China Mobile in Action

- First Online: 11 August 2020

Cite this chapter

- Zhengmao Li 4 ,

- Xiaoyun Wang 5 &

- Tongxu Zhang 6

1371 Accesses

As the carrier with the largest network and the largest number of users in the world, China Mobile has started 5G research and development since 2012, and has achieved positive results in key areas such as demand formulation, key technology research and development, international standard formulation, joint industry trials, and cross-industry application innovation, and has become the “main force” of 5G research and development in China. At the same time, China Mobile is accelerating the five major upgrades in network capabilities, industrial transformation, information consumption, user services, and cooperative ecosystems to create greater benefits and social value for 5G.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Author information

Authors and affiliations.

China Telecom Group Co., Ltd, Beijing, China

Zhengmao Li

China Mobile Communications Group Co., Ltd, Beijing, China

Xiaoyun Wang

China Mobile Research Institute, Beijing, China

Tongxu Zhang

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Zhengmao Li .

Rights and permissions

Reprints and permissions

Copyright information

© 2021 The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Li, Z., Wang, X., Zhang, T. (2021). China Mobile in Action. In: 5G+. Springer, Singapore. https://doi.org/10.1007/978-981-15-6819-0_14

Download citation

DOI : https://doi.org/10.1007/978-981-15-6819-0_14

Published : 11 August 2020

Publisher Name : Springer, Singapore

Print ISBN : 978-981-15-6818-3

Online ISBN : 978-981-15-6819-0

eBook Packages : Engineering Engineering (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Smartphone 360

- Smartphone Model Tracker

- Refurbished Market Tracker

- Smartwatch 360

- Emerging Tech

- Consumer Research

- Smartphone AP-SoC

- Teardown & BOM

- Cellular Tracker & Forecasts

- Smart home Tracker

- PCs and Tablets

- 5G Networks

- Press releases

- White Papers

- Events & Webinars

- Research Portal

- Research services

- Marketing engagement

- Semis professionals

- Mobile operators

- Smartphone professionals

- Report purchases

- Software and services

- Opinion leaders

- In the press

- Vendor briefings

Access quarterly data and market insights showcasing China’s smartphone market share, spanning from Q1 2018.

Counterpoint Quarterly

Smartphones Q1 2024

Sign up to get access to the report.

China Smartphone Shipments Market Data (Q3 2022 – Q4 2023)

Published Date: Feb 21, 2024

Receive quarterly updates in your email

Most Popular Smartphones in China

DOWNLOAD THIS REPORT:

Market Highlights

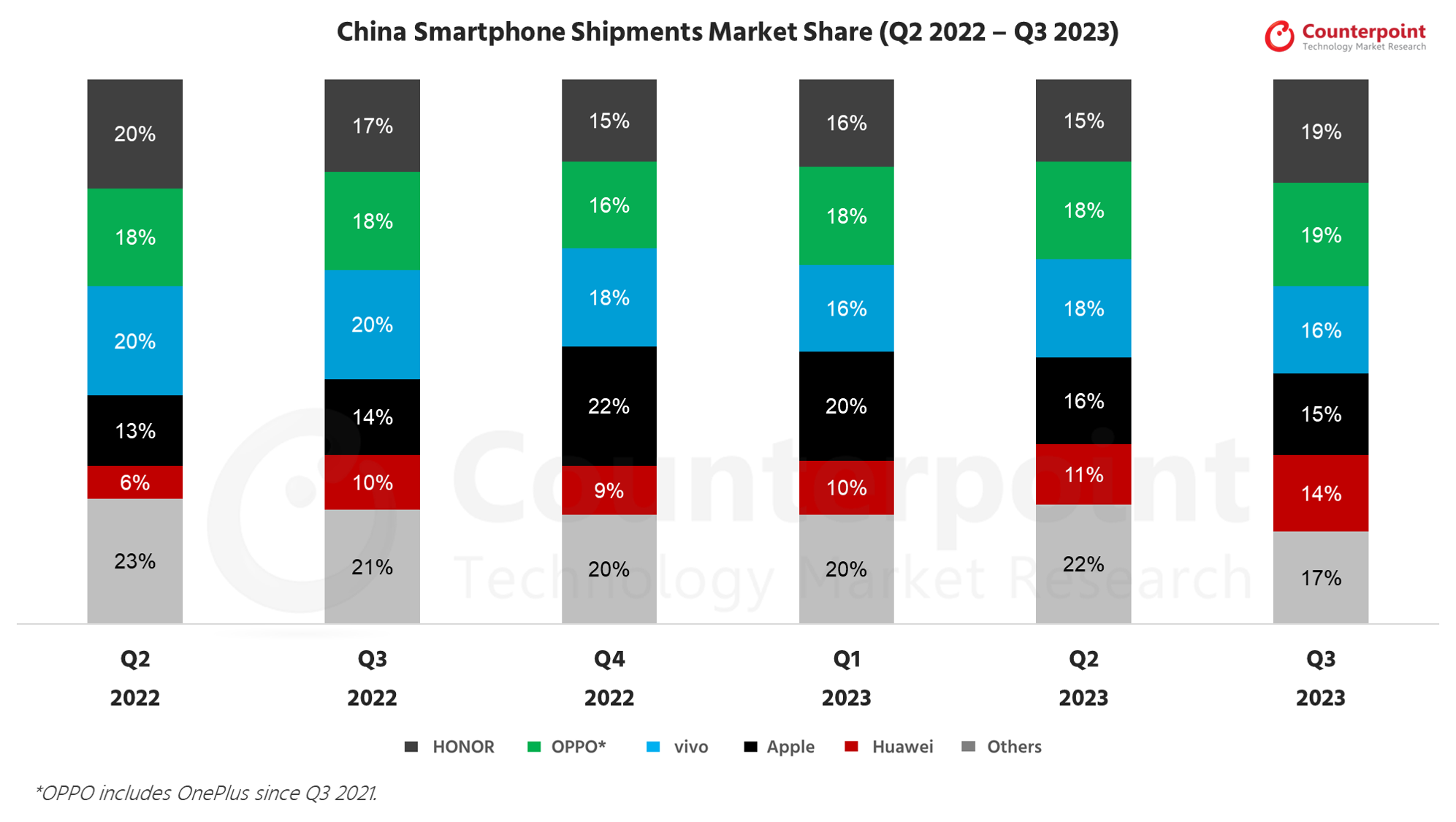

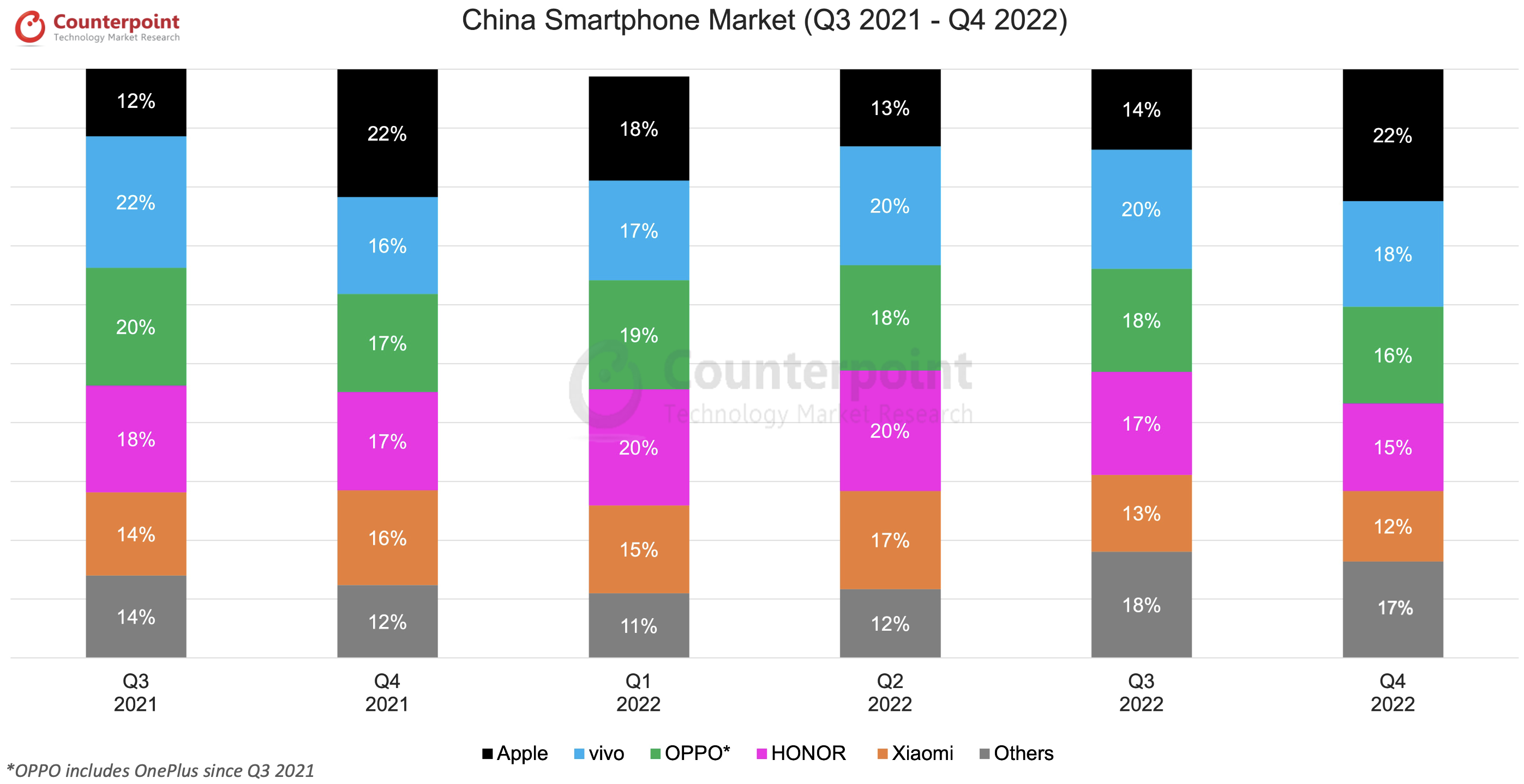

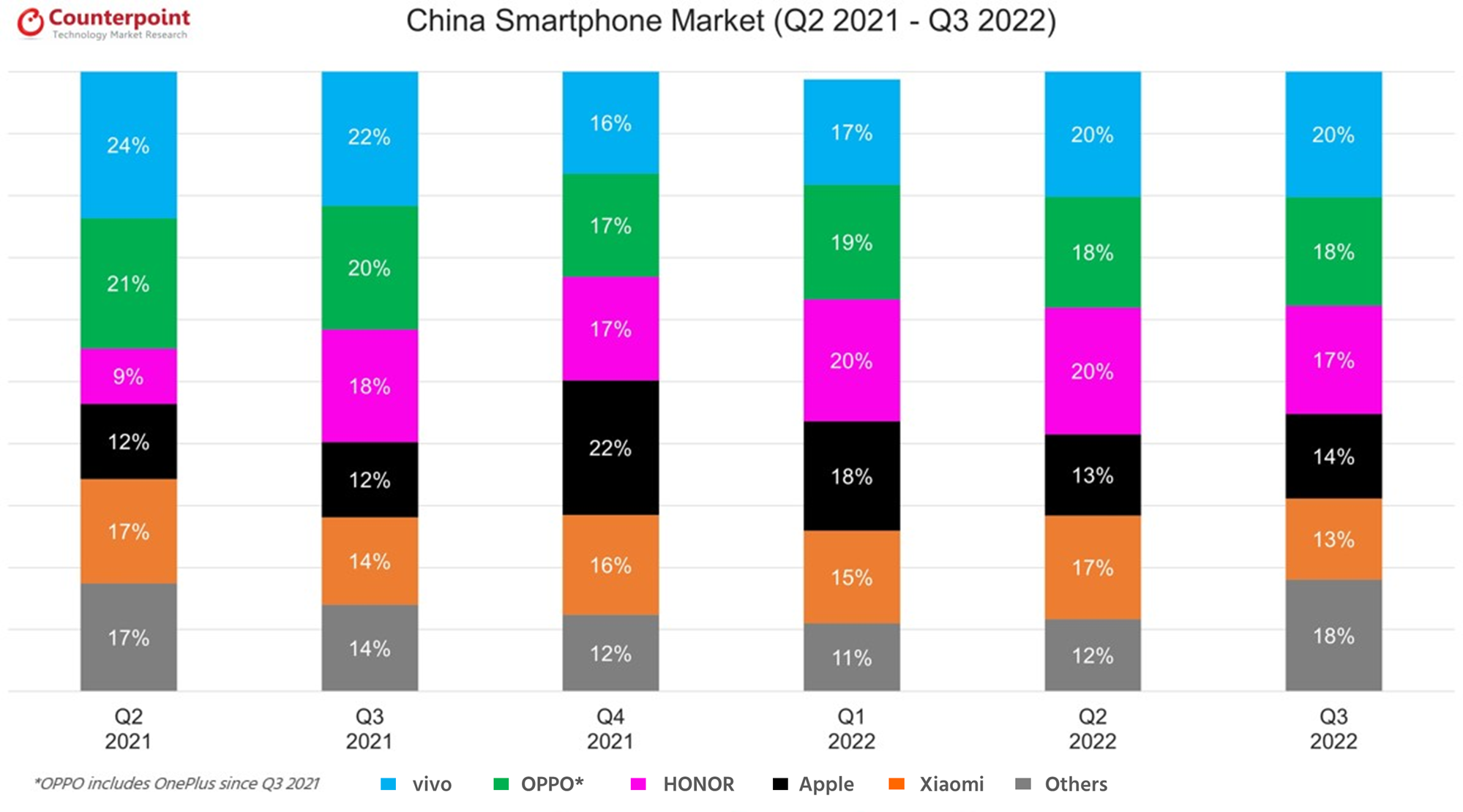

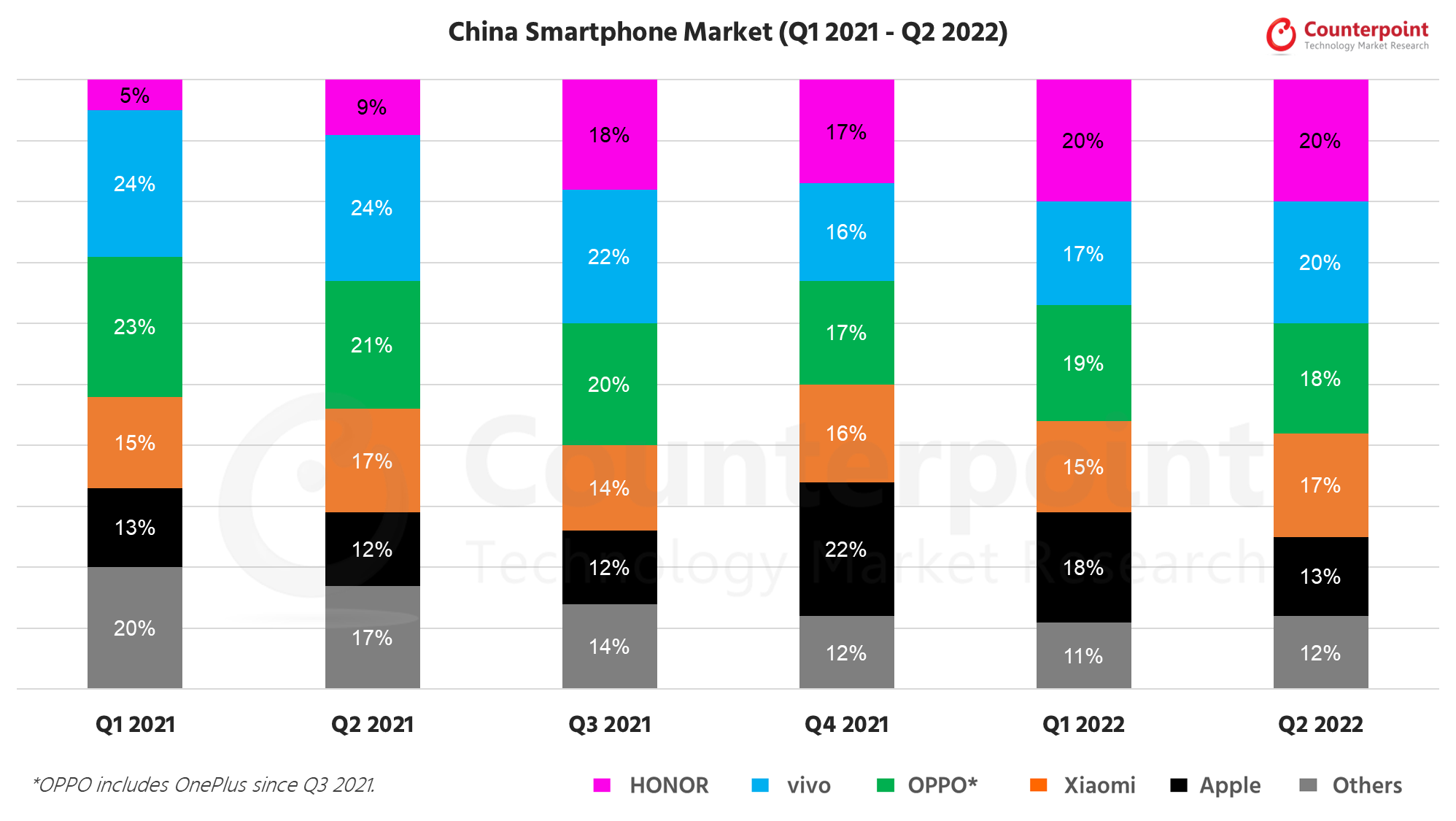

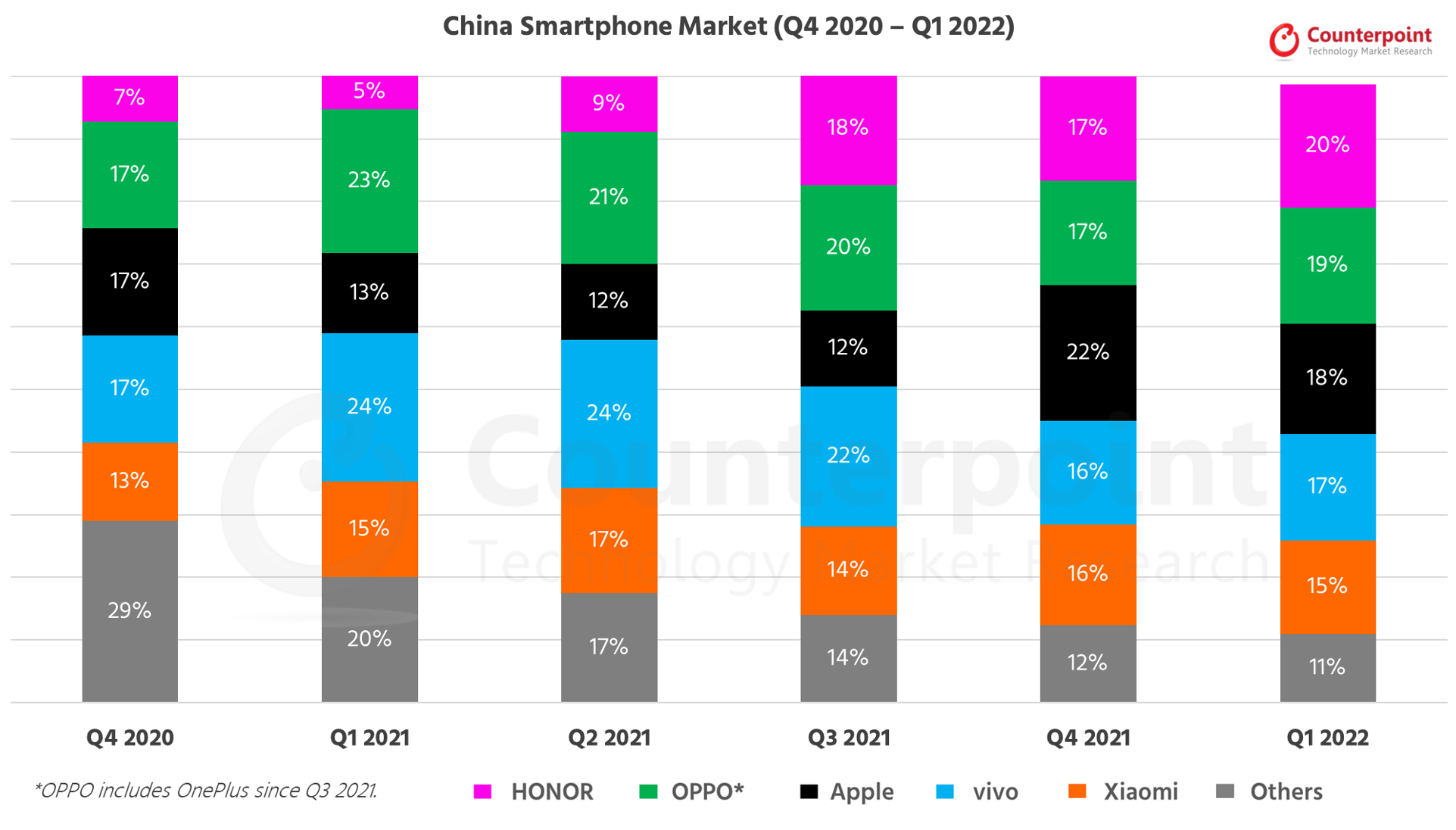

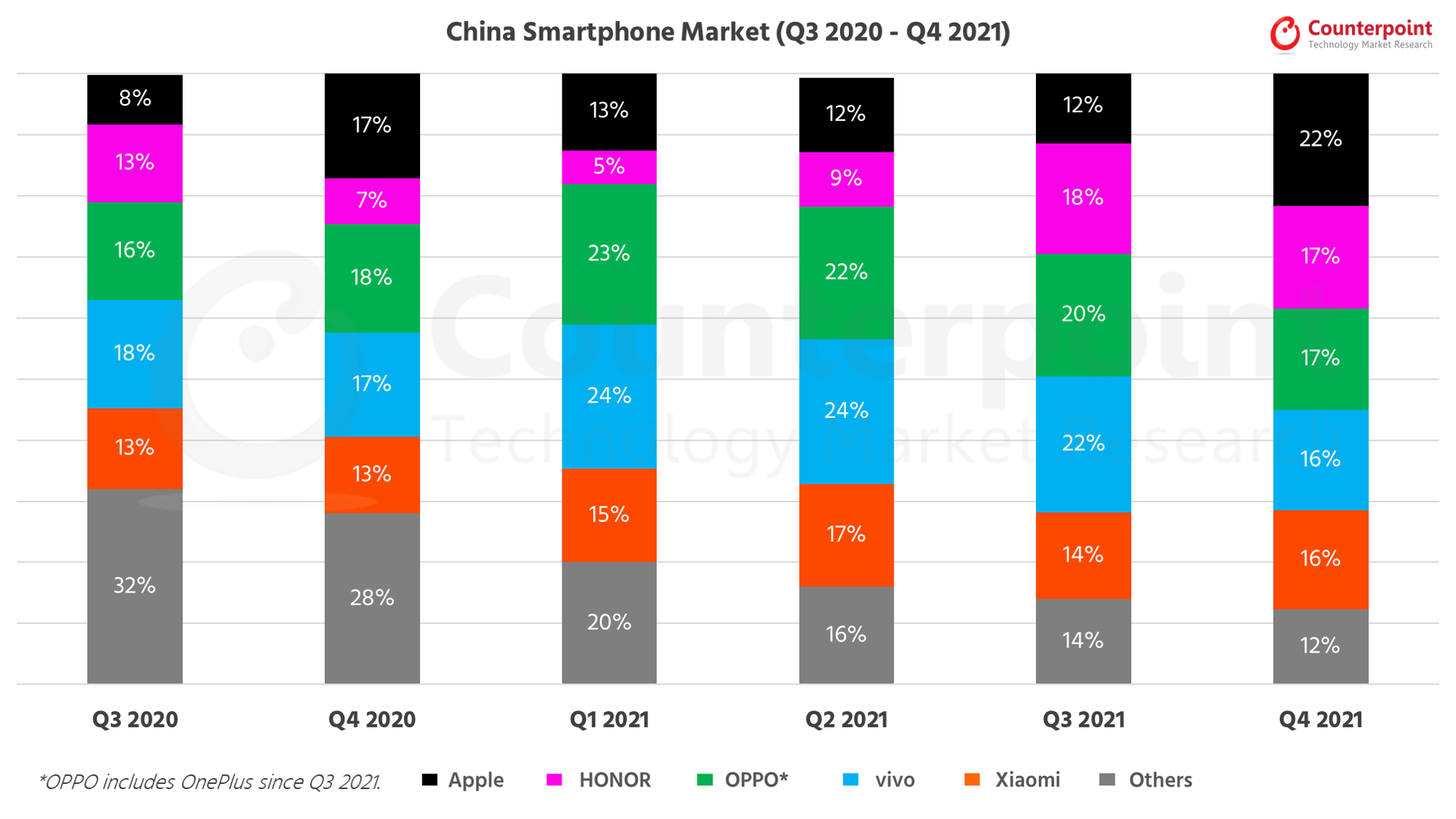

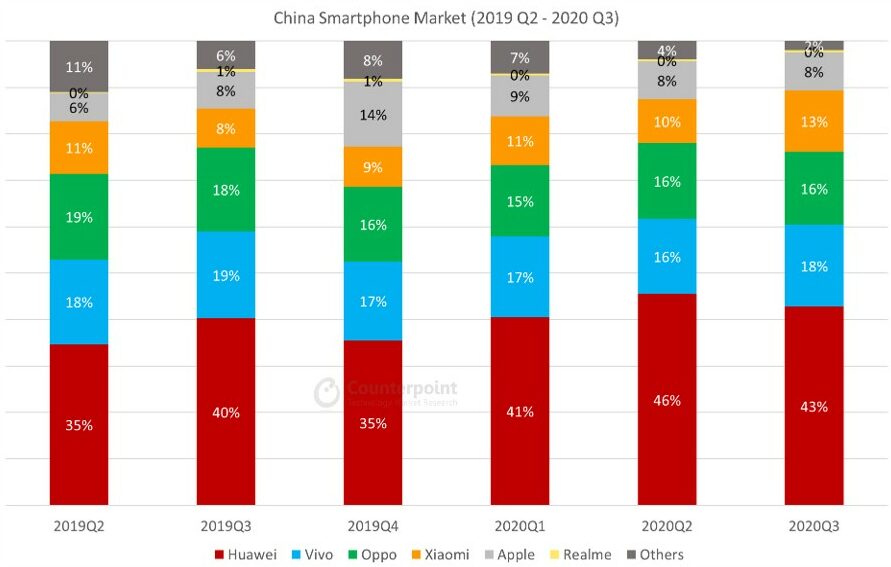

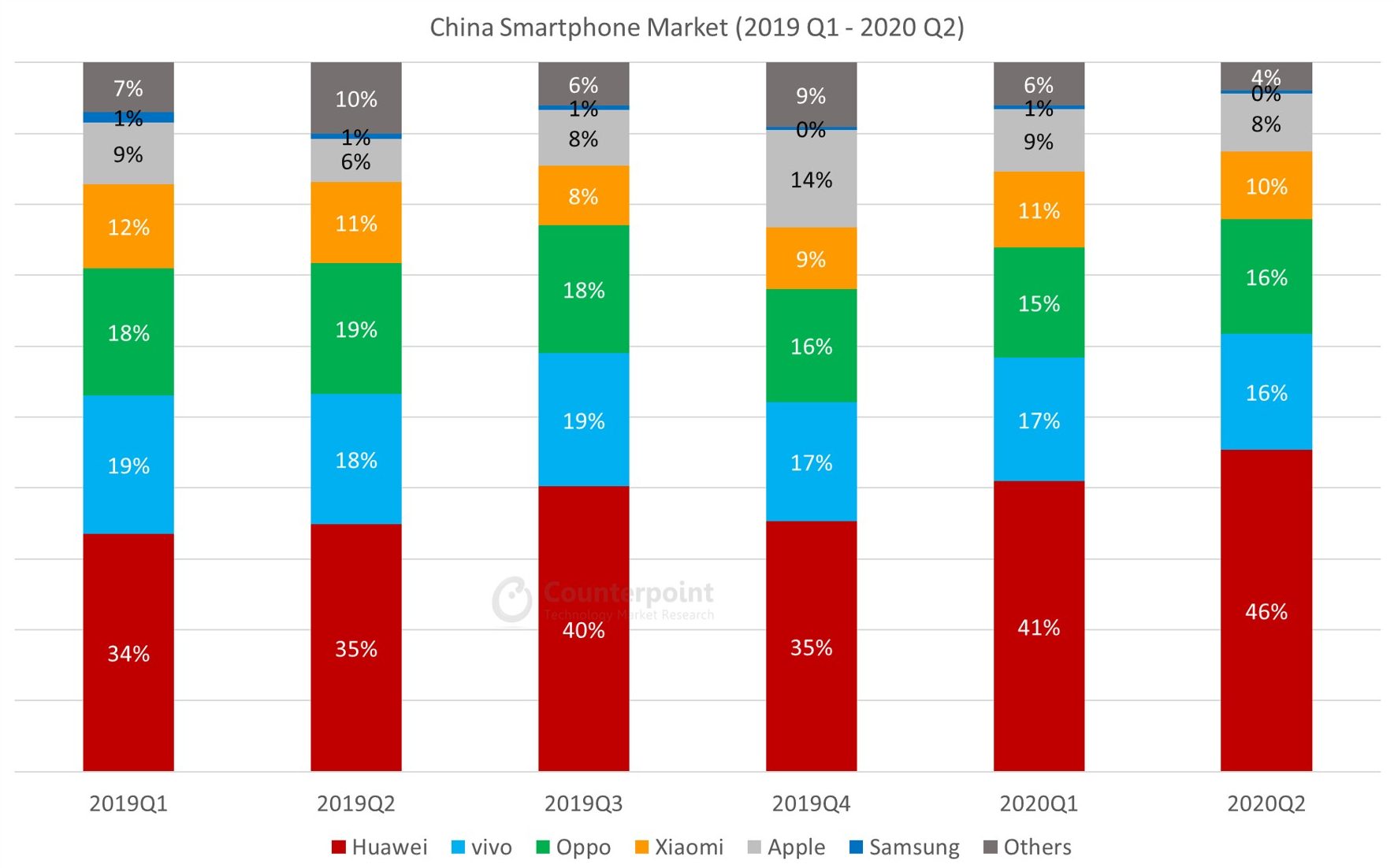

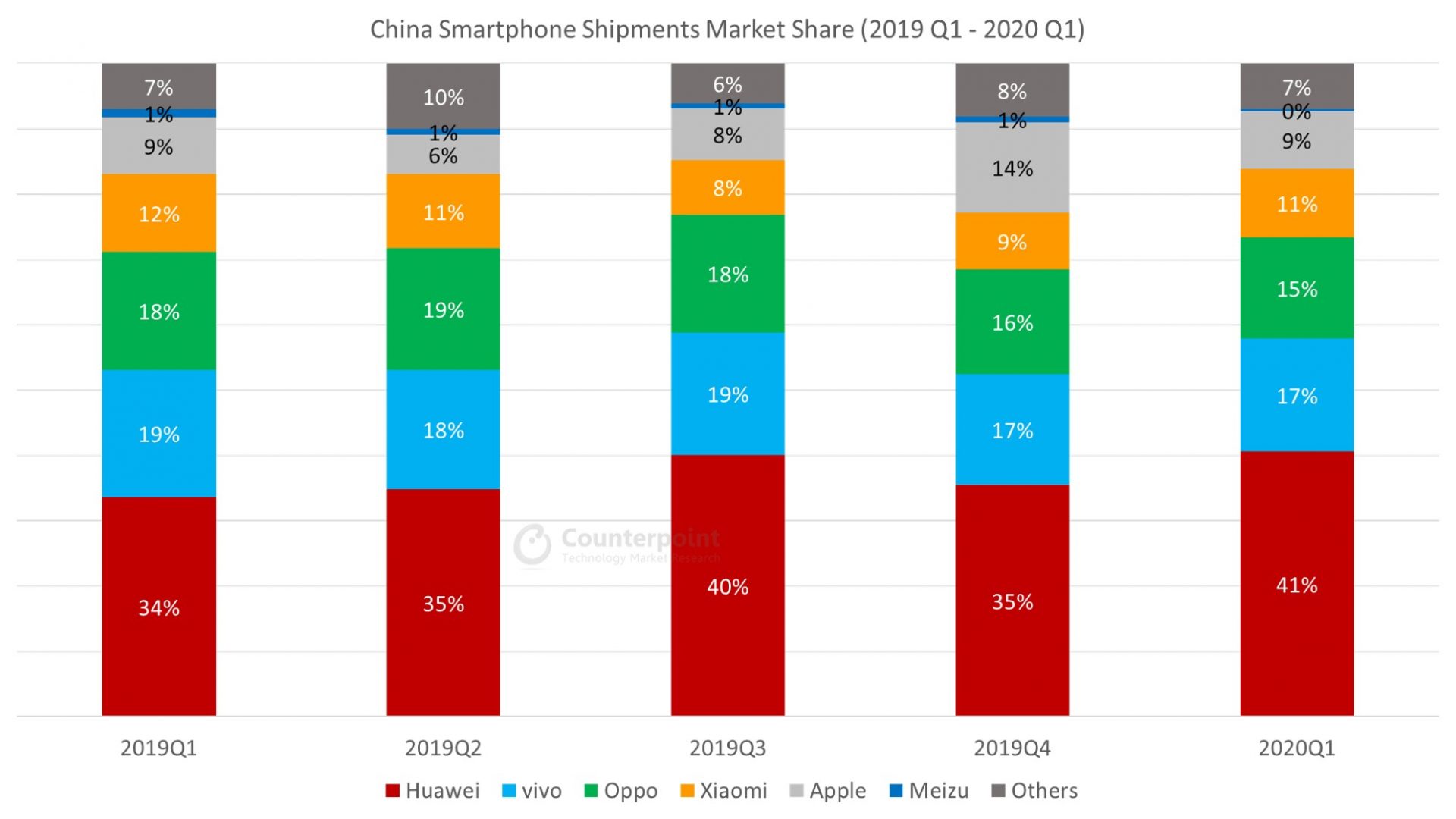

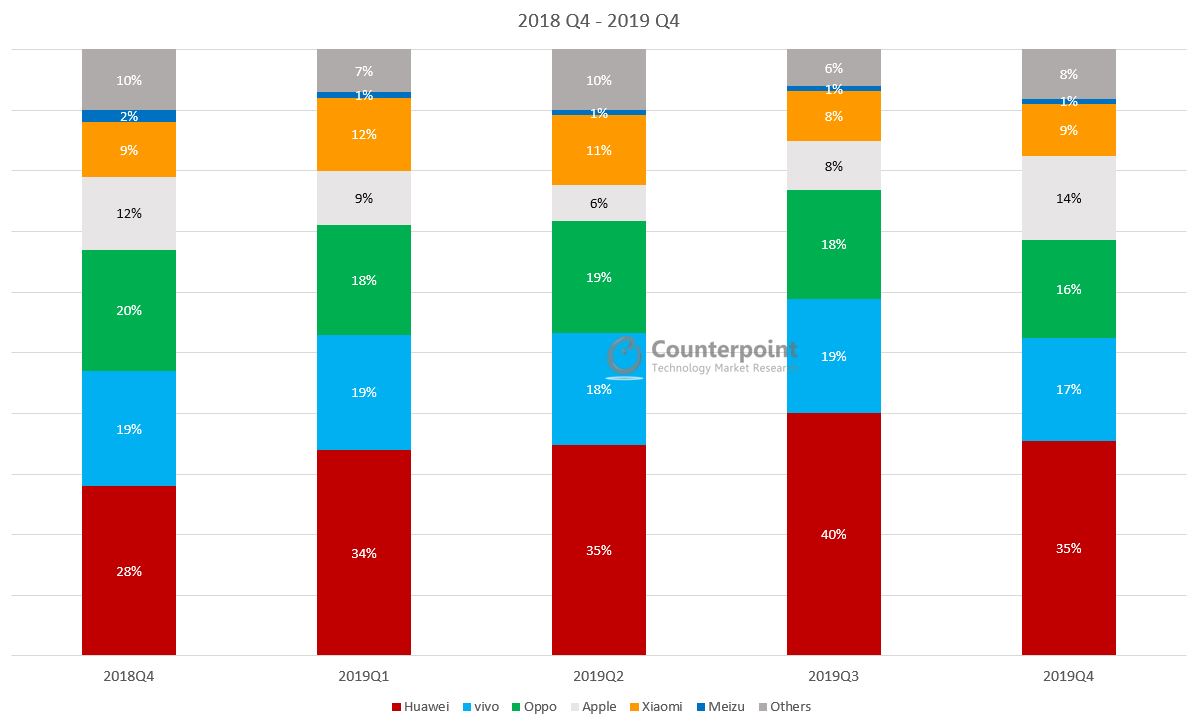

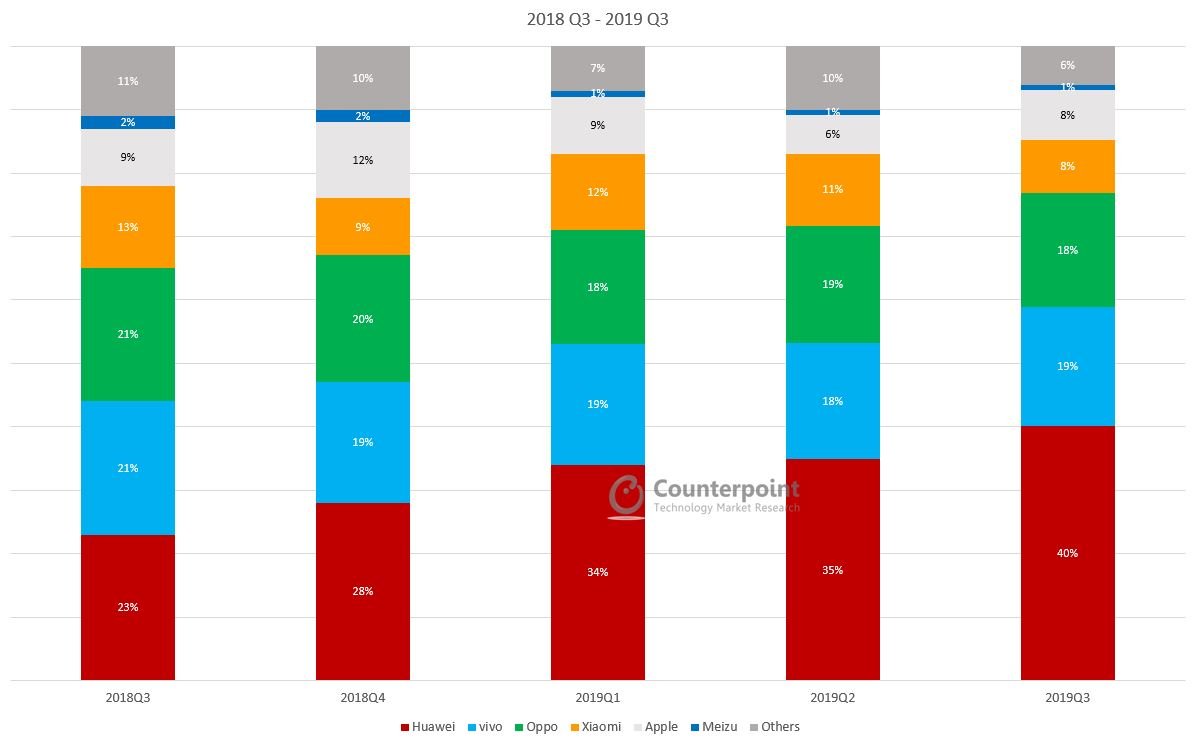

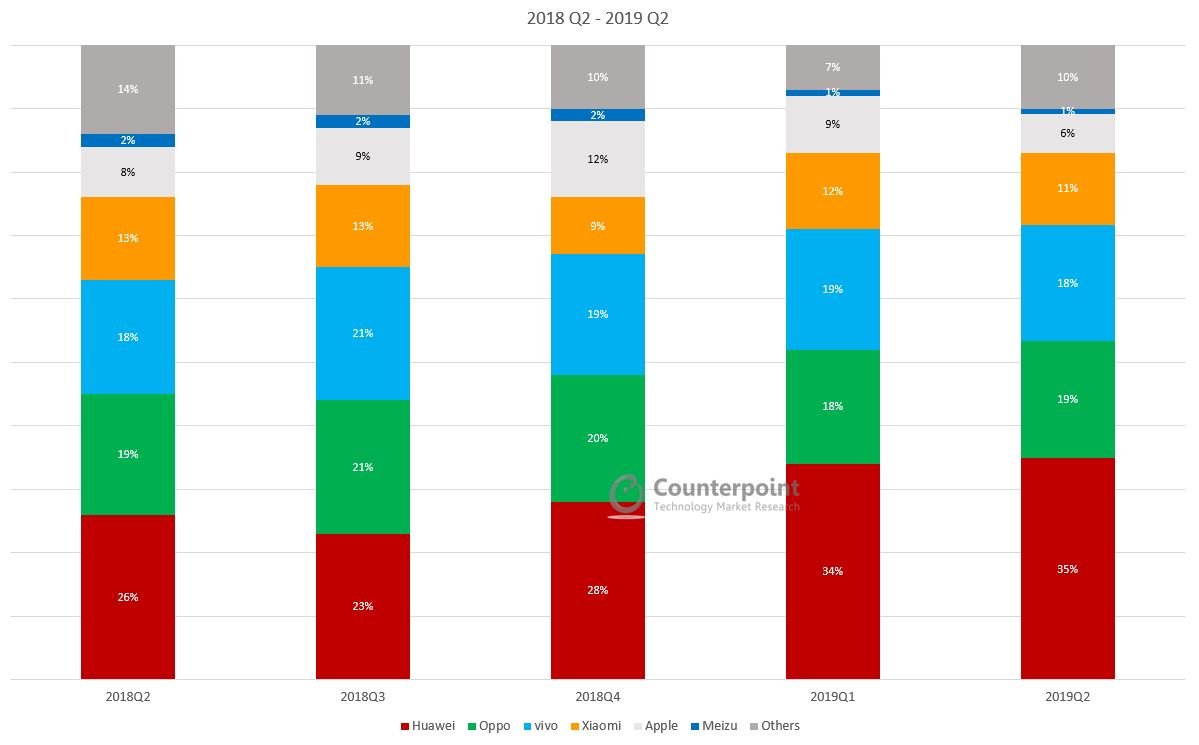

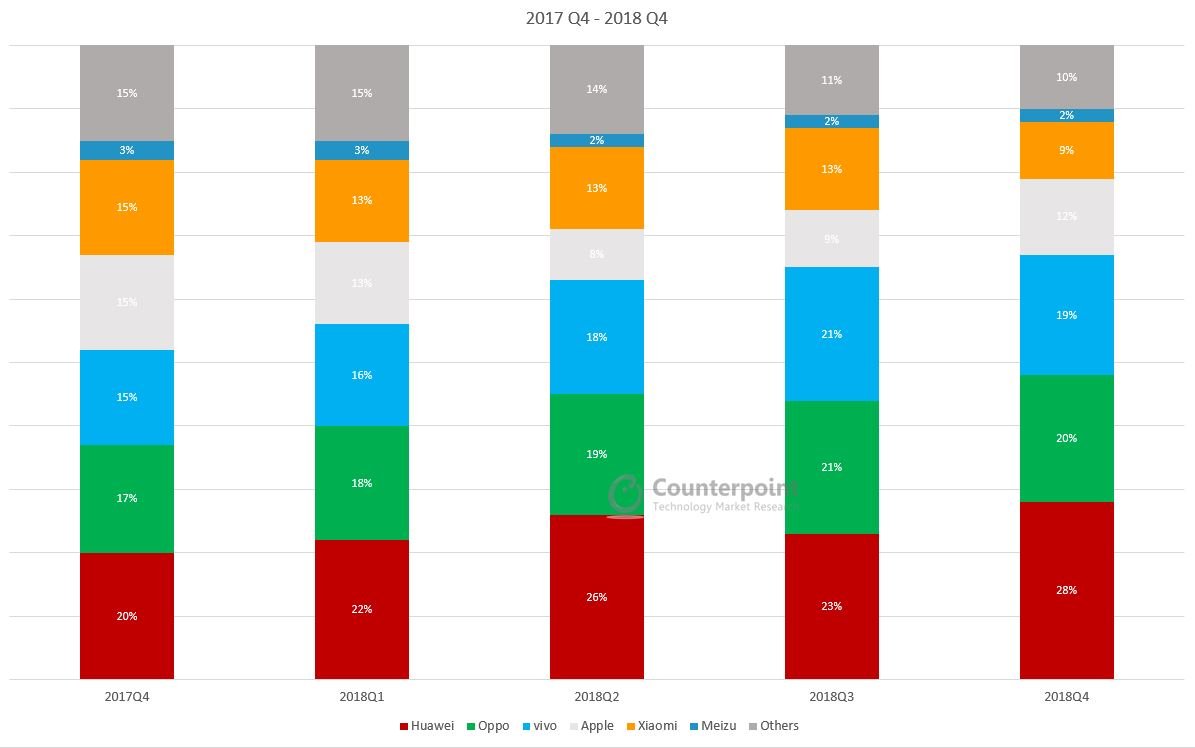

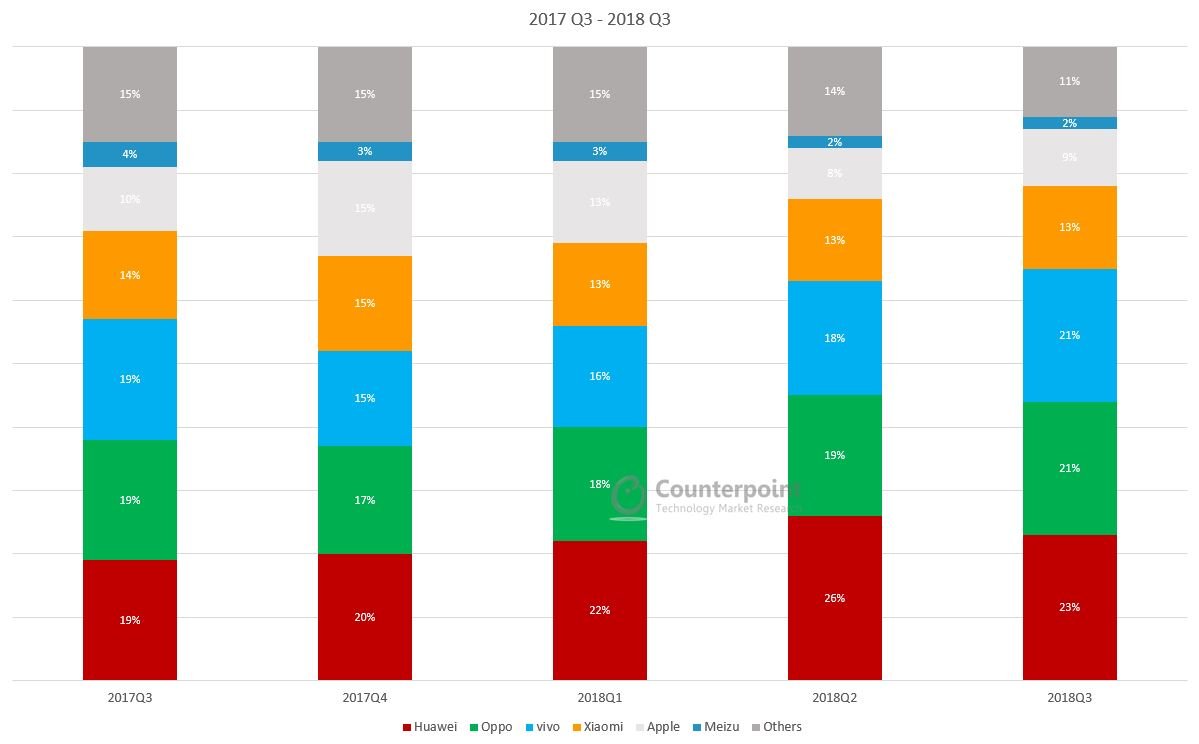

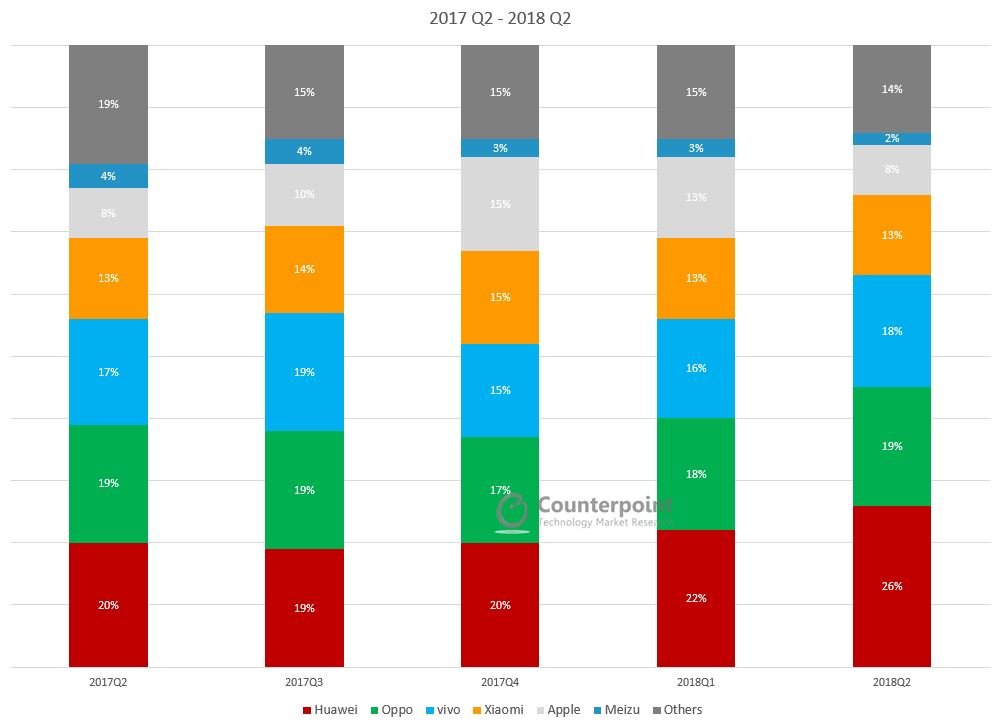

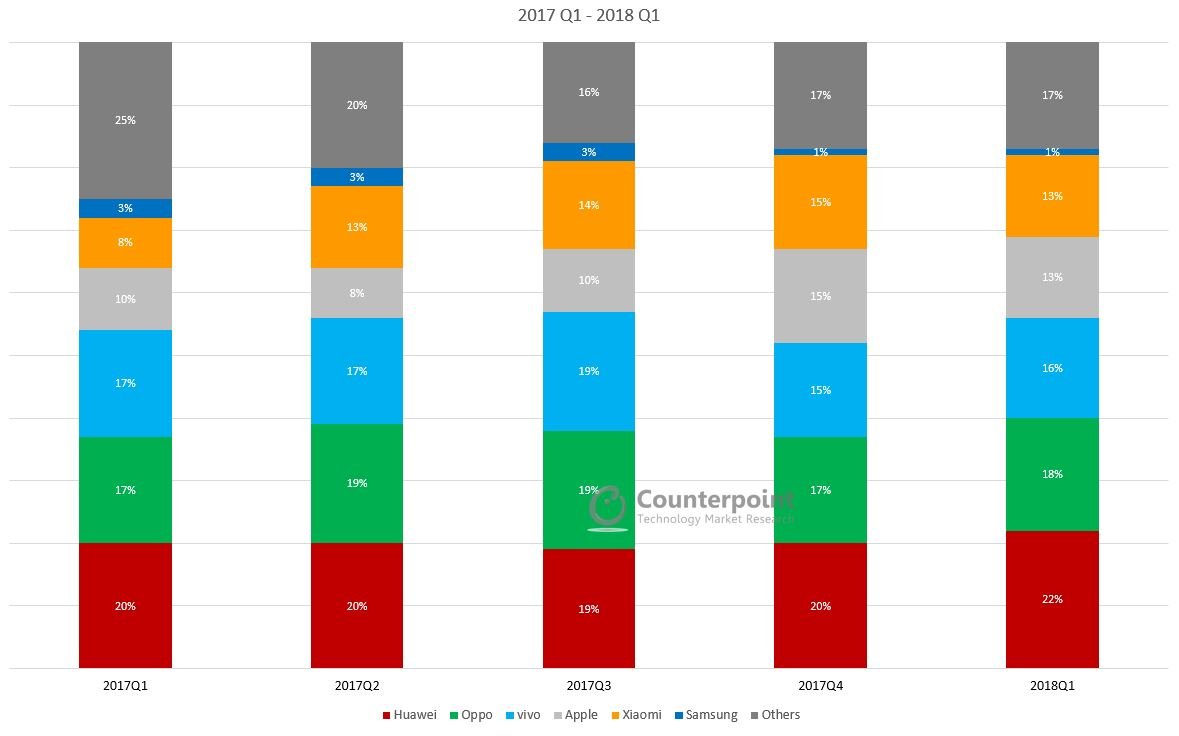

China Smartphone Shipments Market Share (%)

• China’s smartphone shipments rose 1% YoY in Q4 2023, marking the first quarterly increase in more than two years. This was due to OEMs restocking for newly launched models. • Though Apple offered big promotions for the iPhone 15 series, it still witnessed a 6% YoY drop in shipments due to fierce competition from Huawei’s return. • Huawei’s shipments almost doubled YoY driven by the hot-selling Mate 60 series as well as the newly launched Nova 12 series. • Xiaomi saw a strong 13% YoY increase mainly driven by the newly launched Xiaomi 14 series and Redmi K70 series. • HONOR also saw a 1% YoY uptick.

HONOR separated from Huawei in Q4 2020 and its market share does not include Huawei brand family volumes starting Q1 2021.

* OPPO includes OnePlus since Q3 2021.

**Ranking is according to the latest quarter.

*Data on this page is updated every quarter. This data represents the Chinese smartphone market share by quarter (from 2020-2023) by top OEMs.

For detailed insights on the data, please reach out to us at sales(at)counterpointresearch.com. If you are a member of the press, please contact us at press(at)counterpointresearch.com for any media enquiries.

The global smartphone market share numbers are from:

MOBILE DEVICES MONITOR – Q4 2023 (Vendor Region Countries)

Published Date: November 2023

This report is part of a series of reports which track the mobile handset market: Smartphone and Feature Phone shipments every quarter for more than 140 brands covering more than 95% of the total device shipments in the industry.

Recommended Reads:

Global Semiconductor Foundry Market Share: Quarterly

Global XR (AR & VR Headsets) Market Share: Quarterly

Global Smartphone AP-SoC Market Share: Quarterly

Apple iPhone Market Share: 2007 to 2023

Global Electric Vehicle Market Share, Q1 2022 – Q4 2023

Q4 2023 Global Smartphone Sales, Top 10 Best Sellers

Global Smartphone Sales Share by Operating System

Global Smartphone Shipments Share – Last Eight Years of Winners & Losers

Global Smartphone Shipments 2011 – 2023

US Smartphone Market Share: Quarterly

Global Smartwatch Shipments Market Share (Q3 2022 – Q4 2023)

China Smartphone Market Share: Quarterly

Global Smartphone Market Share: Quarterly

India Smartphone Market Share: Quarterly

Counterpoint Macro Index

Q3 2023 highlights.

Published Date: November 10, 2023

• China’s smartphone shipments fell 2% YoY in Q3 2023, narrowing the YoY decline sequentially. This was due to OEMs restocking in preparation for new model launches.

• Huawei’s shipments soared 41% YoY as its newly launched Mate 60 series with Kirin SoC gained momentum immediately after the launch. Apple experienced a slight YoY uptick in shipments driven by the newly launched iPhone 15 series, but the initial supply constraints impacted its overall performance. HONOR also increased YoY mainly driven by the hot-selling HONOR X50 and HONOR 90. OnePlus’ robust growth drove up OPPO’s shipments.

• We expect to see a YoY growth in Q4 2023 as all Chinese OEMs are expected to launch their new models then. It is worth noting that this will come on last year’s low base, as many Chinese cities were still under lockdowns during the same period last year.

Q2 2023 Highlights

Published Date: August 17, 2023

• Smartphone shipments in China fell 4% YoY in Q2 2023 though OEMs provided big promotions during the 618 festival. This was due to weak demands resulting from economic headwinds.

• Apple saw the biggest YoY growth in Q2 as the OEM offered generous price-cuts for the iPhone 14 series during the 618 period. Besides, it still has no competitors in the high-end market which has proven to be more resilient during market headwinds.

• OPPO’s share grew slightly (YoY) as OnePlus showed strong growth piggybacking of the channel support from OPPO. OnePlus compensated for OPPO’s limited online presence by using its online-centric business model to effectively tap into the segment.

• vivo and Xiaomi saw YoY declines as weak economy dampened consumer spending.

• HONOR’s share dropped significantly (YoY) partially because Huawei’s growth posted a challenge for HONOR.

• We anticipate an improvement in smartphone shipments during H2 compared to H1, a strong rebound does not seem to be on the horizon as challenges that affected the performance in H1 are likely to persist.

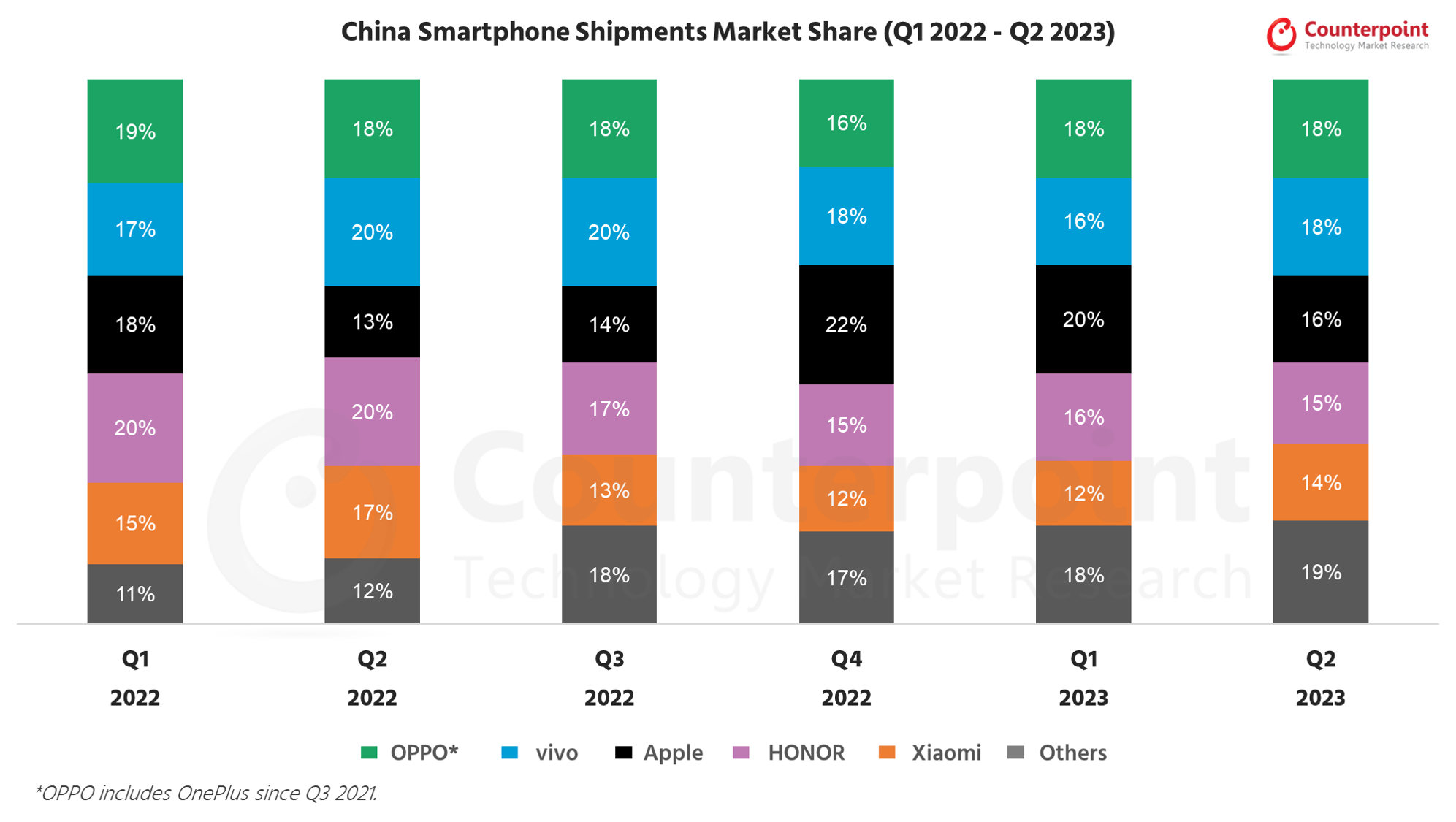

Q1 2023 Highlights

Published Date: May 16, 2023

• China’s smartphone shipments declined 8% YoY in Q1 2023, reaching their lowest level since Q1 2020. However, this was an improvement from the double-digit YoY declines seen in previous quarters as well as a sign of bottoming out.

• Apple’s market share in China increased to 20% in Q1 2023 from 18% in Q1 2022. This was driven by its continued expansion in China’s premium segment with more aggressive promotion and marketing campaigns for the iPhone 14 series.

• In contrast, all the major Android OEMs saw YoY declines as demand in the mass market remained weak. OEMs remained cautious in ramping up production to manage demand carefully and avoid any unhealthy inventory build-up in the market.

• Despite this caution, we expect the market to further recover in H2 2023, as inventory pressure continues to ease and consumer sentiments improve.

For our detailed research on the China smartphone sales market share Q1 2023, click here .

Q4 2022 Highlights

Published Date: February 18, 2023

• Apple registered a QoQ growth of 67% due to the high demand for new iPhone 14 series. Apple market share in China has now reached 22% in Q4 2022.

• vivo dropped to the 2nd position as the OEM’s market share fell to 18%.

• Major Chinese phone market share (Chinese OEMs) saw YoY shipment declines due to overall market instability due frequent COVID lockdowns and weak economic conditions.

• Xiaomi retained its position in the top five even as its market share fell to its lowest in over two years. Xiaomi market share in China reached 12% in Q4 2022.

• Huawei saw a growth of 25% in it’s shipment that helped it capture 8.7% of Chinese market.

For our detailed research on the China smartphone sales market share Q4 2022, click here .

Q3 2022 Highlights

Published Date: December 20, 2022

• Apple was the only major OEM in China to see a YoY increase mainly driven by strong demand for the iPhone 14 Pro models.

• Other major Chinese OEMs saw YoY sales declines due to overall market plunge resulting from frequent COVID lockdowns and weak economic environment.

• Despite sales declines compared to last year, vivo, OPPO and HONOR remained the top 3 brands in China, while Xiaomi dropped one rank to reach 5 th place.

• Although facing sanctions, Huawei also saw a YoY increase due to strong demand for its mid-end Nova 10 and premium foldable smartphones.

For our detailed research on the China smartphone sales market share Q3 2022, click here .

Q2 2022 Highlights

Published Date: August 15, 2022

• Huge smartphone market share gains were made by HONOR in Q2 2022 as the OEM capitalized on strength in the premium market

• iPhone market share continued to eke upwards, with Apple doing extremely well in the ultra-premium segment

Click here to read about the China smartphone sales market in Q2 2022.

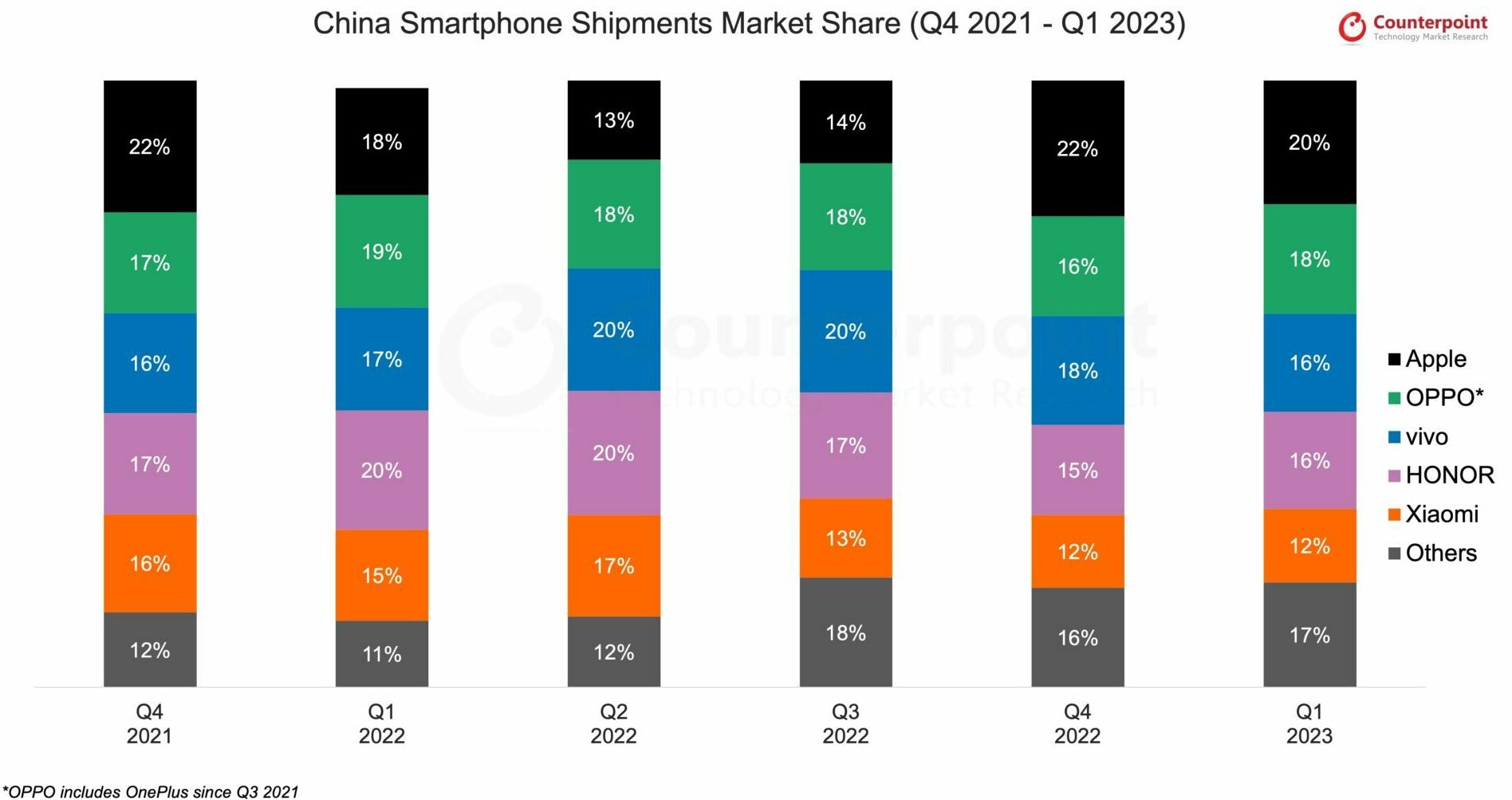

Q1 2022 Highlights

Published Date: May 15, 2022

• In 2022 Q1, China smartphone shipments declined 19% YoY and 12% QoQ to reach 73.7 million units.

• HONOR continued to outperform the market with shipment growing 190% YoY and 4% QoQ in Q1 2022. HONOR led the market during this quarter and captured 20% market share.

• OPPO (including Oneplus) held the second spot with 13.7 million units in Q1 2022.

• Apple slipped to the third spot with 13 million units in Q1 2022. Although Apple’s shipment fell compared to Q4 2021, Apple still registered 11% YoY growth driven by strong demand for iPhone 13 series.

• Dropping to the fourth spot, vivo declined 42%YoY and 9% QoQ to 12.5 million units in Q1 2022. Q1 2022 was its worst performing quarter since the severe pandemic-hit Q1 2020.

Click here to read about the China smartphone market in Q1 2022.

Q4 2021 Highlights

Published Date: February 15, 2022

• China smartphone shipments declined 11% YoY to reach 84 million units. However, the market increased 9% QoQ in Q4 2021.

• Apple’s 13% YoY and 95% QoQ growth helped it lead the China market, capturing 22% market share in Q4 2021.

• For the first time, HONOR reached the second spot after becoming an independent brand. It grew 100% YoY to reach 14 million units.

• vivo slipped to the fourth spot with ~14 million units in Q4 2021, However, it led the overall China smartphone market in CY 2021.

Click here to read about the China smartphone market in Q4 2021.

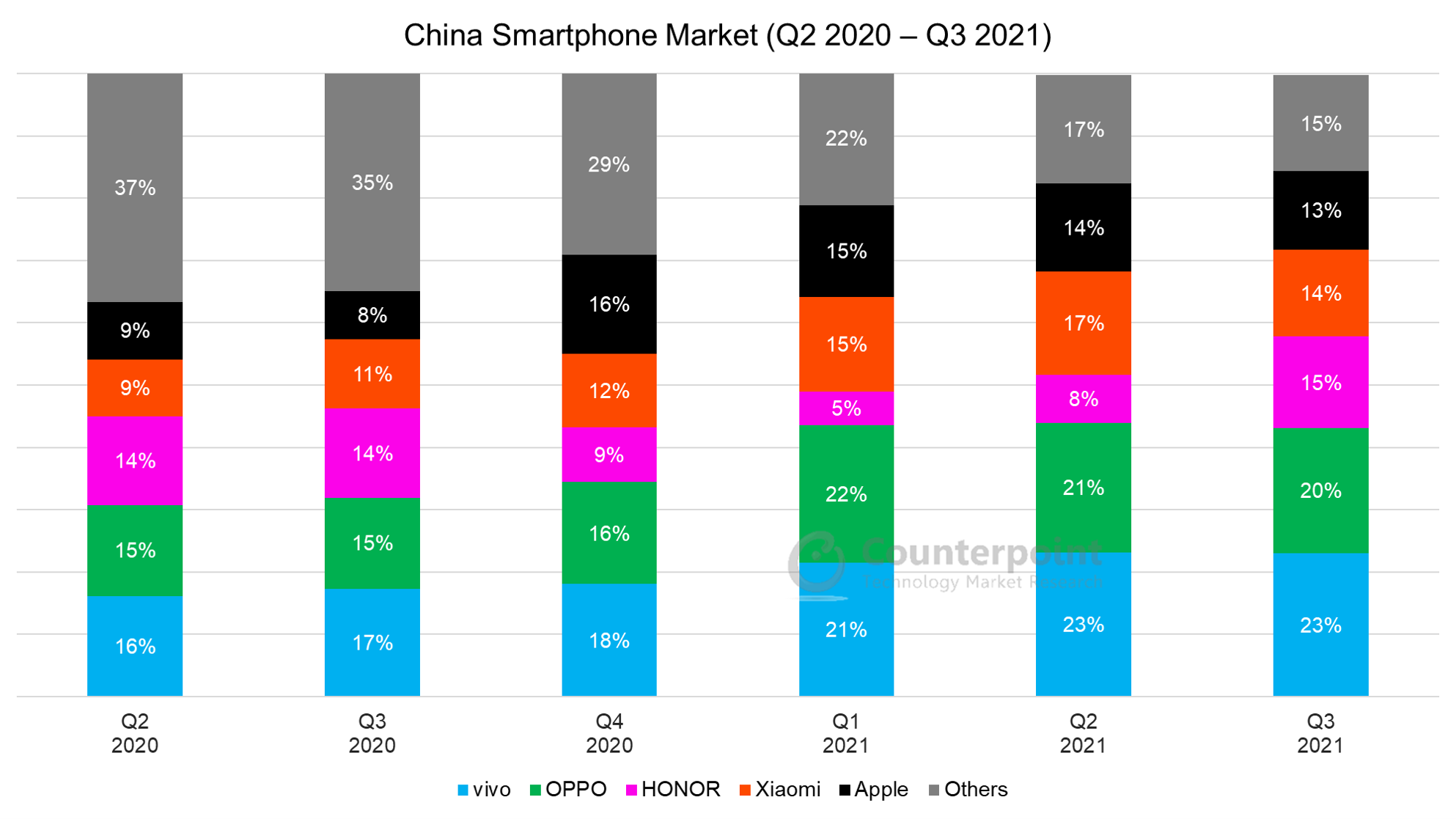

Q3 2021 Highlights

Published Date: November 15, 2021

• Smartphone sales in China increased 3% QoQ but declined 9% YoY in Q3 2021.

• vivo led the market in Q3 2021, capturing a 23% share, followed by OPPO (20%) and HONOR (15%).

• HONOR was the fastest-growing OEM (96% QoQ) in China during the quarter.

• China’s 5G smartphone sales accounted for 79% of total smartphone sales in Q3 2021.

Q2 2021 Highlights

Published Date: August 15, 2021

• Smartphone sales in China declined 13% QoQ and 6% YoY in Q2 2021.

• vivo led the market in Q2 2021, capturing a 23% share, followed by OPPO (21%) and Xiaomi (17%).

• Xiaomi was the fastest-growing OEM (70% YoY) in China, followed by Apple (43%) and OPPO (37%).

#Huawei includes HONOR.

*Ranking is according to the latest quarter.

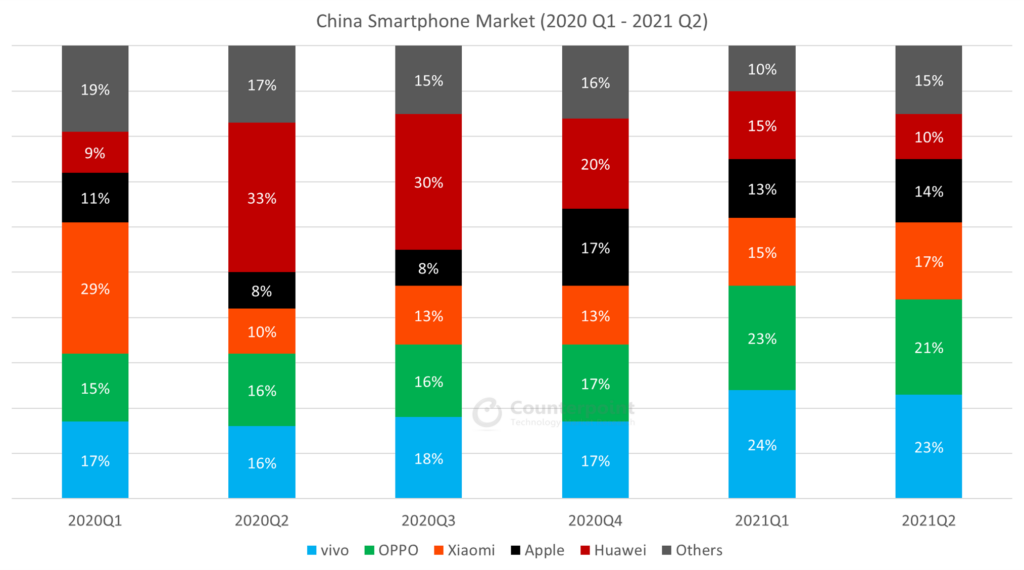

Q1 2021 Highlights

Published Date: May 15, 2021

• Smartphone shipment growth in China turned positive in Q1 2021.

• Smartphone shipments grew 36% compared to last year’s COVID-impacted first quarter to register 90.7mn shipments.

• The quarter marked the inevitable succession of Huawei’s leadership, as the beleaguered handset maker struggled to maintain shipments.

• vivo and OPPO emerged as clear leaders, accounting for nearly half of all smartphones shipped during the period.

Q4 2020 Highlights

Published Date: February 15, 2021

• China’s smartphone market declined 17% YoY in 2020.

• China’s 5G smartphone sales accounted for more than 60% of total smartphone sales in Q4 2020.

• Huawei and HONOR combined took the top spot in the market, capturing 41% share in 2020.

• Apple was the only brand to witness a positive YoY growth in the market in 2020.

#Huawei includes HONOR

Q3 2020 Highlights

• Smartphone sales in China recovered slowly with 6% QoQ growth in Q3. But the growth was still down 14% YoY.

• Xiaomi outperformed the market as the only major OEM to achieve a positive YoY growth in Q3 in China.

• Huawei continued to lead the market with 45% share in Q3 (in smartphone sales). However, its sales have started to decline.

Q2 2020 Highlights

• Smartphone sales in China declined 17% YoY in Q2 2020. However, the sales increased 9% QoQ indicating some signs of recovery.

• Huawei captured a massive 60% share of the 5G smartphone market.

• Huawei reached its highest ever share in China capturing 46% of sales volumes.

• Apple was the fastest-growing OEM (32% YoY) during the quarter.

Q1 2020 Highlights

• China’s Smartphone sales fell by 22% YoY (Year-on-Year) in Q1 2020.

• Except for Huawei, all major OEMs underwent YoY decline.

• However,5G smartphone sales grew sequentially by about 120%. 5G smartphones now capture over 15% of the total smartphone sales.

• Apple and Huawei group , managed to increase market share from the same period last year, clearly out-performing the overall market in Q1 2020

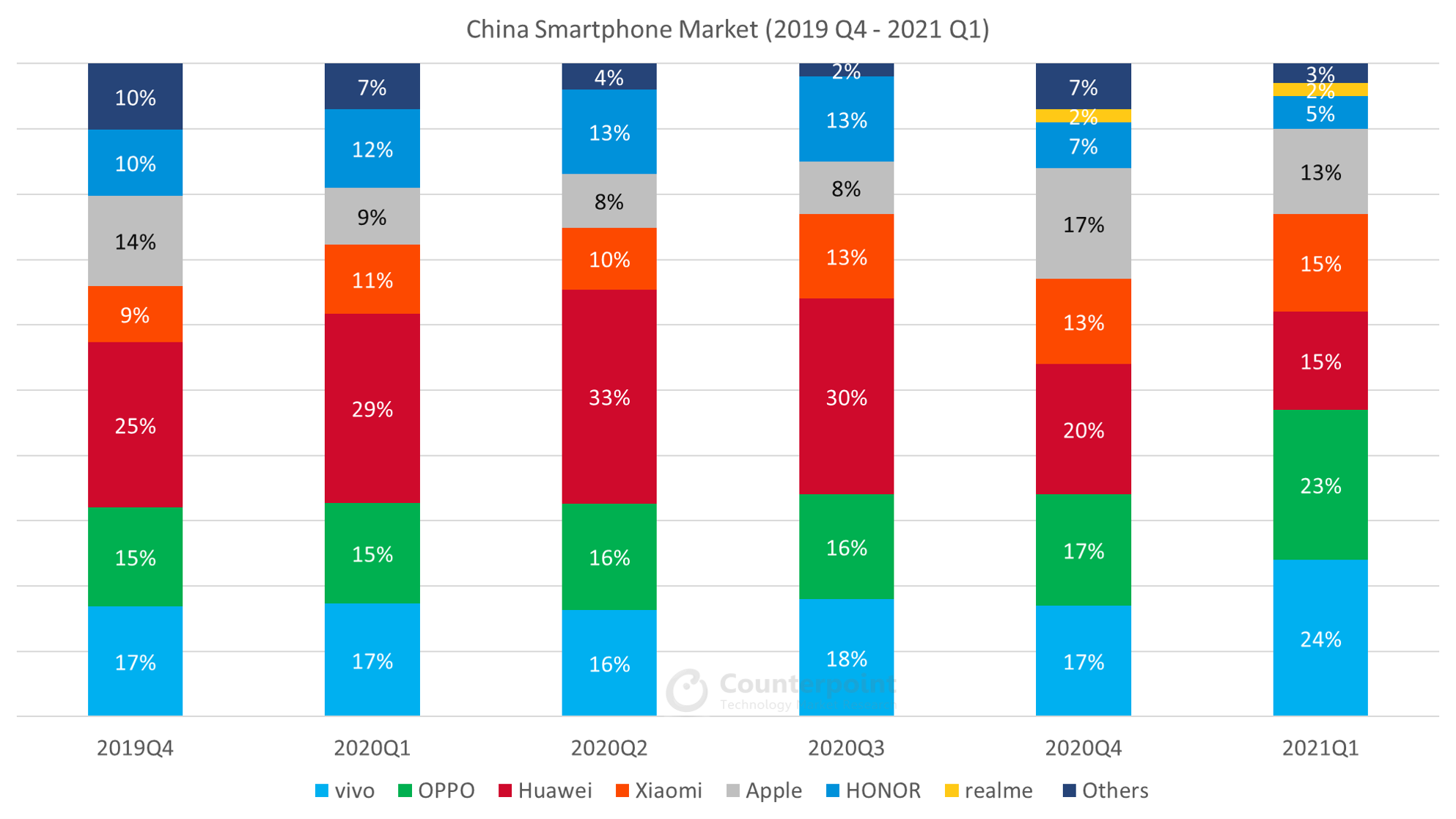

Q4 2019 Highlights

• China’s smartphone market declined for the 10th consecutive quarter in Q4 2019. The decline is expected to continue in the coming quarters due to the impact of nCoV .

• Top 5 OEMs captured 90% of the total market during the quarter as compared to 87% a year ago. This is an indication of the ongoing consolidation in the market.

• Huawei (including HONOR) leads the Chinese smartphone market capturing over one-third of the total smartphone shipments. The OEM has concentrated its efforts in the home market post the trade ban which helped it grow 12% YoY in the region. China now contributes to 60% of the global shipments for Huawei.

• OPPO (19% YoY), vivo (11% YoY) and Xiaomi (8% YoY) all declined during the quarter. Amidst the declining home market, the OEMs have been expanding overseas to attain growth.

• Apple grew 6% YoY driven by the popularity of the iPhone 11 series, which was the first iPhone with dual cameras and launched at a price lesser than its predecessor.

• China led the global 5G market contributing to over 67% of the total 5G shipments in 2019 Q4. This was driven by Huawei (including HONOR), which alone shipped over 6 million 5G devices in the region during the quarter.

Q3 2019 Highlights

• Huawei (including the HONOR brand) leads the Chinese smartphone market with its market share growing to 40%, a record high. Huawei’s total shipments in Q3 reached 41.5 million units.

• For Vivo , the X27, Y93, and Y3 series were the highlights in terms of contribution to sales. While for OPPO , the A9 shipped nearly five million units in the third quarter, making it the best-selling model of the quarter according to our model sales tracker.

• Xiaomi sales continued to decline 38% YoY with the onslaught from Honor brand on one side, and Oppo A-series and Vivo Y-series on the other.

• Apple ‘s iPhone sales were down 14% YoY. However, Apple’s price corrections with iPhone 11 and XR as well as introducing a new palette of colors, have stimulated demand during the last week of September offsetting the sharp annual decline during July and August.

Q2 2019 Highlights

• Huawei (including the HONOR brand) leads the Chinese smartphone market with its market share growing to 36%, reaching a record high.

• Overall, with almost 19% market share for both OPPO and Vivo, the brands became the second and third largest brands in China, respectively.

• Xiaomi is still in the recovery stage in Q2 when compared to last year but increased 8% QoQ.

• Apple ‘s iPhones shipped less than six million, with a 6% market share, the lowest level in a year.

Q1 2019 Highlights

• As the largest smartphone market in the world, the start of 2019 continues the sluggishness from H2 2018.

• The sustained decline can be attributed to the overall economic downturn in China which has resulted in consumers’ prolonged replacement cycles for smartphones.

• Consumer demand continues to remain divided. While some are delaying smartphone upgrades others are buying other electronic products to satisfy their desire for freshness.

• In addition, other factors affecting sales in Q1 2019 includes the lack of new product launches.

Q4 2018 Highlights

• Huawei (including Honor ) was firmly the market leader in China in 2018, capturing 25% market share. We saw outstanding contributions from the Nova series in 2018.

• OPPO and vivo ’s market share did not change much compared to 2017, but their sales have declined slightly.

• Apple’s volume dropped 12% YoY due to its high-ticket price and impact from competitors. But it still has the highest sales revenue among all brands.

Q3 2018 Highlights

• Market consolidation is apparent in China, with the top five OEMs capturing 86% of smartphone share in Q3, increasing from less than 80% in the same period last year.

• Huawei (including Honor) was the market leader in terms of both sales volume and growth momentum in Q3, with its leadership position fixed in China, capturing 23% market share.

• vivo with 4% YoY growth was the second best-selling brand in Q3 capturing 21% market share.

Q2 2018 Highlights

• OPPO and Vivo secured one spot each on the bestselling models list with their flagships, the R15 and the X21.

• Apple iPhone X continue to surpass iPhone 8 sales in China due to decline in price and offers running during the quarter.

• Honor 7C was the fifth best selling model during the quarter. One of the key reasons for the success of Honor 7C was its aggressive pricing (RMB 1100) & sales during 618 festival .

Q1 2018 Highlights

• Huawei continues to lead the Chinese smartphone market with 22% market share followed by OPPO and vivo with 18% and 16% share respectively

• Xiaomi (+51%) and Apple (+32%) were the fastest growing brands among the top five

• Xiaomi was the fastest growing brand in China during the quarter. The growth was driven by Xiaomi’s expansion in the offline segment with aggressive promotions

• By the end of Q1 2018 four out of the top five smartphone OEMs had already launched their devices with notch displays in China

• Apple is now back to YoY growth in the first quarter since Q1 2015, which is an indication that its older generation iPhone user base is now upgrading

Social media

- Privacy Policy

Copyright ⓒ Counterpoint Technology Market Research | All rights reserved

Only fill in if you are not human

- Teardown & BOM

- Cellular Tracker & Forecasts

- Events & Webinars

Term of Use and Privacy Policy

Mobile Telecommunications in China - Market Research Report

New report features & information.

This report has recently been enhanced to feature a new table of contents and more modern research experience. Click here to see a sample of the new layout.

Mobile Telecommunication in China industry trends (2017-2022)

Mobile telecommunication in china industry outlook (2022-2027), poll average industry growth 2022-2027 : x.x lock purchase this report or a membership to unlock the average company profit margin for this industry., mobile telecommunication in china industry statistics, biggest companies in the mobile telecommunication industry in china, what is the mobile telecommunication industry in china, industry definition, industry products and services, industry activities.

0-0.5% increase

0-0.5% decline

>0.5% increase

>0.5% decline

Market research report - table of contents

About this report, main activities, similar industries, additional resources, industry at a glance, industry statistics snapshot, industry structure, executive summary, industry performance, key external drivers, current performance, industry outlook, industry life cycle, products and markets, supply chain, key buying industries, key selling industries, products & services, demand determinants, major markets, international trade, business locations.

Competitive Landscape

Market share concentration, key success factors, cost structure benchmarks, basis of competition, barriers to entry, industry globalization, major companies, operating conditions, capital intensity, technology & systems, revenue volatility.

Regulation & Policy

Industry assistance, key statistics, table: industry data for the, table: annual percentage change for key industry data, table: key ratios for industry key data, table: industry financial ratios, jargon & glossary, product & services segmentation.

Major Players

Analyst insights, table: industry data for the industry, industry jargon.

Purchase to Read Full Report

Similar Reports

Included in spotlight report.

- Our reports include 10 to 20 pages of data, analysis and charts, including:

Included in Report

- Our reports include 30 to 40 pages of data, analysis and charts, including:

IBISWorld is used by thousands of small businesses and start-ups to kick-start business plans

Spend time growing your business rather than digging around for industry ratios and financial projections

Apply for a bank loan with the confidence you know your industry inside and out

Use IBISWorld’s industry ratios and benchmarks to create realistic financial projections you can stand behind

IBISWorld industry market research reports enable you to:

- Find out about key industry trends

- Identify threats and opportunities

- Inform your decisions for marketing, strategy and planning

- Quickly build competitive intelligence

This report on :

- Provides Market Size information to assist with planning and strategic decisions.

- Includes the necessary information to perform SWOT, PEST and STEER analysis.

- Helps you understand market dynamics to give you a deeper understanding of industry competition and the supply chain.

- Analyses key performance and operational metrics so that you can benchmark against your own business, that of your customers’ businesses, or your competitors’ businesses.

The market research report includes:

- Historical data and analysis for the key drivers of this industry

- A five-year forecast of the market and noted trends

- Detailed research and segmentation for the main products and markets

- An assessment of the competitive landscape and market shares for major companies

- And of course, much more

IBISWorld reports on thousands of industries around the world. Our clients rely on our information and data to stay up-to-date on industry trends across all industries. With this IBISWorld Industry Research Report on , you can expect thoroughly researched, reliable and current information that will help you to make faster, better business decisions.

Total Current Assets / Total Current Liabilities

This ratio is a rough indication of a firm’s ability to service its current obligations. Generally, the higher the current ratio, the greater the "cushion" between current obligations and a firm’s ability to pay them. While a stronger ratio shows that the numbers for current assets exceed those for current liabilities, the composition and quality of current assets are critical factors in the analysis of an individual firm’s liquidity.

Total Revenue / Accounts Receivable

365 / Receivables Turnover Ratio

This figure expresses the average number of days that receivables are outstanding. Generally, the greater the number of days outstanding, the greater the probability of delinquencies in accounts receivable. A comparison of this ratio may indicate the extent of a company’s control over credit and collections. However, companies within the same industry may have different terms offered to customers, which must be considered.

Total Revenue / Closing Inventory

This is an efficiency ratio, which indicates the average liquidity of the inventory or whether a business has over or under stocked inventory. This ratio is also known as "inventory turnover" and is often calculated using "cost of sales" rather than "total revenue." This ratio is not very relevant for financial, construction and real estate industries.

365 / Inventory Turnover Ratio

Dividing the inventory turnover ratio into 365 days yields the average length of time units are in inventory.

Total Revenue / Net Working Capital

Because it reflects the ability to finance current operations, working capital is a measure of the margin of protection for current creditors. When you relate the level of sales resulting from operations to the underlying working capital, you can measure how efficiently working capital is being used. *Net Working Capital = Current Assets - Current Liabilities

(Net Profit + Interest & Bank Charges) / Interest & Bank Charges)

This ratio calculates the average number of times that interest owing is earned and, therefore, indicates the debt risk of a business. The larger the ratio, the more able a firm is to cover its interest obligations on debt. This ratio is not very relevant for financial industries. This ratio is also known as "times interest earned."

Total Liabilities / Total Equity

This is a solvency ratio, which indicates a firm's ability to pay its long-term debts. The lower the positive ratio is, the more solvent the business. The debt to equity ratio also provides information on the capital structure of a business, the extent to which a firm's capital is financed through debt. This ratio is relevant for all industries.

Total Liabilities / Total Assets

This is a solvency ratio indicating a firm's ability to pay its long-term debts, the amount of debt outstanding in relation to the amount of capital. The lower the ratio, the more solvent the business is.

(Net Fixed Assets * 100) / Equity

Net fixed assets represent long-term investment, so this percentage indicates relative capital investment structure.

Total Revenue / Equity

It indicates the profitability of a business, relating the total business revenue to the amount of investment committed to earning that income. This ratio provides an indication of the economic productivity of capital.

(Net Profit * 100) / Equity

This percentage indicates the profitability of a business, relating the business income to the amount of investment committed to earning that income. This percentage is also known as "return on investment" or "return on equity." The higher the percentage, the relatively better profitability is.

(Net Profit + Interest and Bank Charges) * 100 / Total Assets

This percentage, also known as "return on total investment," is a relative measure of profitability and represents the rate of return earned on the investment of total assets by a business. It reflects the combined effect of both the operating and the financing/investing activities of a business. The higher the percentage, the better profitability is.

(Total Current Assets * 100) / Total Assets

This percentage represents the total of cash and other resources that are expected to be realized in cash, or sold or consumed within one year or the normal operating cycle of the business, whichever is longer.

(Accounts Receivable * 100) / Total Assets

This percentage represents all claims against debtors arising from the sale of goods and services and any other miscellaneous claims with respect to non-trade transaction. It excludes loan receivables and some receivables from related parties.

(Closing Inventory * 100) / Total Assets

This percentage represents tangible assets held for sale in the ordinary course of business, or goods in the process of production for such sale, or materials to be consumed in the production of goods and services for sale. It excludes assets held for rental purposes.

(Other Current Assets * 100) / Total Assets

This percentage represents all current assets not accounted for in accounts receivable and closing inventory.

(Net Tangible & Intangible Assets * 100) / Total Assets

This percentage represents tangible or intangible property held by businesses for use in the production or supply of goods and services or for rental to others in the regular operations of the business. It excludes those assets intended for sale. Examples of such items are plant, equipment, patents, goodwill, etc. Valuation of net fixed assets is the recorded net value of accumulated depreciation, amortization and depletion.

(All Other Assets & Adjustments * 100) / Total Assets

This percentage represents all other assets not elsewhere recorded, such as long-term bonds.

Average Total Assets

This figure represents the average value of all resources controlled by an enterprise as a result of past transactions or events from which future economic benefits may be obtained.

(Total Current Liabilities * 100) / Total Assets

This percentage represents obligations that are expected to be paid within one year, or within the normal operating cycle, whichever is longer. Current liabilities are generally paid out of current assets or through creation of other current liabilities. Examples of such liabilities include accounts payable, customer advances, etc.

(Current Bank Loans * 100) / Total Assets

This percentage represents all current loans and notes payable to Canadian chartered banks and foreign bank subsidiaries, with the exception of loans from a foreign bank, loans secured by real estate mortgages, bankers acceptances, bank mortgages and the current portion of long-term bank loans.

(Other Current Liabilities * 100) / Total Assets

(Long-Term Liabilities * 100) / Total Assets

This percentage represents obligations that are not reasonably expected to be liquidated within the normal operating cycle of the business but, instead, are payable at some date beyond that time. It includes obligations such as long-term bank loans and notes payable to Canadian chartered banks and foreign subsidiaries, with the exception of loans secured by real estate mortgages, loans from foreign banks and bank mortgages and other long-term liabilities.

(Total Liabilities * 100) / Total Assets

This percentage represents the obligations of an enterprise arising from past transactions or events, the settlements of which may result in the transfer of assets, provision of services or other yielding of economic benefits in the future.

(Total Equity * 100) / Total Assets

This percentage represents the net worth of businesses and includes elements such as the value of common and preferred shares, as well as earned, contributed and other surpluses.

Average Total Liabilities + Average Total Equity

This figure represents the sum of two separate line items, which are added together and checked against a company’s total assets. This figure must match total assets to ensure a balance sheet is properly balanced.

Trusted by More Than 10,000 Clients Around the World

Thousands of Clients across Europe trust IBISWorld to understand industry trends

- The Mobile Economy China 2024

Module: Mobile Operators and Networks

The mobile economy china 2024 79791246.

- Kenechi Okeleke

- Sayali Borole

- James Joiner

- Harry Fernando Aquije Ballon

With the number of 5G connections in China set to reach 1 billion by the end of 2024, operators are ready to initiate the next phase of the technology’s development, including investments in 5G-Advanced. This will enable the industry to focus on new growth opportunities from enhanced 5G capabilities while also delivering economic benefits. 5G’s contribution to GDP in China is expected to reach $260 billion in 2030 (23% of the overall annual economic impact of mobile in China).

In addition to a range of technology, socioeconomic and financial datasets, The Mobile Economy China 2024 examines key trends across the mobile industry in China: the role of 5G-Advanced and 5G RedCap; the impact of network API initiatives; the introduction of 5G new calling; the growing number of telco-satellite partnerships; and the potential of generative AI. Additionally, it explores mobile‘s impact on the SDGs. Finally, the research discusses key industry enablers, including policies for the effective allocation of spectrum.

Contact our research team

Get in touch with us to find out more about our research topics and analysis.

Related Data & Charts

- Lorem ipsum

To cite our research, please see our citation policy in our Terms of Use , or contact our Media team for more information.

Related Research

- In-Building Tech

- Telco Cloud

- 5G NR Release 17

- Private Networks

- Telco AI Deep Dive

- Cloud RAN Deep Dive

- Sponsored Channels:

- Keysight 5G Solutions

- Qualcomm 5G Insights

- 6G Technology & Testing

- Advertise/Sponsor

- Editorial Calendar

- 5G Talent Talk

- Wireless Connectivity to Enable Industry 4.0 for the Middleprise

- Well Technically…

- Will 5G Change the World

- Accelerating Industry 4.0 Digitalization

- White Papers

- Analyst Angle

- Network Infrastructure

- Understanding the 5G Advanced and 6G future

- Rohde & Schwarz 6G Technology & Testing

- Telco Cloud & Edge Forum

China Mobile to launch 5G-A in 300 cities this year: Report

China Mobile also plans to promote the release of over 20 5G-A compatible phones during 2024

Chinese carrier China Mobile plans to launch 5G-Advanced (5G-A) technology in over 300 cities across China this year, according to local press reports.

The telco, which claims a leading role in the development of 5G-A standards, also plans to promote the release of over 20 5G-A compatible phones within the year.

To showcase its new 5G-A network, China Mobile has established 5G-A demonstration halls in various locations across China. The carrier said that customers with the OPPO Find X7 Ultra smartphone can visit these halls to experience the 5G-A technology, according to the report.

China Mobile’s vice president, Gao Tongqing, stated that this launch will further accelerate the development of new information infrastructure and unlock the full potential of 5G technology. The carrier also said it aims to achieve widespread adoption of 5G-A technology in China through partnerships with manufacturers and chip suppliers.

The report also noted that Beijing, Shanghai and Guangzhou are among the first cities where China Mobile will activate the new technology.

China Mobile ended last year with a total of 465 million 5G subscribers, up 42.1% year-on-year and reported a net addition of 138 million 5G subscribers during 2023.

The company’s net profit last year increased 5% year-on-year to CNY131.7 billion ($18.3 billion) while the telco’s operating revenue grew by 6.3% year-on-year to CNY863.5 billion. In the mobile segment, the telco reached a total of 991 million subscribers at the end of 2023, up 1.6% year-on-year.

Capital expenditure totaled CNY180.3 billion, accounting for 20.9% of telecommunications services revenue and decreasing by 1.9 percentage points year-on-year.

China had 11.6 million mobile communication base stations as of the end of last year, of which 3.4 million were 5G base stations. 5G base stations currently account for 29% of total mobile base stations in China. The ratio is 7.8 percentage points higher compared to the end of 2022.

- 5G Advanced

- China Mobile

ABOUT AUTHOR

RELATED POSTS

Four market predictions for 5g ntn (and four phases of direct-to-cellular), aramco and gct semiconductor sign 5g, ai deal in saudi arabia, fcc takes ‘cautious’ approach to network slicing in proposed net neutrality rules.

Since 1982, RCR Wireless News has been providing wireless and mobile industry news, insights, and analysis to mobile and wireless industry professionals, decision makers, policy makers, analysts and investors.

© 2021-2022 RCR Wireless News

- About RCR Wireless News

- Wireless News Archive

- Consumer Goods and Services /

- Consumer Electronics /

- Smartphones and Mobile Devices

Research Report of Mobile Phone Exports in China 2020-2024

- Region: China

- China Research & Intelligence

- ID: 5129168

- Description

Table of Contents

Methodology, related topics, related reports.

- Purchase Options

- Ask a Question

- Recently Viewed Products

Readers may obtain the following information from this report:

- Economic Environment of the Mobile Phone Industry in China

- Policies in the Exported Mobile Phone Industry in China

- Analysis of the Supply of Mobile Phones in China

- Analysis of Exported Mobile Phones in China

- Analysis of Major Destinations of Exported Mobile Phones in China

- Price Trends of Exported Mobile Phones in China

1 Classification and Policy of Mobile Phones 1.1 Classification of Mobile Phones in China 1.2 Related Policies about China’s Mobile Phone Exports 2 China’s Mobile Phone Export, 2017-2020 2.1 Export Volume of Mobile Phones in China, 2017-2020 2.1.1 Total Export Volume of Mobile Phones in China 2.2 Export Value of Mobile Phones by China, 2017-2020 2.2.1 Total Export Value of Mobile Phones in China 2.2.2 Export Value of Segmented Products of Mobile Phones in China 2.3 Export Price of Mobile Phones by China, 2017-2020 2.3.1 Average Export Price of Mobile Phones in China 3 Major Destinations of Mobile Phone Exports by China, 2017-2020 3.1 Major Destinations of Mobile Phone Exports by China, 2017 3.2 Major Destinations of Mobile Phone Exports by China, 2018 3.3 Major Destinations of Mobile Phone Exports by China, 2019 3.4 Major Destinations of Mobile Phone Exports by China, 2020 4 Major Departures of Mobile Phone Exports by China, 2017-2020 4.1 Major Departures of Mobile Phone Exports by China, 2017 4.2 Major Departures of Mobile Phone Exports by China, 2018 4.3 Major Departures of Mobile Phone Exports by China, 2019 4.4 Major Departures of Mobile Phone Exports by China, 2020 Table of Selected Charts Chart Classification of Mobile Phones in China Chart Related Policies about China’s Mobile Phone Exports Chart Export Volume of Mobile Phones from China, 2017-2020 Chart Penetration of Chinese Mobile Phones in Germany and India Chart Export Value of Mobile Phones from China, 2017-2020 Chart Average Export Price of Mobile Phones from China, 2017-2020 Chart Major Destinations of Mobile Phone Exports by China, 2017 Chart Major Destinations of Mobile Phone Exports by China, 2018 Chart Major Destinations of Mobile Phone Exports by China, 2019 Chart Major Destinations of Mobile Phone Exports by China, 2020 Chart Major Departures of Mobile Phone Exports by China, 2017 Chart Major Departures of Mobile Phone Exports by China, 2018 Chart Major Departures of Mobile Phone Exports by China, 2019 Chart Major Departures of Mobile Phone Exports by China, 2020

Background research defines the range of products and industries, which proposes the key points of the research. Proper classification will help clients understand the industry and products in the report. Secondhand material research is a necessary way to push the project into fast progress. The analyst always chooses the data source carefully. Most secondhand data they quote is sourced from an authority in a specific industry or public data source from governments, industrial associations, etc. For some new or niche fields, they also "double-check" data sources and logics before they show them to clients. Primary research is the key to solve questions, which largely influence the research outputs. The analyst may use methods like mathematics, logical reasoning, scenario thinking, to confirm key data and make the data credible. The data model is an important analysis method. Calculating through data models with different factors weights can guarantee the outputs objective. The analyst optimizes the following methods and steps in executing research projects and also forms many special information gathering and processing methods. 1. Analyze the life cycle of the industry to understand the development phase and space. 2. Grasp the key indexes evaluating the market to position clients in the market and formulate development plans 3. Economic, political, social and cultural factors 4. Competitors like a mirror that reflects the overall market and also market differences. 5. Inside and outside the industry, upstream and downstream of the industry chain, show inner competitions 6. Proper estimation of the future is good guidance for strategic planning.

- Smartphones And Mobile Devices

Cell Phones Industry Forecasts - China Focus

- Report

- October 2023

Mobile Phone Chip Global Market Insights 2023, Analysis and Forecast to 2028, by Manufacturers, Regions, Technology, Application, Product Type

Mobile Phone Holder Global Market Insights 2023, Analysis and Forecast to 2028, by Manufacturers, Regions, Technology, Application, Product Type

Cell Phones Markets in China

BRIC Countries (Brazil, Russia, India, China) Mobile Phones Market Summary, Competitive Analysis and Forecast to 2027

- Brazil, China, India, ... Brazil, China, India, Russia

ASK A QUESTION

We request your telephone number so we can contact you in the event we have difficulty reaching you via email. We aim to respond to all questions on the same business day.

Request a Quote

YOUR ADDRESS

YOUR DETAILS

PRODUCT FORMAT

Market Research Assistance

- + 1-888-391-5441

Related Markets

- Wireless Payment

- Wireless Equipment

- Cell Phones

- Smart Phone

- Wireless Networks

- Wireless Internet

- Wireless Technology

Related Market Reports

Research report on china mobile phone export 2020-2024, click here for 15% discount on this report, report description, table of content, news & blog, other reports, our offerings.

Description

According to CRI, from 2017 to 2019, the total volume of China's mobile phone exports declined from 1,213.22 million to 994.09 million. Although the total export volume showed a trend of decreasing, the export value in 2018 increased by 11.52% compared to 2017, reaching USD 140.64 billion. China's mobile phone export price was also at the highest level in 2018, increased by 20.92% year on year, due to the rapid development of domestic high-end smart phones and the rising cost of core parts.

2018 is a year of strong rise of domestic smart phones, especially high-end ones. The competitiveness of domestic medium and high-end smart phones represented by Huawei mobile phones has been enhanced, and even penetrated the price band exclusive to Apple mobile phones.

Hong Kong is always the biggest market among China's mobile phone export destinations.

According to CRI, more than half of China's mobile phone exports came from Guangdong Province. Huaqiangbei, located in Shenzhen, Guangdong Province, is the most prosperous commercial street in Shenzhen, also the main hub of domestic electronic products circulation, especially famous for its mobile phone wholesale and retail business.

China's government encourages enterprises to export mobile phones, with export tax rebate rate 13%, while the USA levied additional duty on Chinese mobile phones.

Readers may obtain the following information through this report:

- Economic Environment of Mobile Phone Industry in China

- Policies in Exported Mobile Phone in China

- Analysis on Supply of Mobile Phone in China

- Analysis of Exported Mobile Phone in China

- Analysis of Major Destinations of Exported Mobile Phone in China

- Price Trend of Exported Mobile Phone in China

- Clinical Results in Diabetics To Be Boosted By Smart Artificial Beta Cells

For a long time, the cure for diabetes type 1 and type 2 has relied on agonizing insulin shots for patients or insulin infusion via mechanical pumps. Regarding this, experts have been creating artificial pancreatic beta cells with the he…

- High-speed Data Transmission And High Volume Needs Propel Fiber Optic Connectors Market

Fiber optic connectors are a substantial fragment of the global telecommunication industry. Optical fibers are joined using fiber optic connectors, which allow the light conduction between two consecutive optical fibers. An additional im…

- Extensive Use of Digital Technologies for Diagnostic Applications To Boost Global Optical Imaging Market

The global optical imaging system market is predicted to reach US$ 3 billion by 2024. It is expected to grow at a stable rate and will post a CAGR of more than 8% in the coming years. The growing market infiltration of digital …

- Foremost Trends In Global Pet Care Market

The global pet care market is foretold to improve in the forthcoming years as matched to the preceding years and will showcase better sales in various market segments. It is estimated that the global pet care market will grow at a CAGR o…

- China To Review Its Food Security Laws

China has arisen as the globe’s firmest developing economy. In addition, China brags about the biggest population pool in the world. In recent times, the one child policy in the republic was terminated. This is anticipated to upsur…

- Global Desktop IP Phone Market Research Report 2024 Published: 08-Jan-2024 Price: US 2900 Onwards Pages: 90 A VoIP phone or IP phone uses Voice over IP technologies for placing and transmitting telephone calls over an IP network, such as The Internet, instead of The traditional public switched telephone network (PSTN). The global Desktop IP Phone market was valued at US$ 2268 million in 2023 and is anticipated to reach US$ 2236.1 million by 2030, witnessing a CAGR of -0.2% during The forecast period 2024-2030. Cisco, Avaya, Mitel, Polycom and Alcatel-Lucent are The leaders of The D......

- Global Desktop IP Phone Market Growth 2024-2030 Published: 04-Jan-2024 Price: US 3660 Onwards Pages: 112 According to our LPI (LP Information) latest study, the global Desktop IP Phone market size was valued at US$ 2218.7 million in 2023. With growing demand in downstream market, the Desktop IP Phone is forecast to a readjusted size of US$ 2186.6 million by 2030 with a CAGR of -0.2% during review period. The research report highlights the growth potential of the global Desktop IP Phone market. Desktop IP Phone are expected to show stable growth in the future market. However, product differe......

- Global Feature Phone Market Growth 2024-2030 Published: 04-Jan-2024 Price: US 3660 Onwards Pages: 109 According to our LPI (LP Information) latest study, the global Feature Phone market size was valued at US$ 3835.6 million in 2023. With growing demand in downstream market, the Feature Phone is forecast to a readjusted size of US$ 3487.9 million by 2030 with a CAGR of -1.3% during review period. The research report highlights the growth potential of the global Feature Phone market. Feature Phone are expected to show stable growth in the future market. However, product differentiation, re......

- Global Desktop IP Phone Market 2024 by Manufacturers, Regions, Type and Application, Forecast to 2030 Published: 01-Jan-2024 Price: US 3480 Onwards Pages: 117 According to our (Global Info Research) latest study, the global Desktop IP Phone market size was valued at USD 2333.7 million in 2023 and is forecast to a readjusted size of USD 2302.6 million by 2030 with a CAGR of -0.2% during review period. A VoIP phone or IP phone uses Voice over IP technologies for placing and transmitting telephone calls over an IP network, such as the Internet, instead of the traditional public switched telephone network (PSTN). Cisco, Avaya, Mitel, Polyco......

- Global Business Phone Systems Market Status and Outlook 2023-2028 Published: 28-Dec-2023 Price: US 3160 Onwards Pages: 126 A business telephone system is a multiline telephone system typically used in business environments, encompassing systems ranging in technology from the key telephone system to the private branch exchange. Our market research experts provide qualitative and quantitative analysis of the market based on involving economic and non-economic factors in the same report with market value (million USD) data for each segment and sub-segment. This way, clients can achieve all their goals while tak......

- Global Satellite Phone Professional Survey Report 2023, Forecast to 2028 Published: 20-Dec-2023 Price: US 3280 Onwards Pages: 108 A satellite telephone, satellite phone or satphone is a type of mobile phone that connects to other phones or the telephone network by radio through orbiting satellites instead of terrestrial cell sites, as cellphones do. Our market research experts provide qualitative and quantitative analysis of the market based on involving economic and non-economic factors in the same report with market value (million USD) data for each segment and sub-segment. This way, clients can achieve all their ......

- Global Satellite Phone Market Research Report 2023, Forecast to 2028 Published: 20-Dec-2023 Price: US 2680 Onwards Pages: 137 A satellite telephone, satellite phone or satphone is a type of mobile phone that connects to other phones or the telephone network by radio through orbiting satellites instead of terrestrial cell sites, as cellphones do. Our market research experts provide qualitative and quantitative analysis of the market based on involving economic and non-economic factors in the same report with market value (million USD) data for each segment and sub-segment. This way, clients can achieve all their ......

- Global Green and Recycled Mobile Phone Industry Research Report, In-depth Analysis of Current Status and Outlook of Key Countries 2023-2028 Published: 14-Dec-2023 Price: US 3380 Onwards Pages: 125 Market Overview of Global Green and Recycled Mobile Phone market: According to our latest research, the global Green and Recycled Mobile Phone market looks promising in the next 5 years. As of 2022, the global Green and Recycled Mobile Phone market was estimated at USD XX million, and it's anticipated to reach USD XX million in 2028, with a CAGR of XX% during the forecast years. Green and Recycled Mobile Phone is segmented by Material into Metal-based, Plastic, Others. Recycl......

- Global Satellite Telephone Professional Survey Report 2023, Forecast to 2028 Published: 14-Dec-2023 Price: US 3280 Onwards Pages: 101 A satellite telephone, satellite phone or satphone is a type of mobile phone that connects to other phones or the telephone network by radio through orbiting satellites instead of terrestrial cell sites, as cellphones do. Our market research experts provide qualitative and quantitative analysis of the market based on involving economic and non-economic factors in the same report with market value (million USD) data for each segment and sub-segment. This way, clients can achieve all their ......

- Pay - as - you - go / Bucket Subscriptions

- Fixed Cost for #of reports

- Customize / Personalize as per your needs

We use cookies to deliver the best possible experience on our website. By continuing to use this site, or closing this box, you consent to our use of cookies. To learn more, visit our Privacy Policy

- Latest News

- Commentaries

- Video Gallery

- Photo Gallery

- Organisation Chart

- Board of Trustees

- International Advisory Panel

- Director & Chief Executive Officer

- Senior Advisor

- Deputy Chief Executive Officer

- Researchers

- Corporate Services

- Corporate Communications

- Information Technology (IT)

- Sustainability

- Annual Report 2022-2023

- Career Opportunities

- Wang Gungwu Visiting Fellows Programme

- ISEAS PhD Scholarship

- K S Sandhu Graduate Scholarship

- Tun Dato Sir Cheng-Lock Tan MA Scholarship

- Information Kit on Relocation to Singapore

- ASEANFocus+

- State of Southeast Asia Survey

- Books on ASEAN

- Useful Links

- ISEAS Books

- ISEAS Perspective

- ISEAS Commentaries

- Temasek Working Paper Series

- Archaeology Programme for Students

- Banteay, Phnom Kulen

- Banten Lama

- Bukit Brown Documentation Project

- Don Meas and Pream Kre, Phnom Kulen

- Fort Canning Spice Garden

- National Gallery Singapore

- Victoria Concert Hall

- Other capacity building projects

- Nalanda-Sriwijaya Centre archives

- Regional Economic Studies

- Regional Social & Cultural Studies

- Regional Strategic & Political Studies

- Indonesia Studies

- Malaysia Studies

- Myanmar Studies

- Philippine Studies

- Thailand Studies

- Vietnam Studies

- Climate Change in Southeast Asia Programme

- NHB Heritage Research Grant

- Introduction

- Library Blog

- Library Catalogue & Digital Archives

- Microform Collection

- Photographs, Glass Plates and Slides

- Private Papers

- Resource Guide

- Subscribed Resources

- Resource Guide – ASEAN

- Resource Guide – Indonesia

- Resource Guide – Malaysia

- Resource Guide – Myanmar

- Resource Guide – Singapore

- Resource Guide – Climate Change

- ISEAS Archives

- Opening Hours

- Library Services

- Become a Member

- Galleries in the Library

- Contemporary Southeast Asia

- Journal of Southeast Asian Economies

- Southeast Asian Affairs

- ISEAS Economics Working Papers

- Southeast Asia Climate Outlook

- Upcoming Events

- Event Highlights

- Regional Outlook Forum

- Singapore Lecture

- Get Involved with ISEAS

- Benefits of Giving

- Support ISEAS

- Donations FAQs

- Corporate Membership

The State of Southeast Asia: 2024 Survey Report

The State of Southeast Asia 2024 Survey conducted by the ASEAN Studies Centre at ISEAS – Yusof Ishak Institute reveals that Southeast Asia’s top preoccupations are with unemployment, climate change, and intensifying economic tensions between major powers. The Israel-Hamas conflict is the region’s top geopolitical concern, while China has edged past the US to become the prevailing choice if the region were forced to align itself in the ongoing US-China rivalry.

Download PDF Version

- Organization Chart

- Deputy Director

- Key Non-Financial and Financial Information

- Annual Report

- Opportunities

- ASEAN Studies Centre

- Singapore APEC Study Centre

- Temasek History Research Centre

- Regional Social & Cultural Studies

- Regional Strategic & Political Studies

- Country Studies Programme

- Library Catalogue

- Collections & Resources

- Using the Library

Flagship Publications

Articles & commentaries.

- Trends in Southeast Asia

- TRUTH-Professional

- TRUTH-Fullview

- TRUTH-Flash

- TRUTH-Mini Program

- TRUTH-Dark Horse List

- DATA MINING

- About QuestMobile Research

- About QuestMobile

- Apply For Trial

Data Insight

More than 300 data metrics that offer a comprehensive picture of companies’ performance.

Deep-dive Analysis

Deep-dive analysis that reveals the real reason behind what the data shows.

Case-based Prediction

Logical prediction of company/market developments based on historical data and cases.

Actionable Solutions

Actionable solutions that are designed to solve specific problems.

Our Capabilities

- Macro Market Study

- Micro Company Study

- User Behavior Study

Total Addressable Market Size, Market GROWTH Projections

User Base, User GROWTH Rate And Penetration Rate

Market Demand Analysis

Value Chain Analysis

Critical Success Factors

Market Participants and Market Share

Advantages and Disadvantages of Major Players

Prediction of Competition’s Developments

Value Chain Analysis of Competitors

Traffic Value

Brand Value

GROWTH opportunity of the whole industry

Future growth and commercial value of target company

Future development strategy

Risk prevention

Brand Loyalty, Bargaining Power

Brand Association, Brand Awareness

Brand Reputation, User Experience

Brand Diagnosis

User Scale and Traffic Conversion Study

User Stickiness and Activeness

Overlapped Users and Their App Usage

Lost and Regained users

Competing Apps

Ad Campaign Effectiveness Evaluation

Marketing Campaign Evaluation (Coverage of Target Population)

Suggestions on Marketing Strategy (Based on Marketing Effectiveness Evaluation)

Marketing Campaign Planning (Based on Target Population’s Profiles)

General Advertising Model and Data of Vertical Sectors

Media Value Assessment and Target Media Proposals

Media Advertising Effectiveness Evaluation and Suggestions on Media Choice Strategy

Interest Cluster Analysis

Preference Cluster Analysis

User Cognition, Evaluation and Attitude

Understanding of Users’ Needs

User Features/Habits (Media Habit, App/Device Usage Habit, etc.)

Users Segmentation and Positioning of Target Market

User Experience NPS/Satisfaction Degree

Competing App’s user Experience/NPS

Customer Journey Map and Pain Spots Attribution

User Satisfaction Degree Projection

Our Vision, Mission And Positioning

To be a trustworthy objective observer, opinion leader and future trend predictor of China Mobile Internet Market.

Empower Chinese Internet Companies and Investors with QuestMobile’s unique data and insightful research.

A top notch thinktank focusing on research and consulting with unmatchable proprietary data resources.

Business Inquiries

Submit Your Requests

Research Report on China Mobile Phone Export 2020-2024

$ 2000 – $ 3000

Description

Additional information, table of contents.

Description According to CRI, from 2017 to 2019, the total volume of China’s mobile phone exports declined from 1,213.22 million to 994.09 million. Although the total export volume showed a trend of decreasing, the export value in 2018 increased by 11.52% compared to 2017, reaching USD 140.64 billion. China’s mobile phone export p rice was also at the highest level in 2018, increased by 20.92% year on year, due to the rapid development of domestic high-end smart phones and the rising cost of core parts. 2018 is a year of strong rise of domestic smart phones, especially high-end ones. The competitiveness of domestic medium and high-end smart phones represented by Huawei mobile phones has been enhanced, and even penetrated the p rice band exclusive to Apple mobile phones. Hong Kong is always the biggest market among China’s mobile phone export destinations. According to CRI, more than half of China’s mobile phone exports came from Guangdong Province. Huaqiangbei, located in Shenzhen, Guangdong Province, is the most prosperous commercial street in Shenzhen, also the main hub of domestic electronic products circulation, especially famous for its mobile phone wholesale and retail business. China’s government encourages enterprises to export mobile phones, with export tax rebate rate 13%, while the USA levied additional duty on Chinese mobile phones.

Readers may obtain the following information through this report: – Economic Environment of Mobile Phone Industry in China – Policies in Exported Mobile Phone in China – Analysis on Supply of Mobile Phone in China – Analysis of Exported Mobile Phone in China – Analysis of Major Destinations of Exported Mobile Phone in China – P rice Trend of Exported Mobile Phone in China

Related products

Global Homomorphic Encryption Market Research Report – Forecast to 2027

Global function as a service market research report- forecast to 2023, global manned guarding services market research report – forecast to 2025, global energy storage market – trends & forecast, 2017-2023.

Special Report

What Investors Want to Know: TLAC-Eligible Senior Debt in China

Sun 07 Apr, 2024 - 10:02 PM ET

China’s five global systemically important banks (G-SIBs) are likely to begin pilot issuance of total loss-absorbing capacity (TLAC)-eligible senior debt in 2Q24, with the initial amounts likely to be small, especially in the offshore markets, says Fitch Ratings. We are likely to align the ratings of TLAC-eligible senior debt with the Chinese G-SIBs’ Long-Term Issuer Default Ratings (IDRs), subject to issuance terms and conditions or any further clarification on its ranking versus existing senior debt. These banks’ IDRs are underpinned by our expectations of a very high probability of government support for the banks, and we expect a similar level of state support to prevent defaults and below-average recoveries (in the unlikely event of default) on TLAC senior debt. We estimate that additional capital and TLAC-eligible senior debt requirements could amount to around CNY1.6 trillion (USD226 billion) for the five G-SIBs by January 2025, and to around CNY6.2 trillion (USD866 billion) by January 2028. This excludes potential offsets from the deposit insurance fund of up to 3.5% of risk-weighted assets (RWA) in 2028, but takes into consideration their capital positions and capital plans which had already been announced at end-1Q24. China’s TLAC consultation paper has stipulated that the loss absorption of TLAC debt will only be triggered after the full write-off or conversion of outstanding tier-2 (T2) instruments. Therefore, all things equal, we expect the coupon rate for TLAC debt to reflect default and loss-severity risks relative to T2 and additional tier-1 bonds. We believe Chinese G-SIBs may replace some of their existing capital instruments or planned capital instrument issuance with TLAC debt in the next few years if it is cost effective.

Why Taiwan Was So Prepared for a Powerful Earthquake

Decades of learning from disasters, tightening building codes and increasing public awareness may have helped its people better weather strong quakes.

Search-and-rescue teams recover a body from a leaning building in Hualien, Taiwan. Thanks to improvements in building codes after past earthquakes, many structures withstood Wednesday’s quake. Credit...

Supported by

- Share full article

By Chris Buckley , Meaghan Tobin and Siyi Zhao

Photographs by Lam Yik Fei

Chris Buckley reported from the city of Hualien, Meaghan Tobin from Taipei, in Taiwan.

- April 4, 2024

When the largest earthquake in Taiwan in half a century struck off its east coast, the buildings in the closest city, Hualien, swayed and rocked. As more than 300 aftershocks rocked the island over the next 24 hours to Thursday morning, the buildings shook again and again.

But for the most part, they stood.

Even the two buildings that suffered the most damage remained largely intact, allowing residents to climb to safety out the windows of upper stories. One of them, the rounded, red brick Uranus Building, which leaned precariously after its first floors collapsed, was mostly drawing curious onlookers.

The building is a reminder of how much Taiwan has prepared for disasters like the magnitude-7.4 earthquake that jolted the island on Wednesday. Perhaps because of improvements in building codes, greater public awareness and highly trained search-and-rescue operations — and, likely, a dose of good luck — the casualty figures were relatively low. By Thursday, 10 people had died and more than 1,000 others were injured. Several dozen were missing.

“Similar level earthquakes in other societies have killed far more people,” said Daniel Aldrich , a director of the Global Resilience Institute at Northeastern University. Of Taiwan, he added: “And most of these deaths, it seems, have come from rock slides and boulders, rather than building collapses.”

Across the island, rail traffic had resumed by Thursday, including trains to Hualien. Workers who had been stuck in a rock quarry were lifted out by helicopter. Roads were slowly being repaired. Hundreds of people were stranded at a hotel near a national park because of a blocked road, but they were visited by rescuers and medics.

On Thursday in Hualien city, the area around the Uranus Building was sealed off, while construction workers tried to prevent the leaning structure from toppling completely. First they placed three-legged concrete blocks that resembled giant Lego pieces in front of the building, and then they piled dirt and rocks on top of those blocks with excavators.

“We came to see for ourselves how serious it was, why it has tilted,” said Chang Mei-chu, 66, a retiree who rode a scooter with her husband Lai Yung-chi, 72, to the building on Thursday. Mr. Lai said he was a retired builder who used to install power and water pipes in buildings, and so he knew about building standards. The couple’s apartment, near Hualien’s train station, had not been badly damaged, he said.

“I wasn’t worried about our building, because I know they paid attention to earthquake resistance when building it. I watched them pour the cement to make sure,” Mr. Lai said. “There have been improvements. After each earthquake, they raise the standards some more.”

It was possible to walk for city blocks without seeing clear signs of the powerful earthquake. Many buildings remained intact, some of them old and weather-worn; others modern, multistory concrete-and-glass structures. Shops were open, selling coffee, ice cream and betel nuts. Next to the Uranus Building, a popular night market with food stalls offering fried seafood, dumplings and sweets was up and running by Thursday evening.

Earthquakes are unavoidable in Taiwan, which sits on multiple active faults. Decades of work learning from other disasters, implementing strict building codes and increasing public awareness have gone into helping its people weather frequent strong quakes.

Not far from the Uranus Building, for example, officials had inspected a building with cracked pillars and concluded that it was dangerous to stay in. Residents were given 15 minutes to dash inside and retrieve as many belongings as they could. Some ran out with computers, while others threw bags of clothes out of windows onto the street, which was also still littered with broken glass and cement fragments from the quake.

One of its residents, Chen Ching-ming, a preacher at a church next door, said he thought the building might be torn down. He was able to salvage a TV and some bedding, which now sat on the sidewalk, and was preparing to go back in for more. “I’ll lose a lot of valuable things — a fridge, a microwave, a washing machine,” he said. “All gone.”

Requirements for earthquake resistance have been built into Taiwan’s building codes since 1974. In the decades since, the writers of Taiwan’s building code also applied lessons learned from other major earthquakes around the world, including in Mexico and Los Angeles, to strengthen Taiwan’s code.

After more than 2,400 people were killed and at least 10,000 others injured during the Chi-Chi quake of 1999, thousands of buildings built before the quake were reviewed and reinforced. After another strong quake in 2018 in Hualien, the government ordered a new round of building inspections. Since then, multiple updates to the building code have been released.

“We have retrofitted more than 10,000 school buildings in the last 20 years,” said Chung-Che Chou, the director general of the National Center for Research on Earthquake Engineering in Taipei.

The government had also helped reinforce private apartment buildings over the past six years by adding new steel braces and increasing column and beam sizes, Dr. Chou said. Not far from the buildings that partially collapsed in Hualien, some of the older buildings that had been retrofitted in this way survived Wednesday’s quake, he said.

The result of all this is that even Taiwan’s tallest skyscrapers can withstand regular seismic jolts. The capital city’s most iconic building, Taipei 101, once the tallest building in the world, was engineered to stand through typhoon winds and frequent quakes. Still, some experts say that more needs to be done to either strengthen or demolish structures that don’t meet standards, and such calls have grown louder in the wake of the latest earthquake.

Taiwan has another major reason to protect its infrastructure: It is home to the majority of production for the Taiwan Semiconductor Manufacturing Company, the world’s largest maker of advanced computer chips. The supply chain for electronics from smartphones to cars to fighter jets rests on the output of TSMC’s factories, which make these chips in facilities that cost billions of dollars to build.

The 1999 quake also prompted TSMC to take extra steps to insulate its factories from earthquake damage. The company made major structural adjustments and adopted new technologies like early warning systems. When another large quake struck the southern city of Kaohsiung in February 2016, TSMC’s two nearby factories survived without structural damage.

Taiwan has made strides in its response to disasters, experts say. In the first 24 hours after the quake, rescuers freed hundreds of people who were trapped in cars in between rockfalls on the highway and stranded on mountain ledges in rock quarries.

“After years of hard work on capacity building, the overall performance of the island has improved significantly,” said Bruce Wong, an emergency management consultant in Hong Kong. Taiwan’s rescue teams have come to specialize in complex efforts, he said, and it has also been able to tap the skills of trained volunteers.

Taiwan’s resilience also stems from a strong civil society that is involved in public preparedness for disasters.

Ou Chi-hu, a member of a group of Taiwanese military veterans, was helping distribute water and other supplies at a school that was serving as a shelter for displaced residents in Hualien. He said that people had learned from the 1999 earthquake how to be more prepared.

“They know to shelter in a corner of the room or somewhere else safer,” he said. Many residents also keep a bag of essentials next to their beds, and own fire extinguishers, he added.

Around him, a dozen or so other charities and groups were offering residents food, money, counseling and childcare. The Tzu Chi Foundation, a large Taiwanese Buddhist charity, provided tents for families to use inside the school hall so they could have more privacy. Huang Yu-chi, a disaster relief manager with the foundation, said nonprofits had learned from earlier disasters.

“Now we’re more systematic and have a better idea of disaster prevention,” Mr. Huang said.

Mike Ives contributed reporting from Seoul.

Chris Buckley , the chief China correspondent for The Times, reports on China and Taiwan from Taipei, focused on politics, social change and security and military issues. More about Chris Buckley

Meaghan Tobin is a technology correspondent for The Times based in Taipei, covering business and tech stories in Asia with a focus on China. More about Meaghan Tobin

Siyi Zhao is a reporter and researcher who covers news in mainland China for The Times in Seoul. More about Siyi Zhao

Advertisement

- Chairman's Statement

- Directors and Senior Management

- Members of the Board of Directors and Board Committees

- Recognition & Awards

- Latest Releases of Results

- FY 2023 Results Announcement (HK Shares)

- FY 2023 Results Announcement (A Shares)

- --> FY 2023 Press Release

- FY 2023 Presentation (HK Shares)

- FY 2023 Presentation (A Shares)

- FY 2023 Results Webcast

- 2023 1-3Q Results (HK Shares)

- 2023 1-3Q Results (A Shares)

- Business Analysis

- Business Review

- Financial Review

- Operating Data

- Monthly Customer Data

- Credit Ratings

- Presentations / Webcasts

- Analyst Coverage

- Regulatory Disclosure

- HKEX Announcements

- SSE Filings

- Financial Reports

- Circulars & Other Documents

- Monthly Return

- US SEC Filings

- Shareholders Information

- Share Information

- Shareholding Structure

- Dividend History

- Stock Quotes & Charts

- Historical Prices Lookup

- Interactive News Chart

- Corporate Communications

- IR Calendar

- Press Releases

- News Highlights

- Fact Sheets

- Photo Gallery

- Video Gallery

- Corporate Images

- Media Contact

- Sustainability Report

- Corporate Governance Report

- Articles & Charter

- Articles of Association

- Audit Committee Terms of Reference

- Remuneration Committee Terms of Reference

- Nomination Committee Terms of Reference

- Sustainability Committee Terms of Reference

- Procedures for Shareholders to Propose a Person for Election as Director

- Policies & Guidelines

- Code of Ethics

- Policy for a Responsible Supply Chain of Conflict Minerals

- Due Diligence Guidance for Responsible Supply Chains of Minerals

- China Mobile Environmental Management Policy

RESULTS HIGHLIGHTS

2019 Interim Results Announcement

- Announcement

- Press Release

- Presentation

- Print this Page

- Add to Favourites

- Email this Page

- Share this Page

- Download Centre

IMAGES

COMMENTS

Financial Reports. 2021 2023. 2018 2020. 2015 2017. 2012 2014. 2009 2011. 2006 2008. 2003 2005. 2000 2002. 1997 1999. Annual Report 2023 (A Shares) Interim Report 2023. Interim Report 2023 ... About China Mobile. Overview; Chairman's Statement; Directors and Senior Management; Members of the Board of Directors and Board Committees; Milestones ...

China Mobile (CM) is the largest mobile operator in Mainland China. It provides 2G services based on GSM technology and 3G/4G services based on Chinese-developed TD-SCDMA/TD-LTE technologies, as well as 5G services based on the 5G SA network. ... Such research report is distributed on the express understanding that, whilst the information ...

China Mobile is one of the earlist and most active operators to promote 5G industry. It is the earliest (2016) operator to define the development plan of 5G, and finished key technology verification in 2016. It launched field tests in 2017, scale trials in 2018, pre-commercial trials in 2019, and the commercial deployment has been planned in 2020.

GSMA Intelligence is the definitive source of global mobile operator data, analysis and forecasts, and publisher of authoritative industry reports and research. Our data covers every operator group, network and MVNO in every country worldwide - from Afghanistan to Zimbabwe. It is the most accurate and complete set of industry metrics available,

China Mobile plans to increase its own 5G base station count to 1 million by the end of 2022.2 According to Hong Kong communications regulator OFCA, 5G coverage has exceeded 90% of the population,3 while CSL states that its network has been extended to country parks, hiking trails, cycle tracks and camping sites.

In 2022, mobile technologies and services generated 5.5% of GDP in China - a contribution that amounted to $1.1 trillion of economic value added. The greatest benefits came from the productivity efects, which reached $720 billion, followed by the rest of the mobile ecosystem, which generated $160 billion. Figure 10.