Hedge Fund Business Plan Template

Written by Dave Lavinsky

Hedge Fund Business Plan

You’ve come to the right place to create your Hedge Fund business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Hedge Fund companies.

Below is a template to help you create each section of your Hedge Fund business plan.

Executive Summary

Business overview.

LeadingEdge Capital is a startup hedge fund company located in Boston, Massachusetts. The company was founded by Robert Wilkens and Stuart Rosenberg, proven strategists of high value investments in their former employment roles as hedge fund managers. Robert Wilkens was a hedge fund manager for fifteen years, building the portfolios of his clients to over 45M within that time. Stuart Rosenberg, a hedge fund manager for thirteen years, built his clients portfolios to over 25M within the years of his employment.

With the breakup of the ownership in their former employment, Robert and Stuart have determined this is the right and best time to open their own hedge fund company. Located in Boston, Massachusetts, a geographic area housing an abundance of serious investors, the new partners believe their former clients will support and invest in the new hedge fund. Toward that end, Robert and Stuart are starting to contract with those clients before the launch of LeadingEdge Capital.

Product Offering

The following are the services that LeadingEdge Capital will provide:

- Proven strategies for significant investment returns

- Deep and thorough market analysis using proprietary tech tools

- Unique client evaluation tools to assess risk appetite

- Thorough market analysis and reports

- Fund evaluation and administration

- Advanced technologies to monitor risk

- Data analysis to support profitable trading opportunities

- Day to day fund management

Customer Focus

LeadingEdge Capital will target all former clients of the prior employer. They will target investors from the Boston area and surrounding region. They will target risk-averse investors in the region. They will target clients at events, through networking opportunities, and industry associations. They will lead and speak at industry and investor events. They will educate potential investors via a unique set of educational video presentations at their website.

Management Team

LeadingEdge Capital will be co-owned and operated by Robert Wilkens and Stuart Rosenberg. They have recruited former associates from their prior employment to join their launch. This includes Mark Tompkins, who will act as the third-party fund administrator, Terry Camden, the independent certified public accountant, Tami Watson, the custodian, and Larry Lawson, the on-call attorney for LeadingEdge Capital.

Robert Wilkens holds a master’s degree in business administration from Harvard University. He is known as a brilliant strategic fund manager and has a wide circle of investors who rely on his capabilities to assess risk and manage the growth of their funds. Stuart Rosenberg is particularly gifted as a leader who can assist risk-averse investors with trust-building tools he built into a proprietary client app. The app helps investors see and track daily market activities and it ties global and national events to those activities to inform the client of a full-picture reason for the fund’s daily performance.

The remaining team members consist of: Mark Tompkins, who will act as the third-party fund administrator, Terry Camden, an independent certified public accountant, Tami Watson, the hedge fund custodian, and Larry Lawson, the on-call attorney for LeadingEdge Capital.

Success Factors

LeadingEdge Capital will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team of LeadingEdge Capital

- Comprehensive menu of services, including educational webinars for new investors

- Proprietary app that assists managers and investors in making key decisions

- Compelling data analysis program to support profitable trading opportunities

- LeadingEdge Capital will offer discounted rates for “anchor investors” during the first six months of the establishment process. This is limited to 100 investors and includes on-going low percentage rates overall for the first-in investor pool.

Financial Highlights

LeadingEdge Capital is seeking $200,000 in debt financing to launch its LeadingEdge Capital. The funding will be dedicated toward securing the midtown Boston office space and purchasing office equipment and supplies. Funding will also be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs for the marketing and networking fees and costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

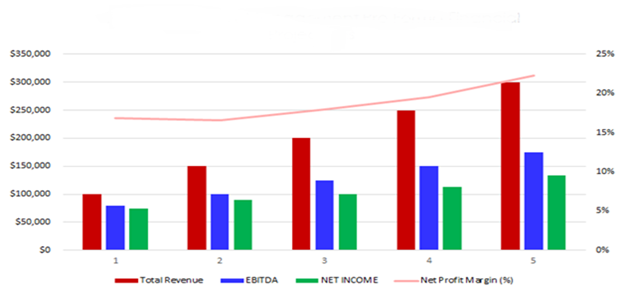

The following graph outlines the financial projections for LeadingEdge Capital.

Company Overview

Who is leadingedge capital.

LeadingEdge Capital is a newly established full-service hedge fund company in Boston, Massachusetts. LeadingEdge Capital will be the most reliable, cost-effective, and efficient choice for investors in Boston and the surrounding communities. LeadingEdge Capital will provide a comprehensive menu of educational, investing, managing and assessment services for any client to utilize. Their full-service approach includes a comprehensive proprietary app and unique tools that are exclusive to LeadingEdge Capital.

LeadingEdge Capital is projecting at least one hundred clients within the first year of business. The team of professionals are highly qualified and experienced in hedge funds and all the permutations and regulations, and have strategic methods to find and evaluate new opportunities. LeadingEdge Capital provides an high-value investment process that will build their clients’ portfolios extensively through years of the best customer service from LeadingEdge Capital.

LeadingEdge Capital History

LeadingEdge Capital is a startup hedge fund company founded by Robert Wilkens and Stuart Rosenberg, proven strategists of high value investments in their former employment roles as hedge fund managers. Robert Wilkens was a hedge fund manager for fifteen years, building the portfolios of his clients to over 45M within that time. Stuart Rosenberg, a hedge fund manager for thirteen years, built his clients portfolios to over 25M within the years of his employment.

Since incorporation, LeadingEdge Capital has achieved the following milestones:

- Registered LeadingEdge Capital, LLC to transact business in the state of Massachusetts.

- Has a contract in place at a midtown Boston office building with 10,000 square foot space for offices and client waiting areas.

- Reached out to numerous former clients to engage them with the new LeadingEdge Capital hedge fund.

- Began recruiting a staff of managers, associated professionals and office personnel to work at LeadingEdge Capital.

LeadingEdge Capital Services

The following will be the services LeadingEdge Capital will provide:

Industry Analysis

The hedge fund investment industry is expected to grow during the next five years to over $123 billion. The growth will be driven by more investors seeking the resilient hedge fund market. The growth will also be driven by continued hedge fund interest driven by consumers who want to learn about the process and are eager for education. The growth will be driven by a greater use of technology to provide lower-risk options for investment that continually bring returns. Costs will likely be reduced as hedge fund managers lower fees to accommodate early entry investors. Costs will also likely be reduced as hedge fund managers continue to have increased access to retail investors.

Customer Analysis

Demographic profile of target market, customer segmentation.

LeadingEdge Capital will primarily target the following customer profiles:

- Former clients at prior employment

- Potential investors at networking events, industry relationships

- Potential Risk-averse investors who can rely on technology at LeadingEdge Capital

- Potential investors who are seeking self-education via webinars

- Potential investors who choose technology as a main driver for decision-making

Competitive Analysis

Direct and indirect competitors.

LeadingEdge Capital will face competition from other companies with similar business profiles. A description of each competitor company is below.

One Star Capital Partners

One Star Capital Partners has been in business in the Boston area for over seventy-five years. The current partners are the children and grandchildren of the original founders of the hedge fund business. The investor portfolio of One Star Capital Partners is a combined 210B, which has been produced via the past several years of wealth-building and wealth-creation for their clients. The company has experienced a loss of clients during the past five years, however, as the descendents of the original partners have been engaged in litigation regarding the ownership percentages of the privately-held company. This has led to some discouragement from clients and organizational changes that are difficult to understand or explain.

The promise of One Star Capital Partners is to build wealth through secure investor commitments that total as much or more than the previous years. The company has led investors toward a global macro investing environment which didn’t prove to be compatible with the event-driven model of prior years. This shift created a net loss of investors during the past five years, although forward-looking statements have recently been made during investor phone calls.

AlphaDrive & Company

With a golfer’s nomenclature and several clients directed into the golf, tennis and soccer investment categories, AlphaDrive & Company are becoming an established hedge fund after the introduction of the company in 2020. The hedge fund is fairly small, with a combined portfolio of all managers standing at 20M in 2023, the fund promises to expand and increase opportunities for investors to explore all sectors of the sports arena, finding attractive potential for earnings among their clientele. One of the unique aspects of this company is that it was founded by two famous golf celebrities and those relationships allow investors to enter the pro am golf tournaments throughout the world. Similar relationships and capabilities allow sports enthusiasts to meet their “favorite” athletes to join in activities as a result of investing with AlphaDrive & Company.

Howard & Howard Capital

Howard & Howard is a Boston-based hedge fund that was established in 2005. It is owned and operated by a father-son investment team. The company focuses on real estate conglomerates, REITS, distressed properties, and other lucrative real estate opportunities that are ripe for investment. The hedge fund represents those who believe their best returns will always come from land or the acquisition of real estate and are willing to invest significant sums of money in appropriate low-risk, high-return ventures. Robert Howard is the president of Howard & Howard Capital, while his son, Thomas Howard is the vice president of the company. Their office building is situated on the harborside of Boston, amid brick-lined walkways and older buildings indicative of early Boston. This feature attracts the potential investors who appreciate the heritage and value of land, especially land that is situated in the Massachusetts region. Investment opportunities include major retail outlets, farm and ranch land, undeveloped residential areas, and other land-based opportunities.

Competitive Advantage

LeadingEdge Capital will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

LeadingEdge Capital will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who are able to provide a comprehensive set of select investment opportunities to current and potential investors.

- Educational webinars via the website for “introductory” investors

- Discounted rates for “anchor investors” for first 6 months of business

Promotions Strategy

The promotions strategy for LeadingEdge Capital is as follows:

Word of Mouth/Referrals

LeadingEdge Capital has built up an extensive list of potential years from prior years of the former hedge fund that employed the founders of LeadingEdge. The former employer is now defunct, which indicates a wide swatch of investors who require a new, fresh set of opportunities to be garnered by the well-known and personable staff of LeadingEdge Capital. Having produced multiple opportunities and millions of dollars of profit with the former hedge fund managers, the former clients are eager to get in on the “anchor investor” program and start earning returns on investments once again.

Professional Associations and Networking

The owners of LeadingEdge Capital will continue extensively networking, attending and speaking at engagements that include current and potential investors. The company has plans to attend national conferences and exhibit at trade shows, where introductory materials can be offered to new investors just entering the market.

Website/SEO Marketing

LeadingEdge Capital will fully utilize their website. The website will be well-organized, informative, and list all the services that LeadingEdge Capital provides. The website will also list their contact information and testimonials from current and former clients. The website will have SEO marketing tactics embedded so that anytime someone types in the Google or Bing search engine “hedge fund company” or “hedge fund company near me”, LeadingEdge Capital will be listed at the top of the search results.

The pricing of LeadingEdge Capital will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for LeadingEdge Capital. Operation Functions:

- Robert Wilkens will be the co-owner and President of the company. He will oversee and manage client relations, investor recruitments and forward-looking opportunities.

- Stuart Rosenberg will be the co-owner and Vice President of the company. He will oversee the technological research and development for the company.

- Mark Tompkins will be the third-party fund administrator.

- Terry Camden will be the independent certified public accountant assisting the company

- Tami Watson will be the Custodian of LeadingEdge Capital, assisting the company

- Larry Lawson will be the on-call Attorney for LeadingEdge Capital.

Milestones:

LeadingEdge Capital will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts for the LeadingEdge Capital

- 6/1/202X – Finalize contracts for LeadingEdge Capital clients

- 6/15/202X – Begin networking at industry events

- 6/22/202X – Begin moving into LeadingEdge Capital office

- 7/1/202X – LeadingEdge Capital opens its office for business

Financial Plan

Key revenue & costs.

The revenue drivers for LeadingEdge Capital are the investment fees they will charge to the investor clients for their services.

The cost drivers will be the overhead costs required in order to staff LeadingEdge Capital. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

LeadingEdge Capital is seeking $200,000 in debt financing to launch its hedge fund company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the events and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Clients Per Month: 175

- Average Fees per Month: $125,000

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, hedge fund business plan faqs, what is a hedge fund business plan.

A hedge fund business plan is a plan to start and/or grow your hedge fund business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Hedge Fund business plan using our Hedge Fund Business Plan Template here .

What are the Main Types of Hedge Fund Businesses?

There are a number of different kinds of hedge fund businesses , some examples include: Global Macro, Event-driven, Relative value, and Directional.

How Do You Get Funding for Your Hedge Fund Business Plan?

Hedge Fund businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Hedge Fund Business?

Starting a hedge fund business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Hedge Fund Business Plan - The first step in starting a business is to create a detailed hedge fund business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your hedge fund business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your hedge fund business is in compliance with local laws.

3. Register Your Hedge Fund Business - Once you have chosen a legal structure, the next step is to register your hedge fund business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your hedge fund business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Hedge Fund Equipment & Supplies - In order to start your hedge fund business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your hedge fund business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful hedge fund business:

- How to Start a Hedge Fund Business

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

- Sample Business Plans

Hedge Fund Business Plan

Any investment manager that launches and manages a hedge fund bears enormous responsibility and must provide their investors with a lot of monitoring.

As a hedge fund manager, it is crucial to have a clear understanding of your target market, investment strategies, and risk management approach. A well-constructed business plan can help to guide your decision-making and set your hedge fund up for long-term success.

Need help writing a business plan for your hedge fund business? You’re at the right place. Our hedge fund business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Hedge Fund Business Plan?

Writing a hedge fund business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your business:

- This section may include the name of your hedge fund business, its location, when it was founded, the type of hedge fund business (E.g., multi-strategy hedge funds, macro hedge funds, long/short equity hedge funds), etc.

Market opportunity:

Product and services:.

- For instance, you may include investment management & portfolio diversification as services.

Marketing & sales strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section

Business description:

- Long/short-term hedge fund

- Event-driven hedge funds

- Macro hedge funds

- Multi-strategy hedge funds

- Global macro hedge funds

- Distressed hedge funds

- Describe the legal structure of your hedge fund company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission statement:

Business history:.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

Future goal:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

- For instance, business owners, individuals interested in investment, institutional investors, etc would be an ideal target audience for a hedge fund business.

Market size and growth potential:

Competitive analysis:, market trends:.

- For instance, the rise of quantitative strategies is there; explain how you plan on dealing with this potential growth opportunity.

Regulatory environment:

Here are a few tips for writing the market analysis section of your hedge fund business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Investment services:

Give a brief description of the investment services the hedge fund provides to its clients. It may include:

- Individual or institutional accounts,

- Specialized portfolio management,

- Risk management.

Investment philosphy:

Risk management:.

In short, this section of your hedge fund plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique selling proposition (USP):

- For example, track record, expert team, and description of your investment strategy could be some of the great USPs for a hedge fund company.

Pricing strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your hedge fund business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your hedge fund business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & training:

Operational process:, equipment & software:.

- Explain how these technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your hedge fund business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founder/CEO:

Key managers:.

- It should include, key executives(e.g. COO, CMO.), senior management, and other department managers (e.g. operations manager, customer services manager.) involved in the hedge fund business operations, including their education, professional background, and any relevant experience in the industry.

Organizational structure:

Compensation plan:, advisors/consultants:.

- So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your hedge fund services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

Financing needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your hedge fund business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample hedge fund business plan will provide an idea for writing a successful hedge fund plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our hedge fund business plan pdf .

Related Posts

Publishing Company Business Plan

Investment Company Business Plan

400+ Sample Business Plans Free

Business Plan Presentation Guide

Frequently asked questions, why do you need a hedge fund business plan.

A business plan is an essential tool for anyone looking to start or run a successful hedge fund business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your hedge fund company.

How to get funding for your hedge fund business?

There are several ways to get funding for your hedge fund business, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your hedge fund business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your hedge fund business plan and outline your vision as you have in your mind.

What is the easiest way to write your hedge fund business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any hedge fund business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

How to Start a Hedge Fund

ON THIS PAGE

How To Start a Hedge Fund

How to start a hedge fund faqs.

- Helpful Slideshows, Videos & Images

- Additional Resources in the Hedge Fund Industry

Starting a hedge fund can be very profitable. With proper planning, execution and hard work, you can enjoy great success. Below you will learn how to start a hedge fund successfully.

Importantly, a crucial step in starting a software company is to complete your business plan. To help you out, you should download Growthink’s Ultimate Business Plan Template here.

Download our Ultimate Business Plan Template here

16 Steps To Start a Software Company

- Choose the Name for Your Hedge Fund

- Develop Your Hedge Fund Business Plan

- Choose the Legal Structure for Your Hedge Fund

- Secure Startup Funding for Your Hedge Fund (If Needed)

- Write Your Investment Agreement

- Secure a Location for Your Business

- Register Your Hedge Fund With the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Hedge Fund

- Buy or Lease the Right Hedge Fund Business Equipment

- Develop Your Hedge Fund Marketing Materials

- Purchase and Setup the Software Needed to Run Your Hedge Fund

- Hire a Team

- Open for Business

1. Choose the Name for Your Hedge Fund

The first step to starting a hedge fund is to choose your business’ name.

This is a very important choice since your company name is your brand and will last for the lifetime of your business. Ideally you choose a name that is meaningful and memorable. Here are some tips for choosing a name for your hedge fund:

- Make sure the name is available. Check your desired name against trademark databases and your state’s list of registered business names to see if it’s available. Also check to see if a suitable domain name is available.

- Keep it simple. The best names are usually ones that are easy to remember, pronounce and spell.

- Think about marketing. Come up with a name that reflects the desired brand and/or focus of your hedge fund.

2. Develop Your Hedge Fund Business Plan

One of the most important steps in starting your own hedge fund is to develop your hedge fund business plan . The process of creating your plan ensures that you fully understand your market and your business strategy. The plan also provides you with a roadmap to follow and if needed, to present to funding sources to raise capital for your business.

Your business plan should include the following sections:

- Executive Summary – this section should summarize your entire business plan so readers can quickly understand the key details of your hedge fund

- Company Overview – this section tells the reader about the history of your hedge fund and what type of hedge fund you operate. For example, you might explain your specific hedge fund strategy here.

- Industry Analysis – here you will document key information about the hedge fund industry. Conduct market research and document how big the industry is and what trends are affecting it.

- Customer Analysis – in this section, you will document who your ideal or target customers are and their demographics. For example, how much money do they have to invest? What do they look for in investment opportunities?

- Competitive Analysis – here you will document the key direct and indirect competitors you will face and how you will build competitive advantage.

- Marketing Plan – your marketing plan should address the 4Ps: Product, Price, Promotions and Place.

- Product : Determine and document what products/services you will offer

- Prices : Document the prices of your products/services

- Place : Where will your business be located and how will that location help you increase sales?

- Promotions : What promotional methods will you use to attract customers to your hedge fund? For example, you might decide to use pay-per-click advertising, public relations, search engine optimization and/or social media marketing.

- Operations Plan – here you will determine the key processes you will need to run your business operations. You will also determine your staffing needs. Finally, in this section of your plan, you will create a projected growth timeline showing the milestones you hope to achieve in the coming years.

- Management Team – this section details the background of your company’s management team.

- Financial Plan – finally, the financial plan answers questions including the following:

- What startup costs will you incur?

- How will your hedge fund make money?

- What are your projected sales and expenses for the next five years?

- Do you need to raise funding to launch your business?

Finish Your Business Plan Today!

3. choose the legal structure for your hedge fund.

Next you need to choose a legal structure for your hedge fund and register it and your business name with the Secretary of State in each state where you operate your business. When in doubt, it is best to consult with a professional.

Below are the five most common legal structures:

1) Sole Proprietorship

A sole proprietorship is a business entity in which the owner of the hedge fund and the business are the same legal person. The owner of a sole proprietorship is responsible for all debts and obligations of the business. There are no formalities required to establish a sole proprietorship, and it is easy to set up and operate. The main advantage of a sole proprietorship is that it is simple and inexpensive to establish. The main disadvantage is that the owner is liable for all debts and obligations of the business.

2) Partnerships

A partnership is a legal structure that is popular among small businesses. It is an agreement between two or more people who want to start a hedge fund together. The partners share in the profits and losses of the business.

The advantages of a partnership are that it is easy to set up, and the partners share in the profits and losses of the business. The disadvantages of a partnership are that the partners are jointly liable for the debts of the business, and disagreements between partners can be difficult to resolve.

3) Limited Liability Company (LLC)

A limited liability company, or LLC, is a type of business entity that provides limited liability to its owners. This means that the owners of an LLC are not personally responsible for the debts and liabilities of the business. The advantages of an LLC for a hedge fund include flexibility in management, pass-through taxation (avoids double taxation as explained below), and limited personal liability. The disadvantages of an LLC include lack of availability in some states and self-employment taxes.

4) C Corporation

A C Corporation is a business entity that is separate from its owners. It has its own tax ID and can have shareholders. The main advantage of a C Corporation for a hedge fund is that it offers limited liability to its owners. This means that the owners are not personally responsible for the debts and liabilities of the business. The disadvantage is that C Corporations are subject to double taxation. This means that the corporation pays taxes on its profits, and the shareholders also pay taxes on their dividends.

5) S Corporation

An S Corporation is a type of corporation that provides its owners with limited liability protection and allows them to pass their business income through to their personal income tax returns, thus avoiding double taxation. There are several limitations on S Corporations including the number of shareholders they can have among others.

Once you register your hedge fund, your state will send you your official “Articles of Incorporation.” You will need this among other documentation when establishing your banking account (see below). We recommend that you consult an attorney in determining which legal structure is best suited for your company.

4. Secure Startup Funding for Your Hedge Fund (If Needed)

In developing your hedge fund plan, you might have determined that you need to raise funding to launch your business.

If so, the main sources of funding for a hedge fund to consider are personal savings, family and friends, credit card financing, bank loans, crowdfunding and angel investors. Angel investors are individuals who provide capital to early-stage businesses. Angel investors typically will invest in a hedge fund that they believe has high potential for growth.

5. Write Your Investment Agreement

Your investment agreement is a crucial document for your hedge fund and can be shown to prospective investors to persuade them to invest. Your investment agreement should define your fees, the commitment required to join the hedge fund, and how investors can receive distributions. You should plan to work with an attorney to create a solid investment agreement.

6. Secure a Location for Your Business

Having the right space can be important for your new hedge fund, particularly if you’d like to meet with hedge fund investors there.

To find the right space, consider:

If you choose to buy or rent a physical location, consider:

- Driving around to find the right areas while looking for “for lease” signs

- Contacting a commercial real estate agent

- Doing commercial real estate searches online

- Telling others about your needs and seeing if someone in your network has a connection that can help you find the right space

7. Register Your Hedge Fund With the IRS

Next, you need to register your business with the Internal Revenue Service (IRS) which will result in the IRS issuing you an Employer Identification Number (EIN).

Most banks will require you to have an EIN in order to open up an account. In addition, in order to hire employees, you will need an EIN since that is how the IRS tracks your payroll tax payments.

Note that if you are a sole proprietor without employees, you generally do not need to get an EIN. Rather, you would use your social security number (instead of your EIN) as your taxpayer identification number.

8. Open a Business Bank Account

It is important to establish a bank account in your hedge fund’s name. This process is fairly simple and involves the following steps:

- Identify and contact the bank you want to use

- Gather and present the required documents (generally include your company’s Articles of Incorporation, driver’s license or passport, and proof of address)

- Complete the bank’s application form and provide all relevant information

- Meet with a banker to discuss your business needs and establish a relationship with them

9. Get a Business Credit Card

You should get a business credit card for your hedge fund to help you separate personal and business expenses.

You can either apply for a business credit card through your bank or apply for one through a credit card company.

When you’re applying for a business credit card, you’ll need to provide some information about your business. This includes the name of your business, the address of your business, and the type of business you’re running. You’ll also need to provide some information about yourself, including your name, Social Security number, and date of birth.

Once you’ve been approved for a business credit card, you’ll be able to use it to make purchases for your business. You can also use it to build your credit history which could be very important in securing loans and getting credit lines for your business in the future.

10. Get the Required Business Licenses and Permits

Generally speaking, a hedge fund only needs a business license to operate. However, depending on the type of hedge fund you start and the amount of money being managed, you may be required to complete additional registrations. You should also plan to register any type of hedgefund with your state’s Securities and Exchange Commission (SEC) office and may need to pass an exam for investment advisors.

Key licenses and registration to keep in mind include:

- General Business License – Most businesses will need to get a business license from their local government in order to operate. This is usually a one-time fee and is required regardless of they type of business you operate.

- SEC Registration – Hedge funds with more than $ 100 million in assets under management will be required to register with the SEC.

- Series 65 Exam – If your hedge fund will be giving investment advice, you and any other investment advisor on your team may need to pass the Series 65 exam.

Depending on the type of hedge fund you operate, you will need to do more research and obtain the necessary licenses and registrations.

10. Get Business Insurance for Your Hedge Fund

Business insurance policies that you should consider for your hedge fund include:

- General Liability Insurance – This insurance protects the hedge fund from third-party claims arising from bodily injury, property damage, personal injury, and advertising injury.

- Commercial Property Insurance – Commercial property insurance protects your business if something bad happens to the property. This could be a fire, natural disaster, or someone breaking in and stealing things.

- Directors and Officers (D&O) Liability Insurance – D&O liability insurance protects the directors and officers of the hedge fund from third-party claims arising from wrongful acts.

- Professional Indemnity Insurance – PI insurance protects the hedge fund from third-party claims arising from professional negligence.

- Workers’ Compensation Insurance – This insurance protects the hedge fund’s employees from injuries sustained while working.

Find an insurance agent, tell them about your business and its needs, and they will recommend policies that fit those needs.

12. Buy or Lease the Right Hedge Fund Business Equipment

A hedge fund needs computers, printers, and phones. If you have a large team, you will also need to provide basic office supplies and equipment. You might also consider purchasing reception furniture and other office furniture, depending on the size of your physical location.

13. Develop Your Hedge Fund Marketing Materials

Marketing materials will be required to attract and retain customers to your hedge fund.

The key marketing materials you will need are as follows:

- Logo – Spend some time developing a good logo for your hedge fund. Your logo will be printed on company stationery, business cards, marketing materials and so forth. The right logo can increase customer trust and awareness of your brand.

- Website – Likewise, a professional hedge fund website provides potential customers with information about the products and/or services you offer, your company’s history, and contact information. Importantly, remember that the look and feel of your website will affect how customers perceive you.

- Social Media Accounts – Establish social media accounts in your company’s name. Accounts on Facebook, Twitter, LinkedIn and/or other social media networks will help customers and others find and interact with your hedge fund.

14. Purchase and Setup the Software Needed to Run Your Hedge Fund

A hedge fund needs software to track its investments and performance. It also needs software to help with accounting and compliance. There are many different types of software that a hedge fund might need, depending on its size and investment strategy.

Some of the most common software programs used by hedge funds include investment tracking software such as Bloomberg and Reuters, accounting software such as QuickBooks or Sage, and compliance software such as ComplianceGuardian.

15. Hire a Team

A hedge fund typically has four types of employees: traders, analysts, back office staff and managers.

Traders are responsible for buying and selling securities. They need to be able to make quick decisions based on market conditions.

Analysts study financial statements and conduct research to find investment opportunities.

Back office staff handle the fund’s financial operations, such as reconciling accounts and preparing financial reports.

Managers are responsible for the overall operation of the fund. They make strategic decisions about which investments to make and how much risk to take on.

To find or recruit good candidates, look for people who have experience working in the financial industry. You can also look for people who have degrees in finance or economics.

16. Open for Business

You are now ready to open your hedge fund. If you followed the steps above, you should be in a great position to build a successful business. Below are answers to frequently asked questions that might further help you.

How to Finish Your Hedge Fund Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to see how Growthink business plan consultants can create your business plan for you.

Is It Hard To Start a Hedge Fund?

The short answer is no. But the longer answer is that it depends on how you define "hard." If by "hard" you mean "costly," then the answer is yes-starting a hedge fund can be very expensive. If, on the other hand, you define "hard" as "challenging," then the answer is a resounding no.

The fact is, starting a hedge fund is not nearly as difficult as most people think. In fact, it's really not that different from starting any other type of business. The key is to have a clear understanding of the steps involved and to be prepared to execute them in a professional and efficient manner. Following the steps outlined above will help you get started.

How Can I Start a Hedge Fund With No Experience?

The answer is you can't-at least not legally. In order to start a hedge fund, you must have a certain level of experience in the industry. This experience can come in the form of working for another hedge fund, working in investment banking or private equity, or having a background in accounting or financial analysis.

In addition to experience, you'll also need to have a sound investment strategy. This doesn't mean that your strategy needs to be perfect, but it does need to be well-thought-out and defensible. You'll also need to have a good understanding of the markets you intend to trade in and the risks involved.

Last but not least, you'll need to raise capital. This can be the most difficult part of starting a hedge fund, but it's also the most important. Without capital, you won't be able to trade and you won't be able to make money for your investors.

What Type of Hedge Fund Is Most Profitable?

There is no one-size-fits-all answer to this question. The type of hedge fund that is most profitable will depend on your investment strategy, your level of experience, and the markets you trade in.

That said, there are certain types of hedge funds that tend to be more profitable than others. For example, hedge funds that use leverage (borrowed money) to make investments tend to be more profitable than those that don't. Similarly, hedge funds that focus on a specific market or asset class tend to be more profitable than those that invest in a wide range of assets.

How Much Does It Cost To Start a Hedge Fund?

Hedge fund startup costs include investment for website development, tax and annual audit, marketing and fund administration.

- Tax and Audit Fee - $25,000 (small hedge funds) and 100,000 (large or complex funds)

- Operational Costs : $150,000 (small hedge funds) and $ 75,000 to $120,000 (offshore)

- Legal Fees : $20,000 to $150,000

- Annual Fund Administration : $24,000 (for emerging funds) and $110,000 (for complex funds)

What Are the Ongoing Expenses for a Hedge Fund?

- Wages – Hedge fund market’s average wage is $347,216. It is anticipated to increase in the next years due to the demand for more skilled employees in the industry.

- Compliance Costs and Other Expenses – Compliance costs range from $700,000 to $14.0 million for hedge funds. Other expenses are administrative costs, legal costs, accounting fees, marketing costs, rent expenses, and depreciation.

How Does a Hedge Fund Make Money?

Hedge funds make money by charging a performance fee, which is typically a percentage of the profits earned on investments. In addition, most hedge funds also charge an annual management fee, which is used to cover the costs of running the fund.

Is Owning a Hedge Fund Profitable?

In general, hedge funds are profitable. However, there is a great deal of variation in the profitability of individual hedge funds. Some hedge funds make very little money, while others make billions of dollars in profits.

Why Do Hedge Funds Fail?

Hedge funds fail for a variety of reasons. Some hedge funds fail because they make bad investments. Others fail because they charge high fees or take on too much risk. And still others fail due to poor decisions from hedge fund managers.

How Big Is the Hedge Fund Industry?

There are 4,519 hedge fund businesses in the U.S. that generated $70.7 billion in revenue last year which represents an annual growth rate of 7.9% over the past five years.

What Are the Key Segments of the Hedge Fund Industry?

Hedge funds are segmented by its investment strategies. The largest segments for the industry is Equity focus. This is followed by a myriad of other products and services including:Fixed Income Focus, Event-driven, Multi-Strategy, Emerging Markets, Global Macro and Distressed Securities.

What External Factors Affect the Hedge Fund Industry?

The external factors that affect the performance of the hedge fund industry include:

- Demand From Retirement and Pension Plans - When retirement and pension plans increase, the hedge fund industry gains higher assets under management revenue, thus increasing the industry’s potential.

- S&P 500 - S&P 500 measures the stock market’s performance. An increase in S&P 500 causes the assets under management to increase as well as its revenue from flat fee. A faster rate of increase in S&P 500 compared with hedge fund returns threatens investor satisfaction.

- Investor Uncertainty - An increase in investor uncertainty harms the hedge fund industry as it inclines investors to withdraw their investments.

- Access to credit: Investing with borrowed money multiplies potential gains for hedge funds so an increase in access to credit also improves the hedge fund’s performance.

- OD – Regulation - As compliance cost for hedge funds increases, the profit margin decreases.

Who Are the Key Competitors in the Hedge Fund Industry?

The four largest hedge funds (Bridgewater, Blackrock, J.P. Morgan and Och-Ziff Capital) are estimated to account for 13.5% of the industry’s total assets under management. The remaining 86% of the industry consists of smaller firms.

What Are the Key Customer Segments in the Hedge Fund Industry?

The key customer segments in the hedge fund market are Pension Funds and Wealth Managers. This is followed by Insura

How Can I Make a Hedge Fund Successful?

Have a marketing plan.

Determine the type of hedge fund that you want to start. Identify your edge and communicate it with prospect investors through your print ads, websites, social media accounts, or email marketing. Find out how you can best reach your audience and invest in a reliable Customer Relationship Management tool to help you determine the progress of your communication with investors.

Choose Reliable Service Providers

Choose partners that will help you make decisions as you start your hedge fund as you cannot handle all operations at once. Find service providers that you can grow with so that you will not need to change providers from time to time, and make sure to work with providers that are fully equipped in their field to assure your investors that they are in good hands.

Develop an IT Budget

Technology plays a significant role in the hedge fund industry since the workflows and systems that are used in this business rely hugely on technology. Have an IT budget that will be able to provide the functionality that your systems need and that will be able to keep up with your business’ growth, so think long-term.

Study Hedge Fund Regulations

Know the agencies and regulatory bodies that you have to comply to and submit all the requirements needed before you start your hedge fund to avoid charges or prosecutions. Make sure to be able to pass the standards required for the registration of your business such as data protection, infrastructure practices, risk assessments, and email archiving.

Keep Your Firm and Investor Assets Safe

Investors make sure that the hedge funds they invest in are taking good care of their investments, so make your security measures compliant not just to the requirements of the monitoring firms but also to your investors’ standards. Identify risks and fill in the gaps with your technology safeguards. Make security a priority in starting up your business.

Document Everything

Make sure to keep a copy of your paper works, security measures, technology safeguards and documents or agreements with your investors. A lot of investors demand full disclosure from their fund managers. Proper documentation will save you from hassle and will also increase investors’ trust and confidence, which positively affects their tendency to invest more.

Continually Raise Capital

Market your hedge fund consistently. Your marketing efforts should not cease after you launch your business. Work hard to keep your firm different from the others and aim to be known by more investors.

How Much Do Hedge Fund Operators Make?

Hedge fund manager salaries range from $70,000 plus performance bonuses to over $1 billion dollars in compensation.

For additional information on the hedge fund market, consider these industry resources:

- Preqin: www.preqin.com

- BarclayHedge, LLC: www.barclayhedge.com

- Hedge Fund Research, Inc.: www.hedgefundresearch.com

- Hedge Fund Mavericks: www.hedgefundmavericks.com

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Need a business plan writer ? Click to see how Growthink’s business plan consulting services can help you create a great business plan.

Other Helpful Business Plan Articles & Templates

- Mon - Fri : 9:00am - 6:00pm EST

- +1 345 749 8390 | +1 212 920 6690

- Work with us

- Hedge Fund Business Plan

- HEDGE FUND RESOURCES

- Information

A hedge fund business plan is a different from writing a typical business plan, mostly due to the fact the hedge fund business model is different from a typical business.

When you create a hedge fund, you are actually creating two businesses: the management company and the fund itself. There are different styles of writing a hedge fund business plan but it should include the following four components: vision, company overview, product strategy, and market analysis.

- How many funds will the management company manage?

- Are there any plans to develop new products for investor?

- How will non-investment-related services be handled? Will they be outsourced?

- What are the factors that will contribute to the success of the business? For example, how dependent is the business on marketing vs. performance?

- Description of how each fund will be managed.

- Description of the different strategies used for each fund.

- What are the investment philosophies and strategies and how will this affect each fund?

- Discussion of expected leverage, turnover rate, characteristics.

- What are the benchmarks for each fund?

Company Overview

- Description of how the management company and fund are structured.

- A list of owners and how profits will be allocated.

- Detail the payments and expenses.

- How are the managers managed?

- What are the strategic alliances that the companies might have, if any?

- How will the management company be staffed?

- Where are the funds domiciled?

- Description of investment process for each fund and how this will impact results.

- Discussion of fee structure(s) and incentives.

Product Strategy

- Describe the products that the management company sells. In most cases, these products are investment management services.

- Describe in detail the investment strategy and philosophy for each fund.

- Discuss sources of risk and returns.

- What analytical tools are used?

- How will investment decisions be made? Who makes them?

- Discuss past fund performance or hypothetical fund performance if these strategies are implemented.

Market Analysis

- Discuss the demand for the services provided by the hedge fund.

- Analyze relevant sector growth and trend.

- Discuss the potential size of the fund.

- Discuss market factors that would impact the fund.

- Discuss the recent experience of investors in the relevant sector.

The Business Plan

Preparing a business plan, whether it’s for a start-up or an existing business, is one of the most important tools used in business management. We have over 27 years of experience in creating business plans for a variety of purposes from starting a business to seeking funding.

Using the Business Plan

A business plan is a tool with three basic purposes: communication, management, and planning. As a communication tool, it is used to attract investment capital, secure loans, convince workers to come on board, and assist in attracting strategic business partners.

The development of a comprehensive business plan shows whether or not a business has the potential to make a profit. It requires a realistic look at almost every phase of business and allows you to show that you have worked out all the problems and decided on potential alternatives before actually launching your business.

As a management tool, the business plan helps you track, monitor, and evaluate your progress. The business plan is a living document that you will modify as you gain knowledge and experience. By using your business plan to establish timelines and milestones, you can gauge your progress and compare your projections to actual accomplishments.

As a planning tool, the business plan guides you through the various phases of your business. A thoughtful plan will help identify roadblocks and obstacles so that you can avoid them and establish alternatives. Many business owners share their business plans with their employees to foster a broader understanding of where the business is going.

Business Plan Basics

A solid business plan precisely defines your business, identifies your goals, and serves as your company’s resume. It helps you allocate resources properly, handle unforeseen complications, and make good business decisions. It provides specific and organized information about your company and how you will repay borrowed money which is a crucial part of any loan application.

Every successful business plan should include some discussion about each of the following areas, since these are what make up the essentials of a good business plan:

› Executive summary › Market analysis › Company description › Organization & management › Marketing & sales management › Service or product line › Funding request › Financials › Appendix

A business plan should be a work-in-progress. Even successful, growing businesses should maintain a current business plan.

How Can We Help?

We're here to answer your questions, simple call or email.

Signup for our Newsletter.

It Makes A Difference With an Experienced Team

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Hedge Fund Business Plan Sample

Published Nov.11, 2016

Updated Apr.23, 2024

By: Shawn Jensen

Average rating 5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

Table of Content

A hedge fund is a form of investment that pools capital from accredited investors and institutions and invest it in assets. The companies involved in this type of business use risk management and portfolio construction techniques to ensure that they make the right investment decisions.

Though risky, this kind of business is very lucrative if well managed. A hedge fund business plan can help you carry out the right decisions once the firm is up and running. OGS capital has helped hundreds of investors to venture into this form of business and succeed successfully. The determination and the skills that the team uses to write the hedge fund business plan are the two most important aspects that give us a higher cutting edge.

Importance of a Hedge Fund Business Plan

It is impossible to get funding from any bank without a well-detailed hedge funds business plan at hand. This document is used by investors to determine an entrepreneurs understanding of the industry and ability to put to good use the money that they get. Here are some of the additional benefits that you will enjoy by having a well thought-out hedge fund business plan .

- Increased ability to convince investors to trust you with their money

- Ability to make intelligent decisions

- Cushion yourself from legal tussles that could arise as a result of discrepancies

To get a clear understanding of the importance of having a hedge funds business plan, let us look at the main sections of the plan and how they influence the growth and success of the company.

Narrows Down on the Investment Opportunities

In any form of business, you need to identify the target audience. The same case applies to a hedge fund investment company; you should be able to come up with a list of assets or industries that you can invest in and get returns. Remember you will need to repay the investors after a given period the agreed amount, and so it is important to make sure that the investments you intend to make are capable of generating maximum returns.

Identify Risks and Growth Opportunities

As mentioned earlier, investment companies that rely on hedge funds to make money are risky. There are some challenges that you need to be aware to avoid pitfalls along the way. Before writing the plan, we will help you carry out a study that will give you a clear perspective of the industry. Using this information, we will be able to identify the risks that you should be aware of as well as growth opportunities that you can use to scale up the company and make maximum returns. All this information will be presented in the plan to convince investors that channeling their hard-earned money to your investment company will help them generate recurring income.

Details of the Recruiting Process

A robust recruiting process will help you to get staff who have the skills and expertise needed to carry out various tasks in the company professionally. Ideally, the recruiting process should not only be chained on the academic qualifications of the job applicants but also the experience and social skills that one possesses. We have a team of business professionals who recently headed human resource departments. They will help come up with a robust strategy to guide you through the hiring process.

Finally, the hedge fund business plan will give details of how the investment company will be registered with the relevant regulatory authorities. We will also go an extra mile and provide a comprehensive list of all hedge fund operational due diligence code of ethics that will give you an added advantage. To find out more information about our business plan writing services , fill the form. Once you submit it, one of our staff members will furnish you with all the information you need to place an order.

Download Sample From Here

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Ice Vending Machine Business Plan

OGScapital at the National Citizenship and Immigration Conference

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

- Search Search Please fill out this field.

The Groundwork

Initial costs, raising capital, 3 ways to get the legal work done.

- Fund Trading

- Hedge Funds

How to Form a Hedge Fund

:max_bytes(150000):strip_icc():format(webp)/troypic__troy_segal-5bfc2629c9e77c005142f6d9.jpg)

Ariel Courage is an experienced editor, researcher, and former fact-checker. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.

:max_bytes(150000):strip_icc():format(webp)/ArielCourage-50e270c152b046738d83fb7355117d67.jpg)

- What Is a Hedge Fund?

- Hedge Fund Manager

- Investing in Hedge Funds

- How a Hedge Fund is Funded

- A Closer Look at Hedge Funds

- Publicly Traded Hedge Funds

- Books About Hedge Funds

- Hedge Funds vs. Private Equity Funds

- Hedge Funds vs. Mutual Funds

- Hedge Funds Performance in the Market

- Quantitative Analysis of Hedge Funds

- Hedge Fund Risk

- Hedge Fund Balance Sheet

- Hedge Fund Due Diligence

- How Hedge Funds Use Leverage

- Two and Twenty

- Hedge Fund Strategies

- Hedge Funds and Taxes

- Relative Value Fund

- Hedge Funds and Distressed Debt

- Returns and Fees

- Life of the Hedge Fund

- Hedge Fund Failures

- Will Hedge Funds Last?

- Massive Hedge Fund Disasters

- Exodus of Hedge Funds

- Hedge Funds and the Financial Crisis

- What to Study in College

- Career Path to a Hedge Fund

- A Day in the Life of a Hedge Fund Manager

- Top Hedge Fund Job Skills

- Step to a Hedge Fund Job

- Licenses for Hedge Fund Managers

- How to Form a Hedge Fund CURRENT ARTICLE

- Legally Establishing a Hedge Fund in the USA

- Hedge Funds and the SEC

- How to Start a Hedge Fund in Canada

- How to Start a Hedge Fund in the UK

- Startup Tips

So you want to start a hedge fund . These alternative investments use pooled funds and a variety of strategies to achieve returns for investors. They are generally formed to identify and take advantage of specific investment opportunities, many of which come with a great deal of risk. But how do you go about setting yourself up to become a hedge fund mogul?

Getting a hedge fund up and running is a bit more challenging than forming a corporation or a limited liability company (LLC) for a private business. It involves navigating investment compliance laws, and you'll need professional legal help at some point along the way.

The laws governing the business are different for every country and state in which you do business. They may also differ—sometimes drastically—based on where your potential investors are located, how you may contact new investor leads, what you are investing in, and how many investors in total your fund attracts.

Wherever you're doing business, these are the basics of getting a hedge fund up and running.

Key Takeaways

- Starting a hedge fund can be time-consuming and expensive due to the many regulatory and legal hurdles you'll encounter, along with the need to raise capital from investors.

- You can hire an experienced hedge fund attorney to handle the cumbersome paperwork involved.

- A hedge fund incubation platform can get you started cheaper and more quickly.

- A legal template service is a less expensive, do-it-yourself option.

Before you put your hard-earned money into the venture, do some hedge fund due diligence . This is a costly and time-consuming process, so you want to make sure you've thought it through thoroughly.

First things first: Do your research and become an expert. This isn't like jumping into the stock or bond market. It's much more complicated with very nuanced steps that you'll have to take. And there are, of course, a number of risks that hedge fund managers need to understand .

Read up on hedge funds and how they operate and talk to experts in the field so you become an expert, too.

Names Are Important

You'll want to choose a name for your fund—one that best describes your investment style and your strategy. This is more difficult than it seems. You want to attract investors, and your name may help draw them to you.

Then determine how you're going to do business. Are you going to set yourself up as an LLC, a trust, or a limited liability partnership (LLP)? The LLP is generally the most popular option.

Hedge funds are expensive ventures with burdensome startup costs that can reach well over the six-figure range. Startup costs for a standard equity fund can run approximately one million dollars in the first year. Start-up costs for more complex credit and systematic funds can run around two million dollars.

Most hedge fund managers will spend the majority of their money the first year on costs related to salaries and for fees for third-party services, such as lawyers and consultants. The chief operating officer (COO) will be a key hire the hedge fund will need right away. The annual salary range for a COO is $130,000 to $190,000.

Get your strategy in place and raise some startup cash before you take the legal steps.

You’ll want to secure a significant amount of capital to manage and make running a hedge fund worthwhile. Raising capital is one of the biggest challenges for hedge fund startups, as potential investors will want to see that you have a significant amount of assets under management (AUM) before entrusting you with their money.

There's no real prescribed target, but you should aim to have at least $5 million in AUM to be successful, while $20 million will make you noticeable to investors. Having $100 million will get you noticed by institutional investors . In general, hedge funds can only operate successfully with large amounts of assets under management due to the powers of leverage and economies of scale .

You may find one or all of the following good sources to go to first for initial investment capital:

- Your own savings

- Family and friends

- Hedge fund seeders

- Endowments or foundations

Eventually, you'll need to attract sophisticated investors who have larger sums of money at their disposal. You'll need to convince them to become investors by touting a track record of repeated success with your initial funding, a clear and understandable investment strategy that has a specific mandate, and a highly-skilled and experienced team on the front and back ends.

Hiring a professional marketing team to sell your fund to outside investors is a common strategy. This team will hone your pitch by crafting the right narrative, explaining the investment process used, and highlighting the fund's successes.

Create a Website

Hedge fund managers are hampered in their efforts to raise funds by regulations that prevent them from publicly advertising a specific fund. They can, however, set up informational websites that explain their investment strategies and experience. Fund managers often seek a wider audience by offering specific trading ideas on these websites.