Essay on Monopoly Market | Micro Economics

In this essay we will discuss about monopoly market. After reading this essay you will learn about: 1. Meaning of Monopoly 2. Sources and Types of Monopoly 3. Monopoly Price Determination 4. Degree of Monopoly Power – Its Measure 5. Meaning of Monopoly Price Discrimination 6. Types of Price Discrimination 7. Conditions for Price Discrimination 8. Benefits of Price Discrimination and Other Details.

- Essay on Control and Regulation of Monopoly

Essay # 1. Meaning of Monopoly :

Monopoly is a market situation in which there is only one seller of a product with barriers to entry of others. The product has no close substitutes. In the words of Salvatore, “Monopoly is the form of market organisation in which there is a single fir m selling a commodity for which there are no close substitutes.”

The cross elasticity of demand with every other product is very low. This means that no other firms produce a similar product. Thus, the monopoly firm is itself an industry and the monopolist faces the industry demand curve. The demand curve for his product is, therefore, relatively stable and slopes downward to the right, given the tastes and incomes of his customers.

ADVERTISEMENTS:

It means that more of the product can be sold at a lower price than at a higher price. He is a price-maker who can set the price to his maximum advantage. However, it does not mean that he can set both price and output. He can do either of the two things. His price is determined by his demand curve, once he selects his output level.

Or, once he sets the price for his product, his output is determined by what consumers will take at that price. In any situation, the ultimate aim of the monopolist is to have maximum profits.

Essay # 2. Sources and Types of Monopoly :

Monopoly may arise from a number of sources and is of various types:

First, grant of a patent right to a firm by the government to make, use or sell its own invention.

Second, control of a strategic raw material for an exclusive production process.

Third, a natural monopoly enjoyed by a firm when it supplies the entire market at a lower unit cost due to increasing economies of scale, just as in the supply of electricity, gas, etc.

Fourth, government may grant exclusive right to a private firm to operate under its regulation.

Such privately owned and government regulated monopolies are mostly in public utilities and are called legal monopolies such as in transport, communications, etc.

Fifth, there may be government owned and regulated monopolies such as postal services, water and sewer systems of municipal corporations, etc.

Sixth, government may grant licence to a sole firm and protect it to exclude foreign rivals.

Seventh, the sole manufacturer of a product may adopt a limit pricing policy in order to prevent the entry of new firms.

Essay # 3. Monopoly Price Determination :

We study the determination of monopoly price in the short-run and the long-run.

It’s Assumptions:

The analysis of the determination of the price, output and profits under monopoly is based on the following assumptions:

(1) There is one seller or producer of a homogeneous product.

(2) There are no close substitutes for the product.

(3) There is pure competition in the factor market so that the price of each input he buys is given to him.

(4) The monopolist is a rational being who aims at maximum profit with the minimum of costs.

(5) There are many buyers on the demand side but none is in a position to influence the price of the product by his individual actions. Thus the price of the product is given for the consumer.

(6) The monopolist does not charge discriminating price. He treats all consumers alike and charges a uniform price for his product.

(7) The monopoly price is uncontrolled. There are no restrictions on the power of the monopolist.

(8) There is no threat of entry of other firms.

Price and Output Determination :

Given these assumptions, the price, output and profits under monopoly are determined by the forces of demand and supply. The monopolist has complete control over the supply of the product. He is also a price- maker who can set the price to his maximum advantage. But he cannot fix the price and output simultaneously.

Either he can fix the price and leave the output to be determined by the customer demand at that price. Or, he can fix the output to be produced and leave the price to be determined by the consumer demand for his product. Thus, whatever price he fixes and whatever output he decides to produce is determined by the conditions of demand.

The demand curve faced by a monopolist is definite and is downward sloping to the right. It is his average revenue curve (AR). Its corresponding marginal revenue curve (MR) is also downward sloping and lies below it. But the manner and extent to which the monopolist will be able to influence price or output will depend upon the elasticity of demand for his product.

If the demand for his product is highly elastic, he can sell more by a small reduction in price. If, on the other hand, the demand is less elastic, the tendency will be to raise the price and profit more by selling less.

Given the demand for his product, the monopolist can select the most profitable output against this demand. His cost of production may be rising, falling or constant. Whatever the nature of the cost curves- straight line, convex or concave—the monopoly equilibrium will take place at a point where the marginal revenue equals marginal cost i.e. ƏR /ƏQ = ƏC /ƏQ.

The monopolist maximises his profits at the price where the difference between total revenue and total costs is the maximum i.e. Max π = TR-TC.

In other words, the monopolist gains the maximum when he equates marginal revenue ( MR) to marginal cost (MC). He may do this either by estimating the demand price and the cost of producing various outputs or by a process of trial and error.

Geometrically speaking, the point of monopoly equilibrium is one where the MC curve cuts the MR curve from below or from the left, and a perpendicular from it to the AR curve determines price.

It implies that

Price > MC = MR. In fact, monopoly price = MC –E/E-1.

AR (Price) = MR MC –E/E-1 and MC = MR

Monopoly Price = MC E/E-1

Thus monopoly price is a function of the MC and the elasticity of demand. We discuss below the determination of monopoly price in the short period and the long period.

(A) Short-Run Monopoly Equilibrium :

In the short-run, the monopoly firm attains equilibrium when its profits are maximised or losses are minimised. Like the competitive equilibrium, this analysis can also he discussed in terms of the total revenue-total cost approach and the marginal revenue-cost approach.

Total Revenue-Cost Approach:

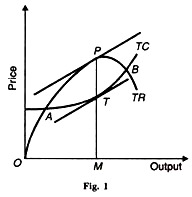

In Figure 1. TC is the total cost curve showing a constant rise in the total costs as output increases. TR is the total revenue curve which goes on rising to begin with, then flattens and later on slopes downward, showing fall in total receipts after a given point.

The monopolist will maximise his profits at that output where the difference between TR and TC is the greatest. This will be the level at which the slopes of TR and TC curves equal. Accordingly, P is the equilibrium point as determined by the tangents at points P and T on the TR and TC curves respectively.

A and В are the break-even points where TR = TC. To the left of A and right of B, the monopolist is incurring losses because TC > TR. Thus his maximum profits will be PT and he will sell OM output at MP Price.

Marginal Revenue-Marginal Cost Approach:

In the short-run, the monopolist can change the price as well as the quantity of the product. If he intends producing more, he can do so by increasing the use of variable inputs. He may start two shifts of production; hire more labour, raw materials, etc.

But he cannot change his fixed plant and equipment. On the other hand, if he wants to restrict his output, he may dispense with certain workers, work for less hours and use less of the variable factors.

In any case, his price cannot be below the average variable costs. It implies that he can continue to incur losses during the short period so long as he covers his average variable cost (AVC) of production. Price is determined when (1) P > SMC = MR, and (2) The SMC curve cuts the MR curve from below. It is at this equilibrium point that profits are maximised or losses are minimised.

Super-normal Profits:

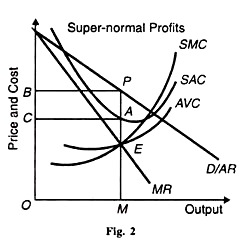

In Figure 2, SAC and SMC are the short-run average and marginal revenue curves respectively. AVC is the average variable cost curve. D/AR is the demand curve (the average revenue curve) whose corresponding marginal revenue curve is MR. The short-run monopoly equilibrium is at point E where the SMC curve cuts the MR curve from below.

The monopolist sells OM output at MP (=OB) price. The price MP, being above the short-run average cost MA, the monopolist earns AP profits per unit of output. Thus total monopoly profits are AP × CA= CAPB.

Normal Profits:

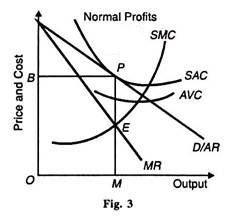

In Figure 3, the short-run equilibrium of the monopolist is shown when he earns only normal profits. The equality of SMC curve and MR curve at point E determines OM output which is sold at MP Price. Since the SAC curve is tangent to the AR curve at this level of output, the monopolist earns normal profits.

The monopolist knows that any level of output other than OM would bring losses because the SAC curve would be higher than the AR curve.

Minimum Losses:

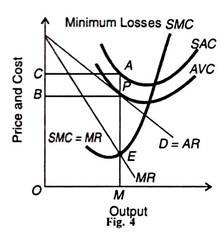

Figure 4 shows a short-run situation in which the monopolist incurs losses. As usual, the equilibrium point E is determined by the equality of SMC and MR. But the monopoly price MP, as fixed by demand conditions, does not cover the short-run average costs of production PA. It just covers the average variable costs MP, represented by the tangency of the demand curve D and the AVC curve at point P.

PA is thus per unit loss which the monopolist incurs. Total losses are equal to BP x PA = BPAC. In this figure, P is the shutdown point for this firm. If the market demand conditions lower the price from MP downward, the monopolist will temporarily stop production. His firm will close down.

(B) Long-Run Monopoly Equilibrium:

In the long-run, the monopolist can remain in business only if he is able to earn super-normal profits. If he was incurring losses in the short-run, he has enough time to make changes in his existing plant in the long- run so as to maximise his profits. With entry of new firms ruled out, he can install a plant which gives him maximum profits.

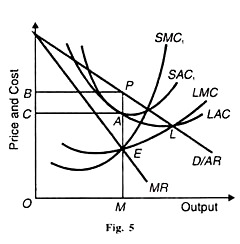

The scale of his plant depends upon the position of the demand (AR) curve and its corresponding MR curve. The most profitable level of output is at the point where the LMC curve intersects the MR curve from below and the SMC curve passes through this point. Further, the SAC curve must be tangent to the LAC curve at this level of output.

Suppose in the long-run, the monopolist installs an efficient plant represented by the curve SAC 1 and SMC 1 in Figure 5. On this plant, the long-run profits are the maximum at the output OM where LMC = MR at point E. Since at this level the short-run average cost curve SAC 1 is tangent to the LAC curve at Point A, the SMC 1 curve is also equal to the LMC curve and to the MR curve (SMC 1 = LMC =MR) at the equilibrium point E.

Thus when the monopoly firm is in long-run equilibrium, it is also in short- run equilibrium. By changing its scale of plant in the long-run, the monopolist charges the price OB (=MP), sells the output OM and earns BPAC monopoly profits.

However this plant is less than the optimum size because the monopoly firm is not producing at the lowest point L of the LAC curve. It has some excess capacity. It is not in a position to take full advantage of the economies of scale due to the small size of the market for his product.

Essay # 4. Degree of Monopoly Power – Its Measure:

In monopoly, the monopolist is able to earn monopoly profit by his superior bargaining power. He is in a better position to exploit the market to his advantage. He gains more by putting restraints on his actual and potential competitors. Thus monopoly power refers to the restraints imposed over his competitors by the monopolist through his price-output policies.

Measurement of Monopoly Power:

There are two important methods of monopoly power:

First, the difference between marginal cost and price. Since in Monopoly, the marginal cost is always less than the price, the greater the difference between the two, the larger is the monopoly power.

Second, the difference between monopoly super-normal profits and competitive super-normal profits is also considered as the measure of monopoly power. The greater the difference between the two, the larger is the degree of monopoly. However, economists have given other measures of monopoly power. We discuss a few. But no method is regarded as perfect.

1. Lerner’s Measure:

One of the earliest methods to measure monopoly power is expressed by Prof. Abba P. Lerner in terms of the bargaining strength. The difference between price and marginal cost is the measure of the degree of monopoly power.

If P is price and MC the marginal cost, the formula for measuring the degree of monopoly power is P-MC/P. A seller’s monopoly power depends upon his ability to sell his product at a price much above his marginal cost.

The larger the gap between price and marginal cost, the greater is the monopoly power. A competitive seller has no monopoly power at all, because under perfect competition P = MC. In all cases, the above formula will give zero. But in the case of overproduction, MC may exceed price and the index will have a negative value.

Moreover, if the seller is a monopolist, the difference between price and marginal cost is always there. The index of monopoly power will, therefore, vary between zero and unity. For instance, if P is Rs.4 and MC Rs.2 the index of monopoly power will be 1/2 i.e. (4-2)/4.

It is, however, not easy for a seller to raise the price of his product in order to increase his bargaining price. The attempt to raise profits by a price rise may be neutralized by the reduction in his sales resulting from raising the price. Therefore, the degree of monopoly power is measured in terms of the elasticity of demand and the formula is:

Degree of monopoly power (DMP) = (P – MC)/ P

For profit maximisation, MC = MR, and the formula becomes

DMP= or the inverse of the elasticity of demand,

P- MR= (P – MR)/ P

By substituting MR = P E-1/E in the above equation,

DMP= (P-P E-1/E)/P = P- PE +P/E/P = PE- PE+P/EP = 1/E

Or the inverse of the elasticity of demand, P/P-MR

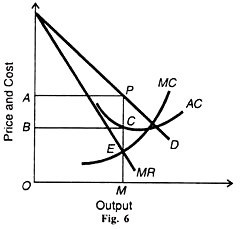

Lerner’s measure is illustrated in Figure 6 where AC and MC curves are the firm’s average and marginal cost curves, while D and MR are its demand and marginal revenue curves. The monopolist firm maximizes its profit at point E where MC = MR.

It produces OM output and sells it at MP Price. The ratio PEIPM is termed as the degree of monopoly power. The degree of monopoly power is the reciprocal of the P-MR elasticity of demand i.e., P-MR/P

Notably, the Marginal Revenue curve is downward sloping as the firm can determine both the price as well as quantities. It is also important to note that all firms produce at the point where the Marginal Revenue Curve (MR) meets with the Marginal Cost curve (MC).

Total Revenue (TR) refers to the entire inflow of revenues resulting from the firm’s economic activity. By this definition, the TR can be derived by obtaining the product of the total quantity (Q) sold by the price (P) at which they are sold at. Consequently, TR=P*Q.

From the graph above, the price follows the Y-axis while the Quantity follows the X-axis. Again, the demand curve is the path along which the firm must produce. Bearing in mind that MR must equate to MR, then, the firm is producing at point J which represents Quantity E and Price A.

Therefore, the equation TR=P*Q is represented by the Rectangle 0EJA which is the total revenue of the firm.

Total Cost (TC) on the other hand refers to the sum of expenditure incurred during the production of the quantity produced by the firm. It is the product of the Average Total Cost (ATC) and the total quantities (Q) produced. Consequently TC=ATC (Q).

At the level of production E, the TC is defined at point H by the Rectangle 0EHB. Profits ( n ) refer to the excess of Total Revenues over Total Costs. That is

In the Graph, The difference can be interpreted as the difference between Rectangle 0EJA and 0EHB. This is represented by the Rectangle BHJA.

The case of a firm operating in a perfectly competitive market structure differs from the monopoly mainly due to the fact that the firm cannot determine the price or the quantity due to the presence of many buyers and many sellers.

The MR curve equates to the demand curve at a level where MR which defining the level of price. Notably, the competition ensures that the firms produce at the levels where the average cost curve is at minimum.

Therefore production is done at the level where MR=AR=AC=MC. In the graph the point would be K where the level of output is at L. Clearly, this level of output is higher than in the case of a monopoly.

Reference List

Cooperative Games, (2010). Learningforlife. Web.

Osborne, M., (2007). Nash Equilibrium: Theory . Web.

Price and Output under a Pure Monopoly , (2010). Tutor2u. Web.

- Retirement and Its Effect on the Economy

- Contrast of Youth Employment Methods Between American and Other Countries

- Prison-Based Drug Treatment Approaches

- T. R. Johnson’s TED Talk The Power in ‘I Am’

- Case Conceptualization of Janet Using DSM IV-TR and Sperry’s Concepts

- Tasmanian Forest Industry

- The Impact of Conditional Cash Transfer Programs from a Risk Management Perspective

- Marginal cost and marginal revenue

- Elasticity of Demand

- Markets and Authority in Institutions

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2019, May 1). Monopoly as a Market Structure. https://ivypanda.com/essays/monopoly-profits-essay/

"Monopoly as a Market Structure." IvyPanda , 1 May 2019, ivypanda.com/essays/monopoly-profits-essay/.

IvyPanda . (2019) 'Monopoly as a Market Structure'. 1 May.

IvyPanda . 2019. "Monopoly as a Market Structure." May 1, 2019. https://ivypanda.com/essays/monopoly-profits-essay/.

1. IvyPanda . "Monopoly as a Market Structure." May 1, 2019. https://ivypanda.com/essays/monopoly-profits-essay/.

Bibliography

IvyPanda . "Monopoly as a Market Structure." May 1, 2019. https://ivypanda.com/essays/monopoly-profits-essay/.

ECON101: Principles of Microeconomics (2021.A.01)

Introduction to a monopoly.

Read this chapter, which discusses monopolies. Be sure to click through to read the sections that follow the introduction.

5. Key Concepts and Summary

How monopolies form: barriers to entry.

Barriers to entry prevent or discourage competitors from entering the market. These barriers include: economies of scale that lead to natural monopoly; control of a physical resource; legal restrictions on competition; patent, trademark and copyright protection; and practices to intimidate the competition like predatory pricing. Intellectual property refers to legally guaranteed ownership of an idea, rather than a physical item. The laws that protect intellectual property include patents, copyrights, trademarks, and trade secrets. A natural monopoly arises when economies of scale persist over a large enough range of output that if one firm supplies the entire market, no other firm can enter without facing a cost disadvantage.

How a Profit-Maximizing Monopoly Chooses Output and Price

A monopolist is not a price taker, because when it decides what quantity to produce, it also determines the market price. For a monopolist, total revenue is relatively low at low quantities of output, because not much is being sold. Total revenue is also relatively low at very high quantities of output, because a very high quantity will sell only at a low price. Thus, total revenue for a monopolist will start low, rise, and then decline. The marginal revenue for a monopolist from selling additional units will decline. Each additional unit sold by a monopolist will push down the overall market price, and as more units are sold, this lower price applies to more and more units. The monopolist will select the profit-maximizing level of output where MR = MC, and then charge the price for that quantity of output as determined by the market demand curve. If that price is above average cost, the monopolist earns positive profits. Monopolists are not productively efficient, because they do not produce at the minimum of the average cost curve. Monopolists are not allocatively efficient, because they do not produce at the quantity where P = MC. As a result, monopolists produce less, at a higher average cost, and charge a higher price than would a combination of firms in a perfectly competitive industry. Monopolists also may lack incentives for innovation, because they need not fear entry.

- Study Notes

- College Essays

AP Microeconomics Notes

- Chapter Outlines

- Chapter 11: Monopoly

- Oligopoly and monopolistic competition have potential monopoly power

- (P – MC) / P

- used to ascertain the pricing power of potential monopolistic powers

- the greater the value, the greater the power

- the sum of the squares of the market shares of firms in a particular market or industry

- purpose: to measure the concentrated power of power generated by shares of the market

- implies that price is greater than marginal revenue

- that could actually lead to a lowering of price by the monopolist in order to induce more sales in a relatively elastic demand market

- controls the supply of the product

- can influence, but not control, the demand by changing the price relative to price elasticity of demand

- higher than competitive prices

- lower than competitive output

- misallocation of resources, inefficiency, and dead-weight loss

- rent seeking

- move towards outputs that are more efficient, through subsidies that rise as outputs rise

- a socially optimal price and output, P = MC, which would require subsidies

- Likely to show some inefficiency relative to the model of perfect competition

- a form of resource misallocation

- resources could have been utilized to produce goods and services but are instead totally wasted

- Higher prices, lower outputs → misallocation of resources

- more than he contributes to production at the margin of the effort of the monopolist

- P > MC is symptomatic of monopoly pricing power

- Definition of monopoly- both a firm and an industry

- there are no opportunities for the resale of the product

- the price differences are not based on cost differences

- has a pricing strategy that looks to charge a higher price and realize more profits

- those with high price elasticity of demand have more choices of substitute products

- Monopolies want to charge each customer exactly the maximum price that each consumer would be willing to pay

- competition would negate the major economies of scale inherent in the nature of these industries

- smaller competitive firms would be less efficient and more costly

- Originally for the electric industry

- Prices and outputs in between those of perfect competition and unregulated monopoly

- this price is approximately the price of the perfectly competitive firm

- includes implicit costs that represent what would have been earned elsewhere with the same resources

- A profit maximizer

- → prices higher than the competitive price

- → outputs lower than the perfect competition output

- Priced at the socially optimal price

- May require government subsidies to survive

You just finished Chapter 11: Monopoly . Nice work!

Previous Chapter Next Chapter

Tip: Use ← → keys to navigate!

How to cite this note (MLA)

More ap econ chapter outlines.

- Chapter 2: The Discipline of Economics

- Chapter 3: Economic Systems

- Chapter 4: The Basics of Supply and Demand

- Chapter 5: Applications of Demand and Supply- Elasticity

- Chapter 6: Theory of Consumer Choice or Behavior

- Chapter 7: Government and Public Sector

- Chapter 8: Costs, Production, Supply

- Chapter 9: Product markets

- Chapter 10: Perfect Competition

- Chapter 12: Imperfect Competition

- Chapter 13: Resource Markets with Applications to Labor

- 47,805 views (12 views per day)

- Posted 11 years ago

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

2022 DBE Self-study Guides Gr. 12 Economics: Dynamics of Markets

This study guide is intended to serve as a resource for teachers and learners. It provides notes, examples, problem-solving exercises with solutions and examples of practical activities.

Do you have an educational app, video, ebook, course or eResource?

Contribute to the Western Cape Education Department's ePortal to make a difference.

Home Contact us Terms of Use Privacy Policy Western Cape Government © 2024. All rights reserved.

Browse Course Material

Course info.

- Prof. Jonathan Gruber

Departments

As taught in.

- Microeconomics

Learning Resource Types

Principles of microeconomics, lecture 12: monopoly ii, description.

This lecture focuses on how monopolies arise, regulation of monopolies, and contestable markets. See Handout 12 for relevant graphs for this lecture.

Instructors: Prof. Jonathan Gruber

- Download video

- Download transcript

You are leaving MIT OpenCourseWare

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Topic Videos

Essay Plan: Limits on Monopoly Power

Last updated 30 Oct 2019

- Share on Facebook

- Share on Twitter

- Share by Email

In this revision video we build an answer to this question: “Using applied examples of your choice, examine two factors that might limit the monopoly power of a business.”

In theory, a firm with monopoly power such as Coca Cola which has over 40 percent of the US carbonated drinks market, has huge scope to keep their prices higher than they might be if they faced more intensive competition and therefore earn high supernormal profits. The existence of barriers to entry in the market such as strong brand loyalty, patents and copyrights also means that these abnormal profits persist in the long run generating higher returns for shareholders perhaps at the expense of consumer welfare. Brand loyalty makes demand for a firm’s products more price inelastic and this allows a business to set prices higher and extract consumer surplus turning it into producer surplus.

However, one constraint on monopoly power can be the role played by industry regulators who might act as a surrogate competitor even in markets where the degree of contestability is low. A good example of this in the UK has been the energy price cap imposed by OFGEM on the leading electricity and gas suppliers in what is an oligopolistic industry. A price cap constrains what a firm can charge which - in theory - leads to lower prices and a reduced level of supernormal profit. This is shown in my analysis diagram - we can see that total profit is lower, prices down and output higher than under a single price profit maximising monopoly. The impact of a regulatory price cap depends on where the ceiling is set and also whether suppliers respond to maximum prices by successfully cutting their own operating costs to protect profit margins.

In some industries, monopoly power is strong because established firms can take advantage of internal economies of scale which reduces their long run average cost (LRAC) and gives them a significant cost advantage over smaller rivals and also potential entrants. Economies of scale lead to higher profits and also make it more difficult for competitor businesses to successfully enter an industry. A good example of this might be the leading commercial banks such as Barclays, Lloyds and HSBC all of whom - under normal economic circumstances - make very high profits of hundreds of millions of £s each year. There are some challenger banks in the industry such as Metro Bank, but many are finding it hard to growth quickly enough to become a genuine threat to the incumbent operators. If these new banks make little impact, then commercial banks with market power can continue to offer low interest rates for savers and also charge more for personal and business loans. In some industries - known as natural monopolies - economies of scale are vast implying that only one supplier can fully exploit them. In this case, competition is likely to remain limited and market power will remain strong in the long run.

However, although economies of scale can give established banks a built-in advantage, market power can be eroded by the impact of new technologies. An example of this can be seen in retail banking services with the relative success of tech-savvy businesses such as Starling and the App-only bank Monzo which is currently the fastest-growing bank in the UK with over 2.5 million customers with savings deposits of over £1 billion. Many challenger firms operate with a different business model to existing firms and they can compete aggressively in price and non-price terms by targeting better what larger firms may have ignored. Their operating costs are usually much lower and they are less at risk of experiencing diseconomies of scale or X-inefficiencies that often plague firms with a dominant market position. Indeed in many sectors, technological change is reducing the barriers to entry for smaller enterprises, many of whom can use internet platforms such as Amazon web services to sell direct to customers. If entry barriers are lower, then a market becomes more contestable and monopoly power is diminished.

- Complex monopoly

- Natural monopoly

- Local monopoly

- Pure Monopoly

You might also like

Perfect competition - short run price and output equilibrium.

Study Notes

Conditions for Price Discrimination Exam Answer

Practice Exam Questions

Snacks on a plane

8th March 2016

Beyond the Bike lesson resource for returning AS students

25th May 2016

Abnormal and Sub-Normal Profits - Key Diagrams

Revenues and profits - selection of revision mcqs.

Bus fares in England to be capped at £2 per journey for 3 months

3rd September 2022

Supernormal profits - World’s 722 biggest companies ‘making $1tn in windfall profits’

6th July 2023

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

THE DYNAMICS OF PERFECT MARKETS GRADE 12 NOTES - ECONOMICS STUDY GUIDES

- Key concepts

- Review of production, costs and revenue

- Perfect competition

- The individual business and the industry

- Market structures

- Output, profit, losses and supply

- How to draw graphs to show various equilibrium positions

- Competition policies

A perfect market is characterised by perfect competition. The conditions that result in perfect competition include:

- Equal access to the technology required for production

- No barriers to entry or exit from the marketplace

- Accurate and available market information

- No participant with the power to set the market price

- According to equilibrium theory, a perfect market will reach an equilibrium where the quantity supplied equals the quantity demanded at the market price

| | ||

| 6. Dynamics of markets: Perfect markets | Examine the dynamics of perfect markets with | HOT QUESTION: Examine in detail how HOT QUESTION: Explain why the As the various market structures When teaching the various HOT QUESTION: Draw three fully labelled HOT QUESTION: In your opinion is the |

6.1 Key concepts

These definitions will help you understand the meaning of key Economics concepts that are used in this study guide. Understand these concepts well.

| Term | Definition |

| Economic loss | When total costs are greater than total revenue. When average revenue is lower than average cost the firm makes an economic loss |

| Economic profit | Profit that is made in addition to normal profit. When average revenue is greater than average cost the firm makes an economic profit |

| Explicit cost | Actual expenditure of business, e.g. wages and interest |

| Implicit cost | Value of inputs owned by entrepreneur and used in the production process (forfeited rental, interest + salary) |

| Long run | The period of production where all factors can change. The time is long enough for variable and fixed factors to change |

| Market | An institution or mechanism that brings together buyers and sellers of goods or services |

| Market structure | How a market is organised |

| Monopolistic competition | A market structure in which businesses have many competitors, but each one sells a slightly different product (e.g. CD’s and books) |

| Monopoly | Exclusive control of a commodity or service in a particular market |

| Normal profit | The minimum earnings required to prevent an entrepreneur from leaving the industry. When average revenue equals average cost the firm makes a normal profit |

| Oligopoly | A market structure controlled by a small group of businesses |

| Perfect competition | A market structure with large numbers of producers and buyers |

| Price taker | Has no influence on price. Takes price that is determined by the market |

| Short run | The period of production where only the variable factors of production can change while at least one factor is fixed |

| Shut-down point | Business will close where MC = AVC |

| The Competition Appeal Court | An institution whose main functions is to review orders made by the Competition Tribunal and amend or confirm these orders |

| The Competition Commission | An institute that investigates restrictive business practices, abuse of dominant positions and mergers in order to achieve equity in the South African economy |

| The Competition Tribunal | An institution whose main function is to approve large mergers, adjudicate in the case of misconduct and issue orders on matters presented to it by the Competition Commission |

Use mobile notes to help you learn these concepts. Instructions for making them are on page xiv in the introduction.

6.2 Review of production, costs and revenue

Production takes place in the short run and the long run

- Short run The short run is the period of production where only the variable factors of production can change. The time period is too short to permit the number of firms in the industry to change.

- Long run The long run is the period of production where all factors can change. The time is long enough for variable and fixed factors to change. It allows enough time for new firms to enter the industry and/or existing firms to exit.

| Total Product/Output | Total product is the maximum output that the firm can produce with the given number of fixed and variable inputs at its disposal | |

| Marginal Product/Output | Marginal product is the additional unit of output which is produced as one more unit of the variable input (labour) is combined with the fixed input | MP=ΔTP ΔQ |

| Average Product/Output | Average product of a variable input shows the contribution that each labourer makes towards production | AP = P Q |

| Fixed Costs (indirect costs/overhead costs) | Costs that remain the same even if the output changes. Examples are rent, depreciation, insurance | |

| Variable Costs (direct costs/prime costs) | Costs that change according to changes in output. E.g. wages the cost of raw materials, electricity etc. | |

| Total cost | The cost/remuneration for all the factors of production used in the production process | TC = FC + VC |

| Marginal costs | Marginal cost is the amount by which total cost increases when one extra product is produced | MC = ΔTC ΔQ |

| Average cost | Average cost is the cost per unit of production | AC = AFC + AVC or TC Q |

| Average fixed cost | To calculate average fixed costs, we divide fixed costs by the amount of goods produced | AFC = FC Q |

| Average varible cost | To calculate average variable costs, we divide variable costs by the amount of goods produced | AVC = VC Q |

| Total Revenue | Total revenue is the total income received from the sale of goods or services | TR = P × Q |

| Marginal revenue | Marginal revenue refers to the extra amount of income gained by selling one more unit of production | MR = ΔTR ΔQ |

| Average revenue | Average revenue refers to the amount a firm earns for every unit sold | AR = TR Q |

Table 6.1: Review of production, costs and revenue It is important to review production, cost and revenue concepts covered in Grade 11. This is vitally important for the understanding of cost and revenue curves for the different market structures which you will study in this section. Summary of costs

| | | | | ||||

| 0 | 120 | 0 | 120 | - | - | - | |

| 10 | 120 | 100 | 220 | 12 | 10 | 22 | 10 |

| 20 | 120 | 160 | 280 | 6 | 8 | 14 | 6 |

| 30 | 120 | 210 | 330 | 4 | 7 | 11 | 5 |

| 40 | 120 | 280 | 400 | 3 | 7 | 10 | 7 |

| 50 | 120 | 400 | 520 | 2.4 | 8 | 10.4 | 12 |

| 60 | 120 | 600 | 720 | 2 | 10 | 12 | 20 |

| 70 | 120 | 910 | 1030 | 1.7 | 13 | 14.7 | 31 |

- The difference between the total cost and variable cost is the fixed cost

- TVC curve starts from 0 and TC starts from the fixed cost curve on the Y- axis.

- The gap between the AC curve and the AVC curve gets smaller as output increases.

- The MC Curve will always cut the AC and AVC curves at their minimum points.

6.3 Perfect competition

Perfect competition occurs in a market structure with a large number of participants who have access to all required information about the market place and are all price-takers. Prices are determined by demand and supply. Examples of market structures demonstrating most conditions of a perfect competition include the stock exchange, the foreign exchange market, the central grain exchange, and agricultural produce markets. A perfect market is a market where no single buyer or seller has a noticeable influence on the price of a good. This gives a true reflection of the scarcity value of goods and services. 6.3.1 Characteristics/conditions of a perfect market Products must be homogenous (i.e. identical)

- Products must be identical. There should be no differences in style, design and quality.

- In this way products compete solely on the basis of price and can be purchased anywhere.

There should be a large number of buyers and sellers

- It should not be possible for one buyer or seller to influence the price.

- When there are many sellers the share of each seller in the market is so small that the seller cannot influence the price.

- Sellers are price takers, they accept the prevailing market price. If they increase prices above the market price, they will lose customers.

No preferential treatment/discrimination

- Collusion occurs when buyers and sellers make an agreement to limit competition. In a perfect market no collusion takes place.

- Buyers and sellers base their actions solely on price, homogenous products fetch the same price and therefore no preference is shown for buying from or selling to any particular person.

Free competition

- Buyers must be free to buy whatever they want from any firm and in any quantity.

- Sellers must be free to sell what, how much and where they wish.

- There should be no State interference and no price control.

- Buyers should not form groups to obtain lower prices, nor should sellers combine to enforce higher prices.

Efficient transport and communication

- Efficient transport ensures that products are made available everywhere.

- In this way changes in demand and supply in one part of the market will influence the price in the entire market.

- Efficient communication keeps buyers and sellers informed about market conditions.

All participants must have perfect knowledge of market conditions

- All buyers and sellers must be fully aware of what is happening in any part of the market.

- Technology has increased competition as information is easily obtained via the internet.

Free access to and from markets

- Producers may enter and leave a market with little interference.

- Entering and leaving a perfect market is easy as less capital is required and there are fewer legal restrictions.

The factors of production are completely mobile

- They can move freely between markets.

In reality there are few perfect markets, however there are some sectors such as mining (e.g. gold) and agriculture (e.g. maize) where many of the conditions are met. These sectors illustrate the way in which the market mechanism works.

6.4 The individual business and the industry

6.4.1 Determining the market price To determine the market price for a firm under perfect competition you need to draw two graphs next to each other. On the left is the graph for the industry and on the right is the graph for the firm (individual producer).

- Figure 6.2 a) (the industry) shows the interaction of demand and supply (market forces).

- The market forces are in equilibrium at the point of intersection of the demand and supply curves, at “e”.

- At equilibrium the quantity demanded is equal to the quantity supplied. This determines the market price.

- Now look at Figure 6.2 b) (firm or individual producer). One producer will not be able to influence the market price and has to accept the market price (P1), he is a price taker.

- Because this is the only price the producer can charge, the demand curve for the producer is a straight line drawn at price P1.

- This horizontal line at the market price (P1) is the demand curve (DD), the average revenue (AR) curve and the marginal revenue (MR) curve.

Read this section on graphs through five times, and redraw each graph each time. 6.4.2 Demand curve for an individual producer The individual producer is a price taker and sells goods at the market price. At this price, demand remains constant. A higher price such as P2 cannot be charged as customers will be lost to other producers. A lower price such as P3 cannot be charged as a small profit or a loss will be made.

| | | |||

| 0 | 5 | 0 | 5 | 5 |

| 1 | 5 | 5 | 5 | 5 |

| 2 | 5 | 10 | 5 | 5 |

| 3 | 5 | 15 | 5 | 5 |

| 4 | 5 | 20 | 5 | 5 |

| 5 | 5 | 25 | 5 | 5 |

| 6 | 5 | 30 | 5 | 5 |

| 1 | 5 | 5 | 2 | 3 |

| 2 | 5 | 5 | 3 | 2 |

| 3 | 5 | 5 | 4 | 1 |

| 4 | 5 | 5 | 5 | 0 |

| 5 | 5 | 5 | 6 | -1 |

| 6 | 5 | 5 | 7 | -2 |

- At all pionts where MR is above MC, the firm is adding to profit. From unit 1-3, the firm is increasing its profit.

- At all points where MC is above MR, the firm is decreasing profit. From unit 5-7, the firm’s profit will decrease.

- The firm maximises profit where MR = MC. The firm maximises its profits at unit 4.

| 0 | 5 | 0 | 1 | -1 |

| 1 | 5 | 5 | 3 | 2 |

| 2 | 5 | 10 | 6 | 4 |

| 3 | 5 | 15 | 10 | 5 |

| 4 | 5 | 20 | 15 | 5 |

| 5 | 5 | 25 | 21 | 4 |

| 6 | 5 | 30 | 28 | 2 |

Table 6.5: Depicting Profit Maximisation

- If TC > TR the business makes a loss. If TR > TC it makes a profit.

- Maximum profit is achieved at units 3 and 4.

- Once the maximum profit is achieved, profits start to decrease with the next unit of output.

- Therefore the firm will not produce more than 4 units.

- At all points where TR is above TC, the firm is making a profit.

- At all points where TC is above TR, the firm is making a loss.

- The gap between TR and TC represents profit.

- Profit is maximised when the gap between TR and TC is the greatest. This is occurs at between 3 and 4 units.

6.5 Market structures

There are FOUR different market structures:

- Monopolistic competition

Table 6.6 shows the 5 broad characteristics which distinguish the four market structures: As you study each market structure in detail, you will be able to identify more distinguishing characteristics.

| Number of businesses | Enough that a single business cannot influence the market price | A very large number | So few that each business must take the actions of the others into account | One business |

| Nature of product | Homogenous (same kind) | Differentiated, e.g. cool drinks | Homogenous or differentiated | Unique product without any close substitutes |

| Market entry | Completely free | Free | From free to restricted | Blocked |

| Control over price | None | Few | Considerable, but less than with a monopoly | Considerable |

| Information | Complete | Incomplete | Incomplete | Complete |

| Examples | International commodity markets, e.g. gold and oil | Fast-food outlets | Petrol and oil markets | Eskom |

6.6 Output, profit, losses and supply

- Given a market price of P3, profit is maximised where MR = MC = P 3.

- This occurs at a quantity of Q 3 .

- At Q 3 the firm’s average revenue (AR) per unit of production is P 3,

- The average cost per unit is C 1 which is lower than the price of P 3.

- The firm is making an economic profit per unit of production of P 3 – C 1.

Another explanation

- Total revenue equals P 3 × Q 3, therefore total revenue is represented by the area 0P 3 E 3 Q 3 .

- Total cost equals C 1 × Q 3, this is represented by the area 0C 1 MQ 3.

- The difference between these two areas is the economic profit which is represented by the light grey shaded area C 1 P 3 E 3 M.

When Average Revenue is above Average cost the firm makes an ECONOMIC PROFIT.

- Given a market price of P 3, profit is maximised where MR = MC at point E 3.

- This occurs at a quantity of Q 3.

- At Q3 the firm’s average revenue (AR) per unit of production is P 3,

- The average cost per unit is C 3 which is higher than the price of P 3.

- The firm is making an economic loss per unit of production which is equal to the difference between C 3 and P 3.

Another explanation.

- Total revenue equals P 3 × Q 3, therefore total revenue is represented by the area 0P 3 E 3 Q 3.

- Total cost equals C 3 × Q 3, this is represented by the area 0C 3 MQ 3.

- The difference between these two areas is the economic loss which is represented by the light grey shaded area C 3 P 3 E 3 M.

- Whether the firm should continue production would depend on the level of AR (that is P3) relative to the firm’s average variable cost.

3. Normal profits

- A firm makes normal profits when total revenue (TR) equals total costs or when average revenue (AR) equals average cost (AC).

- Normal profit is the maximum return the owner of a firm expects to receive to keep on operating in the industry.

- Given a market price of P 2, profit is maximised where MR = MC = P 2.

- This occurs at a quantity of Q 2.

- At Q2 the firm’s average revenue (AR) per unit of production is P2, which is also equal to the average cost per unit C 2 (AC).

- Since AR = AC, the firm earns a normal profit since all its costs are fully covered.

- Point E 2 is usually called the break-even point.

- Total revenue equals P2 x Q2, therefore total revenue is represented by the area 0P2E2Q2.

- Total cost equals C2 × Q2, this is represented by the area 0P2E2Q2.

- Since Total revenue equals Total Cost the producer makes a normal profit.

The individual business can make an economic profit, economic loss or normal profit in the Short Run. They are referred to as short run equilibrium positions. In the long run the individual business will always make normal profit. 6.6.2 The industry The long term equilibrium for the industry and the individual firm The impact of entry and exit on the equilibrium of the firm and industry

- Profits are a signal for the entry of new businesses.

- Losses are a signal for businesses to leave the market.

- The long-term equilibrium in the perfect market will be influenced by the entry or exit of individual businesses.

- If individual farmers are earning an economic profit at P 1.

- New farmers will enter the market, more apples will be supplied.

- The market supply curve will shift to the right from S 1 to S 2.

- The Equilibrium price will drop from P 1 to P 2.

- Individual farmers will then earn normal profits. There will be no further reason for new farmers to enter the market. The industry is in equilibrium.

- If individual farmers are making economic losses, some farmers may leave the industry.

- When a few farmers leave the market, fewer apples will be supplied.

- The market supply curve will shift to the left from S 1 S 1 to S 2 S 2.

- The equilibrium price will increase from P 1 to P 2. Individual farmers will then earn normal profits. There will be no reason for individual farmers to leave the market.

- Therefore in a perfect market the long term equilibrium is achieved when individual firms earn a normal profit.

ACTUAL SHUT-DOWN should only take place when: |

- Point a: a firm will not produce here because AR < AVC

- Point b: it is the lowest price that the firm will charge (shut-down point). It represents the beginning of the supply curve.

- Point c: the firm is making an economic loss. Because AR < AC. The loss is minimised because the firm produces where MR = MC.

- Point d: the firm is making normal profit (breaking even) because AR = AC.

- Point e: the firm is making economic (supernormal) profits because AR > AC.

6.7 How to draw graphs to show various equilibrium positions

First draw your TWO axes: Price (P) on the vertical axis and Quantity (Q) on the horizontal axis. Remember, they meet at the origin (0). Note that the labelling of the axes is not the same for all graphs. In showing the various equilibrium positions the following sequence should be followed.

- Draw the demand curve followed by the Marginal revenue curve, (in a perfect market D = MR = AR).

- Then draw the AC curve.

- Then draw the MC curve which must cut the AC curve at its minimum point.

- Identify profit maximising point. MC = MR

- Determine quantity (drop a line from the profit maximizing point to the x-axis).

- Determine price (extend line upwards from the profit maximizing point to the demand curve) and then extend the line horizontal to the y-axis.

- Compare AR/price to AC to determine profit or loss.

Everything is important – do not leave out anything! Each step counts for marks. Label all axes, curves and graphs. Note the following:

- To show economic profit the AC curve must cut the demand curve.

- To show normal profit the minimum point on AC curve must be at a tangent to the demand curve.

- To show economic loss the AC curve must not touch demand curve.

6.8 Competition policies

6.8.1 Description Competition refers to the existence of free entry into and exit from markets. This ensures that markets are not dominated by certain businesses. 6.8.2 Goals of competition policy

- To prevent monopolies and other powerful businesses from abusing their power.

- To regulate the formation of mergers and acquisitions who wish to exercise market power.

- To stop firms from using restrictive practices like fixing prices, dividing markets etc.

6.8.3 The Competition Act in South Africa The government introduced the Competition Act 89 of 1998 to promote competition in South Africa in order to achieve the following objectives:

- promote the efficiency of the economy (its primary aim)

- provide consumers with competitive prices and a variety of products

- promote employment

- encourage South Africa to participate in world markets and accept foreign competition in South Africa

- enable SMMEs to participate in the economy

- to allow the previously disadvantaged to increase their ownership of businesses

- Define the concept market structure. (2)

- How many sellers will one find in a monopoly market? (2)

- In what market are all participants price-takers? Motivate your answer. (4)

- Explain the shape of the individual demand curve under perfect competition. (4)

- Vodacom (6)

- Explain in your own words the message behind the pie-charts shown above. (4)

|

Related items

- Mathematics Grade 12 Investigation 2023 Term 1

- TECHNICAL SCIENCES PAPER 2 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS JUNE 2022

- TECHNICAL SCIENCES PAPER 1 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS JUNE 2022

- MATHEMATICS LITERACY PAPER 2 GRADE 12 MEMORANDUM - NSC PAST PAPERS AND MEMOS JUNE 2022

- MATHEMATICS LITERACY PAPER 2 GRADE 12 QUESTIONS - NSC PAST PAPERS AND MEMOS JUNE 2022

Home — Application Essay — Business School — Life Lessons I Learned Playing Monopoly

Life Lessons I Learned Playing Monopoly

- University: Cornell University

About this sample

Words: 496 |

Updated: Nov 30, 2023

Words: 496 | Pages: 1 | 3 min read

When the dice directed me to yet another vacant property on the Monopoly board, I recklessly continued to invest. Young and naïve, I thought this was a foolproof tactic for winning easily. It was a strategy that I even attempted to conceal from my friends for fear of losing my “secret weapon.” Although my parents told me that this was no way to excel, I disregarded their opinion; whenever they bested me in a family game, I always convinced myself that my defeat was attributable only to bad luck. I firmly believed that their tactic of selective yet minimum expenditures was vastly inferior to mine.

Say no to plagiarism.

Get a tailor-made essay on

'Why Violent Video Games Shouldn't Be Banned'?

My mania for marching my silver game piece across the Monopoly board ended by first grade, but the economic strategies embodied by board games continued to fascinate me. I sought out increasingly complex economic games, which required me to come up with strategies for everything from financing armies to buying real estate. Ironically, however, my strategy remained as unenlightened as before, disguised only by my greater sophistication and maturity.

It was not until grade six that I saw the flaw in my thinking. At Simon Fraser University’s Mini-University Summer Camp, a program aimed at introducing middle school students to popular university courses, my perspective on economics was revolutionized. One of the most memorable activities during the camp was a mock investment program. During the course of ten days, we bought, kept, or sold our hypothetical shares based on their reported values. I, of course, saw this as another chance to practice my strategy. Immediately, my entire capital of fifty thousand dollars was converted into myriad stocks and bonds. I believed that the majority of my companies would grow, but to my horror, after two days of experimentation, seventy percent of my investments had failed, cutting my funds by almost half.

It was then that I learned a hard life lesson: reality does not always revolve around my ideals. That is a lesson that I have had to relearn throughout life; as an analytical and scientific individual who is attracted to a theoretical understanding of the world, I have to fight my disappointment when an experiment does not go as planned or when a theory proves untrue. As I have matured, however, I have come to recognize that these unexpected “failures” actually represent opportunities to gain new insights. In the case of my investment strategies, I bit the bullet and abided by my parents’ advice to invest in only a few prominent companies. Only then did my portfolio begin to brighten.

Keep in mind: This is only a sample.

Get a custom paper now from our expert writers.

To conclude the essay, monopoly provided my first exposure to the strategic and analytical thinking involved in economics. Today, I burn with questions about this baffling yet intriguing field. I long to understand the mechanisms behind its impact on politics, culture, society, and my own daily life. Through Cornell’s College of Arts and Sciences, I plan to gain the necessary resources to truly understand the complexities of the world economy.

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Dr Jacklynne

Verified writer

- Expert in: Business School

+ 127 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 618 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Are you interested in getting a customized paper?

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Business School

“Entonces, Max, ¿dime porque has venido a España?” I stared blankly at my host Dad while trying to catch a glimpse of how large his moustache really was, as he glanced over his shoulder towards me, his car narrowly avoided [...]

In this essay, I delve into the world of card games, exploring their significance beyond mere entertainment. Card games have long been a source of enjoyment and intellectual stimulation, but they also hold the power to teach [...]

I want to change the cynical, bitter stigma attached to politics. Many only see corruption and greedy lobbying, but politics is my outlet to solve the growing problems of our modern world. Nothing else has the potential to [...]

Choosing the right university can be a daunting task, especially when you have a clear vision of your future career. As an aspiring Human Resources professional, I have carefully researched universities that offer exceptional [...]

For those who start their studies in the U.S. with linguistic disadvantages, AP and IB courses are unattainable dreams. As with many of my fellow international students in California, I could not benefit from the virtues of [...]

When considering where to pursue my college education, the American University in Washington D.C. was an easy choice for me. I was drawn to this prestigious institution for its strong commitment to academic excellence, its rich [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

IMAGES

VIDEO

COMMENTS

The monopolist is a price-maker. The level of output is determined by the demand for the goods and /or service that the monopolist provides. In the case of a monopoly the demand curve is the firm's average revenue curve. Total revenue is calculated using the following formulae: Price x Quantity In this case P1 x Q1.

essay on monopoly structure monopoly exists when there is only one seller of product, when the product has no close substitutes, and when barriers block entry. ... Economics Grade 12 Essay QUIZ; Economics Grade 12 LONG QUIZ; Inflation research; ECONOMICS ESSAYS; Economics P1 essay Eng; Economics P2 Nov 2021;

Here is a compilation of essays on 'Monopoly' for class 9, 10, 11 and 12. Find paragraphs, long and short essays on 'Monopoly' especially written for school and college students. Essay on Monopoly Essay Contents: Essay on the Introduction to Monopoly Essay on the Features of Monopoly Essay on the Growth of Monopoly Essay on the Check on Monopolies Essay on Monopoly and Its Forms Essay ...

Grade 12 Economic Essays for the Next Three-Year Cycle (2021-2023) Macroeconomics - Paper 1 Discuss in detail the markets within the FOUR-SECTOR model (Circular Flow) Discuss in detail ' ... Monopoly is a market structure where only one seller operates. 🗸🗸 ...

Disadvantages of Monopolies. Despite the potential for efficiency and innovation, monopolies also have several disadvantages. One of the main concerns is the lack of competition, which can lead to higher prices and reduced consumer choice. Without competition, monopolies may have little incentive to lower prices or improve the quality of their ...

In this essay we will discuss about monopoly market. After reading this essay you will learn about: 1. Meaning of Monopoly 2. Sources and Types of Monopoly 3. Monopoly Price Determination 4. Degree of Monopoly Power - Its Measure 5. Meaning of Monopoly Price Discrimination 6. Types of Price Discrimination 7. Conditions for Price Discrimination 8. Benefits of Price Discrimination and Other ...

A monopoly is a market structure characterized by only one supplier but many buyers. The one firm which supplies the entire market has enormous market power to determine both the price as well as the quantity supplied to the market. Get a custom essay on Monopoly as a Market Structure. In the process, they not only produce at high prices in ...

The monopolist will select the profit-maximizing level of output where MR = MC, and then charge the price for that quantity of output as determined by the market demand curve. If that price is above average cost, the monopolist earns positive profits. Monopolists are not productively efficient, because they do not produce at the minimum of the ...

The monopolist maximizes profits at the optimal level of output (MC = MR) . controls the supply of the product. . can influence, but not control, the demand by changing the price relative to price elasticity of demand. . Unregulated monopoly can lead to. . higher than competitive prices.

This study guide is intended to serve as a resource for teachers and learners. It provides notes, examples, problem-solving exercises with solutions and examples of practical activities. Language: English. Curriculum Alignment: CAPS aligned. Publication Date: 2022-02-09. Grade:

3.2.3 Briefly describe the term monopoly It is a market structure where only one seller or producer operates (2) 3.2.4 What is required for monopoly to be classified as an artificial monopoly? If entry is restricted by factors such as legal requirement e.g. licencing, patents and copyrights (2)

11.12: Introduction to Monopoly Last updated; Save as PDF Page ID 48429

Description. This lecture focuses on how monopolies arise, regulation of monopolies, and contestable markets. See Handout 12 for relevant graphs for this lecture. Instructors: Prof. Jonathan Gruber. MIT OpenCourseWare is a web based publication of virtually all MIT course content. OCW is open and available to the world and is a permanent MIT ...

7.3.2 Economic profit in the short term. Step 3: This MC curve intersects the AC curve at the minimum point of the AC curve. Step 4: The most important point on the graph is where MC = MR (look for the dot ). At this point: equilibrium/ maximum profit/profit maximisation is reached (all the same point).

monopoly. Short-run equilibrium is very similar to a monopoly and long-run equilibrium of normal profit is very similar to a perfect market. For this reason it is sometimes referred to as a hybrid market structure. [Adapted from www.monopolisticcompetition.co.za, 2017] 4.2.1 Identify ONE example of a monopolistic competitor in the

2.3.1 Identify the type of a monopoly depicted in the cartoon. Artificial (1) 2.3.2 How many firms usually dominate this type of market? One (1) 2.3.3 Describe the nature of the product produced by a monopoly. The product is unique. There is no close substitute for the product (Accept any other correct relevant response) (2)

Hey everyone! Welcome to Wonderland Economics!In this video, you will learn about the one type of market structure, the monopoly, and how to apply basic econ...

Essay Plan: Limits on Monopoly Power. In theory, a firm with monopoly power such as Coca Cola which has over 40 percent of the US carbonated drinks market, has huge scope to keep their prices higher than they might be if they faced more intensive competition and therefore earn high supernormal profits. The existence of barriers to entry in the ...

Marginal product is the additional unit of output which is produced as one more unit of the variable input (labour) is combined with the fixed input. MP= ΔTP ΔQ. Average Product/Output. Average product of a variable input shows the contribution that each labourer makes towards production. AP = P Q.

Introduction. This essay will briefly explain the different market structures as well as evaluate their advantages and disadvantages. It will link the theory and case study of market structures and there will be two main market structures, oligopoly, and monopoly, that will be explained while linking the case study on Apple and Spotify.

ECONOMICS GRADE 12 SESSION 7 (LEARNER NOTES) Page 129 of 165. 2.1 Define the term. balance of payments. (3) 2.2 Name ONE other sub-account or component of the balance of payments. (3) 2.3 Name the item in the financial account which will contain shares bought by foreigners.

To conclude the essay, monopoly provided my first exposure to the strategic and analytical thinking involved in economics. Today, I burn with questions about this baffling yet intriguing field. I long to understand the mechanisms behind its impact on politics, culture, society, and my own daily life. Through Cornell's College of Arts and ...