- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

Real Estate

- Venture Capital

- Asset Management

Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Interview Questions

Investment Banking Interview Questions and Answers

101 common technical, fit, behavioral, and logic investment banking interview assessments with sample answers

Mr. Arora is an experienced private equity investment professional, with experience working across multiple markets. Rohan has a focus in particular on consumer and business services transactions and operational growth. Rohan has also worked at Evercore, where he also spent time in private equity advisory.

Rohan holds a BA (Hons., Scholar) in Economics and Management from Oxford University.

Prior to becoming our CEO & Founder at Wall Street Oasis, Patrick spent three years as a Private Equity Associate for Tailwind Capital in New York and two years as an Investment Banking Analyst at Rothschild.

Patrick has an MBA in Entrepreneurial Management from The Wharton School and a BA in Economics from Williams College.

IB Interview First Impressions - Carrying Yourself

- Common First Investment Banking Interview Questions: Crafting Your Story

30 Common Investment Banking Technical Questions

- WSO's Bonus IB Interviews Tip From An Interviewer

14 Bank-Specific Hard Technical Questions

16 ib product group-specific questions, 16 common ib industry-specific questions, 12 most common behavioral fit questions, 7 exclusive bank-specific behavioural/fit questions.

- 6 Logical Puzzles - Interview Brain Teasers

- Questions To Ask The Interviewer At The End

Bonus Interview Preparation Tips

Hirevue investment banking tips.

- M&I 400 IB Questions Guide Vs WSP's The IB Interview Guide (The Red Book) Vs WSO's IB Interview Prep Course

Full WSO IB Prep Guide & Additional Resources

- List Of Bulge Bracket Investment Banks And Boutiques

The Investment Banking (IB) interview process is highly competitive and designed to rigorously filter out potential candidates. Consequently, answering the behavioral, technical, and logical questions that are asked in the interview with proven answers that we provide is key to converting an interview into an offer.

The following free WSO IB interview guide is a comprehensive tool designed to cover every single aspect of the interview process, guiding you from the very beginning to the very end.

- This guide features 101 of the most common technical, behavioral, logical, and group-specific questions that are asked by investment banking professionals to candidates during the hiring process as well as sample answers to each one of them. It is a great place to start your preparation before investing in our more comprehensive IB interview course .

- This resource includes 21 bank-specific questions from bulge bracket investment banks (Goldman Sachs, J.P Morgan, Citi, etc.).

- This interview guide consists of 16 sections which cater to various phases of the interview process.

Before we begin, we wanted to make sure you know about WSO Academy, a program that guarantees you are job in high finance (including investment banking)...

The Only Program You Need to Land in High Finance Careers

The most comprehensive curriculum and support network to break into high finance.

We’ve all heard about it at one point or another. Forbes has written on it. “First impressions are the best impressions.”

Within just a few seconds of meeting, people will form a solid opinion of who you are. Perfecting your first impression while carrying yourself with a healthy balance of confidence and humility lays the foundation and tone for the rest of the interview. The following section has been written by Patrick Curtis, CEO of WallStreetOasis, based on his vast experience of interviewing candidates for investment banking positions.

Read it over, perfect your entry and learn how to leave a lasting impression on your interviewer from the get-go.

How to Carry Yourself

- The biggest thing I am looking for is humble confidence - someone I would like to grab a beer with.

- Listen, listen, listen!!! So many mistakes happen just because of not listening carefully and not being in the moment.

- Be punchy, brief, and learn how to end a sentence. I can't tell you how many times people have gotten into trouble by rambling off into some ass-backward irrelevant tangent. Learn to be comfortable with a little silence here and there while we absorb your answer.

Common First Investment Banking Interview Questions: Crafting Your Story

There are no excuses for not perfecting what is in your control. Irrespective of the bank, the position, or your region, you can be sure these 2 questions will be asked as they’re a standard in the industry.

Anticipating both of these questions beforehand, crafting a compelling narrative around them, and selling yourself on it will make you stand out from amongst the pool of potential candidates.

1. Walk me through your background/resume

Dial-in a cohesive 90-second resume walkthrough that focuses on the positive and motivating factors behind every transition (school to job, job to better job, most recent job to grad school). A good example:

I went to school to learn how to design cars, but after my first internship I realized that I like interacting with clients directly and pursued full-time roles in B2B sales. In these sales roles, I developed solid selling skills as well as gained exposure to a, b, and c. Since I wanted to continue honing those skills and branch out to focus on x, y, and z, I am seeking a new role/promotion which provides that opportunity…

Be deliberate. Every move you made should have a reason (preferably that you initiated). Don't be negative. Never say you left because you were bored or "wanted to try something new."

2. Why investment banking?

The answer to this question should be tailored uniquely to you and to the firm you are interviewing with. While answering this question, it is key to capitalize on your previous professional/leadership experience, highlight it and create a logical path as to why you are now trying to break into investment banking. A good answer to this question is addressing the three main reasons, illustrated below with an example each:

Given the variety of professional backgrounds that candidates come from, WSO has created a dedicated page to answer this question.

Did you know?

WSO’s “Why investment banking?” article covers 43 sample answers , tailored for students and professionals from backgrounds ranging from law to consulting.

Technical questions are a critical component of almost every investment banking recruiting process. You WILL be asked these questions, and your interviewers will expect detailed and accurate responses. The following section features 30 of the most common IB interview questions, with a detailed sample answer for each of them.

At the end of these 30 questions, we also have provided you with 14 exclusive bank-specific technical questions (from 7 bulge bracket banks) to kickstart your mock interview training.

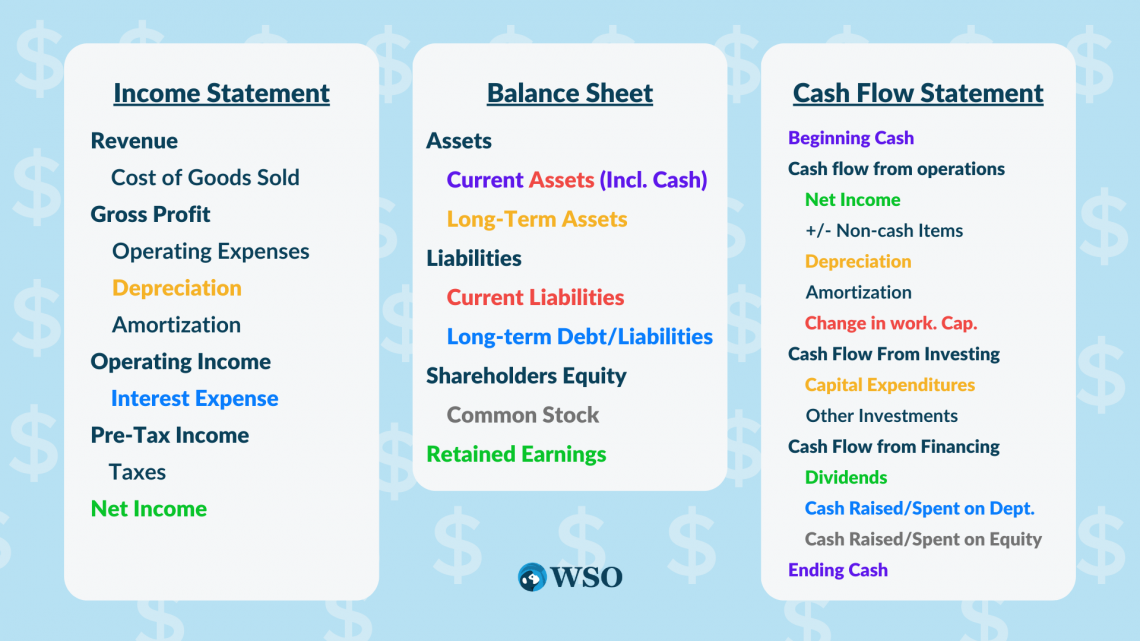

1. What are the three main financial statements?

Sample Answer: The three main financial statements are

- Income Statement

- Balance Sheet

- Statement of Cash Flows

The Income Statement discloses a company's revenues and expenses, which together yield net income over a period of time. The Balance Sheet discloses a company's assets, liabilities, and equity on a specific date. The Cash Flow Statement starts with net income from the Income Statement; then adjusts for non-cash expenses, non-operating expenses like capital expenditures, changes in working capital, or debt repayment and issuance, to arrive at the company's closing cash balance.

2. How are the three main financial statements connected?

Sample Answer: Net income flows from Income Statement into the Cash Flow Statement (CFS) as Cash Flow from Operations. Net income less dividends are added to retained earnings from the prior period's Balance Sheet (BS) to come up with retained earnings as on the date of the current period's BS. The opening cash balance on the CFS is from the prior period's Balance Sheet while the closing cash balance on the CFS is the balance on the current period's Balance Sheet.”

The following chart gives you a more comprehensive overview of how the 3 financial statements are connected to help visualize and present better for your interview:

3. If you could use only one financial statement to evaluate the financial state of a company, which would you choose?

Sample Answer: The cash flow statement because it shows the actual liquidity of the company and how it is generating and using cash. The balance sheet just shows a snapshot of the company at a point in time, without showing the performance of the company, and the Income statement has several non-cash expenses that may not be affecting the company's health and can be manipulated. Overall, the key to a great company is generating significant cash flow and having a healthy cash balance, both of which are disclosed in the CF statement.

4. How would a $10 increase in depreciation expense affect the three financial statements (assuming a 40% tax rate)?

Sample Answer: In the income statement, the depreciation increase of $10 is set off by a reduction of $4 on taxes as depreciation is a tax-deductible expense for the net reduction in net income of $6. In the cash flow statement, net income is reduced by $6, depreciation is increased by $10, net cash from operations and total cash is increased by $4. This increase in cash is because depreciation is a non-cash expense that has no impact on cash while the reduction in taxes affects the cash flow. In the balance sheet, property, plant, and equipment balances reduce by $10, cash balance increases by $4, and retained earnings reduce by $6 due to the reduction in net income.

The following points summarize this:

On the income statement

- $10 depreciation expense, 40% tax rate

- Reduction in net income of $10 x (1 - 40%) = $6

Reduction in net income flows to cash from operations

- Net income reduced by $6

- Depreciation increases by $10

- Net increase in cash from operations of $4

- Ending cash increases by $4

Ending cash flows onto th e balance sheet

- Cash increases by $4

- Property, plant, and equipment lose $10 in value

- Net decrease in assets of $6, matches the net drop in shareholder equity due to the reduction of retained earnings from the $6 is net income

5. “Walk me through the Income Statement”

Sample Answer: The first line of the Income Statement represents revenues or sales. From that, we subtract the cost of goods sold, which gives gross margin. Subtracting operating expenses from gross margin gives us operating income (EBIT). We then (add/subtract) interest expense (income), taxes, and other expenses (income) to arrive at Net Income.

6. What is Enterprise Value?

Sample Answer: Enterprise Value (EV) is the value of an entire firm, both debt, and equity. This is the price that would be paid for the company in the event of acquisition without a premium.

EV = Market Value of Equity + Debt + Preferred Stock + minority interest - Cash

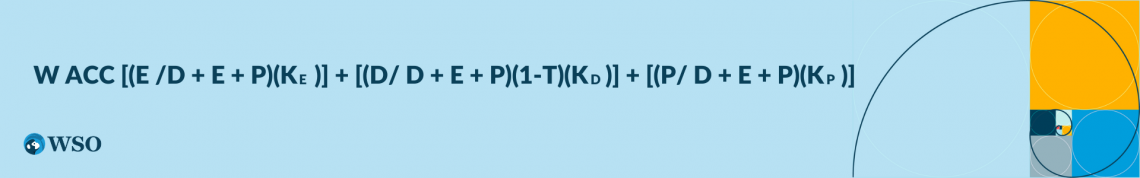

7. What is WACC and how do you calculate it?

Sample Answer: WACC is the acronym for Weighted Average Cost of Capital. It reflects the overall cost for a company to raise new capital, which is also a representation of the riskiness of investment in the company (higher the risk, higher the cost of capital). It is commonly used as the discount rate in a discounted cash flow analysis to calculate the present value of a company's cash flows and terminal value .

The formula below helps you calculate the WACC of a company if you are put on the spot and asked to calculate it as part of your technical interview:

where, E = Market value of equity D = Book value of debt P = Value of preferred stock K E = Cost of equity (Calculate using CAPM) K D = Cost of debt (Current yield of debt) K P = Cost of preferred stock (Interested rate on preferred stock) T = Corporate tax rate

8. What is EBITDA?

Sample Answer: EBITDA stands for Earnings before Interest, Taxes, Depreciation, and Amortization. It gives us a good idea of a company's profitability and is a quick metric for free cash flow because it will allow you to determine how much cash is available from operations to pay interest, CAPEX , etc.

EBITDA = Revenue - Expense (except depreciation and amortization)

It is also often used for rough valuations in a comparable company or precedent transaction analysis as part of the EV/EBITDA multiple.

9. Would you be calculating enterprise value or equity value when using a multiple based on free cash flow or EBITDA?

Sample Answer: EBITDA and free cash flow represent cash flows that are available to repay holders of a company’s debt and equity, so a multiple based on one of those two metrics would describe the value of the whole business from the perspective of all its investors.

A multiple such as the P/E ratio, based on earnings alone, represents the amount available to common shareholders after all expenses are paid, using which you would be calculating the value of the firm’s equity.

10. Can a company have a negative book equity value?

Book equity value is the accounting value of equity derived by subtracting the value of a company's liabilities from its total assets. It is the total shareholder’s equity, an amount shown as “Total Equity” in the Balance Sheet of the company.

Sample Answer: Yes. If there are large cash dividends or if the company has been operating at a loss for a long time.

11. What is typical of an LBO (leveraged buyout) transaction?

A firm (usually a PE firm) uses a high amount of debt (70 - 90%) to finance the purchase of a company, then uses the company's cash flows to pay off that debt over time.

The acquired company’s assets may be used as collateral. Ideally, the original debt of the acquired company would have been partially retired at the time of exit.

In the context of a private equity investment, the debt acts as a way to magnify returns (boost IRR for the fund), but it can also backfire if the acquisition turns south.

12. Why would a company issue equity rather than debt to fund its operations?

Sample Answer: There are many reasons why a company would want to issue equity instead of debt. Some of them are:

- If the company feels its stock price is inflated, it can raise a relatively large amount of capital with comparatively minimal dilution to existing shareholders.

- If the projects the company is looking to invest in do not produce immediate or consistent cash flows to pay its debt.

- If the company wants to adjust the cap structure or pay down debt.

- If the owners of the company want to sell off a portion of their ownership.

13. How is it possible for a company to have a positive net income but go bankrupt?

Sample Answer: This is possible if working capital erodes (such as increasing accounts receivable, lowering accounts payable, lower inventory turnover) or the company is growing so fast that it’s unable to raise enough capital to fund operations. Another possibility is the existence of financial fraud.

14. What are some ways you can value a company?

Sample Answer: The three most common ways of valuing a company are: Comparable companies or multiples analysis: This is the most common way to value a company. This method attempts to find a group of companies that are comparable to the target company and to work out a valuation based on what they are worth. The idea is to look for companies in the same sector and with similar financial statistics (Price to Earnings, Book Value, Free Cash Flow, EBITDA, etc) and then assume that the companies should be priced relatively similarly.

Market valuation or market capitalization: In this method, the market value of equity is used and hence can only be used for publicly traded companies. It is calculated by multiplying the number of shares outstanding by the current stock price.

Discounted cash flow analysis: This method involves calculating the sum of the present values of all future cash flows to give the value of the entire company including debt and equity, which is also called enterprise value .

15. Which of the valuation methodologies will result in the highest valuation?

Here is a list of the four valuation methodologies organized from highest valuation to lowest valuation:

- Precedent Transaction - Since a company will pay a control premium and a premium for synergies coming from the merger, values tend to be high.

- Discounted Cash Flow - Those building the DCF model are frequently optimistic in their projections.

- Market Comps - Based on other similar companies and how they are trading in the market. No control premium or synergies.

- Market Valuation - Based on how the target is being valued by the market. Just equity value, no premiums or synergies.

16. Why might there be multiple valuations of a single company?

Sample Answer: Each method of valuation will generate a different value because it is based on different assumptions, different multiples, or different comparable companies and/or transactions. Generally, the precedent transaction methodology and discounted cash flow method lead to higher valuations than comparable companies' analysis or market valuation does.

The precedent transaction result may be higher because the approach usually will include a “control premium” above the company’s market value to entice shareholders to sell and will account for the “synergies” that are expected from the merger.

17. Walk me through a DCF.

In an interview, it is important to keep your technical overview at a high level. Start with a high-level overview and be ready to provide more detail upon request.

Sample Answer:

- Project out cash flows for 5 - 10 years depending on the stability of the company

- Discount these cash flows to account for the time value of money

- Determine the terminal value of the company - assuming that the company does not stop operating after the projection window

- Discount the terminal value to account for the time value of money

- Sum the discounted values to find an enterprise value

- Subtract the present value of debt (this is generally the market value of debt) and then divide by diluted shares outstanding to find an intrinsic share price

Common questions that follow this are:

Why do you multiply by (1-tax rate)?

Sample Answer: You do this because interest expense (the cost of debt) is tax-deductible so you need to account for the benefit provided by this "debt tax shield."

What is the cost of equity?

Sample Answer: The cost of equity is usually calculated using the Capital Asset Pricing Model (CAPM). CAPM = Risk-free rate + Beta * (Expected market return - Risk-free rate)

What is the exit multiple method for determining the terminal value?

Sample Answer: Find an industry average multiple and multiply it by final year revenue (if using EV/Revenue) or final year EBITDA (if using EV/EBITDA).

18. What is an Initial Public Offering (IPO)?

Sample Answer 1: An IPO is the first public sale of stock in a previously private company. This is known as “going public.” The IPO process is incredibly complex, and investment banks charge high fees to lead companies through it. Companies go public for several reasons—raising capital, cashing out for the original owners, and investor and employee compensation. Some negatives against “going public” include sharing future profits with public investors, loss of confidentiality, loss of control, IPO fees to investment banks, and legal liabilities.

19. What is the difference between accounts receivable and deferred revenue?

Sample Answer: Accounts receivable is revenue, which has been earned and recognized because the product has been delivered, but the customer has not yet paid the cash. Deferred revenue is cash that has been collected for products that have not yet been delivered, so the revenue has not yet been recognized. Accounts receivable is an asset on the Balance Sheet, whereas deferred revenue is a liability.

20. When calculating enterprise value, do you use the book value or the market value of equity?

Sample Answer: You should use the market value of equity always because the book value is not adjusted once it is recorded in the books at the time of issue of the shares. It is common to very often see a share priced in the hundreds or thousands having a face value of $1 or $10. This is due to the historical nature of accounting. Hence, the book value of equity is useless for any kind of valuation, and market value is the preferred metric to use.

21. If enterprise value (EV) is $80mm, and equity value is $40mm, what is the net debt?

Enterprise Value = Equity Value + Net Debt + Preferred Stock + Minority Interest.

Sample Answer: If we assume there is no minority interest or preferred stock, then Net Debt will be $80mm – $40mm, or $40mm.

22. What is the difference between cash-based accounting and accrual-based accounting?

Sample Answer: Cash-based accounting recognizes sales and expenses when cash flows in and out of the company.

Accrual-based accounting recognizes revenues and expenses as they are incurred regardless of whether cash flows in or out of the company at that exact time.

Accrual-based accounting is the more common method for large corporations.

23. What are the major factors that drive mergers and acquisitions?

24. All else equal, should the WACC be higher for a company with a $100 million market cap, or a company with a $100 billion market cap?

Sample Answer 1: Normally, the larger company will be considered “safer” and therefore will have a lower WACC all else being equal. However, depending upon their respective capital structures, the larger company could also have a higher WACC.

Sample Answer 2: Without knowing more information about the companies, it is impossible to say. If the capital structures are the same, then the larger company should be less risky and therefore have a lower WACC. However, if the larger company has a lot of high-interest debt, it could have a higher WACC.

25. What is Beta?

Sample Answer: Beta is a measure of the volatility of an investment compared with the market as a whole. The market has a beta of 1, and hence, investments that are more volatile than the market have a beta greater than 1 while those that are less volatile have a beta less than 1.

26. How/why do you lever or unlever Beta?

Sample Answer: Unlevering beta allows us to remove the effect of debt in the capital structure. This shows us the beta of the firm's equity had it not used any leverage in its capital structure. Also, if we are trying to do a market comparison with a company that's not on the market (so no beta), you can take a comparable company and unlever its beta and use this unlevered beta as a proxy for the unlisted company's beta.

27. What is net working capital?

Net Working Capital = Current Assets – Current Liabilities

Current assets include items on the Balance Sheet like inventory, accounts receivable, prepaid expenses, and other short-term assets. Current liabilities include items such as accounts payable, accrued expenses, deferred revenue, and other short-term liabilities.

An increase in net working capital means more cash is tied up in the operations. This could be from increasing current assets like inventory or accounts receivable. If you increase inventory, for example, it is not (yet) a cost on the Income Statement, but still blocks the cash that was used for purchasing the inventory which needs to be accounted for on the CF statement. This is why in calculating free cash flow you subtract an increase in net working capital.

A decrease in net working capital means less cash is tied up in operations. This could happen due to changes such as increasing accounts payable or reducing inventory. If you reduce inventory, it means you are selling more goods than you are producing, which means you are realizing a cost on your Income Statement. If you are increasing accounts payable, you are preserving your liquidity by taking a little bit longer to pay your vendors for your raw materials/inputs.

Sample Answer: Net Working Capital is calculated as current assets minus current liabilities. It is a measure of a company’s ability to pay off its short-term liabilities with its short-term assets. A positive number means they can cover their short-term liabilities with their short-term assets. A negative number indicates that the company may have trouble paying off its creditors, which could result in bankruptcy if cash reserves are insufficient and further financing cannot be arranged.

28. What happens to free cash flow if net working capital increases?

Intuitively, you can think of working capital as the net dollars tied up to run the business. As more cash is tied up (either in accounts receivable, inventory, etc.), free cash flow will be reduced.

Remember that if the assets go up in value (denoting a purchase of assets), this is a use of cash; and if a liability goes up (denoting funds received), it is a source of cash.

Sample Answer: You subtract the change in Net Working Capital when you calculate Free Cash Flow, so if Net Working Capital increases, your Free Cash Flow decreases and vice versa.

29. How can a company raise its stock price?

Sample Answer: There are many ways a company can raise its stock price, a few of which are:

- A company can repurchase stock, which lowers the number of shares outstanding and therefore increases its value per share.

- It can improve operations to produce higher earnings, causing its EPS to be higher than anticipated by industry analysts, which will send a positive signal to the market.

- It can announce a change to its organizational structure such as cost-cutting or consolidation, which would lead to increased earnings in general.

- It could announce the institution of a dividend policy or an increase in an existing dividend.

- It can announce an accretive merger or an acquisition that will increase earnings per share.

30. If you were the Chief Financial Officer (CFO) of a Fortune 500 company, what would be your concerns? Explain from a high level what the long-term financial implications are for your company.

Sample Answer: Fortune 500 companies are usually in the mature stage of their business lifecycle. This means they have stable growth accompanied by a good amount of stable cash flows and balances. As a CFO of one, I would look out for signs of declining products or services to be discontinued while also actively keeping an eye out for opportunities to expand and grow, either through mergers and acquisitions or by increasing the spending on internal research and development.

WSO’s Bonus IB Interviews Tip From an Interviewer

Walk me through every calculation you are doing. I want to hear you think out loud.

- The process matters far more than your answer and gives you a chance to demonstrate a grip on the concepts.

I sometimes just ask for a simple calculation, along with "Are you sure?" to put on a little pressure and see how you respond.

- I am looking here for you to take five seconds, double-check your math, and answer with a confident, "Yes, I am sure."

Don't be afraid to say, "I don't know" to a tough technical question.

- As an analyst, I expect you to ALWAYS tell me when you don't know something, and never wing your way through an answer.

- If you give an, "I don't know" follow it with, "But here is what I am thinking. Tell me if I am on the right track."

- And walk me through your thoughts. This is a great analyst quality because it shows that you'll think about a problem critically before you call me and ask about it.

Being able to clearly, confidently, and consistently answer the 30 technical questions bank-specific questions above will undoubtedly give you a competitive edge over the applicant pool. However, to achieve full technical mastery, it is critical you expect technical questions that are specific to each of the investment banks.

The following section features 14 exclusive questions (2 per investment bank) for 7 of the biggest investment banks in the world, to help kickstart your training process for your interviews and superdays .

The following questions have been taken from WSO's company database which is sourced from the detailed experiences of more than 30,000 people with IB interviews. The WSO IB Interview Course includes access to over 4,000 interview questions across 400+ banks (no other resource comes close).

Goldman Sachs IB Interview Questions

At a high level, there are 5 steps to an LBO:

- Calculate the total acquisition price, including the acquisition of the target's equity, repayment of any outstanding debt, and any transaction fees (such as the fees paid to investment banks and deal lawyers, accountants, consultants, etc.)

- Determine how that total price will be paid, including: - Equity from the PE sponsor, - Roll-over equity from existing owners or managers, - Debt, seller financing, etc.

- Project the target's operating performance over ~5 years and determine how much of the debt principal used to acquire the target can be paid down using the target's FCF over that time.

- Project how much the target could be sold for after ~5 years in light of its projected operating performance; Subtract any remaining net debt from this total to determine projected returns for equity holders.

- Calculate the projected IRR and MoM return on equity based on the amount of equity originally used to acquire the target and the projected equity returns upon exit.

- An increase in cash flow causes an increase in future value (FV)

- An increase in the growth rate of future cash flows

Factors that may cause a company's PV to decrease:

- Increased discount rate

- Delay in receiving future cash flows

- Reduction in the growth rate of future cash flows

JPMorgan Investment Banking Interview Questions

Sample Answer 2: The Nigerian election takes place in February. Four years ago, President Muhammadu Buhari gained power on a surge of optimism, pledging to restore security and end corruption. His Presidential record has been mixed, and his popularity and health have declined (he recently denied rumors of being replaced by a body double). The old regime may regain political power, impacting the free flow of goods through the country.

An increase in the interest rates will affect the cost of borrowing for companies. This means a lesser amount of funding from banks, which leads to companies having slower growth on average as compared to before the interest rate hike.

The higher cost of borrowing will also affect DCM. I would expect companies to issue fewer bonds or maintain the same capital structure but cut back on other expenses e.g. layoffs. Given the slower growth of companies, I would expect lesser interest from investors on IPOs. The slower growth and low valuations will then lead to an increase in M&A by strategics. On the other hand, the higher cost of borrowing might reduce the amount of leveraged M&A activity at the same time.

Overall, I feel that the increase in interest rates will affect M&A and capital markets negatively, and thus hiring will be down next year.

Morgan Stanley Interview Questions

- Retail or Airlines: EV / EBITDAR (Earnings Before Interest, Taxes, Depreciation, Amortization & Rental Expense)

- Energy: EV / EBITDAX (Earnings Before Interest, Taxes, Depreciation, Amortization & Exploration Expense), EV / Daily Production, EV / Proved Reserve Quantities

- Technology (Internet): EV / Unique Visitors, EV / Page views

Note: Feel free to use multiples that you have picked up from other sources. These are for illustrative purposes.

An earthquake would cause the country’s GDP to immediately decline sharply due to the immediate effects of the earthquake as a lot of productive resources may be put out of use. But then the GDP growth will start to increase to an above-average level as there would be an increased amount of spending on rebuilding the infrastructure.

Citigroup Interview Questions and Sample Responses

Yes, a company could have a negative book equity value if the owners are taking out large cash dividends or if the company has been operating for a long time at a net loss, leading to the company having to take on debt to fund loss of cash. Eventually, equity can be negative implying that the entire operation is funded by debt.

This question is a lot more broad, giving you a lot of room to work with. A common method of answering this question would be bringing up 2-3 different types of financial risk concepts, giving a straight definition as to what they are, and following up with an example to demonstrate applied understanding.

Credit Risk - This is the risk of a possible loss being incurred by a business or an individual, should their borrower fail to repay a loan or meet contractual obligations. It is impossible to quantify credit risk and precisely predict which borrowers will default on loans, but there are risk management teams built to minimize a business’ risk and manage their credit exposure. An example of credit risk would simply be a bank lending a citizen a loan of $100,000 to start their business as an entrepreneur, on which the bank incurs the risk of not having the loan repaid should the citizen’s business go bankrupt.

Another related type of risk would be,

Interest Rate Risk - This is the risk incurred where there may be a reduction in the value of investment assets should the interest rate environment change drastically in a short period. An example of this would be that if interest rates increased, the value of fixed-income investments would decrease.

BoA Sample Questions on Superday

Terminal Value or TV is the value of any investment at the end of the investment period. This will usually assume a constant growth rate into the future. it can be calculated by applying an exit multiple to the company’s last projected year’s EBITDA, EBIT, or Free Cash Flow (multiples method). Alternatively, the Gordon Growth method can be used to estimate TV based on its growth rate into perpetuity.

The formula for calculating TV without accounting for growth is: Expected cash flow / (1 + Required rate of return)^Time

The formula for calculating TV using Gordon Growth is: Terminal Value = Expected dividend / (Required rate of return – Growth rate).

The investment banking division is sometimes referred to as corporate finance and is broadly split into 2 sectors, products and industries. The purpose of both is to provide advisory on transactions, mergers, and acquisitions and to arrange (and sometimes even provide) financing for these transactions.

Investment banking product groups are broken down into:

- Leveraged Finance (LevFin) - Issuance of high-yield debt to firms to finance acquisitions and other corporate activities.

- Equity Capital Markets (ECM) - Advice on equity and equity-derived products (IPOs, shares, capital raises, secondary offerings, etc.)

- Debt Capital Markets (DCM) - Advice on raising and structuring debt to finance acquisitions and other corporate activities.

- Restructuring – Improving the structures of a company to make it more profitable or efficient.

Credit Suisse Interviewing Questions

M&A seems to be off the table because REITs have low cash balances and can't do stock issuances because they would be dilutive. Therefore, my advice would be to basically sell assets in non-core markets to raise cash.

Company A’s EPS is $10 / 10 = $1.00. To complete the deal, Company A must issue 6 ($150 / $25.00) new shares which means that the combined share count after the deal is 16 (10 + 6). Since no cash or debt was used and the tax rates are the same and the combined net income = Company A net income + Company B net income = $10 + $10 = $20. The Combined EPS, therefore, is $20 / 16 = $1.25, which is an increase of 25% in the EPS, and this is what is called accretion.

UBS Questions Asked by Interviewers

Thinking of cash flow/share the same way as earnings per share, the PE for A is 2.5 and B is 2.5. As both their EPS are equal, the transaction is neither accretive nor dilutive.

You need to remember that the leverage multiple stands for Debt/EBITDA; so calculating out the leverage multiples, you will see both A and B are leveraged at 2.5, hence, the combined leverage multiple of A and B is still 2.5; if the transaction is equity-financed, the leverage would decrease and the company would be de-leveraged; deals are usually more accretive with debt due to tax deduction on interest expense.

Most Common Technical Interview Question - WSO Bonus:

15. “pitch me a stock”.

Many interviewers will ask you in one way or another to pitch a stock if you have any experience with trading, a private wealth management internship, a hedge fund internship, or anything that deals with market transactions. If this is you, spend 30 minutes to a couple of hours finding a stock you like and why. Even if it doesn't get asked, it's always better to be safe than sorry. Here's a good explanation of how to answer this question.

Do you have an M&A group interview coming up? Or perhaps an ECM superday right around the corner? We’ve got you covered.

The following 16 group-specific questions have been taken from our forums and company database where over 30,000 candidates have reported their interviewing experiences for different divisions within investment banks.

The following questions and sample answers will help you achieve specialized focus and demonstrate expertise for the group you’re interviewing for.

Mergers & Acquisitions (M&A)

The main reason two companies would want to merge would be the synergies the companies could create by combining their operations. However, some other reasons include gaining a new market presence, an effort to consolidate their operations, gaining brand recognition, growing in size, or gaining the rights to some property (physical or intellectual) that they couldn't gain as quickly by creating or building it on their own.

A strategic buyer is generally a corporation that wants to acquire another company for strategic business reasons such as synergies, growth potential, etc. An example of this would be an automobile maker purchasing an auto parts supplier in order to gain more control of their COGS and keep costs down.

A financial buyer is generally a firm looking to acquire another company purely as a financial investment. An example is a private equity fund doing a leveraged buyout of the company.

Leveraged Finance (LevFin)

- Credit card

A car loan is riskier than a home loan because a car loses its value much quicker. To compensate for the higher risk profile and lack of collateral, credit card companies charge much higher interest rates when compared to a typical car loan and mortgage while the risk associated with a lower value of collateral in car loans is why they carry higher interest rates compared to mortgages.

The software company because of recurring revenues from annual contracts that are even more guaranteed than a hardware store, assuming that both companies are mature.

Debt Capital Markets (DCM)

Think about how bonds are priced – based on their discounted future cash flows. If any of those cash flows is in doubt, then the bond's value falls accordingly. (Think of a UST bond as being priced with risk-weighted cash flows of 100%. A BBB bond might be priced with risk-weighted cash-flows of 95%, just as an example - although in reality the bonds are priced with a spread/all-in yield that implicitly contains the risk, rather than calculating the risk % driving the spread). So any macro event that would impact companies' profitability/cash flow would affect the price of corporate bonds. That said, corporate bond spreads are more driven by micro factors than by broader economic trends unless those economic/systemic factors are very pronounced.

The price and yield of a bond move inversely to one another. Therefore, when the price of a bond goes up the yield goes down.

The reason for this is that the return on a bond (when annualized, this is called yield) is the difference between its current price and future repayment (generally bonds are redeemed at par). The lower the price, the higher is the return as the repayment is constant regardless of its price. As the price increases, the return reduces thereby reducing the yield.

Let’s understand this better with the help of an example. Let’s assume a bond can be redeemed at a par value of $100 on maturity (one year from now). Let’s now assume that the bond is trading at $80. The yield on the bond can be calculated as 25% ((100/80) - 1). What if the price instead was $90? The yield reduces to 11.11% ((100/90) - 1). Hence, higher prices mean lower yields and vice versa.

Equity Capital Markets (ECM)

An Initial Public Offering or IPO is the very first sale of stock to the public by a private company. This is also known as “going public”. Two kinds of companies will undertake an IPO:

- Startup companies looking to raise capital and investors

- Large private companies looking to become publicly traded

To find out more about IPOs, check out WSO’s “What Is An Initial Public Offering (IPO)?” page here .

Since a private company has no market capitalization and no beta, you would most likely use the WACC for a comparable public company adjusted upwards for the lack of liquidity.

Restructuring

This depends on the formal definition of the leverage ratio, but assuming debt/EBIT is implied we can set up two simple equations:

- Debt/EBIT = 5

- EBIT / (Debt * Interest rate) = 5

Solving these equations we find that the interest rate is 4%.

Assuming operating income is EBIT, add back depreciation (a non-cash expense) and deduct CAPEX to get Unlevered Free Cash Flow (UFCF) = 35. Then deduct the interest expense but add back interest tax shield, for the net expense of $9 (15 * (1 - 40%)) assuming 40% tax rate. This gives us a Levered Free Cash Flow (LFCF) of $26.

Value, because the payoff will be quicker. In high inflation periods, short-duration equities are favored as cash flows are eroded less by the higher cost of capital imposed by higher inflation. Growth equities need a longer holding period before capital yielding projects are realized, at which point the discount factor will be higher making them subject to more erosion from inflationary pressure.

It depends, if the product portfolio of the company is vastly different with varying risk profiles, then it would not be right to use WACC as the discount rate. The discount rate is the cost of capital. If the risks in each product line are vastly different, so should the cost of capital. Using a broad stroke denominator such as the company's WACC would not be right in this case.

Sales & Trading (S&T)

Two steps. I’d look at what they’re interested in, and then I’d look at how they wanted to change.

Quite impossible for equities, 0 beta would be risk-free like treasuries. You would have to find two industries that were negatively correlated to remove idiosyncratic risks.

Risk Management

They earn revenue through APR, interchange, late fees, and subscription fees and their primary costs are operations and marketing-related expenses.

Tapering is a balancing act to reverse the effects of quantitative easing once its objectives have been achieved. The Fed must consider the right rate of implementation so as to not lead the economy into a recession.

Are you looking for questions that are unique to particular IB group that you are interested in joining? Do you have an interview coming up and have preferences on what industry you want to join? We've got you covered.

The following 16 industry-specific questions have been taken from our forums and company database where over 30,000 candidates have reported their interviewing experiences for different divisions within investment banks.

The following questions and sample answers will help you achieve specialized focus and demonstrate expertise for the industry you're interviewing for.

Consumer & Retail

The answer to increasing your margins while having lower revenue is to cut back on expenses. Revenue - expenses = gross profit and gross profit/revenue = gross margins.

The increase in shareholders equity would be equivalent to the increase in assets (x), due to the effect of the equation below: Assets = Liabilities + Shareholders equity.

Assets are recorded at cost (what you paid for them).

Energy and Utilities

The main regulatory hurdle that the power sector faces is distributed electricity generation. Distributed generation poses a threat to existing power utilities because it takes away power demand from them.

However, there are a number of ways in which to handle this emerging trend. One way is to structure tariffs in a way that increases affordability. The other is to offer time-of-use tariff structures that can flatten the duck curve , which occurs when renewables ramp down in the evenings, exactly when electricity demand is highest.

If we assume it’s a single asset company, we can estimate the capital efficiency based on historical data and apply it against the company's CAPEX forecast to reach a "new additions" production estimate. From there, applying the historical asset production decline rate against "base" production and summing the numbers together leads us to a forward estimate.

Financial Institutions Group (FIG)

WACC decreases at low levels of leverage due to the tax shield created by interest payments and then increases exponentially due to the increasing riskiness of investing in a highly levered company.

A DCF involves predicting the unlevered free cash flows that a business will generate, discounting it into the present and then adding it up to get the enterprise value.

A DDM on the other hand only looks at dividends the company pays, and then divides it using the required rate of return to find the value of equity.

A DCF typically spits out an enterprise value whereas DDM is an equity value based on the present value of projected free cash flow to equity (% of dividends for a bank since they have regulatory capital requirements, which is a limiter on growth assumptions on a bank DDM).

Comps are more market-based and sensitive to environmental trends, such that in times of high valuations (such as now), comps > DCF, and in times of lower than FMV valuations, DCF > comps.

This is because biotech companies don't operate in perpetuity, we assume that once the patent ends, generics will flood the market driving profits close to zero.

Industrials

Levered beta measures the risk of a firm with debt and equity in its capital structure to the volatility of the market. Unlevered beta removes the debt component.

Take terminal year EBITDA, calculate TEV using current EV/EBITDA multiples of comp set, and take the present value of that total.

Natural Resources

1. Upstream 2. OFS 3. Downstream 4. Midstream

Upstream is likely to be the most volatile, due to its association with risk of exploration and sensitivity to prices. OFS is second because it's adjacent to upstream. Downstream is third because demand is relatively inflexible and is subject mostly to price sensitivity. Midstream is the lowest beta because it's a volume business.

A Section 338(h)(10) election blends the benefits of a stock purchase and an asset purchase.

- Legally it is a stock purchase

- However, accounting-wise it’s treated as an asset purchase.

- The seller is still subject to double-taxation – on its assets that have been appreciated and on the proceeds from the sale.

- The buyer receives a step-up tax basis on the new assets it acquires, and it can depreciate/amortize them so it saves on taxes.

Even though the seller still gets taxed twice, buyers will often pay more in a 338(h)(10) deal because of the tax-savings potential. It’s particularly helpful for:

- Sellers with high NOL balances (more tax-savings for the buyer because this NOL balance will be written down completely – and so more of the excess purchase price can be allocated to asset write-ups).

- If the company has been an S-corporation for over 10 years – in this case, it doesn’t have to pay a tax on the appreciation of its assets.

The requirements to use 338(h)(10) are complex and bankers don’t deal with this – that is the role of lawyers and tax accountants.

- Find key ratios LTV, DSCR, Debt Yield - Assess property value - Assess similar properties in the area - Go over potential covenants

Some statistics to consider in such a situation would be,

- Market Stats (Cap Rate, Rent, Vacancy)

- Asset Class

- Value add or Core

Technology / Media / Telecom (TMT)

MOIC’s simplistic calculation tells investors how much money they’re ultimately receiving from an investment while IRR includes the impact of time over which the returns were generated.

Considering the government measures involving lockdowns, in-store purchases are likely to decrease therefore lowering profits. This can, however, be countered by Apple building an extensive or expanding on its current online infrastructure to ensure an optimal and sustainable online shopping experience for customers.

You've reached the behavioral/ fit interview. This means that the firm believes you are smart enough for the job. At this point, the little things matter. Fit questions are a major part of the IB analyst interview. The focus of fit questions is to see who you are and how you would fit into the firm's culture.

This section features 12 of the most common behavioral/fit questions you are likely to be asked during your interviews, followed by an exclusive set of 7 bank-specific (from 7 bulge bracket banks) behavioral questions to support you in tailoring your response to each bank and walking out with an offer.

1. What are some of your strengths?

If you can, bring up a strength that doesn’t appear on your resume but could catch attention. For example, if you have performed in concert or theatre all your life, learning to be poised in front of strangers and/or large groups, it may be a good strength to share.

2. What is the one word that describes you best?

Motivated, smart, driven, humble, efficient. All of these are good options to use. Make sure to have an example to back up whatever word you choose with a specific story.

3. What has been your favorite class in college and what was your grade?

The course you name should have something to do with business/finance/economics, and the grade you report should be a good one. If you say your favorite class was “dancing”, why are you looking to go into finance? Why do they want to hire you?

It is worth noting however, you must have a genuine justification and rationale behind claiming a finance class was your favorite. If you do not have a compelling reason behind your answer, interviewers will call your bluff and see through it easily.

4. “What is the most important thing your resume doesn’t tell me that I should know?”

Talk about a skill that is unique to you (something that makes you memorable) and that cannot be documented on a resume. Think about things like your communication skills, teamwork skills, etc…not your math skills, which can be seen in GPA or SAT scores. Once you decide on the quality you want to present, illustrate it with a story from your life. A common variation of this question is “What separates you from the last person with your GPA from your school?”

Sample answer: Ever since my freshman year of high school, I have loved to perform. I was in the musical each year of high school, and have had a lead role in a play each year in college. This has allowed me to develop a comfort speaking in public situations, and with people, I don’t know or have just met. I think that this will be an extremely valuable skill in finance, speaking with clients, on the phone, and when presenting my work to my coworkers.

5. “Tell me about a time that…”

There are countless variations of this question, from “Tell me about a time you acted with integrity” to “Tell me about a time that you had difficulty dealing with coworkers”. It is key to have a well-rehearsed response for each of them, and a general guideline to follow.

Ideally, you can come up with 6-8 stories that cover the 30-40 basic questions, with only slight modifications. DON’T wing it. For every potential question, map out the story using the SOAR framework.

Describe the Situation (10-15 seconds), Obstacle (10-15s), Action (60-75s), and Result (15-30s). Stories for these questions should be 1.5 - 2 minutes long and focus only on what's important.

6. What is your biggest weakness?

Seeing as to how common this question is (even outside of the finance industry), we have a dedicated page for this question to support you in answering it perfectly during the interviewer. The “Good Responses To Biggest Weakness Questions” page can be found here .

7. What are you looking for in this job?

The interviewer wants to make sure you are aware of what this job entails, and what most analysts get out of the experience. You should acknowledge the long hours and the heavy workload while making it clear that you are ready to take on the challenge. Emphasize the appeal of a great learning experience that you would be unable to get in any other job straight out of school. Explain how you relish the prospect of pushing yourself and being challenged to do your best work in this job, and working with and learning from successful people.

Sample answer: I am going into this as an unparalleled learning experience. Everyone I have spoken to within the industry tells me you learn everything on the job. While my undergraduate studies prepared me for business, I know that most of the skills I need will be acquired on the job. I understand the hours and the workload, and I want to work incredibly hard to gain real-world experience that isn’t available in any other profession at this stage in my career. I know these skills will prepare me for anything I want to do later in my career.

8. What has been your favorite job so far?

If possible, pick a job that requires similar skills to the job for which you are applying and explain why those skills or requirements made it you're favorite. Talk about how you were forced to learn on the fly or multi-task or think critically because those are all skills you will need in finance.

9. What has been your least favorite job so far?

Talk about a job where you were bored, or not challenged, or not busy. None of those things will be the case in finance so they won’t be an issue.

10. What competitive activities have you participated in, and have they been worthwhile?

Finance is competitive. Firms are always competing for business and colleagues can even be competitive with one another (although most won’t admit it). You need to show that you are comfortable in competitive situations, but still can act with class and show respect.

Sample answer: I played varsity football in college. We won the conference 2 consecutive years and played at the NCAA tournament. Working with my teammates to accomplish a common goal and beat the competition was an amazing experience, really exhilarating.

11. If you had a million dollars that you weren’t allowed to invest, how would you spend it?

Make sure your background backs up whatever answer you give. If you have never volunteered in your life, don’t say you’re going to donate your money to a non-profit and go work for them. Have it relate to something you are interested in, and make sure that whatever you are spending it on can cost roughly a million dollars.

12. What are you interested in?

There are two ways that you can answer this question properly and you may want to explore both in your answer. First, you can mention things that you are interested in that are job-related like keeping up with current events, studying for the CFA, etc. Second, you can speak about your hobbies and your interests outside of work. The latter works great if you happen to share an interest with your interviewer. Hint: If you know the names of your interviewer you can do a little research beforehand and see if you can find any common interests so you can push the conversation in that direction.

WSO's Bonus Tip

"Once you get yourself in that room, I don't care about your GPA or what else you have on your resume. I am looking for 3 things, A connection with myself and the firm's culture, Will you be able to do the work? and Do you have a passion for the job?"

As taken from our forum .

Knowing the culture of each bank before walking into an interview is key to clicking with the interviewer and walking out with an offer.

The following section features 7 exclusive questions for 7 of the biggest investment banks in the world, to help you jump start your training for the respective investment banks you are interviewing for.

The following questions have been taken from WSO’s company database which is sourced from detailed IB interviews experiences of more than 30,000 people.

1. What do you like to do outside of school and work? (Goldman Sachs Behavioral Questions)

Ideally, the interviewer is looking for anything you can speak genuinely and passionately about, and support it with examples of your dedication towards it from your past experiences.

2. What makes you stand out / What should we remember you by? (JP Morgan Fit Questions)

This is similar to the ‘What are your strengths?’ question. Have a concise 30-second pitch prepared. Concentrate on the three main bullets highlighted in the introduction, and identify three of your traits that manifest those qualities. Examples include things like being extremely driven, never giving up, wanting to learn, looking for challenges, etc. Make sure you take only 20-30 seconds and speak with confidence, but make sure to avoid arrogance.

3. What are your leadership involvements outside of finance? (Morgan Stanley Fit Interview)

It is important to show that you are comfortable taking up a leadership role or working under the leadership of someone else. It is important to be able to do both. Talk about past projects that show you being successful in both types of roles. Talk about your teamwork skills (communication, collaboration, etc.) and how those skills are effective when you are the leader as well as when you are supporting someone else’s leadership.

4. Why Citi? (Citigroup Soft Skills Evaluation)

This question can generally be asked by any bank, and the preparation routine is consistent across all such banks. Ideally, you want to tie in and present an alignment between your interests and values, with the firm’s culture, and support this with examples.

An exceptionally strong way of demonstrating this would be networking with current investment bankers at the bank, and talking about the appreciation you felt towards the characteristics of those you networked with (refer to specific people wherever possible) and concluding with how that makes you feel the bank would be a great place to work.

5. What do you consider the biggest negative about this job? (Bank of America Behavioral Questions)

Your interviewer is giving you a chance to give a “negative” about the job and explain why you don’t see it as a negative. The overwhelmingly popular response to this question is the lack of work-life balance, long hours, very unpredictable schedules, etc. Quickly mention the negative and then move on to why it doesn’t bother you.

Sample answer: I have been fortunate enough to have a lot of contacts who work in finance, and their usual response to this question is the long hours. However, every single person I have spoken with has said that they enjoy their job and they think the hours are worth it. This job will give me 4 - 5 years of work experience in only two years. It’s an opportunity I crave and a learning experience I don’t want to miss. I am ready for the challenges and I want to show that I can handle them.

6. How important do you think it is to be maintaining connections in this industry? (Credit Suisse Fit Assessment Question)

While networking is generally seen as important for advancing one’s professional career irrespective of industry, there is significantly more weight placed on its value within the investment banking industry relative to other industries. Ideally, your answer should acknowledge this fact, and you should support this with examples of you maintaining connections with a variety of professionals and the insights you have learned through their shared experiences.

7. What are your hobbies? (UBS Behavioural Interviews)

This question is quite a personal one, so feel free to expand upon this as per your choice. One key point we’d like to iterate is that it is disadvantageous to “fake” an interest or hobby with the intent of faking a “click” with your interviewer. Interviewers can often see through this, and it could potentially harm your chances of getting an offer.

It is much more beneficial to highlight a hobby that requires a set of transferable skills or values to IB, such as competitive sports (which involve having a strong work ethic), and passionately speaking about them.

Everything You Need To Break into Investment Banking

Sign Up to The Insider's Guide on How to Land the Most Prestigious Jobs on Wall Street.

6 Logical Puzzles - Interview Brain Teasers

Logical puzzles, brainteasers, and riddles are an important part of the interview process as they allow the interviewer to determine your critical thinking abilities.

For this section of the interview, interviewers aren’t focused on whether you get the right answers or not. Rather, they are interested in your thought process while solving the riddles you are presented with.

Given this, it is key to walk your interviewer through your thinking as you progress through the riddle, who may even probe you with questions to assist you. Giving them a rundown of your thoughts and occasionally asking if you’re headed in the right direction demonstrates your capabilities to reflect, and approach a problem with composure.

It is still, however, extremely useful to anticipate these logical puzzles beforehand to avoid being put on the spot and caught off guard in the interview. The following section has 5 commonly asked logical puzzles that you can prepare for beforehand to impress your interviewer.

1. A room with no windows has 3 light bulbs. You are standing outside with 3 switches that control each of the three bulbs. If you can only enter the room once, how can you determine which switch controls which bulb?

Answer: First, turn on two switches: call them Switch 1 and Switch 2. Leave them on for a couple of minutes to let them get nice and hot. Then, turn off Switch 1 and enter the room. The bulb that is lit should be the one that is controlled by Switch 2. Of the remaining two bulbs, the hot one is the one controlled by Switch 1. The last one, off and not hot, is controlled by Switch 3.

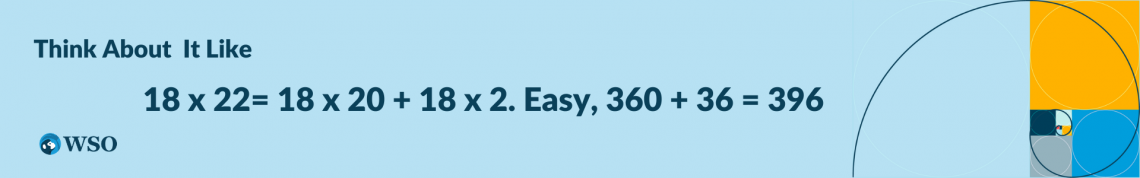

2. What is 17 squared? What’s 18x22?

Answer: Don’t worry; they want to know how you will handle this question, and it is not difficult if you think about it correctly.

Think 17 x 17 is just 17 x 10 plus 17 x 7. You know 17 x 10 is 170. Now 17 x 7 is 10 x 7 and 7 x 7. This gives you 170 + 70 + 49, or 289. Whatever you do, don’t panic!

Now see if you can do 18 x 22: 18 x 20 + 18 x 2. Easy, 360 + 36 = 396.

As far as brainteasers go, this is a rather common one. You will do better if you have practiced these types of questions.

3. How many NYSE-Listed companies have 1 letter ticker symbols?

Answer: It could be 26 (letters in the English alphabet), but it is only 24 because I & M are saved for Intel and Microsoft, in case they change their minds.

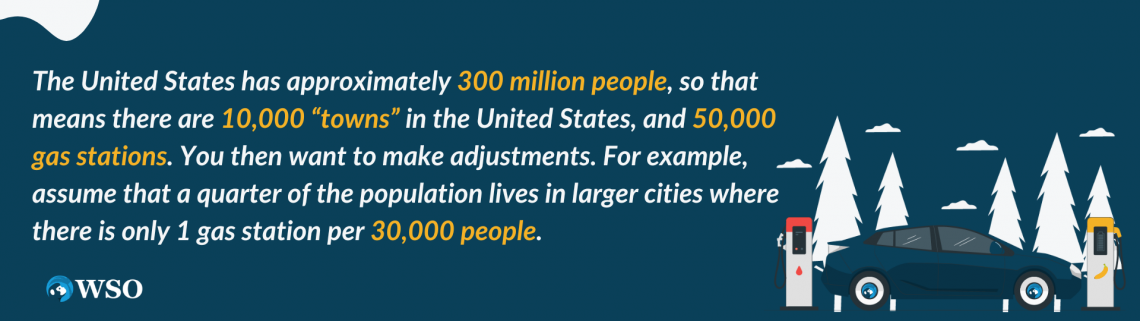

4. How many gas stations are there in the United States?

Answer: With a question like this, the interviewer is looking at your thought process, not that you can figure out how many gas stations are in the U.S.

The easiest way to go about answering a question like this is to start small and work your way to the bigger question. Think about your town. Say your town has 30,000 people, and you have 5 gas stations serving that area.

So you have 7,500 towns with 5 gas stations and 2,500 “towns” with only 1.

Do a little mental math and you get the number of 40,000 gas stations in the U.S.

5. A stock is trading at 10 and 1/16. There are 1 million shares outstanding. What is the stock’s market cap?

Answer: This is just a test of your mental math. If a fourth is .25, an eighth is .125, and a sixteenth is .0625... The stock price is 10.0625 and the Market Cap is 10.0625 million.

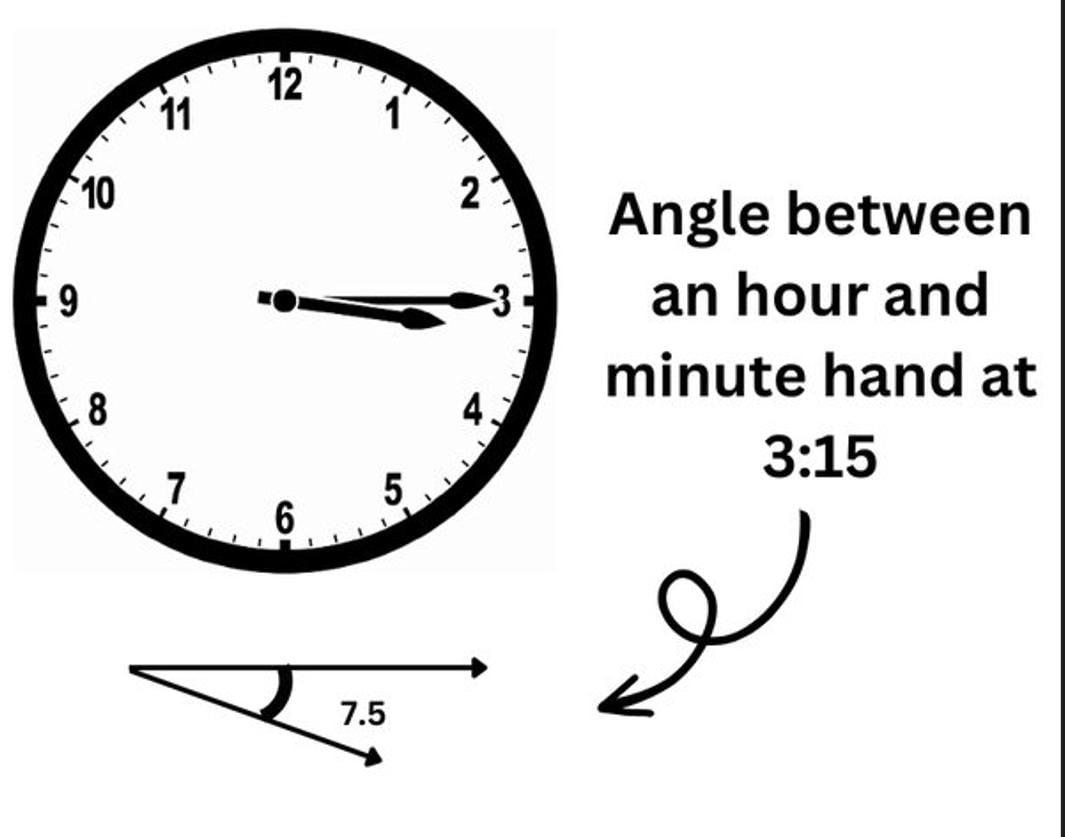

6. How many degrees are there between a clock’s two hands when the clock reads 3:15?

Answer: The quick thought would be 90 degrees, but it isn’t. If the clock is 360 degrees, the minute hand will be exactly at the 90-degree mark. The hour hand will be ¼ of the way between the 3 and the 4. Since there are 12 numbers, the 3 and the 4 are 30 degrees apart, making the hour hand 7.5 degrees beyond the 3, and 7.5 degrees from the minute hand. The picture below helps illustrate this better.

Questions To Ask The Interviewer at the End

After approximately an hour of drilling from the interviewer, here you are, at the very end. The interviewer looks at you and asks, “Do you have any questions for me?” This is your last and best chance to leave a lasting impression, so ask a thoughtful question for which the answer cannot be found with a simple google search.

Some of the questions WSO recommends are

- I bet you were in my shoes a few years ago - what initially attracted you to X bank?

- How would you describe the culture here?

- Can you talk about your role in the last [M&A, ECM, DCM] deal you worked in and what specifically you learned from it?

These questions have been taken from “What Are Some Good Questions To Ask The Interviewer At The End Of The Interview?”, posted by WSO user @soontobe. Check out his full post with additional questions here .

Once you have asked your question, listen sincerely to the interviewer’s response. They want to see if you are genuinely interested, and not simply asking for the sake of asking. Take down notes occasionally if you have to.

As you wrap up, thank the interviewer once again for their time and shake their hands firmly. Sometimes an interview may go extremely well, while at other times not so much so. Irrespective of the situation, show respect and leave on a positive note with the interviewer. A thank-you email a few hours after the interview is generally appreciated.

Resources to learn more about sending thank you emails after interviews:

- The Muse - How to Write an Interview Thank You Note Email Template

- Indeed - Sample Thank You Letter After Interview

- Zety - Thank You Email After an Interview

- The Balance Careers - Thank You email After Job Interview

- Career Sidekick - Thank You Note After Interview

Having mastered all the technical and behavioral/fit questions, as well as logical riddles above, you are in an exceptionally strong position for your IB interviews.

However, there is much more to excelling in IB interviews than simply memorizing sample questions and answers. In a pool of highly qualified and competitive candidates, interviewers look for more than someone who simply aces technicals.

They look for a candidate who would fit right into the company, who are able to stand out and showcase their strengths in a way their competition can’t match.

Given this, it is no surprise that the most successful candidates go above and beyond in the preparation process, taking the time to master the art of selling themselves in an interview and clicking with their interviewers. They build upon their social skills, and utilize these soft skills to steer the direction of the interview in their favour, giving them an upperhand which cannot be matched.

When considering this, it is not a stretch to say one’s soft skills play just as much as a role in their interview’s outcome as their technical skillset.

If you’d like to get started on learning these powerful tips, here are some additional resources from WSO’s hall of fame.

3 Tools That Will Take You A Long Way

- Read Dale Carnegie's How To Win Friends and Influence People : If you have read it, read it again. Take the time to practice every single one of the principles over and over again. You can become excellent at communicating with this one book, and if you are ambitious, please check out Influence by Robert Cialdini .

- Master selling: Again, people think of selling as something you either have or you don't. WRONG. Selling is a skill that brings together preparation and the skills of communications and influence. Read How to Master The Art of Selling by Tom Hopkins . If you are serious, consider creating a Selling Black book to sell your most valuable commodity - YOU.

- If you're bold, dip your toe in the water and learn the most advanced skills of influence - NLP and conversational hypnosis. As part of this, you will learn nuances of language and non-verbal communications that few people even know about. It's hard to learn from a book, so feel free to google for courses on NLP.

Note: This tip was provided by WSO user @geoffblades, A former investment banker at Goldman Sachs and investor at the Carlyle Group. The full writeup by him, “How Do You CRUSH Your Interviews?”, can be found here .

Show Them What They Want to See

Your general personality will come out throughout the interview - there is no hiding it. Being able to do the work well is shown through the confidence you display while answering the general questions along with how well you answer the technicals.

Showing passion is a little more difficult, but it comes out in different ways. A few things that make the interviewer say “This kid knows his stuff” are:

- How excited you are to answer questions,

- The level of detail that you can answer a technical question

- The types of questions that you ask when I tell you about what I do and the product that I trade.

Chances are, showing passion comes from a combination of those examples.

Additionally, this is learned more with experience, but there comes a point in the interview where you have the ability to gain control of the interview and steer it in the direction you want. If you're having a conversation about China or Michael Lewis, you can keep it going by talking about another book that you have read. If you are asked a question, you can answer it in a way that almost guarantees the next question, which you will be prepared for.

The number of choke points in an interview where you can gain control and dictate flow is endless, you just need to learn how to spot them.

Note: These are 2 of 10 tips by WSO user @Gekko21. His full writeup, “Gekko's Guidance (10 Rules To Interviewing) - Part 1” can be found here .

So If You Want To Give Yourself A Leg-Up In Getting An Interview (Written by an interviewer)

Below are a few tips to help give you a boost in your investment banking interview:

- It helps to have a high GPA but is not a guarantee for anything.

- You SHOULD address the question of "Is he/she interested in banking?". If you've never interned in finance and are a non-traditional major, you should be actively involved (pref. at a senior level) in the finance clubs, you should participate in finance/modeling training seminars sponsored by your school, or have a section under interests with "Readings'' or "Favorite Books'' that have a finance tinge to them (more “ When Genius Failed ” or “ Fooled by Randomness ” or “ Barbarians at the Gate ”, less “ Monkey Business ” or “ Liars Poker ”)... Wall Street Journal , DealBook , FT , etc... I wouldn't advise adding that section if the rest of your resume already sells your finance interest... otherwise, it’s overkill and you seem uninteresting and boringly uni-dimensional. You want to be well-rounded.

- Formatting is EVERYTHING and there is NO excuse for typos or inconsistencies in formatting.

The full undergrad recruiting series from our forums is available here:

- UG Recruiting Part I: How A Resume Becomes An Interview

- UG Recruiting Part II: The First Round Interview

- UG Recruiting Part III: The Super Day And Offer

What is Hirevue?

Hirevue is a video conferencing program built to reduce hiring time for their clients whilst still attracting and acquiring talented candidates. Hirevue is used by many major banks including Goldman Sachs, JP Morgan, and Morgan Stanley.

How does Hirevue work?

Hirevue gives candidates a certain set of questions to answer during the interview process, in which their answers are recorded and then analyzed using artificial intelligence (AI). The results provide insights into candidates which investment banks then use to make informed hiring decisions.

The AI tracks and analyzes verbal, as well as non-verbal cues such as facial movements, body language, speech formation, as well as attire, and clothing. These data points are then processed by algorithms and generate results (employability score) allowing employers to predict a candidate’s performance on the job based on their presentation during the interview.

What are the questions asked in Hirevue interviews?

Hirevue aims to predict your capabilities for the job you’re applying for based upon your soft skills and presentation of yourself during the interview. As such, the interview consists of a majority of behavioral questions (as covered above), with some banks not even asking a single technical question to candidates.

The following is a list of 15 sample questions Hirevue has previously asked candidates during interviews, credit to The University of Colorado .

- Tell me a little about yourself.

- What are your long-term career plans?

- What made you leave your previous job?

- Tell me about your strengths and weaknesses.

- Why do you want to work here?

- What makes this position a good fit for you at this point in your career?

- Tell us how your experience and training have prepared you for this position.

- Give us your understanding of our organization

- Tell us about a time when you had to balance multiple priorities. Please give an example that demonstrated how you navigated completing work priorities to attain the best result.

- Describe a work scenario in which you were faced with competing priorities. How did you juggle them all and still meet everyone’s expectations?

- Describe a high-pressure situation (either within a work setting, or beyond) that you were put in unexpectedly. How did you adjust and still create a successful outcome?

- Tell us about a time you were most creative.

- What do you enjoy about working in customer service? What do you dislike or find challenging?

- Explain your approach to completing multiple assignments in a workday.

- Tell us about a mistake you’ve made on the job and what you learned from it.

The following youtube video by Afzal Hussein , an ex-Goldman Sachs employee, shows him covering 18 questions and answers asked by J.P.Morgan’s Hirevue interviews.

WSO’s bonus tips to excelling in Hirevue interviews:

- Dress appropriately (especially for investment banking interviews) This is pretty self-explanatory, make sure you are dressed well and look presentable.

- Rehearse and practice You’re at an advantage with Hirevue as you can anticipate which questions are going to be thrown at you. Prepare for these questions beforehand, rehearse and practice your stories. Record yourself and replay it, find places to improve, and repeat the process until you are able to consistently and confidently answer questions. Ideally, the actual Hirevue interview itself should simply be a rehearsal of your past practice sessions, nothing should be catching you off guard. If you want the upper hand, ask your close friends and other respectable people in the industry to review your recordings and offer feedback. Perfect your delivery, practice makes perfect.

M&I 400 Investment Banking Questions Guide vs WSP’s The Investment Banking Interview Guide (The Red Book) vs WSO’s Investment Banking Interview Prep Course

One question we receive a lot from students and professionals alike, given the many courses flooding the market, is which interview course is the best in the industry for breaking into investment banking. The following table and comparison present a comparison between the top three resource providers: the Wall Street Oasis (WSO), WallStreetPrep (WSP), and Mergers & Inquisitions (M&I). This comparison explains why we believe WSO’s IB Prep Course remains the gold standard in the industry, with features unmatched by competitors.

With that being said, WSO leads the industry for IB recruiting as the IB prep course gives you access to thousands of interview insights by actual candidates all across the world across a variety of divisions in finance. The advantages and insights gained by this are simply unmatched by our competitors, and we believe you’ll feel the same way as us once you’ve got our guide as well.

Many of the sample answers in the guide above were taken from WSO’s very own Investment Banking Interview Prep Course , which features:

- 7,548 questions across 469 investment banks

- 3 Modules to master technical + fit + networking