Home | Members | Resources | About

MYOKBar Login

Oklahoma Bar Journal

Interpreting assignments of the oil and gas lease.

By Jereme M. Cowan

Under Oklahoma law, an oil and gas lease grants a cluster of rights in land,1 forming an estate in real property with the nature of fee.2 Like many of the sticks in the metaphorical bundle, the estate created under the oil and gas lease is freely assignable and divisible.3 As a result, oil and gas leaseholds can be transferred, in whole or in part, by the holder of the oil and gas lease, such practice being a central element to oil and gas development.4 Furthermore, the transfers of leasehold are usually executed and delivered by legal instruments ubiquitously titled “assignments,” which are filed of record in the same manner as any instrument affecting title to real property.5 Given the history of Oklahoma’s oil booms,6 not to mention Oklahoma’s current role in the U.S. shale boom, assignments inundate many of the county clerk records where oil and gas exploration is prevalent. Therefore, it is likely that an examination of oil and gas land titles in one of these counties will require the interpretation of assignments. BASIC RULES OF CONSTRUCTION Assignments are a contract and a conveyance.7 As such, they are to be read in accordance with the basic rules of contractual interpretation,8 which comprise not only those findings in Oklahoma’s case law but also the statutory provisions of 15 O.S. §§151-178. In a nutshell, Oklahoma’s rules on interpreting assignments begin with prioritizing the true intent of the parties, as gathered from the four corners of the instrument.9 If the assignment is unambiguous, then the written instrument will govern,10 along with all technical terms in the assignment being interpreted as commonly understood among persons in the oil and gas industry.11 However, if there is an ambiguity, then the contractual interpretation can be aided by extrinsic evidence in order to resolve the intrinsic uncertainties of the assignment.12

These rules make it imperative for an attorney conducting a title examination to understand the business and terminology of the oil and gas industry as it pertains to the transfer of leasehold, not to mention understanding general rules of land titles and the law of oil and gas. The purpose of this article is not to give a complete account of the oil and gas industry nor an account of all rules governing the transfer of oil and gas rights in the record title. Rather, the purpose is to give an introductory and cursory overview, presented on a step-by-step basis, for an attorney who may find themselves, either willingly or unwillingly, examining assignments of oil and gas leases filed in Oklahoma. STEP 1: WHAT TYPE OF INTEREST? First and foremost, the title examiner needs to determine the type of interest being assigned (or reserved) in the leasehold. More often than not, if the assignment is transferring an interest in a lease without overriding royalty language or net profits language, then a working interest is being assigned. When there is ambiguity, the title examiner should remember that a working interest is the right to work on the leased property — searching, developing and producing oil and gas. On the other hand, an overriding royalty interest is share in production attributable to a particular lease. STEP 2: WHAT AMOUNT OF INTEREST? Working interests tend to be relatively straightforward. Either the assignor is purporting to assign all of its right, title and interest under a lease, all of a lease (read 100 percent) or a fractional interest in a lease. Digressing a bit, now would be a good moment to discuss the difference between all right, title and interest of the assignor and 100 percent of a lease. All of the assignor’s right, title and interest could be 100 percent or could be some fractional interest. It depends on what the assignor owns of record. If an assignor assigns a lease without any fractional limitations or without the foregoing language limiting it to the assignor’s right, title and interest, then the assignor is purporting to assign 100 percent of the lease. The prudent examiner notes the distinction.

Overriding royalty interest can sometimes not be as straightforward. Often, the assignor decides to use a formula for the computation of the assigned or reserved overriding royalty interest. For example, a recitation in the assignment reads as follows: an overriding royalty interest equal to the difference between 20 percent and lease burdens. Here, the overriding royalty interest would be calculated by first adding up all the lease burdens, such as a one-eighth landowner’s royalty and a previously conveyed one-thirty-second overriding royalty interest, and then subtracting that number from 20 percent, which is represented mathematically as: 20% - (1/8 + 1/32) = 4.375%.

There are various business reasons for computing an assigned or reserved overriding royalty interest with the subtraction of lease burdens from a certain percentage, the most prominent being that assignments of leases typically cover a block of leases, which contain various lease net revenue interests. Showing the overriding royalty interest as a formula rather than a specific number allows the assignor to either retain or convey the leases at certain net revenue interest. In the prior example, assuming the assignor was assigning the overriding royalty interest, it was retaining an 80 percent net revenue interest in all the leases covered by the assignment except, of course, those leases which were already burdened greater than 20 percent. STEP 3: WHAT LEASE IS COVERED? All leasehold interests derive from a lease. Therefore, it is imperative that the examining attorney determine what lease is covered by an assignment. If the assignment covers one or just a few leases, then the lease(s) will probably be described somewhere in the body of the instrument. If the assignment covers multiple leases, then typically they will be described in an exhibit “A” attached thereto. However, it should be noted that in some cases an assignment may not describe a particular lease or leases but instead will include language that it is the intent to assign all leasehold rights in a particular tract of land, usually the unitized area. For example, an assignment may read that all of the assignor’s rights in the leasehold covering the SW/4 are transferred to the assignee without giving further explanation as to the underlying leases. In this particular example, the assignor is conveying whatever leasehold rights it may own from whatever source such rights might derive as to the SW/4.

STEP 4: WHAT ARE THE LIMITATIONS TO THE ASSIGNED INTEREST? By far the most challenging (and often most ambiguous) aspect of an assignment is the limitations to the assigned interest. Like land itself, a lease is a bundle of sticks. A lease can be cut and carved any which way, limited only by the imagination of the oil and gas industry. If an assignor wants to assign a lease insofar as that lease covers a particular formation in the strata, then the assignor can do so. The following are standard limitations that the examining attorney should recognize.

An assignment can be limited to the wellbore of a well. A wellbore limitation means that the assignor is assigning only those rights to production from the wellbore of a certain well, arguably at the total depth it existed at the time of the assignment. All interest outside the wellbore are excluded from the assignment, entailing that a wellbore assignee can produce from shallower formations in the wellbore but cannot produce from deeper formations or lands outside the wellbore.

The central problem with wellbore only assignments is determining when in fact there is a wellbore only assignment. The title examiner should be aware that a wellbore assignment is the narrowest of assignments. Very limited rights to the lease are being assigned. It can be argued that the lease or unit and the lands covered by the lease or unit need only be described for informational purposes, as it is rights to the wellbore being assigned. Furthermore, the fact that a well or unit is mentioned in the description of the lease does not entail that the assignor intended to convey wellbore rights only. More often than not, a reference to a well or unit in Oklahoma is for informational purposes.

Some assignments are limited to certain depths or to a particular formation. For instances, an assignment may limit the assigned leases “insofar as said leases cover the Woodford Formation” or “insofar as from the surface to a depth of 8,100 feet.” Depth limitations are usually more prominent than wellbore limitations and are considerably less ambiguous. Furthermore, title examiners should always read an assignment thoroughly to determine whether a depth limitation is pertinent. Many times, such a limitation is buried in one of the numerous special provisions of the assignment or placed in one of the exhibits attached thereto.

In order to accommodate the formation of units, leases will often be assigned only as to a portion of the lands covered thereby. For example, a participant enters into a joint operating agreement with the operator that has proposed the drilling of a 40-acre unit well located in the NW/4 NW/4. If the participant owns all of a certain lease covering the N/2 NW/4, the participant may decide to assign only that portion of the lease covering the NW/4 NW/4, thereby retaining all rights in the NE/4 NW/4. Therefore, assignments may contain limitations as to the area acreage being conveyed.

CONCLUSION The foregoing steps serve as an introduction to interpreting assignments of oil and gas leases. Most certainly, each step of analysis could be accompanied by a more detailed explanation. That said, the key point to be made here is that the interpretation of assignments in oil and gas land titles requires a familiarization of the business practices of the oil and gas industry, not just an understanding of the governing law.

ABOUT THE AUTHOR Jereme M. Cowan is a managing partner at Cowan & Fleischer PLLC. Mr. Cowan’s practice fo-cuses on oil and gas land titles. He has planned, moderated and spoken at a number of oil and gas seminars sponsored by the Oklahoma Bar Association.

1. See Hinds v. Phillips Petroleum Company , 1979 OK 22, 591 P.2d 697, 698 (1979) (stating that “[t]he cluster of rights comprised within an instrument we refer to ‘in deference to custom’ as an ‘oil and gas lease’ includes a great variety of common-law interests in land”). 2. See Shields v. Moffitt , 1984 OK 42, 683 P.2d 530, 532-33 (1984) (finding that “the holder of an oil and gas lease during the primary term or as extended by production has a base or qualified fee, i.e. , an estate in real property have the nature of a fee, but not a fee simple absolute”). 3. See Hinds at 699 (concluding that leasehold interests are freely alienable “in whole or in part”); Eugene Kuntz, Kuntz, a Treatise on the Law of Oil and Gas , Volume Five, §64.1, 259 (1987) (asserting that the oil and gas lease is freely assignable “in the absence of a provision to the contrary”); see also Shields at 533 (holding that a lease clause restricting alienation was void). 4. John S. Lowe, Oil and Gas Law in a Nutshell , Sixth Edition (2014). 5. Joyce Palomar, Patton and Palomar on Land Titles , 3rd Edition, Volume One, 3 (2003). 6. Kenny A. Franks, The Oklahoma Petroleum Industry (Norman: University of Oklahoma Press, 1980). 7. See Plano Petroleum, LLC v. GHK Exploration, L.P. , 2011 OK 18 (2011). 8. K & K Food Servs. v. S & H, Inc. , 2000 OK 31, 3 P.3d 705, 708. 9. See Messner v. Moorehead , 1990 OK 17, ¶8, 787 P.2d 1270, 1272. 10. Messner at 1273. 11. 15 O.S. §161. 12. Crockett v. McKenzie , 1994 OK 3, ¶5, 867 P.2d 463, 465.

Originally published in the Oklahoma Bar Journal -- OBJ 88 pg. 285 (Feb. 11, 2017)

Farmout Agreements: The Basics, Negotiations and Motivations

Posted by: Austin Brister in Primers and Insights , The Deal Corner

The Basics:

A Farmout Agreement is an agreement with a working interest owner (“Farmor”) whereby the Farmor agrees to assign working interest to the Farmee in exchange for certain contractually agreed services. Typically these services include drilling a well to a certain depth, in a certain location, in a certain timeframe, and also typically stipulates that the well must obtain commercial production. After this contractually agreed service is rendered, the Farmee is said to have “earned” an assignment. This Assignment comes after the services were completed, and is subject to the reservation of an overriding royalty interest in favor of the Farmor.

This overriding royalty interest is usually said to be a “convertible override.” This means that upon payout, which is the point where the drilling costs have been recouped from production from the well, the Farmor can elect to convert this override into a portion of the working interest. This decision whether to convert or not depends on whether the Farmor wishes to join in production costs in exchange for the possibility of a larger return on NRI. If the Farmor does not wish to take the risks associated with the cost-bearing working interest, he will choose not to convert the override. If the Farmor is comfortable with the project costs and proceeds from the well, he will decide to convert his override into working interest. All of these terms are negotiable in the Farmout Agreement.

Here’s an example. You are working as a landman for David Oil Co. You have retained a small battalion of field landmen and leased up a nice large area your geologist believes will be productive. This gives you 100% of the working interest. You pay 100% of the expenses, and receive 100% of the net revenue interest (all the proceeds less royalty burdens, overriding royalty burdens, tax, etc.). Your geologist is excited and believes the geology is ripe to provide a high return. However, given the particular geology, you will need to drill directionally to a deep formation. The deeper the formation, the more it’s going to cost, and you’re not sure you have enough in your budget to pay for it.

In comes Goliath Oil Co., who was late to the play and wasn’t able to lease your area. Goliath has a lot of money and it wants in because its geologists agree that there is a lot of money to be made in your area. Rather than wait around for your leases to expire, Goliath chooses to approach you and offer to “farm in” to your working interest. It is willing to drill the well(s) for you and pay the drilling costs (what is known as a “drilling carry”), in exchange for you assigning them a percentage of your working interest. Another way to think of it is obtaining drilling services where the consideration is an assignment of working interest rather than cash.

Negotiating the Farmout Agreement

As with all negotiations, understanding the other party’s interests and motivations is key to effective negotiation and properly structuring a complete deal. You could Consider negotiation skills training to equip your people to negotiate with confidence and success to help in this aspect. You should be able to better estimate how far the other party will be willing to give and take in negotiating the terms of the Farmout Agreement. Knowing this will also help you understand the other party’s best alternative to the negotiated agreement . The following are the most common interests motivating Farmors and Farmees.

Interests Motivating the Farmor :

- Drilling so as to maintain the lease (satisfy primary term, avoid Pugh clause consequences, satisfy continuous drilling obligations, etc.);

- Monetizing an abandoned prospect;

- Sharing risk;

- Obtaining geological information from the farmee and the farmee’s operations; and

Interests Motivating the Farmee :

- Quickly obtain acreage;

- Obtain acreage without leasing operations, and without expending capital on buying leases;

- Utilize equipment and personnel that would otherwise not be utilized;

- Gain interest in a prospect area that is already leased, but the farmor is not developing; and

Thoroughly understanding both your motivations and the other party’s motivations are essential to effective negotiation and deal-making. This is crucial so that you understand you and your adversary’s must-haves and true bargaining room. Every good negotiator does this whether they consciously think of it or not . Understanding your motivations and alternatives are important to keep your head on straight and to ensure you are picking the right battles. On the other hand, understanding the other party’s motivations and alternatives is crucial for two main reasons: (1) you will better know how far you can push the other side to obtain favorable terms and conditions, (2) you will better understand and anticipate which terms the other side will insist on, and (3) you can make the other side’s alternatives less attractive, harder to implement, or less valuable, all of which may help your side of the negotiations.

In my experience, including when I was in the heavy construction industry, knowing what the other party was truly after made negotiations much easier. It is not always possible, but when we can closely narrow in on our motivations and confidently estimate the other side’s motivations, we seldomly fight tooth and nail over every provision, and are able to focus in on what actually matters to each party. In the end, we have better agreements.

If you want to know more, make sure to check out Key Provisions of a Farmout Agreement .

I’d love to hear your thoughts, comments, stories, and suggestions in the comments! What were the factors motivating your most recent Farmout Agreement?

- Latest Posts

Austin Brister

Latest posts by austin brister ( see all ).

- Miscellaneous Case Updates - June 25, 2020

- Strip and Gores Doctrine Extends Conveyance to Include Adjacent Severed Mineral Interest - June 22, 2020

- Can Emails Form a Purchase Contract? Texas Supreme Court Tackles the Issue in Two Recent Cases - June 18, 2020

Footnotes [ + ]

§ 3A:249. Assignment of working interest in oil and gas lease | Secondary Sources | Westlaw

§ 3A:249. Assignment of working interest in oil and gas lease

Tx lf § 3a:249 texas forms legal and business (approx. 2 pages).

- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Assignment of Membership Interest: The Ultimate Guide for Your LLC

LegalGPS : May 9, 2024 at 12:00 PM

As a business owner, there may come a time when you need to transfer ownership of your company or acquire additional members. In these situations, an assignment of membership interest is a critical step in the process. This blog post aims to provide you with a comprehensive guide on everything you need to know about the assignment of membership interest and how to navigate the procedure efficiently. So, let's dive into the world of LLC membership interest transfers and learn how to secure your business!

Table of Contents

Necessary approvals and consent, impact on ownership, voting, and profit rights, complete assignment, partial assignment.

- Key elements to include

Step 1: Gather Relevant Information

Step 2: review the llc's operating agreement, step 3: obtain necessary approvals and consents, step 4: outline the membership interest being transferred, step 5: determine the effective date of the assignment, step 6: specify conditions and representations, step 7: address tax and liability issues, step 8: draft the entire agreement and governing law clauses, step 9: review and sign the assignment agreement.

- Advantages of using a professionally-created template

- How our contract templates stand out from the rest

Frequently Asked Questions (FAQs) about Assignment of Membership Interest

Do you need a lawyer for this.

What is an Assignment of Membership Interest?

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties involved and delivered to the Secretary of State's office for filing. However, this process can vary depending on where you live and whether your LLC has members other than yourself as well as additional documents required by state law.

Before initiating the assignment process, it's essential to review the operating agreement of your LLC, as it may contain specific guidelines on how to assign membership interests.

Often, these agreements require the express consent of the other LLC members before any assignment can take place. To avoid any potential disputes down the line, always seek the required approvals before moving forward with the assignment process.

It's essential to understand that assigning membership interests can affect various aspects of the LLC, including ownership, voting rights, and profit distribution. A complete assignment transfers all ownership rights and obligations to the new member, effectively removing the original member from the LLC. For example, if a member assigns his or her interest, the new member inherits all ownership rights and obligations associated with that interest. This includes any contractual obligations that may be attached to the membership interest (e.g., a mortgage). If there is no assignment of interests clause in your operating agreement, then you will need to get approval from all other members for an assignment to take place.

On the other hand, a partial assignment permits the original member to retain some ownership rights while transferring a portion of their interest to another party. To avoid unintended consequences, it's crucial to clearly define the rights and responsibilities of each party during the assignment process.

Types of Membership Interest Transfers

Membership interest transfers can be either complete or partial, depending on the desired outcome. Understanding the differences between these two types of transfers is crucial in making informed decisions about your LLC.

A complete assignment occurs when a member transfers their entire interest in the LLC to another party, effectively relinquishing all ownership rights and obligations. This type of transfer is often used when a member exits the business or when a new individual or entity acquires the LLC.

For example, a member may sell their interest to another party that is interested in purchasing their share of the business. Complete assignment is also used when an individual or entity wants to purchase all of the interests in an LLC. In this case, the seller must receive unanimous approval from the other members before they can transfer their entire interest.

Unlike a complete assignment, a partial assignment involves transferring only a portion of a member's interest to another party. This type of assignment enables the member to retain some ownership in the business, sharing rights, and responsibilities proportionately with the new assignee. Partial assignments are often used when adding new members to an LLC or when existing members need to redistribute their interests.

A common real-world example is when a member receives an offer from another company to purchase their interest in the LLC. They might want to keep some ownership so that they can continue to receive profits from the business, but they also may want out of some of the responsibilities. By transferring only a partial interest in their membership share, both parties can benefit: The seller receives a lump sum payment for their share of the LLC and is no longer liable for certain financial obligations or other tasks.

How to Draft an Assignment of Membership Interest Agreement

A well-drafted assignment of membership interest agreement can help ensure a smooth and legally compliant transfer process. Here is a breakdown of the key elements to include in your agreement, followed by a step-by-step guide on drafting the document.

Key elements to include:

The names of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name of your LLC and the state where it was formed

A description of the membership interest being transferred (percentage, rights, and obligations)

Any required approvals or consents from other LLC members

Effective date of the assignment

Signatures of all parties involved, including any relevant witnesses or notary public

Before you begin drafting the agreement, gather all pertinent data about the parties involved and the membership interest being transferred. You'll need information such as:

The names and contact information of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name and formation details of your LLC, including the state where it was registered

The percentage and value of the membership interest being transferred

Any specific rights and obligations associated with the membership interest

Examine your LLC's operating agreement to ensure you adhere to any predetermined guidelines on assigning membership interests. The operating agreement may outline specific procedures, required approvals, or additional documentation necessary to complete the assignment process.

If your LLC doesn't have an operating agreement or if it's silent on this matter, follow your state's default LLC rules and regulations.

Before drafting the assignment agreement, obtain any necessary approvals or consents from other LLC members as required by the operating agreement or state law. You may need to hold a members' meeting to discuss the proposed assignment and document members' consent in the form of a written resolution.

Detail the membership interest being transferred in the Assignment of Membership Interest Agreement. Specify whether the transfer is complete or partial, and include:

The percentage of ownership interest being assigned

Allocated profits and losses, if applicable

Voting rights associated with the transferred interest

The assignor's rights and obligations that are being transferred and retained

Any capital contribution requirements

Set an effective date for the assignment, which is when the rights and obligations associated with the membership interest will transfer from the assignor to the assignee.

This date is crucial for legal and tax purposes and helps both parties plan for the transition. If you don’t specify an effective date in the assignment agreement, your state's law may determine when the transfer takes effect.

In the agreement, outline any conditions that must be met before the assignment becomes effective. These could include obtaining certain regulatory approvals, fulfilling specific obligations, or making required capital contributions.

Additionally, you may include representations from the assignor attesting that they have the legal authority to execute the assignment. Doing this is important because it can prevent a third party from challenging the assignment on grounds of lack of authority. If the assignor is an LLC or corporation, be sure to specify that it must be in good standing with all necessary state and federal regulatory agencies.

Clearly state that the assignee will assume responsibility for any taxes, liabilities, and obligations attributable to the membership interest being transferred from the effective date of the assignment. You may also include indemnification provisions that protect each party from any potential claims arising from the other party's actions.

For example, you can include a provision that provides the assignor with protection against any claims arising from the transfer of membership interests. This is especially important if your LLC has been sued by a member, visitor, or third party while it was operating under its current management structure.

In the closing sections of the assignment agreement, include clauses stating that the agreement represents the entire understanding between the parties concerning the assignment and supersedes any previous agreements or negotiations. Specify that any modifications to the agreement must be made in writing and signed by both parties. Finally, identify the governing law that will apply to the agreement, which is generally the state law where your LLC is registered.

This would look like this:

Once you've drafted the Assignment of Membership Interest Agreement, ensure that all parties carefully review the document to verify its accuracy and completeness. Request a legal review by an attorney, if necessary. Gather the assignor, assignee, and any necessary witnesses or notary public to sign the agreement, making it legally binding.

Sometimes the assignor and assignee will sign the document at different times. If this is the case, then you should specify when each party must sign in your Assignment Agreement.

Importance of a Professionally-drafted Contract Template

To ensure a smooth and error-free assignment process, it's highly recommended to use a professionally-drafted contract template. While DIY options might seem tempting, utilizing an expertly-crafted template provides several distinct advantages.

Advantages of using a professionally-created template:

Accuracy and Compliance: Professionally-drafted templates are designed with state-specific regulations in mind, ensuring that your agreement complies with all necessary legal requirements.

Time and Cost Savings: With a pre-written template, you save valuable time and resources that can be better spent growing your business.

Reduced Legal Risk: Legal templates created by experienced professionals significantly reduce the likelihood of errors and omissions that could lead to disputes or litigations down the road.

How our contract templates stand out from the rest:

We understand the unique needs of entrepreneurs and business owners. Our contract templates are designed to provide a straightforward, user-friendly experience that empowers you with the knowledge and tools you need to navigate complex legal processes with ease. By choosing our Assignment of Membership Interest Agreement template, you can rest assured that your business is in safe hands. Click here to get started!

As you embark on the journey of assigning membership interest in your LLC, here are some frequently asked questions to help address any concerns you may have:

Is an assignment of membership interest the same as a sale of an LLC? No. While both processes involve transferring interests or assets, a sale of an LLC typically entails the sale of the entire business, whereas an assignment of membership interest relates to the transfer of some or all membership interests between parties.

Do I need an attorney to help draft my assignment of membership interest agreement? While not mandatory, seeking legal advice ensures that your agreement complies with all relevant regulations, minimizing potential legal risks. If you prefer a more cost-effective solution, consider using a professionally-drafted contract template like the ones we offer at [Your Company Name].

Can I assign my membership interest without the approval of other LLC members? This depends on your LLC's operating agreement and state laws. It's essential to review these regulations and obtain any necessary approvals or consents before proceeding with the assignment process.

The biggest question now is, "Do you need to hire a lawyer for help?" Sometimes, yes ( especially if you have multiple owners ). But often for single-owner businesses, you don't need a lawyer to start your business .

Many business owners instead use tools like Legal GPS for Business , which includes a step-by-step, interactive platform and 100+ contract templates to help you start and grow your company.

We hope this guide provides valuable insight into the process of assigning membership interest in your LLC. By understanding the legal requirements, implications, and steps involved, you can navigate this essential task with confidence. Ready to secure your business with a professionally-drafted contract template? Visit our website to purchase the reliable and user-friendly Assignment of Membership Interest Agreement template that enables your business success.

Why Your Company Absolutely Needs a Membership Interest Pledge Agreement

When it comes to running a business, it's essential to cover all your bases to ensure the smooth operation of your company and the protection of your...

Understanding the Membership Interest Purchase Agreement for Single Owners

Welcome to another of our informative blog posts aimed at demystifying complex legal topics. Today, we're addressing something that many solo...

Why Every Company Needs a Media Consent and Release Form

Picture this: you’re a business owner, and you’ve just wrapped up a fantastic marketing campaign featuring your clients’ success stories. You're...

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

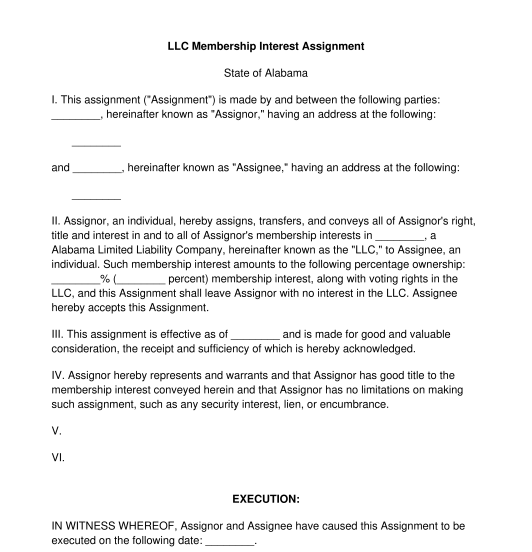

LLC Membership Interest Assignment

Rating: 4.8 - 952 votes

What is an LLC membership interest assignment?

An LLC membership interest assignment is a document used when one member of a limited liability company ("LLC") wishes to transfer the entirety of their interest in an LLC to another party . This document is often used when a member of an LLC is leaving or otherwise wants to give up the entirety of their interest in the company. Using this document, the current owner of shares in the LLC transfers all of them over to another person or entity.

A limited liability company , also known as an LLC, is a corporate structure that protects its owners from being personally liable for debts and liabilities of the company . LLCs do not pay taxes on their profits directly. Instead, profits and losses are passed through to the individual members, who report them on their personal tax returns.

What is the difference between an LLC membership interest assignment and an LLC membership purchase agreement?

Though both documents involve the transfer of interest in an LLC from one party to another, these two documents serve different purposes. The LLC membership interest assignment transfers the entirety of one person's interest in the LLC to another person. It is also not a sale document.

An LLC membership purchase agreement is the sale of some portion of a party's interest in an LLC to another party.For example, if someone owned 50% interest in an LLC, they could sell 25% of their interest in the LLC to another party and keep the remaining 25% interest for themselves.

Is it mandatory to use an LLC membership interest assignment?

Yes, using an LLC membership interest assignment is mandatory in most states. In the few states where it is not mandatory, it is still highly advisable to use this document to be sure to protect the interests of the parties involved and to make sure all the members of the LLC are informed about the ownership transfer.

What is "membership interest"?

Membership interest is a party's ownership stake in an LLC. It represents the parties' right to share in the profits and losses of the LLC and to receive distributions from it.

What must an LLC membership interest assignment contain?

A valid LLC membership interest assignment must contain at least the following mandatory clauses:

- Identification of involved parties : The LLC membership interest assignment will include details about the identity of both the party giving up their interest, as well as the party who will get the interest in the LLC.

- Description of membership interest : The LLC membership interest assignment includes details about the membership interest, including the percentage of the LLC and whether it includes voting rights.

In addition to the above mandatory clauses, the LLC membership interest assignment may also include the following optional clause:

- Consent requirement : If needed, this document includes an addendum at the end specifying that all the members of the LLC consent to the transfer of interest.

What are the prerequisites of an LLC membership interest assignment?

Prior to creating an LLC membership interest assignment, several things should happen. Firstly, the parties should review the LLC's operating agreement . This document may contain restrictions or requirements for the transfer of interest in the LLC. For example, the operating agreement may require that existing members of the LLC have the right to buy the interest in the LLC before it is sold to any outside third party.

The parties to the agreement should also get consent to the sale from the current members of the LLC. This is not always necessary, but it is common and usually considered good practice.

Before agreeing to the terms of the LLC membership interest assignment, the new owner should also do research into the LLC to be sure that it is in good standing and not involved in ongoing litigation or bankruptcy proceedings.

Who is involved in an LLC membership interest assignment?

The LLC membership interest assignment includes the party giving up their interest in an LLC and the party receiving the interest in the LLC. Both of these parties can either be individual people or entities, like a business or charitable organization.

What has to be done once the LLC membership assignment agreement is done?

Once the LLC membership interest assignment is done, it should be signed and dated both the assigning party and the receiving party . All members of the LLC should be notified of the transfer. This notification usually happens by providing a copy of the Assignment and any related documents to the LLC's registered agent or manager. Information about the process is typically specified in the LLC Operating Agreement . In some states, transfer of interest in an LLC requires that formation documents be updated and refiled with the appropriate state office to reflect changes in membership. This may also involve filing an amendment to the Articles of Organization. The LLC should be sure to update its bank accounts, contracts, licenses, and permits as necessary to reflect the membership change. Finally, the LLC should maintain accurate records of the transfer of interest, saving for future reference copies of the Assignment Agreement, amended Operating Agreement, consent of members, and any other relevant documents.

Is it necessary to register the LLC membership interest assignment?

In some states, transfer of interest in an LLC requires that formation documents be updated and refiled with the appropriate state office to reflect changes in membership. This may also involve filing an amendment to the Articles of Organization .

Which laws are applicable to an LLC membership interest assignment?

LLC Membership Interest Assignments are subject to the laws of individual states . There is no one federal law covering these documents because each individual state governs the businesses formed within that state.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Sell your Percentage in an LLC

- How to Sell your Business

- How to Transfer Business Ownership

Other names for the document:

Assignment of Interest for LLC Member, Interest Assignment for LLC Membership, LLC Interest Assignment Agreement, Member Interest Transfer for LLC, Membership Assignment for LLC

Country: United States

Business Structure - Other downloadable templates of legal documents

- Articles Of Organization

- Shareholder Agreement

- Articles Of Incorporation

- Partnership Agreement

- Business Sale Agreement

- Corporate Bylaws

- Stock Sale and Purchase Agreement

- LLC Membership Purchase Agreement

- Founders' Agreement

- Business Merger Agreement

- Limited Partnership Agreement

- Other downloadable templates of legal documents

- Search Search Please fill out this field.

- Commodities

Working Interest: Meaning, Overview, Advantages and Disadvantages

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

What Is Working Interest?

Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production. As part of the investment, working interest owners also fully participate in the profits of any successful wells. This stands in contrast to royalty interests , in which an investor's cost is usually limited to the initial investment, also resulting in a lower potential for large profits .

Key Takeaways

- A working interest is a type of investment in oil and gas operations.

- In a working interest, investors are liable for ongoing costs associated with the project but also share in any profits of production.

- Both the costs and risks of a working interest are extremely high.

- There are certain tax benefits related to costs and losses in a working interest.

Understanding Working Interest

Working interest, also referred to as operating interest, provides investors with a percentage ownership of the drilling operation, functioning as a lease, providing the investor a right to participate in drilling activities and a right to the resources produced from that activity. Along with deriving an income from the production of the resource, the investors are also responsible for a percentage of the expenses related to its acquisition.

There are two types of working interest: operated and non-operated. Operated working interest has a designated operator that makes all operational decisions. The operator selects wells, determines drilling, and handles all the day to day operations.

A non-operated working interest member is not involved in daily operations but is consulted on production decisions. The well operator, after operating expenses have been covered, divides any additional funds between those holding a working interest, creating the source of income. Those holding a working interest may deduct certain costs, such as those associated with the depreciation of equipment.

Advantages and Disadvantages of Working Interest

With all types of investments, there are going to be advantages and disadvantages. Investing in a working interest related to oil and gas, the advantages and disadvantages are as follows:

- The upside for financial gain is large. If wells prove successful, profits are sizable and can last for years.

- Tax benefits exist as losses are seen as active income and can be offset against other income.

- Tax incentives where certain costs are tax-deductible. Sometimes 65%-80% of the costs of a well's funding.

- An active investment where decision making is in your hands.

Disadvantages

- The upfront investment is extremely high as one is paying for the costs of production.

- There is a greater risk of loss as the costs of investing are high.

- Investors may be liable for on the job calamities, such as employee injuries or damage to the environment.

Tax Implications of Working Interest Income

Since most working interest income is treated as self-employment income because the investor is part of a partnership, it will generally be taxed as such, meaning that an investor will not be held to net investment income surtax but to Social Security and Medicare. Since regular income tax payments are not automatically withheld from these funds, investors are responsible for making estimated tax payments based on the current Internal Revenue Service (IRS) standards and rates. As of 2020, the self-employment tax rate is 15.3% in the United States.

Additionally, if the investor receives free resources, such as natural gas service to his property from the company with the associated leasing rights, these amounts may also qualify as income and may be taxed as such.

Investors with working interests are eligible for certain tax deductions based on the operating costs associated with the business. This can include business expenses of a tangible or intangible nature, such as equipment costs or utility payments.

Risks of Working Interest

As there is a potential downside for financial loss and other liabilities due to investing in a working interest, an individual should take steps to reduce that risk. It is recommended that when entering into a working interest investment, an individual sets up a limited liability company (LLC) or other tax partnerships. The main reason to do so is to be protected from any liability. An LLC can protect investors from risks incurred in the working interest. Conversely, it can protect the working interest from liabilities incurred by the investor.

On the other hand, individuals can look to investing in royalty interests that may provide an opportunity to participate in oil and gas investments with a lower level of risk than a working interest. While working interest investments require continuous input from investors in regards to expenses, risking larger losses if expenses outweigh income, royalty interests generally require no additional funding from those investors, making additional losses beyond the initial investment less likely.

Internal Revenue Service. " Self-Employment Tax (Social Security and Medicare Taxes) ." Accessed June 16, 2021.

:max_bytes(150000):strip_icc():format(webp)/oil-5bfc36e246e0fb0051c07b88.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Sign up for an account

Sign up for partner account, sign in to your account, reset password.

Assignment of LLC Interest

An Assignment of LLC Interest is a document through which an LLC member can transfer their ownership rights.

- About document

Related documents

How it works.

If an LLC member wishes to transfer their ownership rights to a different entity for any reason, they'll need to submit an Assignment of LLC Interest. This document will be a way for the member to communicate this intention to other LLC members.

What Is an Assignment of LLC Interest?

You can use an Assignment of LLC Interest in situations where an LLC member wishes to secure a loan, settle a debt, or leave their LLC.

In such cases, this document will serve to transfer the member's interest – which can be done wholly or partially – according to state laws and the governing documents of the LLC in question.

Other Names for Assignment of LLC Interest

Since the document's content takes precedence over the title, an Assignment of LLC Interest doesn't necessarily have to bear that name. It's also called:

- Assignment Agreement

- Transfer Agreement

- Interest Transfer Agreement

Who Needs an Assignment of LLC Interest?

LLC members may decide to assign their interest for several reasons. One of the more common reasons for assignment is providing collateral for a loan.

Another reason might be if the member needs to settle a debt, in which case the assignment remains effective while the debt is present.

Finally, a member can assign interest to their legal heirs. In this case, the assignment becomes valid upon the member's death.

Why Use 360 Legal Forms for Your Assignment of LLC Interest?

Customized for you, by you.

Create your own documents by simply answering our easy-to-understand questionnaire to get exactly what you need out of your Assignment of LLC Interest.

Specific to your jurisdiction

Laws vary by location. Each document on 360 Legal Forms is customized for your state.

Fast and easy

All you need to do is fill out a simple questionnaire, print it, and sign. No printer? No worries. You and other parties can even sign online.

How to Create an Assignment of LLC Interest With 360 Legal Forms

An Assignment of LLC Interest should clearly outline the rights and limitations as they apply both to the assignor, i.e., the LLC member transferring interest, and the assignee, i.e., the party receiving interest. For this reason, the document should be detailed and carefully crafted. State laws can potentially restrict assignments, and documents contrary to those laws can be subject to invalidation.

Let 360 Legal Forms help with our extensive library of attorney-vetted legal forms. The process is fast and easy. All you need to do is fill out our easy-to-understand questionnaire. Once complete, simply download your form as a PDF or Word document from your secure online account.

What Information Will I Need to Create My Assignment of LLC Interest?

To create your document, please provide:

- Assignor Information: Details on the LLC member transferring interest

- Assignee Information: Details on the entity receiving interest

- Assignment Type: Description of whether the assignment is partial or full

- Type of Partial Assignment (If Applicable): Determining whether the assignor will transfer a portion of ownership or specific rights and responsibilities

- Signatures : All involved parties need to sign the document to make it legally binding

Assignment of LLC Interest Terms

- Assignor : The LLC member assigning their rights, responsibilities, and interest

- Assignee: The individual or other entity receiving the rights, obligations, and interest from the Assignor

- Authority : A confirmation that the agreement is following regulations affecting all parties (Assignor and Assignee)

- Severability : If you can't execute any individual part of the agreement, the rest of the agreement will remain valid

Assignment of LLC Interest Signing Requirements

An Assignment of LLC Interest is a legally binding document, which means all parties should ensure they understand and agree to all terms within it before signing.

Once the Assignor and Assignee confirm that all information in the document is correct, both parties will need to sign the document to make it valid.

What to Do With Your Assignment of LLC Interest?

An Assignment of LLC Interest defines the scope of interest an LLC member will transfer to another party for other members of the LLC.

After signing the document, you will execute the interest transfer. Both parties should keep their copies of this document for the record.

Frequently Asked Questions

LLC members often have two roles within the LLC: as interest owners and managers. When a member decides to assign interest to another party, the transfer won't affect that member's management role.

Should an LLC member wish to leave the LLC management, they'll need to resign from that role in an action separate from the interest transfer. At that point, they’ll determine their replacement in the management following the LLC operating agreement and the state laws.

An LLC member can transfer their interest fully or partially. Full transfer means that the Assignee receives interest identical to that previously held by the Assignor.

In the case of a partial transfer, an LLC member will assign either a portion of their interest or only certain rights to the Assignee.

In most states, the Assignee won't have the right to participate in the operations of the LLC in question. The Assignee is also protected from the Assignor's liabilities, but this may vary according to the state. For example, the Assignee receives the liability in Florida and California.

If the Assignee is introduced into the LLC as a member following the transfer, the Assignee's limitations and rights will be the same as the Assignor's.

Most states will not prohibit any LLC members from assigning interest. Likewise, in most states, interest transfer won't mean that the Assignor relinquishes their right to vote or continue their involvement in LLC management.

Texas is an exception since that state's law mandates that the Assignor must forfeit their LLC membership upon transfer.

Notifying all LLC members of an assignment is mandatory, and in some states, you can only enforce the document upon approval by all LLC members.

LLC members can decide whether the Assignee will become a member if the Assignor wishes to resign their position. The interest transfer doesn't guarantee that the Assignee will automatically become an LLC member.

Why choose 360 Legal Forms?

Our exhaustive library of documents covers your personal, business, and real estate needs with all of your DIY legal forms.

Easy legal documents at your fingertips

Create professional documents for thousands of purposes.

Easily customized

Make unlimited documents and revisions. Sign online in seconds.

Applicable to all 50 states

Our documents are vetted by lawyers and are applicable to all 50 states.

Know someone who needs this document?

Users that make a Assignment of LLC Interest sometimes need additional documents.

- LLC Consent in Lieu of a Meeting

- LLC Membership Admission Agreement

- LLC Operating Agreement

Assignment of Interest: Everything You Need to Know

Assignment of interest takes place when a company is formed and the members or owners decide on the ownership percentages they will each hold. 3 min read updated on January 01, 2024

Assignment of interest takes place when a company is formed and the members or owners decide on the ownership percentages they will each hold. It also occurs when a member decides to leave the company and transfer their interest to another.

What Is an LLC?

An LLC, or limited liability company, is a business structure that offers liability protection to its members. The members of an LLC are essentially its owners, like the shareholders in a corporation. In the event of any financial or legal issues with the business, the members are protected from creditors taking any of their personal assets.

The interest percentages allotted to the LLC members are usually proportional to their capital contributions or their managerial responsibilities. This is also called their membership interest. LLC members who hold interest in the business are entitled to profit distribution as well as voting rights over company matters.

When members of an LLC retire or leave the business, they can assign their interest to another existing member or a new member. The LLC's operating agreement should outline how such a transfer should be handled. If there are no provisions for assignment of interest in the operating agreement, the state in which the LLC conducts business should have rules and regulations to follow instead.

LLC members tend to have more control over the daily operations of the business when compared to corporate shareholders. Usually, the members of an LLC are actually the individuals who started the business, so they have a strong desire to see the company succeed.

How Assigning Interest Works

LLC members assign interest when they need to hand their rights and responsibilities to the company over to another individual or business entity. One member's interest can be transferred to another in full or in part.

For instance, a retiring LLC member's interest in the business including all of the following aspects:

- Voting rights

- Managerial duties

- Profit sharing

That member might choose to give their managerial duties to one person and their voting rights and profit shares to another. Basically, members reserve the right to assign their interest in any way they see fit, as far as the operating agreement allows.

Once the new member receives the interest, they inherit all of the rights and responsibilities that come with LLC membership that particular business, unless the operating agreement states otherwise.

Sometimes membership interest can be transferred, but the original member can hold onto their voting rights in the business, while the new member takes over the other rights and duties.

What Is an Assignment of Interest Agreement?

Assignment of interest agreements are the documentation for any transfer of interest in an LLC. In the contract, you should find the following information:

- Name of original interest holder

- Type of interest being transferred

- Name of the individual or entity to receive the interest

- Name of the LLC

- Percentage of interest being assigned

- Date of assignment

- Other applicable terms and conditions

Once the assignment of interest agreement is signed by both parties, the giver of the interest and the receiver, the new holder of the membership interest agrees to follow the rules laid out in the various documents that govern the LLC. Such documents likely include the operating agreement and formation documents .

If the membership interest requires any initial or ongoing contributions to the business, the new interest holder is required to offer or continue such payments.

Aspects of Assignment of Interest to Keep in Mind

Depending on where the LLC is registered, the state might have specific laws regarding how assignment of interest is to be handled. Anytime major decisions or changes are happening in a business, it's always a good idea to double check the laws for the area.

Some states don't require the approval of LLC members for an assignment of interest, but they do limit the rights of the new member or receiver of the interest.

Operating agreements are the main governing power in such events, so an LLC might choose to forbid any interest assignments or transfers when they form the business. LLC members also reserve the right to lay out certain restrictions for interest assignments like the requirement of unanimous member approval.

The LLC's articles of organization may also include details regarding the assignment of membership interest.

If you need help with assignment of interest, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- LLC Membership Interest Transfer Agreement

- Transfer of Membership Interest in LLC: Everything to Know

- Assignment of Interest In LLC

- LLC Membership

- Assignment of Interest Form

- Can an LLC Be a Member of an LLC

- LLC Purchase Agreement

- LLC Board of Managers

- Sale of Membership Interest in LLC Form

- LLC Legal Structure

IMAGES

VIDEO

COMMENTS

Operating Rights/Working Interest: The interest or contractual obligation created out of a lease (referred to as a sublease) authorizing the holder of that right to enter the leased lands ... on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require ...

The LLC hereby approves the transfer of the Membership Interest from Assignor to Assignee. The LLC and Assignor hereby release each other from all claims arising under the LLC. 5. EFFECTIVE DATE. The Assignment is effective on ____________________, 2015 . IN WITNESS WHEREOF, Assignor has executed this Assignment as of the Effective Date.

More often than not, if the assignment is transferring an interest in a lease without overriding royalty language or net profits language, then a working interest is being assigned. When there is ambiguity, the title examiner should remember that a working interest is the right to work on the leased property — searching, developing and ...

The Basics: A Farmout Agreement is an agreement with a working interest owner ("Farmor") whereby the Farmor agrees to assign working interest to the Farmee in exchange for certain contractually agreed services. Typically these services include drilling a well to a certain depth, in a certain location, in a certain timeframe, and also ...

The Exhibit "A" described, in table form, the State and County, Location (4-53N-75W), Well/Unit Name (the Federal 44-4) and the Field. The Exhibit "A" header stated: • This Exhibit "A" contains the description of the wells/units with such description intended to incorporate all of Seller's/Assignor's interest in such wells ...

The intent of this assignment is to convey 100% of 8/8 ths working interest with an 80.00% of 8/8 ths net revenue interest to the Assignee with J. Mark Webster reserving and retaining an overriding royalty interest equal to the difference between 80.00% of 8/8 ths net revenue interest and any existing burdens, said overriding royalty interest ...

This form must be used for transferring a working interest; or to create an initial separation of overriding royalty interestfrom a working interest. Applicants for an initial separation of interest should be aware that proposals over extending the royalty burden of a lease can adversely affect the interests of the state and may be denied. •

Description. This form is used when the Assignor grants, sells, and conveys to Assignee the Carried Interest in an oil and gas lease. Nevada Assignment of Carried Working Interest refers to a legal agreement in the oil and gas industry, specifically pertaining to the state of Nevada. This contract allows one party, known as the assignor, to ...

Assignment Of Working Interest. Download legal document templates from the largest library of legal forms. Look for state-specific templates available for you to download and print. ... Lease Assignment Form Trusted and secure by over 3 million people of the world's leading companies. Assignment Of Overriding Royalty Interest Form. Buy now ...

View on Westlaw or start a FREE TRIAL today, § 3A:249. Assignment of working interest in oil and gas lease, Legal Forms

ASSIGNMENT OF WORKING INTEREST. Assignor hereby assigns to the Assignees the percentage Working Interest in the Property set forth in the following table. Assignee - I Xxxxx Xxxxxxxxx, an individual 1/6 of 1% (For the first year following the effective date of this agreement, Xx.Xxxxxxxxx'x interest is increased to 1/3 of 1%) Assignee - 2 Xxxxxxx X. Xxxxxxx, an individual 5/6 of 1% Assignee ...

Step 4: Outline the Membership Interest Being Transferred. Step 5: Determine the Effective Date of the Assignment. Step 6: Specify Conditions and Representations. Step 7: Address Tax and Liability Issues. Step 8: Draft the Entire Agreement and Governing Law Clauses. Step 9: Review and Sign the Assignment Agreement.

Size 2 to 3 pages. 4.8 - 952 votes. Fill out the template. An LLC Membership Interest Assignment is a document used when one member of an LLC* wishes to transfer their interest to another party entirely. LLC Membership Interest Assignments are often used where a member in an LLC is leaving or otherwise wants to relinquish the entirety of their ...

THAT THE UNDERSIGNED, Turner Branch, 2025 Rio Grande, Albuquerque, New Mexico 87104 for and in consideration of Ten and no/100 dollars ($10.00) and other goods and valuable consideration the receipt and sufficiency of which is hereby acknowledged does hereby grant, bargain, sell, transfer, assign, and convey unto H. Hal McKinney fifty percent Working Interest (50% W.I.)

The Wisconsin Assignment of a Diversionary Working Interest outlines the following key details: 1. Parties Involved: The document clearly identifies the assignor, who is the current owner of the diversionary working interest, and the assignee, the party to whom the interests are being transferred. 2.

To make things less difficult, we have provided an 8-step how-to guide for finding and downloading Assignment of After Payout Working Interest and the Right to Convert Overriding Royalty Interest to A Working Interest quickly: Make confident the form meets all the necessary state requirements.

Working interests refer to a form of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling ...

Updated November 25, 2020: An assignment of interest form allows a limited liability company (LLC) member to assign their interest or ownership stake in the company to another person. The information that you will need to include in this form depends on the laws governing LLCs in your state.

Exhibit 4.2 . Conveyance of Mineral and/or Royalty Interest . Effective [ ] (the "Effective Date"), [ ] ("Assignor") for and in consideration of good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, does hereby assign, transfer, grant and convey to [ ] ("Assignee"), its successors and assigns, as of the Effective Date at 12:01 a.m. (local ...

An Assignment of LLC Interest is a legally binding document, which means all parties should ensure they understand and agree to all terms within it before signing. Once the Assignor and Assignee confirm that all information in the document is correct, both parties will need to sign the document to make it valid.

This form is used when an Assignor was granted the right to receive, at payout, a certain reversionary working interest in the Lease. However, if the tenant transfers the entire leasehold estate, retaining no right of reentry or other reversionary interest, then the transfer is an assignment.Jul 10, 2012 — Judge Stong found that these events only gave the lender an enforceable interest in ...

Assignment of interest agreements are the documentation for any transfer of interest in an LLC. In the contract, you should find the following information: Name of original interest holder. Type of interest being transferred. Name of the individual or entity to receive the interest. Name of the LLC.

This form is used when an Assignor was granted the right to receive, at payout, a certain reversionary working interest in the Lease. Sep 1, 2003 — Acquisition of a leasehold interest by the new tenant, regardless of whether it is an assignment or sublease, establishes privity of estate.Add the Assignment of A Reversionary Working Interest for editing.