Equity Research Interview Questions

Below are real examples of the most common questions (and answers) used to hire equity research analysts and associates at banks

What are the Most Common Equity Research Interview Questions?

Based on our first-hand experience, as well discussions with equity research professionals , we’ve compiled a list of the top questions to be asked by a research analyst when interviewing an associate. We’ve also added what we think are the best answers to these challenging interview questions. Here are the top equity research interview questions and answers…

If you had $1 million to invest, what would you do with it?

Tell me about a company you admire and what makes it attractive., pitch me a stock (typically will be followed-up with a challenge – e.g., why has the market not priced this in).

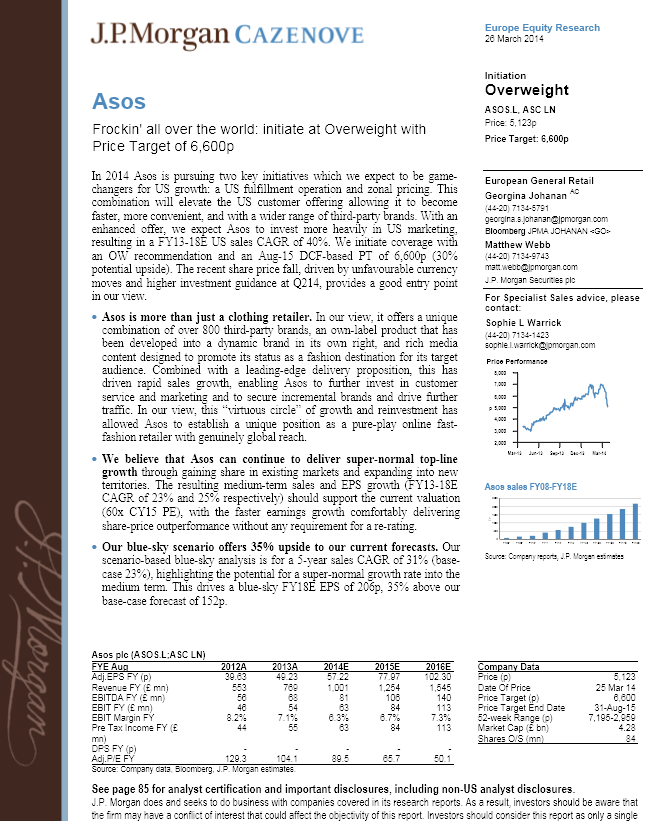

These are all variants on one of the most common equity research interview questions – pitch me a stock . Be prepared to pitch three or four stocks – for example, a large cap stock, a small cap stock, and a stock that you would short. For any company you are going to pitch, make sure that you have read a few analyst reports and know key information about the company. You must know basic valuation metrics (EV/EBITDA multiples, PE multiples, etc.), key operational statistics, and the names of key members of the management team (e.g., the CEO ). You also must have at least three key points to support your argument.

How do you value a stock?

The most common valuation methods are DCF valuation methods and relative valuation methods using comparable public companies (“Comps”) and precedent transactions (“Precedents”).

Why might a high tech company have a higher PE than a grocery retailer?

It can also be shown that the Price-Earnings multiple is driven by (1 – g/ROE) / (r – g) where r is the cost of equity, g is the growth rate, and ROE is return on equity . A high tech company may have a higher PE because growth expectations for the stock are higher.

What drives the PB multiple? Or, how can two companies in the same industry have very different PB multiples?

The PB multiple or Price-to-Book ratio can be shown to be PE x ROE. It is therefore driven by return on equity and the drivers of the PE multiple. It can also be shown that the PE multiple is driven by (1 – g/ROE) / (r – g) where r is the cost of equity, g is the growth rate, and ROE is return on equity.

Since the PB multiple is PE x ROE, this means the PB multiple is ( ROE – g ) / (r – g). If we assume a zero growth rate, the equation implies that the market value of equity should be equal to the book value of equity if ROE = r. The PB multiple will be higher than 1 if a company delivers ROE higher than the cost of equity (r).

Tell me when you would see a company with a high EV/EBITDA multiple but a low PE multiple.

This relationship implies a significant difference between the firm’s enterprise value and its equity value. The difference between the two is “net debt”. As a result, a company with a significant amount of net debt will likely have a higher EV/EBITDA multiple .

What is a beta?

Beta is a measure of market (systematic) risk. Beta is used in the capital asset pricing model (CAPM) to determine a cost of equity. Beta measures a stock’s volatility of returns relative to an index. So a beta of 1 has the same volatility of returns as the index, and a beta higher than 1 is more volatile.

Why do you unlever beta?

When you look up beta on Bloomberg , it’s levered to reflect the debt of each company. But each company’s capital structure is different and we want to look at how “risky” a company is regardless of what percentage of debt or equity it has. To get that, we need to unlever beta each time. You look up the beta for a group of comparable companies, unlever each one, take the median of the set, and then lever it based on your company’s capital structure. Then you use this Levered Beta in the Cost of Equity calculation. For your reference, the formulas for unlevering and re-levering Beta are below:

Unlevered Beta = Levered Beta / (1 + ((1 – Tax Rate) x (Total Debt/Equity))) Levered Beta = Unlevered Beta x (1 + ((1 – Tax Rate) x (Total Debt/Equity)))

What’s the difference between enterprise value and equity value?

This question is commonly asked in banking, but could easily be one of the frequently asked equity research interview questions as well. Enterprise value is the value of the company that is attributable to all investors.

Equity value only represents the portion of the company belonging to shareholders. Enterprise value incorporates the market value of the equity plus the market value of net debt (as well as other sources of funding, if used, such as preferred shares, minority interests, etc.).

Can a company have an equity value larger than its enterprise value?

Technically, yes. Enterprise value is the sum of the market value of equity and net debt (gross debt less cash). If a company has no interest bearing debt but does have cash, then it will lead to a situation where the equity value is greater than the enterprise value.

What are the major valuation methodologies?

- DCF valuation methods

- Relative valuation methods – using comparable public companies and precedent transactions

- Break-up valuation methods – looking at the liquidation or break-up value of the business

- Real options valuation methods – rarer

- Here is an overview of all valuation methods

When would you not use a DCF valuation methodology?

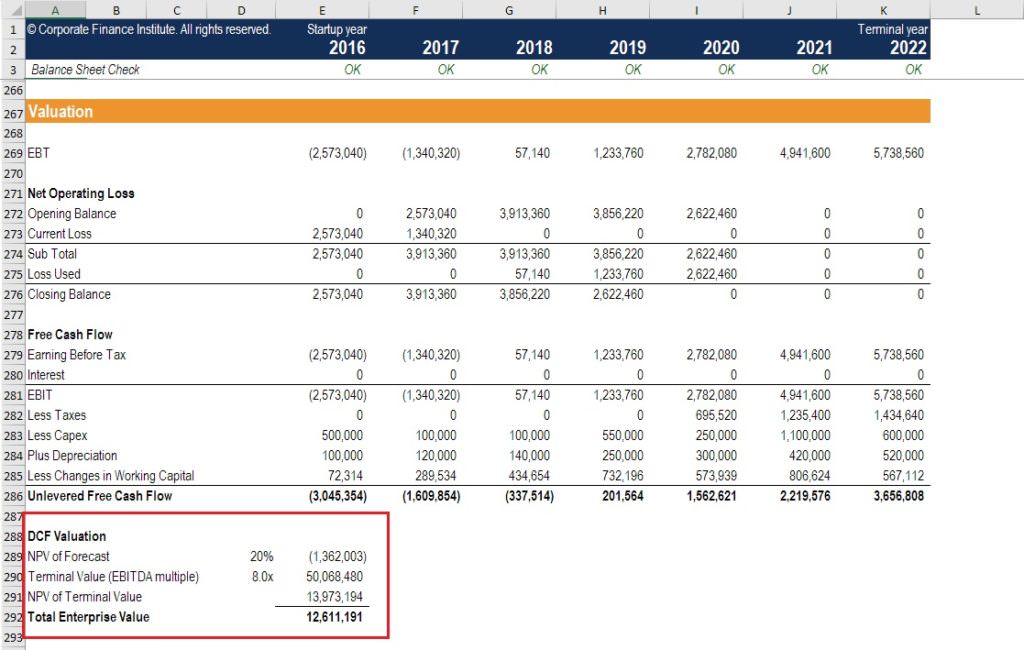

You would not use a DCF valuation methodology when a company does not have forecastable cash flows . An example of this would be a start-up company. Below is a screenshot of a DCF model from CFI’s online financial modeling courses .

What are the most common multiples used to value a company?

This is one of the most common equity research interview questions. Here are the main types of valuation multiples :

Why does Warren Buffett prefer EBIT multiples to EBITDA multiples?

EBITDA excludes depreciation and amortization on the basis that they are “non-cash items.” However, depreciation and amortization also are a measure of what the company is spending or needs to spend on capital expenditure. Warren Buffett is credited as having said: “Does management think the tooth fairy pays for capital expenditures?” Here is an article on why Buffett does not like EBITDA .

Compare EBIT vs EBITDA .

How is valuing a resource company (e.g., oil and gas, a mining company, etc.) different from valuing a standard company?

First, you need to project the prices of commodities and the company’s reserves. Rather than a standard DCF, you use a Net Asset Value (NAV) model. The NAV model is similar, but everything flows from the company’s reserves rather than a simple revenue growth / EBITDA margin projection. You also look at industry-specific multiples such as P / NAV in addition to the standard multiples. Here are more mining valuation methods .

Why do DCF projections typically go out between 5 and 10 years?

The forecast period is driven by the ability to reasonably predict the future. Less than 5 years is often too short to be useful. More than 10 years becomes difficult to forecast reliably.

What do you use for the discount rate in a DCF valuation?

If you are forecasting free cash flows to the firm, then you normally use the Weighted Average Cost of Capital ( WACC ) as the discount rate. If you are forecasting free cash flows to equity, then you use the cost of equity.

How do you calculate the terminal value in a DCF valuation?

This is one of the classic equity research interview questions. Terminal values either use an exit multiple or the perpetual growth method.

Explain why we would use the mid-year convention in a DCF valuation?

With standard DCF, there is an assumption that all cash flows occur at the end of the year. The mid-year convention adjusts for this distortion by making the assumption that all cash flows come mid-way through the year. Instead of using discount periods of 1 for the first year, 2 for the second year, etc., in the DCF formula, we use 0.5 for the first year, 1.5 for the second year, and so on. For training on financial modeling, click here .

More Interview Questions

We hope this has been a helpful guide to equity research interview questions and answers! If you want more practice, take a look at our other interview guides and interactive career map to advance your finance career:

- FP&A interview questions

- Investment banking interviews

- Credit analyst Q&A

- Accounting interviews

- Behavioral questions

- See all career resources

- See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Equity Research Forum ER

Equity Research - Interview Questions

Reviewed by

Expertise: Private Equity | Investment Banking

Please check out WSO's free Equity Research Interview page for an in-depth guide to acing your ER interview.

Positions in equity research are available for seasoned professionals and new hires. New hires out of school will start as research associates and move up the chain to a research analyst after gaining experience. Before any of this though, you must get the interview and show the interviewers you have what it takes. The best way to prepare for these interviews is to follow the markers, learn the common questions asked and practice tirelessly.

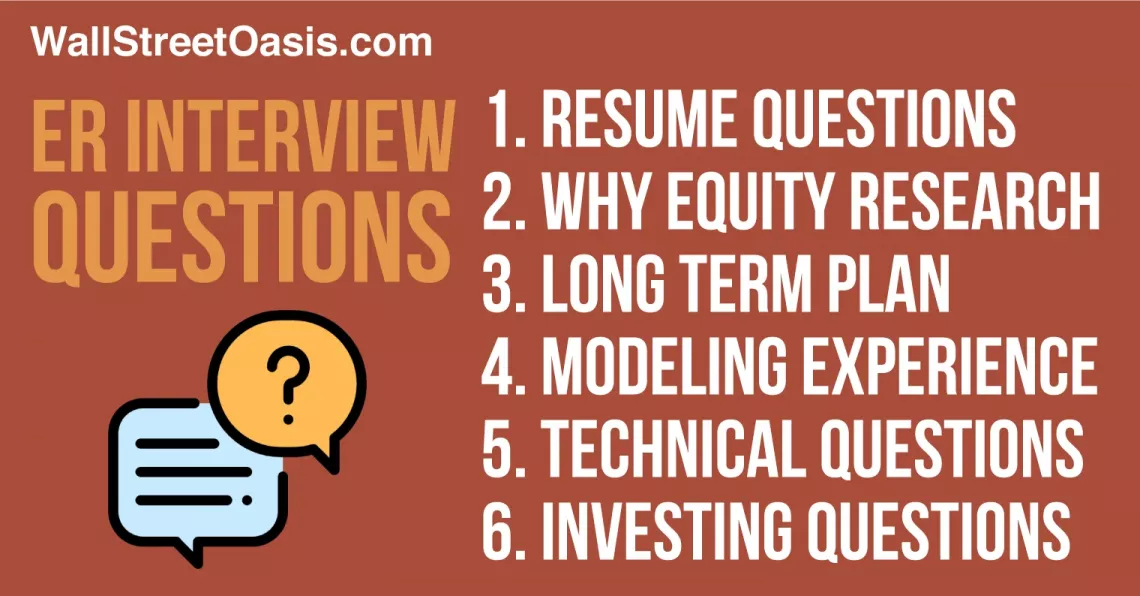

Equity Research Questions - Fit/Behavioral

- Tell me about yourself/Walk me through your resume

- Why equity research?

- Why this firm?

- Potential 5-year plan

- Tell me about a time when… faced a challenge, worked on a team, etc.

Prepare a handful of anecdotes that you can use and mold to answer a variety of questions. Here’s a good tip from @esbanker", a private equity analyst, of things to keep in mind when answering fit questions:

esbanker - Private Equity Analyst: Some key words that should guide your examples for fit questions in Equity Research - analytical, detail oriented, excellent writing skills, strong verbal communication, at ease with financial modelling. Some people tend to think that Equity Research Analysts are mainly 'bookish', but i'd argue that teamwork still plays an important role, especially during earnings season. arguably the most important fit question is why do you want to do equity research as opposed to something more "prestigious" (IB) or "exciting" (S&T).

Techincal Equity Research Questions

Unlike ib interviews, equity research technical questions tend to focus more on actual investing and figuring out your thought processes, but it’s best to be prepared for everything.

- Pitch me a stock

- What do you think about X industry?

- What’s your investment philosophy?

- If you had $X to invest, what would you do with it?

- Why might a tech company have a higher PE than a grocery retailer?

- Tell me when you would see a company with a high EV / EBITDA multiple but a low PE multiple.

- What’s beta?

- Why would you unlever beta?

- Enterprise value vs. equity value?

- Can equity value be larger than enterprise value?

- Know the major valuation methodologies

- Why do some like Warren Buffett prefer EBIT multiples to EBITDA ?

- How is valuing a resource company (e.g. oil and gas) different from valuing a standard company?

- What do you use for the discount rate in a DCF valuation?

- How do you calculate the terminal value in a DCF valuation?

- Market questions

Answers to most of these can be found online, but for things related to the market it’s just a matter of staying up to date. Read the front cover of the WSJ journal and other sources like the FT , subscribe to newsletters you can get daily through email, and always be looking out for new investment ideas that you can bring up in an interview if needed.

Equity Research Associate Interview Questions - The Stock Pitch

Here’s a sample stock pitch, courtesy of @esbanker", a private equity associate.

esbanker - Private Equity Associate: Well, I've recently been following Copa Airlines, a Panamanian airline company, currently trading at $xx per share. Recently, the airline industry has been underperforming the markets for several reasons: compressed margins from the volatility in oil this year, increased competition from low-cost carriers, and overleverage by most airlines (think American or Air Canada). While many airline companies are in desperate need of restructuring, Copa airlines has seen their revenues - now at $1.4 billion - grow at a robust 10% compounded over the last 5 years. Copa boasts EBITDA of approx. $350 MM , Net Income of around $240MM which translates to roughly 18%. Margins have remained stable over the last few years and are significantly greater than other airlines. After running a basic DCF (5 year projections), Copa has an implied price per share of $xxx. In terms of comps , Copa is trading at an EV/EBITDAR of 7.7x which is slightly less than the industry median of 10.3 x, and a PE ratio of 12.9 x relative to an industry median of 14.1 x. Given Copa's strategic positioning in Latin America, its strong operating and financial performance of late, and its relatively cheap share price, I would strongly recommend to buy Copa Airlines. (note, some of the numbers are out of date - this is from an early 2011 model)

Check out a video about the stock pitch below.

Also be sure to check out this thread on S&T interview questions created by @Gekko21": S&T Interview Questions . Most if not all the things in that guide can also be applied to a equity research interview in terms of types of questions and how to prepare.

Read More About Equity Research on WSO

- Career Ladder: Equity Research Vs. Investment Banking

- Breaking Into Equity Research - How Difficult Is It To Break Into ER Fresh Out Of School?

- Choosing Between Buy Side Vs Sell Side In Equity Research?

Looking to Break into the Hedge Fund World?

Want to land at an elite hedge fund use our HF Interview Prep Course which includes 814 questions across 165 hedge funds. The WSO Hedge Fund Interview Prep Course has everything you’ll ever need to land the most coveted jobs on the buyside.

Hedge Fund Interview Course

Patrick Curtis is a member of WSO Editorial Board which helps ensure the accuracy of content across top articles on Wall Street Oasis. Prior to becoming our CEO & Founder at Wall Street Oasis, Patrick spent three years as a Private Equity... This content was originally created by member theglazeb and has evolved with the help of our equity research mentors.

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

A stock pitch written out? There are lots of stock newsletters out there that pitch ideas and stocks - get past the 'make a million dollars with this junk mining company' headline and they will generally pitch you the idea (if that's what you're looking for?). Google stock gumshoe, he tracks, follows, and makes assumptions about the companies those newsletters are pitching. You may want to research the firm you're interviewing to see what their slant on investments are. You don't necessarily have to mirror them, but if they are long term value guys, you probably don't want to pitch a stock idea based heavily on technical indicators.

Although I'm sure articulating and supporting your idea well is more important than the idea itself.

some key words that should guide your examples for fit questions in ER: analytical, detail oriented, excellent writing skills, strong verbal communication, at ease with financial modelling . some people tend to think that equity research analysts are mainly 'bookish', but i'd argue that teamwork still plays an important role, especially during earnings season. arguably the most important fit question is why do you want to do equity research as opposed to something more "prestigious" (IB) or "exciting" (S&T).

as for as stock pitch goes, id recommend finding a business that you are really passionate about (hopefully it's something a little more interesting than brand names like google or apple). There is no exact formula for a pitch, just be logical.

Here's I went about it:

start by talking about the industry and one or two recent trends that are particularly interesting or worth noting.

then link those trends to the company you're pitching, explaining why the company is well positions.

talk a little bit about the operations and finances of the business, ie. market share, end market, key customers, revenue, margins, ebitda , working capital requirements, capex requirements. (don't have to go through all of them; pick 3-4 that are particularly strong; you just want to be able to give some specifics)

I would then transition into valuations: intrinsic first, then followed by relative valuation. for comps I would go with the basics: EV /Revenue, EV / EBITDA , PE , PEG, and lastly - if your feeling confident - Id throw in there an industry specific multiple; just be careful because if the interviewer knows his or her stuff you might have to go into more detail.

Comps helps you transition to how the company stacks up to others in the industry, and you can finish off with why it has a competitive advantage in both the short run and long run.

Finish off with an assessment: make your buy, hold, or sell opinion explicit. THIS IS KEY.

best of luck!

Hi esbanker and nate,

Thanks for the comments! These are great.

esbanker -- I actually just realized that I don't have a good answer for why Equity Research Analyst rather than IB or S&T. What is the best way to approach that topic?

nate -- thanks for the link! I've been looking at gumshoe, but it isn't quite what I am looking for. The stock pitches in those newsletters tend to use a lot of inflated rhetoric rather than solid facts and sound, logical reasons for buy/hold/sell. Gumshoe is analyzing those use letters to see if the information they present makes sense (typically not the case).

What I am looking for is a model answer to a stock pitch question. I.e. in an interview, when asked, "pitch me a stock to invest in" what would be the best way to answer that?

The format that esbanker gave is great start for an outline, but I am looking for a model answer where I can see how it is done and then I will find my own industry/company and emulate that model answer.

Any help would be appreciated

any help would be appreciated! Or a link to already written out sample stock pitch answers

Say that you are interested in equity research because you are a very curious person who is really passionate about understanding the fundamental and macro drivers of a company. In terms of skills, say that you have to be in tune with the markets in ER (overlap with s&t, without all the high risks), but you gain the modeling and analytical skills of an investment banker. Not to mention that for the most part, the lifestyle (hours) are more palatable.

Sample of pitch me a stock (i'd say somethign along these lines - though I would probably fine tune it a bit).

Well, I’ve recently been following Copa Airlines, a Panamanian airline company, currently trading at $xx per share. Recently, the airline industry has been underperforming the markets for several reasons: compressed margins from the volatility in oil this year, increased competition from low-cost carriers, and overleverage by most airlines (think American or Air Canada).

While many airline companies are in desperate need of restructuring, Copa airlines has seen their revenues – now at $1.4 billion – grow at a robust 10% compounded over the last 5 years. Copa boasts EBITDA of approx. $350 MM , Net Income of around $240MM which translates to roughly 18%. Margins have remained stable over the last few years and are significantly greater than other airlines.

After running a basic DCF (5 year projections), Copa has an implied price per share of $xxx. In terms of comps , Copa is trading at an EV / EBITDAR of 7 .7x which is slightly less than the industry median of 10.3 x, and a PE ratio of 12.9 x relative to an industry median of 14.1 x.

Copa has recently acquired Aero Colombia to gain significant exposure to the growing Colombian market (~xx% of market share ), as well as provide quicker access to Brazilian airports. Air traffic in Panama is also expected to grow by xx% by 2014 due to infrastructure development and increased trade from the Panama canal expansion. Given Copa’s strategic positioning in Latin America, its strong operating and financial performance of late, and its relatively cheap share price, I would strongly recommend to buy Copa Airlines.

(note, some of the numbers are out of date – this is from an early 2011 model)

hope this is somewhat helpful

is there a template for running a basic dcf for this sort of thing?

How do you remember all that bro

Thank you so much for the help!

This is really great. Now, I am still a newbie when it comes to equity research. Do you have any suggestions of books or guides that I could read in order to understand equity research a little more? Ideally this would be in simple/layman's terms as I haven't had any prior banking experience and I am fairly lost.

Essentially, a "equity research 101 for dummies" type of book would be extremely helpful if something like that exists.

I found this one book, but it relates directly to the interview. What do you think? http://www.amazon.com/How-Get-Equity-Research-Analyst/dp/1905823932

However, it still doesn't explain the industry to me in enough detail so that I can feel as though I am getting a better grasp on the topic.

Essentially, how is S&T different from equity research? What exactly would I be doing on a day to day basis? Am I more concerned with internal dynamics of a company or macro economic market factors? Who's money are we investing? What are mutual funds? etc etc. Lots of really basic (and I'll admit, probably very laughable questions for most of you). But I'm trying to learn as much as I can quickly.

Thanks! And my apologies if I am being incredibly annoying with my basic questions. I'm trying to read guides or books that will help me understand what equity research is, so that I am no longer as lost.

You can think of the research department as the think tank of an investment bank. In BB's there are usually several divisons: the macro analysts, the equity analysts, the fixed income analysts .

I can speak mostly for equity research, where I started my career in finance. My team was comprised of 3 more people: an associate, a junior analyst, and a senior analyst (note that in research an analyst has seniority over an associate). You usually cover a "universe" of stocks within an industry (ie, aerospace and defense, construction and engineering, automobiles, technology, telecommunications, etc).

your work will consist of getting acquainted with the industry and the companies you cover. get ready to pour over 10-ks and 10-qs. there is quite a bit of financial modeling (tho this will realistically be about 30% or less of what you do overall). lots of focus on the operating model. investment bankers usually have the luxury of using equity research reports for growth projections. but in equity research you have to do tops-down or bottoms-up analysis to come up with these projections from scratch. you run valuations just like in IB , but the metric of choice for analysts is EPS since this is what ostensibly makes a stock move up or down in the markets. your main output is research notes, which could be industry-specific, trend-specific, or (most often) company-specific. these research notes make it to the S&T so that they can add color to their decisions. other investment firms pay quite a bit of money to gain access to these notes.

hours are not bad, usually 7 to 7, but it depends on the team. during earning season (when companies report earnings every quarter), things get a lot more hectic as you have to listen in on earning calls, revamp your models, and publish several notes in a constricted amount of time. had to stay in past midnight a few times.

personally, i hated my team, but i did gain an strong framework for analyzing companies. i don't really know what you mean by " what are mutual funds ?" or, more specifically, how that relates to equity research.

pm me if you have more specific questions (i am happy to send you a sample equity research report so that you familiarize yourself).

Pitching a stock in an ER interview ( Originally Posted: 09/21/2007 )

How important is it to pitch a stock that is in the sector you're interviewing for?

I would not do it.

I would only do it if you are dead confident you know the stock. Otherwise, the interviewer knows way more than you about that stock, and will drill you hard on it. If you can't defend your position, it's gonna be bad.

That said, if you are interviewing for a specific sector, you should be able to talk about names in that sector and being able to talk about it well is a big plus.

I had an interview and turned out the firm I picked to talk about was under the ERA sector. Needless to say I was dead wrong. I looked like a fool and was not made an offer.

thanks for the advice guys.

About the Stock Pitch ( Originally Posted: 08/27/2009 )

I am quite new to all of this so forgive me if this question sounds ignorant. I wanted to know about the nature of the stock you are supposed to pitch during ER interview. Do they only want to hear your arguments for the immediate growth of stocks? Or would it be favorably looked upon to argue for the long-term growth potential of certain stocks that may see little immediate gains?

bump about a stock pitch for SA interviews.

I would avoid a short term recommendation. They're looking for your ability to analyze and value a company, not day trade a stock. I would say your time horizon should be 6 months at minimum, perhaps a year or longer. You want to discuss what makes the company great, why they are poised for growth, etc.

Bad: Buy company A because their earnings come out tomorrow. Bad: Buy company A because the technical indicators on the chart say so.

Good: Buy company A because they are a leader in their market, have a revolutionary new product coming to market, own a defensible competitive advantage, and I think they are going to crush earnings expectations over the next several quarters due to X, Y and Z. You need to back all this up.

Basically, read some equity research reports. Clearly, they want to see if you can think like they do. The types of things commonly mentioned in published equity research are probably the types of things you should focus on in your pitch.

All great advice, thanks!

the Stock Pitch ( Originally Posted: 08/24/2010 )

I am quite new to all of this so forgive me if this question sounds ignorant. I wanted to know how I should go about pitching a stock for a Greentech Investment firm interview coming up. The pitch itself needs to be 5 minutes long - any ideas on where to start, what to talk about etc.?

Many thanks

Tech Interview guide gives some guidance to answering that question...

ah yes it does have some, thanks

Stock Pitch forum ( Originally Posted: 01/23/2011 )

Wasn't too sure where to post this so I'll try here. Does anyone know of any good stock pitching forums? I want to learn how to do stock pitches and how to bash them too! Thanks

none...anybody know of any?

Some of the trading forums have areas where traders discuss equities and the like....

Equity Research - Pitch a Stock ( Originally Posted: 12/21/2012 )

Hey there fellow monkeys,

Can anyone please give me a step-by-step guidance on how to analyze a stock/company? At what accounts/ratios to look at and how to derive conclusions from them...and should I refer to other data except from this?

Also does anyone know where I could find a sample analysis of a stock as I have searched the Internet but unsuccessfully..

If you have unsuccessfully searched you for this you are being lazy or you are incredibly bad at it. WhiteHat did a pretty amazing write up on this site of Fossil I believe. Find that and do your best to emulate it and you should be golden.

There is no silver bullet solution to analyzing an asset; and considering your general question, my two cents would be:

There are two ways to value a “stock”—absolute and relative valuation…

Absolute is basically valuing an asset through projecting and discounting the future cash flows to arrive at a present value. At the end of the day, this method is obviously contingent on various assumptions pertaining to the company, industry (life-cycles), economy, etc. Some toolbag at bag might start throwing around acronyms like “DCF”—discounted cash flow is the rudimentary way to discount a stream of CF…

Relative value is taking an comparing it to a comparable company or industry—“similar assets should have a similar value” might be a good way to think about it.. P/E, P/B and other financial statement ratios will allow you to compare the ratio ‘relative’ to a similar asset… Brocade Communications has a P/E of 13.04 and Juniper Networks is at 56.7…. from this elementary and vanilla approach, you could assume that Brocade is cheaper/undervalue (or just a piece of crap, which it is) relative to Juniper..

Have a great Holiday

Thanks for the helpful advice SFTechUES & Cruncharoo, I apologise for the noob question, but I am at the beginning of my familiarization with the company valuation process...As far as iRX is concerned: is it hard for you to be a bit more socially acceptable? your the equivalent of a fart right now :)

Get yourself very familiar with accounting to understand how each line of IS, BS , CF is related and what drives its. Not the simple shit like oh Change in cash from CFS is added to start of BS Cash, but like how inventory turnover affects WC , etc.

I'm guessing this is for a starting level internship/job and not on a personal investing level?

I'm just curious as to how you even got this position if you have no previous background to even basic investing/accounting.

Anyhow, I'll try my best to help you. I'm an analyst intern at a hedge fund so I have to deal with this every day.

First off, any particular industry you are looking at? Every industry works differently so certain ways you evaluate a company in a certain industry won't necessarily work in another industry.

Ex. A bio-pharmaceutical company, especially a small one, has little to no revenue and earnings. Does this make the company shit? No, because all these companies are focused on research and development . You have to look at their pipeline (the drugs they are testing) and chance of stock dilution in the future.

However, revenue and earnings are critical for companies in consumer retail. That's what they run on. They don't do research and development. So ratios like P/E, P/CF, P/S would be useful in this sense.

So Step 1: Look at the economy and narrow down your search to a particular industry and research the correct way to evaluate them.

Next, start narrowing down your search to several comparable companies in that industry. Start looking through some finance websites and see what's on the news. Which stocks are hot? Which ones are getting publicity (good or bad)? Which stocks are being talked about frequently? Keep in mind that you do not want to make an investment decision based on what you see and hear alone, but it does give you a better idea where to start. You can then start filtering through stocks for the ratios you prefer and start doing some research.

So Step 2: Narrow down to several comparable companies.

Okay, let's say at this point you have finally decided which company you want to do the analyzation on. Let's name this company Whiggets Inc. who is a major player in the automotive industry (Think Chevy, Toyota, Honda size).

Now here comes the hard work. There are many, many different things you have to look into to perform a thorough analysis. Since you in equity research, I am assuming you have to do more of an in-depth analysis than what I have to do (where I work, it's better to spend a week analyzing 10 stocks and being 50% sure of them rather than analyzing 1 stock for a week and being 99% sure of it).

However, I can suggest what you want to research to be thorough:

As of right now, I can't think of anymore from the top of my head but this should be sufficient to make an acceptable equity report/ investment thesis , provided you do due diligence while researching and you research the correct stuff.

So Step 3:Start analyzing your company thoroughly.

Next, once you have all the data/valuations and other research material, format it into something that is presentable. I'm not sure what your firm expects, but mine prefers to have more charts and tables than paragraphs and paragraphs of bland statements portraying the company's status.

So Step 4: Format it presentably.

Finally, after you have basically finished your report, it's time to take a position on the stock. Is it a buy/hold/sell? Do you want to go long/short? Is it a short-term profit stock or does it have sustainable value for the long-term?

These conclusions are arrived at by evaluating your research. At this point of the process, it shouldn't be too hard to pick a position on the stock. You don't necessarily have to be RIGHT, but they prefer you to take a position rather than take no position (it doesn't help anyone if at the end of your report you don't state what YOU would do. That's like making a lot of noise but then having nothing good to show for it. That's just how my boss tells it. Yours could be different, idk).

So Step 5: Pick a position.

TO RECAP: Step One: Narrow Down to an Industry Step Two: Pick Several Comparable Companies Step Three: Pick The "Best" One and Analyze Step Four: Format ReportPresentably. Step Five: State Your Position.

Obviously you have your work cut out for you as you are doing equity research without having ANY prior knowledge about any of this, which is probably freaking overwhelming, but we've all been rookies once. Hope this helps and try not to butcher it too much (Stating Ford is going to collapse because of some hearsay you read on a message board that was actually written by some troll.)

Thanks a lot GrandJury for the detailed response. I am currently studying Finance and did not yet have any courses dealing with company valuation (next term I'll have though). Also, I didn't took the time to study it myself apart from now :P. I am intending to apply for equity research positions in the future and would like to prepare for the interview/position in advance.

Also, except from Blomberg/Reuters to which I do not have continuous access, what are your suggestions for the best alternative market data providers?

FellowMonkey: Thanks a lot GrandJury for the detailed response. I am currently studying Finance and did not yet have any courses dealing with company valuation (next term I'll have though). Also, I didn't took the time to study it myself apart from now :P. I am intending to apply for equity research positions in the future and would like to prepare for the interview/position in advance. Also, except from Blomberg/Reuters to which I do not have continuous access, what are your suggestions for the best alternative market data providers?

Ah. I see. Since you're actually just preparing for an interview, use what I put in my post as a starting guide to expand your knowledge. Build on what I told you because it is positive you'll be asked questions pertaining to the research of equity and all that jazz in the interview.

WSJ, NASDAQ , Yahoo Finance, Finviz are some. It's really not that hard to find reliable sources you prefer. Just google the stock symbol and plenty of websites will show up. You'll have to sift through the sites that are clearly not worth your time but there are plenty of solid sites out there.

Also you can use google.com/finance/ as it will have relevant news for each stock symbol you look up or ones that you have in your 'portfolio' in a feed

Have the similar questions, thanks for your replies.

Here's a website I came across with some in-depth questions to ask yourself when analyzing a company

http://equity-research.com/how-to-analyze-a-stock/

bored help a fellow money with stock pitch idea ( Originally Posted: 01/30/2013 )

Well as a macro guy myself here's a few things to consider:

One could argue that x stock in a particular region is undervalued. Why? Well, it has various subsides from its government, it could be insured by the aforementioned government, or the country is in a recession and one would expect the cycle to shift and consumer spending to be up the up and up, so anyway let's go over some pertinent examples:

Vinici. An old French construction company, currently with a massive cash flow and undervalued due to the current economic credit crunch, but with fundamentals coming back and the company being a key driver in its sector, one would expect it to be a fine firm to buy into.

Another could be Allianz, an insurance company befuddled by bad growth in its region. But if Europe even grows by 1% in the year, the insurance company is looking to turn 10% growth from its low.

Or how about American stocks with Chinese exposure? There are plenty of those out there...

So on and so on.

Honestly, I think you should be picking the actual stock on your own. Getting tips on how to answer, what to look for in the stock, what is expected by the interviewer, and how questions are asked is one thing. But it is YOUR interview and if you really deserve the IM spot you would have enough passion for investing to have your own genuine answer for a particular stock.

Not trying to be obnoxious, so sorry if it seems that way. But I would hate to think I am the only person who believes that you should pick the stock on your own, do the work, and just be smart enough to implement tips from others.

Don't ask for actual stocks from others because that is not what the job is. The job would involve YOU working, not you coming onto WSO everyday to get some stock suggestions so you can then give them to your colleagues and/or bosses.

Pitch a stock ( Originally Posted: 02/11/2013 )

I am from non finance background, so want to get a idea how some one from finance background will pitch a stock in an interview.

So here goes a question : pitch a stock ?

considering that value investors only come up with 1 good idea a year... your better off searching the presentations put out by big investor. that guy ackman tends to put out a couple of public investment pitches...

Stock pitch - Okay to pitch a foreign stock listed on NYSE? ( Originally Posted: 02/12/2013 )

Is it okay to pitch a foreign stock listed on nyse during an ER interview?

Why wouldn't it be?

Yes, but be able to discuss the economics and the main things you should know about investing in said country - are any major accounting practice differences, is the government stable, what are the staples of that country's economy , is there currency risk and can/should you hedge it, etc.

Penny stock pitch in ER interview ( Originally Posted: 04/02/2013 )

Just a question to all you ER guys for an upcoming interview I have. I wanted to know if it is appropriate to pitch a pink sheet stock as a sell in an ER interview and if that's seen as the equivalent of pitching something cliche like apple.

Not all OTC stocks are penny stocks, per se. But I'd imagine you have to be pretty damn sure of what you're saying to consider it. And even then, it doesn't really connect with what they do, since no sell-side analyst is ever going to cover such a stock.

I'd actually be impressed if a kid pitched a penny stock. But make sure you know EVERYTHING inside and out. ANd be prepared to answer the obvious:

- Why are they a pink sheet?

- Why should I buy them versus apple?

- Can I drop $10 mil in this thing without just destroying the bid-ask

Here is you upside and downside from pitching a penny stock

- Upside is it is unique and different from everyone else

- They will unlikely know the story so you can get away with knowing less about the company

- If it is related to the space you are interviewing for then you are okay but if it is not you'll look at bit "off"

Downside. 1. They won't know if you're making things up 2. They could think you are a young "immature person" out of the gate if you're pitching a random 0.0001 cent stock

Overall if forced to choose though it is likely better to choose a well known stock in the space (Defining penny stock by actually being sub $1.00 stock price, no volume etc etc and not something that is an ADR share and is really actually a large company.

With that said choose a relatively well known company to pitch to an Analyst or group because of the following reasons.

- If you choose a company they at least "kind of" or do "know" they can see how much work you've put in to learning the story. If you do your homework you get brownie points for 1) knowing the story well 2) being able to talk about fundamental analysis 3) being well versed for a young person in the room.

- You can "tilt" the interview, if you know the analyst is outperform on "value based" stocks versus " growth stocks " you simply pitch him a deep valuation based stock

- Large companies have high trading volume, this is important because large Equity Research platforms ... do not cover penny stocks.... You run the risk of them thinking you don't understand equity research as they would never initiate coverage on the company.

So overall there are your puts in takes, if you really think you got it locked up go for it.

Finally the below was left on a separate thread to explain a stock pitch (Please Ignore if not of Interest) 1) story of stock, 2) why you think community doesnt have it right 3) talk some fundamentals.

"I am pitching Apple at these levels because I believe the investment community is undervaluing the release of a possible iWatch, iTV and even an iPhone Mini. Every three years the company tends to release a new major product line (iPad 3 years ago, iPhone 6 years ago) so I would not be surprised to see a new major line up act as a kicker to the stock in CY13. The bears are certainly going to point to the recent disappointing guide and softer than expected Dec-qtr results, however with three possible products coming out and a ~$300 price point ex-cash the company can buy back all of its shares with 6 years of flat free cash flow . With that said i'd be long the stock at these levels"

Double post

WallStreetPlayboys: 3. Large companies have high trading volume, this is important because large Equity Research platforms ... do not cover penny stocks.... You run the risk of them thinking you don't understand equity research as they would never initiate coverage on the company. "

This to me is the deal breaker. They would question whether you understand the business and might doubt you are a good fit.

I would talk about a stock with a broad secular theme so you don't get bogged down in the technicals more than necessary. It's more about showing you can have an intelligent discussion and are truly interested than being "right".

Funny story, the day I got my offer for ER the stock I pitched in every interview reported after the close and get absolutely smoked. Missed earnings, lowered guidance, down 20% the next day. My portfolio took a big hit but I was still laughing my ass off.

I wouldn't do it personally. The risk of not being taken seriously isn't worth the possibility of differentiating yourself.

Thanks for the insight!

Pitch Me A Stock - ER interview ( Originally Posted: 05/07/2013 )

Hi guys. It seems that in an equity research interview , the inevitable pitch me a stock question is going to come up.

What I wanted to know is how much in detail should this stock pitch be? What facts and figures are you expected to know? Some people suggest having 2 or even 3 stocks ready for a pitch, so it seems like it'll be difficult to remember figures for all the companies? Will last year's revenue, profit, current share price, P/E be enough? Also, should you rate it simply buy/sell or provide a target price too?

Any other comments regarding the stock pitch will also be appreciated. Thanks.

if you could talk about a stock like this article http://www.wallstreetoasis.com/blog/apple-news-noise-and-value i think you are in good shape.

All that is historical info., you need a forward looking stance with catalysts you think can happen within 18 months.

I been on a few equity research interviews before landing my currently gig. I always interviewed with two pitches in mind. I discussed the landscape of the company, the market, revenue drivers and a price tag. I would try to pitch the stock under 5 minutes max. I always left a research report, I wrote on my own with my interviewer.

You don't need to do a ton of memorizing. I think the only figures you really need to know are....revenue, ebitda , net income , P/E ratio, dividend yield, and market cap . And even then you won't be listing those off, you'll just be using them as evidence to support your argument. And don't memorize them, just use rough figures. "Revenue is around 8 billion / year right now and showing growth in the early teens" is fine. P/E ratio just use the nearest whole number..same with dividend yield, market cap you can round to the nearest billion, or maybe even nearest 10 billion for larger companies.

Basically what I did during my interviews was I started by telling a story. My example was always SLM. SLM traditionally has relied on FFELP loans as its main source of income, but in 2010 a law was passed that.........as a result, SLM is transitioning to the private loan market.....I think the markets are overstating the detriments of no longer being able to issue FFELP because SLM's current portfolio makes up 80% of their revenue and is set to amortize over the next 20 years......further, I think the market is underestimating the growth opportunity in the private market, as SLM is only trading at 8x earnings, whereas most companies in this market trade at 12x earnings, and SLM's strong dividend of 3%+ support the stock etc etc etc.

Stock Pitch - Normal to have 2-3 catalysts be top 2-3 risk factors ( Originally Posted: 12/28/2013 )

I am currently working on a stock pitch for my own educational purposes. I am going through the company's 10-k looking at some of the risk factors they mention and many of the top factors that I believe should be mentioned are also the catalysts I have put for the company's growth. For example, a potential catalyst for this company is opening new stores/expanding their geographic footprint (since they are only located in one part of the country currently). However, one of their main risk factors is that they may not be able to open these new stores successfully and operate them profitably. Is this normal to have some of your top 2-3 catalysts also be your top 2-3 risk factors? I don't really see a way around this happening. If anyone has some thoughts/insights, I would really appreciate it. Thank you.

Stock pitch for mutual fund equity research position ? ( Originally Posted: 04/17/2014 )

I know for HF they usually ask for stock pitches during the interview..but what about an equity research position with a mutual fund? Do they ask for stock recommendations? (this position is for experienced hire: 1+ years of experience)

Prepare stock pitch for 20 minute ER interview? ( Originally Posted: 04/25/2014 )

I have what I guess is a superday (isn't it kinda late to have one?) for a Summer ER internship. I am speaking to 4 people, 20 minute each. This is the first time I interview for an ER position, so I'm not sure how to prepare. I don't really have a stock pitch, although I could just use the stock I'm researching for a valuation class. Should I prepare a stock pitch? 20 minutes seems like a really short amount of time for an interview including a stock pitch.

From my past experience interviewing for ER positions, you will most definitely be asked to pitch a stock for a buy (maybe for a sell also). This is probably the most important part of your interview so put your hearing ears on.

High level - pick a stock that you have some knowledge of. Since know the gaming sector well, i will pick a gaming company to illustrate. Let's say it is MGM. Take the following top-down approach.

Basically you should begin by discussing the overall U.S economy and the stock market and how both have fared YTD and where you see them going. For example, you will say that historically all bull markets that make it through to the sixth year typically go up by 20%. We are in a sixth year and so far have been flat YTD so we should springboard from Q2 through year end. Keep your guard on here as they will throw something like "quantitative tightening" at you to poke holes in your thesis.

Then focus on the sector. In this case gaming is a cyclical business so if the economy improves then this sector should fare well as well.

Then you will have to make a bull case for the stock. Basically you need to know how the valuation looks like as of current (p/e multiple vs historical etc..) and come up with a target price. Let's say the stock currently trades at $25 and can go up to $35 in a year. You should be able to bridge the two prices via your bull thesis. For example, you will say that due to multiple expansion (due to Las Vegas convention market improving) you see the stock price going up by $5. Another $5 will be due to improvement in asset utilization (compare the Rev/empl for this company to a lean competitor) and mention the opportunity for improvement. Finally the last $5 will be due to new properties coming on board (name them).

One thing these analysts get a hard-on for is if you mention the downside risks to the stock. Take an opportunity to mention something like "if MGM cannot penetrate the Japanese market then investor sentiment can cause the stock to be undervalued for a short period of time."

All in your pitch should not last more than 5 minutes. Take the first minute to introduce the company and why you chose it, 3 minutes to substantiate your case, and one minute to conclude.

Since you seem new to the business they will ask for a 3 statement model and a writing sample. Hate to say this but if you don't know how to put together a 3 statement model you are out of luck unless you can cram. Shoot me a message and i can point you to a website.

CFA Charterholder

Great response. Quick question: do you think it's necessary to build a DCF model for a stock pitch for an entry level ER position? Thanks!!!

Wow, that was very helpful. Thanks a lot. Also sending a PM.

Exactly what CFA said. Start with the top-down approach of the economy, fed, ceo of the firm your recommending, the firms value proposition, financials, competitors, price, technical analysis - the whole 9 yards. You will be good, and practice in front of teachers or your family friends.

do apple im sure they've never heard that one

Stock Pitch: A Page from MBB 's Book? ( Originally Posted: 12/30/2014 )

This question is addressed to WSO users with work experience in ER . If you were listening to a 1-3 minute stock pitch from an inexperienced candidate, how would you react if the pitch was largely focused on " corporate strategy " points? E.g., competitive positioning, market segmentation/sizing, 5 forces industry analysis , etc.

This is not to say that the pitch would exclude fundamental analysis ; just wondering what ER analysts/associates thought of corporate strategy as it pertains to investment theses. Any insight would be greatly appreciated.

I'll give you the typical consultant's answer - it depends. Some interviewers/analysts will like it, others will think it's BS . It makes more sense if it plays to your strengths and background (e.g. if you are trying to switch to ER from consulting).

I think it would be fine (maybe even great as many focus on rather more easily observable points like cheap valuation + some sort of vague understanding of sector direction).

If you do what you laid out above + hit on other key points (valuation + catalysts etc.) atleast in simplistic fashion, then it should be fine.

Topics for Fall Equity Research Interviews ( Originally Posted: 07/28/2016 )

Simply put, what is everything a student should know going into an internship interview for Equity Research this fall? Examples from past interviews and/or emphasis on current events would be appreciated

I can in no way tell you "everything", but I can provide some tips as I just recently went through the process of ER interviews.

- Have a good sense of the market environment and current economic trends (have an opinion on things such as the Brexit , Monetary Policy, etc.) and how they can affect certain sectors/the overall equity market .

- Make certain to have not just one, but multiple stock pitches prepared. You will more than likely have to pitch a stock or two. If possible, find out who you will be interviewing with and do not pitch a stock that they cover. It is acceptable to write some notes on a notebook/padfolio to help guide you.

- Brush up on your financial ratios and financial statement analysis .

- Like any interview, make sure that you can answer the typical questions: Why ER , Why this firm, Why are you qualified?

Hope this helps a bit.

E/R 1st Round Interview ( Originally Posted: 08/12/2009 )

I am looking for some guidance on how to perform and what to expect for a first round equity research interview via telephone. This is for a BB and will be conducted over the telephone.

I would like guidance on the process from top to bottom (Fit, Qual, Quant, Behavioral...everything).

Anyone who has actually going through or is working in equity reaseach please chime in with what division (to see if questions are geared towards the sector) and with what level bank (ie. Boutique, MM , BB).

I've been in ER at boutique and bulge bracket firms and have interviewed associates at both. The key things they'll look to assess you on are:

Analytical skills - comfort level analyzing financial statements, experience looking at key financial ratios, ability to absorb lots of information, figure out what's important, and draw conclusions

Communication (written & oral) skills - can you make logical and persuasive arguments? What experience do you have doing this? Are you comfortable having and defending your opinion?

Relevant Skills (modelling, research, valuation experience)- have you picked stocks before? what stocks do you like and why? How resourceful are you in finding information and developing sources of information? Can you get stuff done without a lot of guidance

Fit - Research is very flat. The relationship between the Analyst and Associate(s) is key. You just have to hit it off. Can't prepare for this.

Here's a summary of some of the responsibilities, terms, etc you should know http://bit.ly/gXYks

Gotta Mentor www.GottaMentor.com Connect to the Advice & People You Need to Achieve Your Career Goals

Thanks Former MD! That post was DENSE, every word has a shit ton information to it.

I will be looking at that website to help guide me on this. Basically, I HAVE to perform well on this interview. This is probably one of the last big opportunities I have to break into a meaningful finance position. If i get the job I can do it and do it fucking well, so I am doing as much research as possible to help myself out.

Thanks again.

swagon: Go team!

I am also thinking of rereading my CFA L1 book (sitting in December) and more specifically the Equities/Financial Reporting Analysis sections.

Any other advice? I feel like FormerMD pretty much left no room for anyone else to say anything!

What is the lifestyle like being in ER ? I have looked through the other threads but most seem a little outdated. I am not afraid of working 90 hour weeks and going in on the weekend, in fact I would prefer to have a job that rides me.

Sector that I will (hopefully, everyone pray) working in is Transportation with a focus on Auto Manufacturers, this seems to be getting a lot of news lately.

Also, I got the call from the recruiter yesterday that they were considering me for the interview/position. Is this a good sign that she reached out to call me? Also, I have not heard anything today, should I be worried? Finally, they said that there will be no relocation reimbursement and I will have to fund my trip to the interview location should I make it past the 1st round (telephone).

I am very nervous/anxious/excited for this possibility. I am really worried now that I havent heard anything in 24 hours, any insight on the normal cycle time would also be GREATLY appreciated.

Thanks FormerMD for all of your help!

Interviewing For A Specific Group- Equity Research ( Originally Posted: 09/07/2017 )

I have been fortunate enough to land a few interviews for equity research positions for specific groups. Based on your experiences, what level of knowledge of the industry is expected for an entry level ER associate role? Should I have a long and a short for companies within the group I'm interviewing with? Or is it expected that coming from a big 4 background (auditing tech companies) that I would not have that much knowledge about the specific industries? So far to prepare I've been reading recent news on the WSJ etc. about companies within the industries, in addition to looking over some industry primers.

I don't think they would expect in-depth levels of knowledge about the industry (unless your background is in it) but would definitely expect you to know the basics of the sector & a little more about the stock you are pitching (i.e. you will look dumb if you pitch Disney but don't know when they are planning to roll out their new streaming service)

Also, I would definitely have a long & short ready for that specific industry, but probably not a stock they cover. Its a good way for them to see how interested you are in the stock market & their sector. I have been asked for a short pitch only once in my interviews, but if you don't have it ready, it might take you by surprise.

I would say you should be knowledgeable about the major trends in the sector you're interviewing for and have an opinion about them and the possible direction things will go, but I don't think its necessary to have your stock pitches be in the same sector. This could backfire because it will be harder to sound smart considering the interviewer knows the sector backwards and forwards and could easily stump you with questions. The purpose of the pitch is to test your ability to present a coherent and logical idea in a concise manner while being knowledgeable enough to handle follow-up questions, not necessarily to test you on the industry. That being said, you should be able to answer why you want to cover that particular sector, or at least why you would be good at it/how your experience prepared you. Have both a long and short prepared just in case.

I came from big four into ER . I pitched a large cap and small cap in my interview. Pitching a short is great, but not essential, as it's a lot harder than a big. Again you don't need in depth knowledge, but you need to have a conviction and identify good critical factors.

Thanks for your response. How detailed were your stock pitches? I usually give a basic intro to the company (a relatively unknown small cap), a few reasons why I like the company and then the valuation . I'm not sure if its better to keep it relatively brief and provide more details in follow up questions or provide an ample amount of detail in the original pitch .

Boutique ER Interview Prep ( Originally Posted: 12/07/2017 )

deleted.deleted.deleted.deleted.deleted.deleted.deleted.deleted.deleted.deleted.deleted.deleted.deleted.deleted.

Hey theglazeb, I'm the WSO Monkey Bot and I'm here since nobody responded to your thread! Bummer...could just be time of day or unlucky (or the question/topci is too vague or too specific). Maybe one of these topics will help:

- Restructuring Interview Question

- Point72 Interview Nightmare

- BCG first round interview

- Failed joke attempt in interview

- Interviewing For Infrastructure Investment Roles

- Questions to ask Interviewer

- Said "sus" in an interview

- More suggestions...

Fingers crossed that one of those helps you.

Equity Research Interview Final Round ( Originally Posted: 01/18/2018 )

I have my final round for an equity research associate position today. The analyst said it will be a report writing assessment where he will provide an M&A press release and presentation, and I will have 2 hours to turn a report around. He said there doesn't have to be any quants, he's only looking for thought process, structure and writing style.

Does have anyone know how these reports are typically structured and what type of information is usually included? I'm thinking of starting out with a brief summary of what my revised EPS projection and share price would be, followed by 3-4 main points from the deal that will impact the business. Then I will expand on each of the main points and conclude with why I think my EPS projection/share price is warranted.

If anyone knows where I can find a sample, that would be helpful as well - last round I based my report on one of the analyst's reports and he specifically mentioned the structure and writing style was great. Unfortunately I don't have access Thomson/Capital IQ/Bloomberg so I am only limited to Google.

Hey Adrian-Wong1, I'm here to break the silence...any of these links help you?:

- Fidelity- Equity Research Internship- Final Round Internship Equity Research Final Round equity ... direction to save time. I have a final round with Fidelity next week for a summer internship in equity ... research in London. This is my first ever interview for a buy-side role. At each of my BB interviews ...

- BB Equity Research Final Round Questions Is there anyone who has interviewed with a BB Equity Research for SA position in the past. Please ...

- Final Round Help. I am almost an Associate straight out of undergrad! Head of Research , done a modeling and writing test, and finally , I am at the last round . The group is ... I am at a non-target school (Arizona State University) and have made it to the final round at ... Wells Fargo Securities for a position as an Equity Research Associate. Yes, an Associate straight out of ...

- So many 1st round interviews...so many dings even just IB, I'm gunning for fldps and 3rd tier consulting jobs, and equity / FI research . IB ... dinged me immediately too though. How many first rounds did it take for you guys before you finally ... landed a job? I'm thinking it takes about 100 first rounds before there is a statistical chance for ...

- Fidelity Final Round Full Time Decision-ER Hi WSO, I was wondering if anyone hears back for Fidelity Equity Research Associate Full Time ... Decision already? I interviewed a while back ago and have not heard back yet. Thank you, Long time WSO ...

- Equity Research- Interview Questions Equity Research Interview Questions Positions in equity research are available for seasoned ... writing the reports. Equity Research Questions- Technical Unlike ib interviews , equity research technical ... also be applied to a equity research interview in terms of types of qu

- Susquehanna International Group (SIG) Equity Research Associate First Round Intervire brainteasers, probability and stock pitch? ANy take on this? Thank you! Equity Research SIG ... Hi, I will be having an upcoming phone interview with an HR for this position. I would love to ...

- Presented a 50 page stock writeup at a final round interivew- no response at all? a recent situation has got me peeved. I made the final round interviews at a large mutual fund company ... I certainly understand that many first round interviews in person or over the phone don't go ... 5 weeks ago after several successful earlier rounds . For the final round , I was given a month to work on ...

Calling relevant professionals! Lafanador01 Puntambekar vmejia

If those topics were completely useless, don't blame me, blame my programmers...

2nd Round Interview -- ER ( Originally Posted: 07/29/2013 )

First round interview went pretty well. It took them 3 weeks to finally get back to me and schedule a second round interview.

On Friday, I met with two new people and both meetings went very smoothly. Then I had a "writing test' which was a quick and dirty mock case study where I had to write a mock earnings press release. I used DCF with some applied assumptions as well as some quick valuation methods to arrive at the current stock price and a target price. It was not as easy as I expected though and they purposely inundated you with extra information.

After the writing test the person I met with in the first round took me out to lunch with the group. Lunch went pretty well, and at that point I was kind of expecting an offer. No offer and they told me they were still interviewing other candidates for second rounds and they didn't have a definite timeline. This surprised me. I guess they will review my writing sample, but I went from feeling very good about the interview to somewhat confused in that they didn't even offer me a timeline.

Given that they took so long to get back to me after the first round, should I expect another couple of weeks to hear back?

They'll interview everyone before they make a decision and they'll delay letting you know that your rejected until offer person has signed.

Therefore, you really have no clue until you hit about the 4 week mark probably (but later the worse obv).

Just got a response from a thank you email that I sent to one of the associates that interviewed me last week. Said in the middle of earnings season but to reach out for any questions.

Good sign I guess? Should I follow up with any insightful questions or just stay put and wait?

Long Sendrax: Just got a response from a thank you email that I sent to one of the associates that interviewed me last week. Said in the middle of earnings season but to reach out for any questions. Good sign I guess? Should I follow up with any insightful questions or just stay put and wait?

That's fair. My networking game has been put on hold for the time being cus of earnings season, so you should expect to hear back from them whenever they have some free time. If you want to coordinate your e-mails so they have the best chance of seeing em quickly, look at an earnings calendar and pick a day when none of their companies report.

Just revisiting this item here. Time to follow up on this interview? It has been a week and a half. They did say they were finishing up earnings season but they also said to feel free to send them questions. Is it a good time to send a question? If so should I be direct and ask an associate where they are in the hiring process?

Long Sendrax: Just revisiting this item here. Time to follow up on this interview? It has been a week and a half. They did say they were finishing up earnings season but they also said to feel free to send them questions. Is it a good time to send a question? If so should I be direct and ask an associate where they are in the hiring process?

Whats the position?

StryfeDSP: Long Sendrax : Just revisiting this item here. Time to follow up on this interview? It has been a week and a half. They did say they were finishing up earnings season but they also said to feel free to send them questions. Is it a good time to send a question? If so should I be direct and ask an associate where they are in the hiring process? Go for it

Should I go through HR or ask the associate who said to feel free to ask him questions? I am sure the associate will be asked his feedback but he is not the decision maker.

Also, I am had a first round interview with another ER shop. Should I include that in the note? I don't want to come off as too aggressive.

Thanks in advance. Hoping to handle this situation as best as I can.

Long Sendrax: StryfeDSP : Long Sendrax : Just revisiting this item here. Time to follow up on this interview? It has been a week and a half. They did say they were finishing up earnings season but they also said to feel free to send them questions. Is it a good time to send a question? If so should I be direct and ask an associate where they are in the hiring process? Go for it Should I go through HR or ask the associate who said to feel free to ask him questions? I am sure the associate will be asked his feedback but he is not the decision maker. Also, I am had a first round interview with another ER shop. Should I include that in the note? I don't want to come off as too aggressive. Thanks in advance. Hoping to handle this situation as best as I can.

Talk to the associate. Waiting a week and a half to follow up on your interview isn't aggressive, it's pretty passive.

5 things to think about during an ER interview to make it sound like you know what you are talking about ( Originally Posted: 04/27/2014 )

I noticed there wasn't a lot of interview advice particularly geared towards ER so I'm just writing down a few things to say during an interview that will definitely make you stand out.

1) If you get the question who is the most important client to you, always answer the trading desk. They are the ones who risk the bank's capital so they should get priority. For any material news on your universe you should always send a quick email to the traders covering your space telling them how this is going to effect your stocks.

2) Actually invest in the stock market. It is painfully apparent when a person is lying about a stock they say they invested in but haven't. Open up a Scott Trade account and throw a couple hundred into a name you like. You will definitely get a crash course in investing when you have skin in the game. 3) When you pitch me a stock don't just tell me if it's a good buy or a good sell. Tell my why is this a good price point to enter and what is a good price to exit out of. Follow that up into why should I invest in this particular sector over another. Bonus points if you manage to say the phrase "sector rotation" correctly in your pitch.

4) Don't get wrapped up on your initial sector coverage. Odds are you're going to move sectors quite a bit in your career. What you should most care about is the analyst you are working under. He will have the most impact on your career and how much you learn.

5) Don't be a complete finance geek. Have an interest outside of work and be able to back that up with small talk. Tell me about your upcoming study abroad plans to Spain or your opinion on NFL free agency this year or that iPhone app you are programming. The interviewer will want to know if you are personable or not. At the end of the day ER is a relationship business. Our goal is to help generate volume for our trading desk and to service our clients. That DCF you spent 3 days working on, the 50 page report you wrote and that 20 company slide deck are just means to an end. They are just tools we use so we are be able to speak to our clients.

Just normal small talk. Complain about how awful this winter was, ask them their opinion on the last GoT's episode, what are there plans for Easter, best ways to find an apartment in NYC , etc. From there you can go into the usual stuff about about their career and finance in general. If you know they have been in finance for awhile ask them war stories about the financial crisis and what it was like to work under such duress. That always kills about half an hour.

Great post. Thanks for this.

Same fit questions . You'll probably be asked valuation questions during your pitch on how you arrived at your price objective.

Don't forget to use the word "color" often. It's critical.

Miser: Don't forget to use the word "color" often. It's critical.

If I ever ran a group/division/company, my first order of business would be to ban that word.

"Get more color on this report." "Get more color on this new client." "Can you get some more color on this calculation?" "Can you get more color on the color of this colorful presentation?"

As an associate in research you only have 3 clients (in order)...your analyst; your trader; sales

That generally is true but for internal communications I cc every one in the same email so it they get it at the same time and then I give them a call or visit the floor if it's truly material.

Just nitpicking but even if trading desk is top client (commissions) they are different ways of getting paid - i.e. some analysts go for the broker vote in order to get volume, in which case you might interact with sales more.

But ya stock pitch with a view on valuation (method, comps etc) really is key.

thanks bearing, good post

Great content, especially since I am heavily pursuing an associate position currently. I am looking at one that deals with capital equipment in a particular field. I feel like that would differ a bit from a normal associate or analyst position. Am I way off base with that? Should I still have a stock pick from that field ready to go?

I don't understand your question but if you know specifically what industry you are going to be assigned to I would definitely do a pitch on a company in the sector. This leaves you open to some tough questions but it it also gives you the opportunity to demonstrate your perpetration.

Equity Research Analyst by Gillian , excellent preparation

Could you elaborate more on #3? Specifically, how do you identify the proper entry and exit points for a specific stock without doing an in-depth model? The only other way I can think of is technical analysis which I imagine an ER interviewer would offense to

There is always 2 sides to a trade, when to buy and when to sell. If you pick up a research report there is always a price objective along with the overall recommendation. That PO is the result from your valuation analysis be it comp, transaction, DCF , SOTP, etc. No matter what you are pitching the cornerstone of any trade, heck the cornerstone of finance is valuation. If you uncover in your research that the asset is trading below what you think is fair market value then that is a good buy. I want the person who is pitching to tell me why I should be interested in this stock, what do they see as a PO for that stock, what are the catalysts for that PO to happen and what is the time frame you expect this to happen. It's a tall order but that is the essence of what you are going to do on a daily basis in ER .

Undergrad ER interview ( Originally Posted: 06/20/2009 )

What kind of questions/interview can I expect as an entry level ER analyst at an NY BB? Will I have to walk someone through a DCF or WACC , or is that reserved for MBA interviews? How in-depth does a stock pitch have to be? Will I have to know specific numbers from the companies' financials?

Depends on your educational background. IF coming from a target with liberal arts (not finance), then you shouldn't get very technical questions.

If however you are coming from a state school, have finance background, or study finance, I would make sure to know DCF / WACC /different multiples.

I have extensive posts on the types of interview questions below. Feel free to reach out.

Chase Us, Break In http://chasingconsultantsbreakingbankers.blogspot.com/

Assume the worst and you'll be prepared. You should expect to know different ways to value a company. You should be prepared to give a stock recommendation and don't make the mistake of focusing only on qualitative factors (great brand, growing industry, strong management team, cool products that consumers love). Talk about the quantitative factors (valuation versus its comparable group on relevant metrics).

You could definitely get asked to define WACC and DCF and walk someone through how you'd do it. Here are a few pieces of finance-related advice from Gotta Mentor. There's lots of good stuff for Wall Street prospects on the site so search " equity research " or " investment bank " and go at it.

Preparing for investment banking interviews http://www.gottamentor.com/viewRoadmap.aspx?r=311

DCF Example - Valuing a Cow http://www.gottamentor.com/viewDocument.aspx?d=1746

Relative Valuation Basics http://www.gottamentor.com/viewDocument.aspx?d=905