- Tue. May 28th, 2024

Life Insurance Corporation of India | Official website of Life Insurance Corporation of India.

Har Pal Aapka Saath

Download Forms

What's new, free: e-insurance account (eia) | initiative by irdai in the interest of the policyholder, all indian insurance brokers, all general insurance companies in india, all life insurance companies in india.

Get the free lic assignment form for bank loan pdf

Get, create, make and sign.

Editing lic assignment form for bank loan pdf online

How to fill out lic assignment form for

How to fill out LIC assignment form:

Who needs lic assignment form for:, video instructions and help with filling out and completing lic assignment form for bank loan pdf, instructions and help about lic assignment form pdf, fill lic assignment questionnaire form no 5289 : try risk free, rate free lic form no 5289 pdf download, our user reviews speak for themselves, for pdffiller’s faqs.

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your lic assignment form for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lic Assignment Form Pdf Download is not the form you're looking for? Search for another form here.

Related content lic assignment questionnaire, related features - lic assignment form, keywords relevant to lic assignment form sample filled, related to lic policy assignment form.

Get Lic Assignment Form For Bank Loan

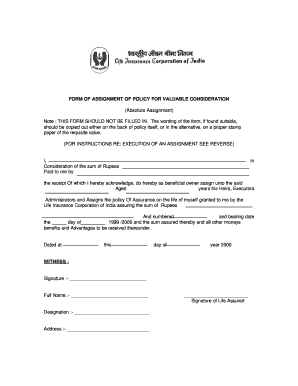

Losing the assignment deed and Policy Document along with this form. The reason for assignment is Type of Assignment (Please P as Applicable) Absolute Conditional Relationship of Assignee with existing Policy holder (Assignor) Notice of Assignment under Section 38 of the Insurance Act.

How It Works

Open form follow the instructions

Easily sign the form with your finger

Send filled & signed form or save

Tips on how to fill out, edit and sign Lic loan form online

How to fill and sign lic assignment form for bank loan, how to edit lic reassignment form sample filled, how to fill out and sign lic surrender form filled sample online.

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The preparing of legal papers can be expensive and time-ingesting. However, with our predesigned online templates, everything gets simpler. Now, working with a Lic Assignment Form requires at most 5 minutes. Our state-specific online blanks and clear guidelines eliminate human-prone mistakes.

Follow our simple steps to get your Lic Assignment Form ready rapidly:

- Pick the web sample from the library.

- Type all necessary information in the required fillable areas. The easy-to-use drag&drop graphical user interface makes it easy to include or relocate fields.

- Ensure everything is completed appropriately, without typos or lacking blocks.

- Apply your e-signature to the page.

- Simply click Done to confirm the changes.

- Download the data file or print out your PDF version.

- Distribute instantly towards the receiver.

Use the quick search and innovative cloud editor to make a precise Lic Assignment Form. Clear away the routine and produce paperwork on the internet!

How to edit Lic surrender application format: customize forms online

Finishing paperwork is easy with smart online instruments. Eliminate paperwork with easily downloadable Lic surrender application format templates you can edit online and print.

Preparing documents and forms needs to be more reachable, whether it is a daily part of one’s profession or occasional work. When a person must file a Lic surrender application format, studying regulations and tutorials on how to complete a form correctly and what it should include may take a lot of time and effort. Nonetheless, if you find the right Lic surrender application format template, finishing a document will stop being a challenge with a smart editor at hand.

Discover a broader range of functions you can add to your document flow routine. No need to print, fill in, and annotate forms manually. With a smart editing platform, all of the essential document processing functions will always be at hand. If you want to make your work process with Lic surrender application format forms more efficient, find the template in the catalog, click on it, and discover a less complicated way to fill it in.

- If you need to add text in a random area of the form or insert a text field , use the Text and Text field tools and expand the text in the form as much as you require.

- Take advantage of the Highlight tool to stress the main aspects of the form. If you need to hide or remove some text pieces, utilize the Blackout or Erase instruments.

- Customize the form by adding default graphic components to it. Use the Circle , Check , and Cross instruments to add these elements to the forms, if needed.

- If you need additional annotations, utilize the Sticky note tool and place as many notes on the forms page as required.

- If the form needs your initials or date, the editor has instruments for that too. Minimize the chance of errors by using the Initials and Date tools.

- It is also easy to add custom graphic components to the form. Use the Arrow , Line , and Draw instruments to change the file.

The more instruments you are familiar with, the simpler it is to work with Lic surrender application format. Try the solution that provides everything essential to find and edit forms in a single tab of your browser and forget about manual paperwork.

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Lic surrender application letter english FAQ

What is the process of lic assignment.

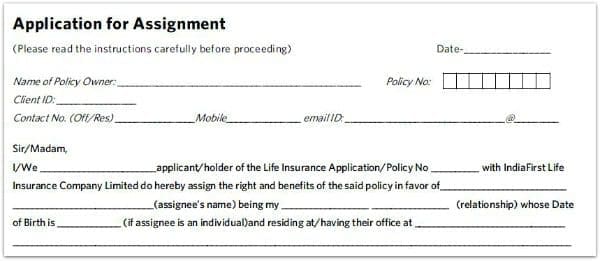

In such an assignment, the insured loses his rights in the policy and the absolute assignee can deal with it independently. The insured needs to either endorse the policy document or make a deed of assignment and register the same with the insurer. A form prescribed by the insurers must be filled and signed.

What is LIC Form 5074 in English?

The Life Insurance Corporation of India or LIC provides a surrender form, namely LIC Form No. 5074, which is also the surrender discharge voucher. This form allows policyholders to initiate the policy surrender procedure.

What are the 2 types of life insurance assignments?

With an absolute assignment, the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

How to fill LIC policy assignment form?

(2) The full name, and age, of the Assignee must be stated. (3) The actual consideration for the assignment received from the assignee should be written in words, not in figures. (4) The Assignor must affix his signature to the Assignment in the presence of a witness other than the Assignee.

What is the purpose of assignment in LIC?

Assignment of the policy refers to the transfer of rights, title, and policy ownership from the policyholder to another person or entity. The person involved in assigning/transferring the policy is called assignor, and the person/institution to which it is assigned is called the assignee.

What is the process of assignment of life insurance policy?

--(1) A transfer or assignment of a policy of insurance, wholly or in part, whether with or without consideration, may be made only by an endorsement upon the policy itself or by a separate instrument, signed in either case by the transferor or by the assignor or his duly authorised agent and attested by at least one ...

How to fill LIC assignment form 3848?

Handy tips for filling out Lic policy assignment form 3848 online Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

What is an example of assignment of life insurance policy?

For instance, a policy owner X wants to gift his life insurance policy to another person named Y. Hence X is doing absolute assignment. Here X is the assignor and Y is the assignee. Now all benefits, returns and even the liabilities are in the name of Y.

Lic reassignment form for bank loan Related content

Lic 311b - california department of social....

F. LIC 604 Current Admission Agreement with authorized signatures. ... positions and...

the assignment of life insurance as collateral...

insured many important benefits in the form of options to surrender the policy for ... See...

RBT4102LIC Multi-Channel Access Point User Manual...

... Networks, Inc.. Document Includes User Manual 1402-LIC.book. ... Enterasys may assign...

Related links form

- Icici Nri Account

- Tdp Option Selection Worksheet

- Row-app-engineering-020812.doc. Rental Housing Inspection Application, Code Enforcement

- Blank Tier List

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to how to fill lic surrender form

- lic policy surrender application letter format in word

- lic form 5074 in english

- lic reassignment form

- lic policy loan application form

- lic loan application form

- lic form no 5074 in english

- lic form filling

- lic surrender application letter pdf download

- lic assignment form filled

- Alternatively

- designation

USLegal fulfills industry-leading security and compliance standards.

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.

BEST Legal Forms Company

Top ten reviews winner - 9 years straight.

USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else".

USLegal received the following as compared to 9 other form sites. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Customer Service 10/10.

Celebrate Banking

Lic policies, assignment and bank loans.

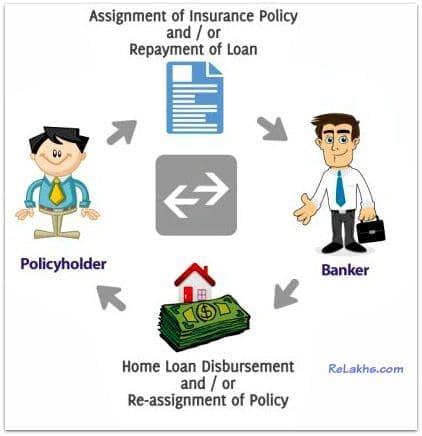

Banks accept LIC policies assigned in their favour as security for loans to be sanctioned. A charge in favour of the bank over the LIC policy is created by assignment of LIC Policy.

Which are the types of LIC policies accepted by banks?

Banks normally accepts the following categories of policies:

a) Endowment Policies b) Whole Life Policies (limited payments or otherwise) c) Joint Life Policies

Some banks accept Children’s Deferred Assurance policies after the policies are adopted by the life assured on their attaining majority. Policies assured on the lives of minors are also accepted after the policies are assigned in favour of said minors on their attaining majority.

Which are the types of LIC policies not accepted by banks?

The following categories of L.I.C. policies are not accepted by banks, mainly because they are not assignable.

a) Children’s Endowment Policy b) Children’s Deferred Assurance c) Policies with nominations under “Married Women’s Property Act”. d) Policies taken out especially for the purpose of Estate Duty and the like.

Whether policies of New Private Sector Insurance companies acceptable?

The Policies issued by new Private Sector Insurance Companies approved by IRDA, are accepted by banks, if

1. The insurance company issue surrender value certificate and 2. The policy is assignable in favour of the bank.

What is meant by assignment?

Assignment means transfer of a right over a property existing or future, or debt by one person to another. Life insurance policies and book debts are two classes of securities, rights over which can be transferred by assignment. Nomination under the Insurance Act is automatically cancelled on assignment. Hence nominees need not join the assignment process.

When a policy is assigned in favour of a bank, it can enforce the right by surrendering the policy to the policy issuer and obtaining the surrender value. This is done after serving a notice of demand on the assignor on default.

What are the conditions to be satisfied for assignment of policy?

1. If there is any existing assignment on the policy, it should be reassigned in favour of the assured. 2. The assigner should assign the policy in favour of the bank by executing the assignment form/ notice of assignment. 3. The bank forwards the policy along with assignment form/ notice of assignment to the insurance company for registration of the assignment in their books. 4. Insurance company returns the policy to the bank after noting the details in their records and the bank keeps the assigned policy in its files.

What happens on the death of assured before settlement of liability?

When a policy is assigned in favour of another person or bank, the assured is transferring all future rights over the policy in favour of the assignee. Hence, in case of death of assured before settlement of the dues of the bank, bank lodges its claim before the insurance company supported by the death certificate and the assigned policy. The insurance company releases the amount in favour of the bank.

What is insurable interest?

Insurable interest arises if beneficiary happen to sustain monetary loss as a result of the death of the life assured. Insurable interest is of a pecuniary nature.

Husband has an insurable interest in the life of his wife and vice versa An employer has an insurable interest in his employee and vice versa.

What are the precautions taken by bank while accepting LIC policies?

1. The age of the assured is got admitted by the LIC. 2. The policy is an assignable policy and does not belong to the non – acceptable categories. 3. The surrender value and paid up amount of the policy is obtained. 4. The policy is in force and the premium is paid up to date by obtaining latest premium paid receipt. 5. No prior assignment exists/ all previous assignments are cancelled. 6. The assignment of policy in favour of the Bank is duly registered with the insurance company. 7. If the Insurance Policy offered as security is on the life of a person other than the borrower, the bank ensures that the borrower has an insurable interest in the life of the assured.

What is meant by re-assignment?

Share this:, related posts.

- Tax Planning

What is ‘Assignment’ of Life Insurance Policy?

Insurance is a contract between the insurance company (insurer) and you (policyholder) . It is a contract with full of jargon. As much as possible, we must try to understand all the insurance terms mentioned in the policy bond (certificate) . One such insurance jargon which is mostly used is Assignment .

If you are planning to apply for a home loan, your home loan provider may surely use this term. So, what is Assignment? Why assignment of a life insurance policy is required? What are different types of assignment? What are the differences between Assignment & Nomination?

What is Assignment?

Assignment of a life insurance policy means transfer of rights from one person to another. You can transfer the rights on your insurance policy to another person / entity for various reasons. This process is referred to as ‘ Assignment ’.

The person who assigns the insurance policy is called the Assignor (policyholder) and the one to whom the policy has been assigned, i.e. the person to whom the policy rights have been transferred is called the Assignee .

Once the rights have been transferred from the Assignor to the Assignee, the rights of the policyholder stands cancelled and the assignee becomes the owner of the insurance policy.

Assigning one’s life insurance policy to a bank is fairly common. In this case, the bank becomes the policy owner whereas the original policyholder continues to be the life assured on whose death the bank or the policy owner is entitled to receive the insurance money.

Types of Assignment

The assignment of an insurance policy can be made in two ways;

- Example : Mr. PK Khan owns a life insurance policy of Rs 1 Crore. He would like to gift this policy to his wife. He wants to make ‘absolute assignment’ of this policy in his wife’s name, so that the death benefit (or) maturity proceeds can be directly paid to her. Once the absolute assignment is made, Mrs. Khan will be the owner of the policy and she may again transfer this policy to someone else.

- Example : Mr. Mallya owns a term insurance policy of Rs 50 Lakh. He wants to apply for a home loan of Rs 50 Lakh. His banker has asked him to assign the term policy in their name to get the loan. Mallya can conditionally assign the policy to the home loan provider to acquire a home loan. If Mallya meets an untimely death ( during the loan tenure) , the banker can receive the death benefit under this policy and get their money back from the insurance company.

- In case if the death benefit received by the banker is more than the outstanding loan amount, the insurer will pay the bank the outstanding dues and pay the balance to the nominee directly. The balance amount (if any) will be paid to Mallya’s beneficiaries ( legal heirs / nominee) .

How to assign a life insurance policy?

The Assignment must be in writing and a notice to that effect must be given to the insurer. Assignment of a life insurance policy may be made by making an endorsement to that effect in the policy document (or) by executing a separate ‘ Assignment Deed ’. In case of assignment deed, stamp duty has to be paid. An Assignment should be signed by the assignor and attested by at least one witness.

Download absolute assignment deed sample format / conditional assignment deed format.

Nomination Vs Assignment

Nomination is a right given to the policyholder to appoint a person(s) to receive the death benefit (death claim) . The person in whose favor the nomination is effected is termed as ‘nominee’. The nominee comes into picture only after the death of the life assured (policy holder) . The nominee will not have the absolute right over the money (claim proceeds) . The other legal heirs of the policy holder can also recover money from the nominee.

(However, as per Insurance Laws (Amendment) Act, 2015 – If an immediate family member such as spouse / parent / child is made as the nominee, then the death benefit will be paid to that person and other legal heirs will not have a claim on the money)

Under nomination, the rights of the policyholder are not transferred. But, assignment is transfer of rights, interest and title of the policy to some other person (or) entity. To make assignment, consent of the insurer is also required.

Important Points

- Assignment of policies can be done even when a loan is not required or for some special purposes.

- If you assign the policy for other purpose other than taking a loan, the nomination stands cancelled.

- If the policy is assigned, then the assignee will receive the policy benefit. Death benefit will be paid to the Nominee, in case the policy is not assigned.

- The policy would be reassigned to you on the repayment of the loan (under conditional assignment) .

- Types of insurance policies used for assignment purpose to get business loans, generally include an endowment plan, money back policy or a ULIP. Home loan providers generally ask for the assignment of Term insurance plans on their names. (The term plan tenure should be more than the home loan tenure)

- An assignment of a life insurance policy once validly executed, cannot be cancelled or rendered in effectual by the assignor. The only way to cancel such assignment would be to get it re-assigned by the assignee in favor of the assignor.

- You can also raise a loan against your policy from your insurance company itself. In this case, your policy would have to be assigned to insurance company.

- An insurer may accept the assignment or decline. (The insurer shall, before refusing to act upon the endorsement, record in writing the reasons for such refusal and communicate the same to the policy-holder not later than thirty days from the date of the policy-holder giving notice of such transfer or assignment)

- In case of death of the absolute Assignee (to whom the policy rights have been transferred under absolute assignment) , the rights under the policy will be transferred to the legal heirs of the assignee.

- You can also assign a life insurance policy under Married Women’s Property Act . (At the time of making the application (buying a policy), a separate MWPA form has to be filled by the proposer for it to be covered under MWP Act. Do note that the existing life insurance policies cannot be assigned under MWP Act)

- Partial assignment or transfer of a policy can also be made. But banks will accept any of your life insurance policies as long as the sum assured is equal to or greater than the loan amount.

Hope you find this post informative and do share your comments.

(Image courtesy of Stuart Miles at FreeDigitalPhotos.net)

About The Author

Sreekanth Reddy

Can a LIC policy be assigned to someone not related by blood??

Dear Chowdhury, Yes, it is possible. However, Assignment is not permitted on all life insurance policies issued under How to buy Term Life Insurance under Married Women’s Property Act?

Very useful and gathered more knowledge

Hi, I got a question in CFP EXAM 5( case study paper) with regard to assignment of money back policy to a minor. I would like to know can a conditional assignment be made to a minor and if yes what about the premium that is yet to be paid? and would a guardian need to be appointed till the minor attains majority? and is it possible that an absolute assignment can be made?

Dear Dhaarini,

Where an assignment is made in favour of minor, the policy can not be dealt with during the minority of the assignee, even with consent of natural guardian or appointed guardian. This means minor assignee cannot raise loan, surrender or further assign the policy during his/her minority.

If the assignment is in favour of a minor, in the event of claim, policy money cannot be paid to him, as he cannot give valid discharge. It is therefore desirable that where the assignee is minor, testamentary guardian should be appointed in respect of all the properties of such minor including the policy moneys. The father i.e. natural guardian of the minor can only appoint the testamentary guardian. The appointment can be done by a separate instrument or on the back of the policy.

What if a wife has taken a policy in the name of his husband and put the nominee herself and also pays all the premiums herself, and now they are taking divorce. So, now can husband assign the policy to her and what benefits she can receive after assignment. Can she withdraw tha amount of the policy??

Dear Monika, Yes, he can make an Absolute assignment in the name of Wife..

Under Life Assurance one can assign a policy only if that policy is a policy of his/her own life. Here wife has taken a policy on her husband life and hence assignment does not arise. In the event of death of her husband she receives the death benefit irrespective of her relationship at the time of death. This is because under Life Assurance the Insurable Interest is required at the proposal stage and needs not be present at the claim stage.

I wanna give my policy to new owner

A assigned his policy to his brother B and B is paying premiums. A’s nominee is his father. What will happen if B dies?

Dear Mr Naidu, May I know what type of Assignment is this??

A assigned his policy to his brother B, out of love and affection as absolute assignment. Whose life is covered?. What happens if B dies?

Dear Mr Naidu, If the assignee (Mr B) dies, then his/her legal heirs will be entitled to the policy money. Kindly note that an assignee cannot make a nomination on the policy which is assigned to him.

“Absolute assignment is generally made for valuable consideration e.g. raising of loan from an individual / institution. This assignment has the effect of passing the title in the policy absolutely to the assignee and the policyholder in no way retains any interest in the policy. The absolute assignee can deal with the policy in any manner he likes and may even transfer his interest to another person or surrender the policy. Under absolute assignment when the assignee (Mr B) dies the benefits go to the legal heirs of the assignee and not to the heirs of the life assured.”

What is the procedure to get the policy assigned? How much time does it take?

Thanks for this. I always like to use study materials by Indians in preparing for my professional exams. The contents here are superb and easy to understand.

Once assignment is done, on whose name Renewal receipts and PPC will be generated.

Dear Gayu ..in the name of Policyholder only.

My colleagues were looking for USPS PS 1000 this month and were informed of an online platform that hosts a ton of fillable forms . If people are wanting USPS PS 1000 too , here’s https://goo.gl/Qqo6in .

Dear Sreekanth, I am having an LIC policy for the past 10 year. now i would like to assign the same to my mother. Now after the assignment, whose life is covered and who gets all the benefit? Do i have to appoint a new nominee after the assignment?

Dear Bhavik ..Life cover will be in your name only. Your mother can get the benefits. You can make her as the nominee.

If policy assigned to absolute assignment from A to B. B is the assignee of the policy and he have all rights of the policy. After assignment who will have a life cover A or B. Who will get the death benefits

Dear Senthil, Life cover – A. Beneficiary – B.

Thanks for this information, Let me know who will pay the remaining premium after assignment.and what are the other reasons for assignment except loan and gift. Manish

Dear Manish ..The policy holder only has to pay the premium.

I have a ULIP assigned to my home loan. I have paid two annual premiums till now. If I dont pay the next premium, will it have any impact on my home loan ? I know that my ulip will get discontinued in this case but can the bank force me to pay the premium legally ?

Dear Kalis, If sum assured falls below the outstanding loan amount then you banker may ask you to assign another policy or pay the premiums on this one.

Thanks. Sum assured is already below the loan amount. In this case, can bank take any legal action against me if I don’t pay the premium?

Dear Kalis..Why do you want to take this risk?

Who will have to pay tax if single premium ULIP where premium is >20% of sum assured is assgned to spouse & she then sureender it.

Dear Vishal ..The insured (policyholder)..

my father aged 72 has taken a ULIP policy on my Child with coverage 10 lakhs .But now he would like to Assign the policy to my mother’s Name aged 67.

Please Clarify weather the life coverage and policy benefits will be transferred to my Mother or will it continue with my son.

Dear Nisha, May I know who is the ‘insured’ in this policy? Is the child just a nominee to the policy? “If he assigns the policy for other purpose other than taking a loan, the nomination stands cancelled. If the policy is assigned, then the assignee will receive the policy benefit. “

Hi.. Really nice blog.very informative and useful. I liked the way You explained very briefly about Assignment’ of Life Insurance Policy.

Hi Srikanth,

Nice article on Assignment!

I Just wanted to know If i nominate my spouse for the life insurance or nominate my child and appoint my spouse how these to things are different in terms claim settlement of life insurance.

Ideally I may want my spouse to look-after my child education until they turn major and they do not misuse the claim amount.

Please let me know if possible your contact number so that we discuss further..

Please suggest.

Thanks, Shravan

Dear Shravan, If you are planning to buy a new Term plan, you can assign the policy under MWP Act by mentioning the Percentages (share in death benefits) among your legal heirs (spouse & kids). You also have the option to write a WILL and give detailed instructions about how the claim amount (if any, on such policy) should be used or allocated.

Dear Sreekant, Thanks for such valuable information. Please do correction on your post that the existing life insurance policies cannot be assigned under MWP Act. Pl correct me if I am wrong. Please let me know that even if I assign the policy unconditionally to the bank for home loan purpose, after repaying the home loan successfully, the bank should re-assign the policy to me. If it does not do this, what options do I have? Thanks again.

Dear Vivek, Yes, only new insurance policies can be assigned (while purchasing new ones) under MWP. I should have written the sentence as ‘You can also assign a new life insurance policy under….’ Thank you for pointing this out. (I have provided all the details about MWP act in another article).

If a policy is assigned with absolute assignment, it cannot be cancelled. It can be done only by another valid re-assignment. So, the banker has to re-assign it after the repayment of loan. When you do not wish to give away your complete control over policy, do not go in for absolute assignment.

thanks for prompt response.

ReLakhs.com is a blog on personal finances. The main aim of this blog is to help you make INFORMED financial decisions by presenting the content on money matters in a simple, unbiased and easy to understand manner.

Popular Posts

Latest court judgements on women’s property rights, who gets the joint bank account monies if one account holder dies, income tax deductions list fy 2023-24 | under old & new tax regimes, top 5 best aggressive hybrid equity mutual funds | equity-oriented balanced funds, useful links.

- Community (Forum) - SignUp

- Forum (Old)

- Privacy Policy

Viewsletter

Cared by T-Square Cloud

Session expired

Please log in again. The login page will open in a new tab. After logging in you can close it and return to this page.

- Share on WhatsApp

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share on Email

Lic Assignment Form For Bank Loan: Fill & Download for Free

Download the form

How to Edit The Lic Assignment Form For Bank Loan freely Online

Start on editing, signing and sharing your Lic Assignment Form For Bank Loan online refering to these easy steps:

- Click on the Get Form or Get Form Now button on the current page to direct to the PDF editor.

- Give it a little time before the Lic Assignment Form For Bank Loan is loaded

- Use the tools in the top toolbar to edit the file, and the change will be saved automatically

- Download your edited file.

The best-reviewed Tool to Edit and Sign the Lic Assignment Form For Bank Loan

Start editing a Lic Assignment Form For Bank Loan in a second

What else do people search.

- lic assignment form for bank loan

- lic assignment questionnaire form pdf download

- lic assignment letter format

- assignment of insurance policy to bank

- assignment of insurance policy pdf

- assignment of life insurance policy form

- lic assignment form no 3846

- how can i assign my lic policy to bank

A simple guide on editing Lic Assignment Form For Bank Loan Online

It has become really simple just recently to edit your PDF files online, and CocoDoc is the best PDF text editor you have ever used to make some editing to your file and save it. Follow our simple tutorial to start!

- Click the Get Form or Get Form Now button on the current page to start modifying your PDF

- Create or modify your content using the editing tools on the tool pane above.

- Affter changing your content, put the date on and make a signature to complete it.

- Go over it agian your form before you click and download it

How to add a signature on your Lic Assignment Form For Bank Loan

Though most people are accustomed to signing paper documents with a pen, electronic signatures are becoming more general, follow these steps to finish the PDF sign !

- Click the Get Form or Get Form Now button to begin editing on Lic Assignment Form For Bank Loan in CocoDoc PDF editor.

- Click on Sign in the tools pane on the top

- A popup will open, click Add new signature button and you'll be given three choices—Type, Draw, and Upload. Once you're done, click the Save button.

- Drag, resize and position the signature inside your PDF file

How to add a textbox on your Lic Assignment Form For Bank Loan

If you have the need to add a text box on your PDF in order to customize your special content, do some easy steps to accomplish it.

- Open the PDF file in CocoDoc PDF editor.

- Click Text Box on the top toolbar and move your mouse to drag it wherever you want to put it.

- Write down the text you need to insert. After you’ve input the text, you can utilize the text editing tools to resize, color or bold the text.

- When you're done, click OK to save it. If you’re not satisfied with the text, click on the trash can icon to delete it and start again.

A simple guide to Edit Your Lic Assignment Form For Bank Loan on G Suite

If you are finding a solution for PDF editing on G suite, CocoDoc PDF editor is a commendable tool that can be used directly from Google Drive to create or edit files.

- Find CocoDoc PDF editor and set up the add-on for google drive.

- Right-click on a PDF file in your Google Drive and choose Open With.

- Select CocoDoc PDF on the popup list to open your file with and give CocoDoc access to your google account.

- Edit PDF documents, adding text, images, editing existing text, highlight important part, polish the text up in CocoDoc PDF editor before pushing the Download button.

PDF Editor FAQ

hey anon !I take it that you know about MCLR or Marginal Cost of Funds based Lending, which has been made applicable w.e.f 1st April 2016 as a counter to the base rate system.Now, about how does MCLR benefits the ultimate consumer is a debatable topic and has to deal upon the type of loan you are indulged in (as mclr is not applicable on auto loans and personal loans) and is completely dependent upon the ongoing interest rate fixed by the RBII,though will try to form a clear pictureDr Raghuram Rajan, our beloved RBI governor (writing this answer on 5th sept ,so he is still our Rbi gov) cut the Repo Rates in the previous fiscal year so that to make loans cheaper for borrowers but banks haven't had started following the same while lending,so interst rates were still based upon the previous rates !Thanks to MCLR, the calculation of interest rates (though a bit complicated) will be based uponMarginal cost of fundsOperation expense of bankCost of carry in the CRRAnd, Tenor premiumexplaining the above,Marginal cost of funds depends uponBank rate interest (charged by banks from consumers)Repo Rate (charged by RBI from banks)Rate of Return on the capitalNow weights are assigned to it with a 92% weight to the sum of (1) and (2) and 8% to (3). Operting expense of bank is nothing but the daily cash requirement for running the bankCost of carry in the CRR means that banks have to take into account the amount of CRR blocked with them which they can't use, because CRR !Tenor Premium is about the time period a.k.a longer the duration of loan period,higher the premium.banks are allowed to charge a premium to the borrower for the risk (uncertainty) associated with lending for longer period.Now the RBI has issued guidelines for the banks so that they can pass on the benfit of a rate cut,down the lane . The main benefit coming out of the base of calculation of bothBanks would now charge you based upon the marginal cost of funds,by taking in account the repo, and tenor premium, so giving you a ‘reset period’ after which your loan rate will be revised plus the ‘spread’ banks levyComing back to the main answer, MCLR will benefit the consumers as now a rate cut in the repo will directly be reflected in the form of marginal costs of funds and customTaking an exampleFor instance, for salaried individuals, ICICI Bank has set a floating rate home loan at one-year MCLR of 9.20% with a spread of 25 bps for loans of up to Rs.5 crore. So, the interest rate will be 9.45% (9.20% +0.25%). This interest rate is valid till 30th April, 2016 (as given in the bank’s website). ICICI Bank has decided to set one-year MCLR as the benchmark rate for their home loans.Though the MCLR is reviewed monthly, your home loan will be reset every year automatically, depending on the agreement with the bank.So, if you take a Rs.50-lakh home loan on 10th April,2016, your home loan interest rate would be 9.45% . You have to pay EMI installments at this rate of interest for the next 12 months.Let’s say one-year MCLR gets revised to 9.% in April, 2017 and the spread remains the same then your home loan interest rate will be reset at 9.25% (MCLR of 9% plus spread of 25 bps)But , the interest rates cannot be predicted to remain low forever, if they increase there will be a swift hike in the interest rate (MCLR) ! Anyway if you predict a rate cut in the near future, you can transfer your loan to a mclr from a base rate oneMany companies prefer being charged with a floating interest rate rather than a fixed one as they hint from guidelines about rate cuts and would be benefitted by oneIt is too early to say if the change in base rate will actually be completely passed on to consumers. Because, do remember that banks still have the option to set a ‘spread‘ on loans. Banks are free to determine the range of spread for a given category of borrower or type of loan. (For example, if the loan interest rate offered to you is 10.25% and the new base rate as per MCLR is say 10%, 0.25% is the spread)As far as banks are concerned, their margins might take a hit in the range of Rs 15,000 to Rs 22,000 crore assuming a 75 basis point decline (source – ICRA). Banks may lose when interest rates drop but will gain when rates increase. So, it all depends on how many instances of ‘rate cuts’ will happen in the future.MCLR is applicable for Banks only. Hence this is irrelevant to home loans offered by NBFCs (Non-Banking Financial Companies) like LIC Housing Finance, Dewan Housing (DHFL), HDFC, Indiabulls housing finance etcThanks for readingImages and example from : ReLakhs.com - Personal Finance Blog

Not thorough with legal titles - go through multiple lawyers to verify the titles.Purchasing new projects is extremely risky. Most well known builders are in a mess. Its rather safe to purchase a completed property than under-construction one. Very few projects finish on time, and the interest cost, rental cost you pay is significant for the low price you do initially.Assuming, builders will supply all those amenities promised as per plan. Power, water, drainage, swimming pool, that overcharged club, garden may end up a room.Underestimating the impact of loan on your life. Most Indians live and work to pay their loans for banks. The house and bank owns them, not the otherway aroundProperty prices need not always go up. When a crash happens, you would be left with an unnecessary loan you end up payingNot counting additional charges - brokerage, TDS, registration, it adds up a lot. Monthly maintenance charges of your flat is additional.Sometimes its best to go for a 3BHK rather than a 2BHK now and thinkiing to purchase a bigger one later. It might pinch a bit, to buy a bigger home, but salaries also increase. Some may never be able to buy that bigger house, as expenses may catch up with children or otherwise.With bank loan, paying unnecessary insurance, you can assign your life insurance or others to your loanNot counting fixed, floating, foreclosure charges while taking a loan. A floating, no foreclosure charges and other value add service charges is the best loan. Private banks often aren’t the best to take a loan.Finally not knowing why they are purchasing the home. People confuse home with investment, and for most, thats their only investments. Even after 20–30 years, all they will be left with is the home, EPF/PPF , LIC amount accrued. They think they should have made a lot of money, alas they don’t do other investments and left with a home, which they never sell for a better post retirement life making it miserable for them.

Postal life insurance is the best.Earlier PLI was available only for a very limited number of professional like Employee of Central government, State Government,PSU,Nationalized Banks etc.As insurance sector has become very competitive over the years, PLI has redefined itself by expanding its clientele.The following professionals are also now eligible for having their lives insured under PLIEmployees of all private educational institutions/schools/colleges recognized by central/state Governments. ( B.Ed , M.Ed)Doctors ( Both working in Private as well as Government )(MBBS,BDS,BPT,BHMS,BUMS,BSMS,BAMS )Engineers( BE,B tech,ME,M tech )Management Consultants(MBA), Chartered Accountants, Architects,Cost AccountantsSoftware professionals ( MCA, MSc (Computer science and IT ) )Lawyers ( Registered with bar council of India )( B.L)Bankers ( Any Nationalised banks, Foreign banks, Regional Rural banks, Scheduled commercial banks, private sector Banks )Bsc ( Nursing, Hotel Management, Viscom )WHAT IS THE PREMIUM AMOUNT ? For the same Sum assured, the premium you pay in PLI is very less compared to other insurance.LOW PREMIUM, HIGH BONUSPLI premium is less compared compared with other insurance agency premiumOn the other hand it gives you high bonus than any other agency in the market.I will explain this with an example.If your age is 25 years, you give Rs.10/- daily until you are 60, and your maturity amount at 60 is Rs.4,24,000/-(Approx).This Rs.10/day is equivalent to monthly premium of Rs.315/-If any mishappening occurs before you’re 60, the Sum assured of Rs.1,40,000/- Plus Bonus accrued thereof is given to the nominee on claim.This Rs.10/- day is frugal and not even costs one chai.Isn’t it a wise decision to spend this money towards your life insurance premium?WHERE TO PAY THE PREMIUM ? : PLI Premiums can be payable at any post office across India.We have 1,55,000 post offices across the nation. You can find a post office more proximal than any other insurance premium office. Further you can also pay your premium ONLINE.Mode of premium payment can be cash/cheque/pay recovery ( For Government employees alone )WHERE CAN YOU BUY PLI POLICY?: Other insurance agents are more available in market where they can serve you at your door step unlike PLI agents. There are very limited number of PLI agents available when compared with other insurance. Still you can contact your nearest post office for getting contact of a PLI agent for buying a PLI policy.FUND INVESTMENT IN MARKET : Unlike other insurance agency does, the PLI funds are not invested in risky market. It gets invested in Debentures and Government securities/bonds which is risk free.IT Rebate : Both PLI and LIC qualifies for IT rebate under Section 80C.RETURNS : PLI gives you more Bonus when compared with other insurance. Even a person working in other insurance companies can’t deny it.CONVERSION OF MATURITY AGE AND SUM ASSURED : The maturity age which you opt for while opening an PLI can be increased or decreased.Likewise there is also an option where the Value of your policy ( Sum Assured ) can also be decreased.Not many use/know this option.PLEDGE : You can assign (pledge ) your PLI policy and can get loan from Nationalized Banks.LOAN FACILITY : You can avail loan from your PLI policy Accrued amount anytime after completion of 36 Months. The loan interest is 10% half yearly which is very less in the market.

More Content Related

Personal swot identify needs understand yourself and discover who you are and what you want you have a choice to make when embarking on any journey. it is possible to simply set off and go somewhere that is anywhere but here. choose a direction...

Bingo prize sheet page 1 of 2 organization id. # name of organization: address: city, state, zip code: game no. game description type number of faces per cards/sheets and color prizes prizes winning arrangement or more or less players players $ $...

Assignment of proceeds of life insurance policy in consideration of the agreement of rich & thompson funeral service, inc. to conduct the funeral and/or services of , insured with , under policy and since i am beneficiary, i hereby transfer and

Product sheet ergotron neoflex lcd and laptop carts highlights cd pans sidetoside for closer access; l arm also reaches low for people wearing bifocals or using a tablet pc ront handle on worksurface, premium f casters, and lightweight design...

Find More relevant Contents for Lic Assignment Form For Bank Loan

by P Sapienza · Cited by 1613 — The lending behavior of state-owned banks is affected ... In contrast, recent theories on the politics of government ownership (Shleifer and Vishny ... lic? An Empirical Analysis”, Journal of Finance, 53: 27-64. Rajan, Raghuram and Luigi ...

It influences jobs, incomes, and opportunities for personal enterprise. Business has a ... encouraging students to complete their assignments at home. ... ships that Canadian companies and the Canadian government have established with other ... compulsory credit requirement for the Ontario Secondary School Diploma.2.

by DJ Elliott · 2013 · Cited by 23 — economy (including the relative size of the gov- ernment and private ... total amount of lending by banks can be circum- vented to some extent by ... lic Offerings. Western nations ... tend to transfer to different assignments every 5 years or so.

Investment Financing Operations. LAC. Latin America and the Caribbean. LIC ... may struggle to finance education as they grapple with ... the Bank is supporting the government in the implementation of remote learning programs. ... learning; a reward system for students having completed the most assignments; and the.

Comments from Our Customers

It is a very good tool to automate the process of sending and collecting data for internal satisfaction surveys and those that are sent to the client once each project in the company has been completed. It allows you to modify the CCS of each form, which allows you to customize it to the company's standards. You have a good option to generate the analysis reports of the survey result. It allows you to condition questions which makes it more versatile. It integrates with many applications and with the website of the company.

- Home >

- Catalog >

- Life >

- life rotten tomatoes >

- Lic Assignment Form For Bank Loan

- Compress PDF

- PDF Converter

- Number Pages

- Delete PDF Pages

- Form Filler

- Create Fillable Forms

- PDF to Word

- PDF to Excel

- Word to PDF

- Excel to PDF

- Protect PDF

Thank you for downloading one of our free forms!

Start Your 14-Day Free Trial Today!

CocoDoc is an all-in-one PDF editor that allows you to create, edit, fill out, sign, and convert PDF documents in a hassle-free way. CocoDoc gets your work done in half the time without sacrificing quality and security!

- Edit and fine-tune your PDF.

- Create or convert your documents into any format.

- E-sign or send for signatures.

- Add text and create text fields.

- Compress your PDF file while preserving the quality.

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

- What is Life Insurance?

- Contract of Insurance

- Why you Need a Life Insurance Now?

- Benefits of Life Insurance

- Life Insurance Vs Other Saving

- LICI Aspire

- New Bula Gold

- Double Gold

- Gold Life Plus

- Micro Insurance

- Rider Options

- Find an Agent

- Premium Calculator

- Get Insured Now

- Premium Acceptance

- Revival of Lapsed Policy

- Policy Loans

- Loss of Policy

- Change of Address

- Change of Payment Mode

Assignments

- Sales & Service Points

- Event Gallery

- Success Stories

- LICIs Superlatives

- Key Statements

- Become a LICI Agent

- Update Information

This image may be subject to copyright.

Email to Friend

- --> --> --> -->