- Search Search Please fill out this field.

- Macroeconomics

Rational Expectations Theory Definition and How It Works

What is rational expectations theory.

The rational expectations theory is a concept and modeling technique that is used widely in macroeconomics . The theory posits that individuals base their decisions on three primary factors: their human rationality, the information available to them, and their past experiences.

The theory suggests that people’s current expectations of the economy are, themselves, able to influence what the future state of the economy will become. This precept contrasts with the idea that government policy influences financial and economic decisions.

Key Takeaways

- The rational expectations theory posits that individuals base their decisions on human rationality, information available to them, and their past experiences.

- The rational expectations theory is a concept and theory used in macroeconomics.

- Economists use the rational expectations theory to explain anticipated economic factors, such as inflation rates and interest rates.

- The idea behind the rational expectations theory is that past outcomes influence future outcomes.

- The theory also believes that because people make decisions based on the available information at hand combined with their past experiences, most of the time their decisions will be correct.

Understanding Rational Expectations Theory

The rational expectations theory is the dominant assumption model used in business cycles and finance as a cornerstone of the efficient market hypothesis (EMH) .

Economists often use the doctrine of rational expectations to explain anticipated inflation rates or any other economic state. For example, if past inflation rates were higher than expected, then people might consider this, along with other indicators, to mean that future inflation also might exceed expectations.

Using the idea of “expectations” in economic theory is not new. In the 1930s, the famous British economist, John Maynard Keynes assigned people’s expectations about the future—which he called “waves of optimism and pessimism”—a central role in determining the business cycle.

However, the actual theory of rational expectations was proposed by John F. Muth in his seminal paper, “Rational Expectations and the Theory of Price Movements,” published in 1961 in the journal, Econometrica . Muth used the term to describe numerous scenarios in which an outcome depends partly on what people expect will happen. The theory did not catch on until the 1970s with Robert E. Lucas, Jr . and the neoclassical revolution in economics.

The Influence of Expectations and Outcomes

Expectations and outcomes influence each other . There is continual feedback flow from past outcomes to current expectations. In recurrent situations, the way the future unfolds from the past tends to be stable, and people adjust their forecasts to conform to this stable pattern.

This doctrine is motivated by the thinking that led Abraham Lincoln to assert, “You can fool some of the people all of the time and all of the people some of the time, but you cannot fool all of the people all of the time.”

From the perspective of rational expectations theory, Lincoln’s statement is on target: The theory does not deny that people often make forecasting errors , but it does suggest that errors will not recur persistently.

Because people make decisions based on the available information at hand combined with their past experiences, most of the time their decisions will be correct. If their decisions are correct, then the same expectations for the future will occur. If their decision was incorrect, then they will adjust their behavior based on past mistakes.

Rational Expectations Theory: Does It Work?

Economics relies heavily on models and theories, many of which are interrelated. For example, rational expectations have a critical relationship with another fundamental idea in economics: the concept of equilibrium . The validity of economic theories—do they work as they should in predicting future states?—is always arguable. An example of this is the ongoing debate about existing models’ failure to predict or untangle the causes of the 2007–2008 financial crisis.

Because myriad factors are involved in economic models, it is never a simple question of working or not working. Models are subjective approximations of reality that are designed to explain observed phenomena. A model’s predictions must be tempered by the randomness of the underlying data it seeks to explain, and the theories that drive its equations.

When the Federal Reserve decided to use a quantitative easing program to help the economy through the 2008 financial crisis, it unwittingly set unattainable expectations for the country. The program reduced interest rates for more than seven years. Thus, true to theory, people began to believe that interest rates would remain low.

The Library of Economics and Liberty. " Rational Expectations ."

Board of Governors of the Federal Reserve System. " The Crisis and the Policy Response ."

Federal Reserve Bank of St. Louis, FRED. " Federal Funds Effective Rate ."

:max_bytes(150000):strip_icc():format(webp)/investment-stock-market--entrepreneur-business-man-discussing-and-analysis-graph-stock-market-trading-stock-chart-concept-1131299321-58e0bfd588dd4998a03ec3d5acc60142.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Search Menu

Sign in through your institution

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Historical Archaeology

- Browse content in Architecture

- History of Architecture

- Browse content in Art

- History of Art

- Browse content in Classical Studies

- Classical Literature

- Religion in the Ancient World

- Browse content in History

- Colonialism and Imperialism

- History by Period

- Intellectual History

- Military History

- Political History

- Regional and National History

- Social and Cultural History

- Theory, Methods, and Historiography

- Browse content in Literature

- Literary Studies (European)

- Literary Studies (Romanticism)

- Literary Studies - World

- Literary Studies (19th Century)

- Literary Studies (African American Literature)

- Literary Studies (Early and Medieval)

- Literary Studies (Poetry and Poets)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Media Studies

- Browse content in Music

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Philosophy of Science

- Philosophy of Religion

- Philosophy of Language

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- History of Religion

- Judaism and Jewish Studies

- Religious Studies

- Society and Culture

- Browse content in Law

- Company and Commercial Law

- Comparative Law

- Constitutional and Administrative Law

- Criminal Law

- History of Law

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Molecular and Cell Biology

- Zoology and Animal Sciences

- Browse content in Computer Science

- Programming Languages

- Environmental Science

- History of Science and Technology

- Browse content in Mathematics

- Applied Mathematics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Browse content in Physics

- Astronomy and Astrophysics

- Biological and Medical Physics

- Computational Physics

- Condensed Matter Physics

- History of Physics

- Mathematical and Statistical Physics

- Browse content in Psychology

- Cognitive Neuroscience

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Regional Anthropology

- Social and Cultural Anthropology

- Browse content in Business and Management

- Business History

- Industry Studies

- International Business

- Knowledge Management

- Public and Nonprofit Management

- Criminology and Criminal Justice

- Browse content in Economics

- Asian Economics

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic History

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- History of Economic Thought

- International Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Browse content in Education

- Higher and Further Education

- Browse content in Politics

- Asian Politics

- Comparative Politics

- Conflict Politics

- Environmental Politics

- International Relations

- Political Sociology

- Political Theory

- Political Economy

- Public Policy

- Security Studies

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- Middle Eastern Studies

- Native American Studies

- Browse content in Social Work

- Social Work and Crime and Justice

- Browse content in Sociology

- Comparative and Historical Sociology

- Economic Sociology

- Gender and Sexuality

- Health, Illness, and Medicine

- Migration Studies

- Occupations, Professions, and Work

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Urban and Rural Studies

- Reviews and Awards

- Journals on Oxford Academic

- Books on Oxford Academic

Rational Expectations and Inflation (3rd edn)

- Cite Icon Cite

This collection of essays uses the lens of rational expectations theory to examine how governments anticipate and plan for inflation, and provides insight into the pioneering research for which the author was awarded the 2011 Nobel Prize in economics. Rational expectations theory is based on the simple premise that people will use all the information available to them in making economic decisions, yet applying the theory to macroeconomics and econometrics is technically demanding. This book engages with practical problems in economics in a less formal, noneconometric way, demonstrating how rational expectations can satisfactorily interpret a range of historical and contemporary events. It focuses on periods of actual or threatened depreciation in the value of a nation's currency. Drawing on historical attempts to counter inflation, from the French Revolution and the aftermath of World War I to the economic policies of Margaret Thatcher and Ronald Reagan, the book finds that there is no purely monetary cure for inflation; rather, monetary and fiscal policies must be coordinated. This fully expanded edition includes the author's 2011 Nobel lecture, “United States Then, Europe Now.” It also features new articles on the macroeconomics of the French Revolution and government budget deficits.

Signed in as

Institutional accounts.

- Google Scholar Indexing

- GoogleCrawler [DO NOT DELETE]

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

- Add your ORCID iD

Institutional access

Sign in with a library card.

- Sign in with username/password

- Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

- Architecture and Design

- Asian and Pacific Studies

- Business and Economics

- Classical and Ancient Near Eastern Studies

- Computer Sciences

- Cultural Studies

- Engineering

- General Interest

- Geosciences

- Industrial Chemistry

- Islamic and Middle Eastern Studies

- Jewish Studies

- Library and Information Science, Book Studies

- Life Sciences

- Linguistics and Semiotics

- Literary Studies

- Materials Sciences

- Mathematics

- Social Sciences

- Sports and Recreation

- Theology and Religion

- Publish your article

- The role of authors

- Promoting your article

- Abstracting & indexing

- Publishing Ethics

- Why publish with De Gruyter

- How to publish with De Gruyter

- Our book series

- Our subject areas

- Your digital product at De Gruyter

- Contribute to our reference works

- Product information

- Tools & resources

- Product Information

- Promotional Materials

- Orders and Inquiries

- FAQ for Library Suppliers and Book Sellers

- Repository Policy

- Free access policy

- Open Access agreements

- Database portals

- For Authors

- Customer service

- People + Culture

- Journal Management

- How to join us

- Working at De Gruyter

- Mission & Vision

- De Gruyter Foundation

- De Gruyter Ebound

- Our Responsibility

- Partner publishers

Your purchase has been completed. Your documents are now available to view.

Rational Expectations and Inflation

Third edition.

- Thomas J. Sargent

- X / Twitter

Please login or register with De Gruyter to order this product.

- Language: English

- Publisher: Princeton University Press

- Copyright year: 2013

- Edition: Third

- Audience: Professional and scholarly;College/higher education;

- Main content: 392

- Keywords: rational expectations theory ; inflation ; economic decision ; macroeconomics ; econometrics ; French Revolution ; budget deficit ; rational expectations ; econometric model ; behavior ; government policy ; agent ; investment decision ; government deficit ; government finance ; monetary policy ; fiscal policy ; economy ; dynamic game ; Reaganomics ; momentum ; Austria ; Hungary ; Germany ; Poland ; hyperinflation ; Czechoslovakia ; Margaret Thatcher ; Raymond Poincar ; Poincar miracle ; Ronald Reagan ; coordination ; monetary authority ; fiscal authority ; monetarism ; Cagan-Bresciani-Turroni effect ; intertemporal government budget ; government budget ; tax smoothing ; real interest rates ; government debt ; depreciation ; Hong Kong dollar ; Hong Kong ; real estate ; common stock ; float policy ; exchange rate ; Brazil ; United States ; taxes ; government expenditures ; macroeconomic theories ; government budget constraint ; Britain ; France ; unpleasant arithmetic ; sustainable plan ; currency ; European Union

- Published: May 5, 2013

- ISBN: 9781400847648

Rationality, History of the Concept

- Living reference work entry

- First Online: 01 January 2016

- Cite this living reference work entry

- Esther-Mirjam Sent 2

2 Citations

This article offers a historical and methodological perspective on the concept of rationality. It gives an overview of the various interpretations of the notion, from self-interest to rational choice and expected utility to strategic rationality and rational expectations. It pays special attention to the ethical dimensions of the concept. The article further places rationality within a long-ranging discussion concerning the status of assumptions within economics. It explicitly considers efforts to test rationality directly. The article concludes with an evaluation of recent efforts to replace rationality with the notion of bounded rationality.

This chapter was originally published in The New Palgrave Dictionary of Economics , 2nd edition, 2008. Edited by Steven N. Durlauf and Lawrence E. Blume

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Institutional subscriptions

Similar content being viewed by others

Bounded Rationality

Dump the Concept of Rationality Into the Deep Ocean

Bibliography.

Alchian, A.A. 1950. Uncertainty, evolution and economic theory. Journal of Political Economy 58: 211–222.

Article Google Scholar

Arrow, K.J. 1987. Economic theory and the hypothesis of rationality. In The New Palgrave: A dictionary of economics , vol. 1, ed. J. Eatwell, M. Milgate, and P. Newman. New York: W.W. Norton.

Google Scholar

Aumann, R.J. 1997. Rationality and bounded rationality. Games and Economic Behavior 21: 2–14.

Aumann, R.J., and S. Sorin. 1989. Cooperation and bounded recall. Games and Economic Behavior 1: 5–39.

Becker, G.S. 1962. Irrational behavior and economic theory. Journal of Political Economy 70: 1–13.

Blaug, M. 1992. The methodology of economics: Or, how economists explain . Cambridge: Cambridge University Press.

Book Google Scholar

Bowles, S. 1991. What markets can – And cannot – Do. Challenge 34(4): 11–16.

Bray, M., and D. Kreps. 1987. Rational learning and rational expectations. In Arrow and the ascent of modern economic theory , ed. G. Feiwel. New York: New York University Press.

Brunswik, E. 1955. In defense of probabilistic functionalism: A reply. Psychological Review 62: 236–242.

Caldwell, B.J. 1994. Beyond positivism: Economic methodology in the twentieth century . London: Routledge.

Daston, L. 1983. Rational individuals versus laws of society. In Probability since 1800 , ed. M. Heidelberger, L. Krüger, and R. Rheinwald. Bielefeld: Universität Bielefeld.

Elster, J. 1989. Social norms and economic theory. Journal of Economic Perspectives 3(4): 99–117.

Friedman, M. 1953. The methodology of positive economics. Reprinted in Hausman (1984).

Gauthier, D. 1991. Morals by agreement . New York: Cambridge University Press.

Gigerenzer, G., and P.M. Todd. 1999. Fast and frugal heuristics: The adaptive toolbox. In Simple heuristics That make us smart , ed. G. Gigerenzer, P.M. Todd, and A.R. Group. New York: Oxford University Press.

Hausman, D. (ed.). 1984. The philosophy of economics . Cambridge: Cambridge University Press.

Hausman, D., and M. McPherson. 1984. Economics, rationality, and ethics. In Hausman (1984).

Hutchison, T.W. 1956. On verification in economics. Reprinted in Hausman (1984).

Kahneman, D., and A. Tversky. 1974. Judgment under uncertainty: Heuristics and biases. Science 185: 1124–1131.

Kirzner, I.M. 1962. Rational action and economic theory. Journal of Political Economy 70: 380–385.

Knight, F.H. 1925. Fact and metaphysics in economic psychology. American Economic Review 15: 247–266.

Machlup, F. 1956. On indirect verification. Reprinted in Hausman (1984).

Mill, J.S. 1836. On the definition and method of political economy. Reprinted in Hausman (1984).

Muth, J.F. 1961. Rational expectations and the theory of price movements. Econometrica 29: 315–355.

Neumann, J. von., and O. Morgenstern. 1944/1955. Theory of games and economic behavior . Princeton: Princeton University Press.

Peterson, C.R., and L.R. Beach. 1967. Man as an intuitive statistician. Psychological Bulletin 68: 29–46.

Robbins, L. 1935. The nature and significance of economic science. Reprinted in Hausman (1984).

Rubinstein, A. 1998. Modeling bounded rationality . Cambridge, MA: MIT Press.

Samuelson, P.A. 1947. Foundations of economic analysis . Cambridge, MA: Harvard University Press.

Sargent, T.J. 1981. Interpreting economic time series. Journal of Political Economy 89: 213–248.

Sargent, T.J. 1984. Autoregressions, expectations, and advice (with discussion). American Economic Review 74: 408–421.

Sargent, T.J. 1993. Bounded rationality in macroeconomics . Oxford: Oxford University Press.

Savage, L.J. 1954. The foundations of statistics . New York: John Wiley & Sons.

Sen, A. 1977. Rational fools: A critique of the behavioral foundations of economic theory. Philosophy and Public Affairs 6: 317–344.

Sen, A. 1987. Rational behavior. In The New Palgrave: A dictionary of economics , vol. 4, ed. J. Eatwell, M. Milgate, and P. Newman. New York: W.W. Norton.

Sent, E.M. 1997. The evolving rationality of rational expectations: An assessment of Thomas Sargent’s achievements . Cambridge: Cambridge University Press.

Sent, E.M. 2004a. The legacy of Herbert Simon in game theory. Journal of Economic Behavior and Organization 53: 303–317.

Sent, E.M. 2004b. Behavioral economics: How psychology made its (limited) way back into economics. History of Political Economy 36: 735–760.

Simon, H.A. 1955. A behavioral model of rational choice. Quarterly Journal of Economics 69: 99–118.

Simon, H.A. 1976. From substantive to procedural rationality. In Method and appraisal in economics , ed. S. Latsis. Cambridge: Cambridge University Press.

Simon, H.A. 1963. Testability and approximation. Reprinted in Hausman (1984).

Smith, V. 1991. Rational choice. Journal of Political Economy 99: 877–897.

Smith, V. 1992. Game theory and experimental economics. In Toward a history of game theory , ed. E.R. Weintraub. Durham: Duke University Press.

Sugden, R. 1991. Rational choice: A survey. Economic Journal 101: 751–783.

Suppes, P. 1961. The philosophical relevance of decision theory. Journal of Philosophy 58: 605–614.

Tisdell, C. 1975. Concepts of rationality in economics. Philosophy of Social Science 5: 259–272.

Tversky, A., and D. Kahneman. 1971. Belief in the law of small numbers. Psychological Bulletin 76: 105–110.

Varian, H.R. 1987. Differences of opinion in financial markets. In Financial risk: Theory, evidence, and implications, Proceedings of the 11th annual economic policy conference of the Federal Reserve Bank of St. Louis .

Weber, M. 1904/1999. The area of economics, economic theory, and the ideal type. In Essays in economic sociology , ed. M. Weber. Princeton: Princeton University Press, 1999.

Winter, S.G. 1964. Economic ‘natural selection’ and the theory of the firm. Yale Economic Essays 4: 225–272.

Download references

Author information

Authors and affiliations.

http://link.springer.com/referencework/10.1057/978-1-349-95121-5

Esther-Mirjam Sent

You can also search for this author in PubMed Google Scholar

Editor information

Editors and affiliations, copyright information.

© 2008 The Author(s)

About this entry

Cite this entry.

Sent, EM. (2008). Rationality, History of the Concept. In: The New Palgrave Dictionary of Economics. Palgrave Macmillan, London. https://doi.org/10.1057/978-1-349-95121-5_2834-1

Download citation

DOI : https://doi.org/10.1057/978-1-349-95121-5_2834-1

Received : 12 September 2016

Accepted : 12 September 2016

Published : 03 December 2016

Publisher Name : Palgrave Macmillan, London

Online ISBN : 978-1-349-95121-5

eBook Packages : Springer Reference Economics and Finance Reference Module Humanities and Social Sciences Reference Module Business, Economics and Social Sciences

- Publish with us

Policies and ethics

- Find a journal

- Track your research

On the site

- business & economics

Assessing Rational Expectations

Sunspot Multiplicity and Economic Fluctuations

by Roger Guesnerie

ISBN: 9780262072076

Pub date: April 13, 2001

- Publisher: The MIT Press

343 pp. , 6 x 9 in ,

- 9780262072076

- Published: April 2001

Out of print

Other Retailers:

- MIT Press Bookstore

- Penguin Random House

- Barnes and Noble

- Bookshop.org

- Books a Million

- Amazon.co.uk

- Waterstones

- Description

Roger Guesnerie contributes to the critical assessment of the Rational Expectations hypothesis (REH).

In this book Roger Guesnerie contributes to the critical assessment of the Rational Expectations hypothesis (REH). He focuses on the multiplicity question that arises in (infinite horizon) Rational Expectation models and considers the implications for a theory of endogenous fluctuations. The REH, which dominates the economic modeling of expectations in most fields of formalized economic theory, is often associated with an optimistic view of the working of the markets—a view that Guesnerie scrutinizes closely. The book is divided into four parts. The first part uses the framework of simple models to characterize the stochastic processes that trigger self-fulfilling prophecies and examines the connections between periodic equilibria (cycles) and stochastic equilibria (sunspots). (A sunspot is a random shock uncorrelated with underlying economic fundamentals.) The second part views sunspot equilibria as overreactions triggered by small variations of intrinsic variables—rather than as fluctuations with no trigger—and looks at the consequences for a monetary theory à la Lucas. The third part develops the basic theory to encompass more complex, multidimensional systems. It focuses in particular on the special class of equilibria generating small fluctuations around a steady state. Broadening the scope, the fourth part looks at the stability of cycles, sunspots in systems with memory, and current research on rational expectations.

Roger Guesnerie is Professor at the Collège de France and President of the Paris School of Economics. He is the author of Assessing Rational Expectations and Assessing Rational Expectations 2 (MIT Press, 2001, 2005).

This book is a master work by one of the three founders of the modern field of General Equilibrium Theory. All economists will want to own this volume. It covers not only classical theory but also the research frontier. It is written with the beauty and clarity that one would expect of a founding father. William A. Brock, Vilas Research Professor of Economics, The University of Wisconsin, Madison

Related Books

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Rational Expectations and Inflation - Thomas J. Sargent (Third Edition)

Rational expectations theory is based on the simple premise that people will use all the information available to them in making economic decisions, yet applying the theory to macroeconomics and econometrics is technically demanding.

Related Papers

Economics Letters

Alain Paquet

Ecos de Economía - A Latin American Journal of Applied Economics

The Rational Expectations Hypothesis was first developed as a theoretical technique aimed at explaining agents’ behavior in a given environment. In particular, it describes how the outcome of a given economic phenomenon depends to a certain degree on what agents expect to happen. Subsequently, it was introduced into macroeconomic models as a way to explain the ineffectiveness of monetary policy. Since then, most of these models have been based on the rational expectations assumption. This paper assesses the real life application of this feature based on two arguments: the determination of an objective reality through beliefs and subjective expectations; and the exclusion of the evolution of human knowledge and innovation in macroeconomic models.

Miguel Virasoro

In economic models, expectations about future parameters influence the behaviour of the agents. To have a well-defined model one has to write down a closed system of equations that relates expected and real values. Infinite rationality with perfect foresight provides a simple and appealing recipe. Other possibilities include adaptive expectations and/or evolving, adaptive agents. In this paper we examine critically some of these ideas in a simple model for inflation.

Scottish Journal of Political Economy

Leslie Oxley

Pop Cohut Ioana

Godwin Nwaobi

Macroeconomic Dynamics

Warren Young

The transcript of a panel discussion marking the 50th anniversary of John Muth's “Rational Expectations and the Theory of Price Movements” (Econometrica 1961). The panel consisted of Michael Lovell, Robert Lucas, Dale Mortensen, Robert Shiller, and Neil Wallace. The discussion was moderated by Kevin Hoover and Warren Young. The panel touched on a wide variety of issues related to the rational-expectations hypothesis, including its history, starting with Muth's work at Carnegie Tech; its methodological role; applications to policy; its relationship to behavioral economics; its role in the recent financial crisis; and its likely future.The panel discussion was held in a session sponsored by the History of Economics Society at the Allied Social Sciences Association (ASSA) meetings in the Capitol 1 Room of the Hyatt Regency Hotel in Denver, Colorado.

Michael Mugisha

American Economic Review

Roger Guesnerie

Geoffrey Woglom

RELATED PAPERS

Review of Development Economics

Berliner Journal für Soziologie

Christian Schneickert

Journal of Neurophysiology

Gloria Queiroz

Statistical Science

Integrative and Comparative Biology

Arthur Bogan

Computers & Fluids

Jurnal Dinamika Penelitian: Media Komunikasi Penelitian Sosial Keagamaan

aris nurbawani

Koustubh Panda

Open Forum Infectious Diseases

Matt Scholz

Chris Harnish

CRC Press eBooks

Joel Oliveira

IEEE Photonics Technology Letters

Neuroscience Letters

MARIA FERNANDA VIDAL CORONEL

George Simpson

Acta Geotechnica

Journal of translational science

Stavros Dimopoulos

Sean Corcoran

Ravindran Visvanathan

International journal of applied earth observation and geoinformation

Daniel Itenfisu

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Classical Theory of Interest: Assumptions, Demand, Features and Criticisms | Economics

In this article we will discuss about:- 1. Assumptions of Classical Theory of Interest 2. Supply and Demand for Capital 3. Determination of Rate of Interest 4. Features of Classical Theory 5. Criticisms.

The economists like Ricardo, J. S. Mill, Marshall and Pigou developed the, classical theory of interest which is also known as the capital theory of interest or the saving-investment theory of interest or the real theory of interest. According to this theory, interest is a real phenomenon and the rate of interest is determined exclusively by the real factors, i.e., the supply of and demand for capital under perfect competition. The supply of capital is governed by thrift (i.e. saving) or time preference and the demand for capital is influenced by the productivity of capital.

Assumptions of Classical Theory of Interest :

The classical theory of interest is based upon the following assumptions:

(i) Perfect competition exists in the factor market.

ADVERTISEMENTS:

This assumption has the following implications:

(a) The equilibrium rate of interest is determined by the competitive forces of demand and supply in the capital market.

(b) Interest rate is flexible, i.e., it freely moves to whatever level the demand and supply forces dictate.

(ii) The theory assumes full employment of resources.

(a) Saving involves sacrifice of abstaining from or postponing of consumption and interest is the reward for abstinence or waiting: it is only when all resources are fully employed, higher rate of interest is paid to induce people to save or abstain from consumption or postpone consumption

(b) Income level is assumed to be constant; it is at the full employment level that income and output do not change and become constant.

(c) The assumptions of full employment and given level of income lead to the further assumption that the demand and supply schedules of capital are independent and do not influence each other; it is only when income changes as a result of a change in investment, that saving changes in consequence.

(iii) Economic agents act rationally, i.e., they are motivated by self-interest and want to maximise economic benefit.

(iv) The price level is assumed to be constant. If it changes then the economic agents do not suffer money illusion, i.e., savers and investors react to changes in the real interest rates and not the changes in the money interest rates.

(v) Money is neutral and serves only as a medium of exchange and not as a store of value.

Supply and Demand for Capital :

Supply of Capital:

The supply of capital depends upon savings which, in turn, depend upon a number of psychological, economic and institutional factors broadly classified as – (a) the will to save, (b) the power to save, and (c) the facilities to save. Saving means curtailment of consumption or postponement of the present consumption. Thus, saving involves a sacrifice, abstinence or waiting. The rate of interest is considered to be the reward for abstinence or waiting.

It is an inducement for the act of saving or foregoing the present consumption. In deciding between the present consumption (which involves no saving) and the future consumption (which requires saving), the individual has to take into consideration the opportunity cost of each alternative and the opportunity cost is measured by the rate of interest.

For example, if the current rate of interest is 5% then by consuming Re. 1 of income now, the individual is foregoing the consumption of Rs. 1.05 one year later. Thus, the higher the current rate of interest, the greater the opportunity cost of present consumption as compared to the future consumption, and, as a result, greater the inducement to save out of the present income.

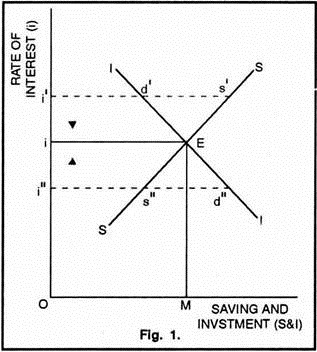

Hence, saving is interest elastic and there is a positive relationship between the rate of interest and saving. The supply curve of capital or the saving schedule (SS curve in Figure 1) slopes upward to the right which indicates that higher the rate of interest, larger will be the savings and greater will be the supply of capital and vice versa.

IMAGES

VIDEO

COMMENTS

1 Introduction. How individuals form their beliefs about uncertain future outcomes is critical to understanding decision making. Despite longstanding critiques (see, among many others, Pesaran (), Manski ()), rational expectations remain by far the most popular framework to describe belief formation (Muth ()).This theory states that agents have expectations that do not systematically differ ...

Tomáš Frömmel. 1. Abstrac t: The rational expectations hypothesis as one of the building blocks of modern. macroeconomic theory i s anal yzed criti cally in this paper. It is concl uded that ex ...

Rational expectations is an economic theory that seeks to infer the macroeconomic consequences of individuals' decisions based on all available knowledge. It assumes that individuals actions are based on the best available economic theory and information, and concludes that government policies cannot succeed by assuming widespread systematic ...

Rational Expectations Theory: The rational expectations theory is an economic idea that the people make choices based on their rational outlook, available information and past experiences. The ...

The theory of rational expectations (RE) is a collection of assumptions regarding the manner in which economic agents exploit available information to form their expectations. In its stronger forms, RE operates as a coordination device that permits the construction of a \representative agent" having \representative expectations."

The rational expectations hypothesis was further developed in macroeconomic theory by Lucas (1972, 1976) and Sargent and Wallace (1975) and has been broadly accepted. The rational expectations ...

This chapter analyses the Rational Expectations Hypothesis (REH), a pillar of forward-looking macroeconomics that emphasizes expectations. It also develops its implications in terms of 'market efficiency' and related concepts.

The rational expectation hypothesis ... of subjects' predictions in order to analyse whether there was a convergence to the fundamental value and to examine the volatility of the process. ... The random difference equation X n = A n X n − 1 + B n in the critical case. The Annals of Probability, 25 (1) (1997), pp. 478-493.

expectations of current and future values. Advocates of the rational expectations hypothesis typically argue that model (2.1) implicitly ignores the costs or ease of obtain ing other relevant information (see for example Willes, 1980, p. 286). The objective of this section is to examine the relevance of these criticisms for

Abstract. This collection of essays uses the lens of rational expectations theory to examine how governments anticipate and plan for inflation, and provides insight into the pioneering research for which the author was awarded the 2011 Nobel Prize in economics. Rational expectations theory is based on the simple premise that people will use all ...

Phillip Cagan. The hypothesis of rational expectations has rapidly gained attention because it is. so natural and appealing. It must make its opponents furious, because, absurd as. they think it is, to attack it is to appear to deny that behavior is rational, an uncom-. fortable position for an economist. Indeed, it is so appealing that one ...

This collection of essays uses the lens of rational expectations theory to examine how governments anticipate and plan for inflation, and provides insight into the pioneering research for which Thomas Sargent was awarded the 2011 Nobel Prize in economics. Rational expectations theory is based on the simple premise that people will use all the information available to them in making economic ...

The rational expectations hypothesis does not argue that the random variable will always have a value of zero - that is, there is not always perfect foresight (Lane, n.d.; see Levine,

Muth's rational expectations hypothesis br the Phillips curve and the analysis of labormarkets. Lucas's ([1972a] 1981) article, "Econo-metric Testing of the Natural Hate Ilypothesis," will serve as the paradigm. 8 The article accomplished three things critical to the development ofnew classical macroeconomics.

Abstract. This article offers a historical and methodological perspective on the concept of rationality. It gives an overview of the various interpretations of the notion, from self-interest to rational choice and expected utility to strategic rationality and rational expectations. It pays special attention to the ethical dimensions of the concept.

5 Individual rationality, decentralization, and the rational expectations hypothesis; 6 Convergence to rational expectations equilibrium; 7 A distinction between the unconditional expectational equilibrium and the rational expectations equilibrium; 8 On mistaken beliefs and resultant equilibria; 9 Equilibrium theory with learning and disparate ...

The Rational Expectations Hypothesis was first developed as a theoretical technique aimed at explaining agents' behavior in a given environment. In particular, it describes how the outcome of a given economic phenomenon depends to a certain degree on what agents expect to happen. Subsequently, it was introduced into macroeconomic models as a ...

by Roger Guesnerie. Hardcover. $45.00. Hardcover. ISBN: 9780262072076. Pub date: April 13, 2001. Publisher: The MIT Press. 343 pp., 6 x 9 in, MIT Press Bookstore Penguin Random House Amazon Barnes and Noble Bookshop.org Indiebound Indigo Books a Million.

Hirschleifer (2007: 14) goes on to explain how "limited attention, memory, and processing capacities force a focus on subsets of available information". Agents integrate most information at face value and tend to overreact to information that is easily processed. Emotions are also critical to the decision-making process.

The Rational Expectations Hypothesis was first developed as a theoretical technique aimed at explaining agents' behavior in a given environment. ... appealing recipe. Other possibilities include adaptive expectations and/or evolving, adaptive agents. In this paper we examine critically some of these ideas in a simple model for inflation ...

The new classical macroeconomics is based on the rational expectations hypothesis. This means that people have rational expectations about economic variables. The implication is that people make intelligent use of available information in forecasting variables that affect their economic decisions. According to this hypothesis, forecasts are unbiased and based on all available information. The ...

Question: Critically examine the rational expectation hypothesis (10 M) Critically examine the rational expectation hypothesis (10 M) There's just one step to solve this. Step 1. Rational expectation theory is developed by American economist John Fraser Muth in 1930.Rational exp... View the full answer. Answer. Unlock.

In this article we will discuss about:- 1. Assumptions of Classical Theory of Interest 2. Supply and Demand for Capital 3. Determination of Rate of Interest 4. Features of Classical Theory 5. Criticisms. The economists like Ricardo, J. S. Mill, Marshall and Pigou developed the, classical theory of interest which is also known as the capital theory of interest or the saving-investment theory of ...