Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- Market Research Surveys

- What is market research survey

Why use surveys?

Survey research methods.

- Conducting market research surveys

- Common mistakes with market research surveys?

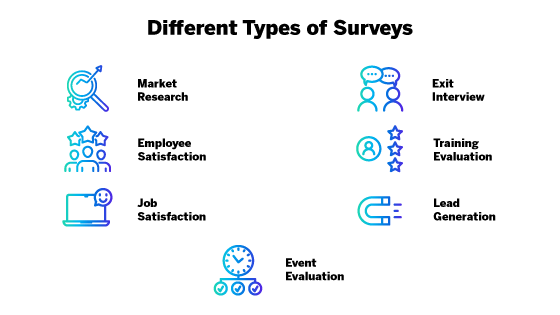

The different types of survey methods

Survey tools for your survey method, what can businesses do with these types of surveys, how to write a research survey (free example templates), try qualtrics for free, types of market research surveys.

20 min read There are different types of survey research you can run, but the majority of research is conducted with just a handful of research survey methods. We explore what they are and how to use them.

What is a market research survey?

A market research survey is a way of getting feedback directly from the people who have the ultimate say in your organization’s success: your customers.

Unlike focus groups or interviews, market research surveys allow you to get detailed feedback at scale — from behaviors to overall experiences — and in a standardized format. Also, as the data is easy to process, you can quickly turn it into actionable insights .

Surveys are used to collect primary research, which means market research data that you collect yourself. The other type is secondary data, which is obtained from other sources, for example census data.

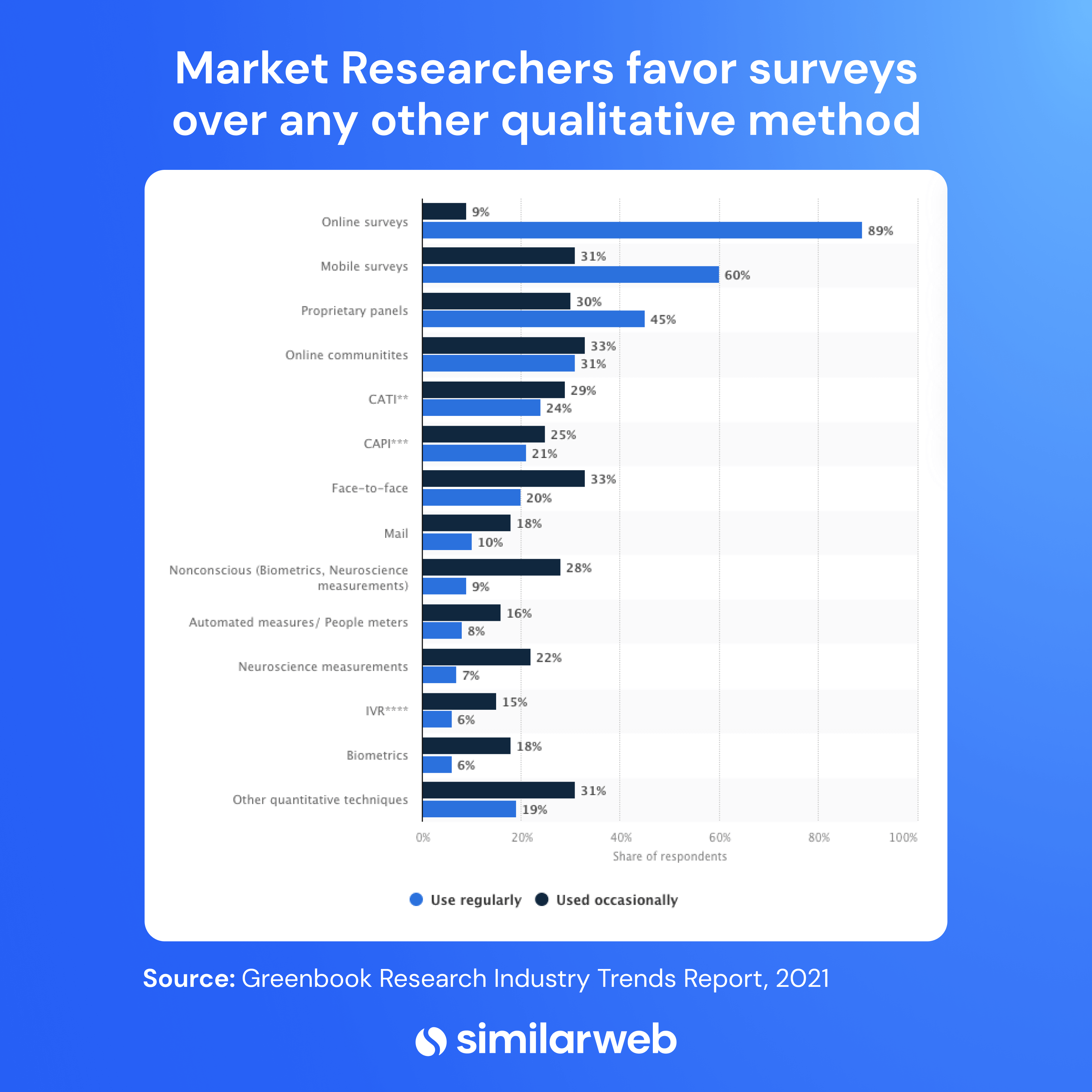

Surveys are among the most popular methods of primary market research, since they can be used to gather qualitative and quantitative research on market trends, and they can cover a huge range of respondents across your customer base. They’re also a format familiar to many people.

Get started with our free survey software

Surveys are ultimately about understanding your target audience, but they can go beyond your customer base. They can be taken by anyone — employees, potential future customers, and even those who don’t want to engage with your business (helping you to identify the ones that do).

However, a survey isn’t a stand-alone solution. It can work alongside other survey methods, such as focus groups, field studies, observation, and market analysis, to help you get a clear picture of your market and decide what direction to take.

But with all these different types of survey methods, and some being better than others in specific areas (e.g. data quality, collecting feedback), where should you start?

To get the best out of each survey research type, consider what you can invest in terms of:

- Time: How quickly do you need the survey research? Do you have time to conduct research?

- Money: Do you have the budget to invest in research overheads?

- Knowledge of analytics: Are you trained to interpret the collected data? If not, do you have a partner you can work with to get the insights you need?

- Research expertise: Do you have clearly defined problems or challenges that you want to explore or understand through surveys?

- Technology capability: Is your survey software up to the task of analyzing the data?

- Your audience’s response: Is it likely that your audience will respond? What survey types (online surveys, etc.) would they be most receptive to?

- Slow responses: Do you have a strategy in place to avoid low response rates?

Conducting market research surveys: best practices

Today’s market research industry is advancing rapidly, thanks in part to new technologies which make it easier to conduct market research, and offer more power and sophistication when it comes to analyzing your data.

Data-driven research is the standard across market research and other disciplines, and within the sector competition between brands is driving progress towards better and better market research tools. Beyond customer satisfaction, demographic questions and competitive analysis, today’s tools can dive deeper into your data, unearthing key drivers behind trends and even providing aggregated data on emotions and attitudes in customer feedback.

However, none of these technological advances can replace humans. To conduct market research successfully, you need to be able to combine tech with insight, intelligence and intuition, especially when you’re dealing directly with target customers, for example during a phone interview or when you’re approaching existing customers whose relationship to your brand needs to be maintained.

As we’ll see in this guide, market research can be used in a huge range of contexts, including brand tracking, customer experience research, employee experience programs, and of course product development. Whichever application you’re looking at, it’s essential to prepare thoroughly before sending out your surveys.

- Make sure your research question has been formulated and agreed by everyone involved in the project

- Develop a communications plan to maximize the chances of people engaging with your survey, including introductions, publicity, reminders and follow-up

- Consider using pre-testing before you fully launch your survey to thoroughly road-test it and iron out any issues

- Close the loop – after the study is complete and actions have been taken, let participations know how their contribution helped

- Consider a research panel for future surveys, either one you’ve built yourself or one managed by a third party provider

What are some common mistakes with market research surveys?

With the right survey tools and appropriate support from your survey platform provider, everything should go smoothly, even if you’re not an expert at doing your own market research. However, there are a few things to watch out for.

Choosing the wrong people to survey

Figuring out who you’re going to survey in the first place may seem like an obvious first step and not one you need to spend much time on. But in fact it’s possible to get it wrong, survey the wrong people and end up running a market research study with unreliable data. This is sometimes called ‘sample framing error’

Getting your sample size wrong

If your sample is too small, you run the risk of getting a sample group that doesn’t adequately reflect your target population. This can throw your entire market research survey off course. But if the sample is too large, you spend time and money on research that doesn’t add significant value. Have a look at our sample size calculator to help determine the right sample size for your market research surveys.

Using the wrong kinds of analysis

Do you know your conjoint analysis from your T-test? Understanding the basic types of statistical tests you can use to analyze market research survey data is essential if you’re not using a survey tool with built-in analytics. You’ll need to match the kind of data you’re collecting to the analysis method you choose in order to get accurate insights from your market research surveys.

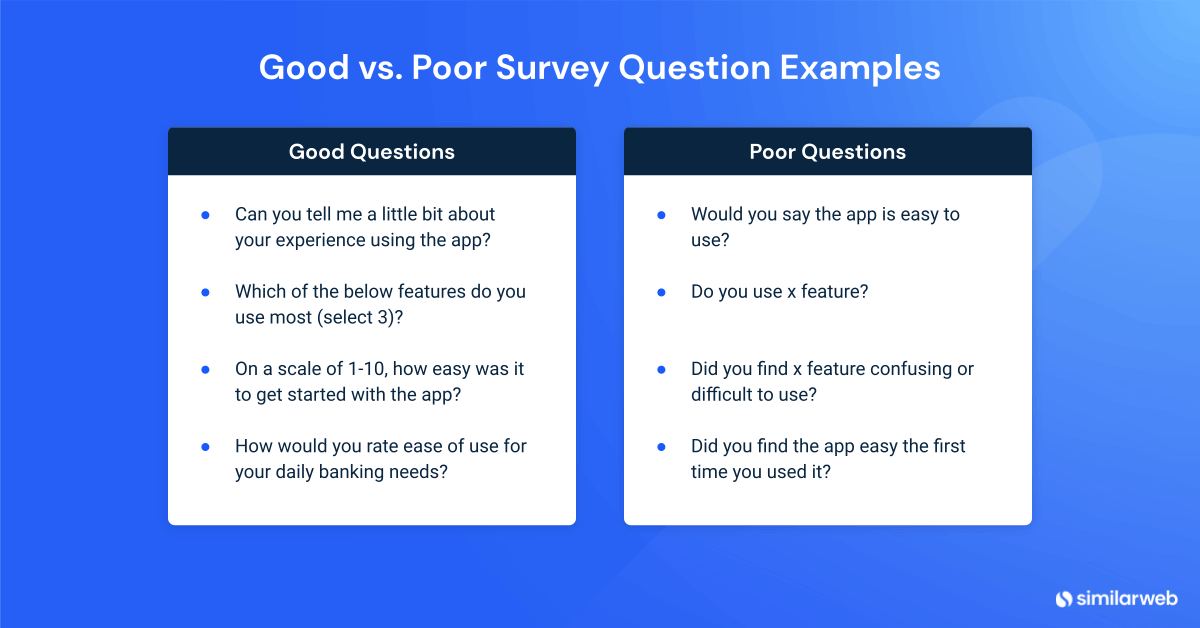

Writing confusing survey questions

Survey questions aren’t like the questions we use in everyday speech, or even like the ones we ask in formal writing. They need to be highly specific, include appropriate context, and be free of any kind of descriptive or persuasive element that might introduce bias. For a primer on writing great market research survey questions, see our guide to great survey questions

You should choose your survey method based on your target audience, distribution capabilities, and the questions you want answered. For example, interviews are far more personal and explorative by nature, but they’re difficult and costly to scale. Online surveys, on the other hand, have far greater reach and much more affordable — but you lose the opportunity to connect with respondents. Let’s go through the different types and how you can use them.

Online surveys

Online surveys are accessible to any participant across the globe, providing they have an internet connection. You can create online surveys using survey platforms and distribute them via email using a link, or respondents can go directly to the online survey and complete it.

Paper surveys

Paper surveys (or written surveys) are printed surveys filled in by hand. This method works well if respondents have enough time (and incentive) to complete the survey, and the researcher is happy to manually collect the data before collating and interpreting the answers.

Mail surveys

Mail surveys provide exceptional geographical coverage as they can be printed off and sent via the post. However, as recipients need to return the surveys for counting, it’s recommended that you include a pre-paid returns envelope in the original envelope, otherwise you’ll have lower response rates.

Telephone surveys

Telephone surveys involve asking respondents a series of questions over the phone. It’s a popular survey method as it’s convenient for researchers and doesn’t require a lot of capital to do. However, researchers may need to invest time to set up interviews with participants and take notes during the process.

In-person interviews / face-to-face surveys

In-person interviews and face-to-face surveys are great opportunities to get more insightful and valuable responses from participants. You can quickly find out why they think and feel the way that they do, providing an unbiased view of a subject or issue. However, like telephone surveys, they require a lot of time to set up and gather data.

Panel surveys

Panel surveys use a pre-selected group of people as the sample, so that the research can be carried out quickly. It presents a happy medium between the speed and quality of research data.

Based on the type of survey method you choose, here are the types of tools you need and can use for each:

A good internet connection is required for participants to access online surveys, though mobile devices data plans mean that most people can connect to the internet easily.

A good survey software platform is needed to give you full functionality and flexibility, so your online surveys can be customized and optimized. However, businesses can get more for their money with a survey software system that does more for the company.

For example, the Qualtrics XM Platform™ is a best-of-breed experience operating system for experience management. It brings all your operational and experience data together from across the organization to help create and improve experiences for employees, customers, prospects and more. It automatically updates records, has an in-built analytics engine and can handle research projects, from start to finish, in a few clicks.

All you need are paper, ink, pens and clipboards — but due to environmental and sustainability concerns, particularly paper waste and ink pollution, you may want to opt for a more digitized solution.

For mail surveys, the resources and concerns are the same as with paper surveys — but the main difference is distribution.

Ultimately, you need a reliable postal service that can deliver to your target audience. It also becomes costly if you want to include international respondents.

As long as you have good connectivity and network coverage, telephone surveys are straightforward. That said, survey calls can last a long time, so if you plan to include international audiences, ensure you can afford the calling costs.

The only requirement for in-person interviews and face-to-face surveys is a venue to hold them in.

These require participants to be available at the time of the research. Traditionally, third-party generated research panels are available as a service to companies that don’t have access to the audiences they need.

The surveys we explored can be used for four purposes in any business:

1. Market surveys

These help you understand who’s out there, what they want, and how you can best meet their needs.

Market description surveys

Purpose: to determine the size and relative market share of the market. Such studies provide key information about market growth, competitive positioning, and tracking share of the market .

Market profiling / segmentation surveys

Purpose: to identify who the customers are , who they are not, and why they are or are not your customers. This is often a descriptive market segmentation and market share analysis.

Stage in the purchase process / tracking surveys

Where is the customer in the adoption process? This information shows Market Awareness – Knowledge – Intention – Trial – Purchase – Repurchase of the product.

2. Customer experience surveys

This kind of survey helps you put yourself in the customer’s shoes and look at your business from their perspective.

Customer intention – purchase analysis surveys

Purpose: Directed at understanding the current customer. What motivates the customer to move from interest in the product to actual purchase? This is key to understanding customer conversion, commitment, and loyalty .

Customer attitudes and expectations surveys

Purpose: Used to direct advertising and improve customer conversion, commitment, and loyalty. Does the product meet customer expectations ? What attitudes have customers formed about the product and/or company?

Learn how you can set up and run customer attitudes and use surveys

Sales lead generation surveys

Purpose: Sales lead generation surveys are for

- assuring timely use and follow-up of sales leads

- qualifying sales leads (thereby saving valuable sales force time)

- providing more effective tracking of sales leads

Customer trust / loyalty / retention analysis surveys

Purpose: Especially helpful for high-priced consumer goods with a long decision and purchase processes (time from need recognition to purchase), this type of study explores the depth of consumer attitudes formed about the product and/or company.

Salesforce effectiveness surveys

Purpose: A combination of measures that focus on the sales activities, performance, and effectiveness in producing the desired and measurable effect or goal. Often measured as a 360-degree survey completed by the salesperson, the client (evaluating the sales call), and the supervisor responsible for evaluating the salesperson.

Customer service surveys

Purpose: Akin to customer satisfaction surveys, customer service surveys instead focus in detail on the actual customer service that was received, the process involved in receiving that service, and the evaluation of the participants in the service process.

Customer service representative (CSR) surveys

Purpose: CSRs often exhibit frustration, burnout, and high turnover . Surveys focus on CSR retention, reducing costs, and increasing the quality of customer relationships.

Attitudes, burnout, turnover, and retention: CSRs hold attitudes that reflect on their job-related activities including:

- the allocation of time

- solutions to customer needs

- how to improve their job

- best practices

- how well internal departments help customers

3. Product surveys

As part of product development, surveys help you find out what features, benefits and attributes appeal most to your customers, and how best to package your product, experience or service.

New product, service or experience concept analysis surveys

Purpose: Concept test studies are appropriate in the initial screening of new product concepts . Likes and dislikes about the concept and evaluation of acceptability and likelihood of purchase are especially useful measures.

Concept optimization, demand estimation, and cost analysis surveys (conjoint analysis)

Purpose: Determines an optimal bundle of features and benefits, and estimates associated demand. This kind of survey develops market share estimates of market potential for the alternative potential products.

Habits and practices, or attitude and usage surveys

Purpose: Directed at understanding usage situations, including how, when, and where the product is used. Habits and practices studies sometimes include a real or virtual pantry audit. Attitude and usage studies are used to understand consumer attitudes towards the product category and to life in general. They also look at product and brand usage, including how, when and where the product is used.

Product satisfaction surveys (attribute, features, promised benefits)

Purpose: Evaluation of the product’s promised bundle of benefits (both tangible and image). Are expectations created for the product by advertising, packaging , and the product appearance fulfilled by the product?

Competitive benchmarking surveys

Purpose: A “best practices” study of “how does the market view us relative to the competition?” Competitive positioning analyses often compare the attributes and benefits that make up the product using multidimensional scaling. These analyses also include an evaluation of key competitors, looking at the same KPIs and attributes as product satisfaction surveys.

Sales forecasting and market tracking surveys

Purpose: Sales forecasting and market tracking studies can include expert opinion (experts estimate the market), judgmental bootstrapping (expert-based rules describing how to use available secondary market information), conjoint analysis (estimation of consumer intentions based on product attributes that are important in the decision), and intentions evaluations (consumer self-reported intentions of future purchases).

Price setting surveys and elasticity of demand analysis

Purpose: Price surveys estimate the elasticity of demand and show optimal price points, including prices too low or too high. Price surveys may estimate the demand for different product or service segments, or different usage situations.

4. Brand surveys

A survey can help you understand how consumers perceive your brand and what values and ideas they associate with it. You can explore what value your brand has and whether people would choose you over competitors in your market niche.

Brand equity analysis surveys

Purpose: What is the psychological value that a brand holds in the marketplace? Brand equity is a composite of brand awareness , brand quality, brand associations, and brand loyalty measures.

Advertising value identification and analysis surveys

Purpose: Advertising value analysis focuses on mapping the hierarchical attributes, benefits, and values that are associated with and portrayed by an advertisement. Means-end analysis is often part of this type of study.

Advertising message effectiveness surveys (media and message)

Purpose: Message effectiveness testing identifies the impressions, feelings, and effectiveness in moving the respondent to a desired goal (increased awareness, more product information, trial, repeat purchase).

Once you know the right type of survey to run, the next step is to write a survey that your respondents will love to take!

Survey methods can be used to help collect data on real business issues and help you answer questions. Qualtrics supports customer surveys on every channel, at every journey stage to get you answers for more informed decisions.

We’ve put together a range of survey example templates that you can use for free to help you get started:

- Employee satisfaction survey template

- Employee exit survey template

- Customer satisfaction (CSAT) survey template

- Ad testing survey template

- Brand awareness survey template

- Product pricing survey template

- Product research survey template

- Employee engagement survey template

- Customer service survey template

- NPS survey template

- Product package testing survey template

- Product features prioritization survey template

In addition, for large-scale research studies, Qualtrics offers market research services to help with everything from questionnaire design and survey methods, to implementation and analysis.

Related resources

Post event survey questions 10 min read, best survey software 16 min read, close-ended questions 7 min read, survey vs questionnaire 12 min read, response bias 13 min read, double barreled question 11 min read, likert scales 14 min read, request demo.

Ready to learn more about Qualtrics?

Business growth

Marketing tips

How to conduct your own market research survey (with example)

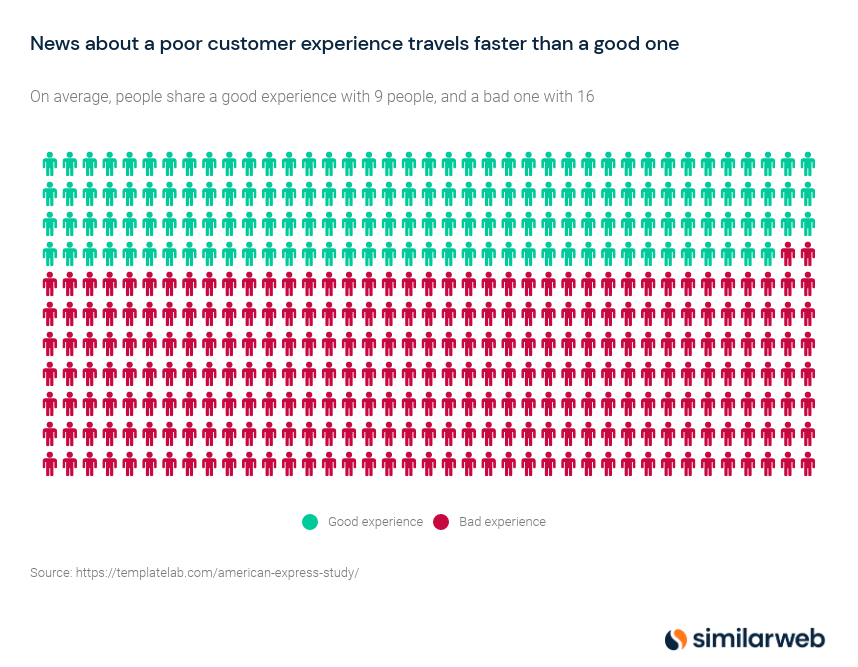

After watching a few of those sketches, you can imagine why real-life focus groups tend to be pretty small. Even without any over-the-top personalities involved, it's easy for these groups to go off the rails.

So what happens when you want to collect market research at a larger scale? That's where the market research survey comes in. Market surveys allow you to get just as much valuable information as an in-person interview, without the burden of herding hundreds of rowdy Eagles fans through a product test.

Table of contents:

What is a market research survey?

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports. Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

A market research survey can collect information on your target customers':

Experiences

Preferences, desires, and needs

Values and motivations

The types of information that can usually be found in a secondary source, and therefore aren't good candidates for a market survey, include your target customers':

Demographic data

Consumer spending data

Household size

Why conduct market research?

Here are some examples of how market research surveys can be used to fill a wide range of knowledge gaps for companies:

A B2B software company asks real users in its industry about Kanban board usage to help prioritize their project view change rollout.

A B2C software company asks its target demographic about their mobile browsing habits to help them find features to incorporate into their forthcoming mobile app.

A printing company asks its target demographic about fabric preferences to gauge interest in a premium material option for their apparel lines.

A wholesale food vendor surveys regional restaurant owners to find ideas for seasonal products to offer.

Primary vs. secondary market research

Market surveys are what's known as "primary research"—that is, information that the researching company gathers firsthand. Secondary research consists of data that another organization gathered and published, which other researchers can then use for their own reports.

Primary research is more expensive and time-intensive than secondary research, which is why you should only use market research surveys to obtain information that you can't get anywhere else.

If you've exhausted your secondary research options and still have unanswered questions, it's time to start thinking about conducting a market research survey.

6 types of market research survey

Depending on your goal, you'll need different types of market research. Here are six types of market research surveys.

1. Buyer persona research

A buyer persona research survey will help you learn more about things like demographics, household makeup, income and education levels, and lifestyle markers. The more you learn about your existing customers, the more specific you can get in targeting potential customers. You may find that there are more buyer personas within your user base than the ones that you've been targeting.

2. Sales funnel research

With a sales funnel research survey, you can learn about potential customers' main drivers at different stages of the sales funnel. You can also get feedback on how effective different sales strategies are. Use this survey to find out:

How close potential buyers are to making a purchase

What tools and experiences have been most effective in moving prospective customers closer to conversion

3. Customer loyalty research

The demographics of your most loyal customers

What tools are most effective in turning customers into advocates

What you can do to encourage more brand loyalty

4. Branding and marketing research

The Charmin focus group featured in that SNL sketch is an example of branding and marketing research, in which a company looks for feedback on a particular advertising angle to get a sense of whether it will be effective before the company spends money on running the ad at scale. Use this type of survey to find out:

Whether a new advertising angle will do well with existing customers

Whether a campaign will do well with a new customer segment you haven't targeted yet

What types of campaign angles do well with a particular demographic

5. New products or features research

What features they wish your product currently had

What they think of a particular product or feature idea

6. Competitor research

Whether your competitors have found success with a buyer persona you're not targeting

Information about buyers for a product that's similar to one you're thinking about launching

Feedback on what features your competitors' customers wish their version of a product had

How to write and conduct a market research survey

Once you've narrowed down your survey's objectives, you can move forward with designing and running your survey.

Step 1: Write your survey questions

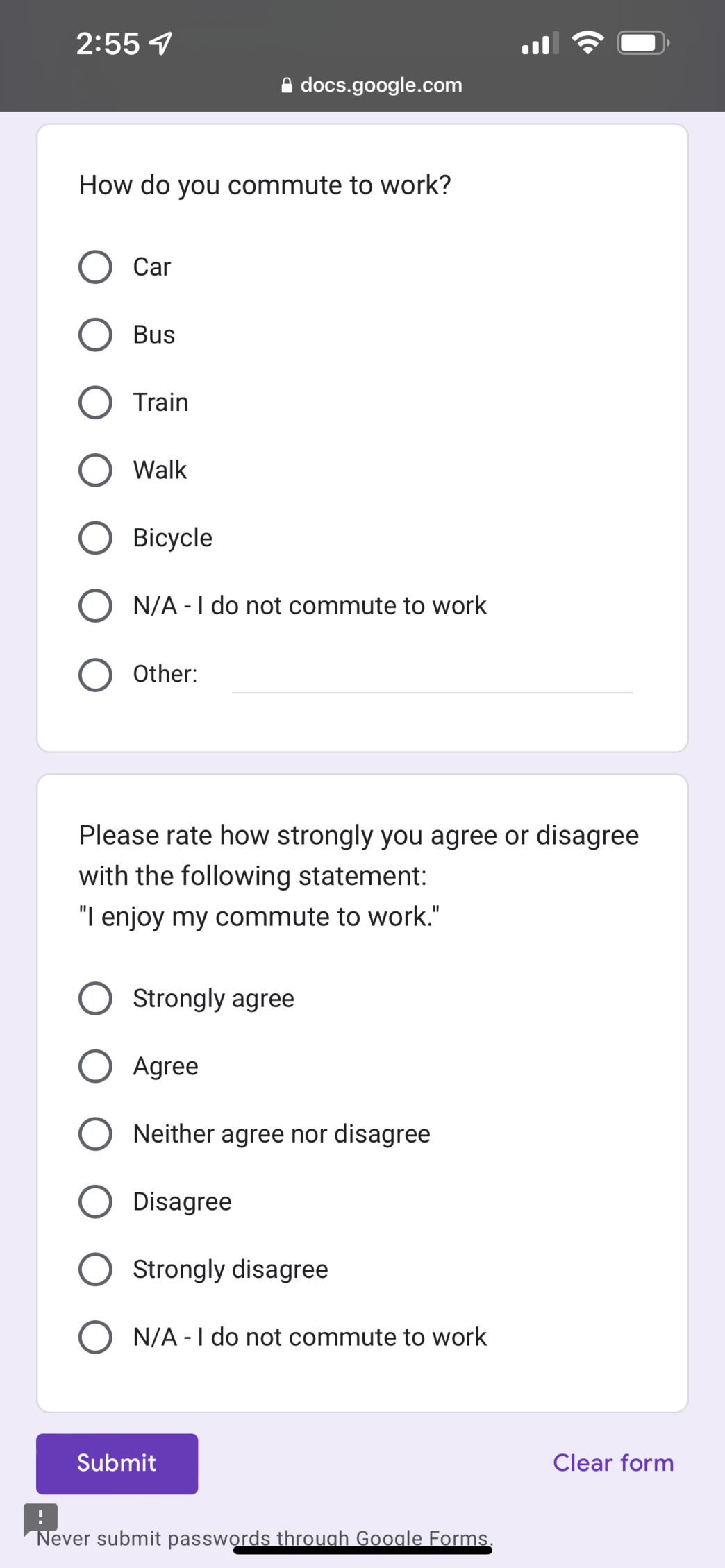

A poorly worded survey, or a survey that uses the wrong question format, can render all of your data moot. If you write a question that results in most respondents answering "none of the above," you haven't learned much.

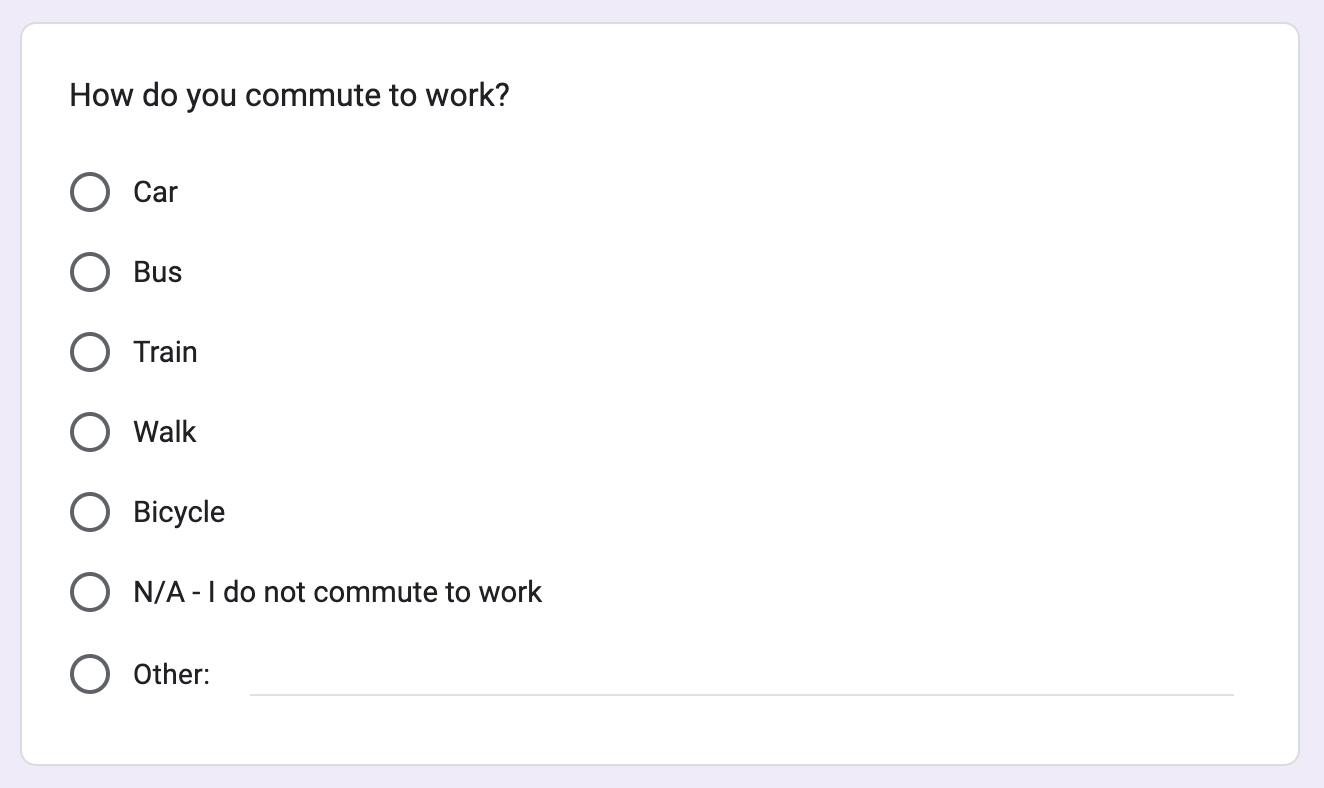

Categorical questions

Also known as a nominal question, this question type provides numbers and percentages for easy visualization, like "35% said ABC." It works great for bar graphs and pie charts, but you can't take averages or test correlations with nominal-level data.

Multiple choice: Use this type of question if you need more nuance than a Yes/No answer gives. You can add as many answers as you want, and your respondents can pick only one answer to the question.

Checkbox: Checkbox questions add the flexibility to select all the answers that apply. Add as many answers as you want, and respondents aren't limited to just one.

Ordinal questions

This type of question requires survey-takers to pick from options presented in a specific order, like "income of $0-$25K, $26K-$40K, $41K+." Like nominal questions, ordinal questions elicit responses that allow you to analyze counts and percentages, though you can't calculate averages or assess correlations with ordinal-level data.

Dropdown: Responses to ordinal questions can be presented as a dropdown, from which survey-takers can only make one selection. You could use this question type to gather demographic data, like the respondent's country or state of residence.

Ranking: This is a unique question type that allows respondents to arrange a list of answers in their preferred order, providing feedback on each option in the process.

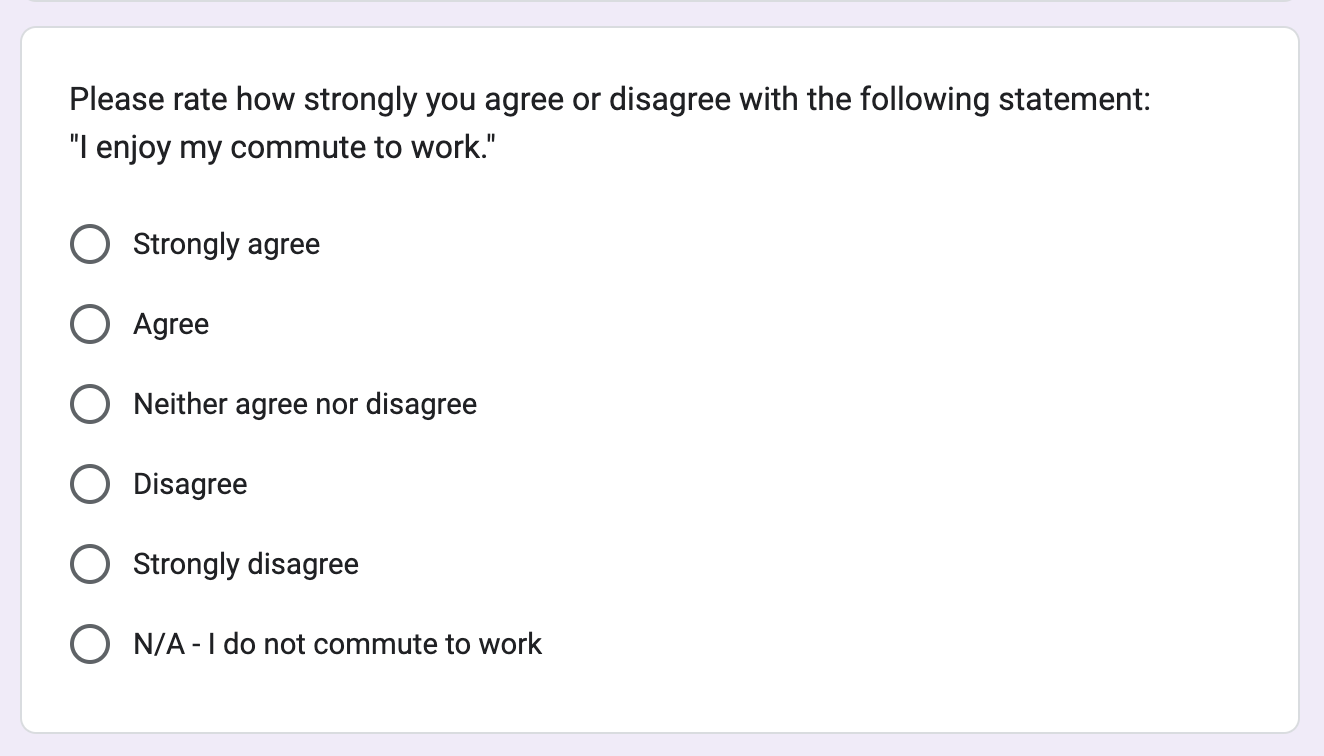

Interval/ratio questions

For precise data and advanced analysis, use interval or ratio questions. These can help you calculate more advanced analytics, like averages, test correlations, and run regression models. Interval questions commonly use scales of 1-5 or 1-7, like "Strongly disagree" to "Strongly agree." Ratio questions have a true zero and often ask for numerical inputs (like "How many cups of coffee do you drink per day? ____").

Ranking scale: A ranking scale presents answer choices along an ordered value-based sequence, either using numbers, a like/love scale, a never/always scale, or some other ratio interval. It gives more insight into people's thoughts than a Yes/No question.

Matrix: Have a lot of interval questions to ask? You can put a number of questions in a list and use the same scale for all of them. It simplifies gathering data about a lot of similar items at once.

Example : How much do you like the following: oranges, apples, grapes? Hate/Dislike/Ok/Like/Love

Textbox: A textbox question is needed for collecting direct feedback or personal data like names. There will be a blank space where the respondent can enter their answer to your question on their own.

Step 2: Choose a survey platform

Most survey apps today look great on mobile, but be sure to preview your survey on your phone and computer, at least, to make sure it'll look good for all of your users.

If you have the budget, you can also purchase survey services from a larger research agency.

Step 3: Run a test survey

Before you run your full survey, conduct a smaller test on 5%-10% of your target respondent pool size. This will allow you to work out any confusing wording or questions that result in unhelpful responses without spending the full cost of the survey. Look out for:

Survey rejection from the platform for prohibited topics

Joke or nonsense textbox answers that indicate the respondent didn't answer the survey in earnest

Multiple choice questions with an outsized percentage of "none of the above" or "N/A" responses

Step 4: Launch your survey

If your test survey comes back looking good, you're ready to launch the full thing! Make sure that you leave ample time for the survey to run—you'd be surprised at how long it takes to get a few thousand respondents.

Even if you've run similar surveys in the past, leave more time than you need. Some surveys take longer than others for no clear reason, and you also want to build in time to conduct a comprehensive data analysis.

Step 5: Organize and interpret the data

Tips for running a market research survey.

You know the basics of how to conduct a market research survey, but here are some tips to enhance the quality of your data and the reliability of your findings.

Find the right audience: You could have meticulously crafted survey questions, but if you don't target the appropriate demographic or customer segment, it doesn't really matter. You need to collect responses from the people you're trying to understand. Targeted audiences you can send surveys to include your existing customers, current social media followers, newsletter subscribers, attendees at relevant industry events, and community members from online forums, discussion boards, or other online communities that cater to your target audience.

Focus questions on a desired data type: As you conceptualize your survey, consider whether a qualitative or quantitative approach will better suit your research goals. Qualitative methods are best for exploring in-depth insights and underlying motivations, while quantitative methods are better for obtaining statistical data and measurable trends. For an outcome like "optimize our ice cream shop's menu offerings," you may want to find out which flavors of ice cream are most popular with teens. This would require a quantitative approach, for which you would use categorical questions that can help you rank potential flavors numerically.

Establish a timeline: Set a realistic timeline for your survey, from creation to distribution to data collection and analysis. You'll want to balance having your survey out long enough to generate a significant amount of responses but not so long that it loses relevance. That length can vary widely based on factors like type of survey, number of questions, audience size, time sensitivity, question format, and question length.

Market research survey campaign example

Let's say you own a market research company, and you want to use a survey to gain critical insights into your market. You prompt users to fill out your survey before they can access gated premium content.

Survey questions:

1. What size is your business?

<10 employees

11-50 employees

51-100 employees

101-200 employees

>200 employees

2. What industry type best describes your role?

3. On a scale of 1-4, how important would you say access to market data is?

1 - Not important

2 - Somewhat important

3 - Very important

4 - Critically important

4. On a scale of 1 (least important) to 5 (most important), rank how important these market data access factors are.

Accuracy of data

Attractive presentation of data

Cost of data access

Range of data presentation formats

Timeliness of data

5. True or false: your job relies on access to accurate, up-to-date market data.

Survey findings:

63% of respondents represent businesses with over 100 employees, while only 8% represent businesses with under 10.

71% of respondents work in sales, marketing, or operations.

80% of respondents consider access to market data to be either very important or critically important.

"Timeliness of data" (38%) and "Accuracy of data" (32%) were most commonly ranked as the most important market data access factor.

86% of respondents claimed that their jobs rely on accessing accurate, up-to-date market data.

Insights and recommendations: Independent analysis of the survey indicates that a large percentage of users work in the sales, marketing, or operations fields of large companies, and these customers value timeliness and accuracy most. These findings can help you position future report offerings more effectively by highlighting key benefits that are important to customers that fit into related customer profiles.

Market research survey example questions

Your individual questions will vary by your industry, market, and research goals, so don't expect a cut-and-paste survey to suit your needs. To help you get started, here are market research survey example questions to give you a sense of the format.

Yes/No: Have you purchased our product before?

Multiple choice: How many employees work at your company?

<10 / 10-20 / 21-50 / 51-100 / 101-250 / 250+

Checkbox: Which of the following features do you use in our app?

Push notifications / Dashboard / Profile customization / In-app chat

Dropdown: What's your household income?

$0-$10K / $11-$35K / $36-$60K / $61K+

Ranking: Which social media platforms do you use the most? Rank in order, from most to least.

Facebook / Instagram / Twitter / LinkedIn / Reddit

Ranking scale: On a scale of 1-5, how would you rate our customer service?

1 / 2 / 3 / 4 / 5

Textbox: How many apps are installed on your phone? Enter a number:

Market research survey question types

Good survey apps typically offer pre-designed templates as a starting point. But to give you a more visual sense of what these questions might look like, we've put together a document showcasing common market research survey question types.

Use automation to put survey results into action

Related reading:

This article was originally published in June 2015 by Stephanie Briggs. The most recent update, with contributions from Cecilia Gillen, was in September 2023.

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Amanda Pell

Amanda is a writer and content strategist who built her career writing on campaigns for brands like Nature Valley, Disney, and the NFL. When she's not knee-deep in research, you'll likely find her hiking with her dog or with her nose in a good book.

- Forms & surveys

Related articles

How to use ChatGPT for copywriting and content ideation

How to use ChatGPT for copywriting and...

12 Linkedin Lead Gen Form examples to inspire your next campaign

12 Linkedin Lead Gen Form examples to...

14 types of email marketing to experiment with

14 types of email marketing to experiment...

8 business anniversary marketing ideas and examples worth celebrating

8 business anniversary marketing ideas and...

Improve your productivity automatically. Use Zapier to get your apps working together.

- Pollfish School

- Market Research

- Survey Guides

- Get started

Market Research Survey: The Complete Guide

This process involves gathering primary (self-conducted) and secondary (information already researched and made available) sources, to fully assess how a business will fare within a particular market and audience.

A market research survey is typically a source of primary information that businesses can use as part of their market research campaigns. It can also exist as a secondary source, in which case, its studies and results are published online or in a print publication.

This article will take a close look at the market research survey, so that you can use it to the optimum benefit for your business.

What Can you Achieve with Market Research?

A market research survey, as its name entails, is used for research purposes. Before we dive into all the aspects of this survey, it is apt to learn how you can use market research to your full advantage.

Market research is critical for a variety of purposes, including marketing , advertising , and branding campaigns.

Aside from providing data-based support for these macro purposes, market research gains you invaluable insight into particular markets. For example, you may consider running a research campaign for the retail market . Market research will help you gather all the relevant information pertaining to this specific market.

Aside from retail, you can conduct market research in a number of verticals, including ecommerce , technology, real estate and many others.

There are plenty of other applications for market research. Here are some of the ways to use market research to your advantage:

- Observe data to prepare for challenges in advance

- Gauge the demand for your product or service

- Learn key market trends and staples

- Discover how your competitors are winning or losing

- Uncover your target market’s desires, preferences, aversions and thoughts

The final point is remarkably crucial for market research and for generally keeping your business afloat. And so, we’ll now dig deep into the market research survey, as this tool is especially useful for this purpose.

Defining a Market Research Survey

This tool is the most commonly used market research method — and for good reason. A market research survey allows you to gather data on your target market. Moreover, it allows businesses to do so by accessing any insights they need, as long as they form corresponding questions to their investigation.

Surveys have a far-reaching history, as they date back to ancient civilizations such as Greece and Rome. There was a surge in survey use in 1930s America, in which the government sought to understand the economic and social state of the nation.

Surveys have taken up a variety of forms, including analog forms, such as paper and mail-in formats .

Telephone surveys were the medium of choice for survey research during the 1960s-90s. But, as technological advancements would have it, those have declined in usefulness as well.

In the present day, surveys are conducted online, particularly through the use of designated software platforms. This type of software has paved the way for easy access to primary research.

Businesses can use online survey software and tools and to carry out all their survey research (save for creating the screener and questions). Many such tools available both allow you to build surveys along with deploying them.

To reiterate, market research surveys are powerful tools, in that they empower businesses to ask any question they choose to better understand their market and consumer base. They also can offer key insights into competitors.

The Components of a Market Research Survey

This tool contains two major components: the screener and the questionnaire . These form the bulk of the insights your primary research will gather.

There are also two auxiliary components to incorporate to make your survey research successful. These include the call-out (introduction) and the thank you message (conclusion).

Unlike the essential components, the need to use these will vary based on your survey deployment method and campaign. For example, an emailed survey won’t require a call-out, as the email itself serves this purpose.

A web or mobile survey, on the other hand, will need a call-out to get the attention of your respondents.

Here is a break-down of each component, beginning with the essential elements:

- These conditions often deal with demographics, which is incredibly important, as you would need to first and foremost, survey your target market. The screener will ensure it is only your target market that takes part in the survey.

- The screener is often comprised of 2-3 questions.

- The questionnaire should ask all the necessary questions you need for a particular campaign or sub-campaign. Or, if used in a preliminary stage of your market research, they can deal with questions particularly designed to segment your target market.

- If respondents are contacted via email, the call-out is in the email’s body, inviting participants to take it, listing why it’s important, its length and what it’s used for.

- If the survey exists within a website (either as a banner, or button), the call-out is the clickable element itself (the button/banner to the survey). It too should explain the survey to respondents.

- If the survey is on a website/app, the call-out has to be visible and attractive enough for users to notice it and click on it.

- The survey often routes users to another page with a thank you message.

- It’s important, as it lets participants know that their survey has in fact been submitted.

How to Create a Market Research Survey

Here are a few steps to take into consideration when starting on a market research survey project.

Step 1: Find a topic your business needs to learn more about.

This is particularly important if it is a topic that has little to no secondary sources. In this case, opting for a survey is the best way to learn more about it firsthand, from the people who matter most: your target market. Pay attention to any problems your business may experience, as surveys should help resolve them.

Step 2: Consider the topic in regards to your target market

When you’ve narrowed down a problem or two, think about your target market. Do you know who constitutes it? If yes, tailor your survey topic into a subtopic that they’ll be most likely to respond to. For example, if your target market is middle-aged men who watch sports, consider whether your problem/topic will be relevant to them.

If you don’t know your target market, you should conduct some secondary research about it first, then perform market segmentation (surveys can help on this front too).

Step 3: Find the larger application of the survey campaign

Now that you’ve settled on a topic/problem and decided on whether it’s fitting for your target market, consider what the parent campaign of the survey would be. Let’s hypothetically say your topic is related to a product. Would a survey on that topic benefit a branding campaign like finding your next slogan? Would it be better suited to settle on a theme for an advertising campaign?

Once you find the most appropriate application or macro campaign to house the survey, your market research will be organized and your survey will be better set up for success.

Step 4: Calculate your margin of error

A margin of error , in simple terms, is a measurement of how effective your survey will be. Expressed as a percentage, it measures the difference between survey results and the population value.

You need to measure this unit, as surveys represent a large group of people, but are made up of a much smaller group. Therefore, the larger the margin of error, the less accurate the opinions of the survey represent an entire population.

Step 5: Create your survey(s)

Now that you’ve calculated the margin of error, start creating your campaign. Decide on how many surveys you would need, in regard to your margin of error and your market research needs.

Start with a broader topic and get more specific in each question. Or, create multiple surveys focused on different but closely related subtopics to your main topic.

Send out your surveys through a trusted survey platform.

Questions to Ask for Various Campaigns

The steps laid out above are part of a simple procedure in developing a market research survey. However, there is much more to these steps, especially that of creating the survey.

Namely, you would need the correct set of questions, as they are the lifeblood of a survey. With so many different survey research campaigns and purposes, brainstorming questions can seem almost counterintuitive.

To avoid information overload and any confusion that creating a survey may incite, review the below question examples. They are organized per campaign type, so you can discern which questions are most suitable for which corresponding research purpose.

Questions for Branding

Branding campaigns include efforts that build the identity of your business; this includes gathering data-backed ideas on logos, imagery, messaging and core themes surrounding your brand. You can use these when embarking on a new campaign, revamping an existing one or when you’re looking to change your brand’s reputation and style.

- Which of these brands do you know?

- What do you like most/least about this brand?

- Which idea is more important? (Use an idea behind setting up your brand’s image/style)

- Which images do you find the most inspiring? (To compare images you’ll use in your marketing/ definitive to your brand)

- What do you like about [brand]? (Can be open-ended)

Questions for Advertising

Using market research for advertising will help you obtain ideas for new advertising campaigns, testing already established campaign ideas and predicting the success of new ones.

- How would you rate the motivating power of this ad?

- Which of the following ads resonate the most with you?

- Do you remember this ad? (Name and image/video of a popular ad within your industry)

- How do you feel after watching this ad?

- What kind of use do you think this product/service produces?

Questions for Comparing Yourself with Competitors

Studying your competitors is often associated with secondary research, but you can gain intelligence on this topic through your own survey research. The great thing about surveys is that you don’t have to focus on one competitor when managing these surveys.

- How often do you use this product/service?

- Which brand do you use for this product/service? (Include one open-ended answer).

- Which of the following products (same kind, different brand) do you find the most useful?

- What about [competitor product] would you like to see change?

- Which brand has improved your life? (Include one open-ended question).

Questions for Market Segmentation

This application is possibly the most challenging, as it involves understanding who your target market already is, then further segmenting it. We understand coming to terms with your target market first, before narrowing it any further down.

Here is how to segment your target market; you’ll notice that the questions are much more granular than the typical questions associated with each topic. (Ex: demographics typically ask for race, age, gender, income, etc).

- Demographic segmentation: Which of the following groups do you identify with most closely? (It can involve anything from music, to shopping habits, to lifestyle choices)

- Geographic segmentation: Which of the following areas do you typically spend time in to make physical purchases?

- Psychographic segmentation: How do you feel about retailers who test their products on animals?

- Behavioral segmentation: How often do you buy this kind of product?

- Sentimental segmentation: How do the following [practices, images, actions] make you feel?

Securing the Most Benefits Out of Your Market Research Survey

As we can deduce from this guide, the market research survey is a critical tool for market research . There is so much to discover about your industry, competitors and chiefly, your customers. But before making any hasty decisions, it is vital to peruse all your research documents, not just the primary research ones, such as surveys.

When you combine primary and secondary research sources, you’re setting up any business move for greater success.

That’s because market research involves studying more than one source. It may appear daunting, but with the right tools, you can design better products, innovate on existing products, appeal to a wider audience and gain more revenue from your marketing efforts.

Thus, pair your market research survey with other research means for a lucrative market research campaign. Knowledge truly is power.

Frequently asked questions

What is a market research survey.

A market research survey is a survey used for conducting primary market research and is the most commonly used market research method. Market research surveys help you understand your target market, gathering data necessary to make informed decisions on content creation, product development, and more.

What are the components of a market research survey?

There are 4 major components in a market research survey. First, we have the callout to get digital visitors to participate in a survey. Next is the screener which determines who is eligible to take the survey based on their demographics information and answers to screening questions. Then, there is the questionnaire—-- this is the heart of the survey, containing a set of open-ended or closed-ended questions. Lastly, there’s the callout. This introduces the survey to respondents. Next, there’s the thank you message. This acts as the conclusion to the survey.

How can you create a market research survey?

Creating a market research survey starts with identifying the topics your business needs to learn more about. Next, you consider topics within the context of your target market and find the larger application of the survey campaign. Calculate your margin of error and then create your survey using online software.

What types of questions should you ask on your market research survey?

You can ask branding related questions to gather information on how your identity of your business is perceived. You can also ask questions that spark ideas for new advertising campaigns. To supplement your secondary research on competitors, ask questions about your business’s place in the industry. Questions can also be used for market segmentation. These are questions on demographic, geographic, psychographic, behavioral and sentimental topics.

How can you get the most benefits out of your market research survey?

You can get the most out of your market research survey by using the correct online survey platform-- one with specific audience targeting for real consumers, radius targeting and quality screening questions-- you’ll get relevant answers from the right audience.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

How to conduct a market survey that works

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

Knowing your audience is the backbone of success whether you’re a small business or a household name. And to know your audience, you need to do some all-important market research. But what’s the best way to go about doing that? Well, the easy answer is to use our market research platform to get on-demand insights into your existing audience and your potential customers.

But, if you want to take the long route, you could conduct a good old fashioned market research survey yourself.

What is a market research survey?

We’re glad you asked. A market research survey is a way of gaining information, insights, and attributes about your target consumers, so you can better understand them and what makes them tick. These surveys are typically conducted by market research companies . More information means more knowledge, which leads to more understanding – helping drive more successful campaigns.

But market research surveys don’t just help you improve your targeting and create campaigns that have impact. They provide valuable insight into the feelings, attitudes, and preferences of your audience – guiding everything from concept testing and launching new products, to brand positioning and customer satisfaction.

But what does it really take to conduct a market survey that works? Let’s get into it.

1. Set a clear goal 2. Know who to survey 3. Get help from survey-savvy people 4. Figure out the best way to get answers 5. Focus on the execution 6. Understand analysis is the answer 7. Uncover the bigger picture

1. Set a clear goal

Start by setting a clear objective of what you want from your market research. This will be determined by your marketing goals. If you’re launching a new product, for example, you’ll want to know what the demand is, how aware people are of your existing products/brand, if they currently use a competitor, and how frequently they buy.

Be precise about the outcome you’re looking for so you can get the answers you need to nail your future marketing campaigns .

- Why are you doing the survey?

- What do you want to find out from your research?

- Is it for product improvements with an existing audience?

- Are you looking to launch a new product into the marketplace and therefore need to know if there’s sufficient demand?

- Are you looking to improve your customer experience?

Knowing what you want to find out will help you identify what information you need. And it’ll help you determine whether a qualitative or quantitative approach works best.

The aim is to find out what your customers are looking for and improve satisfaction with your brand.

Uncovering consumer attitudes could reveal some invaluable insights that will guide your strategy with the customer at the heart.

2. Know who to survey

Market research starts with identifying which market you’re targeting. Who’s your audience? Are you looking at existing customers? Or are you looking to find out more about potential customers?

Think back to your goal here. Keeping in mind what you’re looking to achieve from your market research can help guide who you survey. For example, if you want to build on your customer offering by introducing a priority service, you may just want to gather information from people living in a certain area or earning over a certain amount.

Use regional data to attain precise information about the target customer whose data you need, and narrow it down to support your ultimate goal.

Determine key demographics of your target audience like where they live, their age, gender, or income bracket. You’ll also need to establish the market size of your target market in order to calculate your sample size.

3. Get help from some survey-savvy people

Who knows about surveys? We do.

We teased this at the start, but turning to an existing, ongoing survey (or multiple) could save you a helluva lot of time – and money. So if you need a faster way to understand digital consumers, we give you an on-demand window into their worlds. All in a few quick clicks, in one reliable audience insights platform.

GWI data spans 53 markets and represents over 2 billion internet users, making it the world’s leading market survey on digital consumers.

We provide a level of detail you can’t find elsewhere. Survey research is tricky. So why not leave it to the market research experts? And if you want something super bespoke for your business needs, our Custom research offering might be just the thing.

4. Figure out the best way to get answers

Cast your mind back to steps 1 and 2. Thinking about who you’re looking to survey and what you’re looking to gain will help determine how you get those answers from the right target market.

Knowing the difference between primary research and secondary research, as well as qualitative and quantitative, can go a long way to helping you figure out the best approach.

For example, primary market research is where you gather data that hasn’t been collected before – it’s new, essentially. You can gather primary research via surveys or observations. On the other hand, secondary market research is where you gather data that’s already been collected or conducted before by other people. You can find secondary research in published reports or studies.

Surveys can be carried out in a number of ways, no longer exclusive to telephone surveys and focus groups. The online survey is another option that allows you to take a step away from the time-consuming paper survey. You can also conduct market research in groups or on an individual basis.

Once again, the optimum approach for your brand will depend on your goals and the information you’re trying to capture, as well as your target audience, market share potential, and overall preferences.

If you want to gather in-depth information from Gen Z , for example, you might want to head over to Instagram. With 28% of Gen Zs saying that Instagram is their favorite social media platform, you’re most likely to find them scrolling here where you can try out polls to get answers, and ask follow-up questions that dig a little deeper.

Using quantitative panel data to back this up, market researchers can come away with powerful insights and market analysis they can trust.

5. Focus on the execution

Once you’re clear about your goals, the data you want, the people you need to talk to, and the best way to gather your survey data, it’s important to maximize the sample size.

This means reaching people at the right time, checking out where they’re likely to be, and setting a realistic timeframe for them to share their thoughts.

You’ve got to really keep your target audience in mind here. If you’re physically interacting with people, think about the places they’re likely to visit, and at what times they’ll be there. There’s no use setting up camp at the mall on a weekday if you’re looking to talk to corporate big fish.

If it’s an online survey, understanding which social media platforms or websites they are likely to hang out on, and at what times they tend to be online is vital to getting those survey form completion numbers to hit the high notes.

Conducting some data analysis ahead of the survey can go a long way in helping make the survey easier to reach the right audiences. Take the guesswork out of your marketing research.

6. Analysis is the answer

Once you’ve gathered your market survey responses, they need to be analyzed thoroughly to pull out key trends and findings to allow you to gain some tasty, actionable insights from the data. So, what do you need to be looking at?

- Examine qualitative answers for stand-out quotes and detailed feedback about attitudes and behaviors

- Calculate averages from your quantitative answers

- Compare your results against global and local secondary market research

There are plenty of ways to cross-examine and analyze your market research data based on the type of data you’ve collected and what you’re looking for.

7. Uncover the bigger picture

Conducting a single market research survey is invaluable to brands, but when carried out in isolation, market research can lack real-world relevance.

To get more from your analysis, large-scale market survey data allows you to compare your findings across multiple data points. You can cross-reference it with local subgroups and compare against global averages to clearly see where the value truly lies.

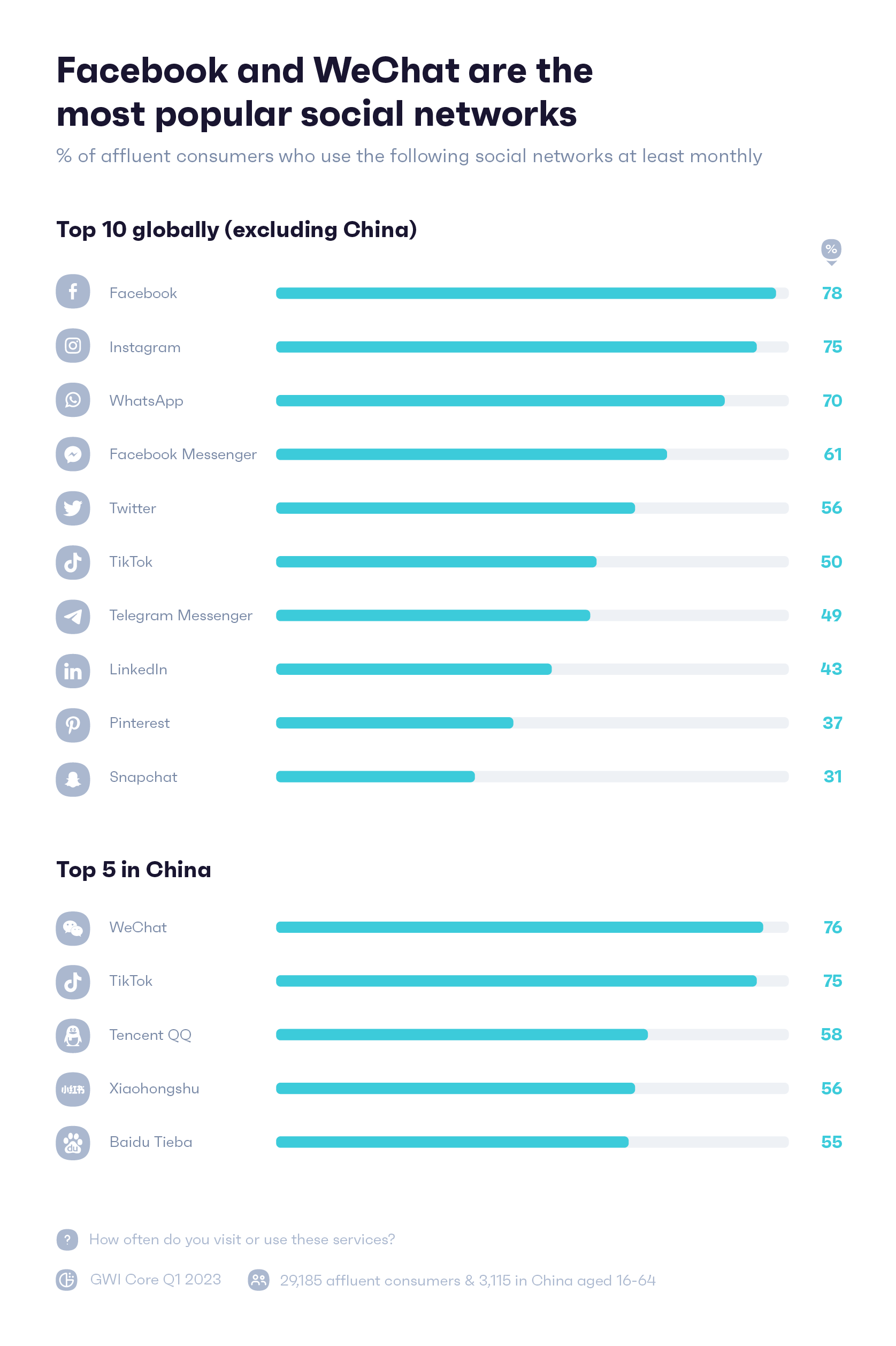

Use case: Identifying affluent consumer behaviors on social media

Here’s a hypothetical example. Let’s say you sell a luxury product. You’ve identified from your own survey results and analytics that social media is prominent in your customers’ lives.

But you need more detail to target high-earners on the channels where they’re most active.

By using a deep data set to dig down into their activity on social media, you can uncover exactly where they spend their time:

Combining this with questions designed to reveal their motivations for using social media takes your understanding to the next level:

Here, 30% of affluent consumers follow/subscribe to companies and brands they purchase from, so we’re more inclined to say they can be targeted with a good social media strategy from brands to be enticed into buying from them.

Uncovering insights like this is key to delivering a well-positioned message that sticks.

Now, you can create a campaign specifically targeted to hit your ideal target market, where they hang out and in a way that speaks to their interests.

Market research surveys are pivotal to success

Market surveys can be used in a variety of ways to help a brand focus more on its target audience and take a more people-based approach.

You can use it to get a better understanding of the perceptions around your brand, test the appetite for a new product, and find customer demographics to accurately pitch an ad campaign. A marketing research survey enables you to gather information about your audience and help to build a buyer persona for each sector of your target audience for more personalized, effective marketing strategies.

Data holds the answers you need to achieve almost every business goal.

But data is powerless without effective analysis. And without effective analysis, no insights can be drawn. So it pays to have third-party survey data sets at your disposal to contextualize your findings. A skillfully-planned market survey that catches customer feedback and experience will deliver findings that could spell the difference between success and failure in a marketing strategy. Leveraging GWI’s data platform means getting clued up on your audience fast, and making decisions you can stand behind.

Never miss a post

By subscribing you confirm you’re happy for us to send you our latest articles.

You’ve read our blog, now see our platform

Every business has questions about its audiences, GWI has answers. Powered by consistent, global research, our platform is an on-demand window into their world.

- Solutions Industry Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Member Experience Technology Use case NPS+ Communities Audience InsightsHub InstantAnswers Digsite LivePolls Journey Mapping GDPR Positive People Science 360 Feedback Surveys Research Edition

- Resources Blog eBooks Survey Templates Case Studies Training Webinars Help center

Market research surveys: The complete guide

Your guide to create and distribute an excellent market research survey., 350+ free survey templates, customer surveys, human resources surveys, marketing surveys, industry surveys, community surveys, academic evaluation surveys, non-profit surveys, what is a market research survey.

Market research surveys are questionnaires that collect responses from a target audience of consumers. A brand uses market research to identify pain points, preferences, and interests of their customers.

A market research survey seeks to understand patterns in a given market. Researchers might segregate markets based on geography, age, gender, or other demographics. Brands can then use Trend analysis , Conjoint analysis , and Turf analysis to analyze their findings and help create actionable insights for their business.

Key attributes of successful marketing research surveys:

Survey research.

Survey research in marketing involves sending customers a questionnaire containing questions about your brand, products, and competitors. Your customers complete the questions according to their preferences. Most brands use online surveys for fast, accurate collection of data.

Send your survey research via email, SMS, QR Code, or other electronic platforms. Participants respond on the web for instant responses.

At QuestionPro, we also offer an offline survey app. The app allows users to capture survey research responses on a mobile or tablet device from anywhere. This is ideal in locations that do not have an internet connection or suffer from an unstable connection.

Good questions

The right survey questions are the most critical part of any market research. Attributes such as language, question type, and answer type help you customize your surveys to fit your needs. Easy-to-read questions that follow a flow receive higher response rates than jumbled, confusing ones.

Survey distribution methods

What’s the best distribution method for high response rates? Will email surveys or a physical mobile kiosk receive higher engagement?

Email surveys remain the most popular form of market research surveys. The popularity of tablet-based kiosks is rising for many B2C businesses as well. These stationary tablets capture live responses from customers at stores and business events.

Specialized survey portals, such as QuestionPro Communities, help generate qualitative research. Through these portals, customers answer less restrictive questions. More open-ended questions pass on more ideas to the company.

Survey analysis

You can’t do much with a bunch of survey responses alone – you need the power to analyze survey data. Online software makes it easy to create, distribute, and analyze surveys in one place.

QuestionPro features a complete set of analytics features:

Trend analysis

- Turf analysis

Gap analysis

Conjoint analysis

MaxDiff analysis

Text analysis

- Strategic analysis (SWOT analysis)

Survey report

A market research survey report showcases the conclusions of your analysis. Reports include current trends and projections of future customer trends and preferences. A good survey report provides company stakeholders with a complete thesis using the available data and analysis from the survey.

Reports streamline the survey result processing. An efficient report process opens the door to implement your findings. You’re able to dive into the innovation process to create products and services that directly help your customers.

Conducting market research surveys

Conducting a successful research survey requires thorough planning and structuring. Follow these tips:

Identify a research objective

Set clear objectives. Take the time to write questions that define your goals and resonate with your customers.

Identify your target audience

Answer two questions to help define your target audience:

Which geographic region does your research target?

What are the qualifying attributes of your ideal survey respondents?

This could include age, gender, household income, or other demographics that narrow your audience.

Create your survey

Survey creation is easy with online tools. Create and send in minutes using survey software. This will free up more time to collect responses and analyze your data.

QuestionPro offers a complete suite of survey creation options with over 350+ ready-made survey templates . Our advanced and standard survey question types allow you to customize surveys for specific demographics. Meet branding requirements with survey design customizations. Powerful logic and branching options help keep respondents engaged and lower drop-out rates.

Distribution, response collection and market analysis

Your survey distribution methods depend on the platform you choose. In QuestionPro, you can distribute custom online surveys through email, SMS, or QR code. We also offer the ability to collect responses offline using our mobile app.

QuestionPro Audience also allows you to purchase respondent data instantly.

Online survey platforms help you receive data in real-time and analyze it much faster. Manual survey input and analysis use Excel sheets. This takes additional time and effort, which reduces the cost-effectiveness of your market research survey.

Why should you conduct a market research surveys for your business?

Knowing the preferences and needs of your target customers is imperative to business success. Without this knowledge, you’re blindly putting out products and services with no idea how they’ll fare.

You need to collect information on the four “Ps” of your business:

P1 - Product

Market research should look at customer behavior and preferences regarding your products and services.

P2 - Placement

A good market research survey provides insights into the most profitable way to position their product in the market. Creative product placements give your business a competitive edge over the competition. Discover the ideal placements through custom market research surveys.

P3 - Pricing

Nothing dictates a product’s journey more than its price. How much are potential consumers willing to pay for a new feature? Will decreasing your product price give you a sales boost? Get the answers to these questions by asking customers.

P4 - Promotions

Use the first three “Ps” to determine the promotion of your products and services. Whether you choose organic or paid promotions, formulate your plan using insights from your research. Successful businesses always conduct thorough market analysis using research studies before making a major promotional push.

Research methods: qualitative and quantitative research

Qualitative market research.

A qualitative market research study focuses on collecting unstructured or semi-structured data from consumers. Information from qualitative research studies drives market insights.

Common methods of successful qualitative market research:

Focus groups

Focus group qualitative research involves getting a few people for a face-to-face discussion. Questions cover what-if scenarios around a specific product or subject of interest.

Platforms like Communities from QuestionPro reduce the need for in-person focus groups. Online portals allow for both data collection and market analysis.

On-call interviews

On-call interviews provide insights into the mind of business leaders or senior officials. This method allows the researcher to “open-up” the survey in the form of a regular conversation. The interview usually spans across several topics of interest.

Innovation research

Innovation research, also referred to as innovation games, seeks to use a group of consumers to generate innovative ideas. Platforms like Communities make it possible for businesses to conduct such qualitative research remotely and tap into global respondents. This allows organizations to get the best ideas from the best minds without the barrier of being physically present.

Advantages of qualitative market research :

Cost-effective

Qualitative research happens on a smaller scale than quantitative research. This reduces the expense to conduct a survey, as you’ll send it to a small group of people.

In-depth insights

The open nature of questions and the freedom for researchers to dive deeper promotes detailed insights.

Flexibility

Researchers enjoy the ability to identify sub-topics of interest as the conversation naturally progresses.

Answering the "Why"

Qualitative market research is a popular option when the objective of the research is to discover why customers do something. Politely pressing respondents to answer crucial questions shows you the reasons behind customer actions.

Quantitative market research

Quantitative market research surveys collect data through structured questionnaires. They use statistical analysis methods to derive meaningful and actionable insights.

Once conducted through pen and paper responses, today quantitative research makes use of advanced market research survey software platforms. Online platforms add additional value to the quality of surveys, responses and insight.

Attributes of quantitative marketing research surveys:

Survey questions

While survey questions may appear to be simplistic, but proper use can elicit the answers you want from customers. Single-select questions, multiple-choice questions, and rating scale questions give you options when creating your survey.

QuestionPro’s survey platform provides a vast range of survey question and question-types with market research survey examples. Varying question types encourage participants to continue through your survey. It’s easy to create your first survey with over 350+ ready-made survey templates available. Simply select, edit, and send!

Survey design

Survey design refers as much to the look of the survey as it does to logic and branching techniques. Good survey design makes questions more precise for the respondents. Add custom logos and brand attributes to create a cohesive, visually appealing questionnaire.

Survey distribution

Email surveys dominate online survey distribution channels. Offline surveys that use kiosks are becoming popular for point-of-sale response collection.

Send or schedule your email market research study with QuestionPro. Our advanced platform also allows you to distribute surveys through QR code, SMS, or embed it on your website.

Survey collection

Survey collection depends on the method of distribution. Survey software platforms make survey data collection easy and allow you to collect data in real-time.

Even better, QuestionPro enables you to track responses. Filter respondents by those who have not started, started but not finished, and those who finished the survey.

Survey analytics in quantitative research includes conjoint analysis , Turf analysis and SWOT analysis .Business and academic researchers often use quantitative research due to the simple application of analytics for data-oriented insights.

In QuestionPro’s market research survey software completes analytics in real-time.

Advantages of quantitative market research surveys:

Fully data-oriented decision making:

The precise nature of quantitative research leads to decision-making based on data.

Zero scope for analytical errors:

Enjoy zero errors with analysis from QuestionPro. By using powerful computing software, our program eliminates human error when analyzing survey data.

Concrete projections:

Projections from the concrete data of quantitative research methods mean you have data-backed insights for your business. Use these projections to accurately predict the spending habits and preferences of your customer base.

Statistical survey analysis techniques

TURF analysis

TURF stands for Total Unduplicated Reach and Frequency. Market analysis using TURF provides details on user frequency and marketing reach without any duplicates. This gives you a real estimate of market potential.

Conjoint analysis explores how different attributes of a given product or service range in importance to a customer. Online survey software makes Conjoint easier than ever before, allowing more businesses to put it to work.

MaxDiff analysis reads consumer preference across different attributes such as branding and advertising. MaxDiff analysis is similar to conjoint analysis, however, it is much simpler to implement.

Gap analysis measures actual performance vs. desired performance. Use gap analysis to determine how to move the needle to a more desirable position.

SWOT analysis

SWOT stands for Strength, Weakness, Opportunities, and Threats. A SWOT analysis takes a holistic view of an organization's key strengths and weaknesses from a business standpoint.

Trend analysis looks to collect data over time. It uses the data to identify plottable trends and relationships in the data changes. You can use this analysis to predict future trends.

Cross tabulation