Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

- Installation and Maintenance and Repair

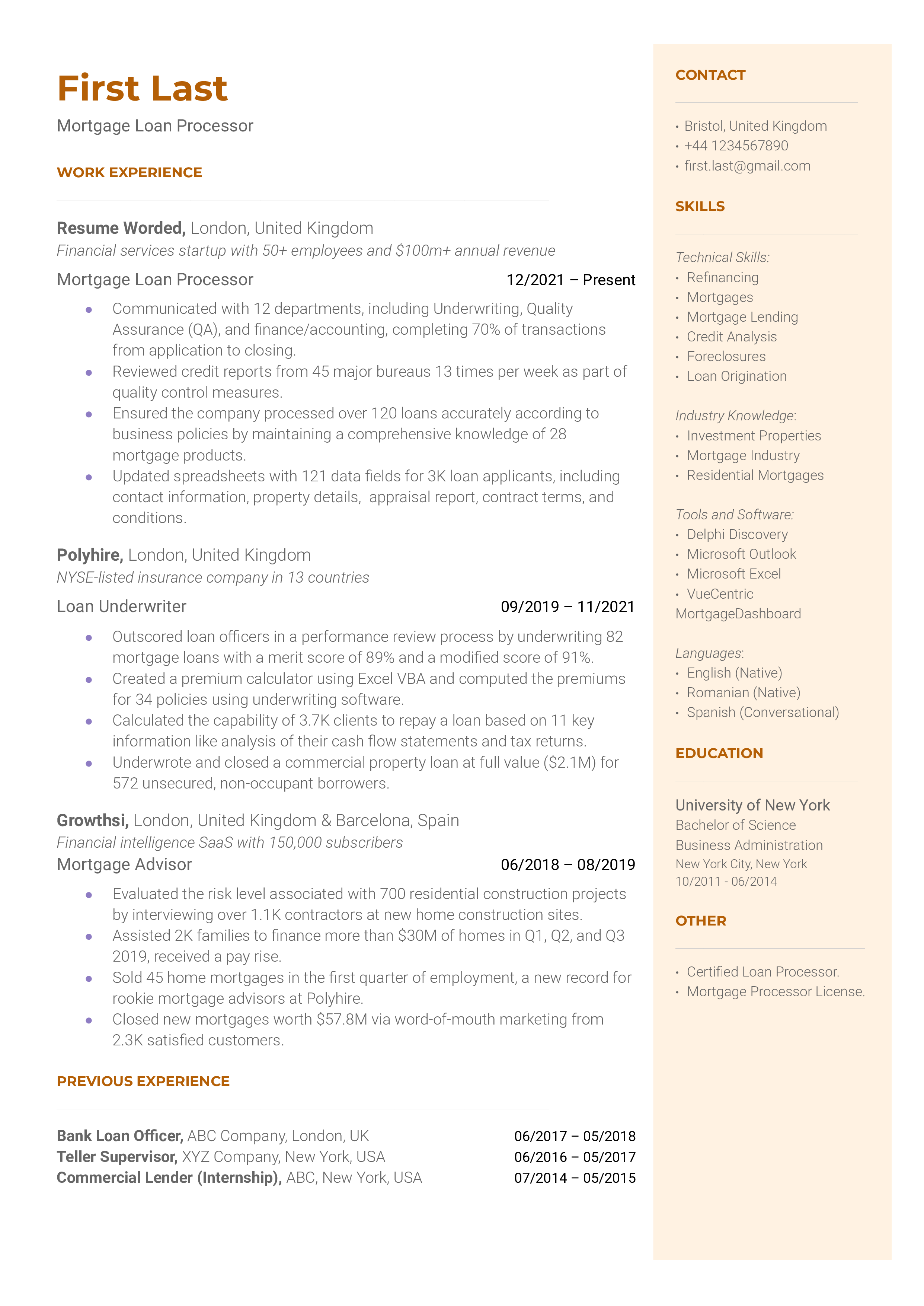

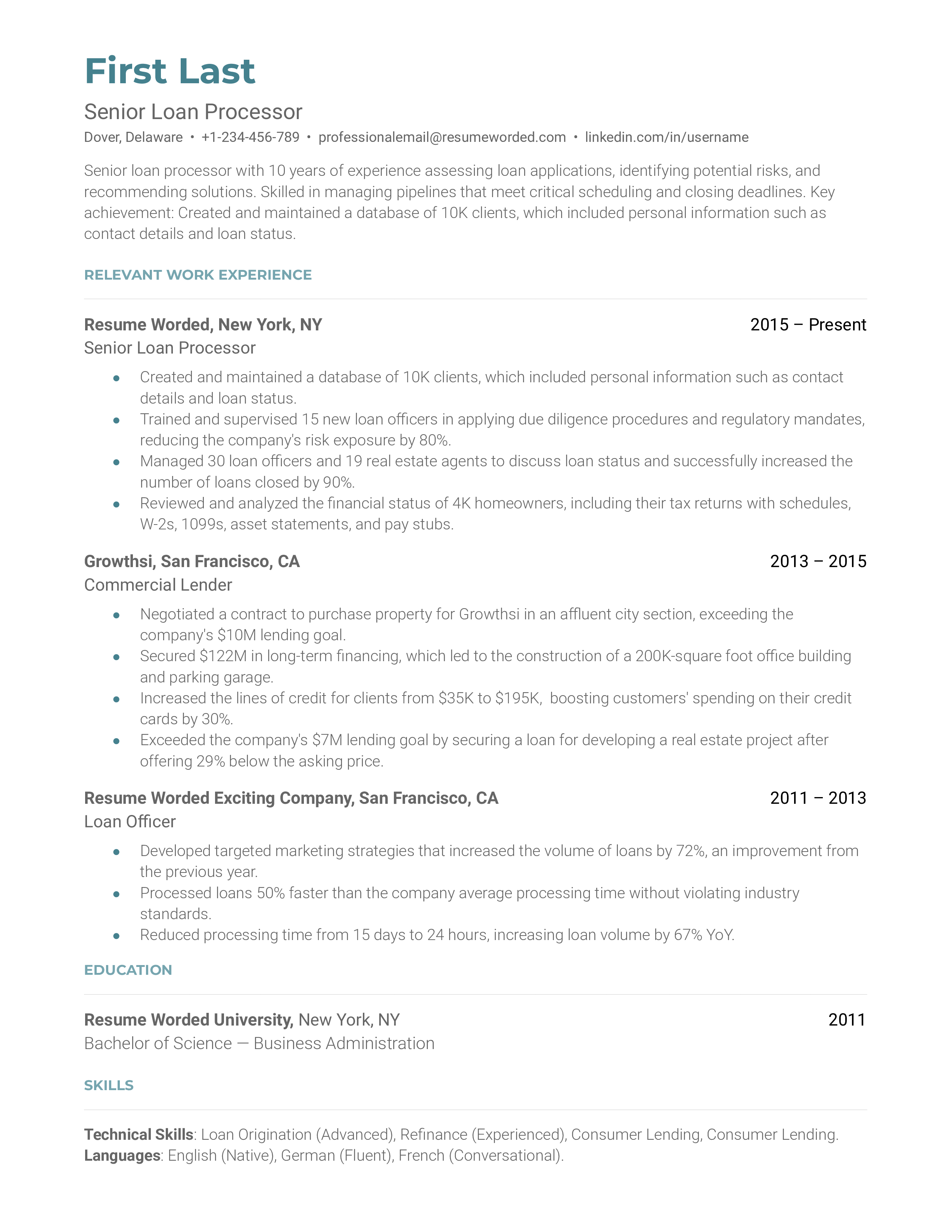

Mortgage Loan Processor Resume Samples

The guide to resume tailoring.

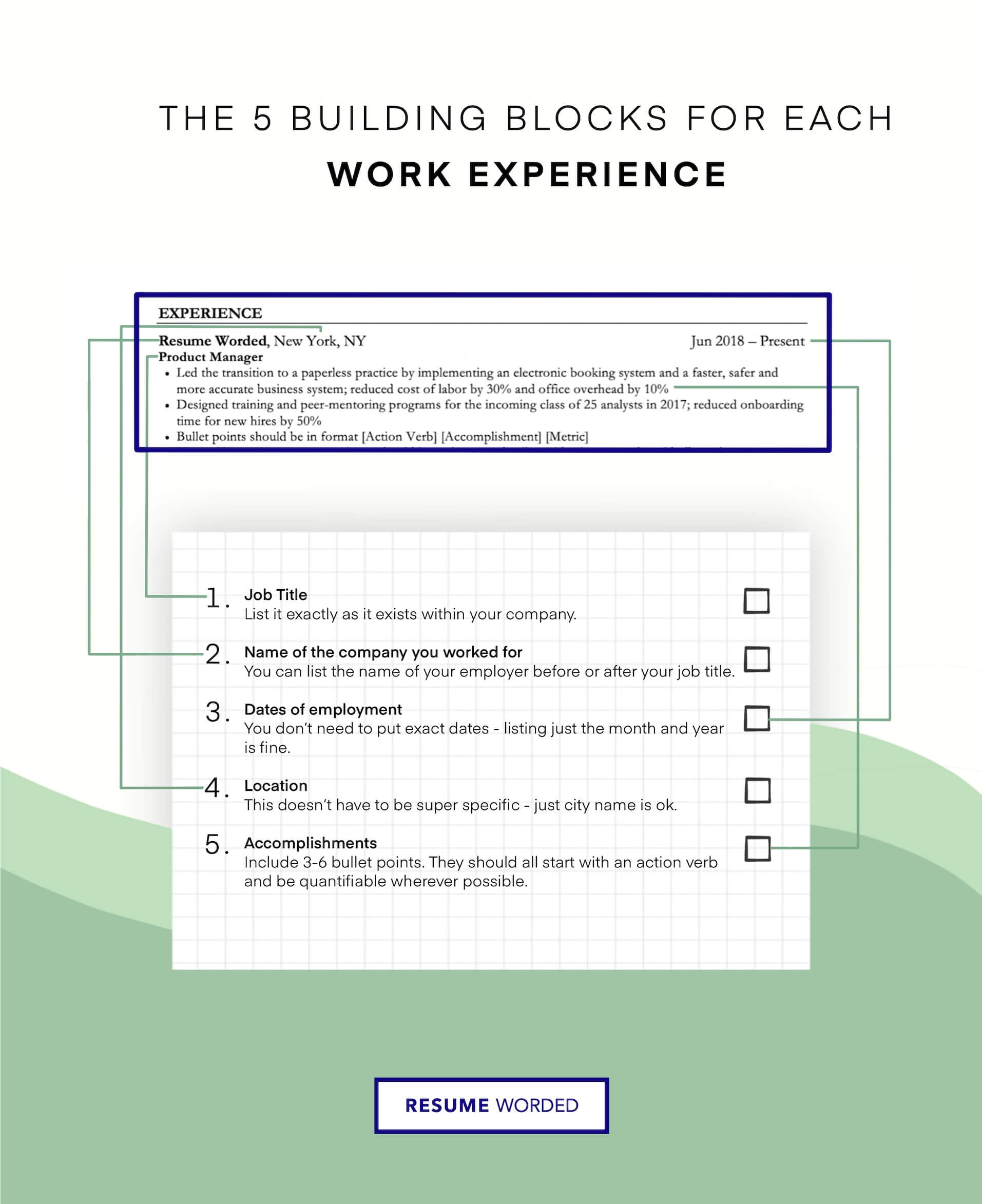

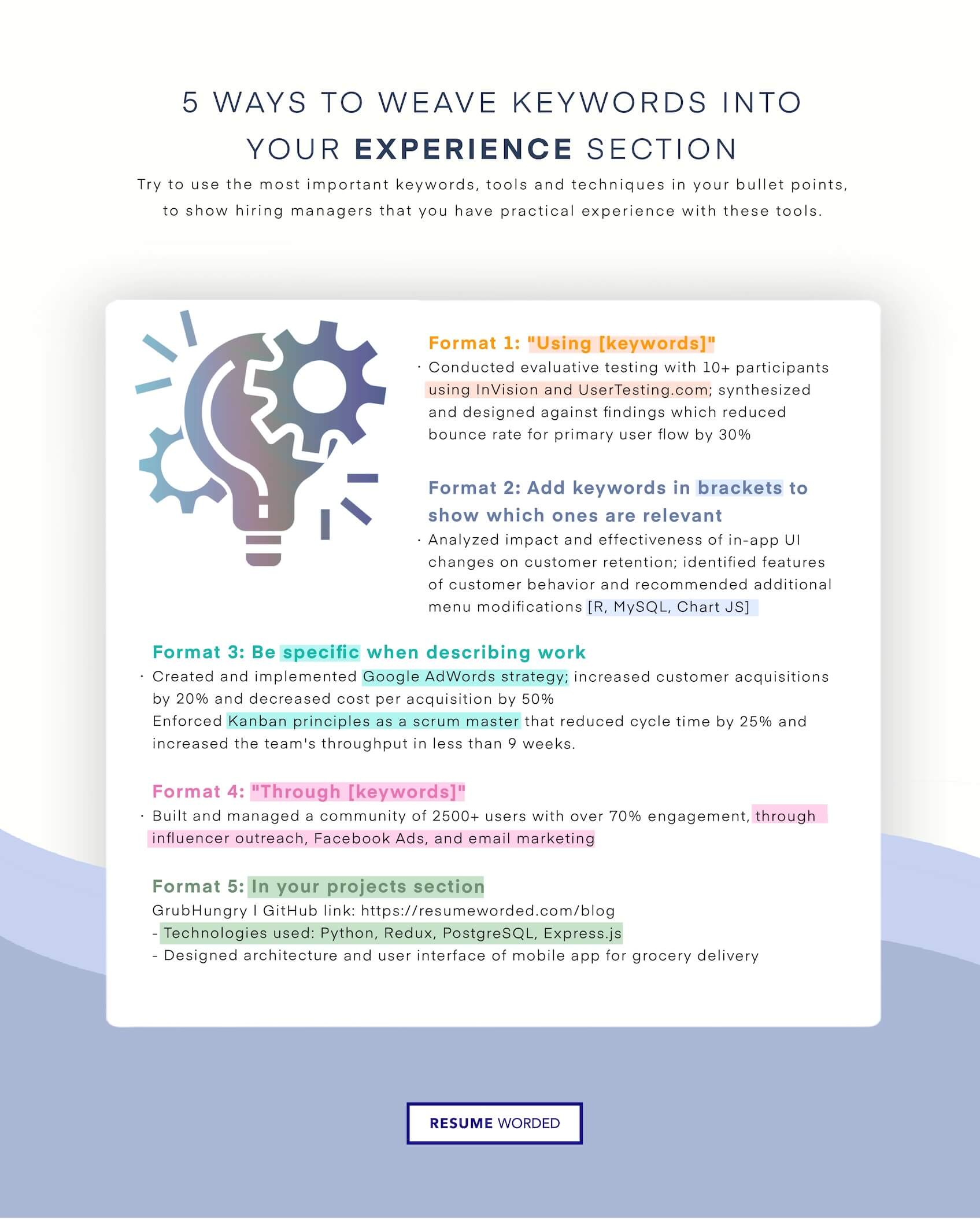

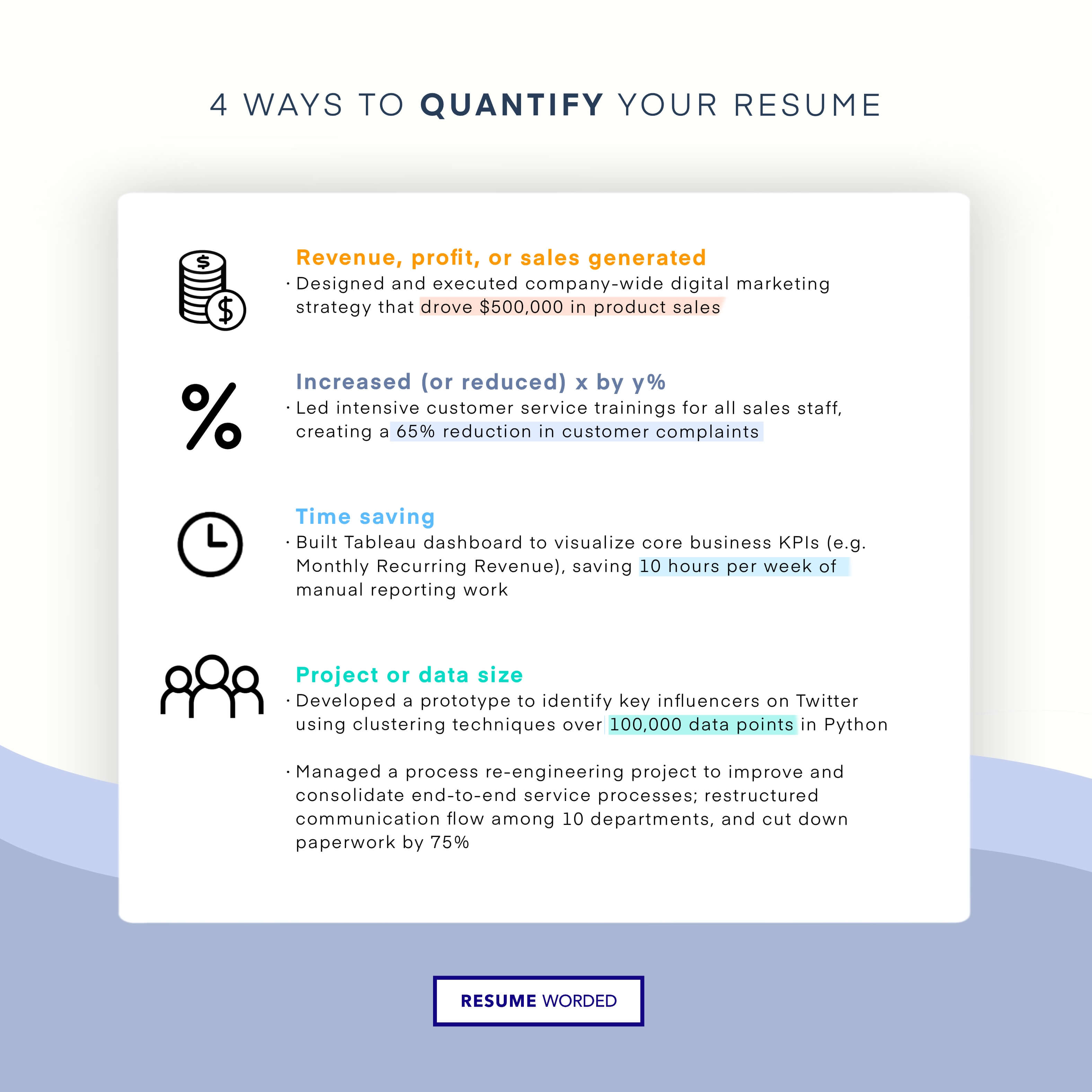

Guide the recruiter to the conclusion that you are the best candidate for the mortgage loan processor job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Performs follow-up work as necessary to achieve conditional approval within established time frames

- Respond to all borrower phone calls and emails in a timely manner promptly and in within the timeframe established by management

- Professional development - SunTrust University, an in-house career growth and employee development program

- Work through and resolve vendor work issues directly with customer and vendors

- Obtains necessary customer documentation to support data provided in the applications

- Works as a liaison between investors, vendors, and borrowers throughout the loan process

- Assists with incoming files to Corporate Underwriting for review, assignment, follow up conditions, subordinations

- Performs other duties as may be assigned

- Ensures loans are processed in accordance with established guidelines and Truth and Lending rules/regulations

- Coordinates mortgage loan closings

- Prepares opening packages and disclosures in a timely fashion

- After settlement, reviews and audits property loans, ensuring final title policy and endorsement is received and lien is correct

- Order title insurance, flood and tax certificates and surveys, reviewing for problems upon receipt

- Ensures accurate printing of preliminary real estate loan documents

- Perform basic LP analysis of C, I, A documents to provide additional information to underwriter

- Assist in the lending process to reduce loan cycle time by interacting with the customer and assisting the loan officer

- Establishes accurate closing date and monitors promised closing dates to meet those established. Meets standards for closing percentages of loans processed

- Proactively manage workflow to ensure loan files meet key milestone dates

- Performs pre-closing, post-closing, or whole loan due diligence review of legal agreements and other closing documents to terms of loan commitment

- Setting and maintaining proper expectation to all parties on the file (including internal customers, e.g., loan officers, sales managers)

- Performs routine loan calculations

- Excellent attention to details. Ability to maintain quality of work even during times of high volume

- Basic knowledge of lending processes, loan principles, loan systems. Knowledge of banking process helpful

- Assist loan officers in meeting overall company goals and guidelines by contributing to the productivity, profitability and loan quality

- Mortgage Lending Knowledge. Understanding of basic real estate terminology, documents and knowledge of federal and state regulations

- Member focus. Ability to provide excellent member service even during times of high volume

- Have a strong working knowledge of VA Portal to order certificates of eligibility and the order of VA appraisals

- Basic knowledge of credit policies and approval processes

- Knowledge of basic lending, real estate contracts and language, foreclosure, short sales and delinquent accounts

- Ability to provide excellent customer service in person and on the phone

- Demonstrates solid leadership ability

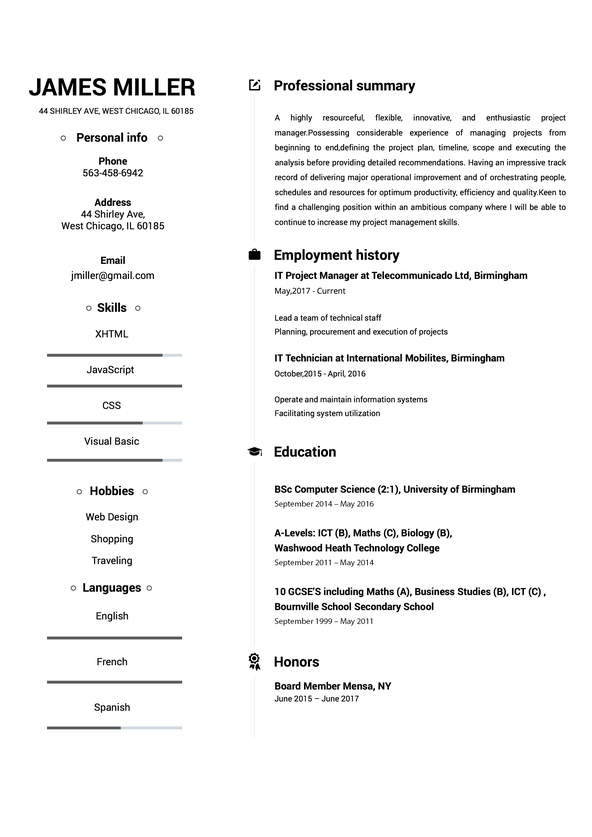

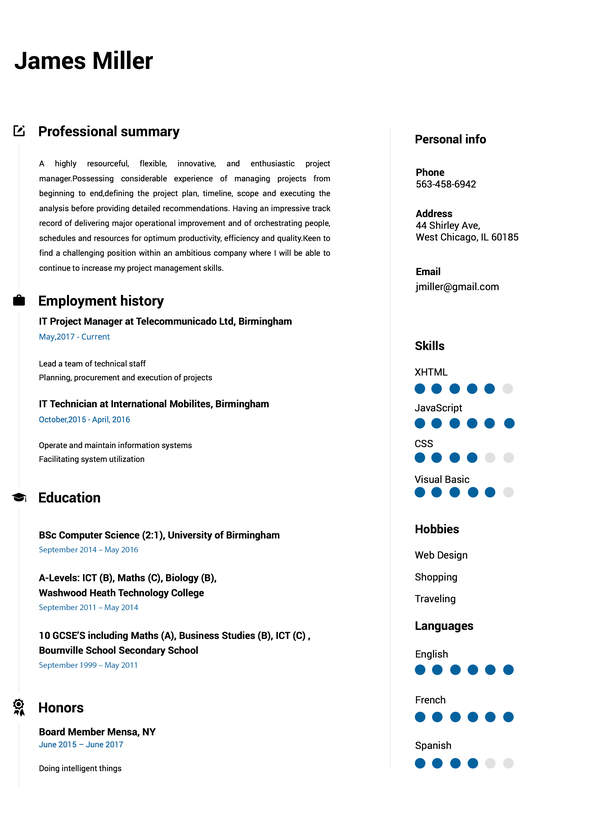

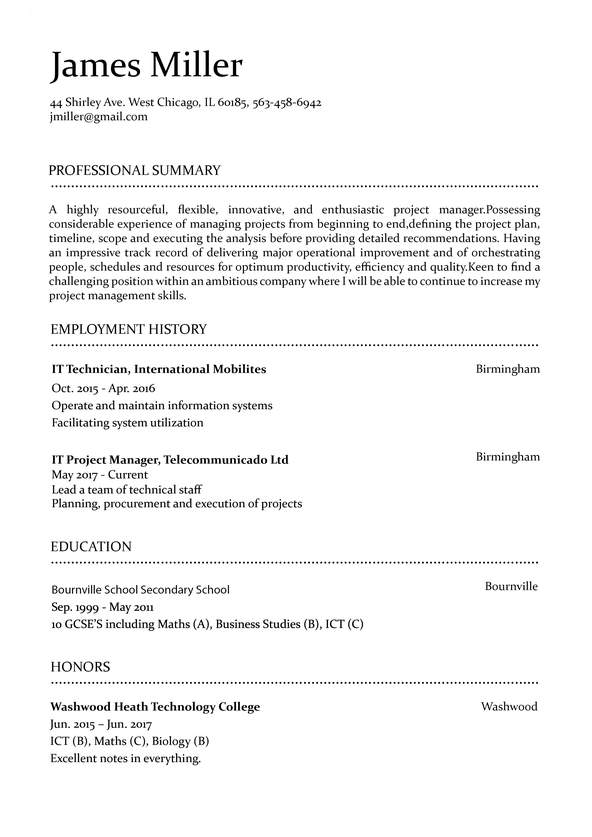

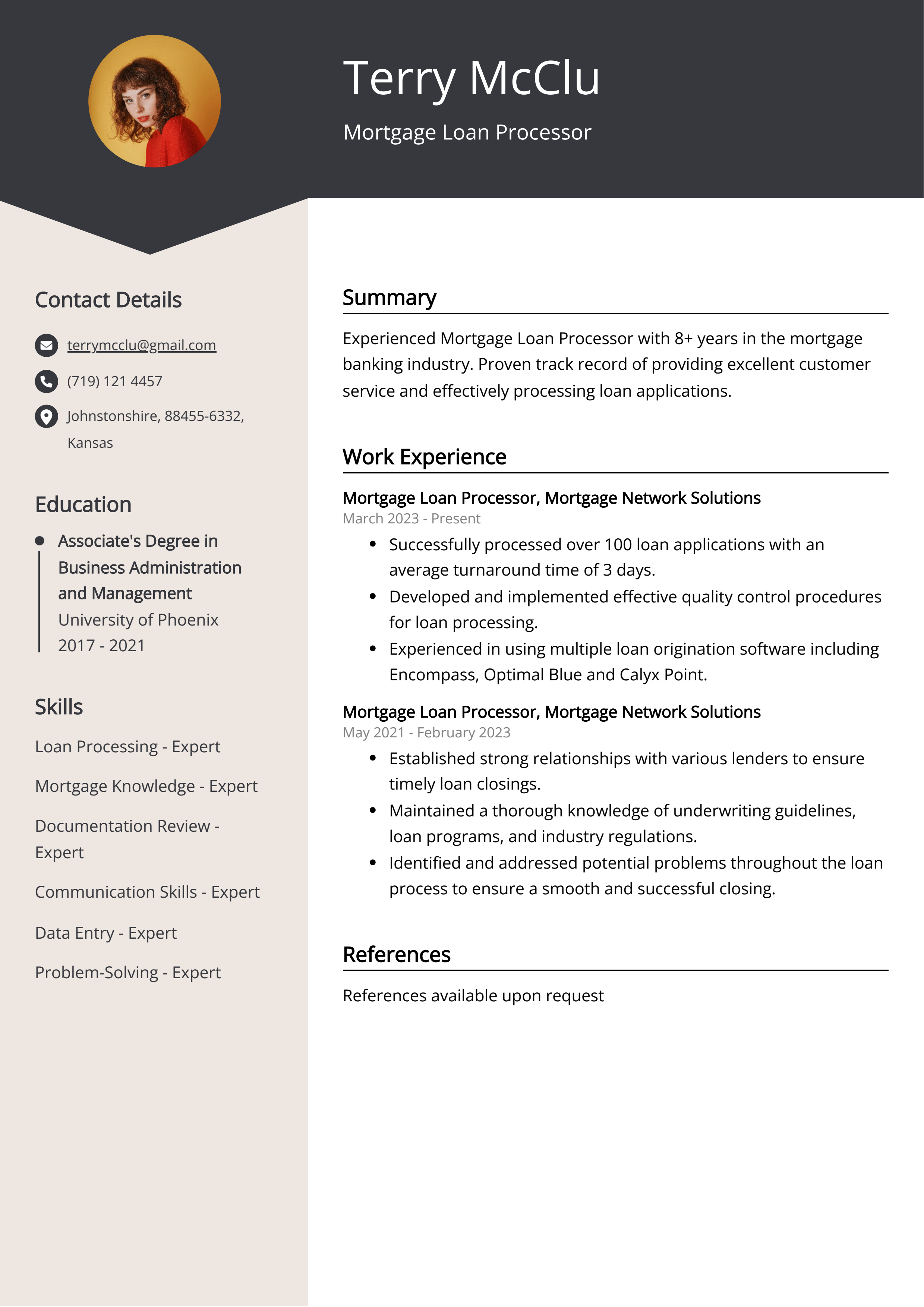

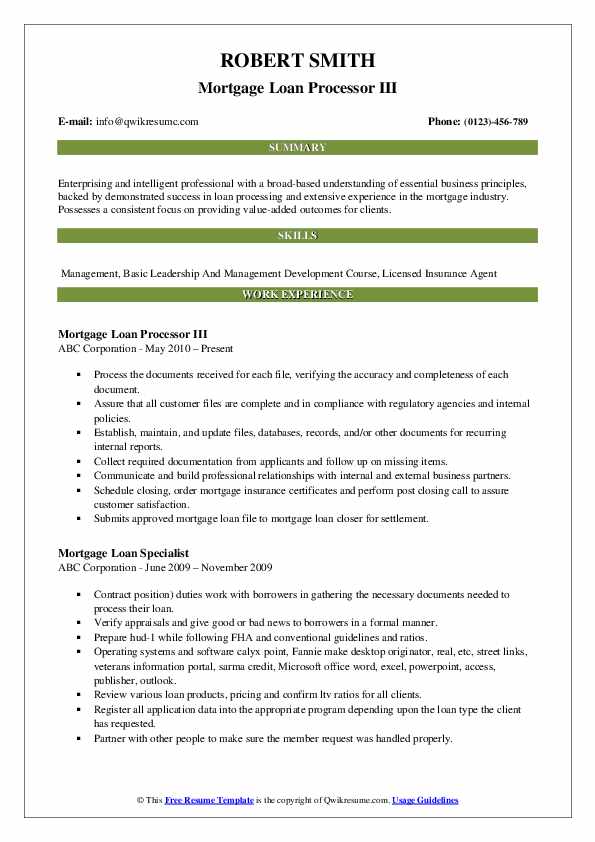

15 Mortgage Loan Processor resume templates

Read our complete resume writing guides

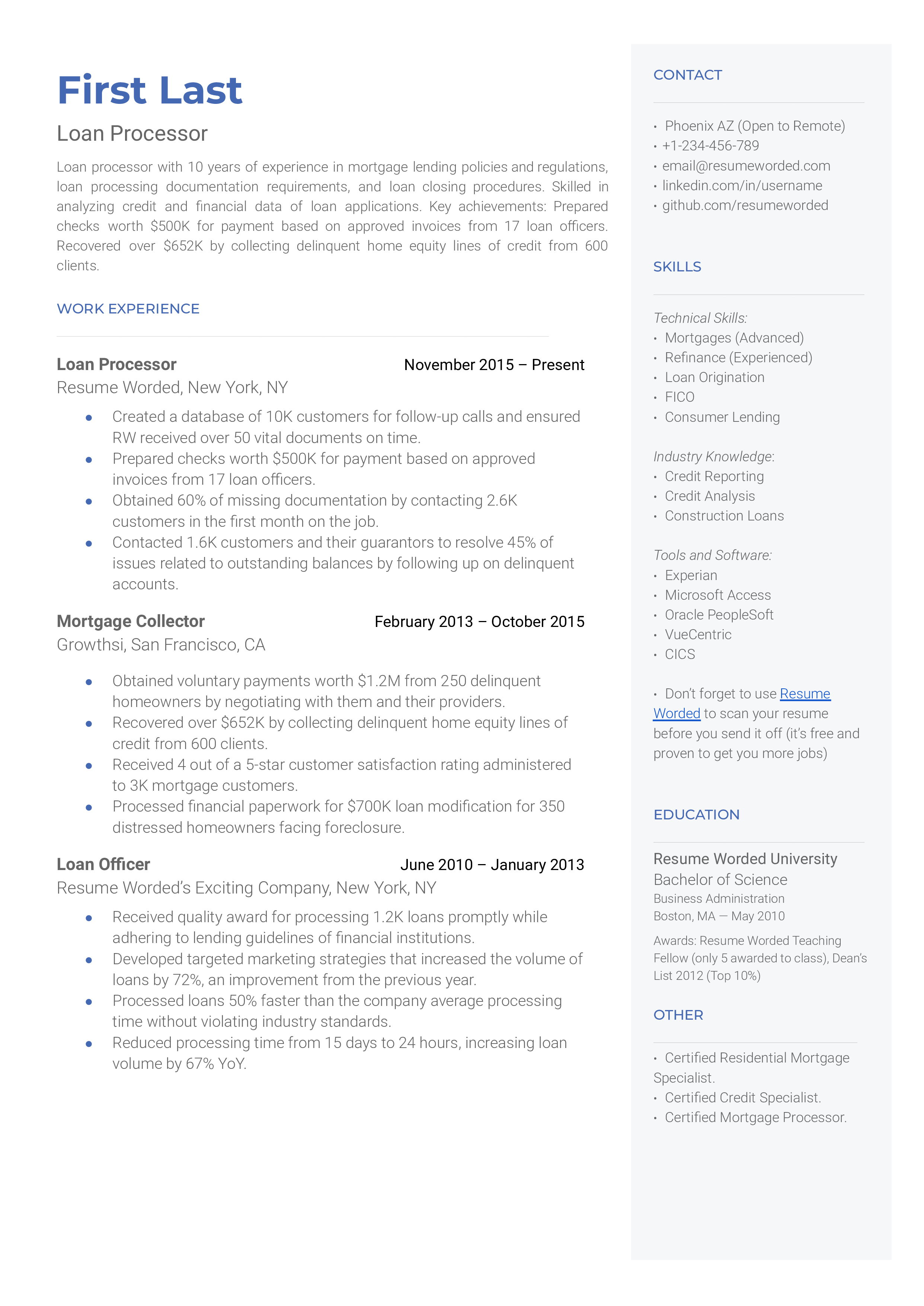

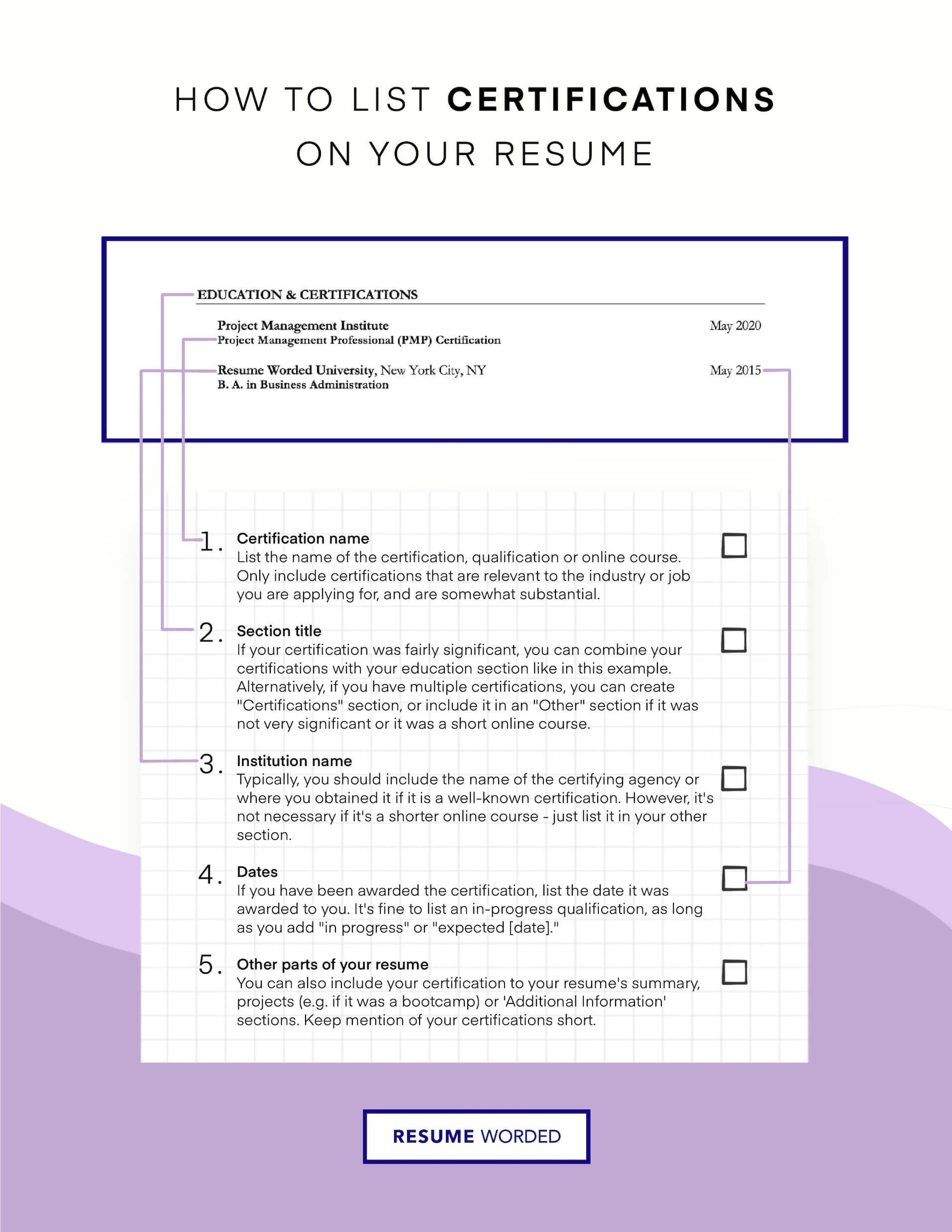

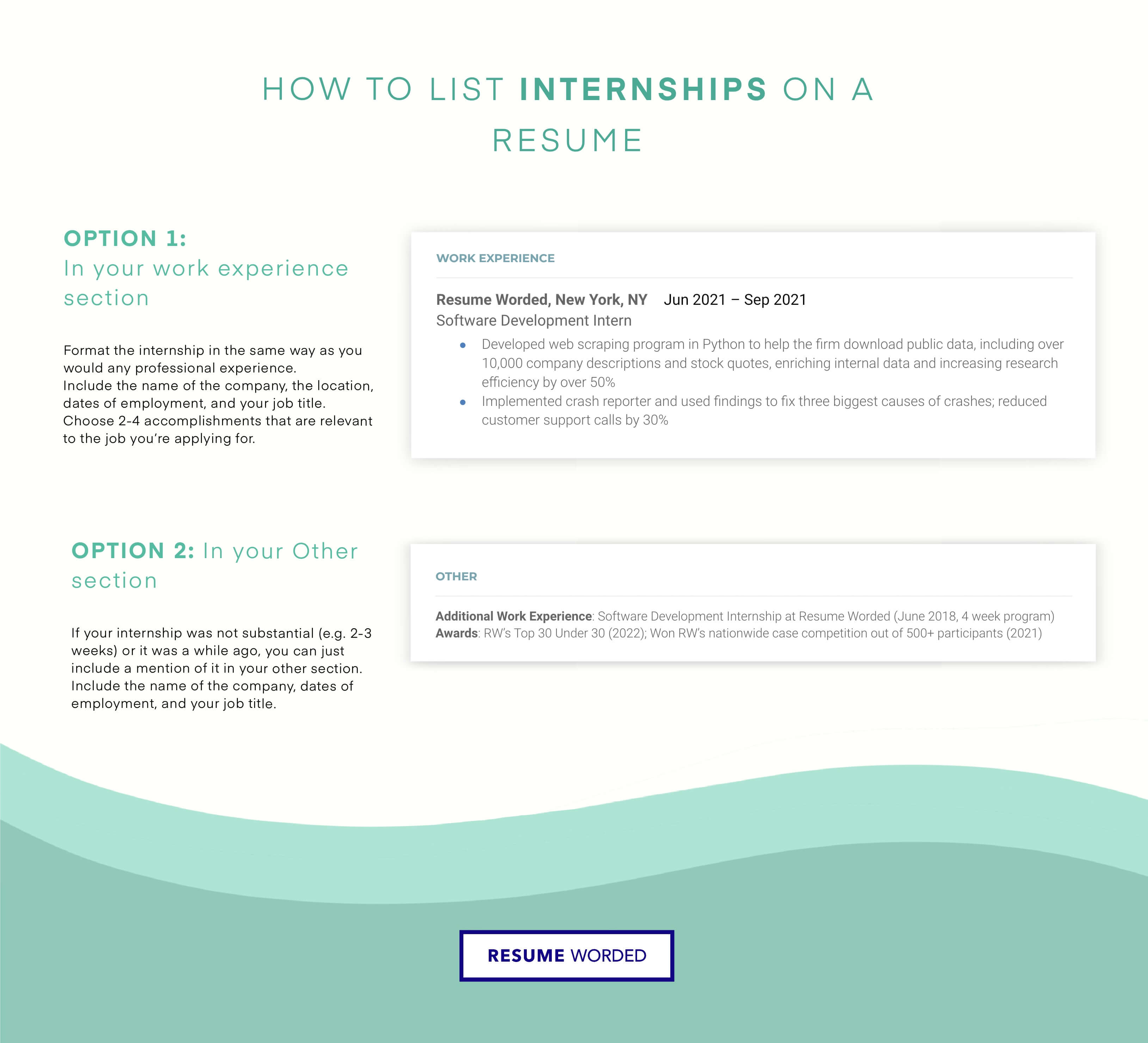

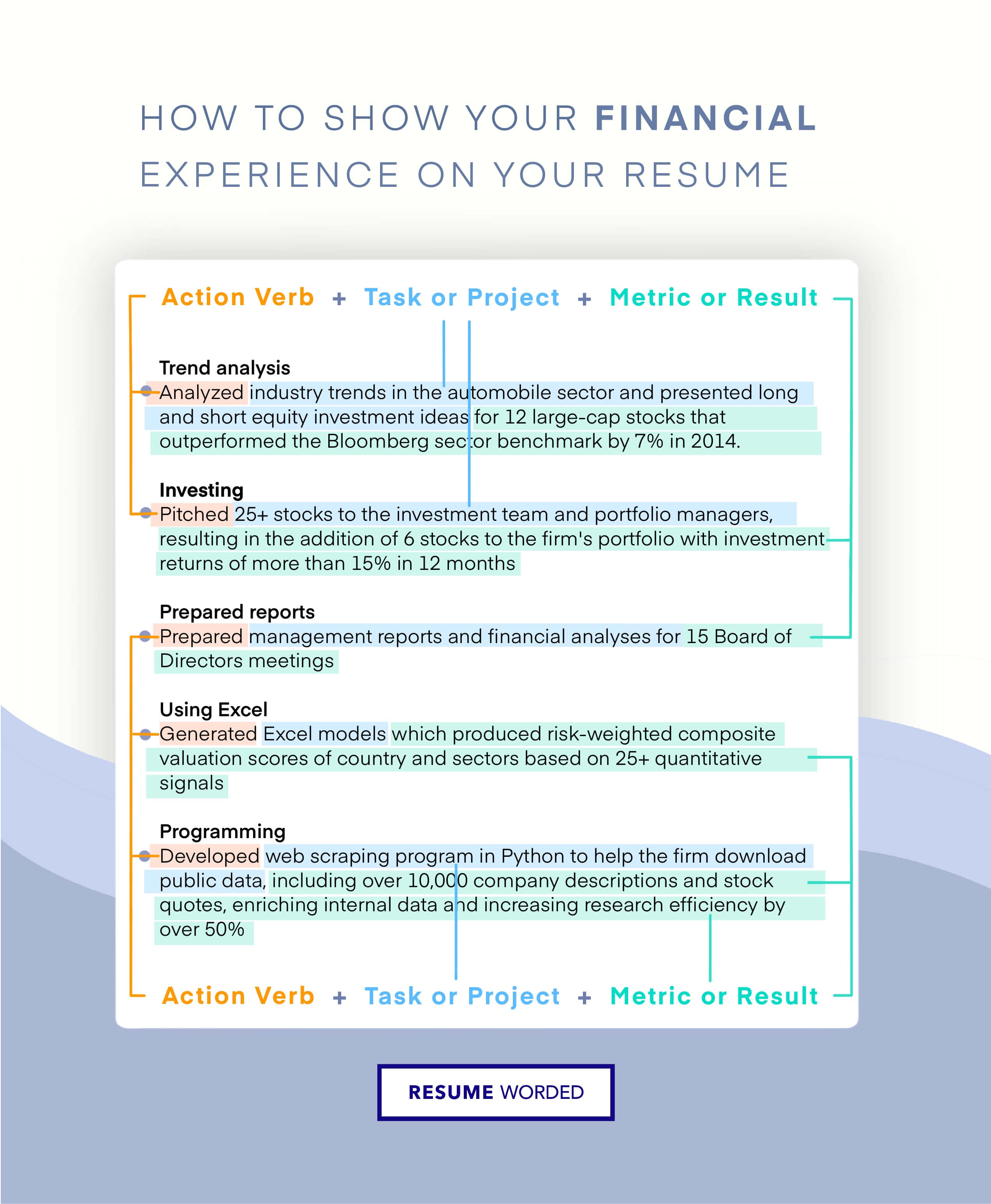

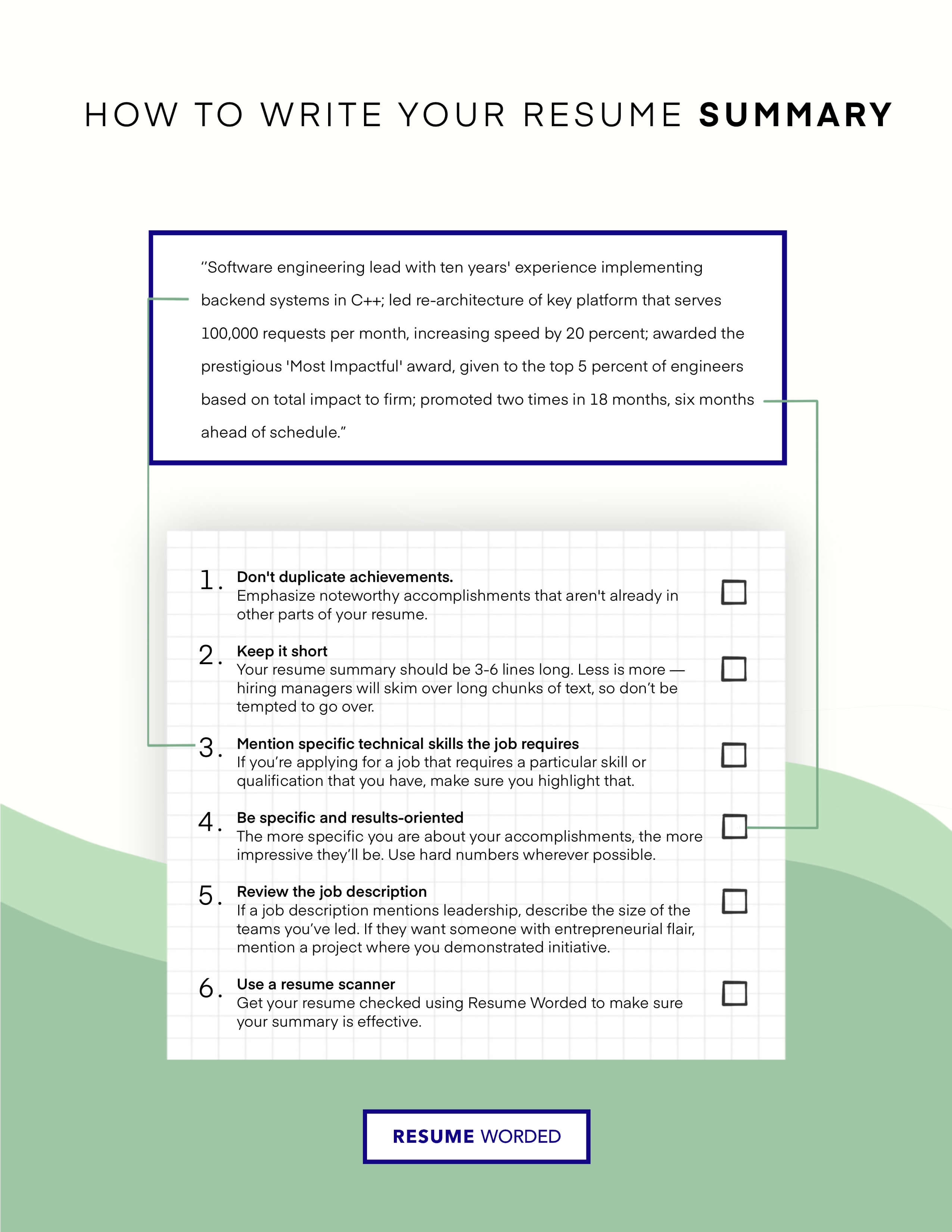

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, mortgage loan processor resume examples & samples.

- Capable of independently processing the most complex loans

- Make judgments as to whether the loan is "reasonable" even if it meets published guidelineson thesurface. If it does not appear reasonable, must escalate for further evaluation

- Maintain knowledge of regulatory changes, external and internal compliance requirements, and investor guidelines to insure loan salability

- 2 years of loan processing experience and function as a senior processor. Capable of independently processing the most complex loans

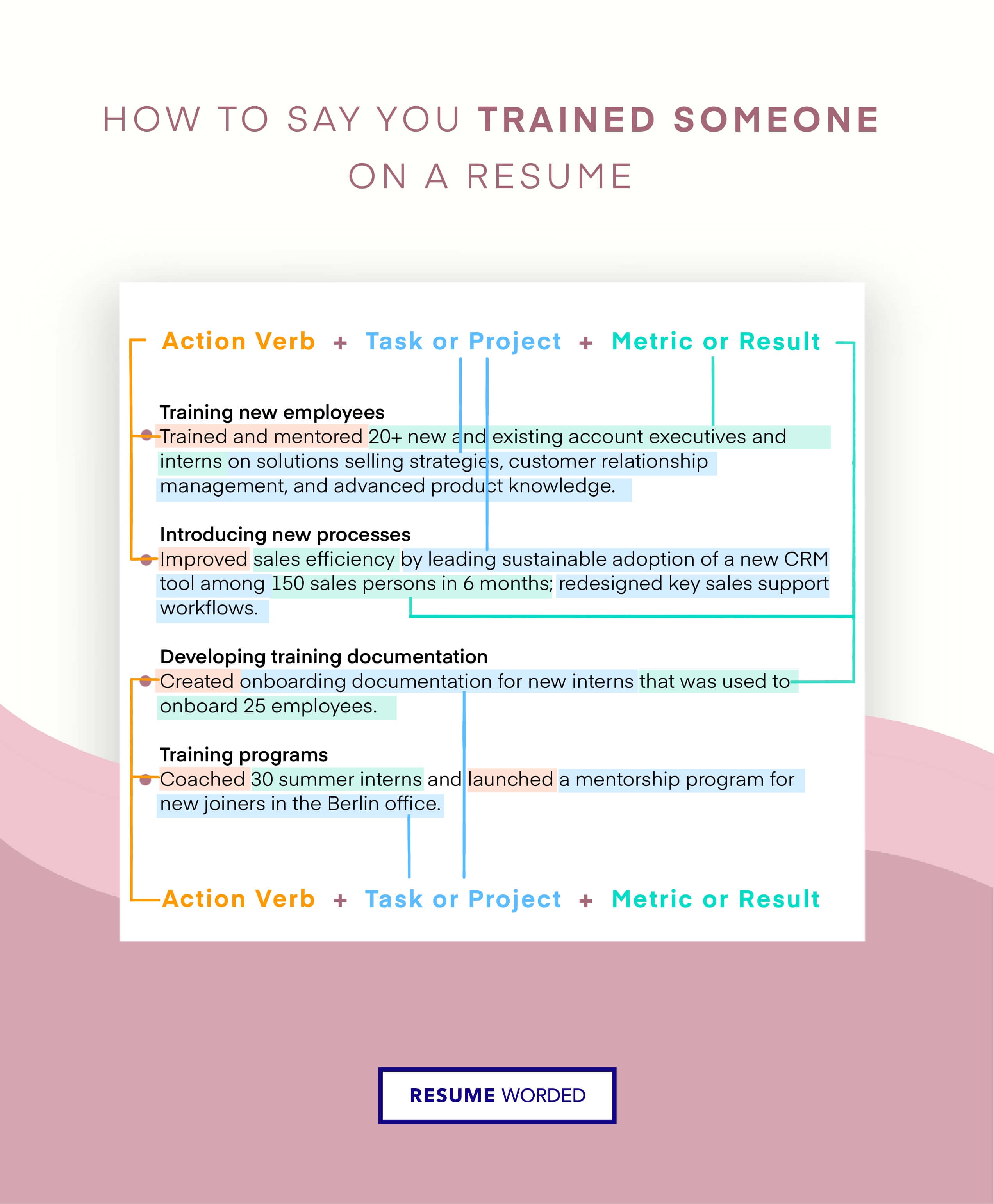

- 5 years of loan processing experience. This senior level processor may be responsible for training entry–level processors and/or providing guidance to other processors. Capable of independently processing the most complex loans. In Addition, the individual will be required to

- Make judgments as to whether the loan is “reasonable” even if it meets published guidelines on the surface. If it does not appear reasonable, must escalate for further evaluation

Commercial Mortgage Loan Processor Multifamily Resume Examples & Samples

- Bachelor’s degree from four-year College or University preferred, but not required

- 2 years of related work experience preferred

- Ability to carry out instructions furnished in written, oral, or diagram form

- Ability to read, analyze, and interpret general business periodicals, professional journals, technical procedures, or governmental regulations

- Ability to write reports, business correspondence, and procedure manuals

- Ability to effectively present information and respond to questions from managers, clients, customers, and vendors

- Ability to communicate and be assertive on the phone with clients, vendors, and city officials

- Proficiency in Excel, Word and other productivity software

- Possess a basic understanding of financial formulas and use of financial calculator

- Minimum one year of experience in loan processing and closing activities

- Basic knowledge of loan processing and closing policies, procedures, documents, underwriting requirements, governmental and agency requirements, terminology, and automated processing systems

Mortgage Loan Processor / Liaison Resume Examples & Samples

- Degree in related field

- Solid Mortgage background

- Computer savvy

- Collect, prepare and assemble closing packages including documentation and disbursement instructions for delivery to title companies. Reconcile the complete file after required information has been obtained and verify underwriting conditions have been satisfactorily cleared by the underwriting or investor. Prepare, verify, and disburse funds to title companies at loan disbursement

- Review new loan application files for compliance, accuracy and completion. Initiate corrective action when needed. Submit credit documentation along with automated findings of borrower criteria to underwriting to obtain final approval

- Primary point of contact during processing for applicants, realtors and/or attorneys, vendors, and other internal lenders and branch banking employees. Answer general customer inquiries and resolve customer issues

- Interact with third party vendors to obtain credit reports, appraisals, title reports, flood certifications, and tax transcripts. May interact with government or insurance agencies as needed

- Review and compile loan documents to comply with loan approval and secondary market guidelines and deadlines. Maintain current knowledge of internal and external regulation, changes to policy, and changes to procedure

- Prepare and balance the Settlement Statement with the title company, verifying the final settlement statement is correct according to compliance regulations. Monitor loan closing dates to assure adherence to scheduled timelines

- Take loan applications or speak with customers about terms of loan in excess of five times per year

- Provide guidance and work direction to new loan processors and assist with training of new hires as applicable; review work of others

- High-school education or equivalent

- 1-2 years post-secondary coursework in finance/accounting or equivalent experience

- Minimum of 5 years of experience in mortgage loan processing and closing activities with thorough knowledge of FHA/VA, USDA, Department of Housing and Urban Development (HUD), and Conventional Loan guidelines

- Must maintain an active registration status with NMLS (Nationwide Mortgage Licensing System and Registry)

- Thorough knowledge of RESPA, TILA and all other mortgage regulations

- Strong decision-making skills and the ability to move quickly between tasks

- High level of analytical abilities, or math aptitude

- Proficient at multi-tasking responsibilities and projects while maintaining deadlines and work quality

- Excellent computer skills, which include Microsoft Office programs and a familiarity with automated vendor processing systems such as Desktop Underwriter (DU)

- Four-year college degree in finance or accounting

- 7+ years’ experience in conventional, HUD, FHA/VA mortgage loan processing

Z-mortgage Loan Processor Resume Examples & Samples

- Document any potential issue or concerns regarding loan reasonableness or potential fraud/misrepresentation and escalate to next level manager or Loan Risk and Recovery depending on the circumstances

- This senior level processor may be responsible for training entry-level processors and/or providing guidance to other processors

- Construction to Perm experience

- Bond Loan experience

- USDA experience

- The position directly interacts with loan officers, customers, Mortgage Support Teams, and external vendors

- Minimum of three years proven and progressive mortgage lending support experience, or equivalent loan processing or underwriting experience

- Proficiency with personal computers as well as pertinent mainframe systems and software packages

- Minimum 3 years of loan processing experience in a mortgage banking company or related financial institution required

- Minimum 3 years of experience working with FNMA/FHLMC guidelines and standard industry guidelines required

- Minimum 3 years of experience of state and federal lending regulations (e.g. Respa, Reg Z, Ecoa, State Fair Lending) required

- Ability to communicate effectively with all levels of Bank personnel, customers, and outside agencies in both verbal\written form

- Computer literate with experience using, Word and industry standard mortgage software, preferably InterLink E3

- Ability to work under deadlines

- Good organization and planning skills

- Ability to pay close attention to detail

- College graduate or above

- Able to work independently, responsible and with proactive attitude

- Familiar with local real estate market and operations

- Proficiency in both Chinese and English, with good knowledge of PC application software Educational

- Contributes to the efforts of the Real Estate Secured Lending Operations unit through team orientation and focused excellence in achieving organizational goals and quality standards

- Effectively and efficiently manages a pipeline of loan applications and loan modifications/conversions (as assigned) to deliver results consistent with established goals

- Provides best in class service to all parties involved in the transaction, including borrowers, builders, Realtors, sales partners, and other internal partners

- Delivers consistent and timely service throughout the lending process. Anticipates borrower needs and proactively maintains service level agreements

- Responsible for adhering to all compliance and regulatory requirements, mortgage policies, and procedures

- Responsible for ordering and ensuring required services are ordered and received, including credit reports, appraisal, title, payoff requests, and property surveys

- Ensures appropriate insurance is obtained and updates the file accordingly

- Completes file maintenance as necessary

- Reviews submitted loan application for completeness and verify procedures per guidelines

- Order necessary documents and follow-up with vendors/third parties to obtain in a timely manner

- Manage pipeline loans within required performance standards for approval and status calls

- Submit loans to underwriting for conditional review and full approval upon receipt of appraisal

- Partner with Sales and Underwriters on difficult and or exception transactions

- Proactively communicate with all parties to the transaction, including, but not limited to title companies, internal team, and vendors

- Run and review AUS findings including LP, DU, and GUS

- Must be knowledgeable about FHA, VA, USDA, and conventional loans

- General servicing experience

- Investor reporting

- Default management

- Financial background

- Quality control

- Collects and reviews required documentation. Calculates income. Updates the file accordingly

- Ensures required verifications, including, deposit, employment, and mortgage are ordered and received

- Prepares and submits the file to underwriting

- Prepares and submits the loan for closing. Coordinates closing with the loan officer, borrower, builder (if applicable), Realtor, and closing agent, as applicable

- Works with the borrower, builder, sales partner, and internal partner, to complete the loan modification and to satisfactorily complete the conversion from the construction phase to the permanent phase of a construction loan, as necessary

- Prepares the loan for modification/conversion. Coordinates the execution of modification/conversion documents with the MBO, borrower, and the closing agent (if applicable)

Senior Mortgage Loan Processor Resume Examples & Samples

- Working collectively with colleagues and key stakeholders to optimize customer experience

- Minimum of an associate’s degree in business, related field or equivalent experience

- Ability to work independently, handle detail and maintain confidentiality

- Proficiency with MS Word and Excel

- Ability to multi-task effectively in a fast-paced environment

- Demonstrated knowledge of the mortgage documents and loan processing

- College degree preferred. Equivalent experience in mortgage banking origination may be a substitute

- 3 years of residential processing experience preferred. Other relevant study or directly related work experience may be considered

- Ability to work overtime (especially at the end of the month)

- Must have 3+ years’ experience: Effectively and efficiently monitors a pipeline of at least 50 loans with the goal of closing at least 25 loans per month

- Reviews customer submitted documentation to ensure the documentation meets the program guidelines

- Must have 3+ years’ experience: Validates credit reports, orders appraisals, surveys, and title insurance, and requests payoffs from other mortgage companies; updates loan files, the mortgage software platform, and tracking system as information is received; prepares final loan package for approval, as well as experience in calculating income to include self-employed borrower

- Processes loan to conform to product guidelines. Gathers all requirements and prepares loan for underwriting approval

- Responsible for adhering to compliance and regulatory requirements

- Manage the receipt, scanning and indexing of loan files or documents from internal departments, third party vendors or external business partners such as title companies and loan customers

- Maintain and manage loan file and document status information through the use of both system generated and manually prepared pipeline reports, adhering to established follow-up procedures. Document receipt into information systems or department’s manual reports

- Communicate by phone, written or electronic communication with internal and external customers (e.g. internal lending staff, title companies, third party vendors, business partners, loan customers, etc.) as needed to accurately complete loan files within prescribed timeframes

- Assist with training and development of new and less experienced employees. Resource for lending production staff and lesser experienced processors staff and less experienced processors

- Prepare reports to identify outstanding issues, department goals and training/development needs

- Prepare loan documents as needed

- Monitor the receipt of loan files, loan documents and security instruments, including car titles and mortgage or deed of trust documents

- Execute mortgage/title filing as needed, to ensure accuracy of security instruments

- Complete more complex corrective actions related to loan documents and loan servicing system data entry

- Assist other departments within Loan Operations with filing or data entry as needed

- Work with third party vendors to obtain data as needed

- Process loan applications through the front end processing system as directed

- Understand TCF’s Policy and Procedure to ensure that all underwriting of non-originated files is in compliance

- Verify accuracy of Overdraft Protection files and set up all Overdraft Protection accounts

- Maintain loan files

- Understand the MHFA program and ensure all information is collected and verified. Produce loan documents. Work with lender and MHFA to ensure complete, accurate loan file

- Assist with training of employees

- Figure aptitude, analytical and problem solving skills

- Two years post high school education

- Monitor and maintain an application pipeline

- Directly communicate with Loan Officers, clients, service providers and branch referring partner to gather and clear underwriting conditions; primarily responsible for documentation collection

- Ordering third party documentation; verify vendor orders are complete and invoices received

- Maintain knowledge of industry compliance standard rules and regulations

- Review Hazard Insurance for required coverage and Insurance Carrier rating

- Review title work for seasoning requirements, liens, entity issues, etc…

- Review flood certificates for flood status

- Minimun of 2 years residential mortgage processing experience on agency products

- Knowledge of RESPA guidelines, general knowledge of all mortgage and consumer lending regulations

- Foundational knowledge of FHA, VA, Conventional, Jumbo (preferred). Other products, (i.e.) CP, USDA, HELOC preferred but not required

- Ability to handle competing priorities effectively and withing established timeframes

- High level of integrity and trust must be a team player with a selfless attitude

- Ability to work varying hours and overtime if needed

- Obtains required documentation and processes less complex loan applications

- Tracks receipt of and reviews post closing legal documents

- Prepares for review, Good Faith Estimates of Closing Costs, Regulation Z disclosures, and other disclosures required by consumer regulation

- Schedules, coordinates loan closings, and clears for disbursement of proceeds

- Performs basic loan calculations

- Verifying information for accuracy and completeness

- Interpret and apply policies

- For more information, contact: Lindsay Silverman at mailto:[email protected]

- Follows up on missing documentation

- Prepares compliance and accounting records and reports, as required by management and regulatory agencies

- Maintains currency in loan processing policies and procedures

- Intermediate level concepts, practices and procedures of commercial and retail loan processing and documentation

- Financial markets and products

- Multi-state real estate, closing, and title practices

- Federal and State lending laws

- Reviewing and interpreting commercial loan documentation and terms

- Reviewing and personal financial statements and supporting documents

- Work independently as well as collaboratively within a team environment

- Raymond James Bank is an EOE/AA and VEVRAA Federal Contractor

- For more information, contact: Lindsay Silverman at [email protected]

- 2 Year College Degree beneficial

- 2 years of secondary market mortgage processing experience required

- Ellie Mae Encompass in a paperless environment preferred

- Problem solving and analytical skills

- Knowledge and experience using loan origination software, MS Word, Excel, and Outlook

- Act as a liaison between borrower, underwriter, loan originator and real estate agent, while maintaining excellent customer service and open communication with parties

- Research program requirements and efficiently obtain the necessary documentation to comply with program guidelines

- Ensure all files in pipeline are current, complete and accurately entered into loan origination software

- Obtain documentation and order services from third parties including: payoffs, flood, appraisal, title insurance, VOE, VOD, credit report updates, etc

- Compile all documentation in a paperless environment and submit a full file to underwriting

- Monitor and clear underwriting conditions in a timely manner, including obtaining documentation necessary to resolve routine title issues

- Document all communication pertinent to the loan transaction within loan origination software

- Help with other areas such as closing and post-closing as directed by management

- College Degree (B.A./B.S.) preferred

- 5 years of secondary market mortgage processing experience required

- Read and interpret supporting documentation and familiarity with required regulations

- Work in a fast-paced, high volume environment, while practicing sound judgment

- Review loan files and monitor reports to maintain compliance with regulatory and established corporate policies and procedures

- Communicates with borrowers, production and/or operations staff on correspondence to loan decisions such as suspended conditions, approval letters and/or denials

- Assist in preparation of reports to identify outstanding issues, department goals and training/development needs

- Acts as a preliminary contact for branch lending offices and Level I processors

- Enters applicant information into the mortgage software platform, prints necessary documents, and completes loan files

- Updates loan files in the mortgage/equity software platform as information is received

- Obtains and reviews necessary customer documentation to support data provided in the applications

- Reviews and verifies tax, lien and homestead information for collateral property

- Ensures that all documentation meets the loan program/product processing and underwriting guidelines

- Ensures that title is clear with no impediments in perfecting the lien

- Validates credit reports, ensures timely ordering and review of required vendor documentation

- Contacts insurance companies for insurance policy information and details

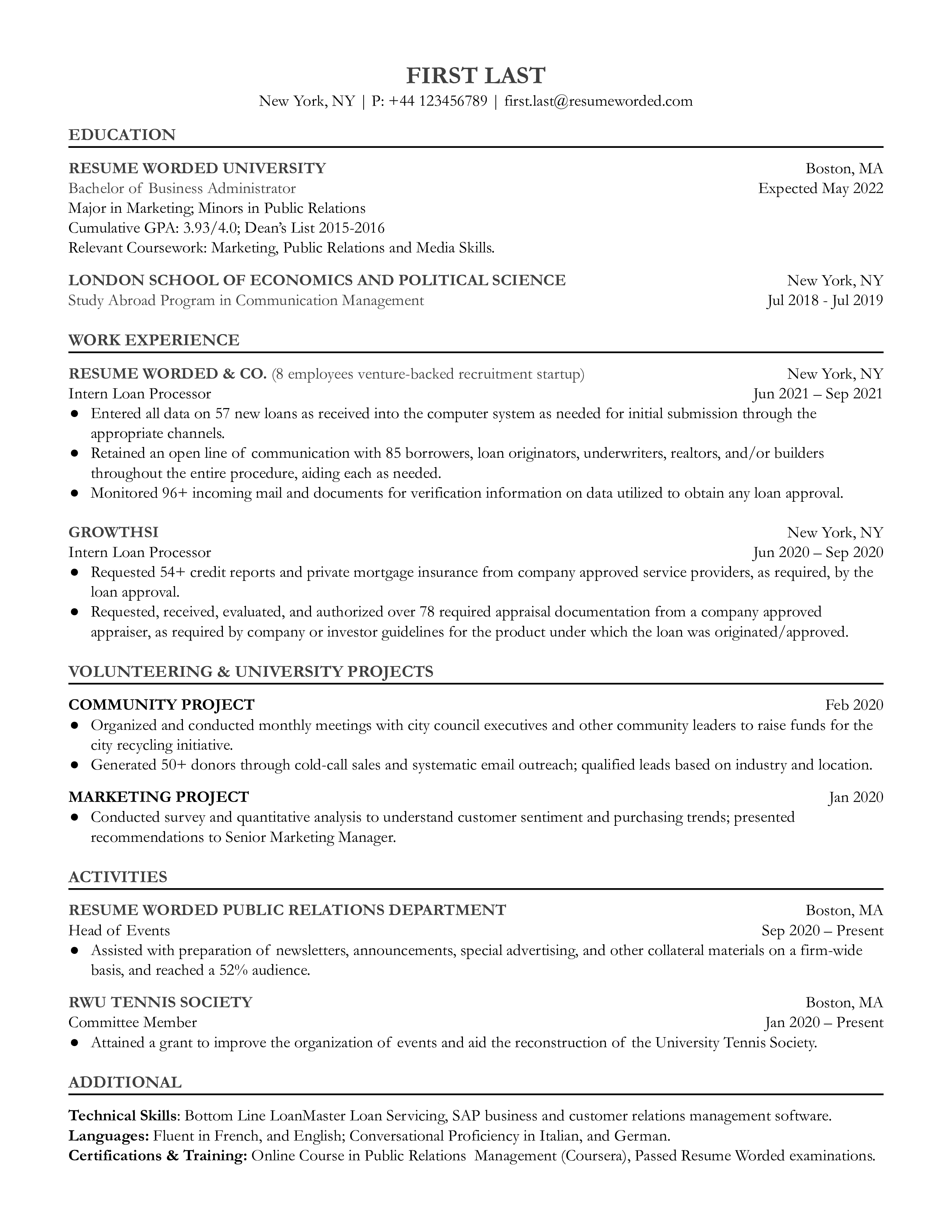

Entry Level Mortgage Loan Processor Resume Examples & Samples

- Accurately documents audit findings for reporting

- Maintain loan status information through the use of pipeline reports. Perform regular follow-up procedures for progress on all loan applications and advise interested parties in a timely manner. Use system comment screens to document the events to ensure management and other staff can at a glance determine the status of the loan file. Update system status coding as appropriate

- Make recommendations to update and/or correct lending policy and procedure manuals

- Assist with training and development of new employees, familiarizing them with their tasks and responsibilities. Suggests to supervisor changes in workload or position responsibilities as necessary

- Ensures that work is completed within the prescribed deadline

- Prepares loan documents

- Keeps up to date on regulatory and procedural policies and is able to assist lenders in perfecting a loan package

- High school education or equivalent

- Working knowledge of Word and Excel or similar data programs in Windows environment

- Excellent organization and time management skills

- Proven ability to coordinate multiple tasks, prioritize workload, and meet deadlines

- Ability to work independently, under pressure and to meet prescribed deadlines

- Ability to deal tactfully and courteously with customers, fellow employees or others in performing the duties assigned

- Must be able to attend work on time and on a regular basis

- Must be able to visually view and read computer screens, documents, and reports

- Must be able to manually operate a PC, calculator, phone, fax machine, and other office equipment

- Effectively and efficiently monitors a pipeline of at least 50 loans with the goal of closing at least 25 loans per month

- Disclosures, such as the 1003 application for mortgages or the LOA application for other consumer loans, the good faith estimate, the initial truth in lending, income and asset information, etc

- Validates credit reports, orders appraisals, surveys, and title insurance, and requests payoffs from other mortgage companies; updates loan files, the mortgage software platform, and tracking system as information is received; prepares final loan package for approval

- Provide guideance, answer questions and act as a mentor to other less experienced Mortgage Loan Processors

- Minimum of 5 years residential mortgage processing experience on agency products

- Minimum of 2 years purchase processing experience

- Foundational knowledge of tax returns; Foundation knowledge of FHA, VA, Conventional, Jumbo (preferred). Other products, (i.e.) CP, USDA, HELOC preferred but not required

- Demonstrated knowledge of purchase lending requirements and documentation

- Computer literate with experience using Microsoft Office, Google Mail and other software and applications

- Capable of effectively communicating information in a professional manner to customers and internal partners

- Optional Preferred Qualifications, depending on department supported

- A minimum of one year of experience in mortgage operations, financial or customer service

- A minimum of three years of mortgage operations experience is required

- A minimum of five years of mortgage operations experience is required

- Ensures the proper and timely completion of loan applications, collecting supporting documentation, pulling credit, documenting assets and liabilities and preparing a comprehensive loan package in preparation for underwriting

- Ensures the POS and LOS systems are populated with the required application data and that loan/processing statuses are accurately maintained

- Dispositions loans according to the underwriting decision, preparing approved loans for submission to closing or coordinating adverse action notices to applicants

- Maintains strict adherence to all compliance and regulatory requirements as well as department policies and procedures

- High school diploma or equivalent is required

- Minimum of three years mortgage operations experience

- Knowledge of Conventional, FHA, VA, Construction Perm guidelines and compliance guidelines

- Associates or Bachelor’s Degree

- Bilingual; English and Spanish

- Time Management — Managing one's own time and the time of others

- Service Orientation — Actively looking for ways to help people

- 1-3 Years experience in mortgage processing

- Extensive Customer Service Skills

- Ability to manage a pipeline of 30-60 Multi-state conventional loans

- Ability to handle and prioritize a large pipeline ensuring rate locks are met while always ensuring the highest level of customer service

- Working knowledge of Microsoft Word, Excel, DU and client specific originating systems

- Gather information and take each file from approval to closing

- Drives for results, analyzes issues and makes decisions

- Demonstrates adaptability

- Collaborates with others and effectively manages relationships

- Demonstrates organizational skills and is able to multi-task effectively

- Have Strong verbal and written communication skills

- Three years of mortgage loan processing experience OR four years of mortgage underwriting and/or closing experience

- One year mortgage processing experience

- Two years recent processing experience (within 12 months of application date), or a Bachelor's degree

- Five or more years of mortgage loan processing experience

- One or more years’ experience working with Desktop Underwriter

- Previous management or leadership experience

- Prepare Daily Reports - loans received, loans remaining for department, loans remaining for underwriter, and post- closing report

- Prepare subordination package for review, enter into SADS database and subordination preparation including final delivery of subordination

- Denial/HMDA files - responsible for all files in corporate underwriting are reviewed and all decision timing is completed within regulatory requirements, including all HMDA information

- HUD Binders - track all case binders for completion for final insurability

- Must be customer service oriented with the ability to work in a multi task environment while maintaining a high-level of flexibility

- Basic knowledge of first and second (subordinate) lending; credit, collateral, assets

Wealth Management Mortgage Loan Processor Resume Examples & Samples

- Three or more years of experience in loan processing and closing activities

- Advanced knowledge of loan processing and closing policies, procedures, documents, underwriting requirements, governmental and agency requirements, terminology, and automated processing systems

- Advanced knowledge of credit policies and approval processes

- Ability to handle stressful situations with calmness and courtesy

- Excellent records and file management skills

- Knowledge and experience using MS Word, Excel, and Outlook

- Knowledge of basic accounting processes and procedures

- Works with partners, borrowers and vendors to request, obtain and/or follow-up on all documentation required for approval. Reviews the documentation for accuracy and inputs the information into the mortgage origination system

- Responds to, and documents inquiries from partners, borrowers and outside vendors to resolve discrepancies. Ensures complete and accurate credit packages are submitted for approval review

- Responsible for meeting all regulatory and compliance requirements associated with mortgage lending. Verifies that the loan documentation is complete and accurate; reports and resolves deficiencies within established timeframes

- Is able to perform basic underwriting skills applying secondary market and banks guidelines to determine credit worthiness. Ensures documentation is complete for analysis

- Responsible for approving basic loan approval conditions provided by partners, borrowers or outside vendors for files ensuring guidelines and bank policies have been met

- Responsible for monitoring all closing dates, rate expirations and Equity Credit Line maturity dates are up to date on a weekly basis

- Responsible for ordering payoff letters and requesting Subordination Agreements

- Responsible for ordering Homeowner’s and Flood Insurance when applicable and reviewing for sufficient coverage amount

- Orders Title Report and Appraisal from third party vendor and is responsible for follow-up

- Responsible for satisfying prior to close conditions and making sure file is clear to close

- Prepares loan commitment letters

- 3 years in mortgage banking or related experience preferred

- Knowledge of bank policy and procedures, secondary market guidelines and compliance regulations, usually acquired through related work experience, is required to ensure bank and regulatory guidelines are met

- Time management skills and attention to detail are required to properly manage and prioritize assigned workload

- Knowledge of Windows with a background in Word or Excel preferred to set up loans on the system and maintain tracking file

- Good written and verbal communication skills are required to respond to inquiries from partners, borrowers and outside vendors

- Reviews and inputs incoming documents (i.e. VOE, VOD, credit, etc.) into Mortgage Loan Operating System (LOS)

- Reviews residential loan application file to verify that application data is complete and meets establishment standards, including type and amount of mortgage, borrower assets, liabilities, and length of employment

- Reruns Automated Underwriting System (AUS) to ensure same automated decision is applicable

- Recommends that loan not meeting standards be denied

- Calls specified companies to obtain property abstract, survey, and appraisal if needed

- Determines if appraisal is to be ordered and what type

- Reviews appraisal for errors and meets underwriting criteria and notifies lender of any discrepancies

- Informs supervisor of discrepancies in title or survey

- Assembles file in electronic imaging system and reviews for completeness and accuracy

- Notes the estimated closing date and type of transaction

- Reads notepad for pertinent information not obvious in file, identifies missing items and notifies appropriate party

- Orders updates to credit report

- Requests needed documentation not previously requested

- Reconciles LOS and AUS

- Gathers all required documentation prior to closing and resubmits for final approval

- Submits mortgage loan application file for underwriting approval

- Orders flood determination

- Types and mails approval and denial letters to applicants

- Confirms closing date and location of closing

- Sends out construction package if necessary to branch lenders

- Prepares closing sheet and sends file to closing department for settlement

- Notates denial or withdrawal status in LOS and prints appropriate package

- Submits denied files to underwriting for review and signatures

- Reconciles fees to determine if funds are missing

- Records data on status of loans, including number of new applications and loans approved, canceled, or denied

- Required: High school diploma or general education degree (GED)

- Four to six years of mortgage lending or similar financial experience and/or education

- Ability to communicate effectively orally and in writing using the English language

- Working knowledge of, Microsoft Office products to include Word, Excel, Access, PowerPoint and Outlook

- Submits loans through DU and orders and follows up on any outside services such as credit reports, title, appraisals

- Monitors loans in process to determine any deviation from standard processing time and to take appropriate actions including notifying the manager for alternatives to ensure timely service

- Notifies the customer of the underwriting decision

- High School diploma or equivalent required

- Two + years of related full doc. processing work experience in residential mortgage lending processing and willingness to learn VA full doc loans

- Requires good analytical and math skills, strong oral and written communication skills, and outstanding computer skills

- Knowledge of FHA, VA, Conventional loans preferred

- Current Mortgage Loan Processing knowledge

- Ability to work flexible hours as needed

- Ability to function in an ever changing environment

- Demonstrate strong interpersonal, organizational, and time management skills

- MS Office proficient

- Excellent customer service skills with strong attention to detail

- Receives and reviews new loan files

- Processes RD, FHA, VA, and Conventional mortgages

- Maintains knowledge of bank’s residential loan policy and credit granting standards

- Attends training seminars as required to further develop job skills

- Effective listening, verbal and written communication skills

- Proficient in Encompass

- Working knowledge of ordering appraisals, flood certifications, verifications, title work and homeowners insurance

Cres Senior Mortgage Loan Processor Resume Examples & Samples

- Receives loan application from MB and Consumer Direct Outbound Reps and reviews documents to ensure all necessary forms have been completed and comply with underwriting, PMI and secondary market guidelines

- Sets up loan files and enters information for tracking of loan. Submits loans through DU/LP automated underwriting system upon validation. Prepares and mails initial or revised disclosures, if applicable

- Ensures all loans are in compliance with internal Bank guidelines and external state and federal regulations (i.e. USPAP, FIRREA, HMDA, RESPA, FNMA, FHLMC, and Fair Lending)

- Four to five years of loan processing experience. FHA and VA processing experience required

- Thorough knowledge of mortgage processing and basic underwriting skills

- Thorough knowledge of federal regulations and regulatory agencies such as USPAP, FIRREA, HMDA, RESPA, FNMA, FHLMC, VA, RD, and Fair Lending

- 0-1 year of mortgage banking processing experience with FHA/VA/FNMA/FHLMC

- Knowledge of mortgage loan products (conventional, FHA/VA, construction lending, HEQ and portfolio programs) and knowledge of mortgage procedures, documentation, and underwriting guidelines

- AUS, mortgage procedures, basic mortgage processing

- Excellent in customer service, highly motivated, focused and goal oriented

- Must have excellent written and verbal (face-to-face and phone) communication skills including professional grammar and demeanor

- Strong organizational skills with attention to detail

- PC and internet proficiency - loan origination software, imaging, Desk Top

Mortgage Loan Processor Assistant Resume Examples & Samples

- Image/index, review and submit completed files via the loan origination system to the underwriting department

- Provide exceptional service for both internal and external customers

- Communicate with various companies to obtain property survey, flood certificate, title commitment and payoff information

- To assist with documentation collection and data entry

- Must be able to work independently and handle multiple priorities

- High school diploma or equivalent work experience required

- Demonstrated ability to prioritize, multi-task, meet deadlines

- Precise attention to detail

- Excellent organizational skills and follow through

Mortgage Loan Processor Team Lead Resume Examples & Samples

- Sets up loan files and enters information for tracking of loan. Submits loans trough DU/LP automated underwriting system upon validation. Prepares and mails initial or revised disclosures, if applicable

- 3-4 years of loan processing experience. FHA and VA processing experience required

- Availability: Monday - Friday 10:00 am - 7:00 pm CST

Home Equity Mortgage Loan Processor Resume Examples & Samples

- Reviews title reports received from title companies for all real estate secured consumer loan/line products. Researches and follows up on problems related to title reports, and interacts with branch personnel and title companies to resolve related issues

- Reviews flood determinations received for real estate secured loans. Ensures banker is informed if property is located in a flood zone. Sends flood letter and notification to customer informing them of requirement to carry flood insurance

- Communicates with Residential Appraisal Services to ensure property evaluation product is received in a timely manner. Compares the report to the system to ensure specifics are correct

- Obtains proof of home owners and flood insurance (if applicable) for all real estate secured loans. Reviews insurance documentation to ensure coverage amounts and dates are sufficient

- Tracks for any additional loan officer requirements, and clear all stipulations of the credit approval prior to preparing the file to be ready for documents

- Orders, and follows through to receipt, all vendor work needed in conjunction with loan request. This includes but is not limited to title reports, flood determinations, and comps/appraisals

- Establishes and coordinates escrow closings with title companies as needed. Follows up on sub escrows when applicable and work with title companies to resolve any issues

- Provides additional support to other areas of Operations as required

- Associate’s Degree in Business or Finance or equivalent combination of education and experience

- Good knowledge of consumer loan and line documentation

- Good knowledge of consumer loan compliance regulations

- Knowledge of MS Windowns and MS Office software, including Word and Excel

- Ability to be a team player

- Ability to work in a fast-paced environment

- Planning and organizational skills

- Written and verbal communication and interpersonal skills

- Processing loan applications

- Verifying employment, assets and liabilities

- Submit file for underwriting and clear condition

- Prepare file for the loan closer

- Help with Final Documents after the loan is sold

- Will train to back up different positions

- Help back up the Mortgage Department’s incoming phone calls

- 2 years Loan processing experience preferred

- Proficient with Microsoft Suite

- Ensure the timely and accurate processing of all loans submitted by MLO's

- Gather information and process each file from initial approval to closing in a timely manner

- Ensure that all loan documentation is complete, accurate, verified and complies with Bank policy

- Support MLO's in preparing files for closing

- Maintain pipeline report and notify management of status as needed

- Act as a liaison between MLOs, underwriter, closing agents and other related parties

- Education: Associates Degree preferred

- Process and complete FHA and conventional mortgage loan files

- Verify all documentation for accuracy and completeness

- Calculate Income, 1040s, etc

- Package loan files complete and thorough for Underwriting

- Obtain required stipulations from borrower, guiding loans from origination through closing

- Maintain communication with Loan Officers on all programs and the status of the loans

- Based upon underwriting decision, finish processing for loan closing or mail adverse action letter to borrowers

- Provide exceptional customer service to both internal and external customers

- Meet goals set forth with team lead

- 2-5 years of experience processing home loans

- Knowledge of pertinent federal, state and local codes, laws and regulations

- Loan Origination skills highly preferred (Encompass)

- Demonstrated communication, telephone and organizational skills

- Strong knowledge of FHA and Conventional mortgage programs

- Knowledge of additional mortgage programs a plus (ie, FHA, Conventional, 203K, VA, Homestyle, Sonyma, etc)

- 3-5 years of experience in Information Technology, preferably in an operations environment

- Experience in a technology operations role

- Experience working in a 24x7 operations facilities

- Experience with technology in the banking industry

- A foundational understanding of technology, including infrastructure, and business applications (built on infrastructure)

- Strong written and oral communication skills are required, and being comfortable speaking in front of others

- Experience communicating to management and business partners

- Must demonstrate strong analytical and excellent communication skills, strong interpersonal skills, and the ability to work well within a team

- Professional certifications preferred (CCNA [CCENT & CCT], MCP, VCP, RHCSA, LPIC-1, Network+, Security+)

Mortgage Loan Processor Senior Resume Examples & Samples

- High School Diploma

- AUS, mortgage procedures

- Customer service

- Requires the ability to work in a fast paced environment, multi-tasking with processor functions for all home lending products

- Daily Loan Assignment - includes receipt of all loan files from branches, logging receipt in UNIFI, assigning to underwriters

- HMG Corporate Underwriting Mailbox - retrieval of all PTCs for outstanding file conditions. The conditions are all electronically delivered to this mailbox, delivered to the underwriters and updated in UNIFI

- Minimum of 1 year of prior conventional and government loan processing experience including review of income documentation, appraisal documentation and applicable forms/documents required by different agencies

- Must be able to work in a high volume environment with minimal supervision while maintain all production service levels

- Strong analytical skills with attention to detail

- Ability to work in a fast paced environment, multi-tasking with processor functions for all home lending products

- Process mortgage loan files which includes but not limited to obtaining all loan documentation and analyzing file items

- Maintain knowledge of regulatory changes, external and internal compliance requirements and investor guidelines to assure loan quality

- Knowledge of automated underwriting systems, such as Desktop Underwriting, Loan Prospector and Government Underwriting System with the ability to analyze findings

- Ensure timely and accurate processing of all orders such as appraisal, verifications, etc. as requested by the Loan Processor

- Input correct loan information into the system for processing

- Respond to inquiries and follow up with key individuals to resolve problems

- Follow up with MLO's on outstanding loan conditions

- Support the Mortgage Loan Processor in preparing files for closing

- Escalate processing issues to the Assistant Mortgage Operations Manager

- Experience: 1-3 years of mortgage lending and banking experience with good knowledge of lending regulations and loan processing in a multi-state lending environment

Mortgage Loan Processor Supv Resume Examples & Samples

- 3 - 5 yearsof processing or underwriting experience mortgage lending

- 2+ years of FHA/VA/FNMA/FHLMC loan processing experience

- Strong math and analytical skills

- Demonstrated ability to prioritize, multi-task and meet deadlines

- If applicable, interviews loan applicant(s) to gather specific information relative to credit, employment, and financial history

- Reviews, organizes and collates application and loan information to ensure timeliness and accuracy in providing a useable credit file to be submitted to underwriting for approval

- Communicates with applicant(s), underwriters and/or creditors to resolve problems or questions regarding application information

- Process files from opening through closing of each loan. Take ownership of loan files once received from mortgage loan officer. Be primary contact for all parties involved in the process of the mortgage loan

- Assemble all loan documents necessary to meet the underwriting guidelines for the particular loan program in process. Obtain the necessary documents from the customer to meet Automated Underwriting System findings

- Review all documents for accuracy and completeness and determine the documentation necessary to be included in mortgage loan file

- Check Vendor screen for completeness

- Analyze borrower(s) Federal Tax returns (if applicable) to determine qualifying income. Complete FNMA Form 1084 Self Employed Cash Flow Analysis for loan files with tax returns

- If responsible for ordering appraisals-title and hazard insurance, track the order and status of ordered appraisals-title and hazard insurance

- Maintain compliance of Good Faith Estimate, Truth-in-Lending, and all other Real Estate Settlement Procedures Act (RESPA) disclosures

- Reviews documentation for completeness and accuracy, ensuring compliance with initial truth-in-lending guidelines. Notify Mortgage Banker of changes to loan file needing Changed Circumstance and re-disclosure

- Responsible for conferring with borrowers concerning questions, procedures, necessary information and forms completion, and loan status

- Communicates in writing and verbally with various parties to the mortgage loan process

- Ability to deal tactfully and effectively with customers as well as fellow employees; and

Summer Internship Mortgage Loan Processor Resume Examples & Samples

- Handling confidential customer information

- Prepares and processes mortgage loan records, files and correspondence from application through approval

- Assures compliance with bank, regulatory and investor guidelines and customer service standards

- Communicates with customers, internal staff, brokers, counsel, title companies, etc. to respond to inquiries, resolve problems and obtain all necessary documentation required for the file

- Assessing customer qualifications for financing by reviewing and analyzing income and asset information

- Communicating with customers on status and obtaining information as needed

- Working with underwriting and closing departments to insure customers service expectations are met

- Pursuing a Bachelor’s degree in Accounting, Finance, Economics, Business, or related discipline

- Strong written and verbal communication, analytical, problem solving and critical thinking skills

- Ability to think and work independently, professional demeanor, high energy and a “can-do” attitude

- Ensure compliance with bank and government regulations

- Data entry of loan applications to bank's processing system and submission to automated underwriting system

- Order and collect documentation necessary to address automated underwriting findings

- Communicate with all parties on status of file

- Work with originator and borrower to clear underwriting conditions

- Interpret automated underwriting decisions

- Solve file issues and problems within bank guidelines

- Knowledge of mortgage investor guidelines

- Knowledge of appraisal process

- Thorough knowledge of automated underwriting

- Thorough knowledge of compliance guidelines

- Excellent organizational, communication, and computer skills

- Time management and prioritization skills necessary to manage workload

- Ability to solve complex loan problems

- Ability to manage difficult situations with borrowers, Realtors, etc

Home Mortgage Loan Processor Resume Examples & Samples

- Provides exceptional customer service to loan officers, branch personnel and outside customers

- Ordering and reviewing all verifications required for loan product/program

- Analyze applicant information/documentation to ensure acceptable to bank or investor guidelines

- Provides timely re-disclosures with updated fees, prices per 2010 Good Faith Estimate (GFE), Truth In Lending and Change of Circumstance regulations

- Manages an assigned pipeline of loans for submission to underwriting while meeting department turnaround time and service commitments

- Regularly communicate items needed and loan status with customers, loan officers and managers

- Calculate income using paystubs, W-2s, tax returns and/or other forms of financial information

- Calculate escrows, payoffs, interim interest to final loan amounts

- Run Automated Underwriting System (Desktop Underwriter or Loan Prospector) according to documentation in loan file

- Consistently updates Encompass Loan Originating System with status and documents received from customers and others

- Orders appraisals and prelim title reports

- Reviews all loan documents for accuracy

- Submits complete files for final underwriting and follows loan through docs and closing to ensure on time delivery to investor

- Maintains a current knowledge of other bank products

- Maintains a current understanding of established Tri Counties Bank policies and procedures including but not limited to regulations as they pertain to mortgage loans: SAFE Act, Equal Credit Opportunity Act (Reg B), Truth in Lending (Reg Z), Bank Secrecy Act (BSA) Fair Housing Act, Real Estate Settlement Procedures Act (RESPA), OFAC compliance, Identity Theft Protection, Unfair Deceptive or Abusive Acts or Practices (UDAAP), Non-public Personal Information (NPPI) regulations, and Home Mortgage Disclosure Act (HMDA)

- Answers phone inquiries from customers and branches

- Performs duties of other loan processors in their absence

- Minimum of 3 years of direct mortgage lending experience

- Recent experience in Fannie Mae, Freddie Mac processing

- Good organizational and prioritization skills to accommodate heavy volumes

- Comprehension of Secondary Market policies and procedures

- Comprehension of Loan Prospector (LP) and Desktop Underwriter (DU) (automated underwriting system)

- Ability to work independently and effectively, collaborate and problem-solves with staff

- Creative thinking to find appropriate solutions or alternative products

- Knowledge of Encompass, Microsoft windows

- 2 years minimum experience in mortgage processing

- Knowledgeable in the areas of mortgage lending, workflow and compliance

- Proficient in time management, organization, planning and prioritization

- Excellent communication skills and attention to detail

- Must be organized, detailed oriented and have excellent communication skills

- Strong communication with Branch Managers throughout the entire loan process; disclosures, required client documentation, credit decision, document preparation, settlement and shipment of loan file to vault in a timely manner

- Strong technology skills, a plus

- Follow and adhere to Credit Union mortgage lending policy, guidelines and procedures including, but not limited to all Federal and State regulations such as, TRID, RESPA, REG Z, REG C (HMDA), REG B (ECOA)

- Perform post-closing review/audit of all closed loan documents to verify that they are accurate and ready to be shipped to investor and/or on-boarded into servicing system

- Follow up and deliver final documents on sold loans

- Monitor recording of final documents to ensure all security instruments and cancellations of liens are recorded in a timely manner

- Clear and resolve pending conditions for loan purchase

- Onboard portfolio loans for loan servicing by sub-servicer or in credit unions core system

- Prepare and send for recording Cancellation of Liens for paid off HELOCs, Equities and Construction Loans

- Resolve real estate loan servicing issues, inquiry or request on the loans serviced at the credit union as well as loan that are being sub-serviced on behalf of the credit union

- Order/obtain required items including, but not limited to: Appraisal/AVM, IRS Tax Transcripts, Payoff(s), Title Flood Certification, Proof of Insurance: Hazard and Flood, Subordination, Verbal Verification of Employment

- Communicate and follow up with the borrower(s) to obtain any items needed for approval and clearance to close the loan

- Provide the borrower and third parties related to the transaction with timely and periodic status updates for the pending loan

- Review and determine if supporting documents to verify income, credit, asset and collateral meet the investor(secondary market) and credit union guidelines

- Record all communications (internal and external) regarding the loan in the LOS conversation log

- Stack loan file following corresponding checklist and submit to underwriting or investor for purchase

- Prepare and process reports, forms, and orders related to cash and other negotiable transactions, loans, credit cards

- Other duties as assigned by management

- Forms and Reports completion. Ability to complete a form or report accurately including, but not limited to explaining form and data, understanding input data, entering data into relevant system(s) and communicating the results

- Team work. Strong ability to work well in a team environment is required

- Organizational skills. Able to handle multiple tasks and balance long and short term assignments

- Time Management. Ability to work efficiently and meet time sensitive deadlines even during times of high volume

- Communication. Strong oral and written communication skills

- Flexibility and adaptability. Able to adjust and adapt to frequent and continuous changes in order to comply with new regulatory changes

- Computer skills. Knowledge and experience using technology and MS Office products

- Problem Analysis. Ability to research and use resources to resolve issues

- The position directly interacts with loan officers, customers, mortgage support teams, and external vendors

- Minimum of five years proven and progressive mortgage lending support experience, or equivalent loan processing or underwriting experience

- Knowledge in analyzing credit, income, and asset documents

- Data entry of loan applications to bank’s processing system and submission to automated underwriting system

- Knowledge of compliance guidelines

- Ability to manage difficult situations between interested parties in the mortgage transaction

- Ability to understand, apply knowledge, and resolve issues that arise between automated underwriting rules and manual underwriting rules

- Two (2) to three (3) years of related experience

Wholesale Mortgage Loan Processor Resume Examples & Samples

- College Degree, business or finance preferred

- Mortgage experience required-Minimum 4 years. Must have processing experience

- Requires excellent verbal and written communication skills

- Requires organization and the ability to manage multiple tasks

- Excel and Word

- Data entry of loan applications to bank’s processing system and submission to automated underwriting findings

- Communicate with all parties on status of file and work with originator and borrower to clear underwriting conditions. Also proactively anticipate problems and work to solve them

- Interpret automated underwriting decisions working with system to obtain best possible outcome for borrower

- Underwrite and approve some mortgage files

- Train and supervise work of Level I and II processors

- Knowledge and mastery of mortgage investor guidelines and appraisal review process

- Mastery of automated underwriting process

- Excellent management skills and ability to train others effectively

- Ability to underwrite complex loan files and render judgments on acceptability

- Three (3) or more years of related with definitive evidence of ability to function at elevated capacity

- Assist experienced processors with routine duties, such as ordering flood certs, ordering appraisals, paying invoices, etc

- Update information from bank statements, paystubs, appraisal to bank’s origination system

- Assist loan officer with assigned duties which may include follow up on outstanding documentation, scheduling appointments, various clerical responsibilities

- Study the automated findings and UW conditions on files to learn the requirements for loan approvals. Obtain the knowledge needed to independently submit quality files to underwriting

- Ability to learn new processes quickly, retain information, and validate received information as applicable

- Ability to read, understand, apply knowledge, and ask for help

- Knowledge of common computer operations

- Excellent organizational skills and attention to detail

- Good communication and listening skills

- Ability to be teachable and respond positively to coaching and training

- Ability to accurately input data with very little margin for error

- Data entry skills (test) with above average quality results

- Typing skills – 35 wpm (test)

- Related education or processing/ real estate experience within a business, such as a bank, credit union, legal firm, insurance company, title company etc

- Review documents for completeness and acceptability of loan conditions

- Review credit, income, assets, disclosures

- Order title, MI and appraisal, if applicable

- Complete required checklists/worksheets

- Obtain additional documentation needed from all sources

- Update systems to reflect accurate information

- Submit for underwriting approval

- Communicate, prepare and mail out commitment letter, notice of incompleteness or declination

- Review title requirements, exceptions, and other information obtained for accuracy, completeness and conformance

- Review and collect underwriting conditions and submit conditions to underwriting for final approval

- Review loan system and documentation in file returning to underwriting, if applicable

- Upon receipt of final approval, prepare authorization to close and send to all parties

- Perform other related duties as assigned or required

- Maintain accurate pipeline by documenting conversation log and tracking loan progress

- Previous mortgage processing experience is strongly preferred

- Must have working knowledge of FNMA/FHLMC, compliance, comprehension of legal documents, and appropriate government lending regulation guidelines for mortgage loans

- Must have excellent oral and written communications skills, as well as excellent customer service skills

- Must have the ability to resolve problems quickly

- Reviews and verifies the mortgage application and all other documentation included in the application

- Performs all processing and pre-closing tasks required to manufacture a loan in compliance with company standards and best practices from point of application to submission to underwriting

- This may include reviewing data integrity of loan files; reviewing and analyzing credit, income, asset, and property documentation; ensuring file meets all compliance and regulatory requirements; collecting documentation from borrowers; and organizing and packaging loan files to submit to underwriting

- Also responsible for communicating with borrowers, realtors, vendors, and loan officers on status of loan files, answering questions, and providing other information as necessary to get the loan ready for closing and may assist in scheduling the loan closing

- Requires High School Degree or Equivalent and some banking, lending procedures, loan processing, or other directly related experience

- Basic knowledge of lending processes, loan principles, loan systems

- Knowledge of banking process helpful

- Review and verify the mortgage application and all other documentation included in the application

- Perform all processing and pre-closing tasks required to manufacture a loan in compliance with company standards and best practices from point of application to submission to underwriting

- Review data integrity of loan files; review and analyze credit, income, asset, and property documentation; ensure file meets all compliance and regulatory requirements; collect documentation from borrowers; and organize and package loan files to submit to underwriting

- Be responsible for communicating with borrowers, realtors, vendors, and loan officers on status of loan files, answering questions, and providing other information as necessary to get the loan ready for closing and may assist in scheduling the loan closing

Mortgage Loan Processor Asst Resume Examples & Samples

- Other duties as required

- Prior experience in residential mortgage processing on agency products is a plus but not required

- Ability to network and interct with others to build internal relationships to foster team environment

- Ability to handle competing priorities effectively and within established timeframes

- High level of integrity and trust; must be a team player with a selfless attitude

Mortgage Loan Processor / Closer Resume Examples & Samples

- High School Diploma/GED required

- Excellent internal and external member service skills required

- Attention to detail with excellent organizational skills

- Must be able to prioritize workload and manage multiple tasks in order to meet departmental goals

- Ability to work independently with stringent guidelines

- Ability to perform tasks on a calculator and function accurately on a computer terminal

- Ability to type 35-40 WPM helpful

- Ability to learn job and perform at a satisfactory level in 3-6 months

- Ability to do FHA, VA, and Conventional loan processing

- Knowledge of mortgage terms and guidelines

- Knowledge of ECOA, Reg. Z, FCRA, and RESPA

- Ability to be bonded

- Analysis of customer financial data

- Obtaining consumer credit reports

- Ordering of real estate appraisals

- Verification of employment

- Preparing loan file for underwriting

- Processes and prepares loans in a timely manner

- Makes mandatory calls to borrowers (i.e., welcome and commitment calls)

- Pipeline manages all assigned loans working within stated timelines reflected in real estate sales contracts, as well as management established turnaround timelines

- Ensures that all loans are cleared and released to the Closing Department no later than five (5) days prior to scheduled closing

- Collects, reviews and submits acceptable documentation in a timely manner. Ensures completeness, accuracy, and legibility of all documentation

- Monitors and/or ensures compliance with Federal and State laws and regulations, in addition to Company policies and procedures

- Demonstrates a high level of professionalism and integrity in all internal and external interactions with employees and customers

- Consistently communicates with borrower and GSM via email and telephone to ensure smooth loan processing and that issues are addressed/resolved in a timely manner

- Ensures that investor requirements are met and warehouse lines are protected

- Ensures that data integrity exists with every transaction

- Associate’s or Bachelor’s degree preferred

- A minimum of three (3) years of conventional, government and state bond loan processing experience required

- Previous experience with Encompass loan origination system preferred

- Thorough understanding of loan processing

- General understanding of all areas of the mortgage industry

- Strong analytical and problem solving ability

- Basic math skills including addition, subtraction, multiplication, division, percentages, and fractions

- Reviews newly originated mortgage loan applications for completeness and compliance with State and Federal regulations

- Rates the quality of newly originated loan applications. Provides results to GSM, Regional Sales Manager and certain members of the Operations Management Team

- Checks each loan package for customer e-Signature acceptance. Contacts GSM if not

- Orders ancillary services including appraisals, flood certificates and IRS transcripts

- Indexes loan documentation utilizing the appropriate place holders in the Encompass system

- Submits loans that pass the Quality Loan Review process directly to the underwriting department

- Issues Notice of Incompleteness notification to customers whose application is incomplete

- Collects, reviews and submits acceptable documentation in a timely manner

- Ensures completeness, accuracy, and legibility of all documentation

- Must be proficient and have a full understanding of RESPA regulations and related compliance knowledge preferred

- Order, process and review all loan file documentation, i.e. appraisal, title commitment, verifications of employment, deposits, etc. for accuracy and completeness

- Review each loan for compliance with all regulatory and investor guidelines

- Implement new investor processing guidelines

- Review and clear loan conditions for compliance with underwriting requirements

- Move loan to closing within 30 days of receipt on 90% of all loan files

- Manage an average pipeline of at least 60 loans a month

- Maintain data integrity of system data fields

- Maintain control of assigned files

- Monitor daily pipeline reports to identify negative trends or problem loans

- Log in and review daily mail

- Coordinate closing with clients, lender, closer and end investors as necessary

- Offer recommendations to streamline and improve processes for the benefit of the customer, and the bank

- Obtain “satisfactory” ratings on all compliance/ audit reviews

- Contact customer and lender on a weekly basis with status updates

- Must have experience processing full doc retail transactions

- Responsible for keeping borrower informed from the time loan is decision through closing

- Input proper loan information into the system for processing

- Review file documentation and make sure all items needed are requested. Order and coordinate loan documents

- Must have strong conventional, FHA, VA, and government loan mortgage processing experience

- Verifying funding on all 203k rehab loans

- Setting up accounting fund sheets and accounts

- Reviewing documentation for compliance with FHA guidelines

- Authorizing the release of funds from the escrow accounts

- Ordering checks for each draw amount within the loan account

- Balancing accounting fund sheet within each loan

- Managing pipeline of active renovation loans to ensure they are in compliance with HUD regulations

- Notify branches, correspondent lenders, inspectors or borrowers of necessary actions and/or documents required to have the rehabs progress in compliance with HUD regulations

- At least 3 years of relevant experience

Mortgage Loan Processor / Analyst Resume Examples & Samples

- Obtains and verifies all data and supporting documentation regarding a customer’s income, assets and liabilities

- Handles customer calls as needed and follows through to obtain any missing information supporting the customer’s application

- Ensures coordination and communication between internal and external customers (including Loan Officer, Realtor, Underwriting Department, Appraiser, Attorney, etc.)

- Monitors the flow of through underwriting and closing to ensure all conditions are met and file is closed on time

- Minimum 2 years’ experience processing VA, FHA, Conventional, NC Housing and VHDA loans

- Knowledge of FNMA/FHLMC, FHA, VA, NC Housing and VHDA underwriting guidelines

- Excellent organizational, oral and written communication skills

- Ability to perform in a fast-paced environment typical to Mortgage Banking

- Experience with Encompass software

- Maintain close communication with customers and internal Ditech partners to ensure proper and timely processing. Communicate with borrowers, Ditech Associates and Vendors in a manner that shows sensitivity, tact, and professionalism

- Determine appropriate documentation as required by processing option, DU, or other automated underwriting or evaluation tools

- Record and analyze all incoming information to ensure guideline compliance and evaluate loan feasibility

- Send written requests or make phone calls to customers, Title Companies/Attorneys, Realtors, and other third parties to obtain additional information required to fulfill the loan

- Issue customer correspondence in a timely manner: Incomplete application letters, Adverse Action notices, Commitment letters, required Re-disclosures and any agency or state specific documents

- Submit a well-documented and complete file to Underwriting that is ready for approval or denial decision

- Review underwriting decision. Contact borrower to communicate loan decision and review supporting items required

- Any other job responsibilities requested by management

- Excellent communication skills (written, verbal, listening)

- Proficiency in Microsoft word and Excel applications

- Encompass experience preferred

- Bi-lingual skills a plus

- Sound judgment skills

- Detail oriented and well organized

- Ability to work independently as well as part of a team

- Ability to handle high pressure situations with calm assurance

- Self-motivated/takes initiative

- Flexible hours may be required to accommodate customer needs

- Overtime may be required to meet deadlines

- Initiates and maintains contact with customers throughout the processing period, assisting them with any questions and notifying them of any additional information needed

- Satisfies conditions and ensures documentation meets requirements

- Sets and maintains proper expectations to all parties

- Performs final review of the completed application packages and prepares the file for approval, specifying any applicable conditions to the approval

- Prepares, if applicable, the "Decline Letter" and ensures accurate disclosure of the reason(s) for the adverse action at whatever time during the processing period it is determined that applicants do not qualify

- Researches problems and files documents as required

- Validate and analyze income documentation

- Calculate income from paystubs and validate to W-2’s

- Calculate self employed income

- Seek out additional documentation as needed to support the income used for qualification

- Address discrepancies

- Validate and analyze asset documentation provided

- Validate sufficient funds to close

- Validate required reserves

- Explain/remove inconsistent/large deposits

- Calculate asset value as required by applicable investor

- Perform initial appraisal review

- Complete the appraisal review form

- Seek corrections for issues and deficiencies

- Validate the appraisal to requirements

- Provide copy to borrower as required by regulations

- Validate ratio related debts

- Analyze credit report for accuracy. Request updates and clarifications as needed

- Run Automated Underwriting System (AUS) engines as needed and ensure supporting documentation required by the Automated Underwriting System (AUS) findings and the investor requirements are met prior to submitting the file to underwriting

- Review flood determination and take required action

- Collect appropriate documentation to clear applicable conditions set by the underwriter

- Complete required work to prepare the loan file for the closer

- Performs the role’s essential functions successfully using required systems and processes

- Meets established service levels for productivity, accuracy and customer service

- Open to change and learning new skills to improve work processes

- Understands processes and procedures necessary to successfully perform tasks

- Possesses the technical and computer skills required in the position

- Demonstrates the ability to learn rapidly and adapt quickly to new processes and technology

Junior Mortgage Loan Processor Resume Examples & Samples

- Gather information and take each file from underwriting decision to closing

- Obtain borrower documentation once underwriting decision has been obtained

- Responsible for ensuring that all loan documentation is complete accurate verified and complies with company policy

- Verify loan documents including income, assets, credit, appraisal and title insurance ultimately verifying application for final submission to underwriting

- Meet crucial deadlines requested

- Communicate with borrowers, fellow employees and clients in a manner that shows sensitivity, tact, and professionalism

- Knowledge of how to read DU findings

Mortgage Loan Processor / Set-up Co-ordinator Resume Examples & Samples

- Maintains and updates loan application information within loan origination software and other applications

- As applicable, orders appraisals, title, survey, verifications, and any other items required for loan approval; conducts regular follow-ups with outside sources regarding outstanding documents

- Verifies the data collected, analyzes, and decides whether it meets guidelines or if other documentation is needed; documents communication through the conversation log; ensures loan application is in compliance with underwriting, investor, RESPA, and HMDA guidelines

- Reviews all disclosures for completeness and compliance

- May facilitate training of junior or newly hired processors regarding specific Prime operations including file flow, loan origination software, and other applications