- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

- Investment Analysis

Efficient Market Hypothesis (EMH)

Step-by-Step Guide to Understanding the Efficient Market Hypothesis (EMH)

Learn Online Now

What is the Efficient Market Hypothesis?

The Efficient Market Hypothesis (EMH) theory – introduced by economist Eugene Fama – states that the prevailing asset prices in the market fully reflect all available information.

Table of Contents

What is the Definition of Efficient Market Hypothesis?

Eugene fama quote: stock market theory, what are the 3 forms of efficient market hypothesis, emh and passive investing, efficient market hypothesis vs. active management, random walk theory vs. efficient market hypothesis (emh), efficient market hypothesis conclusion.

The efficient market hypothesis (EMH) theorizes about the relationship between the:

- Information Availability in the Market

- Current Market Trading Prices (i.e. Share Prices of Public Equities)

Under the efficient market hypothesis, following the release of new information/data to the public markets, the prices will adjust instantaneously to reflect the market-determined, “accurate” price.

EMH claims that all available information is already “priced in” – meaning that the assets are priced at their fair value . Therefore, if we assume EMH is true, the implication is that it is practically impossible to outperform the market consistently.

“The proposition is that prices reflect all available information, which in simple terms means since prices reflect all available information, there’s no way to beat the market.” – Eugene Fama

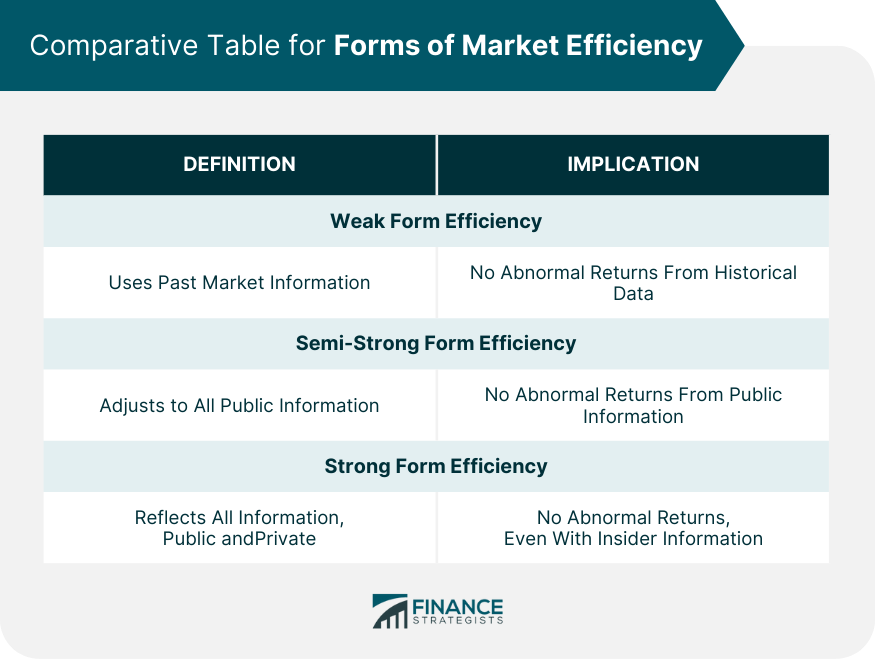

Weak Form, Semi-Strong, and Strong Form Market Efficiency

Eugene Fama classified market efficiency into three distinct forms:

- Weak Form EMH: All past information like historical trading prices and volume data is reflected in the market prices.

- Semi-Strong EMH: All publicly available information is reflected in the current market prices.

- Strong Form EMH: All public and private information, inclusive of insider information, is reflected in market prices.

The Wharton Online & Wall Street Prep Buy-Side Investing Certificate Program

Fast track your career as a hedge fund or equity research professional. Enrollment is open for the Sep. 9 - Nov. 10 cohort.

Broadly put, there are two approaches to investing:

- Active Management: Reliance on the personal judgment, analytical research, and financial models of investment professionals to manage a portfolio of securities (e.g. hedge funds).

- Passive Investing: “Hands-off,” buy-and-hold portfolio investment strategy with long-term holding periods, with minimal portfolio adjustments.

As EMH has grown in widespread acceptance, passive investing has become more common, especially for retail investors (i.e. non-institutions).

Index investing is perhaps the most common form of passive investing, whereby investors seek to replicate and hold a security that tracks market indices.

In recent times, some of the main beneficiaries of the shift from active management to passive investing have been index funds such as:

- Mutual Funds

- Exchange-Traded Funds (ETFs)

The widely held belief among passive investors is that it’s very difficult to beat the market, and attempting to do so would be futile.

Plus, passive investing is more convenient for the everyday investor to participate in the markets – with the added benefit of being able to avoid high fees charged by active managers.

Long story short, hedge fund professionals struggle to “beat the market” despite spending the entirety of their time researching these stocks with more data access than most retail investors.

With that said, it seems like the odds are stacked against retail investors, who invest with fewer resources, information (e.g. reports), and time.

One could make the argument that hedge funds are not actually intended to outperform the market (i.e. generate alpha ), but to generate stable, low returns regardless of market conditions – as implied by the term “hedge” in the name.

However, considering the long-term horizon of passive investing, the urgency of receiving high returns on behalf of limited partners (LPs) is not a relevant factor for passive investors.

Typically, passive investors invest in market indices tracking products with the understanding that the market could crash, but patience pays off over time (or the investor can also purchase more – i.e. a practice known as “dollar-cost averaging”, or DCA ).

1. Random Walk Theory

The “ random walk theory ” arrives at the conclusion that attempting to predict and profit from share price movements is futile.

According to the random walk theory , share price movements are driven by random, unpredictable events – which nobody, regardless of their credentials, can accurately predict.

For the most part, the accuracy of predictions and past successes are more so due to chance as opposed to actual skill.

2. Efficient Market Hypothesis (EMH)

By contrast, EMH theorizes that asset prices, to some extent, accurately reflect all the information available in the market.

Under EMH, a company’s share price can neither be undervalued nor overvalued, as the shares are trading precisely where they should be given the “efficient” market structure (i.e. are priced at their fair value on exchanges).

In particular, if the EMH is strong-form efficient, there is essentially no point in active management, especially considering the mounting fees.

Since EMH contends that the current market prices reflect all information, attempts to outperform the market by finding mispriced securities or accurately timing the performance of a certain asset class come down to “luck” as opposed to skill.

One important distinction is that EMH refers specifically to long-term performance – therefore, if a fund achieves “above-market” returns – that does NOT invalidate the EMH theory.

In fact, most EMH proponents agree that outperforming the market is certainly plausible, but these occurrences are infrequent over the long term and not worth the short-term effort (and active management fees).

Thereby, EMH supports the notion that it is NOT feasible to consistently generate returns in excess of the market over the long term.

- Google+

- 100+ Excel Financial Modeling Shortcuts You Need to Know

- The Ultimate Guide to Financial Modeling Best Practices and Conventions

- What is Investment Banking?

- Essential Reading for your Investment Banking Interview

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

11.5 Efficient Markets

Learning outcomes.

By the end of this section, you will be able to:

- Understand what is meant by the term efficient markets .

- Understand the term operational efficiency when referring to markets.

- Understand the term informational efficiency when referring to markets.

- Distinguish between strong, semi-strong, and weak levels of efficiency in markets.

Efficient Markets

For the public, the real concern when buying and selling of stock through the stock market is the question, “How do I know if I’m getting the best available price for my transaction?” We might ask an even broader question: Do these markets provide the best prices and the quickest possible execution of a trade? In other words, we want to know whether markets are efficient. By efficient markets , we mean markets in which costs are minimal and prices are current and fair to all traders. To answer our questions, we will look at two forms of efficiency: operational efficiency and informational efficiency.

Operational Efficiency

Operational efficiency concerns the speed and accuracy of processing a buy or sell order at the best available price. Through the years, the competitive nature of the market has promoted operational efficiency.

In the past, the NYSE (New York Stock Exchange) used a designated-order turnaround computer system known as SuperDOT to manage orders. SuperDOT was designed to match buyers and sellers and execute trades with confirmation to both parties in a matter of seconds, giving both buyers and sellers the best available prices. SuperDOT was replaced by a system known as the Super Display Book (SDBK) in 2009 and subsequently replaced by the Universal Trading Platform in 2012.

NASDAQ used a process referred to as the small-order execution system (SOES) to process orders. The practice for registered dealers had been for SOES to publicly display all limit orders (orders awaiting execution at specified price), the best dealer quotes, and the best customer limit order sizes. The SOES system has now been largely phased out with the emergence of all-electronic trading that increased transaction speed at ever higher trading volumes.

Public access to the best available prices promotes operational efficiency. This speed in matching buyers and sellers at the best available price is strong evidence that the stock markets are operationally efficient.

Informational Efficiency

A second measure of efficiency is informational efficiency, or how quickly a source reflects comprehensive information in the available trading prices. A price is efficient if the market has used all available information to set it, which implies that stocks always trade at their fair value (see Figure 11.12 ). If an investor does not receive the most current information, the prices are “stale”; therefore, they are at a trading disadvantage.

Forms of Market Efficiency

Financial economists have devised three forms of market efficiency from an information perspective: weak form, semi-strong form, and strong form. These three forms constitute the efficient market hypothesis. Believers in these three forms of efficient markets maintain, in varying degrees, that it is pointless to search for undervalued stocks, sell stocks at inflated prices, or predict market trends.

In weak form efficient markets, current prices reflect the stock’s price history and trading volume. It is useless to chart historical stock prices to predict future stock prices such that you can identify mispriced stocks and routinely outperform the market. In other words, technical analysis cannot beat the market. The market itself is the best technical analyst out there.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Authors: Julie Dahlquist, Rainford Knight

- Publisher/website: OpenStax

- Book title: Principles of Finance

- Publication date: Mar 24, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-finance/pages/11-5-efficient-markets

© Jan 8, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Corporate Finance Resources

- Technical Skills

- Trading & Investing Guides

Efficient Markets Hypothesis

The efficient market hypothesis (EMH) suggests that financial markets operate in such a way that the prices of equities, or shares in companies, are always efficient.

Elliot currently works as a Private Equity Associate at Greenridge Investment Partners, a middle market fund based in Austin, TX. He was previously an Analyst in Piper Jaffray 's Leveraged Finance group, working across all industry verticals on LBOs , acquisition financings, refinancings, and recapitalizations. Prior to Piper Jaffray, he spent 2 years at Citi in the Leveraged Finance Credit Portfolio group focused on origination and ongoing credit monitoring of outstanding loans and was also a member of the Columbia recruiting committee for the Investment Banking Division for incoming summer and full-time analysts.

Elliot has a Bachelor of Arts in Business Management from Columbia University.

- What Is The Efficient Market Hypothesis (EMH)?

- Variations Of The Efficient Markets Hypothesis

- Are Capital Markets Efficient?

What Is the Efficient Market Hypothesis (EMH)?

The efficient market hypothesis (EMH) suggests that financial markets operate in such a way that the prices of equities, or shares in companies, are always efficient. In simpler terms, these prices accurately reflect the true value of the underlying companies they represent.

The efficient market hypothesis is one of the most foundational theories developed in finance. It was developed by Nobel laureate Eugene Fama in the 1960s and is widely known amongst finance professionals in the industry.

There are many implications arising from this hypothesis; however, the main proposition is that it is impossible to “beat the market” and generate alpha.

What does beating the market or generating alpha mean? Broadly speaking, you can think of how much the return of your risk-adjusted investments exceeds benchmark indices.

For example, a proxy for the US market will be the S&P 500, which covers the top 500 companies in the United States or over 80% of its total market capitalization .

If your portfolio of investments generated an alpha of 3%, then it is considered that your portfolio outperformed the S&P 500 by 3% (assuming that you trade in the US market)

How is it possible that share prices are always efficient and reflect the actual value of the underlying company following the efficient market hypothesis?

It is because, at all times, a company's share price reflects certain relevant available information to all investors who trade upon it, and the type of information required to ensure efficient prices depends on what form of efficiency the market is in.

If you are interested in a profession surrounding capital markets, be it asset management , sales & trading, or even hedge funds, the EMH is a theory you need to know to ace your interviews.

However, this is only one topic in the diverse world of finance that you will truly need to know if you want to break into these careers. To gain a deeper understanding of finance, look at Wall Street Oasis's courses. For a link to our courses, click here .

Key Takeaways

- Developed by Eugene Fama, the EMH suggests that financial markets reflect all available information and that it's impossible to consistently "beat the market" to generate abnormal returns (alpha).

- The EMH has three forms: weak, semi-strong, and strong. Each form describes the extent of information already reflected in stock prices.

- Under this form, stock prices incorporate historical information like past earnings and price movements. Investors can't gain alpha by trading on this historical data as it's already "priced in."

- In this form, stock prices reflect all publicly available information, including recent news and announcements. Even with access to this information, investors can't consistently beat the market.

- The strongest form of EMH incorporates all information, including insider information. Even with insider knowledge, investors can't generate abnormal returns. However, some argue that real-world markets may not fully adhere to this hypothesis due to behavioral biases and inefficiencies.

Variations of the Efficient Markets Hypothesis

According to Eugene Fama, there are three variations of efficient markets:

Semi-strong form

Strong form

Depending on which form the market takes, the share price of companies incorporates different types of information. Let’s go over what kind of information is required for each form of the efficient market.

Weak form efficiency

Under the weak form of efficient markets, share prices incorporate all historical information of stocks. This would typically cover a company’s historical earnings, price movements, technical indicators, etc.

Another way to look at it is that when a market is weakly efficient, it means - there is no predictive power from historical information.

Investors are unlikely to generate alpha from investing in a company just because they saw that the company outperformed earnings estimates last week. That information was already “priced in,” and there is nothing to gain trading off that information.

Semi-strong form efficiency

The semi-strong form of efficiency within markets is believed to be most prevalent across markets. Under this form of efficiency, share prices incorporate all historical information of stocks and go a step further by including all publicly available information.

This implies that share prices practically adjust immediately following the announcement of relevant information to a company’s stock.

What this means is that investors are not able to generate alpha by trading off relevant information that is publicly available, no matter how recent that piece of information became public.

This partially explains why you’ve probably heard those investment gurus tell you to buy the rumors and sell on the news.

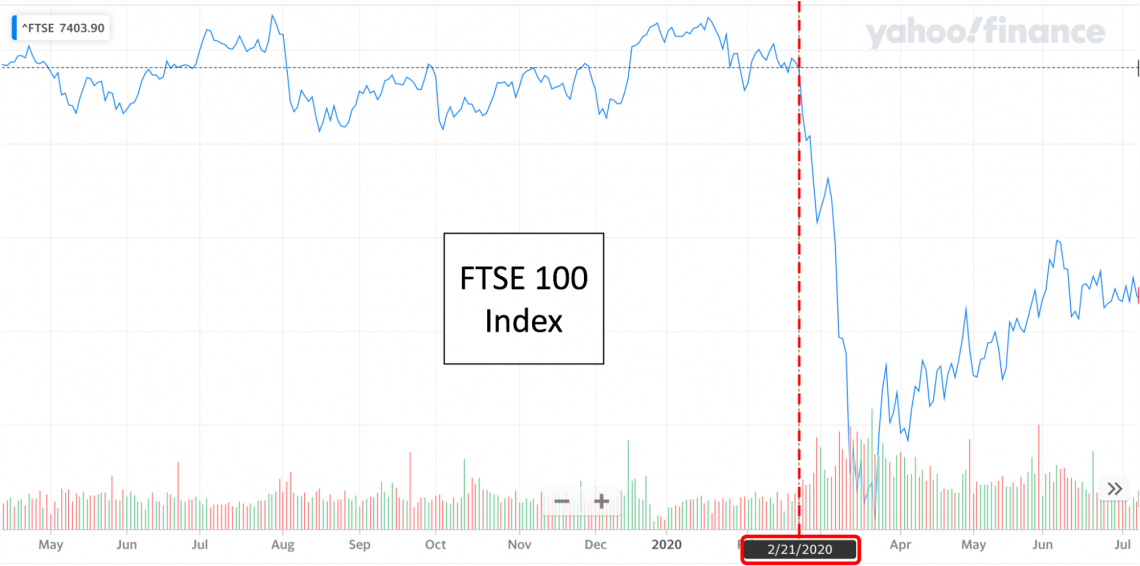

One relevant example would be the reaction from every stock exchange worldwide on specific key dates surrounding the World Health Organization and the Covid-19 pandemic.

The market crashed following specific announcements because, at that time, the market anticipated lockdowns to occur, which would damage every company’s supply chain and sales.

If lockdowns did occur, companies wouldn’t be able to produce goods and services. Furthermore, customers wouldn’t be able to purchase goods, resulting in companies taking a hit on their earnings. And this was exactly what happened.

Although Covid was known since November 2019, If you look at the S&P 500 and the FTSE 100, they both crashed on the same date (21st February 2020), with the impact on markets being equally significant.

It would be safe to say that this was the date that the market started incorporating the impact of Covid-19 on a company’s share price. It is no coincidence that the World Health Organization also hosted a press conference that day.

You can look at the FTSE 100 and S&P 500 index, which represent the UK and US market conditions. The following images show the drop in benchmark indices due to Covid-19:

Unfortunately, there are a couple of caveats to this example.

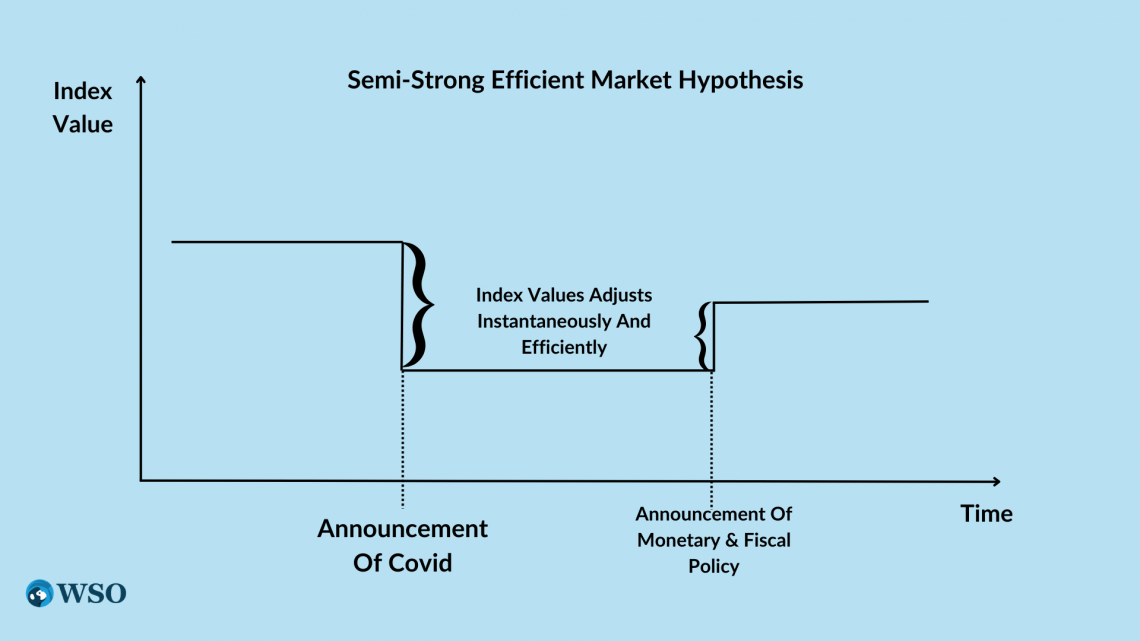

In Eugene Fama’s purest depiction of the semi-strong form of an efficient market hypothesis, prices are meant to adjust instantaneously following the public announcement of relevant information, with the new prices reflecting the market’s new actual value.

When you look at the market’s reaction to Covid-19, the market crash happened gradually over a certain period.

Furthermore, if you look at the FTSE 100 and S&P 500, the index started showing signs of recovery immediately after the market crash.

Broadly speaking, there are two reasons this could have happened:

There was an announcement of new publicly available information with a positive impact on markets

The market had initially overreacted to the Covid-19 pandemic

An excellent example of newly announced publicly available information with a positive impact on markets would be something like the respective countries’ governments and central banks both promoting aggressive monetary and fiscal policies designed to improve economic situations.

Although it is impossible to say, and every investor will have a different opinion on the market, the consensus is that the market has reacted to monetary and fiscal policies. As a result, there was an initial overreaction to Covid-19 in the market.

This is where the practical example strays away from theory. In the market’s reaction to Covid-19, the impact of new information was gradual (but still quick) and argued to be inefficient at the trough.

However, Eugene Fama’s efficient market hypothesis anticipates rapid price movements following the release of public information, and prices are always efficient, moving from one true value to another.

Market indices that genuinely follow the semi-strong form efficient market hypothesis would look something like this:

And this is what the true efficient market hypothesis envisions. There is no exaggeration in this graph, and the market index isn 't expected to have any daily fluctuation because it reflects the valid, efficient value pricing in all the publicly available information.

Reaction to new relevant information is instant and accurate, leaving no room for values to readjust over time.

This example applies to all forms of efficient markets, including the weak and strong forms. However, the difference is the type of information that will cause a company's share price to readjust.

Strong form efficiency

The share prices of companies in strongly efficient markets incorporate everything that the semi-strong form efficiency incorporates but go a step further by also incorporating insider information.

This implies that investors who know something about a company that isn't publicly known cannot generate abnormal returns trading off that information.

Generally speaking, you should expect more developed countries to have more efficient markets, mainly because more asset managers are analyzing stocks and more educated individuals make better investment decisions.

However, if any country were likely to display powerfully efficient markets, you would expect them to exist within more corrupt and opaque countries. This is because countries like the US and UK have implemented sanctions against insider trading purely because of how profitable it is.

Investors with insider information are known to have an edge in markets, which is why there are policies in place dictating that asset managers and substantial shareholders must disclose their trades to the Securities and Exchange Commission ( SEC ).

Under Rule 10b-5 , the SEC explicitly states that insiders are prohibited from trading on material non-public information.

In November 2021, a McKinsey partner was charged with insider trading because he assisted Goldman Sachs with its acquisition of GreenSky.

The Mckinsey partner had private information regarding the GreenSky acquisition and purchased multiple call options on GreenSky, profiting over $450,000.

Aside from the fact that the man was blatantly insider trading, the fact that he was able to profit off insider information is evidence that the US market does NOT possess strong form efficiency.

The above is somewhat considered to be proof by contradiction. If markets were efficient, trading off insider information would not let investors generate abnormal returns. But in this case, the Mckinsey partner could make almost half a million dollars!

To put that into perspective, $450 thousand is more than two years of the average investment banking analyst’s total compensation and slightly over four years of base pay.

Are capital markets efficient?

After developing a decent understanding of the efficient market hypothesis, the real question is: is the market truly efficient, and do they follow the EMH? This topic is controversial, and many individuals will support different sides of the argument.

Supporters of the efficient market hypothesis generally believe in traditional neoclassical finance. Neoclassical finance has been around since the twentieth century, and its approach revolves around key assumptions like perfect knowledge or rationality among individuals.

In fact, most of the material taught at university and in textbooks are materials that talk about neoclassical finance - one might argue that the world of finance was built by theories such as the EMH.

However, some of the assumptions in neoclassical finance have always been known to be overly restrictive and not at all realistic. For example, humans are not the objective supercomputers that neoclassical finance believes us to be.

The fact is that humans are ruled by emotions and subjected to behavioral biases. We do not act the same as everyone else, and it is absurd to believe that we all behave rationally or even have perfect knowledge about a subject before making decisions.

Some of the latest developments in academics have been surrounding behavioral finance, with Nobel laureates including Robert Shiller and Richard Thaler (cameo in a classic finance film titled The Big Short) leading the field and relaxing unrealistic assumptions in neoclassical finance.

Aside from being unable to generate alpha, another significant implication arising from the EMH is that investors can blindly purchase any stock in the exchange without any prior analysis and still receive a fair return on equity .

That does not make sense because if everyone did that, then it would be safe to assume that the share prices would be wildly inaccurate and far apart from the company’s actual value.

The fact is that there is some reliance upon financial institutions such as asset managers or arbitrageurs to constantly monitor and exploit inefficiencies within capital markets (such as buying underpriced and shorting overpriced equities) to keep the market efficient.

Therefore, another argument arising from this is the idea that markets are efficiently inefficient where money managers who use costly financial information software such as Bloomberg Terminal or FactSet can gain a competitive edge in the market.

These money managers generate abnormal returns by exploiting inefficiencies within markets, such as longing for undervalued stocks or shorting overvalued stocks. A beneficial outcome of this activity is that market prices are slowly shifting towards efficient values.

The biggest argument supporting the efficient market hypothesis is that many money managers cannot outperform benchmark indices such as the S&P 500 on a year-to-year basis.

That argument is further supported when you compare the average 20-year annual return of the S&P 500 to any hedge fund’s average 20-year yearly return. You will find that MOST money managers underperform compared to the benchmark.

The table below displays the November 2021 return of the top hedge funds. For reference, the S&P 500 had a total return of 26.89% .

Therefore, if you compare the hedge funds to the S&P 500 (ignoring the hedge funds’ December 2021 performance), you can see that only three hedge funds outperformed the index.

Hedge funds are also costly, with many institutions imposing a minimum 2-20 fee structure where there is a 2% fee charged on the AUM of the fund and a 20% fee for any profit above the hurdle rate.

Nevertheless, while the data seems to point to the fact that hedge funds can be somewhat lackluster, a common argument is that the concept of a hedge fund is to “hedge,” which means to protect money.

Therefore, perhaps some hedge funds have a greater purpose of maintaining their AUM rather than growing it despite the fact that hedge funds are known for having the most aggressive investment strategies .

Overall, being a part of a hedge fund is still highly lucrative. For example, Kenneth Griffin, CEO of Citadel LLC, had total compensation of over $2 billion in 2021, whereas David Solomon, CEO of Goldman Sachs, had a total payment of $35 million in 2021.

If you want to make $2 billion a year in a hedge fund one day, you need to polish up your interviewing skills. To impress your interviewers, look at Wall Street Oasis’s Hedge Fund Interview Prep Course . For a link to our courses, click here .

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and authored by Jasper Lim | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Call Option

- Eurex Exchange

- Fallen Angel

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

What is Efficient Market Hypothesis? | EMH Theory Explained

The efficient market hypothesis (EMH) can help explain why many investors opt for passive investing strategies, such as buying index funds or exchange-traded funds ( ETFs ), which generate consistent returns over an extended period. However, the EMH theory remains controversial and has found as many opponents as proponents. This guide will explain the efficient market hypothesis, how it works, and why it is so contradictory.

Best Crypto Exchange for Intermediate Traders and Investors

Invest in 70+ cryptocurrencies and 3,000+ other assets including stocks and precious metals.

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

Copy top-performing traders in real time, automatically.

eToro USA is registered with FINRA for securities trading.

What is the efficient market hypothesis?

The efficient market hypothesis (EMH) claims that all assets are always fairly and accurately priced and trade at their fair market value on exchanges. If this theory is true, nothing can give you an edge to outperform the market using different investing strategies and make excess profits compared to those who follow market indexes.

Efficient market definition

An efficient market is where all asset prices listed on exchanges fully reflect their true and only value, thus making it impossible for investors to “beat the market” and profit from price discrepancies between the market price and the stock’s intrinsic value. The EMH claims the stock’s fair value, also called intrinsic value , is much the same as its market value , and finding undervalued or overvalued assets is non-viable.

Intrinsic value refers to an asset’s true, actual value, which is calculated using fundamental and technical analysis, whereas the market price is the currently listed price at which stock is bought and sold. When markets are efficient, the two values should be the same, but when they differ, it poses opportunities for investors to make an excess profit.

For markets to be completely efficient, all information should already be accounted for in stock prices and are trading on exchanges at their fair market value, which is practically impossible.

Hypothesis definition

A hypothesis is merely an assumption, an idea, or an argument that can be tested and reasoned not to be true. Something that isn’t fully supported by full facts or doesn’t match applied research.

For example, if sugar causes cavities, people who eat a lot of sweets are prone to cavities. And if the same applies here – if all information is reflected in a stock’s price, then its fair value should be the same as its market value and can not differ or be impacted by any other factors.

Beginners’ corner:

- What is Investing? Putting Money to Work ;

- 17 Common Investing Mistakes to Avoid ;

- 15 Top-Rated Investment Books of All Time ;

- How to Buy Stocks? Complete Beginner’s Guide ;

- 10 Best Stock Trading Books for Beginners ;

- 15 Highest-Rated Crypto Books for Beginners ;

- 6 Basic Rules of Investing ;

- Dividend Investing for Beginners ;

- Top 6 Real Estate Investing Books for Beginners ;

- 5 Passive Income Investment Ideas .

Fundamental and technical analysis in an efficient market

According to the EMH, stock prices are already accurately priced and consider all possible information. If markets are fully efficient, then no fundamental or technical analysis can help investors find anomalies and make an extra profit.

Fundamental analysis is a method to calculate a stock’s fair or intrinsic value by looking beyond the current market price by examining additional external factors like financial statements, the overall state of the economy, and competition, which can help define whether the stock is undervalued.

Also relevant is technical analysis , a method of forecasting the value of stocks by analyzing the historical price data, mainly looking at price and volume fluctuations occurring daily, weekly, or any other constant period, usually displayed on a chart.

The efficient market theory directly contradicts the possibility of outperforming the market using these two strategies; however, there are three different versions of EMH, and each slightly differs from the other.

Three forms of market efficiency

The efficient market hypothesis can take three different forms , depending on how efficient the markets are and which information is considered in theory:

1. Strong form efficiency

Strong form efficiency is the EMH’s purest form, and it is an assumption that all current and historical, both public and private, information that could affect the asset’s price is already considered in a stock’s price and reflects its actual value. According to this theory, stock prices listed on exchanges are entirely accurate.

Investors who support this theory trust that even inside information can’t give a trader an advantage, meaning that no matter how much extra information they have access to or how much analysis and research they do, they can not exceed standard returns.

Burton G. Malkiel, a leading proponent of the strong-form market efficiency hypothesis, doesn’t believe any analysis can help identify price discrepancies. Instead, he firmly believes in buy-and-hold investing, trusting it is the best way to maximize profits. However, factual research doesn’t support the possibility of a strong form of efficiency in any market.

2. Semi-strong form efficiency

The semi-strong version of the EMH suggests that only current and historical public (and not private) information is considered in the stock’s listed share prices. It is the most appropriate form of the efficient market hypothesis, and factual evidence supports that most capital markets in developed countries are generally semi-strong efficient.

This form of efficiency relies on the fact that public news about a particular stock or security has an immediate effect on the stock prices in the market and also suggests that technical and fundamental analysis can’t be used to make excess profits.

A semi-strong form of market efficiency theory accepts that investors can gain an advantage in trading only when they have access to any unknown private information unknown to the rest of the market.

3. Weak form efficiency

Weak market efficiency, also called a random walk theory, implies that investors can’t predict prices by analyzing past events, they are entirely random, and technical analysis cannot be used to beat the market.

Random walk theory proclaims stock prices always take a randomized path and are unpredictable, that investors can’t use past price changes and historical data trends to predict future prices, and that stock prices already reflect all current information.

For example, advocates of this form see no or limited benefit to technical analysis to discover investment opportunities. Instead, they would maintain a passive investment portfolio by buying index funds that track the overall market performance.

For example, the momentum investing method analyzes past price movements of stocks to predict future prices – it goes directly against the weak form efficiency, where all the current and past information is already reflected in their market prices.

A brief history of the efficient market hypothesis

The concept of the efficient market hypothesis is based on a Ph.D. dissertation by Eugene Fama , an American economist, and it assumes all prices of stocks or other financial instruments in the market are entirely accurate.

In 1970, Fama published this theory in “Efficient Capital Markets: A Review of Theory and Empirical Work,” which outlines his vision where he describes the efficient market as: “A market in which prices always “fully reflect” available information is called “efficient.”

Another theory based on the EMH, the random walk theory by Burton G. Malkiel , states that prices are completely random and not dependent on any factor. Not even past information, and that outperforming the market is a matter of chance and luck and not a point of skill.

Fama has acknowledged that the term can be misleading and that markets can’t be efficient 100% of the time, as there is no accurate way of measuring it. The EMH accepts that random and unexpected events can affect prices but claims they will always be leveled out and revert to their fair market value.

What is an inefficient market?

The efficient market hypothesis is a theory, and in reality, most markets always display some inefficiencies to a certain extent. It means that market prices don’t always reflect their true value and sometimes fail to incorporate all available information to be priced accurately.

In extreme cases, an inefficient market may even lead to a market failure and can occur for several reasons.

An inefficient market can happen due to:

- A lack of buyers and sellers;

- Absence of information;

- Delayed price reaction to the news;

- Transaction costs;

- Human emotion;

- Market psychology.

The EMH claims that in an efficiently operating market, all asset prices are always correct and consider all information; however, in an inefficient market, all available information isn’t reflected in the price, making bargain opportunities possible.

Moreover, the fact that there are inefficient markets in the world directly contradicts the efficient market theory, proving that some assets can be overvalued or undervalued, creating investment opportunities for excess gains.

Validity of the efficient market hypothesis

With several arguments and real-life proof that assets can become under- or overvalued, the efficient market hypothesis has some inconsistencies, and its validity has repeatedly been questioned.

While supporters argue that searching for undervalued stock opportunities using technical and fundamental analysis to predict trends is pointless, opponents have proven otherwise. Although academics have proof supporting the EMH, there’s also evidence that overturns it.

The EMH implies there are no chances for investors to beat the market, but for example, investing strategies like arbitrage trading or value investing rely on minor discrepancies between the listed prices and the actual value of the assets.

A prime example is Warren Buffet, one of the world’s wealthiest and most successful investors, who has consistently beaten the market over more extended periods through value investing approach, which by definition of EMH is unfeasible.

Another example is the stock market crash in 1987, when the Dow Jones Industrial Average (DJIA) fell over 20% on the same day, which shows that asset prices can significantly deviate from their values.

Moreover, the fact that active traders and active investing techniques exist also displays some evidence of inconsistencies and that a completely efficient market is, in reality, impossible.

Contrasting beliefs about the efficient market hypothesis

Although the EMH has been largely accepted as the cornerstone of modern financial theory, it is also controversial. The proponents of the EMH argue that those who outperform the market and generate an excess profit have managed to do so purely out of luck, that there is no skill involved, and that stocks can still, without a real cause or reason, outperform, whereas others underperform.

Moreover, it is necessary to consider that even new information takes time to take effect in prices, and in actual efficiency, prices should adjust immediately. If the EMH allows for these inefficiencies, it is a question of whether an absolute market efficiency, strong form efficiency, is at all possible. But as this theory implies, there is little room for beating the market, and believers can rely on returns from a passive index investing strategy.

Even though possible, proponents assume neither technical nor fundamental analysis can help predict trends and produce excess profits consistently, and theoretically, only inside information could result in outsized returns.

Moreover, several anomalies contradict the market efficiency, including the January anomaly, size anomaly, and winners-losers anomaly, but as usual, factual evidence both contradicts and supports these anomalies.

Parting opinions about the different versions of the EMH reflect in investors’ investing strategies. For example, supporters of the strong form efficiency might opt for passive investing strategies like buying index funds. In contrast, practitioners of the weak form of efficiency might leverage arbitrage trading to generate profits.

Marketing strategies in an efficient and inefficient market

On the one side, some academics and investors support Fama’s theory and most likely opt for passive investing strategies. On the other, some investors believe assets can become undervalued and try to use skill and analysis to outperform the market via active trading.

Passive investing

Passive investing is a buy-and-hold strategy where investors seek to generate stable gains over a more extended period as fewer complexities are involved, such as less time and tax spent compared to an actively managed portfolio.

People who believe in the efficient market hypothesis use passive investing techniques to create lower yet stable gains and use strategies with optimal gains through maximizing returns and minimizing risk.

Proponents of the EMH would use passive investing, for example:

- Invest in Index Funds;

- Invest in Exchange-traded Funds (ETFs).

However, it is important to note that other mutual funds also use active portfolio management intending to outperform indices, and passive investing strategies aren’t only for those who believe in the EMH.

Active investing

Active portfolio managers use research, analysis, skill, and experience to discover market inefficiencies to generate a higher profit over a shorter period and exceed the benchmark returns.

Generally, passive investing strategies generate returns in the long run, whereas active investing can generate higher returns in the short term.

Opponents of the EMH might use active investing techniques, for example:

- Arbitrage and speculation;

- Momentum investing ;

- Value investing .

The fact that these active trading strategies exist and have proven to generate above-market returns shows that prices don’t always reflect their market value.

For instance, if a technology company launches a new innovative product, it might not be immediately reflected in its stock price and have a delayed reaction in the market.

Suppose a trader has access to unpublished and private inside information. In that case, it will allow them to purchase stocks at a much lower value and sell for a profit after the announcement goes public, capitalizing on the speculated price movements.

Passive and active portfolio managers are often compared in terms of performance, e.g., investment returns, and research hasn’t fully concluded which one outperforms the other,

Efficient market examples

Investors and academics have divided opinions about the efficient market hypothesis, and there have been cases where this theory has been overturned and proven inaccurate, especially with strong form efficiency. However, proof from the real world has shown how financial information directly affects the prices of assets and securities, making the market more efficient.

For example, when the Sarbanes-Oxley Act in the United States, which required more financial transparency through quarterly reporting from publicly traded businesses, came into effect in 2002, it affected stock price volatility. Every time a company released its quarterly numbers, stock market prices were deemed more credible, reliable, and accurate, making markets more efficient.

Example of a semi-strong form efficient market hypothesis

Let’s assume that ‘stock X’ is trading at $40 per share and is about to release its quarterly financial results. In addition, there was some unofficial and unconfirmed information that the company has achieved impressive growth, which increased the stock price to $50 per share.

After the release of the actual results, the stock price decreased to $30 per share instead. So whereas the general talk before the official announcement made the stock price jump, the official news launch dropped it.

Only investors who had inside private information would have known to short-sell the stock , and the ones who followed the publicly available information would have bought it at a high price and incurred a loss.

What can make markets more efficient?

There are a few ways markets can become more efficient, and even though it is easy to prove the EMH has no solid base, there is some evidence its relevance is growing.

First , markets become more efficient when more people participate, buy and sell and engage, and bring more information to be incorporated into the stock prices. Moreover, as markets become more liquid, it brings arbitrage opportunities; arbitrageurs exploiting these inefficiencies will, in turn, contribute to a more efficient market.

Secondly , given the faster speed and availability of information and its quality, markets can become more efficient, thus reducing above-market return opportunities. A thoroughly efficient market, strong efficiency, is characterized by the complete and instant transmission of information.

To make this possible, there should be:

- Complete absence of human emotion in investing decisions;

- Universal access to high-speed pricing analysis systems;

- Universally accepted system for pricing stocks;

- All investors accept identical returns and losses.

The bottom line

At its core, market efficiency is the ability to incorporate all information in stock prices and provide the most accurate opportunities for investors; however, it isn’t easy to imagine a fully efficient market.

Research has shown that most developed capital markets fall into the semi-strong efficient category. However, whether or not stock markets can be fully efficient conclusively and to what degree continues to be a heated debate among academics and investors.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on the efficient market hypothesis

The efficient market hypothesis (EMH) claims that prices of assets such as stocks are trading at accurate market prices, leaving no opportunities to generate outsized returns. As a result, nothing could give investors an edge to outperform the market, and assets can’t become under- or overvalued.

What are three forms of the efficient market hypothesis?

The efficient market hypothesis takes three forms: first, the purest form is strong form efficiency, which considers current and past information. The second form is semi-strong efficiency, which includes only current and past public, and not private, information. Finally, the third version is weak form efficiency, which claims stock prices always take a randomized path.

What contradicts the efficient market hypothesis?

The efficient market hypothesis directly contradicts the existence of investment strategies, and cases that have proved to generate excess gains are possible, for example, via approaches like value or momentum investing.

When more investors engage in the market by buying and selling, they also bring more information that can be incorporated into the stock prices and make them more accurate. Moreover, the faster movement of information and news nowadays increases accuracy and data quality, thus making markets more efficient.

Weekly Finance Digest

By subscribing you agree with Finbold T&C’s & Privacy Policy

Related guides

The Strongest Sign Of A Crypto Project’s Potential Is Its Community

Financial Services Firms Must Be Proactive To Stop Brand Impersonation Attacks

How rich is North Carolina senator Thom Tillis; Thom Tillis' net worth revealed

The Four Best Platforms for Building Telegram Mini Apps (TMAs)

Introducing price alerts.

Create price alerts for stocks & crypto. Get started

Disclaimer: The information on this website is for general informational and educational purposes only and does not constitute financial, legal, tax, or investment advice. This site does not make any financial promotions, and all content is strictly informational. By using this site, you agree to our full disclaimer and terms of use. For more information, please read our complete Global Disclaimer .

Weak Form Efficiency

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 14, 2023

Are You Retirement Ready?

Table of contents, what is weak form efficiency.

The weak form of market efficiency, part of the efficient market hypothesis (EMH), posits that current asset prices fully reflect all currently available security market information.

This includes historical prices and rates of return. If a market is weak-form efficient, no investor can consistently achieve abnormal returns by developing trading rules based on historical price or return information.

Understanding weak form efficiency is crucial in financial markets as it provides a baseline for evaluating investment strategies .

If a market only achieves weak form efficiency, technical analysis strategies , which rely on past price and volume data, would not consistently yield profitable results.

For these strategies to be consistently profitable, the market needs to achieve a higher level of efficiency, often referred to as semi-strong or strong form efficiency.

Theory of Weak Form Efficiency

Foundation of the theory.

The weak form efficiency theory, as established by economist Eugene Fama in the 1960s, is built on the premise of the random walk hypothesis.

This hypothesis suggests that price changes in securities are independent and identically distributed. Thus, past prices cannot predict future prices.

Assumptions Underlying the Theory

The theory of weak form efficiency assumes rational investors, no transaction costs, and public accessibility to all relevant information. It also assumes that investors react quickly and accurately to new information.

Components of Weak Form Efficiency

Past price information.

In a weak-form efficient market, past prices have no bearing on future prices. This notion discredits technical analysis, which attempts to forecast future prices based on past trends.

Trading Volume

Trading volumes, like price information, are considered to have no predictive power in weak-form efficient markets. Volume indicators used in the technical analysis would thus need to be more effective.

Dividend Yield

In weak form efficiency, dividend yields, like prices and volumes, are considered to have no impact on future returns. This contradicts certain investment strategies that favor high-dividend-yield stocks.

Implications of Weak Form Efficiency

Interpretation of price movements.

Weak form efficiency suggests that price movements are random and not influenced by past trends. This interpretation challenges the validity of trend analysis in predicting future prices.

Impact on Investment Strategies

If a market is weak form efficient, strategies based on historical data analysis, such as momentum or contrarian strategies, would not consistently outperform the market after adjusting for risk.

Evidence Supporting Weak Form Efficiency

Empirical studies.

Numerous empirical studies support weak form efficiency. For instance, the serial correlation coefficient tests on stock returns often fail to find any significant correlation, supporting the random walk hypothesis.

Positive Observations

Markets, especially large and liquid ones like the U.S. stock market, often behave consistently with weak form efficiency. Despite short-term anomalies, the market as a whole tends to reflect available information quickly.

Criticisms Against Weak Form Efficiency

Contradictory empirical evidence.

Contrary to weak form efficiency, empirical evidence such as the momentum effect and calendar effects suggest that past returns can predict future returns to some extent, at least in the short run.

Behavioral Finance Perspectives

Behavioral finance, which considers psychological factors, argues against weak form efficiency. It suggests that cognitive biases can cause markets to deviate from efficiency.

Weak Form Efficiency vs Other Forms of Market Efficiency

Semi-strong form efficiency.

While weak form efficiency considers only past market information, semi-strong form efficiency claims that prices instantly adjust to all publicly available information, not just past prices.

Strong Form Efficiency

The strong form of efficiency goes further, arguing that prices reflect all information, public and private. This means that even insiders with private information cannot consistently earn abnormal returns.

Practical Applications of Weak Form Efficiency

In investment decisions.

Understanding weak form efficiency can help investors make more informed decisions.

For example, it suggests that strategies relying solely on past market data may not yield consistent above-average returns. This insight can help investors diversify their investment approaches and avoid over-reliance on historical data.

In Portfolio Management

Portfolio managers can apply the concept of weak form efficiency to manage risk and optimize returns.

Recognizing that past market data is not predictive of future returns, portfolio managers can adopt strategies that are less dependent on historical trends and more focused on other factors, such as fundamental analysis .

Limitations and Challenges in Weak Form Efficiency

Market anomalies.

Despite the principle of weak form efficiency, market anomalies occur. These anomalies, such as the January effect, where stocks have historically performed better in January, contradict the notion that past price data cannot predict future returns.

Limitations of Information Processing

While weak form efficiency assumes that all investors have access to and process all available information, information processing capabilities vary among investors.

Some investors may be better equipped to understand and react to new information, potentially leading to market inefficiencies.

Final Thoughts

A weak form of efficiency is a form of market efficiency that believes that all past prices of a stock are reflected in its current price. Therefore, it is impossible to achieve above-average returns based on trading systems that rely solely on historical price or return data.

Despite its limitations and the existence of market anomalies, weak form efficiency plays a crucial role in understanding how financial markets work.

It forms the baseline for evaluating investment strategies and provides a lens through which to view price movements and the impact of past market data.

As markets continue to evolve with technological advancements and information dissemination, the relevance of weak form efficiency is likely to be further scrutinized.

New developments, such as algorithmic trading and artificial intelligence, could challenge or reinforce the principles of weak form efficiency.

To navigate the complexities of market efficiencies, having a sound wealth management strategy is crucial to navigate the complexities of market efficiencies.

Whether you're a beginner or an experienced investor, professional guidance can help you understand and apply these theories in your investment journey. Reach out to a trusted financial advisor to discuss your portfolio strategy today.

Weak Form Efficiency FAQs

What is weak form efficiency.

Weak form efficiency states that current stock prices reflect all the past market information, meaning that only investors can consistently outperform the market using strategies based on past price or return data.

How does weak form efficiency affect investment strategies?

If a market is weak-form efficient, strategies that rely on technical analysis or historical price data would not be consistently profitable, as all past information is already reflected in current prices.

What are the other forms of market efficiency?

Other than weak form efficiency, there are semi-strong form and strong form efficiencies. Semi-strong form efficiency asserts that all public information is reflected in stock prices, while strong form efficiency argues that all public and private information is reflected in stock prices.

Can market anomalies exist in a weak-form efficient market?

Yes, market anomalies, which are patterns of returns that seem to contradict the efficient market hypothesis, can occur even in a weak-form efficient market. Examples include the January effect and the momentum effect.

How does behavioral finance challenge weak form efficiency?

Behavioral finance argues that cognitive biases and errors can lead investors to behave irrationally, causing markets to deviate from efficiency. This contradicts the weak form efficiency assumption of rational investors who always optimize their portfolios based on available information.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- AML Regulations for Cryptocurrencies

- Advantages and Disadvantages of Cryptocurrencies

- Aggressive Investing

- Asset Management vs Investment Management

- Becoming a Millionaire With Cryptocurrency

- Burning Cryptocurrency

- Cheapest Cryptocurrencies With High Returns

- Complete List of Cryptocurrencies & Their Market Capitalization

- Countries Using Cryptocurrency

- Countries Where Bitcoin Is Illegal

- Crypto Investor’s Guide to Form 1099-B

- Cryptocurrency Airdrop

- Cryptocurrency Alerting

- Cryptocurrency Analysis Tool

- Cryptocurrency Cloud Mining

- Cryptocurrency Risks

- Cryptocurrency Taxes

- Depth of Market

- Digital Currency vs Cryptocurrency

- Fiat vs Cryptocurrency

- Fundamental Analysis in Cryptocurrencies

- Global Macro Hedge Fund

- Gold-Backed Cryptocurrency

- How to Buy a House With Cryptocurrencies

- How to Cash Out Your Cryptocurrency

- Inventory Turnover Rate (ITR)

- Largest Cryptocurrencies by Market Cap

- Pros and Cons of Asset-Liability Management

- Types of Fixed Income Investments

Ask a Financial Professional Any Question

Discover wealth management solutions near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting..

- Search Search Please fill out this field.

Semi-Strong Form Efficiency: Definition and Market Hypothesis

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

What is Semi-Strong Form Efficiency?

Semi-strong form efficiency is an aspect of the Efficient Market Hypothesis ( EMH ) that assumes that current stock prices adjust rapidly to the release of all new public information.

Basics of Semi-Strong Form Efficiency

Semi-strong form efficiency contends that security prices have factored in publicly-available market and that price changes to new equilibrium levels are reflections of that information. It is considered the most practical of all EMH hypotheses but is unable to explain the context for material nonpublic information (MNPI). It concludes that neither fundamental nor technical analysis can be used to achieve superior gains and suggests that only MNPI would benefit investors seeking to earn above average returns on investments.

EMH states that at any given time and in a liquid market, security prices fully reflect all available information. This theory evolved from a 1960s PhD dissertation by U. S. economist Eugene Fama. The EMH exists in three forms: weak, semi-strong and strong, and it evaluates the influence of MNPI on market prices. EMH contends that since markets are efficient and current prices reflect all information, attempts to outperform the market are subject to chance not skill. The logic behind this is the Random Walk Theory , where all price changes reflect a random departure from previous prices. Because share prices instantly reflect all available information, then tomorrow’s prices are independent of today’s prices and will only reflect tomorrow’s news. Assuming news and price changes are unpredictable then novice and expert investor, holding a diversified portfolio, would obtain comparable returns regardless of their expertise.

Efficient Market Hypothesis Explained

The weak form of EMH assumes that the current stock prices reflect all available security market information. It contends that past price and volume data have no relationship to the direction or level of security prices. It concludes that excess returns cannot be achieved using technical analysis .

The strong form of EMH also assumes that current stock prices reflect all public and private information. It contends that non-market and inside information as well as market information are factored into security prices and that nobody has monopolistic access to relevant information. It assumes a perfect market and concludes that excess returns are impossible to achieve consistently.

EMH is influential throughout financial research, but can fall short in application. For example, the 2008 Financial Crisis called into question many theoretical market approaches for their lack of practical perspective. If all EMH assumptions had held, then the housing bubble and subsequent crash would not have occurred. EMH fails to explain market anomalies, including speculative bubbles and excess volatility. As the housing bubble peaked, funds continued to pour into subprime mortgages. Contrary to rational expectations, investors acted irrationally in favor of potential arbitrage opportunities. An efficient market would have adjusted asset prices to rational levels.

Key Takeaways

- The semi-strong efficiency EMH form hypothesis contends that a security's price movements are a reflection of publicly-available material information.

- It suggests that fundamental and technical analysis are useless in predicting a stock's future price movement. Only material non-public Iinformation (MNPI) is considered useful for trading.

Example of Semi-Strong Efficient Market Hypothesis

Suppose stock ABC is trading at $10, one day before it is scheduled to report earnings. A news report is published the evening before its earnings call that claims ABC's business has suffered in the last quarter due to adverse government regulation. When trading opens the next day, ABC's stock falls to $8, reflecting movement due to available public information. But the stock jumps to $11 after the call because the company reported positive results on the back of an effective cost-cutting strategy. The MNPI, in this case, is news of the cost-cutting strategy which, if available to investors, would have allowed them to profit handsomely.

:max_bytes(150000):strip_icc():format(webp)/usa-stock-market-crash-827585890-bb854fc8911b4026990b0152db976fd6.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

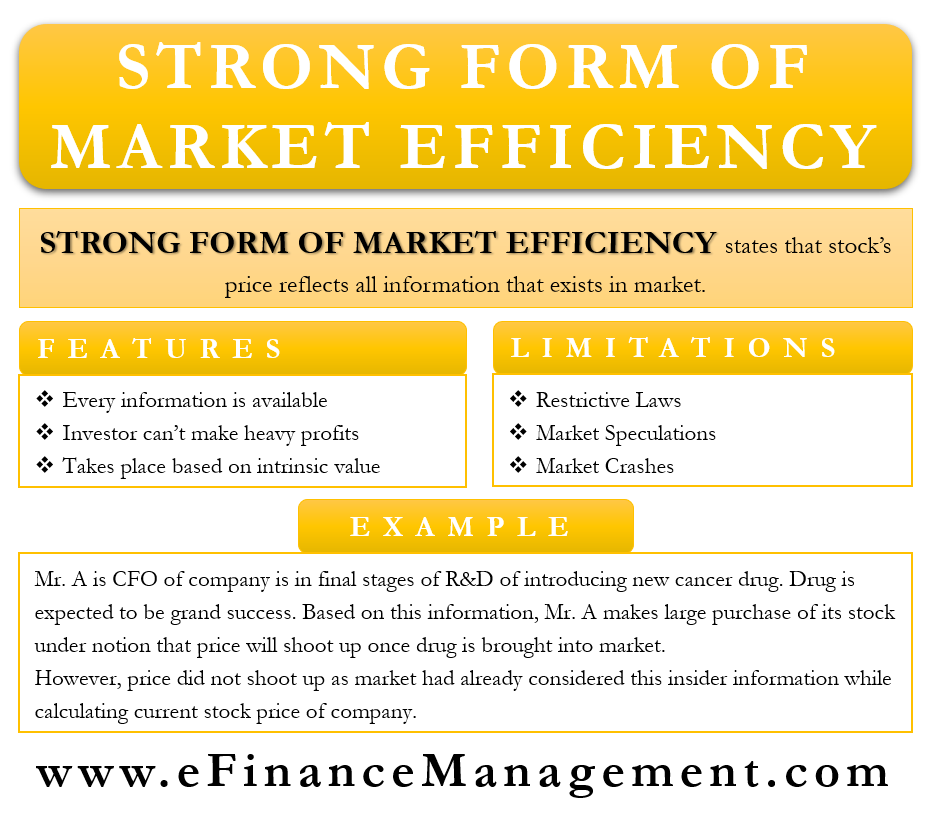

Strong Form of Market Efficiency

- What is the Strong form of Market Efficiency?

The strong form of market efficiency is a version of the EMH or Efficient Market Hypothesis . There are three versions of EMH, and it is the toughest of all the versions. It states that a stock’s price reflects all the information that exists in the market, be it public or private. In other words, each and every bit of information is available to one and all, and hence, an investor cannot make heavy profits. Even insider information or in-depth research cannot help an investor make abnormal profits or provide additional benefits because all the prospective investors have all the information related to the stock. The trade takes place basically on the perception of the individual investor and their assessment of the intrinsic value of the stock.

Burton G.Malkiel proposed this form of market efficiency in the year 1973. In his book titled “A Random Walk Down Wall Street,” he discussed and detailed his hypothesis about this phenomenon. According to him, all information that technical or fundamental analysis and other advisories generate or the earnings estimates that analysts provide is of no use. Instead, “buy-and-hold” is the best strategy that an investor can adopt in such a form of near-perfect market efficiency. This means that an investor should invest and hold the security from a long-term point of view because of the unpredictability of the capital markets and the price volatility.

Efficient Market Hypothesis

Restrictive laws, market speculation and crashes, an example of a strong form of market efficiency.

The concept of the Efficient Market Hypothesis is one of the various investment theories. And it is based on the research of “Eugene Fama” ( Fama and French Three-Factor Model ). It states that the asset pricing is indicative of all the available information in the market. Since there is no new information that can have any impact on the price of the securities, it is very difficult for an investor to make extraordinary profits or beat other investors.

Individual investors may act differently, but the collective market as a unit will always be right or rational. Thus, there will be the presence of outliers or the ones who make extraordinary profits or even losses in the short term. But most investors will make close to the average returns that security provides in the market in the long run. A good strategy in such a case is to invest in an index fund and earn returns that the securities of the underlying benchmark index make. In this manner, an investor will make average market earnings but not extraordinary gains.

Also Read: Semi- Strong Form of Market Efficiency

The theory further states that all the securities are already trading at their fair price or their fair market value. Hence, there are very few chances of finding an overvalued or undervalued stock. Because of this fact, an investor cannot earn big by buying undervalued stocks or selling overvalued stocks. Making big profits is only possible by taking a high speculative risk.

What are the Cons of a Strong form of Market Efficiency?

The limitations of a Strong form of market efficiency are:

Sometimes there are legal restrictions that prevent the sharing of sensitive information with the general public. For example, important researches of a defense equipment manufacturing firm cannot go public. Hence, the market price of its security will not always be reflective of all the information. Similarly, insider trading laws will restrict the sharing of crucial internal information pertaining to a company with the outside world. Hence, the share prices will again not adhere to the principles of the strong form of market efficiency.

There have been multiple instances over the years of display of buying frenzy on the part of the investors. This may or may not have a direct dependence on the underlying value of the asset or market information. Similarly, there have been market crashes with markets tanking without a definite reason or information. Also, a few investors may benefit abnormally from such a situation by buying underpriced stocks at the time of market crashes and selling them later when the markets become normal. Such situations are an anomaly with regard to the concept of a strong form of market efficiency.

In fact, many researchers have directly blamed the efficiency hypothesis for causing market crashes. Financial leaders and advisors who rely on the hypothesis fail to estimate when an asset bubble is about to break, causing severe losses to one and all.

Also Read: Weak Form of Market Efficiency

Let us take the example of Mr.A, who is the CFO of a major pharmaceutical company. The company is in the final stages of research and development of introducing a new cancer drug in the market. The drug is expected to be an effective cure for the disease and shall be priced at around a 40% lower rate than the other competing drugs in the market.