- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

- Project Finance

Project Finance: Free Online Course

Learn the basics of a project finance transaction, key debt, and cash flow metrics, as well as return calculations and common scenarios used to support negotiations using a real case study. Includes FREE Excel template.

Get Certified in Project Finance Modeling

Table of Contents

What is Project Finance?

Before we begin – download the free excel template, video 1: introduction, video 2: project finance primer, video 3: course overview, video 4: timeline and process, video 5: timeline and process, part 2, video 6: construction and operations calculations, video 7: negotiations & optimizations, conclusion & next steps.

Welcome to Wall Street Prep’s free online course on Project Finance!

Project finance refers to the funding of large, long term infrastructure projects such as toll roads, airports, renewable energy using a non-recourse financing structure, which means that debt lent to fund the project is paid back using the cash flows generated by the cash flows generated by the project.

Course objectives: We created this course to provide students and finance professionals pursuing a career in project finance with an understanding the role and interests of the typical participants project finance transaction, key debt and cash flow metrics such as CFADS , DSCR & LLCR, as well as equity return calculations. We hope you enjoy – let’s begin!

Get the Free Project Finance Model Template

By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

This is the first part of a 7 part series, where you will learn about the basics of project finance analysis. Using Heathrow’s expansion of a third runway , we will walk through the basics of a project finance transaction, key debt, and cash flow metrics, as well as return calculations and common scenarios used to support negotiations.

In part 2, you’ll learn the basics of a typical project finance transaction, as well as key project finance jargon and terminology, such as SPV, PPP, CFADS, DSCR , EPV, EPC, DSRA, P90/P50.

In part 3, we introduce our project finance case study: Heathrow Airport’s expansion of a third runway.

The Ultimate Project Finance Modeling Package

Everything you need to build and interpret project finance models for a transaction. Learn project finance modeling, debt sizing mechanics, running upside/downside cases and more.

In part 4, you’ll learn about the typical project finance timeline and process. You’ll learn about the different characteristics of the project development, construction and operation phases of an infrastructure project.

In this lesson, you’ll continue on with the Heathrow Airport case study and learn about the capex , operations, debt and tax mechanics and calculations involved in a project finance transaction.

In part 6, you’ll learn about the cash flow waterfall and set the stage to determine cash flow available for debt service (CFADS), the Debt Service Coverage Ratio (DSCR) , the Loan Life Coverage Ratio (LLCR), determine the all-important Project IRR .

In this final lesson, we will introduce the various interests of the stakeholders involved in a project finance transaction. You will learn about the typical contours of a project finance negotiation and the typical scenarios that a project finance model must accommodate to support these negotiations.

We hope you enjoyed the course and please provide feedback in the comment section below. To learn more about how to build a comprehensive bankable project finance model, consider enrolling in our complete Project Finance Modeling Certification Program.

- Google+

- Project Finance Guide

- Project Finance Career Paths

- Project Finance Model Structure

Well done. Project Finance is really demystified.

A joy to listen.

Glad to hear, and thanks for that feedback!

It´s interesting for me the Scenarios Manager. In the model End i see it but in the other one i don´t know how to make the table and the index. Could you explain me?

If there is a completed version in the model that comes with this course, try to duplicate it. Also check out our FSM course online for its lesson on scenarios.

kindly e mail to me the schedule of On line courses and fees and eligiblity criterion .

We will adjust our work shcedule to match the time lags/leads owing to our geographical locations

Please check out this link: https://www.wallstreetprep.com/support/ , and email [email protected] , and they will get back to you with that information!

Sir , I would consider referring my employees from finance department to go for concise On Line Course . we are taking up BOOT projects of mid sized tickets for food waste digesters and Effluent Treatment and recycling to private industries in India

Hi, Shreepad,

Great, we would love to help your employees!

Dear sir , this free on line course on BOOT Finance is excellant , it enlightened me on all aspects of Long term Project financing . It is crisp, to the point , simplified to understand the complex process of making the financial decision .I work as CEO in Indian … Read more »

Glad to hear the course was helpful!

I think this free Project Finance intro course was brilliant! I wish we could also get the slides

Thank you, Ukamaka! Unfortunately, we do not provide the slides for this course, but please do check out our complete project finance online course! https://www.wallstreetprep.com/self-study-programs/the-ultimate-project-finance-modeling-package/

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Learn Online: Everything you need to build and interpret project finance models for a transaction.

The Wall Street Prep Quicklesson Series

Modern Project Finance: A Casebook

ISBN: 978-0-471-43425-2

October 2003

Benjamin C. Esty

Written as a guide to a dynamic, and increasingly important field, Modern Project Finance: A Casebook provides a detailed description and analysis of project-financed transactions. Other books describe what project finance is and how it works--Benjamin Esty, of the Harvard Business School, brings his expertise to a collection of cases that analyze the challenges of structuring, valuing, and financing project companies.

As a researcher, professor Esty has published numerous articles in both academic and practitioner-oriented journals such as the Journal of Financial Economics, Journal of Applied Corporate Finance, and the Journal of Financial and Quantitative Analysis . In addition, he has written more than 70 case studies, technical notes, and teaching notes on project finance, emerging market investments, and valuation mechanics. He currently serves on the editorial board of the Journal of Structured and Project Finance and regularly advises investment banks, development institutions, government agencies, and project sponsors on a broad range of investment, financing, and valuation issues.

- Provides a new and interesting setting in which to teach advanced principles of corporate finance.

- The cases provide comprehensive coverage of project finance in terms of actual use (i.e., geographic regions, industrial sectors, stages of project execution, etc.) so the reader can see the full range of practice. Cases are set in power, telecom, oil and gas, and mining, and in a range of countries such as Kuwait, Vietnam, Venezuela and Chad.

- Because most cases were written in conjunction with the people actually involved with the deals, the cases include contractual details, commentary, and financial projections that are not typically disclosed through public documents.

- The case studies are "managerial" in nature. They provide descriptive details, but they challenge readers to make important managerial decisions. Readers must identify critical issues (key questions), analyze the available data, and create a plan of action or respose. This process helps students become more adept at management in a way that replicates practice.

- The cases have been "battle-tested" in the classroom. The author has taught every case multiple times, and revised them to ensure they achieve their pedagogical objectives. The teaching notes have been tested and revised-they work in practice.

- Project Finance

Structuring, Valuation and Risk Management for Major Projects

- © 2022

- B Rajesh Kumar 0

Dubai International Academic City, Institute of Management Technology, Dubai, United Arab Emirates

You can also search for this author in PubMed Google Scholar

- Includes insightful case studies on finance in major projects

- Discusses both theoretical perspectives and practical aspects of project finance

- Presents a framework for evaluating structure, value and risk

Part of the book series: Management for Professionals (MANAGPROF)

100k Accesses

14 Citations

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

About this book

Large projects are defining moments for companies and countries. When large projects succeed, they can dramatically improve the social and economic conditions in a region. This book focuses on major aspects of the world’s largest infrastructural, industrial and public service projects through the lens of structuring, valuing, managing risk and financing projects. The book analyses and discuss large projects in government, private and public and private partnership. The author sheds light into the attributes of project finance which have unique structural elements. The book focuses on case studies related to 50 mega projects which includes infrastructural projects, energy related projects, industrial projects, roads, ports and bridges among others. This book covers both the theoretical aspects of financing of mega projects and the practical applications by including case studies of the world’s largest projects in terms of value.

Similar content being viewed by others

The Economics of Mega-projects

Sustainability and Financing Project: The UAE Paradigm

Financing Risk Analysis and Case Study of Public-Private Partnerships Infrastructure Project

- Structured Finance

- Financial Engineering

- Corporate Finance

- Project Management

Table of contents (54 chapters)

Front matter, trends in infrastructure industry.

B Rajesh Kumar

Infrastructure Financing Instruments

Risks inherent in project finance and its mitigation, structuring and implementation of the project, case 1: the chuo shinkansen project, japan, case 2: developing the world’s largest passenger aircraft-airbus a3xx, case 3: south north water transfer project china, case 4: dubailand project, case 5: international space station, case 6: al maktoum international airport, case 7: california high speed rail project, case 8: london cross rail project, case 9: beijing daxing international airport, case: 10 jubail ii industrial city, case 11: hong kong zhuhai macao bridge (hzmb), case 12: gotthard base tunnel (gbt), case 13: channel tunnel uk, case 14: doha metro, case 15: panama canal expansion, authors and affiliations, about the author.

B. Rajesh Kumar is a professor of finance at IMT Dubai (UAE). He received his Ph.D. from the Indian Institute of Technology Kharagpur (IIT Kharagpur, India). His research interests are in areas of applied corporate finance, valuation, M&A and sustainability. He has authored over 65 empirical research papers in refereed journals and seven scholarly books published by publishers such as Springer, Academic Press-Elsevier, Palgrave Macmillan and McGraw-Hill.

Bibliographic Information

Book Title : Project Finance

Book Subtitle : Structuring, Valuation and Risk Management for Major Projects

Authors : B Rajesh Kumar

Series Title : Management for Professionals

DOI : https://doi.org/10.1007/978-3-030-96725-3

Publisher : Springer Cham

eBook Packages : Economics and Finance , Economics and Finance (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2022

Hardcover ISBN : 978-3-030-96724-6 Published: 04 May 2022

Softcover ISBN : 978-3-030-96727-7 Published: 05 May 2023

eBook ISBN : 978-3-030-96725-3 Published: 03 May 2022

Series ISSN : 2192-8096

Series E-ISSN : 2192-810X

Edition Number : 1

Number of Pages : XV, 332

Topics : Business Finance , Risk Management , Project Management , Industries

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- ATM locations

- ATM locator

Estás ingresando al nuevo sitio web de U.S. Bank en español.

Easing complex transactions: project finance case studies, project finance is complex, which is a why a corporate trust partner with comprehensive capabilities is a critical piece of the puzzle..

Improving the country’s aging infrastructure is a top priority, and the $1 trillion Congress recently committed to infrastructure spending will likely kickstart a host of new building projects. At the same time, the American Society of Civil Engineers estimates that the United States needs to spend $4.5 trillion by 2025 to “fix” the country’s infrastructure.

What that means for stakeholders across the infrastructure industry is a growing pipeline of projects, along with the need for project finance expertise to help move projects forward. Bringing those projects to a successful close requires proven expertise, experience and strong communication processes, as well as an ability to work seamlessly with a number of parties and an ability to understand and navigate project finance risks.

As a leading global corporate trust provider , U.S. Bank has experience working on many complex transactions.

“We’ve seen many different approaches to these financings, and we have the ability to come to the table, apply our expertise from prior transactions in the documentation process, and help our clients reach the best outcome on how they’re going to put these complex financing packages together,” says Bob Kocher, managing director, U.S. Bank Global Corporate Trust.

That expertise was recently highlighted in two major project finance projects, where U.S. Bank served as a trustee in bond issuances in the capital stack of the Red River Diversion Project at the Minnesota/North Dakota border and the Central 70 Project in Colorado.

Red River Diversion project

In an infrastructure industry that is no stranger to large, complex projects, the Red River Diversion Project is a notable standout. The $3 billion project is more than a decade in the making, with numerous stakeholders and a mix of funding sources. It’s also a landmark public-private partnership (P3) project in the water infrastructure industry.

The Red River Diversion project represents the first use of the U.S. Army Corps of Engineers’ P3 Pilot Program to reach financial close. The aim of the program is to improve collaboration between the public and private sectors, as well as develop a more efficient alternative financing model for future Corps infrastructure projects.

The Red River Diversion project intends to provide permanent, reliable flood protection to the Fargo-Moorhead metropolitan area. The Red River serves as the state border for much of Minnesota and North Dakota and cuts through the center of Moorhead, Minnesota, and Fargo, North Dakota. Spring flooding in the Fargo-Moorhead metro has been a chronic problem for decades.

The solution is the development of a 30-mile diversion channel. The Army Corps of Engineers is overseeing design and construction, with completion scheduled in 2027.

The Red River Diversion project involved a number of intricate financing sources that were woven together, including developer equity, federal and state funding and $1.1 billion from local tax levies. The Metro Flood Diversion Authority worked with the U.S. Environmental Protection Agency to obtain one of the largest Water Infrastructure Finance Innovation Act (WIFIA) loans in the program’s history, at $569 million. In addition, project financing included $273 million in tax-exempt senior bonds issued through the Wisconsin-based Public Finance Authority.

According to the Corps , the Red River Diversion P3 was an “innovative approach leading to significant gains in efficiency, productivity and resiliency” that saved the federal government $277 million and shortened the construction time by 10 years.

As part of a competitive bid process, U.S. Bank was selected in April 2021 to serve as the bond trustee on the bonds issued by the Wisconsin Public Finance Authority, as well as filling additional roles as the account bank, collateral agent and dissemination agent.

Once U.S. Bank was selected as trustee, it needed to get up to speed quickly with all documents, provide comments regarding duties and liability and communicate to all parties its views on how the transaction should work as it related to the daily activities of the trustee.

“This trustee deal had a tremendous amount of document turnarounds as a result of the complexity of the transaction. It required attention to detail to ensure changes were consistent throughout all the documents,” says Angela Davis, relationship manager, Global Corporate Trust at U.S. Bank.

Keeping communication and workflow on track is a testament to the U.S. Bank team’s diligence in tracking documents, as well as its proactive approach to the collection and distribution of project information and covenants.

“Through our hands-on partnership and ability to work efficiently with other business lines inside of U.S. Bank, our client received everything they needed to keep this project moving forward,” says Davis.

Collectively, the U.S. Bank team will serve as the operational and administrative end of the financing, following the documents, administering the movement of funds and making sure the money is moved from account to account properly. U.S. Bank will be responsible for the billing and collecting funds to pay holders of the bonds and senior notes through 2056.

“P3 projects are the wave of the future, and U.S. Bank is at the forefront of that shift in how infrastructure projects are financed,” says Kocher.

“We can come to the table, apply our expertise from prior transactions in the documentation process, and help our clients reach the best outcome.” Bob Kocher, managing director, U.S. Bank

Central 70 project

Interstate 70, between I-25 and Chambers Road in Denver, is a key corridor that services nearly 1,200 businesses and provides an important regional connection to Denver International Airport. The Central 70 Project will reconstruct a 10-mile stretch of I-70, add one new Express Lane in each direction, remove the aging viaduct and create a four-acre park over a portion of the lowered interstate between Brighton and Colorado Boulevards.

The Central 70 Project involves the refinancing of a 2017 Transportation Infrastructure Finance and Innovation Act (TIFIA) loan, along with the financing of additional costs. As part of the refinancing, the U.S. Department of Transportation’s (DOT) Build America Bureau provided a new TIFIA direct loan with a reduced interest rate, allowing for additional loan principal increase to facilitate project completion.

Besides TlFIA, the project is backed by the proceeds of tax-exempt private activity bond and taxable bond issuances, as well as contributions from the state DOT, the Colorado Bridge and Tunnel Enterprise, the High Performance Transportation Enterprise, and local and state entities . The Series A bond issuance totaled $51,670,000 and the Series B bond issuance totaled $464,955,000.

U.S. Bank served as bond trustee and acted in ancillary roles as the collateral agent and intercreditor agent, paying agent, registrar, transfer agent and dissemination agent. In addition, because bondholder approval was needed to issue the new debt in 2021, U.S. Bank stepped in and served as the tabulation agent for the existing investors.

Key to a successful project finance deal is finding a partner with the expertise, resources and systems to streamline the process, such as tracking necessary compliance requirements and providing online reporting for the client. In addition, these complex deals often require a higher level of client relationship management.

“There is a lot more client interaction than a typical municipal financing, because there is always something going on, whether it is requisitions being paid or the sponsor needing to post financials or updates that need to be disseminated to the market,” says Gretchen Middents, relationship manager, Global Corporate Trust at U.S. Bank. “So, it is a much more hands-on relationship as compared with other assignments that don’t have the same scope of documents and requirements.”

In addition, working with a third-party trustee and agent to perform all project finance roles can produce numerous efficiencies, such as streamlining operations, coordinating workstreams from various parties and providing assistance for investors at every stage of the project lifecycle. Finding a partner with extensive experience servicing all debt vehicles can help guide decision-making with strategic insights and proactive solutions.

“These projects are more of a team effort because of the complexity,” adds Middents, “and being able to rely on others within our organization is key to our success.”

U.S. Bank administers a variety of infrastructure asset types and has the dedicated expertise to assist investors at every stage of the project finance lifecycle. See our extensive suite of services for debt financing here or contact Lars Anderson at [email protected] or Alejandro Hoyos at [email protected] .

Learn about U.S. Bank

Related content.

Direct lending trends in Europe

High-yield bond issuance: 5 traits lawyers should look for in a service provider

High-yield bond issuance: how to avoid 5 common pain points

Top 3 considerations when selecting an IPA partner

Case study: U.S. asset manager expands to Europe

Programme debt clients want reliable service – no matter where they’re based

3 innovative approaches to ESG investing in Europe

European outlook: Trustee experience more important than ever

The ongoing evolution of custody: Tips for renewing your custody contract

Emerging trends in Europe: An outlook from multiple perspectives

The benefit of a multi-jurisdictional European trustee

Maximizing your infrastructure finance project with a full suite trustee and agent

Employee benefit plan management: trustee vs. custodian

4 benefits of independent loan agents

Digital processes streamline M&A transactions

An asset manager’s secret to saving time and money

At your service: outsourcing loan agency work

Middle-market direct lending: Obstacles and opportunities

Managing complex transactions: what your corporate trustee should be doing

Depositary bank and collateral agent

Disclosures.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice. Mortgage, home equity and credit products are offered by U.S. Bank National Association. Deposit products are offered by U.S. Bank National Association. Member FDIC.

- Harvard Business School →

- Faculty & Research →

Project Finance Portal

- Format: Print

- | Language: English

About The Author

Benjamin C. Esty

More from the author.

- January 2024

- Faculty Research

Pioneer Natural Resources: Enhancing the Capital Return Strategy with Variable Dividends

- January 2024 (Revised May 2024)

- December 2023 (Revised April 2024)

Yellow Corporation: On the Verge of Bankruptcy

- Pioneer Natural Resources: Enhancing the Capital Return Strategy with Variable Dividends By: Benjamin C. Esty, Elisabeth Kempf and Scott Mayfield

- Pioneer Natural Resources: Enhancing the Capital Return Strategy with Variable Dividends By: Benjamin C. Esty, Elisabeth Kempf and E. Scott Mayfield

- Yellow Corporation: On the Verge of Bankruptcy By: Benjamin C. Esty and Edward A. Meyer

Edward Bodmer – Project and Corporate Finance

Resolving BS in Project Finance

Project Finance Case Study – Dabhol Power Plant

This webpage puts together information of the Dabhol electric power plant case. The case is old, but it has a lot of project finance lessons. One lesson is the dangerous way students are taught at Harvard before they go to Wall Street. Other issues relate to the danger of a high IRR and a high plant cost. The case includes philosophical issues related to legal structuring versus economic analysis; benchmarking of costs; the use of different types of financial models evaluation of the ability of off-takers to honour contracts.

Dabhol is also an interesting case for me because it was first launched as a breakthrough in electricity investment for India and arguably was an important cause of the downfall of Enron. The central issue in the case is whether risk analysis and valuation should have involved contract evaluation and insurance on PPA contracts or whether the ultimate affordability of the produced electricity to ultimate consumers should have been the focus of the analysis.

PDF File with Case Study of the Dabhol Plant Financed by Enron, GE, and Bectel in India in the Late 1990's

Dabhol Case Introduction

For the Dabhol case I have made an assignment rather than just putting some of my opinions on the website. The outcome of the Dahbol case study is well known in project finance (it is difficult not to call the project a dramatic failure). I am not interested in you just telling me what happened. I am interested in how you would have assessed the risks, the contract structure and other issues at the time the loan was made (a long time ago in the 1990’s). Even though the failure of the case is well known, I would like to know how you would have evaluated both positive and negative aspects of the project financing and how you would have considered nuances involving contract structure (in particular, the PPA pricing); benchmarking of costs, rate of return analysis, and off-taker assessment.

The case is about project finance risk analysis and contract structuring. If you would like to review background in these subjects I have included power point slides that provide discussion of project finance and contracts. You can download these slides by pressing the buttons below. In particular, you need to understand that project finance does not have history and as such benchmarking may be a good idea. You should also understand why a capacity or availability payment is present in some project finance transactions. You can review project finance issues by clicking on the button below to download power point slides.

Power Point Slides that Accompany the Video Lecture Series on The Theory of Project Finance

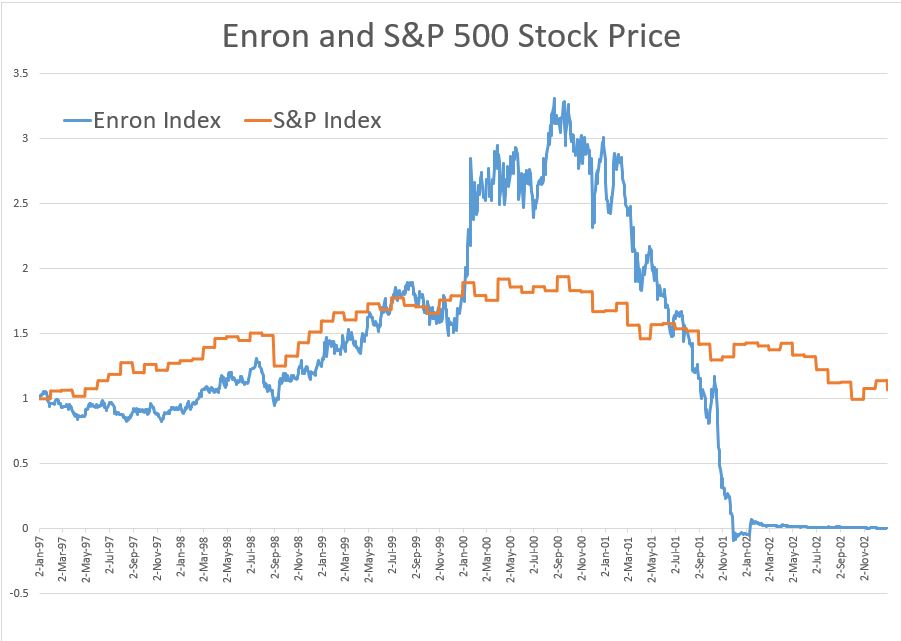

Enron Corporation was the main sponsor (owner or equity investor) and developer of the project. The plant was completed in 2001 and became a disaster at about the same time Enron collapsed. Maybe the Dabhol plant problems in India had something to do with the Enron fall. You can see the Enron stock price data below in case you are young and don’t know story.

In most places in the world (especially in India), the kind of arrangement where the revenue contract (in this case the PPA contract) is negotiated without a bidding process are no longer acceptable. This does not make the Dabhol case obsolete, as the economics of the contracts and political risk associated with the contracts still must be assessed even if a bidding process is used.

Background Resources for Completing Questions Raised in the Case

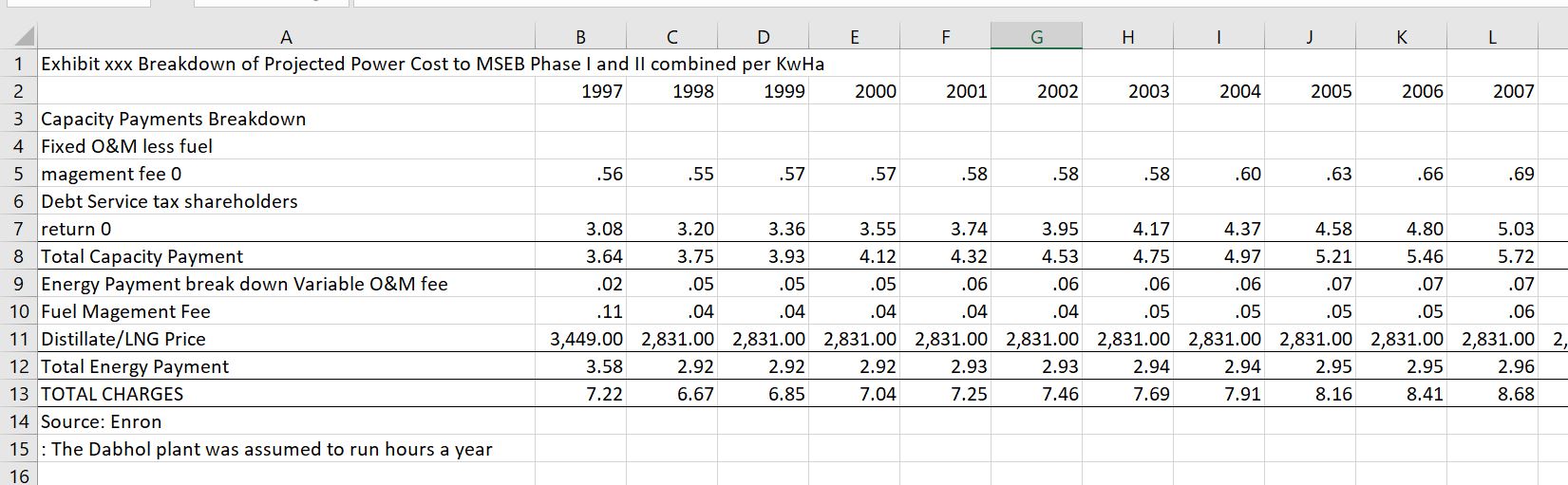

You can find many of the resources on the website except for the Harvard Business School (HBS) write-up. (I am not allowed to put the HBS case itself on the website because of copyright issues. Somebody from HBS has sent me threatening e-mails about this). I have however, put some of the information from the case in screenshots below.

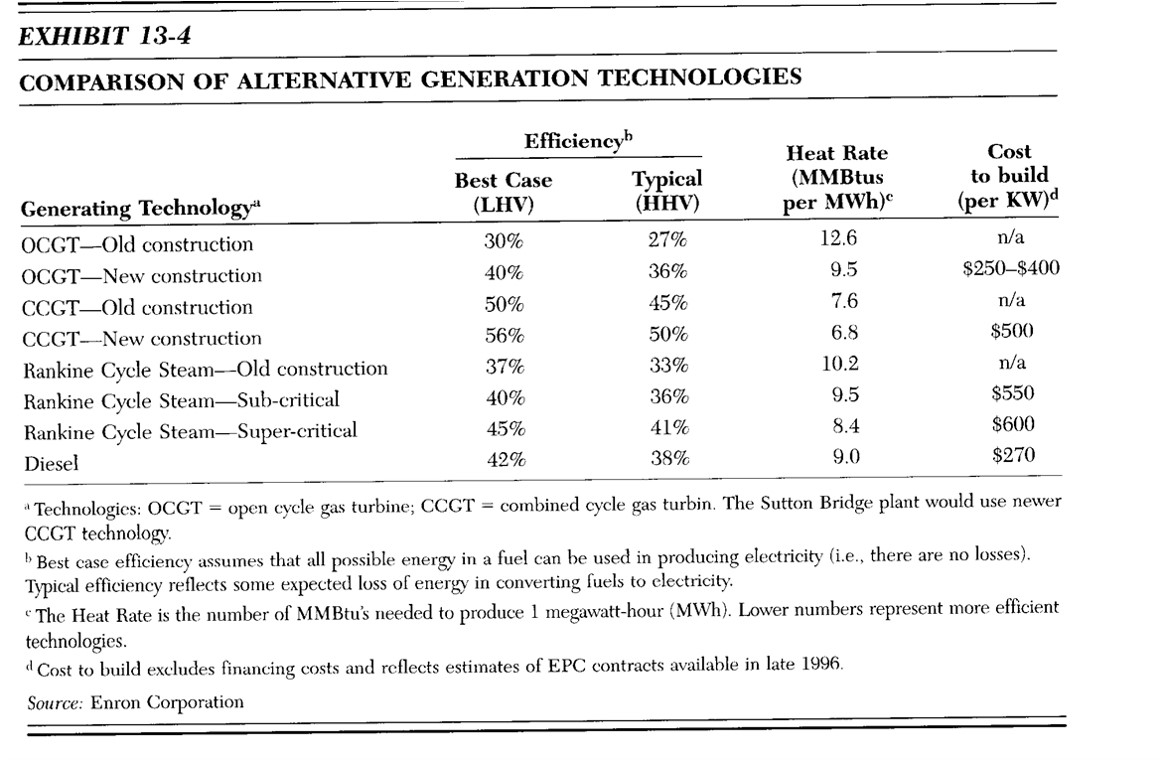

The basis for the case is the HBS Dabhol Case 1. The last exhibit in this case has numbers on the PPA agreement including the capacity charge. (In fact, the PPA was changed after the case write-up, but the re-negotiated numbers are not available). For purposes of this assignment you should use numbers and structure from the data in the HBS Case 1 that is the last page of the case.

Other than the HBS case, resources that should help you completing the case and are available download in different sections include:

- Case from India with Financial Analysis of the off-taker (the buyer of power)

- Read PDF excel utility so you can download data from the PDF to an Excel File

- Database File on exchange rates with the India/US exchange rate

- Files for benchmarking that include EIA data and Lazard

- Other case write-ups that describe various aspects of the case

You can use the buttons I have added below to download and read the background materials. (I wrote a few comments about the Dabhol case a few years ago. You are welcome to read these comments in my case studies preliminary manuscript. But please do not assume these comments are very good. I have not included my comments in the resources available for downloading below.)

Step by Step Instructions for the Dabhol Assignment

The assignment involves writing-up seven parts of the Dabhol project finance case. There are seven parts of the assignment. I would like you to write-up one or a couple of paragraphs on each section, something like a credit memo. Do not worry about the length of this page — I have tried to put a lot of details in the sections so you can concentrate on the central learning issues.

Part 1: Write-up the Summary

Write a succinct summary of the case from a credit analysis perspective (e.g. what were unacceptable risks in the loan agreement and why was the project good or bad from the perspective of risk). Include a couple of sentences in your summary about the implications of the case in the context of general project finance theory. You should probably write this up after you are finished with other parts of the assignment.

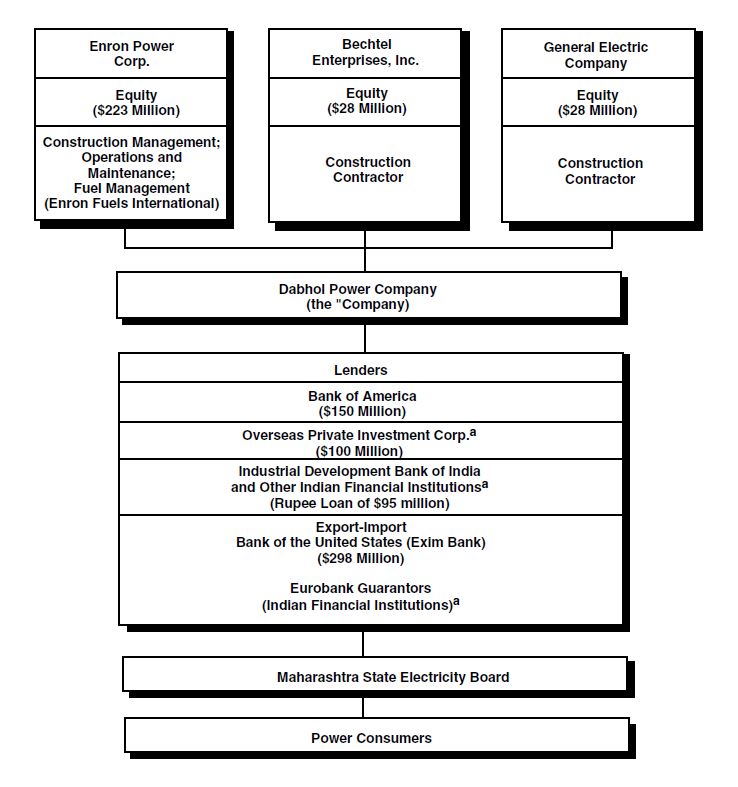

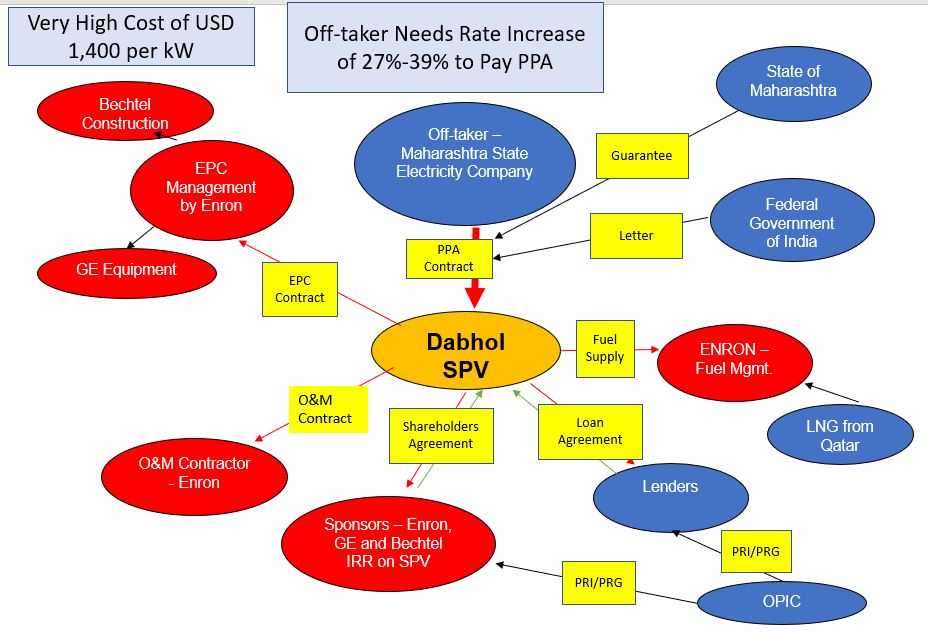

Part 2: Make a Diagram of the Contract Structure and Comment

The Dabhol project was named deal of the year for its contract structure before it imploded. In this section, I would like you to make a diagram of the structure of the contracts in the project financing — the entities and the contracts. Also, in a couple of paragraphs, discuss the general economic concepts of using a purchased power agreement with a capacity charge in an availability-based project. I am looking for a diagram that you can use to discuss risks of contracts not being honoured. I hope you can make it come alive with flows of where the money is coming from and where it is going.

I would also like you to comment on the diagram that is included in Exhibit 1 of the HBS study (shown in the screenshot below). I hope you make a much better diagram that allows the reader immediately understand risks and mitigations associated with the different contracts.

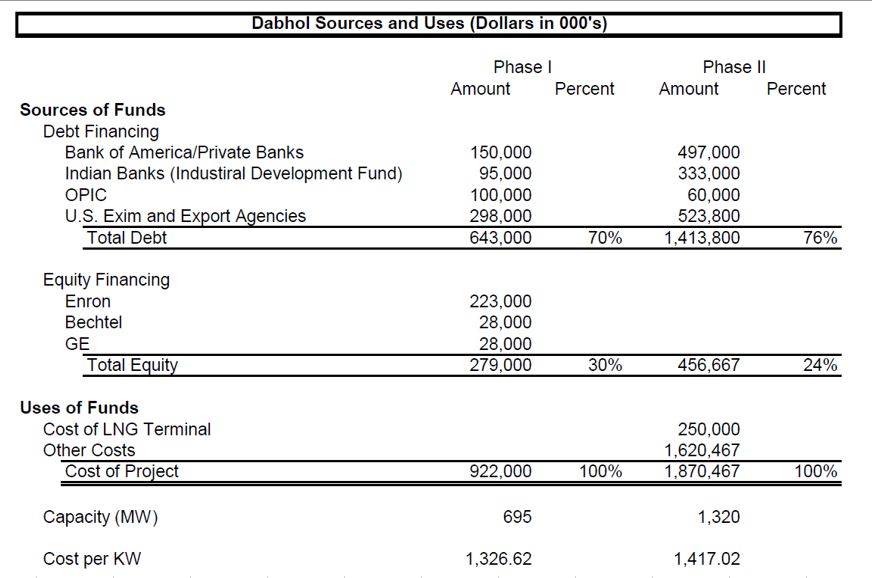

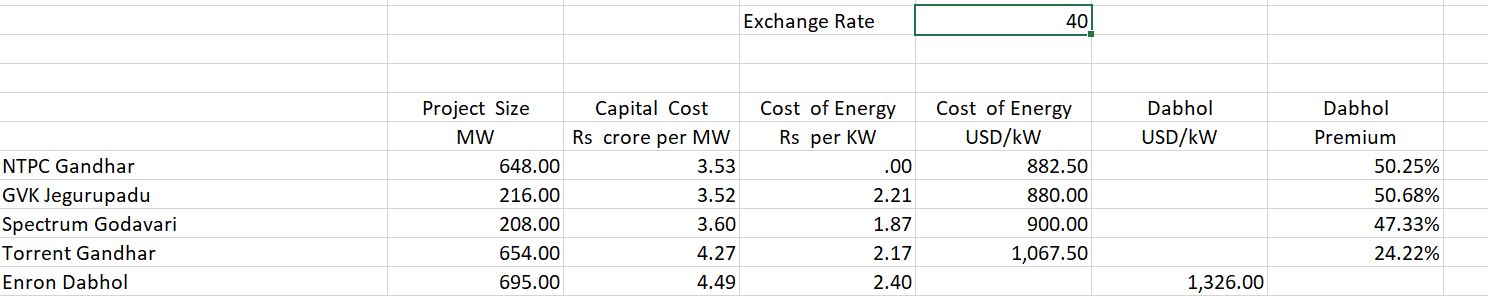

Part 3: Write a Paragraph on Benchmarking of the Cost per Unit

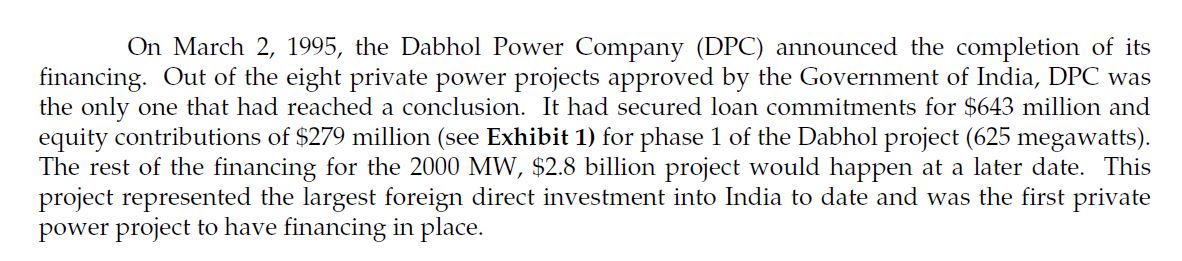

Any project finance investment includes capital expenditures, operating costs, volumes produced and prices. A lot of risk analysis depends whether the amounts for these capital expenditure, operating cost and revenue drivers are reasonable. As project finance does not include financial history, you often need to do some detective work to evaluate unit costs for capital expenditures, operating costs and other items (e.g. capital expenditures per kW). The cost and the capacity are at the top of the HBS case as shown in the screenshot below.

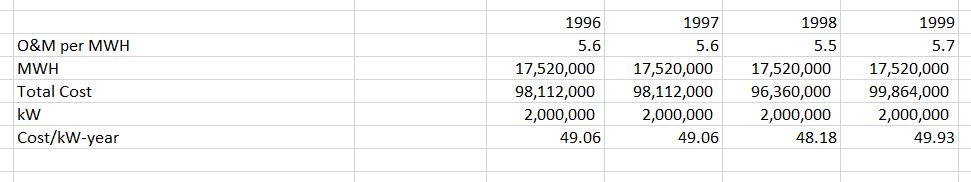

In this section, I would like you to do some cost benchmarking and compute unit costs of Dabhol. This is a bit difficult because of the age or the case, but you could start with an old HBS case that includes capital costs for different types of units. I have clipped a couple of sources in the screenshots below. Once you finished your benchmarking, comment on the reasonableness of the cost structure explain why you think the Dahbol costs are different from other plants. If you are really fancy, you could try also to benchmark the O&M cost.

I have included a photo of the plant that you can maybe use in benchmarking. Tell me if you think there is something special about this plant that makes it different from other plants around the world.

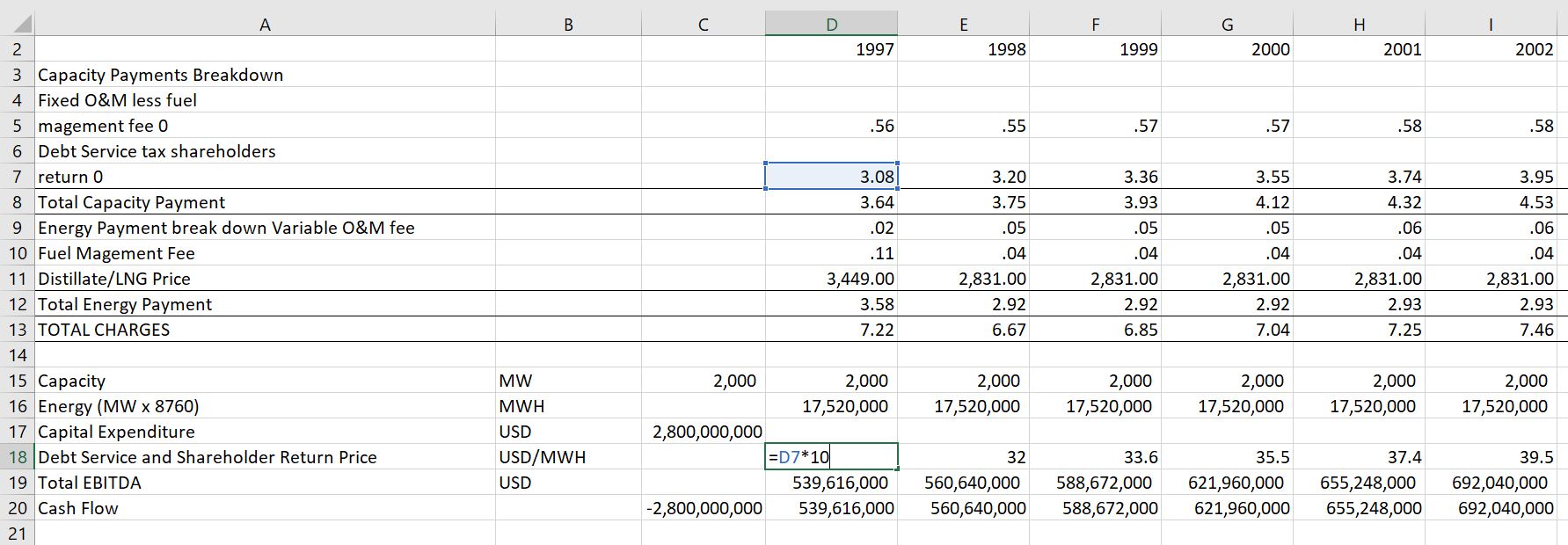

Part 4: Compute the Project IRR from the PPA numbers in the HBS Case 1

In this part of the assignment I would like you to compute the project IRR (return on investment measure in project finance) from information given in the HBS case study on the PPA. I would like you to think about the implications of different return measures. Maybe as lenders you should not care much about the return. Maybe you think a high return is good. For example, S&P includes various criteria in developing credit ratios. One of the S&P criteria is the return on investment – a higher return on investment is associated with better credit quality.

I would like you to: (1) compute the project IRR from the PPA statistics at the bottom page of the HBS Case 1; (2) discuss the difference between project IRR, equity IRR and debt IRR; (3) comment on the level of the project IRR in the context of credit analysis; and, (4) comment on whether the IRR reflects the true returns to investors.

In computing the project IRR, you can use the step-by-step process below. I do not want you to struggle too much with this. I just want you to get a very general idea of what can go into the project IRR calculation and, most importantly, how to interpret the calculation.

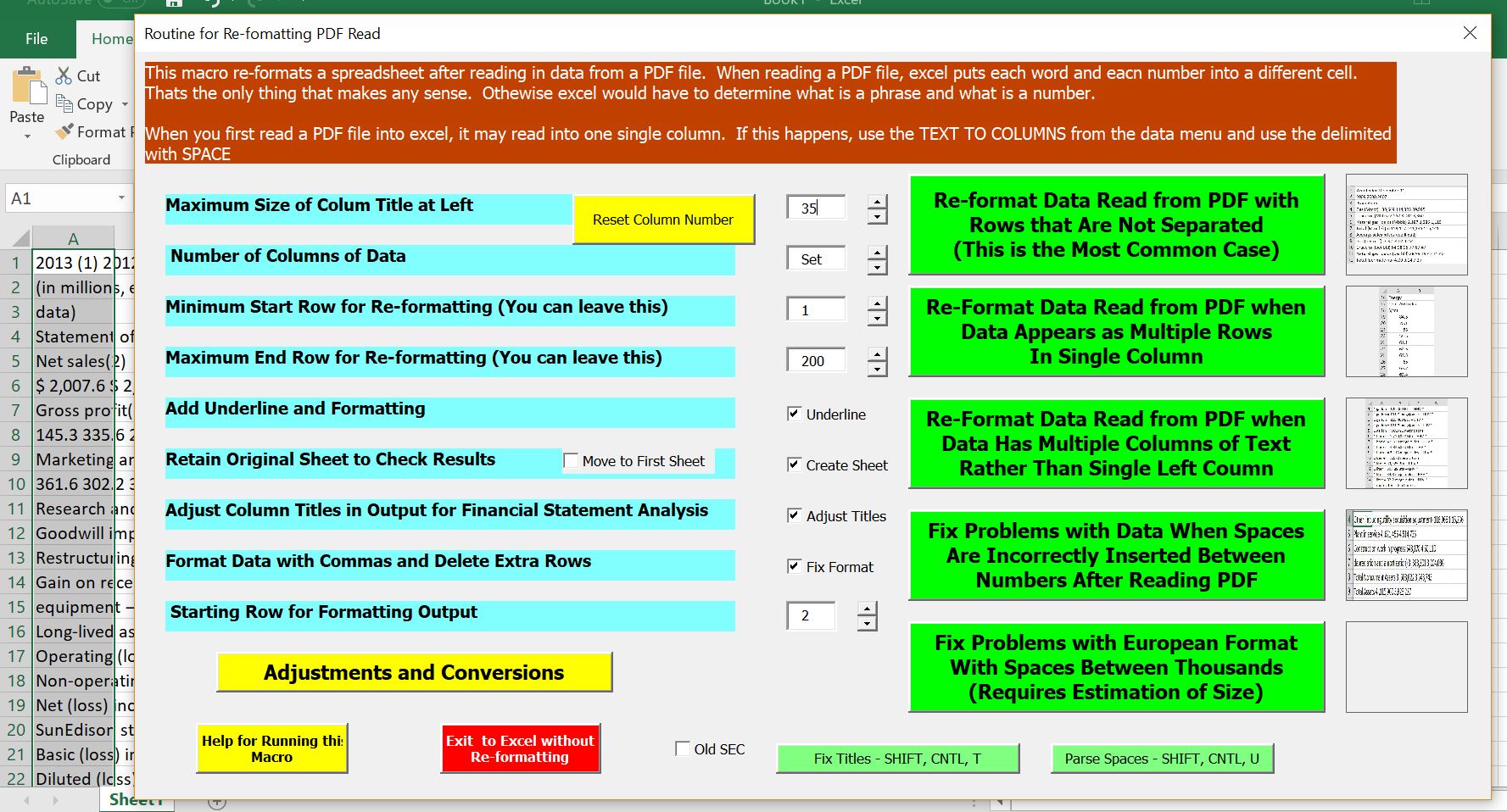

Step 1 : Open the Read PDF Excel file (you can download it by pressing the button below)

Read PDF to Excel File that Allows you to Format Data After Copying from PDF File (Press Shift, Cntl, A)

Step 2: Copy the PPA data at the bottom of the HBS case study to a blank excel sheet (the first screenshot). The second screenshot below shows the messy raw data after you copy and paste it into excel.

Step 3 : Press SHIFT, CNTL, A sequence to get the menu to appear (it is essential that the Read PDF to Excel File is open and you see the SHIFT, CNTL A on the bottom status bar of excel). Then go to the Conversions and Adjustments Button and adjust the REPEAT ROW option. These steps are illustrated in the screenshots below. If you are having trouble, you can send me an e-mail to [email protected] . The menus that should appear are shown in the screen shots below.

When you have finished this process, there should be a second sheet in your file that is cleaned up. The cleaned up sheet should look something like the screenshot below. Then you should add a couple of columns and you can make an analysis of the project IRR.

Step 4 : Insert a column for the construction period (assume a 1-year period) and enter the construction cost of $2.8 billion and the capacity of 2,000 MW for both units as quoted in the case. I have illustrated a little excerpt from this below.

Step 5: Use the absurd assumption that the plant will run 8760 hours per year that is noted in the case (maybe the plant will get a sick day — have an outage of 24 hours in leap years). With this assumption, compute the volumes sold as the capacity multiplied by the hours to arrive at MWH. Assume also that the PPA applies to the entire 2,000 MW of the plant. Do all of your analysis in USD (not USD 000’s or USD millions). In the case, the contract prices are in USD cents per kWh. Convert these to USD per MWH through multiplying by 10. These few calculations are shown in the screenshot above.

Step 6: Assume that the contract structure is such that the fuel revenues in the PPA contract match fuel costs and the operating revenues in the PPA contract match the actual operating expenses. This means that the return is earned through multiplying the capacity charge in USD/MWH by the MWH.

Step 7: Compute the Project IRR on a pre-tax basis using the capital expenditures in the first year as the cash output and the combination of the capacity charge and the management fee multiplied by the volumes as the cash flow input. Use the IRR function in excel. Now do the important part.

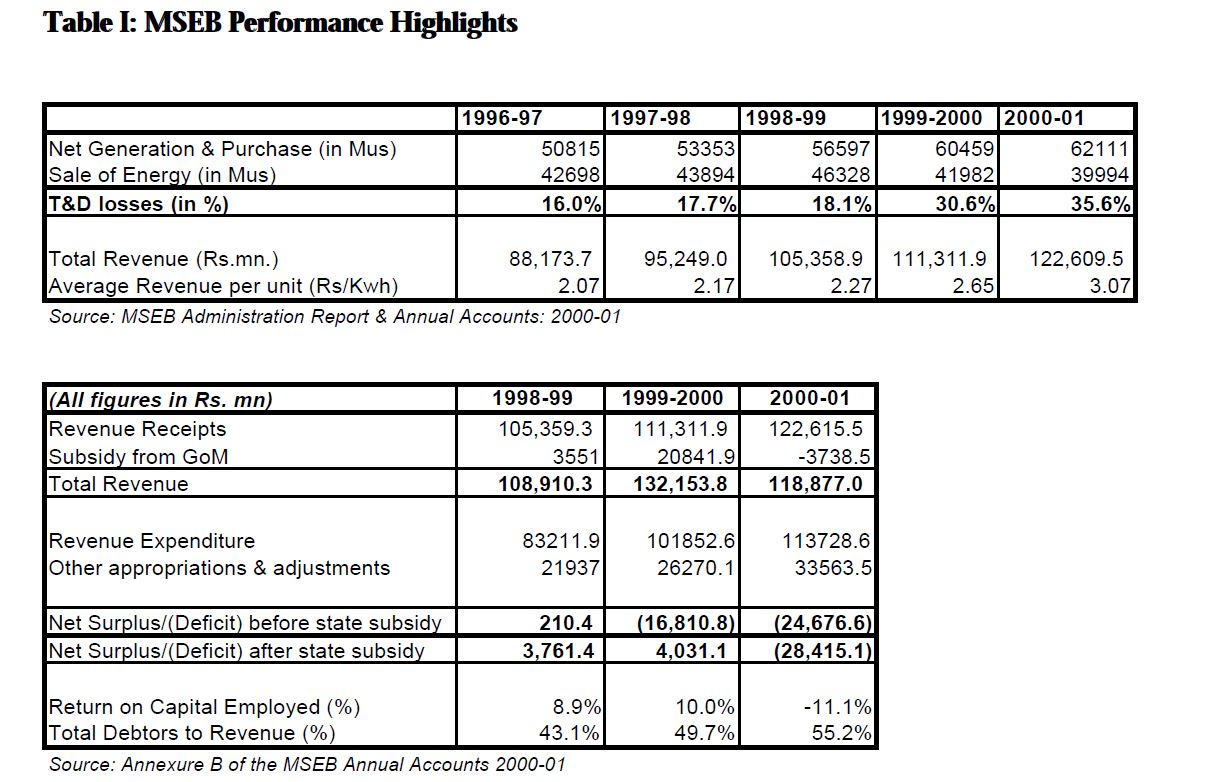

Part 5: Off-taker Analysis

If a project revenue depends on a PPA contract, then risk analysis of the project finance should include: (1) the incentive of the off-taker (the buyer of power) is to break the contract; and, (2) the financial ability of the off-taker to honour the contract are essential elements of project finance risk analysis. The Dabhol case was a classic case where evaluation of the off-taker was a crucial element of credit analysis.

To evaluate risks of the central PPA contract not being honoured, I would like you to compute the effects of the PPA on the prices charged by the off-taker in this section. My hope is for you to think past the fundamental legal structure of contracts and the SPV and examine the economics of the project.

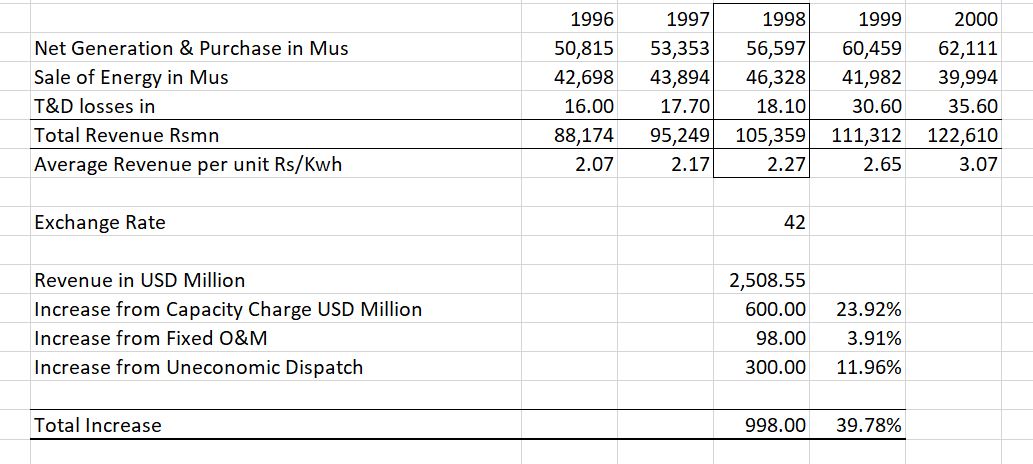

You could get very sophisticated about calculating the effects of the PPA contractor on the off-taker the calculation, but for purposes of this assignment, assume that the revenues and therefore prices charged by the off-taker must be increased by the capacity charges and the operating costs. This means you can make a pro-forma revenue calculation of the offtaker — MSEB — with and without the Dabhol plant. Once you have computed the pro-forma revenue increase, calculate the percent revenue increase that MSEB – the off-taker – must charge to its customers. Finally, as part of your write-up, comment on whether you think the percent increase in revenues will affect the non-technical losses, which is stolen electricity.

For the pro-forma calculation of the revenue increase and percent rate increase, you can use the India perspective case study that is available for download below. In this file you will find a couple of tables that show the revenue of MSEB before attempting to recover charges for the Dabhol plant. Tables that will be useful for this analysis are shown in the screenshot below the button. You can use the read pdf to excel conversion process for this just as you did for the PPA analysis file to do the analysis. Assume that the term Mus in the case study is the same as MWH.

PDF File with Dabhol Case Write-up from Indian Perspective Including Discussion of Finances of MSEB

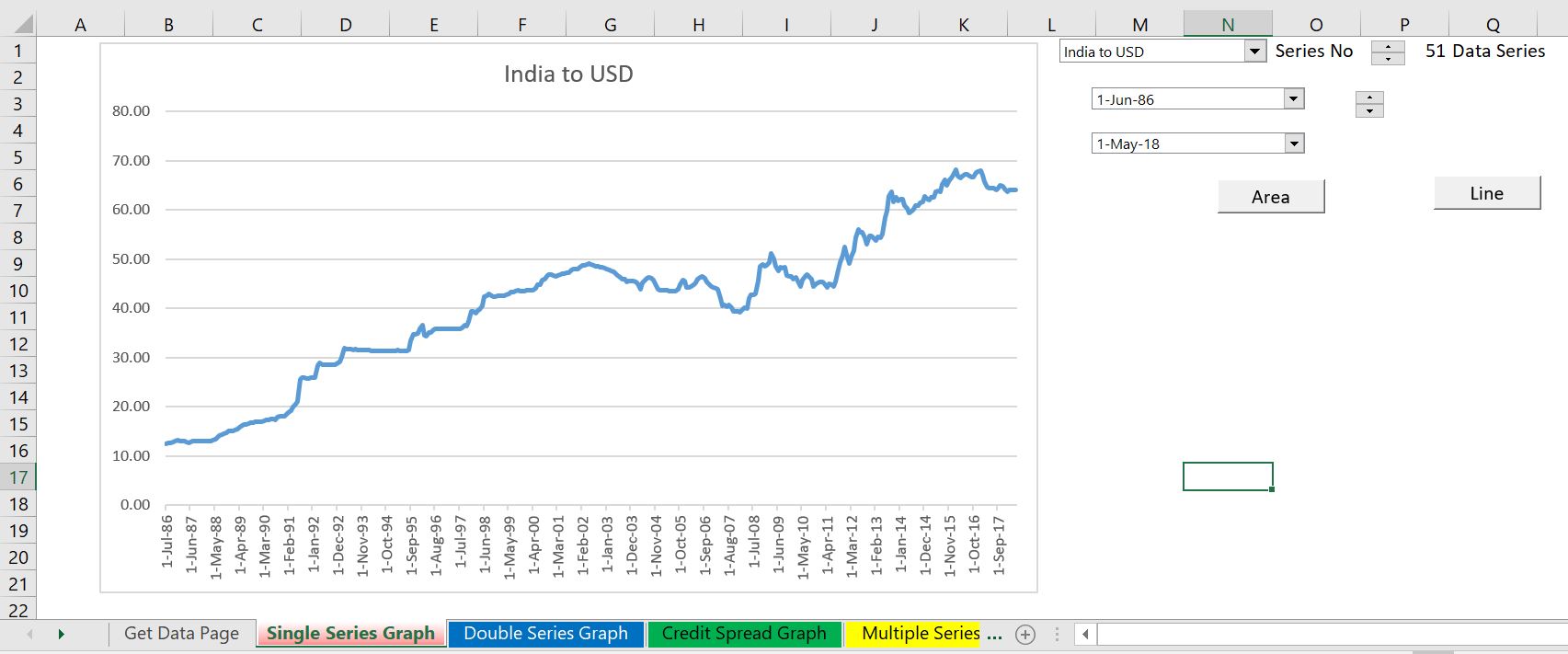

To make your analysis of how much the capacity charge for Dabhol increases rates to MSEB customers, you should first convert the Rupiah to USD in the above table. This can be done by using the interest rate database file that is available for download. Once you have converted the numbers to USD, you can then use the 1998-1999 values to make a pro-forma rate calculation (Revenues in USD divided by MWH). After that, make the same calculation, but add the capacity charges from the Dabhol plant to the revenues and compute the revenue per kWh after the plant is added. Finally, compute the percent change in prices.

In making the calculation, you will need to convert the data in Rupiah to USD. You can do this by using the file below or you can estimate the exchange rate using the graphs below. The graph can be downloaded by pressing the button below.

Interest Rate Database that Extracts Data from the FRED Database with Quick Updates and Flexible Graphs

Part 6: Risk Analysis

Given the contract structure, benchmarking, rate of return calculation and off-taker assessment, write a short credit analysis report. In the credit analysis report, use key credit issues where you write a question (e.g. this is the first large NGCC plant in India, what is the risk of capital cost over-runs). Then you can answer how the risk is mitigated. Alternatively, or in addition, you can make risk matrix where you organise risks (construction, operation, financial) and put the name of the risk in different rows. The columns can include the name of the risk, a description of the risk, mitigation of the risk, and the potential cash flow effect of unmitigated risk.

Part 7: Conclusion and Opinions

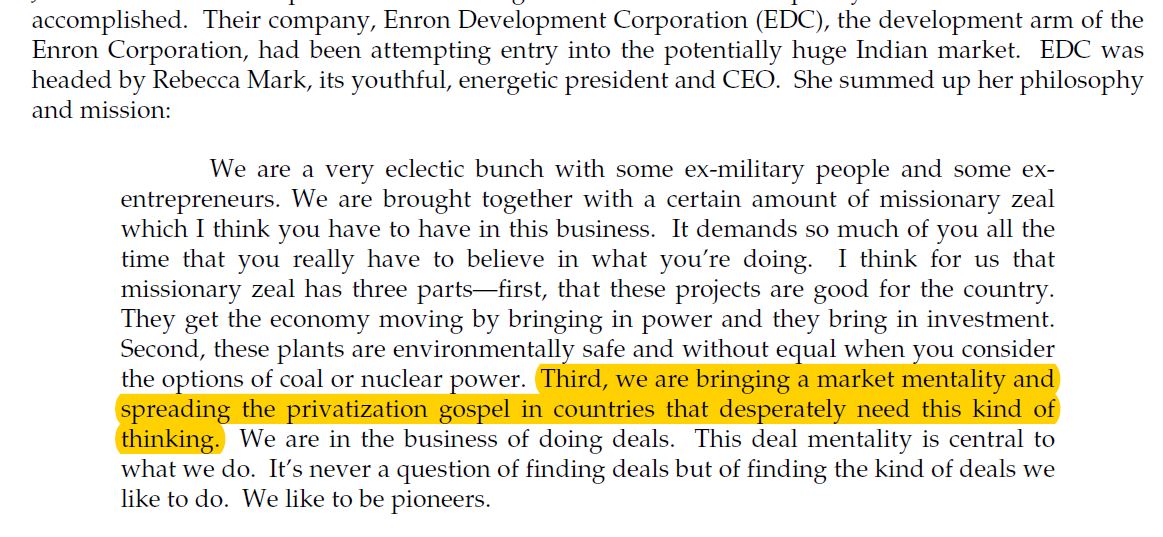

Find the article with the chronology of the project and write a sentence or two on the final resolution of the power plant. Comment on the comical jiberish (apparently taken seriously by students) that Harvard students are given before they go to Wall Street — in particular the statement that Enron was “Spreading the Privatization Gospel” made by Rebecca Mark, a Harvard Alumni who was behind the transaction. The first screenshot below is the amazing crap that Harvard students are given with the case. The second screenshot is a picture of Rebecca Mark with and Indian official.

Given your analysis, write a couple of sentences about what happened to the project and the introductory quote in the HBS case about India “desperately needing” the kind of thinking taught at HBS . Comment on what you think are the major errors that were made in the case.

Other Resources

I have included a few other articles and case studies that you can read. These articles may be amusing to read and provide some further background for the case. I even understand that there is a Bollywood film about the Dabhol project modelled after the Godfather.

Comprehensive Article on the Dabhol Project from the Asia Times

Article on Political Pressure from the U.S. on India Related to the Dabhol Project

Article with Time Line for Dabhol Cronology with Description of Meeting between India PM and Dick Cheny

Article from the Infrastructure Journal Describing the Final Settlement Between Dabhol and the Indian Government

Article with Discussion of the Current Operations and Status of the Dabhol Power Plant After Sale by Enron

My Comments on Possible Answers:

My opinions about the case are probably biased and wrong. But here they are. In terms of credit, this case demonstrates that no matter how many government guarantees, letters of comfort or other legal assurances you have, if the counterparty cannot afford to honour the contract, the project will have big problems. Further if you have promises from OPIC and other insurances, they are not like a letter of credit where you can just go and collect the money as soon as a default occurs. This is aggravated if there are published reports that can be used against you in arbitration.

Most importantly, the project reveals a fundamental question about project finance. This question is whether having really good contracts is most important or whether it is more important to evaluate the economics of the project. I hope you think that both are important. The government of India was heavily criticized for not honouring contracts. This was a valid complaint as private investment in the country dried up to an extent. Enron and its banks were criticized for not evaluating the economics of the project and relying too much on the contract structure of the project.

I think the diagram in the case sucked. First, there was a bizarre line from the SPV to the Bank to the Off-taker. I would hope a better diagram would start with the PPA and have arrows pointing which way the money is flowing. Second, each line should represent a contract. Third, essential elements of the contracts should be highlighted. For the PPA, contract I would put right in the diagram the required price increase to consumers. I am in no way saying the diagram below is any better, but I hope it can be used to thing about risks.

The reason I included this question is to highlight a fundamental fact about project finance. That is that there is no history — no historical trends from financial reports — in project finance. No trends in EBITDA or ROIC to evaluate. No historic volatility in cash flows; no way to compare Debt/EBITDA ratios across different companies operating in the business. Project finance involves large capital investments that must be maintained and produce not very exciting products such as roads, electricity, oil, prison buildings, hospitals, LNG plants etc. The differentiation between projects generally comes down to cost structure and efficiency.

The second point about benchmarking is that it is very difficult to do on an objective apples-to-apples basis with real data. Maybe there are customs duties; maybe added transmission facilities must be built; maybe labour costs are different. In the case of Dabhol, the cost of $2.8 billion relative to capacity of 2,000 MW or a cost per kW of USD 1,400 per kW is very high. This is demonstrated in the table below.

While you may say the comparison with plants around the world is not appropriate; you could also say that comparison with other plants in India is not appropriate because other plants in India were charging high EPC profits and using the political risk premium excuse. The two tables below demonstrate premiums of the Enron plant compared with other plants.

In addition to benchmarking plant costs, the O&M costs should be benchmarked which in general is even more difficult. The Dabhol fixed O&M costs appear surprisingly high. This is demonstrated by comparing the cost per kW-year in the HBS case with current costs that are published by Lazard. Costs in the case study were

In response to my question for this section, I was hoping for comments that the IRR was very high. I was also interested in statements that IRR does not measure the real profit because profit is made from O&M and EPC contracts. You could get even fancier and discuss upside IRR options from continuation of the PPA; use of the LNG terminal for additional business ventures; and, increasing the IRR from re-financing.

There is an issue in project finance that economic rents that are in the IRR amount to transfer of wealth from consumers of electricity in India to investors in the U.S. A high IRR may be suggested to compensate for political risk; but it also increases political risk.

In project finance there is a basic rule. the project IRR must be higher than the cost of debt which is the debt IRR.

Now, some people have mentioned that the IRR as a statistic has flaws. This is true. There is the famous problem of multiple IRR’s when cash flows are positive, then negative, then positive. There is the re-investment rate. There is the theoretical problem of project ranking discussed by McKinsey that almost never happens. But the IRR still provides a good measure of growth in future cash flows. The real problem with IRR is that: (1) it does not account for changing risk of the project; (2) it undervalues far-out cash flows when the IRR is high; and (3) it does not account for probabilities in staged investments. You can find further discussion of this on another page of this site:

My hope in getting a response to this question is that you think about ways to evaluate risks of project counter parties in an objective manner. The idea of the structuring diagram is to show that projects depend on revenues. If there are no revenues, there is of course no money to pay O&M; no money to pay debt service; no money to pay taxes; and no money for equity. When you perform risk analysis, the question is how to do it on an objective basis. I think a good answer to this question would be to try and evaluate what will happen to the off-taker as a result of signing the PPA contract. This is not an easy task as the MSEB, the off-taker may be able to sell more energy because of surpressed demand. But if the demand is not surpressed, then the following four things could happen that would increase rates:

- MSEB must pay the capacity payment of almost USD 600 Million

- MSEB must pay the fixed O&M payment of about USD 98 Million

- MSEB must pay the additional cost of Gas Fuel compared to Coal Fuel if the plant is forced to dispatch. This could cost another approximately USD 300 Million

The next task is to see how much consumers are currently paying to MSEB. This is a bit tricky because you want to find the time period before Dabhol had any effects on revenues and you need to find the number that is not distorted by subsidies. Finally, as the numbers are in Rupee and not in USD, you need an exchange rate adjustment.

Part 6: Risk Write-up

For this section I expected a write-up that ultimately (with hindsight), recognised that the off-taker risk was not really mitigated. It was not even mitigated with the state guarantee. For this you could walk through a scenario where MSEB cannot pay the PPA agreement and then political issues regarding whether three big American companies would not be paid.

In writing up the risk it can be good to state the risk as a question and then answer the question with potential mitigation. If the risk cannot be mitigated and it is a large risk, the loan may not be acceptable.

It may have been good to create a credit issue and then answer the question. For example a question may have been phrased as follows: MSEB will have difficulty paying the PPA contract. In this scenario will the state government honour its guarantee. The answer could then be your discussion about the recession etc.

Another question could relate to the World Bank report — The World Bank issued a report stating that the Dabhol plant is uneconomic. Does the World Bank report provide a means by which the government guarantees may not be honoured if MSEB defaults on the PPA contract.

I made a few comments about the issue of whether the plant was really economically viable and whether the whole thing made economic sense. If the plant does not make sense should the bank lend money.

Review Concepts

In this final section I have included a couple of ideas that I think are important in project finance analysis. I have listed a couple of bullet points and some ways that you may think about the issues. I have also included references to my set of power point slides that describe project finance theory.

- The difference between the structure and analysis of availability projects and output projects — see slides 8-13.

- DSCR definition and use in project finance — see slides 67-74.

- Use of DSCR, LLCR and PLCR in different projects — see slides 75-84.

- IRR in project finance and why IRR is different from ROIC — see slides 89-94.

You can find some of these review concepts in the power point slides that are available for downloading in the button below.

- Browse All Articles

- Newsletter Sign-Up

Entrepreneurship →

- 09 Apr 2024

- Cold Call Podcast

Sustaining a Legacy of Giving in Turkey

Özyeğin Social Investments was founded by Hüsnü Özyeğin, one of Turkey's most successful entrepreneurs, with a focus on education, health, gender equality, rural development, and disaster relief in Turkey. The company and the Özyeğin family have spent decades serving and improving communities in need. Their efforts led to the creation of one of Turkey’s top universities, the establishment of schools and rehabilitation centers, post 2023 earthquake humanitarian shelter and facilities, nationwide campaigns, and an internationally recognized educational training initiative for young children, among other achievements. Harvard Business School senior lecturer Christina Wing and Murat Özyeğin discuss how the company is a model for making a significant impact across multiple sectors of society through giving and how that legacy can be sustained in the future, in the case, “Özyeğin Social Investments: A Legacy of Giving."

- 22 Mar 2024

- Research & Ideas

Open Source Software: The $9 Trillion Resource Companies Take for Granted

Many companies build their businesses on open source software, code that would cost firms $8.8 trillion to create from scratch if it weren't freely available. Research by Frank Nagle and colleagues puts a value on an economic necessity that will require investment to meet demand.

- 12 Mar 2024

How to Bring Good Ideas to Life: The Paul English Story

Paul English is one of the most imaginative and successful innovators of his generation. He cofounded several companies, including Kayak, before starting Boston Venture Studio, where he is currently a partner. This multimedia case, “Bringing Ideas to Life: The Story of Paul English,” explores his process of creative idea generation, examining how he was able to bring so many ideas to market. In this episode, Harvard Business School professor Frances Frei and English discuss how to tell the difference between a good idea and a bad one, the importance of iteration, and taking a systematic (but fast) approach to developing new ideas. They also explore how his process dovetails with Frei’s “move fast and fix things,” strategy from her recent book.

- 05 Dec 2023

What Founders Get Wrong about Sales and Marketing

Which sales candidate is a startup’s ideal first hire? What marketing channels are best to invest in? How aggressively should an executive team align sales with customer success? Senior Lecturer Mark Roberge discusses how early-stage founders, sales leaders, and marketing executives can address these challenges as they grow their ventures in the case, “Entrepreneurial Sales and Marketing Vignettes.”

- 10 Oct 2023

Scaling Two Businesses Against the Odds: Wendy Estrella’s Founder’s Journey

Entrepreneur Wendy Estrella is attempting to simultaneously scale her law practice, as well as her property management and development company. What strategy will benefit both businesses, and is there a downside to scaling them together, rather than focusing on each one separately? Harvard Business School senior lecturer Jeffrey Bussgang and Estrella discuss her unique founder’s journey – from immigrating to the U.S. to building both of her businesses in Lawrence, Massachusetts despite the specific challenges she faced as a minority entrepreneur. The related case is “Wendy Estrella: Scaling Multiple Businesses.”

- 01 Aug 2023

Can Business Transform Primary Health Care Across Africa?

mPharma, headquartered in Ghana, is trying to create the largest pan-African health care company. Their mission is to provide primary care and a reliable and fairly priced supply of drugs in the nine African countries where they operate. Co-founder and CEO Gregory Rockson needs to decide which component of strategy to prioritize in the next three years. His options include launching a telemedicine program, expanding his pharmacies across the continent, and creating a new payment program to cover the cost of common medications. Rockson cares deeply about health equity, but his venture capital-financed company also must be profitable. Which option should he focus on expanding? Harvard Business School Professor Regina Herzlinger and case protagonist Gregory Rockson discuss the important role business plays in improving health care in the case, “mPharma: Scaling Access to Affordable Primary Care in Africa.”

- 05 Jul 2023

How Unilever Is Preparing for the Future of Work

Launched in 2016, Unilever’s Future of Work initiative aimed to accelerate the speed of change throughout the organization and prepare its workforce for a digitalized and highly automated era. But despite its success over the last three years, the program still faces significant challenges in its implementation. How should Unilever, one of the world's largest consumer goods companies, best prepare and upscale its workforce for the future? How should Unilever adapt and accelerate the speed of change throughout the organization? Is it even possible to lead a systematic, agile workforce transformation across several geographies while accounting for local context? Harvard Business School professor and faculty co-chair of the Managing the Future of Work Project William Kerr and Patrick Hull, Unilever’s vice president of global learning and future of work, discuss how rapid advances in artificial intelligence, machine learning, and automation are changing the nature of work in the case, “Unilever's Response to the Future of Work.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 14 Mar 2023

Can AI and Machine Learning Help Park Rangers Prevent Poaching?

Globally there are too few park rangers to prevent the illegal trade of wildlife across borders, or poaching. In response, Spatial Monitoring and Reporting Tool (SMART) was created by a coalition of conservation organizations to take historical data and create geospatial mapping tools that enable more efficient deployment of rangers. SMART had demonstrated significant improvements in patrol coverage, with some observed reductions in poaching. Then a new predictive analytic tool, the Protection Assistant for Wildlife Security (PAWS), was created to use artificial intelligence (AI) and machine learning (ML) to try to predict where poachers would be likely to strike. Jonathan Palmer, Executive Director of Conservation Technology for the Wildlife Conservation Society, already had a good data analytics tool to help park rangers manage their patrols. Would adding an AI- and ML-based tool improve outcomes or introduce new problems? Harvard Business School senior lecturer Brian Trelstad discusses the importance of focusing on the use case when determining the value of adding a complex technology solution in his case, “SMART: AI and Machine Learning for Wildlife Conservation.”

- 17 Jan 2023

8 Trends to Watch in 2023

Quiet quitting. Inflation. The economy. This year could bring challenges for executives and entrepreneurs, but there might also be opportunities for focused leaders to gain advantage, say Harvard Business School faculty members.

- 10 Jan 2023

Time to Move On? Career Advice for Entrepreneurs Preparing for the Next Stage

So many people shift from one job to the next, with little time to consider how the experience changed them and what they want out of future ventures. Julia Austin recommends that entrepreneurs look within and reflect on these questions before they jump into a new opportunity.

- 03 Jan 2023

Wordle: Can a Pandemic Phenomenon Sustain in the Long Term?

Wordle went from a personal game, created by a developer for his girlfriend, to a global phenomenon with two million users in just a few months. Then The New York Times made an unexpected bid to acquire it. But will Wordle outlast other pandemic pastimes? Harvard Business School senior lecturer Christina Wallace discusses the journey of software engineer and accidental entrepreneur Josh Wardle in the case, “Wordle.”

- 26 Oct 2022

How Paid Promos Take the Shine Off YouTube Stars (and Tips for Better Influencer Marketing)

Influencers aspire to turn "likes" into dollars through brand sponsorships, but these deals can erode their reputations, says research by Shunyuan Zhang. Marketers should seek out authentic voices on YouTube, not necessarily those with the most followers.

- 19 Oct 2022

Cofounder Courtship: How to Find the Right Mate—for Your Startup

Like any other long-term partnership, choosing the right cofounder is a complicated decision with big implications for a venture. Julia Austin offers practical advice for entrepreneurs who are searching for "the one."

- 06 Sep 2022

Reinventing an Iconic Independent Bookstore

In 2020, Kwame Spearman (MBA 2011) made the career-shifting decision to leave a New York City-based consulting job to return to his hometown of Denver, Colorado, and take over an iconic independent bookstore, The Tattered Cover. Spearman saw an opportunity to reinvent the local business to build a sense of community after the pandemic. But he also had to find a way to meet the big challenges facing independent booksellers amid technological change and shifting business models. Professor Ryan Raffaelli and Spearman discuss Spearman’s vision for reinventing The Tattered Cover, as well as larger insights around how local businesses can successfully compete with online and big box retailers in the case, “Kwame Spearman at Tattered Cover: Reinventing Brick-and-Mortar Retail.”

- 16 Aug 2022

Now Is the Time for Entrepreneurs to Play Offense

With the specter of recession looming, many worried founders and executives are aggressively shoring up cash. But shrewd entrepreneurs are using these six tactics instead to gain advantage, says Jeffrey Bussgang.

- 26 Jul 2022

Can Bombas Reach New Customers while Maintaining Its Social Mission?

Bombas was started in 2013 with a dual mission: to deliver quality socks and donate much-needed footwear to people living in shelters. By 2021, it had become one of America’s most visible buy-one-give-one companies, with over $250 million in annual revenue and 50 million pairs of socks donated. Later, as Bombas expanded into underwear, t-shirts, and slippers, the company struggled to determine what pace of growth would best allow it to reach new customers while maintaining its social mission. Harvard Business School assistant professor Elizabeth Keenan discusses the case, "Bee-ing Better at Bombas."

- 07 Jul 2022

How a Multimillion-Dollar Ice Cream Startup Melted Down (and Bounced Back)

A Brooklyn-based ice cream shop was getting buzz, and Disney was pitching a brand partnership. So how did the business wind up filing for bankruptcy? A case study by Thomas Eisenmann and Lindsay N. Hyde examines the rise and fall—and recent rebound—of Ample Hills Creamery.

- 10 May 2022

Being Your Own Boss Can Pay Off, but Not Always with Big Pay

Working for yourself might bring freedom and autonomy, but it increasingly comes with a major risk: low pay. Research by William Kerr explores the shifting sands of self-employment.

- 03 May 2022

Can a Social Entrepreneur End Homelessness in the US?

Community Solutions is a nonprofit founded in 2011 by Rosanne Haggerty, with the ambitious goal of ending chronic homelessness in America. Its “Built for Zero” methodology takes a public health approach, helping communities across the US use better data collection and outreach to improve government processes and piecemeal solutions. In 2021, Community Solutions was awarded a $100 million grant from the MacArthur Foundation, and Haggerty and her team had to decide how to prioritize projects and spending to maximize the grant’s impact. Should they continue to focus on unhoused veterans or expand their work to include families and youth in need of housing? Senior Lecturer Brian Trelstad discusses Haggerty’s approach in his case, "Community Solutions."

Free AI Presentation Maker for Generating Projects in Minutes

- Generate ready-to-use presentations from a text prompt.

- Select a style and Visme’s AI Presentation Maker will generate text, images, and icon.

- Customize your presentation with a library of royalty-free photos, videos, & graphics.

Generate a presentation with AI

Brought to you by Visme

A leading visual communication platform empowering 27,500,000 users and top brands.

Presentations Engineered With Visme’s AI Presentation Maker

Ai presentation prompt 1.

Craft a presentation outlining a leading company’s cutting-edge innovations in AI-powered hardware, emphasizing their impact on enhancing workplace productivity and efficiency.

AI Presentation Prompt 2

Generate a comprehensive presentation highlighting the latest digital marketing trends, focusing on strategies for enhancing brand visibility and customer engagement across diverse platforms.

AI Presentation Prompt 3

Create a detailed presentation elucidating a company’s diversified investment portfolio, emphasizing its robust performance, risk mitigation strategies, and the potential for sustainable long-term growth.

AI Presentation Prompt 4

Develop a compelling presentation showcasing a company’s groundbreaking medical devices and software solutions, emphasizing their role in revolutionizing patient care, treatment efficacy, and healthcare accessibility worldwide.

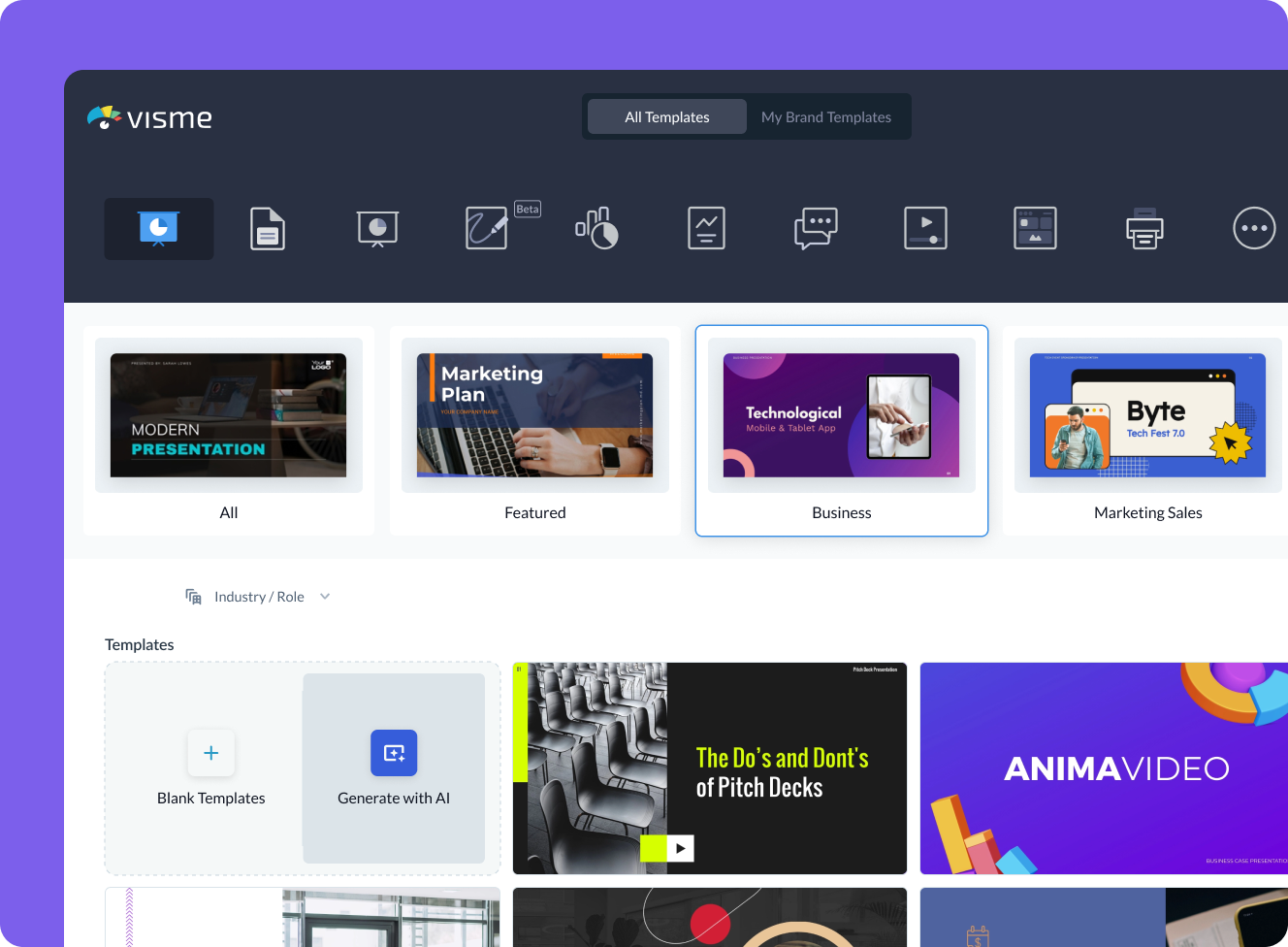

How it works

How to generate AI presentations with Visme

Save time and create beautiful designs quickly with Visme AI Designer. Available inside the Visme template library, this generator tool is ready to receive your prompts and generate stunning ready-to-use presentations in minutes.

- Log in to the Visme dashboard, and open the template library by clicking on Create New button -> Project -> Presentations. Inside the template library, scroll down and click on the Generate with AI option.

- In the popup that opens, type in a prompt and describe in detail what aspects your presentation should feature. If you don’t provide enough information, chatbot will ask you follow-up questions.

- Visme Chatbot will suggest template styles; choose the most relevant for your presentation, and wait for the AI to create the design. Preview, regenerate or open your project in the Visme editor.

- Customize your project in Visme: Pick a color theme or create your own, edit text, and use assets from Visme’s royalty-free library of photos, videos, and graphics, or create your own with AI tools.

Features of the AI Presentations Maker

Ready-to-use presentations in minutes.

Starting is often the hardest part of a project. Visme’s free AI presentation maker helps you overcome this block and generates results within minutes. It gives you a headstart and a good first draft that is ready-to-use with minimal or no customization.

Customize every part of your presentation

Visme editor is easy to use and offers you an array of customization options. Change the color theme of your presentation, text, fonts, add images, videos and graphics from Visme royalty-free library of assets or generate new ones with AI image generator, AI image touchup tools, or add your own. For more advanced customization, add data visualizations, connect them to live data, or create your own visuals.

Add your branding

Stay on-brand even with AI-generated presentations. Quickly and easily set up your brand kit using AI-powered Visme Brand Wizard or set it up manually. Use your brand colors and fonts in AI-generated presentations. Add your logo and upload your brand assets to make a presentation match your company’s branding.

Download, share or schedule your presentation

Share your presentations generated with Visme AI Designer in many ways. Download them in various formats, including PPTX, PDF and HTML5, present online, share on social media or schedule them to be published as posts on your social media channels. Additionally, you can share your presentations as private projects with a password entry.

More than just an AI Presentation Maker

Beautify your content

Unique Elements & Graphics

Browse through our library of customizable, one-of-a-kind graphics, widgets and design assets like icons, shapes, illustrations and more to accompany your AI-generated presentations.

Visualize your data

Charts & Graphs

Choose from different chart types and create pie charts, bar charts, donut charts, pyramid charts, Mekko charts, radar charts and much more.

Make it engaging

Interactivity

Share AI-generated presentations online with animated and interactive elements to grab your audience’s attention and promote your business.

More AI tools in Visme

Ai image generator.

The Visme AI Image generator will automatically create any image or graphic. All you need to do is write a prompt and let AI magic do the rest.

Visme AI Writer helps you write, proofread, summarize and tone switch any type of text. If you’re missing content for a project, let AI Writer help you generate it.

Save yourself hours of work with AI Resize. This feature resizes your project canvas and adjusts all content to fit the new size within seconds.

AI TouchUp Tools

The Visme AI TouchUp Tools are a set of four image editing features that will help you change the appearance of your images inside any Visme project. Erase and replace objects that you don’t want in your photos.

The Brand Wizard

The AI-based Visme Brand Wizard populates your brand fonts and styles across a beautiful set of templates.

Make the most of Visme’s features

Choose the perfect visual from our extensive photo and video library . Search and find the ideal image or video using keywords relevant to the project. Drag and drop in your project and adjust as needed.

Incorporate 3D illustrations and icons into all sorts of content types to create amazing content for your business communication strategies. You won’t see these 3D designs anywhere else as they’re made by Visme designers.

When you share your Visme projects, they’ll display with a flipbook effect . Viewers can go from page to page by flipping the page like a digital magazine. If you don’t want the flipbook effect, you can disable it and share as a standard project.

Remove the background from an image to create a cutout and layer it over something else, maybe an AI-generated background. Erase elements of the image and swap them for other objects with AI-powered Erase & Replace feature.

Create scroll-stopping video and animation posts for social media and email communication. Embed projects with video and animation into your website landing page or create digital documents with multimedia resources.

With Visme, you can make, create and design hundreds of content types . We have templates for digital documents, infographics, social media graphics, posters, banners, wireframes, whiteboards, flowcharts.

Design and brainstorm collaboratively with your team on the Visme whiteboard . Build mind maps and flowcharts easily during online planning and strategy sessions. Save whiteboards as meeting minutes and ongoing notes for projects.

Edit your images , photos, and AI image-generated graphics with our integrated editing tools. On top of the regular editing features like saturation and blur, we have 3 AI-based editing features. With these tools, you can unblur an image, expand it without losing quality and erase an object from it.

Frequently Asked Questions (FAQs)

How can i get better results with the ai presentations maker.

Like any AI generator from a text tool, the prompt is everything. To get better results with the AI Presentation maker, you need better prompts. Write the prompt to be as detailed as possible. Include all the content topics you want the presentation to cover. As for style elements, there’s no need to include it in the prompt. Focus on choosing the style that you like from the Chatbot suggestions. Try to select the style that already features the color palette and shapes that you like. AI will change icons and photos based on text it generates.

How many AI Presentations can I generate?

Visme AI Presentation maker is available in all plans with higher credits/usage available in Premium plans. Note: AI credits are spread amongst all AI features. So if you use other AI features, your credits will be deducted.

Is the Visme AI Designer a third-party API?

No, Visme AI Presentation maker was developed in-house and is a unique tool. However, it does use third-party APIs: ChatGPT and Unsplash.

This website uses cookies to improve the user experience. By using our website you consent to all cookies in accordance with our cookie policies included in our privacy policy.

Create an account

Create a free IEA account to download our reports or subcribe to a paid service.

Net Zero by 2050

A Roadmap for the Global Energy Sector

This report is part of Net Zero Emissions

About this report

The number of countries announcing pledges to achieve net zero emissions over the coming decades continues to grow. But the pledges by governments to date – even if fully achieved – fall well short of what is required to bring global energy-related carbon dioxide emissions to net zero by 2050 and give the world an even chance of limiting the global temperature rise to 1.5 °C. This special report is the world’s first comprehensive study of how to transition to a net zero energy system by 2050 while ensuring stable and affordable energy supplies, providing universal energy access, and enabling robust economic growth. It sets out a cost-effective and economically productive pathway, resulting in a clean, dynamic and resilient energy economy dominated by renewables like solar and wind instead of fossil fuels. The report also examines key uncertainties, such as the roles of bioenergy, carbon capture and behavioural changes in reaching net zero.

Summary for policy makers

Reaching net zero emissions globally by 2050 is a critical and formidable goal.

The energy sector is the source of around three-quarters of greenhouse gas emissions today and holds the key to averting the worst effects of climate change, perhaps the greatest challenge humankind has faced. Reducing global carbon dioxide (CO 2 ) emissions to net zero by 2050 is consistent with efforts to limit the long-term increase in average global temperatures to 1.5˚C. This calls for nothing less than a complete transformation of how we produce, transport and consume energy. The growing political consensus on reaching net zero is cause for considerable optimism about the progress the world can make, but the changes required to reach net zero emissions globally by 2050 are poorly understood. A huge amount of work is needed to turn today’s impressive ambitions into reality, especially given the range of different situations among countries and their differing capacities to make the necessary changes. This special IEA report sets out a pathway for achieving this goal, resulting in a clean and resilient energy system that would bring major benefits for human prosperity and well-being.

The global pathway to net zero emissions by 2050 detailed in this report requires all governments to significantly strengthen and then successfully implement their energy and climate policies. Commitments made to date fall far short of what is required by that pathway. The number of countries that have pledged to achieve net zero emissions has grown rapidly over the last year and now covers around 70% of global emissions of CO 2 . This is a huge step forward. However, most pledges are not yet underpinned by near-term policies and measures. Moreover, even if successfully fulfilled, the pledges to date would still leave around 22 billion tonnes of CO 2 emissions worldwide in 2050. The continuation of that trend would be consistent with a temperature rise in 2100 of around 2.1 °C. Global emissions fell in 2020 because of the Covid-19 crisis but are already rebounding strongly as economies recover. Further delay in acting to reverse that trend will put net zero by 2050 out of reach.

In this Summary for Policy Makers, we outline the essential conditions for the global energy sector to reach net zero CO 2 emissions by 2050. The pathway described in depth in this report achieves this objective with no offsets from outside the energy sector, and with low reliance on negative emissions technologies. It is designed to maximise technical feasibility, cost-effectiveness and social acceptance while ensuring continued economic growth and secure energy supplies. We highlight the priority actions that are needed today to ensure the opportunity of net zero by 2050 – narrow but still achievable – is not lost. The report provides a global view, but countries do not start in the same place or finish at the same time: advanced economies have to reach net zero before emerging markets and developing economies, and assist others in getting there. We also recognise that the route mapped out here is a path, not necessarily the path, and so we examine some key uncertainties, notably concerning the roles played by bioenergy, carbon capture and behavioural changes. Getting to net zero will involve countless decisions by people across the world, but our primary aim is to inform the decisions made by policy makers, who have the greatest scope to move the world closer to its climate goals.

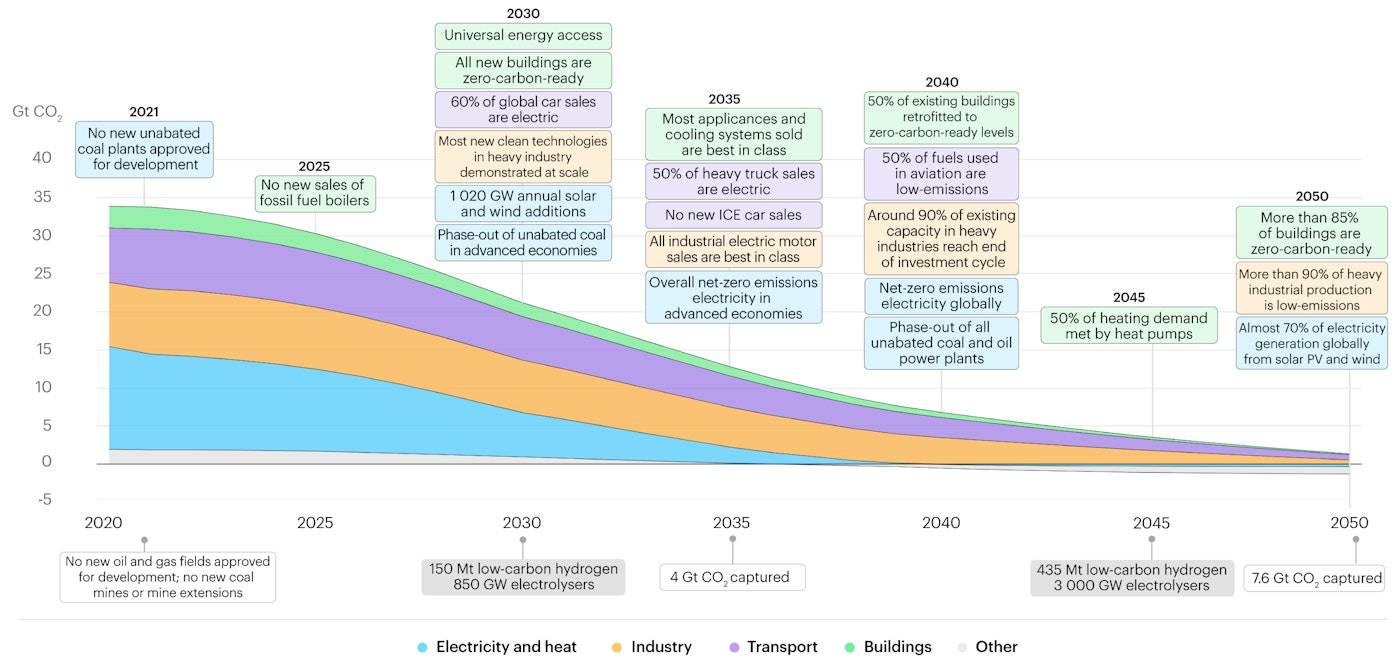

Net zero by 2050 hinges on an unprecedented clean technology push to 2030