Published on 1 Jan 2021

Business Plan Evaluation

What’s a rich text element, static and dynamic content editing.

para link here

What is Business Plan Evaluation?

A business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business. The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team.

The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives. The evaluation process also helps identify areas where improvements can be made to enhance the chances of success. This process is particularly important for solopreneurs who are solely responsible for the success or failure of their business.

Importance of Business Plan Evaluation

The evaluation of a business plan is an essential step in the business planning process. It provides an opportunity for the entrepreneur to critically examine their business idea and identify potential challenges and opportunities . The evaluation process also provides valuable insights that can help improve the business plan and increase the chances of success.

For investors, a business plan evaluation is a crucial tool for risk assessment. It allows them to assess the viability of the business idea, the competence of the management team, and the potential for return on investment. This information is vital in making investment decisions.

For Solopreneurs

For solopreneurs, the evaluation of a business plan is particularly important. As they are solely responsible for the success or failure of their business, it is crucial that they thoroughly evaluate their business plan to ensure that it is feasible, viable, and has the potential to be profitable.

The evaluation process can help solopreneurs identify potential challenges and opportunities, assess the feasibility of their business idea, and determine the likelihood of achieving their business objectives. This information can be invaluable in helping them make informed decisions about their business.

For Investors

Investors use the evaluation process to determine whether or not to invest in a business. They look at various aspects of the business plan, including the business model, market analysis, financial projections, and management team, to assess the potential for success. If the evaluation reveals that the business plan is solid and has a high potential for success, the investor may decide to invest in the business.

Components of a Business Plan Evaluation

A business plan evaluation involves the analysis of various components of the business plan. These components include the executive summary, business description, market analysis, organization and management, product line or service, marketing and sales, and financial projections.

Each of these components plays a crucial role in the overall success of the business, and therefore, they must be thoroughly evaluated to ensure that they are realistic, achievable, and aligned with the business objectives.

Executive Summary

The executive summary is the first section of a business plan and provides a brief overview of the business. It includes information about the business concept, the business model, the target market, the competitive advantage, and the financial projections. The executive summary is often the first thing that investors read, and therefore, it must be compelling and persuasive.

In the evaluation process, the executive summary is assessed to determine whether it clearly and concisely presents the business idea and the plan for achieving the business objectives. The evaluator also assesses whether the executive summary is compelling and persuasive enough to attract the attention of investors.

Business Description

The business description provides detailed information about the business. It includes information about the nature of the business, the industry, the business model, the products or services, and the target market. The business description also provides information about the business's competitive advantage and how it plans to achieve its objectives.

In the evaluation process, the business description is assessed to determine whether it provides a clear and comprehensive description of the business. The evaluator also assesses whether the business description clearly outlines the business's competitive advantage and how it plans to achieve its objectives.

Methods of Business Plan Evaluation

There are several methods that can be used to evaluate a business plan. These methods include the SWOT analysis, the feasibility analysis, the competitive analysis, and the financial analysis. Each of these methods provides a different perspective on the business plan and can provide valuable insights into the potential for success.

It's important to note that no single method can provide a complete evaluation of a business plan. Therefore, it's recommended to use a combination of these methods to get a comprehensive understanding of the business plan.

SWOT Analysis

SWOT analysis is a strategic planning tool that is used to identify the strengths, weaknesses, opportunities, and threats related to a business. This method involves examining the internal and external factors that can affect the success of the business.

In the evaluation process, a SWOT analysis can provide valuable insights into the potential for success of the business. It can help identify the strengths and weaknesses of the business plan, as well as the opportunities and threats in the market.

Feasibility Analysis

A feasibility analysis is a process that is used to determine whether a business idea is viable. This method involves assessing the practicality of the business idea and whether it can be successfully implemented.

In the evaluation process, a feasibility analysis can provide valuable insights into the feasibility of the business plan. It can help determine whether the business idea is practical and whether it can be successfully implemented.

In conclusion, a business plan evaluation is a critical process that involves the assessment of a business plan to determine its feasibility, viability, and potential for success. This process is crucial for entrepreneurs, investors, and other stakeholders as it helps them make informed decisions about the business.

The evaluation process involves analyzing various aspects of the business plan, including the business model, market analysis, financial projections, and management team. The purpose of a business plan evaluation is to identify strengths and weaknesses in the plan, assess the feasibility of the business idea, evaluate the potential for profitability, and determine the likelihood of achieving the business objectives.

Whenever you're ready, there are 4 ways I can help you:

1. The Creator MBA : Join 4,000+ entrepreneurs in my flagship course. The Creator MBA teaches you exactly how to build a lean, focused, and profitable Internet business. Come inside and get 5 years of online business expertise, proven methods, and actionable strategies across 111 in-depth lessons.

2. The LinkedIn Operating System : Join 20,000 students and 50 LinkedIn Top Voices inside of The LinkedIn Operating System. This comprehensive course will teach you the system I used to grow from 2K to 500K+ followers, be named a Top Voice and earn $6.7M+ in income.

3. The Content Operating System : Join 10,000 students in my multi-step content creation system. Learn to create a high-quality newsletter and 6-12 pieces of high-performance social media content each week.

4. Promote yourself to 215,000+ subscribers by sponsoring my newsletter.

How to Write a Business Plan in 2023 [Examples Included]

Table of contents

So you have come up with a business idea that will turn your company into a Forbes 500 enterprise? Sounds great!

However, you are going to need much more than an idea. You will need to do some comprehensive research, create operational standpoints, describe your product, define your goals, and pave out a road map for future growth.

In other words, you are going to need a business plan.

A business plan is a document that precisely explains how you are going to make your startup a success. Without it, your chances of attracting funding and investments significantly decrease.

Do you want to learn how to create a winning business plan that will take your company to the next level? We created a guide that will help you do just that.

Let’s dive in.

What Is a Business Plan?

Why and when do you need a business plan, types of business plans (what to include in each).

- How Do You Write a Business Plan?

Best Practices for Writing a Winning Business Plan

Business plan examples.

- Monitor the Performance of Your Business with Databox

A business plan is a comprehensive document that defines how a business will achieve its goals. It is essentially a road map for growth that includes operational standpoints from all the key departments such as marketing, financial, HR, and others.

Startups use business plans to describe who they are, what they plan to do, and how they plan to achieve it. This is an extremely valuable document for attracting investors.

However, they are valuable for the company members as well. A good business plan keeps executive teams on the same page regarding the strategies they should implement to achieve their set objectives.

Related : Reporting to Investors: 6 Best Practices to Help Increase Funding

While business plans are especially useful for startups, each business should include them. In the best-case scenario, this plan will be updated from time to time and reviewed whether the goals of the company have been met.

The main things that investors want to check out in the business plan are:

- Product-market fit – Have you researched the market demand for your products and services?

- Team efficiency – Does your startup have devoted professionals that will work on achieving your goals?

- Scalability – How probable is growth in sales volumes without proportional growth or fixed costs?

An organized business plan is essentially a blueprint of your goals and it showcases your abilities as an entrepreneur.

Related : Business Report: What is it & How to Write a Great One? (With Examples)

If you want to persuade venture capitalists and banking institutions to invest in your startup, you won’t be able to do it without a solid business plan. Following a clear business plan format is crucial, as it structures your plan in a way that is easily understandable and demonstrates your business’s potential.

A business plan is helpful in two ways – it allows you to focus on the specific goals you set for the future and it provides external parties with evidence that you have done your research in advance.

But don’t just take our word for it – here are some of the things that researchers from Bplans found out when they were analyzing the benefits of business plans with the University of Oregon.

- Companies that use business plans have recorded a 30% faster growth compared to those that didn’t use them.

- Getting investments and loans is twice as likely to happen with the help of business plans.

- There is a 129% increased chance for entrepreneurs to go past the ‘startup’ phase through business plans.

You should create a business plan before you decide to quit your regular job. It can help you realize whether you are ready or not.

Also, creating a business plan is helpful when:

- You want to attract investments or funding from external parties

- You want to find a new partner or co-founder

- You want to attract talented professionals to join your startup

- You need to change things up due to the slow growth

While creating a business plan is an important step, you first have to know how to differentiate all the different types. This will help you choose the one that is most suitable for your business.

Here are the most common types of business plans and what you should include in each.

One-Pager Business Plan

Startup business plan, internal business plan, strategic business plan, feasibility business plan.

The one-pager is a business plan that only includes the most important aspects of your business. It is essentially a simplified version of a traditional business plan.

When creating the one-pager business plan, your primary focus should be on making it easily understandable.

Since this business plan is rather short, you should avoid using lengthy paragraphs. Each section should be around 1-2 sentences long.

The things you should include in a one-pager business plan are:

- The problem – Describe a certain problem your customers have and support the claim with relevant data.

- The solution – How your products/services can solve the issue.

- Business model – Your plan on how to make money. Include production costs, selling costs, and the price of the product.

- Target market – Describe your ideal customer persona. Start with a broad audience and narrow it down by using TAM, SAM, and SOM models. This lets investors in on your thought process. To understand these models better, check out, for example, the importance of proper TAM evaluation for B2B startups .

- Competitive advantage – How are you different from your competitors?

- Management team – Include your business’s management structure.

- Financial summary – This part should revolve around the most significant financial metrics (profit, loss, cash flow, balance sheet, and sales forecast).

- Required funding – Define how much money you need to make your project a success.

PRO TIP: How Well Are Your Marketing KPIs Performing?

Like most marketers and marketing managers, you want to know how well your efforts are translating into results each month. How much traffic and new contact conversions do you get? How many new contacts do you get from organic sessions? How are your email campaigns performing? How well are your landing pages converting? You might have to scramble to put all of this together in a single report, but now you can have it all at your fingertips in a single Databox dashboard.

Our Marketing Overview Dashboard includes data from Google Analytics 4 and HubSpot Marketing with key performance metrics like:

- Sessions . The number of sessions can tell you how many times people are returning to your website. Obviously, the higher the better.

- New Contacts from Sessions . How well is your campaign driving new contacts and customers?

- Marketing Performance KPIs . Tracking the number of MQLs, SQLs, New Contacts and similar will help you identify how your marketing efforts contribute to sales.

- Email Performance . Measure the success of your email campaigns from HubSpot. Keep an eye on your most important email marketing metrics such as number of sent emails, number of opened emails, open rate, email click-through rate, and more.

- Blog Posts and Landing Pages . How many people have viewed your blog recently? How well are your landing pages performing?

Now you can benefit from the experience of our Google Analytics and HubSpot Marketing experts, who have put together a plug-and-play Databox template that contains all the essential metrics for monitoring your leads. It’s simple to implement and start using as a standalone dashboard or in marketing reports, and best of all, it’s free!

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your HubSpot and Google Analytics 4 accounts with Databox.

Step 3: Watch your dashboard populate in seconds.

Related : Check out our comprehensive guide on writing a marketing plan report .

New businesses use startup business plans to outline their launching ideas and strategies to attract funding and investment opportunities. When creating startup business plans, you should primarily focus on the financial aspect and provide evidence that supports it (e.g. market research).

These are some of the main things that should be included:

- Vision statement – Explain your vision for the company and include the overall business goals you will try to achieve.

- Executive summary – A quick overview of what your company is about and what will make it successful. Make sure to include your products/services, basic leadership information, employees, and location.

- Company description – A detailed overview of your company. Talk about the problems you will solve and be specific about customers, organizations, and growth plans. This is the place where you should state your business’s main advantages.

- Market Analysis – Show investors that you have a good understanding of your industry and target market by providing a detailed market analysis. Try to point out certain trends, themes, or patterns that support your objective.

- Organization and management – This section explains the structure and the management hierarchy. Also, describe the legal structure of your business.

- Service or product line – Go into detail about the products and services you are going to sell. Explain the benefits they bring and share your intellectual property plans.

- Marketing and sales – Talk about your marketing strategy and describe how you plan to attract new customers.

- Financial projections – This section should be about convincing your readers why the business will be a financial success. Create a prospective financial outlook for the next few years and it includes forecasts.

An internal business plan is a document that specifically focuses on the activities within your company. While external business plans focus on attracting investors, internal business plans keep your team aligned on achieving goals.

Related : Internal vs. External Reporting: What Are the Differences?

This business plan can differentiate based on how specific you want it to be. For example, you can focus on a specific part of the business (e.g. financial department) or on the overall goals of the whole company.

Nonetheless, here are some things that should universally be included in all internal business plans:

- Mission statement – Focus on the practical, day-to-day activities that your employees can undertake to achieve overall objectives.

- Objectives – Provide specific goals that you want your company to achieve. Make the objectives clear and explain in which way they can be reached. Focus more on short-term objectives and set reasonable deadlines.

- Strategies – Talk about the general activities that will help your team reach the set objectives. Provide research that will describe how these strategies will be useful in the long term.

- Action plans – These plans revolve around particular activities from your strategy. For example, you could include a new product that you want to create or a more efficient marketing plan.

- Sustainability – This refers to the general probability of achieving the goals you set in the internal report. Sometimes, plans may seem overly ambitious and you are going to have to make amends with certain things.

A strategic business plan is the best way to gain a comprehensive outlook of your business. In this document, forecasts are examined even further and growth goals tend to be higher.

By creating a strategic business plan, you will have an easier time aligning your key stakeholders around the company’s priorities.

Here is a quick overview of what a strategic business plan should include:

- Executive summary – Since strategic business plans are generally lengthy, not all executives will have time to go through it. This is why you should include a quick overview of the plan through an executive summary, you can also create an executive summary template to make the step easily repeatable.

- Vision statement – Describe what you wish to achieve in the long term.

- Company overview – This refers to past achievements, current products/services, recent sales performances, and important KPIs.

- Core values – This section should provide an explanation of what drives the business to do what it does.

- Strategic analysis of internal and external environments – Talk about the current organizational structure, mission statements, and department challenges.

- Strategic objectives – Go into detail about the short-term objectives your team should reach in a specific period. Make sure the objectives are clear and understandable.

- Overall goals – This section should include operational goals, marketing goals, and financial goals.

A feasibility business plan is also known as a feasibility study. It essentially provides a foundation for what would be a full and comprehensive business plan. The primary focus of a feasibility plan is research.

The things you should include in a feasibility plan are:

- Product demand – Is there a high demand for your product? Would customers be interested in buying it?

- Market conditions – Determine the customer persona that would be interested in buying your products. Include demographic factors.

- Pricing – Compare your desired price with the current pricing of similar products. Which price would make your service profitable?

- Risks – Determine the risks of launching this new business.

- Success profitability – Is there a good way to overcome the risks and make your company profitable?

How Do You Write a Business Plan Report?

As we explained in the previous heading, there are a few different types of business plan. Depending on the audience you are referring to, the language you use in the plan should be adjusted accordingly.

Nonetheless, there are certain key elements that should be included in all business plans, the only thing that will vary is how detailed the sections will be.

Include these elements in your business plan.

Executive summary

Company description, market opportunity and analysis, competitive landscape, target audience, describe your product or service, develop a marketing and sales strategy, develop a logistics and operations plan, financial projections, explain your funding request, compile an appendix for official documents.

An executive summary is a quick overview of the document as a whole that allows investors and key stakeholders to quickly understand all the pain points from the report.

It is the best way to layout all the vital information about your business to bank officials and key stakeholders who don’t have the time to go through the whole business plan.

If you summarize the sections well, the potential investors will jump into the sections they are most interested in to acquire more details.

You should write the executive summary last since you will then have a better idea of what should be included.

A good executive summary answers these questions:

- Who are you?

- What do you sell?

- How profitable is it?

- How much money do you need?

This section of the business plan aims to introduce your company as a whole. The things you include in the company description can vary depending on if you are only starting a business or you already have a developed company.

The elements included in this section are:

- Structure and ownership – Talk about who the key shareholders in your company are and provide a full list of names. Also, mention details such as where the company is registered and what the legal structure looks like. In most countries, this is a legal requirement for AML regulations.

- History – This segment is if you already have an existing company. Use this section to show your credibility. Include company milestones, past difficulties, and a precise date for how long your company has been operating.

- Objectives – Describe the overall objectives of your company and how you plan to reach them.

Market analysis refers to creating your ideal customer persona and explaining why they would be interested in buying your products.

Market opportunities are the gaps that you found in the current industries and creating a way for your product to fill those gaps.

The most important step in this section is to create a target market (persona) through demographic factors such as location, income, gender, education, age, profession, and hobbies.

Make sure that your target market isn’t too broad since it can put off potential investors.

A good idea is to also include a detailed analysis of your competitors – talk about their products, strengths, and weaknesses.

Related : 12 Best Tools Marketers Use for Market Research

Although you may include a competitive analysis in the market analysis section, this segment should provide a more detailed overview.

Identify other companies that sell similar products to yours and create a list of their advantages and disadvantages. Learning about your competitors may seem overwhelming, but it’s an indispensable part of a good business plan.

Include a comparison landscape as well that defines the things that set you apart from the competitors. Describe the strengths of your product and show which problems it could solve.

Related : How to Do an SEO Competitive Analysis: A Step-by-Step Guide

Use the target audience section to fully describe the details of your ideal customer persona. Include both demographic and psychographic factors.

Ask yourself:

- What are the demographic characteristics of the people who will buy my product?

- What are their desires?

- What makes my product valuable to them?

Make sure to answer all of these questions to get in the mindset of your customers.

If you need more details on how to identify your target audience , check our full expert guide.

When talking about your products and services, be as precise as possible. Mention your target audience and the marketing channels you use for targeting this audience.

This section should reveal the benefits, life cycle, and production process of your products/services. Also, it is a good idea to include some pictures of your products if possible.

When describing your products, you should highlight:

- Unique features

- Intellectual property rights

- What makes the product beneficial

Marketing is the blood flow to your business’s body. Without a good marketing and sales strategy, the chances of your product succeeding are very slim.

It’s always best to already have a marketing plan in place before launching your business. By identifying the best marketing channels, you will show your investors that you researched this topic in detail.

Some of the things you should include are:

- Reach – Explain why a specific channel will be able to reach your target market

- Cost – Is the marketing strategy going to be cost-effective? How much money do you plan on spending on the strategy?

- Competition – Are your competitors already using this channel? If so, what will make your product stand out?

- Implementation – Who will be taking care of the implementation process? Is it a marketing expert? Which suppliers did you reach out to?

Related : 14 Reasons Sales And Marketing Alignment Is Crucial for Skyrocketing Company Growth

This section should explain the details of how exactly your company is going to operate.

These are the things you should include:

- Personnel plan – Define how many people you plan to employ and their roles. Also, if you plan on increasing your staff, you should explain what would be the cause of that.

- Key assets – This refers to assets that will be crucial for your company’s operation.

- Suppliers – Mention who your suppliers will be and what kind of relationship you have with them. Your investors will be interested in this part of the section since they want to be reassured that you are cooperating with respectable counterparties.

The financial projections section is one of the most important parts of your business plan. It includes a detailed overview of expected sales, revenue, profit, expenses, and all the other important financial metrics .

You should show your investors that your business will be profitable, stable, and that it has huge potential for cash generation.

Monthly numbers for the first year are crucial since this will be the most critical year of your company.

At the very least, you should provide:

- Funding needs

- Profit-and-loss statement forecast

- Balance sheet forecast

- Cash-flow statement forecast

Related : How to Write a Great Financial Report? Tips and Best Practices

When providing the funding request, be realistic. Explain why you need that exact amount of money and where it will be allocated.

Also, create both a best-case and worst-case scenario. New companies don’t have a history of generating profits which is why you will probably have to sell equity in the early years to raise enough capital.

This will be the final section of your business plan. Include any material or piece of information that investors can use to analyze the data in your report.

Things that could be helpful are:

- Local permits

- Legal documents

- Certifications that boost credibility

- Intellectual properties or patents

- Purchase orders and customer contracts

After reading the previous heading, you should have a clear idea of how to write a compelling business plan.

But, just to be sure, we prepared some additional information that can be very helpful.

Here are some of the best practices you should implement in your business plan according to the most successful companies.

Keep it brief

Make it understandable, be meticulous about money, design is important.

Generally, business plans will be around 10-20 pages long. Your main focus should be to cover the essentials that we talked about, but you don’t want to overdo it by including unnecessary and overwhelming information.

In business plan, less is more.

Create a good organizational outline of your sections. This will allow investors to easily navigate to the parts they are most interested in reading.

Avoid using jargon – everyone should be able to easily understand your business plan without having to Google certain terms.

Make a list of all the expenses your business incurs. Financial information should be maximally precise since it will directly impact the investor’s decision to fund your business idea.

After you wrap up your business plan, take a day off and read it again. Fix any typos or grammatical errors that you overlooked the first time.

Make sure to use a professional layout, printing, and branding of your business plan. This is an important first impression for the readers of the document.

Now you know what a business plan is, how you can write it, and some of the best practices you can use to make it even better.

But, if you are still having certain difficulties coming up with a great business plan, here are a few examples that may be helpful.

HubSpot’s One-Page Business Plan

Bplan’s free business plan template, small business administration free business plan template.

This One-Page Business Plan was created by HubSpot and it can be a great way to start off your business plan journey on the right foot.

You already have fields such as Implementation Timeline, Required Funding, and Company Description created so you will just need to provide your specific information.

This free business plan template highlights the financial points of the startup. If your primary focus will be your business’ financial plan and financial statements, you can use this template to save up some time.

It can also be useful for making sure everyone in your company understands the current financial health and what they can do to improve it.

If you need additional inspiration to kick start your own business plan, you can check out this free template by small business administration .

You just have to decide which type of plan you want to create and then review the format of how it should look like.

Monitor and Report on the Performance of Your Business with Databox

Tracking your company’s performance is an indispensable part of quality decision-making. It is crucial that you know how your business strategy is performing and whether it needs to be optimized in certain areas.

However, doing this manually will undoubtedly take a hefty amount of your valuable time. You will have to log into all of the different tools, copy-paste the data into your reports, and then analyze it. And this isn’t a one-time thing – you have to do it at least once a month.

Luckily, Databox can lend a helping hand.

By using customizable dashboards from Databox, you will be able to connect data from all your different tools into one comprehensive report. Not only that, but you can also visualize the most important metrics to make your presentation to shareholders immensely more impactful.

Did you spend a lot of time cutting and pasting? Say ‘no more’ to that. You will be able to use that time to better analyze your business performances and monitor any significant changes that occur.

Leave the grueling business reporting process in the past and sign up for a free trial with Databox.

Get practical strategies that drive consistent growth

12 Tips for Developing a Successful Data Analytics Strategy

What Is Data Reporting and How to Create Data Reports for Your Business

What Is KPI Reporting? KPI Report Examples, Tips, and Best Practices

Build your first dashboard in 5 minutes or less

Latest from our blog

- Playmaker Spotlight: Tory Ferrall, Director of Revenue Operations March 27, 2024

- New in Databox: Safeguard Your Data With Advanced Security Settings March 18, 2024

- Metrics & KPIs

- vs. Tableau

- vs. Looker Studio

- vs. Klipfolio

- vs. Power BI

- vs. Whatagraph

- vs. AgencyAnalytics

- Product & Engineering

- Inside Databox

- Terms of Service

- Privacy Policy

- Talent Resources

- We're Hiring!

- Help Center

- API Documentation

Learn to Build a Better Business Plan

Sample Business Plan Gallery

Browse our library of over 550 free business plan examples to kickstart your own plan.

Browse our library of over 550 free business plan examples.

How to Write a Business Plan

Step-by-step guide to establish the foundation of your business quickly and efficiently.

Step-by-step guide to establish the foundation of your business.

Business Plan Template

Build your business using the proven planning template designed by the experts at Bplans.

Use the planning template designed by the experts at Bplans.

Subscribe to Bplans business insights

Stay up to date with the latest business planning, management, growth, and funding trends from bplans..

We care about your privacy. See our Privacy Policy .

Popular Downloads

SWOT Analysis

Easily evaluate your competitive position and develop effective growth strategies.

Refine your competitive strategy using a SWOT analysis.

Cash Flow Forecast

Improve the health of your business by easily estimating your business’s financial future.

Estimate and improve the financial health of your business.

Lean Business Plan Template

Fast, simple, and shareable. Start with a one-page plan to grow alongside your business.

Start with a simple one-page plan to grow alongside your business…

Start Your Business

Business Startup Guide

Get everything in order to start your business and write your business plan.

Get everything in order to start your business.

How to start a business with no money

Is it possible to start a business with no money? Check out this proven process to get your business…

Is it possible to start a business with no money? Check out this�…

Startup Checklist

Break down the startup process and check all the necessary boxes.

Estimating Startup Costs

What will it cost to start your business? These are the expenses you will need to consider.

Do you know what it will cost to start your business?

Write Your Business Plan

Business Planning in Under an Hour

Learn how to write your business plan in under an hour.

1-Page Business Plan Template

A faster, more efficient way to develop your business strategy.

Perfect Your Elevator Pitch

Pitch Guide

Learn how to create a winning elevator pitch deck and speech that will impress investors.

Impress investors with a winning pitch deck and elevator pitch.

Elements of the Elevator Pitch

If you're pitching to investors or building a pitch deck, here are the 7 things you need.

Here are the 7 things you need to include in your elevator pitch.

Components of a Pitch Deck

Here are the 11 slides you must have in your pitch deck.

Investor Pitch Template

Start your pitch off right with a proven pitch deck template.

Get Your Business Funded

Funding Guide

Learn how to prepare your business plan and pitch to secure funding for your business.

Prepare your plan and pitch to secure funding for your business.

Ways to Fund Your Business

When it comes to funding, there isn't a one-size-fits-all method. Here are your options.

Find out what funding options are available for your business.

Grow Your Business

How to Grow Your Business

Growing your business can be just as difficult as starting. Here are proven ways to grow.

Try these proven methods to continue growing your business.

Grow Using Your Business Plan

Turn your business plan into a growth-oriented business strategy.

Set Clear and Actionable Goals

Grow your business by setting clear goals and establishing key metrics for success.

Learn to set clear and actionable goals to grow your business.

How to Forecast Cash Flow

Create a cash flow forecast to help keep your business healthy and plan for the future.

Keep your business healthy using a cash flow forecast.

Tim Berry Blog

Learn from renowned business planning expert and founder of Bplans, Tim Berry.

Business Glossary

Definitions for common terminology and acronyms that every small business owner should know.

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Discover the world’s #1 plan building software

- Personal Finances

- Retirement & Investing

- Homeownership

- Wealth Solutions

10 Steps to Evaluating Your Business Plan

Whether you’re writing your first business plan or updating your current one, the process requires strategic thinking, market research and motivation.

A well-developed business plan is a great way for you to take stock of your company’s attributes and needs. It outlines how you will progress over the coming years and also reveals information about the business owner. It explains how your strengths will be an asset to your business and how you will address areas where you may need help.

Here is an overview of 10 sections a good business plan should include:

1. Executive summary

The executive summary is a condensed version of your full business plan and covers:

- The high points of what your company does (or will do)

- Plans for the future

- How you will execute those plans

- Why your company will be successful

The summary is the big picture. It’s where plan reviewers – including banking partners – will form a first impression of your company. Some people prefer to write this section last while others prefer to write it first.

2. Company description

Explain the different elements of your business. Help plan reviewers quickly understand your goals, marketplace needs, how your products and services will meet those needs, and the competitive advantages of your business.

3. Market analysis

Show you are knowledgeable about the industry and the market in which your business will compete. Include your research findings and conclusions, such as:

- Industry description and outlook

- Information about your target market

- Competitive analysis

- Any known regulatory restrictions

There are many resources that can help you analyze the market, including the SCORE Association and Small Business Development Centers .

4. Organization and management

Explain your company’s organizational structure and ownership, its legal structure, and team backgrounds and qualifications.

5. Service or product line

Emphasize the benefits to customers and focus on why your particular service or product will fill a need for your target customers.

6. Sales and marketing

Your sales strategy should be defined concurrently with the marketing plan. How will you sell your product? Include your sales force and sales activity strategies.

Marketing helps you attract customers. Define your marketing strategy, which should be unique to your company and evaluated on an ongoing basis.

7. Contingency plan

Document how you will deal with some of the good and bad situations of running a business:

- What will you do if your product is an overwhelming success and demand is greater than expected?

- What will you do if initial sales are sluggish? How will you jump-start sales?

8. Funding request

Ask for the amount of money you need, explain why you need it and how it will be used. You will need to provide historical and prospective financial information to support your request.

9. Financial history or projections

Demonstrate your company can meet financial obligations. If you own an established business, supply two to three years of historical data related to its performance. If your business is a start-up or still in its infancy, supply projected data showing the company’s anticipated financial performance for the current and upcoming fiscal years.

10. Personal guarantee

Most business loans require the business owner(s) to personally guarantee repayment of debt. This means the owner of the business agrees to repay the debt using personal means if the business can no longer pay its debt. As a result, you should include the following documents with your business plan funding request:

- Your personal tax returns for the last two to three years.

- A personal financial statement listing the value of your personal assets and the balance(s) of exiting personal debt(s).

With a long history of advocating for entrepreneurs, Bankers Trust understands the needs of small businesses and the value they bring to the community.

Creating your business plan will give your company the foundation and direction needed to reach your goals. Contact us when you’re ready to put your business plan in motion.

- Print article

- Share Article

Chad Solberg

Chad Solberg joined Bankers Trust Company in May 2013 bringing 15 years of banking and finance experience. He currently serves as VP, Business Banking Manager overseeing a team of dedicated business bankers. Prior to joining Bankers Trust, he most recently spent nine years with Wells Fargo as a lender in business banking. Chad was also an examiner with the Federal Reserve Bank of Chicago for three years.

You may also be interested in...

5 Tips for Women Entrepreneurs Starting Their Own Business

Why you should consider leasing your company’s technology

7 Benefits of Using Lockbox for Your Business

Have the education center delivered right to your inbox.

Subscribe to the Education Center to stay up-to-date with the latest Education Center posts on the topics that matter to you.

Select which topics you are interested in, and we’ll send new posts directly to your email inbox: *

Personal Finances Homeownership Retirement & Investing Security Wealth Solutions Business All

- Calculators

- Privacy Policy

Toll Free 1-800-362-1688

© 2022 BankersTrust.com. All Rights Reserved.

Filter by Keywords

10 Best Business Evaluation Tools to Assess Projects in 2024

ClickUp Contributor

February 13, 2024

Rushed and unconsidered choices are the biggest hazard for small and mid-size companies in today’s competitive business landscape. One mistake can make or break an organization, so careful planning and evaluation are crucial.

Business evaluation tools are your secret weapons for making informed decisions about your company’s future . They empower you to assess your strengths, identify areas for improvement, and determine whether your business is on the right track.

So, let’s explore these tools and discover how they can be your North Star in the world of business evaluation. 🌟

What Should You Look for in Business Evaluation Tools?

2. toladata, 3. adobe captivate, 4. open as app company evaluation app, 5. exitadviser, 7. bizex business valuation calculator, 9. valuadder, 10. zoho learn.

Picking the right evaluation tool can be challenging because of the multitude of options. Even though the choice depends on your organization’s particular needs and state of affairs, you can follow some general guidelines to find the most suitable software. When choosing business evaluation tools, consider the following key elements:

- Comprehensive analysis : Look for tools that offer a comprehensive evaluation, including multiple valuation methods (asset, income, market), risk assessment, and benchmarking against industry peers

- User-friendly interface : The tool should have an intuitive and user-friendly interface to make the evaluation process efficient and accessible to users with varying levels of expertise

- Customization : Ensure the tool allows customization to adapt to your business’s requirements, whether it’s industry-specific benchmarks or unique evaluation criteria

- Data accuracy : Accuracy is critical. The tool should provide reliable data sources and transparent calculations to support informed decision-making

- Reporting and visualization : Robust reporting features and data visualization capabilities help you communicate results effectively to stakeholders

- Integration : Consider whether the tool integrates with your existing software and systems to streamline data input and analysis

The 10 Best Business Evaluation Tools to Use in 2024

Business evaluation tools will help you assess projects, make informed decisions, and stay ahead in today’s dynamic business environment. From valuation and performance assessment to impact and project management , these 10 tools are your trusted allies on your path to success.

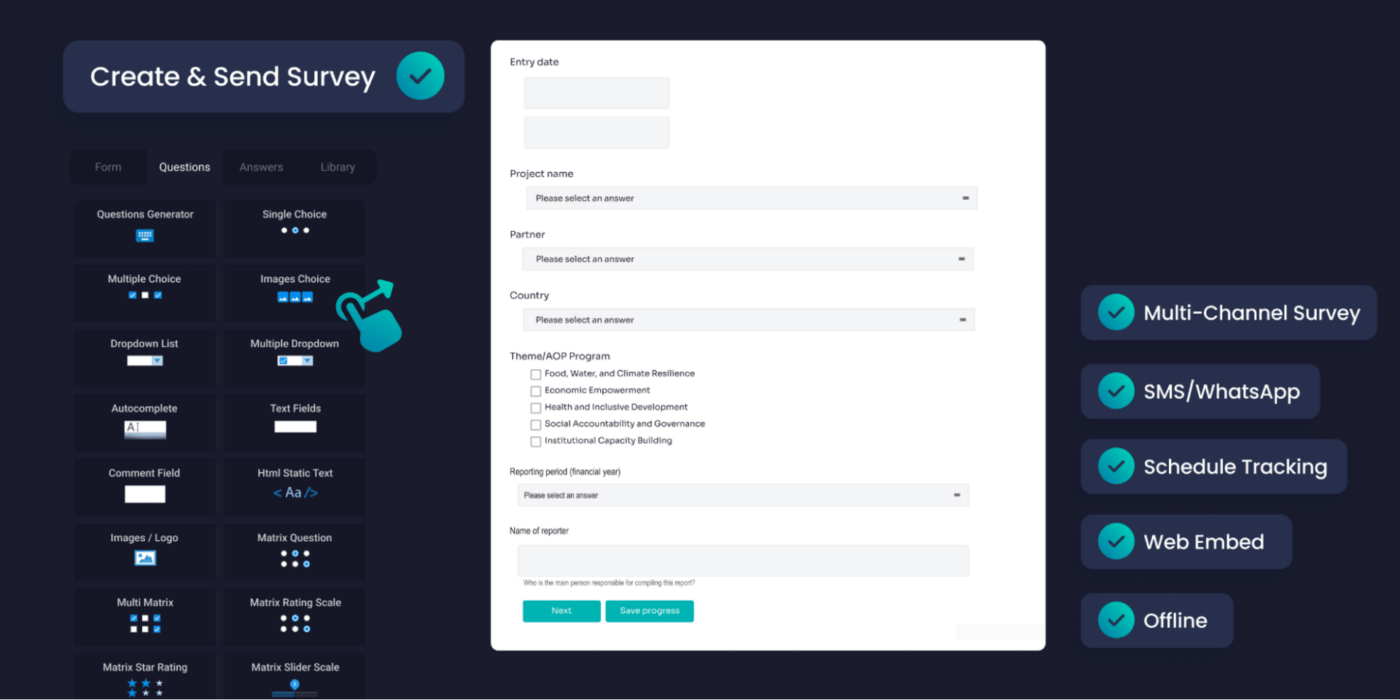

ClickUp is a versatile business evaluation tool that simplifies data collection through its Form view feature. It empowers you to effortlessly gather information from customers , employees, or any target audience.

ClickUp’s Form view offers a wide range of field types , extensive customization options , and the ability to create tasks automatically from form responses. It allows you to tailor your data collection process to your needs.

Whether you require detailed responses, unique field options, or streamlined task creation, Form View optimizes data gathering, ensuring that you receive and manage information in the most valuable and convenient way.

The added value lies in its seamless integration with project management tasks, allowing you to convert form responses into actionable tasks. Using ClickUp’s Project Assessment Template , you can track and present your project’s progress and results with professional-grade visuals, conveniently consolidated in one place. 💯

This comprehensive approach streamlines your evaluation processes , enabling efficient optimization, idea development, and enhanced decision-making within a single, trusted platform.

ClickUp best features

- Provides visual insights into project progress , team performance, and key metrics

- Simplifies data collection with customizable forms and automatic task creation from responses

- Sets and monitors business goals, ensuring alignment with evaluation objectives

- Seamlessly connects with third-party tools and apps for comprehensive data analysis and evaluation

- Allows you to add custom data fields to tasks and projects for specific evaluation criteria

ClickUp limitations

- Learning curve can be challenging for new users due to its extensive features and customization options

ClickUp pricing

- Free Forever

- Unlimited : $7/month per user

- Business : $12/month per user

- Business Plus : $19/month per user

- Enterprise : Contact for pricing

- ClickUp AI is available on all paid plans for $5 per Workspace member per month

*All listed prices refer to the yearly billing model

ClickUp ratings and reviews

- G2 : 4.7/5 (8,000+ reviews)

- Capterra : 4.7/5 (3,000+ reviews)

TolaData offers a web-based monitoring and evaluation platform tailored for non-profit organizations , delivering a robust project tracking, management, and reporting toolkit. Its standout features encompass comprehensive indicator management, aiding in data collection , planning , and monitoring against targets. 🎯

The platform boasts an intuitive interface with a user-friendly layout and customizable dashboards for reporting results. Along with budget tracking and stakeholder engagement, it also excels at activity and task management. TolaData is a priceless resource if you’re looking for an effective and transparent evaluation of your non-profit projects, thanks to improved collaboration and transparency as well as seamless integration with third-party tools for data harmonization.

TolaData best features

- Robust set of tools for managing project indicators

- Provides customizable dashboards that empower users to visualize and report project results effectively

- Integration capabilities with third-party tools facilitate data collection and harmonization from various sources

TolaData limitations

- Limited graphs

- No targets for disaggregated data

TolaData pricing

- Starter : $99/2 users per month

- Small : $229/5 users per month

- Medium : $449/10 users per month

- Large : $999/25 users per month

TolaData ratings and reviews

- G2 : No reviews

- Capterra : 4.9/5 (5+ reviews)

If you think Adobe tools are only for editing images, you’re wrong. Adobe Captivate is a fantastic tool for business evaluation , and here’s why it’s so helpful.

It’s user – friendly , so even beginners can quickly create engaging eLearning content . The ease of use is crucial when evaluating training programs or sharing information efficiently. The interactive features, like customizable interactions and knowledge check questions, boost learner engagement and understanding. It is excellent for assessing how well your training materials work and whether your audience is getting the message. 💌

Plus, Adobe Captivate offers virtual reality experiences , which can give you a unique way to evaluate how immersive your training is. This tool is valuable for HR and people ops agencies and instrumental in implementing new processes within an organization. The latter can help you assess and determine the impact of specific changes on the overall productivity of your team.

Adobe Captivate best features

- Numerous interactive features, including customizable interactions, automated branching, and knowledge check questions

- Virtual reality experience

- Fast and user-friendly eLearning content creation

Adobe Captivate limitations

- Steep learning curve for new users

- Frequent crashes, according to some reviewers

Adobe Captivate pricing

- Subscription : $33.99/month

- Edu Discount : $399

- Full License $1299

*Subscription prices refer to the yearly billing model

Adobe Captivate ratings and reviews

- G2 : 3.9/5 (100+ reviews)

- Capterra : 4.5/5 (100+ reviews)

Open as App Company Evaluation App makes business evaluation more effective and accessible to you. With a few clicks, you can enter your assumptions and business plans, and the app will provide critical insights such as financial charts and discounted cash flows . This saves you time and allows you to make decisions promptly. 🌪️

Plus, the tool lets you visualize your business plans and keep stakeholders and investors in the loop about your company’s estimated business value. You can also share this information as a PDF for clear communication.

Open as App Company Evaluation App best features

- Streamlines company valuation with a few clicks

- Allows the visualization of business plans with financial charts

- Facilitates immediate information sharing via PDF for clear communication

Open as App Company Evaluation App limitations

- Link to the calculator has a long intro

Open as App Company Evaluation App pricing

- Free Version

- Business : $80/month per 10 users

- Enterprise : Contact the company

Open as App Company Evaluation App ratings and reviews

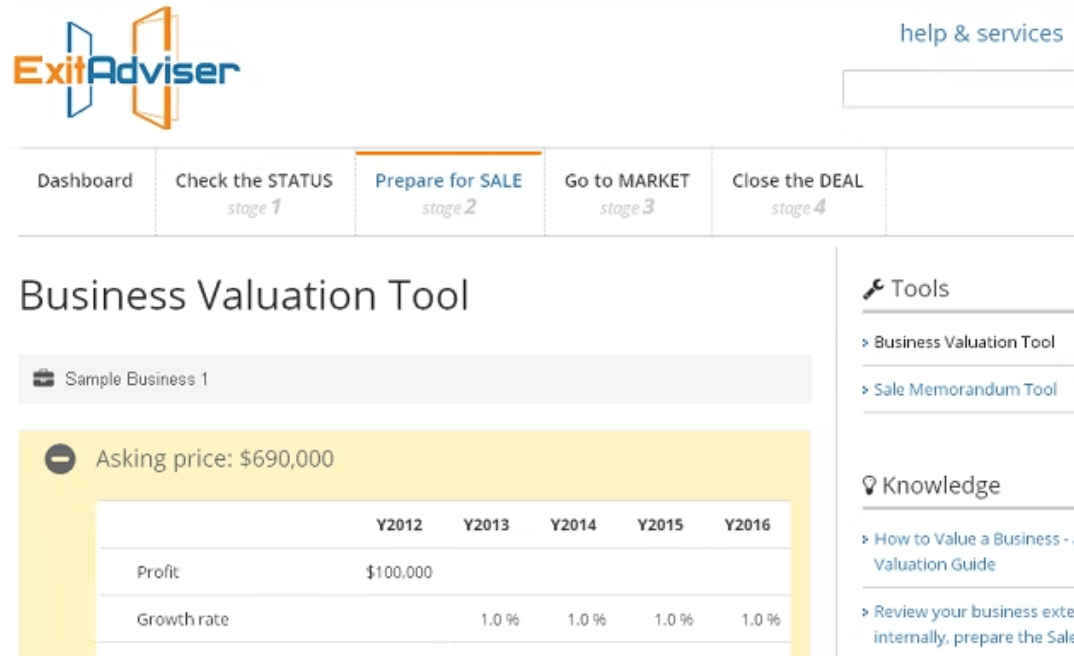

ExitAdviser assists you in evaluating and improving your company’s market position. This analysis gives you the information to make informed decisions about potential changes or new strategies. All you need to do is enter the company’s net profit from the most recent fiscal year and anticipate its sales growth to receive an evaluation.

ExitAdviser provides critical data, including competitor tax payments, employee benefits, and employee satisfaction ratings, alongside industry-specific benchmarks. This comprehensive information gives you a holistic view of your competitive landscape , aiding in strategic planning and decision-making for your business . 💼

ExitAdviser best features

- Provides data on competitor tax payments and employee benefits

- Allows you to compare your company’s performance to competitors

- Provides industry-specific benchmarks for strategic planning

ExitAdviser limitations

- Outdated design

ExitAdviser pricing

- One-time purchase : $99 per user

ExitAdviser ratings and reviews

- Capterra : 4.5/5 (2 reviews)

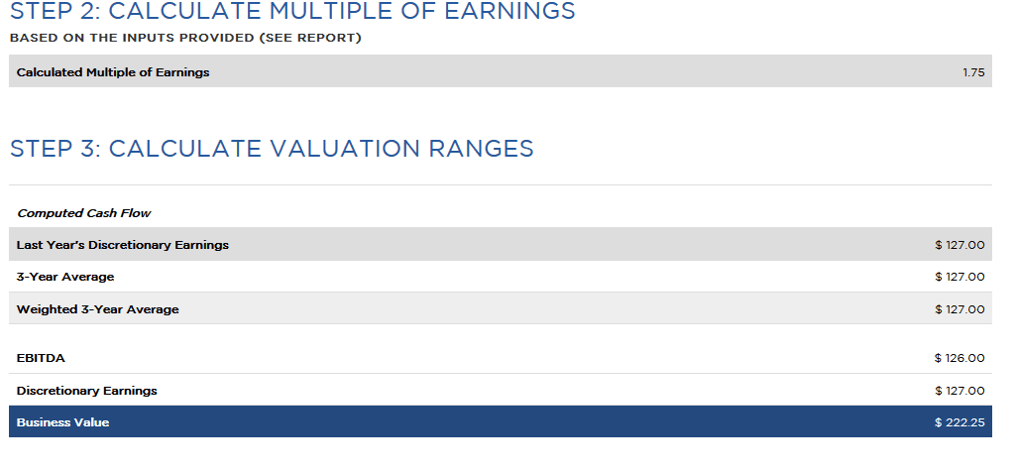

CalcXML offers a thorough assessment of your company’s financial well-being . It dives into crucial details like cash flow and debt ratios, helping you pinpoint areas that need improvement or potential opportunities to capitalize on . 📈

One of the best aspects of the tool is that CalcXML data can be easily incorporated into other applications like QuickBooks Online. As a result, you can improve your financial planning and decision-making and make wiser choices regarding the available funds.

This tool is simple and works with Google Sheets and Microsoft Excel . Regardless of your level of accounting experience, you can easily access and analyze your financial data without having to be an expert in complex spreadsheet software.

CalcXML best features

- Provides a detailed evaluation of your company’s financial health, including cash flow and debt ratios

- Integrates with Microsoft Excel and Google Sheets

- Allows data to be seamlessly imported into other tools

CalcXML limitations

- Lack of qualitative analysis

CalcXML pricing

- Contact the company

CalcXML ratings and reviews

- G2 : 5/5 (1 review)

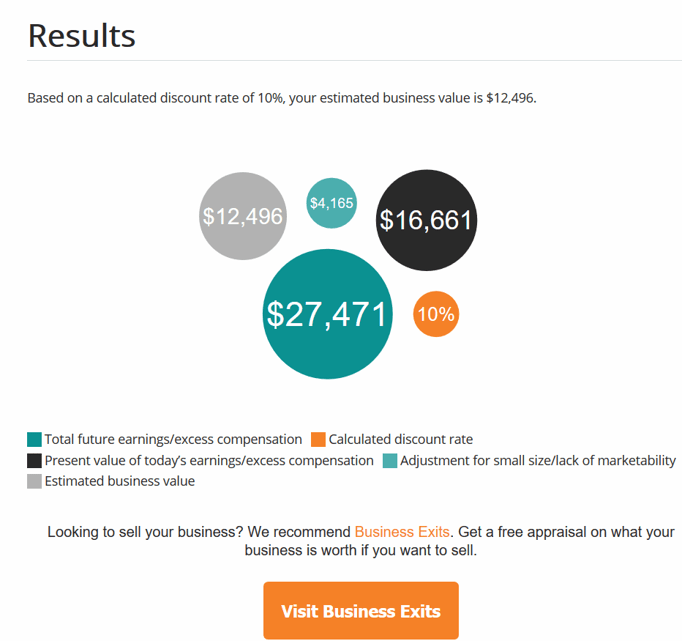

BizEx is a robust platform for business evaluation, focusing on the ‘Multiple of Earnings’ method, which is most widely used in valuing small businesses. The multiple is comparable to the discounted cash flow or capitalization rate mostly used by top business appraisers and analysts, but BizEx streamlines it for small company owners. What sets it apart is the sophistication of its Business Valuation Calculator , which surpasses most free models. 🧮

A comprehensive analysis of the company’s discretionary income and multiple earnings lets you swiftly generate valuation ranges based on various factors . BizEx goes the extra mile by offering the free option to discuss these numbers with a broker, ensuring you have expert guidance for a well-informed business evaluation.

BizEx Business Valuation Calculator best features

- Provides a detailed breakdown of discretionary income and earnings multiples, aiding in instant valuation range generation

- Has an option to connect to a broker

- Calculator offers comprehensive and reliable results

BizEx Business Valuation Calculator limitations

Bizex business valuation calculator pricing, bizex business valuation calculator ratings and reviews.

- Capterra : No reviews

Sopact is a comprehensive solution designed for impact-driven organizations seeking to enhance their impact measurement and management practices .

With Sopact’s evaluation software, you get an all-in-one tool that makes measuring your impact a breeze. No more complicated Excel sheets or surveys that devour your time. Instead, you have a simple dashboard that tracks your progress , helps you spot areas to improve, and lets you share your impact stories easily.

Even better, Sopact uses AI technology to provide real-time insights and continually fine-tune your impact , enabling you to adapt quickly to changes and reach your goals faster. 🤖

Sopact best features

- User-friendly dashboard makes it easy to track progress, identify areas for improvement, and communicate impact to stakeholders

- AI technology supports real-time insights

- Offers a complete solution for measuring and managing the impact of your organization, simplifying the evaluation process

Sopact limitations

Sopact pricing.

- Starting plan : $99/month

Sopact ratings and reviews

- G2 : 5/5 (2 reviews)

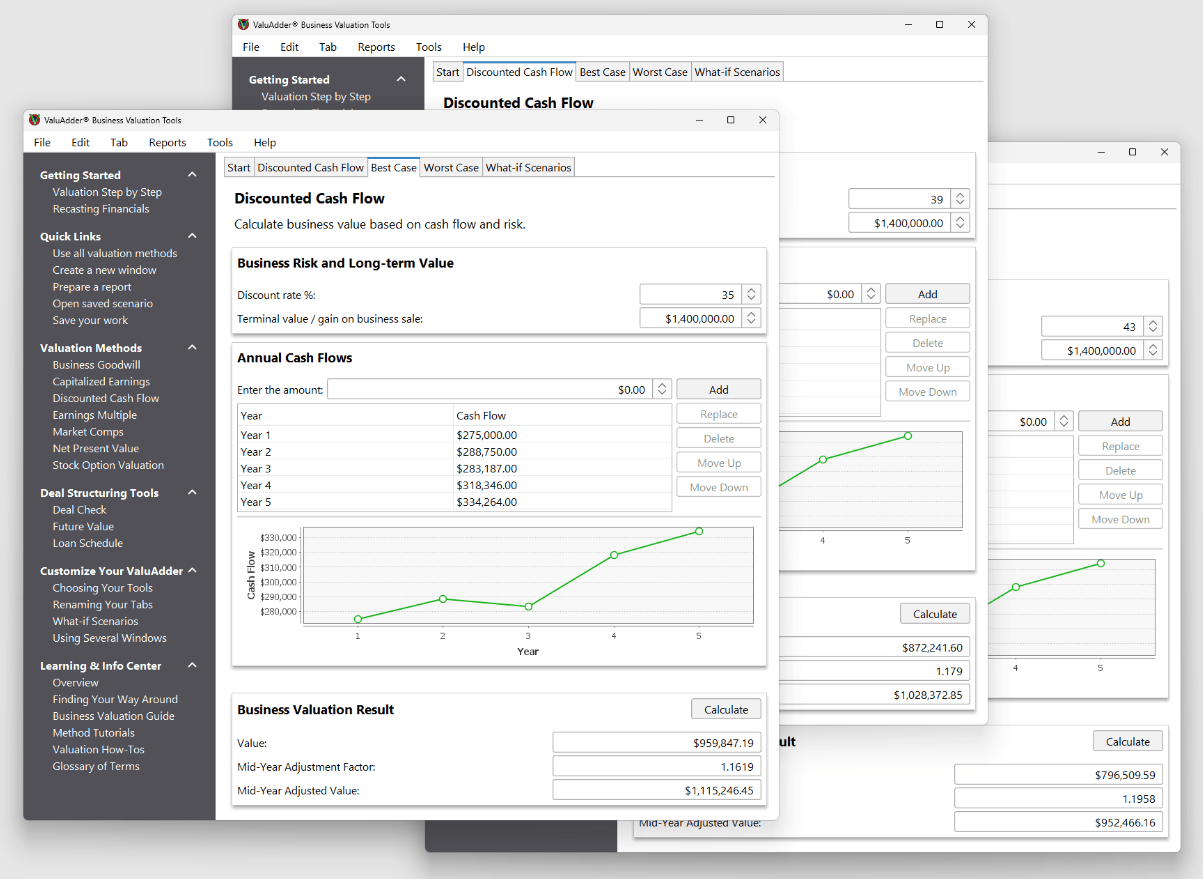

Valuadder employs three standard approaches—asset, income, and market—to thoroughly assess your business’s value . After you download the software, you can calculate value based on earnings and capitalization rates, gaining insights into your financial health and potential. 🤑

Valuadder also assesses goodwill and risk , ensuring you understand all facets of your business. By comparing your business to industry peers, you can set valuable benchmarks, calculate price ranges, averages, and medians, and create in-depth appraisals. These features will help you make data-driven decisions , enhance your competitiveness, and maximize the value and profitability of your business.

Valuadder best features

- Compare your business to industry peers for valuable insights and competitive positioning

- Calculate price ranges, averages, and medians to optimize pricing strategies

- Use net present value and internal rate of return calculations to make informed investment decisions.

Valuadder limitations

- No free trial

- Complex pricing structure

- Only available for computers

Valuadder pricing

Valuadder ratings and reviews.

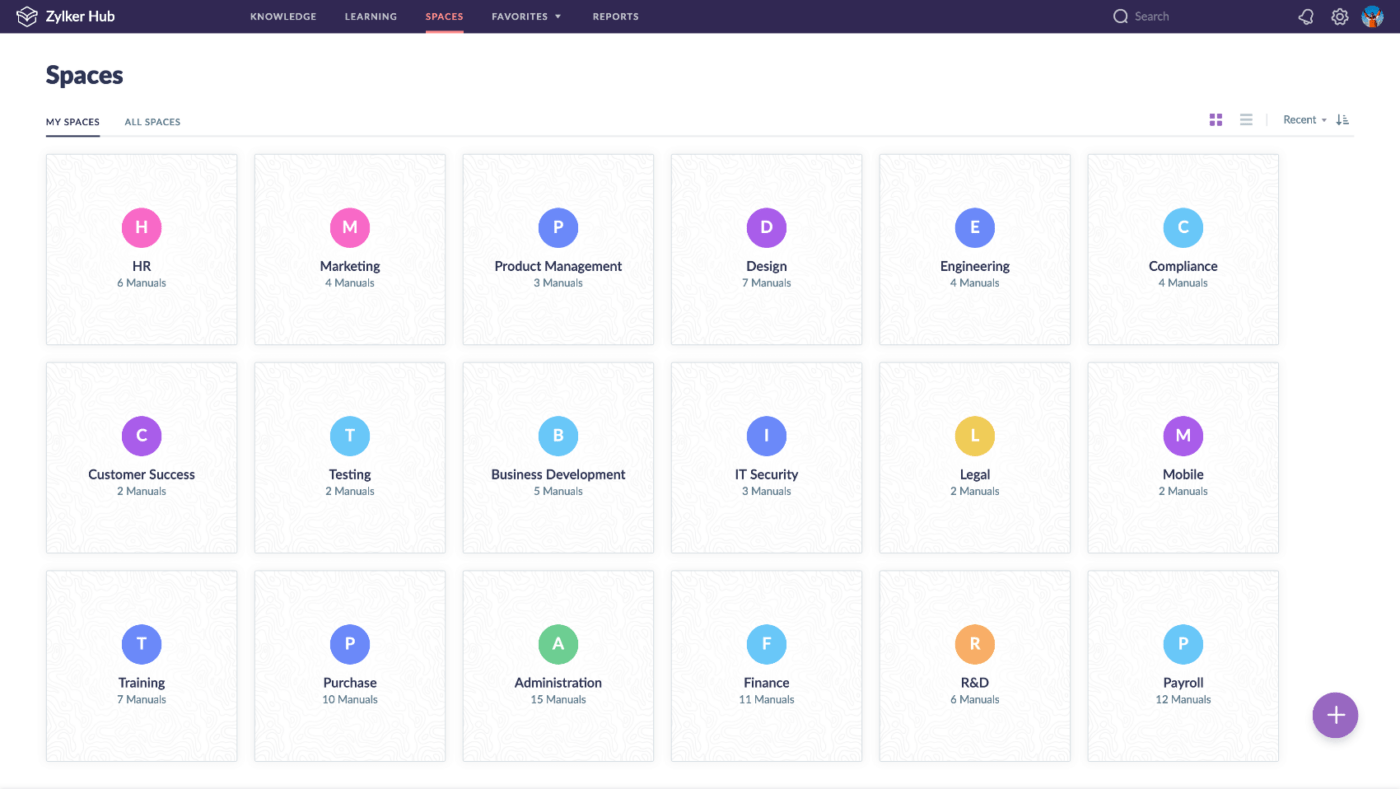

Zoho Learn significantly aids business valuations with a robust knowledge management and training platform. It lets you create customized training programs and assessments , helping you assess your business effectively. With in-depth reports, you can measure the impact of training initiatives, providing valuable insights for business evaluation.

The platform includes reporting tools that enable you to analyze performance and course outcomes. Zoho Learn allows you to create highly customizable quizzes and assessments that can automatically evaluate and grade submissions, providing essential data for evaluation. It can be a valuable tool for assessing the impact and productivity of new processes on your team. 🌞

Zoho Learn best features

- Create engaging and interactive training programs tailored to your organization’s needs

- Evaluate learner performance and track the effectiveness of training programs

- Access comprehensive reports for insights into learner progress and training program effectiveness

Zoho Learn limitations

- Complex UI compared to other tools

Zoho Learn pricing

- Express : $1/month per user

- Professional : $3/month per user

*All listed prices refer to the monthly billing model

Zoho Learn ratings and reviews

- G2 : 4.2/5 (20+ reviews)

- Capterra : 4.7/5 (3 reviews)

Assess, Progress, and Impress

You can expedite your decision-making, review project success, and reach your goals more efficiently with these 10 business evaluation tools . Whether you want to examine your company’s financial health, monitor the effect of your projects, or improve your knowledge management and training efforts, ClickUp is definitely the one to consider. 👍

Questions? Comments? Visit our Help Center for support.

Receive the latest WriteClick Newsletter updates.

Thanks for subscribing to our blog!

Please enter a valid email

- Free training & 24-hour support

- Serious about security & privacy

- 99.99% uptime the last 12 months

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai pitch deck generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

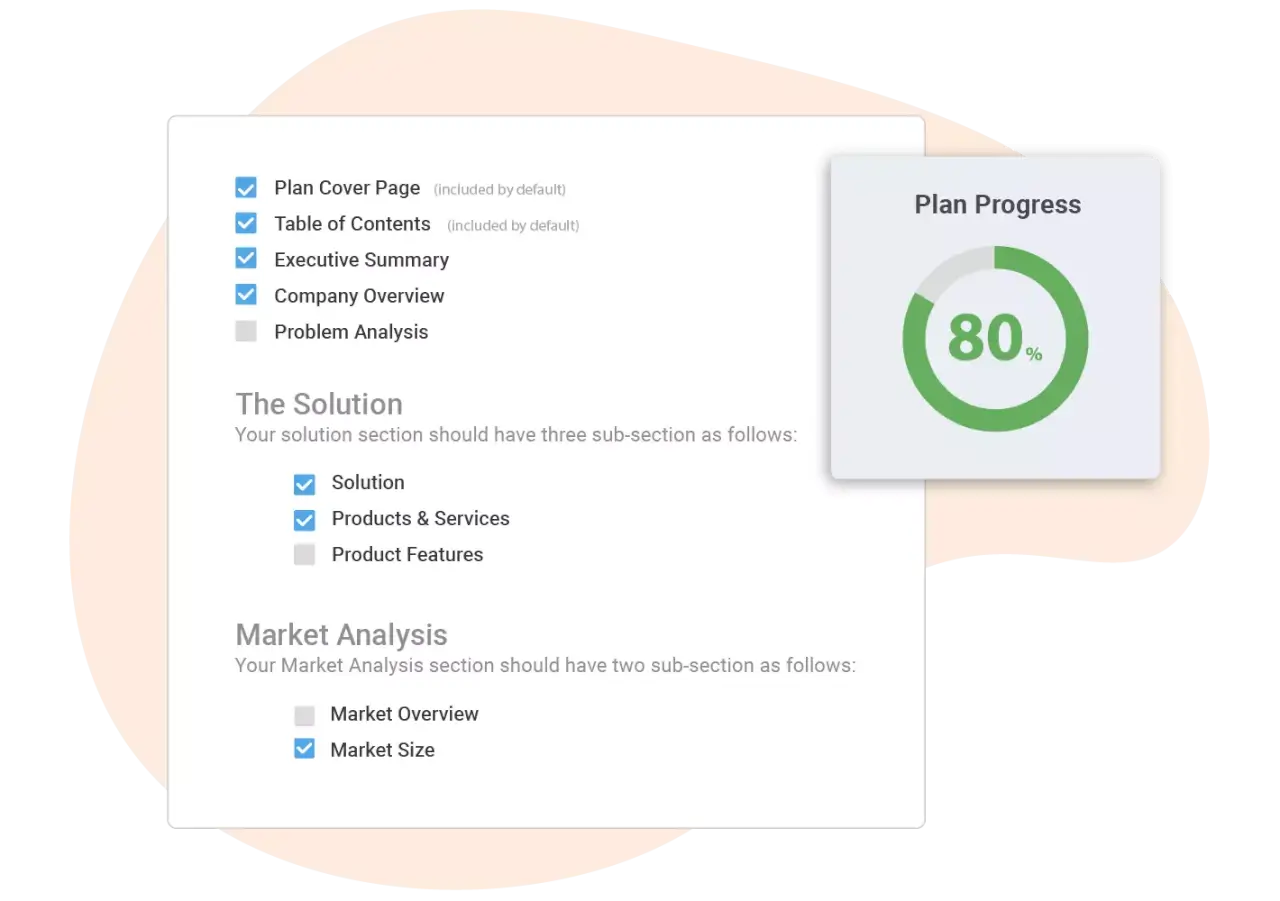

A Complete Business Plan Checklist - Key Points to include in your Business Plan and Track Progress

Creating an effective business plan requires addressing specific strategic and tactical questions with a high level of detail.

After you complete writing your business plan, how will you make sure that your business plan is complete and you did not miss any important details?

The best and easy way is to check your business plan with a standard business plan checklist.

Business plan checklist is the list of most important sections of the business plan that you should include into your business plan in the same order.

This checklist will guide you through the step-by-step process of writing an effective and successful business plan for your startup.

Business Plan Checklist

Please check the sections that you have included in your business plan from below list and track your business plan progress .

Explore our 200+ sample business plans prepared for a wide variety of industries to help you start writing and planning your business plan.

Business plan checklist will also help you to write your business plan table of contents and outline of your business plan.

This business plan checklist is a general guideline for any standard business plan . But you should also keep in mind the purpose of your business plan and include specific details accordingly.

For Example, if you are writing a business plan for a loan from a particular bank, you should learn about their mandatory or specific criteria and must include that details into your business plan.

This business plan checklist prepared here will help you to think through your business and document it in a way that investors and other readers fully understand about your business.

Make your plan in half the time & twice the impact with Upmetrics.

Let's Track Your Business Plan Progress

Popular templates.

11.4 The Business Plan

Learning objectives.

By the end of this section, you will be able to:

- Describe the different purposes of a business plan

- Describe and develop the components of a brief business plan

- Describe and develop the components of a full business plan

Unlike the brief or lean formats introduced so far, the business plan is a formal document used for the long-range planning of a company’s operation. It typically includes background information, financial information, and a summary of the business. Investors nearly always request a formal business plan because it is an integral part of their evaluation of whether to invest in a company. Although nothing in business is permanent, a business plan typically has components that are more “set in stone” than a business model canvas , which is more commonly used as a first step in the planning process and throughout the early stages of a nascent business. A business plan is likely to describe the business and industry, market strategies, sales potential, and competitive analysis, as well as the company’s long-term goals and objectives. An in-depth formal business plan would follow at later stages after various iterations to business model canvases. The business plan usually projects financial data over a three-year period and is typically required by banks or other investors to secure funding. The business plan is a roadmap for the company to follow over multiple years.

Some entrepreneurs prefer to use the canvas process instead of the business plan, whereas others use a shorter version of the business plan, submitting it to investors after several iterations. There are also entrepreneurs who use the business plan earlier in the entrepreneurial process, either preceding or concurrently with a canvas. For instance, Chris Guillebeau has a one-page business plan template in his book The $100 Startup . 48 His version is basically an extension of a napkin sketch without the detail of a full business plan. As you progress, you can also consider a brief business plan (about two pages)—if you want to support a rapid business launch—and/or a standard business plan.

As with many aspects of entrepreneurship, there are no clear hard and fast rules to achieving entrepreneurial success. You may encounter different people who want different things (canvas, summary, full business plan), and you also have flexibility in following whatever tool works best for you. Like the canvas, the various versions of the business plan are tools that will aid you in your entrepreneurial endeavor.

Business Plan Overview

Most business plans have several distinct sections ( Figure 11.16 ). The business plan can range from a few pages to twenty-five pages or more, depending on the purpose and the intended audience. For our discussion, we’ll describe a brief business plan and a standard business plan. If you are able to successfully design a business model canvas, then you will have the structure for developing a clear business plan that you can submit for financial consideration.

Both types of business plans aim at providing a picture and roadmap to follow from conception to creation. If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept.

The full business plan is aimed at executing the vision concept, dealing with the proverbial devil in the details. Developing a full business plan will assist those of you who need a more detailed and structured roadmap, or those of you with little to no background in business. The business planning process includes the business model, a feasibility analysis, and a full business plan, which we will discuss later in this section. Next, we explore how a business plan can meet several different needs.

Purposes of a Business Plan

A business plan can serve many different purposes—some internal, others external. As we discussed previously, you can use a business plan as an internal early planning device, an extension of a napkin sketch, and as a follow-up to one of the canvas tools. A business plan can be an organizational roadmap , that is, an internal planning tool and working plan that you can apply to your business in order to reach your desired goals over the course of several years. The business plan should be written by the owners of the venture, since it forces a firsthand examination of the business operations and allows them to focus on areas that need improvement.

Refer to the business venture throughout the document. Generally speaking, a business plan should not be written in the first person.

A major external purpose for the business plan is as an investment tool that outlines financial projections, becoming a document designed to attract investors. In many instances, a business plan can complement a formal investor’s pitch. In this context, the business plan is a presentation plan, intended for an outside audience that may or may not be familiar with your industry, your business, and your competitors.

You can also use your business plan as a contingency plan by outlining some “what-if” scenarios and exploring how you might respond if these scenarios unfold. Pretty Young Professional launched in November 2010 as an online resource to guide an emerging generation of female leaders. The site focused on recent female college graduates and current students searching for professional roles and those in their first professional roles. It was founded by four friends who were coworkers at the global consultancy firm McKinsey. But after positions and equity were decided among them, fundamental differences of opinion about the direction of the business emerged between two factions, according to the cofounder and former CEO Kathryn Minshew . “I think, naively, we assumed that if we kicked the can down the road on some of those things, we’d be able to sort them out,” Minshew said. Minshew went on to found a different professional site, The Muse , and took much of the editorial team of Pretty Young Professional with her. 49 Whereas greater planning potentially could have prevented the early demise of Pretty Young Professional, a change in planning led to overnight success for Joshua Esnard and The Cut Buddy team. Esnard invented and patented the plastic hair template that he was selling online out of his Fort Lauderdale garage while working a full-time job at Broward College and running a side business. Esnard had hundreds of boxes of Cut Buddies sitting in his home when he changed his marketing plan to enlist companies specializing in making videos go viral. It worked so well that a promotional video for the product garnered 8 million views in hours. The Cut Buddy sold over 4,000 products in a few hours when Esnard only had hundreds remaining. Demand greatly exceeded his supply, so Esnard had to scramble to increase manufacturing and offered customers two-for-one deals to make up for delays. This led to selling 55,000 units, generating $700,000 in sales in 2017. 50 After appearing on Shark Tank and landing a deal with Daymond John that gave the “shark” a 20-percent equity stake in return for $300,000, The Cut Buddy has added new distribution channels to include retail sales along with online commerce. Changing one aspect of a business plan—the marketing plan—yielded success for The Cut Buddy.

Link to Learning

Watch this video of Cut Buddy’s founder, Joshua Esnard, telling his company’s story to learn more.

If you opt for the brief business plan, you will focus primarily on articulating a big-picture overview of your business concept. This version is used to interest potential investors, employees, and other stakeholders, and will include a financial summary “box,” but it must have a disclaimer, and the founder/entrepreneur may need to have the people who receive it sign a nondisclosure agreement (NDA) . The full business plan is aimed at executing the vision concept, providing supporting details, and would be required by financial institutions and others as they formally become stakeholders in the venture. Both are aimed at providing a picture and roadmap to go from conception to creation.

Types of Business Plans

The brief business plan is similar to an extended executive summary from the full business plan. This concise document provides a broad overview of your entrepreneurial concept, your team members, how and why you will execute on your plans, and why you are the ones to do so. You can think of a brief business plan as a scene setter or—since we began this chapter with a film reference—as a trailer to the full movie. The brief business plan is the commercial equivalent to a trailer for Field of Dreams , whereas the full plan is the full-length movie equivalent.

Brief Business Plan or Executive Summary

As the name implies, the brief business plan or executive summary summarizes key elements of the entire business plan, such as the business concept, financial features, and current business position. The executive summary version of the business plan is your opportunity to broadly articulate the overall concept and vision of the company for yourself, for prospective investors, and for current and future employees.

A typical executive summary is generally no longer than a page, but because the brief business plan is essentially an extended executive summary, the executive summary section is vital. This is the “ask” to an investor. You should begin by clearly stating what you are asking for in the summary.

In the business concept phase, you’ll describe the business, its product, and its markets. Describe the customer segment it serves and why your company will hold a competitive advantage. This section may align roughly with the customer segments and value-proposition segments of a canvas.

Next, highlight the important financial features, including sales, profits, cash flows, and return on investment. Like the financial portion of a feasibility analysis, the financial analysis component of a business plan may typically include items like a twelve-month profit and loss projection, a three- or four-year profit and loss projection, a cash-flow projection, a projected balance sheet, and a breakeven calculation. You can explore a feasibility study and financial projections in more depth in the formal business plan. Here, you want to focus on the big picture of your numbers and what they mean.

The current business position section can furnish relevant information about you and your team members and the company at large. This is your opportunity to tell the story of how you formed the company, to describe its legal status (form of operation), and to list the principal players. In one part of the extended executive summary, you can cover your reasons for starting the business: Here is an opportunity to clearly define the needs you think you can meet and perhaps get into the pains and gains of customers. You also can provide a summary of the overall strategic direction in which you intend to take the company. Describe the company’s mission, vision, goals and objectives, overall business model, and value proposition.

Rice University’s Student Business Plan Competition, one of the largest and overall best-regarded graduate school business-plan competitions (see Telling Your Entrepreneurial Story and Pitching the Idea ), requires an executive summary of up to five pages to apply. 51 , 52 Its suggested sections are shown in Table 11.2 .

Are You Ready?

Create a brief business plan.

Fill out a canvas of your choosing for a well-known startup: Uber, Netflix, Dropbox, Etsy, Airbnb, Bird/Lime, Warby Parker, or any of the companies featured throughout this chapter or one of your choice. Then create a brief business plan for that business. See if you can find a version of the company’s actual executive summary, business plan, or canvas. Compare and contrast your vision with what the company has articulated.

- These companies are well established but is there a component of what you charted that you would advise the company to change to ensure future viability?

- Map out a contingency plan for a “what-if” scenario if one key aspect of the company or the environment it operates in were drastically is altered?

Full Business Plan

Even full business plans can vary in length, scale, and scope. Rice University sets a ten-page cap on business plans submitted for the full competition. The IndUS Entrepreneurs , one of the largest global networks of entrepreneurs, also holds business plan competitions for students through its Tie Young Entrepreneurs program. In contrast, business plans submitted for that competition can usually be up to twenty-five pages. These are just two examples. Some components may differ slightly; common elements are typically found in a formal business plan outline. The next section will provide sample components of a full business plan for a fictional business.

Executive Summary

The executive summary should provide an overview of your business with key points and issues. Because the summary is intended to summarize the entire document, it is most helpful to write this section last, even though it comes first in sequence. The writing in this section should be especially concise. Readers should be able to understand your needs and capabilities at first glance. The section should tell the reader what you want and your “ask” should be explicitly stated in the summary.

Describe your business, its product or service, and the intended customers. Explain what will be sold, who it will be sold to, and what competitive advantages the business has. Table 11.3 shows a sample executive summary for the fictional company La Vida Lola.

Business Description