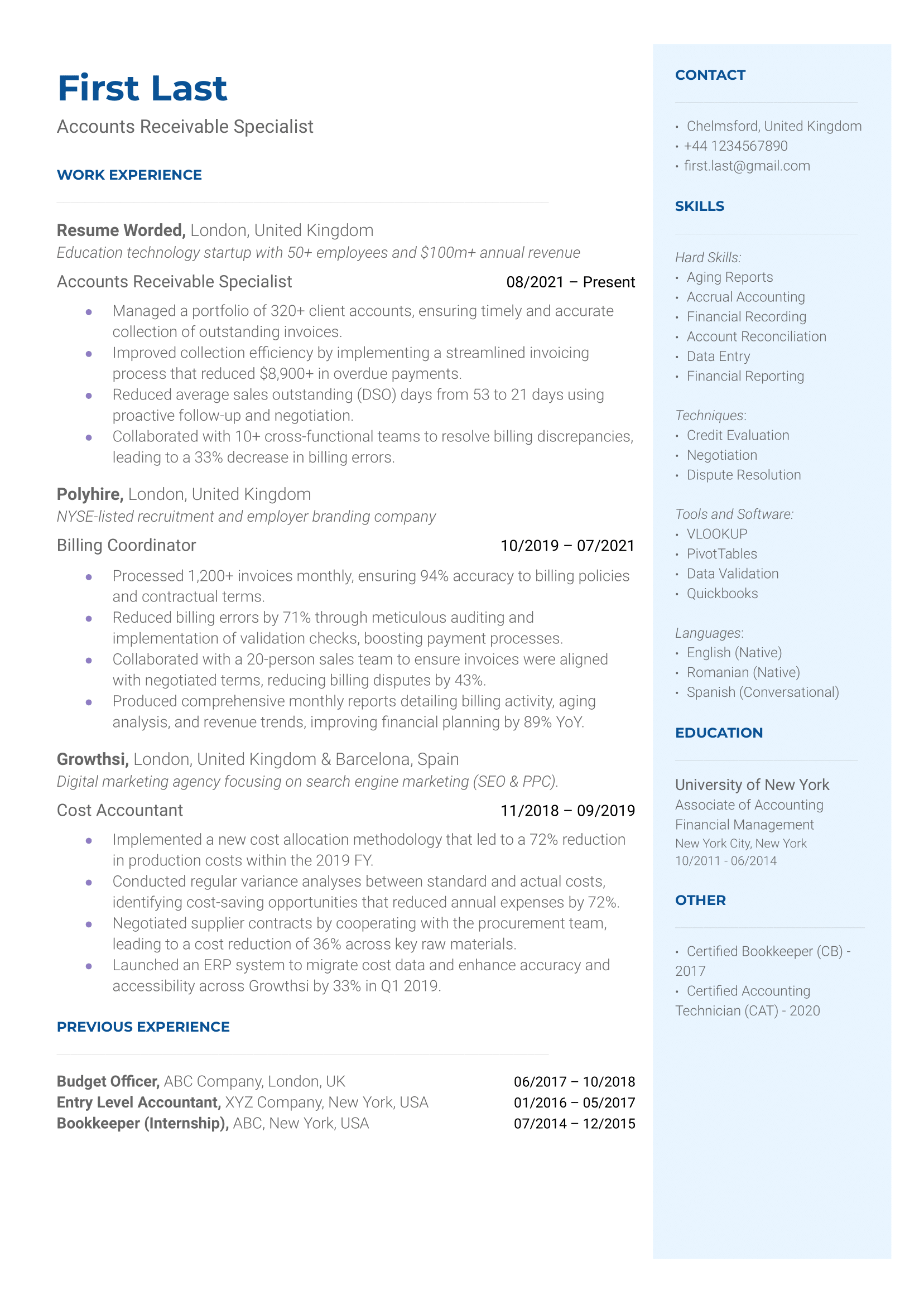

Accounts Receivable Resume

- Account receivable Resumes by Experience

- Account receivable Resumes by Role

- Write Your Accounts Receivable Resume

As an accounts receivable specialist, you play a crucial role in managing a company’s finances. Your expertise lies in handling invoices, tracking payments, and ensuring timely collections.

You excel in analyzing financial data, identifying discrepancies, and resolving payment issues. Crafting a resume that showcases this efficiency isn’t easy, but we’re here to guide you through it.

Just as you’re the master of the financial domain, we know all about resume writing . With our accounts receivable resume examples and handy resume tips , you’ll have companies lining up to interview you!

or download as PDF

Why this resume works

- Apart from the relevant skills, include measurable accomplishments such as reducing probabilities of bad debts, minimizing costs, and maximizing profit margins to make your accounts receivable resume stand taller than your competition.

Accounts Receivable Manager Resume

- Don’t use generic points with zero metrics. For each bullet point you create, refer to and add the amount of money or time it saved for a previous company. You can take inspiration from Charlotte and see how they make mention of “reducing transaction costs by 9,673” via cost-benefit analysis.

Accounts Receivable Supervisor Resume

- Such courses usually expose various forms of accounts to students and prepare them to deal with them in real life. You can also back such qualifications in your account receivable supervisor resume with in-demand skills like Stripe to show your versatility.

Accounts Receivable Specialist Resume

- Consequently, your accounts receivable specialist resume must show strong competencies in bookkeeping, account reconciliation, auditing, and the ability to leverage technology to manage core business functions.

Accounts Receivable Analyst Resume

- To add icing to your accounts receivable analyst resume, highlight quantifiable metrics in cutting costs, automating processes, reducing bad debts, and using tech solutions to support core business operations.

Related resume examples

- Financial Analyst

- Bank Teller

Adapt Your Accounts Receivable Resume to Match the Job Description

One golden rule of resume writing is to include as many relevant skills as you can, which means the ones in the job listing. For accounts receivable analysts, this means highlighting technical expertise relevant to the position, including proficiency in financial software, accounting tools, and data analysis.

Mention your in-depth knowledge of financial regulations, invoicing processes, and payment tracking systems. If the job description asks for specific software like QuickBooks, make sure you put it right near the top of your list.

Though the job likely also calls for soft skills like communication, negotiation, and problem-solving, it’s better to demonstrate those in the work experience section than list them here—they’ll hold more meaning when backed up with examples.

Need some inspiration?

15 popular accounts receivable skills

- QuickBooks Online

- Data Analysis

- Microsoft Excel

- Sage Intacct

- Debt Reconciliation

- Credit Analysis

- Netsuite ERP

- Financial Reporting

- Adobe Acrobat

- Coupa Invoice

Your accounts receivable work experience bullet points

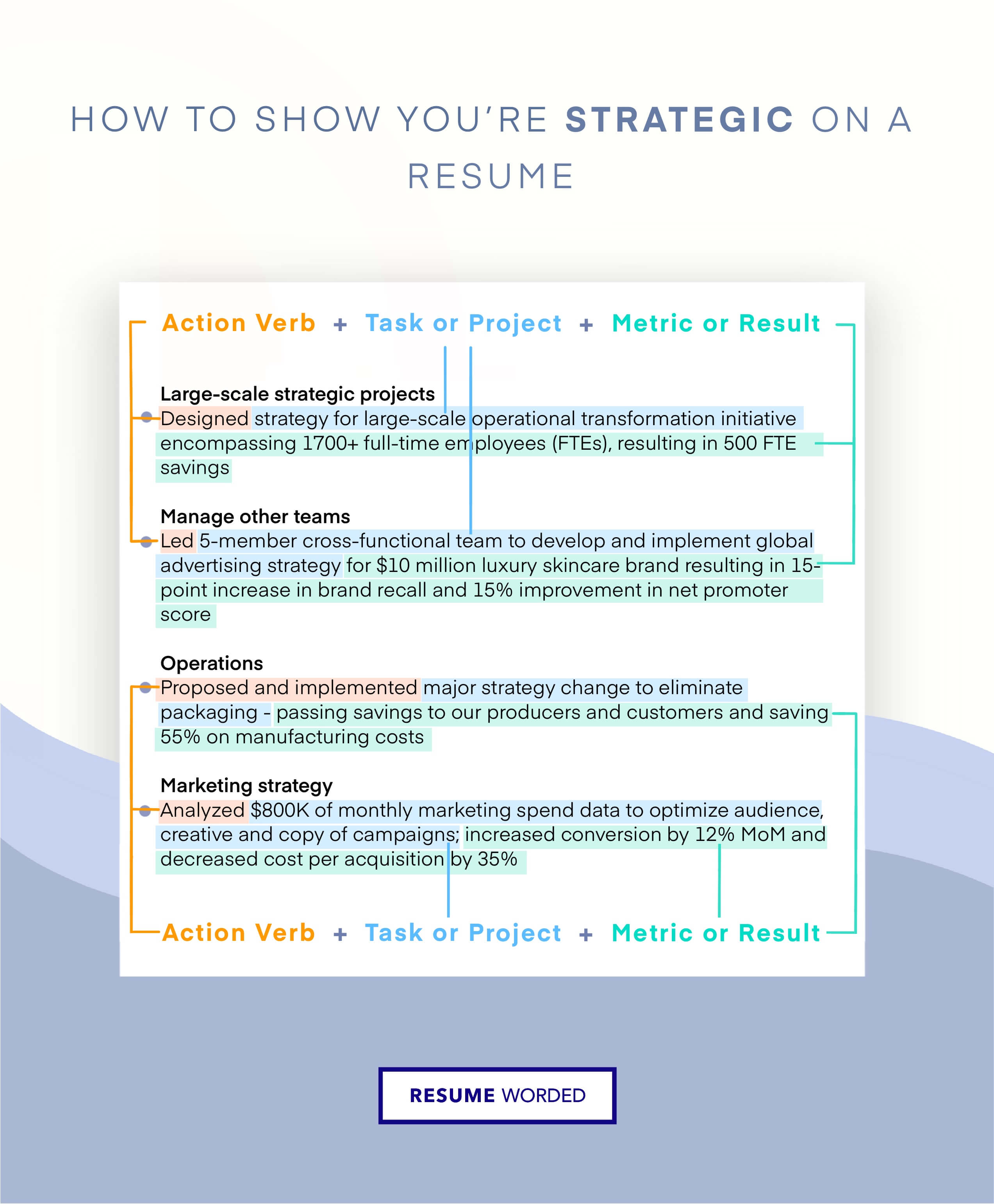

The best work experience sections go beyond naming routine tasks, so focus on showcasing significant achievements that have made a tangible impact on financial operations. The accomplishments you choose to highlight should be striking and impressive, covering both areas the job listing mentions and those you’re personally proud of.

For instance, you could talk about your effective streamlining of invoicing processes, reduction of outstanding receivables, or implementation of efficient collection strategies that enhanced cash flow.

Quantifying your achievements with specific metrics is the icing on the cake. What you can do is, as an example, include the percentage when you mention an increase in efficiency, and throw in the amount of money you process each week.

- Show off your talent for efficiency by mentioning how you reduced DSO averages.

- Highlight the effectiveness of your collections process by showing improved CEI and increased optimization.

- Mention the percentage of overdue receivables you’ve successfully brought back to current status, showing your ability to follow up with clients and resolve payment issues.

- Showcase the percentage of uncollectible debts against total outstanding receivables, demonstrating your success in minimizing bad debt through strong credit risk assessment and debt management skills.

See what we mean?

- Implemented Oracle NetSuite backed payment and invoicing system, reducing billing errors by 41% and improving overall accuracy

- Maintained a collection efficiency rate of 93%, resulting in a substantial reduction in overdue accounts

- Reduced average DSO by 33.3% by streamlining QuickBooks invoicing procedures and implementing a proactive collection approach

- Decreased bad debt ratio by 14% through rigorous credit checks, evaluating customer creditworthiness, and negotiating favorable payment terms

9 active verbs to start your accounts receivable work experience bullet points

- Streamlined

- Spearheaded

- Implemented

- Collaborated

3 Tips for Writing an Outstanding Entry-Level Accounts Receivable Resume

- Even if your previous roles were not directly in the finance or accounting field, highlight transferable skills that are relevant to accounts receivable. Skills such as attention to detail, data analysis, customer service, and communication are valuable in this role, and you might have picked them up in other roles, too.

- You can learn, practice, and use financial knowledge anywhere, so don’t be afraid to mention experiences that aren’t strictly work-related. Maybe you’ve engaged in volunteer work like helping your aunt sort out her finances, or you assisted with bookkeeping tasks for a campus organization. Use that background to your advantage in your resume.

- Emphasize your eagerness to learn and grow within the accounts receivable field. Mention any ongoing education, courses, or workshops you’re attending to enhance your financial knowledge to showcase your enthusiasm and proactive attitude.

3 Tips for Writing an Accounts Receivable Resume as a Seasoned Pro

- If you have some experience as an accounts receivable specialist, showcase your specific areas of expertise, such as credit analysis, collections management, or dispute resolution. Make sure to cover any areas the job post mentions explicitly.

- Account receivable specialists interact with clients a lot, so it’s important to include instances where you’ve provided excellent customer service. This could include resolving billing inquiries promptly or establishing positive relationships.

- Accounts receivable specialists often encounter complex payment issues and disputes, so problem-solving skills are essential to note in your resume. Also, when writing an effective cover letter , describe how you resolved challenging situations, negotiated payment arrangements, or implemented process improvements to prevent recurring payment delays.

Any certifications relevant to finance and accounting can help you elevate your resume. This includes certs like the CARS, CCCP, or NACM, as well as credentials related to financial analysis, such as the CFA.

To satisfy ATS, include plenty of relevant keywords from the job description in your resume, particularly skills pertinent to accounting and accounts receivable. Use standard fonts and formats to ensure ATS compatibility and avoid using images or graphics that might not be recognized by the system, and you’re good to go!

Focus on transferable skills that are relevant to both careers and emphasize your past and ongoing education. For instance, if you’re transitioning from sales to accounts receivable, you could highlight your strong communication and negotiation skills, as those can really come in handy in your new job!

7 Accounts Receivable Resume Examples to Land You a Role in 2023

Accounts receivable professionals are experts in managing financial transactions and ensuring accurate records. As an accounts receivable professional, your resume should be just like a financial statement. It should be accurate, organized, and demonstrate your financial acumen. In this guide, we'll review X accounts receivable resume examples to help you get the job you want.

Resume Examples

Resume guidance.

- High Level Resume Tips

- Must-Have Information

- Why Resume Headlines & Titles are Important

- Writing an Exceptional Resume Summary

- How to Impress with Your Work Experience

- Top Skills & Keywords

- Go Above & Beyond with a Cover Letter

- Resume FAQs

- Related Resumes

Common Responsibilities Listed on Accounts Receivable Resumes:

- Process customer payments and apply them to customer accounts

- Reconcile customer accounts to ensure accuracy

- Resolve customer billing disputes

- Generate and send invoices to customers

- Follow up with customers regarding overdue payments

- Monitor customer accounts for delinquent payments

- Prepare and submit monthly reports to management

- Maintain customer accounts in the accounting system

- Prepare and submit customer statements

- Respond to customer inquiries regarding billing and payment

- Assist with month-end closing activities

- Assist with other accounting tasks as needed

You can use the examples above as a starting point to help you brainstorm tasks, accomplishments for your work experience section.

Accounts Receivable Resume Example:

- Reduced the average time to resolve customer billing disputes by 50% through implementing a new process that streamlined communication between the Accounts Receivable team and customers.

- Improved customer satisfaction scores by 15% by proactively following up with customers regarding overdue payments and providing personalized payment plans to meet their needs.

- Generated monthly reports that accurately tracked delinquent payments, resulting in a 10% reduction in outstanding balances and a 5% increase in on-time payments.

- Implemented a new invoicing system that reduced errors by 25% and improved the accuracy of customer accounts, resulting in a 10% increase in revenue.

- Collaborated with the Sales team to develop a new customer onboarding process that reduced the time to set up new accounts by 30% and improved customer retention rates by 20%.

- Managed the month-end closing process, ensuring all accounts were reconciled and accurate, resulting in a 95% accuracy rate and timely submission of financial reports to management.

- Developed and implemented a new process for preparing and submitting customer statements, resulting in a 20% reduction in errors and a 15% increase in on-time payments.

- Improved the efficiency of the Accounts Receivable team by 25% through cross-training team members on different tasks and implementing a new task prioritization system.

- Resolved a backlog of overdue payments, resulting in a 50% reduction in outstanding balances and a 10% increase in on-time payments.

- Accounts receivable management

- Billing dispute resolution

- Customer service and communication

- Financial reporting and analysis

- Invoicing and account accuracy

- Process improvement and implementation

- Cross-functional collaboration

- Customer onboarding and retention

- Month-end closing and reconciliation

- Time management and prioritization

- Team training and development

- Attention to detail and error reduction

- Payment plan negotiation

- Collections and debt recovery

- Knowledge of accounting software and systems

Accounts Receivable Analyst Resume Example:

- Implemented a new credit analysis process, resulting in a 20% reduction in delinquent accounts and a 10% increase in on-time payments.

- Collaborated with sales team to establish credit limits for new customers, leading to a 15% increase in sales revenue and a 5% decrease in bad debt write-offs.

- Developed and implemented a customer dispute resolution system, reducing the average resolution time by 30% and improving customer satisfaction scores by 15%.

- Streamlined the invoicing process by implementing automation tools, resulting in a 25% reduction in processing time and a 10% decrease in billing errors.

- Conducted regular audits of customer accounts, identifying and recovering $100,000 in outstanding payments and reducing the company's accounts receivable aging by 20%.

- Collaborated with the finance team to implement a cash forecasting model, improving accuracy by 15% and enabling better cash flow management.

- Developed and implemented a comprehensive collections strategy, reducing the company's average days sales outstanding (DSO) by 10% and improving cash flow by $500,000.

- Identified and resolved a billing system issue, resulting in a 30% reduction in billing discrepancies and improving customer satisfaction scores by 20%.

- Collaborated with cross-functional teams to implement a new accounts receivable software, improving efficiency by 20% and reducing manual errors by 15%.

- Proficiency in accounts receivable software

- Strong analytical skills

- Expertise in credit analysis

- Knowledge of cash forecasting models

- Proficiency in automation tools for invoicing

- Excellent collaboration and teamwork skills

- Ability to develop and implement collections strategies

- Skills in dispute resolution

- Experience in conducting audits of customer accounts

- Ability to identify and resolve billing system issues

- Proficiency in implementing new processes and systems

- Strong communication skills

- Ability to manage and improve cash flow

- Expertise in reducing accounts receivable aging

- Strong problem-solving skills

- Ability to establish credit limits

- Proficiency in reducing billing errors and discrepancies

- Strong customer service skills

- Knowledge of sales and finance

- Ability to work with cross-functional teams.

Accounts Receivable Clerk Resume Example:

- Implemented a new invoicing system that reduced processing time by 50% and improved accuracy by 20%.

- Managed a portfolio of 100+ customer accounts, resulting in a 95% collection rate and a 10% decrease in outstanding balances.

- Collaborated with the sales team to resolve customer disputes, resulting in a 30% decrease in payment delays and improved customer satisfaction.

- Developed and implemented a proactive collections strategy, resulting in a 25% reduction in overdue accounts and a 15% increase in on-time payments.

- Streamlined the accounts receivable process by automating payment reminders, leading to a 40% decrease in manual follow-ups and improved efficiency.

- Conducted regular credit reviews and implemented credit limits, reducing bad debt write-offs by 20% and minimizing financial risk.

- Implemented a new cash application system, reducing processing time by 50% and improving accuracy by 20%.

- Developed and maintained relationships with key customers, resulting in a 15% increase in repeat business and improved customer loyalty.

- Generated monthly aging reports and conducted thorough analysis, identifying and resolving payment discrepancies, resulting in a 10% decrease in outstanding balances and improved cash flow.

- Advanced knowledge of invoicing and billing procedures

- Excellent numerical and data entry skills

- Ability to manage and analyze large data sets

- Proficiency in credit control procedures

- Strong communication and negotiation skills

- Ability to develop and implement effective collection strategies

- Proficiency in generating and interpreting financial reports

- Ability to manage customer accounts and resolve disputes

- Knowledge of cash application systems

- Ability to streamline and automate financial processes

- Strong organizational and multitasking skills

- Ability to work collaboratively with sales and finance teams

- Proficiency in Microsoft Office Suite, particularly Excel

- Knowledge of financial risk management

- Excellent customer service skills

- Attention to detail and high level of accuracy

- Ability to maintain confidentiality and handle sensitive information

- Knowledge of relevant financial regulations and standards.

Accounts Receivable Manager Resume Example:

- Implemented a new accounts receivable system, resulting in a 30% reduction in payment processing time and improving overall efficiency.

- Developed and implemented a credit control strategy, reducing bad debt by 20% and improving cash flow by 15%.

- Led a team of 5 accounts receivable specialists, providing training and guidance that resulted in a 25% increase in team productivity.

- Managed the implementation of automated invoicing software, reducing invoice processing time by 40% and improving accuracy by 25%.

- Negotiated payment plans with key clients, resulting in a 15% increase in on-time payments and a 10% reduction in overdue accounts.

- Collaborated with the finance department to streamline the accounts receivable process, reducing the average collection period by 20 days.

- Developed and implemented a customer credit assessment process, resulting in a 10% reduction in credit risk and improved customer payment behavior.

- Analyzed customer accounts and payment trends to identify potential issues, leading to a 15% decrease in payment disputes and improved customer satisfaction.

- Implemented a proactive collections strategy, resulting in a 20% reduction in overdue accounts and a 10% increase in overall cash flow.

- Strong leadership and team management skills

- Excellent negotiation skills

- Proficiency in automated invoicing software

- Ability to develop and implement credit control strategies

- Strong analytical skills for assessing credit risk

- Ability to streamline and improve financial processes

- Expertise in developing customer credit assessment processes

- Ability to identify and resolve payment disputes

- Proactive collections strategy development

- Strong communication and collaboration skills

- Ability to analyze customer accounts and payment trends

- Proficiency in financial reporting and forecasting

- Knowledge of accounting principles and regulations

- Ability to manage and reduce overdue accounts

- Proficiency in Microsoft Office Suite (especially Excel)

- Ability to improve cash flow and reduce bad debt

- Attention to detail and high level of accuracy.

Accounts Receivable Specialist Resume Example:

- Implemented a streamlined payment processing system, resulting in a 25% reduction in payment errors and a 10% increase in overall customer satisfaction.

- Collaborated with the collections team to develop and implement a proactive collections strategy, reducing the average days sales outstanding (DSO) by 15% and improving cash flow.

- Analyzed customer payment trends and identified opportunities for process improvements, leading to a 20% decrease in late payments and a 5% increase in on-time payments.

- Managed the implementation of a new invoicing system, resulting in a 30% reduction in invoice processing time and a 20% increase in invoice accuracy.

- Collaborated with cross-functional teams to resolve complex customer account discrepancies, resulting in a 15% decrease in unresolved issues and improved customer satisfaction.

- Developed and implemented a credit risk assessment framework, reducing bad debt write-offs by 10% and improving the company's credit risk profile.

- Developed and implemented a customer credit application process, resulting in a 20% reduction in credit approval time and improved credit risk management.

- Collaborated with sales and customer service teams to resolve customer inquiries and complaints, resulting in a 15% increase in customer retention and satisfaction.

- Generated and analyzed monthly reports on accounts receivable aging, identifying trends and areas of improvement, leading to a 10% decrease in overdue accounts and improved cash flow.

- Excellent communication and collaboration skills

- Knowledge of credit risk assessment

- Ability to implement process improvements

- Experience in managing payment processing systems

- Proficiency in invoicing systems

- Ability to resolve complex customer account discrepancies

- Experience in developing and implementing collections strategies

- Ability to analyze and interpret financial data

- Knowledge of accounts receivable aging reports

- Experience in customer credit application processes

- Ability to handle customer inquiries and complaints effectively

- Proficiency in Microsoft Office Suite, especially Excel

- Knowledge of accounting principles and practices

- Ability to work in a cross-functional team environment

- Strong attention to detail and accuracy

- Ability to manage and prioritize tasks

- Excellent problem-solving skills.

Accounts Receivable Supervisor Resume Example:

- Implemented a new accounts receivable process that reduced customer payment processing time by 20% and improved cash flow by 15%.

- Developed and implemented a customer credit limit monitoring system, resulting in a 10% reduction in bad debt write-offs.

- Established and maintained strong relationships with key customers, leading to a 25% increase in on-time payments and a 10% decrease in overdue accounts.

- Successfully led a team of 10 accounts receivable specialists, achieving a 20% improvement in team productivity and a 15% reduction in errors.

- Implemented automated reporting tools, resulting in a 30% reduction in time spent on monthly aging reports and improved accuracy by 20%.

- Developed and implemented a customer dispute resolution process, reducing the average resolution time by 50% and improving customer satisfaction scores by 15%.

- Developed and implemented a streamlined accounts receivable process, reducing the average collection time by 25% and improving cash flow by 20%.

- Implemented a customer segmentation strategy, resulting in a 15% increase in collections from high-value customers and a 10% decrease in collections from high-risk customers.

- Developed and delivered training programs for accounts receivable team members, resulting in a 20% improvement in overall team performance and a 10% reduction in training costs.

- Proficiency in accounts receivable processes

- Expertise in implementing automated reporting tools

- Ability to develop and implement customer credit limit monitoring systems

- Excellent customer relationship management skills

- Proficiency in developing and implementing dispute resolution processes

- Ability to streamline accounts receivable processes

- Expertise in customer segmentation strategies

- Strong training and development skills

- Proficiency in financial software and applications

- Excellent analytical and problem-solving skills

- Knowledge of financial regulations and standards

- Ability to work under pressure and meet deadlines

- Excellent organizational and multitasking skills

- Strong decision-making skills.

Senior Accounts Receivable Resume Example:

- Implemented a streamlined collections process, resulting in a 25% reduction in overdue accounts and a 10% increase in on-time payments.

- Collaborated with cross-functional teams to develop and implement a new invoicing system, reducing invoice errors by 15% and improving overall accuracy.

- Analyzed customer payment trends and identified opportunities for process improvement, leading to a 20% decrease in average days sales outstanding (DSO) and improved cash flow.

- Managed a portfolio of key accounts, resulting in a 95% customer retention rate and a 10% increase in revenue from existing clients.

- Developed and implemented a credit risk assessment framework, reducing bad debt write-offs by 20% and improving the overall creditworthiness of the customer base.

- Collaborated with sales and customer service teams to resolve billing disputes and improve customer satisfaction, resulting in a 15% increase in customer loyalty and repeat business.

- Implemented automated payment processing systems, reducing manual errors by 30% and increasing efficiency in the accounts receivable department.

- Developed and implemented a collections strategy, resulting in a 40% reduction in outstanding balances and a 20% increase in cash flow.

- Analyzed and optimized credit terms and payment terms, resulting in a 10% decrease in average DSO and improved working capital management.

- Advanced knowledge of accounts receivable processes and procedures

- Proficiency in automated payment processing systems

- Strong analytical skills for credit risk assessment

- Expertise in collections strategy development and implementation

- Ability to analyze and optimize credit and payment terms

- Proficiency in developing and implementing invoicing systems

- Strong collaboration and team coordination skills

- Excellent customer service and dispute resolution skills

- Ability to manage and retain key accounts

- Proficiency in analyzing customer payment trends

- Strong financial reporting and forecasting skills

- Proficiency in using accounting software and tools

- Excellent communication and negotiation skills

- Strong knowledge of financial regulations and standards

- Excellent problem-solving and decision-making skills

- Strong organizational and time management skills

- Proficiency in data analysis and interpretation

- Ability to work under pressure and meet deadlines.

High Level Resume Tips for Accounts Receivables:

Must-have information for a accounts receivable resume:.

Here are the essential sections that should exist in an Accounts Receivable resume:

- Contact Information

- Resume Headline

- Resume Summary or Objective

- Work Experience & Achievements

- Skills & Competencies

Additionally, if you're eager to make an impression and gain an edge over other Accounts Receivable candidates, you may want to consider adding in these sections:

- Certifications/Training

Let's start with resume headlines.

Why Resume Headlines & Titles are Important for Accounts Receivables:

Accounts receivable resume headline examples:, strong headlines.

- Detail-oriented Accounts Receivables Specialist with 5+ years of experience in managing high-volume accounts and reducing DSO by 20%

- Proactive Accounts Receivables Manager with a proven track record of improving cash flow by implementing process improvements and negotiating payment plans with clients

- Strategic Accounts Receivables Analyst with expertise in data analysis and forecasting, resulting in a 15% reduction in bad debt write-offs

Why these are strong: These resume headlines are strong for Accounts Receivables professionals as they highlight key skills and accomplishments that are relevant to their roles. The first headline emphasizes the candidate's attention to detail, experience in managing high-volume accounts, and ability to reduce DSO. The second headline showcases the candidate's proactive approach, expertise in improving cash flow, and ability to negotiate payment plans with clients. Finally, the third headline highlights the candidate's strategic mindset, expertise in data analysis and forecasting, and ability to reduce bad debt write-offs. All of these factors are crucial for Accounts Receivables professionals and are highly valued by hiring managers.

Weak Headlines

- Accounts Receivable Specialist with Strong Communication Skills

- Experienced Accounts Receivable Clerk with Knowledge of Billing Systems

- Detail-Oriented Accounts Receivable Coordinator with Organizational Skills

Why these are weak: These headlines need improvement as they lack specificity and don't highlight any unique accomplishments or value that the candidates bring to the table. The first headline mentions strong communication skills, but doesn't provide any context or results. The second headline mentions knowledge of billing systems, but doesn't showcase any measurable achievements or certifications. The third headline mentions being detail-oriented and organized, but doesn't provide any examples of how these skills have been applied in previous roles.

Writing an Exceptional Accounts Receivable Resume Summary:

Resume summaries are crucial for Accounts Receivables professionals as they provide a concise yet powerful way to showcase their skills, experience, and unique value proposition. A well-crafted summary can immediately capture the attention of hiring managers, setting the tone for the rest of the resume and positioning the candidate as an ideal fit for the role.

For Accounts Receivables specifically, an effective resume summary is one that highlights their ability to manage and collect outstanding payments from customers, consistently.

Key points that Accounts Receivables should convey in a resume summary include:

Relevant Experience: Clearly mention the number of years of experience you have in Accounts Receivables, highlighting any notable achievements or career highlights. If you have experience with different types of industries that are particularly relevant to the job, mention that too.

Technical and Domain Expertise: Showcase your knowledge of accounting software (e.g., QuickBooks, Xero) and any industry-specific knowledge that would be beneficial to the role (e.g., healthcare, retail).

Attention to Detail: Emphasize your ability to maintain accurate records, reconcile accounts, and identify discrepancies in billing and payments.

Customer Service: Highlight your ability to communicate effectively with customers, resolve disputes, and maintain positive relationships.

Analytical and Problem-Solving Skills: Show that you can analyze data, identify trends, and make informed decisions to optimize payment performance and reduce delinquency rates.

To nail the resume summary, use your best judgment to choose the right combination of these that align closest with the individual role you’re applying for. Remember, your resume summary will be one of the first things that a potential employer will see about you and your Accounts Receivables career.

Here are some key writing tips to help you make the most of it:

Tailor the Summary: Customize your summary for each job application, ensuring that it aligns with the specific requirements and expectations of the hiring company.

Be Concise: Keep your summary brief and to-the-point, ideally within 3-4 sentences. Avoid using buzzwords or jargon, and focus on concrete skills and accomplishments.

Use Metrics and Tangible Outcomes: Whenever possible, include quantitative data to back up your claims, such as reduction in delinquency rates, increase in on-time payments, or improvement in customer satisfaction.

Begin with a Strong Statement: Start your summary with a compelling statement that captures your unique value proposition as an Accounts Receivables professional, and then build on that foundation with your key attributes and experiences.

Proofread and Revise: Ensure your summary is free of grammatical errors and typos, and refine the language to make it as clear and impactful as possible.

Accounts Receivable Resume Summary Examples:

Strong summaries.

Detail-oriented Accounts Receivable Specialist with 5 years of experience in managing client accounts and ensuring timely payments. Skilled in analyzing financial data and resolving discrepancies, resulting in a 20% reduction in outstanding balances. Adept at building strong relationships with clients and collaborating with cross-functional teams to improve overall financial performance.

Results-driven Accounts Receivable Manager with 8 years of experience overseeing the entire AR process, from invoicing to collections. Proven track record of reducing DSO by 15 days and increasing cash flow by 25%. Skilled in implementing process improvements and leveraging technology to streamline AR operations and improve efficiency.

Strategic Accounts Receivable Analyst with 3 years of experience in analyzing AR data and developing actionable insights to improve financial performance. Proficient in Excel and data visualization tools, able to create dashboards and reports that provide valuable insights to senior management. Adept at collaborating with cross-functional teams to implement process improvements and drive results.

Why these are strong: These resume summaries are strong for Accounts Receivables professionals as they highlight the candidates' key skills, accomplishments, and industry-specific experience. The first summary emphasizes the candidate's attention to detail and ability to build strong client relationships, while also showcasing their success in reducing outstanding balances. The second summary showcases the candidate's results-driven approach and quantifiable impact on reducing DSO and increasing cash flow. Lastly, the third summary demonstrates the candidate's strategic thinking and proficiency in data analysis, making them highly appealing to potential employers. Overall, these summaries effectively communicate the candidates' value proposition and demonstrate their ability to drive results in the Accounts Receivables field.

Weak Summaries

- Accounts Receivable professional with experience in managing customer accounts and processing payments, seeking a new opportunity to contribute to a company's financial success.

- Experienced Accounts Receivable Specialist with knowledge of billing and collections processes, looking to leverage my skills to improve cash flow and reduce outstanding balances for a growing organization.

- Accounts Receivable Clerk with a focus on accuracy and attention to detail, committed to ensuring timely and efficient processing of invoices and payments for a variety of clients.

Why these are weak: These resume summaries need improvement for Accounts Receivables as they lack specific achievements or quantifiable results that showcase the candidate's value to potential employers. The first summary provides only a general overview of the candidate's experience, without mentioning any specific accomplishments or skills that set them apart from other candidates. The second summary mentions knowledge of billing and collections processes, but doesn't provide any examples of how the candidate has successfully improved cash flow or reduced outstanding balances in their previous roles. The third summary mentions a focus on accuracy and attention to detail, but doesn't provide any examples of how the candidate has successfully processed invoices and payments in a timely and efficient manner, which would make their profile more compelling to potential employers.

Resume Objective Examples for Accounts Receivables:

Strong objectives.

- Detail-oriented and results-driven Accounts Receivable professional seeking an entry-level position to utilize my strong organizational skills and knowledge of accounting principles to ensure timely and accurate collection of payments and contribute to the financial success of the company.

- Recent graduate with a degree in Accounting and experience in Accounts Receivable, seeking a challenging position to apply my knowledge of financial analysis, credit management, and customer service to optimize cash flow and reduce delinquency rates for a growing organization.

- Highly motivated and customer-focused Accounts Receivable specialist with a proven track record of success in collections and dispute resolution, seeking a position to leverage my communication skills, attention to detail, and ability to work independently to improve the company's cash flow and customer relationships.

Why these are strong: These resume objectives are strong for up and coming Accounts Receivable professionals because they showcase the candidates' relevant skills, education, and experience, while also highlighting their eagerness to learn and contribute to the success of the organization. The first objective emphasizes the candidate's organizational skills and knowledge of accounting principles, which are important attributes for an Accounts Receivable professional. The second objective showcases the candidate's educational background and experience in Accounts Receivable, demonstrating a strong foundation for success in the role. Lastly, the third objective highlights the candidate's success in collections and dispute resolution, making them a promising fit for an Accounts Receivable position where they can further develop their skills and contribute to the company's financial success.

Weak Objectives

- Seeking an Accounts Receivable position where I can utilize my skills and gain experience in the field.

- Recent graduate with a degree in accounting seeking an entry-level Accounts Receivable position.

- Looking for an Accounts Receivable role in a reputable company to enhance my career growth.

Why these are weak: These objective examples lack specificity and fail to highlight the candidate's unique skills or value they can bring to the role. The first objective is too generic and doesn't provide any information about the candidate's background or relevant experience. The second objective only mentions the candidate's degree and doesn't elaborate on any relevant coursework or skills they possess. The third objective is too vague and doesn't provide any information on the candidate's specific career goals or how they can contribute to the company.

Use the Resume Summary Generator

Speed up your resume creation process with the ai resume builder . generate tailored resume summaries in seconds., how to impress with your accounts receivable work experience:, best practices for your work experience section:.

- Focus on specific achievements and metrics: Use numbers and percentages to demonstrate how you improved collections, reduced delinquencies, or increased cash flow.

- Describe your role in the collections process: Outline the steps you took to collect outstanding debts, including any negotiations or settlements you reached.

- Highlight your communication skills: Discuss how you communicated with clients, customers, and internal teams to resolve payment issues and improve collections.

- Demonstrate your knowledge of accounting principles and software: Show how you used accounting software to manage accounts receivable and reconcile payments.

- Call out any awards, recognition, or unique accomplishments associated with your collections work.

- Mention any customer feedback or testimonials relating to your collections work.

- Use industry-specific language: Make sure to use terms and acronyms that are common in the accounts receivable field.

Example Work Experiences for Accounts Receivables:

Strong experiences.

Successfully managed a portfolio of over 500 customer accounts, reducing the average days sales outstanding (DSO) by 20% through effective collections strategies and dispute resolution.

Developed and implemented a new billing system, resulting in a 30% reduction in billing errors and a 25% increase in invoice accuracy.

Collaborated with sales and customer service teams to improve the order-to-cash process, resulting in a 15% increase in on-time payments and a 10% reduction in customer complaints.

Led a team of 5 accounts receivable specialists, providing training and coaching to improve team performance and reduce errors by 25%.

Implemented credit risk assessment procedures, resulting in a 20% reduction in bad debt write-offs and a 15% increase in credit approvals.

Conducted regular analysis of accounts receivable aging reports and identified trends and issues, resulting in a 10% improvement in cash flow and a 5% reduction in past due accounts.

Why these are strong:

- These work experiences are strong because they showcase the candidate's ability to effectively manage accounts receivable processes and teams, as well as their skills in improving collections, billing, and credit risk assessment. The use of specific metrics and results demonstrates their impact on the organization's financial health and efficiency.

Weak Experiences

Processed customer payments and reconciled accounts on a daily basis.

Communicated with customers via phone and email to resolve payment discrepancies and issues.

Assisted in generating monthly reports for management review.

Managed a portfolio of accounts and monitored aging reports to ensure timely collections.

Conducted credit checks and reviewed credit limits for new and existing customers.

Collaborated with sales and customer service teams to resolve billing and payment issues.

Why these are weak:

- These work experiences are weak because they lack specificity, quantifiable results, and strong action verbs. They provide generic descriptions of tasks performed without showcasing the impact of the individual's work or the benefits brought to the company. To improve these bullet points, the candidate should focus on incorporating metrics to highlight their achievements, using more powerful action verbs, and providing clear context that demonstrates their leadership qualities and direct contributions to successful outcomes.

Top Skills & Keywords for Accounts Receivable Resumes:

Top hard & soft skills for accounts receivables, hard skills.

- Invoicing and Billing

- Payment Processing

- Account Reconciliation

- Collections Management

- Financial Reporting

- Credit Analysis and Risk Assessment

- Cash Application

- Customer Service

- Excel and Spreadsheet Management

- Accounting Software (e.g. QuickBooks, SAP)

- Audit and Compliance

- Dispute Resolution

Soft Skills

- Attention to Detail

- Organization and Time Management

- Communication and Interpersonal Skills

- Problem Solving and Analytical Thinking

- Adaptability and Flexibility

- Customer Service and Relationship Building

- Conflict Resolution and Negotiation

- Teamwork and Collaboration

- Multitasking and Prioritization

- Accuracy and Data Entry

- Empathy and Understanding

- Accountability and Responsibility

Go Above & Beyond with a Accounts Receivable Cover Letter

Accounts receivable cover letter example: (based on resume).

As an Accounts Receivable professional, you understand the importance of maintaining strong relationships with clients and ensuring timely payments. Similarly, pairing your resume with a well-crafted cover letter can significantly increase your chances of landing an interview and showcase your dedication to the role. A cover letter is an extension of your resume, an opportunity to highlight your relevant experience and demonstrate your enthusiasm for the position. Contrary to popular belief, creating a compelling cover letter doesn't have to be a daunting task, and the benefits are well worth the effort.

Here are some compelling reasons for submitting a cover letter as an Accounts Receivable professional:

- Personalize your application and showcase your genuine interest in the company and role

- Highlight your experience in managing accounts and collections, and how it aligns with the specific job requirements

- Communicate your understanding of the company's needs and how you plan to contribute to their success

- Share success stories and achievements in improving collections or reducing outstanding balances

- Demonstrate your writing and communication skills, which are essential for effective communication with clients and internal stakeholders

- Differentiate yourself from other applicants who might have opted not to submit a cover letter

By submitting a cover letter along with your resume, you can showcase your unique value proposition and demonstrate your commitment to the role. Take the time to craft a personalized cover letter that highlights your relevant experience and passion for the position, and you'll be one step closer to landing your dream job in Accounts Receivables.

Resume FAQs for Accounts Receivables:

How long should i make my accounts receivable resume.

An ideal Accounts Receivable resume should be one to two pages in length. This is because Accounts Receivables is a specialized field that requires specific skills and experience, and it is important to highlight these in a concise and clear manner. A longer resume may include irrelevant information and make it difficult for the hiring manager to quickly identify the candidate's qualifications. Additionally, a shorter resume can demonstrate the candidate's ability to prioritize and communicate effectively. It is important to focus on relevant experience, skills, and achievements, and to tailor the resume to the specific job description and company.

What is the best way to format a Accounts Receivable resume?

The best way to format an Accounts Receivable resume is to start with a clear and concise summary statement that highlights your experience and skills in the field. Use bullet points to list your relevant experience, including any software or systems you are proficient in. Be sure to include any certifications or training you have received in Accounts Receivable. In terms of formatting, use a clean and professional font, such as Arial or Times New Roman, and keep the layout simple and easy to read. Use bold or italicized text sparingly to draw attention to important information, such as job titles or achievements. It is also important to tailor your resume to the specific job you are applying for. Review the job description and highlight any skills or experience that match the requirements of the position. Use keywords from the job description throughout your resume to help it get past any automated screening systems. Overall, a well-formatted Accounts Receivable

Which Accounts Receivable skills are most important to highlight in a resume?

Some important Accounts Receivable skills to highlight in a resume include: 1. Attention to detail: Accuracy is crucial in Accounts Receivable, so it's important to highlight your ability to pay close attention to details and catch errors. 2. Communication skills: Accounts Receivable professionals need to communicate effectively with customers, colleagues, and management. Highlight your ability to communicate clearly and professionally, both verbally and in writing. 3. Organization: Managing invoices, payments, and customer information requires strong organizational skills. Highlight your ability to prioritize tasks, manage deadlines, and keep accurate records. 4. Analytical skills: Accounts Receivable professionals need to analyze financial data, identify trends, and make informed decisions. Highlight your ability to analyze data and use it to make strategic decisions. 5. Customer service: Accounts Receivable professionals often interact with customers who have questions or concerns about their accounts. Highlight your ability to provide excellent customer service and resolve issues in a timely and professional manner. Overall, it's important to emphasize your ability to manage financial data accurately, communicate effectively, and provide excellent customer service in your Accounts Receivable resume.

How should you write a resume if you have no experience as a Accounts Receivable?

If you have no experience as an Accounts Receivable, you can still write a strong resume by highlighting your transferable skills and relevant education. Here are some tips to help you get started: 1. Start with a strong objective statement: Your objective statement should clearly state your career goals and how you plan to achieve them. This will help the employer understand your motivation and interest in the field. 2. Highlight your education: If you have a degree in accounting, finance, or a related field, make sure to highlight it prominently on your resume. This will show the employer that you have a solid foundation in the principles of accounting. 3. Emphasize your transferable skills: Even if you don't have direct experience in Accounts Receivable, you may have transferable skills that are relevant to the position. For example, if you have experience in customer service, data entry, or bookkeeping, make sure to highlight these skills on your resume. 4. Include any relevant internships or volunteer work

Compare Your Accounts Receivable Resume to a Job Description:

- Identify opportunities to further tailor your resume to the Accounts Receivable job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Related Resumes for Accounts Receivables:

Accounts receivable resume example, more resume guidance:.

- Job Descriptions

- Accounting Job Descriptions

Accounts Receivable Job Description

Accounts receivable professionals generate revenue for companies by ensuring that clients are properly billed for goods or services. They work with other departments to ensure that the correct amounts are collected in a timely manner, verify and record transactions, resolve account discrepancies, and perform other tasks to secure client payments.

Try Betterteam

Post your jobs to 100+ job boards

- Reach over 250 million candidates.

- Get candidates in hours, not days.

Accounts Receivable Job Description Template

We are looking for an analytical accounts receivable professional to assist our accounting department as it receives, processes, and collects on goods sold or services rendered. In this role, you will be required to review account information, correct discrepancies, and ensure that accounts are properly billed and that payments are collected.

To succeed as an accounts receivable professional, you should be a skilled and thorough researcher with excellent communication and record-keeping skills. You should be detail-oriented, organized, and self-motivated with strong math and computer skills.

Accounts Receivable Responsibilities:

- Processing, verifying, and posting receipts for goods sold or services rendered.

- Researching and resolving account discrepancies.

- Processing and recording transactions.

- Maintaining records regarding payments and account statuses.

- Obtaining information from other departments to ensure records are accurate and complete and that accounts receivable ledgers and journals are up-to-date.

- Working with the collections department to review accounts, client payments, credit history, and develop new or better repayment terms.

- Performing administrative and clerical tasks, such as data entry, preparing invoices, sending bill reminders, filing paperwork, and contacting clients to discuss their accounts.

- Generating reports and statements for internal use.

- Engaging in ongoing educational opportunities to update job knowledge.

Accounts Receivable Requirements:

- Bachelor’s degree in accounting, finance, or related field.

- At least 3 years experience in a similar role.

- Strong math, typing, and computer skills, especially with bookkeeping software.

- Excellent communication, research, problem-solving, and time management skills.

- High level of accuracy, efficiency, and accountability.

- Attention to detail.

- Ability to build relationships with clients and internal departments.

Related Articles:

Accounts receivable interview questions, accounting specialist job description, accounting clerk job description, accounting specialist interview questions, accounting clerk interview questions.

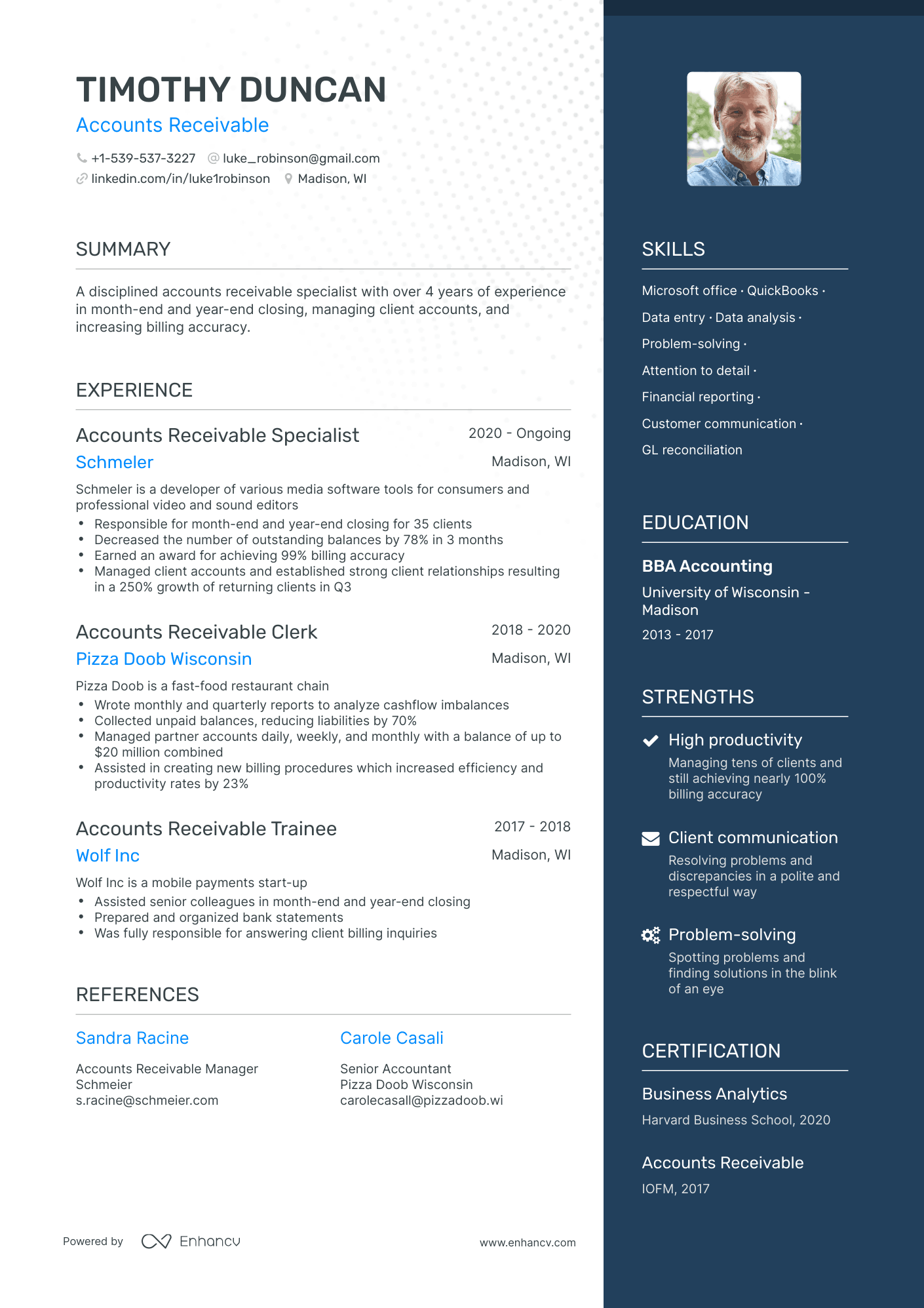

- • Responsible for month-end and year-end closing for 35 clients

- • Decreased the number of outstanding balances by 78% in 3 months

- • Earned an award for achieving 99% billing accuracy

- • Managed client accounts and established strong client relationships resulting in a 250% growth of returning clients in Q3

- • Wrote monthly and quarterly reports to analyze cashflow imbalances

- • Collected unpaid balances, reducing liabilities by 70%

- • Managed partner accounts daily, weekly, and monthly with a balance of up to $20 million combined

- • Assisted in creating new billing procedures which increased efficiency and productivity rates by 23%

- • Assisted senior colleagues in month-end and year-end closing

- • Prepared and organized bank statements

- • Was fully responsible for answering client billing inquiries

5 Accounts Receivable Resume Examples & Guide for 2024

Customize this resume with ease using our seamless online resume builder.

All resume examples in this guide

Resume Guide

Choose the best format for your accounts receivable resume, add your contact information in the resume header, create a compelling accounts receivable resume summary, feature a stand-out accounts receivable experience section, list your education, list your relevant accounts receivable skills, include your accounts receivable certificates, use other relevant sections to put the cherry on top, create a matching cover letter for your accounts receivable resume, key takeaways.

You’re good with numbers and know your way around a spreadsheet, but do you know how to market yourself to a potential employer?

It’s difficult to write a compelling resume which captures an employer’s attention. We’re here to help by giving you everything that you need to write a detailed resume which showcases your experience and skills. In this article, you’ll find a step-by-step guide to crafting each section of your resume.

At Enhancv, we are dedicated to crafting better resumes for our clients so that they can land their dream job. Recently, we did a study and compared our resumes to those formatted in Microsoft office On a multitude of ATS software. We found our resumes performed much better and were much easier to scan for ATS software than simple Word documents.

One reason our resumes did much better was the attention to detail when formatting. Here are some other insights about formatting which you’ll find helpful:

- Length/columns: Whether you choose a double or single column resume doesn’t really matter. However, we found that resumes that are one page in length with two columns perform slightly better.

- Section headings: One important thing about section headings is that you need to have the correct information in it. For example, if you’re writing in the “Experience” section, you should only include experience in there.

- Colors and design: Including creative colors and tasteful graphics can help your resume to stand out more.

- Fonts: You don’t have to stick with his boring old Times new Roman or Arial font, and in fact all Google fonts are read just fine by ATS software.

- File Format: PDF s are significantly better for ATS software to scan than word documents.

You should use a reverse chronological format for your resume, as it allows you to list all of your most recent experiences first.

Another unique way to make your resume stand out is by formatting it in a hybrid resume format . This is great for those who are in a creative industry or those who are switching careers because you can showcase your skills right next to your experience.

Try to limit the amount of white space on your resume by using headings of different sizes to show a differentiation between each section.

Your resume header is an opportunity for you to share all of your up-to-date contact information . Make sure that all the information you provide is correct, and that it matches your cover letter.

Below, you can find a list of the most important things to include in your resume header :

- Your first and last name

- Your phone number

- Your email address

- Your location

- Relevant social media handles (optional)

Your resume summary is important because it is an elevator pitch, a succinct statement on why you think you are the best person to fill the position. It’s also a great place to include keywords which can be scanned by ATS software. Also, it is really your first chance to share a little bit about yourself with a recruiter, so a good resume summary can help you land an interview.

Here’s a list of the most important things to include on a resume summary:

- Your title and years of experience

- Your most relevant skills in your field

- Your top 1-2 professional achievements

Go through the job description and write down three or four key skills that you find there. Use those key skills as a jumping off point to write your resume summary

Your experience section is the keystone of your resume, and it is likely the first place a potential hiring manager will look to see if you’re qualified. That’s why it’s especially important to quantify your experience by using statistics and real-world data to show how you made an impact in your previous roles.

Here’s a checklist of things to include in your resume experience section:

- Reverse chronological order

- Company's name, location, and description

- Date of employment - stress that proper date formatting is important to ATS.

- Achievements and responsibilities

- Resume keywords gleaned from the job description

Three quantifiable achievements in the accounts receivable field

- Reduced outstanding accounts receivable

- Improved efficiency by implementing automated invoicing system

- Achieved a 97% collection rate

- • Reduced outstanding accounts receivable by 30%, leading to a profit increase of $30,000.

- • Improved efficiency by implementing an automated invoicing system,Which led to a 25% decrease in invoice processing time.

- • Achieved a 97% collection rate, while also cultivating strong relationships with customers and identifying potential payment issues in advance

Although your experience section may be considered the most important section on your resume, your education section is almost as important. In your education section give the ability to share not only where you studied, but also show your career progression and formation all the way back to the schools you attended.

Below, you can find a checklist of the most important things to include in your education section:

- Degree Name

- University, college, or other institution

- Location (optional)

- Years attended

- Dean’s list or other academic achievements

Almost as important as your education and experience, your skills section helps to showcase each one of your individual skills . Listing your hard and soft skills on your resume can actually be a way for ATS software to more easily scan your resume.

On your resume should include both hard skills , technical skills which are specific to each workplace, as well as soft skills , people skills. Both of which can help to differentiate yourself from other candidates.

Top 3 technical skills for an accounts receivable specialist

- Collections Management

- Financial Analysis

- Accounts Receivable Systems

Soft skills

Instead of just listing the soft skills that you have on your resume, you should back up what you say by sharing your experience and achievements.

Most popular 3 soft skills for accounts receivable

- Customer Satisfaction

- Attention to detail

When you include certificates on your resume, you help to show a hiring manager you are capable and able to handle the position that you’re applying for. This is especially important for those in the financial sector, as certain certificates can help to prove an aptitude to handle more advanced projects.

Here’s what you should include if you are adding a certificate on your resume:

- Certification name

- Name of issuer

- Year of obtainment

- Location (if applicable)

- Date of expiration (if applicable)

- Expected date of obtainment (if applicable)

Top 3 accounts receivable certificates for your resume

- Certified Credit and Collection Professional (CCCP)

- Certified Receivables Compliance Professional (CRCP)

- Certified Professional Receivables Manager (CPRM)

You may wish to include a “Day in my life/My time” To show more of the intricate inner workings of your schedule.For example, Marissa Mayer included a day in my life section on her resume. Although ATS software doesn’t scan for it, can actually help to position yourself better to a potential manager as it can show how you are a fit for the company’s culture.

Here are some other sections that you may wish to include in your resume:

- Membership of professional associations : Certain professional associations might actually give you an advantage when finding a job. Being a certified public accountant (CPA) might be just the bare minimum to be hired in a role for Accounts Receivable. Look for other professional certifications that might give you an edge.

- Conferences: Conferences are great to include on your resume, especially if you are a speaker at one.

- Language skills: It’s always good to list other languages that you’re proficient in. You never know if that skill will help you to get your foot in the door with me.

- Awards: Any awards that you’ve earned either in school or in your professional experience might be worthwhile to include on your resume.

A cover letter is your first opportunity to go deeper and share more about yourself with a potential hiring manager. Here are some things you should include in your because where letter:

- Contact information that corresponds with the resume’s.

- Achievements in the first paragraph.

- Work experience

- Why you’d be a good fit

- Call to action

Sample cover letter

Dear Mr. Mueller,

I am writing to express my interest in the accounts receivable manager position at Chart Electronics, as advertised on the job listing. With my extensive experience in accounts receivable management and a strong track record of success, I am confident in my ability to contribute to the financial growth and operational efficiency of your esteemed organization.

As an accomplished accounts receivable professional with over [number of years] years of experience, I have gained comprehensive knowledge of the receivables process, financial analysis, and collections management. In my current role as an accounts receivable manager at ABC Management. I have successfully led a team responsible for the efficient management of accounts receivable operations, resulting in improved cash flow and reduced delinquency rates.

Throughout my career, I have consistently demonstrated exceptional financial acumen and a keen eye for detail. I possess a deep understanding of financial regulations and compliance, enabling me to ensure adherence to legal requirements and maintain accurate financial records. I have also been instrumental in implementing process enhancements, streamlining billing and collections procedures, and enhancing the overall efficiency of accounts receivable functions.

In addition to my technical expertise, I am known for my strong leadership abilities and ability to foster positive relationships. I am skilled at motivating and mentoring teams, empowering them to achieve targets and deliver exceptional customer service. My exceptional communication skills enable me to effectively interact with clients, stakeholders, and cross-functional teams to resolve issues and optimize financial operations.

I am impressed by Chart Electronics' reputation as an industry leader, and I am excited about the opportunity to contribute to your continued success. I believe that my skills, experience, and passion for delivering results align perfectly with the requirements of the accounts receivable manager role at your organization.

I would welcome the opportunity to discuss my qualifications in more detail and to learn more about Chart Electronics' vision and goals. Thank you for considering my application. I have attached my resume for your review, and I look forward to the possibility of an interview.

Dave Bautista

Looking to build your own Accounts Receivable resume?

- Resume Examples

The Average Length of a Job Interview: How Long Does It Typically Last?

How to list a double major on your resume, resume for a 16-year-old, 5 tricky as hell job interview questions...and how to answer them right, how to create a cover letter for an internal position, should i make my resume in word.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- ResumeBuild

- Accounts Receivable

5 Amazing accounts receivable Resume Examples (Updated 2023) + Skills & Job Descriptions

Build your resume in 15 minutes, accounts receivable: resume samples & writing guide, neil nelson, employment history.

- Generate customer statements and reports

- Prepare monthly financial statements

- Resolve customer billing disputes

- Assist with month-end and year-end closing

- Prepare and submit reports to management

- Post payments to customer accounts

- Prepare journal entries

- Prepare and send invoices to customers

Do you already have a resume? Use our PDF converter and edit your resume.

- Ensure compliance with accounting policies and procedures

- Maintain accurate customer accounts

Henry Coleman

Professional summary.

- Monitor customer accounts for overdue payments

- Research and resolve payment discrepancies

Xavier Carter

- Prepare bank deposits

- Follow up on past due accounts

- Reconcile customer accounts

Quintin Fox

Not in love with this template? Browse our full library of resume templates

Table of Content

- Introduction

- Resume Samples & Writing Guide

- Resume Example 1

- Resume Example 2

- Resume Example 3

- Resume Example 4

- Resume Example 5

- Jobs Description

- Jobs Skills

- Technical Skills

- Soft Skills

- How to Improve Your Resume

- How to Optimize Your Resume

- Cover Letter Example

accounts receivable Job Descriptions; Explained

If you're applying for an accounts receivable position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers. When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

accounts receivable

- Analyze claims and research to correct errors

- Work any outstanding correspondence’s to make sure they are paid

- Call insurance companies regarding any denials on claims

- Edit billing codes as necessary and rebill claim

- Work any outstanding insurance claims to bring them on a paid status

- Research EOB’s and file in the correct systems

- Accounts payable/receivable.

- Daily banking and receipting monies.

- Daily mail sorting and handling.

- Handling customer queries face to face and over the phone.