When accounting goes unaccounted for

What’s Getting a PhD in Accounting Really All About?

The PhD is based on research. Research is based on psychological or economic theory and statistics. Statistics are based on mathematics. You need to be comfortable taking two years of graduate level econometrics, statistics, and mathematics if you want to do a PhD in accounting. And by the way, I hope you have already taken Calculus I (and not the business school “calculus” that most undergrad degrees require. You need the calculus the engineering and physics undergrads take), Calculus II, Calculus III, and Linear Algebra because you will need to be good at all of those topics before you even step foot into a doctoral program. If you can learn to program and work with relational databases before you enroll in a PhD program, that will also help. Finally, research is more than just numbers and analysis. You need to be a good writer so that you can clearly communicate why the research you are doing is important, what you found, and why it matters.

Share this:

- Click to share on Twitter (Opens in new window)

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Related Posts

- Career Center

The Truth About Public Accounting, Part III: The ‘A’ In PCAOB Stands For ‘Accounting’

- Robert Conway

- March 4, 2021

An article titled “PCAOB Inspections: Public Accounting Firms on Trial” describes the results from an […]

Why You Should (and Shouldn’t) Accept a Full-Time Offer From a Public Accounting Firm

- Amber Setter

- August 3, 2015

Public accounting firms are wrapping up their summer internships and unless one did something horrifically wrong, most can expect full-time offers. Most will accept without a moment of thought or hesitation, but a few perplexed summer interns may be wondering if they should take the offer or not. If you have an offer and are feeling unsure, consider the following when making your decision.

We Forgot to Mention Deloitte Got in Trouble For Cheating This Week, Too

- Adrienne Gonzalez

- April 12, 2024

In a renewed effort to appear to be doing something of value, the PCAOB was […]

Before you go!

Are you looking for a fresh accounting career opportunity, going concern now has thousands of open accounting jobs., take a look – click here.

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

A Ph.D. for me? Really?

If you are a CPA with recent practical experience and a love for the profession, the academic accounting community is ready to embrace your talents.

Still don’t know what you want to be when you grow up? Based on the number of emails and phone calls I receive, you are not alone. Sure, you landed your first accounting job (or maybe your second or third), and your career opportunities look limitless, but the little voice in the back of your mind is telling you that there is something more out there. You may even be contemplating returning to school to pursue a career as an accounting faculty member. That idea isn’t crazy—in fact, it’s an excellent career move.

There’s a serious shortage of accounting faculty right now. Faculty retirements are on the uptick (the average age of a tenured accounting faculty member in the United States is 60), enrollment in accounting programs is increasing, and demand for accounting graduates is at an all-time high. Initiatives such as the Accounting Doctoral Scholars Program have been created to address the shortage, but the problem persists.

The reality is that if you are a CPA with recent practical experience and a love for the profession, the academic accounting community is eager to embrace your talents. These qualifications are the beginnings of a solid application to a doctoral program. With a few more additions (e.g., a strong GMAT score, meaningful recommendations, etc.), you could be golden. Now may be as good a time as ever to take a step back, rethink your future, and seize this opportunity.

Here are some things to consider in assessing whether to go back to school to earn a doctorate:

- A Ph.D. is a research degree. If teaching is the only side of the faculty equation that interests you, you may want to pursue a different avenue to the classroom. For instance, many universities seek lecturers and adjunct faculty to meet classroom demand. Seek an opportunity to meet with college and university accounting program administrators to investigate potential teaching opportunities.

- What disciplinary area of accounting interests you? Tax? Audit? Managerial accounting? Accounting information systems? Financial accounting? Since different programs have different areas of expertise, making this decision early will help you determine which programs to apply to.

- Doctoral programs usually take four to five years to complete. Can you commit this time?

- You won’t necessarily have to live on ramen noodles again. Many universities offer fellowships and assistantships to help offset the costs of a doctoral education.

Now is a great time to consider pursuing a Ph.D. in accounting. A career in academia may be right around the corner for you. Before you commit, take the time to explore this option to ensure it is the right path for you.

Still unsure? The toe almost in the water? Why not explore? Attend Steve Matzke’s session on all things Ph.D., including how to apply and what kinds of salaries accounting professors receive, on Aug. 7 at the AICPA E.D.G.E. Conference in San Antonio.

Steve Matzke is the director–Faculty & University Initiatives at the AICPA. The Edge e-newsletter, is dedicated to providing tips and tools of interest to young professionals, including articles on building career resiliency, networking for success, and de-prioritizing the immediate to focus on the important. Watch for it in your inbox. Subscribe now .

We are the American Institute of CPAs, the world’s largest member association representing the accounting profession. Our history of serving the public interest stretches back to 1887. Today, you'll find our 431,000+ members in 130 countries and territories, representing many areas of practice, including business and industry, public practice, government, education and consulting.

About AICPA

- Mission and History

- Annual Reports

- AICPA Media Center

- AICPA Research

- Jobs at AICPA

- Order questions

- Forgot Password

- Store policies

Association of International Certified Professional Accountants. All rights reserved.

- Terms & Conditions

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- ACCOUNTING EDUCATION

Road map to applying for a doctorate in accounting

Finding the right school is only half the battle..

- Accounting Education

Pursuing a doctorate in accounting can be an exciting and highly rewarding journey. However, especially if you're more accustomed to applying for jobs than to graduate programs, the application process can seem bewildering. It may be more time - consuming and require more preparation than anticipated.

This article can serve as your road map, making you aware of the possible roadblocks, speed bumps, and even the burnout you may encounter along the way (see the sidebar "Tips for Preventing Burnout" below). We outline the process of choosing schools to apply to, getting all your materials ready for application, and planning your time so you can meet the application deadlines. This guide is intended to help you navigate the highly competitive application process and position yourself as a prime candidate for consideration.

ROUTE PLANNING: CHOOSING THE TYPE OF DEGREE TO PURSUE

After you've made the decision to pursue a doctorate in accounting, the next choice you must make is which type of doctorate you want: a Ph.D. in accounting or a doctorate in business administration (DBA) with a concentration in accounting. Traditional accounting Ph.D. programs require full - time residency and consist of face - to - face instruction in a campus classroom. In these programs, tuition is usually waived, and students receive a stipend in exchange for working as a research or teaching assistant.

Nontraditional DBA programs may be conducted completely online or can be "hybrid" programs, where most instruction takes place online, but students are also required to be on campus multiple times throughout the program. One advantage of nontraditional programs is they allow you to pursue a degree while continuing to work, although some students may have difficulty balancing the demands of the program with the demands of their job (see the sidebar "Doctoral Programs for Practitioners" below). A drawback is that the cost of such programs can be quite high ($40,000 to $120,000) compared with the cost of traditional accounting Ph.D. programs. Also, note that having a DBA can affect the types of schools that will hire you as a faculty member, as many larger, research - focused schools prefer or even require candidates to hold a Ph.D. This may not be a problem if you plan to teach at a smaller or teaching - focused school.

CHOOSING SCHOOLS TO APPLY TO

After you determine which type of degree you want to pursue, you will then need to decide which schools to apply to. It is important to keep in mind that most schools accept only a handful of applicants each year. To increase your chances of acceptance into a program, you should apply to at least six to eight schools.

Consider some of the following factors when making this decision:

Accreditation

A school's accreditation status could affect your viability as a candidate for a faculty position. In the United States there are two main types of accreditation: regional and specialized. Regional accreditation applies to the school as a whole, whereas specialized accreditation applies to specific programs within the school. Accreditation from the Association to Advance Collegiate Schools of Business (AACSB) is widely considered the highest standard of accreditation for business schools, and many schools require faculty applicants to possess a Ph.D. or doctorate degree from an AACSB - accredited institution (see the box, "Helpful Resources").

Your future career plans

Consider also where you would like to work after graduation. If you are looking for a position at a research - intensive school, choose a graduate program with a strong reputation for research. Also, note that graduates of a school's accounting Ph.D. program typically do not find their first positions at the school from which they received their Ph.D. Thus, if you know that you would like to work at XYZ University immediately after you finish your Ph.D., you should probably not apply to that school's Ph.D. program.

Your research interests

Explore the type of work your prospective schools' faculties engage in, both the research areas they tend to specialize in (e.g., audit, tax, financial accounting, governmental/ not - for - profit accounting, management accounting, accounting history, etc.) and the research methods (behavioral or archival) they tend to use. This is an important step even if you're not yet sure what type of research you want to engage in, because later in your career you will be expected to develop research interests.

If you find that no one at the school does research you are interested in, or that most of the faculty is engaged in research in areas or methods that don't appeal to you, then that school will probably not be a good fit.

Additional factors

Other factors to consider include location, culture, and reputation. Depending on your situation, a school's location may be a major factor in choosing whether to apply to it. To determine whether a school would be a good cultural fit, consider reaching out to the program's coordinator, current students, or recent graduates. You can usually find their names and contact information on the program's website.

A program's research reputation can be an important factor in your application decision. To get a sense of the school's general and research reputation, speak with the program's coordinator and examine the program's website for listings of faculty publications, job placements of recent graduates, and mentions of its ranking in Public Accounting Report 's Annual Professors Survey. (In this survey, which requires paid access, accounting faculty rank the best accounting doctoral programs in the country.) Additionally, you may want to view Brigham Young University's yearly accounting research rankings.

ROADBLOCKS: APPLICATION REQUIREMENTS AND LOGISTICS

Your application journey may come to a quick end if you encounter certain roadblocks that prevent you from applying to or being accepted into a program. Read prospective schools' admission requirements carefully, and be especially mindful of the following:

Required classes, degrees, and/or work experience

Some schools either require or strongly recommend having certain prerequisite classes (e.g., calculus, linear algebra, and microeconomic theory), a master's degree in business or accounting, or one or more years of work experience.

Most Ph.D. programs require applicants to provide their Graduate Management Admission Test (GMAT) scores. If you have previously taken the GMAT, make sure your score is recent. If you took the test more than five years ago, you will need to retake it.

Studying for the GMAT is important to optimize your chances of being accepted into a program. While minimum score requirements can be in the low to mid - 600s , several schools note on their websites that the average scores of students accepted into the program are 700 or above.

Be aware of application deadlines. Priority deadlines for most Ph.D. programs are in December or January prior to the fall semester of entrance.

Whether a school is accepting doctoral students in a given year

You may find that some schools are not accepting applications to their doctoral program for the upcoming school year because they lack the resources to support doctoral students.

SPEED BUMPS: ALLOW AMPLE TIME TO COMPLETE YOUR APPLICATION

Beware of speed bumps that can slow your application journey. It's advisable to start planning the application process a year in advance. Most schools require the following application materials, all of which can take weeks or even months to compile or obtain:

Recommendation letters

Most schools require two or three letters of reference, and many specify that some or all must be academic references. Depending on how long you have been out of contact with your references, it may take a bit of research and time to find their current contact information and to hear back from them.

Transcripts

Schools will require transcripts from undergraduate and graduate schools you previously attended. Note that transcript processing and delivery time can vary depending on the mode of delivery, holds on your account, and the length of time since graduation.

GMAT scores

You can take the GMAT only once every 16 calendar days, five times within a 12 - month period, and eight times total in your lifetime. Plan accordingly so you can submit or update your GMAT score before your application is due.

If it has been a while since you last updated your r é sumé, you may need some time to research items such as official job duties, dates of service, and reference contact information.

Most schools require applicants to provide a written personal statement and may request additional essays as well. The personal statement is a very important piece of the application process in which you attempt to "sell" yourself to the school; therefore, it is a good idea to put a lot of time and thought into your responses and to hire an editor to read over your responses and provide feedback. Typographical errors, poor grammar, or a lack of enthusiasm are likely to leave a bad impression on the application reviewers.

EYES ON THE PRIZE

The application process is a critical phase in your journey to a doctorate, and it presents many challenges. We hope the tips provided in this article will help keep you on course and prevent you from encountering unwelcome surprises while navigating the application process. Proper planning, preparation, and knowledge can help you achieve your dream of receiving a doctorate in accounting.

Tips for preventing burnout

The process of applying to a Ph.D. program can sometimes feel overwhelming. Here are some ways to alleviate the stress:

Talk to accounting professors about their Ph.D. experience

Most professors would be happy to speak with you about their doctoral journey, including the application process. You are likely to find that they, too, encountered some speed bumps and roadblocks along the way, and they may be able to give you advice.

Stay organized

If you are applying to several schools, it can be difficult to keep up with each program's requirements. A good way to manage this is to keep an Excel spreadsheet or a checklist of each school's requirements and due dates. That way you can check off what you have completed as you go and not worry about forgetting any components.

This help can come in the form of GMAT study courses, having a friend or editor review your essays and r é sumé, or speaking with your target schools' Ph.D. program coordinators for advice (e.g., they may advise you to submit your materials by a certain date to be among the first considered, or to consider retaking the GMAT to increase your chances of acceptance).

Be aware of alternative teaching routes

You don't always need a doctorate to teach at the college level. Many schools require only a master's degree to teach as a part-time (adjunct) lecturer or as a full-time nontenure-track instructor.

Seasoned accounting professionals interested in transitioning from practice to the classroom may consider the AACSB Bridge Program. The Bridge Program is an intense weeklong program held annually at a participating university. Participants gain knowledge on topics such as managing the classroom, creating an engaging learning environment, and planning and delivering courses.

Doctoral programs for practitioners

A CPA with at least three years of professional accounting experience who would like to teach tax or audit at the university level should consider applying to the Accounting Doctoral Scholars (ADS) Program ( adsphd.org ). The ADS Program provides financial support for those pursuing a Ph.D. in accounting who have recent public accounting experience and plan to teach and do research in tax or audit at an AACSB-accredited university after graduation. Those selected for funding receive a total of $40,000 in supplemental payments upon reaching various milestones while pursuing a doctorate in accounting.

Practitioners can also consider participating in the AACSB Bridge Program, an initiative that helps practitioners transition to the classroom and learn teaching and classroom management skills. Visit aacsb.edu/events/bridgeprogram for more information.

About the authors

Sarah Garven, CPA, Ph.D. , is an assistant professor of accounting at Middle Tennessee State University in Murfreesboro, Tenn. Bailee Pennington is a senior at Morehead State University in Morehead, Ky., majoring in accounting and finance.

To comment on this article or to suggest an idea for another article, contact Courtney Vien, a JofA senior editor, at [email protected] or 919-402-4125.

Helpful resources

- List of AACSB-accredited universities and schools, aacsb.edu

- Brigham Young University's accounting rankings, byuaccounting.net

- The Accounting Doctoral Scholars Program, adsphd.org

- AACSB Bridge Program, aacsb.edu/events/bridgeprogram

- Frequently asked questions about GMAT scores and score reports, mba.com

- Information about how often someone can take the GMAT, mba.com

AICPA resources

- " Don't Let These Myths Stand Between You and a Teaching Job ," CPA Insider , Aug. 7, 2017

- " Transitioning Into Academia: A New Pathway for Practitioners ," JofA , March 2016

- " My Pathway From Practitioner to Professor ," JofA , March 2016

- " A Ph.D. for Me? Really? "

- " From Practice to the Classroom ," JofA , Oct. 2012

- " Pursuing a Ph.D. in Accounting: Walking in With Your Eyes Open ," JofA , March 2009

- Extra Credit

- " From CPA to the Classroom: Going From Practitioner to Professor ," JofA , Feb. 28, 2017

- " Pathway to Academia for Accounting Professionals "

- AICPA Accounting Education Center

Where to find August’s digital edition

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

4 questions to drive your audit technology strategy

Discover how AI can revolutionize the audit landscape. Our report tackles the biggest challenges in auditing and shows how AI's data-driven approach can provide solutions.

FEATURED ARTICLE

Single-owner firms: The thrill of flying solo

CPAs piloting their own accounting practices share their challenges, successes, and lessons learned.

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets and Trade

- Operations & Logistics

- Opportunity & Access

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Webinars

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

Our doctoral program in the accounting field offers broadly based, interdisciplinary training that develops the student’s skills in conducting both analytical and empirical research.

Emphasis is placed on developing a conceptual framework and set of skills for addressing questions broadly related to accounting information. While issues of financial reporting, managerial accounting, corporate governance and taxation are the ultimate concern, special emphasis is given to applying basic knowledge of economics, decision theory, and statistical inference to accounting issues.

Spectrum of Interests and Research Methods

Faculty research represents a broad spectrum of interests and research methods:

- Empirical and analytical research on the relation between accounting information and capital market behavior examines the characteristics of accounting amounts, the effect of accounting disclosures on the capital market, the role of analysts as information intermediaries, and the effects of management discretion. Issues examined also include the impact of financial information on stock and option prices, earnings response coefficients, market microstructure, earnings management, voluntary disclosures, and the effect of changes in accounting standards and disclosure requirements.

- Problems of information asymmetries among management, investors, and others are currently under study. This research investigates, analytically and empirically, the structure of incentive systems and monitoring systems under conditions of information asymmetry. Research on moral hazard, adverse selection, risk sharing, and signaling is incorporated into this work.

- Other ongoing projects include research on the economic effects of auditing and regulation of accounting information, and analysis of tax-induced incentive problems in organizations.

- Additional topics of faculty interest include analytical and empirical research on productivity measurement, accounting for quality, activity-based costing for operations and marketing, and strategic costing and pricing.

Preparation and Qualifications

It is desirable for students to have a solid understanding of applied microeconomic theory, econometrics and mathematics (linear algebra, real analysis, optimization, probability theory) prior to the start of the program. Adequate computer programming skills (e.g. Matlab, SAS, STAT, Python) are necessary in coursework. A traditional accounting background such as CPA is not required.

Faculty in Accounting

Christopher s. armstrong, jung ho choi, george foster, brandon gipper, ron kasznik, john d. kepler, jinhwan kim, rebecca lester, iván marinovic, maureen mcnichols, joseph d. piotroski, kevin smith, emeriti faculty, mary e. barth, william h. beaver, david f. larcker, charles m. c. lee, stefan j. reichelstein, recent publications in accounting, fraudulent financial reporting and the consequences for employees, firm boundaries and voluntary disclosure, financial information and diverging beliefs, recent insights by stanford business, how corporate “diversity washers” spin investors, new data on the quality of esg audits catches regulators’ attention, when companies announce earnings surprises, locals reach for their pocketbooks.

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Class of 2024 Candidates

- Certificate & Award Recipients

- Dean’s Remarks

- Keynote Address

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Marketing

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2024 Awardees

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- How You Will Learn

- Admission Events

- Personal Information

- GMAT, GRE & EA

- English Proficiency Tests

- Career Change

- Career Advancement

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Organizational Behavior

- Political Economy

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- RKMA Market Research Handbook Series

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- Majors & Careers

- Online Grad School

- Preparing For Grad School

- Student Life

Top 10 Best PhD in Accounting Programs

Accounting is an abstract subject dealing with numbers and calculations. Personal finance requires strong attention to detail — imagine the meticulousness necessary to achieve a PhD in accounting! Prepare for a few years of mathematical and statistical study, and toning your analytical skills. The program offers a bright future, opening vast career possibilities and excellent job prospects.

A booming field, accounting roles for financial managers are estimated to grow by 17% from 2020 to 2030, according to the Bureau of Labor Statistics. This represents a much higher growth rate than the average for all professions.

Let’s explore the best accounting PhD programs so you can prepare for the next step in your finance career!

Table of Contents

Best PhD in Accounting Programs

The university of texas at austin, mccombs school of business.

PhD in Accounting

The University of Texas at Austin was ranked number one in the country for Accounting PhD programs by the US World & News Public Accounting Report . The University’s McCombs School offers one of the top accounting doctoral programs that welcomes students with diverse disciplines such as economics, mathematics , finance, and engineering.

- Specializations: Financial accounting, managerial accounting, auditing, and taxation.

- Duration : 5 years

- Delivery : On-campus

- Tuition : $1,000 per credit

- Financial aid: Grants, loans, assistantships, and fellowships

- Acceptance rate : 32%

- Location : Austin, TX

The University of Illinois Urbana-Champaign, Gies College of Business

PhD in Accountancy

The University of Illinois at Urbana Champaign is renowned for its top-notch accounting faculty, boasting a high accounting PhD programs ranking by the BYU Accounting Faculty Research Rankings . Out of all the best PhD accounting programs, this one emphasizes productivity and results the most while valuing quality student placements to give you real-world work experience.

- Courses : Mathematical statistics, probability theory, and constructs in accounting research.

- Credits : 96

- Tuition : $652 per credit

- Financial aid : Fellowships, teaching/research assistantships, and tuition waivers

- Acceptance rate : 63.3%

- Location : Champaign, IL

Stanford University, Graduate School of Business

Stanford is one of the most prestigious universities in the world, with 19 institutes encouraging interdisciplinary learning and a $1.69 billion sponsored research budget. It offers one of the country’s top accounting PhD programs, emphasizing both empirical and analytical research. Moreover, its balanced curriculum gives equal importance to coursework, research, and teaching.

- Courses : Financial reporting & management control, empirical accounting research, and microeconomic analysis.

- Duration : 4-5 years

- Tuition : Refer tuition page

- Financial aid: Grants, scholarships, fellowships, and research/teaching assistantships

- Acceptance rate: 5.2%

- Location : Stanford, CA

New York University, Leonard N. Stern School of Business

The Stern School of Business of NYU offers one of the world’s most well-known accounting doctorate programs. The program allows students to study with other schools within the university along with Stern.

- Courses : Empirical research in financial accounting, microeconomic theory, and regression & multivariate analysis.

- Duration : 4 years

- Financial aid: Fellowships and research/teaching assistantships

- Acceptance rate: 21.1%

- Location : New York City, NY

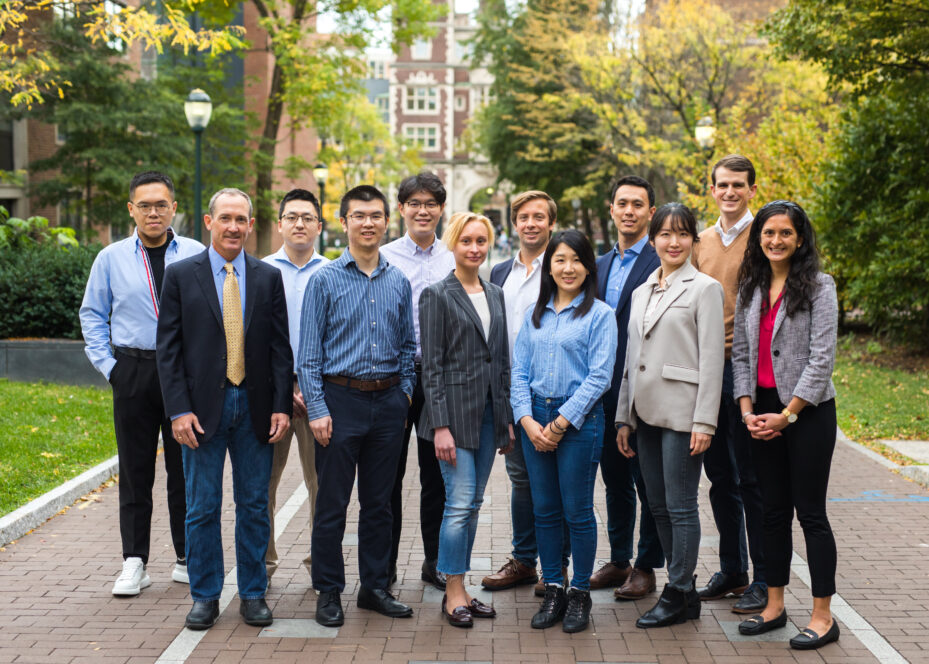

University of Pennsylvania, Wharton School

The University of Pennsylvania and Wharton School are world-renowned names in education. The school’s PhD in accounting program allows students to study with neighboring departments to gain exposure to other fields and innovative ideas from a wide range of disciplines.

- Courses : Empirical design in accounting research and advanced statistical inference.

- Course units: 16

- Financial aid : Full fellowships

- Acceptance rate : 9%

- Location : Philadelphia, PA

The University of Michigan – Ann Arbor, Stephen M. Ross School of Business

The University of Michigan is a prestigious higher learning institution and one of the best public schools in the country. Its PhD in accounting program encourages extensive collaboration between students and faculty in combined research opportunities.

- Courses : Contemporary accounting issues, pre-candidacy dissertation, and candidacy dissertation.

- Financial aid: Full funding and graduate assistantships

- Acceptance rate: 26%

- Location : Ann Arbor, MI

Northwestern University, Kellogg School of Management

PhD Accounting Information & Management

Northwestern University’s Kellogg School is one of the oldest business schools in the world and has made major contributions to business, management, and marketing fields. It offers an information-focused accounting doctorate program with research scope for subjects like information intermediaries in capital markets, properties, and transformations in the information environment of companies.

- Courses : Research in accounting theory, empirical research in accounting, and special topics in empirical accounting research.

- Duration : 5.5 years

- Tuition : $13,085 per quarter

- Financial aid : Scholarships, fellowships, and teaching/research assistantships

- Acceptance rate: 9.3%

- Location : Evanston, IL

The University of Chicago, Booth School of Business

The University of Chicago’s Booth School of Business is known for its eminent faculty delivering groundbreaking research in accounting. This PhD offers doctoral candidates the freedom to explore their own research interests. They also get the opportunity to perform collaborative scholarly work with faculty members.

- Tuition : $66,096 per three quarters ($32,400 for fifth year)

- Financial aid : Grants, teaching/research assistantships, and fellowships

- Acceptance rate: 7.3%

- Location : Chicago, IL

University of North Carolina Chapel Hill, Kenan Flagler Business School

UNC at Chapel Hill is the flagship university of the University of North Carolina system. It’s known as a Public Ivy school, offering a high-quality curriculum taught by renowned faculty. UNC’s Kenan Flagler Business School is world-famous, supporting research in international accounting, accounting information in capital markets, and accounting standard-setting.

- Courses : Empirical accounting research, managerial accounting, and tax research.

- Credits : 48-61

- Financial aid: Teaching fellowship, research/teaching assistantships, and tuition waivers

- Acceptance rate: 25%

- Location : Chapel Hill, North Carolina

The University of Mississippi, Patterson School of Accountancy

The University of Mississippi’s Patterson School is entirely dedicated to accounting studies. Its PhD in accounting program aims to develop scholars with a strong foundation in the historical background of accounting and expert research skills.

- Courses : Contemporary accounting theory, and financial accounting, auditing & accounting information systems research.

- Credits : 77

- Tuition : $504 per credit hour

- Financial aid: Scholarships, fellowships

- Acceptance rate: 88%

- Location : University, Mississippi

What Do You Need to Get a PhD in Accounting?

Generally, you only need a bachelor’s degree in accounting or a related discipline to apply for a PhD program in accounting. Very few programs require a master’s qualification.

The exact requirements vary depending on the program, but you’ll usually need to submit the following to the selection committee:

- GRE or GMAT scores

- Undergraduate transcripts

- Personal essay or research proposal

- Recommendation letters

- Academic resume

Always check specific program requirements for colleges you’re interested in, and contact academic advisors in advance to verify. The top accounting PhD programs can be pretty competitive, so it’s best to carve out ample time to prepare a solid application!

Preparing for an Accounting Doctorate Program

Besides accounting, your PhD program will cover in-depth study of other subjects like economics and statistics. Our advice? Do some background preparation on these subjects, either through self-study or a foundational course.

Additionally, you should prepare yourself for serious research. Unlike undergraduate research, which typically aims to summarize existing knowledge, the goal of a PhD is to make new discoveries. Finally, you should brush up on your teaching skills because your PhD will likely involve giving seminars or tutoring undergraduate students.

Things to Consider When Choosing an Accounting PhD Program

Choosing an accounting PhD program is an individual decision. The right choice depends on various factors that can differ widely depending on the person.

However, here are a few factors that are relevant to practically everyone:

- Budget – What is the cost of tuition and other fees? What financial aid is available?

- Specializations – What disciplines are offered under the program, and what are the faculty’s areas of expertise? How do these match your passions and career goals?

- Program reputation – Is the school well-known? What accreditations does it have?

- Delivery method – Is the program offered on-campus, online, or in a hybrid format?

- Location – If you need to attend classes in person, even occasionally, how easy is it for you to get to campus?

Why Get a Doctorate in Accounting?

If you’re proficient with analytical and mathematical skills, a PhD in accounting can help you secure some of the highest-paying jobs in finance and economics. In these roles, you’ll apply the theoretical concepts you studied during your doctorate to solve real market problems, or transfer your knowledge to the next generation by teaching.

Jobs and Salaries for Doctors of Accounting

A doctorate in accounting can qualify you for a range of exciting and high-level roles in the finance sector.

Here are just some of the roles you’ll be eligible for once you’ve completed your PhD in Accounting, with the median annual salary for each:

- Associate Professor in Accounting ( $80,799 )

- Financial Manager ( $95,518 )

- Finance Director ( $115,603 )

- Analyst/Advisor ( $62,924 )

- Senior Financial Analyst ( $83,091 )

For more on job opportunities in the sector, take a look at our guide to the top 10 best jobs for MBA graduates .

What is the Average Cost of PhD Accounting Programs?

The cost of a PhD in accounting can vary greatly depending on the program and school. Remember, the total cost includes not only tuition, but also living expenses, fees and other study expenses.

Generally, prestigious private universities cost more, while public universities offer lower tuition and fees. Additionally, state residents pay less tuition and fees for state universities than non-resident students. Considering all these factors, the total cost for a doctorate in accounting could be anything from around $10,000 to $70,000 per year.

Wrapping Up

A PhD in accounting will qualify you for some of the best job opportunities in the business and commercial world today. Alternatively, after graduation you could pursue a career in higher education, either in research or as a professor. With experts predicting an increase in accounting job opportunities in the sector in the coming years, the future looks bright for graduates with a doctorate in accounting.

For more on the best courses in finance and accounting, take a look at our guides to the best Master’s in Accounting , the best online MBA Programs , and the top 20 online PhD programs in 2022 .

What Does a PhD in Accounting Do?

With a PhD in accounting, you can work as a professor, consultant, financial manager, analyst, researcher, or one of many high-level jobs in the accounting field.

Can You Get a Doctorate in Accounting?

Yes. Many universities offer doctorate in accounting programs. As long as you meet the eligibility criteria (usually an undergraduate degree in a related field) and present a strong application, you can start your doctorate in accounting.

How Hard is a PhD in Accounting?

Like with any PhD, you need to have a high level of dedication, self-discipline and the ability to conduct strong research to earn a doctorate in accounting. You will also need to demonstrate strong writing, analytical, and presentation skills.

Can an Accountant Have a PhD?

You don’t need a PhD to work as an accountant. Depending on the role, most accountants either have a bachelor’s or a master’s in accounting . However, an accountant who wants to further their career or research in academia may choose to get a PhD in the field.

Do You Need a PhD to Teach Accounting?

A PhD is not typically required to teach accounting in certain settings, such as a community college. However, if you have one, you’ll have a lot more teaching options, including more lucrative positions at universities.

Lisa Marlin

Lisa is a full-time writer specializing in career advice, further education, and personal development. She works from all over the world, and when not writing you'll find her hiking, practicing yoga, or enjoying a glass of Malbec.

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ 30+ Best Dorm Room Essentials for Guys in 2024

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ 12 Best Laptops for Computer Science Students

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ ACBSP Vs AACSB: Which Business Program Accreditations is Better?

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ BA vs BS: What You Need to Know [2024 Guide]

TheGradCafe and Jobbio join forces to connect top talent with great companies

Top 10 best phd in mathematics programs, related posts.

How New Grads Research Companies to Find Jobs

Experience Paradox: Entry-Level Jobs Demand Years in Field

Grad Trends: Interest in Artificial Intelligence Surges

Applying to Big Tech This Year? Here’s How to Ace It.

73% of job seekers believe a degree is needed for a well-paying role–but is it?

Tech Talent Crunch: Cities with More Jobs Than Workers

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

- Last Mile Education Fund Paves the Way for Tech Students, Offers Lifeline Grants

- When to Apply for Grad School: Easy Monthly Timeline [2026-2027]

- 30+ Best Dorm Room Essentials for Guys in 2024

- Best Laptop for Programming Students in 2024

- The Sassy Digital Assistant Revolutionizing Student Budgeting

© 2024 TheGradCafe.com All rights reserved

- Partner With Us

- Results Search

- Submit Your Results

- Write For Us

Explore your training options in 10 minutes Get Started

- Graduate Stories

- Partner Spotlights

- Bootcamp Prep

- Bootcamp Admissions

- University Bootcamps

- Coding Tools

- Software Engineering

- Web Development

- Data Science

- Tech Guides

- Tech Resources

- Career Advice

- Online Learning

- Internships

- Apprenticeships

- Tech Salaries

- Associate Degree

- Bachelor's Degree

- Master's Degree

- University Admissions

- Best Schools

- Certifications

- Bootcamp Financing

- Higher Ed Financing

- Scholarships

- Financial Aid

- Best Coding Bootcamps

- Best Online Bootcamps

- Best Web Design Bootcamps

- Best Data Science Bootcamps

- Best Technology Sales Bootcamps

- Best Data Analytics Bootcamps

- Best Cybersecurity Bootcamps

- Best Digital Marketing Bootcamps

- Los Angeles

- San Francisco

- Browse All Locations

- Digital Marketing

- Machine Learning

- See All Subjects

- Bootcamps 101

- Full-Stack Development

- Career Changes

- View all Career Discussions

- Mobile App Development

- Cybersecurity

- Product Management

- UX/UI Design

- What is a Coding Bootcamp?

- Are Coding Bootcamps Worth It?

- How to Choose a Coding Bootcamp

- Best Online Coding Bootcamps and Courses

- Best Free Bootcamps and Coding Training

- Coding Bootcamp vs. Community College

- Coding Bootcamp vs. Self-Learning

- Bootcamps vs. Certifications: Compared

- What Is a Coding Bootcamp Job Guarantee?

- How to Pay for Coding Bootcamp

- Ultimate Guide to Coding Bootcamp Loans

- Best Coding Bootcamp Scholarships and Grants

- Education Stipends for Coding Bootcamps

- Get Your Coding Bootcamp Sponsored by Your Employer

- GI Bill and Coding Bootcamps

- Tech Intevriews

- Our Enterprise Solution

- Connect With Us

- Publication

- Reskill America

- Partner With Us

- Resource Center

- Bachelor’s Degree

- Master’s Degree

PhD in Accounting: Help Fill a Shortage of Accountant Professors

You may not have known there is a doctoral-level degree in accounting. However, there are doctoral degrees in most fields, giving you the option to pursue the highest possible degree level in your academic area of study, including a PhD in Accounting. Accounting is a complex field that is often offered as a major or an area of focus in business school. Most students who pursue a Master’s Degrere in Accounting are already accountants with experience in public accounting and research. They may also be experienced business professionals with a master’s degree in the business world, such as a master of business administration (MBA).

This is a competitive doctoral-level degree for talented accountants who are truly passionate about pursuing a career in accounting research, consulting, or teaching.

Find your bootcamp match

What is accounting.

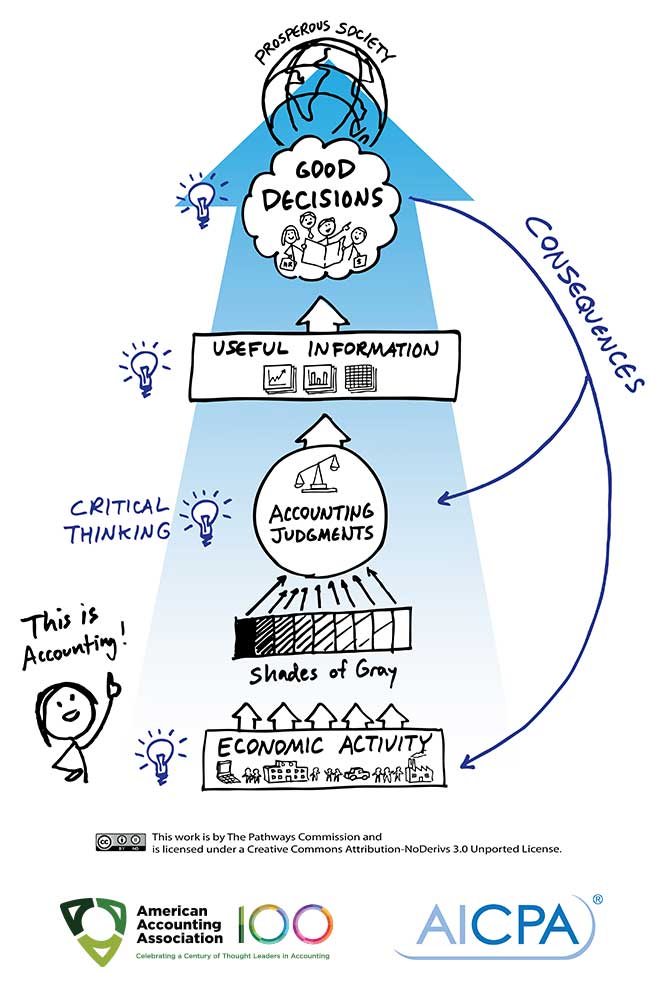

Most people think of accountants as the people who do their taxes. Though some accountants, tax accountants, do spend their time helping individuals and corporations with their taxes, accounting goes far beyond these tax-related duties. The accounting field is actually a growing and highly in-demand academic field. Accounting focuses on recording financial transactions and sorting and summarizing them into reports and analyses. Academic accounting is a field that incorporates related subfields like econometrics, statistics, finance, and theory.

Why Get a PhD in Accounting?

A PhD in Accounting is an excellent degree choice if you are truly committed to the field of accounting and interested in accounting theory. This is because accounting research is often theoretical in nature and like accounting, requires strong analytical and mathematical abilities. Accounting doctoral students are interested in pursuing theoretical concepts of accounting and applying them to real markets. Some of the country’s best business schools offer master’s degree programs in accounting.

If such a program sounds interesting to you, read on for more information on what you can expect as a PhD accounting student.

PhD in Accounting Components

Before considering specific programs in-depth, it’s a good idea to look into what most programs require and include. These are competitive, advanced-level degree programs for strong and dedicated students. Each program will have a slightly different set of curriculum requirements and may have different concentration offerings. Here is a general summary of what you should expect.

Application Requirements

When applying to any PhD program, students typically start their search process by researching program faculty members. This is because PhD programs are so rooted in the doctoral thesis, which requires extensive 1:1 advising and mentorship from an academic advisor and faculty members. One of the most important aspects of your application is a proven academic track record in accounting, math, economics, and finance. Programs require bachelor’s degrees, at a minimum. If you have a Master’s Degree in Accounting and/or are a certified public accountant, you will be a more competitive applicant. Several years of work experience in the field can really help applicants gain entry to their desired program.

Applicants will also be required to submit GRE or GMAT exam scores. Because many doctoral accounting programs are run through business schools, the GMAT is sometimes required.

PhD in Accounting Curriculum

Most universities offer doctoral programs in accounting through their schools of business. For example, one of the best-known programs of its kind is part of Stanford University’s Graduate School of Business. PhD programs in accounting can take approximately four to seven years to complete, depending on your thesis project and its time requirements. Programs start with foundational coursework that prepares students for the final years of dissertation work. Here are some common courses accounting students can expect to see at the PhD level:

- Research Methods

- Capital Market Research

- Statistical Analysis

- Quantitative Methods for Accounting

- Econometrics

- Managerial Accounting

- Theories in Accounting

Most PhD programs prepare students for careers as academics, accounting professors, and expert consultants. For this reason, most programs require that students complete teaching practicums as part of the degree process. Students take the important core accounting classes, they develop as researchers, and they learn how to teach.

Concentrations and Dissertations for an Accounting PhD

You will likely choose an accounting concentration within your doctoral program. Some common concentrations are:

- Public Accounting

- Forensic Accounting

- Accounting Information Systems

Regardless of the concentration you choose, you will pursue a major research project as a doctoral student. This research project is commonly called a doctoral dissertation. It is the culmination of several years of research under the mentorship of a faculty advisor.

It typically results in a published paper and possibly in presentations at conferences and professional organizations. For academics in colleges and universities in the United States, the doctoral dissertation is the first major opportunity to embark on a publishable, in-depth research project.

Top PhD in Accounting Programs

You should now have a better understanding now of what an accounting PhD entails. Therefore, let’s now take a look at some specific programs. It’s important to note that there is no shortage of programs. In fact, there are 536 different doctoral programs in accounting in the US alone. That said, some programs are much stronger and more competitive than others.

Below is a list of some of the best PhD accounting programs in the United States.

Stanford University

The PhD in Accounting at Stanford in Palo Alto, California, is one of the strongest programs in the country. The program requires students to enter with a solid academic foundation in microeconomic theory, econometrics, and math. It also requires students to have basic computer programming skills in programs like STATA, Python, and SAS. After a couple of years of initial coursework, students move on to practicum experiences in teaching and researching before focusing on their dissertation work.

University of Pennsylvania

The Wharton School, the University of Pennsylvania’s school of business, offers a top-notch program that focuses on analytics. Graduates of the program are prepared to dedicate their academic and professional careers to financial and economic research.

The University of Michigan at Ann Arbor

Michigan’s flagship state institution offers an extremely competitive PhD program in accounting, only accepting one to three applicants per year. Students can expect to be fully funded for five years and complete the program in as much time. Students can also expect to spend their first two years on focused research into investor relations, managerial investments, and cash holding.

University of Chicago

The University of Chicago’s Booth School of Business and the Accounting Research Center host this exclusive PhD program in accounting. This program is all about flexibility, allowing its students to cater their program according to their interest in an array of different specializations. Courses offered include econometrics, price theory, finance, and economic modeling. This program consistently produces top graduates who go on to become experts in the field.

The University of Texas at Austin

Out of all of the programs listed here, the McCombs School of Business at the University of Texas offers, by some accounts, offers the top PhD in Accounting program in the country. According to the Public Accounting Report of 2019, it is the #1 program in the nation.

The Texas McCombs PhD, as the program is officially called, stands apart with distinguished faculty and extremely rigorous preparation for academic life. The program prepares students by helping them develop their research and writing skills and by making them highly competitive when entering the job market or the academic world of accounting.

Career Outlook With a PhD in Accounting

There is a shortage of accounting professors in the US. This is great news for someone considering the terminal degree in accounting: a doctoral degree. With a PhD in Accounting, you can help fill this shortage and you will be in high demand. Actually, some students who would have typically stopped their studies with a Master’s Degree in Accounting have decided to continue on to a PhD in Accounting because of the job security the degree offers. Universities need to fill vacancies for accounting professors. This also means that they are willing to pay higher-than-average business faculty salaries to hire and retain accounting professors. The average starting salary for accounting professors under the age of 45 is $101,000.

According to the Bureau of Labor Statistics, the overall accounting field is predicted to see faster-than-average growth between 2019 and 2029.

Should You Get Your PhD in Accounting?

The career outlook alone should be enough to help you answer this question. The answer to this question might be yes, if:

- You are passionate about accounting and accounting theory

- You have a Bachelor’s Degree in Accounting or a related field

- You have some professional experience in the accounting or finance sector

- You are interested in being a university professor in accounting

- You love research

With excellent job security and very comfortable pay, accounting professors can enjoy successful careers. If you’re excited about pursuing this career track, use this article as a guide to launch your PhD in Accounting program research.

About us: Career Karma is a platform designed to help job seekers find, research, and connect with job training programs to advance their careers. Learn about the CK publication .

What's Next?

Get matched with top bootcamps

Ask a question to our community, take our careers quiz.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Harvard Business School →

- Doctoral Programs →

- PhD Programs

Accounting & Management

- Business Economics

- Health Policy (Management)

- Organizational Behavior

- Technology & Operations Management

- Program Requirements

Accounting & Management

Curriculum & coursework.

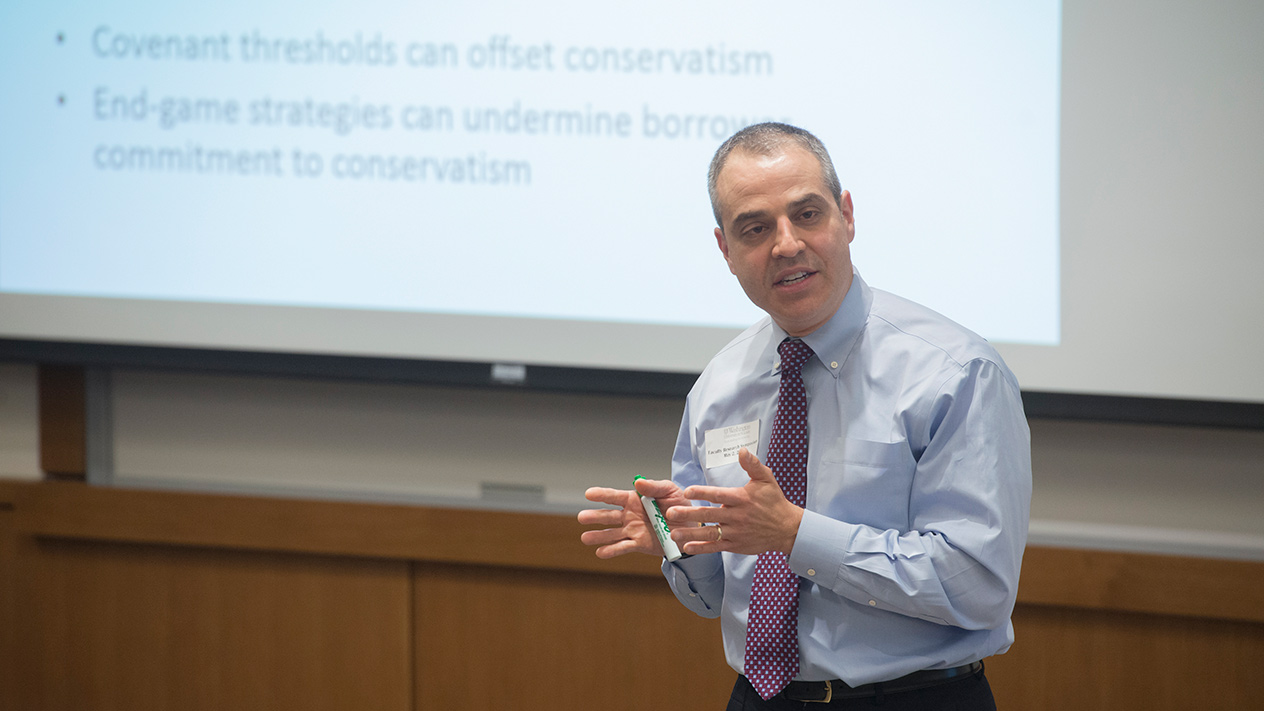

Our programs are full-time degree programs which officially begin in August. Students are expected to complete their program in five years. Typically, the first two years are spent on coursework, at the end of which students take a field exam, and then another three years on dissertation research and writing.

Students in the Accounting and Management program must complete a minimum of 13 semester-long doctoral courses in the areas of business management theory, economic theory, quantitative research methods, academic field seminars, and two MBA elective curriculum courses. In addition to HBS courses, students may take courses at other Harvard Schools and MIT.

Research & Dissertation

Students in accounting and management begin research in their first year typically by working with a faculty member. By their third and fourth years, most students are launched on a solid research and publication stream. In Accounting and Management, the dissertation may take the form of three publishable papers or one longer dissertation.

Recent questions students have explored include: the ways in which managers use retail-level marketing actions to influence the timing of consumer purchases in relation to their firms’ fiscal calendars and financial performance as well as those of their competitors; the role of accounting information in strategic human resource decisions; the evolution, consequences and institutional determinants of unregulated financial reporting practices; the effects of adopting rolling forecasts on forecast quality.

Elliot Tobin

“ I’m constantly inspired to look into new research angles by the brilliant people I run into on campus every day. ”

Current HBS Faculty

- Brian K. Baik

- Dennis Campbell

- Wilbur X. Chen

- Srikant M. Datar

- Aiyesha Dey

- Susanna Gallani

- Brian J. Hall

- Jonas Heese

- Robert S. Kaplan

- V.G. Narayanan

- Joseph Pacelli

- Lynn S. Paine

- Krishna G. Palepu

- Ananth Raman

- Clayton S. Rose

- Ethan C. Rouen

- Tatiana Sandino

- David S. Scharfstein

- George Serafeim

- Anywhere Sikochi

- Robert Simons

- Eugene F. Soltes

- Suraj Srinivasan

- Adi Sunderam

- Charles C.Y. Wang

- Emily Williams

Current Accounting & Management Students

- Ji Ho Kim

- Yiwei Li

- Trang Nguyen

- Konstantin Pavlenkov

- Ria Sen

- Terrence Shi

- Albert Shin

- Elliot Tobin

- Wenxin Wang

- Siyu Zhang

Current HBS Faculty & Students by Interest

Recent placement, yaxuan chen, 2024, hashim zaman, 2022, wei cai, 2020, matthew shaffer, 2019, botir kobilov, 2024, patrick ferguson, 2021, jihwon park, 2020, wilbur chen, 2022, alexandra scherf, 2021, jody grewal, 2019.

ACCOUNTING PhD

The nation’s top accounting program.

Texas McCombs boasts the most prestigious accounting doctoral program in the country and has graduated more than 300 PhD students since its inception in 1934. Are you ready for the best?

Your Future In Accounting

- PhD Program

- Why McCombs

- Department of Accounting

ACADEMIC LIFE AT McCOMBS

Mentorship and practice, application deadline.

The application deadline for the Accounting Doctoral Program is December 15.

AREAS OF SPECIALIZATION

If you are a practicing accountant, these topical areas will be familiar to you. However, we welcome students with backgrounds in Mathematics, Economics, Engineering, Finance, Psychology, or other disciplines to apply. We can remedy any lack of accounting knowledge through additional coursework. Most students enter our accounting doctoral program with some knowledge in these areas:

Financial Accounting

Financial accounting researchers are interested in the use of accounting information by investors, creditors, analysts, and other decision-makers. We are also interested in the preparation of accounting information by managers who may respond to economic incentives and use discretion to manage earnings. Finally, we are also interested in the regulation of accounting information by standard setters and other regulators who are evaluating the relevance and reliability of current and potential accounting information.

Auditing researchers are interested in questions of independence, governance, compliance, auditing processes, and biases. This research helps global standard-setters and regulators adopt standards and policies that protect the integrity of our accounting information.

Managerial accounting research topics include optimal employee compensation and governance, using information for efficiency management, motivating creativity, etc.

Taxation research covers economic incentives, transfer pricing, compliance with tax enforcement, multistate taxation, and numerous topics about accounting for income taxation, where tax rules overlap with financial reporting standards.

RANKINGS & RESEARCH

Academic leadership, research methodologies.

When you earn a doctorate, most of your time is spent developing deep expertise in research methods. Accounting researchers use three main approaches. In all cases, your doctoral studies will involve a firm grounding in statistics and typically a choice of either economics or psychology as an additional foundation.

Archival research involves the statistical analysis of historical data to examine relevant research questions based on economic theory for its predictions. Thus, archival research requires a strong background in statistics and economics, which we provide through rigorous coursework in the business school and the economics department.

Experimental

Experimental or survey methods are commonly used to obtain data to conduct what is broadly known as behavioral research. Behavioral research relies on psychology for its theories. Because this research is interested in what people do and why they do it, it is often necessary to conduct controlled experiments or survey participants. Using experiment or survey methods, researchers in accounting and finance have provided compelling alternative explanations where economic theories fall short.

Analytical research uses quantitative mathematical models to explain and predict behavior. This research is grounded in game theory from economics. Students wanting to conduct analytical research should have even stronger mathematical backgrounds than other applicants. We will design a program of study that builds on those initial strengths with additional coursework in mathematics and economics.

GET READY TO APPLY

Preparation and qualifications, career placement, the world needs you, career destinations.

The primary goal of the Texas McCombs PhD program is to prepare students for exceptional academic careers. Over the last five years, McCombs Accounting PhD alumni have excelled at top institutions globally.

Recent Graduate Placements

Jesse Chan | 2022 | Boston University

Cassie Mongold | 2022 | University of Illinois Urbana-Champaign

Ryan Hess | 2021 | Stanford University (postdoc); Oklahoma State University

Ryan Ballestero | 2021 | Kent State University

Dan Rimkus | 2021 | University of Florida (October 2021 graduation)

Shannon Garavaglia | 2020 | University of Pittsburgh

Jakob Infuehr | 2019 | University of Southern Denmark

Antonis Kartapanis | 2019 | Texas A&M University

Kristen Valentine | 2019 | University of Georgia

Colin Koutney | 2018 | George Mason University

Zheng Leitter | 2018 | Nanyang Technological University

Brian Monsen | 2018 | The Ohio State University

Xinyu Zhang | 2018 | Cornell University

Jeanmarie Lord | 2017 | University of Montana

Ben Van Landuyt | 2017 | University of Arizona

Shannon Chen | 2017 | University of Arizona

Prasart Jongjaroenkamol | 2017 | Singapore Management University

Ying Huang | 2017 | University of Texas - Dallas

Current Students and *Job Market Candidates

Mary adenle, yiying chen, dorothy dickmann, mandy ellison*, kenzie feinberg, michael gonari, nathan herrmann, sean kemsley, minjae kim*, kaitlyn kroeger, jingpei shi, albert wang, are you ready to change the world.

The Texas McCombs Doctoral Program is seeking individuals who are interested in transforming the global marketplace. Are you one of these future thought leaders?

- Youth Program

- Wharton Online

PhD Program