- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Why Do So Many Strategies Fail?

- David J. Collis

Today it’s not unusual for corporations that have dominated their markets for decades to be blindsided by upstarts with radical new business models. A lot of young ventures, on the other hand, raise vast sums of money and attract tens of millions of customers, only to collapse when they can’t figure out how to fend off imitators. In these situations and many others, the underlying cause is often a failure to take a holistic approach to strategy.

Strategy today demands more than classic competitive positioning. It requires making carefully coordinated choices about the opportunities to pursue; the business model with the highest potential to create value; how to capture as much of that value as possible; and the implementation processes that help a firm adapt activities and build capabilities that allow it to realize long-term value. Neglecting any of those imperatives can derail a strategy, but CEOs frequently zero in on just one. Entrepreneurs tend to focus on identifying a golden opportunity and don’t think enough about how to monetize it; leaders of incumbents, on capturing value but not new ways to create it.

By tackling all the elements of strategy and integrating them well, however, firms will greatly increase their odds of success.

Leaders focus on the parts rather than the whole.

Idea in Brief

The problem.

Seemingly successful new companies struggle to turn a healthy profit. Established firms get disrupted by upstarts. Companies that excel at serving their markets can’t adapt when customers’ tastes shift.

The Root Cause

All too often business leaders focus on one element of strategy—such as identifying a golden opportunity presented by new technologies or building advantages that competitors lack. But they either ignore the other components of strategy or don’t recognize the components’ interdependencies.

The Solution

Take a holistic approach and craft a strategy that encompasses carefully coordinated choices about the business model, the competitive position, implementation processes that adapt constantly to the changing environment, and the capabilities needed to win in the long term.

The CEO’s job of crafting a strategy that creates and captures value—and keeps realizing it over time—has never been harder. In today’s volatile and uncertain world, corporations that have dominated their markets for decades can be blindsided by upstarts with radical new business models, miss the boat on emerging technologies, or be outflanked by competitors that are more adept at shaping consumer preferences. Young ventures can raise hundreds of millions of dollars, attract tens of millions of customers, and achieve lofty market valuations, only to collapse when they cannot figure out how to turn a profit or hold off imitators.

- David J. Collis is an adjunct professor of business administration at Harvard Business School and the winner of the McKinsey Award for the best HBR article of 2008.

Partner Center

Yahoo! The story of strategic mistakes

Jerry Yang and David Filo founded Yahoo in January 1994 . Both of them were Stanford graduates. At first, they developed a website named “Jerry and David’s Guide to the World Wide Web”. It was simply a directory of other websites, organized in a hierarchy as a searchable index of pages.

By April 1994, Jerry and David’s Guide to the World Wide Web was renamed “Yahoo! “. The word “YAHOO” is an acronym for “ Yet Another Hierarchically Organized Oracle “.

Yahoo witnessed an enormous and rapid growth throughout the ’90s and diversified its business. It was poised to become a giant and a high profile company.

Yahoo provided a search engine and a directory for other websites in a time when people could only log into a website if they knew the website address. Else there was no way to search a website.

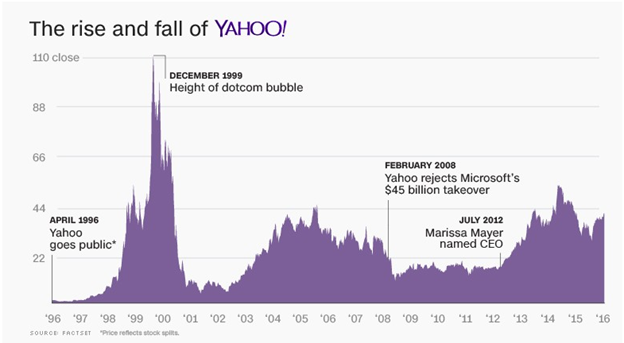

The company started making money from the advertising banners which was the first of its kind and started to grow rapidly. Yahoo went public in April 1996 and its stock price rose by 600 percent within two years and by 1998, Yahoo was the most popular starting point for web users receiving 95 million page views per day.

Yahoo came up with a series of funny advertisements to popularize its search engine. Check this one out!!

Yahoo’s stock became investor’s darling during the dot.com bubble and once closed at an all-time high of $118.75 in 2000. Just after the dot.com bubble crash the stuck plunged to all time lowest (literrally) at $8.11.

Despite the tremendous performance of Yahoo at its early stages, the company started bleeding in the late 2000s due to multiple factors. Here are the top 6 reasons which resulted in Yahoo’s downfall:

Wrong decisions: Yahoo refused to buy Google for 1 million dollars:

Back in 1998, two individuals, Larry Page and Sergei Brin (Google founders), offered to sell their little startup algorithm to Yahoo for $1 million. The algorithm was supposed to help the Yahoo search engine perform faster and enhance the experience of web search.

Yahoo turned down the offer mainly because it wanted its users to spend more time on Yahoo’s own platform and the other Yahoo content so that it can make more money from the advertising banners on the website.

Again, in 2002 Yahoo rejected an offer to buy Google for $5 billion when the CEO Terry Semel refused the deal after months of negotiation. Yahoo offered to buy Google at $3 billion but Google was keen on getting $5 billion. So the deal could never happened. (Thank God!!)

Failing to buy Facebook :

As if saying no to Google was not enough for Yahoo . According to the book called The Facebook Effect by David Kirkpatrick, Yahoo initially offered $1 billion to Facebook but later lowered it to $850 million. David writes that Facebook made its mind in 10 minutes to decline the offer. Although, some stories say that if the offer was submitted at $1.1 billion instead of $1 billion, the board of directors would’ve put pressure on Mark Zuckerberg to sell.

Unsuccessful acquisitions :

Even the successful acquisitions could not bring value to the organization. Yahoo acquired two companies in 1999 that are now ranked by Forbes as some of the worst internet acquisitions of all-time.

The first was a $4.58 billion deal for Geocities, a site that enabled users to build their own personal websites. While Geocities was a pioneer in this regard, it eventually was shut down in 2009 after failing to deliver any value to Yahoo shareholders.

The second was the famous $5.7 billion deal for Broadcast.com, an online television site that was founded by Mark Cuban. Perhaps the idea was way ahead of its time and internet connections were too slow in 1999 to run this type of video content off the web..

Yahoo also bought Tumblr for $1.1 billion in 2013. Many Tumblr users were unhappy with this acquisition and started an online petition which got 170,000 signatures. Yahoo had to write down more than half of Tumblr by 2016 and ultimately sold it to Verizon.

Hiring wrong CEOs :

As experts say, Yahoo has repeatedly hired the wrong CEOs. None of the CEOs at Yahoo including Marissa Mayer had a “strategic vision” that could match what Eric Schmidt at Google brought. Some even blame Marissa Mayer entirely for the wrong decisions.

Lack of clear vision and a string of poor leaders :

It’s very clear from the strategic mistakes of Yahoo that its leadership lacked a clear vision and the overall purpose of the company. Meanwhile, Google and Microsoft were very clear about their strategic direction.

Yahoo was all over the place. During the research, people were asked to identify Yahoo with what first comes to their mind. Some said Mail , Some Media. Some said search. Clearly, Yahoo failed to create a niche for itself that its competitors successfully did.

Some former employees actually saw the slow demise of the company many years before it actually happened as they could see the bureaucratic culture with too much focus on advertising.

It became very difficult to get both investment and alignment. If you built a new product and the home page didn’t want to feature it, you were hosed. Greg Cohn, a former senior product director at Yahoo to Reuters

Declining Microsoft’s acquisition :

This was the final nail in the coffin. In 2008, Microsoft had shown its interest to buy Yahoo for $44.6 billion but Yahoo declined that too (I really don’t know what they were thinking). Since then, the company market value has never reached such numbers. In 2016 Verizon bought Yahoo in a deal worth $4.8 billion.

Yahoo is still not dead though. It is still among the world’s top 10 websites with more than 3.5 billion visits per month . Nevertheless, its place does not augur well for a bright future. Unless Yahoo comes up with any innovation that can change the future of technology, Yahoo! may die gradually in the coming years. It’s a perfect story to learn where the company despite having the right technology and right resources at disposal, failed miserably due to its strategic mistakes.

Interested in reading our Advanced Strategy Stories . Check out our collection.

Also check out our most loved stories below

IKEA- The new master of Glocalization in India?

IKEA is a global giant. But for India the brand modified its business strategies. The adaptation strategy by a global brand is called Glocalization

How Bata became India’s household name despite being a classy international brand?

Bata is not an Indian brand. It is as international as it can be. But what strategies made it India’s highest selling footwear brand?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

How traditional banks in India are dealing with cryptocurrency?

Adaption of cryptocurrency like Bitcoin is rising in India. Despite the removal of the RBI ban by the Supreme Court, banks in India still hesitate to deal with cryptocurrency.

Microsoft – How to Be Cool by Making Others Cool

Microsoft CEO Satya Nadella said, “You join here, not to be cool, but to make others cool.” We decode the strategy powered by this statement.

I'm a Finance professional with passion for economics and stories of the companies. A commercial driven finance person with more than 12 years of experience in the FMCG industry working with some of the biggest brand in the world.

Related Posts

AI is Shattering the Chains of Traditional Procurement

Revolutionizing Supply Chain Planning with AI: The Future Unleashed

Is AI the death knell for traditional supply chain management?

Merchant-focused Business & Growth Strategy of Shopify

Business, Growth & Acquisition Strategy of Salesforce

Hybrid Business Strategy of IBM

Strategy Ingredients that make Natural Ice Cream a King

Investing in Consumer Staples: Profiting from Caution

Storytelling: The best strategy for brands

How Acquisitions Drive the Business Strategy of New York Times

Rely on Annual Planning at Your Peril

How does Vinted make money by selling Pre-Owned clothes?

N26 Business Model: Changing banking for the better

Sprinklr Business Model: Managing Unified Customer Experience

How does OpenTable make money | Business model

How does Paytm make money | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

The Strategic Decisions That Caused Nokia’s Failure

- Share on LinkedIn

- Share on Facebook

- Share on Twitter

- Share via Email

- Download PDF

In less than a decade, Nokia emerged from Finland to lead the mobile phone revolution. It rapidly grew to have one of the most recognisable and valuable brands in the world. At its height Nokia commanded a global market share in mobile phones of over 40 percent. While its journey to the top was swift, its decline was equally so, culminating in the sale of its mobile phone business to Microsoft in 2013.

It is tempting to lay the blame for Nokia’s demise at the doors of Apple, Google and Samsung. But as I argue in my latest book, “ Ringtone: Exploring the Rise and Fall of Nokia in Mobile Phones ” , this ignores one very important fact: Nokia had begun to collapse from within well before any of these companies entered the mobile communications market. In these times of technological advancement, rapid market change and growing complexity, analysing the story of Nokia provides salutary lessons for any company wanting to either forge or maintain a leading position in their industry.

Early success

With a young, united and energetic leadership team at the helm, Nokia’s early success was primarily the result of visionary and courageous management choices that leveraged the firm’s innovative technologies as digitalisation and deregulation of telecom networks quickly spread across Europe. But in the mid-1990s, the near collapse of its supply chain meant Nokia was on the precipice of being a victim of its success. In response, disciplined systems and processes were put in place, which enabled Nokia to become extremely efficient and further scale up production and sales much faster than its competitors.

Between 1996 and 2000, the headcount at Nokia Mobile Phones (NMP) increased 150 percent to 27,353, while revenues over the period were up 503 percent. This rapid growth came at a cost. And that cost was that managers at Nokia’s main development centres found themselves under ever increasing short-term performance pressure and were unable to dedicate time and resources to innovation.

While the core business focused on incremental improvements, Nokia’s relatively small data group took up the innovation mantle. In 1996, it launched the world’s first smartphone, the Communicator, and was also responsible for Nokia’s first camera phone in 2001 and its second-generation smartphone, the innovative 7650.

The search for an elusive third leg

Nokia’s leaders were aware of the importance of finding what they called a “third leg” – a new growth area to complement the hugely successful mobile phone and network businesses. Their efforts began in 1995 with the New Venture Board but this failed to gain traction as the core businesses ran their own venturing activities and executives were too absorbed with managing growth in existing areas to focus on finding new growth.

A renewed effort to find the third leg was launched with the Nokia Ventures Organisation (NVO) under the leadership of one of Nokia’s top management team. This visionary programme absorbed all existing ventures and sought out new technologies. It was successful in the sense that it nurtured a number of critical projects which were transferred to the core businesses. In fact, many opportunities NVO identified were too far ahead of their time; for instance, NVO correctly identified “the internet of things” and found opportunities in multimedia health management – a current growth area. But it ultimately failed due to an inherent contradiction between the long-term nature of its activities and the short-term performance requirements imposed on it.

Reorganising for agility

Although Nokia’s results were strong, the share price high and customers around the world satisfied and loyal, Nokia’s CEO Jorma Ollila was increasingly concerned that rapid growth had brought about a loss of agility and entrepreneurialism. Between 2001 and 2005, a number of decisions were made to attempt to rekindle Nokia’s earlier drive and energy but, far from reinvigorating Nokia, they actually set up the beginning of the decline.

Key amongst these decisions was the reallocation of important leadership roles and the poorly implemented 2004 reorganisation into a matrix structure. This led to the departure of vital members of the executive team, which led to the deterioration of strategic thinking.

Tensions within matrix organisations are common as different groups with different priorities and performance criteria are required to work collaboratively. At Nokia,which had been acccustomed to decentralised initiatives, this new way of working proved an anathema. Mid-level executives had neither the experience nor training in the subtle integrative negotiations fundamental in a successful matrix.

As I explain in my book, process trumps structure in reorganisations . And so reorganisations will be ineffective without paying attention to resource allocation processes, product policy and product management, sales priorities and providing the right incentives for well-prepared managers to support these processes. Unfortunately, this did not happen at Nokia.

NMP became locked into an increasingly conflicted product development matrix between product line executives with P&L responsibility and common “horizontal resource platforms” whose managers were struggling to allocate scarce resources. They had to meet the various and growing demands of increasingly numerous and disparate product development programmes without sufficient software architecture development and software project management skills. This conflictual way of working slowed decision-making and seriously dented morale, while the wear and tear of extraordinary growth combined with an abrasive CEO personality also began to take their toll. Many managers left.

Beyond 2004, top management was no longer sufficiently technologically savvy or strategically integrative to set priorities and resolve conflicts arising in the new matrix. Increased cost reduction pressures rendered Nokia’s strategy of product differentiation through market segmentation ineffective and resulted in a proliferation of poorer quality products.

The swift decline

The following years marked a period of infighting and strategic stasis that successive reorganisations did nothing to alleviate. By this stage, Nokia was trapped by a reliance on its unwieldy operating system called Symbian. While Symbian had given Nokia an early advantage, it was a device-centric system in what was becoming a platform- and application-centric world. To make matters worse, Symbian exacerbated delays in new phone launches as whole new sets of code had to be developed and tested for each phone model. By 2009, Nokia was using 57 different and incompatible versions of its operating system.

While Nokia posted some of its best financial results in the late 2000s, the management team was struggling to find a response to a changing environment: Software was taking precedence over hardware as the critical competitive feature in the industry. At the same time, the importance of application ecosystems was becoming apparent, but as dominant industry leader Nokia lacked the skills, and inclination to engage with this new way of working.

By 2010, the limitations of Symbian had become painfully obvious and it was clear Nokia had missed the shift toward apps pioneered by Apple. Not only did Nokia’s strategic options seem limited, but none were particularly attractive. In the mobile phone market, Nokia had become a sitting duck to growing competitive forces and accelerating market changes. The game was lost, and it was left to a new CEO Stephen Elop and new Chairman Risto Siilasmaa to draw from the lessons and successfully disengage Nokia from mobile phones to refocus the company on its other core business, network infrastructure equipment.

What can we learn from Nokia

Nokia’s decline in mobile phones cannot be explained by a single, simple answer: Management decisions, dysfunctional organisational structures, growing bureaucracy and deep internal rivalries all played a part in preventing Nokia from recognising the shift from product-based competition to one based on platforms.

Nokia’s mobile phone story exemplifies a common trait we see in mature, successful companies: Success breeds conservatism and hubris which, over time, results in a decline of the strategy processes leading to poor strategic decisions. Where once companies embraced new ideas and experimentation to spur growth, with success they become risk averse and less innovative. Such considerations will be crucial for companies that want to grow and avoid one of the biggest disruptive threats to their future – their own success.

About the author(s)

Yves L. Doz

is an Emeritus Professor of Strategic Management and the Solvay Chaired Professor of Technological Innovation, Emeritus at INSEAD.

About the series

Corporate governance, share this post, view comments.

Rahul Tripathi

30/03/2024, 03.42 pm

I found this article on the strategic decisions behind Nokia's failure incredibly insightful! 📉 As someone interested in business strategy and management, understanding the factors that led to Nokia's downfall provides valuable lessons for avoiding similar pitfalls in the future. 💡 The analysis of Nokia's missteps, from failing to adapt to changing market trends to underestimating the competition, highlights the importance of agility and innovation in today's dynamic business landscape. 🔄💡

Moreover, the article offers actionable insights that can be applied to various industries, making it a must-read for anyone involved in strategic decision-making processes. 🌟 Thank you for sharing such informative content! I'll definitely keep these lessons in mind as I navigate my own business endeavors. 👍📚

- Log in or register to post comments

Anonymous User

16/03/2022, 10.44 am

Nokia is the one of the oldest phone and also it is existed until now

17/09/2021, 07.41 pm

Why does Nokia fail

26/06/2021, 09.54 pm

Someone really should dig into the tale of Nokia Music, that of OD2, a successful independent company bought by Nokia in 2007. In less than four years through marketing bodges, strategic failures, interference from gormless management in the USA, and even more nepotistic and mostly incompetent management in the UK, a profitable company with numerous high profile corporate customers was brought to its knees by talent free people who should never have been promoted into the positions they were in. Well worth digging into, just don't interview the management or you will never get to the truth.

03/06/2021, 01.56 am

As I read through many of these comments, the word "dillusional" kept coming to mind. For starters, Windows OS was as good as either Android or iOS. The main thing lacking were just a few more core apps. That was really it.

Sure, they could easily have run Andoid, and as soon as that idea was floated, Microft instantly shuttered their offices.

The fact that Nadella had his trojan horse Elop do the deal on Friday and hand everyone their walking papers on Monday is proof positive that Microsoft never had any good intentions for Nokia.

MS could have easily thrown one of their legions of Devs onto the task of writing apps. which would have solved the app. store issue in a hurry.

Instead, Nadella destroyed Microfts own eco-system by loosing that lucrative and Crucial market sector. A permanent wound that still haunts them to this day, and showcased Nadella as being far Inferior to Ballmer as well as Gates.

While my first inclination is to assume some nefarious reason for this, I do have to acknowledge however the old addage: "Don't attribute to maclice, what can easily be explained by stupidity"

30/10/2020, 04.23 pm

Why only Nokia there are a number of business world wide which have failed because of its own Founders/CEO/COO lapses some of the reasons which I contribute are as follows.... 1. Lack of vision future 2. Innovation in new age computing revolution 3. High Salary package 4. Founders cannot be pushed out or replaced easily. 5. Management Decisions 6. Dysfunctional Hierarchy 7. Growing Bureaucracy 8. Internal rivalry

21/01/2018, 12.17 am

Captain of the ship knows how to sink the boat. Stephen (the first non Finnish CEO in history of Nokia) joined in 2010 from Microsoft and made a deal to use Windows only despite the fact that Android was growing and already captured huge market share. There was a lot of pressure from Nokia employees to move to Android but he ignored all. He fired a lot of people. It was famous in Nokia Espo office (H/Q) that he is a Trojan Horse. He later sold Nokia mobile business to Microsoft and earned millions of dollars in the deal. Later, he joined Microsoft again. Looks like the plan was to promote Windows Mobile at the cost of Nokia (that failed badly)

Sheila Yovita

13/01/2018, 04.20 am

If the company is at crises, what should the managers do? Could it be one of the option go for advices from top management consulting firms or any other third parties that can help to formulate better strategies to save the company? Assuming they went for consulting firms, then the firms were failed to help Nokia as well?

22/12/2017, 02.34 am

I would love to also see something similar about Blackberry. They were the prime brand for many early adopters and business users of cellular phones here in the USA. Similar to Nokia they also had/have secure network platform. I wonder if their demise was also due to strategic mistakes, and if similar to Nokia they also got bogged down with tactical activities and lost sight of overall strategy.

21/12/2017, 05.00 am

I agree with everyone, broadly. Nonetheless we should NEVER FORGET that Nokia would be far far better (as a Smartphone maker), than it is today.

Another illustration of a North American Corporation that did so well from its foundational years in the 19th Century and well into its first centenary is NORTEL Networks... I read a book about the rise, growth and maturity of NORTEL and it became one great role model for me... Unfortunately, NORTEL failed to go the length any longer than the beginning of the 21st Century; NORTEL collapsed for reasons that are too embarrassing to speak openly abbout - or even in privacy!

I'm working on to establish a Corporate and Product Branding Consultancy in town (Accra, Ghana), and this article on Nokia, like others, is what I've been looking out for, to help learn and know how to start and grow an enterprise and keep it growing and succeeding decade after decade, century after century!

I'm learning!

17/12/2017, 07.59 pm

"While Symbian had given Nokia an early advantage, it was a device-centric system in what was becoming a platform- and application-centric world." Well, actually Nokia pioneered the app-centric world. Go check. Only it's User Interface didn't keep up with the emerging competition.

07/12/2017, 05.51 am

Nokia is still alive... and much more than a mobile phone manufacturer. Nokia is the biggest network equipment maker in the world, employees +100k people and ~25 billion € in revenue in 2016...

30/11/2017, 05.40 pm

Good article. Thanks.

Interesting side note: While working in Japan around 2002, I heard "on the street" that Nokia ran a research center in Japan. Intended to tap the vast and growing Japanese mobile market. They saw everything that was coming in the Western world. Good cameras. Apps. Cost effective mobile internet & services. Mobile email messaging on a mass scale. Multi media devices. Long before the iPhone was invented. Nokia deemed the Japanese market too challenging and closed their research center. Turned a blind eye. The competition was already too far ahead.

28/11/2017, 03.21 am

Another consideration is that Nokia stayed committed to hardware-based human-computer factors as differentiation far longer than it should have: optical strip for scrolling, buttons for menus, buttons for navigation, etc. What the iPhone showed is that software-based UX was the more flexible and powerful approach.

26/11/2017, 04.40 pm

Just imagine, if Nokia had seen the future and adopted Android operating systems before 2009-10, perhaps the horizons of the mobile Eco system would have been very different today. Similarly, Blackberry also failed to see the shift in the mobile market from a communicating device to a multi Media device. Phones transcended the mere communication and functional level to take control of our social lives and presence. The social sites and e commerce growth were trends and changes that both these behemoths failed to see or gauge. They still remain extremely hardware centred, building very physically robust devices but perhaps falling short on the imagination part. I think this is entirely a matter of leadership vision and imagination.

25/11/2017, 12.00 am

Unless I am misremembering, I am sure I had a Samsung phone in the early 2000s. It was nothing like the Samsung mobiles of today. It was not user friendly, the operating system was a mess and I soon went back to Nokia but it's not true to say that Samsung hadn't entered the mobile communications market, they just hadn't entered the smart phone market. (Not that I don't agree with the thrust of the article - Nokia's downfall was very much of its own making).

24/11/2017, 11.53 pm

I think a similar story can be told about Microsoft under Ballmer. What Symbian was for Nokia, Windows was for Microsoft at one time. Nadella came in just at the right time to lift the company out of that slumber and made it take a leap of faith in the Cloud world. The results are evident. Microsoft is sailing at its lifetime best share prices. On the contrary, when we look at Apple, they seem to be following the footsteps of Nokia. Slowly but surely they are becoming a victim of their own success.

Leave a Comment

Please log in or sign up to comment., related reads.

How Nokia Bounced Back (With the Help of the Board)

Quy Huy & Timo Vuori

Why Successful Companies Usually Fail

Y. Doz, K. Wilson

Spanning the Boundaries That Limit Organisational Innovativeness

Our website has a lot of features which will not display correctly without Javascript.

Please enable Javascript in your browser

Here how you can do it: http://enable-javascript.com

More From Forbes

How kodak failed.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

(Update 1-19-2012 — Kodak has filed for bankruptcy protection .)

There are few corporate blunders as staggering as Kodak’s missed opportunities in digital photography, a technology that it invented. This strategic failure was the direct cause of Kodak’s decades-long decline as digital photography destroyed its film-based business model.

A new book by my Devil’s Advocate Group colleague, Vince Barabba , a former Kodak executive, offers insight on the choices that set Kodak on the path to bankruptcy. Barabba’s book, “ The Decision Loom: A Design for Interactive Decision-Making in Organizations ,” also offers sage advice for how other organizations grappling with disruptive technologies might avoid their own Kodak moments.

Steve Sasson, the Kodak engineer who invented the first digital camera in 1975, characterized the initial corporate response to his invention this way:

But it was filmless photography, so management’s reaction was, ‘that’s cute—but don’t tell anyone about it.’ via The New York Times (5/2/2008)

Kodak management’s inability to see digital photography as a disruptive technology, even as its researchers extended the boundaries of the technology, would continue for decades. As late as 2007, a Kodak marketing video felt the need to trumpet that “Kodak is back “ and that Kodak “wasn’t going to play grab ass anymore” with digital.

To understand how Kodak could stay in denial for so long, let me go back to a story that Vince Barabba recounts from 1981, when he was Kodak’s head of market intelligence. Around the time that Sony introduced the first electronic camera, one of Kodak’s largest retailer photo finishers asked him whether they should be concerned about digital photography. With the support of Kodak’s CEO, Barabba conducted a very extensive research effort that looked at the core technologies and likely adoption curves around silver halide film versus digital photography.

The results of the study produced both “bad” and “good” news. The “bad” news was that digital photography had the potential capability to replace Kodak’s established film based business. The “good” news was that it would take some time for that to occur and that Kodak had roughly ten years to prepare for the transition.

Gado via Getty Images

The study’s projections were based on numerous factors, including: the cost of digital photography equipment; the quality of images and prints; and the interoperability of various components, such as cameras, displays, and printers. All pointed to the conclusion that adoption of digital photography would be minimal and non-threatening for a time. History proved the study’s conclusions to be remarkably accurate, both in the short and long term.

The problem is that, during its 10-year window of opportunity, Kodak did little to prepare for the later disruption. In fact, Kodak made exactly the mistake that George Eastman, its founder, avoided twice before, when he gave up a profitable dry-plate business to move to film and when he invested in color film even though it was demonstrably inferior to black and white film (which Kodak dominated).

Barabba left Kodak in 1985 but remained close to its senior management. Thus he got a close look at the fact that, rather than prepare for the time when digital photography would replace film, as Eastman had with prior disruptive technologies, Kodak choose to use digital to improve the quality of film.

This strategy continued even though, in 1986, Kodak’s research labs developed the first mega-pixel camera, one of the milestones that Barabba’s study had forecasted as a tipping point in terms of the viability of standalone digital photography.

The choice to use digital as a prop for the film business culminated in the 1996 introduction of the Advantix Preview film and camera system, which Kodak spent more than $500M to develop and launch. One of the key features of the Advantix system was that it allowed users to preview their shots and indicate how many prints they wanted. The Advantix Preview could do that because it was a digital camera. Yet it still used film and emphasized print because Kodak was in the photo film, chemical and paper business. Advantix flopped. Why buy a digital camera and still pay for film and prints? Kodak wrote off almost the entire cost of development.

As Paul Carroll and I describe in " Billion-Dollar Lessons: What You Can Learn From The Most Inexcusable Business Failures of the Last 25 Years ," Kodak also suffered several other significant, self-inflicted wounds in those pivotal years:

In 1988, Kodak bought Sterling Drug for $5.1B, deciding that it was really a chemical business, with a part of that business being a photography company. Kodak soon learned that chemically treated photo paper isn’t really all that similar to hormonal agents and cardiovascular drugs, and it sold Sterling in pieces, for about half of the original purchase price.

In 1989, the Kodak board of directors had a chance to take make a course change when Colby Chandler, the CEO, retired. The choices came down to Phil Samper and Kay R. Whitmore. Whitmore represented the traditional film business, where he had moved up the rank for three decades. Samper had a deep appreciation for digital technology. The board chose Whitmore. As the New York Times reported at the time,

Mr. Whitmore said he would make sure Kodak stayed closer to its core businesses in film and photographic chemicals. via The New York Times (12/9/1989)

Samper resigned and would demonstrate his grasp of the digital world in later roles as president of Sun Microsystems and then CEO of Cray Research. Whitmore lasted a little more than three years, before the board fired him in 1993.

For more than another decade, a series of new Kodak CEOs would bemoan his predecessor’s failure to transform the organization to digital, declare his own intention to do so, and proceed to fail at the transition, as well. George Fisher, who was lured from his position as CEO of Motorola to succeed Whitmore in 1993, captured the core issue when he told the New York Times that Kodak

regarded digital photography as the enemy, an evil juggernaut that would kill the chemical-based film and paper business that fueled Kodak’s sales and profits for decades. via The New York Times (12/25/1999)

Fisher oversaw the flop of Advantix and was gone by 1999. As the 2007 Kodak video acknowledges, the story did not change for another decade. Kodak now has a market value of $140m and teeters on bankruptcy. Its prospects seem reduced to suing Apple and others for infringing on patents that it was never able to turn into winning products.

Addressing strategic decision-making quandaries such as those faced by Kodak is one of the prime questions addressed in Vince Barabba’s book, “ The Decision Loom .” Kodak management not only presided over the creation technological breakthroughs but was also presented with an accurate market assessment about the risks and opportunities of such capabilities. Yet Kodak failed in making the right strategic choices.

This isn’t an academic question for Vince Barabba but rather the culmination of his life’s work. He has spent much of his career delivering market intelligence to senior management. In addition to his experiences at Kodak, his career includes being director of the U.S. Census Bureau (twice), head of market research at Xerox , head of strategy at General Motors (during some of its best recent years), and inclusion in the market research hall of fame.

Vince Barabba

“ The Decision Loom ” explores how to ensure that management uses market intelligence properly. The book encapsulates Barabba’s prescription of how senior management might turn all the data, information and knowledge that market researchers deliver to them into the wisdom to make the right decisions. It is a prescription well worth considering.

Barabba argues that four interrelated capabilities are necessary to enable effective enterprise-wide decision-making—none of which were particularly well-represented during pivotal decisions at Kodak:

1. Having an enterprise mindset that is open to change. Unless those at the top are sufficiently open and willing to consider all options, the decision-making process soon gets distorted. Unlike its founder, George Eastman, who twice adopted disruptive photographic technology, Kodak’s management in the 80’s and 90’s were unwilling to consider digital as a replacement for film. This limited them to a fundamentally flawed path.

2. Thinking and acting holistically. Separating out and then optimizing different functions usually reduces the effectiveness of the whole. In Kodak’s case, management did a reasonable job of understanding how the parts of the enterprise (including its photo finishing partners) interacted within the framework of the existing technology. There was, however, little appreciation for the effort being conducted in the Kodak Research Labs with digital technology.

3. Being able to adapt the business design to changing conditions. Barabba offers three different business designs along a mechanistic to organismic continuum—make-and-sell, sense-and-respond and anticipate-and-lead. The right design depends on the predictability of the market. Kodak’s unwillingness to change its large and highly efficient ability to make-and-sell film in the face of developing digital technologies lost it the chance to adopt an anticipate-and-lead design that could have secured the it a leading position in digital image processing.

4. Making decisions interactively using a variety of methods . This refers to the ability to incorporate a range of sophisticated decision supporttools when tackling complex business problems. Kodak had a very effect decision support process in place but failed to use that information effectively.

While “ The Decision Loom ” goes a long way to explaining Kodak’s slow reaction to digital photography, its real value is as a guidepost for today’s managers dealing with ever-more disruptive changes. Given that there are few industries not grappling with disruptive change, it is a valuable book for any senior (or aspiring) manager to read.

- Editorial Standards

- Reprints & Permissions

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets and Trade

- Operations & Logistics

- Opportunity & Access

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Webinars

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Operations, Information & Technology

- Organizational Behavior

- Political Economy

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Get Involved

- Reading Materials

- Teaching & Curriculum

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

Learning from Strategic Success and Failure

Organizations facing complex, ambiguous, and dynamic environments find adaptive learning a key to survival and success. This study proposes three models of organization response in such environments. 1) A model of how aspiration levels or goals adapt over time, 2) A model of the riskiness of strategic choices made, and 3) A model of the innovativeness of search activities (R&D). In each model, the difference between performance and aspiration level is posited to be an important explanatory variable. Using the MARKSTRAT game as a research environment, the data are consistent with all three models.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Class of 2024 Candidates

- Certificate & Award Recipients

- Dean’s Remarks

- Keynote Address

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Marketing

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2024 Awardees

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- GMAT & GRE

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Letters of Recommendation

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Entering Class Profile

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- How You Will Learn

- Admission Events

- Personal Information

- GMAT, GRE & EA

- English Proficiency Tests

- Career Change

- Career Advancement

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Education & CV

- International Applicants

- Statement of Purpose

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- RKMA Market Research Handbook Series

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

Build plans, manage results, & achieve more

Learn about the AchieveIt Difference vs other similar tools

We're more than just a software, we're a true partner

Strategic Planning

- Business Transformation

- Enterprise PMO

- Project + Program Management

- Operational Planning + Execution

- Integrated Plan Management

- Federal Government

- State + Local Government

- Banks + Credit Unions

- Manufacturing

Best practices on strategy, planning, & execution

Real-world examples of organizations that have trusted AchieveIt

Ready-to-use templates to take planning to the next level

Research-driven guides to help your strategy excel

Pre-recorded & upcoming webinars on everything strategy & planning

- *NEW!* Podcast 🎙️

13 Notorious Examples of Strategic Planning Failure

RELATED TAGS:

Strategic planning failure occurs when businesses cannot identify and solve issues surrounding disruptive software systems to achieve their corporate goals. Businesses experience strategic planning failure on many different levels, including large corporate scales, like when a merger fails, or on more specific individual levels when team members cannot value or support one another.

Avoiding strategic planning failure in businesses involves corporate leaders and team members recognizing where changes are necessary to best achieve success. Here are some examples of business planning failure from 13 companies with notorious cases.

1. Hewlett Packard

Hewlett Packard (HP) is a technology company specializing in hardware and software development. At their prime, HP oversaw the development of computers, printers, and software.

In 2002, CEO Carly Fiorina merged HP with another technology company , Compaq, to form HPQ. However, the merger occurred without allowing employees to adjust to each other’s company cultures, leading to mistrust and lack of support across all company levels. Neither company had the time to compare and sync their system software to find where they were compatible and needed to make adjustments.

Planning failures don’t have to define a company — many businesses can move beyond them if they learn from the experience. Now, HP is primarily known for its printer technology, but the company recently transformed what could have been a business tragedy into a growth opportunity.

2. Xerox

Xerox Holding Corporation offers document goods and services in both digital and print formats. In 2001, after suffering financially for a couple of years, Xerox appointed Anne Mulcahy CEO in hopes that her enthusiasm and drive could turn the business around.

While the company made strides under her leadership, previous federal investigations hurt company performance and made it challenging to implement new improvement strategies. Management’s poor legal and ethical choices, which had roots in weak core company values, led to Xerox’s business strategy planning failure.

Cisco is a telecommunications and networking company that offers goods and services for software and hardware technology. In 2011, they announced a new product that required targeting a new market instead of focusing on a product fit for their existing one. The lack of strategic planning cost over 6,500 employees their jobs and hurt the company’s financial performance.

4. Unum/Provident

Unum Group is an insurance provider that merged with Provident in 1999 to form UnumProvident. Under this merger, they became the first insurance company to offer group disability coverage as a part of employee plans.

They are a company whose strategic planning failed, as they spent large sums of money on training and integrating the systems and cultures of the two companies. The two environments were too different, creating significant dips in UnumProvident stock and the break of the merger in 2007 .

FREE RESOURCE

Common Challenges to Plan Execution Guide

Download this guide to understand how organizations who establish uniformity, create visibility, and promote accountability excel at execution.

5. Laidlaw

Laidlaw International Inc. is a transportation company specializing in intercity and public transit. Like Cisco, they tried to expand their business beyond their determined market by providing ambulances in addition to public transit. This ultimately hurt their business and led to them declaring bankruptcy.

6. Motorola

Motorola is a communications company that specializes in phones that tried to market luxury cellphones in 2009. However, due to the strategic planning failure, investing in this kind of technology and market caused Motorola to lose millions. In 2014, Lenovo, a computer company, bought Motorola and still owns the brand .

7. Green Tree Financial

In the 2008 housing market recession, Green Tree Financial, a mortgage financer, experienced great losses due to the market crash. With backing from the Lehman brothers, the company used aggressive marketing tactics to improve business, leading to legal consequences. Conseco, a financial firm, bought Green Tree to help put the business back on its feet but instead led to Green Tree Financial declaring bankruptcy due to strategic planning failure.

8. Kodak

While Cisco and Motorola’s strategic planning failures preach caution when investing in new technology, Kodak is the opposite. Kodak, a camera company, lost business and sales in the rise of digital cameras and photos when they didn’t invest in the new technology. Because of this, the camera market took off without them as customers wanted newer models and chose competition.

9. WorkerExpress

WorkerExpress is a company allowing customers to contact construction workers to hire by the hour directly. However, without research and planning, they didn’t realize there was little market for this. The company had to change its approach to business to instead work with construction contractors directly.

10. Schlitz Brewing Company

Schlitz Brewing Company is a beer brand based in Milwaulkee that argued that its product made the city famous. They experienced business strategy planning failure when they tried to change their brewing process in 1967 to cut production costs. The public did not receive the change well, and it changed how people viewed their brand and products, causing another company to buy Schlitz in 1982.

Instead of strategically forming a plan to cut production costs, Schlitz sacrificed the quality of their product, leading to the rejection of their beer by the public.

eBay is an online auction site where companies and individuals bid on products. eBay represents another strategic planning failure example where a merger was the cause.

In 2005, eBay decided to merge with Skype, thinking it would enhance their business. However, the values and systems of the two firms did not integrate well with each other. In 2009, eBay reversed the merger but already experienced significant decreases in stock .

12. Iridium

Iridium Satellite Communications is a global communications network whose investment in technology did not have the desired effect on the public, who rejected their phones for being too expensive. Because the company failed to plan for this reaction, Iridium did not find the public success they were hoping for.

13. UPS

UPS, a shipping company located in the U.S., rolled out a new shipping initiative during the holiday season in 2013 with a promise to have all packages delivered by a particular time before the holidays. However, the company did not anticipate the high demand that would follow this plan, which overwhelmed workers and delivery teams, causing large amounts of packages to arrive later than promised.

UPS did not deliver its promises, and it bought new planes and trucks to execute its plan. They did not recognize the logistical difficulties in training new staff for their delivery promises, all of which hurt the company.

Learn How to Prevent Strategic Planning Failure With AchieveIt

Failure to plan strategically can drastically change a company’s history and trajectory. When setting goals and plans for your business, it is best to account for the unknown circumstances that might arise, such as market reaction and merger costs. By planning for the future, you can best prepare your business for problems and have a plan for handling them.

With AchieveIt, our software systems can help your company manage and implement business plans and initiatives . Test AchieveIt’s certified strategic planning software to improve how your company reaches its goals.

Ready to improve your plan execution?

Organizations of all types leverage AchieveIt to manage, execute, and connect their most important initiatives. Replace manual processes & siloed systems with interconnected plans in a single, automated platform .

Meet the Author Chelsea Damon

Chelsea Damon is the Content Strategist at AchieveIt. When she's not publishing content about strategy execution, you'll likely find her outside or baking bread.

Related Posts

Balanced Strategy: Mastering the Art of Zooming In and Out

Everything You Need to Know About Business Mission and Vision Statements

Excel vs. AchieveIt for Strategic Planning

Hear directly from our awesome customers

See first-hand why the world's best leaders use AchieveIt

See AchieveIt in action

Stay in the know. Join our community of subscribers.

Subscribe for plan execution content sent directly to your inbox.

Enjoying the sneak peek?

Get in touch for a live walkthrough..

IMAGES

VIDEO

COMMENTS

Business strategies often fail. This is well-know by now: According to studies, some 60–90% of strategic plans never fully launch. The causes of derailment vary widely, but execution consistently...

July 15, 2016. A generation ago, a “Kodak moment” meant something that was worth saving and savoring. Today, the term increasingly serves as a corporate bogeyman that warns executives of the need...

In these situations and many others, the underlying cause is often a failure to take a holistic approach to strategy. Strategy today demands more than classic competitive positioning.

It’s very clear from the strategic mistakes of Yahoo that its leadership lacked a clear vision and the overall purpose of the company. Meanwhile, Google and Microsoft were very clear about their strategic direction.

The following years marked a period of infighting and strategic stasis that successive reorganisations did nothing to alleviate. By this stage, Nokia was trapped by a reliance on its unwieldy operating system called Symbian.

This strategic failure was the direct cause of Kodak’s decades-long decline as digital photography destroyed its film-based business model. A new book by my Devil’s Advocate Group colleague,...

We investigate how and why the Nokia Corporation failed to develop a successful strategic response to the threats of Apple and Google in the smartphone business and instead worsened its situation through several badly timed decisions.

This chapter provides a wisdom-oriented reading of one of the most spectacular business failures of recent times: the collapse of Nokia mobile phones between 2007 and 2015.

Learning from Strategic Success and Failure. Organizations facing complex, ambiguous, and dynamic environments find adaptive learning a key to survival and success. This study proposes three models of organization response in such environments. 1) A model of how aspiration levels or goals adapt over time, 2) A model of the riskiness of ...

Avoiding strategic planning failure in businesses involves corporate leaders and team members recognizing where changes are necessary to best achieve success. Here are some examples of business planning failure from 13 companies with notorious cases.