Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

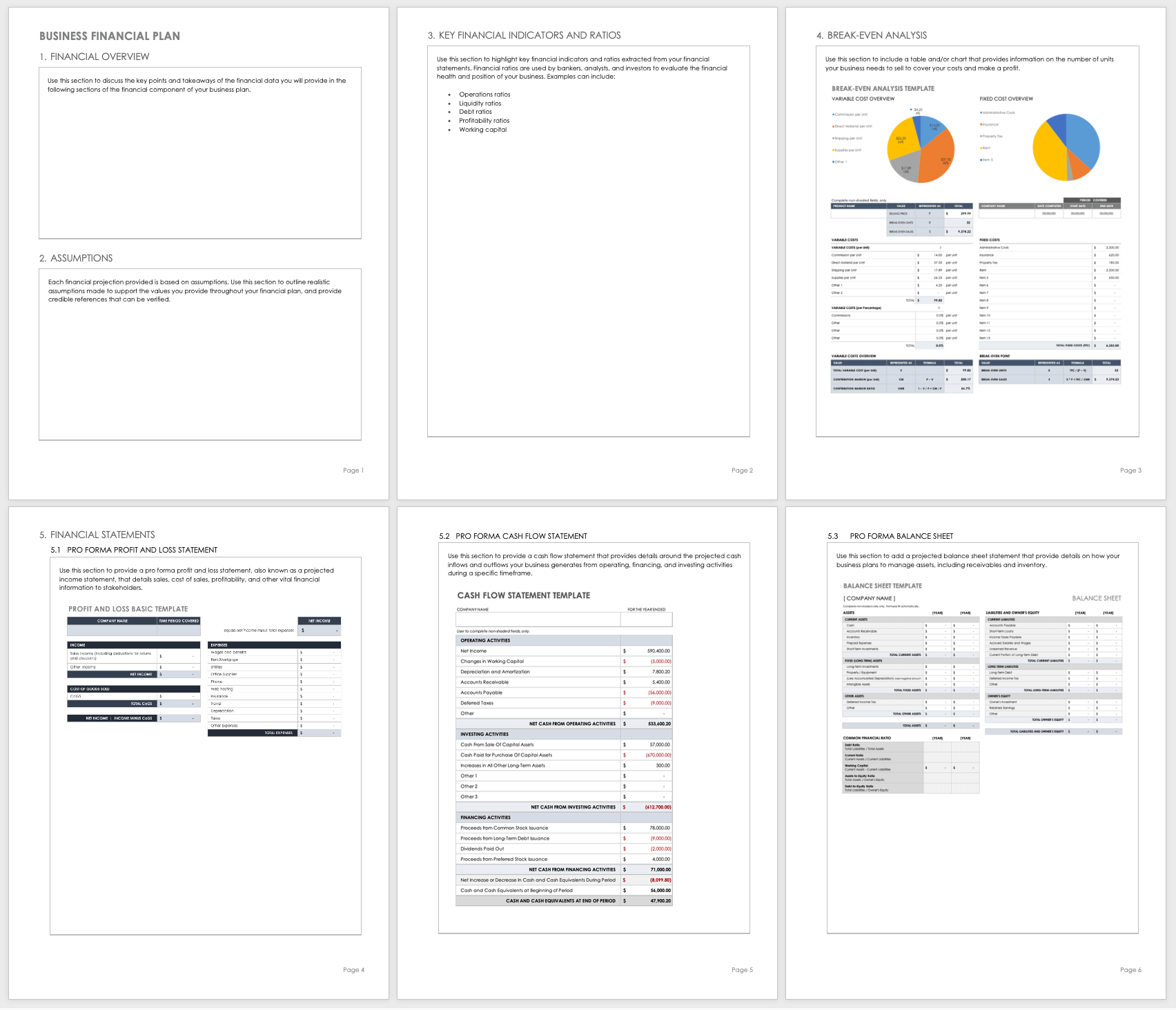

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

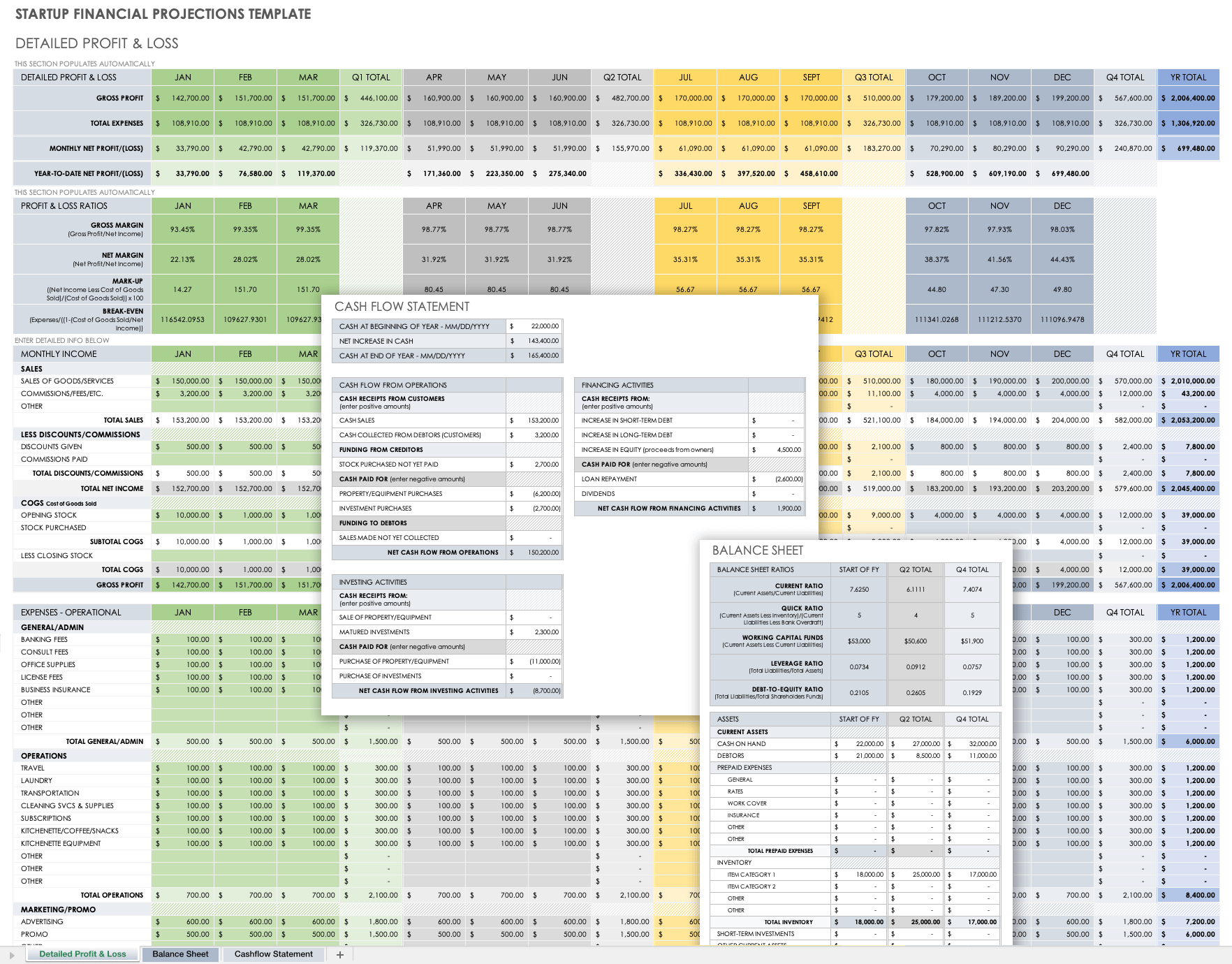

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

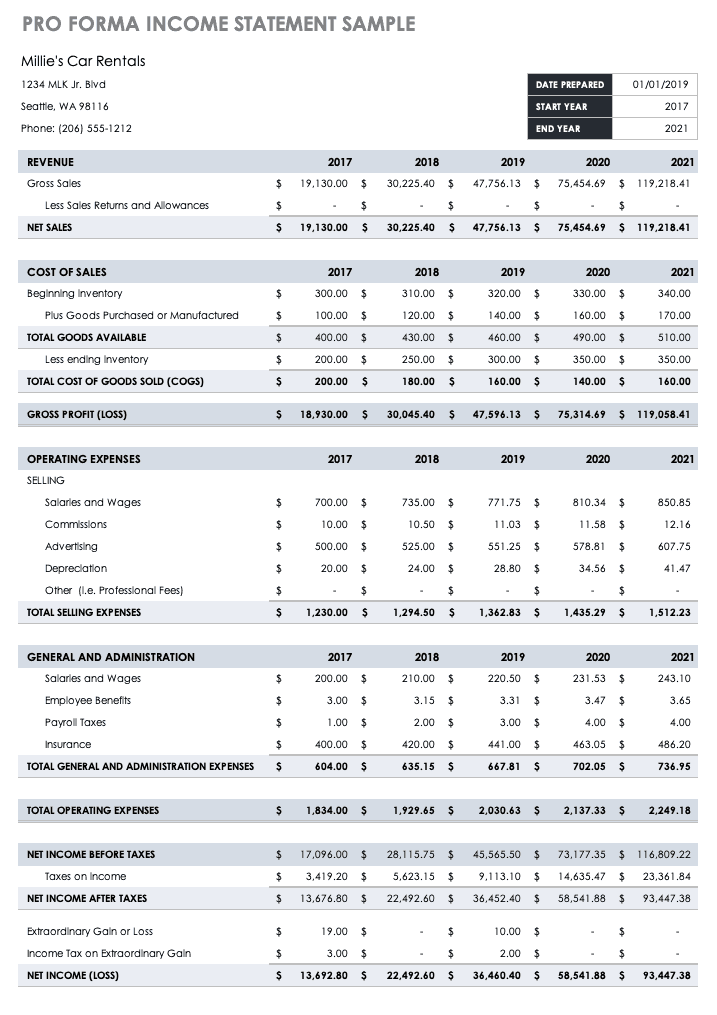

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

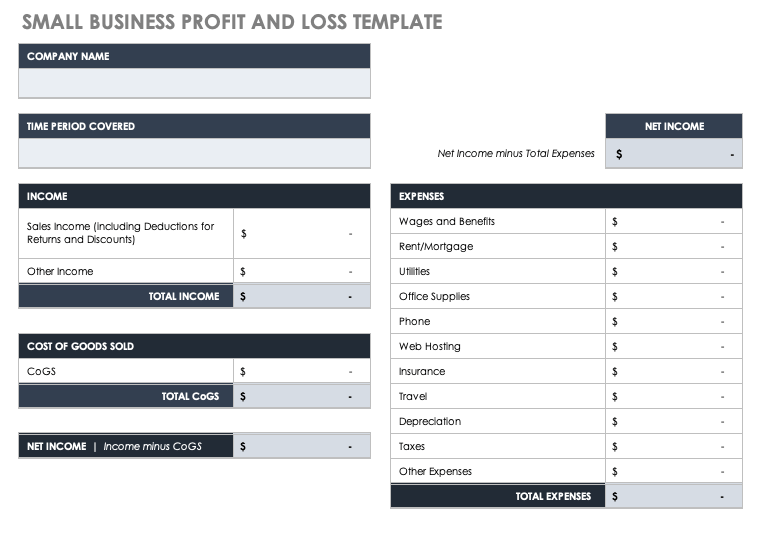

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

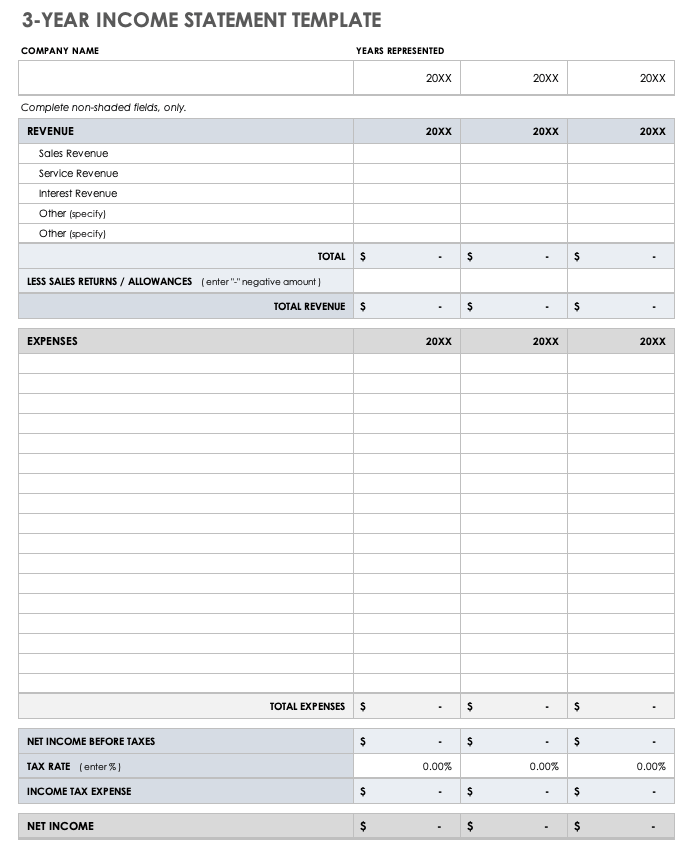

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

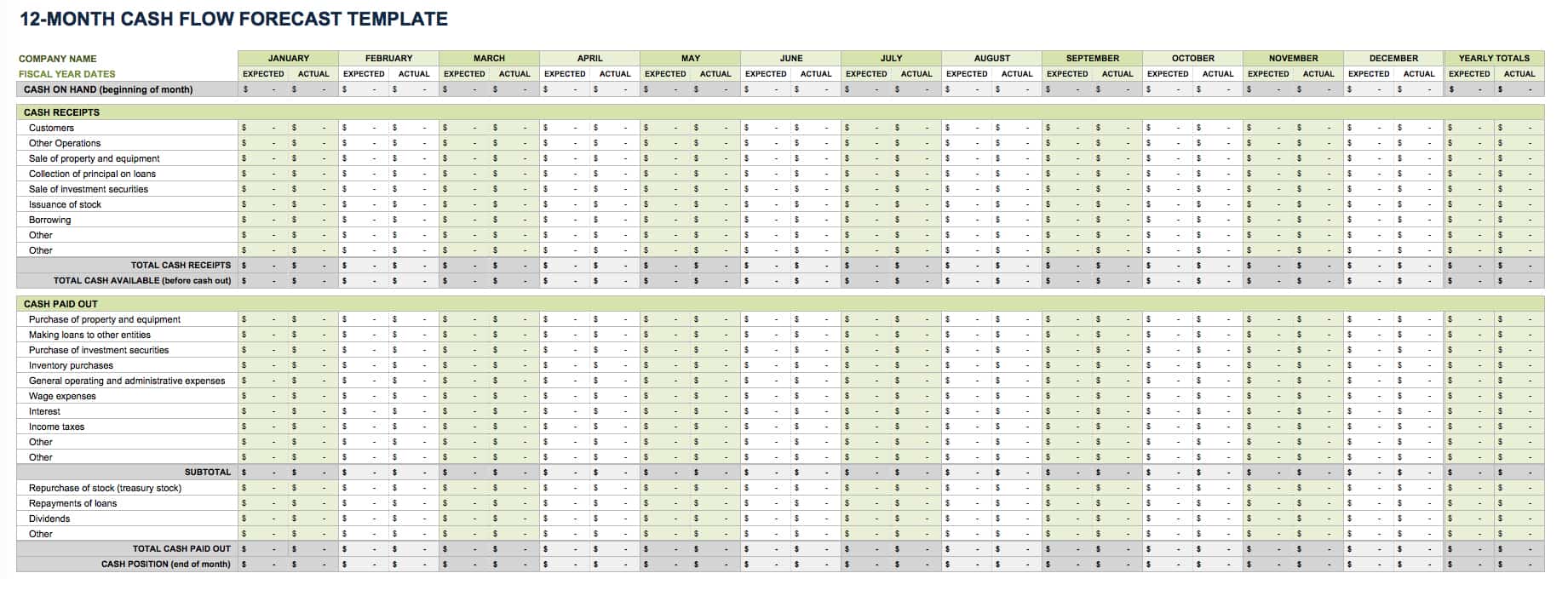

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

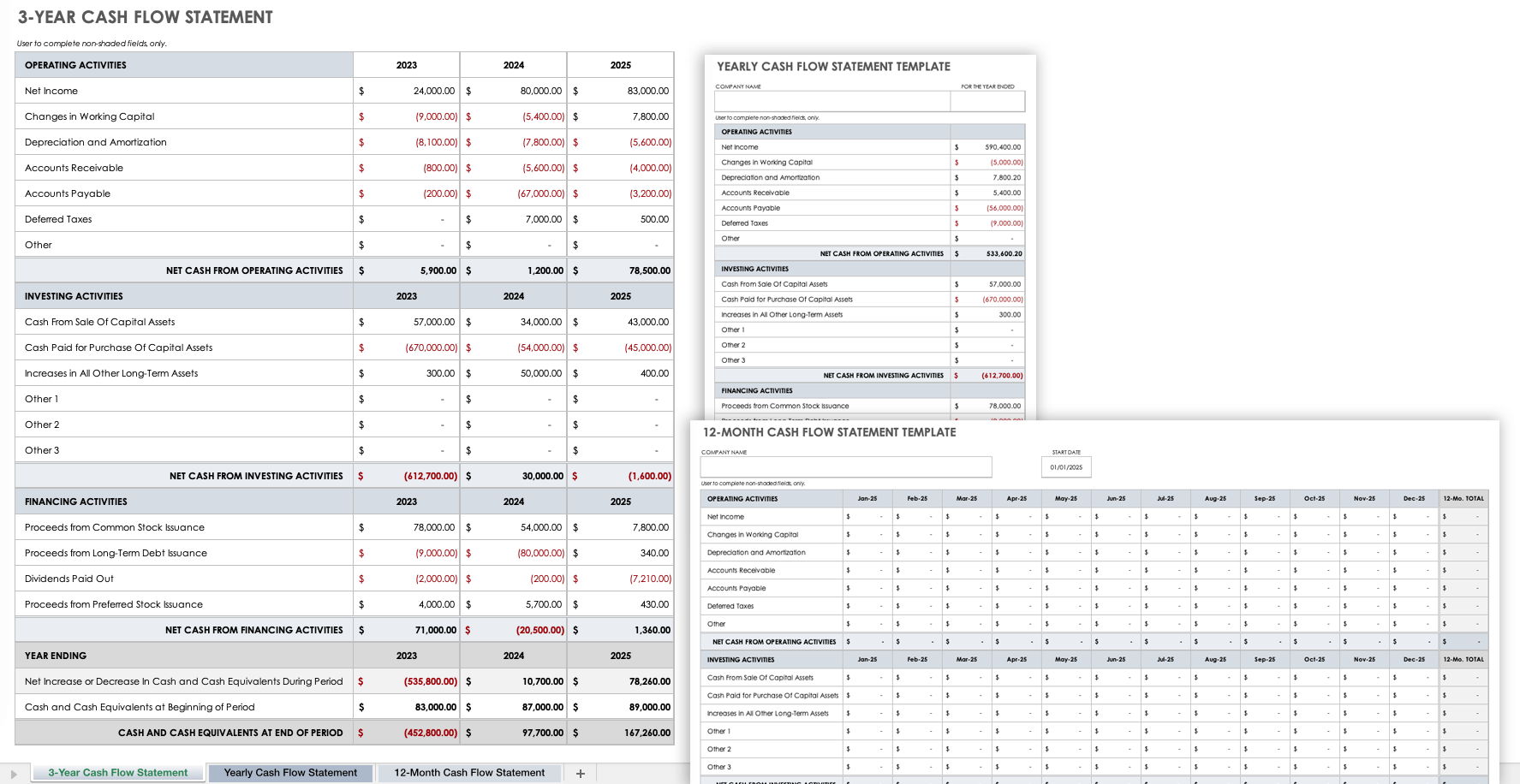

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

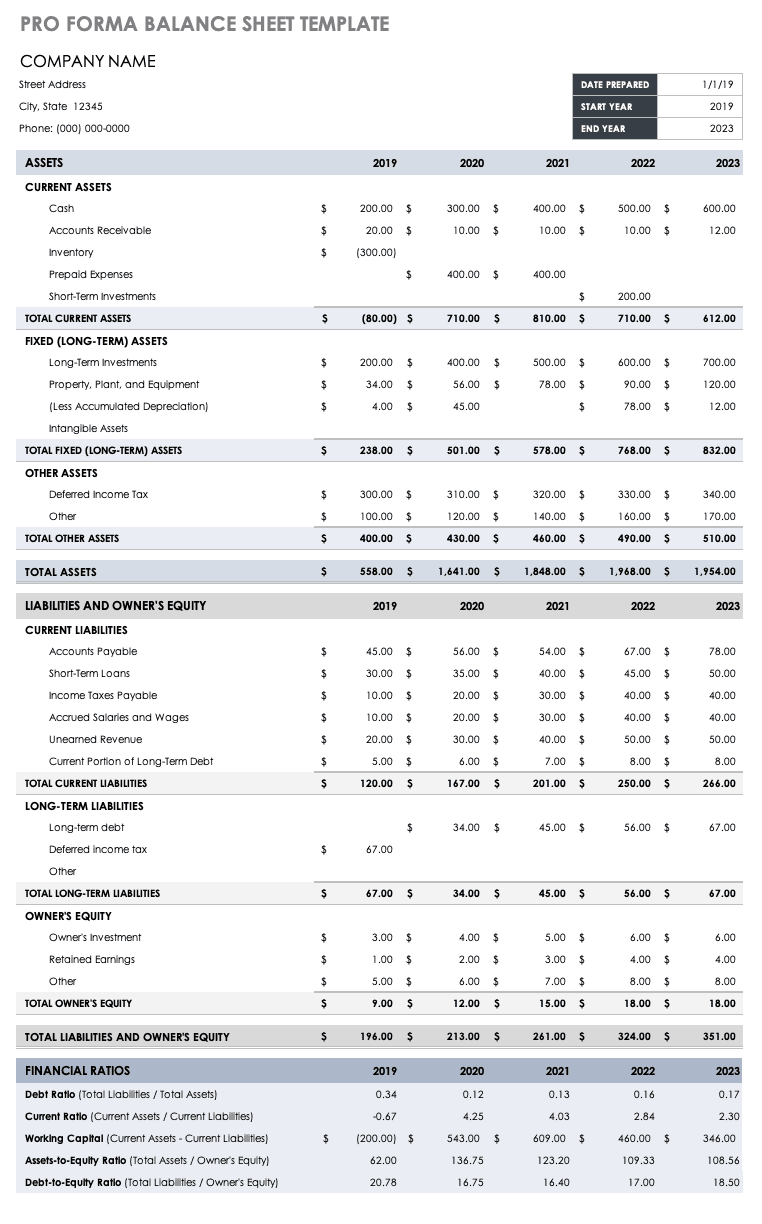

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

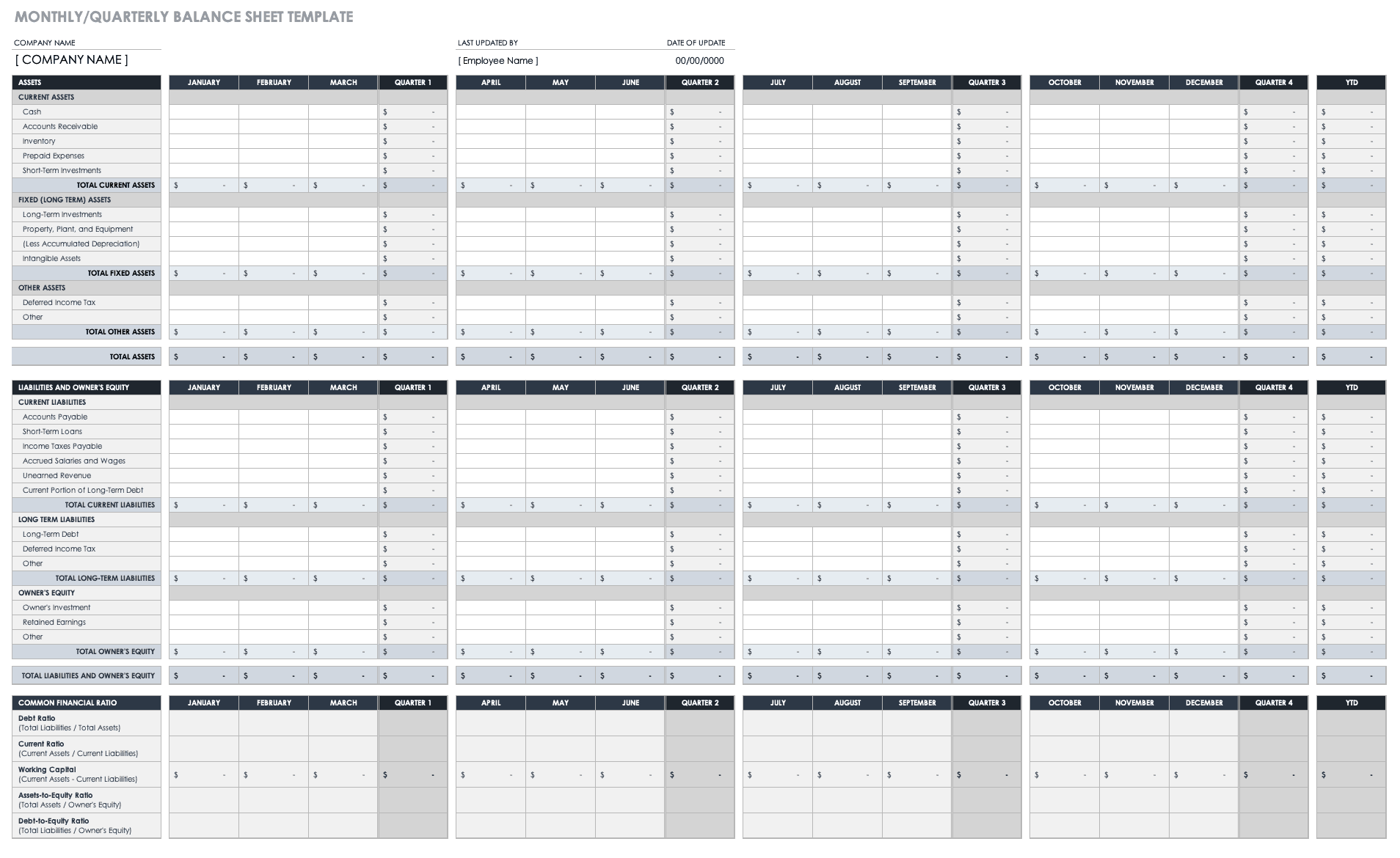

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

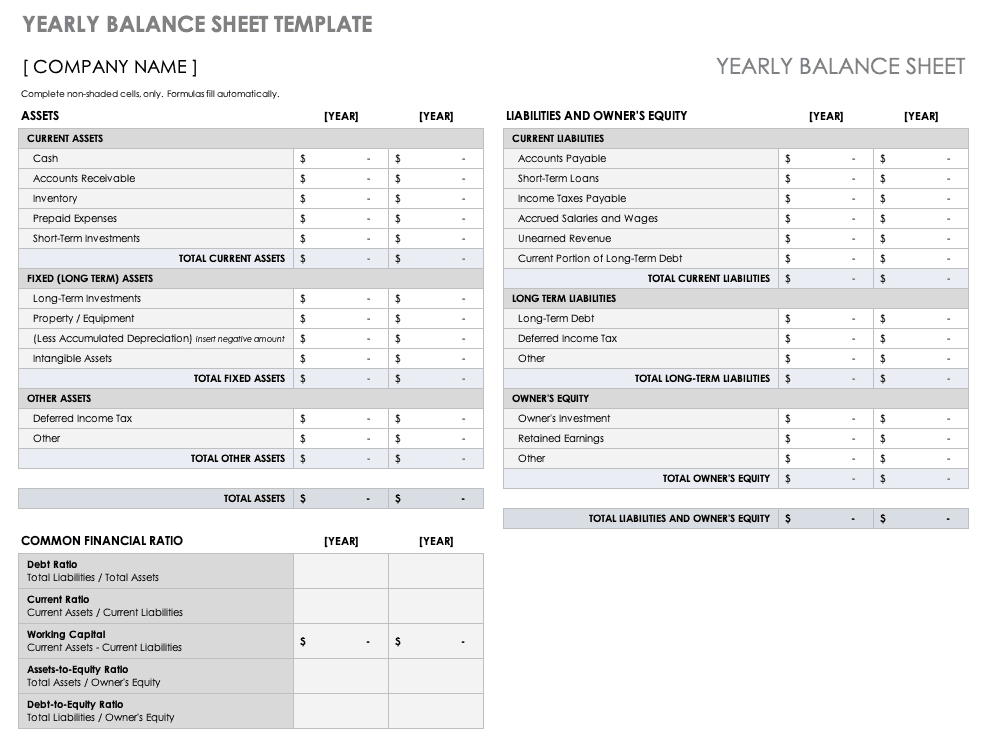

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

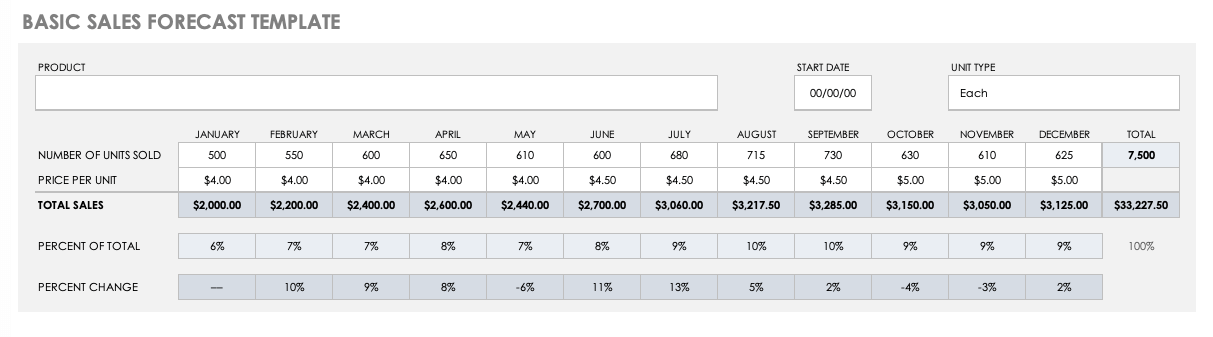

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

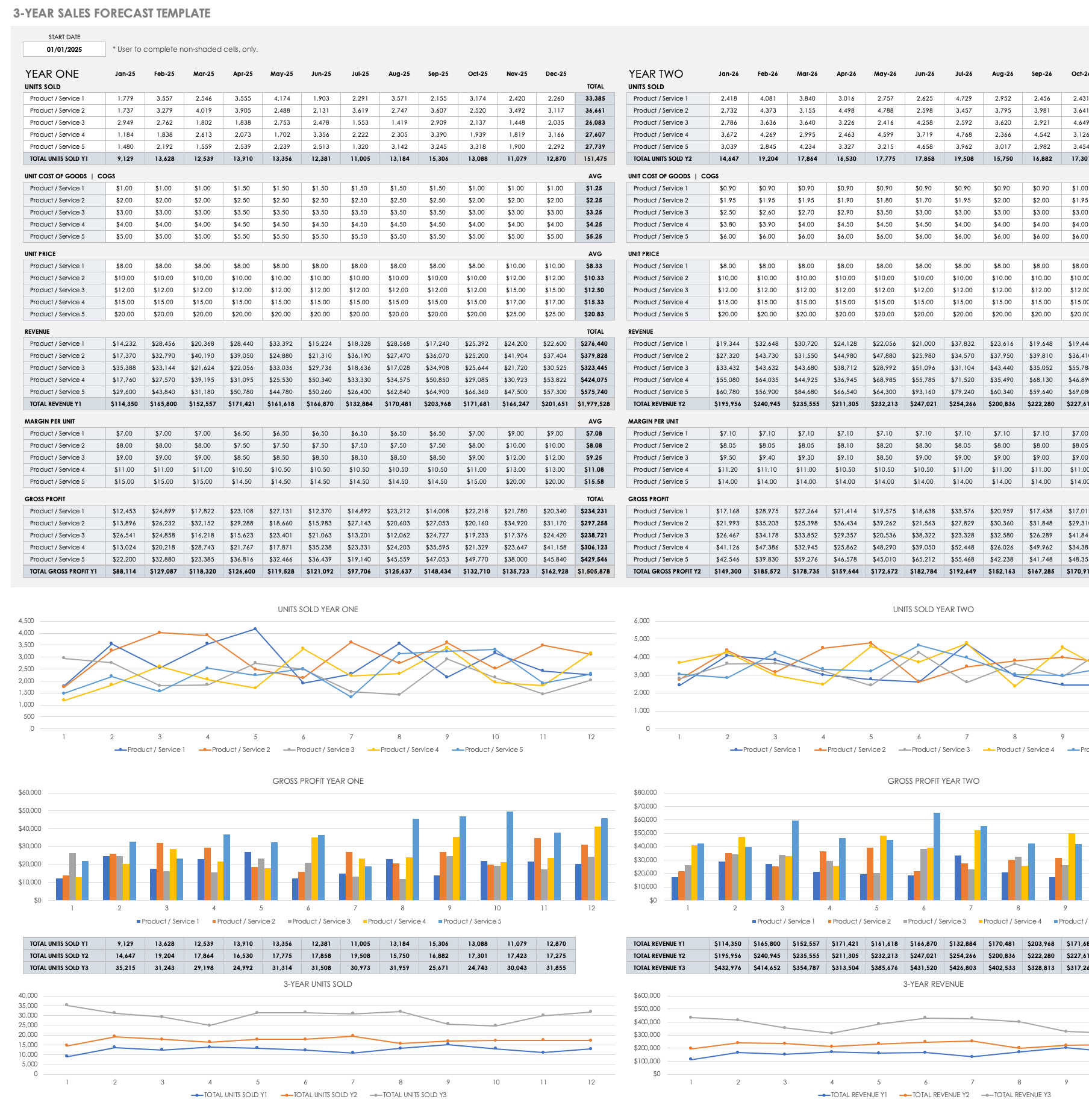

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

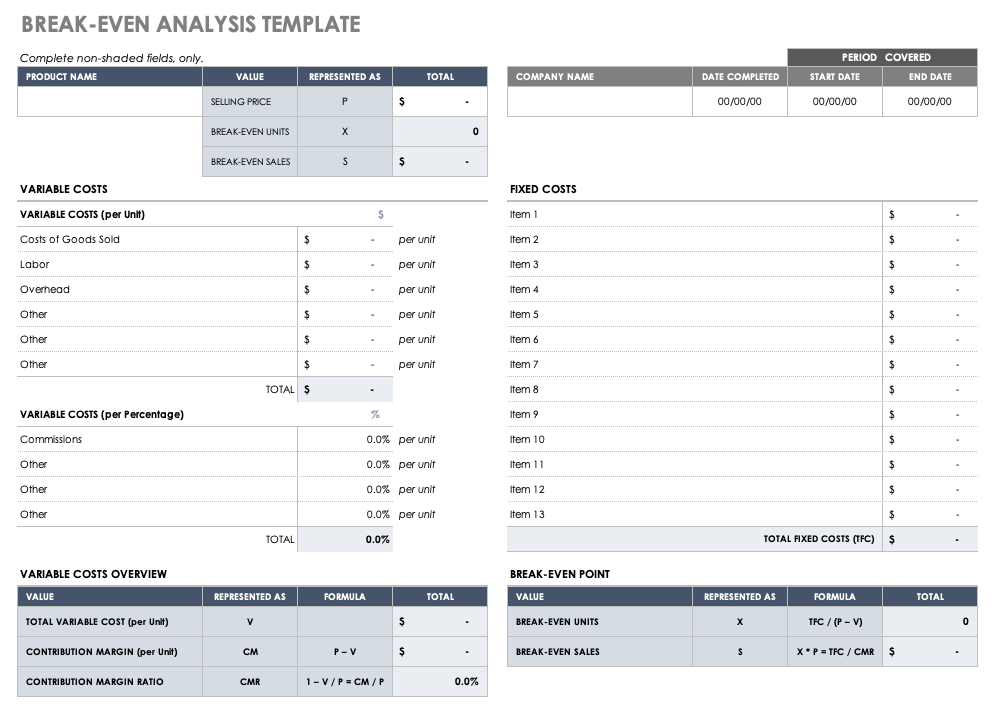

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

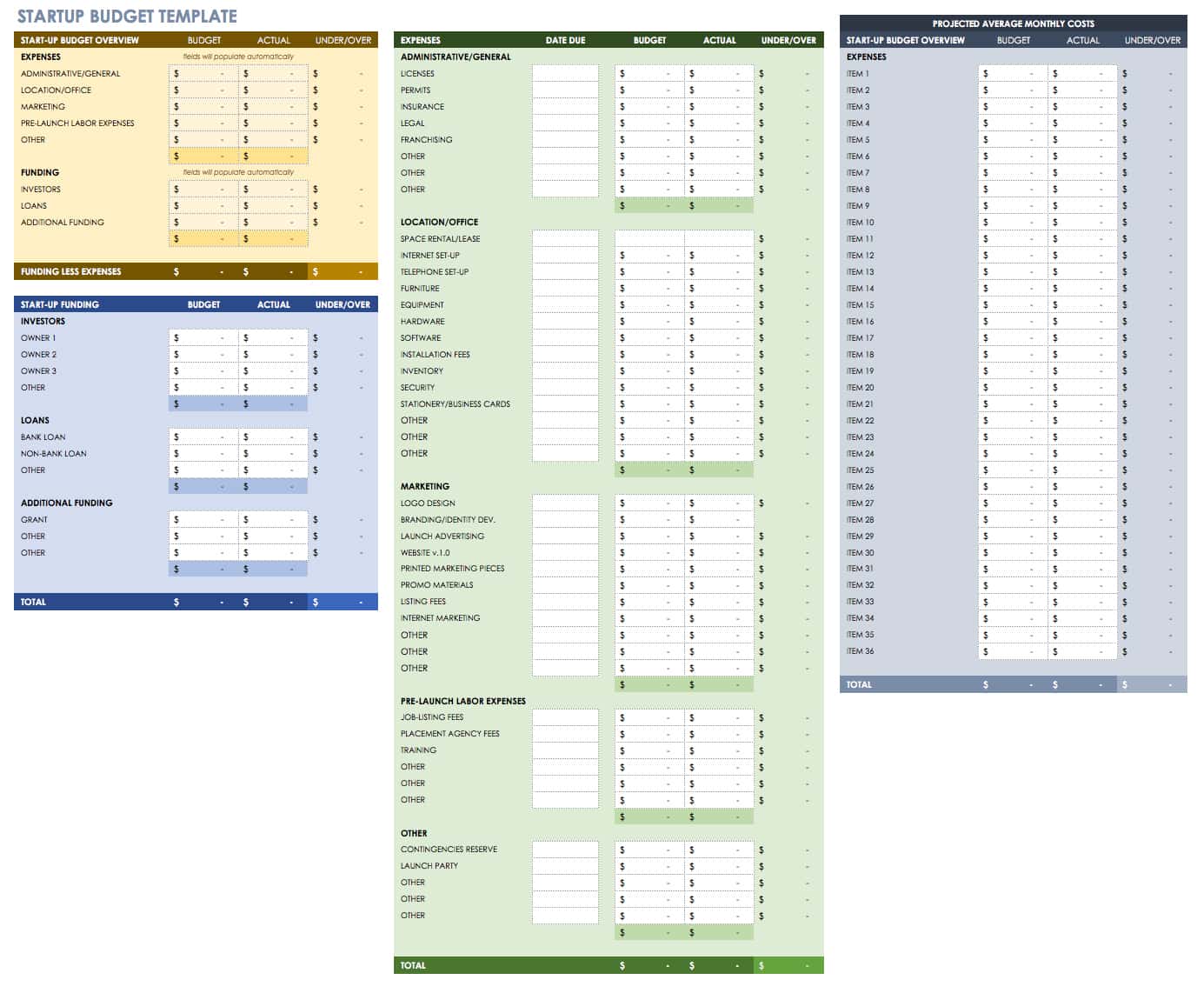

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

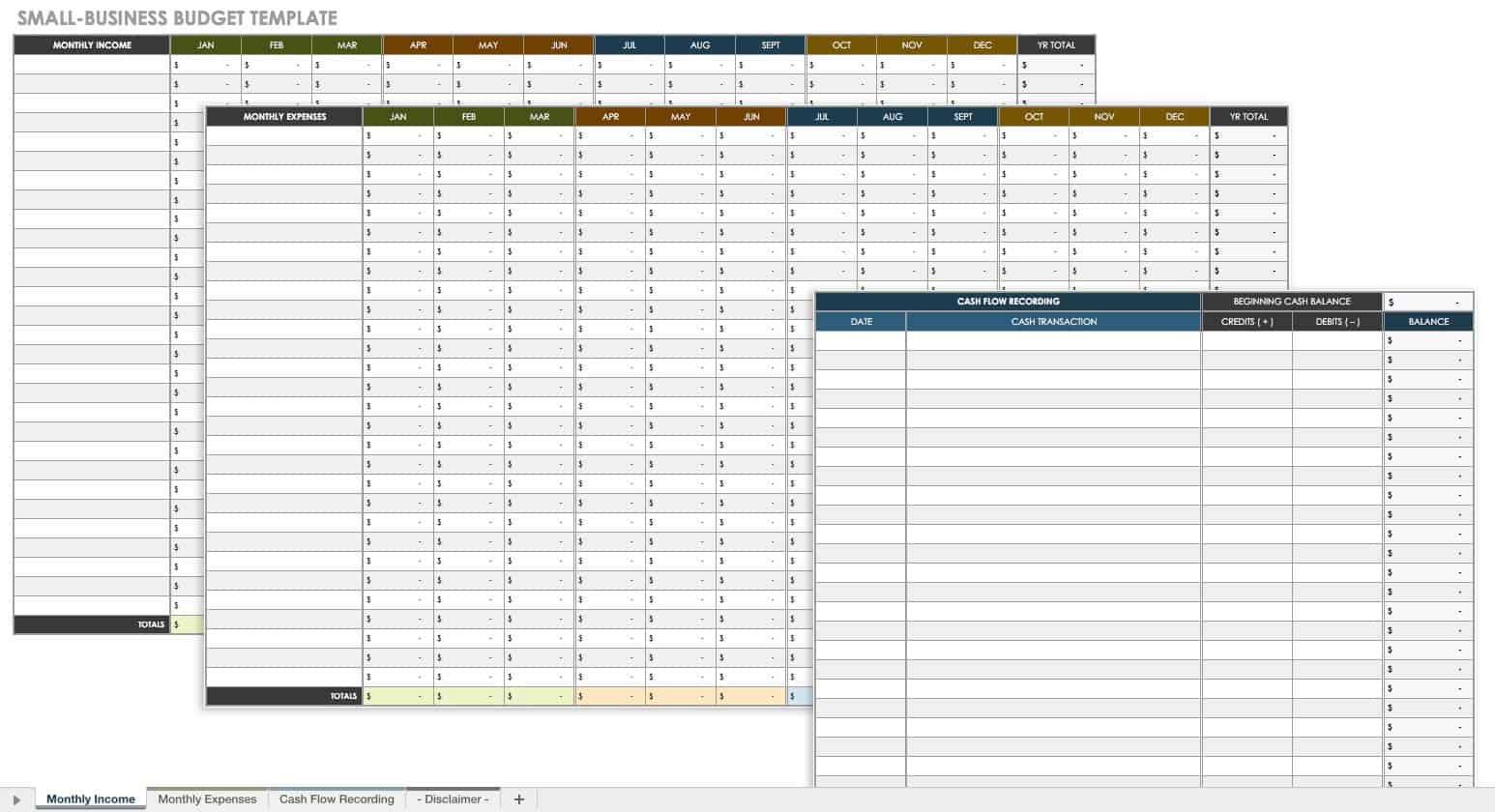

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

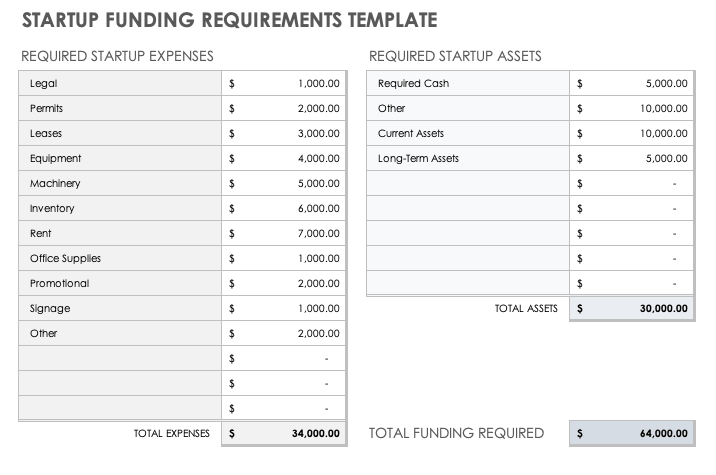

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

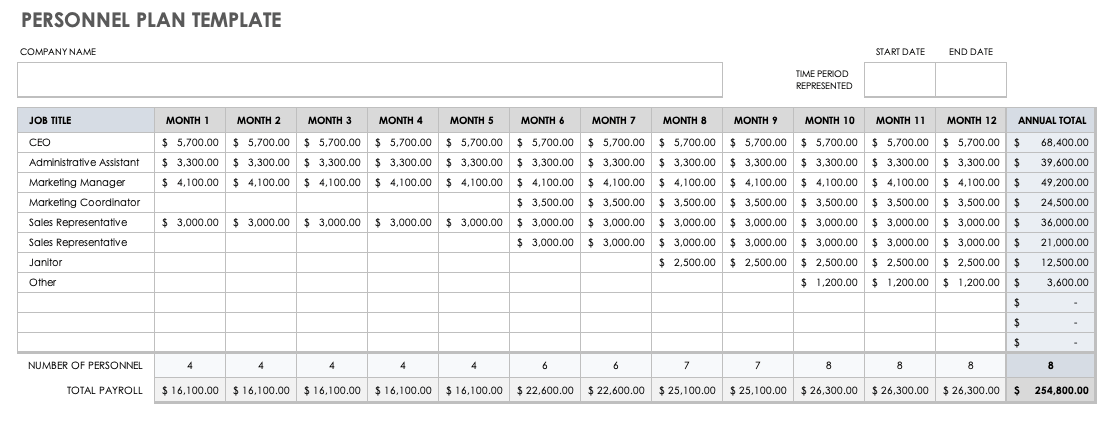

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Original text

A long term forecast is not a necessary part of a basic business plan. However, it is an excellent tool to help you open up your thinking about the company's future. Furthermore, venture capitalists will almost always want a long term forecast to get a feel for growth prospects.

The further out you forecast, the less accuracy you can maintain, so use round numbers, except where you know exact amounts; e.g.: rent expense if you have a long term lease.

The most important part of the long term forecast is not the numbers themselves, but the assumptions underlying the numbers. So make sure your assumptions are stated clearly and in detail in a narrative attachment. This will communicate your vision of the company's future and how you anticipate realizing that vision.

You will note that there are some lines on the bottom of this spreadsheet which may not be on a twelve-month P & L. This is to help you do some planning about funding growth:

- NET PROFIT BEFORE TAX is the same as Net Profit on a 12-month Profit and Loss spreadsheet.

- INCOME TAX allows you to estimate how much of your profit will have to go to the IRS.

- NET PROFIT AFTER TAX is what is left for you to use.

- OWNER DRAW/ DIVIDENDS is how much the owners plan to take out for themselves.

- ADJUSTMENT TO RETAINED EARNINGS is the amount of profit actually left in the business to increase Owners' Equity and fund growth.

If you need help with your profit and loss projection, you can get free, customized advice from a SCORE mentor. Mentors are available online or in a chapter near you .

Begin filling out this spreadsheet and share it with your mentor to increase your chances for marketing success.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

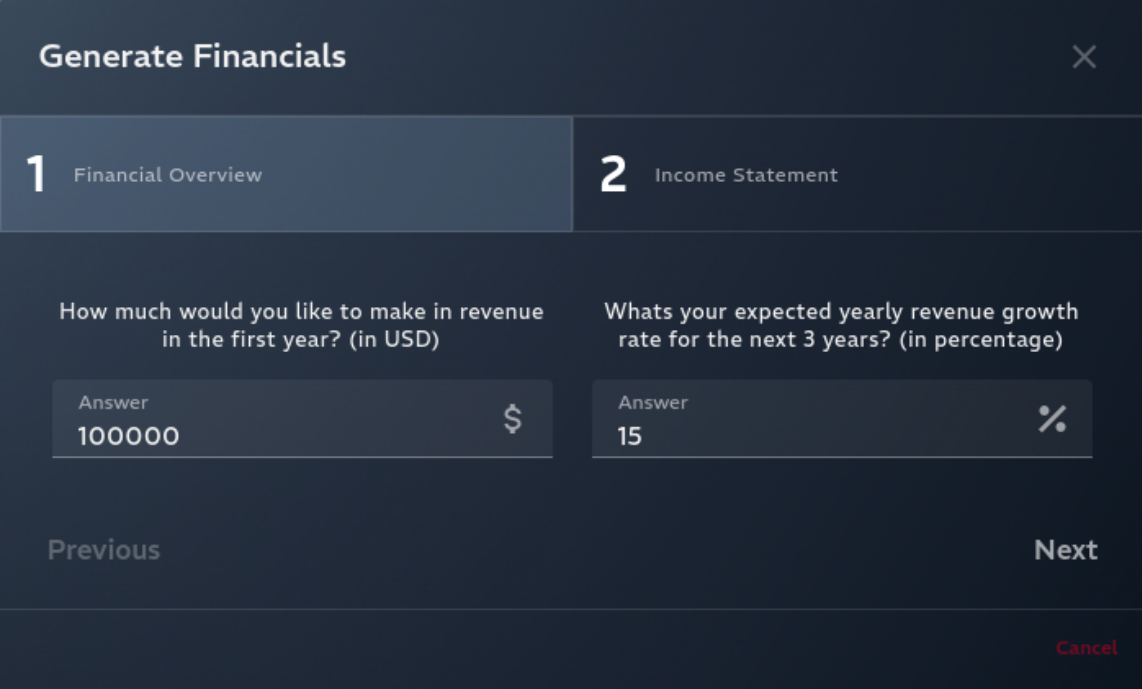

Plannit Financial Projections

Take Your Business Plan to the Next Level

Financial projections are a crucial part of any business plan. Plannit AI’s financial projections and income statement generator simplifies the process, allowing entrepreneurs to create accurate, detailed financial forecasts with ease. This feature streamlines the process of generating your initial financial information.

Comprehensive Financial Overview

Our algorithms merge seamlessly with the GPT-4 engine to learn from your revenue model, business information and financial inputs, to automatically generate a comprehensive financial overview for your business plan. This includes an in-depth look at the projected growth rate of the company, the expected revenue, and the anticipated expenses.

10x More Powerful AI

We utilize the GPT-4 engine at our own expense to ensure that you have access to the most powerful AI in the industry. This allows us to provide you with the most accurate and detailed financial overview possible.

Simplified User Experience

Answer a few additional questions to allow us to calculate your financial projections and generate an income statement for your business plan. All in under 30 seconds.

Detailed 3-Year Income Statement

Based on your revenue model, your business information and your financial inputs, we generate a detailed 3-year income statement for your business plan, formatting your vision into dollars.

Simple, Accurate, and Detailed

Plannit only requires a few additional inputs to generate your detailed financial overview and income statement. It also learns from your revenue model and takes industry standards into account.

Increase Your Chances of Getting Funded

Accurate financial projections.

Plannit AI’s financial projections and income statement generator ensures that your business plan is backed by accurate, detailed financial forecasts. This increases your chances of securing funding and support from investors and lenders.

Professional Income Statement

Download your plan with a professional income statement that is formatted to industry standards and editable. This will help you present your business plan in a professional manner and increase your chances of securing funding.

By leveraging Plannit's financial projections and income statement generator, you can ensure that your business plan is backed by a detailed financial overview that puts numbers behind your vision and provides you with a blueprint for a successful outcome.

Create Your Business Plan Today

Plan Projections

ideas to numbers .. simple financial projections

Home > Financial Projections Template Excel

Financial Projections Template Excel

This free 4 page Excel business plan financial projections template produces annual income statements, balance sheets and cash flow projections for a five year period for any business.

Financial Projections Template Download

What’s included in the financial projection template, 1. income statements.

The first page of the financial projection template shows income statements for the business for 5 years.

2. Balance Sheets

3. Cash Flow Statements

The third page provides the cash flow statements for 5 years.

4. Ratios and Graphs

The final page of the financial projections template contains a selection of useful financial ratios for comparison purposes. In addition it shows revenue, net income, cash balance, and cumulative free cash flow by year in graph form for easy reference.

How to use the Financial Projections Template

If you want to know how to use the financial projections template, then we recommend reading our How to Make Financial Projections post, which explains each step in detail.

More Financial Projections Templates and Calculators

Select a category from the menu to the right or chose one of the templates or calculators below.

Popular Revenue Projection Templates

- Retail Store Revenue Projection

- Drop Shipping Business Revenue Projection

- Sandwich Shop Revenue Projection

- Salon Business Plan Revenue Projection

- Microbrewery Business Plan Revenue Projection

Popular Calculators

- Days Sales Outstanding Calculator

- Return on Investment Calculator

- Sales Forecast Spreadsheet

- Gross Margin Calculator

- Business Operating Expenses Template

Financial projections are critical to the success of your business plan, particularly if the purpose is to raise finance. Accordingly we have designed our financial projection for startup template to help you test your business idea and create a five year business plan financial projection.

The financial projection template will help you to carry out your own financial projections and test your business idea. Therefore simply amend the highlighted input elements to suit your purposes, and the financial projection template does the rest.

Alternatively, you can use our online calculator to provide a quick and easy way to test the feasibility of your business idea.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. Michael has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a BSc from Loughborough University.

Three-Year Financial Projections Template

Identify revenue sources, estimate potential growth rates for these sources, determine costs related to these sources, prepare initial draft of projection, assess market and economic trends, approval: financial controller for draft.

- Prepare initial draft of projection Will be submitted

Revise projection based on feedback

Obtain projected balance sheet and profit and loss statement, estimate potential investments and expenditures, include inflation and exchange rate effects, approval: cfo for revised projections.

- Obtain projected balance sheet and profit and loss statement Will be submitted

- Estimate potential investments and expenditures Will be submitted

- Include inflation and exchange rate effects Will be submitted

Incorporate feedback, refine and finalize projections

Review additional revenue opportunities, estimate risks and uncertainties, approval: ceo for final version.

- Incorporate feedback, refine and finalize projections Will be submitted

- Review Additional revenue opportunities Will be submitted

- Estimate risks and uncertainties Will be submitted

Prepare presentation for board members

Present final projection to board of directors, approval: board of directors.

- Present final projection to board of directors Will be submitted

Communicate approved financial projections to relevant departments

Archive final version of three year financial projections, take control of your workflows today., more templates like this.

3 Year Business Plan Template

In today’s fluid business environment, developing a structured and detailed business plan is essential for both small business startups, as well as large corporations. If you’re ready to develop a three-year business plan , you already know it is a thoughtful and essential approach to a sustained plan for growth and movement forward. However, tackling the complete business plan can be slightly overwhelming when you examine the components that go into such a document. We’re here to suggest solutions for a successful outcome in your process of completing a business plan. In this article, you’ll see the framework of a 3-year business plan template , segment by segment, which will create “digestible bites” for your thought processes; one step at a time. The many benefits of creating a three-year business plan are just ahead, so let’s get to work.

Download our Ultimate Business Plan Template here >

Three Year Business Plan Template

Executive summary.

The initial portion of your business plan will offer an executive summary that includes a brief sketch of the essential components of your plan: a business overview, success factors, and a three-year financial plan. This snapshot of your business enables busy executives or other stakeholders an opportunity to quickly review your business and make a quick decision to more fully explore the complete business plan that follows. And, further to consider, many lenders or investors will make a decision regarding your business based on the executive summary alone. As a result, the executive summary is as critical in and of itself as is the remainder of your business plan.

It will detail the type of business you’ve started, the business location, and the industry in which it operates. Detail only the salient facts in this summary and offer your mission statement, as well. Include in a few brief remarks, the success factors already achieved, and outline a clear, concise picture of the financial status of your business. Using the business plan helps to rein in any temptation to oversell your business; keep it concise and clear overall.

Company Overview

Next, the company overview section of the business plan is presented. Start with general statements and refine them as the overview continues. For example, “company name” operates in the “industry” sector, leveraging our expertise in “specific skills/experience.” Started in “date,” our primary products/services include a “list of products/services.” And, we are targeting a “specific target customer”, aiming to meet their needs and surpass expectations.” From this general idea, move to the company’s complete list of products or services, including the legal structure of the business, how the business operates, and the location(s) of business. Crucial information will also include the plans to generate revenue within the current status and a three-year forecast of financial projections.

The company description should also include major milestones already achieved, key customers, long-term contracts in place, and other primary facts; such as number of customers served, prototypes or products built, leases secured and employees hired. Each of these details is an indicator of business health and comparative success within the industry sector.

Industry Analysis

Next, an industry analysis will need to be compiled and shared in the business plan. An industry analysis is a crucial component of any business plan, as it provides an in-depth understanding of the market dynamics, trends, and competitive landscape. Include in your business plan the current and projected market size, including potential opportunities for growth. And, finally, analyze the current trends and dynamics within the industry. This may include technological advancements, regulatory changes, consumer preferences, or shifts in distribution channels. Highlight any emerging trends that may affect your business.

Customer Analysis

A full market analysis of your target audience follows the industry analysis. Identify the target market and its demographics, preferences, and buying behavior. Who are your customers? Do they want speed of delivery, a set price point, or comfort in ordering? Reading the data and responding satisfactorily can make the difference between a company that fails within three years and one that will thrive through it.

Review the data outlining the current target market trends and dynamics within the industry. This may include technological advancements, regulatory changes, consumer preferences, or shifts in distribution channels. Highlight any and all emerging trends that may affect your business. If, at this point, you’re wondering why the analysis of the industry and target audience are so thorough, you’ll be glad to know the results are critically integral to the marketing plan and sales strategies that follow these sections of your business plan.

Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitor Analysis

The competitors you face in your industry need to be analyzed and thoroughly examined in order to win your target audience over the offers of your competitors. First, Identify your main competitors and evaluate their strengths, weaknesses, market share, and strategies. Determine what sets your business apart and how you can gain that competitive advantage if your business does not hold it already. Remember to support your analysis with relevant data, statistics, and market research. The industry analysis should demonstrate your knowledge of the industry and your ability to navigate its challenges successfully. Also, you’ll want to collect the data from secondary and indirect competitors, as well. Such competitors often take a leap into a larger market position while completely unnoticed.

In this section of the plan, turn the analysis on your business to examine the competitive advantages your business has to outperform both direct and indirect competitors. Expand on the advantages of the business, such as the products or services offered, operational systems that outperform others, the ideal location of the business, and the intellectual property held by your business. These are salient factors that give your business a boost in terms of relevance and advantage.

Marketing Plan

The marketing strategy for the business is based on the status of current marketing efforts and data collected during the analysis of the industry, customers, competitors and internal processes of the business. It makes sense to pull all the elements together to form a cohesive marketing plan directed exactly to the ideal customer base. Include in this portion of the plan the current products and/or services, pricing and promotions plans. The business to date should identify its capability to generate revenue, resulting in profitability, a quality highly desired by lenders and investors. It proves that you have a solid plan for reaching new customers, you can attain new customers profitably, and the customer acquisition cost is significantly less than the customer lifetime value. Include in the plan sub-sections highlighting products, services and pricing, promotions plan and the product distribution plan.

Operations Plan

The operations plan is where reality meets expectations and, sometimes, it’s not a happy introduction. In a three-year business plan, much of the information is still speculative, while the present picture remains too new to extrapolate and analyze the data. A three-year business plan can, however, offer a healthy look at the present sales and revenue, strategic moves and options, paving the way to an informed look in years two and three ahead. The operations plan is affected by both the revenue collected or outstanding and the strategic moves that could follow.

Contained within the operations plan are the key day-to-day processes that have been accomplished within year one, as listed:

- Established a production facility/office that meets current and future needs.

- Developed strong supplier relationships to ensure a reliable supply chain.

- Implemented efficient inventory management systems to optimize stock levels.

- Hired and trained skilled personnel to handle production, sales, marketing strategy, and customer service.

- Implemented quality control measures to maintain high product/service standards.

The extent to which the key operational plan is detailed, lenders and investors will understand how developed your business is internally and externally, as well as how “hungry” for growth your business may be. These factors can exponentially affect future business.

Management Team

The introduction of the key management team in this plan is also indicative of your attention to detail and the drive you have to move toward years three, ten and twenty. Offer the name, title and background of each management person and include the members of the board of directors or board of advisors, if such exist within the corporate structure. These are the hungry executives, ready to work hard to make the business better for all. As the business owner, be sure to highlight your specific qualifications to run a successful business.

Financial Plan

Finally, introduce the financial plan at the end of the business plan. It is a multi-part framework for making decisions regarding how to parse out, invest, and best use the monies received. Based on the market analysis and sales forecasts, project the following financials for the next three years:

- Year 1: Revenue of [amount], with an operating expense of [amount].

- Year 2: Revenue of [amount], with an operating costs of [amount].

- Year 3: Revenue of [amount], with an operating expense of [amount].

Indicate when achieving profitability will occur, such as “by the end of Year One” and pinpoint when, at what date, the business expects steady revenue growth thereafter. The projections need to be based on conservative estimates and prudent financial management.

Provide a conclusion at the end of the business plan and construct the executive summary after the body of the business plan is complete. Indicate throughout the conclusion the processes that make it a viable document for the years ahead. Update the business plan as needed, during that time and continue to refer to the data and analyses collected, the conclusions formed and the ways in which competitors can be overcome by differentiation and better product positioning. After completing the business plan, you’ll have the confidence to share it as a viable, sustainable document that indicates a healthy foundation, a growing revenue stream and a solid plan for long-term growth and success ahead. Congratulations!

Click here to finish your business plan today.

How To Create Startup Financial Projections [+Template]

Businesses run on revenue, and accurate startup financial projections are a vital tool that allows you to make major business decisions with confidence. Financial projections break down your estimated sales, expenses, profit, and cash flow to create a vision of your potential future.

In addition to decision-making, projections are huge for validating your business to investors or partners who can aid your growth. If you haven’t already created a financial statement, the metrics in this template can help you craft one to secure lenders.

Whether your startup is in the seed stage or you want to go public in the next few years, this financial projection template for startups can show you the best new opportunities for your business’s development.

In this article:

- What is a startup financial projection?

- How to write a financial projection

- Startup expenses

- Sales forecasts

- Operating expenses

- Income statements

- Balance sheet

- Break-even analysiFinancial ratios Startup financial

- rojections template

What is a financial projection for startups?

A financial projection uses existing revenue and expense data to estimate future cash flow in and out of the business with a month-to-month breakdown.

These financial forecasts allow businesses to establish internal goals and processes considering seasonality, industry trends, and financial history. These projections cover three to five years of cash flow and are valuable for making and supporting financial decisions.

Financial projections can also be used to validate the business’s expected growth and returns to entice investors. Though a financial statement is a better fit for most lenders, many actuals used to validate your forecast are applied to both documents.

Projections are great for determining how financially stable your business will be in the coming years, but they’re not 100% accurate. There are several variables that can impact your revenue performance, while financial projections identify these specific considerations:

- Internal sales trends

- Identifiable risks

- Opportunities for growth

- Core operation questions

To help manage unforeseeable risks and variables that could impact financial projections, you should review and update your report regularly — not just once a year.

How do you write a financial projection for a startup?

Financial projections consider a range of internal revenue and expense data to estimate sales volumes, profit, costs, and a variety of financial ratios. All of this information is typically broken into two sections:

- Sales forecasts : includes units sold, number of customers, and profit

- Expense budget : includes fixed and variable operating costs

Financial projections also use existing financial statements to support your estimated forecasts, including:

- Income stateme

- Cash flow document

Gathering your business’s financial data and statements is one of the first steps to preparing your complete financial projection. Next, you’ll import that information into your financial projection document or template.

This foundation will help you build the rest of your forecast, which includes:

- Cash flow statements

- Break-even analysis

- Financial ratios

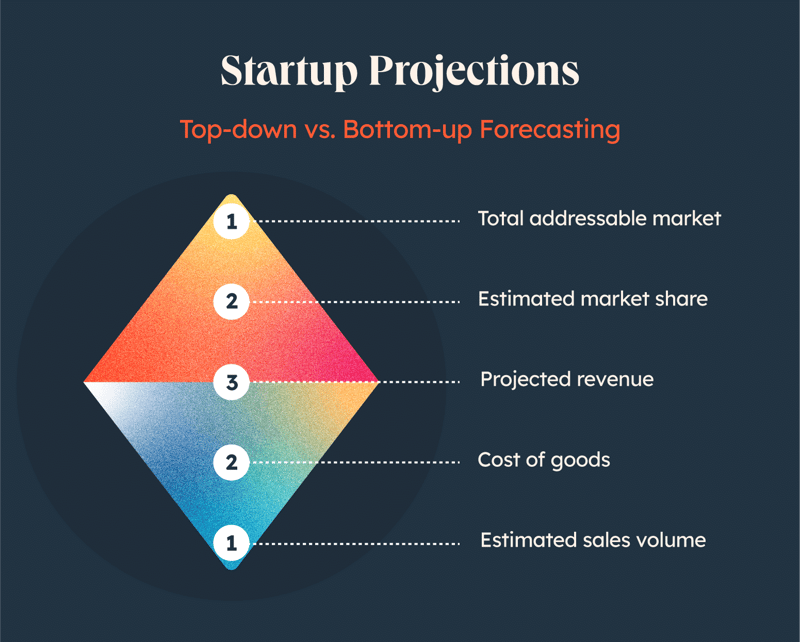

Once all of your data is gathered, you can organize your insights via a top-down or bottom-up forecasting methods.

The top-down approach begins with an overview of your market, then works into the details of your specific revenue. This can be especially valuable if you have a lot of industry data, or you’re a startup that doesn’t have existing sales to build from. However, this relies on a lot of averages and trends will be generalized.

Bottom-up forecasting begins with the details of your business and assumptions like your estimated sales and unit prices. You then use that foundation to determine your projected revenue. This process focuses on your business’s details across departments for more accurate reporting. However, mistakes early in forecasting can compound as you “build up.”

1. Startup expenses

If your startup is still in the seed stage or expected to grow significantly in the next few quarters, you’ll need to account for these additional expenses that companies beyond the expansion phase may not have to consider.

Depending on your startup stage, typical costs may include:

- Advertising and marketing

- Lawyer fees

- Licenses and permits

- Market research

- Merchandise

- Office space

- Website development

Many of these costs also fall under operating expenses, though as a startup, items like your office space lease may have additional costs to consider, like a down payment or renovation labor and materials.

2. Sales forecasts

Sales forecasts can be created using a number of different forecasting methods designed to determine how much an individual, team, or company will sell in a given amount of time.

This data is similar to your financial projections in that it helps your organization set targets, make informed business decisions, and identify new opportunities. A sales forecast report is just much more niche, using industry knowledge and historical sales data to determine your future sales. Gather data to include:

- Customer acquisition cost (CAC)

- Cost of goods sold (COGS)

- Sales quotas and attainment

- Pipeline coverage

- Customer relationship management (CRM) score

- Average Revenue Per User (ARPU), typically used for SaaS companies

Sales forecasts should consider interdepartmental trends and data, too. In addition to your sales process and historical details, connect with other teams to apply insights from:

- Marketing strategies for the forecast period

- New product launches

- Financial considerations and targets

- Employee needs and resources from HR

Your sales strategy and forecasts are directly tied to your financial success, so an accurate sales forecast is essential to creating an effective financial projection.

3. Operating expenses

Whereas the costs of goods solds (aka Cost of Sales or COGS) account for variable costs associated with producing the products or services you produce, operating expenses are the additional costs of running your startup, including everything from payroll and office rent to sales and marketing expenses.

In addition to these fixed costs, you’ll need to anticipate one-time costs, like replacing broken machinery or holiday bonuses. If you’ve been in business for a few years, you can take a look at previous years’ expenses to see what one-time costs you ran into, or estimate a percentage of your total expenses that contributed to variable costs.

4. Cash flow statements

Cash flow statements (CFS) compare a business’s incoming cash totals, including investments and operating profit, to their expected expenses, including operational costs and debt payments.

Cash flow shows a company’s overall money management and is one of three major financial statements, next to balance sheets and income statements. It can be calculated using one of two methods:

- Direct Method : calculates actual cash flow in and out of the company

- Indirect Method : adjusts net income considering non-cash revenue and expenses

Businesses can use either method to determine cash flow, though presentation differs slightly. Typically, indirect cash flow methods are preferred by accountants who largely use accrual accounting methods .

5. Income statements

Your income statement projection utilizes your sales forecasts, estimated expenses, and existing income statements to calculate an expected net income for the future.

In addition to the hard numbers available, you should apply your industry expertise to consider new opportunities for your business to grow. If you’re entering Series C, you should anticipate the extra investments and big returns that you’re aiming to experience this round.

Once you’ve collected your insights, use your existing income statement to track your estimated revenue and expenses. Total each and subtract the expenses from the revenue projections to determine your projected income for the period.

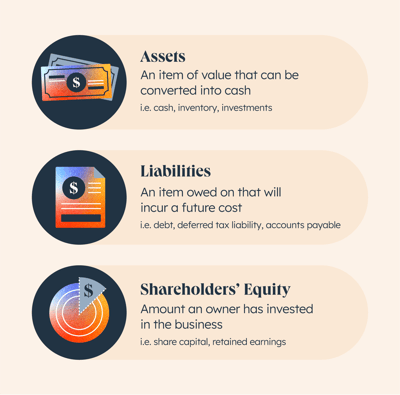

6. Balance sheet

Your balance sheet is the final of the big three financial documents needed to establish your company’s financial standing. The balance sheet makes a case for your company’s financial health and future net worth using these details:

- Company’s assets

- Business’s liabilities

- Shareholders’ equity

This document breaks down the company’s owned assets vs. debt items. It most directly tracks earnings and spendings, and it also doubles as an actual to establish profitability for prospective investors.

7. Break-even analysis

Launching a startup or new product line requires a significant amount of capital upfront. But at some point, your new endeavor will generate a profit. A break-even analysis identifies the moment that your profit equals the exact amount of your initial investment, meaning you’ve broken even on the launch and you haven’t lost or gained money.

A break-even point (BEP) should be identified before launching your business to determine its viability. The higher your BEP, the more seed money you’ll need or the longer it will be until operations are self-sufficient.

Of course, you can also increase prices or reduce your production costs to lower the BEP.

As your business matures, you can use the BEP to weigh risks with your product decisions, like implementing a new product or removing an existing item from the mix.

8. Financial ratios

Financial ratios are common metrics that lenders use to check financial health using data from your financial statements. There are five core groups of financial ratios used to evaluate businesses, as well as an example of each:

Efficiency ratios : Analyze a company’s assets and liabilities to determine how efficiently it manages resources and its current performance.

Formula : Asset turnover ratio = net sales / average total assets

Leverage ratios : Measure a company’s debt levels compared to other financial metrics, like total assets or equity.

Formula : Debt ratio = total liabilities / total assets

Liquidity ratios : Compare a company’s liquid assets and its liabilities to lenders to determine its ability to repay debt.

Formula : Current ratio = current assets / current liabilities

Market value ratios : Determine a public company’s current stock share price.

Formula : Book value per share (BVPS) = (shareholder’s equity - preferred equity) / total outstanding shares

Profitability ratios : Utilize revenue, operating costs, equity, and other other balance sheet metrics to asses a company’s ability to generate profits.

Formula : Gross profit margin = revenue / COGS

Graphs and charts can provide visual representations of financial ratios, as well as other insights like revenue growth and cash flow. These assets provide an overview of the financial projections in one place for easy comparison and analysis.

Startup Financial Projections Template

As a startup, you have some extra considerations to apply to your financial projections. Download and customize our financial projections template for startups to begin importing your financial data and build a road map for your investments and growth.

Plan for future success with HubSpot for Startups

A sound financial forecast paves the way for your next moves and reassures investors (and yourself) that your business has a bright future ahead. Use our startup financial projections template to estimate your revenue, expenses, and net income for the next three to five years.

Ready to invest in a CRM to help you increase sales and connect with your customers? HubSpot for Startups offers sales, marketing, and service software solutions that scale with your startup.

Get the template

3 Year Financial Projection

What do you think of this template.

Product details

Financial projections use existing or estimated financial data to forecast your business’s future income and expenses. They often include different scenarios so you can see how changes to one aspect of your finances such as higher sales or lower operating expenses might affect your profitability.

Your business plan’s financial projections will be the most analyzed part of your plan by investors and banks. While never a precise prediction of future performance, an excellent financial model outlines the core assumptions of your business and helps you and others evaluate capital requirements, risks involved, and rewards that successful execution will deliver.

Having a solid framework in place also will help you compare your performance to the financial projections and evaluate how your business is progressing. If your performance is behind your projections, you will have a framework in place to assess the effects of lowering costs, increasing prices, or even reimagining your model. In the happy case that you exceed your projections, you can use your framework to plan for accelerated growth, new hires, or additional expansion investments.

Hence, the use of 3 years financial projections is multi-fold and crucial for the success of any business. Your projections should include three core financial statements – the income statement, the cash flow statement, and the balance sheet. The following section explains each statement in detail.

When it comes to financial forecasting, simplicity is key. Your 3 years financial projections do not have to be overly sophisticated and complicated to impress, and convoluted projections likely will have the opposite effect on potential investors. Keep your tables and graphs simple and fill them with credible data that inspires confidence in your business plan and vision.

Your 3 years financial projections should be tied to a list of assumptions. For example, one assumption will be the initial monthly cash sales you achieve. Another assumption will be your monthly growth rate. As you can imagine, changing either of these assumptions will significantly impact your projections.

This template will primarily be useful to financiers in the preparation of financial plans for the development of the company. Also, this template can be used by company leaders when preparing a company development strategy.

Investment companies can use the slides in this template when preparing information for clients about the development of companies and the need to purchase shares. This template can also be used by startups when preparing for a meeting with investors.

Economists and analysts can use this template when preparing financial forecasting and long-term cash flow reports.

3 Year Financial Projection is a professional and modern template that contains six stylish and fully editable slides. If necessary, you can change all elements of the slide in accordance with your corporate requirements. This template will be useful for financiers, company executives, startups, economists. 3 Year Financial Projection template will complement your presentations and will be a great addition to your collection of professional presentations.

Related Products

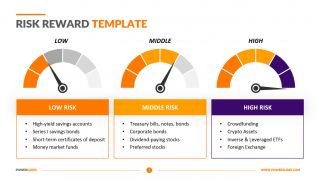

Risk Reward Template

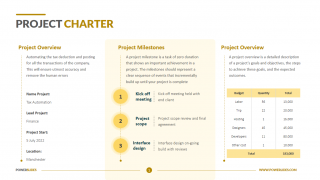

Project Charter

Agile Marketing vs Traditional Marketing

Earning Statement

Project Management Timeline

Bitcoin PowerPoint

Vertical vs Horizontal Integration

Standard Operating Procedure

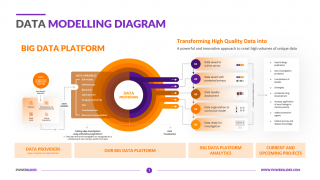

Data Model Diagram

Career Path

You dont have access, please change your membership plan., great you're all signed up..., verify your account.

PowerSlides.com will email you template files that you've chosen to dowload.

Please make sure you've provided a valid email address! Sometimes, our emails can end up in your Promotions/Spam folder.

Simply, verify your account by clicking on the link in your email.

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

Business Financial Projections Plan Template

What is a Business Financial Projections Plan?

A business financial projections plan is a strategy created to forecast and plan for a business's financial future. It includes estimating and planning for the growth and financial performance of the business over the short-term and long-term. This plan typically includes specific strategies and goals to ensure that the financial plan is achieved.

What's included in this Business Financial Projections Plan template?

- 3 focus areas

- 6 objectives

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

Who is the Business Financial Projections Plan template for?

This business financial projections plan template is designed for businesses of all sizes and industries. It will guide you through the process of creating a financial projection plan that is tailored to your unique business needs and goals. This template will help you make informed decisions about your finances and give you a clear direction for the future of your business.

1. Define clear examples of your focus areas

Focus areas are the areas of your business that you want to focus on for improvement. These areas will then be broken down into objectives and actionable items that you can use to reach your desired goals. Examples of strategic focus areas that could fall under a Business Financial Projections Plan could be: Financial Projections, Operational Efficiency, and Human Resources.

2. Think about the objectives that could fall under that focus area

Objectives are the goals that you have for each focus area. They should be specific and measurable to ensure that you are achieving the desired results. Examples of some objectives for the focus area of Financial Projections could be: Increase Revenue, and Lower Cost of Goods Sold.

3. Set measurable targets (KPIs) to tackle the objective

KPIs, or Key Performance Indicators, are metrics used to measure the progress of your objectives. They should be specific and measurable so you can track your progress. For example, a KPI for increasing revenue could be to “Increase Revenue by 10%” or for reducing customer service response time could be “Reduce Average Response Time by 1 Minute”.

4. Implement related projects to achieve the KPIs

Projects, or actions, are the steps you need to take to achieve your objectives and reach your KPIs. These should be specific initiatives that you need to do in order to reach your goals. For example, if you want to increase revenue you could develop integrated sales programs or if you want to reduce customer service response time you could enhance customer support.

5. Utilize Cascade Strategy Execution Platform to see faster results from your strategy

Cascade Strategy Execution Platform is a powerful tool designed to help companies reach their goals faster. With advanced analytics and real-time performance management, you can track the progress of your strategy and ensure that you are reaching your objectives. With Cascade, you can easily create, track, and measure your business financial projections plan.

Financial Projections for Startups [Template + Course Included]

January 11, 2022

Adam Hoeksema

Financial projections are an important part of any business plan or startup pitch deck. They allow a company to estimate future revenues, expenses, and profits, and to identify potential risks and opportunities. We have been helping founders create financial projections through our templates, tools, and custom financial modeling services since 2012. I thought it was finally time to write a comprehensive article that should answer the key questions that we get from founders again and again. So here is what I plan to cover:

What are financial projections?

Why should a startup create financial projections, how to create a financial forecast , creating sales projections based on data, forecasting operating expenses, salary projections.

- Startup cost forecasting

Pro forma financial statements

Existing business vs. startup vs acquisition forecasting, how to know whether my projections are realistic, what will investors and lenders be looking for in my projections, tools used for financial forecasting.

But first, who am I, and do I know anything about financial projections?

My name is Adam Hoeksema and I am the Co-Founder of ProjectionHub. Since 2012 we have helped over 50,000 entrepreneurs create financial projections between our software tool and our business projection spreadsheet templates .

I didn’t spend a decade on Wall Street or make a killing in private equity, and I haven’t even raised VC funding myself.

But I did spend over a decade launching a growing an SBA (Small Business Administration) lender in the Indianapolis, IN area. During that time we made over 1,800 small business loans and we often asked our clients for financial projections along with their loan applications. That is why I started ProjectionHub.

So 10 years ago my experience was with helping small, main street businesses create projections and secure loan funding to start their dream. Along the way, I learned a ton about startup projections for tech-based businesses as well. Today about 50% of our work is with small businesses looking for an SBA loan and 50% is with tech-based businesses looking to raise capital from investors.

With that background in mind, I want to share with you what I have learned along the way to try to make your financial forecasting process just a little bit easier. Let’s dive in!

Financial projections are estimates of the future financial performance of a company. These projections are typically based on a set of assumptions and are used to help businesses plan for the future and make informed decisions about investments, financing, and other strategic matters. Most ProjectionHub customers use pro forma financials to help external stakeholders, such as investors and lenders understand a company's financial position and future prospects. Financial projections typically include projections of income, expenses, cash flow, and balance sheet items.

There are many opinions on whether a startup needs to create a forecasted balance sheet and how many years a set of projections should be. At ProjectionHub, all of our financial projection templates have an integrated pro forma income statement, cash flow and balance sheet in annual and monthly format for 5 years. This seems to meet the needs of 99% of our customers, so I think it is pretty safe to say that your investor or lender might not require all of that level of information, but they probably won’t require more than a 5-year forecast of your 3 statement financials.

So it sounds like a lot of work to create a financial forecast, so why do we create projections? No one can know the future. Isn’t it just a pointless exercise?

Well, I think it is smart for an entrepreneur to create a set of projections before they start a business to understand what they are getting themselves into and what it will take to break even and generate a profit.

I could beat that drum all day, and you know what it doesn’t really matter. Even if we know it is a good idea to create projections before throwing our life savings into a new venture, most entrepreneurs will not create projections before starting their business. I have just come to accept this!

So the real reason to create projections is because the people with the money, the investors and lenders ask for them.

- Investors will ask for a financial model because they want to see how you plan to use their money, how long you think it will last, and what the potential return could be.

- Lenders will ask to see financial projections for startups or new projects or divisions in a business because they want to be able to see whether you think you can pay them back or not. How does your debt service coverage ratio look? How many cups of coffee are you going to have to sell to make your monthly loan payment?

Now that we know why we are creating projections and who the audience is, let’s get into the “how.”

So the plan now is to walk through how to create a set of financial projections, how to do good research to take a data-driven approach when modeling, what tools you can use to help you with research, and then how to know whether your forecast is realistic once you are done. We are going to look at:

- Creating revenue projections

- Operating Expenses

- Salaries Forecasting

- How to get investor and lender-ready projections

Revenue Projections

This is where we will camp out for a while. I want to show you a few examples of different types of revenue models to show you how I approach creating revenue projections.

If you have a stable, existing business, then it is possible that the best approach to creating sales projections is simply to take last year’s numbers and apply a growth rate based on your expectations of growth. Since that approach is quite straightforward I am not going to spend any time on that today. Our Existing Business Forecast Template will be perfect for you in this scenario.

We are going to focus on more of a first principles approach. I am going to outline two different approaches that I often take when building a financial model. First a capacity approach and then a customer funnel approach.

Capacity-Based Revenue Projections

I use a capacity-based approach to revenue projections when a company is pretty certain to have demand for their products or services and their revenue is more of a function of your price x capacity.

Here are some examples of businesses where I would take a capacity-based approach.

Farming Projections

For a farm, your revenue forecast is going to be based on how many acres you are farming x the yield per acre x the price per unit for your crop. You don’t really need to worry about whether you have a customer or not. Since most crops are commodities you won’t need to find a customer, you simply sell into the ready made market at the market price.

Trucking Projections

Trucking is similar in the sense that as long as you have a valid license and a working truck, you will be able to find loads to deliver. The question is more about how many trucks do you have, how many miles per day can each truck drive and what price will you be able to earn per mile. Again this is about capacity and price, not whether or not you can find a customer. This is the approach we take to show how a trucking business with one truck can generate $400k in annual revenue .

Daycare Facility

A daycare facility will also be able to calculate a capacity based on the size of the facility and the teacher-to-student ratio requirements. Once you have your capacity it is mostly a function of pricing to determine your revenue forecast. You can see a screenshot from our daycare financial forecast tool to see how we think about modeling this type of business.

I would say most tech businesses do not fall into a capacity-based projection approach.

For tech companies, I typically use a customer funnel-based approach to forecasting revenue.

Customer Funnel-Based Revenue Projection Approach

These are companies where your customer might not even know your product or service exists and might not know that they want it or need it so you are going to have to really go out and market and sell. You will likely have a customer funnel that will have leads that convert into customers over time.

Here are some examples of business models where I would use a customer funnel approach to financial modeling.

B2B SaaS Projections

For a B2B SaaS product you will probably have an advertising budget and a sales team that will drive leads that your team will work to qualify. Then some percentage of those sales qualified leads will turn into customers. You will need assumptions for things like:

- A monthly ad budget

- Cost per click to attract a website visitor

- Percentage of website visitors that become sales qualified leads

- Percentage of sales qualified leads that the sales team converts into customers

- Average monthly spend per customer

DTC Product Forecasting

For direct to consumer product companies you will have a similar customer funnel. Once you get to a customer, then you might have assumptions like:

- Average order value

- % of customers that become repeat customers

- How often do repeat customers repurchase

Consumer Apps

For a consumer mobile app you will need assumptions for things like:

- Monthly ad budget

- Cost per download

- Organic / word of mouth downloads

- % of customers that download the app that convert into active users

- % of active users that churn each year

- Average monthly spend per active user per month

So this should give you an idea of the structure of assumptions that you will need in order to approach creating projections, but I just left you with a bunch of assumptions that you have no idea how to fill in with realistic data.

Next I want to show you what I would do in order to research and find good data for your sales projections.

So how do you know how many people are searching on Google for terms that are relevant to your product or service? How do you know how much it would cost to advertise and get a click for that term? How do you know what a reasonable conversion rate is from a website visitor to a customer? How do you know what the average order value is for an ecommerce business like yours, etc?

I recorded an entire course on this , but I have listed some tools and some slides below to show you my typical research process.

As you will notice in the slides, I start out be simply doing Google research to try to find reasonable assumptions for as many of the key assumptions as I can.

From there, I like to use the following tools:

- Ahrefs - I use this tool for competitor research to determine how much organic traffic my competitors are getting and thereby how much organic traffic my website might get over time.

- Google Trends - I use Google Trends to see seasonality trends in a business.

- Google Adwords Keyword Tool - I use this tool to forecast how much it will cost per click to attract a website visitor, and to see search volume for certain keywords.

- Bizminer - You can use Bizminer industry reports to get an idea of key industry ratios to get an idea of whether your projections are realistic for your industry.

When forecasting expenses I like a couple of different resources to help me forecast my expenses and ensure that my expense projections are within industry standards.

Expenses for Small Businesses