How To Write the Perfect Investor Update (Tips and Templates)

What is an Investor Update?

An investor update is a document that includes recent wins and losses, financials, team updates, customer wins, and core metrics. They are typically shared via email but can also be shared via PDF, deck, or link.

For many startup founders, investor updates are shared every month but can also be shared on a quarterly (or more frequent) basis. Learn more about why and how to create investor updates for your business below:

Why Send Investor Updates?

Step into the shoes of your investors and it will help understand the importance of investor updates. Put simply, an investor’s (venture capitalist) job is to deploy limited partners’ capital by investing in startups, generate excess returns, and pay back their limited partners with the hopes of doing it again. This means that an investor’s success hinges on the success of their portfolio company. Put simply, your investors need you to succeed.

Your investors likely have other investments and can’t be expected to know exactly where to help each company. In a crowded space building, strong relationships centered on trust and transparency is an easy way to stand out amongst other startups. By sending regular investor updates you can stay top of mind for your investors and tap into their knowledge, resources, and capital to continue to grow your business.

Below you will find our guide to help you write the perfect investor update by understanding what metrics and data to share, properly asking for help, sharing big wins and losses, and raising additional capital. We’ve also included 7 of our favorite investor update templates.

Related resource: What is a Capital Call?

Essential Communication

We believe that regular communication with investors and important stakeholders is key to a startup’s success. If your investors don’t know what’s going on in your business, they don’t know how to help. Building a reporting cadence with your investors is a great way to promote transparency and build a relationship focused on trust.

Related Reading: Should You Send Investor Updates?

Follow-On Funding

One of the biggest reasons to report to your investors is the increased likelihood of follow-on funding. In our own research, we have found that companies that regularly communicate with their investors are twice as likely to raise follow-up funding.

Try Visible to find investors, track your raise, share your deck, and update investors. Give it a free try for 14 days here .

Networking Opportunity

Generally speaking, investors' networks often have had experience as an operator and investors. Tapping into their network can be an easy way to find introductions to investors, partners, potential hires, and mentors. Getting an investor to go to bat for you will likely carry a bit more weight. As Tomasz Tunguz, VC at Redpoint Ventures, states;

“Investors network frequently, work together, and have long-term relationships with each other so a referral should go a long way.”

Finding Talent

In hand with tapping into their network, investors are a great resource when it comes to hiring top talent. Between their other portfolio companies and previous experience most investors likely know a number of solid candidates to fill a role. If they don’t have someone in mind for the job, they can at least help talk you through the different candidates you are weighing for an open position.

Knowledge and Experience

Between their own experience and other portfolio companies, investors have seen just about anything. If you have an operational or tactical question investors are a great resource and can lend experience and knowledge.

Related Resources:

- Our 15 Favorite Newsletters for Startup Founders

- How to Write the Perfect Investment Memo

- 3 Tips for Cold Emailing Potential Investors + Outreach Email Template

Accountability & Reflection

One of the often overlooked benefits of sending monthly investor updates is the reflection and accountability it offers founders. Investor updates can be a great forcing function for founders to look back at the previous month or quarter and better understand what is and is not working for their business.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Tips For Writing Investor Updates

Investor updates can be a tricky balance between informing investors and keeping things succinct and digestible. Most things boil down to keeping your updates consistent and regular.

Keep the Cadence Consistent

If you commit to sending a monthly update, you'll want to make sure you stick to sending an investor update every month. Skipping an update when times are tough can be a negative signal to investors.

Keep Metrics the Same

Make sure to keep the metrics you are tracking stay the same from month to month. For example, if you are calculating net new MRR using a certain formula, keep that consistent from month to month.

Stick to a Format

When creating an update, sticking to a regular format or template is a great way to help get the ball rolling every month. If you're not sure where to get started, we studied our data to understand the most popular components included in Visible Updates, check it out below:

- 81% of Updates include “Highlights”

- 47% of Updates include a “Team” section

- 42% of Updates include “Product Launches”

- 42% of Updates include a “KPIs” section

- 39% of Updates include a “Fundraising” section

Investor Update Templates: Examples For Your Next Update

Sending your first investor update can be a daunting task. We believe that the best place to learn is from someone who has been there before. Luckily, countless founders and investors have shared their templates and best practices for sending investor updates.

We suggest starting with a template you like and tweaking it to your needs (more on this later). Once you’ve found your format, it is all about making sure you keep tabs on the data and context so you are not scrambling when it is time to send. A couple of small steps when sending your first Update:

- Gather your data — As you should be sharing other a few metrics with investors, it is important to keep tabs here. These should be vital to your business and something that you have on hand at all times.

- Review the month — A perk of sending an investor update is the ability to look back at the previous month. Think about any major highlights, lowlights, areas you need help, so you can start to craft your Update.

- Add context — Sharing your data without context can be dangerous. Do your best to explain any metric movements.

- Send it — Getting your update sent out a consistent basis is a win. If you’re looking to get an idea of when founders using Visible send their Updates, check out our post, “ Most Popular Times to Send Your Investor Update .”

1. Techstars Minimum Viable Update

In the “Minimum Viable Investor Update”, Jens Lapinski, Former Managing Director of Techstars METRO, lays out 3 items that he finds most useful in his portfolio early-stage company monthly updates.

2. Founder Collective “Fill-in-the-Blank” Investor Update Email Template

An investor Update template for busy founders put together by the team at Founder Collective. Simply fill out the bolded sections and have your investor Updates out the door in no time.

3. Kima Ventures Investor Update Template

An Update template put together by Jean and the team at Kima. Quickly fill in the quantitative and qualitative data Kima finds most useful.

4. GitLab Investor Investor Update Email Template

A 6 part template put together by the team at GitLab. Built for investors to quickly read and locate the information that is most relevant to them.

5. Y Combinator Investor Update Template

An investor update template from Aaron Harris of Y Combinator. Aaron recommends highlighting repeatable key performance indicators (KPIs) and major asks for your investors.

6. Shoelace: Investor Update Email Template

A template based off of Reza Khadjavi’s, Founder & CEO of Shoelace, investor update email used to wow investors.

7. The Visible “Standard” Investor Update Email Template

Our Standard Monthly Investor Update template put together from best practices and tips from Visible users.

For more ideas, check out our investor update template library here .

Related Reading: 4 Items to Include in Your Next Investor Update (If You Want to Drive Engagement)

8. Bread & Butter Ventures Update Template

Bread & Butter Ventures is an early-stage VC firm based in Minnesota investing globally while leveraging their state and region’s unparalleled access to strong corporate connections, commercial opportunities, and industry expertise for the benefit of our teams. Learn more about what Brett Brohl of Bread & Butter Ventures likes to see in an Update below:

Sharing Metrics and Data

Determining what metrics and key performance indicators (KPIs) to share with your investors can be tricky. There are a slew of different key metrics and different investors may have their eyes on different things. Changing metric names or what you are reporting can be an easy way to break trust with investors. At the end of the day, it is most important that you share the same metrics from month to month. And as we’ve discussed before, it is okay to share bad months!

We suggest sharing a handful of key performance indicators (KPIs) with your investors. Depending on your relationship, some may only want to see 3 metrics while others may want to see 10. Talk with your investors and discuss what types of key metrics they’d like to see. A couple of examples are churn rate, number of active users, monthly recurring revenue (MRR), burn rate, and more.

Related reading: Startup Metrics You Need to Monitor

Every company has missed the mark and any investor is aware that this happens. Building a company is hard! With that being said, we do have a few areas where investors would expect some data:

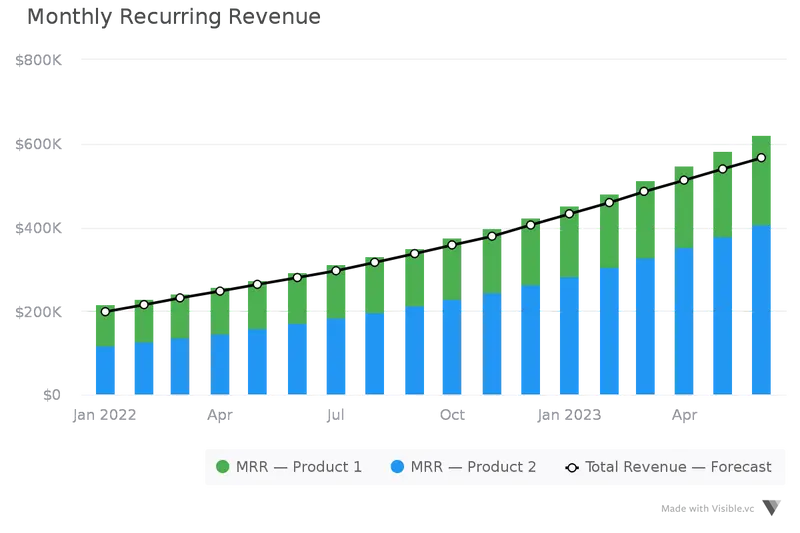

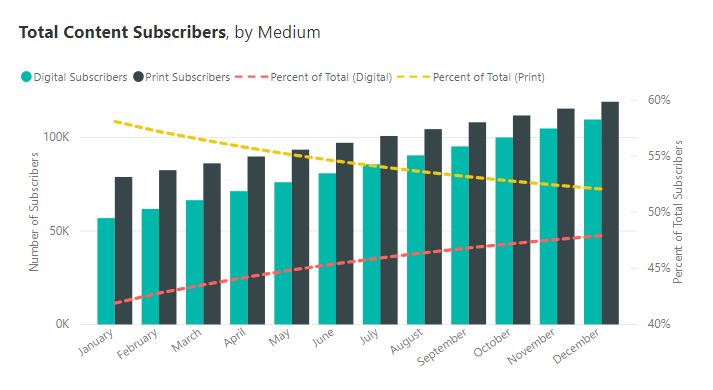

Being able to generate revenue is essential to a business. However, you determine to measure revenue should be kept consistent from month to month. For example, don’t share bookings one month and revenue the next. For SaaS companies, including your monthly recurring revenue (MRR) and the movements are always good to include as well.

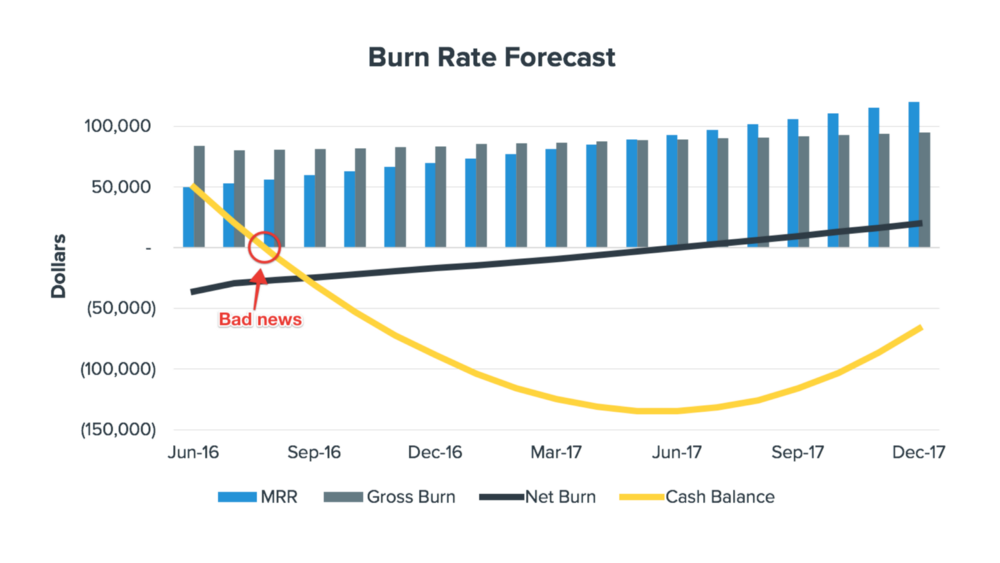

Cash is king. Cash is the lifeblood of your business and investors expect some insight into how their capital is being managed and used. This is also a great way for you as a founder to stay accountable and on top of your spending as you continue to grow your business.

As we mentioned above, cash is king. By tracking and reporting your burn rate, you will be able to avoid surprises with investors. A common mistake we see founders make is surprising their investors when their cash balance is low and months to 0 is nearing. Sharing your burn rate is an easy way to build trust with your investors and give them a better idea of when you’ll need to raise a new round.

Generating solid margins is a must for any successful business. Except the “gig economy,” Frank Mastronuzzi of Greenough Consulting Group suggest that every business should have at least a 55% margin. While likely more important during a fundraise, sharing your margins will help investors evaluate your COGS and acquisition costs.

Number of Active Users

Depending on your company goals and KPIs, the number of active users could be valuable to understanding growth.

Being able to keep your burn rate under control is an easy way to grow your business. In the early days, some investors may want to keep close tabs on burn rates to understand what part of your funnel may be lacking.

Customer Acquisition Costs

Being able to efficiently acquire and expand customers is a surefire way to grow. Without a sustainable way to acquire new customers, a business will struggle to grow or even exist.

Related Reading: Customer Acquisition Cost (CAC): A Critical Metrics for Founders

Sharing Wins and Losses

One of the most exciting aspects of being a founder is sharing and celebrating your victories. As we all know, with every victory comes plenty of losses. Investors are keyed in on your success so it is important to stress both wins and losses equally.

Sharing Wins/Highlights With Investors

Sharing your company’s accomplishments is generally pretty straightforward. Share why and how you accomplished your goal and carry on. Investors generally won’t be able to move the needle for your wins but is best to keep them informed so they can signal to their network of your successes.

Most important is to call out individual contributors when it comes to sharing major accomplishments. All employees like to be recognized for their contributions and there is no greater place to do so than in front of your outside stakeholders.

Along the lines of sharing individual kudos, it is also a great time to highlight new hires. A shout-out to new hires will make offer them a warm welcome and the chance to open up to investors.

Sharing Losses/Lowlights With Investors

The most dreaded and arguably the most important aspect of an investor update; sharing losses. Startups are hard and everyone involved with the process knows this. It is vital that you key your investors into any troubles you are facing and why you are facing them. We find it best to layout the lowlight and offer a solution to improve this moving forward (If you do not have a solution read on to the “Asking for Help” section below).

Generally speaking, nothing is ever as good or as bad as it seems. Sharing bad news is an easy way to strengthen your relationship with investors and they know you’ll be open and honest with them moving forward. Most importantly, this gives your investors an opportunity to step in and help to keep you moving in the right direction.

Related Reading: How to Deliver Bad News to Investors

Asking Investors for Help

Last but certainly not least is asking your investors for help. While every section mentioned above lends itself to asking questions, it is most important to lay out actionable questions where you believe your investors can help.

By laying out a pointed list of areas you could use help, you can easily tap into your investors’ network, resources, experiences, and capital. A couple of key areas we see founders have the most success:

Related Resource: Navigating Investor Feedback: A Guide to Constructive Responses

Closing Deals

From our article, “ You Should be Asking Your Investors for Help. Here’s How. ”

“At its core, building a VC-backed business is about generating revenue. The biggest value add for a business? Closing more deals. Your investors are in the “deal-making” business and likely have a knack for closing deals.

Use your investor’s professional networks to make an intro, set a meeting, or bring in the necessary backup to close a large deal. If you see your investor has a specific connection you’re looking for, don’t beat around the bush. Ask the investor for the exact intro you’re looking for and tell them how they can be of most value.”

Help With Hiring

Talent is the resource every company is in competition for on a daily basis. Any tool or resource you can use to find top talent for your business is worth leveraging. Investors generally happen to help fill an open role and often have an extensive network to do so. Be specific as possible about the role, as well as items like the experience level required, and target compensation to make it low-maintenance for your investors.

Pro tip: Include a direct link to a LinkedIn search that fits the criteria of the person you’d like to hire to make it easy as possible for investors.

Fundraising

One of the main reasons to send investors monthly updates is the increased likelihood of raising follow on funding. If you have properly communicated with investors, chances are they will be more enthusiastic to invest in your next round. We have found that companies that regularly send investor updates double their chances of raising follow on funding. When it comes down to it and an investor has to make a decision between 2 investments; 1 that has been communicating and 1 that has not been communicating. It is easy to go with the one that has been transparent and has made an effort to build a relationship.

Even if your investors are not interested in committing follow-on capital, they may be able to introduce you to other investors they know . Investors know other investors. Venture capital is a tight-knit community and one positive recommendation can make waves.

Related Resource: 9 Tips for Effective Investor Networking

Pro tip: Include a light version of your pitch deck that investors can circulate with investors they can make an intro to.

Recommended Reading: How to Write the Perfect Investment Memo

Investor Update Template Real Life Example

If you’ve browsed through our investor update template, you’ve probably noticed they share a lot of similarities. Most of the Updates include the sections listed above. Of course, every business is different. The size, stage, and relationship with your investors will impact your Update template.

In order to help you best write an Update, let’s use a real-life example. Let’s say we are a seed stage SaaS company that has recently raised $1M and we are starting to scale revenue:

First things first, we need to write an introduction. This can be as personalized or informal as you’d like. We suggest something like the following:

“Hey Investor Name — Hope all is well! I can’t believe August is already in the books. We had a great month that we’ll dig into below. As always, feel free to reply back to this email with any questions or give me a call at 123.456.7890.”

We suggest starting with highlights. This will set the tone for the Update and give investors a quick rundown of what is going well for your business. This should include things like new hires, product updates, and growth (always try to quantify if you can!). Here is an example of some company highlights:

- We just hired person X to head up our sales team. They bring 10+ years of experience in the space and are going to be a great fit. You can connect with them on LinkedIn here .

- We have finally gotten New Product Y out of beta and into the hands of our users. Early signs show a big opportunity. We’ve increased usage by 50% week over week and have already exceeded our quarterly goal of Y users.

- Our sales team is on fire! We’ve closed our largest 2 clients to date — Big Name A and Big Name B. Both are great logos and are our largest contracts to date.

Sharing lowlights is never. However, it is a crucial part of building trust with investors so they can help you overcome pain points. Including steps for how you plan to fix the problem is always appreciated. Check out an example below:

- We have been struggling to find a customer success leader. We’ve opened up our search to new job boards and are offering a bonus to anyone who refers a new hire. If you know anyone that fits these parameters , please send them our way.

- New trials have been lagging behind pace. In order to help get this back on track, we are bringing in an SEO specialist to help us increase website traffic and website-to-trial conversion.

Ask are potentially the most beneficial aspect on an investor update. As you are requesting help from your investors, be as pointed and direct as possible to make it easier on them. Here are some examples:

- Here is our target list of investors for our Series A round and our most up to date fundraising deck . We’re looking for introductions to any of the investors listed in the ‘Research’ stage.

- We’re looking for introductions to candidates for this [ specific job title ] in the [specific industry]. Ideally, this person would work at a company with at least X employees and control his own budget.

- Do you know someone I should meet in [specific city]? I’ll be traveling there next month and am trying to fill my calendar.

As we mentioned above determining what metrics to share is up to you and your investors. For our example, we’ll focus on a couple of key metrics every company should be tracking . Here is an example of how you might present that data:

As we mentioned earlier, revenue has been cruising this month. It is our best month to date and we’ve closed our largest customers.

As you know, our team has been rallied around improving our True North KPI. Our recent product pushes and GTM campaigns have really paid off as shown above.

I feel great about our cash position. We have 18+ months of runway so I can stay focused on building the business and don’t have any immediate need to raise capital.

Try Ranking Your Investors

Just as investors are comparing you to their other investments don’t be afraid to rank your investors relative to their peers. As Brock Benefiel, business author writes ,

“Ranking investors can be an intimidating idea, but when done right can provide a useful way for founders to spur increased engagement from their investors and better illustrate their additional needs from the board. To handle it in the most tactful manner, focus less on creating a zero-sum, Game of Thrones-style battle between investors for the top spot and instead provide up-to-date developments on how investors have made a specific impact on the business.“

Related Resource: How to Find Investors

Related Resource: 6 Helpful Networking Tips for Connecting With Investors

Get Started with a Visible Update Template

Getting in the habit of sending monthly investor updates is a surefire way to help with fundraising, hiring, and growing. To get started, pick a template from our library and tailor it to your business. Just remember that at the end of the day, sending anything is better than sending nothing at all.

Related Resource: Best Practices for Creating a Top-Notch Investment Presentation Visible allows founders to update investors, track key metrics, and raise capital all from one platform. Try Visible for free to send your next investor update.

To learn more about sending your first update with Visible , check out our guide (with videos).

Exponentially

How to write a great investor update (+templates)

Why and how to keep your investors happy.

👋 Hey, I’m Jamie, and I’m here to share actionable advice to help you raise money and grow your startup.

You got your investment round closed. Congrats.

You think you can get back to building your startup, and forget all about VC’s for a while.

But you can’t.

Your new investors, they need to be managed. They need to be kept informed. They need to be kept warm for next time.

The humble investor update is your friend.

Here’s how to do it right.

Let’s get to it 🚀

Why write an investor update?

“Writing a good update forces a founder to focus on the right things and keeps your investors engaged and helping.” ~ Aaron Harris

Once you manage to close your investment round, you want to get back to building your company.

There’s so much to do, keeping your investors up to date feels like an afterthought.

But writing a regular investor update should be something you prioritise, and here’s why:

Your current investors will be your starting point for your next funding round.

The next funding round? That’s the last thing you want to be thinking about right now.

But your current funding won’t last forever. Who will be your first port of call for future funding? That’s right, your current investors.

Keeping them informed of the ups and downs of your startup journey is critical to building a constructive relationship.

Communication builds trust.

They might be able to help you.

You might want to hide the challenges you are facing. Don’t.

Your investors are already bought in, so they of course want to do whatever they can to help you succeed. They might be able to make useful intros for you, or help you think through some problem you are facing. Many investors (the better ones) have operational experience, so could give advice on your product.

Good investors can do more than give you money.

It helps keep you accountable

A regular investor update can do much more than keep your investors happy. It can also help you.

Keeping yourself accountable and focussed on what matters is half the battle. Well maybe not half, but it’s important.

Writing is a superpower. Writing clearly is thinking clearly.

So think of your investor update like a diary for your business, and see what that unlocks for you.

How frequently should I send investor updates?

“ When startups are doing well, their investor updates are short and full of numbers. When they're not, their updates are long and mostly words. ” ~ Paul Graham

The simple answer is to try to aim for a monthly update. That’s long enough for you to have some news, but not so long that they start to forget you exist!

You can also send a one-off update if you have particularly exciting or timely news to share.

If this is too much for you, find a cadence you can commit to, whether that is bi-monthly or quarterly. Less frequent than that is not a great look.

Find a cadence that works for you and stick to it.

What should I include in an investor update?

“People often report metrics incorrectly, like confusing bookings (sales) with MRR (revenue), or they start to count activities (like customers and revenue) that are not yet implemented” ~ James Orsillo , Operating Partner at Underscore VC

You can keep your update short and sweet, you don’t need to write Shakespeare here. Bullet points are fine. Short paragraphs are fine. Highlight the key numbers that are critical to your business.

Here’s a few things you should cover:

Current cash on hand

How much dough have you got left in your company account.

Current runway

This is your projection for when you think you would run out of money, given your current spend/revenue each month.

KPIs/Metrics

What metrics are you focussed on improving? Usually revenue or users. What’s happened since last month?

Any highlights

What’s been happening this month? Are there any highlights you can share to show progress? You can also add shoutouts here. If an investor has helped you last month, be sure to call it out in your next update!

Any lowlights

What are the challenges you are facing? What are you struggling with? Let your investors know and ask for help!

When you ask for help, be specific and make it easy for them to help you. For example , “instead of asking for intros to SaaS companies, provide them with a clear definition of the type of companies you want to connect [to], a blurb they can use, and a spreadsheet of all the companies on your wishlist. ” ~ Ryan Hoover

What’s next

Share a bit about the experiments you plan to run next month. What are you focussed on?

All of these can be accomplished with just a couple of bullet points each. Again we don’t need pages and pages, just a medium length email is perfect.

What are some mistakes that founders make with investor updates?

The first mistake is just not doing investor updates at all.

Another mistake is oversharing. There are some things you might not want to share. Why? Well you should think that your investor update could end up in the hands of your competitors. That shouldn’t happen, but sometimes it does.

Can you share a template that I can use?

Here are a few templates I found that I think would work well.

Notion Investor Update Template

_Underscore.vc Investor Update Template

500 Global Investor Update Template

An idea I had whilst writing this is that you can actually do this even before you have investors . Just write an “investor update” email to yourself each month with these key points and I think you will find it really helpful.

Or write it and share it with your friends and family.

You get a diary of progress that you can also use to look back on when you are pulling together info for fundraising materials. And it helps you think about what really matters and what you want to accomplish.

Why not right?

Until next time,

Did you enjoy this edition of Exponentially?

Please take a second to help me improve!

👍 It was awesome!

😐 Meh - was ok.

👎 Not interesting to me.

Ready for more?

- Investor updates

What is an investor update?

How to write a great investor update, keep your metrics consistent , commit to a cadence, use a consistent format, investor update template, download the free template, how to choose which metrics to share with investors, what to include in your next investor update, financials and kpis, customer wins, send and track investor updates on carta.

An investor update includes detailed information about your company’s financials, key hires, and customer wins. As your company grows, things change quickly. Sending investor updates at regular intervals is a crucial (and underrated) way to build trust and confidence with your backers. The better your relationship with your investor, the more likely they are to participate in your next round and refer you to new potential investors. Informed investors are also better equipped to guide your company through any challenges.

Below, you’ll learn a few ways to write better investor updates.

Regular updates will help your investors track the growth of your company. Early on, talk with your investors about their expectations for updates. Are there specific metrics they’d prefer to see? What is their preferred style of communication? Setting clear expectations and consistently communicating will build trust between you and your investors. In addition to your investors particular preferences, here are some evergreen tips to keep in mind:

To provide a clear picture of your company, include the latest numbers for consistent metrics in each update.

Do not switch what you are tracking between updates or pick your “best metrics”—investors will see through this.

Sometimes even the most successful companies have updates with down metrics—that’s okay. Without an honest update, investors will not know when or how they can help.

Regular updates instill confidence.

Most small startups send monthly updates.

Growth or late-stage companies typically send quarterly updates

Ensure your updates are easy to scan by including key information in headlines.

Consistent formatting allows investors to easily compare updates.

Using an investor update template makes it easier to keep your investors informed as your company grows.

Wondering what a great investor update looks like? Download the template below to see a sample investor update. You can use the financials and KPI calculator to organize your data for your next update.

We asked experienced investors which metrics they care about from companies in consumer software, enterprise software, fintech, hardware, marketplace, and e-commerce. The financials and KPI spreadsheet templates above are designed to help ensure your updates are impactful and relevant.

When an investor reads a company update, they’re looking for indications of your company’s trajectory. Depending on your stage, this could mean signs of product-market fit or whether your organization is scaling successfully. Most of all, investors want to understand whether you’re hitting key metrics and financial goals, including cash runway and burn rate .

Investor updates typically have five major sections:

Financials and key performance indicators (KPIs)

Updates can also include miscellaneous items like new board members , your latest product launches, or recent press coverage.

Don’t bury the lede. Your investors want to scan your updates for the most important information about your company. Put your takeaways at the top.

Update investors on your financials, including your burn rate, so your next round does not come as a surprise.

We recommend focusing on a single KPI (key performance indicator), and showing progress against that metric in every update. Depending on your industry, your metric could be daily active users, monthly recurring revenue, or time spent in product.

Whether you’ve landed your first customer or renewed a seven-figure contract, your investors want to hear about it. In addition to customer numbers or sales metrics, consider including new logos added, as well as positive customer quotes or net promoter score (NPS).

As your company scales, your team will change. It can be challenging to find the right lead for engineering or marketing, but when you do, your investors will want to celebrate with you.

Whether you’re trying to make an executive hire, sell to key customers in a certain segment, or expand to a new country, your investors may be able to help. Your investors have extensive networks and connections, and they want you and your company to succeed. Let them know how they can help in this section of your investor update.

Your investors already turn to Carta for information on their portfolio companies’ cap tables and valuations . Now, you can share milestones and company performance with them on the same trusted platform.

Here’s how it works:

Use our templates to include the metrics your investors want to see.

Select recipients based on their share class or relationship to your company, using data already in Carta.

Keep track of which investors have viewed your updates.

To start sending and tracking your investor updates through Carta, reach out to our sales team to upgrade to the Growth or Enterprise plans . If you already have one of these plans, head to the Shareholders tab to send your first investor update.

Related Content

- All templates

Investor Update Presentation Template

AI generated Pitch Deck 🤖

Once you secure funding from investors, keeping a strong relationship with them where they trust you and the work you're doing becomes of utmost importance. For that, reliable investor updates and reports make a ton of difference. To help achieve that, we've described all key components of an investor update template. You can also get those vital templates for free with us in a downloadable or online form.

What is an investor update?

Investor updates are a way of keeping your backers informed of your company's processes and securing your startup's well-being. Sending regular investor reports allows you to be transparent about the work you do. It also keeps valuable insight in check by continually revising the big picture of what your company is doing and keeping track of your overall performance.

What do investors want to see in an investor update?

The idea of an investor update is for your financial backers to get steady glimpses at the company's performance over key indicators. They'll want to understand how your financials stand, how well you're doing concerning goals, and how well your teams and company are performing in alignment with those.

Of course, investors will want to see what's happened with the key metrics to your business. Include those as visually and clearly as possible in your updates. Focusing on a single KPI can also make up for a good strategy in this sense to then report your progress in that area throughout every subsequent report. Strategize this way to give a clearer vision of the way your startup is moving along.

If you've achieved a milestone or particularly significant achievement, highlight it on the upcoming update. It should support the notion that all your hard work and the trusted funds are paying off in more ways than once.

Free Investor Finder

Be mindful of your presentation and format.

Be consistent in the format you choose for your initial investor report template. Then, keep using that structure for all subsequent renditions to make it easier for investors to follow you every period. This is where investor update templates lend a beautiful hand. Tracking differences and changes should flow when you stick to a particular structure and format every period.

How often are investor updates sent?

How often you send out investor updates will depend on a series of factors. Take into account you want to nourish healthy relationships with your investors. To do that and overcome any challenges you face, you should establish a certain periodicity when investors would like to have an update from you in their inbox. Usually, these investor updates happen monthly, but large companies tend to reduce the frequency. You should check with your stakeholders to see if they wish quarterly or even bi-yearly reports from you. Also, suggest what makes you feel at better ease about the reality of how often you can sit down to comprise stunning summaries on your essential business areas. Bear in mind that updating your investors regularly can also translate in keener attention, which can eventually lead to even more funding. Don't make it come across as if you didn't want to deliver updates. The more frequently you report willingly, the better it is for your overall startup performance in many ways.

Whichever kind of agreement you reach on the regularity of your reports, every business should know how to nail an impressive investor's update. The key components of an investor update template we'll now give you should ease this process. They should also cut back on the amount of time it'll take to produce a well-designed and relevant presentation.

How to write the perfect investor update

First of all, your reports need to reflect more than just data. Convey your brand and company spirit through them. Let them speak of the passion you have for your work. When you're writing an investor update, fill it with the same energy you have to develop your product or service. Look at it any way you can to translate your brand into your updates.

Let's go over our free investor update template slides now. We do that as a way to discuss the most critical slide content for every investor update you send.

First, kick off your update with the official company name, your personal details, including position and contact data, such as email address and phone number. Include the date, and think of this as the period you're presenting.

The second slide should have a brief executive summary that clearly shows your company's most significant accomplishments in a set period. Make this really concise. Only include your priority highlights for this report.

Devote the following three slides to presenting any new features or stand-out news you have for investors. Use a full slide to focus on your biggest highlight and use the others to break down news on any new features.

The sixth slide of your investor update should serve as a roadmap for the year. Present your company's evolution to date, along with any milestones you might have reached.

The next slide in this report should focus on metrics and KPIs. Follow this with a current annual run rate. Then, go into MRR growth for the past 30 days. What would be your tenth slide by now should show a graphic of your annual run rate's evolution. Next comes a monthly revenue graph. Do this overtime for the year. If yours is a SaaS business , let your subsequent slide describe your monthly recurring revenue churn.

Move on with this report with a focus on target markets and growth channels. Update any activity on your core acquisition channels, as well, before you continue with new information on your average customers, their acquisition cost, and lifetime value. From here, present your product and growth team. Add any highlights or changes in regards to the faces behind all your hard work.

As the last section to this, describe your financials. Title a slide to show you're getting there and display your figures on the subsequent one if you'd like. We suggest a revenue vs. spend graph for the year, which can be followed by a slide on your product's core features. Include any new milestones for which you're aiming next.

You can decide to wrap up with a reminder of your contact details as an invitation for investors to contact you on any needs that might come up as of their review of this report.

Exercise relevant customization

Remember to tailor all this thinking of your audience, right? You should know your investors well by the time you sit down to give reports on your startup. Let your slides speak of your brand and passion and highlight your good and could-do-better with select milestones for the near future, if possible. Hopefully, rather than stress over figures and rendition, these investor updates will be a reliable approach at steady growth for your company on diverse fronts.

Most popular templates

The Startup Pitch Deck Template

977047 uses

Airbnb Pitch Deck Template

972882 uses

Uber Pitch Deck Template

837144 uses

Investor Deck Template

625510 uses

Sequoia Capital Pitch Deck Template

593390 uses

Investment Proposal Template

482787 uses

Need a hand?

to access the full template

How to Write an Investor Update — Important Tips and Examples

Bijan Moallemi

Founder and CEO

Get The Playbook for Board and Investor Communications

Building strong relationships with investors is vital for any non-bootstrapped business. But your investors aren’t in the weeds of the day-to-day work with you. That’s why investor updates are so important in the investor-executive relationship.

Investor updates give you a chance to share context about business performance and plans in between board meetings. And when done well, consistently sharing that context helps you unlock the value of your investors (beyond the money they put into your business).

Don’t leave your investors in the dark between board meetings. Take the time to craft regular updates that convey the numbers and also leverage financial storytelling skills to explain the “why” behind performance.

Table of Contents

What Are Investor Updates?

Investor updates are documents shared at regular intervals — ideally at least monthly — to give investors news and information about the business. They’re a way to connect with investors and provide insight into growth trajectory, performance to plans, and capital efficiency.

The timing and frequency of your investor updates may depend on the current state of both your business and the market. When venture funds were flowing freely, and the economy was thriving, you may have gotten by with infrequent investor updates. Heading into 2023 with so much market uncertainty, increasing the frequency of investor updates is critical.

Best-in-class executives always stay on top of investor updates. But according to Jason Lemkin at SaaStr, the expectations are higher for everyone now.

From Jason Lemkin, Founder of SaaStr, on Twitter

How Do Company Updates Differ for Different Investors?

You can think about your investors in two tiers — the insiders who get board meeting access and the less-involved shareholders on your cap table.

The difference in how you update these two tiers of investors is about access. You give insiders a deeper level of information while running board meetings , digging deep into the granular details of business performance to diagnose opportunities and issues.

But the less-involved stakeholders get a higher-level update. The general investor update should include enough information to show how your business is tracking against goals. Include any information you’d be willing to share with a broader audience of the investing community. You can assume the investor update will have more visibility beyond the group you share it with, so anything that you want to keep private should stay in the official board deck .

How to Use Software to Increase Transparency & Trust with Investors

Benefits of investor updates.

Regular updates allow the business to nurture strong relationships and keep investors up-to-date and involved with the company.

Here are some benefits of sending out consistent investor updates.

Consistent Communication Builds Trust

Consistent, reliable communication with stakeholders shows investors know how things are going with the business. That transparency helps build trust in the company.

Updates Show Investors How They Can Help

Providing the right KPIs gives investors strategic insight into how they can collaborate to help with business success. For example, investors may see opportunities in high-level plans to recommend stand-out candidates or new hires for open roles.

Updates Show Opportunities for Follow-on Funding

When you show investors how their money has been put to work to execute goals, they’re more likely to want to invest more to help the business grow and succeed, whether it’s independently or in future funding rounds .

Investors Can Share Expertise With the Business

Investors have a lot of collective knowledge relevant to the business in a variety of different areas. The more the business communicates with investors , the easier it is for them to serve as mentors and leverage their expertise to help the company.

Updates Hold the Business Accountable

Sharing KPIs and reflections on results holds business leaders accountable for performance. It also gives investors a chance to challenge financial assumptions and make observations, so you adjust plans as needed.

Download this playbook and learn how to build a strategic bond with your investors.

Build Your Investor Update Template

There’s no one-size-fits-all way to provide an investor update. But whether you’re creating a slide deck, sharing a Loom overview, or writing out a memo, your investor update should include the following information:

- A message from the founders or top executives.

- A summary of the current state of the business.

- Any areas where investors can help or offer support.

- Your most important metrics and KPIs.

- Department highlights and challenges.

- Business goals before the next update.

Whichever format you choose, there’s one thing to keep in mind — keep it consistent each time you share an update. A consistent format makes life easier for you because you can swap updated information out in the template. And it also helps investors better understand the growth journey that your business is following.

Metrics That Matter for Investor Updates

The metrics you share should show that the business understands what is important to investors. Whether it’s a metric that’s trending lower than investors might like or developing proactive strategies for growth, investors want to see that you’re planning ahead.

You also want to make sure that you’re using the metrics to explain the right narrative about your business. It’s about explaining the “why” behind your numbers, not just sharing a laundry list of relevant metrics.

The specific metrics you focus on will depend on the maturity of your business, your business and go-to-market models, and overall performance to plan. But as you think through the narrative, you’ll want to include metrics that cover operational efficiency, state of the sales pipeline, go-to-market efficiency, revenue growth, and retention, at the very least.

Here are some of the specific metrics that you should consider using to update your SaaS investors.

Cash Conversion Score

This critical capital efficiency metric measures current return on investment (ROI) of dollars put into the business. For SaaS businesses, this metric is essential to give investors a deeper understanding of recurring revenue as a proxy for ROI. When combined with other metrics, your cash conversion score provides deeper insight into market/product fit, as well as the scalability of sales and marketing teams.

Burn Multiple

Sharing your burn multiple gives investors insight into how much revenue the business generates per dollar burned. This shows how efficiently your company can generate revenue using capital raised from funding rounds. Investors like this metric since it demonstrates how well the business distributes capital across the business. It also provides strategic insight into potentially extending the company’s runway via proactive cash management.

Gross Margin

Your g ross margin is the percentage of income the business is left with after subtracting the cost of goods and services or the cost of revenue . Gross margin shows investors the percentage of money the company gets to keep compared to the amount of money the company brings in.

SaaS Quick Ratio

The SaaS quick ratio compares monthly recurring revenue ( MRR ) against expenses to measure startup cash flow . This highlights your ratio of MRR growth compared to churn and contraction MRR. It’s an at-a-glance directional financial metric for comparing top-line and bottom-line growth and stability. It shouldn’t be used alone to judge the financial health of the business, though, so make sure investors know it’s just part of the picture.

Net Dollar Retention (NDR)

Also called net revenue retention (NRR), this metric compares the revenue earned from customers at the start of a given period to the revenue earned from them at the end of the period. This helps define lost revenue from customer churn or downgrades, as well as any increases in total revenue over a specified period. For SaaS businesses, this important metric gives insight into customer success, renewals, and upsells of the product. Investors want to see that you’re not only retaining customers but also effectively managing customer retention costs to ensure profitability.

LTV/CAC Ratio

The LTV/CAC ratio measures the relationship between the company’s customer lifetime value (LTV) and customer acquisition cos t (CAC). This ratio shows your ROI based on how much it cost the business to get a new customer and what they’ve paid the business thus far. This financial efficiency metric is helpful for gauging the company’s profitability now and in the future.

The CAC ratio is the cost to acquire annual recurring revenue (ARR). This financial metric provides insights into the relationship between new bookings and upsells and the company’s marketing, showing investors if current marketing strategies are effective.

CAC Payback Period

The CAC payback period is the amount of time it takes to recover acquisition costs per customer. Investors are interested in this metric because it shows a company’s ability to achieve returns on acquisition costs alongside invested capital.

SaaS Rule of 40

This financial ratio is used by SaaS companies to compare the company’s revenue growth to its profitability. The SaaS rule of 40 states that a healthy SaaS business has a combined growth rate and profit margin of at least 40%. It’s a great at-a-glance indicator of the company’s performance and sustainability for investors because a business can still be considered healthy even if it’s unprofitable or the growth rate falls as long as the combined ratio is 40% or more.

Investor Update Example

In 2020, job search and recruitment platform Untapped tripled its headcount and revenue, opening the opportunity for the next round of funding. As Untapped prepared for that funding round, they needed to tell investors their financial story and the story of their future growth. Their investor update provided metrics that delivered a compelling growth narrative.

Here’s a high-level outline of what that investor update example might have looked like.

Sample Investor Update Outline

Executive summary.

- Brief introduction from executives

- ARR with context, explaining how Untapped tripled its revenue

- Expenses with context, explaining how Untapped tripled its headcount

- Burn multiple to show financial efficiency and potential to extend runway

- LTV/CAC ratio analysis to show ROI based on CAC

- Milestones achieved thus far

Investor Asks

- Funding to help support growth

- Leads for open roles from diverse backgrounds

KPIs and Results

- Modeling complex scenarios around headcount growth

- Reviewing ROI on sales and marketing spend

- Analysis of CAC ratio to access marketing success

- CAC payback period for strategic insight into ability to achieve returns on investments

Department Highlights

- Updates on customer acquisition and active users

- Sales and Marketing pipeline and targeting plan updates

- Customer retention metrics , KPIs, and trends

- New programs/tools implemented or upgraded

- Major role changes or introductions

- Scenario planning to help achieve goals

- Plans for future business growth

- Fundraising goals for next steps

How to Write An Investor Update

Writing an investor update doesn’t need to be time-consuming, and it doesn’t need to share too many details. Whether it’s a quarterly or monthly update, it should provide an overview of how things are trending, including key metrics that show highlights, challenges, and areas the business could use help from investors.

Here’s how you can approach the most common sections of the typical investor update.

After a brief introduction, provide a summary of the company’s finances and operations. Typically, there’s a brief summary for each department. In a SaaS company, that should include finance, sales, marketing, operations, product, and engineering.

Summaries don’t need to include anything sensitive but should include some quantitative measuring of major milestones and any significant challenges. Consider including at-a-glance financial metrics like your gross margin, burn multiple, cash conversion score, LTV/CAC ratio, and SaaS quick ratio.

Areas Investors Can Help

Investors want to help the business succeed, so it’s important to tell them exactly how they can do that. Offer crisp, clear information about how investors can contribute.

Maybe that means getting warm introductions to candidates for open executive roles. Or an introduction to someone involved at a company that’s a key partnership opportunity. In some cases, you may be able to get another perspective on a particular operational challenge you’re facing. And maybe more commonly, it could be surfacing the opportunity to be involved in an upcoming funding round.

Results and KPIs

While investors prize MRR/ARR and net dollar retention, be conservative with what else you share. Outside of board meetings, only share KPIs you’re comfortable sharing with potential new investors or the general market. Also consider including some findings from scenario planning here, with outputs from worst, base, and best-case models you’re comfortable sharing. You want to show growth, operational efficiency, and financial efficiency while addressing any challenges the business experienced by providing context and plans for improvement.

Department Highlights and Goals

Break down the business by department and share initiatives and progress on goals in each department. CAC ratio and burn rate will be relevant here. Your department-level updates should include some insight into performance to plan and an overview of how headcount has changed and will change in each area.

Simplify Investor Updates with Mosaic

Investor updates should tell the company’s financial story with your metrics. But that requires context, so your investors really get the “why” behind the numbers. These updates should be proactive and action-oriented, so the takeaway is that the company is prepared for agile scenario planning , addressing any challenges, and making adjustments to meet goals and improve efficiency.

The finance team needs access to the latest numbers and time to collaborate with executive leadership on strategic insights and the metrics that matter.

Mosaic gives you access to real-time data, so you get automated calculations and forecasts without hours of manual work to compile the necessary data. With Mosaic’s templates, dashboards, and metric visualizations, you can show investors the trends and at-a-glance projections that tell your financial story. These analytic tools connect to systems you already use, allowing you faster, real-time access to the metrics that matter.

For investor updates, Mosaic offers an operational efficiency dashboard that brings your story around capital efficiency and profitability to life.

You can also create custom dashboards from scratch to ensure you present the right metrics at the opportune time. And with role-based permissions, you can share the canvas directly with investors so they can always check in on company performance.

Don’t give investors backward-looking data points. Show you have your eye on the future and the company’s potential to grow and succeed. Mosaic’s finance automation helps you demonstrate proactive financial analysis and strategic insight into improved operational efficiency, profitability, and growth for the business. Financial data analysis software , like Mosaic, can empower you to create dynamic forecasts and projections that offer a forward-looking perspective to investors.

Request a personalized demo today and discover how Mosaic can help you create investor updates that instill confidence and keep investors engaged.

FAQs About Investor Updates

What are the main components of an investor update.

Investor updates will vary based on the needs and circumstances of your business, but generally your update should include:

- An executive summary

- A section where you ask investors for input on any issues or questions you have

- A section where you walk through important metrics, KPIs, and financials

- Department-by-department summaries and updates

- Updates on goals and and growth plans

How often should investor updates be delivered?

Investor updates are most commonly delivered monthly – if not bi-weekly – though at minimum they should be delivered quarterly.

What format should investor updates be delivered in?

The two most common ways to deliver investor updates are either in a written document like a Google Doc or in a slide deck. Since they typically occur in-between board meetings, investor updates aren’t usually presented, though some companies include a video overview. Take it to another level by giving investors access to a Mosaic canvas that stays up-to-date in real time.

Related Content

- Top 3 Executive Dashboard Examples

- How to Run a Board Meeting: A Guide for Business Leaders

- The 12 Most Important Operational Metrics & KPIs to Track in SaaS

Never miss new content

Subscribe to keep up with the latest strategic finance content.

The latest Mosaic Insights, straight to your inbox

Own the of your business..

- All templates

Investor Update Template

Investor updates are an important part of running a startup. As a founder or CEO, you are responsible for keeping your investors informed about the progress of your business and any relevant developments. While this can be a time-consuming task, it is essential for maintaining trust and transparency with your investors.

One way to make this process easier is to use this investor update template. It allows you to organize and present your information in a clear and concise manner, making it easier for investors to understand and track your progress.

So, what should you include in an investor update? Here are some key elements to consider:

- Executive summary: This should be a brief overview of the main points of your update, highlighting any major developments or achievements.

- Key performance indicators (KPIs): These are the metrics that are most important to your business, such as revenue, customer acquisition, or retention. Provide an update on how your business is performing against these KPIs.

- Progress against milestones: If you have set specific goals or milestones for your business, provide an update on how you are progressing towards achieving them.

- Future plans: Share your plans for the future, including any new initiatives or projects you are working on.

- Challenges and risks: It's important to be honest with your investors about any challenges or risks your business is facing. Share any potential obstacles or concerns, and how you plan to address them.

By following this template, you can keep your investors up to date on your progress and ensure that they are fully informed about the state of your business. This not only helps to build trust and transparency, but also keeps your investors excited about your growth and success.

Need a hand?

Create powerful business content together.

How To Write Investor Updates (With Template and Examples)

Updated October 17, 2023 by Xtensio

Investor reports share key qualitative and quantitative data with your financial investors, including important information about recent wins, the state of finances, and other relevant insights. These reports are meant to give investors a high-level view of what’s going on in your business over time. Use this step-by-step guide to create your investor updates reports, easily. Explore this template .

Xtensio is your team space for beautiful living documents . Create , manage and share business collateral, easily.

Table of Contents

Your guide to creating powering investor updates reports.

It’s important to maintain a healthy relationship with investors and key stakeholders by providing regular portfolio updates. You need to build relationships so you can build trust, transparency, and long-lasting partnerships with your investors. Investor reports highlight important information about recent wins, the state of finances, and other relevant insights, and are meant to give investors a high-level view of what’s going on in your business over time. These reports will help you maintain a healthy relationship with investors and key partners. Here’s how:

- Provide investors with an ongoing glimpse of your company’s performance over key metrics.

- Build trust with VC firms and angel investors by making it easy for them to make decisions about actions they might take with their portfolio.

- Increase your chances of receiving help, time, and introductions from investors.

Your investor updates report should take only a few minutes a month and will create an everlasting impact on your business and future endeavors. Xtensio’s free monthly investor updates report template makes it easy to keep track of productivity, roadblocks, and deadlines. You can also use the Annual Report Template to give your investors an overall summary of your company’s yearly achievements.

1. Create your investor updates report header and highlight monthly achievements

Introduce your investor updates report by adding your company name, the project name, and the name of who prepared the report. You will also want to add the date so it’s easy to go back and reference these reports for your investors, partners, and stakeholders. You can also update the logo, the folio color scheme, and the background to match your company branding.

QUICK TIP: Once you set up your header section and update the color scheme and background to match your brand, you can save a custom template to easily repurpose for your ongoing investor reports.

2. Give a high-level overview of business initiatives and metrics your investors care about

Highlight key stats – number of employees and locations, monthly/annual revenue growth, or other important stats your investors would want to know about. Some factors to think of when using the stoplight report:

- Monthly growth — Highlight key growth info from the start so investors get a clear overview. What major sales did your team make this month?

- Product development — Did you introduce new products or services this month? Showcase what your team accomplished in terms of launching new product features and/or services.

- Marketing initiatives — Here’s your chance to show stakeholders what you’ve done to attract new customers. Did you start a monthly webinar series, or launch a new workshop or campaign?

- Company wins & losses — Give an overview of any awards, accomplishments, or major lists you were included in this month. Were you ranked as the top place to work? Do you have high customer satisfaction?

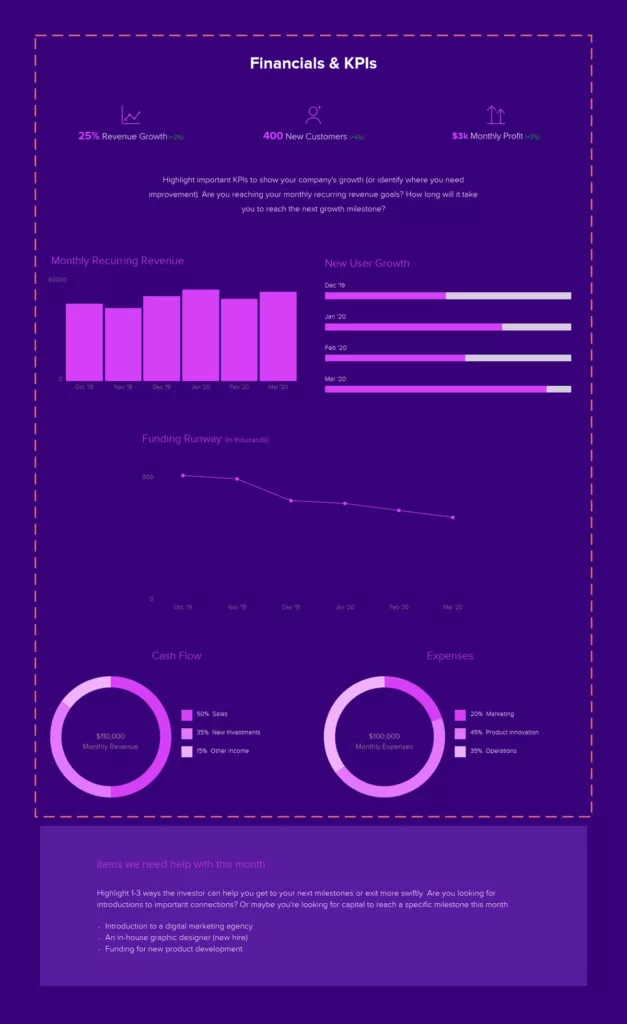

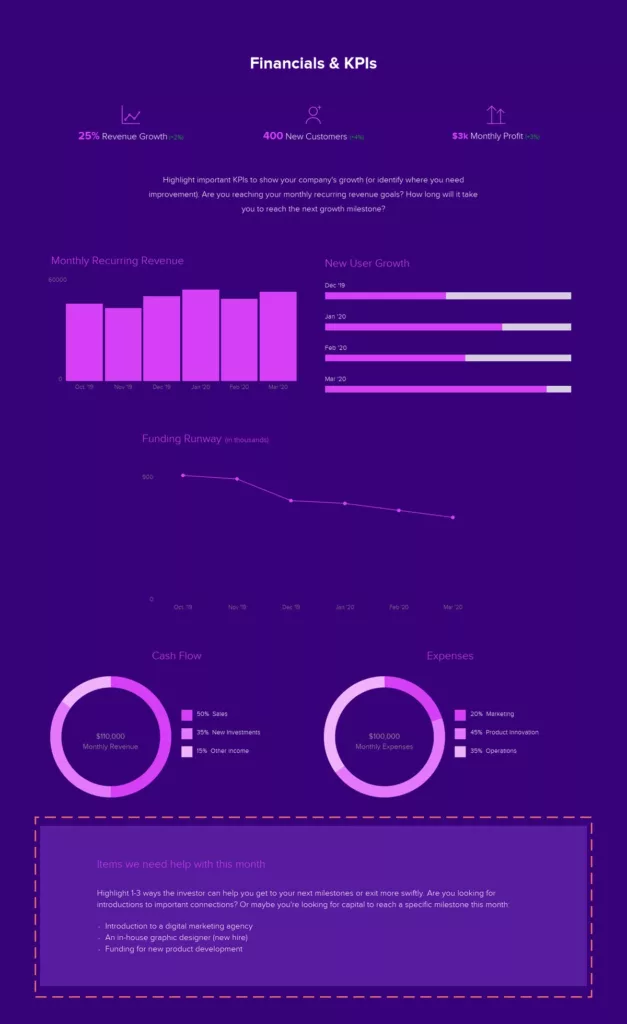

3. Detail your financials and KPIs

Highlight important KPIs to show your company’s growth (or identify where you need improvement). Are you reaching your monthly recurring revenue goals? How long will it take you to reach the next growth milestone?

Use charts and graphs to highlight key financial data.

- Revenue — Being able to generate revenue is essential to a business. How much did you grow this month? How many new customers did you bring in? What’s your monthly profit margin? However, you determine to measure revenue should be kept consistent from month to month. For example, don’t share bookings one month and revenue the next.

- Cash & burn — Cash is king and investors expect to see some insight into how their capital is being managed and used in your organization. Use a line chart to highlight your funding revenue month over month. And pie charts will help detail your cash flow and expenses.

- Margins — Generating solid margins is a must for any successful business. While this is more important during fundraising, sharing your margins will help investors evaluate your COGS and acquisition costs.

4. Ask your investors for help

Arguably, this is the most important part of the investor report – especially for your company. Highlight 1-3 ways the investor can help you get to your next milestones or exit more swiftly. Are you looking for introductions to important connections? Or maybe you’re looking for capital to reach a specific milestone this month:

- Introduction to a digital marketing agency

- An in-house graphic designer (new hire)

- Funding for new product development

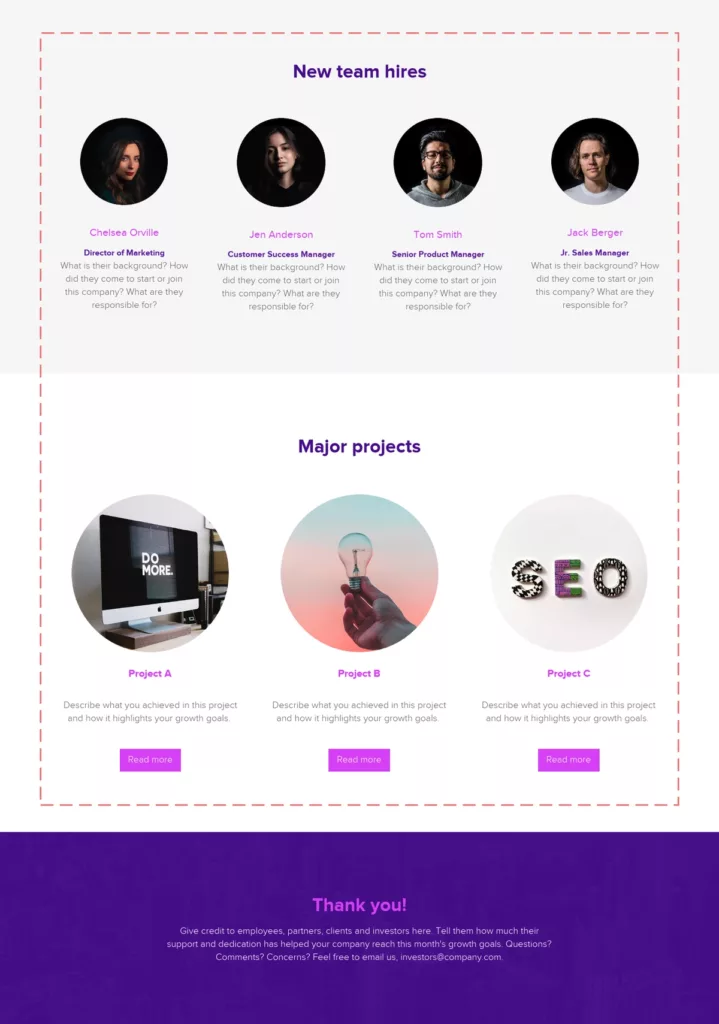

5. Showcase new hires, important projects and give credit to key players

Put a face to your company by introducing key hires you made this month. Add a photo, their name, and title. What is their background? How did they come to start or join this company? What are they responsible for?

Did you start (or complete) any major projects this month? Describe what you achieved in each project and how it highlights your growth goals.

Lastly, give credit to employees, partners, clients, and investors. Tell them how much their support and dedication have helped your company reach this month’s growth goals. Questions? Comments? Concerns?

Share your investor updates report as a link, monitor, evaluate & iterate

Remember, these are just guidelines for what information goes into your investor updates report. You’ll want to focus your monthly report on what matters the most to your investors, stakeholder, and partners.

When you’ve finished creating your investor updates status report with Xtensio’s editor, you can send the live link to your folio to share it as a responsive webpage (and add password protection), export a PDF or present it as a slideshow during an investor meeting. The monthly investor updates report is adaptable just like other Xtensio tools , it can and should be repurposed, revisited, and revised regularly.

Design, manage and share beautiful living documents… easily, together. Explore Xtensio

- Click and edit anything… together.

- Customize to match your branding.

- Share with a link, present, embed or download.

Teamspace for beautiful living documents .

261,479 users and counting…

- Book a Demo

- Core Community

- 45 School Street, 2nd Floor (Boston’s Old City Hall) Boston, MA 02108

- (617) 303-0064

- [email protected]

- Name This field is for validation purposes and should be left unchanged.

A Simple Board and Investor Update Template (With Examples)

Article Contributors

James orsillo, underscore vc.

In this Article:

Tips for your investor update, a note about metrics, how transparent should you be, seed investor update template (option 1), seed investor update template (option 2), series a investor update template (option 1).

If you’re getting ready to send an investor update, you might be asking yourself questions like: What should I include? How transparent should I be?

When sharing an update, you’ve got to provide enough detail without overloading the reader. It can be hard to strike the right balance.

Before gathering data and writing your investor update, take a minute to think from an investor’s perspective. Investors—like you—are often bombarded with emails. They may be tracking dozens of startups, so make it easy for them to digest and respond. You’ll ultimately benefit.

To focus, ask yourself: After they skim through your email, what is the one thing you want the investor to take away? Do you desperately need hiring help? Are you crushing your revenue goal?

Startup Secret: Include a TL;DR section at the top that highlights the main takeaways. Was this a good month? Why?

Think about how you can nurture investors with data about your progress. That way, when you’re ready to raise your next round, investors will be excited to engage.

Using an investor update template makes it easier to outline and structure information, but ultimately, it’s up to you to select data to support your desired outcome. For an editable version of these templates, see our copy in Coda .

As you fill out an investor update template, keep the following in mind.

- Be concise. Avoid writing long intros to your emails. Cut any rambling text.

- Make it easy to read: Use bullet points and subheadings.

- Don’t be overly salesy—it can hurt your credibility. Avoid superlatives.

- If something meaningful is happening in your business, good or bad, keep investors in the know. Never surprise them—they’ll start to lose trust.

- Include real numbers and metrics when you can and explain how they compare to plan.

- Make your asks for help specific and actionable.

- For any update you share, include a “so what” to connect the dots. You shipped X product. You got X media coverage. What is the benefit or result, and why does it matter?

- Mention the market. What’s happening with your competitors, and what does that mean for your business?

- If reporting numbers or metrics, provide context. How do these compare to your expectations? Your budget? The prior year?

- Share any relevant positive or negative trends you notice, and explain how investors should think of them in the future.

Be sure that the metrics you report conform to a normal convention. “ People often report metrics incorrectly , like confusing bookings (sales) with MRR (revenue), or they start to count activities (like customers and revenue) that are not yet implemented,” says James Orsillo , Operating Partner at Underscore VC. “That’s dangerous.”

→ See clear definitions in our SaaS Operating Metrics Template .

The real answer: Be very transparent, but pick the right medium. “I’m always biased toward transparency—it’s good to share highs and lows,” says Lily Lyman , Underscore VC Partner.

“If you do have sensitive information that you don’t want to disclose in writing, don’t shy away from it,” says James . “Just pick up the phone.”

Picking the right medium can depend on your comfort level, your market, and the topic at hand. Ask yourself:

- Would you be comfortable with an investor forwarding this to someone in their network?

- Would you be comfortable with an investor storing this in their database as they track your progress?

- Will an investor need to have this context to help you?

- Will this item likely spark a discussion?

We appreciate monthly updates from Seed and Series A companies. However, as you scale beyond that, quarterly becomes the norm.

Dear Friends of [Company] ,

Hope you are doing well! Here is a quick update from the last X weeks/month/quarter at the company.

Main Updates

[Reminder: Underscore’s SaaS Metrics overview is here .]

- Traction : We finished the last quarter at $XX ARR. Currently tracking at $XX and with the [Customer] season picking up again this quarter, we’re targeting higher growth for the rest of Q.

- New Customers : Added some great enterprise software logos: [X Customer] , [Y Customer] , [Z Customer] : and crossed X paying customers.

- Customer Love : Keeps on growing! New case studies and quotes on [URL to Page] . We are also on [Rating Site] now, trending strong at X/5 .

- Burn & Runway: Still projecting cash runway until [ Month/Year] assuming base case revenue growth.

- Team : We are now XX + members strong. Really excited to have [Name] join as [Title] to help us [Job Goals] !

- Customer Advisory Board: We are forming a customer advisory board of thought leaders and influencers in [Industry] – already 10 members strong.

Q3 Priorities

- Pipeline building remains the biggest GTM priority. We are actively working towards a free trial flow, and investing in ads and other salestech accelerants.

- Partnerships as a GTM channel is also something we are keen to experiment with this year. The [Industry] ecosystem is ripe for this – any suggestions here would be welcome.

- Our CS function is evolving to help us hit market leading NPS and NRR next year. We are now X member-strong and are building out motions for onboarding, success, and support to streamline customer ops.

- [Customer Use Case] is top of mind on the product side. We are working on some exciting products which will make doing [Customer Use Case] truly simple. More on this next month!

- Working towards doing a mini customer event in [Month] and a customer conference in [Month] .

Best ways to help are

- Hiring recommendations for the [Title w/ Link to Job Description] role. Very important to close this.

- Community Suggestions: We are looking to work with communities such as X , Y , and Z , where [Customers] hang out. Warm intros to any such community you know of would be helpful.

- Advice on growth: Always looking for tactical advice on growth and partnership recommendations.

- Warm intros: Can never get enough of ‘em. Anything especially at [List of Companies] would be great.

- Customer Advisory Board: If you know any great [Customer Role] leaders who you think highly of, we would love to speak with them.

- Use us: Many of our investors are using us for [Use Case] . It is a great way to know the product better and spread the word!

Co-Founders

PS: ICYF “What does [Company] do exactly?” “We are a [Boilerplate Description] .”

Hi everyone,

Hope you’re having a great summer so far. Here’s our monthly investor update.

But first, how you can help:

Does anyone know a good PR consultant? The holidays will be an awesome opportunity to get our message out to the media and other outlets that will be covering this.

July Summary

- Closed our first 4-figure MRR / $35k ARR customer.

- We hired our first full-time Marketing Manager. [Name] comes to us from [Company] and starts this month.

- We’re now winning deals against major competitors (including [Competitor] , [Competitor] , and [Competitor] ), onboarding larger brands such as [Brand] and won over a few previously churned customers last month. This signifies the investments we’ve made across product, sales, and support these last few months.

- $X in the bank

- X total customers (+X% MoM)

- $XX Ending MRR | $XX Ending ARR (+X% MoM)

- X months of runway, cash out date

- New sales bookings (% of target for month or quarter)

Product Updates

- We announced integrations with [Product/Company] and [Product/Company] .

- Launched a beta of our [Product Feature] .

- Expanded carrier support for numerous carriers throughout South America and Europe.

- Built integration with XYZ (not yet announced).

MRR was a bit flat in July despite having a strong month in net new customers as we’re recovering a bit from last month’s churn and there’s a lag in reporting usage-based revenue, which will reflect in future months.

August Focus

We’re continuing to focus on:

- Building a great [Product] and officially rolling it out to all customers.

- Onboarding Marketing Manager – step on the growth pedal and prepare content and marketing campaigns ahead of [Event] .

- Preparing for our Q4 fundraise.

Happy customer quote of the month:

A quick reminder of what we do:

[Insert two-sentence pitch here. website.url.]

[Company] ’s mission is to… [Company] is a [Boilerplate Description] . In September, we crossed over XX [Customer/User Milestone] .

Company Update

| X | X | X | X | |

| X | X | X | X | |

| X | X | X | X | |

| X | X | X | X | |

| X | X | X | X | |

| X% | X% | X% | X% | |

| 5 New | 3 New | 2 New | 7 New |

We had a solid month for new bookings, primarily customers that upgraded from the freemium funnel. [Customer X] was the largest at 50 seats @ $XXX MRR. Our first AE is still ramping but managed to close $XXX in new MRR.

We released one new feature: [Feature Description] . We believe this will accelerate [Customer Goal] .

$XX in cash, burn was $X in [Month] .

- Hiring: Unfortunately, we are still having difficulty hiring engineers. Resolution: We are now using Hired.com to help fill the pipeline.

- Low Morale: The team was feeling low after we lost a big contract to a competitor. Resolution: Installed cold brew coffee on tap.

How You Can Help

- VP Sales: We are narrowing in on final candidates for our VP Sales search. Please send me comps for total compensation (base, bonus, and equity) for VP Sales roles at similar stage startups?