- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Netflix’s Bold Disruptive Innovation

- Adam Richardson

Every now and then, the business world presents us with a lab experiment that we can observe in realtime. Netflix’s announcement that it is splitting off its DVD-by-mail business from its streaming business is just such an experiment. The DVD business will now go by the name Qwikster, and the streaming business will stay under […]

Every now and then, the business world presents us with a lab experiment that we can observe in realtime. Netflix’s announcement that it is splitting off its DVD-by-mail business from its streaming business is just such an experiment. The DVD business will now go by the name Qwikster, and the streaming business will stay under the Netflix brand. It is Clayton Christensen ‘s innovator’s dilemma incarnate, and Netflix is very publicly trying to solve it. Like its 60% price increase did earlier this year, this move is understandably causing consternation amongst some customers. It’s a bold move, one that will cost them in the near term, but Netflix I’m sure has done the calculus and is looking at the endgame 5-10 years out, not 5-10 months.

- Adam Richardson is a creative director at the global innovation firm frog design and the author of Innovation X: Why a Company’s Toughest Problems Are Its Greatest Advantage . His background combines experience in product development, product strategy, and customer research.

Partner Center

Disruptive Innovation: A Case Study on How Netflix is Transforming the Living Room

Student thesis : Master thesis

Innovation has always been a crucial factor in business strategy across various market segments. In light of the digitalization revolution, the entertainment industry has been affected greatly, both in positive and negative ways. Long standing market incumbents such as Blockbuster have felt the disruptive shift of a new market player, Netflix. Its disruptively innovative strategy was simple enough to cater to small consumer segments, while rapidly gaining market traction. Eventually Netflix disrupted not only the market giant Blockbuster, but also consumers’ living rooms. Clayton M. Christiansen’s theory on disruptive innovation provides context and guidelines in better understanding the differences between sustaining innovation and disruptive innovation. Furthermore, it reflects over “The Innovators Dilemma” where, innovators must decide how to best invest their resources so as not to loose market share. This Thesis aims to better understand the effects of disruptive innovation within the entertainment content industry. The research utilizes a case study approach, using Netflix as the case company. Due to technological advancements the TV and entertainment content industry has drastically changed with new methods of consuming content, and new business models to disrupt the market. Having disrupted the market, Netflix remains a leading force among consumers. Moreover, in recent years, the competition within the market has radically increased. The project goes on to explore Netflix’s possible outcomes for future markets.

Documents & Links

File : application/pdf, 4.75 MB

Type : Text file

Inside Netflix: Innovation, Originals, and Cultural Phenomena

)

Netflix's journey from a DVD-by-mail service to becoming one of the planet's most recognized companies is an exemplary case study in business model transformations. Its 2007 pivot to streaming, followed by a successful foray into original content in 2013, has reshaped the entire entertainment industry and profoundly influenced global pop culture. In this exploration, we'll delve into Netflix's pivotal business decisions, examine its competition – primarily with Max, Disney+, and Amazon Prime Video – assess its pricing power, and uncover why Netflix continues to reign as the king of content.

Key Insights

Transformation and innovation: The company's shift to a subscription-based model and early adoption of streaming technology in 2007 were both pivotal moves that redefined media consumption globally.

Original content: Netflix's strategic pivot to producing original content in 2013, starting with "House of Cards," marked a significant shift from content distributor to content creator.

Cultural impact: The "Netflix Effect" demonstrates the platform's profound influence on global pop culture, from reviving interest in 1980s culture through "Stranger Things" to sparking a chess boom with "The Queen's Gambit."

Future challenges and resilience: Despite facing stiff competition from other streaming services such as Max, Disney+, and Amazon Prime Video, Netflix has maintained a leading position in the streaming industry.

Founded by Reed Hastings and Marc Randolph

Founded by Reed Hastings and Marc Randolph on August 29, 1997, in California, Netflix is undoubtedly one of the best case studies of impressive business model transformations, evolving from a DVD-by-mail service to one of the largest and most well-known companies worldwide in less than two decades.

Randolph, with a background in marketing, and Hastings, a software engineer, were inspired by the potential of the internet to revolutionize traditional business models. Hastings had just months before co-founding Netflix sold his first company, Pure Atria, and was immediately eager to start a new venture. The idea for Netflix reportedly appeared from Hastings' frustration with a hefty late fee for a rented movie, which highlighted the limitations and customer pain points of the existing rental system.

The company's name itself, a blend of "net" from the internet and "flix," a shorthand for flicks, signified its future direction. They envisioned a service where customers could rent DVDs online and have them delivered by mail, bypassing the need for physical stores and late fees. This model was leveraging the growing accessibility of the internet and the U.S. Postal Service's reliable delivery system to offer a new level of convenience to customers. Netflix's initial business model revolved around a pay-per-rental service, but it soon pivoted to a subscription-based model, allowing customers unlimited rentals for a flat monthly fee, a groundbreaking concept at the time.

Fast-forward to arguably the most crucial pivot in the history of Netflix: the transition from DVD rentals to video streaming. In 2007, Netflix introduced its streaming service and thereby became one of the early adopters in this space. Netflix's investment in personalized recommendation algorithms set it apart from competitors from the start, creating a unique value proposition by helping users find content they love, thereby increasing user engagement and satisfaction.

Despite its early success in streaming, roughly one-third of Netflix's revenue was still generated by its legacy DVD-by-mail business in 2012. On September 29, 2023, Netflix announced the dispatch of its last iconic red envelope, officially closing down the DVD rental service. Today, Netflix is synonymous with streaming, boasting over 260 million paying subscribers worldwide. The company's streaming sales grew to $33.6 billion in FY 2023, having grown its revenue at 23% CAGR over the last decade.

Netflix's Revenue Growth Since 2012

)

Provider Goes Producer: Netflix's Pivot to Original Content

Beside the obvious crucial move into streaming in 2007, another game-changer came in 2013 when Netflix launched its first original series, "House of Cards." This bold move was not just an expansion of its library but a complete redefinition of its business model and brand identity. By producing its own content, Netflix aimed to reduce its reliance on licensing agreements, which were becoming increasingly costly and complex. Main reasons for the pivot:

Control over content: Producing original content gave Netflix control over its library, ensuring a steady stream of exclusive offerings to attract and retain subscribers.

Global reach: Original productions allowed Netflix to tailor content for different regions and languages, fostering a more global audience and scaling internationally.

Branding: By producing its own content, Netflix not only began winning awards and elevating its brand status but also became a top choice for well-known movie directors and actors to collaborate with, further adding brand equity.

Industry disruption: This shift challenged traditional media production and distribution models, positioning Netflix as a competitive force against Hollywood studios and television networks.

The success of Netflix's original content is evident in its popularity among viewers and critical acclaim. Series like "Stranger Things," "The Crown," "Squid Game," and "Narcos" among others have garnered massive global audiences and significant industry awards.

Despite its successes, Netflix faces challenges in its pivot to original content. The increasing competition from other streaming services, such as Amazon Prime Video, Disney+, and Max, has intensified the battle for viewer attention and top-tier content. This competition has put Netflix in a position where deploying large sums of capital seems inevitable, making it challenging to achieve high cash flow margins over time.

The Streaming Wars with Disney

As of the second quarter of 2022, Disney had officially overtaken Netflix in total paying subscribers, marking a significant milestone given Netflix's long-standing dominance in the video streaming sector. However, Netflix has since reclaimed its leading position. Below, we present a visualization of the ongoing streaming war:

)

Further reading: Disney's Most Notable Acquisitions Since Inception

It is important to note that Disney counts its subscribers per SVOD solution, meaning someone subscribing to the entire Disney package could be counted three times in the total, since Disney offers Disney+, Hulu, and ESPN+. Consequently, one could argue that Disney's total number of subscribers is artificially inflated. Of course, the value of each subscriber can also vary due to pricing differences. In this regard, Netflix charges the most within its peer group and has also demonstrated strong pricing power over time:

)

The Streaming Wars for Profitability

The chart below is interesting for several reasons. First, it illustrates the questionable impact of Disney+'s aggressive marketing and low pricing strategy during its initial years following its 2019 launch. There's a clear threat to Disney+'s profitability, especially with customers becoming accustomed to lower prices. As of early 2024, Netflix's subscription fee stands at $14.99 per month, while Disney+ offers its service at $7.99 per month. Similarly, Amazon Prime Video charges $7.99 per month as a standalone service, though most of its viewership comes from subscribers bundled with the broader Amazon Prime package.

)

Number of Quality TV Shows by Streaming Provider

Besides Netflix's premium pricing, these statistics from Statista further ad color to why Netflix is a market leader within video streaming. This chart illustrates the number of TV shows available on each major video streaming platform in the U.S. as of January 2024, ranked by IMDb quality rating:imag

)

The Netflix Effect

Netflix has not only transformed how we consume entertainment but has also profoundly influenced popular culture, fashion, tourism, and even hobby trends. This phenomenon, often dubbed "The Netflix Effect," exemplifies the platform's power to elevate niche interests into global trends. A typical example of this is the surge in chess's popularity following the release of "The Queen's Gambit."

When "The Queen's Gambit" premiered in 2020, it didn't just capture audiences with its riveting storytelling and stellar performances; it sparked a worldwide chess frenzy. The series, which follows the journey of a young chess prodigy, Beth Harmon, played a pivotal role in bringing the ancient game back into the limelight.

Following the show's release, online chess platforms like Chess.com witnessed a dramatic increase in users. Retailers reported a significant uptick in chess set sales, and Google searches for chess-related terms hit record highs. This resurgence wasn't limited to virtual spaces; chess clubs and tournaments also saw boosted interest, indicating a tangible impact on offline chess engagement.

Netflix's impact extends far beyond "The Queen's Gambit." Here are a few other examples where the streaming service has significantly influenced various aspects of culture:

Stranger Things and the 80s revival "Stranger Things" didn't just become a cultural phenomenon for its intriguing plot and endearing characters; it also reignited a passion for 1980s culture. From fashion choices, like the resurgence of retro styles and music, to a renewed interest in Dungeons & Dragons, the series brought the 80s back into contemporary relevance.

Money Heist and the Dali mask The Spanish series "Money Heist" (La Casa de Papel) had a global impact on pop culture, most notably through the iconic Salvador Dali mask and red jumpsuit worn by the characters. These symbols have been adopted in protests worldwide, showing how a television show's imagery can transcend its original context and gain a new meaning in the real world.

Narcos and the Increased Interest in Colombian History "Narcos," a series about the history of drug cartels in Colombia, significantly boosted interest in the country's history and issues surrounding drug trafficking. While the show faced criticism for its portrayal of Colombia, there's no denying it brought international attention to the nation's past and present challenges.

Fun fact: Bezos tried to acquire Netflix

Jeff Bezos expressed interest in acquiring Netflix just months after its launch. He invited Netflix's co-founders, Marc Randolph and Reed Hastings, to Amazon's headquarters to discuss a potential buyout. At the meeting, Bezos proposed purchasing Netflix for a sum between $14 and $16 million.

Randolph and Hastings, who admired Amazon and the booming e-commerce market, saw parallels between their aspirations to become digital category market leaders. This shared vision typically forms a solid foundation for mutual respect. However, after considering the offer, the Netflix co-founders decided against selling to Amazon. They however viewed Bezos's interest as an endorsement of Netflix's potential and believed that their business could achieve greater success independently. Interestingly, this encounter and the subsequent decision to reject Bezos's offer might have been the inspirational spark leading them to pivot their business model toward a subscription-based service, which would eventually revolutionize entertainment consumption.

Netflix's evolution from a modest DVD-by-mail rental service to a global leader in video streaming is a testament to its continuous innovative capabilities. The company's foray into original content production has not only redefined its business model but also set new standards in the entertainment industry, with other giants such as Disney and Amazon following Netflix with similar initiatives. With a commitment to creating diverse and high-quality content, Netflix has captivated audiences worldwide, maintaining its stronghold in the streaming wars despite formidable competition.

As the landscape of digital media continues to evolve, Netflix's ability to anticipate and respond to changing consumer preferences and technological advancements will be crucial to its sustained success. While challenges such as rising competition and the costs of content production loom large, Netflix's track record of resilience and creativity bodes well for its future. By continuing to push the boundaries of storytelling and innovation, Netflix is poised to remain at the forefront of the global entertainment industry, shaping the way stories are told and experienced in the digital age.

Why are finance professionals around the world choosing Quartr Pro ?

With a broad global customer base spanning from equity analysts, portfolio managers, to IR departments, the reasons naturally vary, but here are four that we often hear:

Eliminate hours of searching for specific data points buried deep inside company material.

Everything you need for qualitative public market research in one single platform.

Understand the qualitative aspects of entire industries or specific companies.

Incorporate AI functionality into your daily workflow.

- Request personal demo

- Discover Quartr Pro

- Harvard Business School →

- Faculty & Research →

- May 2007 (Revised April 2009)

- HBS Case Collection

- Format: Print

- | Pages: 15

About The Author

Willy C. Shih

Related work.

- August 2014

- Faculty Research

Netflix in 2011

- Netflix in 2011 By: Willy Shih and Stephen Kaufman

Netflix & Blockbuster – Case Study Of Disruptive Innovation

Written By:

Post Date – Update:

It’s rare for a week without me tuning into Netflix to watch something or at least browse its offerings to find my next binge-worthy series. I know I’m not alone in this habit; countless others probably engage in the same routine.

That’s why examining the Netflix and Blockbuster case study is so enlightening. It offers a riveting look at how disruptive innovation can permanently alter the digital landscape. One company survived and flourished, while the other faded into business irrelevance. As we delve into key learnings from this case study, we also discuss what contemporary companies can do to avoid meeting the same fate as Blockbuster.

Table of Contents

Understanding disruptive innovation, netflix’s early challenges, low-end footholds, new market footholds, blockbuster’s missed opportunities, the importance of transformation in business, 1. adapt or perish, 2. recognize low-end footholds, 3. embrace technology early, 4. customer-centric approach, 5. stay ahead through innovation, 6. use data intelligently, 7. anticipate future trends, 8. understand market signals, 9. transformation is continuous, listen to our podcast about streaming wars chronicles: the netflix & blockbuster case study of disruptive innovation below or by clicking here., 5 questions to ask when considering a solid wood furniture manufacturer, what is solid wood vs. engineered wood, hardwood solids furniture, what does the term mean, netflix & blockbuster: a case study in disruptive innovation.

One of the most compelling case studies in disruptive innovation is the saga of Netflix and Blockbuster. This story provides valuable insights into how Netflix managed to upend the industry, positioning itself as a dominant force in today’s digital landscape.

Continue reading as we delve deeper into the disruptive journey of Netflix and Blockbuster.

Digital disruption has been a game-changer in entrepreneurial strategies since the late 20th Century. Contrary to popular belief, disruptive innovation is not the same as mere creativity.

While creating a fuel-efficient engine might draw a new consumer base, the minor variations from standard engines do not categorize it as disruptive. True disruption focuses on targeting sectors that established companies overlook or revolutionizing an existing system.

This case study delves into how Netflix applied disruptive innovation to dethrone Blockbuster in the home entertainment industry.

Brief History Of Netflix

Understanding its history is crucial to grasp the scale of Netflix’s disruption fully. Netflix was founded in 1998 by Reed Hastings and Marc Randolph in Scott’s Valley, California, with an initial investment of $2.5 million from Hastings.

Opting to distribute DVDs rather than bulky and fragile VHS tapes, Netflix started with 30 employees and 925 available titles. Over time, the company introduced a monthly subscription model, eliminating the single rental system. It positioned itself as a consumer-friendly alternative to Blockbuster’s model, often including late fees and hidden charges.

Netflix wasn’t always the giant we know today. In 2000, the company even offered to sell itself to Blockbuster for $50 million—an offer that Blockbuster refused.

Following the dot-com bubble burst and the 9/11 attacks, Netflix was forced to lay off two-thirds of its staff. However, the proliferation of affordable DVD players and an IPO in 2002 helped the company regain its footing.

Disruptive Strategies Used By Netflix

Netflix employed various disruptive approaches to outmaneuver Blockbuster in the market. Continue reading to uncover two of these critical, innovative strategies.

Netflix initially targeted lower-end markets that Blockbuster ignored. It presented itself as a hassle-free alternative to Blockbuster by eliminating late fees. This allowed Netflix to grow its customer base steadily.

The company focused on improving service speed and video quality, gradually becoming a preferred choice over Blockbuster for many consumers.

Netflix further disrupted the industry by introducing DVDs and streaming services. Their easy-to-use online interface and innovative recommendation algorithm provided an experience Blockbuster couldn’t match.

They also invested in creating original content, widening their market appeal, and keeping audiences engaged.

Blockbuster’s business model worked well for a time, but their complacency in innovation left them vulnerable to disruption. They continued to rely on an aging model that included late fees and did not adapt quickly enough to new technologies.

When they finally attempted to catch up, it was too late, and they were already in decline.

While disruptive innovation is crucial for capturing market share, continual transformation is essential. Netflix’s willingness to adapt allowed it to evolve from a DVD rental service to a streaming giant.

Conversely, Blockbuster’s resistance to change led to its downfall. The case of Netflix vs. Blockbuster is a compelling example of how disruptive innovation can reshape industries and why companies must adapt to survive.

Lessons From The Netflix & Blockbuster Case Study On Disruptive Innovation

The evolution of Netflix and the decline of Blockbuster serve as an epic tale of disruptive innovation in the business landscape. This case study provides insights into strategic decision-making and offers lessons on how to deal with market transformation.

Here are ten key lessons companies can learn from this saga.

The inability of Blockbuster to adapt to emerging technologies and new consumer preferences, especially around the convenience of movie rentals, was a critical downfall. Companies must be agile and willing to adapt their business models to remain relevant.

Netflix capitalized on the aspects of the market that Blockbuster ignored, primarily around consumer annoyance with late fees. Companies should be cautious not to ignore market segments that might seem less profitable or secondary, as they may become entry points for disruptive competitors.

Netflix took a risk by betting on DVDs and online streaming. Companies should look towards emerging technologies as opportunities for future growth and be willing to invest early, even if the technology hasn’t yet reached mass adoption.

Netflix’s recommendation algorithm, easy-to-use interface, and concern for customer experience made them a consumer favorite. Companies should place the customer at the center of their business model and continually strive to improve the user experience.

Netflix invested in original content to differentiate itself further from Blockbuster and new competitors. Companies must continuously innovate and expand their offerings to keep customers engaged and deter potential entrants.

Netflix has been a pioneer in utilizing big data to understand customer behavior and preferences. Companies should leverage data analytics to make more informed decisions and to tailor their services/products to individual customer needs.

While Blockbuster remained committed to physical stores, Netflix anticipated the shift toward digital consumption. Forecasting and acting upon trends can differentiate between leading the market or becoming obsolete.

Blockbuster missed the signals when Netflix offered to sell itself for $50 million, and consumers began to show dissatisfaction with late fees. Recognizing and acting upon market signals, even subtle ones, can impact a company’s trajectory.

Even after establishing itself as a leader in streaming, Netflix continues to evolve and adapt. Understanding that transformation is an ongoing process rather than a one-time event is crucial for long-term success.

10. Learn From Failures

Both Netflix and Blockbuster had their share of mistakes. However, Netflix has shown an ability to learn from its failures, pivot, and recover. Companies should not only celebrate successes but also see failures as learning opportunities.

The tale of Netflix and Blockbuster is a masterclass in understanding disruptive innovation and market transformation mechanics. By recognizing early signs of disruption, staying adaptable, and being committed to continuous improvement and innovation, companies can remain competitive and relevant in their respective markets.

Find out more about how Mondoro can help you create, develop, and manufacture excellent home decor and home furniture products – don’t hesitate to contact me , Anita . Check out my email by clicking here , or become a part of our community and join our newsletter by clicking here .

Mondoro gives out a FREE Lookbook to anyone interested . You can receive a copy of our latest Lookbook by clicking here.

Listen to our Podcast called Global Trade Gal . You can find it on all major podcast platforms. Try out to listen to one of our podcasts by clicking here.

Subscribe to our Mondoro Company Limited YouTube Channel with great videos and information by clicking here.

Related Questions

One of the things we look at when we go into a new solid wood furniture manufacturer is in-house kiln wood drying. We also want to know if they understand how to join the wood properly and have the equipment. Also, if the manufacturer is in a hot and tropical climate if they have a dry room to help control the wood moisture levels. We like to work with factories that cut and shape all the wood and have in-house finishing facilities.

You can discover more by reading our blog 5 Questions To Ask When Considering A Solid Wood Furniture Manufacturer ; read more by clicking here.

Solid wood is cut down from the tree , cut into wood boards, and then used for manufacturing. On the other hand, engineered wood is considered manmade as it is usually manufactured with wood chips, wood shavings, and an adhesive. Today the manufacturing of engineered wood is extremely technical.

You can discover more by reading our blog All About Teak Wood And Outdod? by clicking here.

Hardwood solids can include non-solid woods such as engineered woods. Hardwood solids are used in furniture and other industries to classify what wood is used in a product. The terms usually do not classify what type of wood is used.

You can discover more by reading our blog Hardwood Solids Furniture, What Does The Term Mean? by clicking here .

- Latest Posts

- Navigating Waves: Understanding Fluctuations In Global Container Shipping Rates – April 29, 2024

- Timeless Charm Of Ceramic Table Lamps: A Deep Dive Into Elegance And Functionality – April 16, 2024

- Shapr3D And Procreate: Perspective On Home Decor And Furniture Design – April 11, 2024

Share Our Post On:

Anita Hummel

- Recent Updates

- Weekly Newsletter

- Monthly Newsletter

- Quarterly Newsletter

- AR/VR & Digital twins

- AI & Data Analytics

- IoT & Wearable

- Sensors & Perception

- 3D Printing

- Energy Tech

- Transportation

- Mining & Blue Economy

- Food & Living

- Communication

- Entertainment

- Manufacturing

- Work & Management

- Public Service

- Accelerators

- Death Valley

- Investments

- Exit & IPO

- Valuation & Financing

- Idea & IP

- Academic Research

- Corporate Research

- Public-funded Research

- Economics of Innovation

- Growth Economics

- Publications

- Patents & IP

- Future of Work

- Sustainable Development

- Smart Manufacturing

- Job Transformation

- Industry Transformation

- Competition & Monopoly

- National Response

- Education & Skills

- Social Change

- Venture Capital

- Capital Market

- Philanthropy

- Personality

- Sustainability Goals

- Business Model

- Complementary

- Externality

- Disruptive Innovation

- Incremented Innovation

- Schumpeter’s Creative Destruction

- Redesign for Winning

- Monopolisation

- Porter’s Five Forces

- Business Cycle

- Human Capital

- R&D Management

- Tripple Helix

- Intellectual Property

- Productive Knowledge

- Technology Managment

- Organization Agility

- Innovation Culture

- Infrastructure

- R&D facility

- Great by Choice

- Build to Last

- Good to Great

- Scientific discovery

- Adaptation & Refinement

- Start-up acquisition

- Technology Development

- Innovation Diffusion

- Jobs, Privacy & Security

- Regulation & Law

- Sustainability

- Equity & Inclusiveness

- Climate Change

- Environment

- Individual Preferences

- Planet and Society

- Political Economy

- Market Power & Monopoly

- Globalisation

- Schumpeter’s creative destruction

- Startups & VC

- Human Role in Work

- Value of Natural Resources

- Patents & Ideas for Redesign

- Case Studies

- White Papers

Technology, Society and Policy

Netflix Disruptive Innovation – renting to streaming

Contrary to subsidies for creating a market for primitive alternatives, scale and externalities have made netflix led video streaming a disruptive innovation.

- Rokon Zaman

- Created: March 15, 2022

- Last updated: January 7, 2024

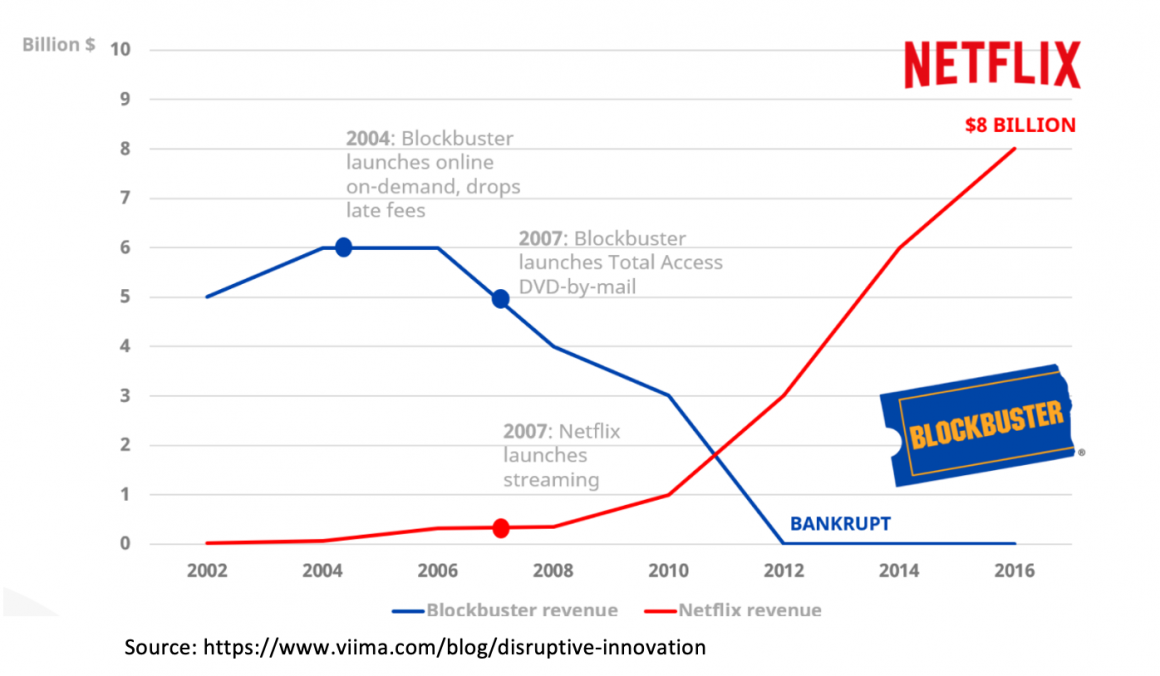

Netflix Disruptive Innovation is a textbook example of the rise of a startup and the fall of a giant due to technology discontinuity. The underlying reason has been the discontinuities created by two technologies: DVD and digitization of video content. Although incumbent rental service providers managed to withstand the effect of the reinvention wave created by the DVD mailing service, they failed to survive with the impact of video as a streaming service. With the rise of the digitization wave, a late entrant Netflix has become a poster child of disruptive innovation, whereas once market leader Blockbuster disappeared.

In the 1980s, the growing adoption of video recorders and players at home started creating the market of rental service of VHS videotapes. Among others, Blockbuster was a pioneer. It grew like a giant with 9,094 stores and 84,300 employees at its peak in 2004. However, the video products experienced reinvention in the late 1990s due to the emergence of the optical disk as DVD. Unlike VHS tape, DVDs were far lighter, opening the option of a DVD mailing service. During the same time, a new reinvention wave in the form of digitization of content and delivery over the net started to pop up. However, despite the potential, it kept struggling for multiple reasons. Some of them were the necessity of set-top boxes, slow downloading speed, and high bandwidth cost.

However, in the 2010s, this reinvention wave started gathering momentum due to positive externalities . Like many other examples, late entrant Netflix exploited unfolding positive externalities. The company got into video streaming services, but video rental service providing giants like Blockbuster were slow to respond. Subsequently, streaming services took over both rental and mailing services, and the market tipped, making Netflix disruptive innovation poster child.

Key takeaways from Netflix disruptive innovation examples

- Insufficiency of great ideas –Netflix’s disruptive innovation success of streaming video content had roots in the video-on-demand service idea pursued by several Startups in late the 1990s. Unfortunately, all of them went bankrupt before taking off.

- Externalities and consumer preferences matter –the proliferation of the Internet and the habit of watching poor-quality video clips facilitated the take-off of Netflix’s video stream services.

- Importance of timing for synchronized response s –timing in synchronizing inputs from multiple stakeholders resonated with Netflix’s push of streaming services.

- Competition challenges disruption success –due to limited runway of evolving video streaming service innovation, followers have been taking over Netflix’s disruption success.

Defining disruptive innovation: setting the context for comprehending Netflix disruptive innovation

Upon birth, products evolve with incremental advancement, forming an S-curve -like innovation lifecycle . The declining rate of progress at maturity starts encouraging innovators to explore alternative technology cores for reinvention. In many instances, innovators succeed in finding suitable emerging technology cores. Hence, they embark on reinvention by changing the matured technology core. However, perpetually, alternatives around reinvention appear in primitive form, producing loss-making revenue. Therefore, invariably, dominant producers busy profiting from mature products show reluctance to lead or make an early switch to the new waves. Despite the promise of unleashing radical or revolutionary innovation , for sure, new waves are fraught with pervasive uncertainties. Hence, incumbent firms suffer from innovators’ Dilemma syndrome.

However, those new waves sometimes grow and become a better alternative to matured ones, turning inferior alternatives into creative destruction . Hence, due to timely switching failure, incumbent producers of matured products suffer from disruptive business, as creative destruction waves turn into disruptive innovations . Therefore, disruptive innovation is the disruptive effect on the business of incumbent firms due to switching failure to creative destruction wave formed out of reinvention.

For example, RCA suffered from disruptive innovation due to the rise of Transistor radios and TVs. Similarly, the disruptive innovation effect of the digital camera made Kodak bankrupt. Other examples include cell phone, iPod, music streaming, PC, word processor, and many more. Like all those disruptive innovations, video streaming is a notable one—that grew out of the reinvention of tangible video products. The formation of video as digital content and its delivery over the internet has become a radical innovation, as it destroyed the demand for video rental and DVD mailing services. It has become a disruptive innovation due to the disappearance of incumbents and the rise of a late entrant–Netflix.

Rise of VHS tape video rental service:

The invention of the video cassette recorder (VCR) in 1956 opened the door to revolutionizing the movie industry. It seeded the changing television-watching habits. However, still the 1970s, its adoption did not pick up due to high costs; there was the need to change the costly rotating head. For example, in 1956, the price tag of Ampex’s VRX-1000 was US$50,000 (equivalent to some US$325,000 today). It also needed a highly-skilled operator.

Miniaturization of electronics and adoption of VHS standards led to the rapid adoption of VCR at home. It also contributed to the growing availability of movies on VHS tapes. Hence, a demand got created for renting movies as VHS cassette tapes. The world’s first video rental store renting out copies of films for private use started in 1975. The ease of getting movies to watch with VCR at home positively affected the adoption and creation of demand for rental services. Hence, due to the advancement and price reduction of VCR and the positive Externality Effect , the rental service market started growing rapidly. Furthermore, scale advantage fueled monopolization leading to the formation of dominant rental service provider Blockbuster, founded in the USA in 1985.

The emergence of DVD mail delivery service—could not Netflix disruptive innovation

To overcome the deteriorating quality of video recorded on magnetic tape, innovators were after the reinvention of video recording and playback means. It led to the emergence of DVD—digital video disk. The compactness of DVD created the window of reinventing video rental service, making it a DVD mailing service. Hence, among others, a startup, Netflix got into renting DVDs by mail in1997. As opposed to driving or walking to video rental stores, customers started finding the option of browsing catalogs on websites, placing an order, and getting delivery through the mail more preferable.

Therefore, DVD mailing services started to grow as a new wave, posing a threat to the video rental service of dominant players like Blockbuster. Among others, startup Netflix launched its DVD mailing service in 1998 through Netflix.com. However, the service was facing difficulty due to poor collection and limited adoption of DVD players. For example, Netflix debuted in 1998 with 925 titles—almost the entire catalog of DVDs at the time.

However, due to the superior quality of DVD content and decreasing price of players, demand for DVD subscriptions rapidly ramped up. In the USA and many other high-income countries, DVD players became a popular gift for holiday sales in late 2001. In addition to being a pioneer with DVD mailing services, Netflix also focused on attaining proprietary technologies, leading to getting a US patent covering its subscription rental service and several extensions.

As usual, successful high video rental service provider Blockbuster responded late to this new wave. Albeit late, Blockbuster launched its DVD mailing service in 2004, reaching 2 million users by 2006.

Growing profit and record DVD mailing did not let Netflix to complacent: a key driver of leading disruptive innovation

Due to the rapid adoption of the DVD mailing service, Netflix posted its first profit in 2003, earning $6.5 million on revenues of $272 million. Its’ profit soared to $49 million on $500 million in revenues in 2004. Netflix’s collection also ramped to 35,000 different films in 2005. But, despite the record shipping of 1 million DVDs every day and soaring profit, Netflix did not rest on enjoying the success. Instead, it focused on destroying the success of the DVD mailing service. Hence, Netflix embarked on reinvention by making movies digital content and delivering them over the Internet. In retrospect, it was an essential requirement for the uprising of Netflix disruptive innovation.

Digitization of video content and delivery over the net: struggled to take off but finally made it

Ironically, video on demand (VOD) over the net started in the early 1990s. Despite its adoption in hotels, it did not take off in the home market, the majority segment. Many startups pursuing VOD for the home market over the Internet got burst in the late 1990s. Underlying factors stunting the growth of VOD at the infancy included low Internet penetration, muffled speed, high cost of bandwidth, and need for special purpose equipment. The bandwidth solution could have been overcome by sending low-resolution videos, but viewers were not used to it. But the same VOD as streaming service became a mega success story down the road—primarily due to positive externalities. Hence, the timing for synchronization with externalities highly matters for the rise of the reinvention wave as creative destruction.

To bring radical innovation in movie selection and viewing experience, Netflix embarked on reinvention. Hence, in January 2007, Netflix launched a streaming media service–introducing video on demand via the Internet. But it was inferior due to only 1,000 films available for streaming compared to 70,000 available on DVD. Besides, internet speed was still a barrier. But among other externalities, the growing habit of watching video steam through YouTube played a positive role. Subsequently, the rapid expansion of Internet penetration, the rapid growth of speed, and the quick adoption of smart TVs led to ramping up the diffusion of streaming services. However, to tip this new wave towards Netflix, the company undertook serval measures. Forming agreements with movie-making studios and producing premier content are among them.

Late entrant Netflix leads reinvention out of digitization and once-dominant Blockbuster suffers from disruptive innovation—making Netflix disruptive innovation

Reinvention waves out of digitizing movies and sending them to home viewers as streaming service has grown as creative destruction. It has destroyed the demand for video rental and mail delivery of DVDs. Although both Netflix and Blockbuster became strong in DVD mailing service, Netflix became far more aggressive than others to lead the next wave, video streaming service. Like in the past, Blockbuster was late. Unfortunately, the rapid scale-up of Netflix’s streaming services and tipping did not give time to Blockbuster to switch. Hence, unlike the past, in turning late move to DVD mailing an apparent success, Blockbuster suffered from the burn of the disruptive effect of streaming services.

Unlike Blockbuster, Netflix did not become content with its success. The rapid growth of DVD subscriptions and soaring profit could have been a reason for Netflix’s management to keep exploiting the current wave. If it did so, a new entrant could have driven the streaming service, making both Blockbuster and Netflix sufferers from the disruptive innovation. Surprisingly, being a dominant player in DVD mailing service wave, Netflix took the dive to reinvent—subsequently destroying its profitable business. Due to growing positive externalities, reinvention wave streaming services took off. Through additional measures, like partnership and premium content creation, Netflix successfully tipped the streaming wave towards it.

Consequentially, once valued at $8.4 billion (1994), Blockbuster is now bankrupt. On the other hand, late entrant Netflix through the self-inflicting creative destruction wave became a $203 billion company in 2020. The company witnessed $29.7 billion in revenue and $5.1 billion in net income in 2021. Hence, the fall of once giant Blockbuster and the rise of late entrant Netflix out of creative destruction is a typical example of the disruptive innovation effect of digitization. Indeed, Netflix disruptive innovation offers lessons to startups and incumbents.

Netflix–suffering from a lack of sustaining innovation?

Irresectivetive of attaining a great height, invariably, all innovations suffer from competition. Besides, evolving externalities keep opening new innovation opportunities and closing the attractiveness of existing ones. Netflix is no exception. Hence, Netflix is bound to keep releasing successive better versions to sustain its success. Unfortunately, due to its weakness in it, Netflix suffered a subscription loss in 2022, plummeting stock price. Add-based innovations started to show positive results. By the way, Netflix will keep experiencing such a reality. Hence, Netflix should keep paying greater attention to sustaining innovation–by advancing quality and reducing the cost through a systematic Flow of Ideas . Netflix is also not immune to the next wave of creative destruction.

You may find these articles relevant:

Evolution of iPhone as Seasonal Crop—why does Apple keep releasing better versions?

Innovation S-curve – episodic evolution

Apple’s Innovation Strategy – creating and monopolizing

Self-Reinvention for Sustaining Success of Japanese Firms

Subscribe now to our newsletter

You May Also Like

AI job loss–will it render all jobs obsolete?

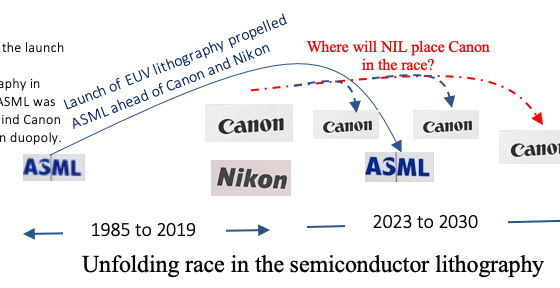

Nanoimprint Lithography Disruption–Canon vs. ASML rivalry unfolds

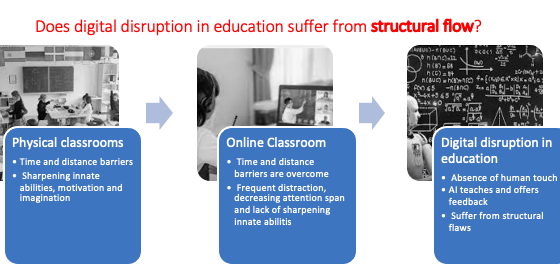

Digital Transformation in Education–moving towards disruption?

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Input your search keywords and press Enter.

Brought to you by:

Netflix, Inc.

By: Frank T. Rothaermel, David R. King

The case is set in 2023. The protagonists are Ted Sarandos and Greg Peters, co-CEOs of Netflix, a subscription streaming service and content production company. In Q4 2022, Netflix gained 7.7 million…

- Length: 26 page(s)

- Publication Date: Feb 2, 2023

- Discipline: Strategy

- Product #: MH0080-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

The case is set in 2023. The protagonists are Ted Sarandos and Greg Peters, co-CEOs of Netflix, a subscription streaming service and content production company. In Q4 2022, Netflix gained 7.7 million new subscribers (223 million worldwide) after losing 1.2 million in the year's first half. The scale of subscriber defection (in Q1 and Q2) across all geographic regions other than Asia concerned investors. By mid-2022, Netflix's share price plummeted by over 72%. The streaming company's market capitalization fell from $306 billion in November 2021 to a low of $74 billion, a loss of $232 billion. Dubbed the streaming wars, Netflix must contend with a host of competitors, some of them with deep pockets: Amazon Prime, Apple TV+, Disney+, HBO Max, Hulu, Paramount+, Peacock, and YouTube TV, among others.

Learning Objectives

Strategic leadership; strategy process, industry life cycle; business strategy (core competencies), innovation & technology strategy (disruptive innovation); business model innovation (matching business model and technology strategy; network effects; long tail; corporate strategy; diversification (vertical integration along the value chain; products and services; geography); international expansion (CAGE distance model; liability of foreignness); strategy implementation and execution

Feb 2, 2023

Discipline:

Geographies:

Asia, Europe, United States

Industries:

Advertising industry, Broadcasting and streaming media industry, Film and video industry, Media industry, Media, entertainment, and professional sports

McGraw-Hill Education

MH0080-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Disruptive Innovation in Entertainment Industry: A Case Study on Netflix

Added on 2023-06-11

About this Document

End of preview

Want to access all the pages? Upload your documents or become a member.

Forensics Readiness to Analyse the Disruptive Innovation in Automotive Industry lg ...

Innovation management: disruptive innovation, technology innovation, dyson's vacuum cleaner, apple's risk, p&g's strategic importance, p&g's innovation success, gore model difficulties lg ..., impact of cloud forensics readiness to analyse the disruptive innovation in automotive industry lg ..., benefits and drawbacks of global business environment - a study on netflix inc. lg ..., use of reward management to improve performance lg ..., business model canvas for netflix assignment 2022 lg ....

IMAGES

VIDEO

COMMENTS

Netflix's Bold Disruptive Innovation. by. Adam Richardson. September 20, 2011. Every now and then, the business world presents us with a lab experiment that we can observe in realtime. Netflix ...

1.1 Growing Pains of Disruptive Innovation. Innovation has always been a key component for the growth and development of any company, organization, or industry. Innovation is what drives performance and growth, it is central to the success of any business and it must be an integral part of a business strategy.

This Thesis aims to better understand the effects of disruptive innovation within the entertainment content industry. The research utilizes a case study approach, using Netflix as the case company. Due to technological advancements the TV and entertainment content industry has drastically changed with new methods of consuming content, and new ...

Keywords: Netflix, disruptive innovation, agile approaches, technology, business 1. Introduction Swann (2009) argues that innovation is one of the most important economic and business phenomena of current time and a topic of great practical and policy interest, with widespread implications for the economy and society.

This case study focuses on Netflix's technological journey, emphasizing its role as a startup that revolutionized a sector through tech-savvy approaches. Until 2023, Netflix continues to innovate. This exploration delves into how Netflix has evolved as a platform organization, leveraging advanced technologies to enhance user experience and ...

The presented paper will firstly examine and analyse the existing literature, including contributions, and points of view of several authors, in order to. achieve a comprehensive definition of ...

Netflix : disrupting the entertainment market with digital technologies, time and again. Abstract. This case study focuses on Netflix's technological journey, emphasizing its role as a startup that revolutionized a sector through tech-savvy approaches. Up until 2023, Netflix continues to innovate.

This case study will focus on the disruptive tactics applied by Netflix to surpass Blockbuster Inc. Additionally, it will highlight examples of bad decisions Netflix CEO, Hastings made, as well as ...

Inside Netflix: Innovation, Originals, and Cultural Phenomena. Netflix's journey from a DVD-by-mail service to becoming one of the planet's most recognized companies is an exemplary case study in business model transformations. Its 2007 pivot to streaming, followed by a successful foray into original content in 2013, has reshaped the entire ...

Netflix approach to innovation has become a model for many other companies over the globe to create an environment focused on customer centricity, elect quality as a statement, and align employees with strategy. Keywords: Netflix, disruptive innovation, agile approaches, technology, business. 1.Introduction. Swann (2009) argues that innovation ...

Netflix's chief executive officer was confronted with disruption from a variety of digital rivals. ... It offers a vehicle for students to thoroughly explore Clayton Christensen's disruptive innovation concept. In particular, it offers the opportunity to see two disruption examples in one case. Through the case, students will understand both ...

Disruptive Innovation. Netflix is an example of Basic Research/Incremental Innovation — as it started with DVD rentals and soon went on to transform itself into Disruptive Innovation — they ...

Abstract. Reed Hastings founded Netflix with a vision to provide a home movie service that would do a better job satisfying customers than the traditional retail rental model. But as it encouraged challenges it underwent several major strategy shifts, ultimately developing a business model and an operational strategy that were highly disruptive ...

Strategic Innovation Management at Netflix: A Case Study. : Netflix is a company that implemented a disruptive innovation and shocked the business market with its way to create and deliver value to their customers, breaking away with the old way to watch a movie at home. The culture of freedom and responsibility engaged by a radical ...

The evolution of Netflix and the decline of Blockbuster serve as an epic tale of disruptive innovation in the business landscape. This case study provides insights into strategic decision-making and offers lessons on how to deal with market transformation. Here are ten key lessons companies can learn from this saga. 1.

Netflix Disruptive Innovation is a textbook example of the rise of a startup and the fall of a giant due to technology discontinuity. The underlying reason has been the discontinuities created by two technologies: DVD and digitization of video content. Although incumbent rental service providers managed to withstand the effect of the reinvention wave created by the DVD mailing service, they ...

This article is a study case of the rise of Netflix, the world's leading subscription streaming entertainment service with over 200 million paid streaming memberships in over 190 countries ...

The case is set in 2023. The protagonists are Ted Sarandos and Greg Peters, co-CEOs of Netflix, a subscription streaming service and content production company. In Q4 2022, Netflix gained 7.7 million new subscribers (223 million worldwide) after losing 1.2 million in the year's first half. The scale of subscriber defection (in Q1 and Q2) across all geographic regions other than Asia concerned ...

Netflix, the pioneer of streaming service, is noted for its game-changing strategies that has not only set the foundation of Over-the-Top (OTT) services but also introduced the major trends of the ...

Innovation. Netflix's culture of innovation, which encourages risk-taking and experimentation, is a model worth emulating for CxOs. ... The Netflix case study offers a rich tapestry of insights ...

Netflix's Disruptive Technologies: A Case Study Introduction Netflix is widely regarded as a pioneer in the entertainment industry, leveraging disruptive technologies to revolutionize how content is consumed. This assignment explores Netflix's strategic adoption of disruptive technologies, its competitive advantage, value proposition, and its role as a disruptive innovator in today's market.

Strategic innovation management at Netflix: a case study: Autor(es): Souza, Ingrid Teixeira Romero, Fernando: Palavras-chave: Netflix Disruptive innovation Agile approaches Technology Business: Data ... Netflix is a company that implemented a disruptive innovation and shocked the business market with its way to create and deliver value to their ...

This research paper explores the concept of disruptive innovation in the entertainment industry with a case study on Netflix. It covers the background, aim, objectives, research questions, and key theoretical findings. The paper also discusses the ways in which entertainment consumption has been changed due to Netflix.

The case study has explored a disruptive innovation, Netflix by reviewing its adoption categories, analyzing its design in the phases before and after its release, evaluating its entrepreneurship and start-up potential and using analytics to understand and predict consumer behavior towards the same. ... Disruptive Innovation: How Netflix ...