Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

How to Choose the Best Legal Structure for Your Business

Small business resources.

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Online only. Expires 4/27/2024

Table of Contents

Your business’s legal structure has many ramifications. It can determine how much liability your company faces during lawsuits. It can put up a barrier between your personal and business taxes – or ensure this barrier doesn’t exist. It can also determine how often your board of directors must file paperwork – or if you even need a board. [Related article: What to Do if Your Business Gets Sued ]

We’ll explore business legal structures and how to choose the right structure for your organization.

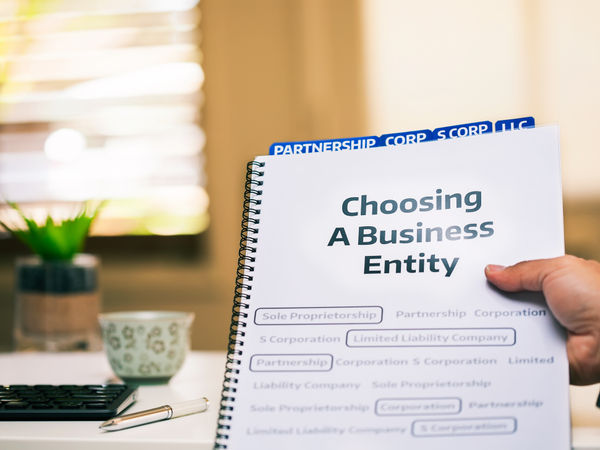

What is a business legal structure?

A business legal structure, also known as a business entity, is a government classification that regulates certain aspects of your business. On a federal level, your business legal structure determines your tax burden. On a state level, it can have liability ramifications.

Why is a business legal structure important?

Choosing the right business structure from the start is among the most crucial decisions you can make. Here are some factors to consider:

- Taxes: Sole proprietors, partnership owners and S corporation owners categorize their business income as personal income. C corporation income is business income separate from an owner’s personal income. Given the different tax rates for business and personal incomes, your structure choice can significantly impact your tax burden.

- Liability: Limited liability company (LLC) structures can protect your personal assets in the event of a lawsuit. That said, the federal government does not recognize LLC structures; they exist only on a state level. C corporations are a federal business structure that includes the liability protection of LLCs.

- Paperwork: Each business legal structure has unique tax forms. Additionally, if you structure your company as a corporation, you’ll need to submit articles of incorporation and regularly file certain government reports. If you start a business partnership and do business under a fictitious name, you’ll need to file special paperwork for that as well.

- Hierarchy: Corporations must have a board of directors. In certain states, this board must meet a certain number of times per year. Corporate hierarchies also prevent business closure if an owner transfers shares or exits the company, or when a founder dies . Other structures lack this closure protection.

- Registration: A business legal structure is also a prerequisite for registering your business in your state. You can’t apply for an employer identification number (EIN) or all your necessary licenses and permits without a business structure.

- Fundraising: Your structure can also block you from raising funds in certain ways. For example, sole proprietorships generally can’t offer stocks. That right is primarily reserved for corporations.

- Potential consequences for choosing the wrong structure: Your initial choice of business structure is crucial, although you can change your business structure in the future. However, changing your business structure can be a disorganized, confusing process that can lead to tax consequences and the unintended dissolution of your business.

If you have to expand your business to another state , you won’t have to create a new company or structure, but you may have to register it as a “foreign entity.”

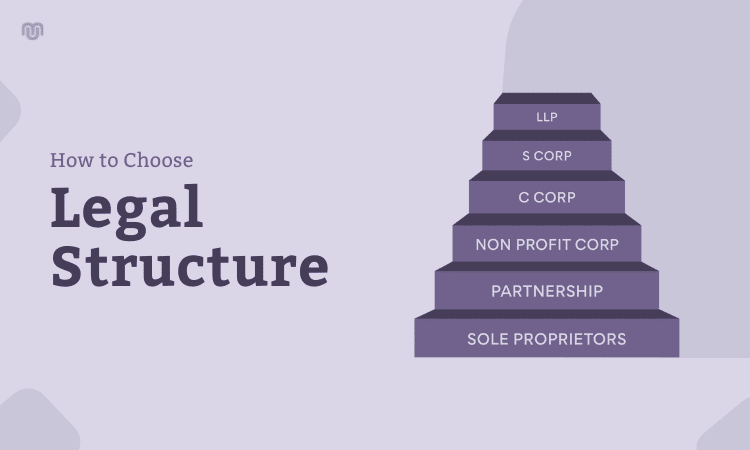

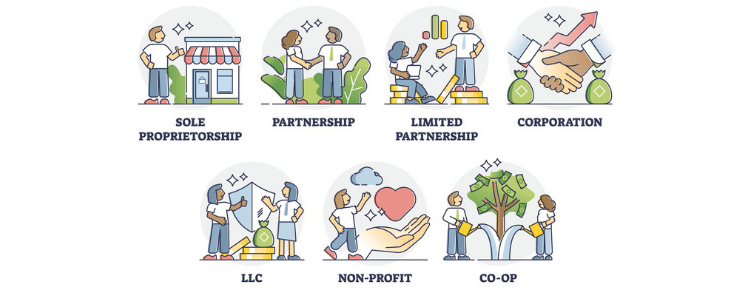

Types of business structures

The most common business entity types are sole proprietorships, partnerships, limited liability companies, corporations and cooperatives. Here’s more about each type of legal structure.

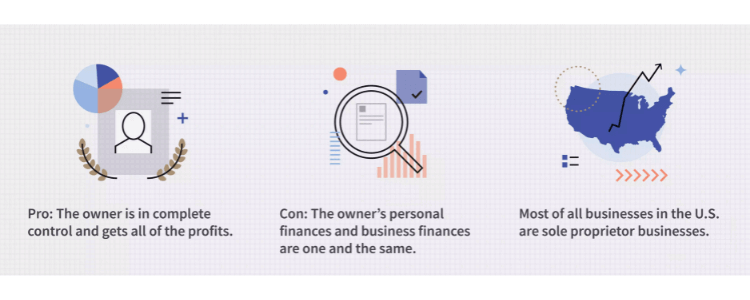

Sole proprietorship

A sole proprietorship is the simplest business entity. When you set up a sole proprietorship , one person is responsible for all a company’s profits and debts.

“If you want to be your own boss and run a business from home without a physical storefront, a sole proprietorship allows you to be in complete control,” said Deborah Sweeney, vice president and general manager of business acquisitions at Deluxe Corp. “This entity does not offer the separation or protection of personal and professional assets, which could prove to become an issue later on as your business grows and more aspects hold you liable.”

Proprietorship costs vary by market. Generally, early expenses will include state and federal fees, taxes, business equipment leases , office space, banking fees, and any professional services your business contracts. Some examples of these businesses are freelance writers, tutors, bookkeepers , cleaning service providers and babysitters.

A sole proprietorship business structure has several advantages.

- Easy setup: A sole proprietorship is the simplest legal structure to set up. If you – and only you – own your business, this might be the best structure. There is very little paperwork since you have no partners or executive boards.

- Low cost: Costs vary by state, but generally, license fees and business taxes are the only fees associated with a proprietorship.

- Tax deduction: Since you and your business are a single entity, you may be eligible for specific business sole proprietor tax deductions , such as a health insurance deduction.

- Easy exit: Forming a proprietorship is easy, and so is ending one. As a single owner, you can dissolve your business at any time with no formal paperwork required. For example, if you start a day care center and wish to fold the business, refrain from operating the day care and advertising your services.

The sole proprietorship is also one of the most common small business legal structures. Many famous companies started as sole proprietorships and eventually grew into multimillion-dollar businesses. These are a few examples:

- Marriott Hotels

Partnership

A partnership is owned by two or more individuals. There are two types: a general partnership, where all is shared equally, and a limited partnership, where only one partner has control of operations and the other person (or persons) contributes to and receives part of the profits. Partnerships can operate as sole proprietorships, where there’s no separation between the partners and the business, or limited liability partnerships (LLPs), depending on the entity’s funding and liability structure.

“This entity is ideal for anyone who wants to go into business with a family member, friend or business partner – like running a restaurant or agency together,” Sweeney said. “A partnership allows the partners to share profits and losses and make decisions together within the business structure. Remember that you will be held liable for the decisions made as well as those actions made by your business partner.”

General partnership costs vary, but this structure is more expensive than a sole proprietorship because an attorney should review your partnership agreement. The attorney’s experience and location can affect the cost.

A business partnership agreement must be a win-win for both sides to succeed. Google is an excellent example of this. In 1995, co-founders Larry Page and Sergey Brin created a small search engine and turned it into the leading global search engine. The co-founders met at Stanford University while pursuing their doctorates and later left to develop a beta version of their search engine. Soon after, they raised $1 million in funding from investors, and Google began receiving thousands of visitors a day. Having a combined ownership of 11.4% of Google provides them with a total net worth of nearly $226.4 billion.

Business partnerships have many advantages.

- Easy formation: As with a sole proprietorship, there is little paperwork to file for a business partnership. If your state requires you to operate under a fictitious name ( “doing business as,” or DBA ), you’ll need to file a Certificate of Conducting Business as Partners and draft an Articles of Partnership agreement, both of which have additional fees. You’ll usually need a business license as well.

- Growth potential: You’re more likely to obtain a business loan with more than one owner. Bankers can consider two credit histories rather than one, which can be helpful if you have a less-than-stellar credit score.

- Special taxation: General partnerships must file federal tax Form 1065 and state returns, but they do not usually pay income tax. Both partners report their shared income or loss on their individual income tax returns. For example, if you opened a bakery with a friend and structured the business as a general partnership, you and your friend are co-owners. Each owner brings a certain level of experience and working capital to the business, affecting each partner’s business share and contribution. If you brought the most seed capital for the business, you and your partner may agree that you’ll retain a higher share percentage, making you the majority owner.

Partnerships are one of the most common business structures. These are some examples of successful partnerships:

- Warner Bros.

- Hewlett-Packard

- Ben & Jerry’s

Limited liability company

A limited liability company (LLC) is a hybrid structure that allows owners, partners or shareholders to limit their personal liabilities while enjoying a partnership’s tax and flexibility benefits. Under an LLC, members are shielded from personal liability for the business’s debts if it can’t be proven that they acted in a negligent or wrongful manner that results in injury to another in carrying out the activities of the business.

“Limited liability companies were created to provide business owners with the liability protection that corporations enjoy while allowing earnings and losses to pass through to the owners as income on their personal tax returns,” said Brian Cairns, CEO of ProStrategix Consulting. “LLCs can have one or more members, and profits and losses do not have to be divided equally among members.”

According to Wolters Kluwer , the cost of forming an LLC comprises the state filing fee and can vary depending on your state. For example, if you file an LLC in New York, you must pay a $200 filing fee, a $9 biennial fee, and file a biennial statement with the New York Department of State .

Although small businesses can be LLCs, some large businesses choose this legal structure. The structure is typical among accounting, tax, and law firms, but other types of companies also file as LLCs. One example of an LLC is Anheuser-Busch, one of the leaders in the U.S. beer industry. Headquartered in St. Louis, Anheuser-Busch is a wholly owned subsidiary of Anheuser-Busch InBev, a multinational brewing company based in Leuven, Belgium.

Here some other well-known examples of LLCs:

- Hertz Rent-a-Car

To learn more about LLCs, read our LLC tax guide , our comprehensive overview of starting an LLC , and our guide to creating an LLC operating agreement.

Corporation

The law regards a corporation as separate from its owners, with legal rights independent of its owners. It can sue, be sued, own and sell property, and sell the rights of ownership in the form of stocks. Corporation filing fees vary by state and fee category.

There are several types of corporations, including C corporations , S corporations, B corporations, closed corporations, and nonprofit corporations.

- C corporations: C corporations, owned by shareholders, are taxed as separate entities. JPMorgan Chase & Co. is a multinational investment bank and financial services holding company listed as a C corporation. Since C corporations allow an unlimited number of investors, many larger companies – including Apple, Bank of America and Amazon – file for this tax status.

- B corporations: B corporations, otherwise known as benefit corporations, are for-profit entities committed to corporate social responsibility and structured to positively impact society. For example, skincare and cosmetics company The Body Shop has proven its long-term commitment to supporting environmental and social movements, resulting in an awarded B corporation status. The Body Shop uses its presence to advocate for permanent change on issues like human trafficking, domestic violence, climate change, deforestation and animal testing in the cosmetic industry.

- Closed corporations: Closed corporations, typically run by a few shareholders, are not publicly traded and benefit from limited liability protection. Closed corporations, sometimes referred to as privately held companies, have more flexibility than publicly traded companies. For example, Hobby Lobby is a closed corporation – a privately held, family-owned business. Stocks associated with Hobby Lobby are not publicly traded; instead, the stocks have been allocated to family members.

- Open corporations: Open corporations are available for trade on a public market. Many well-known companies, including Microsoft and Ford Motor Co., are open corporations. Each corporation has taken ownership of the company and allows anyone to invest.

- Nonprofit corporations: Nonprofit corporations exist to help others in some way and are rewarded by tax exemption. Some examples of nonprofits are the Salvation Army, American Heart Association and American Red Cross. These organizations all focus on something other than turning a profit.

Corporations enjoy several advantages.

- Limited liability: Stockholders are not personally liable for claims against your corporation; they are liable only for their personal investments.

- Continuity: Corporations are not affected by death or the transferring of shares by their owners. Your business continues to operate indefinitely, which investors, creditors and consumers prefer.

- Capital: It’s much easier to raise large amounts of capital from multiple investors when your business is incorporated.

This structure is ideal for businesses that are further along in their growth, rather than a startup based in a living room. For example, if you’ve started a shoe company and have already named your business, appointed directors and raised capital through shareholders, the next step is to become incorporated. You’re essentially conducting business at a riskier, yet more lucrative, rate. Additionally, your business could file as an S corporation for the tax benefits. Once your business grows to a certain level, it’s likely in your best interest to incorporate it.

These are some popular examples of corporations:

- General Motors

- Exxon Mobil Corp.

- Domino’s Pizza

- JPMorgan Chase

Learn more about how to become a corporation .

Cooperative

A cooperative (co-op) is owned by the same people it serves. Its offerings benefit the company’s members, also called user-owners, who vote on the organization’s mission and direction and share profits.

Cooperatives offer a couple main advantages.

- Increased funding: Cooperatives may be eligible for federal grants to help them get started.

- Discounts and better service: Cooperatives can leverage their business size, thus obtaining discounts on products and services for their members.

Forming a cooperative is complex and requires you to choose a business name that indicates whether the co-op is a corporation (e.g., Inc. or Ltd.). The filing fee associated with a co-op agreement varies by state.

An example of a co-op is CHS Inc., a Fortune 100 business owned by U.S. agricultural cooperatives. As the nation’s leading agribusiness cooperative, CHS reported a net income of $422.4 million for fiscal year 2020. These are some other notable examples of co-ops:

- Land O’Lakes

- Navy Federal Credit Union

- Ace Hardware

The five types of business structures are sole proprietorship, partnership, limited liability company, corporation and cooperative. The right structure depends mainly on your business type.

Factors to consider before choosing a business structure

For new businesses that could fall into two or more of these categories, it’s not always easy to decide which structure to choose. Consider your startup’s financial needs, risk and ability to grow. It can be challenging to switch your legal structure after registering your business, so give it careful analysis in the early stages of forming your business.

Here are some crucial factors to consider as you choose your business’s legal structure. You should also consult a CPA for advice.

Flexibility

Where is your company headed, and which type of legal structure allows for the growth you envision? Turn to your business plan to review your goals and see which structure best aligns with those objectives. Your entity should support the possibility for growth and change, not hold it back from its potential. [Learn how to write a business plan with this template .]

When it comes to startup and operational complexity, nothing is more straightforward than a sole proprietorship. Register your name, start doing business, report the profits and pay taxes on it as personal income. However, it can be difficult to procure outside funding. Partnerships, on the other hand, require a signed agreement to define the roles and percentages of profits. Corporations and LLCs have various reporting requirements with state governments and the federal government.

A corporation carries the least amount of personal liability since the law holds that it is its own entity. This means creditors and customers can sue the corporation, but they can’t gain access to any personal assets of the officers or shareholders. An LLC offers the same protection but with the tax benefits of a sole proprietorship. Partnerships share the liability between the partners as defined by their partnership agreement.

An owner of an LLC pays taxes just as a sole proprietor does: All profit is considered personal income and taxed accordingly at the end of the year.

“As a small business owner, you want to avoid double taxation in the early stages,” said Jennifer Friedman, principal at Rivetr. “The LLC structure prevents that and makes sure you’re not taxed as a company, but as an individual.”

Individuals in a partnership also claim their share of the profits as personal income. Your accountant may suggest quarterly or biannual advance payments to minimize the effect on your return.

A corporation files its own tax returns each year, paying taxes on profits after expenses, including payroll. If you pay yourself from the corporation, you will pay personal taxes, such as those for Social Security and Medicare, on your personal return.

To simplify payroll complexities and taxation issues, consider using a payroll service. Check out our reviews of the best payroll services to find a partner that fits your needs and budget.

If you want sole or primary control of the business and its activities, a sole proprietorship or an LLC might be the best choice. You can negotiate such control in a partnership agreement as well.

A corporation is constructed to have a board of directors that makes the major decisions that guide the company. A single person can control a corporation, especially at its inception, but as it grows, so does the need to operate it as a board-directed entity. Even for a small corporation, the rules intended for larger organizations – such as keeping notes of every major decision that affects the company – still apply.

Capital investment

If you need to obtain outside funding from an investor, venture capitalist or bank, you may be better off establishing a corporation. Corporations have an easier time obtaining outside funding than sole proprietorships.

Corporations can sell shares of stock and secure additional funding for growth, while sole proprietors can obtain funds only through their personal accounts, using their personal credit or taking on partners. An LLC can face similar struggles, although, as its own entity, it’s not always necessary for the owner to use their personal credit or assets.

Licenses, permits and regulations

In addition to legally registering your business entity, you may need specific licenses and permits to operate. Depending on the type of business and its activities, it may need to be licensed at the local, state and federal levels.

“States have different requirements for different business structures,” Friedman said. “Depending on where you set up, there could be different requirements at the municipal level as well. As you choose your structure, understand the state and industry you’re in. It’s not ‘one size fits all,’ and businesses may not be aware of what’s applicable to them.”

The structures discussed here apply only to for-profit businesses. If you’ve done your research and you’re still unsure which business structure is right for you, Friedman advises speaking with a specialist in business law.

Max Freedman and Matt D’Angelo contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

- Best CRM Software for Nonprofits

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

Types of Business Structures Explained

13 min. read

Updated January 5, 2024

The choice you make about what type of business structure is appropriate for your company will affect how much you pay in taxes, the level of risk or liability to your personal assets (your house, your savings), and even your ability to raise money from angel investors or venture capitalists.

So, the structure you choose is significant.

This guide will explain the basics of common business structures, but we can’t tell you exactly which structure you should choose—if you need that kind of advice, you should consult a lawyer or an accountant.

- Sole proprietorship

The simplest business structure is the sole proprietorship. If you don’t create a separate legal entity, your business is a sole proprietorship.

The main advantage of the sole proprietorship is that it’s relatively simple and inexpensive. The disadvantage is that it doesn’t create a legal separation between you and your personal assets and business assets. If you’re sued or your business folds—your personal assets are fair game for creditors and in terms of legal liability.

Who is a sole proprietorship for?

A sole proprietorship is ideal for self-employed individuals like personal trainers offering individual coaching or artists selling unique items on platforms like Etsy.

Key considerations

- Cost-effective setup: The primary expense is usually the DBA (“doing business as”) registration. Some states may require public notice, like a newspaper ad. Generally, the total cost is below $100.

- Simplified taxation: Sole proprietorships are “pass-through” tax entities. Profits and losses are reported directly on the owner’s taxes, necessitating only a few additional tax forms if you’re the sole worker.

- Hiring employees is possible: Being a “sole” proprietor doesn’t restrict hiring. If you employ others, tax processes become slightly more intricate.

- Limited ways to raise funding: You can’t sell company stock, limiting fundraising avenues.

- Potential loan difficulties: Banks might hesitate to grant loans to sole proprietorships due to perceived credibility issues.

- Full personal liability: If the business faces debt or legal issues, your personal assets, including your home, car, and savings, are vulnerable.

Dig deeper:

Should you register as a sole proprietorship?

Explore the pros and cons of incorporating as a sole proprietorship.

How sole proprietorships are taxed

Understand how registering as a sole proprietor impacts your taxes.

Brought to you by

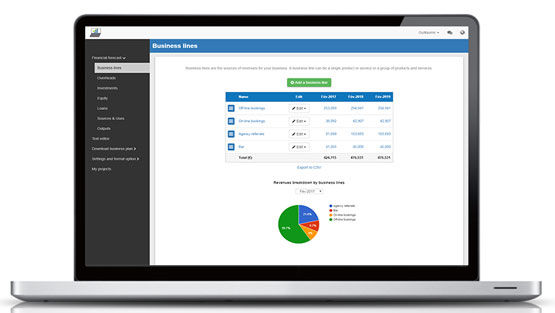

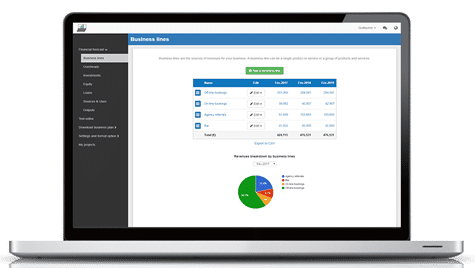

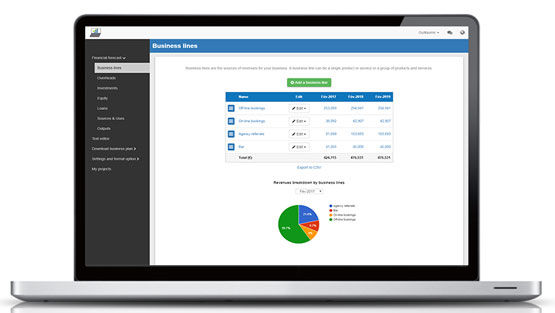

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Partnerships

Still a relatively simple business structure, a partnership involves two or more individuals sharing ownership of their new business. They’ll contribute to the business in some way and share in profits and losses.

Partnerships are harder to describe because they change so much. State laws govern them, but the Uniform Partnership Act has become the law in most states. That act, however, mainly sets the specific partnership agreement as the real legal core of the partnership so that the legal details can vary widely.

Usually, the income or loss from partnerships passes through to the partners without any partnership tax. The agreements can define different levels of risk, which is why you’ll read about some partnerships with general and limited partners, with different levels of risk for each. Your partnership agreement should clearly define what happens if a partner withdraws, buy and sell arrangements for partners and liquidation arrangements if necessary.

What are the types of partnerships?

- General partnership: Assumes equal involvement of all parties in profits, liabilities, and duties. Any intentional imbalance should be specified in the partnership agreement.

- Limited partnership: Suited for partners in an investor role with limited involvement in daily operations. This structure is more complex and less common.

- Joint venture: Designed for a single project or a limited duration, operating similarly to a general partnership.

Who is a partnership for?

A partnership is similar to an extended sole proprietorship and is ideal for two or more individuals wanting to start a business jointly.

To make the partnership more effective, you and your partners should have skillsets, connections, or other unique benefits that complement each other.

For example, a personal trainer and nutritionist building an online fitness program. One entrepreneur has experience building an exercise regiment with clients. The other understands how to create balanced meal and supplement recommendations.

They have unique but complementary knowledge that, when combined, creates a more valuable product/service.

- Partnership agreement: While not mandatory, it’s advisable to draft a partnership agreement, ideally reviewed by legal counsel, to clarify roles and responsibilities, ownership, and what will happen if a partner wants to leave the partnership.

- Tax implications: Partnerships are “pass-through” entities, meaning profits and losses are directly passed to the partners. Refer to the IRS for partnership tax details.

- Additional costs: Since it’s a good idea to have a lawyer look over your partnership agreement, don’t forget to factor in this added expense.

- Trust in partnership: Ensure your partner is trustworthy, as partners share responsibility for business decisions and debts. A well-drafted partnership agreement can prevent future conflicts.

How to create a business partnership agreement

Even if you’re not in an official partnership, you should consider drafting a partnership agreement. Doing so will clearly define rights and responsibilities and help you amicably resolve any disputes.

How partnerships are taxed

Understand how registering as a partnership impacts your taxes.

Plan for changes with a buy-sell agreement

What will you do if you or your partner quits, sells their portion of the business, or passes away?

How to find the right business partner

A partnership is more than a legal structure. It’s a relationship between entrepreneurs who share a passion for an idea and bring unique skill sets. So, how do you find the right person to make your partnership thrive?…

Traits to look for in a business partner

What makes a good business partner? If you’re considering someone with the following traits, you likely have a good fit.

How many partners should you have?

What’s the ideal number of business partners? The right mix of people and skillsets can lead to tremendous business growth. But too many may lead to disaster.

What to do when your business partner is your life partner

Should your significant other be your business partner? Learn your legal options and how to find the right ownership fit for your business and relationship.

- Limited liability company

Should your business fall on hard times, does the idea of being held personally responsible for all losses sound intimidating?

It’s understandable—plenty of would-be entrepreneurs shudder at the thought of the bank seizing their personal assets should the business go south.

A limited liability corporation (or LLC) is, in some ways, the best of both worlds. It allows for the flexibility of a partnership or sole proprietorship but, as the name suggests, limits the liability of those involved, similar to a corporation. An LLC is usually a lot like an S corporation. It offers a combination of some limitations on legal liability and some favorable tax treatment for profits and transfer of assets.

Who is a limited liability corporation for?

An LLC is ideal for those wary of personal liability in business. If you possess significant personal assets or operate in a lawsuit-prone industry—an LLC safeguards your personal finances.

- Complexity: While offering more protection, an LLC is harder to establish than a sole proprietorship or partnership.

- Tax benefits: LLCs maintain “pass-through” tax status, meaning you’re taxed only on your profit share, which is reported on personal taxes.

- Single-member LLCs: Most states allow single-person LLCs, making it a potential alternative to sole proprietorships.

How to form a limited liability company

Interested in forming an LLC? Here are the steps you’ll need to take.

How to create an LLC operating agreement

Set the rules for how your LLC will operate, including the management structure, individual responsibilities, ownership percentage, and other important information.

LLC costs and fees explained

Make sure you’re aware of all the costs and fees associated with forming an LLC.

How LLCs are taxed

Understand how registering as an LLC impacts your taxes.

- Corporations

Shareholders, a more complex legal structure, and more intricate tax requirements are all characteristics of a corporation.

Corporations are either the standard C corporation, the small business S corporation, or the benefit corporation or B corp. The C corporation is the classic legal entity of the vast majority of successful companies in the United States.

Corporations can switch from C to S and back again, but not often. The IRS has strict rules for when and how those switches are made. You’ll almost always want to have your CPA, and in some cases, your attorney, guide you through the legal requirements for switching.

Who is a corporation for?

Corporations are best suited for larger, established businesses with multiple employees, plans for rapid scaling, or intentions to trade or attract significant external investments publicly. A corporation might not be the right choice if you’re a small business owner or work with a small team.

What are the types of corporations?

C corporation.

What we typically think of when we refer to corporations, where all shareholders combine funds and are then given stock in the newly formed business.

A C corp is a separate tax entity, meaning your business can deduct taxes. It also means that earnings can be taxed twice, as they are concerning your business and your personal taxes if you take income as dividends. However, good tax planning can often minimize the impact of double taxation.

Most lawyers would agree (but verify this with your lawyer who is familiar with your unique business) that the C corporation is the structure that provides the best shielding from personal liability for owners, and provides the best non-tax benefits to owners. Many companies with ambitions of raising major investment capital and eventually going public consider the C corporation.

S corporation

An S corp is similar to a traditional C corporation, with one major difference: Profits and losses can be “passed through” to your personal tax return without being taxed separately first.

In practical terms, the owners can take their profits home without first paying the corporation’s separate tax on profits. In most states, an S corporation is owned by a limited number of private owners (25 is a common maximum), and only individuals (not corporations) can hold stock in S corporations.

To become an S corp, you must first set your business up as a corporation within your state and then request S corp status. The IRS instructions for Form 2553 (which you’ll need to file to become an S corp) can help you determine if you qualify.

B corporation

Does your company have a dedicated social mission, a good cause built into its foundation that you’d like to continue furthering as your company grows? If so, you might consider becoming a B corporation, which stands for “benefit corporation.”

However, the name is a bit misleading; a B corp isn’t an entirely different structure than a regular C corporation. It’s a C corp vetted and approved for B corp status. Some states give tax breaks to B corps, and it’s a great way to stand behind a cause.

So, why would you choose a B corp over a nonprofit? The biggest difference is in ownership—with a nonprofit, no owners or shareholders exist. A B corp, which is still a type of corporation, still has shareholders who own the company. So, a B corp has a social mission but is still a for-profit company (as opposed to a nonprofit) with an end goal of returning profits to the shareholders.

- Liability: Corporations offer the most protection for personal assets.

- Capital raising: The ability to sell stock enhances investment potential.

- Taxation: Corporate taxes are separate (except for S corps), but the structure can lead to double taxation, especially for C corporations.

- Complexity: Establishing a corporation is more intricate than other business structures, requiring more paperwork and formalities.

How to form a corporation

Follow these ten steps to incorporate as a C, S, or B corporation.

How are corporations taxed?

Understand how registering as a corporation impacts your taxes.

S corporation basics

Should you choose an S corp as the legal structure for your business? Learn the basics and what alternatives are available.

B corporation basics

Should you choose a B corp as the legal structure for your business? Check out this detailed overview of how this business entity functions and the pros and cons you’ll contend with.

A nonprofit is a “not-for-profit” business structure, meaning the business does not exist to generate revenue for shareholders, but rather funnel business revenue into a social mission, cause, or purpose.

Who is a nonprofit for?

Nonprofits cater to those with missions centered on charitable, educational, scientific, or religious purposes. Examples include homeless shelters, conservation groups, arts centers, and educational institutions.

What’s the difference between a nonprofit and a cooperative?

Like a nonprofit, a cooperative is a business with a social mission that doesn’t divide income between shareholders but toward a cause or purpose. However, while some states view nonprofits and cooperatives as the same, a cooperative differs because the members own it, referred to as “user-owners.”

If you plan on organizing your business to be democratically owned, looking into the cooperative business structure might be a good idea to look into the cooperative business structure .

- Complex setup: Establishing a nonprofit requires steps similar to forming a corporation, including filing articles of incorporation, creating bylaws, and organizing board meetings.

- Fundraising will be your main priority: Nonprofits generally rely on fundraising and grants to keep a flow of income into their business.

What is a nonprofit corporation and how to start one

Learn the basics of setting up a nonprofit corporation.

How to earn income as a nonprofit corporation

Learn how related and unrelated business activities can generate revenue for a nonprofit corporation.

- Making your business legally compliant

Choosing a business structure is the first legal step you’ll take. Your choice will impact your taxes, fundraising, and personal liability.

Tim Berry, founder of Palo Alto Software (maker of Bplans) reminds small business and startup founders that choosing a business entity or structure is something to take seriously. He says:

“Make sure you know which legal steps you must take to be in business. I’m not an attorney, and I don’t give legal advice. I strongly recommend working with an attorney to review the details of your company’s legal establishment and licensing. The trade-offs involved in incorporation versus partnership versus other structures are significant. Small problems developed at the early stages of a new business can become horrendous problems later on. In this regard, the cost of simple legal advice is almost always worth it. Don’t skimp on legal costs.”

TLDR: Take time, carefully weigh your options, and consult a legal professional.

Once you’ve chosen, check off the remaining legal requirements to start a business. While you can complete most of these in any order, here are a few suggestions.

- Apply for a federal and state tax ID

- Obtain licenses and permits

- Register your business name

Clarify your ideas and understand how to start your business with LivePlan

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

.png?format=auto)

Table of Contents

Related Articles

3 Min. Read

How to Apply for an EIN: Federal Tax ID Number

3 Reasons Why You Shouldn’t Wait to Register for a DBA

4 Min. Read

How to Create a Business Partnership Agreement

9 Min. Read

How to Legally Register for Your Business Name

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Sole Proprietorship

Partnership, limited liability company (llc), corporation, templates and examples to download in word and pdf formats, how to choose the best legal structure for your business.

Deciding on a specific type of legal structure when you've just started your business journey can be complicated. It's hard to know exactly what the differences are, how the different structures can benefit you, and what any risks might be.

Luckily, it doesn't have to be so complicated! In fact, we've published this guide on everything you need to know about choosing the right legal structure for your business to help you along the way.

The most common business structures are sole proprietorships, partnerships, limited liability companies, and corporations. Here, you'll learn about each one in detail to help you choose the right fit for your business, as well as a non-profit, which you might consider for a new charitable business.

What type of structure you choose will make a big difference over the life of your business. It can have significant tax implications, as well as implications for your personal level of risk. It is not a decision that should be made lightly.

Below, we examine each common business structure in detail.

A sole proprietorship is the simplest type of business structure and the easiest to form and maintain. A sole proprietorship is basically a business that is you - and you are the business! For example, if you were a freelance writer on the internet and wanted to operate as a sole proprietorship, you wouldn't have to do anything at all to already be up and running, as long as you wanted to operate under your name.

In a sole proprietorship, no separate legal entity is created. If you'd like to operate under a special name, like a new business name or just a different name other than your own legal name, you would file what is called a "Doing Business As" (or DBA, as it is referred to) document with your state. All this document does is tell the state that you, as a legal person, are doing business under the name you've chosen for your business.

Because of the simplicity of the sole proprietorship, the way that your taxes are handled is also fairly simple. The taxes of the sole proprietorship would "pass through" to you, meaning you report any profit or loss on your own taxes and don't have to go through a separate process for the business.

One of the biggest drawbacks to a sole proprietorship is that you can be personally on the hook for any business liabilities - whether you make a big financial loss one year or whether your business gets sued. That's because in a sole proprietorship, there is no separation between you as a person and you as a business, so anything you own, in terms of assets, may be up-for-grabs by any creditors or the public to whom you are facing liability.

Another big drawback is that you may have a hard time raising any money. In a sole proprietorship, you can't issue stock in the company, so it could be hard to attract capital investors. You also may not have much success getting a bank loan, because banks generally don't favor lending to sole proprietorships.

How to form a sole proprietorship

To create a sole proprietorship, as mentioned above, you wouldn't have to file anything with your state other than a DBA, if you'd like. There can be fees associated with the DBA form, which vary per state. But keep in mind you might have separate documents to file, depending on your business. These could include special licenses or permits.

Why you might choose a sole proprietorship

A sole proprietorship is a good idea if you are a solopreneur with a small business and you are planning to keep it that way. It's very easy to form (you either have to file no documents or just one DBA) and you can get focused on starting your business right away. It's also very cheap to get started.

Especially if your business may not be facing a high level of risk, a sole proprietorship might be for you. A sole proprietorship wouldn't be recommended if, let's say, you ran a business that dealt with large amounts of other people's money on a regular business, or as a health professional, or really any area where the risk of being liable for something serious is high.

Final overview

Sole proprietorship benefits:.

1. It's cheap and easy to form.

2. Taxes are easy to keep track of.

3. You still have the option to have employees if you would like.

Sole proprietorship drawbacks:

1. There is a high level of personal risk for liabilities.

2. You may have difficulty raising funds.

If a sole proprietorship is the simplest business structure for an individual looking to operate their own small business, a partnership might be considered that for two or more people.

In a partnership, the two or more "partners," as they are called, each generally have a say in how the company runs (depending on the structure of the partnership) and each own a piece of the company, including its profits and losses.

In a partnership, you can also have different types of partners - general partners and limited partners - or you can have just a general partnership with all the same types of partners. General partners are equally responsible for everything: all the profits, any potential losses, any liabilities that might come up, and general responsibility for the company, including the amount of work done. Limited partners are those that are basically only partners for a financial reason, in that they invest but have not much else to do with how the company runs. Overall, partnerships with limited partners are a little rarer, as people like to go into partnerships with equal weight.

Imagine a situation where two people decide to open a yoga studio together. Their structure of choice may be a partnership.

A joint venture, formed with a Joint Venture Agreement , is a type of general partnership that only lasts for one specific project or a limited amount of time.

Joint venture is a generic term for any business relationship between two parties for a limited time. A joint venture could be for a brand new business, or just one marketing promotion, or even just a project between two already-formed businesses. In a joint venture, the parties could decide to form a temporary partnership, with a Partnership Agreement , but they don't have to: they can also retain their fully separate legal identities and just operate with a Joint Venture Agreement.

Taxes in a partnership can pass through, just like in a sole proprietorship.

The formation of a partnership, however, can be very complicated. Many states have adopted something called the Uniform Partnership Act, which makes the written Partnership Agreement very important. Partners will need to figure out everything from how they'll run the day-to-day business to what happens if the business folds or if someone wants to leave.

The Uniform Partnership Act is similar to a model statute or model law, in that it was drafted to be applicable uniformly, but states each had to individually adopt it. The Uniform Partnership Act, or UPA, gives guidance on how business partnerships should be formed, governed, and dissolved.

How to form a partnership

As mentioned above, the basis of partnership formation is the written Partnership Agreement, which sets out all of the details of the business relationship between the parties. Unless you also want to file a DBA, you won't need to file any partnership documents with your state.

Keep in mind, however, that as above, you may need specific licenses or permits for your particular business model.

Why you might choose a partnership

A partnership is a good idea if you are running a small business with another individual or a few individuals. As with a sole proprietorship, it's very easy to form (you either have to file no documents with the state or just one DBA) and you can get focused on starting your business right away. It's also very cheap to get started, just like a sole proprietorship.

If you're not sure of the trustworthiness of your potential partners, however, a partnership may not be the way to go for you, as you could be exposing yourself to a high level of risk just because of the actions of your partners. Either way, however, you should always have a well-written Partnership Agreement in place.

Partnership benefits:

1. It's relatively cheap to form.

2. Generally, unless you have a DBA, you won't need to file with the state.

3. Taxes pass through.

Partnership drawbacks:

1. The Partnership Agreement can be a complicated document.

2. It can be very risky if your partners are not trustworthy.

A Limited Liability Company, or LLC for short, has largely become the preferred form of structure for many small- to medium-sized businesses, and even for a lot of solo business owners. The reason for this is because it has a lot of benefits of other types of business structures, without as much of the risk.

In an LLC, there is a lot of customization available for how the business is run. LLCs can be used for small businesses or large ones. You can form an LLC just for yourself or have an LLC with many different members. The main benefit of an LLC is that your personal assets are shielded from liability - hence the name, "limited liability" company.

Taxes still pass through in LLCs. If you are a single-member LLC, the taxation is similar to a sole proprietorship. In a multi-member LLC, you are taxed on just your portion of the profits.

LLCs can, therefore, be formed for almost any purpose - for a single freelance artist or a group of people looking to open a bakery together, for example. LLCs can even be formed for professionals, like a legal or medical practice.

Since all business structures are formed according to the state, and not federal, government, the requirements to file and run the business, especially for the more complicated structures, can vary.

Forming an LLC is more complicated than either a sole proprietorship or partnership, as it involves filing specific documents in a specific form with the state.

How to form an LLC

An LLC is generally filed with your state by drafting Articles of Organization , the creation document for the company. Before this, you'll also have to ensure that you have a business name that will work by running a search on your proposed business name with your state's Secretary of State (usually this can be done easily on the Secretary of State website). An Operating Agreement is also a very good idea to have drafted (though it is not required), especially if you have more than one LLC member.

If you would like to operate under a special name for your LLC, you may also have to file a DBA.

Why you might choose an LLC

An LLC is a good idea when you want to have the maximum amount of liability protection for your business, either as a solo business owner or as part of a team and you don't want to build a corporation (more on that below). It's also a good idea if you still want the simplicity of taxation and the ability to organize your business as you like.

Whenever you file your LLC, make sure you keep all of the records separate to ensure your liability protection. Your organizational records, banking records, and, if applicable, personnel records all need to be records of the LLC specifically, not mixed in with your own personal records.

LLC benefits:

1. You are protected from personal liability.

2. Taxes pass through.

LLC drawbacks:

1. It's a little more expensive and complicated to form than a sole proprietorship or partnership.

2. Your liability is subject to the separateness of all of your records.

A corporation is generally the most complex legal structure , involving a lot of time and resources at its formation and then on through its life. A corporation is its own separate entity - often sometimes compared to a business version of a legal "person." In other words, the corporation is its own body separate and apart from you or any of the other owners, called "shareholders."

A corporation can take one of three main forms: the C corporation, the S corporation, or the lesser-known B corporation.

Most big companies in the United States, like Fortune 500 companies, are organized into a C corporation. It's the "traditional" corporate structure that people think of when they think of corporations. In a C corp, there are owners, called shareholders as noted above, who all put money into the business and receive shares, or stock, in return. The corporation gets taxed on its own - but so do any shareholder earnings, which means that with corporations, there is what's called "double taxation." All that means is that money into the corporation gets taxed as does money to the shareholders. In a C corp, there is almost no personal liability of the shareholders. Additionally, there is the possibility of the shareholders earning a lot of income if the corporation ever goes public.

The S corporation is a slightly different entity, similar to the C corp, but with the possibility of pass-through taxation. As discussed in the other business forms, what this means is that profits and losses can go straight to the owner or owners of the S corp, making it a good idea for small businesses. The S corp is a little more limited than the C corp in most states, however, as it can usually only be held by a certain limit of private individuals (for example, up to 25 owners that all have to be real people, rather than legal entities).

A B corporation is a lesser-known structure than the others and that's because it won't be applicable to most people. B Corps are designed for those that want to form essentially a C corporation but for some social good. The B stands for "benefit." A B Corp is very similar to a C Corp, except that sometimes the corporation receives certain tax breaks.

How to form a Corporation

Corporations are formed by filing a significant document covering the details of the corporation with the Secretary of State, called the Articles of Incorporation . Most corporations need to have a viable business name and go on to obtain a tax identification number from the Internal Revenue Service.

It's a good idea to also draft a document called the Corporate Bylaws , which set down the governing rules for the corporation.

Why you might choose a Corporation

You might decide to file a corporation if you are looking for a lot of growth potential for your business or if you knew you wanted to start bringing on shareholders right away. A corporation is a good idea if you plan to hire a lot of employees, as well.

It's probably not a good idea for very small business or individuals who don't plan to grow at a very high rate, as the expense of setting up and maintaining the structure, as well as the double taxation, would easily make it more cumbersome than its worth.

Corporation benefits:

2. Raising capital may be easier here than any other business form.

Corporation drawbacks:

1. It's more expensive and complicated to form than any other business form.

2. It's also complicated and expensive to maintain.

3. Double taxation may end up costing you more.

A non-profit is different than all of the other business structures - and the difference is in its name. Non-profits are created for a different reason than just generating profit; usually, the reason is some kind of social cause.

Non-profits are tax-exempt entities, and because of this, they need to have a specific purpose that is either charitable, religious, or educational.

How to form a Non-profit

Forming a non-profit requires Articles of Incorporation with the Secretary of State. You'll then need to file specifically to obtain tax-exempt status from both your state and the federal government.

If you plan to have multiple people in your non-profit, drafting Non-Profit Bylaws is a good idea.

Why you might choose a Non-profit

The option for a non-profit is really only there if you have a business that is for charitable, religious, or educational purposes. Once you decide that you do, then you must ensure you really aren't running a business for profit and that the primary purpose is for another reason. If those requirements are met, the non-profit is the best choice for you.

If you'd like to run a business for a social cause, but still want to have the main goal of earning a profit, a B corporation might be better suited to your needs. With a non-profit, one of the main activities will simply have to be fundraising to keep the business afloat. In a B corporation, however, you can do good and still turn a profit.

Non-profit benefits:

1. Tax-exempt status can be obtained.

2. It's the best structure for any primarily charitable business.

Non-profit drawbacks:

1. You must meet the requirements to open a non-profit.

2. Your business can't be run primarily to earn a profit.

When deciding what type of structure might be best for you, ask yourself the following questions:

1. How much time and effort am I willing to put in to set up the business at the beginning?

2. How much time and effort am I willing to put in to maintain the business over time?

3. Is pass-through taxation important to me?

4. What will be personal liabilities be?

5. Am I interested in easily raising capital?

Once you've asked yourself these questions, with the knowledge obtained from this guide, you'll be in a great place to decide what the best structure is for your needs.

About the Author: Anjali Nowakowski is a Legal Templates Programmer at Wonder.Legal and is based in the U.S.A.

- Partnership Agreement

- Articles Of Organization

- Non-Profit Bylaws

- Corporate Bylaws

- Articles Of Incorporation

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

Determine the Legal Structure of Your Business

Free Small Business Partnership Contract Template

Radhika Agarwal

- December 13, 2023

13 Min Read

Consider the following situation: You have a brilliant business idea and have planned your business down to the last detail. You are most probably ready to get going. But, hold on. Did you choose a legal business structure? If not, you might want to decide the same before starting out.

Though picking an option amongst several similar-looking ones might seem intimidating at first, picking the right one can save your business from several legal hassles later on.

A proper legal structure decides whether you’ll stay on the good side of the law or not, both literally and figuratively.

Want to know how? Follow along to find out.

Why Does the Legal Structure of a Business Matter?

Against popular belief, a legal structure not just decides the taxes you’ll pay. It also decides the level of risks to your personal assets (your personal savings, car, house, etc.) and your business’s ability to raise funds through loans and investments .

Going through all of your options can help you decide which one fits the best for your business. Moreover, it also helps you finalize if you would need an attorney’s help or not.

So, if you want to get a quick overview of what different types of business structures would look like, read on.

What Are Different Types of Business Structures?

Depending upon the type of ownership, liability on personal assets, and size of the firm, the following legal structures exist in the US:

Sole Proprietorship

Partnership, corporation.

Suppose you plan on selling artwork, retail products, or any product or service under the sun for that matter. Also, you want to go through as little paperwork and legal procedures as possible.

Then a sole proprietorship might be for you. Especially, if you plan on starting the business under your name, you might not have to do any paperwork at all.

Even if you want to have a domain name , registering your domain name would be the only legal procedure you’ll have to go through. And that’s fairly simple and inexpensive.

Hence, a sole proprietorship is a perfect business structure type for those who have a product or service and wish to start selling it right out.

How to form a sole proprietorship?

A sole proprietorship is fairly simple to form. If you have your business idea and plan sorted, you can start your business. Without any official registration or legal framework whatsoever.

Although you should keep in mind that depending upon your industry you might need to get some licenses and permits before you start.

If you are doing business under a name other than your own, you would also have to get a DBA or “ doing business as.”

A sole proprietorship has the following advantages:

- Easy to set up: A sole proprietorship is fairly easy to set up and involves little or no legal hassles.

- Relatively Inexpensive: Setting up a sole proprietorship is the cheapest of all legal structures. All you have to pay is a small fee for a business license and business tax depending upon the location of your business .

- Dissolution is easy: As your business has no stakeholders except you, the dissolution can happen without any disagreements or problems.

- You are the sole benefactor of profits and sole bearer of losses: Your profits belong only to you and you aren’t answerable to anyone for your losses.

Disadvantages

Although sole proprietorship might look like a great option right now, it has its fair share of disadvantages too. Which are as follows:

Liability on your assets: As you and your business are a single legal entity, if things go south your personal assets would be in danger. i.e., you’ll have to pay the debts incurred through your business using your personal assets.

Difficulty in raising capital: It is tougher for sole proprietors to acquire a small business loan or funding. Banks are often less willing to give loans to sole proprietors as they are considered less credible. Also, you cannot sell stocks to generate funds as a sole proprietor .

Limited tax savings: Sole proprietorships do not get tax benefits like corporations do for offering benefits like medical reimbursements and insurances to their employees.

Suppose you are an architect and want to start a firm with your friend who’s an interior designer.

Depending upon the ratio of contributions you make towards the working of the firm you’ll have a certain share in profits and losses of the firm.

It can either be equal or 40 to 60, etc. Also, the size of contributions can be measured both by the size of your investments or the amount of work you provide.

For example, if your friend has invested a higher sum of money but you work more. So, chances are that your ratio in profits would be equivalent.

Apart from that, a partnership is a lot like a sole proprietorship but instead of being the sole owner of the business, you have a partner.

Your partner would have a predetermined share in the profits and losses of your firm.

How to form a partnership?

Just like a sole proprietorship a partnership is fairly simple to form. The only difference is a partnership agreement .

Having a partnership agreement is crucial to this business structure type. A lot of things can go haywire if you don’t work on pre-decided terms and conditions.

Your partnership agreement would decide your share in profits and losses, the type of partnership you have, and what would happen if you decide to dissolve the partnership in the future.

Types of partnership

A partnership can be of the following types:

- General Partnership: In a general partnership, all the partners have an equivalent stake in the business.

- Limited Partnership: A limited partnership has partners who play the role of an investor and have no say in the functioning of the business.

- Joint Venture: A joint venture is a partnership that exists for a limited period or for certain projects.

The advantages of a partnership can be given as follows:

Easy to form: Just like a sole proprietorship, a partnership is fairly easy to form. And requires a very little amount of legal procedures.

Has more growth potential: As a partnership combines the strengths and talents of all partners, it has more growth potential than a sole proprietorship.

Moving forward without a partnership agreement can be disastrous: You shouldn’t move forward without a proper legal agreement . There are a lot of things that can go awry without one. And coming to terms with an agreement that suits everyone is difficult for a lot of partnerships.

Unlimited liability on your personal assets: Just like a sole proprietorship, there’s an unlimited liability on your personal assets. In such structures, you can lose your personal belongings if your business fails.

Difficulty in dissolution: Dissolution is tougher in partnerships as the business has multiple stakeholders.

Consider the following situation: You want to start a business but have a significant amount of personal belongings that you don’t want to risk.

Then an LLC or a limited liability company might be for you. In an LLC you are taxed only on your profits.

Also, there’s no liability on your personal assets as you and your business are separate legal entities.

An LLC is a fairly new legal structure and is good for industries where lawsuits are common. Moreover, an LLC gets the best of both worlds.

Its tax structure is like a partnership and it has a limited liability structure like a corporation.

Also, unlike a corporation, an LLC can be set up by smaller businesses too.

How to form an LLC?

An LLC is formed by creating a separate legal entity for your business. Although it requires way more paperwork than a sole proprietorship or partnership, it is a more secure structure than either of those.

And you might think that a little paperwork is worth the benefits it provides. And it definitely is! You can form an LLC either on your own or with a partner.

The specific amount of paperwork required for an LLC varies from state to state.

Your personal assets would be safe: One of the major benefits of any limited liability structure is that your personal assets remain unaffected if things go downhill.

The tax structure is beneficial: You are only taxed on your profits in an LLC.

An LLC is tougher to set up: It is comparatively more expensive and complicated to set up. You might have to take some legal advice as well before you set up an LLC.

An LLC has to be dissolved within 30 years: An LLC has to be dissolved in 30 years or less, depending upon your pre-decided agreement. Although, all states have different laws regarding the dissolution of an LLC.

Corporations are one of the most commonly known types of business structures out there. They are usually larger, have more employees, and take the highest amount of legal work to set up.

The biggest advantages of a corporation are its limited liability structure and the tax benefits it gets.

Most of the bigger companies and MNCs follow this structure, but if you have a small business it is neither possible nor feasible to have such a structure. Though, a lot of LLCs and partnerships turn into corporations as they grow bigger.

How to set up a corporation?

Setting up a corporation requires the highest amount of paperwork and legal procedures.

You have to register your business name and get your EIN or employer identification number, etc.

Also, depending upon your state and type of corporation the legal procedure for setting up a corporation would differ.

Types of corporation

A corporation can be divided into the following types depending upon its size and functions:

A C Corp is the most common type of corporation out there. Most MNCs follow this structure.

To form a C Corp you collect fundings and give stocks equivalent to the funding to your investors.Although double taxation might be a problem, C Corp has the highest opportunity of getting investments. Hence, most companies follow this structure when they go public. For example, if you are a corporate firm with a large number of employees and investors, you’ll follow this structure. Microsoft, Intel, and Apple are popular examples of C Corps.

An S Corp is a pass-through tax entity and is usually owned by families or small groups.

Also, the motive of a C Corp is to grow big and go public, while an S Corp exists to generate profits for its owners. Hence, both the structures fulfill different motives for their owners. An S Corp is very similar to an LLC and is a structure that can be followed by small businesses. A lot of S Corps turn into C Corps as they grow bigger. Apart from that, people choose this structure mainly for the tax benefits it offers.

For example, organization XYZ works towards the social and economic upliftment of underprivileged children. But at the same time, it has investors to whom it has to send back profits. Hence, XYZ organization is not a non-profit but a B Corp. A B Corp is an excellent way of standing behind a social cause and many states provide tax benefits to such structures. Ben & Jerry’s, Seventh Generation, and Etsy are popular B Corps in the US. If we try to understand this further through the example of Ben and Jerry’s, the company has three main motives- product quality, economic reward, and service to the community. Because Ben and Jerry’s is a for-profit company that stands behind a cause it becomes eligible for its B Corp status.

The most limited possible liability: Corporations give the highest amount of protection to your personal assets. If things go awry, your personal assets will be the safest in this structure.

Corporations have a high potential to raise capital: With the option of selling stocks to get funding and more credibility to get loans, raising capital is fairly easy for corporations.

Taxes are filed separately from personal taxes: As taxes are filed separately from personal taxes in corporations your business becomes eligible for corporate tax breaks.

Difficult to set up: Corporations go through way more procedures, legal or otherwise and are fairly difficult to set up. The structure is also not an ideal one for smaller businesses.

Double taxation: You have to pay taxes on both the earnings of the corporation as well as on the dividend you get from it. This disadvantage mainly holds true for a C Corp.

If you want to work towards a social cause and channel all your energies towards it, a non-profit organization would fit the best for you.

The chief difference between any other legal structure and a non-profit is that a non-profit solely exists for fulfilling a social cause and not for earning profit.

Such organizations get tax-exempt status from the government.

As a nonprofit is run for serving society and for personal values, it does not have any advantages or disadvantages as such.

But you should keep the following things in mind before starting a nonprofit organization :

- Your setup will be similar to that of a corporation: You’ll have to register your business’s name as well as your taxation number as a non-profit to get tax exemptions.

- You should have a solid system in place to collect funds: If you choose this business structure, generating funds to keep your firm going will be a chief priority.

In conclusion, the legal structure of a business plan greatly depends upon the said firm’s function and size. The number of legal formalities you are able and willing to fulfill, the laws of the state your business will function from, and so on.

Also, getting legal advice from an attorney while deciding your structure can be of great help for your business. A little expense and effort, in the beginning, can take your business a long way in the future.

Your legal structure would impact a lot of aspects of your business. Hence, you should choose it wisely.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

About the Author

Radhika is an economics graduate and likes to read about every subject and idea she comes across. Apart from that she can discuss her favorite books to lengths( to the point you\'ll start feeling a little annoyed) and spends most of her free time on Google word coach.

Related Articles

How to Write a Business Plan Complete Guide

How to Write Competitive Analysis in a Business Plan (w/ Examples)

Business Startup Checklist: 10 Steps for a Great Start

Reach your goals with accurate planning.

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

- How to Draft an Effective Business Plan Considering the Legal Implications

The road to the creation of a new business is a long one that is often filled with unexpected challenges and accomplishments. While the unpredictable nature of starting a business can be appealing to some, for many there is value in developing a plan to help guide new owners through the first months and years of operation. For this reason, one of the most important steps that entrepreneurs can take when starting out is to carefully and thoughtfully develop a comprehensive business plan.

What Is a Business Plan?

A business plan is both a map and a marketing tool for your business. A business plan helps you carefully set forth the purpose, goals, and priorities of your new business, along with guideposts to help ensure that you stay on the right path. For instance, a business plan may require you to consider what the primary purpose of your business is, or the good or service you intend to provide, who your potential customers are, and how you intend to reach them in an effective and efficient manner. A business plan also allows you to make an honest evaluation of the current status of your business and what you will need to do to get to where you would like to be. This includes taking the time to compile your business balance sheet, analyze existing income and expenses, and determine anticipated financial needs.

Creating a detailed business plan can help business owners acquire outside funding .

In addition, a business plan serves as a marketing tool for new business owners who are attempting to gain financial backing, operational support, or mentoring for their new business. The financial aspects of a business plan lets potential funders or lenders analyze your current income streams and the likelihood of repayment, while the detailed explanation of your business objectives and operational plans helps to convince interested parties that you have taken the time to carefully plan your business endeavors and are invested in the success of your company.

How to Write a Business Plan

There is no one specific way to write a business plan. However, there are key components that most business plans should include, and these are good starting points when working on your own plan. It may also be worth reaching out to an experienced corporate attorney to help you review and revise your business plan before presenting it to others in the business community.

Business plans typically start with a summary of the business and its objectives, and then they describe the operations of the business, the good or service it will be providing, and potential income streams in more detail. Business plans should also include a detailed description of the proposed management structure of the business, including officers or directors and possibly the envisioned composition of the board. Additionally, business plans typically include extensive financial documentation, such as balance sheets, income projections or growth model projections, any pending loan applications, tax returns of the entity, and copies of any relevant legal agreements. If the business has already been in operation for some time, the business plan may also include financial records for the months of operation.

- Summarize the business and its objectives

- Outline how the business is organized and managed

- Describe what the business sells

- Identify potential income streams

- Include financial information, such as balance sheets and projections

Using Your Business Plan