Functional Currency vs Presentation Currency

Determining a company's functional currency is crucial, yet complex. Most would agree that navigating functional vs presentation currency can be confusing.

This article will clearly define functional and presentation currency, providing easy-to-understand examples and outlining straightforward translation procedures per IFRS guidelines.

You'll learn the key differences between functional and presentation currency, how to accurately determine a company's functional currency using primary indicators and secondary factors, and understand the impact currency choice has on financial statement analysis.

Introduction to Functional vs Presentation Currency

The functional currency refers to the primary currency used in a company's operations, while the presentation currency is the currency used to report the company's financial statements. There are some key differences between these two concepts:

Defining Functional Currency IFRS and Presentation Currency

Functional currency is the currency of the primary economic environment in which an entity operates. It reflects the underlying transactions, events, and conditions under which the entity conducts its business.

Presentation currency is the currency in which an entity presents its financial statements. Companies can choose to present their financials in a currency different from their functional currency.

For example, a French company doing most of its business in the Eurozone would likely have the Euro as its functional currency. However, it may present its financial statements in US dollars to make it easier for potential American investors to understand.

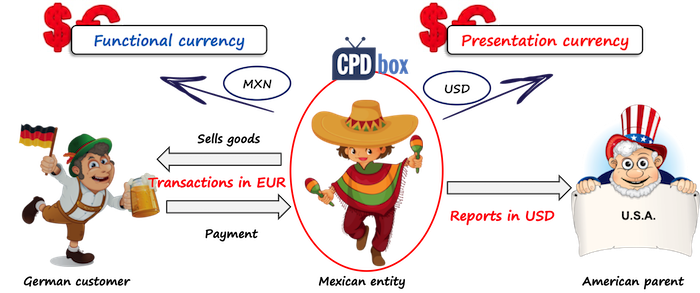

Exploring Functional Currency vs Presentation Currency Examples

Here are some examples to illustrate the difference:

A Canadian company that operates mainly in Canada and conducts transactions in Canadian dollars (CAD) would have CAD as its functional currency . If it presents financial statements in CAD, then CAD would also be its presentation currency .

An American company with operations across Europe and Asia that mostly transacts in British Pounds (GBP) would likely have GBP as its functional currency . However, it may present statements in US dollars (USD) for easier investor understanding, making USD its presentation currency .

A multinational company headquartered in Japan but transacting primarily in USD may use USD as its functional currency and JPY as its presentation currency for reporting purposes in its home country.

Significance of Functional Currency vs Local Currency

Choosing an appropriate functional currency is important for accurate financial reporting in international business. Using a non-functional local currency can distort financial statements during currency translation and not portray the true financial situation. On the other hand, the presentation currency can be tailored for investor convenience without impacting the underlying transactions.

What is the difference between functional currency and presentation currency?

The key difference between functional currency and presentation currency relates to which currency is used for measurement and reporting purposes in financial statements.

Functional Currency

The functional currency is the primary currency used by an entity to generate revenues, incur expenses, and operate day-to-day business activities. It is the currency of the primary economic environment in which an entity operates.

Some key indicators for determining an entity's functional currency include:

- The currency that mainly influences sales prices for goods and services

- The currency of the country whose competitive forces and regulations mainly determine the sales prices

- The currency that mainly influences labor, material, and other costs of providing goods or services

Presentation Currency

The presentation currency is the currency in which an entity presents its financial statements. Companies with foreign operations often translate functional currency financial statements into a presentation currency for consolidation purposes.

For example, a French company with a Euro functional currency may translate its financial statements into US Dollars for presentation if it has substantial operations in the United States or its investors are primarily US-based.

Key Differences

The main differences between functional and presentation currencies:

- Purpose - Functional currency reflects day-to-day business operations, while presentation currency is used for financial reporting.

- Determination - Functional currency depends on the primary economic environment, presentation currency is a choice based on user needs.

- Translation - Transactions in non-functional currencies require translation, presentation currencies involve translating entire financial statements.

In summary, the functional currency reflects the practical currency flows of regular business activities, while the presentation currency serves financial statement users and their preferred currency.

What is the difference between transactional currency and functional currency?

Functional currency is the primary currency used in a company's operations, while transactional currency is the currency used for individual transactions. Here are some key differences:

Functional currency reflects the main currency environment in which a company operates. It is usually the currency that mainly influences sales prices, labor, materials and other costs of providing goods or services. Some of the primary indicators for determining functional currency include:

- Currency that mainly influences sales prices

- Currency of the country whose competitive forces and regulations mainly determine sale prices

- Currency that mainly influences labor, materials and other costs

- Currency in which funds from financing activities are generated

- Currency in which receipts from operating activities are usually retained

Transactional currency is the currency used when buying or selling goods, services or assets. It is determined separately for each transaction based on the currency in which the transaction takes place. For example, if a French company purchases materials from a supplier in the U.S., the transactional currency would be USD.

Presentation currency is the currency used to present an entity's financial statements. Companies can choose any currency for financial reporting, regardless of functional currency. Presentation currency does not impact recognition or measurement in the financial statements.

For example, a Canadian company does most of its business in the U.S. Its functional currency is likely USD since that is the primary currency influencing its revenues, expenses, and cash flows. However, it can choose to present its financial statements in CAD as its presentation currency to better report performance to Canadian investors and stakeholders. The choice of presentation currency does not change the underlying recognition or measurement of transactions.

In summary, functional currency depends on a company's primary operating environment, transactional currency is determined separately for each transaction, and presentation currency is an independent choice for financial reporting. Properly distinguishing between these concepts is important from an accounting perspective.

What is an example of a functional currency?

For example, if a US-based multinational oil and gas company that uses the US dollar as its reporting currency maintains a distinct and separable operating subsidiary in Northern Africa that sells all of its oil production in transactions denominated in the US dollar, the US dollar would be the functional currency of that subsidiary.

Some key reasons why the US dollar is the functional currency in this example:

- The subsidiary's oil sales, which are likely the main source of revenue, are all denominated and settled in US dollars. This indicates the US dollar is the main currency influencing sales prices and cash flows.

- As a separable entity dealing almost exclusively in US dollars, the local currency of Northern Africa likely has little direct influence on the subsidiary's operations and transactions.

- The parent company's reporting currency is the US dollar, so maintaining the same functional currency simplifies consolidation and internal reporting.

- Oil is a global commodity typically traded in US dollars on international markets. The local currency likely has little impact on production costs or sales prices.

In summary, the key transactions, events, and conditions that impact this subsidiary's cash flows are primarily denominated in US dollars, making it the most appropriate functional currency based on IFRS guidance. The local currency in Northern Africa has little direct influence.

What is an example of presentation currency?

The subsidiaries use their local currency to prepare their financial statements, whereas the parent company uses USD to prepare its consolidated financial statements. USD, in this case, is called the presentation currency.

Here is an example to illustrate the difference between functional currency and presentation currency:

Consider a company XYZ Inc. that has a subsidiary in the UK. The UK subsidiary conducts all its business and transactions in British Pounds (GBP). So GBP is the functional currency for the UK subsidiary, as it reflects the economic reality of the subsidiary's operations.

However, XYZ Inc. prepares its consolidated financial statements in US dollars (USD). So when the parent company is consolidating the UK subsidiary's financial statements, it has to translate them from GBP to USD using the applicable foreign exchange rates. USD here is simply the presentation currency - it is the currency in which the consolidated financial statements are presented for the benefit of the parent company.

The key difference is:

Functional currency - reflects the underlying transactions, events, and conditions that are relevant to the entity.

Presentation currency - is simply the currency in which the financial statements are presented. It may be different from functional currencies of consolidated entities.

So in this example, GBP is the functional currency (based on UK subsidiary's operations) while USD is the presentation currency (for consolidation purposes at the parent company).

The choice of presentation currency is usually based on factors like investors' location, comparability with industry peers, headquarters location, etc. It does not change the underlying functional currencies used by individual entities for their operations.

sbb-itb-beb59a9

Determining a company's functional currency.

This section outlines the primary and secondary indicators that determine an entity's functional currency under IFRS guidelines.

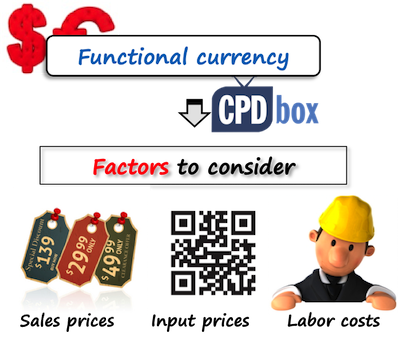

Primary Indicators of Functional Currency

The currency which mainly influences sales prices and labor, material & other costs is given priority. Also considered is the currency in which funds from financing are generated and retained earnings held.

Some key factors when assessing an entity's functional currency include:

- The currency that mainly influences sales prices for goods and services. This is often the currency in which sales prices for its goods and services are denominated and settled.

- The currency of the country whose competitive forces and regulations mainly determine the sales prices of its goods and services.

- The currency that mainly influences labor, material and other costs of providing goods or services. This will depend on whether the entity's costs are primarily incurred and settled in a particular currency.

Funds from financing activities and the currency in which retained earnings are held and dividends are paid are also key considerations.

Assessing Secondary Factors

Other factors like the currency in which receipts from operating activities are usually retained and whether transactions with the reporting entity are in this currency.

Some secondary indicators to consider:

- The currency in which funds from financing activities are generated

- The currency in which receipts from operating activities are usually retained

- Whether transactions with the reporting entity are usually in a particular currency

These secondary factors can provide additional context in determining an entity's functional currency, especially when the primary indicators do not clearly identify a single currency.

Functional Currency vs Presentation Currency IFRS Compliance

Under IFRS guidelines, an entity's functional currency is the currency of the primary economic environment in which it operates. This is not necessarily the currency in which the entity presents its financial statements (presentation currency).

When an entity's functional currency differs from its presentation currency, it must translate its financial results into the presentation currency using the relevant foreign exchange rates. This translation process can impact revenues, expenses, assets and liabilities reported in the financial statements.

Compliance with IFRS requires entities to determine functional currency based on the primary economic environment, rather than choice. This ensures the financial statements reflect the underlying transactions, events and conditions relevant to the entity.

Careful determination of functional currency using the IFRS guidelines is important, as it has implications for the recognition, measurement and disclosure of transactions in the financial statements. Getting this right is key for comparability, consistency and transparency under IFRS standards .

Translating Foreign Currency Transactions

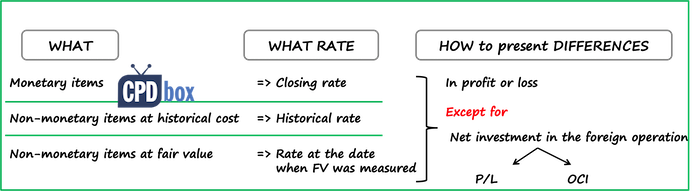

Spot rate application for initial recognition.

When a transaction denominated in a foreign currency first occurs, it must be translated into the functional currency by applying the spot exchange rate on the date of the transaction. The functional currency is the primary currency used in the company's operations.

For example, if a US company purchased inventory priced at 100,000 Mexican Pesos when the spot rate was 1 USD = 20 MXN, the initial recognition of the inventory in US dollars would be $5,000 (100,000 MXN / 20 MXN per USD). Using the spot rate at the date of initial transaction allows the foreign currency amount to be accurately translated into the functional currency.

End-of-Period Translation Procedures

At the end of each reporting period, foreign currency monetary items must be translated using the closing rate. The closing rate is the current exchange rate on the last day of the reporting period. This translation creates foreign exchange gains and losses that are recognized in profit or loss.

Non-monetary items measured at historical cost continue to use the same exchange rate as at the date of initial recognition. Only monetary items are retranslated at the end of each reporting period.

For example, using the previous example, if at the end of the reporting period the USD/MXN exchange rate changed to 1 USD = 18 MXN, the 100,000 MXN inventory would now translate to $5,555 USD (100,000 / 18). This difference of $555 is recognized as a foreign exchange gain.

Handling Exchange Rate Fluctuations

Foreign currency transactions can create exchange differences when exchange rates fluctuate over time. These exchange differences occur both on settlement of monetary items as well as at each financial reporting date for outstanding foreign currency monetary items.

For practical purposes, these gains and losses arising from foreign currency transactions are generally recognized as an expense item in profit or loss during the period of change. This helps account for the effect movements in exchange rates have on the financial reporting currency from period to period.

Translating Financial Statements into a Presentation Currency

If a company's presentation currency differs from its functional currency, additional translation is required using appropriate exchange rates in order to present uniform financial statements.

Presentation Currency Example: Assets and Liabilities

For financial reporting purposes, assets and liabilities are translated at the closing rate on the date of the financial statements between the functional and presentation currencies.

For example, if a company's functional currency is the Mexican Peso, but it presents financial statements in US Dollars, all assets and liabilities would be translated into US Dollars using the spot exchange rate on the last day of the reporting period. This allows assets and liabilities to be accurately stated in the presentation currency.

Income and Expense Translation Approach

Income and expenses should be translated using actual exchange rates at the dates of transactions, or an appropriate average rate over the reporting period.

Using the previous example, revenue and expenses originally denominated in Mexican Pesos would be translated into US Dollars by applying the exchange rates in effect on the date those transactions occurred. An average exchange rate for the period can also be used for simplification purposes. This method helps avoid distortion from exchange rate fluctuations.

Equity Items Translation Considerations

Components of equity are translated using the exchange rates at the date those components arose, rather than current closing rates at financial statement date.

For instance, common stock issued in Mexican Pesos would use the historical exchange rate at issuance date when translating the stock value into the US Dollar presentation currency. This prevents equity balances from showing artificial gains/losses due to exchange rate changes after stock issuance.

Impact of Functional vs Presentation Currency on Financial Analysis

Using appropriate functional and presentation currencies impacts key financial statement metrics and ratios used by analysts to assess performance.

Effects on Assets, Liabilities, and Equity

Line items reflecting economic events that occurred over past periods can be materially impacted when translated from functional to presentation currency. For example, if a company conducts most of its business in the Euro but reports in US dollars, fluctuations in the EUR/USD exchange rate can significantly impact the reported values of assets, liabilities, and equity over time.

This can distort period-over-period comparisons and trend analysis if the effects of foreign currency translation are not isolated. Analysts evaluating solvency measures like debt-to-equity ratios must understand how choice of presentation currency influences the values used in their models and ratios.

Trend Analysis and Exchange Rate Distortions

Fluctuations in exchange rates between functional and presentation currencies can distort trends in financial metrics over reporting periods. If revenues are earned in a foreign currency but converted to the presentation currency using current exchange rates each period, growth may appear volatile due purely to currency swings.

Similarly, margin analysis can be obscured when cost of goods sold is recorded in one currency but revenue converted at varying rates each period. Analysts must normalize data by using constant exchange rates before modeling trends.

Influence on Financial Ratios

Ratios involving margin analysis, solvency assessments and other metrics can vary significantly depending on currencies used. If a company conducts most business in its functional currency, converting financial statements to a different presentation currency using current exchange rates can introduce distortion.

For example, a company reporting improving profit margins year-over-year in its functional currency could show declining margins in the presentation currency due to exchange rate changes alone. Evaluating performance should focus on functional currency, with presentation conversion impacts isolated.

Conclusion and Key Takeaways

In summary, properly distinguishing between functional and presentation currencies is vital for accurate IFRS-compliant financial reporting and analysis.

Recap of Functional Currency vs Presentation Currency

The functional currency reflects the underlying economics of a company's operations, while the presentation currency allows for uniform financial statement presentation across a multinational company's subsidiaries. Key differences include:

- Functional currency is the currency of the primary economic environment in which an entity operates. It impacts how transactions are recorded and how assets and liabilities are translated.

- Presentation currency is the currency in which financial statements are presented. It allows standardized reporting across geographies.

Importance of Accurate Functional Currency Determination

Companies must carefully evaluate functional currency based on IFRS guidelines and key indicators such as cash flows, sales prices, financing, and expense settlement currencies. Inaccurate functional currency selection can lead to distorted financial reporting.

Implications for Financial Statement Analysis

Using appropriate functional and presentation currencies significantly impacts trends, ratios, and benchmarks used in financial statement analysis :

- Asset valuation - Translating asset costs into different currencies impacts valuations and depreciation.

- Equity - Foreign currency translation directly flows through to equity on the balance sheet.

- Revenue and margin trends - Top-line growth and profitability metrics are skewed by currency swings. Normalizing currency effects is critical for accurate analysis.

Proper determination and application of functional and presentation currencies as dictated by IFRS is vital for financial reporting quality and cross-border financial analysis.

Related posts

- Cash Flow Statement vs Funds Flow Statement

- Balance Sheet vs Income Statement

- Financial Statement Presentation: Structure and Requirements

Cash Flow Statement Direct Method vs Indirect Method

How to Manage Client Trust Accounts in Xero: Ensuring Compliance

Offshore Staffing in the Philippines: Why You Should Consider South America Instead

We've received your job requirements, and our team is working hard to find the perfect candidate for you. If you have more job openings available, feel free to submit another job description, and we'll be happy to assist you.

- Submit a New Job Description

Unlock the Talent Your Business Deserves

Hire Accounting and Finance Professionals from South America.

- Start Interviewing For Free

What’s a functional and presentation currency under IAS 21?

When preparing financial statement a company must determine its functional and presentation currencies.

The functional currency is the currency of the primary economic environment where the entity operates, in most cases this will be the local currency (e.g. Euro in Ireland, GBP in UK)

When determining the functional currency, an entity should consider the following factors:

Primary factors

- The currency than mainly influences sales prices for goods and services

- The currency of the country whose competitive forces and regulations mainly determine the sales price of goods and services

- The currency that mainly influences labour, material and other costs of providing goods and services.

Secondary factors

- The currency from which issuing debt and equity is generated

- The currency in which receipts from operating activities are usually retained

What’s a presentation currency?

The presentation currency is the currency in which the entity presents its financial statements and this may be different from the functional currency, (e.g. If the entity in question is a foreign owned subsidiary. It may have to present its financial statements in the currency of the parent company, even though that is different from their normal trading currency).

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- About policy and insights at ACCA

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

CPD technical article

01 March 2009

IAS 21 the effects of changes in foreign exchange rates

Multiple-choice questions

Graham Holt

Graham holt explains the importance of exchange rates when it comes to accounting for any transactions carried out in foreign currencies, this article was first published in the march 2009 edition of accounting and business magazine., studying this technical article and answering the related questions can count towards your verifiable cpd if you are following the unit route to cpd and the content is relevant to your learning and development needs. one hour of learning equates to one unit of cpd. we'd suggest that you use this as a guide when allocating yourself cpd units..

The purpose of IAS 21 is to set out how to account for transactions in foreign currencies and foreign operations.

The standard shows how to translate financial statements into a presentation currency, which is the currency in which the financial statements are presented. This contrasts with the functional currency, which is the currency of the primary economic environment in which the entity operates.

Key issues are the exchange rates, which should be used, and where the effects of changes in exchange rates are recorded in the financial statements.

Functional currency is a concept that was introduced into IAS 21, The Effects of Changes in Foreign Exchange Rates , when it was revised in 2003. The previous version of IAS 21 used a concept of reporting currency. In revising IAS 21 in 2004, the IASB’s main aim was to provide additional guidance on the translation method and determining the functional and presentation currencies.

The functional currency should be determined by looking at several factors. This currency should be the one in which the entity normally generates and spends cash, and that in which transactions are normally denominated. All transactions in currencies other than the functional currency are treated as transactions in foreign currencies.

The entity’s functional currency reflects the transactions, events and conditions under which the entity conducts its business. Once decided on, the functional currency does not change unless there is a change in the underlying nature of the transactions and relevant conditions and events. Foreign currency transactions should initially be recorded at the spot rate of exchange at the date of the transaction. An approximate rate can be used. Subsequently, at each balance sheet date, foreign currency monetary amounts should be reported using the closing rate. Non-monetary items measured at historical cost should be reported using the exchange rate at the date of the transaction. Non-monetary items carried at fair value, however, should be reported at the rate that existed when the fair values were determined.

Exchange differences arising on monetary items are reported in profit or loss in the period, with one exception. The exception is that exchange differences arising on monetary items that form part of the reporting entity’s net investment in a foreign operation are recognised in the group financial statements, within a separate component of equity. They are recognised in profit or loss on disposal of the net investment. If a gain or loss on a non-monetary item is recognised in equity (for example, property, plant and equipment revalued under IAS 16), any foreign exchange gain or loss element is also recognised in equity.

Presentation currency and functional currency

An entity can present its financial statements in any currency. If the presentation currency differs from the functional currency, the financial statements are retranslated into the presentation currency. If the financial statements of the entity are not in the functional currency of a hyperinflationary economy, then they are translated into the presentation currency as follows:

- Assets and liabilities (including any goodwill arising on the acquisition and any fair value adjustment) are translated at the closing spot rate at the date of that balance sheet

- Income statements are translated at the spot rate at the date of the transactions (average rates are allowed if there is no great fluctuation in the exchange rates)

- All exchange differences are recognised in a separate component of equity.

At the entity level, management should determine the functional currency of the entity based on the requirements of IAS 21.

An entity does not have a choice of functional currency. All currencies, other than the functional one, are treated as foreign currencies. An entity’s management may choose a different currency from its functional one – the presentation currency – in which to present financial statements.

At the group level, various entities within a multinational group will often have different functional currencies. The functional currency is identified at entity level for each group entity. Each group entity translates its results and financial position into the presentation currency of the reporting entity.

Normal consolidation procedures are followed for the preparation of the consolidated financial statements, once all the consolidated entities have prepared their financial information in the appropriate presentation currency.

Translation of a foreign operation

When preparing group accounts, the financial statements of a foreign subsidiary should be translated into the presentation currency as set out above. Any goodwill and fair value adjustments are treated as assets and liabilities of the foreign entity, and therefore retranslated at each balance sheet date at the closing spot rate.

Exchange differences on intra-group items are recognised in profit or loss, unless they are a result of the retranslation of an entity’s net investment in a foreign operation when it is classified as equity.

Dividends paid in a foreign currency by a subsidiary to its parent firm may lead to exchange differences in the parent’s financial statements. They will not be eliminated on consolidation, but recognised in profit or loss. When a foreign operation is disposed of, the cumulative amount of the exchange differences in equity relating to that foreign operation is recognised in profit or loss when the gain or loss on disposal is recognised.

The notion of a group functional currency does not exist under IFRS; functional currency is purely an individual entity or business operation-based concept. This has resulted in IAS 21 becoming one of the more complex standards for firms converting to IFRS.

In addition, many multinational groups have found the process time-consuming and challenging, particularly when considering non-trading group entities where the standard’s emphasis on external factors suggests that the functional currency of corporate subsidiaries might well be that of the parent, regardless of their country of incorporation or the currency in which their transactions are denominated.

Entities applying IFRS need to remember that the assessment of functional currency is a key step when considering any change in the group structure or when implementing any new hedging or tax strategies. Furthermore, should the activities of the entity within the group change for any reason, the determination of the functional currency of that entity should be reconsidered to identify the changes required. Management must take care to document the approach followed in the determination of functional currency for each entity within the group, using a consistent methodology across all cases, particularly when an exercise of judgment is required.

Case study 1

An entity, with the dollar as its functional currency, purchases plant from a foreign entity for €18m on 31 May 2008 when the exchange rate was €2 to $1. The entity also sells goods to a foreign customer for €10.5m on 30 September 2008, when the exchange rate was €1.75 to $1. At the entity’s year end of 31 December 2008, both amounts are still outstanding and have not been paid. The closing exchange rate was €1.5 to $1. The accounting for the items for the period ending 31 December 2008 would be as follows:

The entity records the plant and liability at $9m at 31 May 2008. At the year-end, the amount has not been paid. Thus using the closing rate of exchange, the amount payable would be retranslated at $12m, which would give an exchange loss of $3m in profit or loss. The asset remains at $9m before depreciation.

The entity will record a sale and trade receivable of $6m. At the year-end, the trade receivable would be stated at $7m, which would give an exchange gain of $1m that would be reported in profit or loss. IAS 21 does not specify where exchange gains and losses should be shown in the statement of comprehensive income.

Case study 2

An entity has a 100%-owned foreign subsidiary, which has a carrying value at a cost of $25m. It sells the subsidiary on 31 December 2008 for €45m. As at 31 December 2008, the credit balance on the exchange reserve, which relates to this subsidiary, was $6m. The functional currency of the entity is the dollar and the exchange rate on 31 December 2008 is $1 to €1.5. The net asset value of the subsidiary at the date of disposal was $28m.

The subsidiary is sold for $45m divided by 1.5 million, therefore $30m. In the parent entity’s accounts a gain of $5m will be shown. In the group financial statements, the cumulative exchange gain in reserves will be transferred to profit or loss, together with the gain on disposal. The gain on disposal is $30m minus $28m, therefore $2m, which is the difference between the sale proceeds and the net asset value of the subsidiary. To this is added the exchange reserve balance of $6m to give a total gain of $8m, which will be included in the group statement of comprehensive income.

Graham Holt is an ACCA examiner and principal lecturer in accounting and finance at Manchester Metropolitan University Business School

Related topics.

- Corporate reporting

- ACCA Careers

- ACCA Career Navigator

- ACCA-X online courses

Useful links

- Make a payment

- ACCA Rulebook

- Work for us

- Supporting Ukraine

Using this site

- Accessibility

- Legal & copyright

- Advertising

Send us a message

Planned system updates

View our maintenance windows

Annual Reporting

Knowledge base for IFRS Reporting

IAS 21 Presentation currency

Ias 21 the effects of changes in foreign exchange rates, use of a presentation currency other than the functional currency, translation to the presentation currency.

38 An entity may present its financial statements in any currency (or currencies). If the presentation currency differs from the entity’s functional currency , it translates its results and financial position into the presentation currency . For example, when a group contains individual entities with different functional currencies, the results and financial position of each entity are expressed in a common currency so that consolidated financial statements may be presented.

39 The results and financial position of an entity whose functional currency is not the currency of a hyperinflationary economy shall be translated into a different presentation currency using the following procedures:

- assets and liabilities for each statement of financial position presented (ie including comparatives) shall be translated at the closing rate at the date of that statement of financial position;

- income and expenses for each statement presenting profit or loss and other comprehensive income (ie including comparatives) shall be translated at exchange rates at the dates of the transactions; and

- all resulting exchange differences shall be recognised in other comprehensive income .

40 For practical reasons, a rate that approximates the exchange rates at the dates of the transactions, for example an average rate for the period, is often used to translate income and expense items. However, if exchange rates fluctuate significantly, the use of the average rate for a period is inappropriate.

41 The exchange differences referred to in paragraph 39(c) result from:

- translating income and expenses at the exchange rates at the dates of the transactions and assets and liabilities at the closing rate .

- translating the opening net assets at a closing rate that differs from the previous closing rate .

These exchange differences are not recognised in profit or loss because the changes in exchange rates have little or no direct effect on the present and future cash flows from operations. The cumulative amount of the exchange differences is presented in a separate component of equity until disposal of the foreign operation .

When the exchange differences relate to a foreign operation that is consolidated but not wholly-owned, accumulated exchange differences arising from translation and attributable to non-controlling interests are allocated to, and recognised as part of, non-controlling interests in the consolidated statement of financial position.

42 The results and financial position of an entity whose functional currency is the currency of a hyperinflationary economy shall be translated into a different presentation currency using the following procedures:

- all amounts (ie assets, liabilities, equity items, income and expenses , including comparatives) shall be translated at the closing rate at the date of the most recent statement of financial position, except that

- when amounts are translated into the currency of a non-hyperinflationary economy, comparative amounts shall be those that were presented as current year amounts in the relevant prior year financial statements (ie not adjusted for subsequent changes in the price level or subsequent changes in exchange rates).

43 When an entity’s functional currency is the currency of a hyperinflationary economy, the entity shall restate its financial statements in accordance with IAS 29 before applying the translation method set out in paragraph 42, except for comparative amounts that are translated into a currency of a non-hyperinflationary economy (see paragraph 42(b)).

When the economy ceases to be hyperinflationary and the entity no longer restates its financial statements in accordance with IAS 29, it shall use as the historical costs for translation into the presentation currency the amounts restated to the price level at the date the entity ceased restating its financial statements.

Translation of a foreign operation

44 Paragraphs 45–47, in addition to paragraphs 38–43, apply when the results and financial position of a foreign operation are translated into a presentation currency so that the foreign operation can be included in the financial statements of the reporting entity by consolidation or the equity method .

45 The incorporation of the results and financial position of a foreign operation with those of the reporting entity follows normal consolidation procedures, such as the elimination of intragroup balances and intragroup transactions of a subsidiary (see IFRS 10 Consolidated Financial Statements ).

However, an intragroup monetary asset (or liability ), whether short-term or long-term, cannot be eliminated against the corresponding intragroup liability (or asset) without showing the results of currency fluctuations in the consolidated financial statements . This is because the monetary item represents a commitment to convert one currency into another and exposes the reporting entity to a gain or loss through currency fluctuations.

Accordingly, in the consolidated financial statements of the reporting entity , such an exchange difference is recognised in profit or loss or, if it arises from the circumstances described in paragraph 32, it is recognised in other comprehensive income and accumulated in a separate component of equity until the disposal of the foreign operation .

46 When the financial statements of a foreign operation are as of a date different from that of the reporting entity , the foreign operation often prepares additional statements as of the same date as the reporting entity ’s financial statements.

When this is not done, IFRS 10 allows the use of a different date provided that the difference is no greater than three months and adjustments are made for the effects of any significant transactions or other events that occur between the different dates.

In such a case, the assets and liabilities of the foreign operation are translated at the exchange rate at the end of the reporting period of the foreign operation .

Adjustments are made for significant changes in exchange rates up to the end of the reporting period of the reporting entity in accordance with IFRS 10. The same approach is used in applying the equity method to associates and joint ventures in accordance with IAS 28 (as amended in 2011).

47 Any goodwill arising on the acquisition of a foreign operation and any fair value adjustments to the carrying amounts of assets and liabilities arising on the acquisition of that foreign operation shall be treated as assets and liabilities of the foreign operation . Thus they shall be expressed in the functional currency of the foreign operation and shall be translated at the closing rate in accordance with paragraphs 39 and 42.

Disposal or partial disposal of a foreign operation

48 On the disposal of a foreign operation , the cumulative amount of the exchange differences relating to that foreign operation , recognised in other comprehensive income and accumulated in the separate component of equity , shall be reclassified from equity to profit or loss (as a reclassification adjustment) when the gain or loss on disposal is recognised (see IAS 1 Presentation of Financial Statements (as revised in 2007)).

48A In addition to the disposal of an entity’s entire interest in a foreign operation , the following partial disposals are accounted for as disposals:

- when the partial disposal involves the loss of control of a subsidiary that includes a foreign operation , regardless of whether the entity retains a non-controlling interest in its former subsidiary after the partial disposal; and

- when the retained interest after the partial disposal of an interest in a joint arrangement or a partial disposal of an interest in an associate that includes a foreign operation is a financial asset that includes a foreign operation .

48B On disposal of a subsidiary that includes a foreign operation , the cumulative amount of the exchange differences relating to that foreign operation that have been attributed to the non-controlling interests shall be derecognised, but shall not be reclassified to profit or loss .

48C On the partial disposal of a subsidiary that includes a foreign operation , the entity shall re- attribute the proportionate share of the cumulative amount of the exchange differences recognised in other comprehensive income to the non-controlling interests in that foreign operation .

In any other partial disposal of a foreign operation the entity shall reclassify to profit or loss only the proportionate share of the cumulative amount of the exchange differences recognised in other comprehensive income .

48D A partial disposal of an entity’s interest in a foreign operation is any reduction in an entity’s ownership interest in a foreign operation , except those reductions in paragraph 48A that are accounted for as disposals.

49 An entity may dispose or partially dispose of its interest in a foreign operation through sale, liquidation, repayment of share capital or abandonment of all, or part of, that entity. A write-down of the carrying amount of a foreign operation , either because of its own losses or because of an impairment recognised by the investor, does not constitute a partial disposal. Accordingly, no part of the foreign exchange gain or loss recognised in other comprehensive income is reclassified to profit or loss at the time of a write-down.

Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). Individual jurisdictions around the world may require or permit the use of (locally authorised and/or amended) IFRS Standards for all or some publicly listed companies. The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. The specific status of IFRS Standards should be checked in each individual jurisdiction . Use at your own risk. Annualreporting is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org or the local representative in your jurisdiction .

IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency IAS 21 Presentation currency

Automated page speed optimizations for fast site performance

Discover the latest MyICAEW app for ACA students and members, available to download now. Find out more

- Benefits of membership

Gain access to world-leading information resources, guidance and local networks.

- Visit Benefits of membership

Becoming a member

98% of the best global brands rely on ICAEW Chartered Accountants.

- Visit Becoming a member

- Pay fees and subscriptions

Your membership subscription enables ICAEW to provide support to members.

Fees and subscriptions

Member rewards.

Take advantage of the range of value added or discounted member benefits.

- Member rewards – More from your membership

- Technical and ethics support

- Support throughout your career

Information and resources for every stage of your career.

Member Insights Survey

Let us know about the issues affecting you, your business and your clients.

- Complete the survey

From software start-ups to high-flying airlines and high street banks, 98% of the best global brands rely on ICAEW Chartered Accountants. A career as an ICAEW Chartered Accountant means the opportunity to work in any organisation, in any sector, whatever your ambitions.

Everything you need to know about ICAEW annual membership fees, community and faculty subscriptions, eligibility for reduced rates and details of how you can pay.

Membership administration

Welcome to the ICAEW members area: your portal to members'-only content, offers, discounts, regulations and membership information.

- Membership regulations

Members are required to supply certain information to the members’ registrar and to pay annual fees and subscriptions. These matters are governed by regulations.

- Continuing Professional Development (CPD)

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant.

The ICAEW Chartered Accountant qualification, the ACA, is one of the most advanced learning and professional development programmes available. It is valued around the world in business, practice and the public sector.

ACA for employers

Train the next generation of chartered accountants in your business or organisation. Discover how your organisation can attract, train and retain the best accountancy talent, how to become authorised to offer ACA training and the support and guidance on offer if you are already providing training.

Digital learning materials via BibliU

All ACA, ICAEW CFAB and Level 4 apprenticeship learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf using the BibliU app or through your browser.

- Find out more

Take a look at ICAEW training films

Focusing on professional scepticism, ethics and everyday business challenges, our training films are used by firms and companies around the world to support their in-house training and business development teams.

Attract and retain the next generation of accounting and finance professionals with our world-leading accountancy qualifications. Become authorised to offer ACA training and help your business stay ahead.

CPD guidance and help

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant. Find support on ICAEW's CPD requirements and access resources to help your professional development.

ICAEW flagship events

ICAEW boasts an extensive portfolio of industry-leading conferences. These flagship events offer the opportunity to hear from and interact with all the key players in the industry. Find out what's coming up.

Leadership Development Programmes

ICAEW Academy’s in-depth leadership development programmes take a holistic approach to combine insightful mentoring or coaching, to exclusive events, peer learning groups and workshops. Catering for those significant transitions in your career, these leadership development programmes are instrumental to achieving your ambitions or fulfilling your succession planning goals.

Specialist Finance Qualifications & Programmes

Whatever future path you choose, ICAEW will support the development and acceleration of your career at each stage to enhance your career.

Why a career in chartered accountancy?

If you think chartered accountants spend their lives confined to their desks, then think again. They are sitting on the boards of multinational companies, testifying in court and advising governments, as well as supporting charities and businesses from every industry all over the world.

- Why chartered accountancy?

Search for qualified ACA jobs

Matching highly skilled ICAEW members with attractive organisations seeking talented accountancy and finance professionals.

Volunteering roles

Helping skilled and in-demand chartered accountants give back and strengthen not-for-profit sector with currently over 2,300 organisations posting a variety of volunteering roles with ICAEW.

- Search for volunteer roles

- Get ahead by volunteering

Advertise with ICAEW

From as little as £495, access to a pool of highly qualified and ambitious ACA qualified members with searchable CVs.

Early careers and training

Start your ACA training with ICAEW. Find out why a career in chartered accountancy could be for you and how to become a chartered accountant.

Qualified ACA careers

Find Accountancy and Finance Jobs

Voluntary roles

Find Voluntary roles

While you pursue the most interesting and rewarding opportunities at every stage of your career, we’re here to offer you support whatever stage you are or wherever you are in the world and in whichever sector you have chosen to work.

ACA students

"how to guides" for aca students.

- ACA student guide

- How to book an exam

- How to apply for credit for prior learning (CPL)

Exam resources

Here are some resources you will find useful while you study for the ACA qualification.

- Certificate Level

- Professional Level

- Advanced Level

Digital learning materials

All ACA learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf via the BibliU app, or through your browser.

- Read the guide

My online training file

Once you are registered as an ACA student, you'll be able to access your training file to log your progress throughout ACA training.

- Access your training file

- Student Insights

Fresh insights, innovative ideas and an inside look at the lives and careers of our ICAEW students and members.

- Read the latest articles

System status checks

Getting started.

Welcome to ICAEW! We have pulled together a selection of resources to help you get started with your ACA training, including our popular 'How To' series, which offers step-by-step guidance on everything from registering as an ACA student and applying for CPL, to using your online training file.

Credit for prior learning (CPL)

Credit for prior learning or CPL is our term for exemptions. High quality learning and assessment in other relevant qualifications is appropriately recognised by the award of CPL.

Apply for exams

What you need to know in order to apply for the ACA exams.

The ACA qualification has 15 modules over three levels. They are designed to complement the practical experience you will be gaining in the workplace. They will also enable you to gain in-depth knowledge across a broad range of topics in accountancy, finance and business. Here are some useful resources while you study.

- Exam results

You will receive your results for all Certificate Level exams, the day after you take the exam and usually five weeks after a Professional and Advanced Level exam session has taken place. Access your latest and archived exam results here.

Training agreement

Putting your theory work into practice is essential to complete your ACA training.

Student support and benefits

We are here to support you throughout your ACA journey. We have a range of resources and services on offer for you to unwrap, from exam resources, to student events and discount cards. Make sure you take advantage of the wealth of exclusive benefits available to you, all year round.

- Applying for membership

The ACA will open doors to limitless opportunities in all areas of accountancy, business and finance anywhere in the world. ICAEW Chartered Accountants work at the highest levels as finance directors, CEOs and partners of some of the world’s largest organisations.

ACA training FAQs

Do you have a question about the ACA training? Then look no further. Here, you can find answers to frequently asked questions relating to the ACA qualification and training. Find out more about each of the integrated components of the ACA, as well as more information on the syllabus, your training agreement, ICAEW’s rules and regulations and much more.

- Anti-money laundering

Guidance and resources to help members comply with their legal and professional responsibilities around AML.

Technical releases

ICAEW Technical Releases are a source of good practice guidance on technical and practice issues relevant to ICAEW Chartered Accountants and other finance professionals.

- ICAEW Technical Releases

- Thought leadership

ICAEW's Thought Leadership reports provide clarity and insight on the current and future challenges to the accountancy profession. Our charitable trusts also provide funding for academic research into accountancy.

- Academic research funding

Technical Advisory Services helpsheets

Practical, technical and ethical guidance highlighting the most important issues for members, whether in practice or in business.

- ICAEW Technical Advisory Services helpsheets

Bloomsbury – free for eligible firms

In partnership with Bloomsbury Professional, ICAEW have provided eligible firms with free access to Bloomsbury’s comprehensive online library of around 80 titles from leading tax and accounting subject matter experts.

- Bloomsbury Accounting and Tax Service

Country resources

Our resources by country provide access to intelligence on over 170 countries and territories including economic forecasts, guides to doing business and information on the tax climate in each jurisdiction.

Industries and sectors

Thought leadership, technical resources and professional guidance to support the professional development of members working in specific industries and sectors.

Audit and Assurance

The audit, assurance and internal audit area has information and guidance on technical and practical matters in relation to these three areas of practice. There are links to events, publications, technical help and audit representations.

The most up-to-date thought leadership, insights, technical resources and professional guidance to support ICAEW members working in and with industry with their professional development.

- Corporate Finance

Companies, advisers and investors making decisions about creating, developing and acquiring businesses – and the wide range of advisory careers that require this specialist professional expertise.

- Corporate governance

Corporate governance is the system by which companies are directed and controlled. Find out more about corporate governance principles, codes and reports, Board subcommittees, roles and responsibilities and shareholder relations. Corporate governance involves balancing the interests of a company’s many stakeholders, such as shareholders, employees, management, customers, suppliers, financiers and the community. Getting governance right is essential to build public trust in companies.

- Corporate reporting

View a range of practical resources on UK GAAP, IFRS, UK regulation for company accounts and non-financial reporting. Plus find out more about the ICAEW Corporate Reporting Faculty.

Expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry, alongside data on the state of the economy.

- Financial Services

View articles and resources on the financial services sector.

- Practice resources

For ICAEW's members in practice, this area brings together the most up-to-date thought leadership, technical resources and professional guidance to help you in your professional life.

Public Sector

Many ICAEW members work in or with the public sector to deliver public priorities and strong public finances. ICAEW acts in the public interest to support strong financial leadership and better financial management across the public sector – featuring transparency, accountability, governance and ethics – to ensure that public money is spent wisely and that public finances are sustainable.

Sustainability and climate change

Sustainability describes a world that does not live by eating into its capital, whether natural, economic or social. Members in practice, in business and private individuals all have a role to play if sustainability goals are to be met. The work being undertaken by ICAEW in this area is to change behaviour to drive sustainable outcomes.

The Tax area has information and guidance on technical and practical tax matters. There are links to events, the latest tax news and the Tax Faculty’s publications, including helpsheets, webinars and Tax representations.

Keep up-to-date with tech issues and developments, including artificial intelligence (AI), blockchain, big data, and cyber security.

Trust & Ethics

Guidance and resources on key issues, including economic crime, business law, better regulation and ethics. Read through ICAEW’s Code of Ethics and supporting information.

Communities

ICAEW Communities

Information, guidance and networking opportunities on industry sectors, professional specialisms and at various stages throughout your career. Free for ICAEW members and students.

- Discover a new community

ICAEW Faculties

The accountancy profession is facing change and uncertainty. The ICAEW Faculties can help by providing you with timely and relevant support.

- Choose to join any of the faculties

UK groups and societies

We have teams on the ground in: East of England, the Midlands, London and South East, Northern, South West, Yorkshire and Humberside, Wales and Scotland.

- Access your UK region

- Worldwide support and services

Support and services we offer our members in Africa, America, Canada, the Caribbean, Europe, Greater China, the Middle East, Oceania and South East Asia.

- Discover our services

ICAEW Faculties are 'centres of technical excellence', strongly committed to enhancing your professional development and helping you to meet your CPD requirements every year. They offer exclusive content, events and webinars, customised for your sector - which you should be able to easily record, when the time comes for the completion of your CPD declaration. Our offering isn't exclusive to Institute members. As a faculty member, the same resources are available to you to ensure you stay ahead of the competition.

Communities by industry / sector

Communities by life stage and workplace, communities by professional specialism, local groups and societies.

We aim to support you wherever in the world you work. Our regional offices and network of volunteers run events and provide access to local accounting updates in major finance centres around the globe.

- Ukraine crisis: central resource hub

Learn about the actions that ICAEW members are taking to ensure that their clients comply with sanctions imposed by different countries and jurisdictions, and read about the support available from ICAEW.

Insights pulls together the best opinion, analysis, interviews, videos and podcasts on the key issues affecting accountancy and business.

- See the latest insights

- Making COP count

This series looks at the role the accountancy profession can play in addressing the climate crisis and building a sustainable economy.

- Read more on COP28

Professional development and skills

With new requirements on ICAEW members for continuing professional development, we bring together resources to support you through the changes and look at the skills accountants need for the future.

- Visit the hub

When Chartered Accountants Save The World

Find out how chartered accountants are helping to tackle some of the most urgent social challenges within the UN Sustainable Development Goals, and explore how the profession could do even more.

- Read our major series

Insights specials

A listing of one-off Insights specials that focus on a particular subject, interviewing the key people, identifying developing trends and examining the underlying issues.

Top podcasts

Insights by topic.

ICAEW Regulation

- Regulatory News

View the latest regulatory updates and guidance and subscribe to our monthly newsletter, Regulatory & Conduct News.

- Regulatory Consultations

Strengthening trust in the profession

Our role as a world-leading improvement regulator is to strengthen trust and protect the public. We do this by enabling, evaluating and enforcing the highest standards in the profession.

Regulatory applications

Find out how you can become authorised by ICAEW as a regulated firm.

ICAEW codes and regulations

Professional conduct and complaints, statutory regulated services overseen by icaew, regulations for icaew practice members and firms, additional guidance and support, popular search results.

- Training File

- Practice Exam Software

- Ethics Cpd Course

- Routes to the ACA

- ACA students membership application

- Join as a member of another body

- How much are membership fees?

- How to pay your fees

- Receipts and invoices

- What if my circumstances have changed?

- Difficulties in making changes to your membership

- Faculty and community subscription fees

- Updating your details

- Complete annual return

- Promoting myself as an ICAEW member

- Verification of ICAEW membership

- Become a life member

- Become a fellow

- Request a new certificate

- Report the death of a member

- Practising certificates

- Advancement to fellowship regulations

- Regulations relating to membership cessation, readmission and resignation

- ICAEW's guide to directors' duties and responsibilities

- Information to be supplied by members

- Payment of annual subscription

- Power to change subscription fees

- New members

- Career progression

- Career Breakers

- Volunteering at schools and universities

- ICAEW Member App

- Working internationally

- Self employment

- Support Members Scheme

- CPD is changing

- CPD learning resources

- Your guide to CPD

- Online CPD record

- How to become a chartered accountant

- Register as a student

- Train as a member of another body

- More about the ACA and chartered accountancy

- How ACA training works

- Become a training employer

- Access the training file

- Why choose the ACA

- Training routes

- Employer support hub

- Get in touch

- Apprenticeships with ICAEW

- A-Z of CPD courses by topic

- ICAEW Business and Finance Professional (BFP)

- ICAEW Annual Conference 2024

- Audit & Assurance Conference 2024

- Restructuring & Insolvency Conference

- Virtual CPD Conference

- Virtual Healthcare Conference 2024

- All our flagship events

- Financial Talent Executive Network (F-TEN®)

- Developing Leadership in Practice (DLiP™)

- Network of Finance Leaders (NFL)

- Women in Leadership (WiL)

- Mentoring and coaching

- Partners in Learning

- Board Director's Programme e-learning

- Corporate Finance Qualification

- Diploma in Charity Accounting

- ICAEW Certificate in Insolvency

- ICAEW Data Analytics Certificate

- Financial Modeling Institute’s Advanced Financial Modeler Accreditation

- ICAEW Sustainability Certificate for Finance Professionals

- ICAEW Finance in a Digital World Programme

- All specialist qualifications

- Team training

- Start your training

- Improve your employability

- Search employers

- Find a role

- Role alerts

- Organisations

- Practice support – 11 ways ICAEW and CABA can help you

- News and advice

- ICAEW Volunteering Hub

- Support in becoming a chartered accountant

- Vacancies at ICAEW

- ICAEW boards and committees

- Exam system status

- ICAEW systems: status update

- Changes to our qualifications

- How-to guides for ACA students

- Apply for credits - Academic qualification

- Apply for credits - Professional qualification

- Credit for prior learning (CPL)/exemptions FAQs

- Applications for Professional and Advanced Level exams

- Applications for Certificate Level exams

- Tuition providers

- Latest exam results

- Archived exam results

- Getting your results

- Marks feedback service

- Exam admin check

- Training agreement: overview

- Professional development

- Ethics and professional scepticism

- Practical work experience

- Access your online training file

- How training works in your country

- Student rewards

- TOTUM PRO Card

- Student events and volunteering

- Xero cloud accounting certifications

- Student support

- Join a community

- Wellbeing support from caba

- Student mentoring programme

- Student conduct and behaviour

- Code of ethics

- Fit and proper

- Level 4 Accounting Technician Apprenticeship

- Level 7 Accountancy Professional Apprenticeship

- AAT-ACA Fast Track FAQs

- ACA rules and regulations FAQs

- ACA syllabus FAQs

- ACA training agreement FAQs

- Audit experience and the Audit Qualification FAQs

- Independent student FAQs

- Practical work experience FAQs

- Professional development FAQs

- Six-monthly reviews FAQs

- Ethics and professional scepticism FAQs

- Greater China

- Latin America

- Middle East

- North America

- Australasia

- Russia and Eurasia

- South East Asia

- Charity Community

- Construction & Real Estate

- Energy & Natural Resources Community

- Farming & Rural Business Community

- Forensic & Expert Witness

- Global Trade Community

- Healthcare Community

- Internal Audit Community

- Manufacturing Community

- Media & Leisure

- Portfolio Careers Community

- Small and Micro Business Community

- Small Practitioners Community

- Travel, Tourism & Hospitality Community

- Valuation Community

- Audit and corporate governance reform

- Audit & Assurance Faculty

- Professional judgement

- Regulation and working in audit

- Internal audit resource centre

- ICAEW acting on audit quality

- Everything business

- Latest Business news from Insights

- Strategy, risk and innovation

- Business performance management

- Financial management

- Finance transformation

- Economy and business environment

- Leadership, personal development and HR

- Webinars and publications

- Business restructuring

- The Business Finance Guide

- Capital markets and investment

- Corporate finance careers

- Corporate Finance Faculty

- Debt advisory and growth finance

- Mergers and acquisitions

- Private equity

- Start-ups, scale-ups and venture capital

- Transaction services

- Board committees and board effectiveness

- Corporate governance codes and reports

- Corporate Governance Community

- Principles of corporate governance

- Roles, duties and responsibilities of Board members

- Stewardship and stakeholder relations

- Corporate Governance thought leadership

Corporate reporting resources

- Small and micro entity reporting

- UK Regulation for Company Accounts

- Non-financial reporting

- Improving Corporate Reporting

- Economy home

- ICAEW Business Confidence Monitor

- ICAEW Manifesto 2024

- Election explainers

- Spring Budget 2024

- Energy crisis

- Levelling up: rebalancing the UK’s economy

- Resilience and Renewal: Building an economy fit for the future

- Social mobility and inclusion

- Investment management

- Inspiring confidence

- Setting up in practice

- Running your practice

- Supporting your clients

- Practice technology

- TAS helpsheets

- Support for business advisers

- Join ICAEW BAS

- Public Sector hub

- Public Sector Audit and Assurance

- Public Sector Finances

- Public Sector Financial Management

- Public Sector Financial Reporting

- Public Sector Learning & Development

- Public Sector Community

- Latest public sector articles from Insights

- Climate hub

- Sustainable Development Goals

- Accountability

- Modern slavery

- Resources collection

- Sustainability Committee

- Sustainability & Climate Change community

- Sustainability and climate change home

- Tax Faculty

- Budgets and legislation

- Business tax

- Devolved taxes

- Employment taxes

- International taxes

- Making Tax Digital

- Personal tax

- Property tax

- Stamp duty land tax

- Tax administration

- Tax compliance and investigation

- UK tax rates, allowances and reliefs

- Artificial intelligence

- Blockchain and cryptoassets

- Cyber security

- Data Analytics Community

- Digital skills

- Excel community

- Finance in a Digital World

- IT management

- Technology and the profession

- Trust & Ethics home

- Better regulation

- Business Law

- UK company law

- Data protection and privacy

- Economic crime

- Help with ethical problems

- ICAEW Code of Ethics

- ICAEW Trust and Ethics team.....

- Solicitors Community

- Forensic & Expert Witness Community

- Latest articles on business law, trust and ethics

- Audit and Assurance Faculty

- Corporate Reporting Faculty

- Financial Services Faculty

- Academia & Education Community

- Construction & Real Estate Community

- Entertainment, Sport & Media Community

- Retail Community

- Career Breakers Community

- Black Members Community

- Diversity & Inclusion Community

- Women in Finance Community

- Personal Financial Planning Community

- Restructuring & Insolvency Community

- Sustainability and Climate Change Community

- London and East

- South Wales

- Yorkshire and Humberside

- European public policy activities

- ICAEW Middle East

- Latest news

- The World’s Fastest Accountant

- Access to finance special

- Attractiveness of the profession

- Audit and Fraud

- Audit and technology

- Adopting non-financial reporting standards

- Cost of doing business

- Mental health and wellbeing

- Pensions and Personal Finance

- More specials ...

- The economics of biodiversity

- How chartered accountants can help to safeguard trust in society

- Video: The financial controller who stole £20,000 from her company

- It’s time for chartered accountants to save the world

- Video: The CFO who tried to trick the market

- Video: Could invoice fraud affect your business?

- Corporate reporting update and VAT on private hire vehicles

- AI in audit: the good, the bad and the ugly

- Company size thresholds and CGT on residences

- Lessons in leadership from ICAEW's CEO

- So you want to be a leader?

- A busy new tax year, plus progress on the Economic Crime Act

- Does Britain have a farming problem?

- Budget 2024: does it change anything?

- Will accountants save the world? With ICAEW CEO Michael Izza

- Crunch time: VAT (or not) on poppadoms

- Where next for audit and governance reform?

- More podcasts...

- Top charts of the week

- EU and international trade

- CEO and President's insights

- Diversity and Inclusion

- Sponsored content

- Insights index

- Charter and Bye-laws

- Archive of complaints, disciplinary and fitness processes, statutory regulations and ICAEW regulations

- Qualifications regulations

- Training and education regulations

- How to make a complaint