Small Business Trends

How to create a business plan: examples & free template.

This is the ultimate guide to creating a comprehensive and effective plan to start a business . In today’s dynamic business landscape, having a well-crafted business plan is an important first step to securing funding, attracting partners, and navigating the challenges of entrepreneurship.

This guide has been designed to help you create a winning plan that stands out in the ever-evolving marketplace. U sing real-world examples and a free downloadable template, it will walk you through each step of the process.

Whether you’re a seasoned entrepreneur or launching your very first startup, the guide will give you the insights, tools, and confidence you need to create a solid foundation for your business.

Table of Contents

How to Write a Business Plan

Embarking on the journey of creating a successful business requires a solid foundation, and a well-crafted business plan is the cornerstone. Here is the process of writing a comprehensive business plan and the main parts of a winning business plan . From setting objectives to conducting market research, this guide will have everything you need.

Executive Summary

The Executive Summary serves as the gateway to your business plan, offering a snapshot of your venture’s core aspects. This section should captivate and inform, succinctly summarizing the essence of your plan.

It’s crucial to include a clear mission statement, a brief description of your primary products or services, an overview of your target market, and key financial projections or achievements.

Think of it as an elevator pitch in written form: it should be compelling enough to engage potential investors or stakeholders and provide them with a clear understanding of what your business is about, its goals, and why it’s a promising investment.

Example: EcoTech is a technology company specializing in eco-friendly and sustainable products designed to reduce energy consumption and minimize waste. Our mission is to create innovative solutions that contribute to a cleaner, greener environment.

Our target market includes environmentally conscious consumers and businesses seeking to reduce their carbon footprint. We project a 200% increase in revenue within the first three years of operation.

Overview and Business Objectives

In the Overview and Business Objectives section, outline your business’s core goals and the strategic approaches you plan to use to achieve them. This section should set forth clear, specific objectives that are attainable and time-bound, providing a roadmap for your business’s growth and success.

It’s important to detail how these objectives align with your company’s overall mission and vision. Discuss the milestones you aim to achieve and the timeframe you’ve set for these accomplishments.

This part of the plan demonstrates to investors and stakeholders your vision for growth and the practical steps you’ll take to get there.

Example: EcoTech’s primary objective is to become a market leader in sustainable technology products within the next five years. Our key objectives include:

- Introducing three new products within the first two years of operation.

- Achieving annual revenue growth of 30%.

- Expanding our customer base to over 10,000 clients by the end of the third year.

Company Description

The Company Description section is your opportunity to delve into the details of your business. Provide a comprehensive overview that includes your company’s history, its mission statement, and its vision for the future.

Highlight your unique selling proposition (USP) – what makes your business stand out in the market. Explain the problems your company solves and how it benefits your customers.

Include information about the company’s founders, their expertise, and why they are suited to lead the business to success. This section should paint a vivid picture of your business, its values, and its place in the industry.

Example: EcoTech is committed to developing cutting-edge sustainable technology products that benefit both the environment and our customers. Our unique combination of innovative solutions and eco-friendly design sets us apart from the competition. We envision a future where technology and sustainability go hand in hand, leading to a greener planet.

Define Your Target Market

Defining Your Target Market is critical for tailoring your business strategy effectively. This section should describe your ideal customer base in detail, including demographic information (such as age, gender, income level, and location) and psychographic data (like interests, values, and lifestyle).

Elucidate on the specific needs or pain points of your target audience and how your product or service addresses these. This information will help you know your target market and develop targeted marketing strategies.

Example: Our target market comprises environmentally conscious consumers and businesses looking for innovative solutions to reduce their carbon footprint. Our ideal customers are those who prioritize sustainability and are willing to invest in eco-friendly products.

Market Analysis

The Market Analysis section requires thorough research and a keen understanding of the industry. It involves examining the current trends within your industry, understanding the needs and preferences of your customers, and analyzing the strengths and weaknesses of your competitors.

This analysis will enable you to spot market opportunities and anticipate potential challenges. Include data and statistics to back up your claims, and use graphs or charts to illustrate market trends.

This section should demonstrate that you have a deep understanding of the market in which you operate and that your business is well-positioned to capitalize on its opportunities.

Example: The market for eco-friendly technology products has experienced significant growth in recent years, with an estimated annual growth rate of 10%. As consumers become increasingly aware of environmental issues, the demand for sustainable solutions continues to rise.

Our research indicates a gap in the market for high-quality, innovative eco-friendly technology products that cater to both individual and business clients.

SWOT Analysis

A SWOT analysis in your business plan offers a comprehensive examination of your company’s internal and external factors. By assessing Strengths, you showcase what your business does best and where your capabilities lie.

Weaknesses involve an honest introspection of areas where your business may be lacking or could improve. Opportunities can be external factors that your business could capitalize on, such as market gaps or emerging trends.

Threats include external challenges your business may face, like competition or market changes. This analysis is crucial for strategic planning, as it helps in recognizing and leveraging your strengths, addressing weaknesses, seizing opportunities, and preparing for potential threats.

Including a SWOT analysis demonstrates to stakeholders that you have a balanced and realistic understanding of your business in its operational context.

- Innovative and eco-friendly product offerings.

- Strong commitment to sustainability and environmental responsibility.

- Skilled and experienced team with expertise in technology and sustainability.

Weaknesses:

- Limited brand recognition compared to established competitors.

- Reliance on third-party manufacturers for product development.

Opportunities:

- Growing consumer interest in sustainable products.

- Partnerships with environmentally-focused organizations and influencers.

- Expansion into international markets.

- Intense competition from established technology companies.

- Regulatory changes could impact the sustainable technology market.

Competitive Analysis

In this section, you’ll analyze your competitors in-depth, examining their products, services, market positioning, and pricing strategies. Understanding your competition allows you to identify gaps in the market and tailor your offerings to outperform them.

By conducting a thorough competitive analysis, you can gain insights into your competitors’ strengths and weaknesses, enabling you to develop strategies to differentiate your business and gain a competitive advantage in the marketplace.

Example: Key competitors include:

GreenTech: A well-known brand offering eco-friendly technology products, but with a narrower focus on energy-saving devices.

EarthSolutions: A direct competitor specializing in sustainable technology, but with a limited product range and higher prices.

By offering a diverse product portfolio, competitive pricing, and continuous innovation, we believe we can capture a significant share of the growing sustainable technology market.

Organization and Management Team

Provide an overview of your company’s organizational structure, including key roles and responsibilities. Introduce your management team, highlighting their expertise and experience to demonstrate that your team is capable of executing the business plan successfully.

Showcasing your team’s background, skills, and accomplishments instills confidence in investors and other stakeholders, proving that your business has the leadership and talent necessary to achieve its objectives and manage growth effectively.

Example: EcoTech’s organizational structure comprises the following key roles: CEO, CTO, CFO, Sales Director, Marketing Director, and R&D Manager. Our management team has extensive experience in technology, sustainability, and business development, ensuring that we are well-equipped to execute our business plan successfully.

Products and Services Offered

Describe the products or services your business offers, focusing on their unique features and benefits. Explain how your offerings solve customer pain points and why they will choose your products or services over the competition.

This section should emphasize the value you provide to customers, demonstrating that your business has a deep understanding of customer needs and is well-positioned to deliver innovative solutions that address those needs and set your company apart from competitors.

Example: EcoTech offers a range of eco-friendly technology products, including energy-efficient lighting solutions, solar chargers, and smart home devices that optimize energy usage. Our products are designed to help customers reduce energy consumption, minimize waste, and contribute to a cleaner environment.

Marketing and Sales Strategy

In this section, articulate your comprehensive strategy for reaching your target market and driving sales. Detail the specific marketing channels you plan to use, such as social media, email marketing, SEO, or traditional advertising.

Describe the nature of your advertising campaigns and promotional activities, explaining how they will capture the attention of your target audience and convey the value of your products or services. Outline your sales strategy, including your sales process, team structure, and sales targets.

Discuss how these marketing and sales efforts will work together to attract and retain customers, generate leads, and ultimately contribute to achieving your business’s revenue goals.

This section is critical to convey to investors and stakeholders that you have a well-thought-out approach to market your business effectively and drive sales growth.

Example: Our marketing strategy includes digital advertising, content marketing, social media promotion, and influencer partnerships. We will also attend trade shows and conferences to showcase our products and connect with potential clients. Our sales strategy involves both direct sales and partnerships with retail stores, as well as online sales through our website and e-commerce platforms.

Logistics and Operations Plan

The Logistics and Operations Plan is a critical component that outlines the inner workings of your business. It encompasses the management of your supply chain, detailing how you acquire raw materials and manage vendor relationships.

Inventory control is another crucial aspect, where you explain strategies for inventory management to ensure efficiency and reduce wastage. The section should also describe your production processes, emphasizing scalability and adaptability to meet changing market demands.

Quality control measures are essential to maintain product standards and customer satisfaction. This plan assures investors and stakeholders of your operational competency and readiness to meet business demands.

Highlighting your commitment to operational efficiency and customer satisfaction underlines your business’s capability to maintain smooth, effective operations even as it scales.

Example: EcoTech partners with reliable third-party manufacturers to produce our eco-friendly technology products. Our operations involve maintaining strong relationships with suppliers, ensuring quality control, and managing inventory.

We also prioritize efficient distribution through various channels, including online platforms and retail partners, to deliver products to our customers in a timely manner.

Financial Projections Plan

In the Financial Projections Plan, lay out a clear and realistic financial future for your business. This should include detailed projections for revenue, costs, and profitability over the next three to five years.

Ground these projections in solid assumptions based on your market analysis, industry benchmarks, and realistic growth scenarios. Break down revenue streams and include an analysis of the cost of goods sold, operating expenses, and potential investments.

This section should also discuss your break-even analysis, cash flow projections, and any assumptions about external funding requirements.

By presenting a thorough and data-backed financial forecast, you instill confidence in potential investors and lenders, showcasing your business’s potential for profitability and financial stability.

This forward-looking financial plan is crucial for demonstrating that you have a firm grasp of the financial nuances of your business and are prepared to manage its financial health effectively.

Example: Over the next three years, we expect to see significant growth in revenue, driven by new product launches and market expansion. Our financial projections include:

- Year 1: $1.5 million in revenue, with a net profit of $200,000.

- Year 2: $3 million in revenue, with a net profit of $500,000.

- Year 3: $4.5 million in revenue, with a net profit of $1 million.

These projections are based on realistic market analysis, growth rates, and product pricing.

Income Statement

The income statement , also known as the profit and loss statement, provides a summary of your company’s revenues and expenses over a specified period. It helps you track your business’s financial performance and identify trends, ensuring you stay on track to achieve your financial goals.

Regularly reviewing and analyzing your income statement allows you to monitor the health of your business, evaluate the effectiveness of your strategies, and make data-driven decisions to optimize profitability and growth.

Example: The income statement for EcoTech’s first year of operation is as follows:

- Revenue: $1,500,000

- Cost of Goods Sold: $800,000

- Gross Profit: $700,000

- Operating Expenses: $450,000

- Net Income: $250,000

This statement highlights our company’s profitability and overall financial health during the first year of operation.

Cash Flow Statement

A cash flow statement is a crucial part of a financial business plan that shows the inflows and outflows of cash within your business. It helps you monitor your company’s liquidity, ensuring you have enough cash on hand to cover operating expenses, pay debts, and invest in growth opportunities.

By including a cash flow statement in your business plan, you demonstrate your ability to manage your company’s finances effectively.

Example: The cash flow statement for EcoTech’s first year of operation is as follows:

Operating Activities:

- Depreciation: $10,000

- Changes in Working Capital: -$50,000

- Net Cash from Operating Activities: $210,000

Investing Activities:

- Capital Expenditures: -$100,000

- Net Cash from Investing Activities: -$100,000

Financing Activities:

- Proceeds from Loans: $150,000

- Loan Repayments: -$50,000

- Net Cash from Financing Activities: $100,000

- Net Increase in Cash: $210,000

This statement demonstrates EcoTech’s ability to generate positive cash flow from operations, maintain sufficient liquidity, and invest in growth opportunities.

Tips on Writing a Business Plan

1. Be clear and concise: Keep your language simple and straightforward. Avoid jargon and overly technical terms. A clear and concise business plan is easier for investors and stakeholders to understand and demonstrates your ability to communicate effectively.

2. Conduct thorough research: Before writing your business plan, gather as much information as possible about your industry, competitors, and target market. Use reliable sources and industry reports to inform your analysis and make data-driven decisions.

3. Set realistic goals: Your business plan should outline achievable objectives that are specific, measurable, attainable, relevant, and time-bound (SMART). Setting realistic goals demonstrates your understanding of the market and increases the likelihood of success.

4. Focus on your unique selling proposition (USP): Clearly articulate what sets your business apart from the competition. Emphasize your USP throughout your business plan to showcase your company’s value and potential for success.

5. Be flexible and adaptable: A business plan is a living document that should evolve as your business grows and changes. Be prepared to update and revise your plan as you gather new information and learn from your experiences.

6. Use visuals to enhance understanding: Include charts, graphs, and other visuals to help convey complex data and ideas. Visuals can make your business plan more engaging and easier to digest, especially for those who prefer visual learning.

7. Seek feedback from trusted sources: Share your business plan with mentors, industry experts, or colleagues and ask for their feedback. Their insights can help you identify areas for improvement and strengthen your plan before presenting it to potential investors or partners.

FREE Business Plan Template

To help you get started on your business plan, we have created a template that includes all the essential components discussed in the “How to Write a Business Plan” section. This easy-to-use template will guide you through each step of the process, ensuring you don’t miss any critical details.

The template is divided into the following sections:

- Mission statement

- Business Overview

- Key products or services

- Target market

- Financial highlights

- Company goals

- Strategies to achieve goals

- Measurable, time-bound objectives

- Company History

- Mission and vision

- Unique selling proposition

- Demographics

- Psychographics

- Pain points

- Industry trends

- Customer needs

- Competitor strengths and weaknesses

- Opportunities

- Competitor products and services

- Market positioning

- Pricing strategies

- Organizational structure

- Key roles and responsibilities

- Management team backgrounds

- Product or service features

- Competitive advantages

- Marketing channels

- Advertising campaigns

- Promotional activities

- Sales strategies

- Supply chain management

- Inventory control

- Production processes

- Quality control measures

- Projected revenue

- Assumptions

- Cash inflows

- Cash outflows

- Net cash flow

What is a Business Plan?

A business plan is a strategic document that outlines an organization’s goals, objectives, and the steps required to achieve them. It serves as a roadmap as you start a business , guiding the company’s direction and growth while identifying potential obstacles and opportunities.

Typically, a business plan covers areas such as market analysis, financial projections, marketing strategies, and organizational structure. It not only helps in securing funding from investors and lenders but also provides clarity and focus to the management team.

A well-crafted business plan is a very important part of your business startup checklist because it fosters informed decision-making and long-term success.

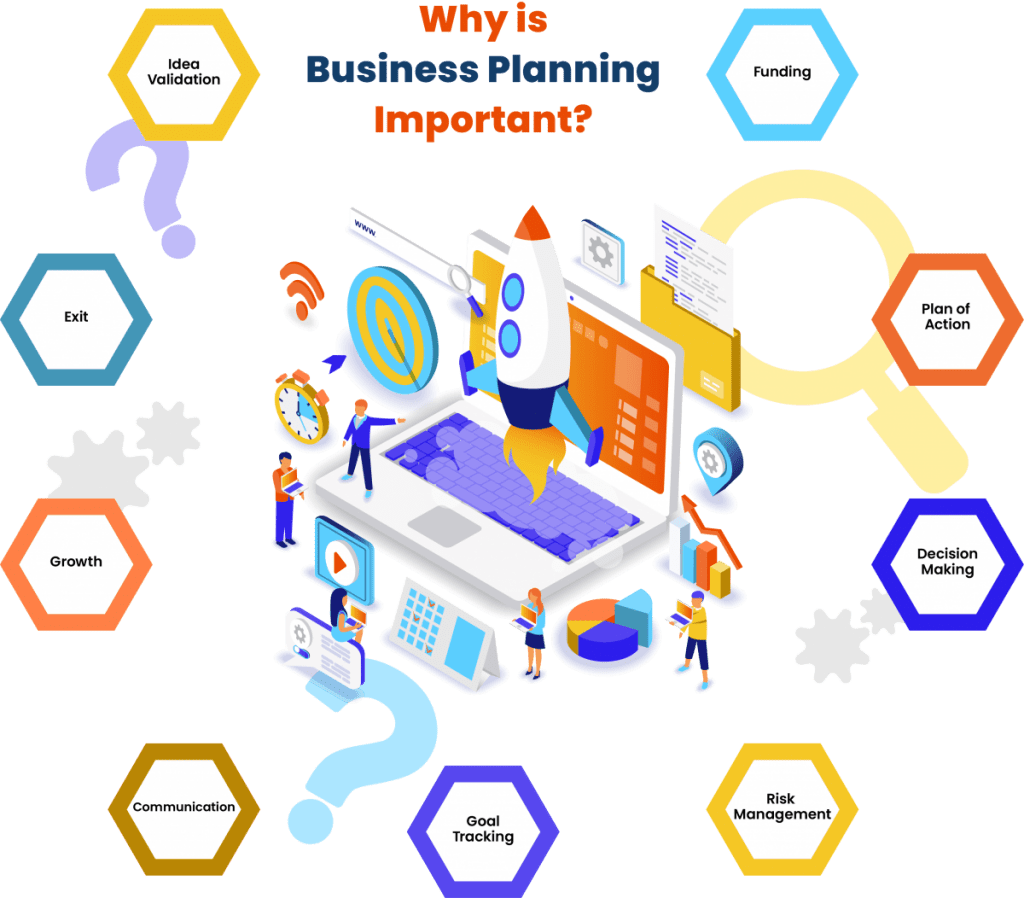

Why You Should Write a Business Plan

Understanding the importance of a business plan in today’s competitive environment is crucial for entrepreneurs and business owners. Here are five compelling reasons to write a business plan:

- Attract Investors and Secure Funding : A well-written business plan demonstrates your venture’s potential and profitability, making it easier to attract investors and secure the necessary funding for growth and development. It provides a detailed overview of your business model, target market, financial projections, and growth strategies, instilling confidence in potential investors and lenders that your company is a worthy investment.

- Clarify Business Objectives and Strategies : Crafting a business plan forces you to think critically about your goals and the strategies you’ll employ to achieve them, providing a clear roadmap for success. This process helps you refine your vision and prioritize the most critical objectives, ensuring that your efforts are focused on achieving the desired results.

- Identify Potential Risks and Opportunities : Analyzing the market, competition, and industry trends within your business plan helps identify potential risks and uncover untapped opportunities for growth and expansion. This insight enables you to develop proactive strategies to mitigate risks and capitalize on opportunities, positioning your business for long-term success.

- Improve Decision-Making : A business plan serves as a reference point so you can make informed decisions that align with your company’s overall objectives and long-term vision. By consistently referring to your plan and adjusting it as needed, you can ensure that your business remains on track and adapts to changes in the market, industry, or internal operations.

- Foster Team Alignment and Communication : A shared business plan helps ensure that all team members are on the same page, promoting clear communication, collaboration, and a unified approach to achieving the company’s goals. By involving your team in the planning process and regularly reviewing the plan together, you can foster a sense of ownership, commitment, and accountability that drives success.

What are the Different Types of Business Plans?

In today’s fast-paced business world, having a well-structured roadmap is more important than ever. A traditional business plan provides a comprehensive overview of your company’s goals and strategies, helping you make informed decisions and achieve long-term success. There are various types of business plans, each designed to suit different needs and purposes. Let’s explore the main types:

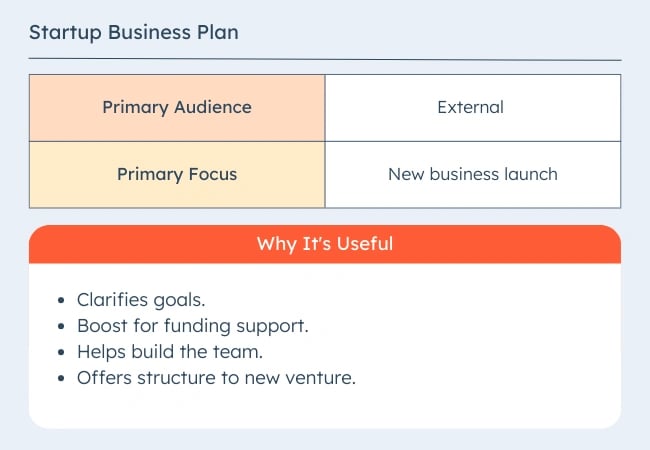

- Startup Business Plan: Tailored for new ventures, a startup business plan outlines the company’s mission, objectives, target market, competition, marketing strategies, and financial projections. It helps entrepreneurs clarify their vision, secure funding from investors, and create a roadmap for their business’s future. Additionally, this plan identifies potential challenges and opportunities, which are crucial for making informed decisions and adapting to changing market conditions.

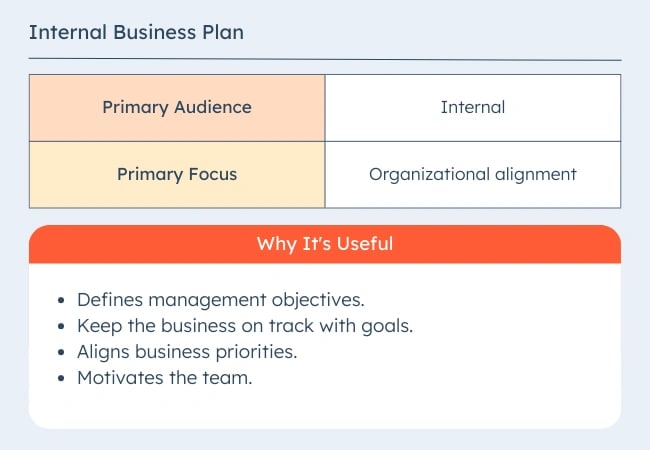

- Internal Business Plan: This type of plan is intended for internal use, focusing on strategies, milestones, deadlines, and resource allocation. It serves as a management tool for guiding the company’s growth, evaluating its progress, and ensuring that all departments are aligned with the overall vision. The internal business plan also helps identify areas of improvement, fosters collaboration among team members, and provides a reference point for measuring performance.

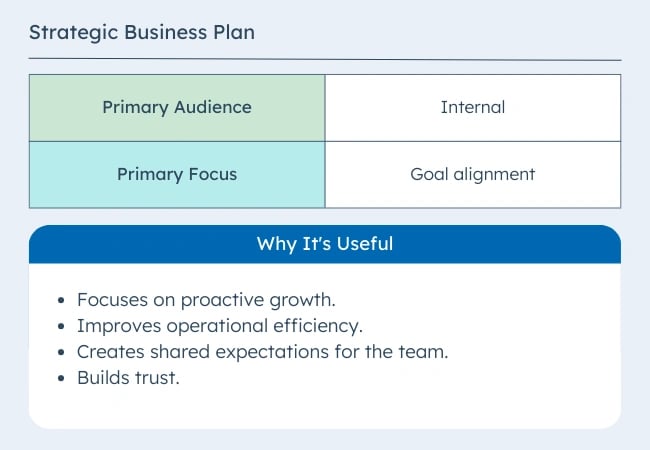

- Strategic Business Plan: A strategic business plan outlines long-term goals and the steps to achieve them, providing a clear roadmap for the company’s direction. It typically includes a SWOT analysis, market research, and competitive analysis. This plan allows businesses to align their resources with their objectives, anticipate changes in the market, and develop contingency plans. By focusing on the big picture, a strategic business plan fosters long-term success and stability.

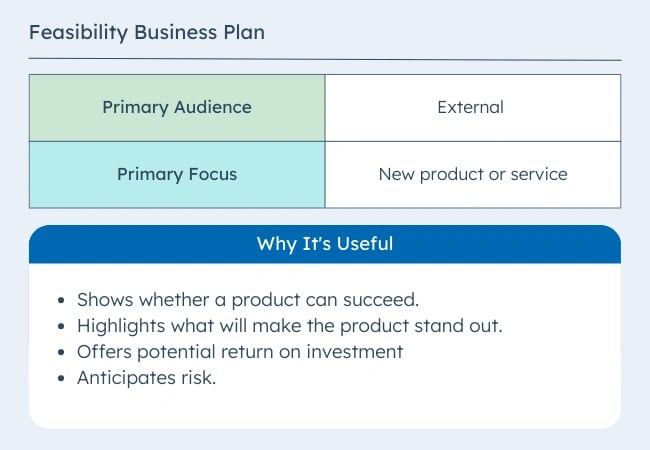

- Feasibility Business Plan: This plan is designed to assess the viability of a business idea, examining factors such as market demand, competition, and financial projections. It is often used to decide whether or not to pursue a particular venture. By conducting a thorough feasibility analysis, entrepreneurs can avoid investing time and resources into an unviable business concept. This plan also helps refine the business idea, identify potential obstacles, and determine the necessary resources for success.

- Growth Business Plan: Also known as an expansion plan, a growth business plan focuses on strategies for scaling up an existing business. It includes market analysis, new product or service offerings, and financial projections to support expansion plans. This type of plan is essential for businesses looking to enter new markets, increase their customer base, or launch new products or services. By outlining clear growth strategies, the plan helps ensure that expansion efforts are well-coordinated and sustainable.

- Operational Business Plan: This type of plan outlines the company’s day-to-day operations, detailing the processes, procedures, and organizational structure. It is an essential tool for managing resources, streamlining workflows, and ensuring smooth operations. The operational business plan also helps identify inefficiencies, implement best practices, and establish a strong foundation for future growth. By providing a clear understanding of daily operations, this plan enables businesses to optimize their resources and enhance productivity.

- Lean Business Plan: A lean business plan is a simplified, agile version of a traditional plan, focusing on key elements such as value proposition, customer segments, revenue streams, and cost structure. It is perfect for startups looking for a flexible, adaptable planning approach. The lean business plan allows for rapid iteration and continuous improvement, enabling businesses to pivot and adapt to changing market conditions. This streamlined approach is particularly beneficial for businesses in fast-paced or uncertain industries.

- One-Page Business Plan: As the name suggests, a one-page business plan is a concise summary of your company’s key objectives, strategies, and milestones. It serves as a quick reference guide and is ideal for pitching to potential investors or partners. This plan helps keep teams focused on essential goals and priorities, fosters clear communication, and provides a snapshot of the company’s progress. While not as comprehensive as other plans, a one-page business plan is an effective tool for maintaining clarity and direction.

- Nonprofit Business Plan: Specifically designed for nonprofit organizations, this plan outlines the mission, goals, target audience, fundraising strategies, and budget allocation. It helps secure grants and donations while ensuring the organization stays on track with its objectives. The nonprofit business plan also helps attract volunteers, board members, and community support. By demonstrating the organization’s impact and plans for the future, this plan is essential for maintaining transparency, accountability, and long-term sustainability within the nonprofit sector.

- Franchise Business Plan: For entrepreneurs seeking to open a franchise, this type of plan focuses on the franchisor’s requirements, as well as the franchisee’s goals, strategies, and financial projections. It is crucial for securing a franchise agreement and ensuring the business’s success within the franchise system. This plan outlines the franchisee’s commitment to brand standards, marketing efforts, and operational procedures, while also addressing local market conditions and opportunities. By creating a solid franchise business plan, entrepreneurs can demonstrate their ability to effectively manage and grow their franchise, increasing the likelihood of a successful partnership with the franchisor.

Using Business Plan Software

Creating a comprehensive business plan can be intimidating, but business plan software can streamline the process and help you produce a professional document. These tools offer a number of benefits, including guided step-by-step instructions, financial projections, and industry-specific templates. Here are the top 5 business plan software options available to help you craft a great business plan.

1. LivePlan

LivePlan is a popular choice for its user-friendly interface and comprehensive features. It offers over 500 sample plans, financial forecasting tools, and the ability to track your progress against key performance indicators. With LivePlan, you can create visually appealing, professional business plans that will impress investors and stakeholders.

2. Upmetrics

Upmetrics provides a simple and intuitive platform for creating a well-structured business plan. It features customizable templates, financial forecasting tools, and collaboration capabilities, allowing you to work with team members and advisors. Upmetrics also offers a library of resources to guide you through the business planning process.

Bizplan is designed to simplify the business planning process with a drag-and-drop builder and modular sections. It offers financial forecasting tools, progress tracking, and a visually appealing interface. With Bizplan, you can create a business plan that is both easy to understand and visually engaging.

Enloop is a robust business plan software that automatically generates a tailored plan based on your inputs. It provides industry-specific templates, financial forecasting, and a unique performance score that updates as you make changes to your plan. Enloop also offers a free version, making it accessible for businesses on a budget.

5. Tarkenton GoSmallBiz

Developed by NFL Hall of Famer Fran Tarkenton, GoSmallBiz is tailored for small businesses and startups. It features a guided business plan builder, customizable templates, and financial projection tools. GoSmallBiz also offers additional resources, such as CRM tools and legal document templates, to support your business beyond the planning stage.

Business Plan FAQs

What is a good business plan.

A good business plan is a well-researched, clear, and concise document that outlines a company’s goals, strategies, target market, competitive advantages, and financial projections. It should be adaptable to change and provide a roadmap for achieving success.

What are the 3 main purposes of a business plan?

The three main purposes of a business plan are to guide the company’s strategy, attract investment, and evaluate performance against objectives. Here’s a closer look at each of these:

- It outlines the company’s purpose and core values to ensure that all activities align with its mission and vision.

- It provides an in-depth analysis of the market, including trends, customer needs, and competition, helping the company tailor its products and services to meet market demands.

- It defines the company’s marketing and sales strategies, guiding how the company will attract and retain customers.

- It describes the company’s organizational structure and management team, outlining roles and responsibilities to ensure effective operation and leadership.

- It sets measurable, time-bound objectives, allowing the company to plan its activities effectively and make strategic decisions to achieve these goals.

- It provides a comprehensive overview of the company and its business model, demonstrating its uniqueness and potential for success.

- It presents the company’s financial projections, showing its potential for profitability and return on investment.

- It demonstrates the company’s understanding of the market, including its target customers and competition, convincing investors that the company is capable of gaining a significant market share.

- It showcases the management team’s expertise and experience, instilling confidence in investors that the team is capable of executing the business plan successfully.

- It establishes clear, measurable objectives that serve as performance benchmarks.

- It provides a basis for regular performance reviews, allowing the company to monitor its progress and identify areas for improvement.

- It enables the company to assess the effectiveness of its strategies and make adjustments as needed to achieve its objectives.

- It helps the company identify potential risks and challenges, enabling it to develop contingency plans and manage risks effectively.

- It provides a mechanism for evaluating the company’s financial performance, including revenue, expenses, profitability, and cash flow.

Can I write a business plan by myself?

Yes, you can write a business plan by yourself, but it can be helpful to consult with mentors, colleagues, or industry experts to gather feedback and insights. There are also many creative business plan templates and business plan examples available online, including those above.

We also have examples for specific industries, including a using food truck business plan , salon business plan , farm business plan , daycare business plan , and restaurant business plan .

Is it possible to create a one-page business plan?

Yes, a one-page business plan is a condensed version that highlights the most essential elements, including the company’s mission, target market, unique selling proposition, and financial goals.

How long should a business plan be?

A typical business plan ranges from 20 to 50 pages, but the length may vary depending on the complexity and needs of the business.

What is a business plan outline?

A business plan outline is a structured framework that organizes the content of a business plan into sections, such as the executive summary, company description, market analysis, and financial projections.

What are the 5 most common business plan mistakes?

The five most common business plan mistakes include inadequate research, unrealistic financial projections, lack of focus on the unique selling proposition, poor organization and structure, and failure to update the plan as circumstances change.

What questions should be asked in a business plan?

A business plan should address questions such as: What problem does the business solve? Who is the specific target market ? What is the unique selling proposition? What are the company’s objectives? How will it achieve those objectives?

What’s the difference between a business plan and a strategic plan?

A business plan focuses on the overall vision, goals, and tactics of a company, while a strategic plan outlines the specific strategies, action steps, and performance measures necessary to achieve the company’s objectives.

How is business planning for a nonprofit different?

Nonprofit business planning focuses on the organization’s mission, social impact, and resource management, rather than profit generation. The financial section typically includes funding sources, expenses, and projected budgets for programs and operations.

Image: Envato Elements

Your email address will not be published. Required fields are marked *

© Copyright 2003 - 2024, Small Business Trends LLC. All rights reserved. "Small Business Trends" is a registered trademark.

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

- Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

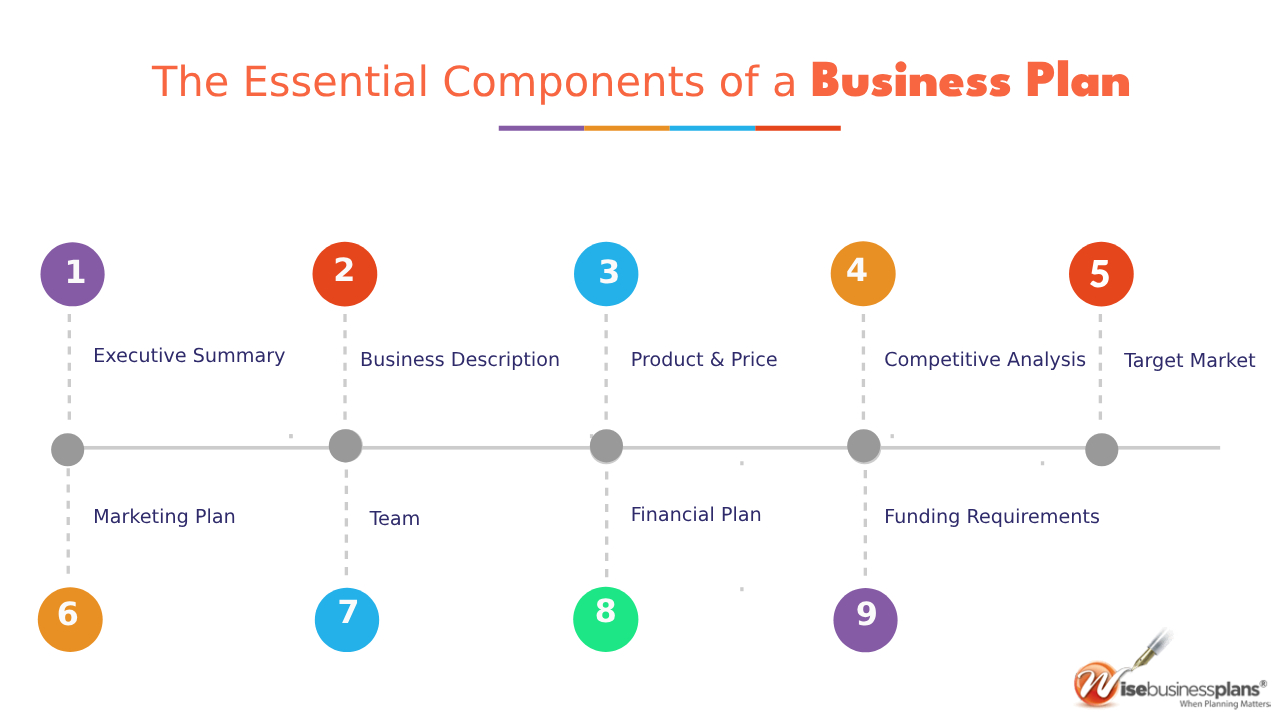

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

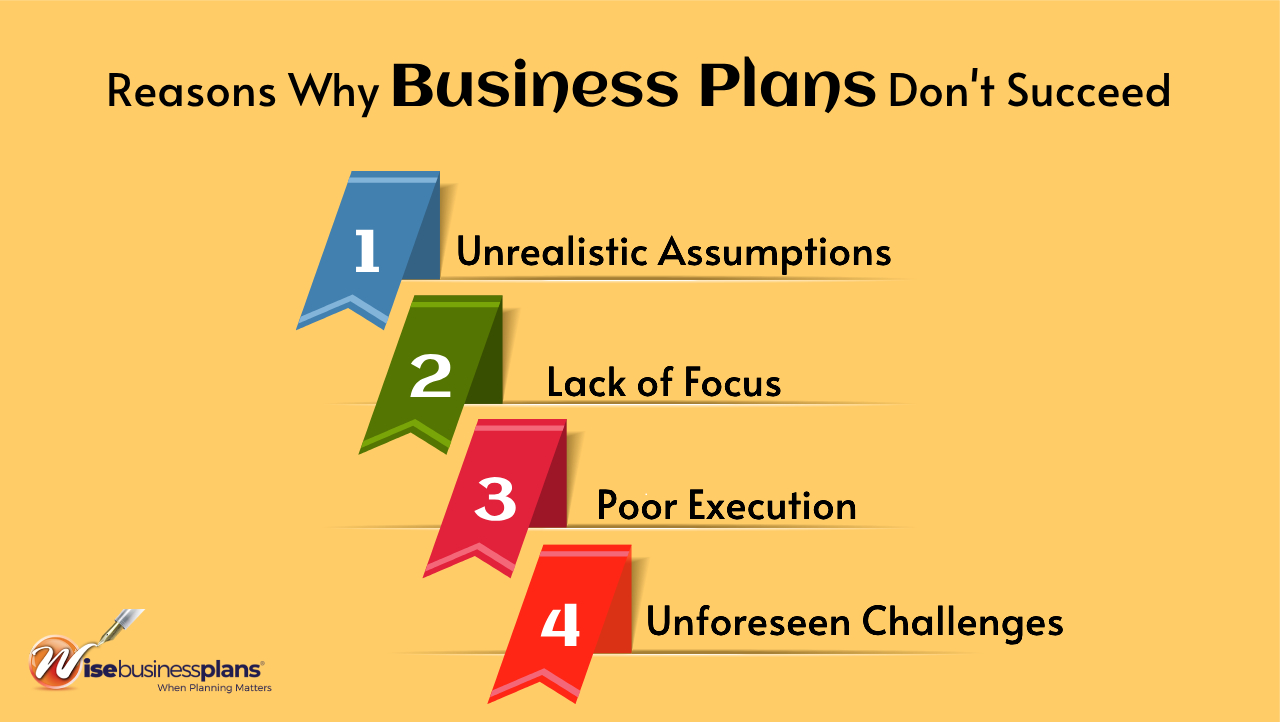

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Leave a Reply

Your email address will not be published. Required fields are marked *

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

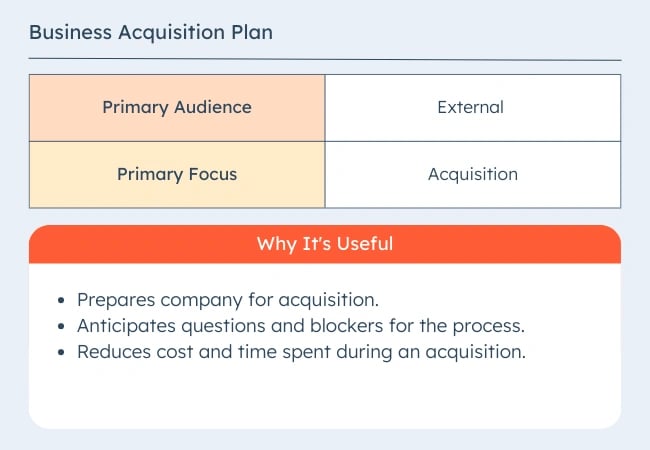

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![3 main purposes of business plan How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![3 main purposes of business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![3 main purposes of business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated April 17, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.