- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Deed of Trust: Definition, Uses

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Table of Contents

Deeds of trust vs. mortgages

How does a deed of trust work, deed of trust by state, deeds of trust vs. warranty deeds.

A deed of trust is a real estate transaction agreement that allows a third-party trustee to hold the property title until the borrower repays the lender in full. The third party in a deed of trust is typically a title company or real estate broker [0] Cornell Law School Legal Information Institute . Deed of Trust . Accessed Jun 1, 2023. View all sources .

Over half of states use deeds of trust instead of mortgages , which involve only two parties. However, in many states, home loans are colloquially referred to as “mortgages,” although they may legally be deeds of trust.

The main difference between a mortgage and a deed of trust is that if you fall behind on loan payments, the property can be foreclosed on more quickly with a deed of trust than with a mortgage.

A deed of trust is not to be confused with a living trust , which is an estate planning tool that helps avoid probate. It also doesn’t transfer ownership of the real property as a property deed does.

Deeds of trust and mortgages are lending agreements that place a lien, or legal claim until debt repayment, on real property. Here’s how they’re similar:

They’re subject to state laws.

Both are public record.

Both allow for foreclosure.

Both are considered contracts as opposed to loans.

However, there are two key differences:

Number of parties involved. A mortgage involves two parties: the lender and the borrower, while a deed of trust involves three parties: the lender, the borrower and the trustee.

Foreclosure type and time. Mortgages typically have to go through a judicial foreclosure, while deeds of trust generally can use a nonjudicial foreclosure process without involving the courts. Because a nonjudicial foreclosure process tends to be faster and less expensive than a judicial one, it usually takes less time and effort to foreclose with a deed of trust than with a mortgage.

As a home buyer, you don’t have the option to choose between a mortgage or a deed of trust, even if you live in one of the nine states that allow both. In those states, the lender chooses which document to use.

A deed of trust works similarly to a mortgage by making a piece of real property the collateral for a loan. This means that if you don’t make your loan payments on time, your lender can foreclose on the property. Unlike a mortgage, though, a deed of trust typically allows for foreclosure without the need to first obtain a court order.

Here’s how the process works:

The trust deed includes a promissory note that spells out the exact terms of the loan including the principal, interest, occupancy, insurance and maintenance requirements. The borrower signs this note, agreeing to repay the borrowed money.

The trustee holds legal ownership of the property or in some states just holds the lien, which is a legal claim to the asset, but has no control over that property unless the borrower doesn’t make their scheduled payments per the terms of the agreement.

While the buyer is making payments, the lender keeps the promissory note. Once the loan is paid off, however, the promissory note is marked “paid in full” and the deed is returned to the buyer. At this point, the buyer will own the property outright.

Requirements to create a deed of trust

A valid deed of trust must always involve three parties:

The borrower, also known as the trustor.

The lender, also known as the beneficiary .

The trustee, which is typically a title company that holds legal title to the real property or, in some states, just holds the lien.

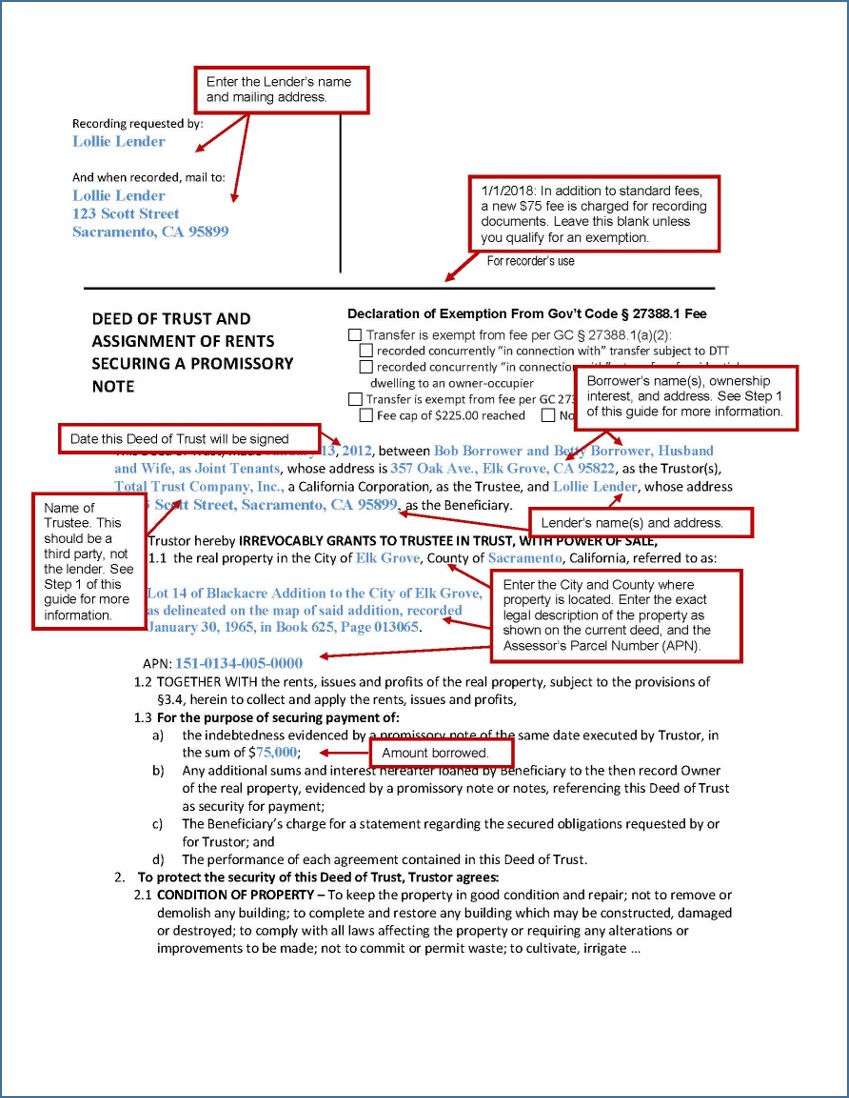

The deed of trust document should contain the following information:

The names of all the involved parties (borrower, lender and trustee).

A description of the property involved.

The original amount of the loan.

Loan inception and maturity dates.

Any fees or riders involved.

What will happen in the event of loan default.

Depending on the nature of the sale, any other relevant details.

The following states (and Washington, D.C.) use deeds of trust instead of mortgages:

California.

Massachusetts.

Mississippi.

New Hampshire.

New Mexico.

North Carolina.

Rhode Island.

Washington.

West Virginia.

Deeds of trust and mortgages are allowed in these states:

South Dakota.

All remaining states use only mortgages:

Connecticut.

New Jersey.

North Dakota.

Pennsylvania.

South Carolina.

A warranty deed is a document required by some lenders before they approve financing. It certifies that the seller is the true owner of the property and has the right to sell it and that there are no outstanding debts, liens, judgments or encumbrances on the property.

A deed of trust is a lending contract, while a warranty deed is offered by a seller to a buyer for the buyer’s protection.

You can deduct your loan interest payments on your income tax return for home mortgages and deeds of trust. To do so, just be sure the property has been recorded as your principal residence in your county records [0] IRS.gov . Publication 936 (2022), Home Mortgage Interest Deduction . Accessed Jun 1, 2023. View all sources .

If you have a loan secured by a deed of trust and your lender sells that trust deed, an assignment of trust deed assigns that deed of trust to the new buyer of your loan (typically another lender). The assignment of deed of trust grants the new loan purchaser all rights to the property and is recorded as public record along with the original deed of trust.

A reconveyance in a deed of trust is a transfer of property (minus the lien) to the borrower from the trustee or the lender. This happens when the borrower has paid off the loan and satisfied the terms of the debt, and it means the lender no longer has an interest in the property.

You can deduct your loan interest payments on your income tax return for home mortgages and deeds of trust. To do so, just be sure the property has been recorded as your principal residence in your county records

On a similar note...

Compare online will makers

Using a deed of trust

A deed of trust is used to secure a loan on real property. Learn how this legal document can be an easy way for a lender to collateralize a loan.

Find out more about property owners

by Brette Sember, J.D.

Brette is a former attorney and has been a writer and editor for more than 25 years. She is the author of more than 4...

Read more...

Updated on: February 1, 2023 · 2 min read

Understanding a deed of trust

Deed of trust vs. mortgage, wraparound mortgages, assignment of a deed of trust.

A deed of trust is a legal document that essentially puts a piece of property up as collateral for a loan. Although sometimes used in place of a mortgage, a deed of trust functions differently and makes foreclosing on the property simple for the lender.

A deed of trust is used with a loan when real property is used to secure the loan. The deed gives the lender the right to receive the proceeds of the sale of the property at auction if the loan is not paid. Unlike a warranty deed , which immediately transfers the owner's rights in the property to the buyer, a deed of trust is not intended to transfer title to a property unless the loan is unpaid.

A deed of trust has three parties:

- trustor: the property owner borrowing the money

- lender: the person or company making the loan, sometimes called the beneficiary

- trustee: the person or company (often an escrow company ) who holds legal title to the real property under the deed and has the responsibility of selling the property at auction if the trustor doesn't make the required payments on the loan

A mortgage and a deed of trust are both used to secure a loan, which is a separate document. One difference between these two legal documents is that a deed of trust has three parties (trustor, lender, and trustee) while a mortgage has only two (lender and borrower). In the case of a mortgage, if a borrower does not pay the associated loan, the property must be foreclosed on in court so that the lender can sell it. A deed of trust, on the other hand, does not require a court process. The trustee can sell the property without a court order if the trustor does not pay. Because of this, a deed of trust allows for a faster and less expensive process if the loan is not paid.

A wraparound mortgage, also known as an inclusive deed of trust, is used when there is an existing mortgage on the property that remains in place. For example, Sandra has a mortgage on her home. Marco buys the home with the promise to pay her the monthly mortgage amount she owes, which Sandra then uses to pay the mortgage in her name. This arrangement is made legally binding with a deed of trust. If Marco doesn't pay Sandra, she forecloses and gets the property back without a court proceeding. So in essence, Marco's loan wraps around the existing mortgage to cover it, hence the name for this type of deed of trust.

Like any deed, a deed of trust can be transferred from one person to another, similar to the way a bank can sell a loan to another bank. The document that transfers a deed of trust, called an assignment of a deed of trust, must be filed in the county clerk's office to be valid.

A deed of trust is a convenient way to avoid a court proceeding if a loan is not paid. This type of nonjudicial foreclosure is quick and inexpensive for the person or company lending the money. You can prepare a deed of trust yourself or you can use an online service provider .

You may also like

Why do I need to conduct a trademark search?

By knowing what other trademarks are out there, you will understand if there is room for the mark that you want to protect. It is better to find out early, so you can find a mark that will be easier to protect.

October 4, 2023 · 4min read

What is a power of attorney (POA)? A comprehensive guide

Setting up a power of attorney to make your decisions when you can't is a smart thing to do because you never know when you'll need help from someone you trust.

May 7, 2024 · 15min read

How to Start an LLC in 7 Easy Steps (2024 Guide)

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

May 16, 2024 · 22min read

Legal Dictionary

The Law Dictionary for Everyone

Deed of Trust

A deed of trust is an agreement that is made between a lender and a borrower, to allow a neutral third party to act as a trustee over a piece of property. The trustee holds legal title to the property until the borrower can pay off his debt. As he repays the debt, the borrower keeps the actual title to (and possession of) the property, and maintains full responsibility over the premises, unless the deed of trust says otherwise. The legal title to the property, however, is held by the trustee. To explore this concept, consider the following deed of trust definition.

Definition of Deed of Trust

- A document that secures a debt, in which a debtor places legal ownership of real property with a trustee, to be held in trust until the debt is repaid.

What is a Dead of Trust

A deed of trust is a legal document that a borrower and a lender agree to make, which permits a neutral third party to enter the fold as a trustee over a piece of real property. For example, the deed of trust permits the trustee to hold onto the property while the borrower repays his debt. During this time, the borrower keeps the actual title to the property, and remains fully responsible for the property. The trustee, on the other hand, holds on to the legal title.

Deeds of trust have become less popular as more people have opted for mortgages. One of the main differences between a deed of trust and a mortgage is that, with a mortgage, everyone involved in the transaction has a vested interest in the outcome of the arrangement. With a deed of trust, an impartial third party serves as trustee. For example, a deed of trust can only be sold by the trustee, who is not permitted to change the selling price to benefit either the borrower or lender.

Once the sale of a property under a deed of trust is finalized, the trustee distributes the proceeds to the lender, with the remainder to the borrower. The lender receives the amount necessary to fully satisfy the debt, and the borrower receives whatever is left over.

The term “trustee” refers to any person who is in a position of trust, responsibility, or authority for the benefit of another person. A trustee is “trusted” with another person’s property. Trustees may be responsible for carrying out certain tasks, but without the benefit of earning an income for their efforts. When it comes to real property, a trustee is a holder of the property, typically on behalf of a beneficiary . This means that the trustee holds the property for the beneficiary until the beneficiary is ready to take the property over.

Difference Between Deed of Trust and Mortgage

In order to better understand the difference between a deed of trust and a mortgage, it is important to first define promissory notes. A promissory note does as its name suggests: it contains a “promise” on the part of the borrower to repay the amount he is borrowing. A promissory note is essentially an IOU. Both mortgages and deeds of trust are considered promissory notes, and both use real property to secure the loan. This means that, if the borrower fails to make his monthly payments, the lender is permitted to foreclose on the property, based on the promise in the mortgage or deed of trust having been broken.

Many people believe that a mortgage is the loan that they take out on their property, but this is not actually true. The mortgage is the document that the borrower gives to the lender to allow the lender to place a lien on his property. If a property owner is unsure as to whether he has a mortgage or a deed of trust, the borrower can review the documents he received when the property was initially sold to him. The only time the difference between a deed of trust and a mortgage becomes an issue is if the property goes into foreclosure . This is because the foreclosure process is different for a property under deed of trust.

Foreclosure

Another difference between a deed of trust and a mortgage is the foreclosure process. A foreclosure is the sale of a piece of property by a lender when a borrower has failed to make his loan payments as agreed. The lender then sells the property to recoup what is owed so that the loan can be fully satisfied.

When a piece of property under a deed of trust goes into foreclosure, the foreclosure sale does not have to adhere to the same procedures that a foreclosure on a mortgaged property must heed. With a foreclosure on a mortgaged property, the rules are stricter, and the parties involved are held to a higher level of accountability. A foreclosure sale under a deed of trust, however, does not require court intervention in most states.

Power of Sale

A power of sale is a clause found in most deeds of trust that allow a trustee to sell the property if the borrower defaults on his loan, and the property goes into foreclosure. The courts have consistently held that a deed of trust with a power of sale clause effectively serves as the property owner’s permission for a trustee to conduct a nonjudicial foreclosure in the event that the borrower defaults on his payments. What this means is that the lender does not need to sue the borrower in state court. Instead, the lender instructs the trustee to mail or serve the required notices that the property will be auctioned off at a “trustee’s sale.”

Once the property is sold at the trustee’s sale, the borrower’s title is automatically terminated. The trustee then issues a deed transferring the legal title to the property to the highest bidder. The bidder then records that deed and becomes the new owner of record. This is why lenders prefer deeds of trust over mortgages. They can sell the property much more quickly, recovering the collateral of the loan without needing to incur the expenses that would be involved with suing the borrower.

The length of time that it takes to complete a trustee’s sale – or power of sale foreclosure – varies wildly, depending on the jurisdiction . Some states, like Virginia, have incredibly short time lines, Virginia’s being only two weeks. The process begins only when the lender or trustee records a notice of default, no matter how long the borrower has been in default on his payments. Poor economic conditions have also influenced states to extend the time in which to sell the property, understanding that it may take longer than usual to do so in a struggling economy.

Deed of Trust Form

For borrowers who wish to conduct their own real estate transactions, they can use a free deed of trust form, which can be found on the internet. They must file the completed and signed deed of trust form with the county clerk within the jurisdiction of their property. Filing the deed of trust form with the county clerk is crucial because the filing itself acts as a sort of notice to any interested parties that the property is being purchased under a deed of trust.

Assignment of Deed of Trust

An assignment of deed of trust transfers the interest that the original borrower had under the deed of trust to a new bank. Typically, the deed of trust is recorded shortly after the lender signs it. If further assignments of deed of trust are to follow, each must be recorded with the county clerk.

Lenders buy and sell loans all the time, with usually little to no effect on the borrower. The assignment of deed of trust simply serves as permission for one lender to sell the loan to another lender. Once the loan is re-assigned, the new lender takes over the same lien on the same piece of property, essentially stepping into the shoes of the prior lender. The borrower can be provided with a copy of the assignment of deed of trust upon repaying his debt in full.

Deed of Trust Example Concerning an Assignment of Deed of Trust

An example of a deed of trust action can be found in the case of Maria Mendoza v JPMorgan Chase Bank. In November of 2007, Maria and Juan Mendoza took out a loan in the amount of $540,600 from JPMorgan Chase Bank. The loan was secured by a deed of trust. In the loan, the Mendozas were listed as the borrowers, Chase as the lender and beneficiary, and North American Title Company as the trustee. Unfortunately, by March of 2011, the Mendozas had fallen behind on their payments – to the tune of nearly $55,000.

On March 4, 2011, Chase reassigned the deed of trust to Chase Home Finance, LLC. California Reconveyance Company then replaced North American Title Company as the trustee on the loan. California Reconveyance Company issued a notice to the Mendozas indicating their default on the loan and the trustee’s intention to sell the property. Maria Mendoza filed a lawsuit challenging the assignment of the deed of trust, as well as the substitution of California Reconveyance Company as trustee.

Mendoza’s argument was that Colleen Irby, who had signed the assignment as an officer of Chase, was actually an employee of California Reconveyance Company. Mendoza had gleaned this information from Irby’s LinkedIn.com page, where she identified herself as an employee of the latter. Mendoza therefore alleged that Irby acted fraudulently in performing the assignment. Mendoza accused Irby of being a “robo-signer,” which is someone who simply signs documents, with no legal authority whatsoever. Mendoza argued that the substitution of the trustee was equally fraudulent.

The defendants filed a motion to dismiss , which was ultimately granted by the trial court. Mendoza then appealed to California’s Court of Appeals for the Third District. The Court of Appeals ultimately affirmed the dismissal primarily because Mendoza failed to provide enough factual evidence in her complaint , and in her appeal . The court explained its decision, stating:

“We uphold the trial court’s ruling because plaintiff lacks standing to challenge the assignment of her loan and deed of trust. Plaintiff makes the rote assertion that if afforded the opportunity, she would provide more facts to coincide with the emerging jurisprudence . That promise does not meet her burden of disclosing in her briefing what new facts she can now state to revive her wrongful foreclosure claim. As a result, the trial court did not abuse its discretion by foreclosing additional amendments.”

The Court concluded by saying that:

“[Mendoza] offers no new factual allegations to merit an opportunity to further amend her complaint or to demonstrate that the trial court abused its discretion. She has had three opportunities to state a viable claim against these defendants and has fallen far short of the mark.”

Related Legal Terms and Issues

- Collateral – Something of value pledged as security for repayment of a loan.

- Defendant – A party against whom a lawsuit has been filed in civil court, or who has been accused of, or charged with, a crime or offense.

- Lien – An encumbrance placed on a person’s property to secure a debt the property owner owes to another person or entity.

- Promissory – Containing, implying, or having the nature of a promise.

- Search Search Please fill out this field.

What Is a Trust Deed?

Understanding trust deeds, trust deed vs. mortgage, what is included in a trust deed, foreclosures and trust deeds.

- Investing in Trust Deeds

- Real-World Example

The Bottom Line

- Personal Finance

Trust Deed: What It Is, How It Works, Example Form

:max_bytes(150000):strip_icc():format(webp)/troypic__troy_segal-5bfc2629c9e77c005142f6d9.jpg)

- Foreclosure: Definition, Process, Downside, and Ways To Avoid

- Avoid Foreclosure

- Workout Agreement

- Mortgage Forbearance Agreement

- Short Refinance

- Pre-foreclosure

- Deliquent Mortgage

- How Many Missed Mortgage Payments?

- When to Walk Away

- Phases of Foreclosure

- Judicial Foreclosure

- Sheriff's Sale

- Your Legal Rights in a Foreclosure

- Getting a Mortgage After Foreclosure

- Buying Foreclosed Homes

- Investing in Foreclosures

- Investing in REO Property

- Buying at an Auction

- Buying HUD Homes

- Absolute Auction

- Bank-Owned Property

- Deed in Lieu of Foreclosure

- Distress Sale

- Notice of Default

- Other Real Estate Owned (OREO)

- Power of Sale

- Principal Reduction

- Real Estate Owned (REO)

- Right of Foreclosure

- Right of Redemption

- Tax Lien Foreclosure

- Trust Deed CURRENT ARTICLE

- Voluntary Seizure

- Writ of Seizure and Sale

- Zombie Foreclosure

A trust deed —also known as a deed of trust —is a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property. The trust deed represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

Although trust deeds are less common than they once were, some 20 states still mandate the use of one, rather than a mortgage , when financing is involved in the purchase of real estate. Trust deeds are common in Alaska, Arizona, California, Colorado, Idaho, Illinois, Mississippi, Missouri, Montana, North Carolina, Tennessee, Texas, Virginia, and West Virginia.

A few states—such as Kentucky, Maryland, and South Dakota—allow the use of both trust deeds and mortgages.

Key Takeaways

- In financed real estate transactions, trust deeds transfer the legal title of a property to a third party—such as a bank, escrow company, or title company—to hold until the borrower repays their debt to the lender.

- Trust deeds are used in place of mortgages in several states.

- Investing in trust deeds can provide a high-yielding income stream.

Investopedia / Danie Drankwalter

A trust deed is a transaction between three parties:

- Lenders , officially known as beneficiaries . These are the interests a trust is supposed to protect.

- A borrower , otherwise known as a trustor . This is the person who establishes a trust.

- A trustee , a third party charged with holding the entrusted property until a loan or debt is paid for in full.

In a real estate transaction—the purchase of a home, say—a lender gives the borrower money in exchange for one or more promissory notes linked to a trust deed. This deed transfers legal title to the real property to an impartial trustee , typically a title company, escrow company, or bank, which holds it as collateral for the promissory notes . The equitable title—the right to obtain full ownership—remains with the borrower, as does full use of and responsibility for the property.

This state of affairs continues throughout the repayment period of the loan. The trustee holds the legal title until the borrower pays the debt in full, at which point the title to the property transfers to the borrower. If the borrower defaults on the loan, the trustee takes full control of the property.

Trust deeds and mortgages are both used in bank and private loans for creating liens on real estate, and both are typically recorded as debt in the county where the property is located. However, there are some differences.

Number of Parties

A mortgage involves two parties: a borrower (or mortgagor) and a lender (or mortgagee). When a borrower signs a mortgage, they pledge the property as security to the lender to ensure repayment.

In contrast, a trust deed involves three parties: a borrower (or trustor), a lender (or beneficiary), and the trustee. The trustee holds title to the lien for the lender's benefit; if the borrower defaults, the trustee will initiate and complete the foreclosure process at the lender's request.

Type of Foreclosure

In the event of default, a deed of trust will result in different foreclosure procedures than a mortgage. A defaulted mortgage will result in a judicial foreclosure, meaning that the lender will have to secure a court order. Trust deeds go through a non-judicial foreclosure, provided that they include a power-of-sale clause.

Judicial foreclosures are more expensive and time-consuming than non-judicial foreclosures. This means that in states that allow them, a deed of trust is preferable to a mortgage from the lender's point of view.

Contrary to popular usage, a mortgage is not technically a loan to buy a property; it's an agreement that pledges the property as collateral for the loan.

A deed of trust will include the same type of information stated in a mortgage document, such as:

- The identities of the borrower, lender, and trustee

- A full description of the property to be placed in trust

- Any restrictions or requirements on the use of the property while it is in trust

- The terms of the loan, including principal, monthly payments, and interest rate

- The terms of any late fees and penalties in the event of repayment

In addition, a trust deed will also include a power of sale clause that gives the trustee the right to sell the property if the borrower defaults.

Mortgages and trust deeds have different foreclosure processes. A judicial foreclosure is a court-supervised process enforced when the lender files a lawsuit against the borrower for defaulting on a mortgage. The process is time-consuming and expensive.

Also, if the foreclosed property auction doesn't bring in enough money to pay off the promissory note, the lender may file a deficiency judgment against the borrower, suing for the balance. However, even after the property is sold, the borrower has the right of redemption : they may repay the lender within a set amount of time and acquire the property title.

In contrast, a trust deed lets the lender commence a faster and less expensive non-judicial foreclosure, bypassing the court system and adhering to the procedures outlined in the trust deed and state law. If the borrower does not make the loan current, the property is put up for auction through a trustee's sale.

The title transfers from the trustee to the new owner through the trustee's deed after the sale. When there are no bidders at the trustee sale, the property reverts to the lender through a trustee's deed. Once the property is sold, the borrower has no right of redemption.

Furthermore, a trustee has the responsibility of paying the proceeds from the sale to the borrower and lender after the sale is finalized. The trustee will pay the lender the amount left over on the debt and pay the borrower anything that surpasses that amount, thereby allowing the lender to purchase the property.

Pros and Cons of Investing in Trust Deeds

Investors who are searching for juicy yields sometimes turn to the real estate sector—in particular, trust deeds.

In trust deed investing, the investor lends money to a developer working on a real estate project. The investor's name goes on the deed of trust as the lender. The investor collects interest on the loan; when the project is finished, the principal is returned to the investor in full. A trust deed broker usually facilitates the deal.

High-yielding income stream

Portfolio diversification

Illiquidity

No capital appreciation

What sort of developer enters this arrangement? Banks are often reluctant to lend to certain types of developments, such as mid-size commercial projects—too small for the big lenders, too big for the small ones—or developers with poor track records or too many loans. Cautious lenders may also move too slowly for developers up against a tight deadline for commencing or completing a project.

Developers like these are often in a bit of a crunch. For these reasons, trust deed investors may often expect high interest rates on their money. They can reap the benefits of diversifying into a different asset class without having to be experts in real estate construction or management. This is a form of passive investment .

Trust deed investing has certain risks and disadvantages. Unlike stocks, real estate investments are not liquid , meaning investors cannot retrieve their money on demand. Also, investors can expect only the interest the loan generates; any additional capital appreciation is unlikely.

Invested parties may exploit any legal discrepancies in the trust deed, causing costly legal entanglements that may endanger the investment. The typical investor with little experience may have difficulty, as it takes specific expertise to find credible and trustworthy developers, projects, and brokers.

Real-World Example of a Trust Deed

A short-form deed of trust document used in Austin County, Texas , covers the requirements for most lenders. The form begins with a definition of terms and spaces for the borrower, lender, and trustee to fill in their names. The amount being borrowed and the address of the property are also required.

After this section, the document goes on to specify the transfer of rights in the property and uniform covenants including:

- Details about payment of principal and interest

- Escrow funds

- Property insurance and structure maintenance

- Structure occupancy—stipulating the borrower must take up residency within 60 days

The form also includes nonuniform covenants, which specify default or breach of any of the agreement terms. And it specifies that the loan the document deals with is not a home equity loan —that is, something the borrower will receive cash from—but one for purchasing the property.

The deed of trust ends with a space for the borrower's signature, which must be done in the presence of a notary and two witnesses, who also sign.

What Is Assignment in a Deed of Trust?

In real estate law, " assignment " is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.

What Is Reconveyance in a Deed of Trust?

In real estate law, reconveyance means the transfer of a property from a lender or trustee to a borrower. This usually happens at the end of a mortgage or other loan, when the borrower has satisfied the terms of their debt.

Who Can Be a Trustee in a Deed of Trust?

Some states have laws limiting who can act as a trustee in a deed of trust. In these states, the trustee must be a bank, credit union, thrift, title insurance company, attorney, or other company specifically authorized to hold a trust. In other states, anyone can act as a trustee.

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee. Only after the borrower has satisfied the terms of their debt to the lender will the property be fully transferred to the borrower.

Rocket Lawyer. " Which States Allow Deeds of Trust? "

Legal Information Institute. " Non-Judicial Foreclosure ."

Legal Zoom. " Naming a Trustee in Your Deed of Trust ."

:max_bytes(150000):strip_icc():format(webp)/CreditKarmaHomeTheBalanceDesktop-5ce0ca77a10445b98f7bc73d4e37580b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Deed of Trust

Jump to Section

What is a deed of trust.

A deed of trust, also called a trust deed, is a legal agreement made at a property's closing. It is a type of secured real estate transaction used in some states in place of a mortgage. The individual purchasing a property and a lender make this agreement, which states that the property buyer will repay a loan. A third party, known as a trustee, holds the property's legal title until the loan gets paid in full.

A deed of trust is the security for a loan and gets recorded in public records. Some states will require a borrower to sign a deed of trust to take out a home loan, much like other states require signing a mortgage. Fundamental differences exist between deeds of trust and mortgages, however. For example, a deed of trust requires more people to be involved in the property sale than a mortgage would. Only a mortgage gets executed through the judicial system.

What Must a Deed of Trust Include?

To be considered a legally binding document, any deed of trust needs to cover several critical details. Required information includes the following:

- Original loan amount

- Description of the property used as collateral or security ( here is an article about using collateral for a loan)

- Names of all parties involved (such as trustor, beneficiary, and trustee)

- The inception date of the loan

- The maturity date of the loan

- Any fees, such as late fees

- Provision and requirements of the mortgage

- Legal procedures in case of default, such as a power of sale clause ( here is an article about power of sale)

- Acceleration and alienation clauses to explain when the homeowner is considered delinquent or what happens when the individual sells the property

- Any riders with clauses such as terms of an adjustable-rate mortgage or prepayment penalties

Who Is Involved With a Deed of Trust?

Three parties must be involved with any deed of trust:

- Trustor: This party is the borrower. A trustor is sometimes called an obligor.

- Trustee: As a third party to a deed of trust, the trustee holds the property's legal title.

- Beneficiary: This party is the lender.

A trustee represents neither the borrower nor the lender. Instead, the trustee is an entity that holds the power of sale in case a borrower defaults. The trustee is typically a title or escrow company.

How Does a Deed of Trust Work?

A borrower gives a lender one or more promissory notes in exchange for the deed of trust. Promissory notes are documents that the borrower signs which state the borrower's promise to pay back a debt. The promissory note will contain information such as the interest rate along with other obligations of the agreement.

After the borrower pays the deed in full, the trustee will reconvey the property to its buyer. A promissory note is marked as paid in full once the buyer pays the loan entirely, and the property buyer receives the deed.

A trustee may file a notice of default if the borrower does not pay following the terms of the promissory note. A trustee may also substitute a different trustee for handling foreclosure.

Get Free Bids to Compare

Leverage our network of lawyers, request free bids, and find the right lawyer for the job.

Deed of Trust Versus Mortgage

A deed of trust and a mortgage serve a similar purpose, but some key distinctions exist between the two types of legal documents.

Differences Between Deeds of Trusts and Mortgages

Significant differences between the two documents include the following:

- Foreclosure type: The foreclosure type a property owner faces will depend on whether the property owner has a deed of trust or mortgage. Someone who has a deed of trust typically faces a nonjudicial foreclosure, while a lender will need to go through the courts if a mortgage comes into play.

- Expense and length of foreclosure process: Since a lender will have to seek judicial foreclosure to take back a property using a mortgage loan, a mortgage generally takes more money and time for foreclosure proceedings. As a result, mortgage lenders tend to use deeds of trust in states that allow them. A lender will almost always spend less time and incur lower costs reclaiming a property when using a deed of trust instead of a mortgage.

- Parties involved: Only two parties, a borrower and a lender, are engaged in a mortgage contract. A deed of trust has a trustee, the neutral third party, involved in addition to the borrower and lender.

Similarities Between Deeds of Trusts and Mortgages

The two agreements also have a few significant similarities, including:

- Both agreements are distinct from loans: Neither a deed of trust nor a mortgage is a home loan. The loan states that a property owner will pay back a set amount of money to a lender, while both a deed of trust and a mortgage place a lien on a property.

- Both agreements allow for foreclosure: Both a deed of trust and mortgage give a lender a method of taking back a property via foreclosure. These agreements essentially state that if the borrower does not follow the loan terms, the lender can put the property into foreclosure.

- State law dictates both types of agreements: Both mortgages and foreclosure deeds are subject to state laws. The specific type of contract a lender must use will depend on what is legal in a particular state.

Image via Unsplash by tierramallorca

Deed of Trust Versus Promissory Note

A deed of trust often requires a promissory note, but the promissory note is a specific document type. While a deed of trust describes the terms of debt as secured by a property, a promissory note acts as a promise that the borrower will pay the debt.

A borrower signs the promissory note in favor of a lender. The promissory note includes the loan's terms, such as payment obligations and the loan's interest rate. However, although the promissory note is usually a separate document, both a deed of trust and a mortgage can be legally considered a type of promissory note.

During the term of a loan, a lender keeps the promissory note, and the borrower only has a copy of the note. Once the borrower pays off the loan, the promissory note is marked as "paid in full." Then, the borrower receives the note with a recorded reconveyance deed.

Can You Use a Deed of Trust Anywhere?

State law governs the use of both deeds of trust and mortgages. Some states only legally allow mortgages, while other states only allow lenders to use deeds of trust. A few states will allow either type of contract. In these states, the lender gets to choose the type of agreement a borrower receives. Some states use neither mortgages nor deeds of trust but instead use other contracts such as security deeds for loan transactions to give lenders a security interest in the property.

Since state laws vary regarding the type of document you can use, it's always essential to consult with an experienced lawyer to discuss legal options and your state's requirements. A lawyer can also help ensure that you create and use a legally binding document that protects you in your specific situation regarding real estate transactions for residential or commercial property.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Need help with a Deed of Trust?

Meet some of our deed of trust lawyers.

Experienced attorney and tax analyst with a history of working in the government and private industry. Skilled in Public Speaking, Contract Law, Corporate Governance, and Contract Negotiation. Strong professional graduate from Penn State Law.

I've been a Real Estate attorney for over 25 years. I handle real estate transactions, commercial collections, foreclosures, replevins, landlord tenant issues and small business matter.

My career interests are to practice Transactional Corporate Law, including Business Start Up, and Mergers and Acquisitions, as well as Real Estate Law, Estate Planning Law, Tax, and Intellectual Property Law. I am currently licensed in Arizona, Pennsylvania and Utah, after having moved to Phoenix from Philadelphia in September 2019. I currently serve as General Counsel for a bioengineering company. I handle everything from their Mergers & Acquisitions, Private Placement Memorandums, and Corporate Structures to Intellectual Property Assignments, to Employment Law and Beach of Contract settlements. Responsibilities include writing and executing agreements, drafting court pleadings, court appearances, mergers and acquisitions, transactional documents, managing expert specialized legal counsel, legal research and anticipating unique legal issues that could impact the Company. Conducted an acquisition of an entire line of intellectual property from a competitor. In regards to other clients, I am primarily focused on transactional law for clients in a variety of industries including, but not limited to, real estate investment, property management, and e-commerce. Work is primarily centered around entity formation and corporate structure, corporate governance agreements, PPMs, opportunity zone tax incentives, and all kinds of business to business agreements. I have also recently gained experience with Estate Planning law, drafting numerous Estate Planning documents for people such as Wills, Powers of Attorney, Healthcare Directives, and Trusts. I was selected to the 2024 Super Lawyers Southwest Rising Stars list. Each year no more than 2.5% of the attorneys in Arizona and New Mexico are selected to the Rising Stars. I am looking to further gain legal experience in these fields of law as well as expand my legal experience assisting business start ups, mergers and acquisitions and also trademark registration and licensing.

Small firm offering business consultation and contract review services.

Scott graduated from Cardozo Law School and also has an English degree from Penn. His practice focuses on business law and contracts, with an emphasis on commercial transactions and negotiations, document drafting and review, employment, business formation, e-commerce, technology, healthcare, privacy, data security and compliance. While he's worked with large, established companies, he particularly enjoys collaborating with startups. Prior to starting his own practice in 2011, Scott worked in-house for over 5 years with businesses large and small. He also handles real estate leases, website and app Terms of Service and privacy policies, and pre- and post-nup agreements.

Michelle F.

I provide comprehensive legal and business consulting services to entrepreneurs, startups and small businesses. My practice focuses on start-up foundations, business growth through contractual relationships and ventures, and business purchase and sales. Attorney with a demonstrated history of working in the corporate law industry and commercial litigation. Member of the Bar for the State of New York and United States Federal Courts for the Southern and Eastern Districts of New York, Southern and eastern District Bankruptcy Courts and the Second Circuit Court of Appeals. Skilled in business law, federal court commercial litigation, corporate governance and debt restructuring.

I am a corporate and business attorney in Orange County, CA. I advise start-ups, early-growth companies, investors, and entrepreneurs in various sectors and industries including technology, entertainment, digital media, healthcare, and biomedical.

Find the best lawyer for your project

Real Estate

North Carolina

I am looking for a Warranty Deed for the sale of property in St. Croix, USVI. All forms I locate are specific to one of the US 50 states.

State listed below as my state is not relevant ... I need a Warranty Deed form or written up for USVI property.

You will need to consult with a real estate attorney in USVI.

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Real Estate lawyers by top cities

- Austin Real Estate Lawyers

- Boston Real Estate Lawyers

- Chicago Real Estate Lawyers

- Dallas Real Estate Lawyers

- Denver Real Estate Lawyers

- Houston Real Estate Lawyers

- Los Angeles Real Estate Lawyers

- New York Real Estate Lawyers

- Phoenix Real Estate Lawyers

- San Diego Real Estate Lawyers

- Tampa Real Estate Lawyers

Deed of Trust lawyers by city

- Austin Deed of Trust Lawyers

- Boston Deed of Trust Lawyers

- Chicago Deed of Trust Lawyers

- Dallas Deed of Trust Lawyers

- Denver Deed of Trust Lawyers

- Houston Deed of Trust Lawyers

- Los Angeles Deed of Trust Lawyers

- New York Deed of Trust Lawyers

- Phoenix Deed of Trust Lawyers

- San Diego Deed of Trust Lawyers

- Tampa Deed of Trust Lawyers

ContractsCounsel User

Deed to home & Airbnb

Location: california, turnaround: a week, service: drafting, doc type: deed of trust, number of bids: 2, bid range: $675 - $1,600, promissory note secured by deed of trust, turnaround: less than a week, bid range: $1,200 - $2,000, want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Contact Us: (916) 442-4204 Tap Here To Call Us

A Deed of Trust can be Assigned Apart from the Note, and that often occurs just before a foreclosure. But What Does That Mean? Not Much, the Deed of Trust is Inseparable from the Note

Notes and Deeds of Trust are often assigned to different parties. The question posed is what happens if the Deed of Trust alone is assigned ? A typical assignment of the Deed of Trust alone will purport to assign “all beneficial interest under that certain Deed of Trust dated xyz..” But the long-established law in California is clear: the beneficial interest under a Deed of Trust is held by the party who holds the Note (or is entitled to enforce it), without regard to the assignment of the Deed of Trust .

The subject was again addressed by the California Courts in Domarad v. Fisher & Burke, Inc. (1969) 270 Cal. App. 2d 543 ). The Court noted that a deed of trust is a mere incident of the debt it secures and that an assignment of the debt carries with it the security. “The deed of trust is inseparable from the debt and always abides with the debt, and it has no market or ascertainable value, apart from the obligation it secures and that a deed of trust has no assignable quality independent of the debt, it may not be assigned or transferred apart from the debt, and an attempt to assign the deed of trust without a transfer of the debt is without effect. (emph. added)”

In Stockwell v. Barnum ((1908) 7 Cal. App. 413) the Court stated that this Code “is wholly foreign to deeds of trust, which, instead of creating a lien only, as in the case of a mortgage, passes the legal title to the trustee, thus enabling him in executing the trust to transfer to the purchaser a marketable record title. It is immaterial who holds the note. The transferee of a negotiable promissory note, payment of which is secured by a deed of trust whereby the title to the property and power of sale in case of default is vested in a third party as trustee, is not an incumbrancer to whom power of sale is given…” Stockwell @ 417.

And more recently “it has been established since 1908 that this statutory requirement that an assignment of the beneficial interest in a debt secured by real property must be recorded in order for the assignee to exercise the power of sale applies only to a mortgage and not to a deed of trust.” ( Calvo v. HSBC Bank USA, N.A. (2011) 199 Cal.App.4th 118 , 122.)

Why is that? There is a technical difference between the two security instruments. The mortgage only involves two parties –the borrower who grants the power of sale to the lender, and the lender who then holds the beneficial interest in the mortgage plus the power of sale. A deed of trust, on the other hand, involves three parties: the borrower, the lender, and the trustee who is granted conditional title to the encumbered property as well as the power of sale.

Thus, the deed of trust may thus be assigned one or multiple times over the life of the loan it secures. But if the borrower defaults on the loan, only the current beneficiary may direct the trustee to undertake the nonjudicial foreclosure process. “[O]nly the ‘true owner’ or ‘beneficial holder’ of a Deed of Trust can bring to completion a nonjudicial foreclosure under California law.” Yvanova v. New Century Mortgage (62 Cal. 4th 919) (2016)

An Alternative The Commercial Code also provides a mechanism for recording an assignment of the security if there has been an off-record transfer of the note but no recorded assignment of the deed of trust or mortgage. The buyer of the note can record a copy of the transfer agreement whereby the note was acquired, together with a sworn statement that a default has occurred, and in that event may proceed with a nonjudicial foreclosure. ( Cal. Com. Code, § 9607, subd. (b))

Photos: flickr.com/photos/discoveroregon/49807993897/sizes/l/ flickr.com/photos/mlp52/5208316490/sizes/l/ flickr.com/photos/hazphotos/2615058018/sizes/c/

- LEGAL GLOSSARY

More results...

- Browse By Topic – Start Here

- Self-Help Videos

- Documents & Publications

- Find A Form

- Download E-Books

- Community Organizations

- Continuing Legal Education (MCLE)

- SH@LL Self-Help

- Free Legal Consultation (Lawyers In The Library)

- Ask a Lawyer

- Onsite Research

- Interlibrary Loan

- Document Delivery

- Borrower’s Account

- Book Catalog Search

- Passport Services

- Contact & Hours

- Library News

- Our Board of Trustees

- My E-Commerce Account

SacLaw Library

Www.saclaw.org.

We will be closed Monday, May 27th for Memorial Day.

- Documentary Transfer Tax

- Identifying grantors and grantees

- Free Sources

- Community Resources

Deed of Trust and Promissory Note

Templates and forms.

A deed of trust, also called a trust deed, is the functional equivalent of a mortgage. It does not transfer the ownership of real property, as the typical deed does. Like a mortgage, a trust deed makes a piece of real property security (collateral) for a loan. If the loan is not repaid on time, the lender can foreclose on and sell the property and use the proceeds to pay off the loan.

Deed of trust is not used for transferring property to a trust A trust deed is not used to transfer property to a living trust (use a Grant Deed for that). Other than the terminology, trust deeds and living trusts have nothing in common. A living trust is used to avoid probate, not to provide security for a loan. Visit our page on Estate Planning for more information on that topic.

A trust deed is always used together with a promissory note (also called “prom note”) that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

A trust deed gives the third-party “trustee” (usually a title company or real estate broker) legal ownership of the property. This means that the trustee has no control over the property as long as the borrower (aka property owner or “trustor”) makes the agreed-upon loan payments and keeps the other promises in the trust deed. If the borrower defaults, however, the trustee has the power to sell the property to pay off the loan without having to file an action in court. The lender (also known as “beneficiary”) is then repaid from the proceeds.

Step-by-Step Instructions

Determine the parties to the agreement.

There will be three parties to these agreements. Identifying these parties ahead of time will make it easier to complete the forms.

Beneficiary

The beneficiary, more commonly known as the lender, is the person or company that lends the borrower money, and who will be entitled to be repaid from the proceeds of a foreclosure. If the lender is a corporation, be sure to include language such as “Lender is a corporation organized and existing under the laws of California” in your documents.

Borrower(s)

If there are two or more borrowers, they will be borrowing the money “jointly and severally.” This means each debtor is responsible (liable) for the entire amount of the debt. A creditor may collect from whichever debtor has the “deep pocket” (lots of money); the debtor who pays may demand contributions from the other debtors. Joint borrowers will want to carefully consider whether or not they wish to be jointly responsible with their co-borrower.

When the property used as security for the loan is owned by more than one person, you may want to consider who you will name as borrowers and owners of the property on the deed of trust. The names of all owners of the property, and their spouses, must be included to give the entire property (all owners’ interests in the property) as security. A co-owner can only give as security his or her interest in the property. In other words, a lender wants to be sure that all owners and their spouses sign the deed of trust as a condition of lending the money (unless the lender is willing to take as security one co-owner’s interest in property).

When a bank or savings and loan finances the purchase of real estate, the trustee is almost always a title or trust company. Sometimes real estate brokers act as trustees. Attorneys commonly write in the name of a title company as trustee on a trust deed, without consulting the title company. Title companies even give out trust deed forms with their names already printed in the “trustee” space. They don’t mind being named as trustee because a trustee has nothing to do unless the borrower defaults. If that happens, most title or escrow companies turn the deed over to a professional foreclosure firm.

Prepare the Deed of Trust and Promissory Note

The Deed of Trust and Promissory Note must be in a format that the Sacramento County Clerk/Recorder’s Office will accept. Customizable templates may be downloaded from these links:

- Promissory Note

- Deed of Trust

Sample filled-in forms with instructions are available at the end of this Guide.

Get the Signatures Notarized

Notarization is required before recording these documents with the County Recorder. The notary’s acknowledgment of the trustor’s signature is formal proof that the signature is genuine. You can find a notary at your bank, a mailing service, or in the Yellow Pages. with instructions are available at the end of this Guide.

Record the Signed Documents at the County Recorder’s Office

Take the original signed and notarized Deed of Trust and Promissory Note to the County Recorder’s Office for the county where the property is located. In Sacramento, this is at 3636 American River Drive, Ste. 110, Sacramento CA 95864. You will need to pay a fee (you can check the current recording fees in Sacramento ). The clerk in the recorder’s office will take your original documents and stamp them with the date, time, a filing number, and book and page numbers. The original documents will be mailed back to you. Note: trust deeds are exempt from the documentary transfer tax. California Revenue and Taxation Code § 11921 .

What Happens Next?

If the borrower pays off the loan without defaulting (as happens in most cases), the beneficiary (lender) will request the trustee execute and record a deed reconveying the property to the borrower. You can find a Deed of Full Reconveyance on the Find A Form page of our website.

For more Information

At the law library:.

Deeds for California Real Estate KFC 170 .R36 (Self Help)

The Deed of Trust must be in a format the Sacramento County Recorder’s Office will accept. See the sample templates of the Deed of Trust and the Promissory Note below.

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.

Assignment of Deed of Trust (Commercial Real Estate Loan) (TX) | Practical Law

Assignment of Deed of Trust (Commercial Real Estate Loan) (TX)

Practical law standard document w-035-0853 (approx. 18 pages).

Assignment of Deed of Trust and Note (Commercial) (NC)

This template is an assignment of deed of trust and note that may be used to assign and transfer an existing deed of trust on North Carolina real property from the current lender to a new lender. This template includes practical guidance and drafting notes. Assignment of deeds of trust should be recorded in the same place as the deed of trust was originally recorded, which is in the office of the county clerk in the county where the subject property is located. See N.C. Gen. Stat. § 47-20.1. With respect to formatting, North Carolina law states that the recorder's office may charge an additional fee if a document submitted for recording does not comply with the following requirements: • Be on 8.5 x 11 or 8.5 x 14 inch white paper • Contain legible print • Be in black ink typed or printed in a font size no smaller than 9 points • Have a three-inch blank margin at the top of the first page • Have blank margins of at least one-half inch on the remaining sides of the first page and on all sides of subsequent pages • Have text typed or printed on one side of a page only • Have the type of instrument identified at the top of the first page See N.C. Gen. Stat. § 161-14. Additionally, the name and address of the person who prepared and drafted the assignment should be printed on the first page. See N.C. Gen. Stat. § 47-17.1. For further information on recording requirements in North Carolina, see Commercial Real Estate Financing (NC). Promissory notes are negotiable instruments under the North Carolina Uniform Commercial Code. See N.C. Gen. Stat. § 25-3-104. A note should be assigned by indorsement, either to a named assignee or through an indorsement in blank in which the holder of the note is whoever is currently in possession of the note. An ""allonge"" stating ""pay to the order of"" may be attached to a promissory note to achieve an indorsement. See N.C. Gen. Stat. § 25-3-204. A separate assignment of the related deed of trust must be recorded in the county land records where the deed of trust was recorded. North Carolina courts have held that the promise to pay a deed of trust is also a promise to pay a promissory note secured by such deed of trust. However, the evidence of transfer is strictly construed, and particularly if there is a power of sale clause, separate documents should be prepared to assign the note and the deed of trust. See In re Foreclosure of a Deed of Tr. Executed by Hannia M. Adams & H. Clayton Adams, 204 N.C. App. 318, 693 S.E.2d 705 (2010). For a North Carolina allonge template, see Allonge to Note (Commercial) (NC). For further guidance on recording an assignment of deed of trust in North Carolina, see Commercial Real Estate Financing (NC). For further information on promissory notes, see Promissory Notes (Acquisition Loan). For information on the Uniform Real Property Electronic Recording Act, see Uniform Real Property Electronic Recording Act State Law Survey. See also N.C. Gen. Stat. § 47-16.4.

It looks like Graceland won't be auctioned off. But how did the possibility ever occur?

Amid the ongoing foreclosure debacle of the Graceland estate , Shelby County Register of Deeds said that they do not have a deed of trust on file for the property.

A representative from the Shelby County Register of Deeds said that this was extremely uncommon and that a typical document filed during foreclosure proceedings like an assignment of substitute trustee or substitute trustee's deed were not on file in the office either.

Wednesday morning, a Memphis judge ruled that a foreclosure auction of Elvis Presley’s iconic Graceland estate cannot proceed. Chancellor JoeDae Jenkins issued the ruling in Shelby County Chancery Court in Memphis. Representatives from the company behind the sale did not appear in court.

Shortly after the hearing, The Daily Memphian reported that "someone claiming to represent the company," said in an email statement Naussany Investments and Private Lending would be dropping their case.

However, the Shelby County Chancery Clerk's office confirmed it has not received any correspondence from Naussany Investments since the court proceeding ended Wednesday.

Why was a foreclosure sale possible for Graceland?

Public notice for the foreclosure sale of the property was posted earlier this month . The notice alleged that Promenade Trust, which controls the Graceland estate at 3734 Elvis Presley Blvd., owed $3.8 million to Naussany Investments and Private Lending after failing to repay a loan taken out by Lisa Marie Presley on May 16, 2018. Naussany says Graceland was used as collateral on the loan.

A foreclosure is the forced sale of a property due to non-payment of a loan. The lender will sell the property to recover the loss of funds due to the owner not paying the balance of a loan.

Tennessee is a "deed of trust state," meaning that in the event of a default on a loan, the lender is required to publicly notice a public sale of the property. This non-judicial sale of a property can be done without going through the courts.

"Tennessee specifically does have a very quick ability for non-judicial foreclosure sale," John D Smith, a real estate attorney in Memphis said.

In Tennessee, the lender is required by state law to issue a notice advertising a public sale for three consecutive weeks in a newspaper of local circulation. Naussany Investments and Private Lending LLC advertised the notice of foreclosure sale in The Commercial Appeal for three consecutive weeks beginning on May 5.

"It used to be some time ago that there was a requirement that you had to give an actual notice of default to the borrower and that the publication could not start until 60 days had passed from that initial notice of default," Smith said.

Attorneys: Potential Graceland foreclosure was unusual

Darrell Castle, another attorney who specializes in foreclosures in Memphis, said that these circumstances are not common.

"I'm not sure I have seen it before. OK, of course, I've only been doing this for 40 years," Castle said. "How do you foreclose without it, without a deed (of trust)? I don't get that one."

Smith also said this is uncommon, and it complicates the foreclosure process.

According to Rocket Mortgage , a deed of trust is a documented agreement between a lender and a home buyer at the closing of a property. A deed of trust is similar to a mortgage but involves a third party that uses the home as collateral for a loan.

The third party holds the estate's legal title, in the event that the purchaser cannot pay the loan the third party would then hold the rights to the property.

In the case of the Graceland estate, there is no deed of trust on file for the property. Smith said in the case of the now defunct foreclosure sale of Graceland, Tennessee is a "race-notice state," which means that a deed of trust must be of record in order for it to be enforceable.

"If it's true, that (the deed of trust) is not there, I think that that would give a strong case for Elvis's heirs or granddaughter to make the case that this is a fraudulent transaction," Smith said.

Memphis-based law firm Morton and Germany is representing Keough and Promenade Trust. During Wednesday's hearing, attorney Jeff Germany argued that without any opposition present, the court should adhere to the facts presented before it. Germany discussed the alleged falsified deed of trust attached to the lawsuit.

In the lawsuit, the defense claims a stamp from notary Kimberly Philbrick, whose notary stamp appeared to be listed on the deed of trust, was forged. Germany said Philbrick has attested she did not notarize any such document, nor has she met ever Lisa Marie Presley.

Brooke Muckerman covers Shelby County Government for The Commercial Appeal. She can be reached at (901) 484-6225, [email protected] and followed on X, formerly known as Twitter @BrookeMuckerman.

IMAGES

VIDEO

COMMENTS

Assignment. When a lender sells the loan, it assigns the trust deed to the buyer. "Assignment" means to convey a claim or a right to another party, known as the "assignee.". This is done by creating another legal document — the assignment of trust deed — and having it signed by both buyer and seller. The trust deed, and other ...

An assignment of trust deed is necessary if a lender sells a loan secured by a trust deed. It assigns the trust deed to whoever buys the loan (such as another lender), granting them all the rights ...

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

Assigning Trust Deeds. For financial benefit, lenders sometimes choose to sell their rights in deed of trust mortgages to other lenders. This process is known as assignment of the mortgage.

A deed of trust is a real estate transaction agreement that allows a third-party trustee to hold the property title until the borrower repays the lender in full. The third party in a deed of trust ...

A deed of trust (also known as a trust deed) is a document sometimes used in financed real estate transactions, generally instead of a mortgage. Deeds of trust transfer the legal title of a ...

Like any deed, a deed of trust can be transferred from one person to another, similar to the way a bank can sell a loan to another bank. The document that transfers a deed of trust, called an assignment of a deed of trust, must be filed in the county clerk's office to be valid. A deed of trust is a convenient way to avoid a court proceeding if ...

The assignment of deed of trust simply serves as permission for one lender to sell the loan to another lender. Once the loan is re-assigned, the new lender takes over the same lien on the same piece of property, essentially stepping into the shoes of the prior lender. The borrower can be provided with a copy of the assignment of deed of trust ...

To transfer ownership rights in real estate, a grant deed is commonly used. When a loan is obtained to purchase real estate, a deed of trust is often used to give the lender rights in the real ...

Deeds of trust are used in conjunction with promissory notes. The deed of trust is the security for the amount loaned to finance the real estate purchase, and is secured by the underlying piece of real estate. The deed of trust is what secures the promissory note. The promissory note includes the interest rate, the payment amounts and terms ...

Trust Deed: A trust deed is a notice of the release of merchandise to a buyer from a bank, with the bank retaining the ownership title to the released assets. The bank remains the owner of the ...

A Deed of Trust definition is most easily expressed as an agreement between a borrower, a lender and a third party known as the Trustee. Deeds of Trust work in a simple manner: a lender gives money to a borrower for a home purchase. In exchange, the lender receives a promissory note that guarantees the borrower will repay the loan amount.

Trustee: As a third party to a deed of trust, the trustee holds the property's legal title. Beneficiary: This party is the lender. A trustee represents neither the borrower nor the lender. Instead, the trustee is an entity that holds the power of sale in case a borrower defaults. The trustee is typically a title or escrow company.

FOR VALUE RECEIVED, the undersigned hereby grants, assigns and transfers to. all beneficial interest under that certain Deed of Trust dated executed by. to and recorded as Instrument No. Recorder's office of. on. , as Trustor , Trustee , of Official Records in the County County, California. Describing land therein as (insert legal description):

A typical assignment of the Deed of Trust alone will purport to assign "all beneficial interest under that certain Deed of Trust dated xyz.." But the long-established law in California is clear: the beneficial interest under a Deed of Trust is held by the party who holds the Note (or is entitled to enforce it), without regard to the ...

A trust deed is always used together with a promissory note (also called "prom note") that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party "trustee" (usually a title company or real estate broker) legal ownership of ...

An assignment of deed of trust under Texas law. This Standard Document can be used to assign and transfer the beneficial interest under a Texas deed of trust from one lender to another lender. This Standard Document is intended for use with the financing of commercial properties in Texas and has integrated notes with important explanations and drafting and negotiating tips for both the ...

Assignment of deeds of trust should be recorded in the same place as the deed of trust was originally recorded, which is in the office of the county clerk in the county where the subject property is located. See N.C. Gen. Stat. § 47-20.1. With respect to formatting, North Carolina law states that the recorder's office may charge an additional ...

ASSIGNMENT OF DEED OF TRUST. FOR VALUABLE CONSIDERATION, the undersigned hereby grants, assign, and transfers to all beneficial interest under that certain Deed of Trust dated by to as Trustee, and recorded , in Book/Reel , at Page/Image , Series Number of Official Records of County, California, together with the Promissory Note secured by said ...

ASSIGNMENT OF DEED OF TRUST. See Exhibit A attached hereto and made a part hereof. TOGETHER with the note or notes therein described or referred to, the money due and to become due thereon with interest, and all rights accrued or to accrue under said Deed of Trust. A notary public or other officer completing this certificate verifies only the ...

ASSIGNMENT OF DEED OF TRUST . FOR VALUE RECEIVED, the undersigned hereby grants, assigns, and transfers to all beneficial interest under that certain Deed of Trust dated executed by , Trustor, to , Trustee, and recorded as instrument no. of official records in the County Recorder's Office of California, describing land therein as: ...

Tennessee is a "deed of trust state," meaning that in the event of a default on a loan, the lender is required to publicly notice a public sale of the property.

Tennessee Attorney General Jonathan Skrmetti is looking into the attempted foreclosure auction of Elvis Presley's iconic Memphis home, known as Graceland, by an alleged private investment company.

Assignment and Insurance Provision; Kaneohe, Koolaupoko, Oahu, Tax Map Key: ... Amend Grant of Nonexclusive Easement under Land Office Deed No. S- -29145 ... Kevin S. Albert, Kimberly L. Albert, and the Albert Revocable Trust for Unlawful Damage to Stony Coral and Live Rock Resulting from the February 20, 2023 Nakoa