A Comprehensive Uber Eats Case Study- 2023

Nowadays, when we are hungry, do we always cook?

Not always, right?

Instead of thinking about what to cook, most of us search for our mobile phones.

Just take our mobile and order our favorite food from our favorite restaurants.

The answer is through food delivery apps.

In this Uber Eats case study, we will discuss one food delivery app that has gained popularity since its invention. It is none other than “Uber Eats.”

We will learn about the Uber Eats case study, digital marketing strategy, and Uber Eats competitor analysis.

There was a time when eating outside was a sort of social gathering. While it is still the same for many, eating out has become more of a necessity.

It could range from a cup of relaxing tea to a craving for a sweet. Now that necessity is delivered to one’s doorstep.

Although people nowadays depend a lot on food delivery apps. How did the idea of ordering food originate?

This article summarizes how online food ordering existed, the major players in this field, and the Uber Eats case study and marketing strategy.

How did the Food Delivery Idea Emerge?

Uber Eats case study reveals that this service began during World War II.

Then, people did not have a kitchen or home appliances, so they did not have other cooking options.

Food delivery services started spreading to the United States and Philadelphia from the UK.

They supplied food to the needy and those who were at home.

Also, the government ensured that each house was filled with food so nobody stayed hungry. This method spread fast to other parts of the country, including New York and Columbus.

When its benefit began spreading to other parts of the world, others also jumped into this field. Then, in 1952, Australia started its first food delivery service.

Modern Food Delivery System

By then, restaurants had introduced toll-free numbers so customers could call to order food without charges. With time, the idea of a food ordering system was appreciated by many.

This way, customers could contact the restaurants and enjoy their favorite food delivered to their homes. It led to the invention of online food ordering and delivery services.

Today, there is hardly any country where we will not find a food ordering and delivery service. Moreover, as more and more restaurants join the race, the online food ordering market expands.

As a result, online food ordering and delivery systems have started gaining fame over the previous years.

Digital Age Driving the Growth of Online Food Ordering Services

Online food ordering and delivery popularity is a significant aspect of the digital age culture. We could find Millennials considering online food ordering quite common in recent times. Due to the increase in online customers, the Uber Eats market has grown.

However, most traditional businesses have embraced these trends and moved online despite the growing demand.

With the advent of modern technologies, the food industry gained several new investors regularly.

The online food delivery service is booming with popular apps like Uber Eats and other meal delivery services. Forbes predicted that this industry will have annual sales of around $365 billion worldwide by 2030.

The online food delivery industry has grown immensely over the past five years.

Headed by platform-to-consumer services, such as DoorDash and Uber Eats, online food delivery service has expanded, including takeaways, thus, increasing the potential revenue.

The past few years have also witnessed more partnerships as large businesses attempt to reduce competition in the market.

COVID-19 has driven the industry a few years into the future, as many of us ordered food online for the first time during the lockdown.

Uber Eats case study proves that Uber Eats reported a massive increase in orders between February and March when the entire world was in lockdown.

This case study will examine Uber eats analysis and the Uber Eats Marketing strategy that helped them gain popularity and increase revenue.

What is SWOT Analysis?

SWOT analysis is a strategic planning and management method to help organizations identify strengths, weaknesses, opportunities, and threats.

It evaluates an organization’s competitive position, external and internal factors, and existing and future potential.

Uber Eats Case Study

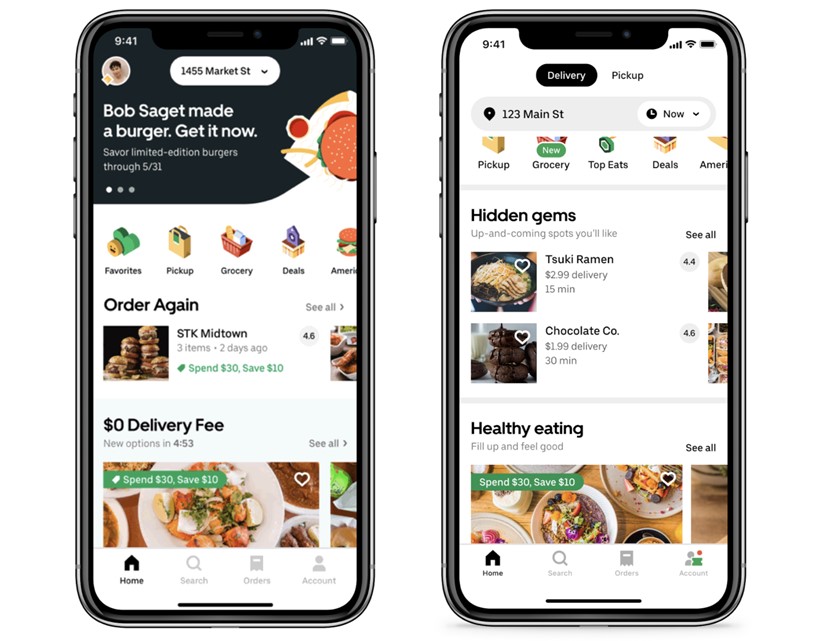

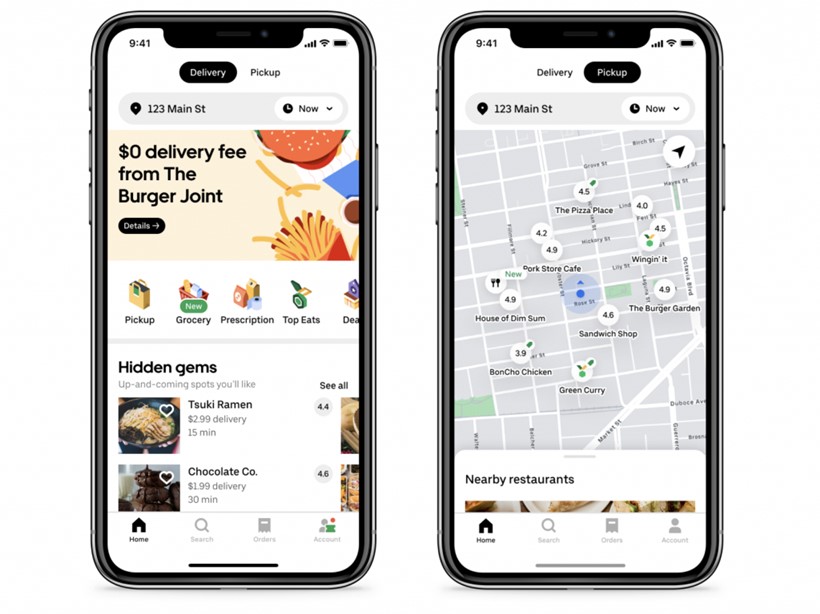

Uber Eats is an online food ordering service by Uber Technologies. It operates in over 6,000 cities across 45 nations and is expanding its business fast.

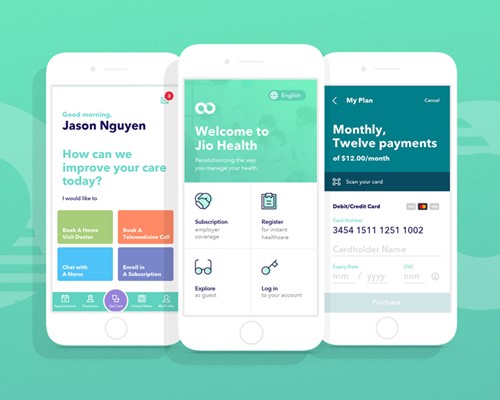

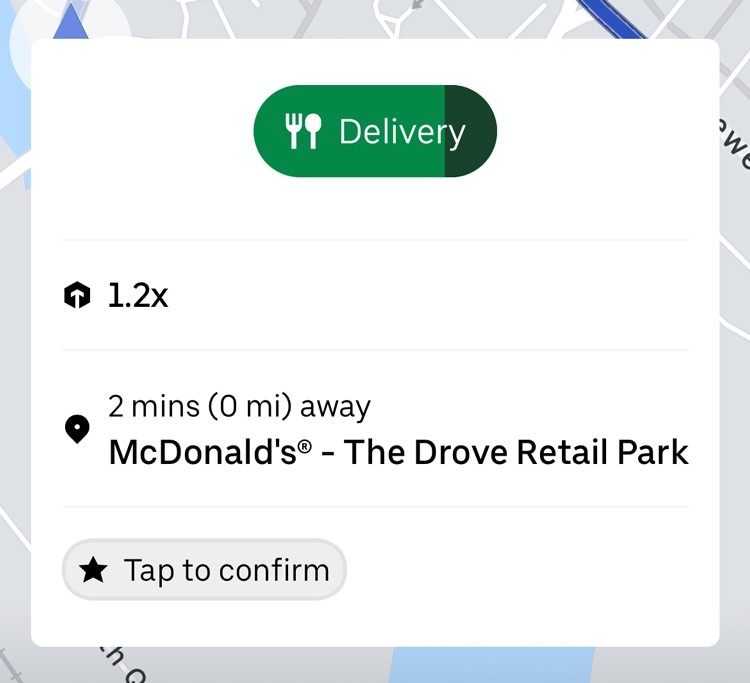

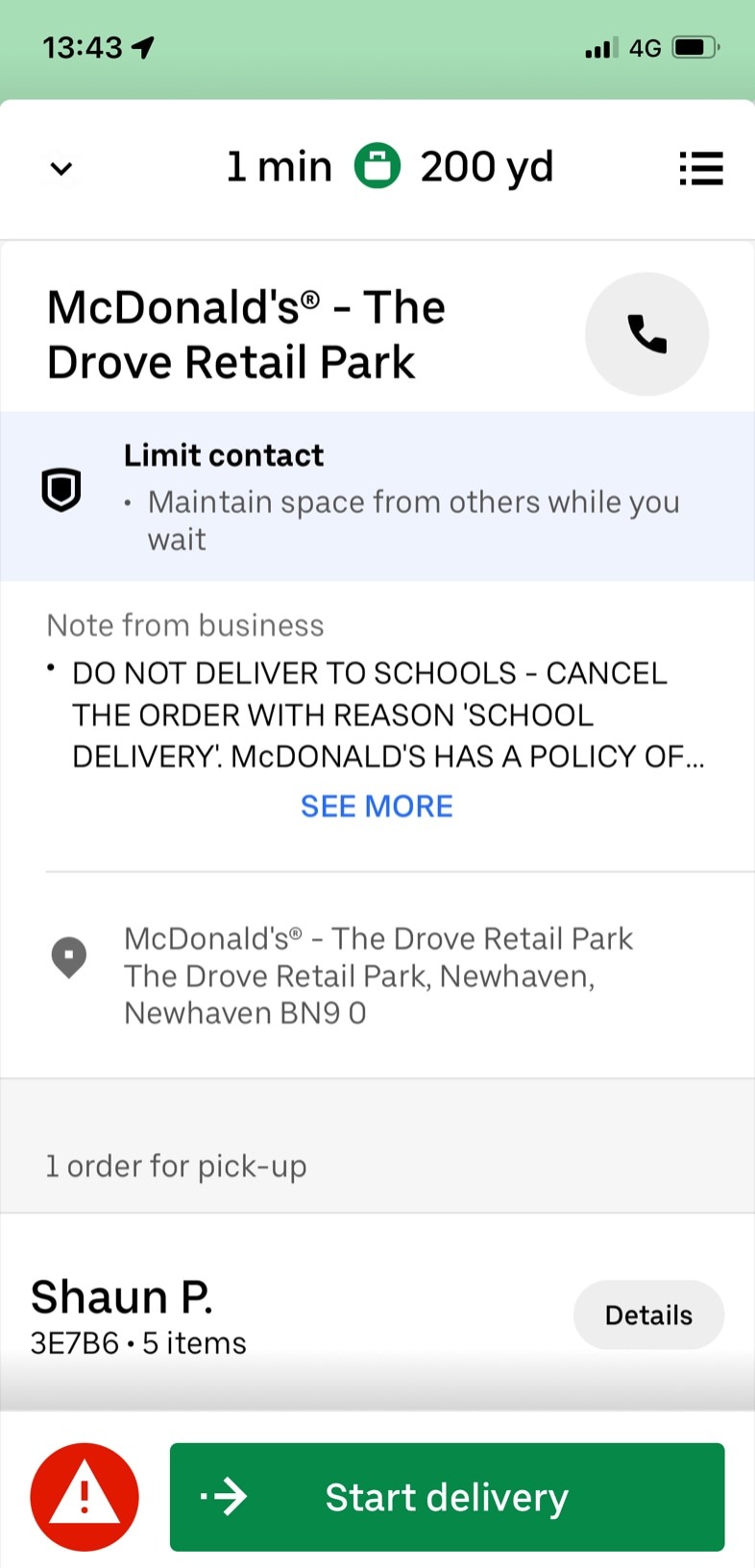

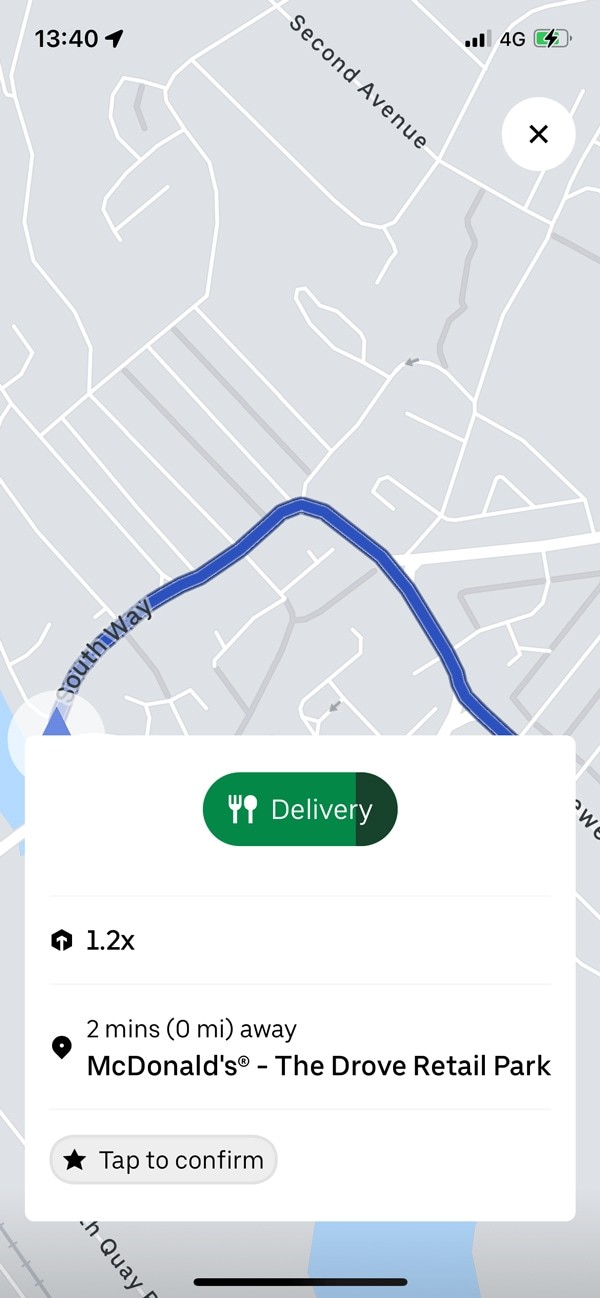

Customers use a separate smartphone app, Uber Eats, to order food online. It allows customers to order food from a selected range of restaurants. The collected food is delivered to customers by Uber drivers.

With Uber’s Fast Delivery, customers can get their favorite food from their favorite restaurants within 10 minutes at their doorstep. Being a late participant in the online food delivery business, UberEats has its advantages.

It got the opportunity to learn from other prominent players in the market and redefine the competitive landscape.

This Uber Eats case study analyzes the major competitors, recent trends in customer behaviors, and Uber Eats marketing tactics execution.

The Uber Eats case study proves that one of the significant reasons behind Uber Eats success is its strong brand image and its unique values.

According to the Uber Eats case study, it has lower delivery rates and faster delivery than Grubhub, Postmates, and other online food delivery services.

However, ordering food from Uber Eats gave many a limited experience. Uber Eats case study shows that there were restricted food choices and restaurants. Moreover, no option for food customization makes customers feel unsatisfied with Uber Eats.

The company focuses on customer reviews and keeps upgrading its service. For example, in 2016, Uber Eats launched two ways to order food.

First, customers could order from restaurants through the app or pre-fixed lunch options. Then, Uber would deliver the same in 10 minutes.

These new features made Uber Eats more convenient and satisfied many customers with different needs and preferences.

Uber Eats Case Study- Acquisition by Zomato

On 21 st January 2020, the only big news was that Zomato acquired Uber Eats. The deal has been in progress since 2019 and was finally concluded for $350 million. This deal was an all-stock transaction.

Zomato did not pay the monetary prize for this deal but offered an equal share in the company. Customers trying to order food from Uber Eats came across Zomato’s page.

A Uber Eats case study proves that the exit of Uber Eats from the food delivery industry has made the food delivery market a duopoly between Swiggy and Zomato.

Uber Eats is the third most popular name in online food delivery. Swiggy was and is still a tremendous competitor. While Swiggy gets nearly 1.4 million orders daily, Zomato receives around 1.2 million orders, whereas Uber Eats gets only 4 lakh daily.

When this challenging competition was going on, the two startups, Zomato and Swiggy, saw a new competitor in the market. The e-commerce giant, Amazon, entered the food delivery market with new strategies and offerings.

SWOT Analysis of Uber Eats

- Speedy delivery. Customers get their favorite food within 10 minutes at their doorstep.

- Flexibility in food delivery.

- A separate team of drivers handling Uber Eats deliveries avoids overlap with regular Uber cab drivers.

- No hidden charges ensure transparency and consistency in price.

- Restricted selection of restaurants.

- To know the reviews of restaurants, customers need to log in to Yelp.

- The items under the “Uber Instant Delivery” menu are prepared beforehand and kept in the driver’s vehicle. It is the reason why customers throw food many times.

Opportunity

- Uber Eats is available in over 6,000 cities across 45 countries and is expanding.

- Being a late entry in the online food delivery industry, Uber eats got the chance to learn from other major players’ mistakes.

- Give customers the option to place orders in advance. It will help them in assessing the demand for food from each restaurant.

- Offer customers the flexibility to get their food delivered at their available time.

- Uber Eats is a new name in the online food delivery industry.

- Other major food delivery apps like Postmates partner with Chiptole, Starbucks, and other famous companies.

Top 5 Competitors of Uber Eats

Revenue of Uber Eats

Uber Eats is a name that has become synonymous with distraction, challenging norms, and changing rules in an industry that has been around for decades.

Though Uber Eats has had its share of challenges since its launch, its forward-thinking, flexible approach helped it become an industry leader.

This Uber Eats case study narrates the story of Uber Eats, including how it started, became the third most popular food delivery app, and became a common name in everyday life.

Streamlyn Academy is a digital marketing institute that delivers Internet Marketing & Programmatic Advertising courses to industry executives, entrepreneurs, and recent graduates.

- Digital marketing courses in Bangalore

- #34, Koramangala 4th Block, Near Sony World Junction 80ft Road, AVS Layout, 20th L Cross Road Bengaluru, Karnataka 560034

- +(91)-9036276981 , +(91)-9883790299

- [email protected]

Quick Links

- Our Courses

- Certifications

- Corporate Training

- Hire From Us

- Write for Us

Information

- Privacy Policy

- Terms & Conditions

- Cookie Policy

Streamlyn Media

- © Copyright 2015-2024 Streamlyn Academy | All rights reserved

Your details have been submitted successfully.

Our team will get back to you shortly., we have received your message., someone from our team will contact you soon., thank you for enquiring about our course., our student counsellor will connect with you shortly., our academic counselor will contact you to schedule a demo as per your convenient time, for downloading our free digital marketing guide, we have sent the guide to the mail id provided. please check..

TheBigMarketing.com

Uber Eats Marketing Strategy 2024: A Case Study

Uber Eats, the food delivery branch of Uber, has changed the online food scene greatly. It uses many smart marketing steps. This way, it leads the market, grows its users, and keeps customers coming back.

We will look at what makes Uber Eats’ marketing work so well. This covers using social media , rewarding customers, and always looking for new ways to be better than rivals. Uber Eats makes sure it connects with people who use the service.

Key Takeaways:

- Uber Eats’ marketing strategy includes digital marketing, growth tactics, and ads

- Using social media sites like Instagram, Facebook, and YouTube is key for making people aware of the brand

- Getting customers to come back through referral programs and rewards is important for keeping them

- Having partnerships and sponsoring events helps Uber Eats stay on top and reach more areas

- By entering new areas and bringing out new items, Uber Eats meets the changing needs of customers

Leveraging Social Media Platforms for Brand Awareness

Uber Eats uses a full approach for digital marketing . This means they focus a lot on social media. Platforms like Instagram, Facebook, and YouTube are key for them. They use these to reach out and create a strong online community.

They catch their audience’s eye with great visuals, helpful videos, and content made by other users. This strategy helps Uber Eats start real conversations. It brings excitement and curiosity about their brand. More and more users find their way to Uber Eats because of this.

Uber Eats is great at making content that looks good on social media. They share images and videos that make you want to order food. These visuals are not just pretty. They make people curious and interested in seeing more from Uber Eats.

Uber Eats also gets their customers to help with brand awareness. They ask them to post their food stories and photos with special hashtags. This content from users doesn’t just show proof that people enjoy Uber Eats. It also gets more people to share and talk about their services.

Uber Eats tailors their content for each social media platform. On Instagram, it’s all about beautiful food photos. On Facebook, they share videos that inform you about new eating spots. This makes sure that they reach the right people in the right way on each platform.

With this mixed tactic in social media, Uber Eats expands its reach. They connect better with people and get them more involved. Their smart use of social media has made them top in the food delivery game.

Incentivizing Customer Loyalty

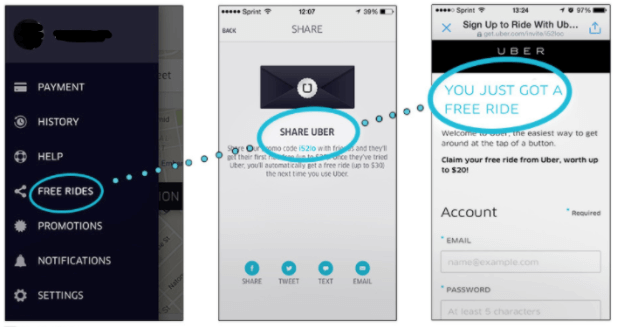

Uber Eats knows how important loyal customers are. They reward users for sticking with them. Rewards come from referral programs and loyalty schemes.

One key strategy is the referral program. Customers invite friends and family to join. When these new users buy something, both the person who invited them and the new customer get discounts.

Uber Eats also has loyalty programs for regular customers. These programs offer things like special discounts and personalized deals. They show Uber Eats’ thanks and keep users coming back.

Their approach to keeping customers happy works well. It brings in new people and keeps existing customers coming back. This boosts loyalty and keeps users happy.

Strategic Partnerships and Event Sponsorships

Uber Eats knows how important partnerships and sponsorships are. They team up with local businesses and sponsor events. This helps them reach more people and offer great deals to their customers. Both Uber Eats and its partners benefit from this.

By working with local businesses, Uber Eats gets access to new customers. This increases its presence in the market. These partnerships also open doors to promote each other’s services, attracting more customers.

Sponsoring events is key to Uber Eats’ marketing. They support events that match their brand and connect with potential customers. This could be anything from music festivals to sports events.

Event sponsorships also allow Uber Eats to give out special deals. This draws in new customers and improves their experience. It helps make Uber Eats the top choice at events.

Uber Eats uses these strategies to grow and maintain its market presence. Through partnerships and sponsorships, they reach new customers and offer unique benefits. This cements Uber Eats as a leading name in food delivery.

Expanding into New Markets and Launching Innovative Products

Uber Eats is always on the lookout for new markets and innovative products. By doing thorough market research and listening to what customers say, it stays ahead. It makes sure its services are what users need and want.

The company understands what people in different areas like and need. By looking at market trends and finding new opportunities, Uber Eats grows. This helps it reach more customers who want easy online food delivery.

Moreover, to lead the food delivery market, Uber Eats keeps innovating. Its research and development team works hard. They create new products and features that make things better for customers and restaurants.

The Role of Market Expansion

Getting into new markets is key for Uber Eats to grow. This brings in more customers and a variety of restaurants. It means users get a lot more choices of food.

Also, by reaching more markets , Uber Eats can work more effectively. It can get better deals with restaurants, deliver faster, and offer better prices to its customers.

Innovative Products Driving User Engagement

Uber Eats aims to keep customers happy by bringing in new products. It makes sure its app is easy to use and efficient. Features like easy order tracking help a lot.

For example, the “Uber Eats Pass” is a subscription that offers free deliveries on certain orders and discounts. This keeps customers coming back more often.

There’s also a “Virtual Kitchen” feature for delivery-only restaurants. It’s a smart way for new food businesses to start with less cost.

By moving into new markets and offering new products, Uber Eats stays on top. It’s committed to giving users a great dining experience at home. It keeps pushing technology forward to meet customers’ needs.

Uber Eats keeps leading in food delivery by expanding and innovating. It adapts to user needs and offers top convenience, choice, and value.

Maintaining Brand Consistency Across Platforms

Uber Eats is successful because it keeps its brand the same on different platforms. This makes Uber Eats stand out in the busy online food world.

Uber knows that a unified brand connects well with people. It combines its messages, look, and tone. This makes the brand strong, trusted, and liked by its customers.

On social media, Uber Eats’ content matches its brand. It uses the same colors, fonts, and designs. This makes customers feel at home, no matter where they see Uber Eats.

Uber Eats also keeps its tone the same everywhere. It does this on social media, in ads, and when talking to customers. This shows its brand personality and values.

Because it focuses on being consistent, Uber Eats has built a strong image. People can easily recognize and feel close to the brand. This creates a smooth and unified experience, which makes people think highly of Uber Eats.

Brand Consistency in Action

Let’s see why keeping the brand consistent is crucial:

Uber Eats is consistent on social media, its website and app, and in ads. This makes the brand memorable and liked, helping Uber Eats grow.

Image showing how important it is for a brand to stay consistent to be strong and recognized by customers.

Strategic Use of Incentives and Discounts

Uber uses incentives and discounts to draw and keep customers. These offers improve the customer experience. They make Uber Eats a top choice for online food delivery.

Referral Programs

Uber Eats rewards customers for bringing in new users. Through referral programs, customers get discounts or credits. This happens when their referred friends make a first purchase. It boosts loyalty and grows Uber Eats’ community.

Loyalty Programs

Uber Eats has loyalty programs to thank its regular customers. By joining, customers get points or rewards for how much they order. These can be exchanged for future discounts or special perks. It encourages more frequent use of Uber Eats.

Discounted Fares

Uber Eats sometimes reduces prices on selected restaurants or meals. This makes favorite dishes more budget-friendly. It shows the value Uber Eats adds for its customers.

Promotional Codes

Uber Eats often gives out promo codes that provide discounts. These codes are shared through social media, emails, and local business partnerships. Using these codes, customers can save money. This makes Uber Eats their go-to choice over other services.

Uber Eats’ strategy of using incentives and discounts is key to its growth. It includes referral and loyalty programs, plus discounted fares and promo codes. This makes Uber Eats both popular and a strong brand in the food delivery world.

Local Partnerships for Enhanced Customer Experience

Uber Eats is committed to an awesome customer experience. It works with local spots and sponsors events for special deals. This makes using Uber Eats more fun and affordable.

These partnerships mean you get lots of food choices nearby. Uber Eats teams up with famous restaurants. So, you can try different foods easily on their platform.

For example, Uber Eats and XYZ Bistro joined forces. Now, Uber Eats users get cool discounts at XYZ Bistro. This deal helps XYZ Bistro get more customers and gives you great offers on your meals.

Uber Eats also supports events to make your experience better. They provide special discounts at local festivals and concerts. This way, you enjoy lower prices and a good time, all thanks to Uber Eats.

They were a sponsor at the XYZ Food Festival. Attendees got a discount code from Uber Eats. Aligning with events like this connects Uber Eats to the local food scene and with you during fun times.

Through these efforts, Uber Eats boosts your experience by offering unique deals. By working with local spots and sponsoring events, they bring convenience, savings, and a sense of community. Uber Eats is a top choice for food delivery because of this.

Expanding Online Food Delivery with Uber Eats

Uber Eats has changed the way we get food by offering online delivery. Customers can pick their favorite meals from many restaurants. This makes getting food delivered easy and adds to the enjoyment of using Uber Eats.

On the Uber Eats app or website, you can look at lots of food types. Whether you want lunch, dinner, or just a snack, Uber Eats has many options. This variety meets all kinds of food cravings.

After you order, Uber Eats connects you with a delivery person. They make sure your food arrives fast and fresh. You can see where your order is at every step. This keeps you informed until your food arrives.

Uber Eats is now a big name in online food delivery. It meets the demand for easy and safe food delivery. This helps customers and gives local restaurants a chance to make more money. They can get their food to more people.

Uber Eats is working hard to grow and offer great service. It’s easy to use, has many restaurants, and delivers quickly. Uber Eats is a top choice for online food delivery. It gives you lots of food options right where you are.

In conclusion, Uber Eats’ case study shows its amazing success. This is thanks to its well-planned marketing strategies. The use of digital marketing, rewards for customers, partnerships, and growth in the market has made Uber Eats a top choice in the online food delivery sector.

Uber Eats has made the most of digital marketing. Platforms like social media and targeted ads helped reach its audience. With eye-catching visuals and helpful content, Uber Eats grew its online presence and brand awareness.

Uber Eats has also used customer rewards well. Programs like referrals and loyalty schemes have kept customers coming back. These rewards have led customers to suggest Uber Eats to others, growing the platform’s user base.

By partnering with local stores and sponsoring events, Uber Eats has widened its reach. These partnerships have allowed Uber Eats to offer special deals and discounts. This has helped it stay a top choice for customers looking for food delivery.

To wrap it up, Uber Eats’ marketing strategies have clearly worked well. The blend of digital marketing, rewards for users, smart partnerships, and growth plans has led to its big success in the busy online food delivery market.

What is the marketing strategy of Uber Eats?

How does uber eats leverage social media platforms, how does uber eats incentivize customer loyalty, does uber eats form partnerships with local businesses, how does uber eats expand into new markets, how does uber eats maintain brand consistency, does uber eats offer incentives and discounts to customers, does uber eats partner with local businesses for enhanced customer experiences, what services does uber eats offer, what can we learn from the uber eats marketing strategy, related posts.

Editorial Team

Tim hortons marketing strategy 2024: a case study, twitch marketing strategy 2024: a case study.

See what Dashmote can do for you

Email adress

Cracking the code of Uber Eats: }

Cracking the code of Uber Eats:

A case study

Uber Eats is an online food ordering and delivery platform that was launched by Uber back in August 2014. It originally began in California as one of the experimental services UberFRESH to deliver convenience-store items. One year later, the platform was renamed Uber Eats. For the first time, the company has broken a product out into its own standalone app. Since then, the company has come a long way to become a significant representation of the modern digital culture. During the Covid pandemic, it had a 70% increase in gross booking and drove more than 50% of the total revenue of Uber in 2021 [1] . Today, it operates in over 6,000 cities across 45 nations, and it is continuously expanding.

Few companies (Google, Amazon, Apple) can compete well in two markets at the same time. Uber has won the ride-hailing market in terms of market share. Is the company doing just as well in the food delivery market? During Uber’s recent Q3 earnings call, the company reported a revenue growth of $8.3 billion, which increased 72% YoY. Among that, Mobility Revenue grew 73% YoY and 8% QoQ to $3.8 billion, and Delivery revenue grew 24% YoY and 3% QoQ to $2.8 billion [2] . Unarguably, the solid earnings prove that Uber Eats, with over 81 million users world-widely, is succeeding in the food delivery industry [3].

In this article, we conduct an Uber Eats case study on a global scale. By leveraging Dashmote’s Data Analytics SaaS platform, we summarised a number of key features on this platform around the globe. It includes the growth of digital storefronts in Q3, the most popular cuisine types, and the top-listed beverage brands. After reading the article, you will gain a more sophisticated understanding of the general popularity of Uber Eats, and its current food and beverage trends.

Uber Eats 2022 Q3 digital storefronts growth

According to our Q3 food delivery data, the growth in Uber Eats‘ digital storefronts in major European countries has been slowing down. Uber Eats NL and Switzerland saw a quarter-on-quarter decrease in restaurant listings on its platform. Belgium and France grew by less than 1%. In the UK, after a double-digit growth of 10.75% in Q2, the growth in restaurant listings decreased dramatically to 0.52% in Q3. However, in Germany, it saw a staggering QoQ growth of 36.47%. This is not mistaken. In fact, the company is growing its German delivery business and plans to include 70 cities by the end of the year, expanding from its roster of 14 cities in March 2022 [4] . Our data clearly reflects this expansion.

Uber Eats is the 2nd biggest food delivery platform in the U.S., controlling over 25% of the food delivery market [5] . Our data shows that the U.S. remained the company’ largest market. It has around 450k restaurants listed on its platform and a QoQ growth of 1.85%. This restaurant base is 4 times the size in Japan.

Popular Cuisine types on Uber Eats

According to Dashmote’s data, fast food, burger, and American cuisine are the dominating choices across the largest markets for Uber Eats. In NZ, Asian food ranked as the 3 rd most listed cuisine type after fast food and burger.

One would expect Uber Eats France to showcase some French cuisine. Mistakenly, burgers, American, and fast food make up the top 3 cuisines in France. Moreover, Italian cuisine has been ruling the world for the last decades, but not on Uber Eats. Italian food, such as pasta and pizza, did not make it to the top 3 for most of the major countries where Uber Eats operates in.

A key takeaway from this data is that global consumers increasingly value convenient and fast food, and a key aspect driving the food delivery industry is the fast and busy life of people. Understanding the key trends on Uber Eats will benefit your business in adapting to consumer demands and discovering opportunities in the market.

Top listed beverage brands on Uber Eats

Our data shows that Coca-Cola remained the biggest beverage brand on Uber Eats across all major markets. In the US and the UK, Coca-Cola is now around double the size of Pepsi in terms of brand listing. Sprite and Fanta make it to the top 5 listed brands for most of the countries that are in scope. Moreover, we discovered some dark horses in the top listed beverage brands in some major countries, as shown in the visual below.

Overall, Uber Eats, along with the online food delivery industry, has witnessed an immense expansion since the pandemic began. However, our data shows that the market growth, in terms of restaurant listings, has been slowing down in Q3 2022. This can be also reflected in Uber's Q3 revenue reports, where Delivery revenue grew 24% YoY but only 3% QoQ.

After all, Uber Eats is still a success story in the food delivery industry with growing popularity. Understanding the food and beverage trends on the platform is essential for companies that can expand into the aggregator territory. Dashmote is the leading big data and AI analytics company in the food & beverage industry. We help F&B enterprises by empowering leaders and analysts to track and analyse publicly available data to contribute to making strategic decisions for your brand. Do you want to know more about retrieving market insights across food delivery and F&B?

→ Please contact [email protected].

Stop making uninformed decisions

Start liberating the power of data with Dashmote

How To Develop A Successful Food Delivery App Like UberEats

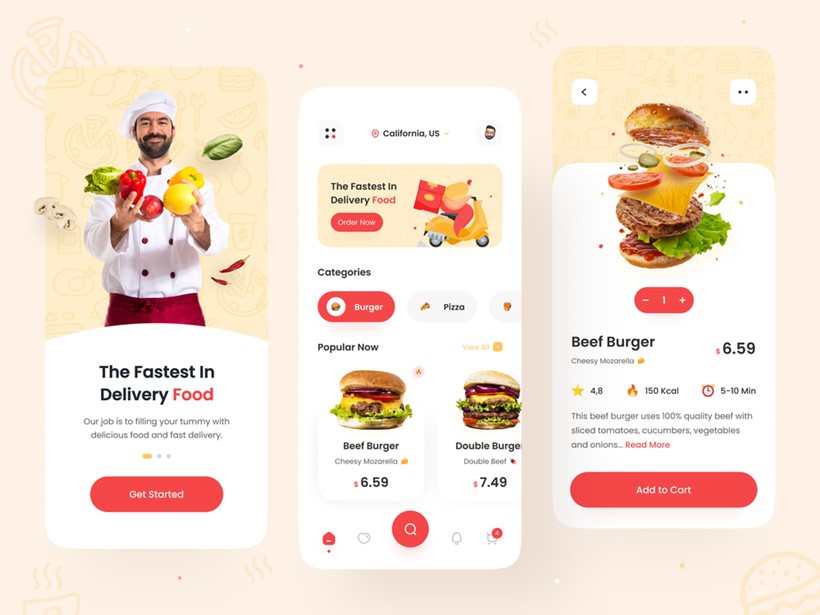

Food ordering is not a novel concept, but on-demand mobile apps have significantly enhanced the process, making it more seamless, faster, and convenient. As a result, the food delivery app industry has become well-established. It’s projected to reach $63.5 billion by 2025, driven in part by the accelerated adoption due to the impact of COVID-19. Given the success of UberEats in this industry, we aim to uncover the strategies behind Uber Eats case study and provide a comprehensive guide on how to create an app similar to UberEats.

1. Uber Eats Case Study: Business Model

Uber Eats is one of the 20 most-used apps in recent years. Its business model has inspired millions of food delivery startups to join the game. The UberEats app is both a restaurant aggregator and a delivery agent. Thus, a food delivery app like Uber performs two different features:

- UberEats uses a traditional food delivery model, listing partners-restaurants in a single app.

- At the same time, UberEats handles order delivery. The company uses its own logistics network to deliver orders from restaurants that don’t have a delivery option.

Besides, the food delivery application provides users with many functions, making food ordering even more convenient. The most notable food delivery app features are:

- Tailored restaurant recommendations

- Advanced search filters

- Order tracking

- Customizable delivery details

Jio Health – Telemedicine App Built by Savvycom

2. How Does UberEats Make Money?

To raise profit, the company applies three main monetization strategies, including:

- Delivery Fee: Before 2018, UberEats has had a flat rate of $4.99 delivery fee. Now the company uses a pricing calculator. It estimates a delivery order fee based on the distance between customers and restaurants. Thus, the delivery fee varies from $2 to $8 per order.

- Revenue Sharing from Restaurants: The platform charges restaurants from 15% to 40% fee for each order received via UberEats.

- Advertising: Another source of UberEats revenue is a marketing fee. Restaurant partners pay for promotion via the app search and come up as the first search result. This popular monetization strategy among restaurants increases their visibility on the app.

3. How To Make A Food Delivery App: A Step-by-step Guide

To make apps like UberEats popular among users, you need something more than copying UberEats feature list and monetization model. In this section, we have gathered handy insights on how to develop a unique food ordering app that can surpass UberEats.

Step 1: Watch The Food Delivery Industry For Hot Trends

To be ahead of competitors, you need to be aware of the most current food delivery industry trends, including new delivery channels. In order to achieve this, consider the following food ordering trends:

a/. Social Media

To make your app unique in your niche, think about ordering via social media accounts. The first company that used this ordering option was Domino’s Pizza. Domino’s Pizza customers can use their Twitter account to order pizzas. In order to achieve this, app users need to tweet a pizza emoji to the Domino’s Pizza Twitter account.

But how does Domino’s Pizza know what type of pizza you want and your delivery address? Here’s how:

- Before taking advantage of this service, Domino’s Pizza customers need to create a “pizza profile” on Domino’s online delivery service.

- The customers save their default orders, also known as Easy Orders.

- Then, app users link this pizza profile with their Twitter account.

b./ Virtual Assistant

Chabot has become a handy assistant in many areas, including food ordering. This technology allows ordering via messengers and requests food by a single word. Let’s check some examples:

- Domino’s pizza is at the top of the technological wave again. The company has developed Dom, a chatbot for ordering food via Twitter and Facebook messengers. Dom also informs customers about the latest deals and vouchers.

- Grubhub is another example of the successful use of modern technologies. The delivery marketplace has integrated its system with Alexa, Amazon’s virtual assistant. Now, Grubhub customers can reorder any of their last three purchases made via the platform. Besides placing orders, Alexa also tells the estimated delivery time.

- Just Eat has decided to keep up with the current trends and integrate Alexa into their ordering system as well. Thanks to new Amazon hardware, Echo Show , Just Eat can place orders by voice and check the courier’s location.

c./ Smartwatch

Wearable devices have quickly become an integral segment of the consumer electronics industry. And, by August 2019, there have been over 38 million smartwatches sold globally. Some businesses use Android and Apple smart devices. Some examples are:

- Domino’s was a pioneer who launched a food ordering app for Android watches which simplifies ordering.

- OrderUp is another brand that has decided to enter the wearable devices market. The company introduced its latest app for the Apple Watch. Now, OrderUp customers can place orders, track delivery statuses, and see the estimated time of arrival.

Step 2: Choose Food Delivery Model

During this stage, you need to select a food delivery model that will work for your business and meet your goals. There are two main models currently presented on the food delivery market. They are:

Step 3: Research Your Target Market

To develop an outstanding food delivery app, you need to know your customers or your target audience. Why? Simply because once you understand who will be using your products, it is easy to build an app that ideally meets your target audiences’ needs.

Your target audience could be narrow, such as gluten-free raw vegans, or broad, like pizza lovers.

To draw a clear picture of your target audience, use demographic criteria and create a target customer profile. In order to achieve this, you need to clarify the following points:

Social characteristics, including income, gender, nationality, age, and so on.

- How do your target customers spend their free time?

- What potential customer problems your product may solve?

- What feeling will your product provoke from your customers?

- Why should your customers use your product, rather than competitors?

By clarifying all of these points, you will have a good idea of your target customers.

Step 4: Choose The Main Features Of UberEats-like Food Delivery Services

When developing a mobile app like Uber for food delivery, consider the following features:

- Registration and Login: Think about log in via email and social media profiles, such as Facebook and Twitter.

- Search: Empower your food delivery app with search by meal, filters, as well as the food category. This section should include pictures of dishes, the process, and a description of the meal.

- Order placing: Once users select the meal they want they can add it to the shopping cart.

- Order checkout: After users select their food, they can place their orders. This section of the food delivery app like Uber should include all selected dishes, and the total price the user should pay.

- Payment: When the order is ready, allow your users to pay for it via the built-in payment gateway. Our advice is to integrate several payment systems, such as PayPal, Stripe, MangoPay. We applied this strategy to custom marketplace development. Besides these payment options, let your customer have a Cash on Delivery option.

- Notifications: You can notify your customers about the order status via push notifications and SMS.

- Order Tracking: Empower your food delivery app like UberEats with real-time order tracking by using the CoreLocation framework for iOS apps and Google Location API for Android apps. Besides, Mapkits and Google Maps will help your couriers to find the best route to the customer’s location.

- Reviews and ratings: Let your app users share their experience via reviews, and rate restaurants on your platform. User reviews will add dynamic content to your app and social proof.

Step 5: Select The Technology Stack of Food Delivery App Development

Depending on the business model of your food delivery startup, you might need different technologies. Still, we have gathered an essential tech stack for Uber-like apps in the table below:

- Restaurant listing:

- Grubhub API

- FourSquare API

- Payment gateway:

- Find user location:

- Core Location Framework

- Google Places API

- Google Maps

- Push notifications:

- Urban Airship

- Firebase Cloud Messaging

4. How Much Does It Cost to Develop A Food Delivery App?

T he cost of the mobile app consists of many elements, including the number of platforms, feature list, the number of integrations, and so on. Your mobile development team will come up with a precise app estimation only after the discovery (inception) phase. The discovery (inception) phase is the first step you and your development team take to build a solid foundation for app development. This stage includes several components, such as:

Functional specification

- UX/UI design

- Visual prototypes

After this stage, you will have a clear vision of the end solution. In our experience, this phase takes 4-6 weeks. The product discovery phase can help you with:

- Defining the scope of work

- Developing the project roadmap

- Setting a realistic MVP budget

- Planning your resources

- Testing the app MVP with a target audience

- Developing a solid investment pitch

So, how much will the food delivery app cost? We need from 50 hours to create UI/UX design, from 66 hours to build the app’s back-end, while the development stage may take from 120 hours per each platform.

5. In a nutshell

The popularity of food ordering services makes on-demand food apps a prospective niche for investments. Still, to stand out from the crowd, you should adopt current food ordering industry trends. For your future food delivery app, you can apply either an Order-Only or Order and Delivery Model. With the app MVP, you can gather insights from your target audience and add other features during the second development stage.

- Phone: +84 24 3202 9222

- Hotline: +1 408 663 8600 (US); +612 8006 1349 (AUS); +84 32 675 2886 (VN)

- Email: [email protected]

About Vance Duong

Related Posts

Top 5 technology consulting companies in asia [2024], why cybersecurity is a crucial element in the software development cycle, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Become A Partner!

Grow your valuable network with us

Download Our Company Profile Now!

We can onboard IT staff in just 2 weeks! Boost productivity while saving time.

Share Your Needs

We’ll respond within 24 hours

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Share Podcast

Uber’s Strategy for Global Success

How can Uber adapt its business model to compete in unique global markets?

- Apple Podcasts

As Uber entered unique regional markets around the world – from New York to Shanghai, it has adapted its business model to comply with regulations and compete locally. As the transportation landscape evolves, how can Uber adapt its business model to stay competitive in the long term?

Harvard Business School assistant professor Alexander MacKay describes Uber’s global market strategy and responses by regulators and local competitors in his case, “ Uber: Competing Globally .”

HBR Presents is a network of podcasts curated by HBR editors, bringing you the best business ideas from the leading minds in management. The views and opinions expressed are solely those of the authors and do not necessarily reflect the official policy or position of Harvard Business Review or its affiliates.

BRIAN KENNY: The theory of disruptive innovation was first coined by Harvard Business School professor Clayton Christensen in his 1997 book, The Innovator’s Dilemma . The theory explains the phenomenon by which an innovation transforms an existing market or sector by introducing simplicity, convenience, and affordability where complication and high cost are the status quo. Think Netflix disrupting the video rental space. Over the years, the term has been applied liberally and not always correctly to other examples, but every so often, an idea comes along that really fits the bill. Enter Uber, the ridesharing behemoth that turned the car service industry on its head. In a few short years after launching in 2010, Uber became the largest car service in the world, as measured in ride count. Last year, Uber drove 6.2 billion riders. Today’s case takes us to London in 2019, where Uber is facing the latest in a long list of challenges from regulators threatening their ability to continue operating in that important market. In this episode of Cold Call , we welcome Alexander MacKay to discuss the case entitled, “Uber: Competing Globally.” I’m your host, Brian Kenny, and you’re listening to Cold Call on the HBR Presents network.

Alexander MacKay is in the strategy unit at Harvard Business School. His research focuses on matters of competition, including pricing, demand, and market structure. Alex, thanks for joining us on Cold Call today.

ALEX MACKAY: Thank you, Brian. Very happy to be here.

BRIAN KENNY: The idea of Uber seems so simple, but it was revolutionary in so many ways. And Uber has been in the headlines many times for both good and bad reasons in its decade of existence. So we’re going to touch on a lot of those things today. So thanks for sharing the case with us.

ALEX MACKAY: Brian, I’m very happy to. It’s a little funny, we’ve actually started to see the first few students who have never hailed a traditional taxi in our classrooms. So I think increasingly, the contrast between the two is going to be pretty difficult for people to fully understand.

BRIAN KENNY: Let me ask you to start by telling us what your cold call would be when you set up the class here.

ALEX MACKAY: The case starts off with the current legal battle going on in London. And so the first question I just ask to start the classroom is: What’s the end game for Uber in London? What do they look like 10 years from now? In the midst of this ongoing legal battle, there has been back and forth, some give and take from both sides, Transportation for London, and also on the Uber side as well. And there’s actually a recent court case that has allowed Uber to have a little more time to operate. They bought about 18 more months of time, but this has been also brought with additional, stricter scrutiny, and 18 months from now, they’re going to be at it again trying to figure out exactly what rules Uber’s allowed to operate under.

BRIAN KENNY: It seems like 18 months in the lifetime of Uber is like a decade. Everything seems to happen so quickly for this company. That’s a long period of time. What made you decide to write this case? How does it relate to the work that you’re doing in your research?

ALEX MACKAY: A big focus of my research is on competition policy, particularly the realms of antitrust and regulation. And here we have a company, Uber, whose relationship with regulation has been really essential to its strategy from day one. And I think appreciating the effects of regulation and how its impact Uber’s performance in different markets, is really critical for understanding strategy and global strategy broadly.

BRIAN KENNY: Let’s just talk a little bit about Uber. I think people are familiar with it, but they may not be familiar with just how large they are in this space. And the space that they’ve sort of created has also blown up and expanded in many ways. So how big is Uber? Like what’s the landscape of ridesharing look like and where does Uber sit in that landscape?

ALEX MACKAY: Uber globally is the biggest ridesharing company. In 2018, they had over $10 billion in revenue for both ridesharing and their Uber Eats platform. And you mentioned in the introduction, that they had over 6 billion rides in 2019. That’s greater than 15 million rides every day that’s happening on their platform. So really, just an enormous company.

BRIAN KENNY: So they started back in 2010. It’s been kind of an amazing decade of growth for them. How do you explain that kind of rapid expansion?

ALEX MACKAY: They were financed early on with some angel investors. I think Kalanick’s background really helped there to get some early funding. But one of the critical things that allowed them to expand early into many markets that helped their growth was they’re a relatively asset light company. On the ground, they certainly need sales teams, they need translation work to move into different markets, but because the main asset they were providing in these different markets was software, and drivers were bringing their own cars and riders were bringing their own phones, the key pieces of hardware that you need to operate this market, they really didn’t have to invest a ton of capital. In fact, when they launched in Paris, they launched as sort of a prototype, just to show, “Hey, we can do this in Paris without too much difficulty,” as their first international market. So being able to really scale it across different markets really allowed them to grow. I think by 2015, their market cap was $60 billion, five years after founding, which is just an incredible rate of growth.

BRIAN KENNY: So they’re the biggest car service in the world, but they don’t own any cars. Like what business are they really in, I guess is the question?

ALEX MACKAY: They’re certainly in the business of matching riders to drivers. They’ve been able to do this in a way that doesn’t require them to own cars, just through the use of technology. And so what they’re doing, and this is I think pretty well understood, is that they’re using existing capital, people who have cars that may be going unused, personal cars, and Uber is able to use that and deploy that to give riding services to different customers. Whereas in the traditional taxi model, you could have taxis that you didn’t necessarily own, but you leased them or you rented them, but they had the express purpose of being driven for taxi services. And so it wasn’t using idle capital. You kind of had to create additional capital in order to provide the services.

BRIAN KENNY: So you mentioned Travis Kalanick a little bit earlier, but he was one of the co-founders of the company, and the case goes a little bit into his philosophy of what expansion into new markets should look like. Can you talk a little bit about that?

ALEX MACKAY: Certainly. Yeah. And I think it might even be helpful to talk a bit about his background, which I think provides a little more context before Uber. He dropped out of UCLA to work on his first company, Scour, and that was a peer-to-peer file sharing service, a lot like Napster, and actually predated Napster. And where he was operating was sort of an evolving legal gray area. Eventually, Scour got sued for $250 billion by a collection of entertainment companies and had to file for bankruptcy.

BRIAN KENNY: Wow.

ALEX MACKAY: He followed that up with his next venture, Red Swoosh, and that was software aimed at allowing users to share network bandwidth. So again, it was a little bit ahead of its time, making use of recent advances in technology. Early on though, they got in trouble with the IRS. They weren’t withholding taxes, and there were some other issues with his co-founder, and there was sort of a bad breakup between the two. Despite this, he persevered and ended up selling the company for $23 million in 2007. And after that, his next big thing was Uber. So one thing I just want to point out is that at all three of these companies, he was looking to do something that leveraged new technology to change the world. And by nature, sometimes businesses like that operate in a legal gray area and you have very difficult decisions to make. Some other decisions you have to make are clearly unethical and there’s really no reason to make some of those decisions, like with the taxes and with some other things that came out later on at Uber, but certainly one of the things that any founder who’s looking to change the world with a big new technology company has to deal with, is that often, the legal framework and the regulatory framework around what you’re trying to do isn’t well established.

BRIAN KENNY: Obviously drama seems to follow Travis where he goes. And his expansion strategy was pretty aggressive. It was almost like a warlike mentality in terms of going into a new market. And you could sort of sum it up as saying ask forgiveness. Is that fair?

ALEX MACKAY: Yeah. Yeah. Ask for forgiveness, not permission. I think they were really focused on winning. I think that was sort of their ultimate goal. We describe in the case there’s this policy of principle confrontation, to ignore existing regulations until you receive pushback. And then when you do receive pushback, either from local regulators or existing sort of taxicab drivers, mobilize a response to sort of confront that. During their beta launch in 2010, they received a cease-and-desist letter from the city of San Francisco. And they essentially just ignored this letter. They rebranded, they used to be UberCab, and they just took “Cab” out of their name, so now they’re Uber. And you can see their perspective in their press release in response to this. They say, “UberCab is a first to market cutting edge transportation technology, and it must be recognized that the regulations from both city and state regulatory bodies have not been written with these innovations in mind. As such, we are happy to help educate the regulatory bodies on this new generation of technology and work closely with both agencies to ensure compliance.”

BRIAN KENNY: It’s a little arrogant.

ALEX MACKAY: Yeah, so you can see right there, they’re saying, what we’re operating in is sort of this new technology-based realm and the regulators don’t really understand what’s going on. And so instead of complying with the existing regulations, we’re going to try to push regulations to fit what we’re trying to do.

BRIAN KENNY: The case is pretty epic in terms of it sort of cuts a sweeping arc across the world, looking at the challenges that they faced with each market they entered, and none more interesting I think the New York City, which is obviously an enormous market. Can you talk a little bit about some of the challenges they faced going into New York with the cab industry being as prevalent as it was and is?

ALEX MACKAY: Yeah, absolutely. I mean, I think it’s pretty well known for people who are familiar with New York that there were restrictions on the number of medallions which allowed taxis to operate. So there was a limited number of taxis that could drive around New York City. This restriction had really driven up the value of these medallions to the taxi owners. And if you had the experience of taking taxis in New York City prior to the advent of Uber, what you’d find is that there were some areas where the service was very, very good. Downtown, Midtown Manhattan, you could almost always find a taxi, but there are other parts of the city where it was very difficult at times to find a cab. And when you got in a cab, you weren’t sure that you were always going to be given a fair ride. And so Uber coming in and providing this technology that allowed you to pick up a ride from anywhere and sort of track the route as you’re going on really disrupted this market. Consumers love them. They had a thousand apps signups before they even launched. Kalanick mentioned this in terms of their launch strategy, we have to go here because the consumers really want us here. But immediately, they started getting pushback from the taxicab owners who were threatened by this new mode of transportation. They argued that they should be under the same regulations that the taxis were. And there were a lot of local government officials that were sort of mobilized against Uber as well. De Blasio, the Mayor of New York, wrote opinion articles against Uber, claiming that they were contributing to congestion. There was a lot of concern that maybe they had some safety issues, and the taxi drivers and the owners brought a lawsuit against Uber for evading these regulations. And then later on, and this was the case in many local governments, de Blasio introduced a bill to put additional restrictions on Uber that would make them look a lot more like a traditional taxi operating model, with limited number of licenses and strict requirements for reporting.

BRIAN KENNY: And this is the same scenario that’s going to play out almost with every city that they go into because there is such an established infrastructure for the taxi industry in those places. They have lobbyists. They’re tied into the political networks. In some instances, it was revealed that they’ve been connected with organized crime. So not for the faint of heart, right, trying to expand into some of the biggest cities in the United States.

ALEX MACKAY: Absolutely. Absolutely. And what’s sort of fascinating about the United States is it’s actually a place where a company can engage in this battle over regulation on the ground. And de Blasio writes his opinion article and pushes forward this bill. Uber responds by taking out an ad campaign, over $3 million, opposing these regulations and calling out de Blasio. So again, we sort of have this fascinating example of Uber mobilizing their own lobbyists, their lawyers, but also public advertising to sort of convince the residents of New York City that de Blasio and the regulators that are trying to come down on them are in the wrong.

BRIAN KENNY: Yeah. And at the end of the day, it’s consumers that they’re really making this appeal to, because I guess my question is, are these regulations stifling innovation? And if they are, who pays the ultimate price for that, Uber or the consumer?

ALEX MACKAY: Consumers definitely loved Uber. And I don’t think any of the regulators were trying to stifle innovation. I don’t think they would say that. I think their biggest concern, their primary concern was safety, and a secondary and related concern here was losing regulatory oversight over the transportation sector. So this is a public service that had been fairly tightly regulated for a long time, and there was some concern that what happens when this just becomes almost a free market sector. At the same time, these regulators have the lobbyists from the taxicab industry and other interested parties in their ear trying to convince them that Uber really is like a taxi company and should be regulated, and really emphasizing the safety concerns and other concerns to try to get stricter regulations put on Uber. And part of that may be valid. I think you certainly should be concerned about safety and there are real concerns there, but part of it is simply the strategic game that rivals are going to play between each other. And the taxicab industry sees Uber as a threat. It’s in their best interest to lobby the regulators to come down on Uber.

BRIAN KENNY: And what’s amazing to me is that while all this is playing out, they’re not turning their tails and running. They’re continuing to push forward and expand into other parts of the world. So can you talk a little bit about what it was like trying to go into countries in Latin America, countries in Asia, where the regulations and the regulatory infrastructure is quite different than it is in the US?

ALEX MACKAY: In the case, we have anecdotes, vignettes, one for each continent. And their experience in each continent was actually pretty different. Even within a continent, you’re going to have very different regulatory frameworks for each country. So we sort of pick a few and focus on a few, just to highlight how the experience is very different in different countries. And one thing that’s sort of interesting, in Latin America, we focus on Bogota in Colombia, and what’s sort of interesting there is they launched secretly and they were pretty early on considered to be illegal, but they continue to operate despite the official policy of being illegal in Colombia. And they were able to do that in a way that you may not be able to do it so easily in the United States, just because of the different layers of enforcement and policy considerations that are present in Colombia and not necessarily in the United States. Now, when I talk about the current state of Uber in different countries, this is continually evolving. So they temporarily suspended their operations early in 2020 in Columbia. Now they’re back. This is a continual back and forth game that they’re playing with the regulators in different markets.

BRIAN KENNY: And in a place like Colombia, are they not worried about violence and the potential for violence against their drivers?

ALEX MACKAY: Absolutely. So this is true sort of around the world. I think in certain countries, violence becomes a little bit more of a concern. And what they found in Colombia is they did have more incidents where taxi drivers decided to take things into their own hands and threaten Uber drivers and Uber riders, sometimes with weapons. Another decision Uber had to make that was related to that was whether or not to allow riders to pay in cash. Because in the United States, they’d exclusively used credit cards, but in Latin America and some other countries like India, consumers tended to prefer to use cash to pay, and allowing that sort of opened up this additional risk that Uber didn’t really have a great system in place to protect them from. Because when you go to cash, you’re not able to track every rider quite as easily, and there’s just a bigger chance for fraud or for robbery and that sort of thing popping up.

BRIAN KENNY: Going into Asia was also quite a challenge for them. Can you talk a little bit about some of the challenges they faced, particularly in China?

ALEX MACKAY: They had very different experiences in each country in Asia. China was a unique case that is very fascinating, because when Uber launched there, there were already existing technology-based, you might call them, rideshare companies, that were fairly prominent, Didi and Kuaidi, And these companies later merged to be one company, DiDi, which is huge. It’s on par with Uber in terms of its global presence as a ridesharing company. When Uber launched there, they didn’t fully anticipate all the changes they would have to make to going into a very different environment. In China, besides having established competitors, Google Maps didn’t work, and they sort of relied on that mapping software to do their location services. So they had to completely redo their location services. They also, again, relied on credit cards for payments, and in China, consumers increasingly used apps to do their payments. And this became a little bit of a challenge because the main app that Chinese customers used, they used WeChat and Alipay primarily, they were actually owned by parent companies of the rival ridesharing company. So Uber had to essentially negotiate with its rivals in order to have consumers pay for their ridesharing services. And so here are a few sort of localization issues that you could argue Uber didn’t fully anticipate when they launched. The other thing about competing in China that’s sort of interesting is that Chinese policy regarding competition is very different from policy in the United States and much of Europe. For the most part, there’s not the traditional antitrust view of protecting the consumers first and foremost. That certainly comes into play, but the Chinese government has other objectives, including promoting domestic firms. And so if you think about launching into a company where there’s a large established domestic rival that certainly increases the difficulty of success, because when push comes to shove, the government is likely to come down on the side of your rival, which is the domestic company, and not the foreign entrant.

BRIAN KENNY: Yeah, which is understandable, I guess, to some extent. This sounds exhausting, to be sort of fighting skirmishes on all these fronts in all these different places in the world. How does that affect the morale or tear at the fabric maybe of the culture at a company like Uber, where they’re trying to manage this on a global scale and running into challenges every step of the way?

ALEX MACKAY: It certainly has an effect. I think Uber did a very good job at recruiting teams of people who really wanted to win. And so, if that’s the consistent message you’re sending to your teams, then these challenges may be actually considered somewhat exciting. And so I think by bringing in that sort of person, I think they actually fueled this desire to win in these markets and really kept the momentum going. One of the downsides of this of course is that if you exclusively focus on winning and getting around the existing regulations, there does become this challenge of what’s ethical and what’s not ethical? And in certain business areas, there actually often is a little bit of a gray line. I mean, you can see this outside of ridesharing. It’s a much broader thing to think about, but regulation of pharmaceuticals, regulation of use of new technologies such as drones, often the technology outpaces the regulation by a little bit and there’s this lag in trying to figure out what actually is the right thing to do. I think it’s a fair question whether or not you can disentangle this sort of principle of confrontation that’s so pervasive throughout the company culture when it comes to regulation from this principle confrontation of other ethical issues that are not necessarily business driven, and whether or not it’s easy to maintain that separation. And I think that’s a fair question, certainly worthy for debate. But what I think is important is you can set up a company where you are abiding by ethical issues that are very clear, but you’re still going to face challenges on the legal side when you’re developing a new business in an area with new technology.

BRIAN KENNY: That’s a great insight. I mean, I found myself asking myself as I got through the case, I can’t tell if Uber is the victim or the aggressor in all of this. And I guess the answer is they’re a little bit of both.

ALEX MACKAY: Yeah. I think it’s fair to characterize them as an aggressor, and I think you sort of need to be if you want to succeed and if you want to change the world in a new technology area. In some sense, they’re a victim in that we’re all the victim as consumers and as firms of regulations that are sometimes difficult to adapt in real time to changing market conditions. And there’s a good reason why they are sticky over time, but sometimes that can be very costly. Going back to something we talked about earlier, I think there are hardly any consumers that wanted Uber kicked out of New York City. I think everyone realized this was just so much superior to any other option they had, that they were really willing to fight to keep Uber around in the limited ways they could.

BRIAN KENNY: So let’s go back to the central issue in the case then, which is, how important is it to them, in terms of their global strategy, to have a presence in a place like London? They’re still not profitable by the way, we should point that out, that despite the fact that they are the largest in the space, they haven’t turned the corner to profitability yet. I would imagine London’s kind of important.

ALEX MACKAY: Absolutely. London is a key international city, and a presence there is important for Uber’s overall brand. So many people travel through London, and it’s a real benefit for anyone who travels to be able to use the same service at any city you stop in. At the same time, they’re facing these increasing regulatory pressures from London, and so it’s a real question whether or not, 10 years from now, they look substantially different from the established taxi industry that’s there. And you can kind of see this battle playing out across different markets. As another example, in Ghana. When they entered there, they actually entered with a framework for understanding. They helped build the regulations for ridesharing services in Ghana when they entered. But over time, that evolved to additional restrictions as the existing taxi companies pushed back on them. So I think a key lesson here in all of this is that the regulations that you see at any given point in time aren’t absolutely fixed, for anyone starting a technology-based company, there will be regulations that do get created that affect your business. Stepping outside of transportation, we can see that going on now with the big tech firms and sort of the antitrust investigations they’re are under. And the policymakers in the US and Europe are really trying to evolve the set of regulations to reflect the different businesses that Apple, Facebook, Microsoft, Google are involved in.

BRIAN KENNY: One thing we haven’t touched on, and it’s not touched on in the case obviously because it just sort of started fairly recently, is the pandemic and the implications of the pandemic for the rideshare industry as fewer people find themselves in need of going anywhere. Have you given any thought to that and whether that’s going to have any effect on the regulations?

ALEX MACKAY: It certainly could. Uber is in a somewhat fortunate position, at least if you judge by their market capitalization, with respect to the pandemic. Initially their stocks took a pretty big hit, but rebounded pretty quickly, and part of this is because the primary part of their business is the transportation through Uber X, but they do also offer the delivery services through Uber Eats, and that business has really picked up during this pandemic. There’s certainly a mix of views about the future, but I think most people do believe that at some point we’ll get back to business as usual, at least for Uber services, when we come up with a vaccine. I think most people anticipate that they’ll be resuming use of Uber once it becomes safe to do so. And I think, to be frank, a lot of people already have resumed using Uber, especially people who don’t have cars or who see it as a valuable alternative or a safer alternative to public transit.

BRIAN KENNY: Yeah, that’s a really good point. And the Uber Eats thing is interesting as another example of how it’s important for businesses to re-imagine the business that they’re in because that, in many ways, may be helping them through a really tough patch here. This has been a really interesting conversation, Alex, I want to ask you one final question, which is, as the students are packing up to leave class, what’s the one thing you want them to take away from the case?

ALEX MACKAY: So I would hope the students take away the importance of regulation in business strategy. And I think the case of Uber really highlights that. And if you look at the conversation around Uber I’d say for the first 10 years of their existence, it was essentially around the superiority of their technology and not so much how they handled regulation. If you think back to the cease-and-desist letter that San Francisco issued in 2010, if Uber had simply stopped operations then, we wouldn’t have the ridesharing world that we have today. So their strategy of principle confrontation with respect to regulation was really essential for their future growth. Again, this does raise important ethical considerations as you’re operating in a legal gray area, but it’s certainly an essential part of strategy.

BRIAN KENNY: Alex, thanks so much for joining us on Cold Call today. It’s been great talking to you.

ALEX MACKAY: Thank you so much, Brian.

BRIAN KENNY: If you enjoy Cold Call, you might like other podcasts on the HBR Presents Network. Whether you’re looking for advice on navigating your career, you want the latest thinking in business and management, or you just want to hear what’s on the minds of Harvard Business School professors, the HBR Presents Network has a podcast for you. Find them on Apple podcasts or wherever you listen. I’m your host, Brian Kenny, and you’ve been listening to Cold Call , an official podcast of Harvard Business School on the HBR Presents Network.

- Subscribe On:

Latest in this series

This article is about competitive strategy.

- Global strategy

- Government policy and regulation

Partner Center

How Uber Disrupted An Industry With An Explosive Approach

Table of contents.

In this strategy study, we’re going to delve into a company that impacted everything from people’s everyday lives and entrepreneurial dreams to the startup world and city legislature.

Its story and strategy are fascinating, often problematic, and definitely worth exploring. So let’s embark on a different kind of Uber ride.

Despite disrupting transport around the globe, Uber defines itself as a technology company , not a transport company - hence their legal name Uber Technologies Inc. It was one of the first companies to embrace and define “the sharing economy” concept and created a two-sided digital marketplace for drivers and riders.

Uber’s mission was to make transportation as easy to access as running water and they wanted to do it in a different way - without owning its own vehicle fleet like your regular taxi company.

That asset-light strategy is what makes Uber so incredibly scalable and it proved to be a huge draw for investors. Since Uber’s launch in 2010, the company has attracted over $25 billion in VC funding.

Their business model and immense financial backing helped Uber achieve:

- Present in 10,500+ cities across 70 countries

- 131 million monthly active platform customers

- Nearly 23 million rides per day worldwide

- Over 5 million drivers worldwide

- 118 million users in 2021

- Annual revenue of $17.4 billion in 2021

- A 68% share of the US rideshare market .

Uber’s numbers are astronomical and the company is a perfect example of a disruptive and transformative brand. However, as we dive deeper into Uber’s strategy, you’ll see that Uber faced and is still facing many challenges - the biggest one among them being its (un)profitability.

But let us start at the very beginning...

{{cta('eed3a6a3-0c12-4c96-9964-ac5329a94a27')}}

It all began on a cold night in Paris...

It was a snowy winter night in Paris in 2008. Two friends and successful startup founders, Travis Kalanick and Garrett Camp, were attending the annual tech conference LeWeb. More importantly, they were trying to get a cab but couldn’t find one.

What if you could just request a ride from your phone?

This idea, based on a very real need at that moment, is what sparked the creation of Uber.

After the conference, the entrepreneurs went their separate ways, but when Camp returned to San Francisco, he continued to be fixated on the idea and bought the domain name UberCab.com.

In 2009, Camp was still CEO of StumbleUpon, but he began working on a prototype of UberCab as a side project. At the time, UberCab was still an idea for a shared luxury cab service that could be ordered via an app.

Camp had managed to persuade Kalanick to join UberCab in an advisory role and on July 5, 2010, the first Uber rider requested a trip across San Francisco. Kalanick became Uber’s CEO in December 2010, while Ryan Graves, Uber’s first CEO, assumed the role of the COO and board member.

Uber’s app, enabled its users to order a ride with a tap of a button . A GPS identified the rider’s location, and the cost was automatically charged to the card on the user account. Uber’s simplicity fueled its early popularity among users as well as investors and the startup quickly became one of the hottest companies in San Francisco.

By October 2010, the company received its first major funding of $1.25 million and in 2011 its growth skyrocketed. Early in the year, the company raised $11 million and went on to expand to New York, Seattle, Boston, Chicago, Washington D.C. as well as abroad in Paris.

Yes, just a year after the first Uber ride was requested, Uber had already launched internationally in Paris, where the idea for Uber first took root.

In December at the 2011 LeWeb Conference, the very conference “responsible for Uber’s inception”, Kalanick announced that Uber raised another $32 million in Series B and that investors like Jeff Bezos and Goldman Sachs got on board.

In 2012, Uber launched its arguably most popular service UberX. UberX provided an option of ordering a more affordable car as an alternative to its original black car service. That’s when Uber became really appealing to the mass market.

Behind Uber’s explosive growth are an innovative business model and growth strategy that we must explore before diving into Uber’s global expansion.

Key takeaway #1: build solutions for real-world problems

Successful products and services identify real problems and figure out how technology can be leveraged to solve them. Uber’s founders made sure they’re going to be able to get a ride during a cold winter night by using mobile technology to transform on-demand transportation.

All about Uber’s scalable business model

When talking about Uber’s business model, we need to mention that since its launch, Uber has expanded and diversified its services. It’s no longer just a ride-hailing service - it also offers food delivery (Uber Eats) and trucking (Uber Freight).

However, for the sake of simplicity, we’ll mostly focus on Uber's core business of ridesharing and the business model revolving around it.

The basic idea behind Uber is to connect riders that need to get somewhere with drivers that are willing to take them there. Riders create the demand while drivers provide the “supply” and Uber acts as the marketplace where both parties can seamlessly connect.

As you can see, Uber has two key users and it has to provide strong value propositions for both drivers and passengers in order to attract enough users for the platform to function as intended.

Let’s see why passengers and drivers use Uber.

Uber’s value propositions

- Convenient on-demand ride bookings

- Real-time tracking

- Cheaper rates compared to taxis

- Accurate estimated time of arrival

- Automatic credit card rides

- Lower wait time for a ride

- Upfront pricing

- Multiple ride options

For drivers

- Highly flexible source of income for people who own (or are willing to loan) a car

- Completely flexible working hours

- Good trip allocation

- Assistance in getting vehicle loans

- Weekly or even daily payments

Uber’s target market

While the appeal of Uber is quite obvious, who exactly do they target?

As evident from the value propositions, Uber has two main target segments - passengers who want a fuss-free experience ride from A to B and drivers that want flexibility and some extra income, usually on the side.

When it comes to passengers, Uber’s website’s headline for a long time was: Everyone’s private driver . That instantly lets us know that Uber’s target market is very, very wide. It’s everyone who needs a ride .

While targeting several customer segments with different cost-conscious and more luxurious service options, what’s perhaps more important is how Uber reached its audience at the very beginning as you can’t just target everyone from the get-go.

It’s all about passionate early adopters

Uber did a masterful job attracting its first users - passengers as well as drivers. When it comes to launching a marketplace the first few weeks are absolutely crucial as there needs to be enough supply and demand for service to feel worthwhile.

Uber developed a highly targeted and localized early adopter strategy in the Silicon Valley area. They knew that launching there meant that the company will be interacting regularly with the tech community who are continually looking for new tools and services that improve their quality of life. People there were ideal early adopters and Uber reached them by sponsoring tech events, providing free rides, and in general driving awareness among this audience.

San Francisco also has notoriously spotty cab service which was perfect for Uber. As early adopters, completely fed up with the taxi situation in the city, tried Uber, they took to blogs, social media and every other way possible to tell their friends about this new way to ride.