G/L Account Determination in SAP SD

Most of the transactions in SAP are recorded against the GL account. During creation of billing document form a sales order , an accounting document is created where material value is posted against a G/L account. The post describes how the system determines the G/L account for a material sold to a particular customer by the GL account determination technique.

Lets try to create a sales order for a customer with some material and then creating a billing document from the sales order which also generated the accounting document.

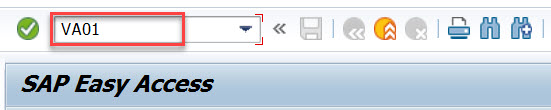

To create sales order go to Tx- Va01

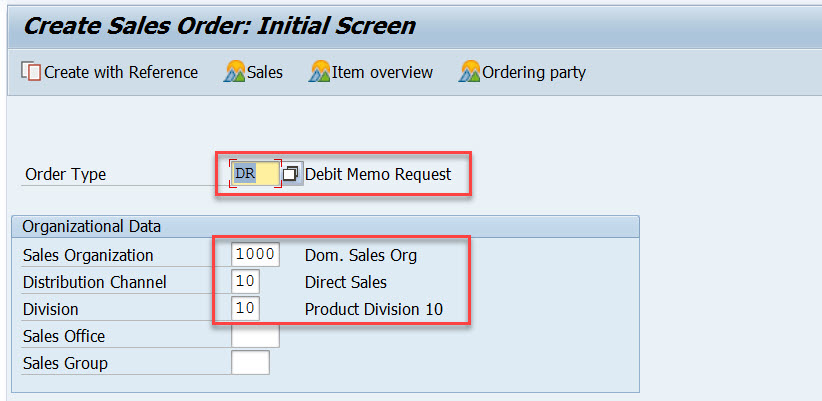

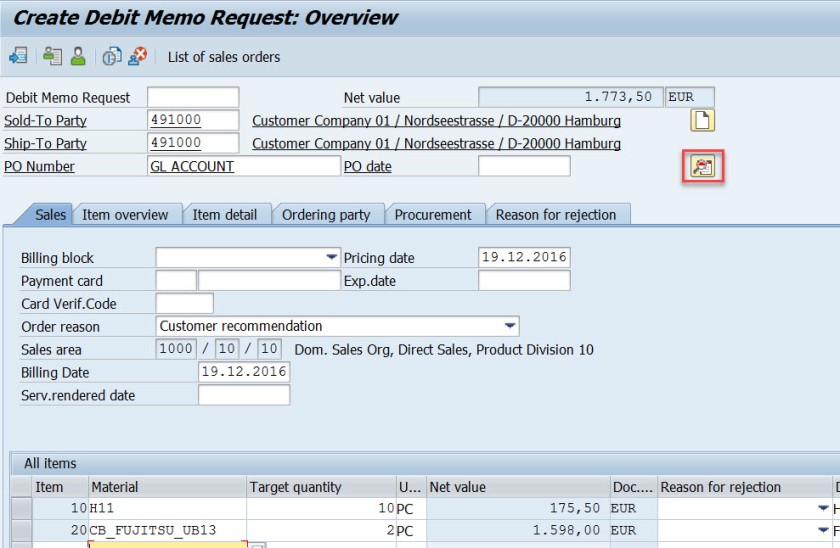

Lets create a debit memo request for the sales area 1000/10/10.

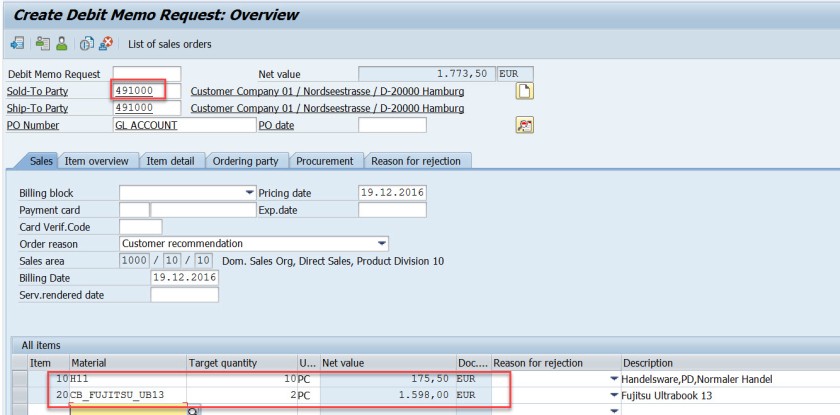

Provide the customer number and few materials and its quantity and double click on the first material to see the item details.

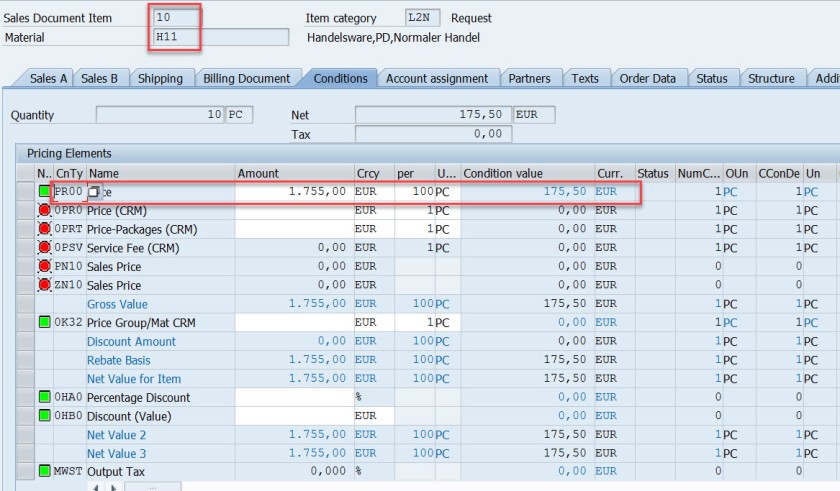

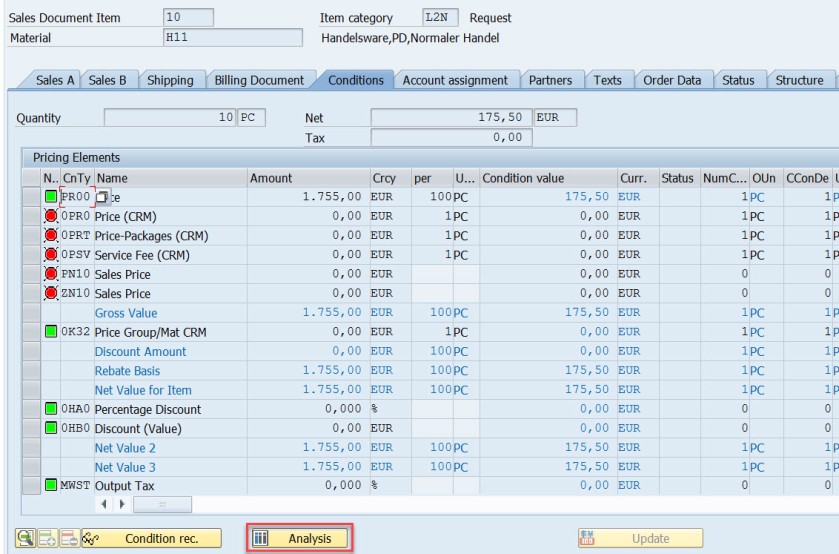

From the pricing procedure – for the pricing condition type- PR00 material value is calculated as 175.50 EUR.

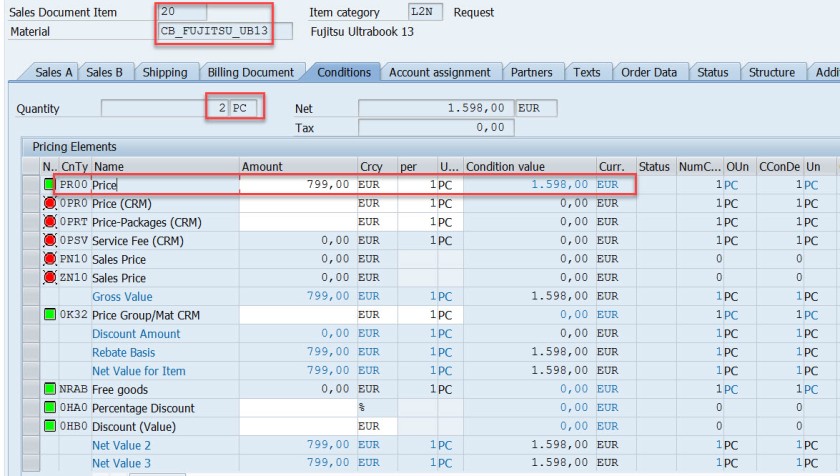

For the second material for the pricing condition type- PR00 material value is calculated as 1598.00 EUR. Go back.

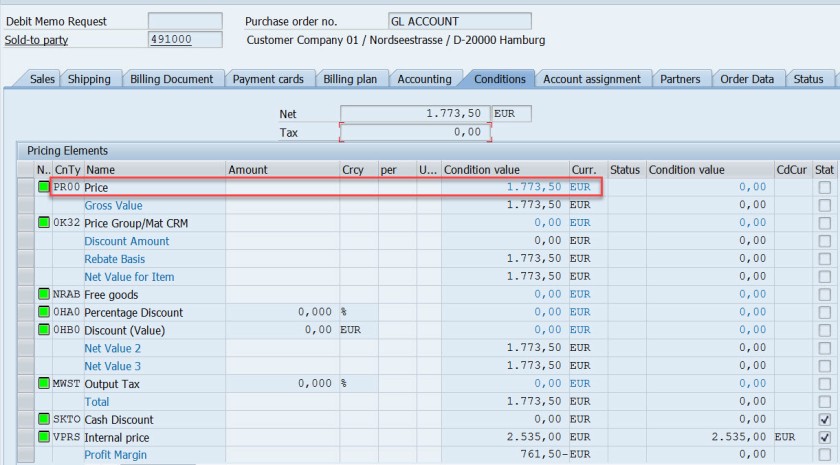

Select the header button.

In the header section, in the Conditions tab, the total price is the sum of two materials.

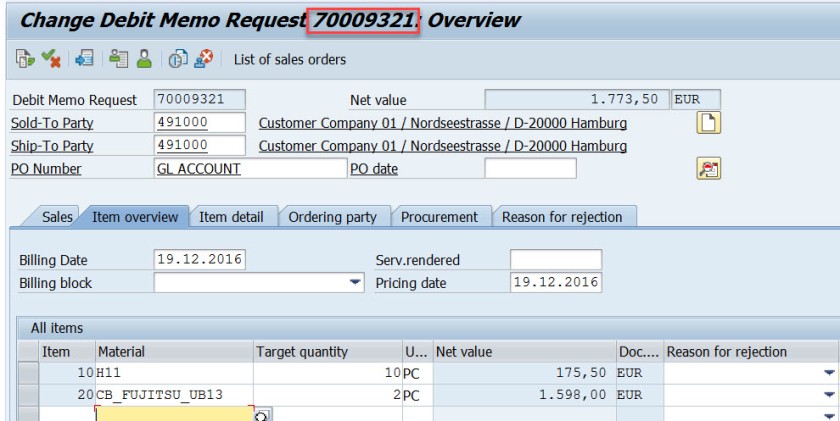

Save and DMR is created.

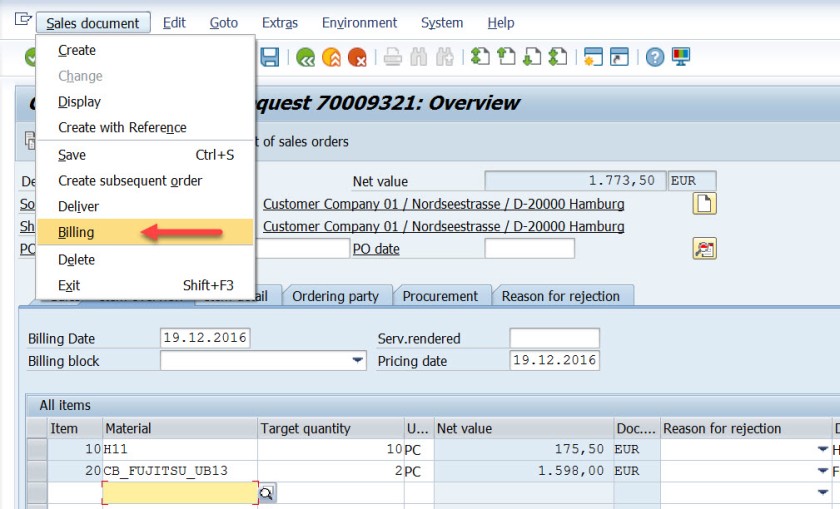

Go to Tx- VA02 and from the menu choose Billing.

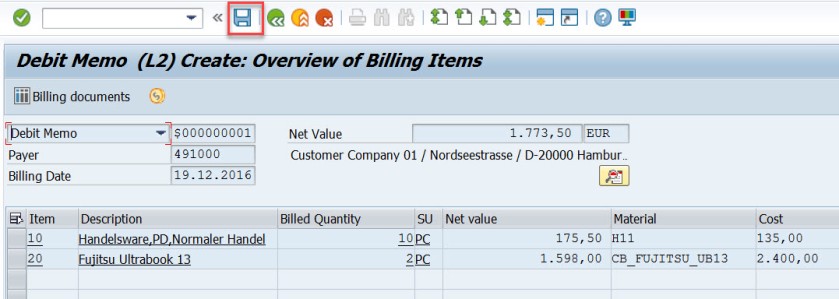

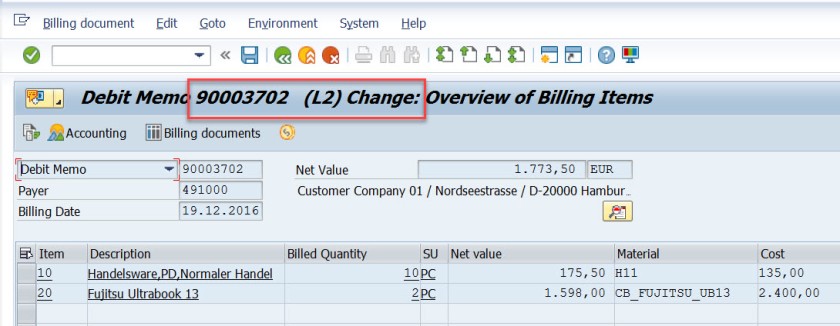

Select Save button to create a billing document. mark billing document type is determined as – L2.

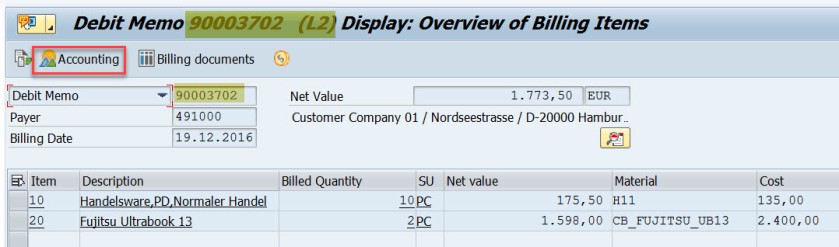

Go to Tx- VF03 and display the billing document. Choose Accounting button.

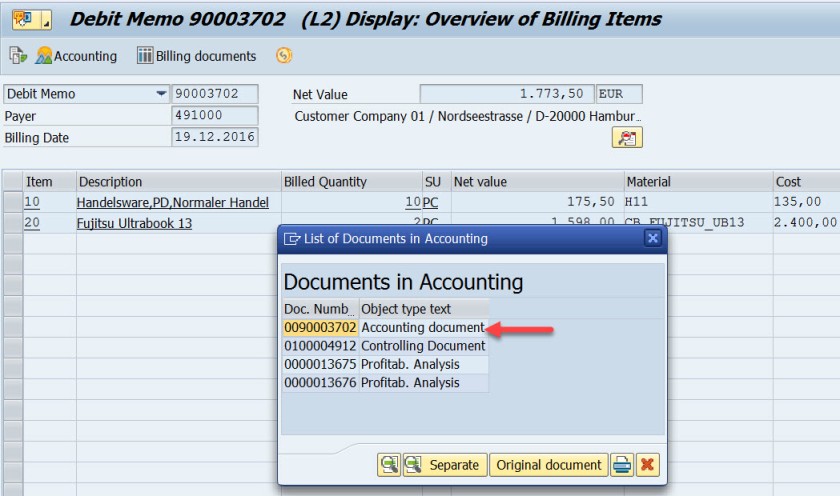

Choose Accounting document.

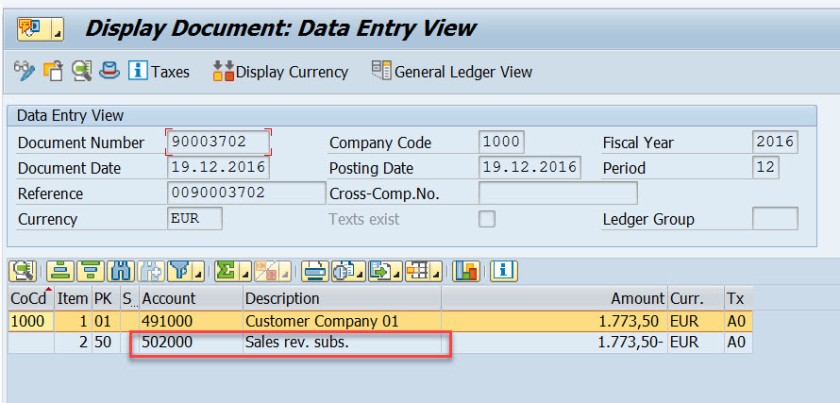

Here is the accounting doc with few lines.

First entry is for the customer as we used the customer – 491000, the account becomes 491000 for the customer.

For the second line, the GL account calculated as 502000. Let’s figure it out how this g/L account is determined.

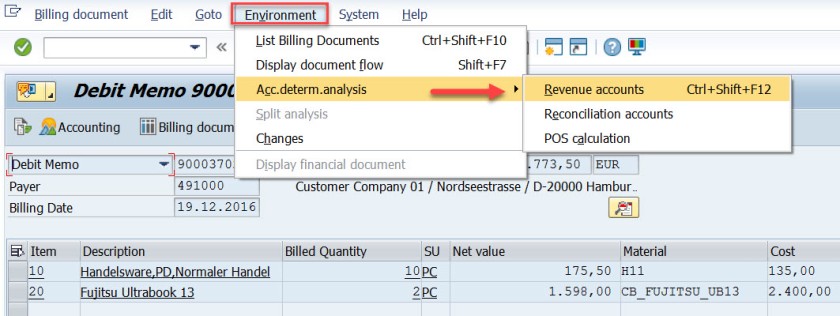

Go to Tx- VF02 and edit the billing document.

From menu, navigate along the highlighted path.

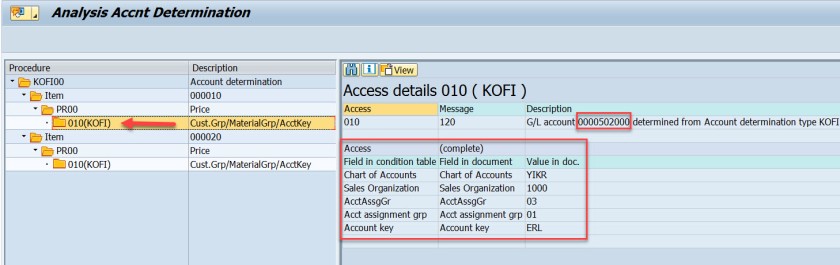

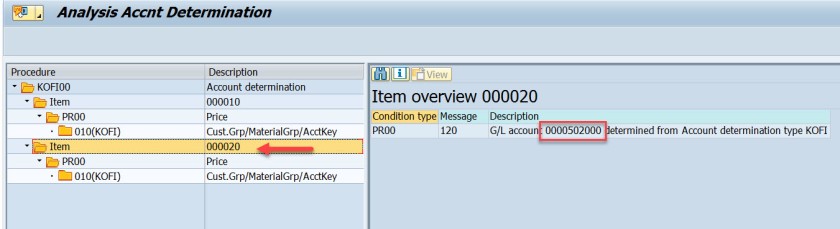

Well, it says the Account Determination procedure is KOFI00 and for the first item , for the pricing condition type PR00, the G/L account as 502000.

Same for the second item.

The G/L account determination requires few customizing steps.

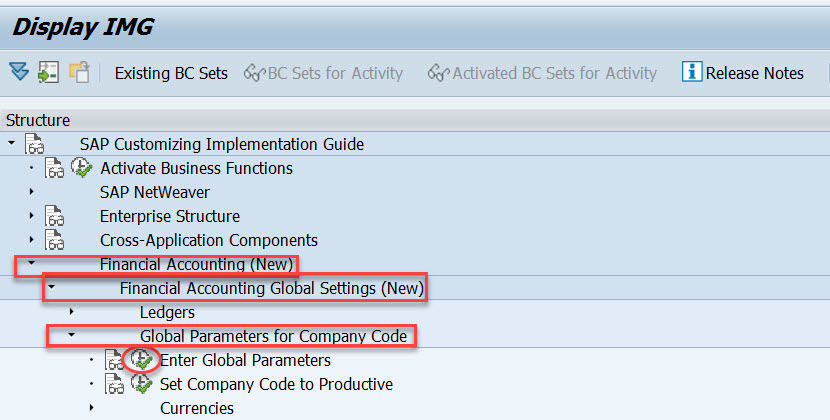

First check what is the chart of account assigned to the company code. In SPRO IMG structure navigate along the highlighted path to see the chart of account assigned to the company code.

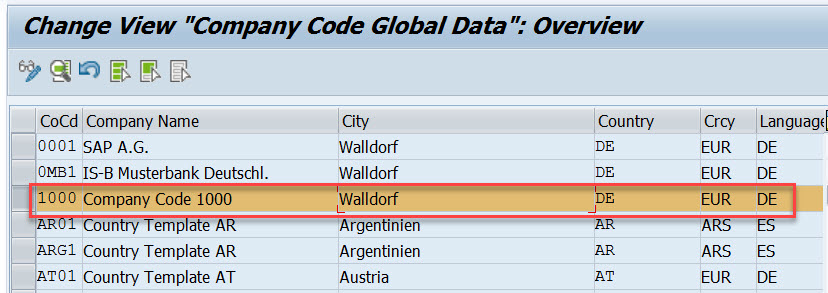

For the demo we use company code- 1000

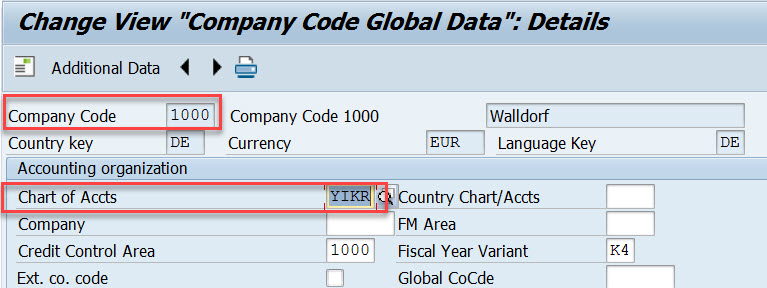

The chart of account is – YIKR

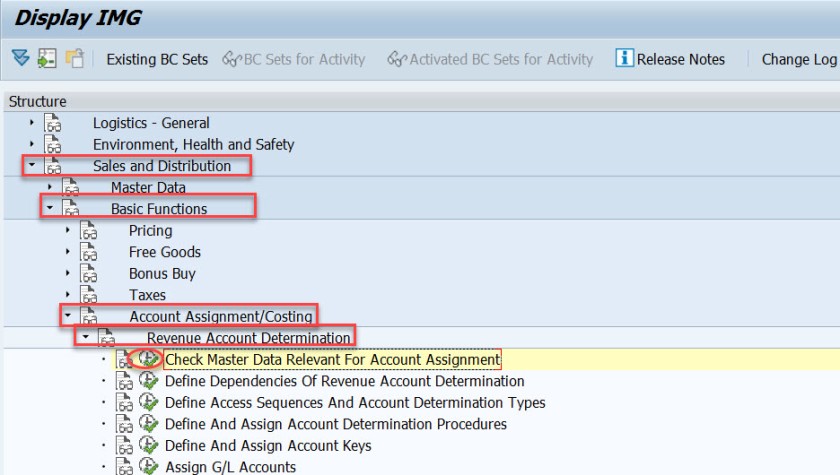

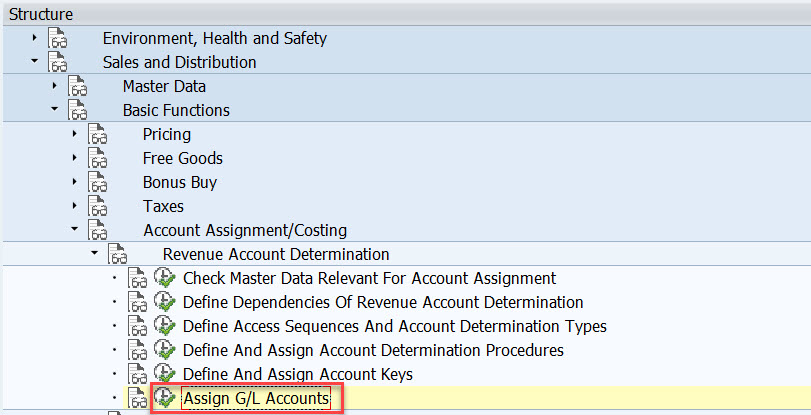

Next step , the customizing in the Sales&Distribution section for the Account Assignment/Costing.

First execute – Check master data relevant for account assignment.

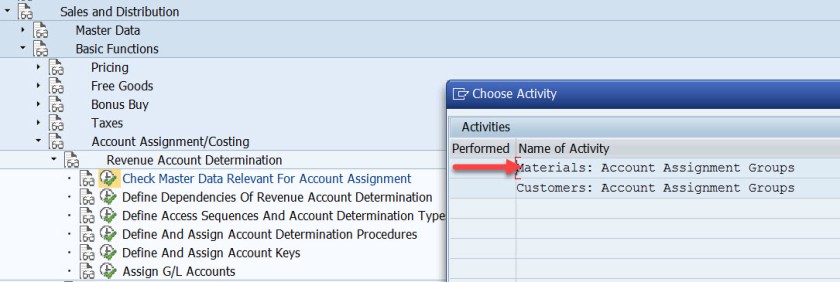

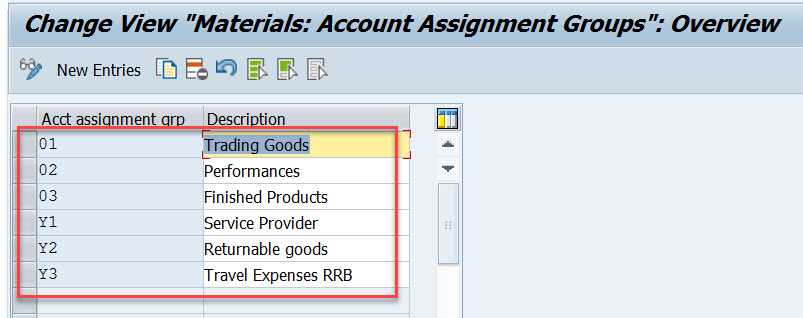

Select first option- Materials : Account Assignment Groups.

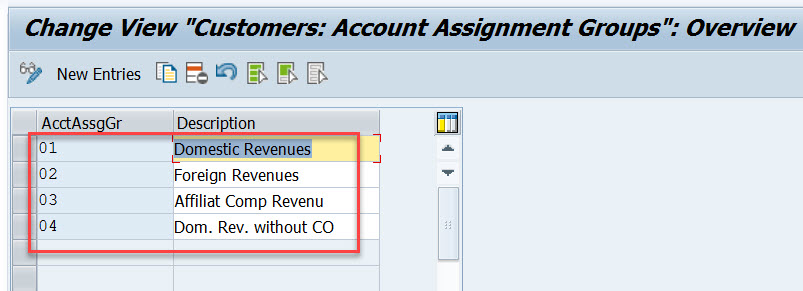

Here Material account assignment group is created which is assigned to the material master when created in Tx- MM01

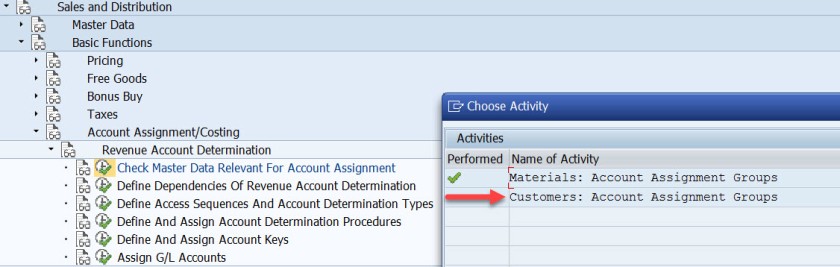

Select second option- Customer : Account Assignment Groups.

Here Cusomter account assignment group is created which is assigned to the customer master when created in Tx- XD01

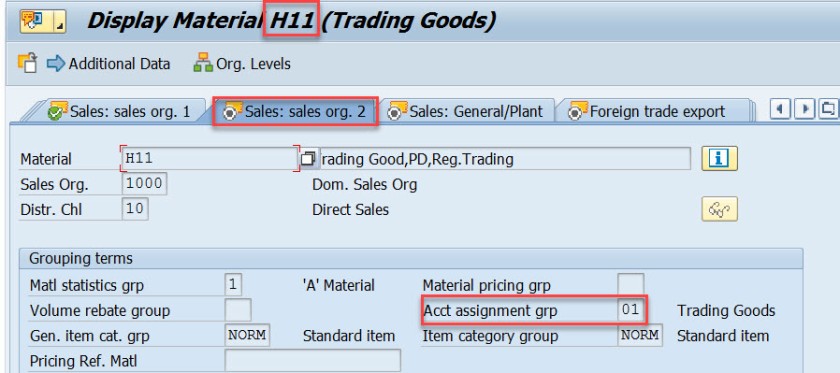

For our used material in sales order- H11, open this material in Tx- MM03 and in the Sales: sales org.2 tab, the material account assignment group is assigned to the material.

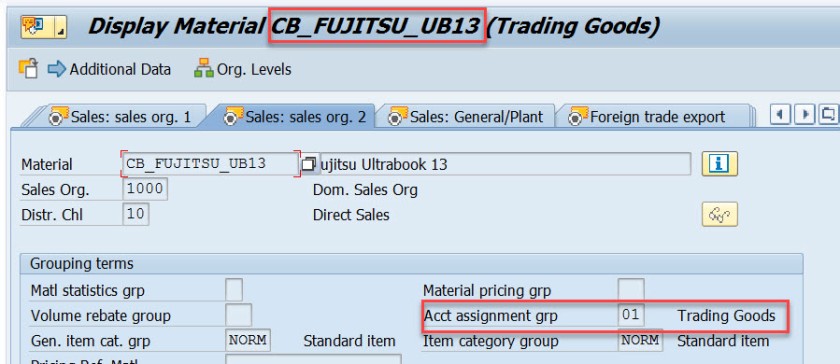

Similarly for another material used in sales order, it is assigned to the material account assignment group.

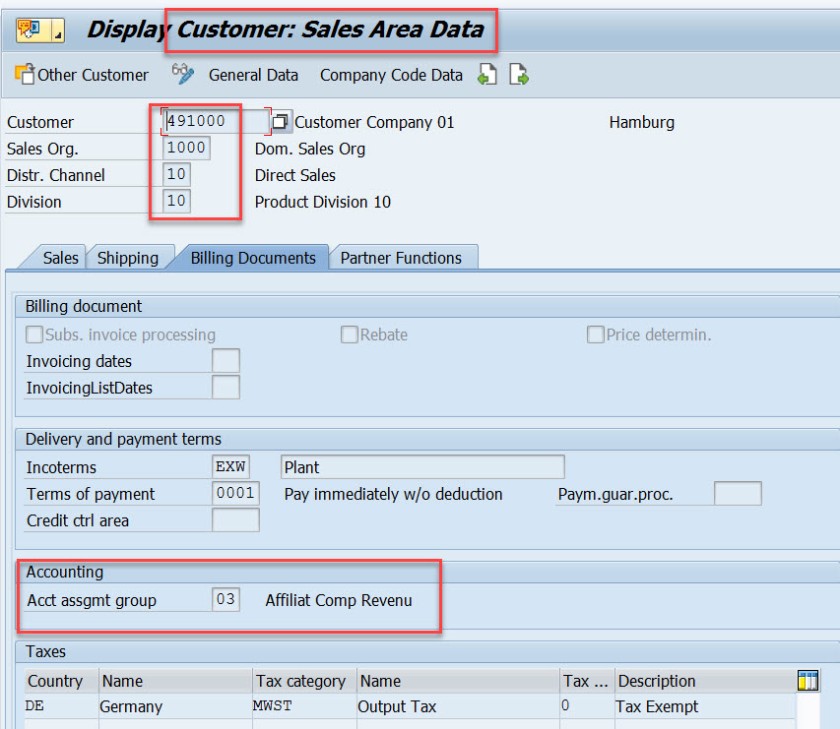

For our customer – 491000, open this customer in Tx- XD03 and go to the sales area data & in the billing document tab, customer account assignment group is assigned to the customer.

This customer and material account assignment group will help to determine the GL account.

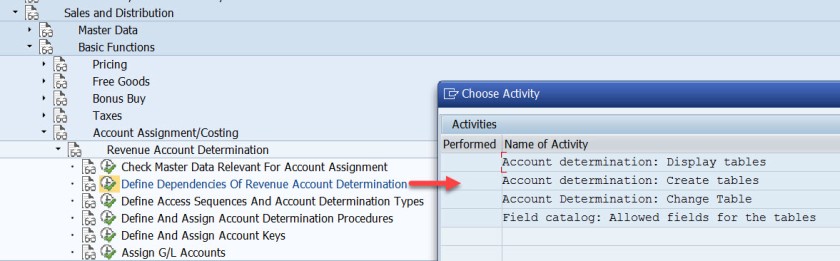

GL account determination uses the condition technique. Now the next step is to define the condition tables. So choose option- Define Dependencies of Revenue Account Determination. If you want to create new tables you can choose Create Table option. For this demo we are leaving this as already we have few condition tables.

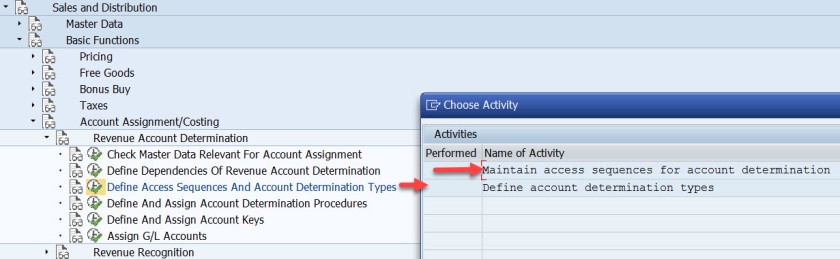

Next is defining the access sequence and the condition type. So choose the highlighted opton.

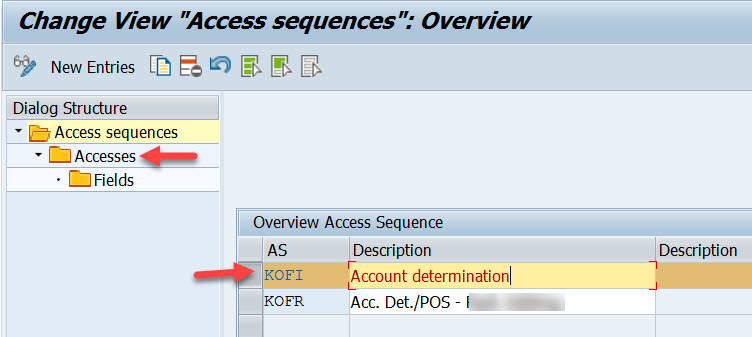

Access Sequence is defined as – KOFI( a new access sequence can be created bu New Entries button ). Select the access sequence and choose Accesses from left hand section to see all the access lines with condition table.

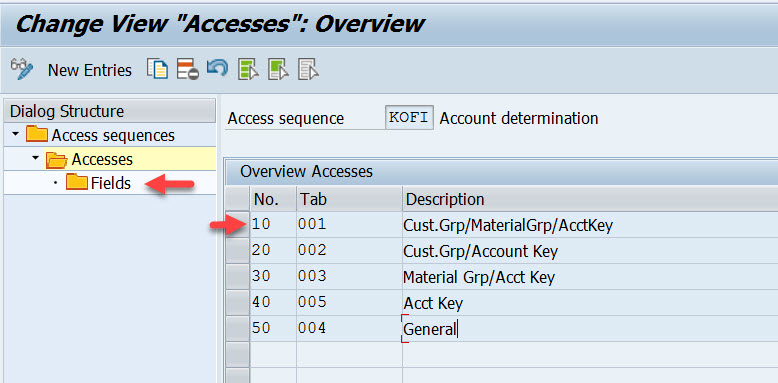

Well this access sequence KOFI has five access line each refers to one condition table.

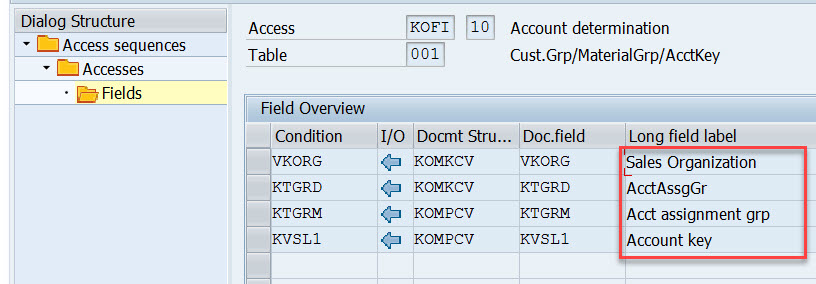

Select one access line and choose Fields button to see all the fields included in the condition table to form the access line 10.

Access line-10 with condition table 001 has 4 fields.

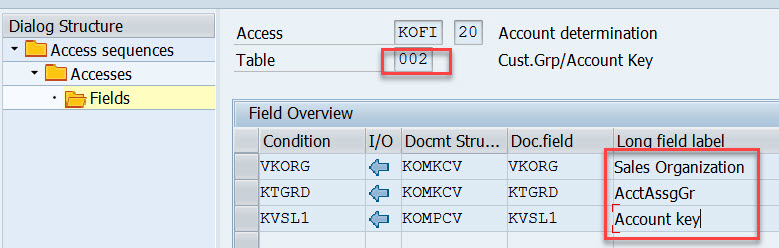

Similarly for other access lines with condition tables other fields are there.

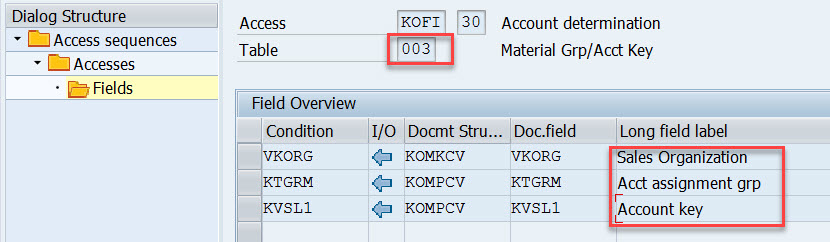

For access line 30.

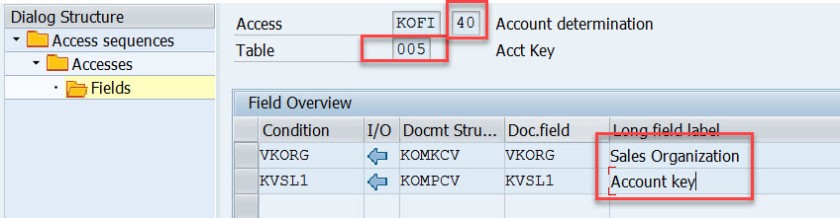

For access line 40.

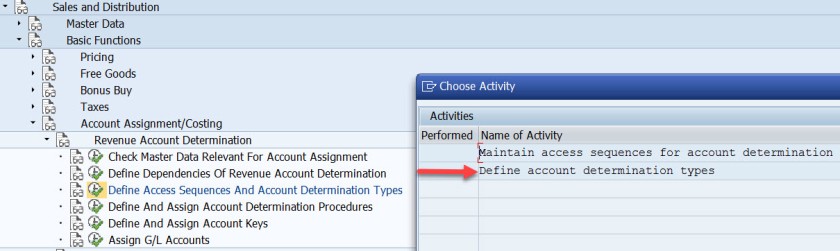

Choose Define Account Determination type.

Here Condition type- KOFI is created which is assigned to the access sequence KOFI which has 5 access lines with different condition tables.

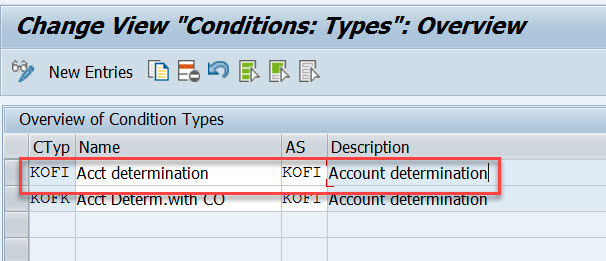

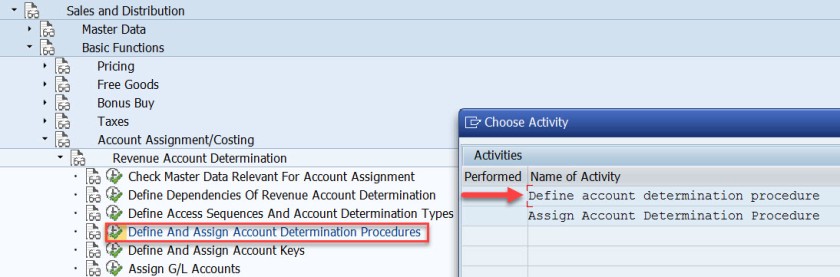

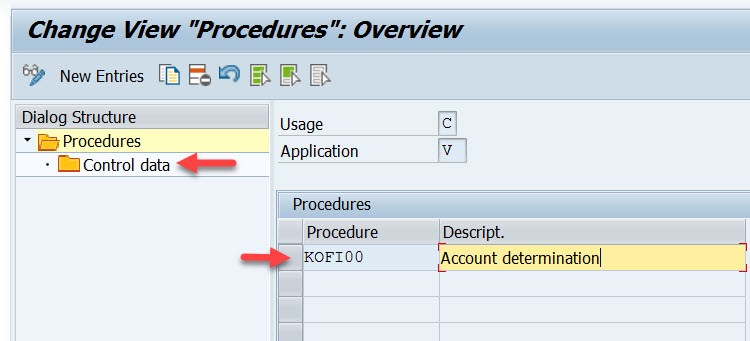

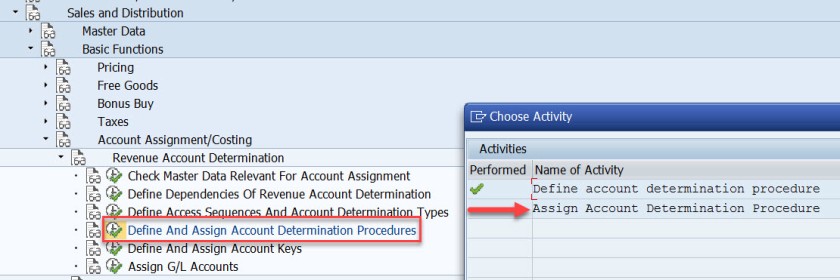

Choose the option as pointed to create account determination procedure.

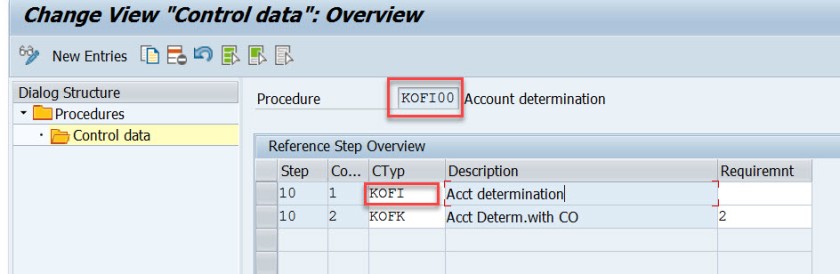

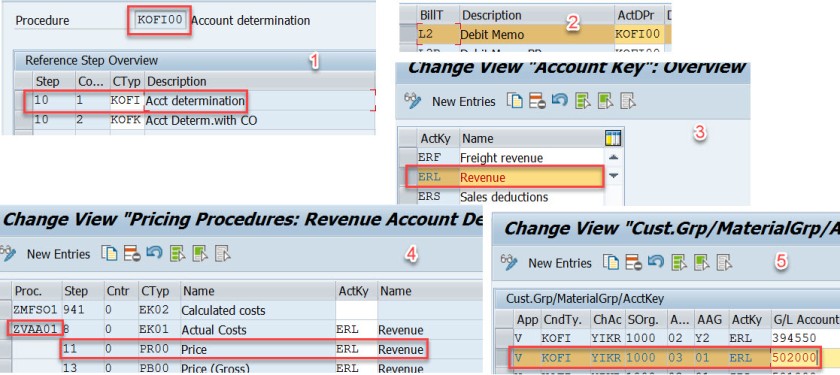

Procedure KOFI00 is created and assigned to the account condition types. Choose the procedure and select Control data from left side.

Here the account determination procedure is assigned to the condition type.

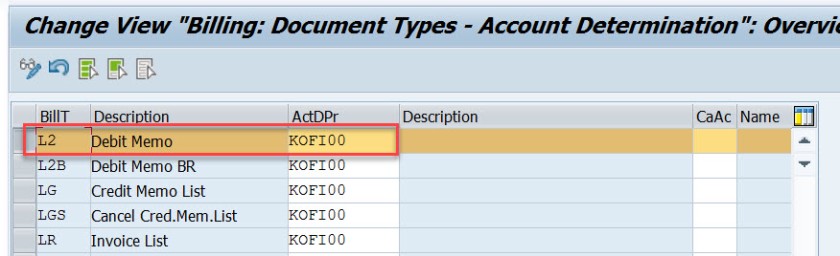

Choose the option – Assign account determination procedure.

Here the account determination procedure is assigned to the billing type.

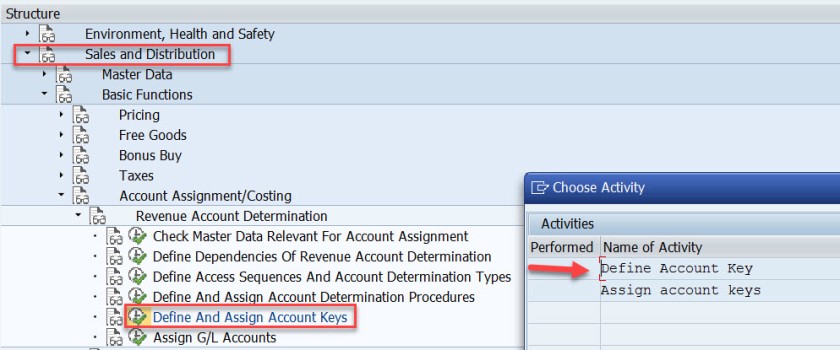

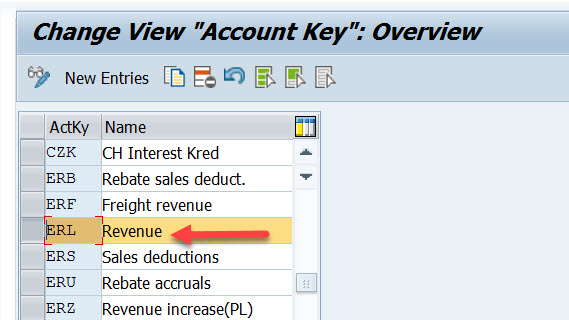

Next step is to define account key. Choose the marked option.

For different types like revenue, tax and other different account keys are defined. For revenue its ERL.

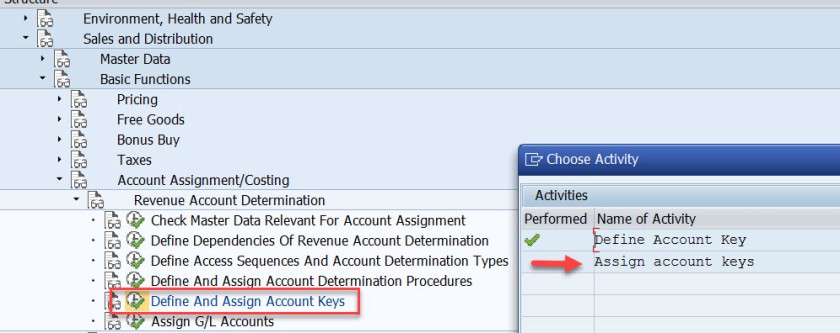

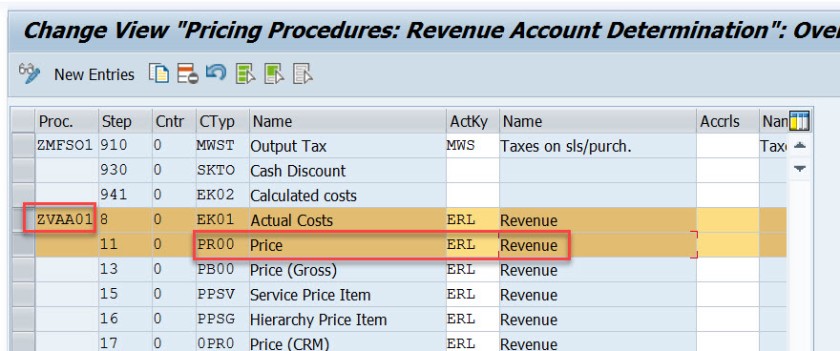

Next step is to assign the account key to the pricing procedure – condition type PR00.

Here for the pricing procedure ZVAA01 and condition type PR00, the account key is assigned as ERL.

In the above created sales order, item we can check the pricing procedure as below bu selecting the Analysis button in the conditions tab of the item detailed screen.

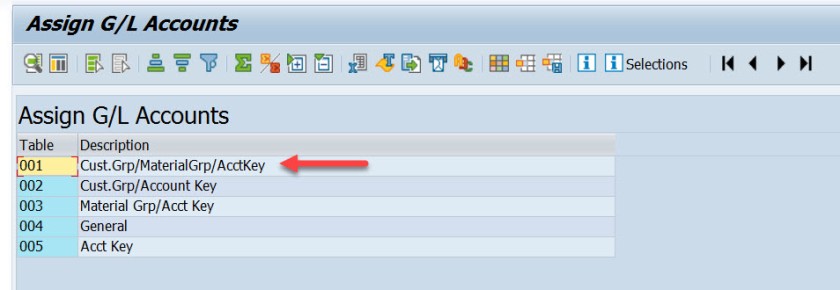

Next time is to assign the G/L account. Choose the marked option.

Here we have five options. as account condition type KOFI of the account determination procedure KOFI00 is assigned to the access sequence – KOFI with five access lines.

This is like maintaining the condition records. During the GL account determination process, it checks to find the GL account by taking all the values from the billing document and checking against the condition records for table 001. If found it calculated the G/L account and if not found then checks for the condition records for the second table and so on upto 005 until it finds a G/L account.

Choose/double click on the first line.

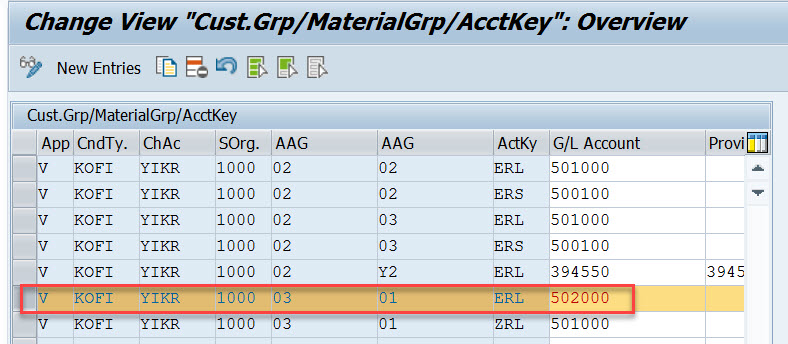

Here we have maintained for V-Sales, KOFI- account condition type, YIKR as the chart of account and other four fields like sales org, customer account group, material account group and account key comes from the condition table, for our demo purpose we have assigned the G/L account as- 502000.

( Before assigning to the G/L account here it should be created first).

For our demo

- From Billing Type L2 it derives the account determination procedure as- KOFI00

- From account determination procedure- KOFI00 it find the account condition type as – KOFI

- During creation of billing its finds for the item, pricing procedure and the condition type as PR00

- Then it finds the account key for the pricing procedure with condition type PR00 as ERL

- The customer account assignment group is – 03

- The material account assignment group is – 01

- The chart of account as- YIKR fot the company code- 1000

- By taking all these values, the G/l account number calculated as – 502000

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

12 comments

Very well explained

Can you please explain me how to assign different GL account while creating accounting document? What changes do I have to make?

is there any way to do a mass analysis on how account assignment has been done over a period of time? ie which tables were used with with criteria? We want tot clean up the SD account assigment tables which currently have over 100.000 entries and are not manageble anymore.

It’s truly a nice and useful piece of info. I’m happy that you shared this useful info with us. Please keep us up to date like this. Thank you for sharing.

Hi. I have an inquiry regarding the classification of ERL account group. In my current company, there are two GL accounts which are currently tagged to ERL (Revenue) – one is cash and another is VAT adjustment (based on their description). My question is, are those two accounts valid to be determined under ERL? If so, what is the impact if this matter is unresolved? Hope someone can take up and provide me a good input. Many thanks in advance.

this is how the fucking a document must be. excellent!

Thank you so much, detail explanation. Appreciate the hard work

Could you add little detail on ” how does the pricing procedure ZVAA01 and condition type PR00 linked/determined for an item”

Pricing procedure is not determined on the item level. Pricing Procedure is determined on the header level. In tx- OVKK , the determination of pricing procedure customizing are maintained. The sales area, document pricing procedure and the customer pricing procedure determines the pricing procedure. When an order is created we know the sales area(sales org, dist channel and division), the document pricing procedure derived from the document type and from the sold-to-party (customer) the customer pricing procedure is derived. With all these information, Pricing procedure is derived.

The pricing procedure contains condition types like PR00 and others. In Tx- VK11/VK12/Vk13 we can maintain pricing condition records against each condition types. When we enter a material in an item, from the already determined pricing procedure it gets the condition types and tries to find the pricing condition record for the material. This is how the price is found for that item condition type.

Hope this helps!

Like Liked by 1 person

Thanks to you Siva and Manish, I am not in to SD but was trying to have extended understanding between FI-SD integration and found your tutorial, its really help full. I was going through with the tutorial and played your videos as well in you tube. It helps me to understand the process and bridge the gaps from SD side. Really appreciate your effort on preparing and sharing the knowledge

Thanks for the details .suggest reading the note on account-determination helpful things are described there

execellent..well done..thank you

Leave a Reply Cancel reply

- Already have a WordPress.com account? Log in now.

- Subscribe Subscribed

- Copy shortlink

- Report this content

- View post in Reader

- Manage subscriptions

- Collapse this bar

- What is SAP MM?

- SAP MM Training Tutorials for Beginners

- SAP Master Data

- SAP MM Valuation Class

- SAP MM Tree Menu

- SAP MM Split Valuation

- What is MRP in SAP MM

- SAP Reverse Material document

- SAP MM Process Flow

- SAP MM Movement Types

- SAP Vendor List

- Delete Material in SAP

- SAP MM Release Strategy

- SAP MM Accounting Entries

- SAP MM Pricing Procedure

- SAP MM Transaction Codes

- SAP MM Certification Cost in India

- SAP MM Consultant Salary & Job Profile

- SAP MM Interview Questions

Valuation Class and How to Link it with GL Account

Updated May 17, 2023

What is Valuation Class?

SAP Valuation classes are used to assign different valuation methods to different material types or groups of materials. A valuation class determines how the system values materials during inventory management and accounting processes.

How Does Valuation Class Work in SAP?

Here's how valuation classes work in SAP:

Definition: A valuation class represents a grouping of materials that have similar characteristics for valuation purposes. It is a key organizational element that helps in defining the rules for valuing materials in SAP.

Material Master: Each material in SAP is assigned to a valuation class in its material master record. The valuation class determines which valuation method and account determination will be used for the material.

Valuation Methods: SAP provides various valuation methods, such as standard price, moving average price, and FIFO (First-In, First-Out). The valuation class determines which valuation method will be used for materials assigned to that class.

Account Determination: Valuation classes are also used to determine the general ledger (GL) accounts for inventory postings. Different valuation classes can be mapped to different GL accounts based on the material valuation method.

Configuring Valuation Classes: Valuation classes are configured in SAP through the customizing settings. The configuration involves defining the valuation classes, assigning valuation methods to each class, and specifying the GL accounts for inventory postings.

Use in Transactions: Valuation classes come into play during various inventory management and accounting transactions. For example, when goods are received or issued, the valuation class determines how the material's value is updated. Similarly, during goods movements, inventory valuation is based on the valuation class and assigned valuation method.

Use Valuation Classes

Valuation classes in SAP are primarily used for the following purposes:

Material Valuation: Valuation classes determine the valuation method used for material. For example, you can assign a valuation class to a material that uses the standard price valuation method, while another valuation class may use the moving average price method. This allows for different materials to be valued differently based on their characteristics.

Account Determination: Valuation classes play a crucial role in determining the general ledger (GL) accounts used for inventory postings. When goods are received or issued, the valuation class associated with the material determines the GL accounts to which the value of the inventory is posted.

Price Control: Valuation classes help control how prices are updated for materials. For materials with a moving average price, the valuation class determines whether the price is updated after each goods receipt or based on periodic price calculations. For materials with a standard price, the valuation class specifies a fixed price for the material.

Reporting and Analysis: Valuation classes provide a way to group materials with similar valuation characteristics. This grouping can be helpful in reporting and analyzing inventory values, costs, and variances. You can generate reports and perform analysis based on valuation classes to gain insights into inventory valuation and profitability.

Material Type or Group Specifics: Valuation classes can be assigned to specific material types or groups to ensure consistent valuation across similar materials. For example, you can assign a valuation class to a group of raw materials, finished goods, or spare parts to maintain consistent valuation methods and GL accounts within each group.

How to link Valuation Class with a GL account?

Please follow the steps below to link the valuation class with the gl account:

- Execute transaction code OB41 in the SAP Command field

- Next, select the Valuation Class that you want to link with a GL account.

- Now click on the Account Assignment button.

- Select the G/L Account option

- Next, click on the New Entries button.

- Now enter the company code, chart of accounts, and GL account number that you want to link with the Valuation Class.

- Click on the Save button to save your changes.

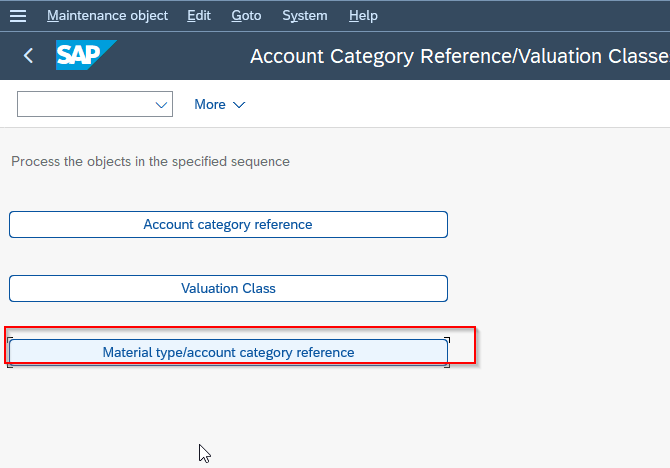

How to Define Valuation Class?

Please follow the steps below to define the valuation class:

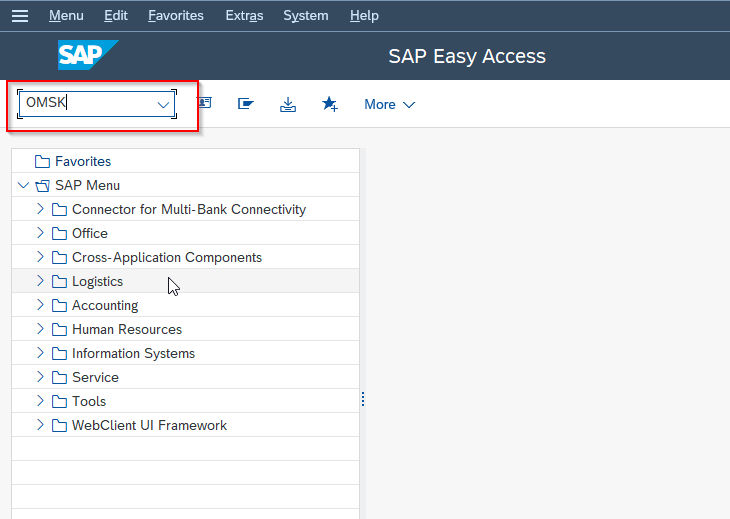

Execute transaction code OMSK in the SAP Command field

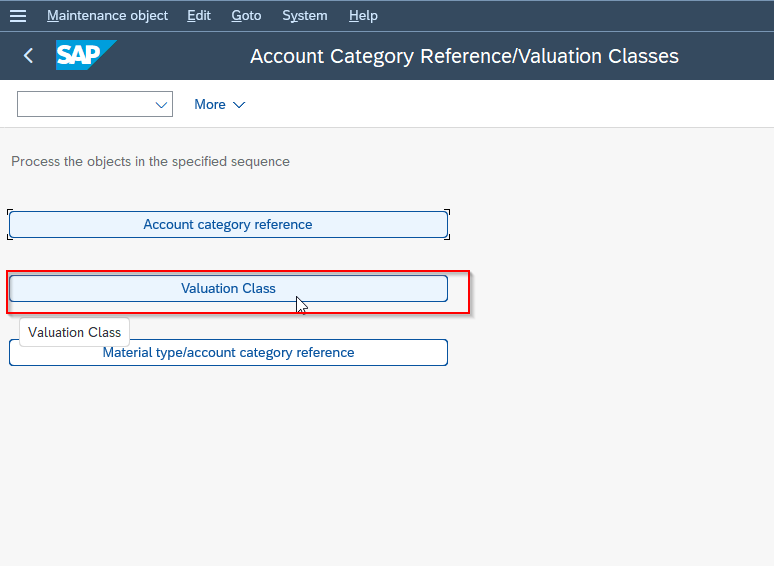

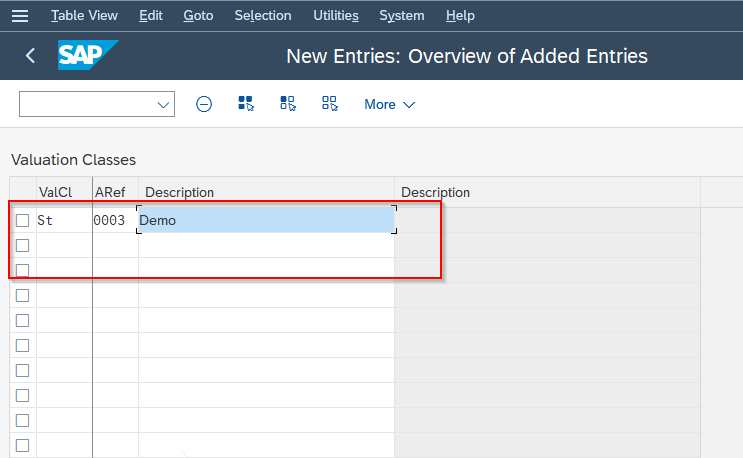

On the next screen click on the Valuation Class option

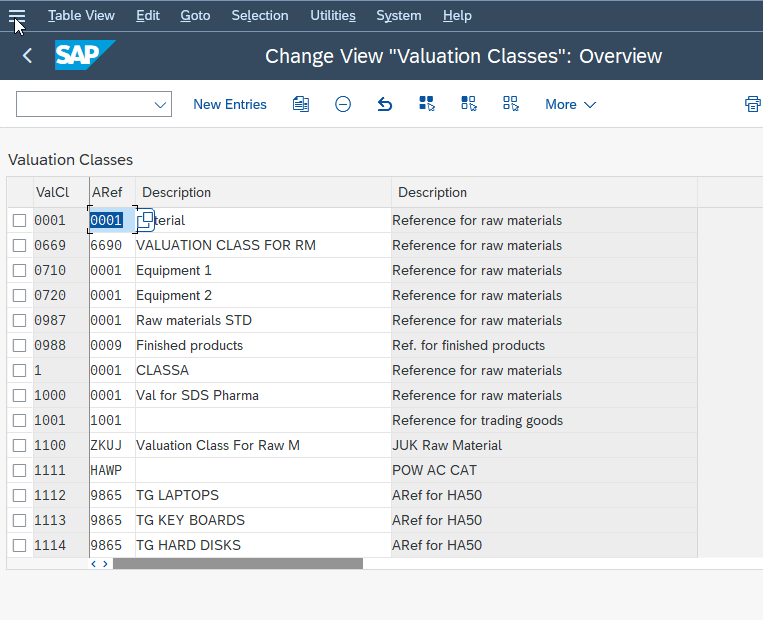

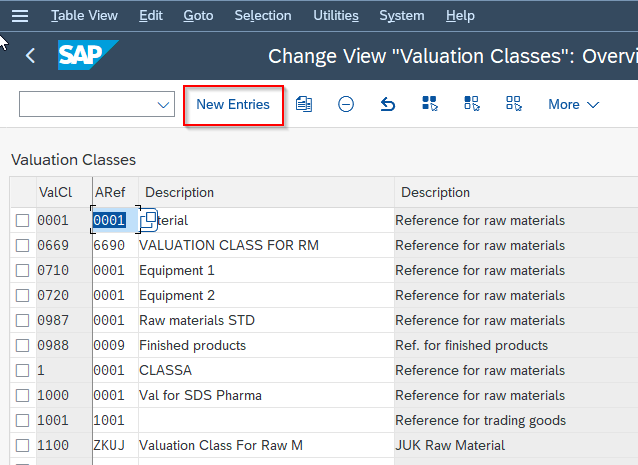

Next on Change View "Valuation Classes": Overview screen you will see the list of previously defined valuation classes.

Click on the New Entries button to create a new valuation class.

Next, enter all the details for the new valuation classes as shown in the image below:

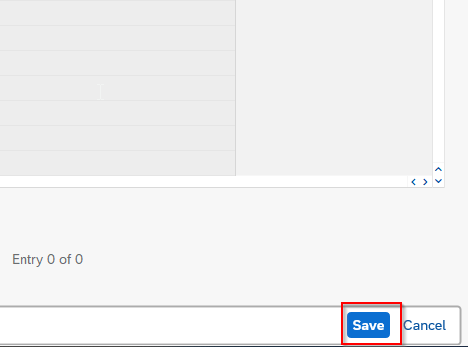

Now click the Save button to save the new details

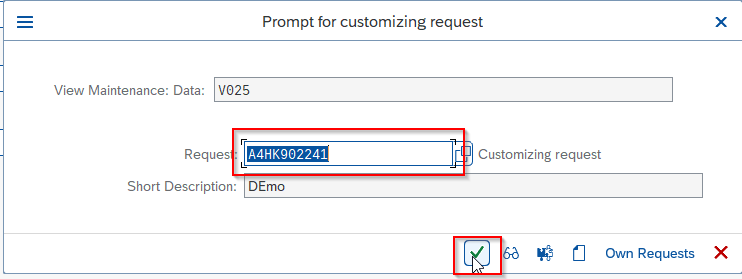

Now choose your Customization request number and press Enter button to proceed.

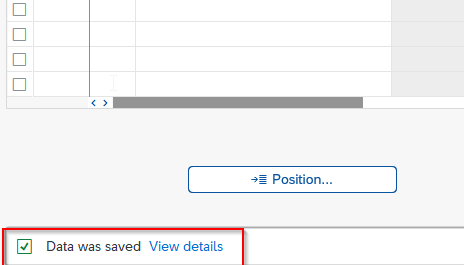

A message Data was saved will be displayed on your screen meaning all the configurations have been saved.

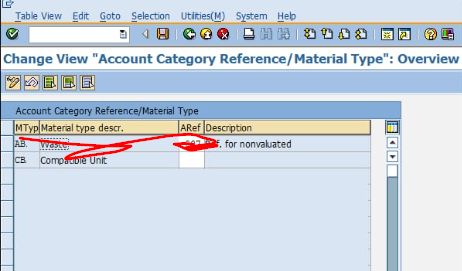

Next, go back and click the Material Type/Account Category Reference option.

Here the user map material type with ARef (Account reference) . G/L accounts can now be posted for different material types.

You group together different materials with similar properties into valuation classes so that you do not have to manage a separate stock account for every material.

The following table contains examples of possible valuation classes:

- Valuation class Description

- 3001 Colors

- 3002 Paints

- 3030 Operating supplies

- 3100 Trading goods

Which valuation class a material can be assigned to depends on the material type. You can define the following assignments in Customizing:

- All materials with the same material type are assigned to just one valuation class.

- Different materials with the same material type are assigned to different valuation classes.

- Materials with different material types are assigned to a single valuation class.

A material is assigned to a valuation class in the material master record. The system checks whether the material type allows the material to be assigned to the valuation class specified.

The system refers to the valuation class of a material to determine which stock account to post to when a posting is made for this material.

1. In the accounting view of Material Master (Material master has various views eg., Basic views, Purchasing views, Production, Sales and Distribution , Accounting and Controlling views) amongst other values we have a Valuation Class field. This Valuation class is the vital link which ensures that Accounting documents are posted automatically. Every material will have a valuation class field. Examples of Valuation Class might be Finished Goods, Raw Materials etc.

2. The combination of this Valuation Class and the Movement Type helps in determining the Gl accounts. GL accounts are automatically updated with this combination with the help of transaction key for the GL code available using the transaction code OBYC.

Material movements in MM happen with respect to a Movement Type. Examples of Movement Type could be the following:

- Goods receipt - movement type 101

- Goods issue to production order/consumption - movement type 261

- Goods delivered to the customer - movement type 601

How can we change Valuation class?

Ans: First, go to mm02 -> Account view-1 and change the valuation class

- 30 Jun 2010 7:35 am rekha Hi, Thanks for logical part of the MM FI integration. Could you further elaborate which T. Code is used for customizing the assignments mentioned by you? Regards,

- 30 Jun 2010 9:55 am rekha User transaction code OBYC, there use the appropriate trasaction keys and assign the GL Code to hope it helps let me know if not, Kind regard s

- 08 Jul 2010 10:30 am rekha Hi Could you further elaborate which T. Code is used for customizing the assignments mentioned by you?

Defining General Ledger (G/L) Accounts and Cost Elements

After completing this lesson, you will be able to define a G/L account .

Chart of Account

Each G/L is set up according to a chart of accounts. The chart of accounts contains the definitions of all G/L accounts. The definitions consist of the account number, the account name, and the type of G/L account (e.g. balance sheet, non operating expenses/revenues, primary costs/revenues, secondary costs or cash accounts).

Assignment of Company Codes to Chart of Accounts

A chart of accounts can be used by multiple company codes so that the general ledgers of these company codes have an identical structure.

General Ledger Account and Cost Element

The two segments of the G/L master record from a Financial Accounting perspective are as follows:

The chart of accounts segment contains a description of the account, the account type that classifies how the account can be used in FI and/or CO and, the account group that controls the company code segment fields, and the consolidation account number.

The company code segment contains values specific to how the company code will manage that account.

Account Groups

Accounts with the same account group normally have similar business functions. You can, for example, have an account group for:

Cash accounts

Expense accounts

Revenue accounts

Other balance sheet accounts

The account groups are assigned number ranges. You can control which account numbers are permissible for cash accounts, expense accounts, and so on, through the number ranges.

Account groups also control the appearance of the company code segment of G/L accounts. Account groups control:

The fields that are required for data entry

The fields that are optional for data entry

The fields that are display only.

The fields that do not show up at all in the company code segment

Reconciliation Accounts

Expenditures versus costs.

In the economical theory, there are two approaches for values:

In the first approach, the values in Financial Accounting and Management Accounting are the same:

Controlling provides additional reporting opportunities by separating the FI documents along additional characteristics, such as segments, profit centers, projects, stored in a coding block. The results may be P&L statements and balance sheets per segment, per profit center or per project.

In the second approach (most used in central Europe), Management Accounting is based on cost and revenues. Costs are only those expenditures, which are as follows:

Related to the business of the company

Exactly assigned to periods (source specific)

For example, a gift to a welfare organization is an expenditure, but not a cost, because it is not the business of the company to make gifts.

Expenditures, which do not meet the definition of costs, are only reflected in Financials, and not in Management Accounting. They are called neutral expenditures.

SAP provides the opportunity to realize each of the theories. In SAP S/4HANA revenues, expenditures, and cost are represented by financial accounts and separated by the Account Type of the accounts. Based on the account type, the accounts used in CO are also called cost elements.

Account Types

The controlling area-specific data is only needed for Secondary Costs and Primary Costs or Revenue accounts. In the controlling area-specific data, you assign a Cost Element category. This category determines which account can be used for which business transaction in CO.

Create a Primary Cost Account

Log in to track your progress & complete quizzes

/support/notes/service/sap_logo.png)

2828996 - How to determine GL account using Material Group?

- How to assign Material Group to Valuation Class?

- How to determine GL account for "free-text based item" without material master record in Purchase Order?

Environment

- Sourcing & Procurement

- SAP S/4HANA Cloud Public Edition All Versions

- SAP Fiori

S4_PC, SAP S/4HANA Cloud Public Edition, MM-SRV-ACC, MM-PUR-GF-ACC, procurement, Sourcing and Procurement, 102665, 101602, material group, valuation class, free text based item, no material master , KBA , MM-PUR-GF-ACC , Account assignment , MM-SRV-ACC , Account Assignment , How To

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

COMMENTS

Use. You can assign one or more account assignments to an item. Multiple account assignment allows you to apportion the costs covered by a purchase order partly to your own cost center and partly to others, for example. You specify which account assignment object is to be charged via the account assignment category. Account Assignment Category.

G/L account assignments for the charts of accounts INT and the valuation grouping code 0001 are SAP standard. Activities. 1. Create account keys for each chart of accounts and each valuation grouping code for the individual posting transactions. To do so, proceed as follows: a) Call up the activity.

Instead a Material Group is assigned to a Valuation Class using SSCUI 102424. Keywords New material groups, Define Material Groups, G/L account, S/4hana cloud, LO-MD-MM , KBA , LO-MD-MM , Material Master , How To

G/L Account Determination in SAP SD Most of the transactions in SAP are recorded against the GL account. During creation of billing document form a sales order , an accounting document is created where material value is posted against a G/L account. ... Here Material account assignment group is created which is assigned to the material master ...

Note the following rules for account assignments: You need to specify a true Controlling object in each posting item. You cannot assign to a object such as a statistical project without specifying a true Controlling object. In each posting item, you can specify up to three statistical Controlling objects in addition to the true Controlling object.

Please follow the steps below to link the valuation class with the gl account: Execute transaction code OB41 in the SAP Command field. Next, select the Valuation Class that you want to link with a GL account. Now click on the Account Assignment button. Select the G/L Account option.

Chart of Account. Each G/L is set up according to a chart of accounts. The chart of accounts contains the definitions of all G/L accounts. The definitions consist of the account number, the account name, and the type of G/L account (e.g. balance sheet, non operating expenses/revenues, primary costs/revenues, secondary costs or cash accounts).

Symptom. You create a purchase order with account assignment using transaction ME21N. You enter a material group, from which a G/L account is determined using the valuation class. If you then switch to a material group that does not determine a G/L account via the valuation class, the system deletes the previous G/L account and prompts you to ...

In the General Ledger work center go to the Companies view. Select Company XYZ and press Actions - Set Defaults for G/L Accounts (XYZ represents the Company ID). In the activity,make a default assignment for G/L Account ABC, for example Free Cost Object ID DEF (ABC represents the G/L Account ID, DEF represents the Free Cost Object ID).

In transaction FS00, while creating a balance sheet G/L account to be used as an inventory account for Material Management, the checkbox "Apply Acct Assignments Statistically ..." is not available. You have checked the steps outlined in KBA 2274763 .

Symptom. You are creating a Purchase Requisition or Purchase Order with a non-valuated material (which has no Accounting view in the material master). You expect that a GL account is determined by the system - similarly to free text items - based on the valuation class assigned to the material group in table T023 (transaction OMQW).

How to determine GL account for "free-text based item" without material master record in Purchase Order? SAP Knowledge Base Article - Preview ... free text based item, no material master , KBA , MM-PUR-GF-ACC , Account assignment , MM-SRV-ACC , Account Assignment , How To . About this page This is a preview of a SAP Knowledge Base Article.