Core banking modernization: Unlocking legacy code with generative AI

The ultimate guide to product innovation in banking, capture more of the finance market – 3 approaches, 3 crucial questions about the culture crisis in banking, 3 ways banks can get great roi from the cloud, accenture banking blog other blogs banking blog capital markets blog insurance blog.

- Meet Our Bloggers

- More From Banking

- English US English

19 Dec 2023

The pace of change is not slowing down. Customers’ expectations have radically changed, and they expect much more from their banking products and services than ever before. To maintain relevance, banks need to be on the pulse of these needs and create products to solve them—to unlock value for both their customers and the bank.

The reality is that, over the past decade, banks’ products have converged toward functional equivalence while becoming emotionally devoid. And as banks increased their reliance on digital touchpoints during the pandemic, they became even less connected with their customers.

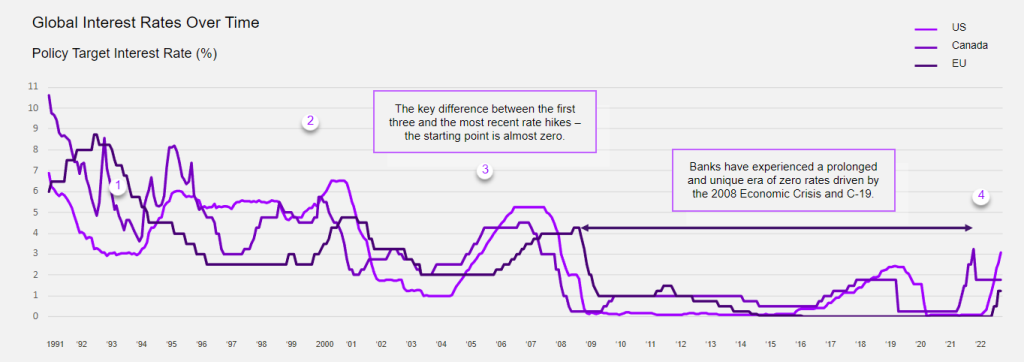

To add to this paradox, zero rates have distorted the market, driving many banks to focus on individual products instead of the customer as a whole. As rates continue to rise, the limitations of this approach will be exposed, proving a new reality of value for banks.

How can banks spark this change, taking advantage of a rising rates environment to innovate for today’s needs and customer values? We believe there has never been a better time to be in the banking industry, and banks have both the opportunity and the restored profitability to prioritize product innovation and fuel growth.

Banks are well positioned to take a proactive role as they face changing regulations, shifting consumer preferences and rising interest rates. Today, they must rediscover their creative mojo and innovate for today’s customers.

In this guide:

The history of product innovation in banking

What impact have zero rates had on banking product innovation, what is the opportunity for banking product innovation in a rising rates environment, qorus-accenture innovation awards leading the way in banking innovation, what are some innovative product ideas that banks can explore now, how can banks start accelerating their product innovation, product innovation resources for banks.

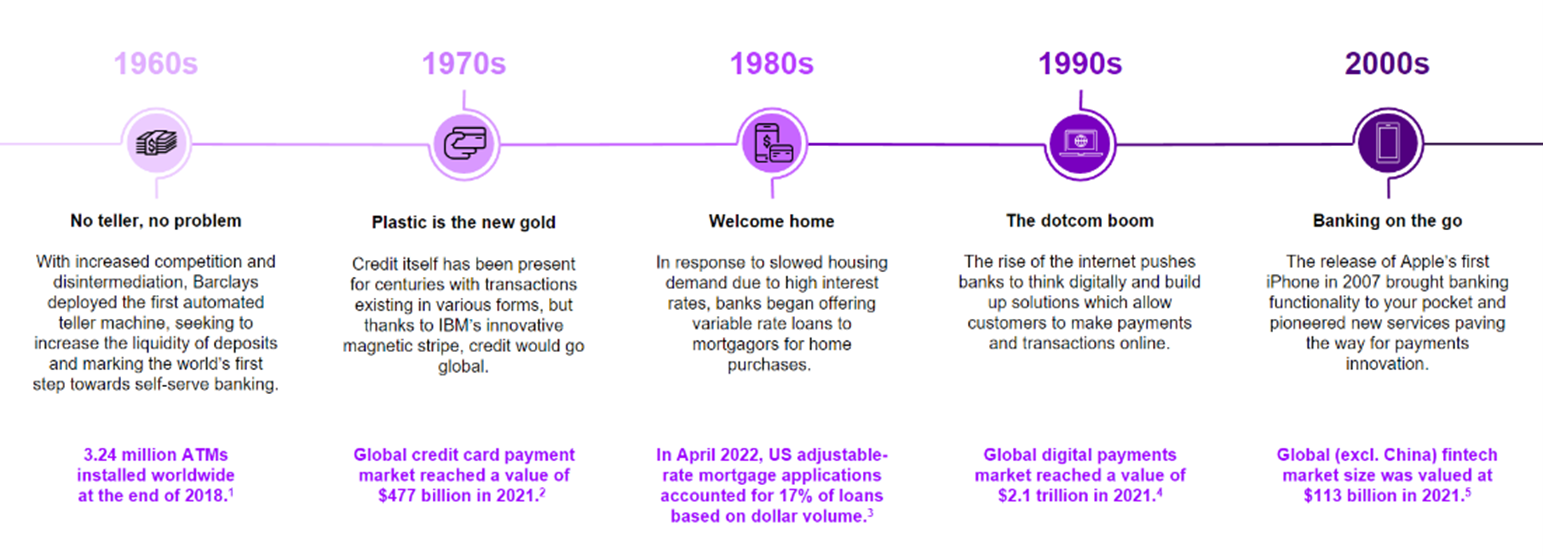

In the decades before the Great Recession, banks relied on unrelenting product innovation to drive growth. From reward cards and no-fee checking to adjustable-rate mortgages, debit cards and instant credit, this innovation has benefitted customers and banks alike.

But over the last two decades, banks have shifted their focus away from innovation. The 2008 financial crisis turned the attention of banks toward economic recovery, adhering to new regulatory standards and driving down costs by digitizing their processes and experiences.

In parallel, changes in consumer needs and the rise of new technologies set the stage for a new operating environment. But innovation did not slow down. Neobanks, fintechs and bigtechs started driving industry innovations such as buy now, pay later lending models and early payday lending.

Today, new competitive threats continue to emerge in all shapes and sizes. Bigtechs are leveraging their consumer data, advanced analytics capabilities and large network effects to partner with nimble fintechs, capturing significant market share across their expanding global footprint—all without a banking license. These non-traditional competitors show ambitions beyond becoming digital banks, and their foray into financial services focuses on creating new sources of value and strengthening their ecosystem by reimagining business models.

Banking Top 10 Trends for 2023: Our annual report predicts the trends that will shape banking’s future.

A decade of zero rates distorted the market by causing a flood of cheap cash and enabling alternative lenders and venture-capital-backed fintechs to fuel the acquisition of emerging and underserved customer segments. During this period, the product calculus changed rapidly, forcing banks to focus on optimizing and marketing individual products rather than developing integrated propositions for customers.

This is revealed in the shrinking role of banks relative to the overall financial system, new competitors and other intermediaries. This trend is apparent in developed economies such as the US, the UK, Europe, Japan and others. This has been partly engineered by regulators seeking to reduce risk within the banking system that became evident in the 2008 financial crisis.

While these regulations and risk controls aimed to build a more resilient economy, the legal, regulatory and policy standards have not evolved to address the new competitive banking environment. The last decade saw an explosion of non-regulated players, such as fintechs, bigtechs and non-banks, and these competitors have attacked the banking value chain to build and serve all the products of a bank without the constraints of banking regulations.

Additionally, during this time, the persistence of zero interest rates resulted in four major directional changes that drove customers and growth outside the banking industry:

- Personal banking experienced a proliferation of new fintech banks, reaching 250 globally in 2022. Cheap deposits and streamlined experiences powered by more than $300bn in funding helped neobanks open more than 33mn accounts since 2019.

- Rock-bottom rates fueled massive off-balance-sheet funding. The number of personal and consumer lenders exploded, while new entrants such as neobanks quintupled the value of digital lending since 2010. (Even Goldman got into the game with Marcus offering personal loans and savings.)

- Fintechs systematically disaggregated small business banking, with entrants like Square and Kabbage emerging. PayPal acquired Swift Financial to bolster its SMB lending business. Brex built a SMB credit card business. And Shopify and Uber started offering integrated banking.

- Private credit took off as firms looked to fill the void caused by the retreat of banks from middle-market and other types of ‘riskier’ lending opportunities. PE firms offered high yields for institutional and wealthy investors, outperforming the S&P500, the Russell 2000, and venture capital during a period of low interest rates.

Sources: The Financial Brand, Accenture Research, S&P Capital IQ, CB Insights, SVB, Insider intelligence, Bloomberg

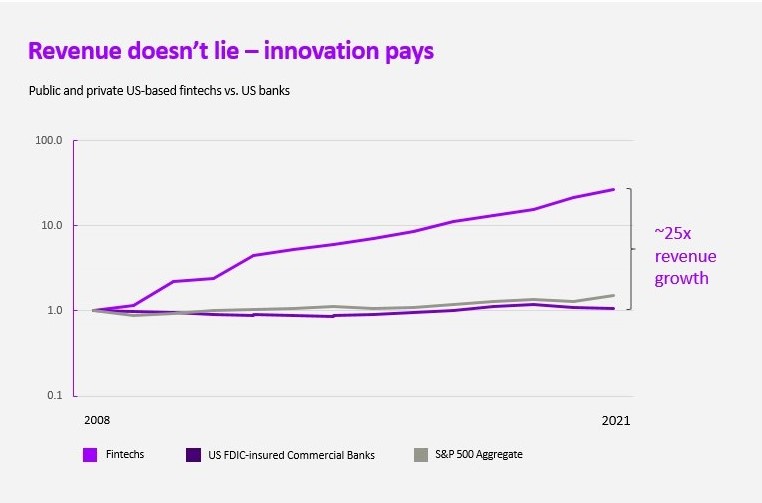

And revenue doesn’t lie—innovation pays. The post-recession difference is evidenced in the soaring revenue growth of fintechs while banks stagnated. Accenture research shows fintech revenues have grown to a material share: $100bn in the US alone. This trend is not unique to the US; new competitors have captured a higher share of revenue in the UK and China, also home to some of the world’s leading neobanks and bigtechs.

Today, amid rising interest rates, macroeconomic volatility and a changing regulatory landscape, banks have the advantage. Strong and diversified balance sheets, trust, economies of scale and experience adapting to change together set the stage for banks to return to their innovative roots.

And just as zero interest distorted product economics, we see the rising interest rates as the gravity pulling business and product strategies back together. This will have a number of impacts:

- Deposits are the new rocket fuel: Low beta deposits are the premium liability every bank wants. Rising rates will drive separation between hot-deposit banks and diversified banks that effectively use digital experiences to manage front- and back-book spreads.

- From product siloes to the total customer : Banks will begin offering holistic value propositions and end-to-end functionality, developing products that link deposits and lending and amplify value.

- Unbundling and rebundling of banking: Banks will deliver growth by unbundling their legacy tech and product distribution and rebundling with partners at lower costs and faster times to market.

- A neo-normal: Neobanks funded by hot deposits are facing pullbacks in investor funding and falling valuations . Banks have a once-in-a-generation opportunity to acquire fintechs to find new customers, accelerate innovation and absorb desirable fintech talent.

- The latent digital dividend: Coming out of the pandemic, 97% of customer touchpoints are either online or mobile. Finding a way to leverage modern data and technology systems to cross/up-sell products in a similar fashion to a branch experience will unlock enormous value in customer relationships.

The Qorus-Accenture Banking Innovation Awards is a global program that honors trailblazers in the banking industry. The 2023 ceremony commemorated a decade of groundbreaking advancements and showcased the year’s most extraordinary and promising innovations.

Bradesco was named Global Innovator 2023 for the bank’s ongoing dedication to innovation, as part of its commitment to delivering world-class experiences to its customers, partners and employees. Bradesco launched several new products and services, including its E-agro platform, that uses data analytics to improve farmers’ access to resources and support, and an internal e-commerce platform that allows employees to request and track corporate supplies.

And there must be an artificial intelligence (AI) mention when it comes to banking innovation. In fact, with its growing popularity, the awards saw this technology infused in most categories. ABN AMRO took the Future Workforce award for ‘ABN AMRO Contact Centre GenAI’. It uses generative AI systems to enable call center agents to swiftly answer customer queries and improve agent performance and job satisfaction.

Intesa Sanpaolo received the Reimagining the Customer Experience award for ‘Ellis: Cognitive AI & GenAI Revolutionize Customer Service’. This intelligent digital assistant operates across the bank’s mobile app, internet banking and public website platforms and uses artificial intelligence to chat with customers.

The awards also highlighted the need to focus on sustainability across categories. BNP Paribas Fortis , for instance, claimed the Beyond Core Banking Offerings award for its ‘HappyNest’ initiative that makes energy efficient housing more accessible by offering new green properties to rental customers who can later buy their homes at a discount.

We encourage you to take a moment and browse the full list of 2023 winning innovations.

To kickstart the ideation process, we asked our global banking team: “How might we address the evolving financial needs and behaviors of consumers with products and services that can drive revenue growth in an increasingly uncertain environment?”

We pitched over 150 product ideas, with the goal of growth and meeting the needs of today’s customers. We are sharing almost 50 in this guide, categorized by eight product themes, to help banks rediscover their creative mojo for product innovation.

Sumita Bhattacharya, Managing Director – Banking Innovation Lead & NE Innovation Lead

Banks need to break down product silos to enable a holistic view of value and loyalty. The fundamentals of loyalty have changed. With new entrants, access points and innovation, customers today are not only faced with a constant barrage of choices but with exciting possibilities that have enabled the “Age of Switch.”

While loyalty is not dead, it can’t be taken for granted. Consumers are increasingly willing to try brands that will serve them better. They want to see their banks reward them for their loyalty—not just to a single product, but across the bank’s offerings. Recognizing consumers for both the extent of their dependence on the bank and their longevity is more critical than ever and will require banks to demonstrate (and demonstrate again) the value of maintaining this relationship.

- TD Rewards launched partnerships with Starbucks and Amazon, allowing clients to accrue points for debit spending and to spend points however they want.

- Earn More Starbucks Stars With Your Eligible TD Credit Card and TD Access with Visa Debit Card | TD Canada Trust

- April is an embedded solution that can be integrated into any application to offer customers the ability to seamlessly file their taxes based on their financial data.

- April | Embed intelligent tax experiences (getapril.com)

- Tally, a California-based consumer tech start-up built one of the first automated debt managers that helps customers save thousands on credit card interest payments.

- Get Help Paying Off Credit Card Debt Faster — Tally (meettally.com)

- Shop Small by American Express is a yearly initiative that incentivizes consumers to shop at its local small-business partners to earn extra cash-back and points.

- Learn more about Shop Small | American Express CA

- Mox Credit introduces the ability for customers to get cash-back calculated right upon purchase and then have it credited to their account daily.

- Mox Credit | Mox

- VitraCash has launched an industry-first debit card that places a customer's cards in a single wallet and selects the best card for a transaction based on cash-back, insurance and FX fees.

- VitraCash - Home

- Novus has introduced the ability for customers to make an impact with every purchase—they earn impact coins that can be donated to 10 different causes.

- Make your money count | Novus

- Mana Interactive helps to unlock rewards for gamers in their purchases and gameplay with the ability to access their account in a VR environment.

- About Us | Mana

- Tangerine offers a Money-Back Credit Card which rewards customers with an extra 2% money-back when they deposit their rewards in a Tangerine savings account.

- Money-Back Credit Card | Tangerine

Michael Abbott, Senior Managing Director – Global Banking Lead

Rising rates create a window of opportunity for banks to de-commoditize products by developing solutions like those of Amazon Prime that reward total engagement with the bank. Think rewards multipliers for higher deposits, or discounts on mortgage rates—tiered offerings that value the overall relationship. The most creative banks will take it even further by incorporating non-banking products , which means 2023 will be a year of product innovation.

- CIBC launched Smart Start to offer zero-cost banking accounts until customers turn 25, supplemented with no-fee stock and ETF investing as well as SPC+ membership to help set young adults up for success.

- Get Unlimited Everyday Banking for Youth Under 25 | CIBC

- SingleKey offers tenant screening that goes beyond credit scores and a rental guarantee should a tenant stop paying rent.

- Rent Guarantee & Tenant Background Checks | SingleKey

- Citi Bank launched Custom Cash, a new type of cash-back card that provides 5% rewards on a customer’s top spend category. It incentivizes them to buy the things and experiences they love.

- Citi Launches Custom Cash—A Next-Gen Cash Back Credit Card

- Zirtue is a relationship-based lending platform that allows users to lend money to friends and family, setting their own repayment terms and conditions.

- Zirtue | Lend and Borrow Money with Friends & Family | Relationship-based Lending

- Splitwise offers a single interface for those in relationships or living with roommates to help track bills and expenses and easily make transfers to settle balances.

- Split expenses with friends. :: Splitwise

Jess Murray, Managing Director – Song, Banking & Capital Markets Lead, North America

Banks face a trust paradox . While customers trust banks with their money, only 19% of them say they are interested in receiving advice from a bank. And the expectation around life-centric advice has only increased throughout the pandemic.

To this end, we are witnessing leading banks “democratize advice” products and services typically provided to wealthier investors, making advice more accessible to the mass-affluent segment through analytics and digital advice tools that deliver more meaningful, contextual, personalized experiences.

- Max is a tool that helps customers earn more by presenting the highest-yield accounts so they can maximize their interest on their savings, emergency and sinking funds.

- https://www.maxmyinterest.com

- Yendo is a revolving credit product on a mobile platform that taps into an individual’s equity in their vehicle regardless of credit history or score.

- https://www.yendo.com

- PocketSmith, a financial software product from New Zealand, includes a comprehensive scenario planner that allows customers to create and test different financial situations on multiple accounts to predict financial outcomes.

- https://www.pocketsmith.com/global-personal-finance-software/new-zealand/

- Ikigai, a new challenger app in the UK, enables customers to access a relationship manager for a flat $10 subscription fee, making financial advice available regardless of how much the customer can invest.

- ikigai - Self-care for your money

- Cogni is a digital banking challenger app that blends personalized financial and exciting lifestyle services access across Web2 and Web3 finance.

- Welcome to Cogni • Banking 3.0 (getcogni.com)

- Finmarie, a German-based financial start-up that targets women enables its customers to use an app to set up bookings with its specialists for one-to-one personal financial coaching.

- Financial freedom & wealth accumulation for women | Jennifer (finmarie.com)

- Key, a Toronto start-up, brings co-ownership and leasing to the homeownership market. Customers put 2.5% down and build equity with each monthly payment.

- Home Page (lifeatkey.com)

- Sweater is a fintech firm that is making venture capital funds accessible to everyday customers with a clear fee structure across their investments on the platform.

- Sweater | The VC Fund for Everyone (sweaterventures.com)

- Standard Chartered launched Autumn, a platform that provides a single dashboard view of a customer’s financials and can be used to personalize goals or analyze scenarios.

- Autumn - Your Finance & Wellness App

- FRICH is a new social banking app aimed at millennials and gen Z, where users can compete in community challenges to see how their financial position compares with others’.

- Social Finance for Gen Z | Frich (getfrich.com)

- NatWest emerged on TikTok to promote an online toolkit with learning modules on sustainability, business strategy and mindset designed to inspire entrepreneurs.

- NatWest Online – Bank Accounts, Mortgages, Loans and Savings

Sumita Bhattacharya – Managing Director, Banking Innovation Lead & NE Innovation Lead

Banks need to focus on solutions that address the diverse needs of consumers and communities. Consumers of all ages and locations are increasingly embracing brands that act with purpose. In a Forbes study, 88% of consumers said they wanted companies to help them make a difference in their communities .

In 2021, nearly 20% of the US population remained unbanked or underbanked . Many consumers also struggle to make the right choices when it comes to managing their financial futures. Organizations that innovate to provide greater access to credit and capital can win with a wider segment of consumers who haven’t been served or served well.

- What if we made credit accessible to those with bank accounts but who lack exposure to credit products by giving them an alternative credit score?

- Petal creates a Cash Score using consumers’ banking history. It draws on factors such as income, spending and savings rather than a traditional credit score.

- Petal - Responsible credit for the modern world. (petalcard.com)

- The Community Affordable Loan Solution, offered by Bank of America, aims to make homeownership a reality for members of predominantly minority communities—basing eligibility on income and location.

- Bank of America Introduces Community Affordable Loan Solution™ to Expand Homeownership Opportunities in Black/African American and Hispanic-Latino Communities

- Huntington Bank has launched Standby Cash, which allows clients to qualify for a small line of credit based on their checking account and payment history rather than credit score.

- Building Credit With No History: Does Standby Cash Affect Credit? | Huntington Bank

- The Walmart Money Center enables customers to access multiple financial services, from cash and money transfers to insurance and tax services, at their local Walmart.

- Money Center - Walmart.com

- Stellantis partnered with Kiri Technologies to design a new rewards program that encourages Fiat 500 electric-car drivers to adopt an ecological driving style based on their speed and energy usage.

- e-Mobility by Stellantis presents with Kiri Technologies the innovative program dedicated exclusively to New 500 customers, to reward sustainable driving | e-Mobility | Stellantis

- Visa has announced the launch of an advisory service for financial institutions, retailers and other businesses looking to engage in Web3, crypto and the metaverse.

- Visa Introduces Crypto Advisory Services to Help Partners Navigate a New Era of Money Movement | undefined

- HSBC UK’s efforts toward financial inclusion led to the introduction of higher- contrast colours and tactile raised dots as standard features on its bank cards, making it easier to differentiate between different cards.

- Accessible Cards | Accessibility - HSBC UK

- PKO Bank Polski offers debit cards that can be used in multiple currencies. This enables customers to make payments without currency conversion costs.

- PKO Bank Polski (pkobp.pl)

- As a new start-up based in India, Tortoise aims to upset purchasing products with a 'save now, buy later’ program. Customers enroll in a savings plan and get cash-back which they can use for their purchase.

- Tortoise Savings App

- Standard Chartered has launched Shoal, where customers can specify the green projects in which their savings should be invested. They then get updates on the funded projects as well as a ‘competitive rate of return’.

- We've launched Shoal (sc.com)

I’ll introduce my excitement for the potential in this space by quoting Serena Williams : “I have never liked the word retirement. It doesn’t feel like a modern word to me…Maybe the best word to describe what I’m up to is ‘evolution’.”

And I agree—retirement is a dated concept and banks have long neglected the opportunity to rethink the experience. Generationally, we are seeing boomers thrive as they age and develop new needs in this phase of life, including anything from second careers to the rise of the ‘silver divorce’. In parallel, younger generations are redefining the meaning of success, and have accelerated the FIRE (financial independence, retire early) trend.

Add to these the aging population and the inter-generational wealth transfer, and it becomes clear that attitudes around ‘retirement’ as an ultimate, monolithic goal have changed. Banks must shift to longer-term planning focused on health and wellness.

- Timeline helps financial advisors to plan for their customers’ future based on specific goals and modelling different investment outcomes.

- Empowering Financial Advisers and Financial Planning Firms | Timeline

- ClearEstate is a Canadian estate settlement tool that gives users access to a beneficiary portal and dedicated estate professionals and executor coaches.

- ClearEstate | Online Estate Planning and Settlement Service

- Finary is an aggregation tool that enables customers to track multiple asset classes and their associated performance to predict and simulate financial independence.

- Finary | Real-Time Portfolio Tracker & Stock Tracker

- Papa pairs seniors and retired individuals with companions who can lend a hand, take walks and reduce social isolation by building relationships between generations.

- Papa | Companionship for Older Adults | Flexible Family Care

Jared Rorrer, Managing Director – Global Commercial Banking Lead

With the current economic uncertainty, banks’ immediate focus going into 2023 will be on doing the basics well. Be it ensuring the new LOS is adopted effectively to enhance credit quality or improving data quality or basic process effectiveness and control, the name of the game will be ‘finish what you started and make the bank hum’.

But don’t be fooled: the window to complete the basic blocking and tackling will be short-lived. When we emerge from what will hopefully be a light recession, the progress to digital will accelerate. Banks must be ready to build on the foundational work they have been doing and to deliver fully digital experiences. They should also strive to bring their data to life using AI, to drive smarter solutions from AML/KYC and onboarding to risk decisioning and customer outreach.

- Kabbage from American Express is a cashflow management offering that provides funding based on a customer’s financial information, with the decision delivered within minutes.

- Tools to help grow your business | Kabbage from American Express

- Moov is a data-driven marketplace that brings together buyers and sellers of surplus manufacturing equipment, while also handling payment and logistics to reduce lead times.

- Used Semiconductor Equipment Marketplace | Moov

- Atelier gives lower-interest loans to smaller property developers who make substantial reductions in the lifetime carbon impact of their developments.

- Atelier rewards property developers who go green with cheaper finance (finextra.com)

- Italian bank Illimity has introduced b-ilty, a subscription model for SMB financing. SMBs receive personalized financial services with a dedicated relationship manager.

- illimity, b-ilty

- Klarna recently partnered with Liberis to provide personalized and pre-approved financing offers, all from the Klarna platform.

- Klarna Collaborating With Liberis | PYMNTS.com

- Nymbus has a banking-as-a-service offering that enables customers to launch a fully secure and compliant digital bank or credit union.

- Banking-as-a-service (BaaS) | Nymbus

- Railsr offers a new way for retailers to create exceptional customer experiences through white label solutions such as buy now, pay later and rewards programs.

- Railsr, Formerly Railsbank | The Global Embedded Finance Platform

- Milo is driving Web3 lending by launching the first crypto mortgage that enables customers to purchase land and real estate in digital forms.

- Milo | 30 Year Crypto Mortgage Loan

- Comarch’s Relationship Manager Assistant provides RMs with a 360° view of customers and offers advanced tools that automatically assign leads to the right team.

- Digital banking software, IT business products for banks (comarch.com)

Banking is necessary for SMBs to operate their business, but it is often not top of mind. Market innovation and the advent of embedded banking is changing how SMBs interact with banking products. New value-added services and new, more convenient channels are making it easier for SMBs to access their banking services.

SMB owners are willing to pay a premium for services that save time, and we expect new SMB banking experiences to drive $92 bn of market growth. There is pressure on banks to radically simplify the SMB experience and provide an ecosystem of solutions that help these customers manage their businesses and solve their biggest pain points.

Banks that are not prioritizing investment in this segment risk losing customer mindshare to non-banks (e.g., Shopify or Amazon) and neobanks that are providing niche financial offerings.

- NatWest has recently unveiled Climate Hub, a tool that supports SMBs to better understand their climate impact and access information on green loans and green asset financing.

- Make a change today for a greener tomorrow | NatWest

- Nuula is a super-app that helps SMBs track their business metrics (cashflow, credit etc.) and access loans and lines of credit. It also offers private wealth management.

- Nuula | Your business at your fingertips

- Storefront is a technology platform on which property owners can list their space, from a shop to an office block, making it easier for them to monetize underused physical locations.

- Storefront | +10,000 pop-up shops, showrooms, event venues to rent (thestorefront.com)

- Mastercard Local is a new rewards program which, in partnership with banks and credit unions, offers customers 5% cash-back when they support their community by shopping local.

- Shop at Local Businesses and Earn Cashback | Mastercard Local

- Canadian Western Bank collaborated with Temenos to develop a new offering for SMBs: Temenos Virtual COO. It supports decision making with insights drawn from business and financial data.

- Temenos Core Banking and Canadian Western Bank - Success Story

Michael Abbott, Senior Managing Director – Global Banking Lead

While banks are fiercely competitive, banking itself is built on a foundation of collaboration. There are many areas in the industry where banks are simply better together. No bank gets a gold star for being the best in compliance, and payments would never work if everyone used a different protocol. The advent of commercially-driven embedded banking, the movement beyond payments to standards for loyalty and rewards, and the explosion in AML/KYC (and its associated costs) together are giving banks cause to think beyond their four walls and find new ways to collaborate even more.

- Apple Pay is a payment service that replaces all of the customer’s physical cards with a single wallet enabling contact-less payments, transaction dashboards and secure purchases through a single interface.

- Apple Pay - Apple (CA)

- Facebook has recently announced the launch of special QR codes for easier in-app payments working between Messenger users in the US.

- Meta Pay: Simple, Secure, Free Payments (facebook.com)

- OatFi helps drive B2B payments through an API-powered credit stack, enabling any business to launch its own ‘buy now, pay later’ offering for its customers.

- OatFi | Working Capital Infrastructure for B2B Payments

- Nova Credit is a new-age credit bureau that unlocks a customer’s international credit history and risk profile by accessing consumer-permissioned data.

- Nova Credit

- Honey is a browser extension tool that drives savings for consumers by applying coupons and discounts from across the web to their online purchases.

- Automatic Coupons, Promo Codes, and Deals | Honey (joinhoney.com)

- Akoya enables financial institutions, from big banks to neobanks, to securely exchange consumer data such as balances, loans, investments and credit limits.

- Akoya | Financial data APIs for Open Finance

PAY NOW OR PAY LATER? The U.S. banking industry’s next move

So, now you have a few product ideas. But it takes more than ideas to succeed. Cultivating a culture of obsessive innovation is important, but it’s not enough. Today, banks should:

- Operating in product silos. Break down internal silos to avoid competing on price or submitting to rate maximization apps. Banks should develop offerings linked across products to help customers manage inflationary pressures and meet their financial goals.

- Asking what other banks are doing. Banks that focus on catching up with neobanks or direct competitors will only be fast followers, capable of developing table-stake experiences at best. Stop comparing yourself to the bank down the street, or within the confines of your current projects. It’s time to innovate, not imitate.

- Building innovation muscles. Incorporate routines such as monthly product value hack sessions and ideation challenges. Include non-team members in these sessions to include outside perspectives. Re-evaluate and prioritize product backlogs regularly.

- Getting ready for M&A. As rates continue rising and fintech and challenger bank valuations fall, this could be a once-in-a-decade opportunity for banks to improve their long-term ROE through acquisition. In the process they could bring onboard valuable next-generation talent.

- Measuring what matters. Continue to develop metrics that not only drive value-based decisions for innovation on a micro and macro scale, but also enable operational accountability.

- Addressing the customer as a whole. Banks will need to continue to innovate on both sides of the balance sheet and look for ways to reward customers for borrowing as well as depositing money.

- Elevating the partner ecosystem. The evolution of powerful ecosystems provides the capabilities and technology required to scale innovation, and now is the time to double down on building a robust external network.

Qorus and Accenture Announce Winners of 2023 Banking Innovation Awards

Building a culture that drives sustained growth

The life centricity playbook

Innovation Unleashed

To continue these product innovation conversations, connect with us .

Special thanks to Rebecca Weill, Accenture Consulting Analyst, for contributing to this blog.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors. This document may refer to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied. Copyright© 2022 Accenture. All rights reserved. Accenture and its logo are registered trademarks of Accenture.

Related posts, by jess murray, how banks can reimagine a winning loyalty strategy, by michael abbott & jess murray & keri smith, breaking barriers: exploring how banks scale generative ai for growth, by michael abbott, 5 ways to reignite customer relationships for growth, what’s next 3 powerful cx takeaways from sibos, four big ideas in the wake of sibos 2022, by michael abbott & steve smith, why retail banking presents rare opportunities right now, by jess murray & scott reddel & adam tomlinson, why banks should look beyond advice for growth, by sulabh agarwal, is there any limit to how much banks can innovate, by damian pettit, how can banking ops help increase productivity, by jess murray & jess lin & alexandra tyler, banking on brand purpose: three ways to unlock roi, get the latest blogs delivered straight to your inbox..

Next Post - How to deal with rising competition and risk in commercial payments

Suggested Post - How to deal with rising competition and risk in commercial payments

Subscribe Get the latest blogs delivered straight to your inbox.

Share

Banking Pitch Deck Guide 2024 Insights (Template + Examples Included)

January 9, 2024

Presentation and Pitch Expert. Ex Advertising.

$100mill In Funding. Bald Since 2010.

Ladies and gentlemen, buckle up for an exhilarating journey through the thrilling world of banking! Now, you may be thinking, “Did he just say ‘thrilling’ and ‘banking’ in the same sentence?” Yes, indeed.

This guide is crafted for banking professionals like you, who understand the importance of a compelling pitch. With insights drawn from industry experts and successful case studies, we’ll navigate you through the nuances of creating a persuasive and effective banking pitch deck.

What’s up! I’m Viktor, a pitch deck expert , presentation expert , and crazy about burgers. I’ve been a pitch deck expert for 10+ years and helped clients raise millions and win pitches, with my unique approach to creating pitch decks.

Whether you’re a startup seeking funding or an established bank pitching a new product, the key to success lies in your ability to captivate your audience. Let’s see what a pitch deck guide for the banking industry is.

Book a free personalized pitch deck consultation and save over 20 hours of your time.

Join hundreds of successful entrepreneurs who’ve transformed their pitch decks with my help.

Let me develop an investor ready deck by using my hands-off approach, which includes: market research, copy, design, financials, narrative and strategy.

One week turnaround time.

The least you will get is 10 actionable tips & strategies to own that next presentation, worth $599, for free.

Crafting a Compelling Narrative: A Central Element of Your Banking Pitch Deck

Varo money pitch deck, what is a banking pitch deck.

A banking pitch deck is a presentation that banking institutions or financial startups use to provide an overview of their services, highlight their unique selling propositions, and demonstrate how they can add value to potential clients or investors.

Just like pitch decks in other industries, a banking pitch deck typically includes sections such as

1. Company Overview: Brief introduction to the bank or financial institution. 2. Mission and Vision: The bank’s purpose and long-term goals. 3. Services: Detailed description of the bank’s services or products. 4. Market Analysis: Overview of the current market and potential opportunities. 5. Competitive Advantage: Unique features that set the bank apart from its competitors. 6. Business Model: How the bank generates revenue. 7. Team : Profiles of key team members. 8. Financials : Key financial data and projections. 9. Ask : What the bank is seeking from potential clients or investors, like partnerships or investments?

The goal is to convince the audience that the bank’s services or products are valuable, differentiated, and worth investing in or using.

How to Create a Banking Pitch Deck Presentation?

Creating an effective banking pitch deck involves several steps. It’s important to remember that the goal is to engage and persuade your audience, whether they’re potential investors, clients, or partners. Here’s a step-by-step guide:

- Understand Your Audience: Knowing who you are pitching to will help tailor the presentation to their interests and concerns.

- Set a Clear Objective : Define what you want to achieve with the pitch. Are you seeking investment, partnerships, or new clients?

- Outline Your Deck: Plan the sections you’ll include, based on the information you need to convey. The typical sections might include an introduction, problem statement, solution, market analysis, competitive analysis, business model, marketing and sales strategy, team, financial projections, and your “ask.”

- Start with a compelling story that introduces the problem you’re solving.

- Clearly explain your solution and why it’s unique.

- Use data to support your points in the market and competitive analysis sections.

- Highlight the qualifications of your team.

- Provide realistic financial projections.

- Keep the design clean and professional.

- Use visuals like charts and infographics to represent data.

- Keep text to a minimum, use bullet points for clarity.

- Stick to a consistent color scheme that aligns with your brand.

- Practice Your Presentation: The delivery of your pitch is as important as the content. Practice until you can present confidently and answer potential questions.

- Incorporate Feedback: If possible, do a few practice runs with trusted colleagues or mentors and make adjustments based on their feedback.

- Prepare for Questions: Anticipate questions you might get and be prepared to answer them clearly and confidently.

Remember, a successful banking pitch deck isn’t just about sharing information; it’s about persuasion. It needs to showcase why your bank or financial institution is a worthy investment or the right solution for potential clients.

The Exact Banking Pitch Deck Structure You Can Steal And Use

If you’re looking to create a banking pitch deck, here’s a tried-and-true slide structure you can follow:

- Company name, logo, tagline

- Contact information

- Description of the problem in the current market

- Statistics and facts to back it up

- Your product/service and how it addresses the problem

- Key features and benefits

- Description of the target market and its size

- Market trends and growth potential

- Screenshots, mockups, or videos of your product/service

- Detailed explanation of how it works

- How you plan to make money

- Pricing strategy and revenue streams

- How you plan to attract and retain customers

- Marketing and distribution strategy

- Overview of competitors and their strengths/weaknesses

- Your unique selling propositions (USPs) and how you differentiate

- Current users/customers, revenue, partnerships, etc.

- Key milestones and achievements

- Revenue and expense projections for the next 3-5 years

- Key assumptions behind your projections

- Key team members and their qualifications

- Advisory board members if any

- How much money you’re raising and what it will be used for

- Equity offered in return

- Potential exit strategies for investors

- Comparable exits in your industry

- Clearly state what you want from investors

- Thank investors for their time

- Provide contact information for further questions

Remember to keep each slide clear and concise, with a focus on visuals to keep your audience engaged. Each slide should serve a purpose and help build your overall story.

Get My Template That Helped Companies Win Millions in Funding

An impressive pitch deck is crucial for catching the attention of potential buyers and investors when presenting a Banking startup.

However, the process of creating an effective deck can seem overwhelming. The good news is that it doesn’t have to be. The key is to know which slides to include. Although templates are readily available on websites like Canva, Slidesgo, and Google Slides, they may not be consistent with your brand.

As a result, you may need to spend countless hours personalizing them to match your brand guidelines. Fortunately, there is a better solution.

My clients have achieved success by utilizing my written template structure, which enables them to create exceptional banking pitch decks in half the time. With this template, they were able to design a deck that accurately reflected their brand.

Why is it important to understand your audience when creating a banking pitch deck?

Understanding your audience is crucial when creating a banking pitch deck for several reasons:

- Tailored Content: Each audience has different needs, concerns, and interests. Investors might be interested in your financial projections and growth strategy, while potential clients might be more concerned with your services and customer experience. By understanding your audience, you can tailor your content to address their specific interests.

- Relevant Language: The level of financial knowledge can vary greatly between audiences. For example, a pitch to industry experts or investors may include more technical jargon, while a pitch to potential clients or the general public should use simpler, more accessible language.

- Effective Persuasion: Knowing your audience allows you to appeal to their motivations, fears, and desires, which can make your pitch more persuasive. For example, if you know your audience values sustainability, you could highlight your bank’s commitment to environmentally friendly practices.

- Engagement : Understanding your audience helps you craft a presentation that resonates with them and keeps them engaged. This includes the use of appropriate humor, stories, and examples.

- Preparedness : Anticipating the questions or concerns your audience might have allows you to prepare suitable responses and incorporate answers into your presentation where appropriate.

In short, understanding your audience is essential for creating a pitch deck that effectively communicates your message and achieves your goals.

Why is it important to craft a compelling story when creating a banking pitch deck?

Crafting a compelling story is essential when creating a banking pitch deck because:

- Engagement : Storytelling is a powerful tool for engaging your audience. Instead of a dry presentation filled with facts and figures, a story can captivate the audience, making your pitch memorable.

- Emotional Connection: Stories often evoke emotions, which can make your pitch more impactful. An emotional connection can make your audience more receptive to your message and more likely to act in your favor.

- Simplicity : A well-crafted story simplifies complex ideas, making them easier for your audience to understand. This is particularly important in banking, where concepts can be complicated.

- Context : A story provides a context for your data, making it more meaningful. For example, instead of just stating that your bank has grown by X%, a story could explain how your team’s hard work and innovative ideas led to that growth.

- Differentiation : A unique story can set your bank apart from competitors. It can highlight your unique journey, values, and vision, showing why your bank is special.

Remember, your story should be relevant and authentic, aligning with your bank’s brand and values. It should weave through your entire pitch deck, providing a coherent narrative that ties all your points together.

How important are design and visuals when creating a banking pitch deck?

Design and visuals are incredibly important when creating a banking pitch deck for several reasons:

- Simplicity and Clarity: A well-designed pitch deck with clear visuals helps simplify complex information. Graphs, charts, and infographics can make data easier to understand and more memorable.

- Engagement : Visually appealing slides can grab attention and keep your audience engaged throughout the presentation. Good design can also enhance the storytelling aspect of your pitch, making it more impactful.

- Professionalism : High-quality design and visuals project a sense of professionalism and credibility. They show that you’ve invested time and effort into your presentation, which can create a positive impression.

- Branding : Design elements like color schemes, fonts, and logos help reinforce your brand identity throughout the presentation.

- Memory and Recall: People generally remember visuals better than text. By including relevant images, diagrams, or charts, you increase the chance that your audience will remember key points from your presentation.

Hold on. You might want to check my list on the best presentation books. Why?

It’s 1O crucial books that will help you improve the design and structure of your presentations, besides improving its delivery. Check it out below.

However, it’s crucial to avoid overloading your slides with too many visuals or design elements, as this can distract from your message. The key is to use design and visuals to enhance your message, not overshadow it.

How to prepare for questions and objections when presenting a banking pitch deck?

Preparing for questions and objections is essential when presenting a banking pitch deck. Here are some tips to help you be prepared:

- Anticipate Possible Questions: Consider your audience and what questions they might have based on the information you present. This could include questions about your financial projections, competition, regulatory issues, or anything else relevant to your pitch.

- Research and Gather Data: Be ready to back up your answers with data and research. This shows that you’ve done your homework and increases your credibility.

- Practice Q&A Sessions: Do a practice run with colleagues or mentors, and ask them to play devil’s advocate. This will help you refine your answers and feel more confident when facing questions.

- Be Honest and Transparent: If you don’t know the answer to a question, don’t try to fake it. Instead, admit that you don’t know but will follow up with a response later. Honesty and transparency build trust with your audience.

- Stay Calm and Confident: Be confident in your pitch and your ability to answer questions. Even if you face a challenging question or objection, stay calm and composed. Take a deep breath, listen carefully to the question, and respond thoughtfully.

- Reinforce Your Key Messages: Use questions and objections as an opportunity to reinforce your key messages. For example, if someone questions your business model, use the opportunity to reiterate why it’s effective.

By preparing for questions and objections, you demonstrate that you’re thoughtful and knowledgeable about your bank’s services and products. This can help build trust with your audience and increase your chances of success.

What nobody will tell you: Crucial considerations to keep in mind when developing your restaurant pitch deck and business

10 insights. These are things no advisor, startup event organizer or coach will tell you for free. We’ve done the research and combined it with our experience to give you these insights with no strings attached.

Market Analysis and Trends in Banking: Key Insights for Your Pitch Deck

Importance in Pitch Deck Development: In the fast-paced world of banking, a pitch deck must not only demonstrate your business’s value proposition but also reflect a deep understanding of the current market landscape. Incorporating market analysis and trends in your pitch deck serves multiple purposes:

- Establishes Credibility: Showcases your knowledge of the banking sector, which builds trust with your audience.

- Highlights Opportunities: Identifies gaps or emerging trends that your business can capitalize on.

- Guides Strategy: Informs your strategic direction, ensuring it aligns with the market realities.

Research-Based Insights: Recent studies and reports indicate several key trends in the banking sector:

- Digital Transformation: The rapid shift towards digital banking solutions, driven by customer demand for convenience and efficiency.

- Regulatory Changes: Ongoing adaptations to comply with evolving global financial regulations.

- Sustainable Banking: Increasing focus on sustainable practices and ESG (Environmental, Social, and Governance) factors in investment.

Actionable Steps:

- Conduct In-Depth Market Research: Gather data on current banking trends, customer behaviors, and competitor strategies. Utilize reputable sources like industry reports, financial news, and market analysis studies.

- Analyze Customer Demographics and Preferences: Understand the changing needs and preferences of banking customers, focusing on how digital innovations are reshaping customer expectations.

- Identify Emerging Opportunities: Look for gaps in the market that your business can address. For instance, are there underserved customer segments or unmet needs in digital banking?

- Evaluate the Impact of Regulations: Assess how recent regulatory changes affect your business model and how you can turn compliance into a competitive advantage.

- Incorporate Sustainability: Discuss how your banking solutions align with sustainable practices, catering to the growing demand for responsible banking.

- Use Data to Tell a Story: Present this analysis in your pitch deck through compelling data visualizations and narratives that connect these trends to your business proposition.

- Forecast Future Trends: Offer a forward-looking perspective, predicting how these trends might evolve and how your business is poised to adapt.

By integrating a thorough market analysis and banking trends into your pitch deck, you can demonstrate a sophisticated understanding of the industry, which is crucial for attracting investors, partners, or clients in the banking sector. This approach not only showcases your business acumen but also positions your proposition as both relevant and forward-thinking in the dynamic world of banking.

Understanding Financial Regulations: Essential Insights for Your Banking Pitch Deck

Significance in Crafting a Banking Pitch Deck: In the banking industry, navigating the complex landscape of financial regulations is not just about compliance; it’s a strategic imperative. Incorporating a clear understanding of financial regulations into your banking pitch deck demonstrates to your stakeholders – be it investors, partners, or regulators – that you are committed to operating within the legal framework and are mindful of the risks and obligations involved. This aspect is crucial for:

- Building Trust and Credibility: Shows your commitment to legal and ethical banking practices.

- Risk Mitigation: Highlights your proactive approach to managing regulatory risks.

- Strategic Decision Making: Ensures your business strategies are aligned with regulatory requirements and anticipates changes in the legal landscape.

Research-Backed Insights: Key regulatory trends and considerations in the banking sector include:

- Global Regulatory Frameworks: Understanding the Basel III and IV frameworks, which set global standards for bank capital adequacy, stress testing, and liquidity risks.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Increased emphasis on combating financial crime and ensuring customer due diligence.

- Data Protection and Privacy Laws: Compliance with regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) in handling customer data.

- Comprehensive Regulatory Analysis: Research and document the specific regulatory requirements relevant to your banking niche. Utilize authoritative sources like government publications, legal analysis, and industry reports.

- Integrate Regulatory Compliance into Business Strategy: Clearly articulate in your pitch deck how your banking services or products comply with existing regulations and how you plan to adapt to upcoming changes.

- Risk Assessment and Management: Include a section in your pitch deck on how you identify, assess, and manage regulatory risks. This can involve compliance checks, internal audits, and regular monitoring.

- Showcase Compliance as a Competitive Advantage: Turn regulatory compliance into a unique selling proposition (USP), especially if your solutions offer innovative ways to meet these regulations more effectively or efficiently than competitors.

- Prepare for Future Regulatory Changes: Demonstrate foresight by discussing potential future regulatory changes and how your business plans to stay ahead. This could involve engaging with regulatory bodies or investing in compliance technology.

- Data Security and Privacy Measures: Detail your approach to protecting customer data, aligning with privacy laws and building customer trust.

- Visual Representation of Compliance Pathways: Use infographics or flowcharts in your pitch deck to visually represent your compliance roadmap and how it integrates with your overall business strategy.

Incorporating a detailed understanding of financial regulations into your banking pitch deck reinforces the message that your business is not only compliant but also resilient and forward-thinking in a regulatory landscape that is constantly evolving. This approach can significantly elevate the perceived value and credibility of your banking proposition.

Technology Integration in Banking Services: Strategic Insights for Your Pitch Deck

Relevance in Banking Pitch Deck Development: Incorporating technology integration into your banking pitch deck is critical, as it demonstrates your understanding of the digital transformation in the banking sector. In today’s tech-driven world, banks and financial institutions are expected to offer innovative, secure, and user-friendly digital services. Showcasing how your proposal leverages technology effectively can:

- Differentiate Your Offering: Highlights your innovative approach in a market where digital services are increasingly valued.

- Enhance Customer Experience: Indicates your commitment to providing seamless and efficient banking experiences.

- Showcase Efficiency and Security: Demonstrates how technology improves operational efficiency and enhances security measures.

Research-Backed Insights: Recent trends and technological advancements in banking include:

- Digital Banking and Mobile Solutions: A surge in demand for digital banking services, especially mobile banking apps.

- Blockchain Technology: Implementation of blockchain for secure and transparent transactions.

- Artificial Intelligence and Machine Learning: AI-driven solutions for personalized banking experiences and improved risk management.

- Cybersecurity Enhancements: Advanced cybersecurity measures to protect sensitive financial data.

- Detail Specific Technologies Used: Explain the specific technologies you plan to integrate, such as AI, blockchain, or cloud computing. Show how these technologies address specific banking challenges or customer needs.

- Highlight Benefits of Tech Integration: In your pitch deck, clearly articulate the benefits of technology integration, such as improved customer service, enhanced security, or operational efficiency.

- Showcase User Experience (UX) Design: Present the design and functionality of your digital banking interfaces, emphasizing ease of use and accessibility.

- Data-Driven Decision Making: Illustrate how the use of technology enables better data analysis and decision-making processes in banking operations.

- Compliance and Security Measures: Detail the security protocols and compliance measures in place, especially when implementing new technologies.

- Innovative Use Cases: Provide examples or case studies where technology integration has led to tangible improvements in banking services.

- Future Tech Roadmap: Outline your future plans for technology adoption and innovation, showing you are prepared for ongoing digital transformation in the banking industry.

By focusing on technology integration in your banking pitch deck, you effectively communicate your commitment to innovation and modernization in the banking sector. This approach not only aligns with current industry trends but also positions your offering as a forward-thinking solution in a highly competitive market.

Customer Experience and Engagement Strategies: Elevating Your Banking Pitch Deck

Importance in Banking Pitch Deck Development: In the banking sector, where products and services are often complex and highly regulated, customer experience (CX) and engagement become crucial differentiators. Integrating a clear strategy for CX and engagement in your pitch deck can significantly elevate your proposition by:

- Differentiating Your Brand: Demonstrating a customer-centric approach sets you apart in a crowded market.

- Building Customer Loyalty: Good CX leads to higher customer satisfaction and loyalty, which is key for long-term success.

- Driving Revenue Growth: Enhanced customer experience can directly impact revenue, as satisfied customers are more likely to use additional services.

Research-Based Insights: Key findings in banking CX include:

- Personalization: Customers expect banking services tailored to their individual needs.

- Omnichannel Experience: Seamless experience across digital and physical channels is highly valued.

- Tech-Driven Service Models: Adoption of technologies like AI for personalized recommendations and automated customer service.

- Map Customer Journeys: Detail the customer journey for your banking services, identifying touchpoints where experience can be enhanced.

- Implement Personalization: Explain how your services can be tailored to individual customer needs, using data analytics for personalized product offerings.

- Omnichannel Integration: Show how your banking services provide a cohesive experience across multiple channels (online, mobile, in-branch).

- Leverage AI and Automation: Describe how AI and automation technologies are used to improve customer service and operational efficiency.

- Focus on User Interface (UI) and User Experience (UX): Highlight the design and usability of your digital banking platforms, ensuring they are intuitive and user-friendly.

- Customer Feedback Loops: Incorporate mechanisms for regularly gathering and acting on customer feedback to continuously improve CX.

- Training and Development: Outline training programs for staff to ensure high-quality customer interactions at every touchpoint.

- Measure and Showcase CX Metrics: Use metrics like Net Promoter Score (NPS) or Customer Satisfaction (CSAT) scores in your pitch deck to demonstrate the effectiveness of your CX strategies.

- Case Studies or Testimonials: Include real-life examples or customer testimonials to illustrate the success of your CX initiatives.

By focusing on customer experience and engagement strategies in your banking pitch deck, you emphasize your commitment to meeting and exceeding customer expectations. This approach not only showcases a customer-first mentality but also indicates that your banking services are designed with the end user’s needs and satisfaction as a top priority.

Risk Management and Mitigation Strategies: Core Elements for Your Banking Pitch Deck

Criticality in Banking Pitch Deck Creation: In the banking industry, effective risk management is not just a regulatory requirement but a strategic asset. Showcasing robust risk management and mitigation strategies in your pitch deck signals to stakeholders that your bank is capable of identifying, assessing, and managing potential risks. This is vital for:

- Building Stakeholder Confidence: Demonstrates to investors, regulators, and clients that you are prepared to handle uncertainties effectively.

- Ensuring Sustainable Growth: Effective risk management is key to the long-term stability and growth of the bank.

- Compliance and Resilience: Highlights your bank’s commitment to compliance and its resilience against financial shocks.

Research-Based Insights: Key focus areas in banking risk management include:

- Credit Risk Assessment: Innovations in credit scoring and risk assessment techniques.

- Market and Liquidity Risk: Tools and strategies for managing market fluctuations and liquidity challenges.

- Operational Risk Management: Addressing risks arising from internal processes, systems, and people.

- Cybersecurity Threats: Evolving strategies to combat increasing cyber threats in the digital banking landscape.

- Risk Identification and Assessment: Clearly articulate in your pitch deck how your bank identifies and assesses various types of risks, using state-of-the-art tools and methodologies.

- Risk Mitigation Strategies: Detail the specific strategies and tools your bank employs to mitigate identified risks, such as diversification, hedging, or insurance.

- Technology Integration in Risk Management: Explain how technology, like AI and machine learning, is used in risk prediction and management.

- Training and Awareness Programs: Highlight programs aimed at increasing risk awareness and management skills among your staff.

- Regulatory Compliance: Showcase how your risk management strategies align with regulatory requirements, emphasizing your commitment to compliance.

- Real-Time Monitoring and Reporting: Describe systems in place for continuous monitoring and reporting of risk exposures.

- Scenario Analysis and Stress Testing: Detail how your bank conducts scenario analyses and stress tests to prepare for potential adverse events.

- Cybersecurity Measures: Elaborate on the cybersecurity protocols and measures implemented to protect against digital threats.

- Case Studies or Examples: Provide examples where your risk management strategies successfully mitigated risks, underscoring their effectiveness.

By focusing on risk management and mitigation strategies in your banking pitch deck, you effectively communicate your bank’s capability to handle the complex risk environment of the financial sector. This approach reassures stakeholders of your bank’s stability, resilience, and forward-thinking mindset, which are essential in today’s dynamic financial landscape.

Sustainable and Ethical Banking Practices: Enhancing Your Banking Pitch Deck

Relevance in Banking Pitch Deck Presentation: Incorporating sustainable and ethical banking practices into your pitch deck is crucial in today’s socially conscious market. It demonstrates to investors, clients, and regulators that your bank is not only focused on financial success but also committed to positive social and environmental impacts. This approach is essential for:

- Aligning with Global Trends: Reflecting a growing global emphasis on sustainability in the financial sector.

- Building Trust and Reputation: Showcasing ethical practices builds trust with customers and strengthens your brand reputation.

- Attracting Socially Conscious Investments: Appealing to a growing segment of investors who prioritize environmental, social, and governance (ESG) criteria.

Research-Based Insights: Emerging trends and key areas in sustainable and ethical banking include:

- Green Financing: Providing loans and funds for environmentally friendly projects.

- Social Responsibility Initiatives: Programs focused on social welfare, community development, and financial inclusion.

- Governance and Transparency: Adhering to high standards of corporate governance and transparency in operations.

- Detail Sustainable Banking Products: Include in your pitch deck specific products and services that support environmental sustainability, such as green bonds or sustainable investment funds.

- Showcase Social Responsibility Efforts: Highlight initiatives or programs that demonstrate your bank’s commitment to social responsibility, community engagement, and financial inclusion.

- Emphasize Ethical Practices: Explain your bank’s approach to ethical decision-making, fair lending practices, and avoidance of financing harmful industries.

- Incorporate ESG Criteria: Discuss how your bank integrates Environmental, Social, and Governance (ESG) criteria into its operations and decision-making processes.

- Demonstrate Compliance with Sustainable Regulations: Show your adherence to any relevant sustainable banking regulations or guidelines, both local and international.

- Sustainability Reporting: Include sustainability reports or metrics in your pitch deck to quantify your bank’s impact on environmental and social factors.

- Leverage Technology for Sustainability: Highlight how digital banking solutions contribute to reduced environmental impact, such as paperless operations or energy-efficient data centers.

- Community Engagement and Partnerships: Describe partnerships with NGOs or community organizations to enhance your social impact.

- Case Studies or Success Stories: Provide examples of successful sustainable banking initiatives or projects your bank has undertaken.

By emphasizing sustainable and ethical banking practices in your pitch deck, you communicate a forward-thinking and responsible approach. This not only aligns with current trends and customer expectations but also positions your bank as a leader in the movement towards a more sustainable and equitable financial sector.

Effective Financial Forecasting and Modeling: A Key Component of Your Banking Pitch Deck

Significance in Banking Pitch Deck Development: Effective financial forecasting and modeling are fundamental in a banking pitch deck, as they provide a quantifiable and realistic projection of your bank’s financial future. This is critical for:

- Demonstrating Financial Viability: Convincingly projecting the bank’s growth, profitability, and stability.

- Informing Strategy: Guiding strategic decisions based on forecasted financial outcomes.

- Building Investor Confidence: Giving potential investors a clear view of expected returns and financial health.

Research-Based Insights: Financial forecasting in banking typically involves:

- Advanced Analytical Tools: Utilization of sophisticated software for more accurate and detailed financial projections.

- Scenario Analysis: Considering various economic scenarios to understand potential impacts on the bank’s finances.

- Regulatory Impact Assessment: Evaluating how regulatory changes could affect future financial performance.

- Utilize Robust Forecasting Tools: Employ advanced financial modeling software to ensure accuracy and depth in your forecasts.

- Incorporate Realistic Assumptions: Base your financial forecasts on realistic and well-researched assumptions about market conditions, interest rates, and regulatory environments.

- Present Multiple Scenarios: Include best-case, worst-case, and most-likely scenarios in your financial models to demonstrate preparedness for various market conditions.

- Align Forecasts with Business Strategy: Ensure that your financial projections align with your overall business strategy and objectives.

- Regularly Update Financial Models: Reflect changes in the market, economy, and regulatory environment to keep your forecasts relevant.

- Detail Revenue Streams and Cost Structures: Clearly outline your bank’s revenue streams and cost structures to provide a comprehensive understanding of your financial model.

- Include Key Financial Metrics: Highlight important financial metrics such as Return on Equity (ROE), Net Interest Margin (NIM), and Loan-to-Deposit ratio in your pitch deck.

- Sensitivity Analysis: Perform sensitivity analyses to understand how changes in key variables impact your financial forecasts.

- Graphical Representations: Use charts and graphs to visually represent financial data, making it easier to comprehend and more impactful.

- Expert Validation: Consider having your financial models reviewed or validated by financial experts to add credibility.

By focusing on effective financial forecasting and modeling in your banking pitch deck, you effectively communicate a well-founded, strategic, and financially sound vision of your bank. This approach not only adds credibility to your pitch but also demonstrates a thorough understanding of the financial dynamics and drivers of success in the banking industry.

Competitive Analysis in the Banking Sector: Enhancing Your Pitch Deck’s Impact

Importance in Banking Pitch Deck Creation: A comprehensive competitive analysis is a cornerstone of a successful banking pitch deck. It demonstrates an understanding of your bank’s position in the market and helps in identifying unique selling points and areas for improvement. This analysis is crucial for:

- Strategic Positioning: Understanding where your bank stands in relation to competitors helps in crafting a distinctive market position.

- Identifying Market Gaps: Spotting opportunities that competitors haven’t capitalized on.

- Tailoring Products and Services: Aligning your offerings more closely with customer needs, especially where competitors fall short.

Research-Based Insights: In competitive analysis for the banking sector, consider:

- Market Share Analysis: Understanding the distribution of market share among competitors.

- Service Offerings Comparison: Evaluating how your products and services stack up against those of your competitors.

- Technology Utilization: Assessing how competitors are leveraging technology to enhance customer experience and operational efficiency.

- Customer Service Strategies: Comparing approaches to customer service and relationship management.

- Identify Key Competitors: List your primary competitors, including both traditional banks and emerging fintech companies.

- Analyze Competitor Strengths and Weaknesses: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for each competitor, focusing on areas such as financial performance, product offerings, technological adoption, customer service, and brand reputation.

- Benchmark Your Bank: Compare your bank’s performance against competitors in key areas such as interest rates, fees, service quality, digital banking capabilities, and customer satisfaction.

- Customer Feedback and Reviews: Analyze customer feedback and reviews of competitors to identify their pain points and areas where your bank can excel.

- Monitor Competitor Movements: Keep track of any new product launches, marketing campaigns, or strategic moves by competitors.

- Assess Market Trends: Understand broader market trends and how competitors are responding to these trends.

- Highlight Unique Differentiators: Use this analysis to pinpoint and emphasize your bank’s unique selling propositions in your pitch deck.

- Visual Data Representation: Incorporate charts, graphs, and tables to visually compare and contrast your bank with competitors.

- Include Actionable Insights: Based on your analysis, propose specific strategies or initiatives that your bank can undertake to gain a competitive edge.

- Regular Updates: Continuously update your competitive analysis to reflect the latest market developments and shifts in competitive dynamics.

By integrating a thorough competitive analysis into your banking pitch deck, you provide evidence of a strategic, well-informed approach to your bank’s market positioning. This not only reinforces the credibility of your pitch but also showcases your proactive stance in navigating the competitive landscape of the banking sector.

Investor Relations and Fundraising Strategies: Key Focus for Your Banking Pitch Deck

Critical Importance in Banking Pitch Deck Development: In the banking sector, effective investor relations and fundraising strategies are vital components of a pitch deck. They demonstrate your bank’s ability to not only attract but also maintain fruitful relationships with investors. This is essential for:

- Securing Capital: Essential for growth, expansion, or launching new initiatives.

- Building Investor Confidence: Showing potential investors that you have a clear, viable plan for using and managing their funds.

- Long-Term Relationship Building: Establishing and maintaining ongoing relationships with investors, crucial for future funding rounds.

Research-Based Insights: Key areas to focus on include:

- Investment Attraction: Strategies to make your bank appealing to investors.

- Effective Communication: Best practices for transparent and regular communication with investors.

- Return on Investment (ROI): Demonstrating a clear path to profitability and ROI for investors.

- Define Your Value Proposition: Clearly articulate what makes your bank a valuable investment opportunity. Highlight unique aspects like innovative banking services, technology adoption, or strong market positioning.

- Develop a Clear Funding Plan: Outline how you intend to use the raised capital. Be specific about how the funding will contribute to growth, product development, or market expansion.

- Showcase Financial Health: Include detailed financial statements and projections to provide a clear picture of your bank’s financial health and growth potential.

- Investor Targeting: Identify and target potential investors who have a history of investing in the banking sector or show interest in your specific banking niche.

- Communication Strategy: Develop a strategy for regular and transparent communication with investors, including updates on progress, challenges, and market changes.

- ROI Projections: Offer realistic projections of return on investment, supported by data and market analysis.

- Demonstrate Compliance and Stability: Highlight your bank’s compliance with financial regulations and stability in the face of market fluctuations, as these are key concerns for investors.

- Use of Technology in Investor Relations: Utilize digital tools and platforms for efficient investor communications and updates.

- Leverage Success Stories: Share past successes or case studies where investment led to significant growth or innovation in your bank.

- Engage with Investor Feedback: Encourage and incorporate feedback from potential investors to refine your approach and offerings.

Incorporating these investor relations and fundraising strategies into your banking pitch deck will demonstrate to potential investors that your bank is not only a viable investment opportunity but also committed to maintaining strong, transparent, and mutually beneficial relationships with its investors. This approach is crucial in securing the trust and capital necessary to drive your bank’s success and growth.

Significance in Banking Pitch Deck Design: Crafting a compelling narrative in your banking pitch deck goes beyond presenting facts and figures; it involves telling a story that resonates with your audience. This is critical because:

- Engaging Your Audience: A compelling narrative captures and retains the attention of investors or stakeholders.

- Emotional Connection: Stories create an emotional connection, making your pitch more memorable and impactful.

- Simplifying Complex Information: A good narrative can make complex banking concepts more understandable and relatable.

Research-Based Insights: Studies in marketing and communication suggest that storytelling is a powerful tool for persuasion and engagement. In the context of banking, this involves:

- Customer Success Stories: Illustrating how your services have positively impacted customers.

- Historical Milestones: Sharing your bank’s journey, challenges overcome, and successes achieved.

- Vision and Future Goals: Painting a picture of where your bank is headed and the impact it aims to make.

- Start with Your ‘Why’: Begin your narrative by explaining why your bank exists. What problem are you solving? What is your mission?

- Personalize Your Story: Include personal anecdotes or stories from team members or clients that give a human face to your bank.