Six Key Points on Loan Participations | Practical Law

Six Key Points on Loan Participations

Practical law legal update 9-522-3963 (approx. 4 pages).

- Lenders can reduce their exposure to a borrower's credit risk by selling interests in their loans.

- An investor can acquire an interest in a borrower's loan without becoming a lender under the loan agreement.

Point One: Privity

Point two: borrower's consent, point three: economics, point four: participant voting, point five: due diligence, point six: swaps and dodd-frank.

Trending News

Related Practices & Jurisdictions

- Corporate & Business Organizations

- Financial Institutions & Banking

- All Federal

As the secondaries market continues to grow and increase in complexity, we have noticed an uptick in interest among our clients in selling (and buying) loan participations. Participation arrangements can be a powerful tool for institutions on either side of the transaction – sellers can free up capital on their balance sheet, pare back funding obligations and reduce exposure to certain borrowers or industries, and buyers can get the economic benefit of a loan without having to manage a direct relationship with the borrower or comply with (typically more stringent) restrictions and consent requirements for direct assignments. Plus, while the transaction is undoubtedly complex, both parties can leverage the Loan Syndications and Trading Association’s form documentation to keep attention focused on those provisions most important to their institution and the specific transaction. Done right, a bespoke participation arrangement lets everyone leave the field a winner (trophies optional).

Below we discuss broadly the participation structure and its benefits, typical principal documentation and some key considerations and commonly-negotiated provisions.

Participation Structure and Its Benefits

For the uninitiated, a participation is best understood in contrast with an assignment. Both are mechanisms by which a lender of record under a loan agreement ( i.e. , the entity that is actually party to the contract as a lender) can transfer all or part of its interest in a funded or unfunded loan to a third party. However, unlike with an assignment (where the assignee steps fully into the shoes of the assignor as lender of record, and assumes direct contractual privity with the borrower and legal and beneficial ownership of the loan), the seller of a participation interest retains title to the loan and direct contractual privity with the borrower ( i.e. , the participant does not become a lender of record under the loan agreement) along with certain rights and obligations, and the buyer of a participation interest assumes the economic benefits and risks. The contractual relationship for a participation is just between the seller and buyer – the borrower is not typically involved, and indeed is often not even aware of the transaction.

Among the benefits to sellers of loan participations, perhaps the most obvious is the cash received from the buyer upon settlement. Loan participations in the non-distressed secondaries space are often purchased for prices at or near par ( i.e. , 100% of the principal amount of the debt participated), and that cash lands immediately on the seller’s balance sheet. For unfunded loans, because the participation agreement obligates the participant to fund (or reimburse, depending on timing) future draws through the seller, a seller also benefits by shifting much of the responsibility to fund future draws to the participant (noting, of course, that this introduces new credit risk with respect to the buyer). In addition, regulated lenders are not typically required to hold capital against participated loans. Sellers can also realize value by retaining some of the economics of the loan they’re selling a participation interest in. We see many participations where sellers retain some or all upfront fees paid by the borrower in respect of the loan, and a number where the buyer takes a haircut on the interest payments that are passed through to them, with the seller retaining the difference (noting that, if a seller is not passing along all or substantially all of the rights and obligations under the loan, the parties should carefully consider with counsel whether the sale would still be considered a true participation under New York law – if it wouldn’t, buyer may be at risk of being considered a mere contractual counterparty of seller subject to seller’s credit risk). Taken together, sellers can use participation arrangements to put cash on their balance sheets, reduce exposure to certain borrowers or industries and decrease regulatory capital obligations in compliance with internal or external requirements.

On the buyer’s side of the transaction, buyers benefit from being able to realize some or all of the economic benefits of a loan without incurring origination expenses, the bulk of ongoing administration expenses or the legal expense associated with preparing the underlying loan documentation (subject, of course, to indemnities, etc., that can flow through to a participant, e.g. , agent expenses). From a credit perspective, depending on buyer’s internal comfort level, a buyer can draft to varying degrees behind the seller’s credit analysis and diligence of the borrower. In addition, since participants are typically not disclosed to a borrower, a buyer can generally keep its status as participant confidential.

Buyers and sellers alike benefit from not needing to seek consents and pay assignment or other fees that might be required in the case of a direct assignment.

Typical Principal Documentation

Sellers and their counsel typically hold the pen when documenting participation arrangements. While drafting parties can and do use their own forms, it often makes sense to leverage the Loan Syndication and Trading Association’s (LSTA) standard form participation agreement for par/near-par ( i.e. , non-distressed) trades as a starting point – even for bespoke, heavily-negotiated participations. The LSTA’s form participation agreement was developed to facilitate efficient documentation of transactions in the high-volume secondary market (where participations are often used as a backup settlement option for debt trades that can’t settle by assignment), and accordingly generally tracks market-standard terms and mechanics for participation arrangements. The LSTA form splits the participation agreement into two documents: (i) a longer set of standard terms and conditions (often referred to as STCs, and available here for LSTA members), which contains a baseline set of market-standard provisions, and (ii) a relatively short form agreement setting forth the transaction-specific terms of the participation (often referred to as the TSTs, and available here for LSTA members), which incorporates the STCs by reference and lets parties toggle on or off (often via checkbox), or otherwise supplement or modify, the various provisions of the STCs. The LSTA’s bifurcated documentation pulls all the transaction-specific information, business terms and frequently negotiated provisions into a more manageable document.

Of course, there are a number of points in the LSTA forms that counsel will typically want to smooth out when using them outside of the more commoditized secondary loan trading market ( e.g. , the need for trade confirmations and funding memoranda, delayed compensation, etc.). Nevertheless, starting with LSTA forms helps both buyer and seller cut down on legal expense, and focuses attention on the terms and provisions that are of particular importance to the parties and the specific deal. These efficiencies can also facilitate innovation.

Key Considerations and Commonly-Negotiated Provisions

Elevation . Buyer’s rights to request “elevation” of its participation ( i.e. , to seek to become a direct lender under the loan agreement) is often the subject of negotiation. Under the STCs, a buyer can always elevate if seller goes into bankruptcy. Otherwise, it’s up to the parties – in some transactions buyers are free to elevate at any time. In others, elevations triggers are heavily tailored, and can include conditions tied to seller’s credit rating, the amount of seller’s loans or commitments under the facility, disputes over collateral value (particularly for participations in NAV loans) or the occurrence of certain events (or failures by seller to take certain actions) under the loan documents.

Voting . The voting provisions in the participation agreement govern whether, when and to what extent, the buyer can direct seller’s votes as a lender under the loan documents. Participation provisions in loan agreements will sometimes limit a seller’s ability to grant voting control to a participant beyond the typical suite of “sacred” provisions ( e.g. , facility size, interest rates, payment dates, term, etc.). Otherwise, the parties can and do tailor the allocation of control to their liking – from no buyer voting rights at all to full buyer voting rights and everything in between. Buyers will often push for control over at least the “sacred” provisions in the loan documents. Sometimes buyers request decision-making power over waivers of certain events of default, facility subordination or other provisions important to the buyer’s credit analysis or institutional concerns. If the underlying loan agreement does include limitations on the seller’s ability to grant voting control, parties will typically clarify in the participation agreement that any voting rights allocated to buyer are allocated only to the extent it would not violate the loan agreement.

Sub-participations . One standard provision of the STCs we frequently see negotiated is the requirement that seller consent to a requested sub-participation by buyer “not be unreasonably withheld or delayed.” Often, sellers will request that that language be deleted. Buyers, in turn, will request some exceptions ( e.g. , permitting sub-participations to affiliates, if seller’s hold on the facility drops below some specified amount, etc.).

Loan agreement diligence . Buyers and sellers should take care to consider the terms of the underlying loan documentation when documenting participation arrangements. Loan agreements in the secondaries market do not always include the detailed assignment and participation provisions lenders might expect in a loan agreement drafted with an eye towards syndication – indeed, it’s not infrequent that we see loan agreements that are silent on the subject. Sometimes there will be credit agreement provisions that necessitate representations from buyer or seller ( e.g. , a representation that buyer is not an affiliate of the borrower, not on a disqualified institution list or not otherwise an ineligible buyer) or explicitly require that seller maintain a participant register for tax purposes. While uncommon, credit agreements occasionally include borrower or other consent requirements for lender participations (and often the consequence for failing to obtain that consent is that the transaction is void). Additional complexities are introduced when participating in a bilateral loan – in the event a buyer wants to elevate its participation interest, significant revisions to the loan documents may be required to accommodate a multi-lender structure. Often specifically tailored provisions are required in the participation agreement to address a given loan agreement.

The above is just a sampling of bespoke provisions.

Current Legal Analysis

More from cadwalader, wickersham & taft llp, upcoming legal education events.

Sign Up for e-NewsBulletins

- Publications

" * " indicates required fields

Assignment, novation or sub-participation of loans

Transfers of loan portfolios between lending institutions have always been commonplace in the financial market. A number of factors may come into play – some lenders may wish to lower their risks and proportion of bad debts in their balance sheets; some may undergo restructuring or divest their investment portfolios elsewhere, to name a few. The real estate market in particular has been affected by the announcement of the “three red lines” policy by the People’s Bank of China in 2020 which led to a surge of transfers, or attempted transfers, of non-performing loans. Other contributing factors include the continuous effects of the Sino-US trade war and the Covid-19 pandemic.

T +852 2905 5760 E [email protected]

Transferability of Loans

The legal analysis regarding the transferability of loans can be complex. The loan agreement should be examined with a view to identifying any restrictions on transferability of the loan between lenders, such as prior consent of the debtor and, in some cases, whether such consent may be withheld. Other general restrictions may apply given that most banks have internal confidentiality rules and data protection requirements, the latter of which may also be subject to governmental regulations. Certain jurisdictions may restrict the transfer of loans relating to specific types of receivables – mortgage or consumer loans being prime examples. It is imperative to conduct proper due diligence on the documentation and underlying assets in order to be satisfied with the transferability of the relevant loans. This may be complicated further if there are multiple projects, facility lines or debtors. It is indeed common to see a partial transfer of loans to an incoming lender or groups of lenders.

Methods of Transfer

The transfer of loans may be carried out in different ways and often involves assignment, novation or sub-participation.

A typical assignment amounts to the transfer of the rights of the lender (assignor) under the loan documentation to another lender (assignee), whereby the assignee takes on the assignor’s rights, such as the right to receive payment of principal and interest on the loan. The assignor is still required to perform any obligations under the loan documentation. Therefore, there is no need to terminate the loan documentation and, unless the loan documentation stipulates otherwise, there is no need to obtain the debtor’s consent, but notice of the assignment must be served on the debtor. However, many debtors are in fact involved in the negotiation stage, where the parties would also take the opportunity to vary the terms of the facility and security arrangement.

Novation of a loan requires that the debtor, the existing lender (transferor) and the incoming lender (transferee) enter into new documentation which provides that the rights and obligations of the transferor will be novated to the transferee. The transferee replaces the transferor in the loan facility and the transferor is completely discharged from all of its rights and obligations. This method of transfer does require the prior consent of the relevant debtor.

Sub-participation is often used where a lender, whilst wishing to share the risks of certain loans, nonetheless prefers to maintain the status quo. There is no change to the loan documentation – the lender simply sells all or part of the loan portfolio to another lender or lenders. From the debtor’s perspective, nothing has changed and, in principle, there is no need to obtain the debtor’s consent or serve notice on the debtor. This method of transfer is sometimes preferred if the existing lender is keen to maintain a business relationship with the debtor, or where seeking consent from the debtor or notifying the debtor of any transfer is not feasible or desirable. In any case, there would be no change to the balance sheet treatment of the existing lender.

Offshore Security Arrangements

The transfer of a loan in a cross-border transaction often involves an offshore security package. A potential purchaser will need to conduct due diligence on the risks relating to such security. From a legal perspective, the security documents require close scrutiny to confirm their legality, validity and enforceability, including the nature and status of the assets involved. Apart from transferability generally, the documents would reveal whether any consent is required. A lender should seek full analysis on the risks relating to enforcement of security, which may well be complicated by the involvement of various jurisdictions for potential enforcement actions.

A key aspect to the enforcement consideration is whether a particular jurisdiction requires that any particular steps be taken to perfect a security interest relating to the loan portfolio (if the concept of perfection applies at all) and, if so, whether any applicable filing or registration has been made to perfect the security interest and, more importantly, whether there exists any prior or subsequent competing security interest over all or part of the same assets. For example, security interests may be registered in public records of the security provider maintained by the companies registry in Bermuda or the British Virgin Islands for the purpose of obtaining priority over competing interests under the applicable law. The internal register of charges of the security provider registered in the Cayman Islands, Bermuda or the British Virgin Islands should also be examined as part of the due diligence process. Particular care should be taken where the relevant assets require additional filings under the laws of the relevant jurisdictions, notable examples of such assets being real property, vessels and aircraft. Suites of documents held in escrow pending a potential default under the loan documentation should also be checked as they would be used by the lender or security agent to facilitate enforcement of security when the debtor defaults on the loan.

Due Diligence and Beyond

Legal due diligence on the loan documentation and security package is an integral part of the assessment undertaken by a lender of the risks of purchasing certain loan portfolios, regardless of whether the transfer is to be made by way of an assignment, novation or sub-participation. Whilst the choice of method of transfer is often a commercial decision, enforceability of security interests over underlying assets is the primary consideration in reviewing sufficiency of the security package in any proposed loan transfer.

Hong Kong , Shanghai , British Virgin Islands , Cayman Islands , Bermuda

Banking & Asset Finance , Corporate

Banking & Financial Services

A Bird’s-eye View of Some Key Restructuring Options and Processes in Bermuda, the British Virgin Islands and the Cayman Islands

This article focuses on restructuring options and processes only, and will merely touch on formal in...

Similar but Different

While the basic features of the trust remain, there are some notable differences in how trusts can b...

Material adverse change clauses in light of the Covid-19 pandemic

Experts from each of our key global offices provide jurisdiction specific advice and answer question...

Managing the court process

Economic Substance update Q4 2020

The facilitation of cross border restructurings in Bermuda, the British Virgin Islands and the Cayman Islands

In this update, we consider the powers and discretion of the domestic courts in Bermuda, the BVI and...

Economic Substance update Q1 2020

On 18 February 2020, the Economic and Financial Affairs Council (ECOFIN) announced that Bermuda and ...

Offshore listing Vehicles to benefit from the Shanghai - London stock connect

Offshore deal value through June 2018 nearly matches 2017 total

Snapshot Petitions Report 2017

- Select your option

- find a lawyer

- find an office

- contact you

- Online Courses

Loan participations vs. syndications: What’s the deal?

Posted on Jun 29, 2021 by Bob Laffler, CPA | Tags: Accounting , Auditing

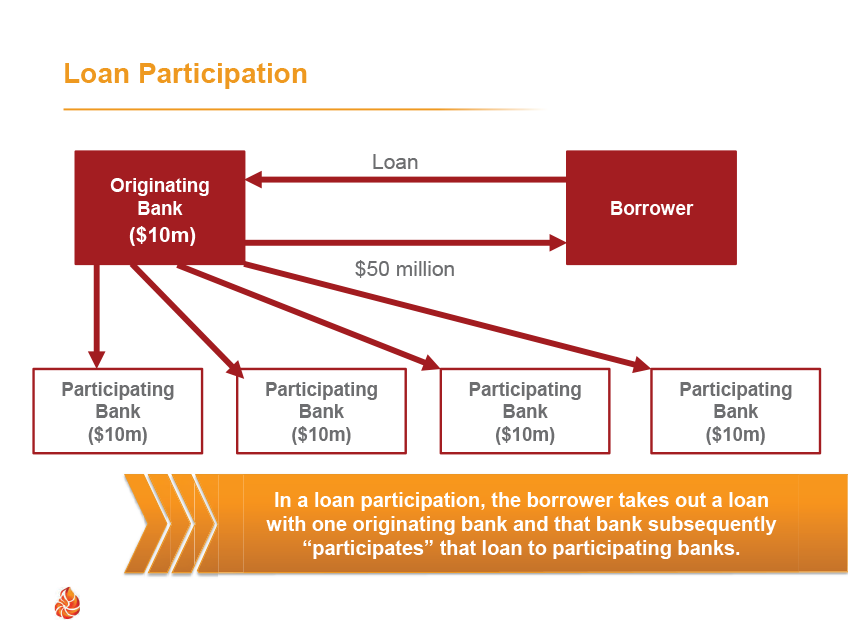

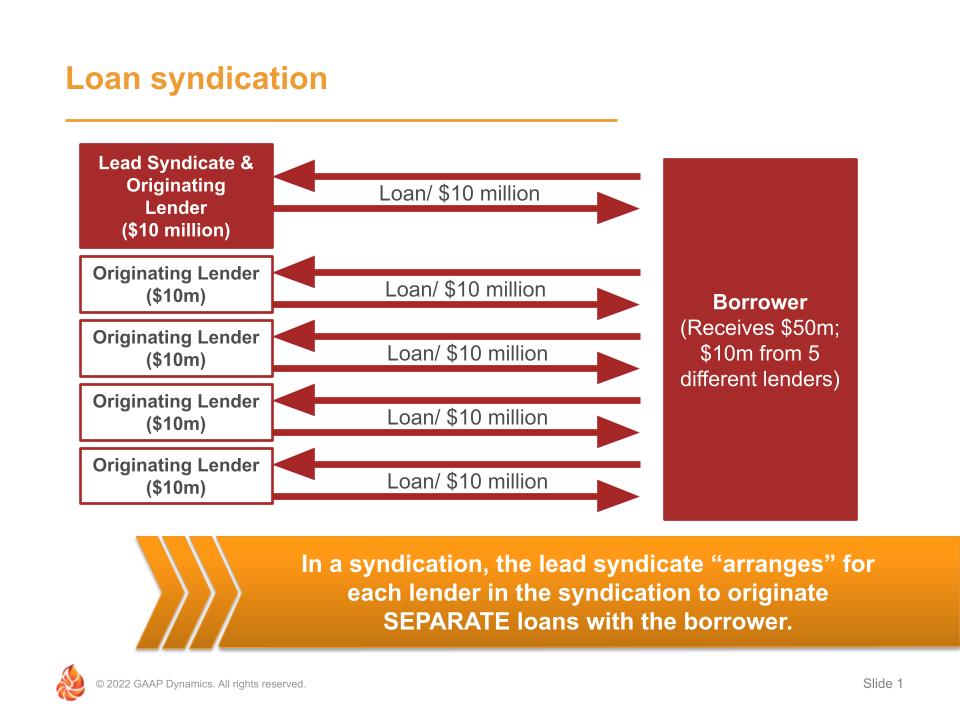

Loan participations and loan syndications are terms often interchanged to describe a lending arrangement involving more than one lender; however, for accounting and reporting purposes, these are two different types of transactions with unique considerations and issues. We often get questions from participants in our classroom Banking Industry Fundamentals training programs and have dedicated time to this subject in our eLearning series available on the Revolution, our online learning platform.

While both loan participations and syndications involve multiple lenders, the way each is structured results in different accounting issues, including derecognition under ASC 860 and recognition of fees under ASC 606 and/or ASC 310.

Loan Participations:

In a loan participation, the originating bank enters into several lending arrangements. The first transaction is the loan origination to the borrower. This transaction will follow the normal accounting for loans under ASC 310. The unloading of a portion of the loan to participating banks represents a “transfer of a financial asset” (i.e. the loan, or a portion of the loan) and must be assessed for derecognition under ASC 860. This analysis involves determining if the participating loan represents a “participating interest” under ASC 860 and further whether control over the participating loan has been relinquished by the originating bank.

Loan Syndications:

In a loan syndication, the bank with the “relationship” with the borrower likely does not want to assume the risk of issuing such a large loan. As a result, rather than underwrite the entire loan and look to participate it out to other banks, the lead bank acts as a “syndicate”, matching the borrower up with multiple lenders, each of which underwrites and originates its own loan to the borrower. As a result, there are multiple loans issued by numerous banks to the one borrower.

Loan syndications do not involve any “transfers of financial assets” as each loan in a syndication is between a respective originating bank and the borrower. As a result, ASC 860 and the analysis of derecognition is not an issue. However, there are some issues for the lead syndicate bank involving revenue recognition related to the fees it collects from the borrower. Some of these fees may represent “syndication fees” for arranging the deal, as well as typical lenders fees for the loan it has underwritten itself. Also, these arrangements may involve the lead syndicate servicing the series of loans on behalf of the syndicate banks. For these loans, other than its own originated loan, the lead syndicate will need to recognize a servicing asset (or liability) in accordance with ASC 860.

How do you tell the difference?

As it is illustrated above, these two arrangements (a loan participation and syndication) have unique terms even though they achieve the same economic result. Therefore, the only way to know whether you are dealing with a participation or syndication is the READ the loan agreements! Careful consideration should be given to the legal underwriters and parties to the contract, contractual terms of the instruments, and other conditions to make a final analysis.

Often it is a legal determination that will dictate whether it is a loan participation or syndication. Once this determination is made, it’s on to the accounting analysis!

About GAAP Dynamics

We’re a DIFFERENT type of accounting training firm. We don’t think of training as a “tick the box” exercise, but rather an opportunity to empower your people to help them make the right decisions at the right time. Whether it’s U.S. GAAP training, IFRS training, or audit training, we’ve helped thousands of professionals since 2001. Our clients include some of the largest accounting firms and companies in the world. As lifelong learners, we believe training is important. As CPAs, we believe great training is vital to doing your job well and maintaining the public trust. We want to help you understand complex accounting matters and we believe you deserve the best training in the world, regardless of whether you work for a large, multinational company or a small, regional accounting firm. We passionately create high-quality training that we would want to take. This means it is accurate, relevant, engaging, visually appealing, and fun. That’s our brand promise. Want to learn more about how GAAP Dynamics can help you? Let’s talk!

Disclaimer

This post is published to spread the love of GAAP and provided for informational purposes only. Although we are CPAs and have made every effort to ensure the factual accuracy of the post as of the date it was published, we are not responsible for your ultimate compliance with accounting or auditing standards and you agree not to hold us responsible for such. In addition, we take no responsibility for updating old posts, but may do so from time to time.

Comments (0)

Add a comment.

Allowed tags: <b><i><br> Add a new comment:

Ready To Make a Change?

Cookies on the GAAP Dynamics website

Learning Library

Loan participations: what your financial institution needs to know.

Considering Loan Participations for your financial institution? Not sure what they even are? Want to learn the pros and cons? Curious about the process for setting them up? You’re in the right place.

This article will give a basic introduction, review the possible perks and pitfalls, and cover what’s involved to buy or sell loan participations at your financial institution.

The 2020 Banking and Capital Markets Outlook from Deloitte Insights points out a range of disruptive changes for today’s financial institutions. From technology demands to changes in a COVID-19-affected world, it’s a lot.

Their advice: Over the next decade, “banks should remain true to their core identity as financial intermediaries, matching demand with supply of capital.”

Banks and credit unions must continue to effectively manage risk and complex financial matters, according to Deloitte’s analysis. Loan participations are one tool you have to mitigate risk and ensure a flow of capital to your customers.

How do both the originating and participating institutions benefit?

Stuff Your Mind, Not Your Inbox. Get the info you need a couple times a month. Subscribe Now!

What are Loan Participations?

First, let’s get on the same page on what they even are. Loan participations are “an instrument that allows multiple lenders to participate or share in the funding of a loan.”

This can help lenders mitigate risk. Additionally, participations can allow your institution to diversify balance sheets while increasing revenue and liquidity.

There are three primary kinds, each varying in ownership and responsibility.

- Participation: In this loan participation arrangement, the loan is underwritten and closed by a lead financial institution. Then, that bank or credit union subsequently sells portions of the loan to other financial institutions.

- Syndication: “Multiple lenders coming together to fund a large loan for a single borrower”, according to Avana Capital .

- Assignment: The original lender transfers rights and obligations to the purchasing financial institution. In this structure, risk moves as well.

For the first two types, participants reap the rewards of interest earned. However, all parties share the risks if the borrower defaults. In a syndicate, the goal can be to facilitate a loan that’s larger or more risky than any single institution can handle .

Some loan participations have a third-party handle loan servicing. There are also many software platforms that integrate with your core system to facilitate the process.

Loan participation notes are considered fixed income securities . Upon maturity of a loan, there is a complete return of principal, with interest arriving through fixed periodic payments. Auto loans and mortgages are the most common loans in these portfolios.

Pros of Loan Participations

Loan participations can be a win for both sellers and buyers. Otherwise, why would they exist? The specific benefits depend on your institution size and goals.

For larger institutions, loan participations can help reduce credit risk, increase capital, and obtain liquidity. This lets them take advantage of new lending opportunities. In this case, they are the lead financial institution selling loans (or portions of) to others.

A smaller institution, or one in a slow-growth market, may approach loan participations from the other side. For them, it can empower investment in a strong deposit base with higher yielding assets, while reducing geographic-associated risks.

They would be receiving the loans from other lenders. Of course, a small or slow-growth market institution can be the lead, while a larger institution may be the buyer.

Here’s a benefit summary of loan participations from both perspectives:

- Take advantage of profit sharing. Buying loan participations allows you to share in the profits of the lead bank. Your institution can reap the revenues of a strong lending market, even if your own is currently slow.

- Diversify your assets. Reduce risk by investing in a variety of loans from a range of geographic areas. This diversification minimizes exposure to potential losses in your service area from economic downturns or natural disasters. Essentially, being able to “weather storms” to serve your local base.

- Manage regulatory limits. Loan participations open the possibility to funding unusually large loans you may otherwise be legally prohibited from servicing.

- Reduce lending risk . Distributing risk among multiple institutions is helpful to banks or credit unions that may be in a community with a higher than average rate of delinquency. This lets you continue lending at affordable rates.

- Maintain profitable customer relationships. Have a large-scale borrower? Selling loan participations lets you stay “the institution of record” for them, retaining the lead role in their relationship.

Cons of Loan Participations

After talking about all the benefits of loan participations, we promised an honest discussion of its possible downfalls. The following section covers reasons why you may not wish to participate in loan participations.

Or, if you do, be aware of these potential issues ahead of time.

Complexity & Regulatory Attention

As with any investment, caution is essential. Loan participations “have numerous advantages but are complex and attract regulatory attention,” notes a CUNA Lending Council white paper .

“They need to be ‘done right’ to work, and require quality partners and resources or access to those resources.” Increased complexity and greater regulatory scrutiny are just two of the downsides of loan participations.

Loan participations can involve greater risk than traditional lending. Wait, what?

“Reducing risk” is a potential benefit of the process. That is true. It can help you spread out risk, so in the event of default, your institution shares that financial hit. And, of course, the larger the loan, the heavier the possible losses.

Another risk is that other institutions may offer their more risky loans for participation. Perform strong due diligence ahead of time to avoid this situation, unless your goal is to increase risk for a portion of your portfolio, at the possible benefit of stronger returns.

Even if the loans are solid, you may have less data on the performance. That’s where you need to ensure detailed and consistent monthly participation reports .

Just like your lending policies, it’s up to your institution to decide the degree of acceptable risk for the program.

Terms & Red Flags

Loan participation agreements can bring their own share of negatives. Of course, good due diligence will illuminate any issues ahead of time. For example, ensure the agreement is based on pro rata , meaning each participant has an equal share.

In this arrangement, all cash flows should be divided equally, with all parties having the same priority.

When reviewing a loan participation agreement, look for these red flags:

- Purchasing institution’s interest rate differs from contractual loan rate : Sometimes a lead bank will structure it in this way to gain some compensation for servicing the loan. While there are ways to justify loan servicing compensation, this approach will cause cash flows to be disproportionate.

- Allowance for lead FI to repurchase the participated portion of the loan: Instead, include a “right of first refusal” provision.

- Requirement that participants obtain permission before selling their interest in the loan: This gives the lead bank unequal control.

What’s the Process for Setting Up Loan Participations?

Thinking of hosting or joining a loan participation? The process differs whether you are a buyer or a seller. We’ll approach it from both perspectives.

- Put loan participation policy in place: This policy will prepare you for the buying process. Include underwriting standards and parameters on purchases, loan types, and amounts.

- Get familiar with the market: Sign up for notifications of loan participation offerings. Seller institutions often provide notifications of offerings to existing partners.

- Evaluate offerings: If you find an attractive loan participation opportunity, you’ll need to sign a confidentiality agreement to see the seller’s due diligence package.

- Review sample files: Once an agreement is signed, you can have access to a sample of files from the loan pool.

- Perform due diligence: Here’s where you can reduce risks and ensure your institution is protected to the greatest extent possible. It’s also when you’re able to decide if the opportunity makes sense for your institution. Share concerns and request arrangement modifications.

- Close on loan: You’ll receive an updated balance of each loan at closing. Sign the master agreement, and the seller will receive funds.

- Receive payments: Your institution will start receiving prorated principal and interest payments each month. The monthly payment will have a servicing fee deducted.

Sellers have two options for initiating a loan participation. They may set it up internally, which can be a complex process.

Another option is to use a third-party, which manages the buying, selling, and servicing process. Whether you do it yourself or use a third-party, selling will involve:

- Establishing a loan participation policy

- Organizing portfolio data for potential buyers

- Deciding on pricing

- Reaching out to your buyers network

- Negotiation

The time and involvement of offering loan participations will depend on whether or not you involve a third-party. Sellers are responsible for providing monthly trial balance reports, delinquency reports and other applicable statements.

If handled in-house, embrace specialized software (that’s two of many possible options) platforms to save time, reduce errors, and simplify regulatory compliance.

A third-party servicer handles all necessary forms, policies, distributions, and reporting.

Whether the buyer or seller, there can be costs to loan participations. As a buyer, you have the option of managing in-house or through a third-party servicer. Both options have costs.

For in-house, consider needed staff time, additional training, reporting obligations, and possible software licensing and integration costs.

Third-party servicers handle all necessary steps, and charge by deducting a fee before distributing monthly payments.

Additionally, consider consulting fees. It’s recommended that both buyers and sellers get expert opinions from accountants and lawyers before signing agreements.

Important: For both buyers and sellers, loan participations are not a “set it and forget it” investment. Regular reviews to assess risk, as well as close communication with the lead bank is necessary to ensure smooth operation.

Deciding If Loan Participations Are Right For Your Institution

So, are loan participations right for your institution? That’s for you to decide. Here’s a summary of the factors you can consider:

- Investment goals: Are you looking to increase income through calculated risk investment strategies?

- Loan income: Are your loans not bringing in desired income? Or, is your servicing area below regional or national averages in volume or risk?

- Growth: Is your institution looking to grow without expanding service area or population?

- Willingness to learn: Loan participations may be a new direction for your institution. Ensure you’re ready for the effort involved in learning and implementation.

- Regulatory awareness: Attention from your regulator won’t decrease with loan participations. Is the reward worth the additional costs of compliance?

As you can see, it’s not a simple yes or no. Take some time, do your research, and discuss with your team the benefits and downsides for your specific institution.

Investment Practices are Just the Start

Banks and credit unions of all sizes embrace loan participations as part of a diverse investment portfolio. Consider guidance and recommendations from FDIC (the basics are close enough at a high level) to help decide whether to move forward at your institution.

Loan participations are a valuable tool in a highly competitive banking environment. Our goal is to help you recognize and understand the tools available, while sharing our insights so you can make sound investment decisions.

Investment strategies are just one category in our Learning Library. From lending products to marketing strategies to executive benefit programs, we’re here for you. Be sure to Subscribe to the Learning Library to stay informed.

Want to have a 15-minute chat about these or other programs? Let’s make it happen! You choose the date and time. We’ll confirm and send a web meeting invite. Your time is valuable; if 15 minutes is all you can share, that’s what it will be.

See you then!

Image credits: Toy office by www_slon_pics . List by Memed_Nurrohmad . Coin stack by Kevin Schneider . Mountaineers by Thomas Mareschal . Dice by Willi Heidelbach . Caution signs & flowchart by Gerd Altmann . Laptop cash exchange by Mediamodifier . Time cost quality triangle by Dirk Wouters . Contract by aymane jdidi . All from Pixabay.

Blogger. Speaker. Futurist. Part-time Jedi.

Dedicated to helping your credit union, large or small, deliver mission-focused financial empowerment to your members. And make a positive impact on your community while you’re at it.

Most Popular

- Universal Bankers: 7 Pros & Cons (In 2023)

- GAP & Depreciation Coverage: What Sets Them Apart?

Content Topics

- Car Buying Services

- Data Management

- Depreciation

- Direct Insurance

- Executive Benefits

- Financial Empowerment

- Investments

- Payment Protection

- Recapture & Refinance

Connect & Engage

Enjoying this article.

Keep the learning going strong!

Send Me More Insights Like This.

Keep Me Updated!

</i>No thanks, continuous learning is overrated.<i>

Worldwide: Assignment, Novation Or Sub-Participation Of Loans

Transfers of loan portfolios between lending institutions have always been commonplace in the financial market. A number of factors may come into play – some lenders may wish to lower their risks and proportion of bad debts in their balance sheets; some may undergo restructuring or divest their investment portfolios elsewhere, to name a few. The real estate market in particular has been affected by the announcement of the "three red lines" policy by the People's Bank of China in 2020 which led to a surge of transfers, or attempted transfers, of non-performing loans. Other contributing factors include the continuous effects of the Sino-US trade war and the Covid-19 pandemic.

TRANSFERABILITY OF LOANS

The legal analysis regarding the transferability of loans can be complex. The loan agreement should be examined with a view to identifying any restrictions on transferability of the loan between lenders, such as prior consent of the debtor and, in some cases, whether such consent may be withheld. Other general restrictions may apply given that most banks have internal confidentiality rules and data protection requirements, the latter of which may also be subject to governmental regulations. Certain jurisdictions may restrict the transfer of loans relating to specific types of receivables – mortgage or consumer loans being prime examples. It is imperative to conduct proper due diligence on the documentation and underlying assets in order to be satisfied with the transferability of the relevant loans. This may be complicated further if there are multiple projects, facility lines or debtors. It is indeed common to see a partial transfer of loans to an incoming lender or groups of lenders.

METHODS OF TRANSFER

The transfer of loans may be carried out in different ways and often involves assignment, novation or sub-participation.

A typical assignment amounts to the transfer of the rights of the lender (assignor) under the loan documentation to another lender (assignee), whereby the assignee takes on the assignor's rights, such as the right to receive payment of principal and interest on the loan. The assignor is still required to perform any obligations under the loan documentation. Therefore, there is no need to terminate the loan documentation and, unless the loan documentation stipulates otherwise, there is no need to obtain the debtor's consent, but notice of the assignment must be served on the debtor. However, many debtors are in fact involved in the negotiation stage, where the parties would also take the opportunity to vary the terms of the facility and security arrangement.

Novation of a loan requires that the debtor, the existing lender (transferor) and the incoming lender (transferee) enter into new documentation which provides that the rights and obligations of the transferor will be novated to the transferee. The transferee replaces the transferor in the loan facility and the transferor is completely discharged from all of its rights and obligations. This method of transfer does require the prior consent of the relevant debtor.

Sub-participation is often used where a lender, whilst wishing to share the risks of certain loans, nonetheless prefers to maintain the status quo. There is no change to the loan documentation – the lender simply sells all or part of the loan portfolio to another lender or lenders. From the debtor's perspective, nothing has changed and, in principle, there is no need to obtain the debtor's consent or serve notice on the debtor. This method of transfer is sometimes preferred if the existing lender is keen to maintain a business relationship with the debtor, or where seeking consent from the debtor or notifying the debtor of any transfer is not feasible or desirable. In any case, there would be no change to the balance sheet treatment of the existing lender.

OFFSHORE SECURITY ARRANGEMENTS

The transfer of a loan in a cross-border transaction often involves an offshore security package. A potential purchaser will need to conduct due diligence on the risks relating to such security. From a legal perspective, the security documents require close scrutiny to confirm their legality, validity and enforceability, including the nature and status of the assets involved. Apart from transferability generally, the documents would reveal whether any consent is required. A lender should seek full analysis on the risks relating to enforcement of security, which may well be complicated by the involvement of various jurisdictions for potential enforcement actions.

A key aspect to the enforcement consideration is whether a particular jurisdiction requires that any particular steps be taken to perfect a security interest relating to the loan portfolio (if the concept of perfection applies at all) and, if so, whether any applicable filing or registration has been made to perfect the security interest and, more importantly, whether there exists any prior or subsequent competing security interest over all or part of the same assets. For example, security interests may be registered in public records of the security provider maintained by the companies registry in Bermuda or the British Virgin Islands for the purpose of obtaining priority over competing interests under the applicable law. The internal register of charges of the security provider registered in the Cayman Islands, Bermuda or the British Virgin Islands should also be examined as part of the due diligence process. Particular care should be taken where the relevant assets require additional filings under the laws of the relevant jurisdictions, notable examples of such assets being real property, vessels and aircraft. Suites of documents held in escrow pending a potential default under the loan documentation should also be checked as they would be used by the lender or security agent to facilitate enforcement of security when the debtor defaults on the loan.

DUE DILIGENCE AND BEYOND

Legal due diligence on the loan documentation and security package is an integral part of the assessment undertaken by a lender of the risks of purchasing certain loan portfolios, regardless of whether the transfer is to be made by way of an assignment, novation or sub-participation. Whilst the choice of method of transfer is often a commercial decision, enforceability of security interests over underlying assets is the primary consideration in reviewing sufficiency of the security package in any proposed loan transfer.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

© Mondaq® Ltd 1994 - 2024. All Rights Reserved .

Login to Mondaq.com

Password Passwords are Case Sensitive

Forgot your password?

Why Register with Mondaq

Free, unlimited access to more than half a million articles (one-article limit removed) from the diverse perspectives of 5,000 leading law, accountancy and advisory firms

Articles tailored to your interests and optional alerts about important changes

Receive priority invitations to relevant webinars and events

You’ll only need to do it once, and readership information is just for authors and is never sold to third parties.

Your Organisation

We need this to enable us to match you with other users from the same organisation. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use.

- Search Search Please fill out this field.

- Personal Finance

Participation Mortgage: What It Is, How It Works

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

What Is a Participation Mortgage?

The term participation mortgage refers to a type of home loan that allows different parties to team up and share in any income or proceeds that result from the rental or sale of a piece of a mortgaged property. Agreements may include partnerships between borrowers, between borrowers and lenders , or among different lenders.

Participation mortgages reduce the risk to participants and allow them to increase their purchasing power. Many of these mortgages, therefore, tend to come with lower interest rates , especially when multiple lenders are also involved.

Key Takeaways

- A participation mortgage is shared between several borrowers who also split income or proceeds generated from renting or selling the property.

- These mortgages are most common in commercial real estate deals.

- Lenders of participation mortgages are typically non-traditional, such as entrepreneurs who want real estate investments without having to directly develop or maintain properties.

- Participation mortgages can reduce default risk, resulting in lower interest rates.

How Participation Mortgages Work

Once common in the past, participation mortgages are still financed to some degree. They involve two or more parties who agree to take on the risk of financing a piece of property in exchange for a certain percentage of the profits that result from its rental or sale.

As noted above, two or more borrowers may decide to team up in this type of loan . In other cases, borrowers and lenders, or multiple lenders may team up to share in the equity. These types of loans give borrowers more purchasing power and also cuts down the risk of default to lenders.

Participation mortgages are often used in commercial real estate transactions, such as the purchase of office buildings and apartment complexes, which anticipate ongoing rental income .

The parties involved normally split the net operating income (NOI)—the sum of revenues from the operation of the property minus any operating expenses . A typical profit split would be 55/45, with the lender receiving the smaller share. The lender gets a portion of the resale revenues—often all the profits above a specific benchmark, including repayment of the loan principal.

You can use a participation mortgage to finance the purchase of a commercial property or another asset that you intend to rent out, such as a boat.

Repayment terms for participation mortgages vary based on the lender and the type of agreement. Some may require interest-only payments. In other cases, the borrower(s) may be required to pay both principal and interest payments—just like a traditional mortgage. There are some cases, though, where lenders require a balloon payment . This is when the remaining balance is paid at the end of the loan.

Issuers of participation mortgages are often non-traditional lenders. They may be entrepreneurs looking for real estate investments without the hassle of developing or maintaining properties themselves. In other cases, these lenders may be pension funds looking for quality investments that return more than bonds but don’t have the volatility of stocks. By taking part in this type of agreement, these investors effectively act as silent partners .

Special Considerations

Borrowers give up a lot of equity in return for a lower rate by a lender in a participation mortgage. But depending on how the deal is structured, the interest savings could well offset the loss of equity. In the near term, it could make it possible for the borrower to develop a more substantial property than they might otherwise be able to afford.

A consideration for lenders is the problem of monitoring cash flow . They must inspect the borrower’s books to ensure that any declared net revenues are accurate. Otherwise, a lender would not know if the developer was padding expenses to report lower net income. Moreover, a developer could cut corners on improvements or even safety features, since he bears the cost of all repairs but only gets a share of net income—a form of moral hazard .

A particular appeal for pension funds is the built-in inflation proofing of participation mortgages. Most pensions include cost-of-living adjustments (COLA) that increase payouts during inflationary times. Since real estate prices generally track inflation , participation mortgages ensure higher returns on equity during periods of inflation.

Advantages of Participation Mortgages

The advantage of a participation mortgage to a borrower is the lower interest rate charged by a lender. This makes up for diminished earnings on the loan with the income revenue stream and the future sale revenue.

From a borrower’s perspective, participation loans are similar to the introductory teaser rates offered with an adjustable-rate mortgage (ARM). The difference, though, is that the low rate is stable over the life of the loan. Because they're able to take part in the profits, lenders are also able to cut down the amount of risk that stems from any possible default .

:max_bytes(150000):strip_icc():format(webp)/mortgage-69f02f04cdae4863806bd0455255106e.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Loan Participation Agreement

Jump to Section

What is a loan participation agreement.

A loan participation agreement is an agreement between a lender (lead lender) and a party who purchases an interest in an underlying loan (participant). In this agreement, the lead lender maintains control over the loan and manages the relationship with the borrower. The lead lender is responsible for originating the loan, communicating with the borrower, and servicing the loan. The lead lender accepts payments from the borrower, initiates collection actions, and forecloses on the loan collateral in the event of a default. Participants are not permitted to make claims against the borrower and can only request reimbursement for their participation from the lead lender.

Common Sections in Loan Participation Agreements

Below is a list of common sections included in Loan Participation Agreements. These sections are linked to the below sample agreement for you to explore.

Loan Participation Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.A 6 dex10a.htm LOAN PARTICIPATION AGREEMENT , Viewed October 24, 2021, View Source on SEC .

Who Helps With Loan Participation Agreements?

Lawyers with backgrounds working on loan participation agreements work with clients to help. Do you need help with a loan participation agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate loan participation agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

Meet some of our Loan Participation Agreement Lawyers

Erdal Turnacioglu of Erdal Employment Law focuses on providing employment solutions to both employees and businesses, whether through litigation, review of employee handbooks, workplace investigations, or training seminars.

Charlton M.

Charlton Messer helps businesses and their owners with general counsel and contract drafting services. He has helped over 500 businesses with their legal needs across a variety of industries in nearly a decade of practice.

Dan "Dragan" I.

I received a bachelor’s degree in philosophy from Northwestern University in 1996 and then got my JD at University of Illinois College of Law in 1999. I have been a lawyer helping people with legal issues in the United States and Internationally since then. That includes litigation as well as contracts/transactions. I am also passionate about helping small and medium businesses with trademark registration and trademark-related legal projects. The law can be confusing and complicated for people, and I am passionate about providing professional legal services to my clients while simultaneously making the legal process less confusing and stressful for them. My goal is to help clients navigate through both good and difficult times by tailoring my skills, experience, and services to their specific needs. I am currently licensed and authorized to practice before the Illinois courts and the United States District Court for the Northern District of Illinois. Internationally I am one of a select few American attorneys licensed and authorized to practice before the United Nations ICTY/IRMCT, the International Criminal Court, and the State Court of Bosnia-Herzegovina. Clients have retained me internationally alongside local counsel in several European countries, Australia, and Africa in private legal matters. I have also been appointed by the United Nations to represent persons at the ICTY/IRMCT and chosen by indigent accused to represent them. Since 2009 my law firm has handled domestic and international cases, including Trial litigation (including Commercial, Premises Liability, Personal Injury, Criminal Defense, and General Litigation) and Transactional work (Contracts, Corporate formation, and Real Estate Transactions). I enjoy helping less experienced practitioners and students evolve and improve. I served as an instructor/lecturer on Oral Advocacy and Trial Practice for the participants of the ADC-ICT & ICLB Mock Trial since 2014, and have presented Advocacy Training lectures for the ADC-ICT on several topics as well as regularly lecturing to visiting University and Bar groups from around the world. If you or a loved one have a legal matter of importance, let's see if I can help you with it!

Current practice includes: employment law, family law, business law and personal injury.

I have been practicing law exclusively in the areas of business and real estate transactions since joining the profession in 2003. I began my career in the Corporate/Finance department of Sidley's Los Angeles office. I am presently a solo practitioner/freelancer, and service both business- and attorney-clients in those roles.

I am a New Mexico licensed attorney with many years of world experience in real estate, transactional law, social security disability law, immigration law, consumer law, and estate planning.

Brent has been in practice since 2007 and been the principal attorney and owner of The Walker Firm, LLC since 2014. Brent focuses on providing an array of general counsel services to individuals and companies in a variety of industries.

Find the best lawyer for your project

How it works.

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Loan Participation Agreement lawyers by city

- Austin Loan Participation Agreement Lawyers

- Boston Loan Participation Agreement Lawyers

- Chicago Loan Participation Agreement Lawyers

- Dallas Loan Participation Agreement Lawyers

- Denver Loan Participation Agreement Lawyers

- Houston Loan Participation Agreement Lawyers

- Los Angeles Loan Participation Agreement Lawyers

- New York Loan Participation Agreement Lawyers

- Phoenix Loan Participation Agreement Lawyers

- San Diego Loan Participation Agreement Lawyers

- Tampa Loan Participation Agreement Lawyers

related contracts

- Accredited Investor Questionnaire

- Adverse Action Notice

- Bridge Loan

- Bridge Loan Contract

- Collateral Assignment

- Commercial Loan

- Convertible Bonds

- Convertible Note

- Convertible Preferred Stock

- Cumulative Preferred Stock

other helpful articles

- How much does it cost to draft a contract?

- Do Contract Lawyers Use Templates?

- How do Contract Lawyers charge?

- Business Contract Lawyers: How Can They Help?

- What to look for when hiring a lawyer

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- 14985 60th Street North Stillwater, MN 55082

- Phone (651) 439-2951

- Fax (651) 439-1417

MBA Article – Dos and Don’ts of Loan Participations

Loan participations have been a valuable tool in commercial lending for years. This is true primarily because they allow banks to participate in transactions that would otherwise present too much risk for them alone, or allow them to purchase or sell an interest in a transaction necessary to comply with their legal lending limit. Loan participations also allow banks the opportunity to diversify their loan portfolio with transactions, or within lending markets, in which they have minimal experience or expertise.

Prior to late 2007, when the most recent recession began, loan participations were used regularly. However, since that time, and continuing with the adoption of FASB 140, which took effect as of November 15, 2009, many banks have shied away from using loan participations. Properly managed, loan participations still have value in today’s lending marketplace and appear to be regaining popularity. With that in mind, it is important to understand not only what banks cannot do within the scope of a loan participation, but also understand what they should do to protect their interests.

THE DON’Ts OF LOAN PARTICIPATIONS

Although FASB 140, as amended by FASB 166, is merely an accounting standard, its adoption has had the largest impact on what banks can no longer do with respect to loan participations. Specifically, FASB 140, as amended by FASB 166, requires loan participations to (i) be based on a pro-rata ownership interest in the loan; (ii) require all cash derived from the loan to be shared based on pro-rata ownership, except for cash stemming from services rendered (i.e. an origination fee or a servicing fee); and, (iii) be non-recourse. In the event a loan participation fails to meet these requirements, it may not invalidate the participation agreement; however, the participation likely will not be treated as a sale of a portion of the loan. Rather it will most likely be treated as a direct loan from the participating bank to the borrower. In such case, certain unintended consequences such as exceeding a bank’s legal lending limit and other regulatory compliance violations may occur.

Loan participations prior to 2009 commonly included Last-In-First-Out (LIFO), First-In-Last-Out (FILO), or other accounting variations which were loan participation structures utilized by lead banks to facilitate the sale of loan participations. However, those types of accounting variations and structures do not comply with the current requirement that loan participation ownership be structured on a pro-rata basis.

Additionally, prior to 2009, loan participations also regularly allowed the lead bank to retain non-service based fees, such as non-usage fees on revolving lines of credit, pre-payment penalties and late fees, just to name a few. Retention of those types of fees clearly violates the current requirement that all cash derived from the participated loan be shared based on pro-rata ownership. It is important to note that service based fees need not be shared based on pro-rata ownership. Thus, the lead bank may still retain service based fees, such as loan origination fees, loan renewal fees and loan servicing fees.

Lastly, some loan participation agreements previously contained mandatory sale or buy-back provisions in favor of participant banks. These provisions ranged from mandatory buy-out of a participant by the lead bank upon the occurrence of an event of default by the borrower, to at-will repurchase. Depending on the specific language, these types of provisions allowed lead lenders better control of the particular lending relationship with the borrower or were an incentive for a participant bank purchasing an interest in a loan. These types of provisions are now contrary to the requirement that sales of participating interests be non-recourse and a true sale. Although, it is important to recognize that a lead lender may still buy back a participating interest from a participant bank, they just cannot have a required sale/buy-back in the loan participation agreement.

THE DOs OF LOAN PARTICIPATIONS

In addition to the issues that lenders should avoid in loan participations as noted above, which are primarily driven by the changes to the applicable FASB standards, lenders should ensure that the terms and conditions of their loan participation agreements guard against the unfortunate consequences experienced by both lead and participant banks during the most recent recession.

First, many lead banks and participant banks alike experienced a great deal of frustration with loans participated to more multiple participants. Previously, many lead banks used the same form of participation agreement to govern loans participated to multiple participants as they did for loans participated to a single participant. Unfortunately, loans participated to multiple parties present their own unique issues and should be documented accordingly. Specifically, many loan participation agreement forms allow the lead bank to take certain actions without the consent of participants and require participant consent for other actions. Although these types of consent provisions were sufficient for loans participated to a singular participant, they proved problematic for multi-participant loans because, when read together, such consent provisions are sometimes interpreted as requiring unanimous approval by all participants. This type of unintended interpretation allowed participants owning just a small percentage of a loan to veto any action decisions by the remainder of the lending group. For this reason, it is strongly recommended that when contemplating a loan to be participated by multiple parties, a master loan participation agreement is utilized, rather than individual loan participation agreements for each participant to ensure proper and unambiguous voting requirements for any given loan administration or collection action.

Second, as recently experienced by many lenders, the dynamics of loan participations change significantly when either the lead lender or a participant has been closed by the FDIC, and the applicable interest in the participated loan is assigned to an acquiring bank. The insertion of a participant bank with loss-share remedies with the FDIC substantially alters how that party may act within the scope of the loan participation. Particularly troubling for the other parties to the participated loan were collateral liquidation scenarios that were favorable for all of the parties without loss-share, but not deemed as favorable to a party with loss-share. With respect to this issue, there are a few noteworthy considerations. A loan participation agreement cannot divest a lead lender or a participant of its ownership because of a FDIC take-over. Such a provision would violate the requirement that loan participations be sold without recourse. However a provision can be included in the participation agreement to contemplate that the servicing responsibilities are to be transferred to one of the participant banks upon the closure of the lead bank by the FDIC. New ownership of the lead bank’s rights may have a different servicing philosophy. Common differences of opinion among the lead banks and participants involve issues such as what constitutes an event of default, when to call an event of default, enforcement of non-monetary loan covenants, whether to utilize a loan workout or forbearance agreement, collateral liquidation strategies, and an assortment of other issues. These are just a few of the many issues that should be carefully considered by the lead bank and participants when the parties are negotiating the participation agreement. Participation agreements are not “one size fits all” documents. In fact, the majority of participation agreements should be customized to fit the transaction and the specific lead and participant banks.

Another issue that arose frequently during the recession involved the ownership of foreclosed or surrendered collateral which caused lead, and participant, banks to ask how such collateral should be carried by the banks following liquidation or surrender in light of the fact the “loan” no longer exists. In reality, such collateral should be treated as OREO or OPPO. Depending on the nature of the asset, a limited liability company is the most favored ownership entity structure for this scenario and will continue to be, especially with the changes to the limited liability company rules set to take effect as of August 1, 2015. Placing OREO or OPPO participated assets into a limited liability company can significantly limit both the lead and participant banks’ exposure to non-contractual liability, with the banks each obtaining an ownership interest in the entity equal to their pro-rata share in the participated loan. This is particularly important where the assets involve businesses which are, and will continue to be, open to the public after the asset foreclosed or surrendered. It is important to note that lead and participant Minnesota banking corporations must obtain approval from the Minnesota Department of Commerce prior to the formation of such entities. The participation agreement should include a provision that contemplates the formation of such an entity and, to the extent possible, proposed drafts the entity’s formation documents should be negotiated and prepared simultaneously with the participation agreement.

In the last decade, there have been significant changes to both the relationship of parties to a participated loan and the language of loan participation agreements. Although significant, these changes have not altered the fact that banks can continue to utilize participated loans as a valuable part of their businesses, but doing so within the parameters of today’s requirements and in light of prior experiences.

Published by:

Related Articles

- Jellum Law Announces a New Partner January 13, 2023

- Happy Holidays from Jellum Law December 21, 2022

- Continuing Resolution Extended and Prime Rate Notice December 16, 2022

- Celebrating Jellum Law Staff November 22, 2022

- Jellum Law Adds New Team Member to the Litigation Team November 8, 2022

- About Jellum Law

Jellum Law 651-439-2951 [email protected] 7616 Currell Blvd, Suite 245 - Woodbury, MN 55125

What You Should Know About Loan Participation Accounting

- No Comments

If you’re a banker, you are probably curious about loan participation accounting. It is an essential part of determining your loan’s true worth. The purchaser and originator of the loan both want to see the true sale of the participating interest in the loan. However, when it comes to accounting for loan participation, you should remember that there are several different rules that apply. Read on to find out more about loan participation accounting. Here are a few of them:

Bank’s Obligations to Participant

As a bank, a participating company in loan participation accounting has certain rights and obligations. The Bank is required to pay payments promptly and shall apply the money received from a Participant’s loan to the bank account designated by the Participant. However, the Participant may be required to provide written instructions to the Bank on how to receive payments from the Bank. Listed below are some of the Bank’s obligations to a Participant in loan participation accounting.

In addition to the requirements for loan participation , banks must be aware of the potential consequences of changing FASB standards. In addition to ensuring that loan participations are compliant with the new standards, banks must make sure that their participation agreements contain specific provisions that protect them from adverse consequences. To prevent such a problem, banks should review participation agreements and implement a process to review them before entering into a loan participation.

In addition, loan participations can be beneficial to community banks when the lead bank maintains control of large customer relationships. However, lending limits and capital adequacy issues should be carefully considered before entering into a participation agreement. To understand the benefits and drawbacks of loan participations, banks should take the time to review the FDIC’s guidelines on loan participation accounting. It can help them decide if loan participations are right for them.

In today’s competitive financial environment, loan participations have become an important tool for community banks. They provide liquidity to the financial system by enabling banks to participate in loan transactions, purchase interest in the loans, and transfer funds to the originating bank in exchange for cash payments. By following these guidelines, participating banks can minimize the risks and maximize the profit of their lending operations. If a bank can meet these requirements, it will remain competitive.

Bank’s Share of Collections

A bank’s share of collections in loan participation accounting is determined by the amount of its participation in the total collection of the customer’s loans. Before, loan participations were commonly structured using the Last-In-First-Out (LIFO) or First-In-Last-Out (FILO) method. These accounting variations were used by lead banks to facilitate the sale of loan participations, but these practices do not meet the new requirement that loan participation ownership is structured on a pro-rata basis.

Lenders should make sure their loan participation agreements contain a clause protecting them from potential liability for losses or adjusting the lender’s share of collections. A loan participation agreement should specify the role of the lead institution and define how its participation obligations should be measured. It should also state the rights and responsibilities of each party, including dispute resolution procedures. These provisions are crucial in loan participation accounting. Moreover, banks must comply with the lending restrictions of the government when entering into loan participation agreements. One exceptional feature of BankLabs Participate platform is the built-in NDA and loan agreement documents. Of course, there is always an option to upload and use your own custom document if you need.

Tracking Transactions

Whether the Bank’s Share of Interest in a Loan Participation is deductible in the Accounting Book or Balance Sheet is a question you might have. Loan participations are financial products in which the Bank participates in a loan and accepts part of the risk for the borrower. Typically, these loans are for small business loans or large commercial real estate loans. Banks can use loan participations for many different purposes, including improving their liquidity, interest rate risk management, diversified portfolios, and attracting and retaining customers by serving their credit needs, even if they are above their lending limit.

One of the most difficult tasks when originating and managing loan participation is the back office organization. Keeping track of transactions, dates, approvals, and important loan documentation can be tedious for a loan officer. That is why investing in loan participation management software is so important, especially if you originate multiple loans with multiple institutions participating.

Even if you participate in several loans, the organizational aspects can get confusing and lost in the inbox. With a central location for all transaction history and dates noted, a loan officer can get a full picture of the status of your bank’s loan portfolio instantly. You can see which will close next and which have already been completed. Custom reports also help you share this information with your team. Having correspondences in one central location rather than several different inboxes can be a lifesaver and easily pulling up documents with specific accounting information on them with the click of a button can make balancing your accounts easy.

What is a Participation Loan?

Comments are closed.

- Participate

SALES [email protected] 501-246-5148

SUPPORT [email protected] 501-313-3414

Get ahead of the competition.

Demos of our products take only 30 minutes and we offer a free trial.

Schedule Your Demo Today

Schedule a Demo

All Rights Reserved.

- Schedule A Demo

- What is Rimon?

- Awards and Recognitions

- Representative Clients

- Streamlined Structure

- Our Principles

- Recent Firm News

- Diversity, Equity, and Inclusion

- All-Star Team

Search our capabilities across practice areas, industries and regions

Search the rimon team.

- Industry-Specific Blogs

After London and Paris, Rimon Set on Further International Expansion, Law360 Reports

Rimon Partner Rodrigo Castillo Cottin Highly Recommended by Leaders League for Wealth Management

Global Law Firm Rimon PC expands international reach with opening of new London office

- Asia Pacific

- Latin America

- Middle East

- North America

Regional Practices

- Albuquerque

- Kansas City

- Los Angeles

- Minneapolis

- Northern Virginia

- Philadelphia

- Research Triangle, North Carolina

- San Francisco

- Santa Barbara

- Silicon Valley

- St. Petersburg

- Washington, D.C.

- Join Our Team Open Positions Lateral Partners

- Client Portal

Insights & Analysis

Top ten issues to consider when dealing with loan participations, insights douglas j. schneller · john j. hanley · july 24, 2018.

Rimon Partners, John Hanley and Douglas Schneller , have an important update titled “Top Ten Issues to Consider When Dealing with Loan Participations”.

Loan participations can be an effective way for lenders to reduce their exposure to a borrower’s credit and manage their loan portfolios and liquidity, and for investors to acquire an interest in a loan without becoming a lender of record under the loan agreement. Although loan participations are customarily used in the loan market, they differ from assignments (i.e. outright sales) in several important ways.