Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

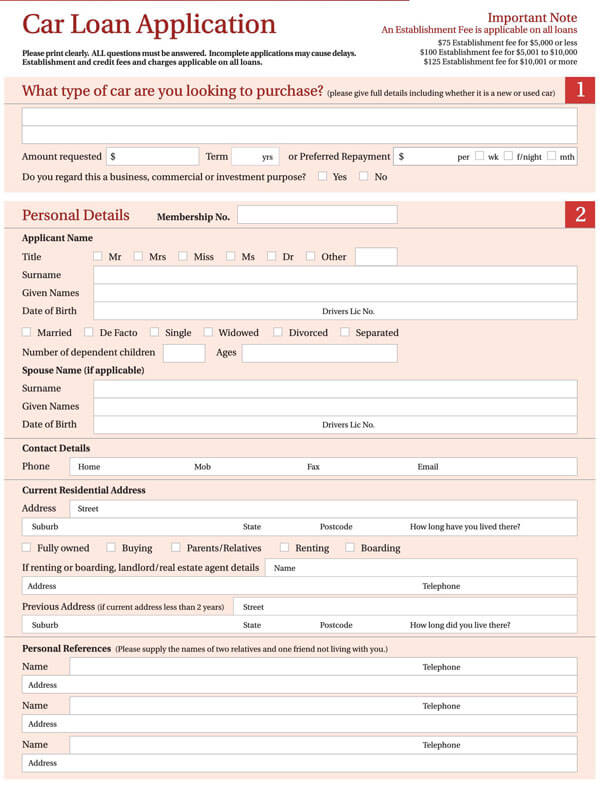

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

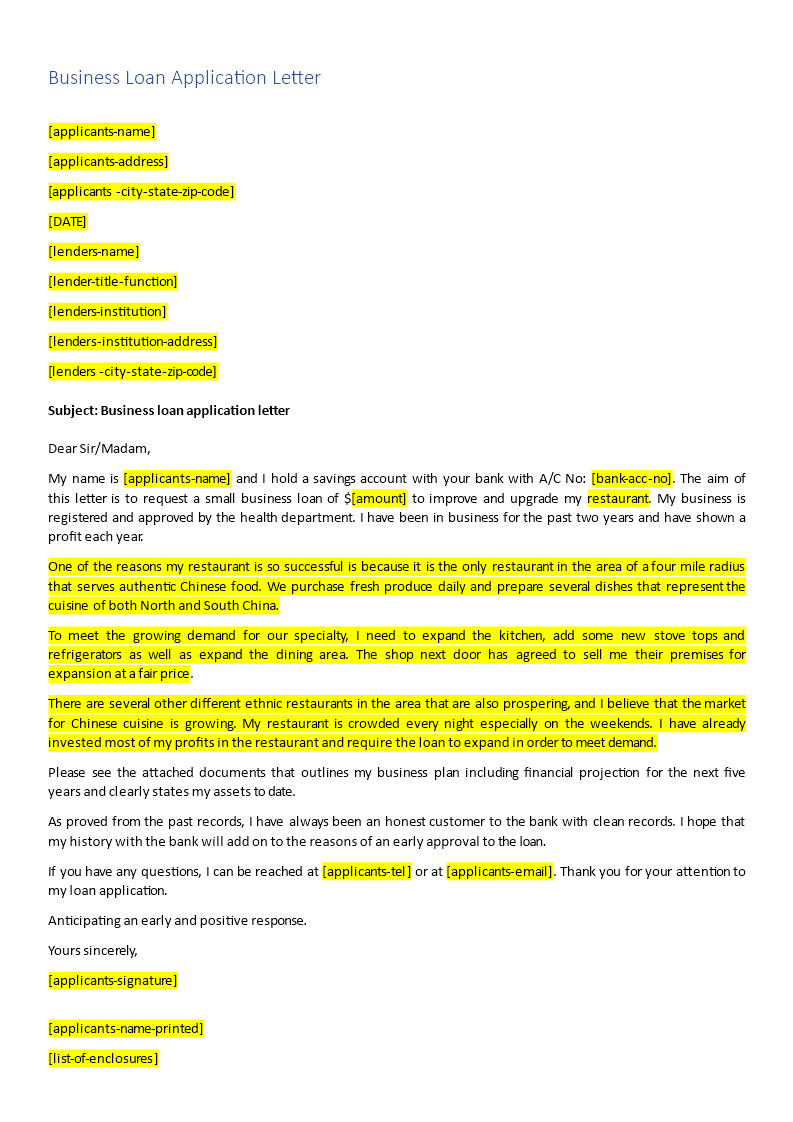

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Home » Letters » Bank Letters » Loan Application Letter | Sample Application Letter to Bank Manager for Loan

Loan Application Letter | Sample Application Letter to Bank Manager for Loan

To, The Loan Officer, __________ (Bank Name), __________ (Branch Address)

Date: __________ (Date)

Subject: Loan Application

Dear Sir/Madam,

I am writing to apply for a loan from __________ (Bank Name) to __________ (state the purpose of the loan, e.g., purchase a home, start a business, etc.).

I am __________ (Your Name), and I have been a loyal customer of __________ (Bank Name) for __________ (mention duration, if applicable). I believe that with your financial assistance, I will be able to achieve my goals and fulfill my financial obligations.

I am requesting a loan amount of __________ (mention loan amount) with a repayment period of __________ (mention repayment period). I have attached all the necessary documents, including proof of income, identification, and any other relevant documents required for the loan application process.

I assure you that I am capable of repaying the loan amount in a timely manner, as per the agreed terms and conditions. I am open to discussing the details of the loan application and providing any additional information if required.

Thank you for considering my loan application. I look forward to a favorable response from your end.

Yours sincerely,

__________ (Your Name) __________ (Your Contact Information)

By lettersdadmin

Related post, complaint letter to bank for amount deduction as processing charge – sample complaint letter regarding unexplained deduction from bank account, letter to bank for non-payment of loan – sample explanation letter for delay in loan payment, kyc confirmation letter – sample request for processing submitted kyc confirmation, sample job joining application for house job – house job joining application sample, complaint letter to employer about discrimination – complaint letter about discrimination at work, letter to editor complaining about loudspeaker nuisance – write a letter to the editor complaining about loudspeaker nuisance, write a letter to the editor about the noise pollution during the festival, privacy overview.

How to Write a Loan Application Letter

Table of Contents

Sometimes, taking out a loan can become inevitable. Whether dealing with piled-up medical bills or a financial emergency, it’s common to turn to fast and convenient borrowing options. According to statistics, advances and loans accounted for more than 60% of bank assets in the European Union in 2021.

If you wish to take out a loan, you’ll have to fill out a loan application or request letter that details what you need the money for and how you’ll use it. The best way to appeal to a lender is by using a convincing tone and showcasing a clear plan for the money. Keep reading as we look at ways you can achieve this and ensure that your loan is granted successfully.

What is a Loan Application Letter?

A loan application letter is a typed or handwritten letter provided to your lender, helping them decide whether to approve your loan request. This letter is written when the borrower is seeking financial assistance from a lender to pay off some bills or other expenses.

When Do You Need One?

You might require a loan application letter in the following financing situations:

- When you wish to borrow money from the SBA (Small Business Administration) since it recommends and encourages applicants to start their loan proposals with an executive summary or a loan application letter

- When a borrower opts for a loan from a conventional bank lender and has to demonstrate that their business is financially viable and experiencing growth

In some situations, you aren’t required to write a loan application letter. These include scenarios like when a borrower is seeking equipment financing and said equipment serves as collateral, when someone requests a business line of credit with business bank statements or financial statements, and when a borrower seeks a term loan online using alternative lenders who want to go over your recent bank statements.

Essential Loan Application Elements

There are specific guidelines you need to follow when writing a loan application:

1. Header and Greeting

Whether you’re filling out a loan application letter for a personal or business loan, it’s crucial that you start with a header and greeting. Include several sentences that outline the necessary, accurate details of your loan request in the header. If you’re opting for a business loan, then you need to include the following details:

- Company name

- Company phone number

- Company address

- Loan agent or lender’s name and title

- Loan agent or lender’s contact details

- A subject line stating the desired loan amount

Follow this by incorporating a greeting right below the header so that you introduce your application with a friendly tone.

2. Loan Request Summary

You will have to provide your lender or loan agent with an overview of your loan request in this section. Ensure this section is concise, detailing only crucial information that’ll enable the lender to reach the letter’s body quickly. Entrepreneurs applying for a business loan should state why they are trustworthy borrowers, basic business details, the ideal loan amount, and the use of the loan.

3. Basic Business Details

It would be best if you started by making a clear loan request which includes the amount you wish to borrow. When you write a few sentences about the workings of your business, they should include the following information:

- The legal business name

- Any DBA used by the organization

- The amount of time the business has been operating

- The business structure

- Number of employees

- An overview of what the company does

- Profits and annual revenue, if applicable

Once this is done, you can move on to the next step, which is explaining why you need a loan. Don’t also forget to outline how you plan to repay the owed amount if the lender grants the loan.

4. Loan Usage

Every lender’s goal is to minimize risk as much as possible, so don’t be surprised if they carefully scrutinize your application before deciding whether to accept or disapprove it. They will assess whether you can pay back the loan entirely on time. Make a solid outline of how you intend to use the loan and why granting you the funds is a wise investment. It’s essential to inform the lender that you have clear goals you will accomplish if the loan application is approved.

5. Proof of How You’ll Pay Back the Loan

In order to show your company’s financial health, you’ll need to use figures from the latest balance sheet or income statement. These records are essential because they demonstrate that you can repay the loan.

Additionally, you must include any additional business finances to prove you’re a low-risk investment. State down any existing debt and a schedule detailing how you’ll pay it back if you owe someone else money. Perhaps, you’re a new business, but profits are stable. In that case, ensure you mention this, as it proves your ability to repay the loan.

Once you achieve this, you can add a particular cash flow prediction to give the lender an idea of your payback plan, including the principal and interest amount.

6. Give Accurate Information

There’s no doubt that lending money is a risky investment. You can make your lender’s life easier by providing factual and correct details to ensure both parties agree with the terms of the deal. For example, include your accurate credit history. If you are dishonest during the loan application process, you will be considered a fraud, and there will be repercussions for your actions.

Tips for Writing a Loan Application Letter

- Before sending a loan letter request, check your business and personal credit scores and whether you need to take specific steps to improve them

- Provide transparent, genuine, and concise explanations

- Ensure all information is factual and relevant

- Keep all your financial statements ready, such as business balance sheets, cash flow statements, PSL statements, etc

- Submit every relevant credential with your loan application request letter

- Include the date, time, method, and manner you’ll use to make your payment

- Avoid writing a letter that is unnecessarily wordy and long

- Follow the rules available online on writing formal letters, so you don’t use an informal tone while assembling your loan application letter

- Whether including your business’s current assets, liabilities, or financial health, don’t jot down false information that can get you into legal trouble.

Loan Terms and Penalties

If you fail to pay your loan on time, cancellation fees or penalties may apply that depend on the number of days you’re overdue on the payment. For example, if you’ve looked into how to get a title loan with a lien , you know that your car will be used as collateral. In case you default on payment or provide false information, you are likely to lose ownership of the vehicle.

You should go through the loan terms and conditions as this will enable you to determine how many days your payments can be delayed, how much penalties are for late payments, and the amount you’ll be charged if you cancel your loan. Choosing a loan provider that offers the lowest and most amenable terms is recommended.

Whatever reason you have for acquiring a loan, writing a solid loan application letter will improve your chances of obtaining the financial help you need. This application letter should be composed in a polite, convincing tone and include accurate information. You can do thorough research to pick a lender whose provided options align with your requirements. Consider beforehand how much money you need and apply for the relevant loan.

Join the thousands who have sharpened their business writing skills with our award winning courses.

Copyright © 2024 Businesswritingblog.com.

All Formats

22+ Sample Loan Application Letters – PDF, DOC

There are times when we need financial aid to push through with our education, business ideas, or other personal projects or goals which require a huge amount of money for its realization. It is for this reason that lending companies have been existing ever since the days of old. Today, the primary step to being taken by someone who wants to borrow money from another individual or institution is to write a loan application letter .

Loan Application Letter

- Google Docs

- Apple Pages

Application for Loan Sample PDF

Simple Loan Application Letter

Application for Loan

Loan Letter Sample

Loan Request Letter

Letter for Loan Request

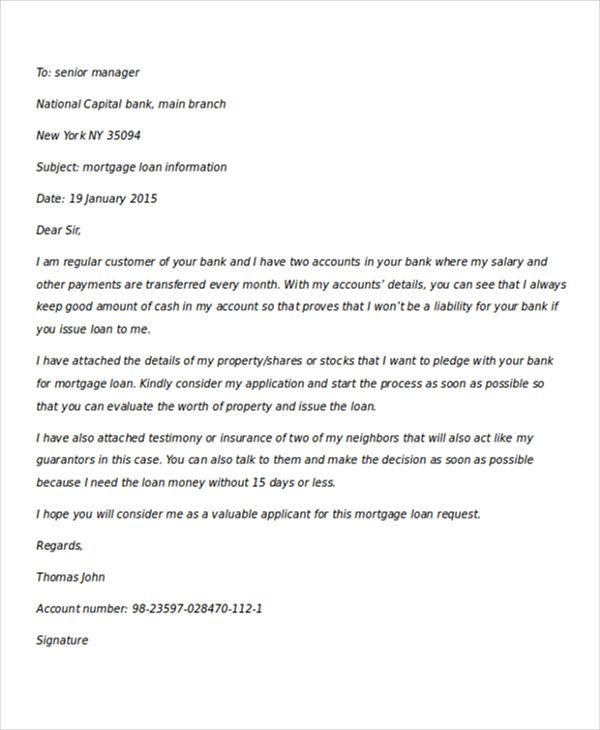

Formal Loan Purpose Application Letter to Senior Manager

Formal Event Management Small Business Letter

Sample Vehicle Application Letter Example

Agricultural Office Vehicle Application Letter Template

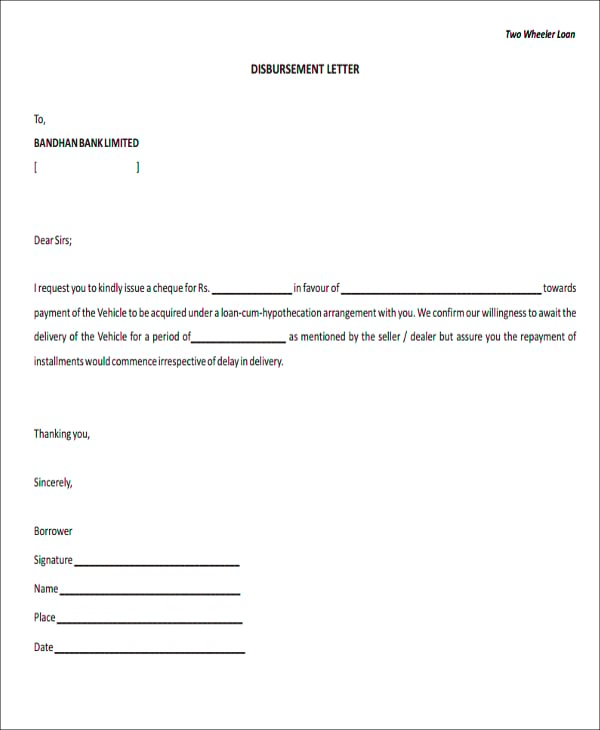

Sample Foreclosure Disbursement Application Form Letter

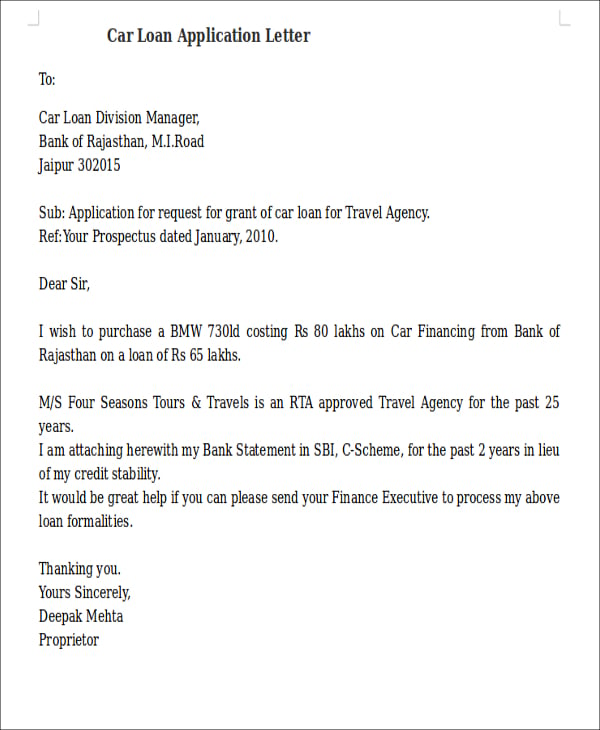

Example Work Travel Agency Letter

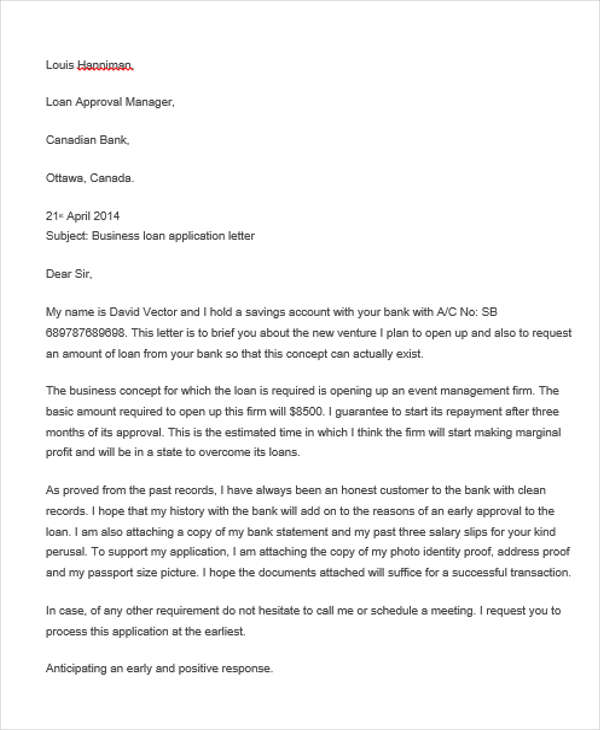

Application Letter to Canadian Bank for Loan

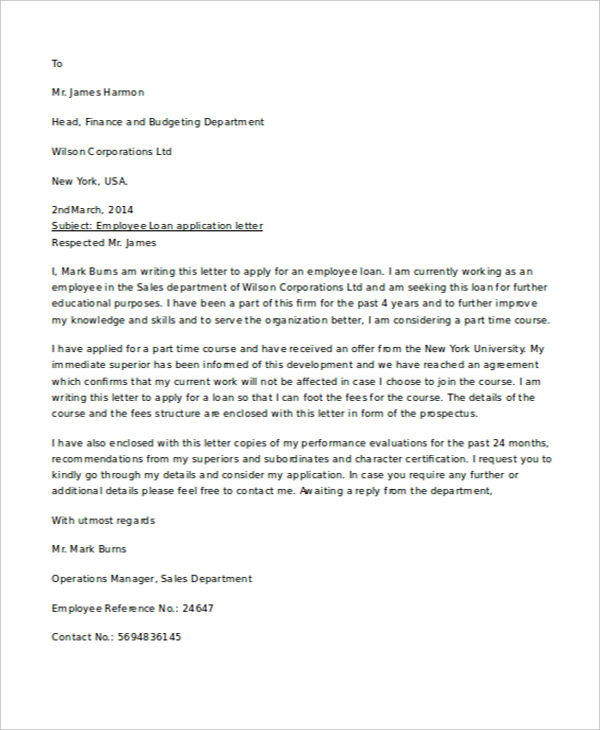

Sales Department Employee Application Letter Example

The Loan Application Process

- Before the loan contract , the borrower would send a loan application cover letter to the prospective lender to express his or her intent to ask for a loan.

- Afterward, when the lender has decided to consider the application for a loan made by the borrower, the borrower, and the lender would convene to negotiate the terms of the loan.

- The payment method, whether personal, through a check, online banking, etc.

- The number of times the payment is going to be made. There are various options. For example, the loan can be paid at one time, or it can be done in yearly or monthly installments.

- The amount of interest to be added on top of the loaned amount. The interest is the amount of money that is charged by the lender to the borrower on top of the amount which he/she has loaned. You may also see job reference letters .

- The assets (land, buildings, vehicles, or other properties) of the borrower would serve as collateral damage in case the borrower fails to make his/her payment on the time it is due.

Basic Senior Typist Home Loan Application Letter Template

Mortgage Loan Application Letter with Boss Recommendation

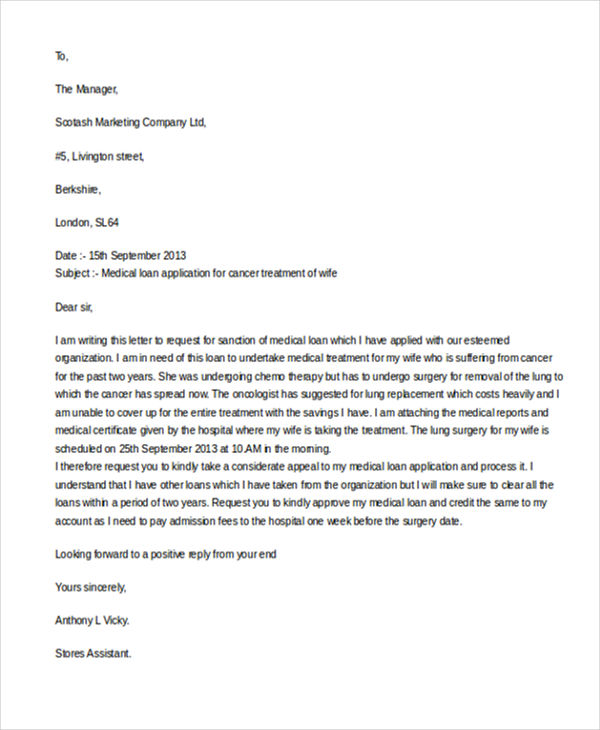

Professional Medical Loan Facility for Cancer Treatment

Professional Education Application Letter Template

Request Urgent / Emergency Loan Letter for Borrowing Money

Free Commercial Vehicle Application Letter Template

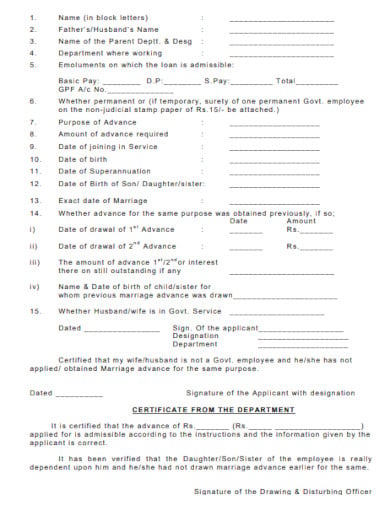

Loan Application Letter for Wedding/Marriage Template

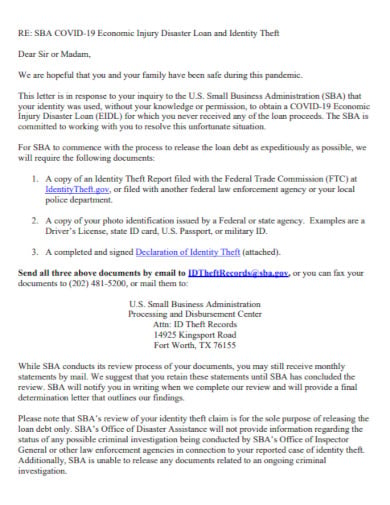

Sample Staff Loan Request Application Letter for Covid-19

Things To Remember in Writing a Loan Application Letter

- Observe the proper rules for writing formal letters.

- State your intent to borrow a specific amount of money.

- Explain in detail the reason for borrowing money. You must be offering a clear, honest, and transparent explanation as to how you intend to utilize the money you intend to borrow. You may also see free application rejection letters .

- Enumerate your assets and liabilities.

- State the time, date, manner, and method which you prefer to make your payment.

More in Letters

Loan requisition letter, loan application letter template, sample loan application letter template, simple loan application letter template, loan application letter to employer template, personal loan application letter template, loan application letter for school fees template, loan application letter to bank manager template, loan application letter for house rent template, loan application letter from employee template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

- EXPLORE Random Article

How to Write a Letter to a Bank Asking for a Loan

Last Updated: January 4, 2024 References

This article was co-authored by Carla Toebe . Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems. There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 203,793 times.

Businesses applying for a loan from a lending institution may be asked to prepare a loan request letter. This letter should include documentation of a strong management team, substantial experience in the industry and a complete understanding of the current marketplace. The letter should not only introduce your business to the lending institution, but it should also clearly state how much money you need, how you will repay the loan and the security you would pledge to back up the loan. [1] X Research source

Writing an Executive Summary

Describing Your Business

- Include a narrative discussion of the development of your products or services since the inception of your business. Detail the volume of business each product generates. Describe significant changes in your products or services. [8] X Research source

- Briefly state your tentative goals for the next 5 years. [9] X Research source

- Describe your work force, including the size and their critical skills. [10] X Research source

- Briefly describe your supplies and name your major suppliers. [11] X Research source

Writing the Loan Request

Including Other Documentation

- Make sure to include the assumptions behind the projections and state clearly that your estimated results are projections, which means they aren't guaranteed, and may not be reached.

Expert Q&A

- The quality of your writing reflects on your business. Use simple, straightforward language. Avoid arcane terms and acronyms. Make your request clear and well-organized. Thanks Helpful 0 Not Helpful 0

- Be positive. Keep the focus on demonstrating how you plan to be successful. Thanks Helpful 0 Not Helpful 0

- If you're not sure how to word your letter, work from a template or example letter. A quick online search for “example bank loan request letter” or “bank loan request letter template” will bring up numerous examples that you can modify to suit your needs. Thanks Helpful 0 Not Helpful 0

You Might Also Like

- ↑ http://www.allbusiness.com/how-to-prepare-a-loan-proposal-11725601-1.html

- ↑ https://www.sba.gov/offices/district/nd/fargo/resources/how-prepare-loan-proposal

- ↑ http://bisonfinancial.com/loans/sample-executive-summary/

- ↑ https://www.bdc.ca/EN/articles-tools/money-finance/get-financing/Pages/how-write-proposal-business-loan.aspx?caId=tabs-1

- ↑ http://www.thedailymba.com/2011/02/14/the-advantages-of-a-business-loan/

- ↑ http://www.captureplanning.com/articles/92131.cfm

- ↑ http://www.brs-seattle.com/loan%20proposal.pdf

- ↑ https://www.sba.gov/content/financial-projections

About this article

Reader Success Stories

Tiffany Burnham

Aug 8, 2016

Did this article help you?

Aug 7, 2016

Colleen Rollins

Apr 11, 2016

- About wikiHow

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

- Consumer Letters

- Bank Loan Request

How to Write a Bank Loan Application Letter: Example and Writing Tips

Last updated on January 02, 2023 - © Free-Sample-Letter.com

What is Bank Loan Application?

A bank loan application is a request made to a financial institution , such as a bank, to borrow a specific amount of money. The purpose of the loan can vary, such as to fund a business venture, pay for education expenses, or make a large purchase.

In order to apply for a loan, an individual or business must complete an application that includes personal and financial information, as well as details about the purpose of the loan and the requested amount . The lender will use this information to evaluate the borrower's creditworthiness and determine whether to approve the loan and at what terms.

Step-by-Step Guide: Crafting a Successful Loan Request Letter

Here are some tips on how to write a bank loan application letter:

- Identify the purpose of the loan and the amount you’re requesting . Be specific and clearly state your financial needs. For example: "I am writing to request a loan of $10,000 to cover the costs of my daughter's tuition at XYZ University." or "I am writing to request a loan of $50,000 to fund the expansion of my small business, XYZ Company."

- Explain your current financial situation and provide evidence of your ability to repay the loan. This may include income statements, tax returns, and other financial documents. For example: "I have been self-employed as the owner of XYZ Company for the past 5 years and have consistently earned a net profit of $30,000 per year / I have been employed as a software engineer at ABC Company for the past 8 years and have a stable income of $75,000 per year. Attached, you will find my tax returns and financial statements as evidence of my ability to repay the loan."

- Describe the specific use of the loan proceeds and how they will benefit you or your business. Be sure to include a detailed plan for how you will use the funds and how you will generate the income to repay the loan. For example: "The loan funds will be used solely for my daughter's tuition and other education-related expenses. I have a budget in place and am confident that I can make the monthly loan payments while still being able to cover my other financial obligations." or "The loan funds will be used to purchase additional inventory and hire two additional employees, which will allow us to increase our sales and profitability. I have a solid business plan in place and am confident that these investments will enable us to repay the loan within 3 years."

- Include any supporting documents that may help your case , such as financial statements or a business plan. For example: "In addition to the documents mentioned above, I have also included a copy of my budget plan, which shows my projected income and expenses for the next 3 years." or "In addition to the documents mentioned above, I have also included a copy of my detailed business plan, which outlines my marketing strategy and projected financial performance."

- Request a specific repayment plan and timeline. Be realistic and considerate of the lender's needs when proposing a repayment schedule . For example: "I am requesting a loan repayment period of 3 years, with monthly payments of $1,500. I understand that this may be negotiable and am open to discussing alternative repayment terms that work for both parties."

- Express your appreciation for the lender's consideration and provide contact information for follow-up. Thank the lender for their time and make it easy for them to get in touch with you if they have any questions. For example: "Thank you for considering my loan request. I am confident that this investment will help my business grow and thrive / I am confident that this investment in my daughter's education will pay off in the long run. If you have any questions or would like to discuss further, please don't hesitate to contact me at 555-555-5555 or by email at [email protected]."

➤ You May Also be Interested in Our Sample Letter to Request an Alternative Payment Plan from a Creditor

Need to Write a Bank Loan Request Letter? Use Our Free Templates for Success

For applying loan in a bank or financial institution.

Dear (mr/miss etc. + Loan manager name),

Following my visit to the bank yesterday where all necessary papers were filed regarding my loan request, here are a few more details pertaining to the loan.

I have been a long-standing customer with (name of bank) for over (number) years now and I recently applied for a (personal/company) loan of ($/€ amount). This loan will allow me to pay for (reason needed) which I have been planning for some time now.

My preferred loan structure, after much thought, is a (secured/unsecured) loan. I believe this is the best option for me and I also hope to be able to pay it off within (X years).

I prefer to take out a shorter loan period rather than the popular long term packages, and therefore hope that you will be able to see this as a positive factor in granting me this loan.

I am currently employed at (company name) and have been the (name of position) for (No. of years). Should you require any references or further information, please do not hesitate to contact (my boss/the HR Dept. etc.) at any time. They can be reached on (tel. no.) or via email on: ([email protected]).

As requested by (Mr./Miss X), please find (enclosed/attached) copies of my most recent bank statements for the last (3/6) months.

I am available to come in and speak with you at any time, I do hope that you will look favorably on my request and I very much look forward to hearing from you.

(name/signature)

Bank Loan Request Letter for Small Business (SBA)

Dear [Loan Manager's Name],

I am writing to request a loan of $50,000 from the Small Business Administration (SBA) to fund the expansion of my small business, XYZ Company.

I have been self-employed as the owner of XYZ Company for the past 5 years and have consistently earned a net profit of $30,000 per year. Attached, you will find my tax returns and financial statements as evidence of my ability to repay the loan.

The loan funds will be used to purchase additional inventory and hire two additional employees, which will allow us to increase our sales and profitability. I have a solid business plan in place and am confident that these investments will enable us to repay the loan within 3 years. In addition to the documents mentioned above, I have also included a copy of my detailed business plan, which outlines my marketing strategy and projected financial performance.

I am requesting a loan repayment period of 3 years, with monthly payments of $1,500. I understand that this may be negotiable and am open to discussing alternative repayment terms that work for both parties.

Thank you for considering my loan request. I am confident that this investment will help my business grow and thrive. If you have any questions or would like to discuss further, please don't hesitate to contact me at 555-555-5555 or by email at [email protected].

[Your Name]

You may also find these examples useful:

- Expert Advice: How to Write a Successful Administrative Letter

- Sample Bad Check Notice Letter: How to Request Payment for a Bounced Check

- Get Your Security Deposit Back: Use This Sample Letter for Claiming It

- Winning Grants: A Step-by-Step Guide to Crafting a Successful Request Letter

- Write a Winning Refund Request Letter with These Tips

- How to Write an IOU Letter (Writing Tips and Samples)

- How to Write a Successful Sponsorship Proposal Letter

- Email Template to Advise Customer of a Returned Check

We also recommend:

- IOU Template and Promissory Note - Sample & Free Download

- Payment Plan Request Letter - Sample & Free Download

- Bank Customer Service Representative Sample Cover Letter

- Banking Internship Sample Cover Letter

- Bank Teller Sample Cover Letter - Tips & Free Download

- Annual Leave Request Letter - Sample & Free Download

- Funeral Leave Request Letter - Sample & Free Download

- Refund Request Letter - Sample & Free Download

- Claiming Back a Security Deposit Letter (Tips & Samples)

Word & Excel Templates

Printable Word and Excel Templates

Loan Application Letter

Applying for the loan requires you to provide a lot of documentation. Some organizations ask you to fill out the loan application form, while in some cases, you have to write a loan application letter to the institute to apply for the loan.

The loan application letter allows you to add all the details that you are required to provide. The letter is written to the loan manager of the company, and he then decides whether he should accept the application or not. The letter should include the personal information of the applicant, and since it is a formal letter, it should be written to the point by avoiding unnecessary details. The lender should follow a standard format while writing the loan application letter. The loan manager should be told about the intended use of the money.

The first paragraph of the letter should state the reason for lending the money. It should be assured in the letter that you will not use this money for any illegal purpose. The date on which the applicant will return the borrowed money should be mentioned in the letter.

You should also include information about you in the letter that can make the reader feel that you are a trustworthy person. Here is a sample letter that can help you learn about the structure and format of the letter.

Loan application letter:

Dear [Recipient’s Name],

It is stated that I am writing this letter to request a loan from the finance office of your company because of some of my very peculiar and essential needs. My mother is seriously ill, and I must get her treated at the hospital, for which I need money. Please accept my loan application and sanction me $2000. I assure you that I will return you the loan from the deductions of my gross salary.

I will be highly grateful for this favor of yours.

I am looking forward to your reply.

[Your Name]

Preview and Details of Template

File: Word ( .doc ) 2003 + and iPad Size: 31 KB

More options

I am writing this letter to get a loan from your bank branch situated in New Jersey. Currently, I am working as a sales executive for ABC Organization and need a $10,000 loan. I am in utmost need of this amount as I have to meet the surgery expenses of my father. I have gone through all the requirements related to the loan process and have enclosed the necessary documents along with this email. Please let me know what other documents I need to send you, and you can call me at any time for further queries. I hope you will give a positive response to my request.

This application is a request to ask for a loan from your organization. I am Christiana Roseland, and I am currently running a bakery in New Jersey. I am planning to open a new branch according to the rising demand of people. For this purpose, I need $70,000/- and I will return the amount in installments. I have thoroughly read the rules and policies for the loan process and hopefully, I will return the entire amount within the given time period and the financial pronouncement has been affixed with this application. Waiting to get positive feedback from you.

This letter is a request for a loan application to construct a house. I am the managing director at ABC Company, and my monthly salary is not adequate to meet the construction expenses. I will return the due amount according to the company’s rules and policies and will not let you be disappointed. I contacted the admin office to find out the details, and Mr. Jackson has provided me with all the information. If you need additional information, you can ask me at any time. Thank you for taking my request into account.

Dear Madam, I, Darcy Louis, work in the security office of your company. I live in Valley Stream and travel two hours daily to come to the office. I do not have a personal vehicle, and sometimes it creates a lot of difficulties, and I often arrive late to the workplace. I want to apply for a loan because I have to buy a motorcycle. I need $10,000 in this regard. I have chosen a six-month installment plan, and 20% of my salary will be deducted each month. I request that you accept my loan application. I will be grateful to you. Thanking in anticipation.

Dear Sir, I am Dorothy John, and I live in Toronto. I am running a branch of ABC School. The strength of students is increasing with each session, and it is becoming difficult to adjust to the large number of students in a limited space. Therefore, I need to open a new branch adjacent to the current school and construct a new building, but I do not have enough money. I learned about your loan policy and want to apply for it. I have attached the needed documents along with the application. I am hoping to hear a quick response from you.

I am Julia Hughes, and I am writing this message to ask for a loan from your bank. I have an account in your Brooklyn branch, and my account number is [#]. I have a small business marketing in Brooklyn, and I intend to open a new branch in the Netherlands. Hence, it can be a source of ease for hundreds of people. The savings I have and the loan I am asking for will be of great help in expanding my business. Kindly send me an email detailing all the formalities for the loan process. I would like to ask you to send me a confirmation message so I may visit your branch on an immediate basis.

- Letter Requesting Transfer to another Department

- Letter Requesting Promotion Consideration

- Umrah Leave Request Letter to Boss

- Ramadan Office Schedule Announcement Letters/Emails

- Letter to Friend Expressing Support

- Letter to Employer Requesting Mental Health Accommodation

- Letter Requesting Reference Check Information

- Letter Requesting Salary Certificate

- Letter Requesting Recommendation from Previous Employer

- One Hour Off Permission Letter to HR

- Payroll Apology Letter to Employee

- Advice Letter to Subordinate on Effective Communication

- Advice Letter to Subordinate on Time Management

- Letter to Patient for Feedback/Responding Survey/Online Form

- Holiday Cocktail Party Invitation Messages

Business Loan Application Letter Sample: Free & Effective

In this article, I’ll guide you through the process step-by-step, drawing from my personal experiences, and provide you with a handy template to get you started. Whether you’re a seasoned business owner or just starting out, these insights will help you craft a compelling letter that stands out to lenders.

Key Takeaways

- Understand Your Audience: Know the lender’s requirements and tailor your letter accordingly.

- Be Clear and Concise: Communicate your business’s needs and how the loan will be used in a straightforward manner.

- Provide Detailed Information: Include pertinent details about your business and your plan for the loan.

- Use a Professional Tone: Maintain a formal tone throughout the letter to convey seriousness and professionalism.

- Follow a Structured Format: Use a clear and logical structure to make your letter easy to read and understand.

- Include Supporting Documents: Attach essential documents that can vouch for your business’s credibility and financial health.

Step-by-Step Guide to Writing a Business Loan Application Letter

Step 1: understand the lender’s requirements.

Before you begin writing, it’s crucial to understand the lender’s criteria. Each financial institution has its unique set of requirements for loan applications. Familiarize yourself with these to tailor your letter effectively.

Step 2: Start with Your Contact Information

Begin your letter with your contact information at the top, followed by the date and the lender’s details. This establishes a professional tone from the outset.

Your Name Your Business Name Your Business Address City, State, Zip Code Date Lender’s Name Lender’s Institution Lender’s Address City, State, Zip Code

Step 3: Craft a Compelling Introduction

Trending now: find out why.

In the opening paragraph, introduce yourself and your business. Clearly state the purpose of your letter – to apply for a business loan – and the amount you are requesting. This sets the stage for the details that follow.

Step 4: Detail Your Business Plan

This is where you shine. Outline your business plan, emphasizing how the loan will contribute to your business’s growth. Be specific about how you intend to use the funds. Will they be used for expanding operations, purchasing equipment, or maybe for bolstering your working capital? Lenders want to see that you have a clear plan in place.

Step 5: Showcase Your Business’s Financial Health

Include a brief overview of your business’s financial status. Highlight your revenue, profit margins, and financial projections. This demonstrates to lenders that you have a viable business capable of repaying the loan.

Step 6: Mention Collateral (If Applicable)

If you’re offering collateral against the loan, specify what it is. This could be equipment, real estate, or inventory. Detailing the collateral reassures lenders about the security of their investment.

Step 7: Conclude with a Call to Action

End your letter by thanking the lender for considering your application and expressing your willingness to provide further information if needed. Include a polite request for a meeting or a conversation to discuss the application further.

Step 8: Professional Sign-Off

Sign off your letter with a professional closing, such as “Sincerely,” followed by your name and position within the company.

Template for a Business Loan Application Letter

[Your Name] [Your Business Name] [Your Business Address] [City, State, Zip Code] [Date]

[Lender’s Name] [Lender’s Institution] [Lender’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to apply for a business loan of [Loan Amount] for [Your Business Name]. As [Your Position] of the company, I am committed to guiding our business to new heights, and this loan is a crucial step in our growth strategy.

Our plan is to allocate the loan towards [Specific Use of Loan]. This investment is projected to [Expected Outcome of Loan Investment], enhancing our profitability and ensuring our ability to repay the loan.

Enclosed with this letter, you will find our business plan, financial statements, and cash flow projections, providing a comprehensive view of our business’s financial health and growth potential.

Thank you for considering our loan application. I am looking forward to the opportunity to discuss this further and am happy to provide any additional information required.

[Your Name] [Your Position] [Your Contact Information]

Tips from Personal Experience

- Personalize Your Letter: While using a template is helpful, adding personal touches that reflect your business’s unique aspects can make your letter stand out.

- Be Transparent: Honesty about your business’s current financial situation and how you plan to use the loan builds trust with lenders.

- Proofread: A letter free from grammatical errors and typos shows attention to detail and professionalism.

I’d love to hear your thoughts or experiences with writing business loan application letters. Do you have any tips to share or questions about the process? Feel free to leave a comment below.

Frequently Asked Questions (FAQs)

Q: What is a business loan request?

Answer: A business loan request is a formal request made by a business to a lender or financial institution for a loan to finance business operations or expansion.

Q: What information is typically included in a business loan request?

Answer: A business loan request typically includes information about the business, including its financial history, plans for the loan proceeds, and a projected financial statement.

It may also include personal financial information about the business owner or owners.

Q: How is a business loan request typically made?

Answer: A business loan request is typically made in writing, through a loan application or business plan submitted to a lender or financial institution.

Q: What documentation is required to support a business loan request?

Answer: Documentation that may be required to support a business loan request can include financial statements, tax returns, and personal financial information.

It may also include business plan, projected financial statement, and any collateral that the business can offer.

Q: What are the potential outcomes of a business loan request?

Answer: The potential outcomes of a business loan request can include the lender or financial institution approving the loan, denying the loan, or offering a modified loan amount or terms.

The interest rate, repayment period, and other terms of the loan will be based on the creditworthiness of the business and the lender’s lending policies.

Q: What is a business loan request letter?

Answer : A business loan request letter is a formal written document submitted by an individual or a business to a financial institution or lender, seeking financial assistance in the form of a loan.

It outlines the purpose of the loan, the amount requested, and provides supporting information to convince the lender of the borrower’s creditworthiness.

Q: How do I start a business loan request letter?

Answer : To start a business loan request letter, begin by addressing it to the appropriate person or department at the lending institution.

Use a formal salutation such as “Dear [Lender’s Name]” or “To Whom It May Concern.” Introduce yourself or your business and clearly state the purpose of the letter, which is to request a loan.

Q: How should I structure a business loan request letter?

Answer : A business loan request letter should follow a professional and organized structure. It typically includes an introduction, a body, and a conclusion.

The introduction should clearly state the purpose of the letter and provide essential details about yourself or your business.

The body of the letter should elaborate on the loan request, including the amount needed, the purpose of the loan, and any supporting information or documents.

Finally, the conclusion should express appreciation for the lender’s time and consideration, while offering your contact information for further communication.

Q: What tone should I use in a business loan request letter?

Answer : A loan request letter should maintain a formal and professional tone throughout. It should be respectful, concise, and polite. Avoid using overly technical jargon or informal language.

It is important to demonstrate professionalism and credibility to increase your chances of a favorable response.

Q: How long should a business loan request letter be?

Answer : A business loan request letter should be concise and to the point, typically ranging from one to two pages.

Avoid excessive details or unnecessary information that may distract from the main purpose of the letter. Keep the content focused, clear, and persuasive.

Q: What is the purpose of a business loan request letter?

Answer : The purpose of a business loan request letter is to formally request financial assistance from a lender or financial institution.

It serves as a written proposal, outlining the borrower’s need for funds, the purpose of the loan, and the borrower’s ability to repay.

The letter aims to persuade the lender that the loan is a viable investment with a solid repayment plan and potential for positive outcomes.

Q: How important is a business loan request letter?

Answer : A business loan request letter is crucial when seeking a loan from a lender or financial institution.

It acts as a formal request, providing essential information about the borrower, the purpose of the loan, and the borrower’s ability to repay.

A well-written and persuasive loan request letter increases the likelihood of the loan being approved, as it demonstrates professionalism, credibility, and a clear understanding of the borrower’s financial needs.

Related Articles

Personal loan request letter sample: free & effective, request letter for working capital loan: the simple way, personal loan paid in full letter sample: free & effective, sample letter to bank requesting extension of time for loan payment: free & effective, ask someone for money in a letter sample: free & effective, business loan request letter sample: free & customizable, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Start typing and press enter to search

Bank Loan Application Letter I Loan Application Letter

How to write a loan application letter that will get you the loan you need.

A Loan application letter is an important for any loan request process, whether for business or personal reasons. You must ensure that the letter’s tone and content accurately represent you and your request when you write a letter to a bank requesting for a loan. Here are some advice for writing a loan application letter that will have loan institutions beg you for money.

Research the Lender

You need to do your researching on the lender before writing your loan request letter. Learn about the different loan packages that are provided and the documentation requirements for each. In addition to describing the loan’s purpose and how it will help you achieve your goals, your loan application letter should include details about you and your business, also including your personal income and expenses, credit history, assets, and debt commitments.

Know What They’re Looking For

Loan application letters are formal requests for loans. They contain basic information about the borrower, such as name and contact information; an explanation of why they need money; and the loan’s purpose. Loan application letters are often written by small business owners looking for loans from private investors or banks. If you’re looking to borrow money, here’s what you should know: when and how to write a loan application letter, who should write it, and what information it should include.

Loan Application Letter

Yours faithfully

Suraj Dutta

Personal Loan Application Letter Dated:……/……/……..

The Branch Manager United Bank of India North Lakhimpur Lakhimpur

Subject: Application for Personal loan.

Respected Sir,

I am serving our reputed Organization XYZ Pvt. Ltd. As coordinator since June 1999. I hereby apply for a personal loan of Rs. 500000.00( five lakh only) for a term of three years. I need this money for the expansion of my house. Therefore I would be much obliged if you can grant the above-requested loan for the purpose mentioned above. I am ready to submit all my necessary documents.

So please sanction my loan application and do the needful at the earliest.

Thanking you.

Yours faithfully

Suraj Das Coordinator XYZ Pvt.Ltd.

I hope this has been helpful. If you have any questions about writing loan application letters, please feel free to contact me.

You can use this letter for these Queries Also

- loan application letter

- bank loan application letter

- loan application letter to bank manager

- business loan application letter sample

- loan application letter to company

- personal loan application letter

- education loan application letter

- loan application letter sample

- loan application letter format

- simple loan application letter

- home loan application letter

- personal loan application letter sample

- sample of loan application letter

- bandhan bank loan application letter

- loan application letter sample to bank

- loan letters

- loan request letter

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Letters.org

The Number 1 Letter Writing Website in the world

Sample Loan Request Letter

Last Updated On March 3, 2020 By Letter Writing Leave a Comment

A loan request is written by a bank’s customer or employee and addressed to the bank manager, human resource manager or direct employer.

A loan request letter is important to sell the business idea or investment to the lender. It is a formal request that shows how you plan to use the money and helps the lender know if the business is worthy of the money being borrowed. Additionally, this letter shows the lender of the initiatives you will take to repay the money.

Tips for writing a sample loan request letter

- Read and understand the guidelines for loan borrowing and repayment

- Give the precise reason why you need the loan

- Mention the amount of money you are requesting

- Enclose the necessary support documents where applicable

- Address the reader in a polite and professional language

- Describe how you will repay the loan

- Use the business format style

- Keep the letter directly to the point

Sample Loan Request Letter Templates

When you are short of money for your business, you can borrow a loan from your bank. Check out our free loan request letter template and sample letters that can help you get started in borrowing some funds.

_____________

Date (date on which letter is written)

________________

Sub:_________________________________________

Dear _________________,

My name is ____________, I have been banking with your bank for ____________ years under the name ____________. I am grateful for the good services that you provide to your customers. I hereby write this letter to request for a ____________ dollars loan for my ____________ business.

I wish to venture into a new business that will be involving manufacturing new products from recycled materials. I wish to make products for decoration like chandeliers from recycled glass and plastic. This business will offer job opportunities to approximately ____________ number of people.

I have read and understood the terms and conditions for the loan and I wish to request for ____________ period to repay in full. The repayment will be made in ____________ installments. Kindly see the attached business proposal, the duly filled and signed small business request form for your consideration. Should you have any questions, kindly reach me through my mobile ____________.

I hope that you will approve this loan request at your earliest.

Thank you, I look forward to your response.

Yours Truly,

(__________________)

__________ __________ __________ __________

Date: _____ (Date on Which Letter is Written)

Subject: Request for Loan.

I am a ……………….(type of relationship with the bank) account holder of your bank for the past ………. years and have always maintained high deposits with your bank. Now I am planning to take a loan for …………………………………………(the reason for the loan).

In view of the above, I would request that a loan of …………………………(amount required) may kindly be granted to me for a period of …………years. I have attached all forms and documents as required by the bank for the same. I would be grateful if the same can be processed at the earliest.

Thanking you in anticipation.

With Regards

Yours truly,

___________

Name and Signature

Are you in a fix and you are looking to request a loan from your employer? Here is a good example of a sample loan request letter that will guide you through writing a precise and convincing request.

Malcom Kane,

35 South Tarkiln Hill Dr.

Grove City, OH 43123

United States

Date:____________ (Date on which letter is written)

Jill Crosby,

Intex Enterprises

304 Sunbeam Court

Delaware, OH 43015

Sub; Request for a salary loan

Dear Mrs. Crosby,

I hereby write to make a humble request for a $ 4,000 loan. The loan will be deducted from my salary every month and I wish to repay the loan in 12 months. I wish to take this loan to pay medical bills for my wife who has been hospitalized for one month.

I am in a difficult financial position due to the huge hospital bill. She has been treated but cannot be discharged because of the pending bills and the medical insurance is only paying part of it. Kindly grant me this loan at your earliest so that my wife may be discharged.

I have read and understood the requirements for borrowing and repaying a salary loan issued by the company. I will repay with a monthly installment of $400 inclusive of interest until it is fully repaid. Kindly contact me through 796-473-6840 if you have any questions.

Thank you in advance

Yours sincerely,

Malcom Kane

I am a salary account holder of your bank for the past five years and have always maintained high deposits with your bank. Now I am planning to take a loan for construction of my house the land for which already belongs to me.

In view of the above, I would request that a loan of Rs 30 lakhs may kindly be granted to me for 15 years. I have attached all forms and documents as required by the bank for the same. I would be grateful if the same can be processed at the earliest.

Thanking you in anticipation,

With Regards,

____________

Loan Request Letter Email Formats

Business loans can enable you to develop your business beyond your financial abilities. Have a look at the loan request letter in an email format that you can customize to borrow funds for your business.

Dear Manager,

I am writing to request a small business loan for my bakery business. I have been an account holder in your bank for seven years and I wish to extend my appreciation for your excellent services. I request $ 1,000 to extend the eating area of my business Cake Hub. I am a renowned baker in Oklahoma in providing bakery services for weddings, parties, and in-service.

I started my business four years ago and it has grown enormously over the years. I have employed twenty people in my business in various departments. Due to a large number of customers, I intended to expand the eating area to an outside space where we will be serving cake and beverages. This area will be developed like a garden, well landscaped, with chairs and tables.

I aim at making Cake Hub a place where people can have a good time. This expansion will help me achieve maximum productivity and customer satisfaction. I will repay this loan in installments in six months.

I herewith attach the approved plan, the financial states for the business, and loan application form. Please treat this request with priority.

Lidia Mcfarland

Dear Mr. Stone

I have been a faithful patron of your bank, Benson Bank, with a savings account for the last seven years. There has never been any overdraft against my account. My salary is also banked into my account at your bank at every month-end, and there is always sufficient balance in my savings account.

As such, I am writing to request a loan of $80,000 for my recent purchase of a new home. I have attached the necessary loan documents and forms as per your bank regulations.

Please contact me if you need further information to assist you in making the approval of my request. Your prompt approval response would be appreciated.

Thanking you in advance

Manny Moses

Account Holder

Loan requests are important to help people in financial difficulties. When writing a loan request to your bank or employer, it is essential to describe why you are borrowing the money and the plans you have.

Additionally, mention the amount of money you need and how you intend to repay it. In such a letter, business format, polite and professional language, and concise content are expected.

Megha Kothari

Comments are disabled for this post.

Related Letters:

- Sample Request Letter for personal loan

- Sample Request The Payment Of Personal Loan

- Sample Request Letter

- Sample Letter For Request A Refund

- Request Letter – Salary Request Letter

- Sample Leave Request Letter

- Request Letter – Cheque Book Request Letter

- Request to Waive Bank Fee

- Sample Charity Funds Request Letter

- Request Letter for a Bank Statement

- Salary Request Letter

- Change of Address Request Letter

- Request Letter

- Request Letter – Change of Address Request Letter

- Request Letter Template

- Credit Increase Request Letter

- Credit Request Letter

- Request Letter – Request for an Endorsement or Testimonial

- How to Write a Request Letter

- Pay Rise Request Letter

- Request Letter for Allowance

- Salary Hike Request Letter

- Request For The Postponement Of The Last Day

Leave a Reply Cancel reply

You must be logged in to post a comment.

- Search Search Please fill out this field.

What Is a Letter of Explanation for a Mortgage?

Why do you need a letter of explanation, how to write a letter of explanation.

- Frequently Asked Questions (FAQs)

The Bottom Line

- Buying a Home

How to Write a Letter of Explanation for a Mortgage

A letter of explanation may help you get approved for a mortgage

:max_bytes(150000):strip_icc():format(webp)/LindsayFrankel-0e50cf9508f64df899aea94f1640c276-2fc39a1b539547cba44e7b84423e2d0f.jpeg)

Wichayada Suwanachun / Getty Images

When you apply for a mortgage, the lender will review information such as your credit history, employment, income, assets, investments, and outstanding debts. But your financial statements, credit report, and tax returns don’t always tell the full story about your financial situation.

A letter of explanation helps clarify any information that might give a lender pause. Learn more about when you might need a letter of explanation for a mortgage application and how to write the letter.

Key Takeaways

- Some mortgage lenders may request a letter of explanation if there is confusion about any details in your financial documents.

- If you’re applying for a government-backed mortgage like an FHA or VA loan, a letter of explanation may be required.

- Even if your lender doesn’t require a letter of explanation, including one may help clarify details in your mortgage application that could otherwise lead to denial.

- You may need to include supporting documentation to give your letter of explanation more credibility.

A letter of explanation, sometimes referred to as an LOX or LOE by mortgage underwriters, is similar to a cover letter for a job application. Just as a cover letter expands on the details in your resume, a mortgage letter of explanation further explains your financial documents. For example, you might need to explain that last year’s income wasn’t typical because you took a sabbatical, or that you missed a payment due to a healthcare emergency.

“A letter of explanation is not a standard or defaulted requirement for a mortgage application,” said Shmuel Shayowitz, president and chief lending officer at Approved Funding, a licensed mortgage bank and direct lender. However, your mortgage lender may request one if your financial information needs clarification. If you’re applying for a government-backed loan, the agency that insures the loan may also require a letter of explanation in certain situations.

Even if it’s not required, it can’t hurt to include a letter of explanation with your mortgage application. “The default for some processors and underwriters is to assume the worst or to err on the side of caution when something is unclear or complicated,” Shayowitz said. “Being proactive with explanation letters can go a long way in helping a loan processor and mortgage underwriter understand something that might be confusing.”

In particular, the following situations merit the inclusion of a letter of explanation.

Erratic Income or Gaps in Employment

Most lenders look for a consistent and reliable income that ensures you can keep up with your mortgage payments. If you were unemployed or did not receive income for more than a month over the last two years, you should include a letter of explanation that details the reason you weren’t working, such as:

- Childbirth or caring for another family member

- Pursuing further education

- Being laid off

- Being self-employed or working in a seasonal industry

- Going out of business or downsizing

If you were able to make regular payments on your debts and support yourself with savings during that time, be sure to mention that in the letter.

Issues on Your Credit Report

If your credit report shows red flags, like missed payments or defaults, bankruptcies , or foreclosures , it’s essential to include a letter of explanation noting what happened and why it’s not likely to reoccur. You’ll also want to include the date of the event, the name of your creditor, and the account number associated with the delinquent debt.

No Rental or Mortgage Payment History

If you have been living with a friend or family member rather than making monthly housing payments for your own place, the homeowner you live with will need to write a letter of explanation. The homeowner should explain that they haven’t charged you rent and include the dates you lived on their property before signing the letter.

Profits or Losses From Farming

If you filed Schedule F with your tax return because you earned or lost income from a farm property, you’re required to include a letter of explanation. Include the address of the farm and clearly state that it is not located on the property you’re buying with the mortgage.

Large Deposits or Withdrawals

If you received a large deposit to your bank account, the lender might think you accepted a gift or a loan from a family member and wonder if your income is sufficient without additional help. A large withdrawal may also indicate to the lender that you’re having financial troubles. There are other reasons for large bank transactions, however. For example, you may have received a bonus from your employer, liquidated investments at an opportune time, or withdrawn funds for a home renovation. Include a letter of explanation that shows why the atypical transaction occurred.

Possible Occupancy Questions

Lenders underwrite vacation homes and investment properties differently from primary residences. It’s illegal to misrepresent your occupancy intentions. If you’re applying for a primary residence mortgage for a property located far from your employer, or if you’re applying for a second home mortgage for a property in close proximity to your primary residence, the lender may think you intend to use it as a rental property.

If you think the lender may have questions about how you intend to use the property, include a letter of explanation.

Address Discrepancies

If any of your documents show a different address, you should include a letter of explanation with a reason for the discrepancy to assure the lender you’re not a victim of identity theft.

“Your explanation letter should be specific, precise, and well-communicated,” said Shayowitz. Avoid general statements about your ability to manage your finances and speak to a specific issue.

For example, if you missed a payment, explain why it happened, point to your otherwise positive payment history, and state when you brought your account back up to date. A statement like “I make every effort to stay on top of my payments” is too vague because it won’t provide the lender with the details they need to make an approval decision.