15 Sample Letters of Loan Request from Employer

In today’s dynamic business environment, employees may find themselves in situations where they need to seek financial assistance from their employers.

Whether it’s for an unforeseen medical expense, educational purposes, or a housing loan, the ability to craft a concise and respectful loan request letter is invaluable. This article aims to provide a comprehensive guide on how to structure a loan request to an employer, presenting 15 distinct sample letters that cater to a variety of circumstances.

Sample Letters of Loan Request from Employer

These samples are designed to serve as a blueprint, demonstrating the tone, structure, and key elements that should be included in an effective loan request letter. Each example addresses different scenarios, ensuring that readers have a broad spectrum of templates from which to draw inspiration.

The goal is to equip employees with the necessary tools to communicate their financial needs professionally and succinctly, fostering a constructive dialogue between them and their employers.

Sample Letter 1: Medical Emergency Loan Request

Request for Loan Due to Medical Emergency

Dear [Employer’s Name],

I am writing to request a short-term loan from [Company Name] due to an unexpected medical emergency within my family. Despite having health insurance, the out-of-pocket expenses for [describe medical treatment or surgery] have proven to be a significant financial burden.

I respectfully request a loan of [amount], which I plan to repay through payroll deductions over [specify repayment period]. I have attached the necessary medical documents and a detailed repayment plan for your consideration.

Your understanding and support in this matter would be greatly appreciated.

Sincerely, [Your Name] [Your Job Title]

Sample Letter 2: Educational Loan Request

Request for Educational Support Loan

I am reaching out to request financial assistance in the form of a loan to support my continuing education. As you are aware, I have been pursuing [degree or certification] to further my skills and contribute more effectively to our team.

The total cost of the program is [amount], and I am seeking a loan of [amount] from [Company Name], with a commitment to repay the sum within [time frame]. I believe this investment in my education will not only benefit my personal development but also add value to our team and company.

Thank you for considering my request. I am happy to discuss this further and provide any additional information needed.

Sample Letter 3: Housing Loan Request

Request for Housing Loan

I am writing to formally request a loan for a down payment on a home. After years of saving, I am close to achieving the dream of homeownership but find myself slightly short of the necessary funds.

I respectfully request a loan of [amount], which I propose to repay through monthly deductions from my salary over [time frame]. I believe securing a home will provide me with the stability needed to continue focusing and excelling in my role within [Company Name].

Your support with this personal milestone would be deeply appreciated.

Sample Letter 4: Emergency Financial Assistance Loan Request

Request for Emergency Financial Assistance

I am in a difficult financial situation due to [describe emergency, e.g., a family crisis or unexpected major expense], and I am writing to request a loan from [Company Name] as a means of temporary assistance.

I am seeking a loan of [amount] to address this urgent matter. I am committed to repaying this amount in full over [time frame], through payroll deductions or as per any repayment schedule you deem fit.

I appreciate your consideration of my request during this challenging time.

Sample Letter 5: Vehicle Purchase Loan Request

Request for Loan for Vehicle Purchase

As I currently rely on public transportation to commute to work, which is becoming increasingly unreliable, I am planning to purchase a vehicle to ensure I can maintain my punctuality and dependability at work.

I respectfully request a loan of [amount] from [Company Name] to assist with this purchase. I propose a repayment period of [time frame], with deductions directly from my salary.

Thank you for considering my request to support this necessary investment in my daily commute.

Sample Letter 6: Loan Request for Family Support

Request for Loan to Support Family Needs

I find myself in a challenging position, needing to support my family due to [describe situation, e.g., spouse’s job loss, family illness]. To manage this temporary financial strain, I am requesting a loan from [Company Name].

I am seeking a loan of [amount] with a repayment plan spread over [time frame]. This support would significantly alleviate the current financial pressures my family is facing.

I appreciate your consideration of my situation and am available to discuss this request further.

Sample Letter 7: Personal Development Course Loan Request

Request for Loan for Personal Development Course

I am committed to personal and professional growth and have been accepted into a [describe course or program] that aligns with my role and future career aspirations within [Company Name].

To cover the cost of this program, I am requesting a loan of [amount], which I plan to repay over [time frame] through payroll deductions.

Your support in my pursuit of further development would be greatly appreciated.

Sample Letter 8: Loan Request for Legal Expenses

Request for Loan to Cover Legal Expenses

Due to unexpected legal matters, I am incurring significant expenses that are beyond my current financial capabilities. Thus, I am seeking a loan from [Company Name] to help manage these costs.

I respectfully request a loan of [amount], with a repayment plan to be deducted from my monthly salary over [time frame]. This support would help me navigate through this challenging period with one less burden.

Thank you for considering my request. I am available to discuss this in more detail if required.

Sample Letter 9: Debt Consolidation Loan Request

Request for Loan for Debt Consolidation

To better manage my finances and reduce interest costs, I am seeking a loan for debt consolidation. By consolidating my debts, I aim to have a single, manageable repayment that can be deducted from my salary over a period of [time frame].

I respectfully request a loan of [amount] from [Company Name] for this purpose. I am committed to financial responsibility and believe this step will aid in achieving a more stable financial future.

Your understanding and assistance would be greatly appreciated.

Sample Letter 10: Loan Request for Wedding Expenses

Request for Loan for Wedding Expenses

As an important and joyous occasion in my life approaches, I find myself in need of financial assistance to cover some of the expenses associated with my upcoming wedding.

I am respectfully requesting a loan of [amount] from [Company Name], which I plan to repay through deductions from my salary over [time frame]. This support would mean a great deal to me during this special time.

Thank you for considering my request. I am happy to provide further details or discuss a repayment plan that aligns with company policies.

Sample Letter 11: Loan Request for Home Renovation

Request for Loan for Home Renovation

I am planning to undertake necessary renovations to my home, which will improve living conditions and increase the property’s value. To finance this project, I am requesting a loan from [Company Name].

I seek a loan of [amount] and propose a repayment period of [time frame], with the amount to be deducted from my monthly salary.

Your assistance with this personal investment would be highly appreciated.

Sample Letter 12: Loan Request for Childcare Expenses

Request for Loan for Childcare Expenses

With the recent changes in my family situation, I am faced with unexpected childcare expenses that are crucial for my ability to continue working and providing for my family.

I am requesting a loan of [amount] from [Company Name], to be repaid over [time frame] through payroll deductions. This support would greatly assist me in ensuring reliable care for my children.

Thank you for considering my request. I am available to discuss any details or concerns you may have.

Sample Letter 13: Loan Request for Relocation Expenses

Request for Loan for Relocation Expenses

In light of my recent promotion/transfer, I am in the process of relocating closer to our [new location/office]. This move is essential for me to fulfill my new role effectively. However, the relocation expenses are substantial.

I am requesting a loan of [amount] from [Company Name] to cover these costs, with a plan to repay the amount over [time frame] through my salary.

Your support in this significant career step would be invaluable.

Sample Letter 14: Loan Request for Elderly Care Expenses

Request for Loan for Elderly Care Expenses

As my parents age, their need for specialized care has increased, leading to unexpected financial burdens. To ensure they receive the necessary care, I am seeking a loan from [Company Name].

I respectfully request a loan of [amount], with a repayment plan over [time frame] through salary deductions. This would greatly assist me in providing for my parents’ needs.

Thank you for considering my request and for your support during this time.

Sample Letter 15: Loan Request for Professional Attire

Request for Loan for Professional Attire

To maintain a professional appearance aligned with [Company Name]’s standards, I find myself in need of a wardrobe update. Professional attire represents a significant expense, and thus, I am requesting a loan to cover these costs.

I am seeking a loan of [amount] to be repaid over [time frame] through my salary. This investment in my professional presentation will not only benefit me but also reflect positively on our company.

Your consideration of my request would be greatly appreciated.

Each of these letters is crafted to address specific scenarios, demonstrating the importance of tailoring your request to your personal circumstances while maintaining a professional tone. Remember, the key to a successful loan request is clarity, respect, and a well-thought-out repayment plan that aligns with both your needs and the company’s policies.

Related Posts

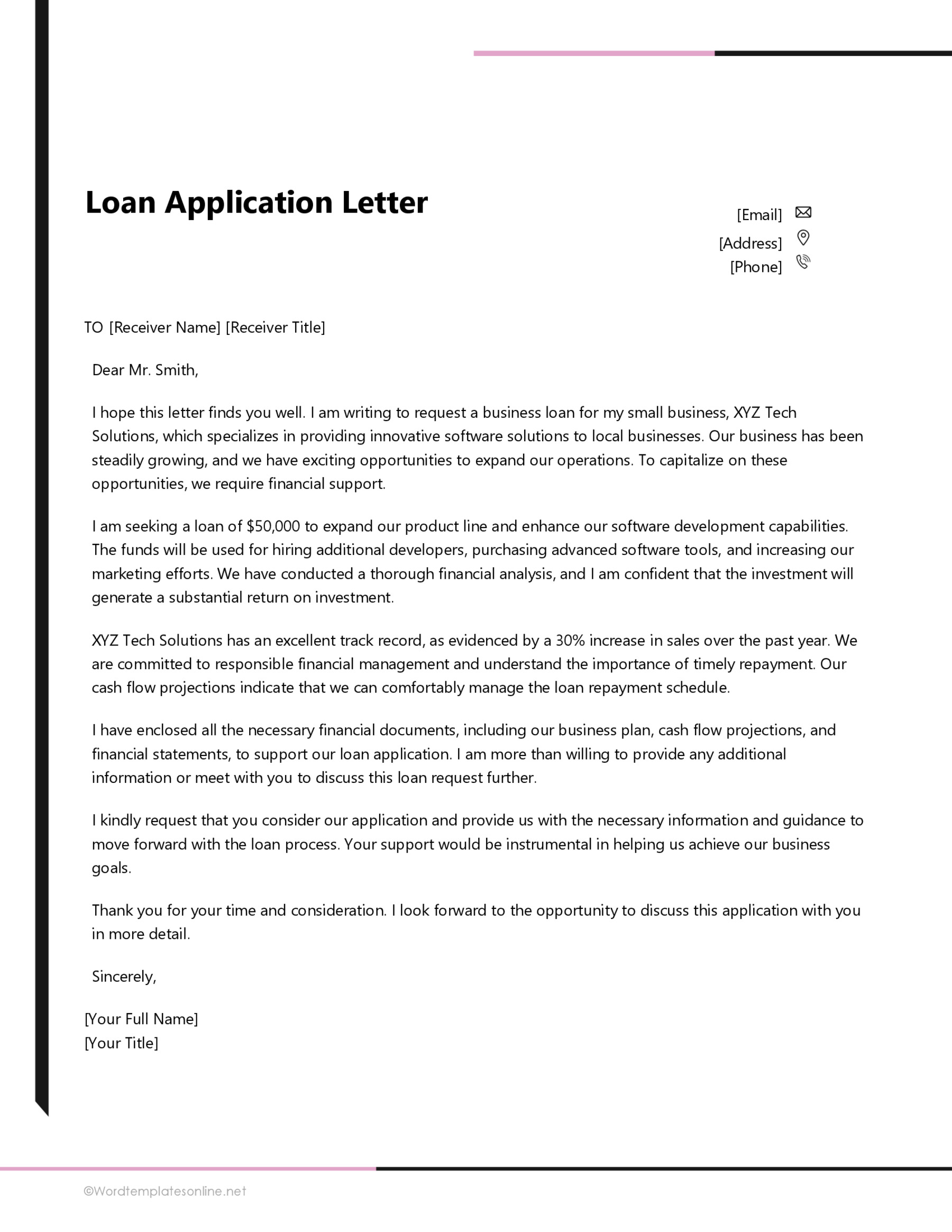

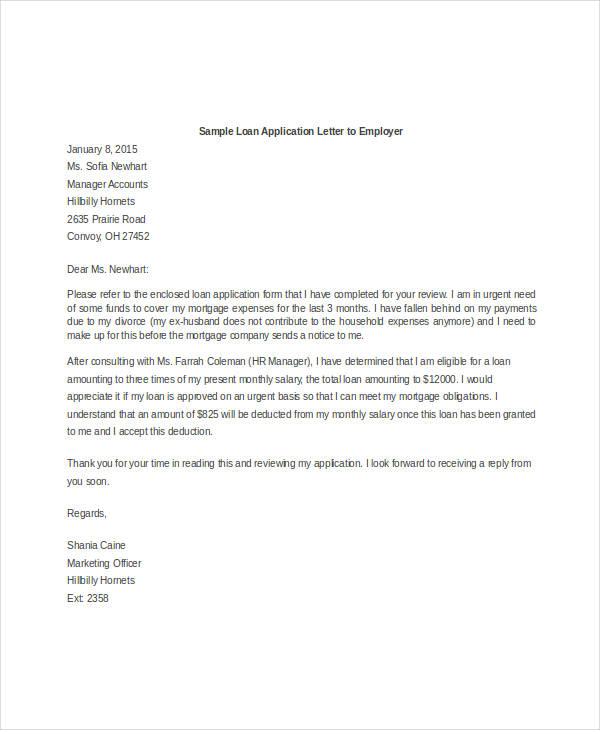

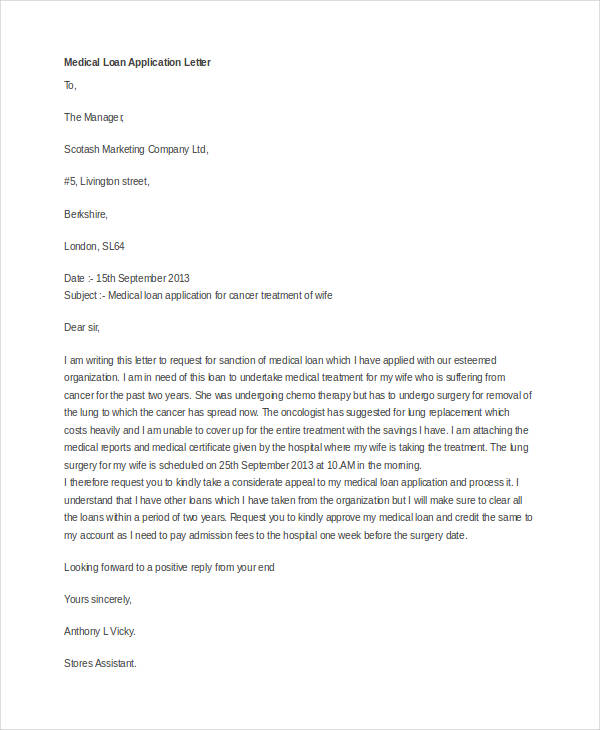

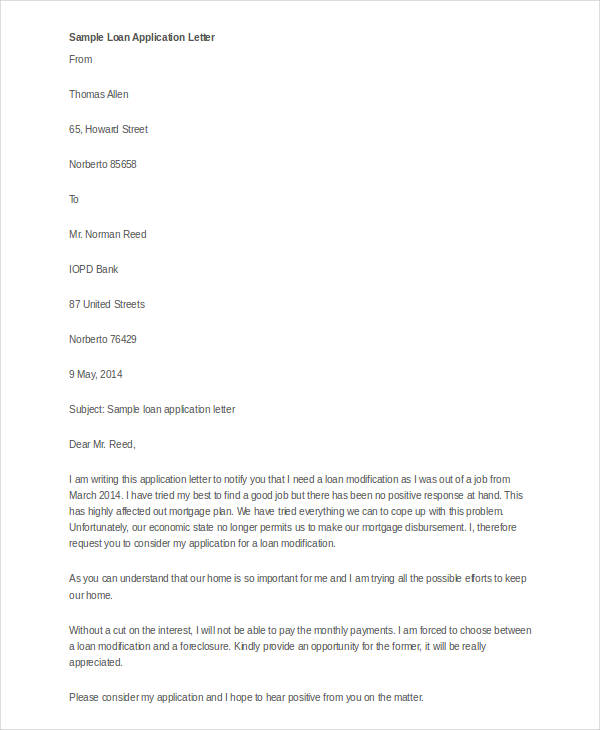

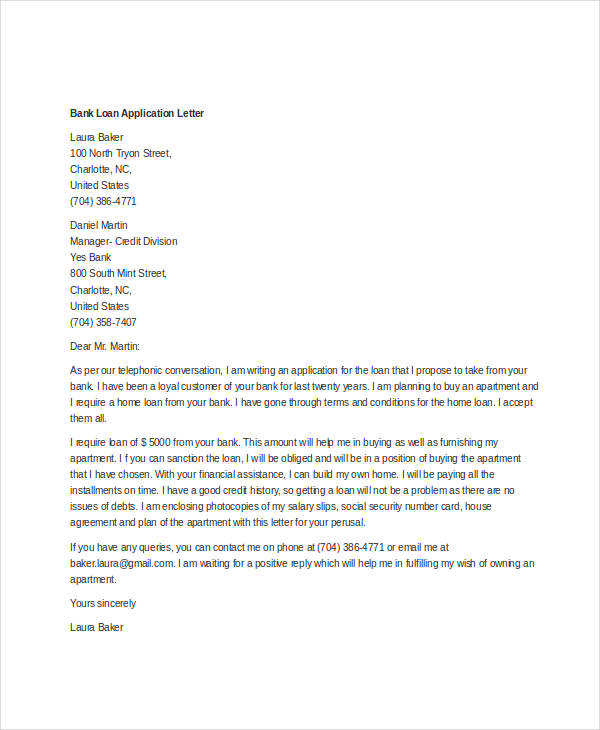

WTO / Applications / 20 Best Loan Application Letter Samples (Guide and Format)

20 Best Loan Application Letter Samples (Guide and Format)

An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time.

The letter helps lenders get acquainted with the borrowers better to determine if they qualify for the loan based on the information provided or not. Writing it is important because it helps convince lending institutions to lend you a specific amount of money. It is their first impression of you, which is why it should be written with great care. In this article, we will guide you on how to write it, the type of information you should provide, and some pointers that will help you highlight your strengths in the letter.

Brief Overview- What to Include

There are no strict rules for writing an application for a loan. It depends on the borrower to decide what information to include, but the following items are typically included in it:

- Contact information

- Explanation of why money is needed

- Amount of money being requested

- Purpose of the money

- Details about employment history

- Personal references

- Company information

- A list of supporting documents

When to Write?

Two main situations warrant this letter. The first instance is when you are seeking a loan from a conventional bank lender. Conventional bank lenders are financial institutions that do not offer loans but make them available to the general public. Conventional banks usually require applicants to submit this application to prove their creditworthiness.

The second situation that warrants its use is when applying for an SBA-guaranteed loan. An SBA-guaranteed loan involves the federal government; applicants must undergo additional screening before they are approved for funding. Applicants can improve their chances of getting an SBA guarantee by submitting a personalized, formal loan application with supporting documentation.

There are situations when you do not necessarily need to write this letter, such as when you are borrowing from friends and family, from an alternative lender who may only require your bank statements or pay slips, when seeking equipment financing, and lastly when you are requesting a business line of credit.

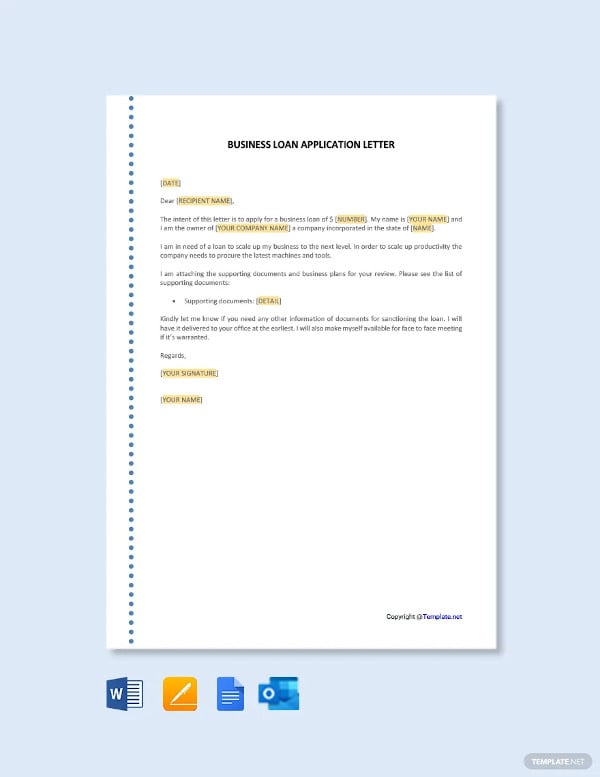

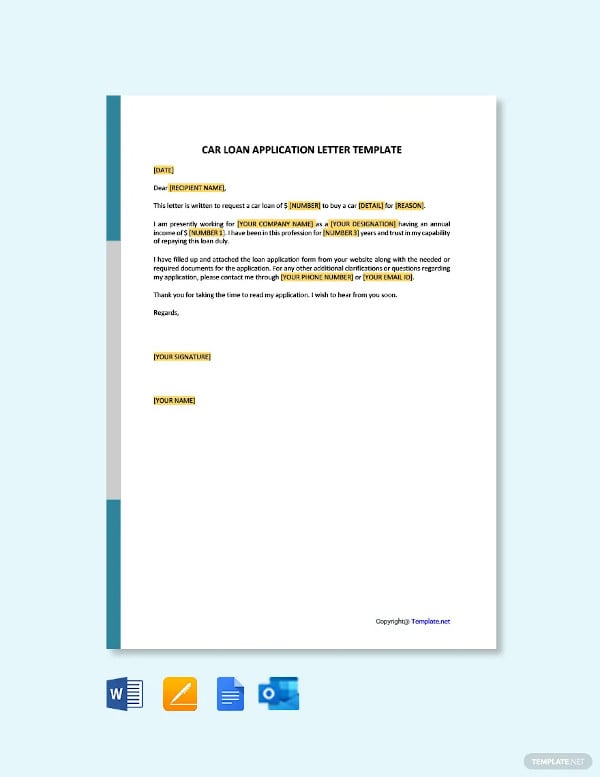

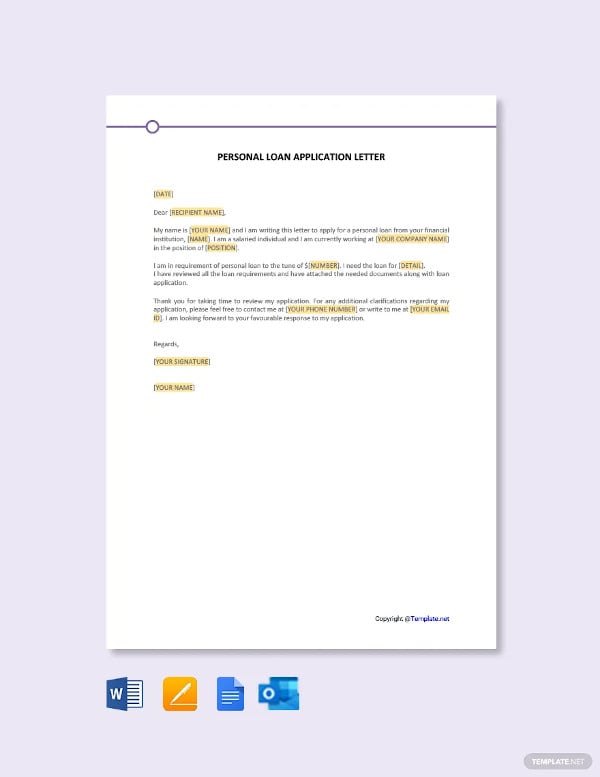

Free Templates

Pre-writing Considerations

Applying for a loan involves being prepared for anything, so it is important to have the things you need before writing. Do some research on your lender, and write down notes about why they are suitable for you and what you would like them to know about your project. Write those questions that may arise during the process of applying for your loan. Check your credit score and know your rights as a borrower when you apply for a loan.

After you have done all of the above, review everything and ensure that what you’ve written is easy to understand by someone who has not read your notes or audited your finances. When applying for a loan in a major financial institution or applying for an SBA loan, you will almost always be required to write an application letter for a loan. It is important to note that unless it is supported by a sound credit situation or proper financial planning, it may not be enough to help you secure the loan.

Fortunately, there are two things that you can do to increase your loan limit and increase your chances of getting a loan. You can first check your business and personal credit scores from accredited credit reporting bureaus such as TransUnion, Equifax, and Experian and take the necessary steps to improve them.

The second thing that you can do is to prepare your business financial statements, i.e., your profit and loss statement, cash-flow statement, balance statement, etc., for the past six months and attach them to your letter. These documents are essential when applying for a loan as they help the financial institution assess your creditworthiness and increase your chances of securing a loan.

How to Write a Loan Application?

Writing it can seem daunting, but it can be a simple process if you follow the proper format and include all the required information.

The following is a summary of the information you must provide in your letter:

The header is an integral part of the standard business letter format. It should include:

- Your name and contact information : Make sure to include your full name, address, and contact information. This should include a mailing address with a zip code, a business email address, and your cell phone number where you can be reached.

- The date : Include the month, day, and year of the letter. You must ensure that you write the date on which the letter was created.

- The name of the recipient : This will be a bank representative in many cases, but it can also be an SBA representative or another financial institution to whom the borrower is addressing the letter.

Subject line

When writing it, make sure to include a clear subject line that will help the recipient understand the purpose of the letter. Make sure to include whether the loan is for personal or professional use in the subject line.

“Loan Request Application Letter.”

Address your letter correctly. If you do not know who will be reading it, write “ To Whom It May Concern .” If you are trying to get a business loan, address it to the company’s representative issuing the loan. If you are applying for a personal loan, address it to the bank or whoever provides it.

Introduction

It should begin with a brief statement of the goal and amount you are requesting. It should also state your qualifications for the loan and any other pertinent information that can be used for your evaluation as a borrower such as your financial status, your work history, the length of time you have been in business, etc.

The body is the main part of the letter, and it should contain all the information the recipient will need to decide whether to grant the loan or deny the request.

Some of the information that must be covered in the body includes:

- Basic business information : If you are writing it, the first item to include in the body of the letter is details about your business. This information will help the lender understand who you are and will serve as the foundation for your loan application. Some of the information that you should cover in this section includes your business’s registered name, business type (i.e., partnership , sole proprietorship, LLC , etc.), nature of your business (i.e., what you do), main services and products, your business model, the number of employees that you have, and your annual generated revenue.

- The purpose of the loan : You must explain why you need the loan and the purpose for which it is being requested. This can be to purchase or expand a business, for a personal reason, or to pay some debt.

- Present yourself as being trustworthy : To get a loan, you need to establish trust with the lender. This can be achieved by explaining what you do for a living, providing some identity documents, and demonstrating why you deserve to be trusted.

- Explain how you intend to pay back : Explain briefly how you plan on repaying the loan. This should include a timeline for repayment and be supported by evidence such as a business plan, personal financial statement, or credit report .

- Proof of financial solvency : In some cases, you will be asked to provide evidence that the funds requested are not your only source of income. Documents like bank statements or tax returns can help you prove that you have other sources of funding, which will increase the likelihood that your request will be granted.

In the conclusion, you must thank the lender for considering your request. Briefly mention all the attached financial documents. Remember that each lender has their own set of loan application requirements and may request different information or documentation from borrowers, so make sure to double-check the specific instructions provided by the lender.

Once you have finished writing the letter, be sure to sign it at the bottom. You may include phrases such as:

“Respectfully yours” or “Sincerely yours”.

Place your name and contact information directly above the signature line.

SBA Loan Application Letter Template

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

[Loan Officer’s Name]

[Bank Name]

[Bank Address]

Dear [Loan Officer’s Name],

I am writing to apply for a Small Business Administration (SBA) loan to help fund my [business name]. I am excited to have the opportunity to present my business plan to you and explain why I believe my business is a great candidate for an SBA loan.

[Provide an introduction to your business, including its history, products or services offered, and unique selling proposition. Explain why you started the business and what sets it apart from competitors. This should be no more than two paragraphs.]

I am seeking an SBA loan in the amount of [$ amount], which will be used to [briefly explain how the funds will be used]. My business has experienced steady growth in recent years, but we need additional capital to take advantage of new opportunities and expand our reach.

[Provide a detailed explanation of how you plan to use the funds, including any expected return on investment. Be specific about the amount of money you need, how long you will need it for, and how it will be used.]

As part of my loan application, I have included the following documents for your review:

- Business plan

- Financial statements for the past three years

- Tax returns for the past three years

- Cash flow projections

- Articles of incorporation

- Personal financial statements for all owners

A list of collateral that will be used to secure the loan, if applicable

[Provide a comprehensive list of all the documents you have included with your application. Make sure you have included everything the bank has asked for, and any additional documents that may be relevant.]

I am confident in the future success of my business and believe that an SBA loan is the right choice for us. I understand that the loan application process can be lengthy, and I am committed to providing any additional information or documentation that may be required to support my application.

Thank you for considering my loan application. I look forward to hearing from you soon.

Loan Application Letter Sample

Make your small business loan application more polished with our simple sample letters. They’re crafted to help you convey your needs professionally and improve the impact of your request.

Sample letter 1

Dear Sir/Madam,

I am writing to apply for a Small Business Administration loan to support my growing business, GreenTech Innovations. Established in 2018, we specialize in eco-friendly technology solutions. Our recent market analysis indicates significant growth potential in sustainable energy products.

To capitalize on this opportunity, we require additional funding for research and development, marketing, and expanding our team. An SBA loan would enable us to invest in these critical areas, fostering innovation and job creation. Our business plan, attached to this application, outlines our strategy for a sustainable and profitable future.

GreenTech Innovations has a strong financial track record, with consistent revenue growth over the past three years. We have maintained a healthy cash flow and have a solid plan for loan repayment, as detailed in our financial projections. Our commitment to financial responsibility and strategic growth makes us an ideal candidate for an SBA loan.

Thank you for considering our application. We are committed to contributing positively to the economy and the environment. Your support would be instrumental in helping us achieve our goals.

Jordan Smith

Owner, GreenTech Innovations

Sample letter 2

Dear Business Loan Officer,

I am reaching out to request a business loan for my company, Bella’s Boutique, a unique clothing and accessories store located in downtown Springfield. Since our opening in 2019, we have become a beloved part of the local community, known for our exclusive designs and personalized customer service.

This loan is sought to enhance our inventory, upgrade our in-store technology, and expand our online presence. These improvements are essential for keeping pace with the evolving retail landscape and meeting the growing demands of our customers. Our detailed business plan is attached for your review.

Financially, Bella’s Boutique has demonstrated resilience and growth, even amid challenging economic times. Our sales figures have shown a steady increase, and we have a clear plan for managing the loan and ensuring its repayment. We believe these factors make us a strong candidate for a loan.

Your consideration of our loan application is greatly appreciated. This funding will not only help Bella’s Boutique thrive but will also support the local economy by providing more employment opportunities and enhanced retail experiences.

Thank you for your time and consideration.

Warm regards,

Isabella Martinez

Founder, Bella’s Boutique

The effectiveness of these sample letters as a guide for someone seeking to write a loan application lies in several key aspects. Firstly, they demonstrate the importance of a clear and concise introduction, where the purpose of the letter is immediately stated, ensuring the reader understands the intent from the outset. This is crucial in any formal business communication. Both samples skillfully describe the nature and background of the respective businesses, providing just enough detail to give the reader a sense of the company’s identity and market position without overwhelming them with unnecessary information. This balance is vital in maintaining the reader’s interest and establishing the context of the request.

Moreover, the letters excel in explicitly stating the purpose of the loan, which is a critical component of any loan application. They outline how the funds will be utilized to grow and improve the business, demonstrating not only a clear vision but also a strategic approach to business development. This helps in building a sense of trust and reliability with the lender. Furthermore, the inclusion of financial health indicators, such as past revenue growth, cash flow management, and a repayment plan, adds to this trust by showing financial responsibility and foresight.

The writers also incorporate attachments like business plans and financial projections, which provide additional depth and substantiation to their claims. This shows thorough preparation and professionalism, which are highly regarded in the business world. Finally, the tone of the letters is appropriately formal yet approachable, and they conclude with a note of gratitude, reflecting good business etiquette. This combination of clarity, conciseness, relevance, and professionalism makes these letters exemplary guides for anyone looking to draft an effective and persuasive business loan application.

Tips for Writing

Following are some tips for writing this letter:

Be specific

Be sure to include specific details in it to keep the reader’s attention. Ensure that you include information about the purpose of the loan, how much money you need, and the reason why you are a good candidate for a loan.

Brevity is essential when writing this letter. Stick to the essential points and avoid extraneous details. This will help to ensure that your letter is easy to read and that the reader is not distracted by irrelevant information.

Address the appropriate person

Ensure that you address your letter to the most relevant party for your particular situation.

Consider contacting the bank to find out to whom it should be addressed. This is how you can be sure that it will get to the right person.

Use a proper format and layout

As with all letters, you should use clear, concise paragraphs and avoid unnecessary jargon. Make sure to use the appropriate format for formal letter writing and use a professional, polished layout.

Include business financial statements

The financial statements for your company must be attached to your letter if you are a business owner. In this way, the reader will better understand your overall financial situation and help demonstrate that you are a good candidate for a loan.

The following are some of the purposes for which you may request a small business administration loan: to start a new business, to buy new equipment or inventory for your company, to upgrade or expand an existing business, to cover unanticipated expenditures, to pay off high-interest debt, to fund marketing campaigns, to move your office to a new location, to buy insurance for your business, to purchase stock, to buy out shareholders, and for any other lawful reason authorized by the lender.

Key Takeaways

Here are the key takeaways from this article:

- When writing an application for a loan, be sure to provide specific details about the purpose of the loan, how much money you need, and why you are a good candidate for a loan.

- Use the standard business letter format and use clear, concise paragraphs.

- Brevity is vital when writing such a document, so mention only the essential points and avoid extraneous details.

- Address your letter to the most relevant party for your situation, and be sure to include your company’s financial statements.

About This Article

Was this helpful?

Great! Tell us more about your experience

Not up to par help us fix it, keep reading.

Applications , Forms

Application for texas title (form 130 u) – guide & overview.

40 Free Credit Application Forms and Samples

Applications , Forms , Guides

How to fill out a rental application form [expert guide].

Applications , Education

11 best college application essay examples (format guide), thank you for your feedback.

Your Voice, Our Progress. Your feedback matters a lot to us.

Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

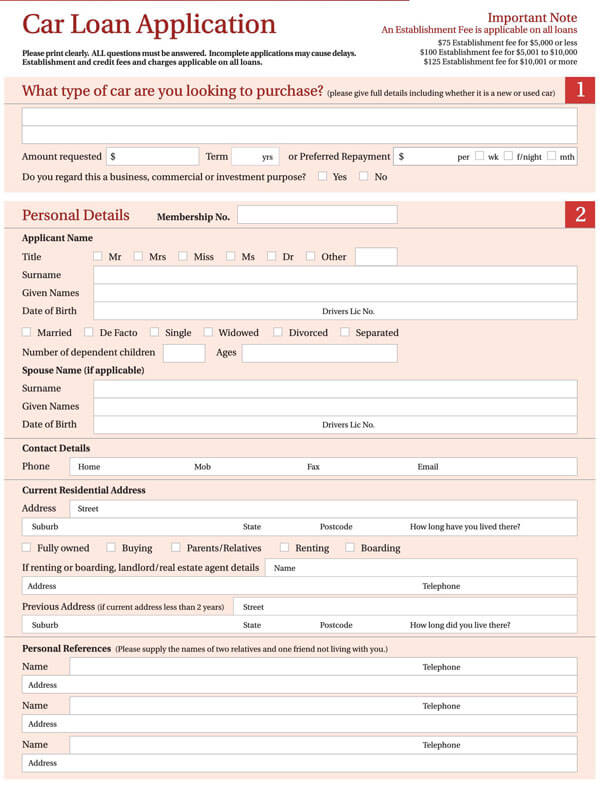

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

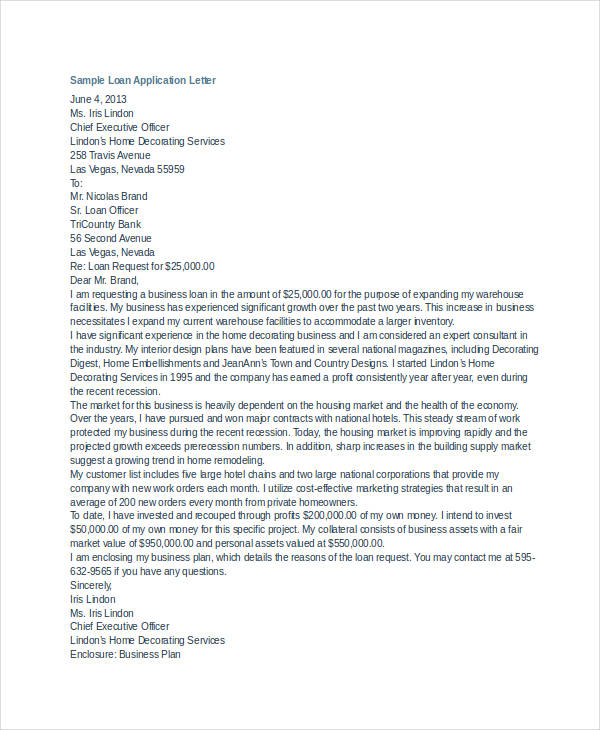

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Request Letter For Loan From The Company

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Email Address]

[Phone Number]

[Company Name]

[Company Address]

Subject: Request for Loan

Dear [Company Name] Management Team,

I hope this letter finds you well. I am writing to formally request a loan from [Company Name] to address [briefly explain the purpose of the loan, such as medical expenses, education, home improvement, etc.]. I have been a dedicated and committed employee at [Company Name] for [X years], and I believe that this loan would greatly assist me in managing my current financial situation.

I understand that [Company Name] offers loan opportunities to employees as a means of providing support during times of financial need. I have carefully reviewed the terms and conditions of the employee loan program and am confident that I will be able to meet the repayment obligations as outlined.

The requested loan amount is [specific amount], which I intend to use for [clearly explain how you plan to use the funds]. This loan will play a significant role in helping me overcome my current challenges and enable me to continue contributing effectively to the company.

I am committed to repaying the loan through [specified repayment period, such as monthly deductions from my salary]. I am more than willing to sign any necessary agreements and complete the required documentation promptly to facilitate the loan process.

I kindly request that the company's management team consider my application for the loan and provide me with the necessary guidance on how to proceed. I assure you that I will adhere to all terms and conditions associated with the loan and will make every effort to ensure timely repayment.

Thank you for your time and consideration. I am grateful for the opportunity to be part of [Company Name] and for the support that the company provides to its employees. Please feel free to contact me at [your phone number] or [your email address] if you require any further information or clarification.

[Your Employee ID, if applicable]

Enclosure: [List any documents you are attaching, such as income verification, loan application form, etc.]

Sample Application Letter For Lending Company: Free & Effective

As someone who has crafted numerous application letters for various lending companies, I have gained a unique perspective on what it takes to create a compelling and successful application.

Key Takeaways

- Understand the Purpose : Learn why a well-crafted application letter is crucial for loan approval.

- Gather Information : Know the necessary details to include in your letter.

- Structure Your Letter : Follow a clear and professional format.

- Personalize Your Approach : Tailor the letter to the specific lending company.

- Highlight Relevant Information : Emphasize your financial stability and repayment capacity.

- Proofread and Edit : Ensure your letter is free of errors.

- Use a Template : Adapt a provided template to your needs.

Navigating the world of finance and loans can be daunting. Whether you’re applying for a personal loan, a mortgage, or a business loan, the application letter you submit is a critical component of the process.

It’s your chance to present yourself as a credible and trustworthy borrower. Drawing on my extensive experience in writing application letters, I will outline a straightforward approach to crafting a letter that stands out.

Step-by-Step Guide

Step 1: understand the purpose.

Your application letter should succinctly convey why you’re seeking the loan and how you plan to use it. It’s also your opportunity to make a personal connection with the lender and demonstrate your financial responsibility.

Step 2: Gather Necessary Information

Trending now: find out why.

Before you start writing, gather all relevant information. This includes:

- Personal details (name, address, etc.)

- Loan amount and purpose

- Employment and income details

- Financial statements and credit history

Step 3: Structure Your Letter

A well-structured letter is key. Generally, it should include:

- Introduction : Briefly introduce yourself and state the purpose of the letter.

- Body : Detail your financial situation, loan purpose, and repayment plan.

- Conclusion : Summarize your request and express gratitude.

Step 4: Personalize Your Approach

Research the lending company to understand their preferences and tailor your letter accordingly. This shows that you’ve put thought into your application.

Step 5: Highlight Relevant Information

Focus on what’s most important: your ability to repay the loan. Highlight stable income, financial discipline, and a solid credit history.

Step 6: Proofread and Edit

Ensure your letter is free from grammatical errors and typos. This reflects your professionalism and attention to detail.

Step 7: Use a Template

A template can be a great starting point. Here’s a basic structure:

[Your Name] [Address] [City, State, Zip] [Email Address] [Phone Number] [Date]

[Lender’s Name] [Company Name] [Company Address] [City, State, Zip]

Dear [Lender’s Name],

[Introduction – Introduce yourself and state the purpose of the letter.]

[Body – Discuss your financial situation, the purpose of the loan, and your repayment plan.]

[Conclusion – Summarize your loan request and express thanks.]

Sincerely, [Your Name]

Tips from Personal Experience

- Be Concise : Lenders appreciate brevity. Keep your letter to one page.

- Be Honest : Don’t exaggerate your financial situation. Honesty builds trust.

- Customize for Each Application : Avoid using a generic letter for all applications.

- Use Professional Language : Maintain a formal tone throughout your letter.

Conclusion and Comment Request

Writing an application letter for a lending company doesn’t have to be overwhelming. By following these steps and using the provided template, you can create a letter that effectively communicates your needs and financial stability.

I’d love to hear your thoughts and experiences with loan applications. Please leave a comment below with your insights or questions!

Frequently Asked Questions (FAQs)

Q: What is a loan application letter?

Answer : A loan application letter is a formal document submitted to a financial institution or lender to request financial assistance in the form of a loan. It typically outlines the purpose of the loan, the amount requested, and provides relevant personal and financial information.

Q: How do I start writing a loan application letter?

Answer : To begin writing a loan application letter, you should start with a formal salutation, such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Clearly state the purpose of your letter and introduce yourself by providing your name and contact information. Mention the specific loan product or program you are applying for and express your interest in obtaining the loan.

Q: What information should be included in a loan application letter?

Answer : A loan application letter should include your personal information, such as your full name, address, contact details, and social security number. It should also provide details about the loan, including the loan amount, the purpose of the loan, and the desired repayment term. Additionally, include information about your employment, income, and any collateral you may offer.

Q: Why is a loan application letter important?

Answer : A loan application letter is important because it serves as your formal request for financial assistance. It provides lenders with essential information about your financial situation, creditworthiness, and the purpose of the loan. The letter allows lenders to assess your eligibility for the loan and make an informed decision regarding your application.

Q: How should I structure my loan application letter?

Answer : A well-structured loan application letter typically consists of an introduction, body paragraphs, and a conclusion. In the introduction, state the purpose of the letter and provide your personal information.

The body paragraphs should focus on explaining the reason for the loan, your financial background, and any supporting documents or references. Conclude the letter by expressing your gratitude and including your contact information for further communication.

Q: What tone should I use in a loan application letter?

Answer : When writing a loan application letter, it is essential to maintain a professional and formal tone throughout the document. Use polite and respectful language, and avoid using any slang or informal expressions. The tone should convey your seriousness and commitment to repaying the loan.

Q: Can you provide tips for writing an effective loan application letter?

Answer : Certainly! Here are a few tips for writing an effective loan application letter:

- Clearly state the purpose of the loan and be specific about how you intend to use the funds.

- Provide accurate and detailed information about your financial situation, including your income, assets, and liabilities.

- Use a professional tone and proper grammar and spelling.

- Highlight any relevant qualifications or experiences that may enhance your credibility as a borrower.

- Explain how you plan to repay the loan and provide supporting evidence of your ability to do so.

- Include any additional documents, such as bank statements or tax returns, that can support your application.

- Proofread your letter thoroughly to ensure it is error-free and presents your case effectively.

Q: Is it necessary to include supporting documents with the loan application letter?

Answer: Yes, it is advisable to include relevant supporting documents with your loan application letter. These documents can vary depending on the lender’s requirements and the type of loan you are applying for.

Commonly requested documents include bank statements, tax returns, pay stubs, identification documents, and proof of assets or collateral. Including these documents demonstrates your financial stability and helps lenders make an informed decision.

Related Articles

Business request letter sample: free & effective, sample letter to a company requesting something: free & customizable, business plan cover letter sample: free & customizable, payment proposal letter sample: free & effective, congratulations job offer email sample: free & effective, sample request letter for confirmation after probation: free & effective, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

Applications , Request Letters

Loan Request Letter (Format & Sample Applications)

A Loan Request Letter is a letter written by a loan applicant and addressed to a lending institution, generally sent as a part of the loan application process. A loan request letter introduces you to the bank or other lending institution, clearly describes your planned use for the loan funds, and describes how you will pay back the loan. It is the part cover letter and part resume because you demonstrate the qualities that make you a good candidate for a loan by outlining your qualifications.

Anyone who applies for personal or business loan should write a loan request letter and enclose it with their loan application. This letter is often the lending institution’s first impression of you as a borrower. Therefore, it should be professional, clear, and concise, easily fitting into one page.

Important: Write using a professional format and in a professional tone. Banks and other lending organizations are concerned about your ability to repay the loan. Pointing out your financial problems works against you – instead, point out your qualifications as a borrower. Remember, this letter is your first contact with the lender and uses it to showcase your company as a reliable borrower.

What a Lender Needs to Know

In order to consider your loan request, a lender needs some information about you or your company. Although this information is included in detail in your loan application, your letter should formally introduce your request. Here is what you should include in your loan request letter:

- Your name and/or your company name, including any DBA

- Your contact information

- Your business entity structure

- Brief description of your business

- Your number of employees

- How long you have been in operation

- Annual revenue and profits if your company is profitable

- Amount of loan requested

- How the funds will be spent

- Your financial security

- A list of enclosures

The bank or lending institution is primarily concerned with how the money they are lending will be spent and repaid. Be sure to include information on these two critical points in your letter.

In addition to the loan application, you should enclose applicable financial documents, such as tax returns. Send your business plan, cash flow statement, and profit and loss (P&L) statement.

Loan Request Letter (Format)

{your name}

{your company’s name}

{your address}

{lender name}

{lender title}

{lender institution name}

{lender address}

RE: {(Small business) or (Personal)} loan request for {amount}

Dear {lender name}:

The purpose of this letter is to request a {(small business) or (personal)} loan in the amount of {amount} for the purpose of {purpose}. {Use this space to discuss your small business. Include name, business structure, and industry.}

{Business name} began operation on {date}, with {number} employees. As a {business structure type}, {business name} has consistently grown and now employs {number} individuals. {Use this space to discuss your marketing presence.}

{Use this area to briefly discuss your most recent year’s revenue and profit, if profitable. Discuss revenue and profit consistently over time when possible.}

{Use this area to describe the reason for the loan request.} {Use this area to explain that the opportunity is immediately available, but you lack sufficient immediate funds.}

Attached, please find our business plan, our annual profit and loss statement, and our most recent cash flow statement for your review. These financial documents and our strong credit score of {number} combine to make us a safe credit risk for {lending institution name}.

I would greatly appreciate the opportunity to speak with you about a {(small business) or (personal)} loan. I can be reached at {phone number} or by email at {email address}.

Thank you for your time and your consideration of my request.

{your signature}

Sample Loan Application Letter

Matthew Dobney

Entirely Electronics

3048 West First Street

Spavinah, OK 89776

EntirelyElectronics.com

June 22, 2048

Mr. James Burrows

SBA Loan Administrator

Bank of American Businesses

New York, NY 65782

RE: Small business loan request for $20,000

Dear Mr. Burrows:

The purpose of this letter is to request a small business loan in the amount of $20,000 for the purpose of enlarging our warehouse.

Entirely Electronics began operation on June 1, 2020, with two employees. As a partnership, Entirely, Electronics has consistently grown and now has 20 full-time employees. Entirely Electronics has been quite successful in obtaining a proportionate share of the online electronic retail community. Our online presence has grown from our website alone to Facebook, Instagram, and Yelp. Our marketing techniques consistently drive new customers to Entirely Electronics, and we boast a high customer retention rate.

Last year, Entirely, Electronics saw a growth of 25% in revenue over the previous year. Our profit margin remained stable at 18% throughout the year.

Our growth has created a significant shortage of available warehouse space, and market research shows we will continue to grow. As we look to the future, we understand we must create more warehouse space to continue growing. Although our revenue is consistent, we do not have the immediate large amount needed to complete the necessary expansions to our warehouse.

Attached, please find our business plan, our annual profit and loss statement, and our most recent cash flow statement for your review. These financial documents and our strong credit score of 790 combine to make us a safe credit risk for Bank of American Businesses.

I would greatly appreciate the opportunity to speak with you about a small business loan. I can be reached at 983-744-6597 or by email at [email protected] .

Loan Request Letter Template

Writing a loan request letter takes a bit of time and research, but does not have to be difficult. Using the above format, you can easily request a loan for your small business or a personal need. The sample letter demonstrates how to make a great first impression on a lending institution.

How did our templates helped you today?

Opps what went wrong, related posts.

Boyfriend Application Forms

Rental Application Forms & Templates

Rental Application Denial Letter: Template and Example

Leave Application Cancellation Letter

Cancellation Letter for House Purchase – Sample & Template

Sample Application Cancellation Letter (Tips & Template)

How to Write a Maternity Leave Letter

Leave of Absence Letter for Personal Reasons

Thank you for your feedback.

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

Home > Finance > Loans

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.

Put simply, this is your chance to convince your lender of your creditworthiness. Especially if you have a slightly low credit score or some other concern, you want to use this section to show that you will absolutely repay your loan.

6. Close the letter

Finally, you can add a few finishing touches.

Usually you should close with a short paragraph or two that refers the reader to any attached documents (like financial statements) and asks them to review your loan application.

You may also want to include a sentence expressing willingness to answer any questions―or just saying you’re looking forward to hearing back.

Then end things with your signature, list any enclosed documents, and you’re done!

Well, sort of.

At this point, we strongly recommend you print off your business loan request letter and read it―out loud, if possible. This will help you catch any errors. Because no, your lender isn’t a writing teacher, but you still want to make a good impression.

Plus, if you make typos on something like your business name or desired loan amount, that inaccuracy could lead to confusion from your lender―slowing down your loan approval process.