Search NAIC

Recommended, center for insurance policy and research.

The Center for Insurance Policy and Research provides data and education to drive discussion and advance understanding of insurance issues among policymakers, insurance commissioners and other regulators, industry leaders, and academia. It conducts research and provides analysis on important insurance issues. Through this work, the Center drives dialogue and action on today’s insurance issues.

Search CIPR

Nuclear Verdicts, Tort Liability, and Legislative Responses

Mar. 21, 2024

Insurance to Improve Quality of Life: Understanding and Addressing Barriers to the Financial Inclusion of Insurance

Mar. 17, 2024

Center for Insurance Policy and Research Annual Report 2023

Mar. 13, 2024

Journal of Insurance Regulation

The Impact of Regulation on Customer Satisfaction: Evidence From the US Auto Insurance Industry

Feb. 28, 2024

Abstracts of Significant Cases Bearing on the Regulation of Insurance 2023

Feb. 27, 2024

No-Fault Auto Insurance Reform in Michigan: An Initial Assessment

Back to Basics: Climate Risk – Financial Resilience

Jan. 23, 2024

Understanding Insurance Decisions: A Review of Risk Management Decision Making, Risk Literacy, and Racial/Ethnic Differences

Jan. 22, 2024

Climate Risk in the Commercial Mortgage Portfolios of Life Insurers: A Focus on Sea Level Rise and Flood Risks

Jan. 17, 2024

Call for Papers 2024 - Related to CIPR key initiatives

NAIC/CIPR Research Fellows Program 2024

Dec. 19, 2023

The Case for Pausing Any Immediate Embrace of the Social Inflation Argument for Legal System Reforms

Nov. 28, 2023

State Resiliency Map

Learn what disaster resilience information is available on each state and territory's insurance department website.

Jeff Czajkowski Director, Center for Insurance Policy and Research [email protected]

Eryn Campbell Regulatory Research Services Manager [email protected]

Patrick Cho Post-Doctoral Researcher [email protected]

Kelly Edmiston Policy Research Manager [email protected]

Shaveta Gupta Catastrophe Risk and Modeling Advisor [email protected]

Paula Harms Senior Research Analyst [email protected]

Connie Roland CIPR Coordinator [email protected]

Anna Kruglova Post-Doctoral Researcher [email protected]

Florent Nkouaga Post-Doctoral Researcher [email protected]

Brian Powell Catastrophe Risk Resilience Specialist [email protected]

Brenda Rourke Communication Research Scientist [email protected]

Emma Tapp Research Librarian [email protected]

Address 1100 Walnut Street Suite 1500 Kansas City, MO 64106 United States

Library & Archives

Can't find what you are looking for? Visit our Library to search for archived CIPR analysis and research.

What can we help you find?

Talking trends: insurance hot topics under the spotlight.

February 8, 2022

For a recent Talking Trends webinar, we invited a panel of Willis Towers Watson experts to discuss some of the hot topics that North American property & casualty (P&C) insurers will face in the next few years.

Alongside the regular challenges of running a business, dealing with catastrophes and serving customers, the insurance industry has had a number of unique challenges in 2020 and 2021. These have included working remotely, planning return(s) to work, regulatory challenges, the effects of social inflation on claims, and the unanticipated changes in loss and premium patterns.

So, what do these macro socioeconomic and industry trends mean for how insurers better engage existing and new customers, become more effective in how they make and implement decisions, and ultimately unlock new sources of revenue and profitability? That was the starting point for questions posed to our panel by Americas P&C Sales and Practice Leader Katey Walker.

- Charlie Carwin — Americas Product Leader, Capital Modeling and ERM (Enterprise Risk Management)

- Scott Gibson — Director, focusing on Business Process Excellence

- Yi Jing — Director, focusing on reserving and M&A

- Michael McPhail — Director, PPCU (Product, Pricing, Claims and Underwriting)

Impact for core functional areas

Katey Walker: Efficiency and effectiveness have been big topics for insurers in 2021. Given that our expectation is that the focus on these areas will continue, what impacts do you foresee for core functional areas?

Charlie Carwin: If you look at the past trend in capital modeling, everyone got excited with all the possibilities and what they could do with models. To take the analogy of a car, companies started building their own engines, adding their own transmission and own braking systems, and perhaps deciding if they wanted air conditioning or not.

The end result was large and expensive to maintain models that were producing value — but not necessarily in line with the costs associated with them.

So, a key trend is simplification: how insurers are approaching quantification and the modeling of risk. Companies are more and more interested in off-the-shelf models, the buy-versus-build-type situation. To go back to the car analogy, they're not interested in building their car; they're more interested in driving it and extracting value that way.

Associated with that is simplification on the IT side. “The great resignation” has been an influential factor in companies’ interest in cloud solutions or other solutions that are more scalable and that allow them to reduce the reliance on owned hardware and IT teams.

Michael McPhail: Picking up on what Charlie said about off-the-shelf solutions, that’s true across the entire insurance process.

Whether it’s a policy or claims administration system, many carriers recognize the benefits of simplifying their processes. A big issue often is that they have all these old legacy systems. Trying to move completely off the legacy system can be hard. Starting afresh is a big challenge but might be justified by the benefits in some cases; however, the use of application programming interfaces (APIs) in off-the-shelf software is making the task of connecting legacy and new systems much more straightforward.

Katey Walker: Beyond simplification, the other big word we hear in tackling efficiency is automation. How is that changing the landscape?

Scott Gibson: I’d describe it as not so much changing the landscape but enabling it. So, if we go back to Charlie’s car analogy, for example, we need some sort of road — a layer that’s going to provide the ability to use the insights of a model in multiple ways.

That’s where automation comes in, particularly in light of the proliferation of different tools and data sources and the push from regulators for transparency in understanding how information is being used to affect the customer.

Automation can play a key role because, when you think of compliance risk, for example, it's not a value-added operation. But it needs to be done, and it needs to be done accurately and to a deadline. Automation is a great opportunity to streamline and provide efficiencies.

In addition, the bots can do the repetitive tasks so that users can focus on extracting the value out of those processes. And that takes us back to simplification, where instead of having long-drawn-out, complex and highly manual processes, automation cleans up the edges so that carriers can focus on the sources of added business value.

Ways of working

Katey Walker: Let’s extend these concepts of simplification and automation. How do these change what actuaries and we, as consultants, spend our time doing?

Yi Jing: From a reserving standpoint, there are more uncertainties than ever. I think companies are really looking for actuaries to provide insights about how to deal with these uncertainties and, more so, how to quantify them.

So, for example, for COVID-19, how do we measure the direct COVID-19 claims? How do we assess or reflect the indirect COVID-19 impact? And in October, we saw inflation hit a 30-year high, so how do we account for future inflation and our reserves if that's not in the historical data?

There is certainly a need to go beyond some traditional methodologies and explore new methods or tools to help address some of these challenges and questions both in the shorter and longer term.

Katey Walker: While we’re talking about insight and circling back to the idea of driving value, all of you have worked for insurers, so what are your perspectives on ways for insurers to capitalize on both?

Scott Gibson: One aspect was our project list kept growing and growing, and we could never knock enough things off of it to whittle it down. That's kind of how I moved into the business process excellence space. And I think that challenge is becoming even more dramatic because the pace of change is accelerating in the industry; the management questions are getting larger and larger, including now, for example, around climate risk.

The best part of my role now is I get to ask if a company could refine a process and smooth it over; if eight days became five days, what is the opportunity to create more value for the business?

Michael McPhail: Senior insurance executives want to know the answers to “why” questions. “Tell me why trends are happening this way. Tell me why there is adverse claims development,” and so on. These historically have been hard questions to answer.

You can do some wonderful analysis, but if you can't answer that question, it really doesn't matter. And this is where I think predictive analytics can be really useful because, oftentimes, when someone can't answer that question, they start scrambling and point to some sort of anecdotal evidence that becomes a story that may or may not be true.

With data science becoming more common, and senior executives understanding analytics better and better, they're looking for more robust answers. So, I think combining predictive analytics with communicating results clearly is a significant opportunity to add value.

Katey Walker: But can predictive analytics be overdone?

Michael McPhail: Yes, but don’t get me wrong, predictive analytics are a wonderful thing and companies benefit hugely from using them, in my opinion. The danger is becoming fixated on things being perfect — which takes way too long. I had a coworker who once told me that you can get a 95% solution at 20% of the time and cost of a perfect one, and I’ve remembered that. Models aren’t meant to be perfect; they’re meant to be useful.

Katey Walker: Pricing is always a hot topic, so could we turn for a moment specifically to the opportunities you see in this area. What are some of the key aspects for potential pricing improvements in your view?

Scott Gibson: I come at this from the perspective of how to optimize what is a big workflow for insurers.

With rate indications, for example, there tend to be discrete points in time when insurers are considering the indication information for a particular state and line of business. What would be helpful is to move to a more continuous flow of information, so that the data from underwriting, claims, reserving or wherever drives when those changes are required and which pieces of information are most important to the indication. It could also automatically bring in maybe new, relevant external and internal trend information to drive a faster and more efficient pricing process.

Michael McPhail: One area is just quickening decision making. A big part of that is looking for broad strokes rather than trying to be overly precise. If I think about a rate indication, there are a lot of components that an insurer could spend a whole lot of time on, such as picking loss trends. We can use automation to make that faster while maintaining accuracy.

Another opportunity is to be able to better incorporate information from the claims and underwriting teams on a real-time basis. If underwriters are continually making risk-based adjustments, let's say on schedule rating outside the filed rating algorithm, how can that information get back into the pricing process to potentially improve the pricing models? This is far from an isolated example, as insurers have tended to do the pricing process in silos with limited communication and sharing of information between teams.

And finally, one area that I think is more directly related to improving the actual pricing process itself is considering the impacts of pricing changes on a portfolio over many periods, rather than just the filing period. Companies often make short-term decisions based on annual profitability targets but don’t necessarily factor in that a rate increase will likely have an impact on customer behavior and could lead to premium leakage. Predictive analytics can definitely help improve portfolio management by thinking about how customer behavior is impacted over many periods.

Katey Walker: Any thoughts on how simplification, automation and analytics can enhance the reserving process?

Yi Jing: When companies are doing quarterly — or even monthly — reporting, actuarial departments can be very stretched and are faced with the long project lists that Scott mentioned earlier.

So, the opportunity, as we see it, is to better use people's time by potentially automating tasks such as selection of loss development factors. Actuaries can then spend more time doing deep-dive analysis to reveal some of the drivers of the results being seen. This might include implementing diagnostic tools to pick up trends, assess those trends and find anomalies.

Another area attracting investment in our experience is better management reporting, so that senior managers have a better understanding of what the numbers mean through the use of automated executive dashboards and suchlike.

Michael McPhail: I’d just add a comment on the overlaps in the use of predictive analytics in giving indicators for action on pricing and reserving. For example, we’ve started working with insurers to use machine learning to understand the drivers of prior year development that can be verified with claims teams for explanation to senior management.

Katey Walker: Related to management insight, visualization has been a buzzword in recent years. So where does that fit into the future role of sharing results?

Michael McPhail: No question, it’s huge. My opinion is that it should be simple to understand and see what’s trying to be communicated, e.g., the drivers of a result. If it takes five minutes to explain the visualization, that’s self-defeating.

Yi Jing: I’d echo that. The clearer you can make the information jump out of a graph related to, say, adverse development in various lines of business and frequency severity trends, the better it is.

The “T” word: Transformation

Katey Walker: A lot of what we’ve been talking about comes back to transformation. Each thing is changing what insurers do and how they do it. So where do companies start if they consider transformation as perhaps too great a challenge?

Scott Gibson: Absolutely. So in a lot of cases, the best bet is start small; look for easy wins or changes to a process. Automation is often a good solution because it doesn’t involve going back and fixing a process, not to mention it can build some momentum for further transformational activities. Later, it’s always possible to then go back and review the process itself.

Charlie Carwin: I feel there are pretty established best practices in capital modeling, but what is changing is that senior managers actually need to be able to see the results — and in a timely manner.

So when I think about visualization, for example, I think of it as just making sure that there's the marginal impact of capital from a material decision on every report. So it shouldn't be determining the decision; it shouldn't be this is what's making the decision by any means. But it should be available and should be impacted.

But for that to actually happen, you have to have capital models that are responsive. It can't take two days to run it, or you can't have a process where, for example, it takes three weeks to get an answer to a question such as: “What is the capital impact of changing the reinsurance program?”

And so, if I think about the components of transformation, one is the out-of-the-box model, as I mentioned before. Then you have automation, where some of the more manual processes are no longer necessary, where you can actually have the robots do that work and make everything much more efficient and get to the answers more quickly.

The what-if questions are always going to exist with, for example, questions about the impact of inflation and changing operational risk coming to the fore in the last couple of years. Where capital is really coming into play is that the models have to be ready to answer those questions, or at least quantify the marginal impact of capital. That's a big difference compared with even five years ago.

Katey Walker: So going back to the buy-versus-build discussion, where do you think we’re going from here?

Charlie Carwin: Historically, actuaries have liked to program; I like to program. But insurers can get a lot more value out of actually using the models than creating the models. This applies equally to larger companies that are looking for ways to reduce some of the risks, including key man risk; reduce maintenance costs; and have ready-made scalability. So, it's definitely driving buy versus build.

Michael McPhail: Away from the capital modeling side, similar arguments can be applied to open-source platforms, which have become quite popular in areas like pricing.

The problem is when someone leaves suddenly there's no one around to pick up the pieces on the coding and the governance chain is broken. That's part of why people are moving to more off-the-shelf solutions because they are starting to recognize some of the pitfalls.

Katey Walker: Does stability present the same transformational issues in reserving?

Yi Jing: Yes, I think a lot of companies are investing in a better tool to do their reserving, and I think also tightening documentation of processes for others to follow.

Let’s not forget that, particularly recently, people turnover across the industry has been high. With the pandemic, people may feel changing jobs is a little easier given that you don't have to relocate. Retaining talent is part of maintaining that stability, and insurers can engage people with more challenging, interesting and exciting work.

To that end, let the robots be robots, taking over some of the tedious and repetitive work. I think that’s important to bringing in young talent to the insurance industry.

Challenges brought about by the pandemic

Katey Walker: Obviously we’ve been living through the pandemic. How will it challenge companies’ efficiency and expense structures?

Yi Jing: As people have worked from home extensively, this has obviously posed efficiency challenges, but I’d also bring this back to my point about engaging people remotely with satisfying work.

Charlie Carwin: I’d point to the need for a different focus on different risks: deflations, whether the asset mix is correct and how premium volumes are changing — amongst other things.

Beyond these, I go back to the term I used earlier — “the great resignation.” I think we're seeing that continuing because of things like key man risk, joining up complex processes remotely, and the benefits of flexibility and agility that the pandemic has highlighted.

Linked to the heat companies are seeing in the job market, I think there’s a general push for trying to make sure that actuaries are doing the type of work that actuaries are fit to do, not necessarily the work that actuaries have to do. Automation and making processes more efficient and more focused on extracting the value can clearly contribute to that.

Scott Gibson: Echoing those comments, I’d add that we've actually seen that the companies that have already adopted automation were more resilient after the pandemic hit.

Another interesting thing is how the pandemic has affected the work/life balance. People have been home and, because they're home, they can go run an errand more easily than if they were in an office environment. So, it's creating a sort of an asynchronous working environment that is exacerbated by time differences. You can't necessarily knock on the cubicle next to you and expect the person to be able to tackle a task immediately. Robots can fill that void because they're going to work 24/7. They don't get tired.

But it’s not a case of replacing people. The majority of companies, when we’ve polled them, are actually looking to augment human productivity, not replace it.

So the pandemic has definitely been a potential accelerator for automation and transformation projects, helped by the fact that travel and other expenses have fallen significantly.

Mergers and acquisitions

Katey Walker: A perpetual hot topic is M&A. Do we see a shift in how companies are approaching buying and selling?

Yi Jing: At the beginning of the pandemic, we thought M&A activity would be low given all the uncertainties. It turned out it was, and remains, a hot market. I think that says the industry still has excess capital and sees challenges as opportunities.

Features of the market include a strong interest in specialty business. Moreover, we’re seeing many companies are putting a lot more focus on underwriting strength. The question they want to get answered is: “Is the business as good as the seller is telling them?” Another facet of transactions is companies looking for adding network platforms, such as the Liberty's recent acquisition of the State Auto.

Going forward, I think having an efficient due diligence process is very important. Clients are certainly looking for us to provide better and quicker insights.

The next big thing

Katey Walker: So, to wrap up, I’d like to ask each of you for your take on the next big thing in the coming three to five years.

Charlie Carwin: It’s already happening, but transition to the cloud. I see that growing over the next five years along with automation of the less fun, more repetitive aspects of back-office insurance work.

Scott Gibson: I’d say it’s automation plus. Right now, many companies are automating a specific process or part of a process but have seen the benefits and want to spread their automation wings further.

Michael McPhail: Going first is an advantage on this question, so I agree that simplification and automation are where things are heading.

Yi Jing: I think about what I would like, and that’s knowing, for example, that come quarter- or month-end, my full complement of reserving data will be available the next day — or perhaps more realistically, won’t take weeks or months to produce.

What we believe the webinar discussion illustrates is that insurers’ journey to the future and being best in class does require a deep understanding of all the critical elements involved from strategic to tactical, combined with the technology to make it happen.

If you would like to discuss any of the issues or comments with us, please do contact us.

Related Capabilities

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Next in insurance: Top insurance industry issues in 2022

The insurance industry is no longer predictable.

The business of insurance, which once was stable and predictable, isn’t that way anymore. Growth without sacrificing profitability is challenging, climate change is irrevocably impacting certain risk profiles, distribution needs have become truly omnichannel and customers expect products tailored just for them. All the while, technology has continued its relentless advance and an emerging player ecosystem is threatening to shake up customer acquisition. As a result, industry executives now have to make an array of deliberate and aggressive strategic choices to succeed. Incremental change or hoping to avoid change altogether are no longer viable options.

Compounding the difficulty of addressing these challenges is how the COVID-19 pandemic accelerated them. Customer and employee expectations changed more in 18 months than they did in the previous two decades. This has put immense pressure on the industry and carriers have had to adjust practically—in some cases, literally—overnight. Even though the pandemic has ebbed and flowed, the pace of change has remained relentless.

Commitment is an act, not just a word

Despite disruption and the new entrants trying to take advantage of it, the good news for many carriers is that they still have a competitive advantage that others can’t easily replicate. There’s room in most market segments for multiple players, but because not all competitive levers are fully or equally available to everyone, insurers typically focus on one of the following five areas: 1 - digitization, data and integration; 2 - brand and distribution; 3 - superior, innovative products; 4- strategic partnerships; 5 - effective structuring.

Unfortunately, while most insurers do try to focus on their strengths, they also typically underinvest in these areas and fail to act with urgency, resulting in a race to the middle. We tell clients that they need to fully fund and support their way to play and hold themselves accountable for the results. In other words, commitment without action won’t get you very far.

While carriers may have been able to get away with a fuzzier approach in the past, that is not the case today. Private equity, asset managers and other new entrants are moving quickly, with great focus and discipline, to capitalize on industry disruption. Companies that continue to work from three- to five-year timelines that are vague and lack strategic focus are likely to lose market share and perhaps even wind up as someone else’s acquisition.

Companies that continue to work from three- to five-year timelines that are vague and lack strategic focus are likely to lose market share and perhaps even wind up as someone else’s acquisition.

Real-life examples: Ways to play

Leading carriers aren’t relying on past success. They’re defining new ways to remain relevant and grow.

Data & Integration: Digital Simplification Operator

Leverages advanced tech and data capabilities to create a seamless, digital-first experience from quote and sale all the way to claims. Features simplicity and competitive prices.

Distribution: Ecosystem Orchestrator

Creates an integrated ecosystem (typically via partnerships) that offers customers “more than just insurance,” focusing on distribution and product offerings to win at the point of sale.

Products: Unmet Needs Customizer

Develops innovative differentiated, and customized products to address unserved / underserved segments or new, emerging risks via advanced analytics and pay-as-you go pricing.

Partnerships: Platform Services Innovator

Extends core capabilities by offering products and services to other carriers, distributors or other adjacent businesses. Creates scale by funding differentiating competencies and experiences.

Structuring: Economic Value Creator

Employs a lean operations focus to compete competitively on price and enable investments in key strategic areas.

What makes a winner?

Based on our experience working with all segments of the industry, we’ve observed that most successful insurers in today’s environment have a few key traits. In particular, they:

Say “no” to what doesn’t fit

Define a strategic direction and say “no” to what doesn’t fit. Simply setting financial goals isn’t enough. Committing to a way to play, then continuing to do everything you did before while funding whatever else comes along, is not a strategic direction. Leaders know how to prioritize.

Fully fund their strategy

They don’t shortchange big bets or dilute key investments with allocations to less vital areas. Of note, they’re typically able to make these investments because they’ve implemented structural, financial and tax approaches that minimize their cost ratios.

Get creative with products

They’re able to identify new product categories (as opposed to just adding new features) and have the brand strength to deliver them. For example, early movers are designing products that take into account two increasingly important issues: Stakeholders’ environmental, social and governance (ESG) concerns and the still overlooked employer as distributor market for a wide variety of financial and service needs, particularly retirement and college savings and paying for childcare or elder care.

Get involved in partnerships and make deals

Get involved in partnerships and make deals to meet strategic goals. Inorganic strategies have a long history in the industry but have picked up steam recently as carriers focus on core competencies and enhancing technology. In fact, partnerships and deals have become a necessity for most carriers to enable their chosen ways to play. They take part in ecosystems and invest in InsurTech. Although most of these kinds of investments aren’t game-changers on their own, when they get the acquiring company closer to a strategic goal, they’re worth it.

That said, the best ecosystems and InsurTech innovations in the world aren’t going to help you if they don’t align with your strategy or if you’re not executing your strategy properly. As carriers find new partners, technologies and business models that align to their core principles or strategic growth plan, they can test their value and determine whether or not to adopt the innovation or maintain the partnership.

60% of consumers don’t feel they’re financially confident or covered across their long-term security and emergency needs. Source: PwC/LIMRA 2020 research

Technology platforms that drive strategy

Even a clear and consistent strategy is going to founder if your technology can’t enable it. We haven’t spoken with a single business leader who doesn’t recognize that investments in new technologies are the best way to facilitate market access, risk selection and management, quality financial information and customer service capabilities. However, we’ve seen many carriers fail to stick to a coherent strategy beyond “digitization.” There’s often a lack of clarity and correspondingly nebulous goals about how these substantial investments relate to the business. The above discussion of funding a competitive advantage also applies here. Carriers should fully invest in ways that build on their strengths and hold the organization accountable for the results. At the risk of repeating ourselves, we’ve seen time and again that many carriers simply don’t do this. Customers (and employees) increasingly expect insurers to be as easy to work with as an online retailer—and new entrants are giving them exactly what they want. If you can’t, you’re going to lose business and employees.

A truly strategic technology platform features:

A core processing system

A core processing system that efficiently issues policies and contracts, enables payments and keeps track of finances. You don’t need bells and whistles for their own sake, but you do need something that does the essential job of helping you achieve scale faster.

Digital data and integration capabilities

Digital data and integration capabilities that enable access to and understanding of your own data and from third parties to inform management decisions and enable new capabilities.

Customer/user-facing systems

The absolutely vital customer and user-facing systems that support your call centers, customer chat and walk-in locations. They enable carrier representatives to immediately determine client identities and service histories to quickly solve customers’ problems. Moreover, an effective integration layer facilitates quick incorporation of new partners and solutions into your digital capabilities.

Reporting and compliance platforms

Reporting and compliance platforms that provide high-quality data, facilitate accurate financial reporting and accounting and enable effective compliance.

Cloud, because no insurer needs to—and, more importantly, probably shouldn’t—support its own infrastructure anymore. Those that do risk it being an impediment to operational flexibility. Practically everything in insurance eventually becomes a margin game, with the advantage going to the carriers that can scale effectively, drive out cost and achieve broad price competitiveness. Carriers with adaptable cores that can be quickly configured for new innovations—a key advantage of cloud technology—can achieve this scale faster.

Changing customer expectations 2018 to 2021

Source: PwC 2018 and 2021 surveys of 6,000 insurance customers.

The path forward

None of this is easy, and no single company has mastered all of these ways to win. But, we’ve never seen a truly competitive insurer that didn’t at least:

Set and stick to clear goals.

Support business goals with a technology strategy that’s built on and integrates proprietary and third-party data.

Fully invest in and hold itself accountable for achieving 1 and 2.

Whatever your business focus—data and integration, brand and distribution, products, strategic partnerships or structuring—these three are absolutely essential.

The ‘Next in insurance’ series

The war for talent, esg considerations, the workforce, which brings your strategy to life and holds the key to the future of the business.

Insurers feel insecure in the war for talent. They think — often rightly so — that they lag behind other “sexier” industries in attracting and retaining the best people. However, recent changes in what employees expect of their employers and the nature of work itself offer insurers a great opportunity to level the playing field. Companies that proactively and convincingly demonstrate flexibility and offer meaningful career paths with ample room for development are showing that insurance can be as professionally and personally rewarding an industry as any. In other words, it’s time for insurers to play offense instead of defense.

The increasing breadth and importance of ESG considerations, from investment strategy and underwriting to public perception

The insurance industry has long paid close attention to environmental issues because they directly affect how carriers evaluate and price risk and pay out claims. But sustainability and governance are becoming equally important. For the former, insurers are experiencing increased scrutiny of their business models. For example, what’s the right balance between covering climate-related risks and underwriting initiatives that could increase those very same risks? Such sustainability concerns relate directly to governance issues. Insurance leaders now have to meet formal, increasingly detailed ESG reporting requirements covering everything from their investments to how they underwrite business. And investors, customers and the workforce are paying close attention.

Download Next in insurance report

Related content, winning the war for talent.

This webinar tackles a key issue -- maybe the key issue -- facing the insurance industry: How can we attract, train and retain the talent that we need and that...

The New Competitive Landscape Webcast

Listen to our latest On-Demand Webinar featuring Andrew Robinson, CEO at Skyward Specialty Insurance Group, and Andy Cohen, COO, Snapsheet...

Insurers can win the war for talent—if they tell their story

PwC’s Next In Insurance describes how insurers can win the war for talent in an insurance industry talent crisis.

Insurance: US Deals 2024 outlook

We expect insurance companies to continue to focus on simplifying their portfolios by divesting assets that are deemed non-core to their strategy.

Insurance Leader, Consulting Solutions, PwC US

Consulting Principal, PwC US

Francois Ramette

Principal, Insurance Consulting, Strategy&, PwC US

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Merger Information

- Stock & Dividends

- Shareholder Services

- Enterprise Contacts

- Divisional Contacts

- Media Contacts

The COVID-19 pandemic has dramatically reshaped global insurance markets. Its impacts are largely felt through asset risks, notably capital markets volatility, and weaker premium growth prospects.

Featured Content

Us life insurance 2024 outlook: rising interest rates to boost investment income.

The World's Largest P&C Insurers, 2023

Innovating for insurance: charting a "smarter" path to the s&p 500, related insights.

- April 24, 2024

As overall results improve, Progressive sees 'urgent need of rate' in 1 state

- April 23, 2024

Majority of US life insurers' Q1 earnings projected to grow YOY, sequentially

- April 22, 2024

Sustainability Insights: The Impact Of Rising Insurance Premiums On U.S. Housing

- April 19, 2024

Cat losses weigh on Travelers stock as earnings season gets underway

Global freight, insurance, crew wages to spike as israel attacks iran: shippers.

- April 18, 2024

Insurance Capital Adequacy Criteria: Impact As Expected Following UCO Resolution

- April 15, 2024

Majority of US managed care insurers projected to see revenue growth in Q1 2024

- April 12, 2024

Globe Life shares plummet, rebound slightly after short report

- April 9, 2024

James River-Global Indemnity deal comes amid evolving E&S market

- April 5, 2024

GEICO leads pack in slashing insurance advertising spend

Shares in managed care insurers drop as medicare advantage payments fall short.

- April 3, 2024

Wrangle over Baltimore bridge claim begins as shipowner seeks to cap liability

Comprehensive statutory financial data for Property & Casualty (P&C) and Life & Health (L&H) filing groups and cross-sector groups with US P&C L&H operations.

Markets in Motion

Cultivate a deeper understanding of global events and market dynamics from all angles with Markets in Motion from S&P Global. Our weekly newsletter features macro and micro perspectives of the issues driving markets and the global economy, shaped by the news and insights produced across S&P Global's peerless research teams.

The Mounting Cost of Climate for Insurers

Climate-related disasters are leading to increased claims across the insurance industry. As floods, heat waves, fires, and extreme weather becomes more common, insurers are re-evaluating their exposure.

Stay informed with essential data, news, and insights for insurance, including resources for underwriting, actuarial, product management, risk management, and investment management.

Related Events & Webinars

U.s. insurance hot topics, transition your perspective, european insurance conference 2023, 39th annual insurance conference.

Products tied to S&P DJI benchmarks have long been at the forefront of the fixed-indexed, variable, and structured annuity markets, as well as the indexed universal and variable life markets.

Despite substantial geopolitical volatility, sometimes-turbulent debt and equity markets, and quite active catastrophe seasons in both 2017 and 2018, the insurance sector continues to demonstrate resilience.

Credit Markets

Market dynamics, private markets.

Featured Content

Artificial Intelligence, Insurers and Insurance Agents

Generative AI applications are making many tasks easier while at […]

Proven Ways to Start and Grow an Independent Agency

Independent agents enjoy unlimited growth potential. However, hard work may […]

Accelerate Your Digital Transformation Without Overburdening IT

This paper details how your business can enhance its customer service operations with...

Connect and Communicate with Carriers with a Multi-Carrier API Exchange

Traditionally, navigating multiple carrier systems to input and retrieve...

Simplifying the Insurance Sales Process in a Digital Era

Join this exciting conversation about the future of insurance sales […]

8 Reasons to Consider a New Insurance Payments Processor

There are few technological decisions more impactful than how you collect payments. Choosing...

Newest Research

Young Agents Survey Results 2024

What do young agents like most? What do they like […]

Insurance Journal April 15, 2024 Issue

The Young Agents Issue with Survey Results; Markets: Directors & Officers Liability; Cannabis Editorial Panel...

Commercial Insurance Rapid Launch

This eBook provides a comprehensive framework for insurance agents to […]

Insurance Journal April 1, 2024 Issue

The Real Estate Issue (A&E, Association D&O, and Commercial Property); Markets: EPLI; Guide to Cyber Markets

Guide to Cyber Markets 2024

This guide provides a platform for markets to quickly share […]

Want insights like this in your inbox?

Subscribe to Research & Trends e-newsletter to receive new research and reports delivered to you every Friday.

Most Viewed

Popular Topics

Agency management.

Weathering the Storm: Cyber Insurance Risk in 2024

Webinar Insurance Journal

Insuring Cannabis Claims: A Look at Trends, Surprises & Concerns

Agency Salary Survey Results 2024

Special Report Insurance Journal

Agents of the Year 2023

Insurance Journal’s Hospitality Risks Directory

Directory Insurance Journal

Guide to Workers’ Compensation Markets 2023

Examining insurance companies’ use of technology for innovation

- Published: 16 November 2021

- Volume 47 , pages 520–537, ( 2022 )

Cite this article

- Davide Lanfranchi ORCID: orcid.org/0000-0002-1774-7026 1 &

- Laura Grassi ORCID: orcid.org/0000-0002-0720-7034 1

12k Accesses

17 Citations

Explore all metrics

The insurance industry is innovating. Business models, services and processes are rapidly evolving, largely backed by technological developments. The particular historical context of COVID-19 provides a suitable case to understand the relevance of exploiting technology to react quickly to traditional and emerging risks. Focusing on the initiatives put in place by the most influential insurance companies at the global level, we have framed the innovation mechanisms in the industry, highlighting four rationales underpinning these initiatives ( Adaption , Expansion , Reaction and Aggression ), which differ according to the relevance of the technology in use and innovation to the portfolio of risks covered. Overall, it emerges that insurance companies have the room and capability to innovate, in many cases using technological applications to cover new and existing risks. While the initiatives studied concern the entire value chain, basic primary activities, such as product development, sales and claims management, show that innovation based on new or existing technology determines the success and competitiveness of the business.

Similar content being viewed by others

Health Innovations from an Innovators’ Perspective

The Development of InsurTech in Europe and the Strategic Response of Incumbents

Releasing Trapped Value: The Coming Challenge of Innovation in the Context of Emerging Markets

Avoid common mistakes on your manuscript.

Introduction

In the absence of insurance, it would be complicated for individuals and businesses to cope with the negative consequences of economic activity or mitigate the effects of uncontrollable events and so recover from unfortunate situations or, at least, contain the ensuing financial burden (Zweifel and Eisen 2012 ). This point is becoming clearer and clearer as our world faces increasing levels of uncertainty. By transferring the risk of a loss, insurance certainly played a major role in protecting people from consequences arising from the COVID-19 pandemic (Liedtke 2021 ; Qian 2021 ), an event not even listed among the 20 most likely risks before 2020 (World Economic Forum 2020 ).

The social value of the support insurance companies provide to consumers is undeniable (The Geneva Association 2012 ; OECD 2020 ). During the pandemic, this included deferring premium payments, adjusting coverage terms and conditions and even providing additional coverage benefits, although insurers did not always provide transparent or clear information to policyholders about coverage conditions, in particular on the exclusions relating to COVID-19 losses (OECD 2020 ). Thus, while in some cases insurance companies rejected consumer claims, the fact that the population had a coherent insurance coverage mitigated the most negative effects of the pandemic. Health insurance, for example, was able to provide a better quality of life and more extensive healthcare for those who were covered; a lack of coverage could have led to delayed diagnosis and repercussions on physical and psychological health, including high stress levels (Shin et al. 2021 ; Sampson et al. 2021 ).

COVID-19 acted as a catalyst for innovation in insurance, as in other service industries (Heinonen and Strandvik 2020 ), although the insurance industry is generally known for its conservatism (Nam 2018 ). The sector is, so far, clearly struggling with innovation and change (Zweifel 2021 ; Nam 2018 ), and insurance companies are not taking full advantage of the intangible nature of their products and services, which could enable them to become digital leaders (Stoeckli et al. 2018 ), despite several efforts having been made. Data abundancy has facilitated the emergence of new insurance business models, ranging from peer-to-peer insurance (Stoeckli et al. 2018 ) and personalisation achieved through wearable devices (McCrea and Farrell 2018 ; McFall 2019 ) to insurance policies tailored to individual behaviour (Dijksterhuis et al. 2016 ), such as pay-how-you-drive (PHYD) policies, where pricing reflects driving style (Stoeckli et al. 2018 ). Ultimately, these kinds of pay-as-you-live policies induce policyholders to adopt preventive measures (Wiegard and Breitner 2019 ), with potential economic and financial benefits. However, legal concerns must be considered, as using self-tracking data to assess and price individual risk (Cather 2020 ) is fraught with practical, regulatory and reputational obstacles (McFall and Moor 2018 ) and the availability of technological solutions is not a guarantee of better performance per se (Lanfranchi and Grassi 2021 ).

COVID-19 drove innovation mechanisms in the industry (Heinonen and Strandvik 2020 ) and forms the context of this research. We observed the greater or lesser relevance of innovating through the medium of technology, whether already in place in these companies or introduced for this purpose, and how technology can help companies to react quickly to traditional and/or emerging risks. By analysing the most representative insurance companies at the global level, this research focuses specifically on the role played by technology and market impulses in cultivating innovative initiatives in the sector. Our aim is to provide tangible support to insurance companies when they are working on their future innovation designs, ensuring that they first have a clear idea of the role that they want to attain, or maintain, in the market. Any chosen direction will depend on their attitude to risk and their risk strategies, while careful attention must be paid to potential pandemic or global systemic events akin to the COVID-19 pandemic that could arise in the future, nowadays considered decidedly more probable than in the past (World Economic Forum 2021 ).

The rest of the paper reviews extant literature by presenting the main studies on technology and market impulses that give rise to innovation. The subsequent sections will provide details on the methodological aspects (Methodology), followed by a discussion of the results (Results and Discussion) and the conclusions (Conclusions).

Overview of innovation processes and models in insurance: technology and market impulses

The role of technology.

Digital transformation has become an important enabler of innovation (Urbinati et al. 2020 ). In recent years, the surge in innovation has also interested financial markets (Guo and Liang 2016 ). Eling and Lehmann ( 2018 ) analysed the impact of digitalisation on the insurance value chain, highlighting that the main areas affected are interaction with customers, adaptation to their behaviour, automation of business processes and decisions, improvements to existing products and new product offerings. A new concept, InsurTech, a “phenomenon comprising innovations of one or more traditional or non-traditional market players exploiting information technology to deliver solutions specific to the insurance industry” (Stoeckli et al. 2018 , p. 289), is gaining interest within the insurance sector, driven by increased customer satisfaction and efficiency (McKinsey & Company 2018 ). The concept has a significant place within society as well; InsurTech offers new opportunities, such as higher insurance inclusiveness (Altamirano and van Beers 2018 ), individual empowerment (Zavolokina et al. 2016 ) and improvement to public health (Yamasaki and Hosoya 2018 ).

The effects of InsurTech are being felt across various types of insurance. For instance, health insurance must deal with the emergence of new medical technologies and wearable devices, which can be used to gather useful but sensitive patient data (Banerjee et al. 2018 ) and convert a previously uninsurable physical health risk into an insurable risk (Lakdawalla et al. 2017 ), while artificial intelligence can give users digital access to their health status, enabling them to improve their health-related behaviour (Yamasaki and Hosoya 2018 ). Looking at the home insurance industry, big data analytics and artificial intelligence play a central role in providing services that aim to prevent or mitigate losses, as people purchasing home insurance benefit from real-time acknowledgement of potentially dangerous situations (Lehrer et al. 2018 ). Furthermore, new technologies can be used to estimate loss distribution in the agricultural insurance industry, in particular, new geospatial web-based applications and cloud-based solutions (Hiestermann and Ferreira 2017 ). In general, we can now gain a better understanding of the exposure to risk associated with natural disasters, a key point in assessing the need for catastrophic insurance, for instance (McAneney et al. 2016 ).

InsurTech can also help to improve existing products, services and processes, as well as enable new business models. For instance, advanced technology underpins insurance models ranging from behaviour-based pricing, widely studied in the car insurance industry (Derikx et al. 2016 ; Weidner et al. 2016 ; Wijnands et al. 2018 ), to personalisation linked to data retrieved from wearable devices (McCrea and Farrell 2018 ; McFall 2019 ). Peer-to-peer insurance models are another example, where people can partly share risks with each other (Stoeckli et al. 2018 ). These can contribute to rebuilding trust in the insurance industry by reducing conflicts of interest, as usually these solutions do not include any entities that benefit from refused claims (Stoeckli et al. 2018 ). Nevertheless, InsurTech may possibly introduce new concerns like privacy issues (Banerjee et al. 2018 ) and discrimination, for instance in price personalisation (Meyers and Van Hoyweghen 2018 ), or result in non-improvement of efficiency (Lanfranchi and Grassi 2021 ).

The role of the market

Insurers provide protection and encourage a better understanding of risks, reducing public anxiety and concern (McAlea et al. 2016 ) and helping entrepreneurs, individuals and corporations to handle risk. They also support continuing advancement by proposing new products (Śliwński et al. 2017 ). However, if insurance companies are to play a central role in society, creating value for their customers by transferring the risk of a loss from one entity to another in exchange for payment, they must be ready to serve the current and prospective needs of the market. Therefore, the insurance sector can innovate its products and processes in a twofold manner, firstly by dealing with market demand and customers’ existing risks and secondly by addressing new risks. Consumers are increasingly demanding offers that are better value for money, more convenient, better quality and more suited to their own requirements (Kose et al. 2018 ). The availability of data can give impulse to new initiatives. New medical technologies provide additional information, meaning that it is now possible to insure illnesses in cases where the risk distribution was not previously known (Lakdawalla et al. 2017 ), while a lack of data can hinder these risks from being insured (McAlea et al. 2016 ). The profusion of new and emerging risks is escalating and becoming more critical, with risks derived from changing business environments, disruptive environmental patterns, evolving social and demographic trends, technological advancements (as well as the increasing relevance of data) and new medical and health concerns (Capgemini and Efma 2019 ) that generate additional innovation impulses.

Literature on innovation processes is flourishing and different models are emerging all the time (Du Preez and Louw 2008 ). Technology and market demands have been recognised as the two main drivers of innovation (Voss 1984 ; Van den Ende and Dolfsma 2005 ; Brem and Voigt 2009 ; Di Stefano et al. 2012 ; Maier et al. 2016 ). Technology (Maier et al. 2016 ) enables the creation of commercialised innovative products (Du Preez and Louw 2008 ; Maier et al. 2016 ), as well as innovation in services (Geum et al. 2016 ) and processes (Brem and Voigt 2009 ). In the same way, customer needs and the market itself are the source of new ideas (Du Preez and Louw 2008 ) that aim to satisfy consumer demands (Nicolov and Badulescu 2012 ). The research question guiding this study thus relates to how insurance companies innovate by leveraging technology to address market needs in response to the COVID-19 pandemic.

Methodology

We built on research on technology and market innovation to set out a conceptual framework of the potential ways in which insurance companies can innovate. Considering the exploratory nature of our work, we conducted 30 case studies on an inductive basis, moving from the specific to the general, which is suitable in cases where previous literature studying a situation or concept is scarce or fragmented (Elo and Kyngäs 2008 ).

Our sample is composed of the most representative insurance companies at the global level, i.e. the top 30 by net written premiums (source: Orbis database, see the Appendix for an overview of these companies). We systematically mapped the initiatives taken by each company to address the COVID-19 pandemic, with a focus on their short-term responses (i.e. the first quarter after the start of the pandemic).

To gather data on the initiatives, we triangulated information from two sources. The first is the insurance companies’ websites, which have been used as a source of information in previous research (Ashta 2018 ; de Oliveira Malaquias and Hwang 2018 ). The websites mostly include information relating directly or indirectly to the company’s innovation status (Axenbeck and Breithaupt 2021 ) and were the first touchpoint used by customers during lockdowns to learn about newly implemented initiatives. They were thus used as a way for insurance companies to share news on their innovations with their customers. The second consisted of press releases and investor relations. These were the main sources of official information for shareholders, stakeholders and customers, conveyed virtually through various media channels.

To identify the innovative initiatives properly, we based our work on Baregheh et al. ( 2009 , p. 1325), according to whom “Innovation can be defined as the effective application of processes and products new to the organization and designed to benefit it and its stakeholders”. We searched for results that satisfied the following three properties. Firstly, they had to be real company initiatives, so we disregarded opinion papers or suggestions for the industry, taking the position that innovations are such when they are effective and tangible applications (Baregheh et al. 2009 ). Secondly, the initiatives had to create value, provide benefit and economic value (Garcia and Calantone 2002 ) to at least one stakeholder, and/or solve a problem or a social need (Edwards-Schachter 2018 ). Thirdly, the initiatives had to have been developed as an immediate response to the COVID-19 pandemic. Data were supplemented by a thorough analysis of secondary sources, such as business news channels (e.g. CNBC), articles from industry-specific and business magazines (e.g. Forbes) and interviews published in the press (e.g. CEO of Company 1). Where possible, we directly tested the tools under study ourselves (e.g. the Company 13 chatbot).

We analysed these materials through content analysis, a widely-adopted method (Elo and Kyngäs 2008 ) that provides a systematic and objective means of describing phenomena (Krippendorff 1980 ; Downe-Wamboldt 1992 ; Sandelowski 1995 ), enabling researchers to make “replicable and valid inferences from data to their context, with the purpose of providing knowledge, new insights, a representation of facts and a practical guide to action” (Elo and Kyngäs 2008 , p. 108). All the authors were involved in the analysis to reduce personal bias.

The top 30 insurance companies launched 112 initiatives overall (Table 1 ). Most insurance companies had introduced specific initiatives, except for five companies where no innovation was reported and which remained conservative. With more than five new initiatives in a couple of months, some companies were clearly more responsive, stating their commitment towards their customers and drive for innovation, and they are also the largest in terms of net written premiums.

Considering the specific insurance line in which the different initiatives are developed, we see a clear prevalence of health insurance initiatives (54%), which is reasonable considering the nature of the pandemic event. Another 27% of initiatives is transversal to all insurance lines (ranging from health insurance to car insurance, home insurance and so on). Overall, 81% of initiatives dealt specifically or generically with health concerns. Initiatives in other insurance lines were less common, with car insurance (5%) and home insurance (4%) slightly more relevant.

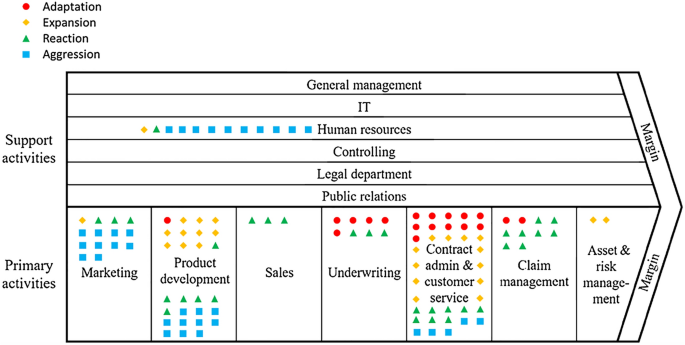

Further, the initiatives covered different activities of insurance companies. Accordingly, we decided that the first step was to map their impact on the different activities within the insurance value chain (Rahlfs 2007 , Fig. 1 ), following Eling and Lehmann ( 2018 ). Primary activities refer to the creation of products/services and their transfer to the buyer (Porter 2008 ). These initiatives spread across all activities, from product innovation, such as creating solutions to address the risk of infection (e.g. artificial intelligence-based symptom checkers developed by Company 8) to innovations in services and processes (e.g. making claims remotely by phone, internet, e-mail or app, introduced by Company 9). Support activities refer to those that support primary activities by providing various firm-wide functions (Porter 2008 ); these were also impacted, e.g. HR practices, with many companies implementing distance-working solutions (e.g. Companies 1 and 27).

Distribution of initiatives along the insurance value chain by rationale (insurance value chain from Rahlfs 2007 )

Focusing on technology, insurance companies responded to the pandemic in two main ways. On the one side, they exploited their existing technological arrangements, expanding their use or opting to adopt new technologies. In the U.S., Company 13 trained its existing chatbot to detect suspicious infection in a timely manner. In addition, the chatbot had a marketing purpose, as it could also propose appropriate insurance products offeed by Company 13. Several insurance companies, including Company 22, offered remote medicine solutions to their customers, e.g. live-video conferencing with medical experts, with the aim of reducing infection by avoiding doctors’ surgeries. At the same time, there were cases where technology was not always central to the insurance company’s response. For instance, several insurance companies, such as Company 1, extended their grace period for paying premiums (especially for customers who typically paid in cash in a brick-and-mortar agency or who were facing temporary financial difficulties). Others, including Companies 7 and 16, extended their existing health insurance cover and explicitly included coronavirus infections.

During the worst stage of the pandemic, insurance companies found themselves dealing with new risks, but at the same time they had to deal with those already in place. The risk of infection was clearly central in extending existing products. Customers benefitted from extended policy coverage, as did doctors in their professional civil liability insurance (e.g. a subsidiary of Company 27) with reference to telemedicine and everything else beyond their usual sphere of expertise deployed while fighting the pandemic. Collateral psychological issues related to lockdown measures raised concerns. The responses ranged from a 24/7 hotline during the crisis (e.g. Company 22) to a COVID-19 microsite and emotional support (e.g. Company 22) and free subscriptions to Netflix and Spotify (e.g. Company 9 in Turkey). Qualified personal trainers, chefs and dieticians were brought in to offer free advice and consultations on matters relating to nutrition and wellness, and customers were offered discounts for home grocery deliveries (e.g. Company 9 in Turkey). Insurance companies set up initiatives linked to many primary activities in the value chain that had been affected by the pandemic. For instance, with regard to claims management, in one case Company 25 and its supplier were able to determine the cause of a house roof leak through a ‘drive-by’ survey.

Cases can be distinguished into two sets according to the relevance of technology. In the first, existing technologies were ratcheted up and technological innovation introduced in answer to the emergency; in the other, technology did not play a major role.

Cases can also be classified according to the level of innovation in the portfolio of risks covered by the insurance companies. In this classification, the first set consists of insurance companies that innovated their portfolio of risks covered, implementing initiatives to create value for customers facing new difficulties. The second set consists of insurance companies that adopted solutions intended to deal with existing risks.

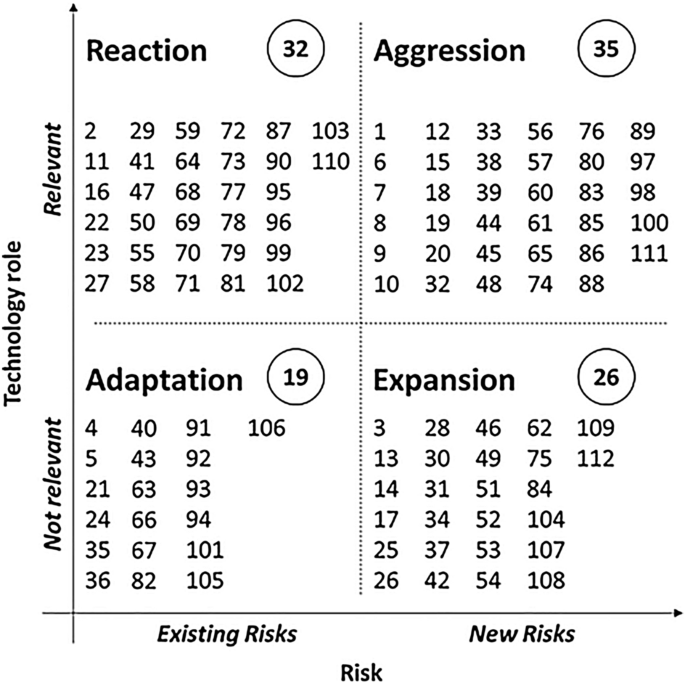

Building on the evidence from the various cases, we extrapolated four different rationales for the initiatives (Fig. 2 ), based on the relevance of the technology (high–low) and the market-driven risk portfolio (focus on existing risks–new risks). The four rationales gave rise to four classes: Adaption , Expansion , Reaction and Aggression .

Technology and market impulses in innovation as a response by insurance companies to COVID-19. Each initiative is mapped on the basis of the role played by technology and the risk to which it refers. Four classes have emerged: Adaptation, Expansion, Reaction and Aggression . The encircled data refer to the number of initiatives. The numbers in each sector refer to our coding of each initiative

Adaptation (low relevance of technology/focus on existing risks)

These initiatives address needs relating to pre-existing risks, where technology did not play a major role. Many of these initiatives concerned underwriting (five out of 19). Examples include flexibility in premium payments (e.g. Company 29) and special enrollment periods for companies to offer health cover to employees who had previously declined such cover (e.g. Company 1). In contract administration and customer services (11 out of 19 initiatives), insurance companies adapted their premiums ex-post, reducing them as a consequence of fewer claims (e.g. Company 26: 15% refund on two months’ car insurance premiums for their customers). In this class of initiatives, the technology impulse is clearly limited, while the market impulse consists of consumer demand for insurance companies to provide a service appropriately adapted to the specific context, possibly minimising the negative impacts of the pandemic.

Expansion (low relevance of technology/focus on new risks)

These solutions address new risks, without requiring technology to play a major role. Initiatives in this class were mainly in contract administration and customer services (12 out of 26). Several insurance companies (e.g. Companies 1, 7 and 22) expanded the areas covered in their health insurance policies, for example by waiving co-payments, coinsurance and deductibles for diagnostic tests, treatment and health complications associated with COVID-19. Moreover, Company 22 and other insurance companies enabled expedited access to treatment. In the U.S., hospitals in some states with high numbers of infections, such as New York and Washington, no longer needed advance approval from Company 22 to admit their insured patients requiring hospitalisation. Expansion initiatives concerning product development were also put in place (10 out of 26). For instance, Company 9 expanded its portfolio by offering insurance to all Chinese medical experts in Italy, in order to protect their safety and health more comprehensively. These initiatives are hence not linked to strong technological impulses; the market impulse was related to customer demand, with users asking insurance companies to expand the scope of their usual services and products to address new risks.

Reaction (high relevance of technology/focus on existing risks)

These initiatives address pre-existing risks, with the aim of reacting to the difficulties arising from the pandemic, and continue serving customers in an effective and efficient way by making greater use of current technologies or adopting new ones. Some of these initiatives concerned contract administration and customer services (eight out of 32), with several insurance companies (e.g. Company 13) temporarily waiving members’ out-of-pocket costs for telehealth consultations (also known as telemedicine). Similarly, due to lockdown restrictions and the need to reduce the movement of people, Company 22 expanded its telehealth coverage and offered all telehealth consultations with their network providers at no cost to all their members. Concerning claims management, there were a significant number of reactive initiatives (eight out of 32). Many insurance companies (e.g. Companies 25 and 26) stopped all in-home damage inspections to avoid their employees entering people’s homes. Instead, they conducted remote claims assessments through video chat lines or video collaboration tools. Concerning sales-related initiatives (three out of 32), an interesting example came from Company 17. Under the restrictions imposed by various local authorities, the company operated with skeleton staff in its branches and call centres, requiring people to use the internet more intensely, while pointing to the benefits and ease of purchasing from the safety of one’s home. Consistent with Eling and Lehmann ( 2018 ), it is clear that the range of different responses in the market had built on digital interaction between customers and insurance companies from the beginning of the sales process (e.g. Company 8) and throughout the validity of the policy, whether the policyholder had made a claim (e.g. Company 25) or not (see, for instance, Company 20’s wellness advice). In this class of solutions, the technology impulse is significant, allowing companies to react to the emergency and continue serving the market, providing the same experience as before, regardless of the specific situation.

Aggression (high relevance of technology/focus on new risks)

Many insurance companies started leveraging their existing technologies to develop products for dealing with the new risks. A Swiss-based telehealth subsidiary of Company 8 introduced artificial intelligence-based symptom checkers to help patients decide whether they were infected, as well as wearables and diagnostics to better understand patient needs and steer them towards their nearest healthcare facilities. Similarly, Company 7 was working to provide speedy health assessments via its mobile app, which members could download at no cost. Digitalisation was instrumental to both new and existing products. Technology enabled insurance companies to update and improve traditional products centred on protection, such as helping members isolating in their homes get through difficult patches (e.g. Company 1). Several insurance companies focused on marketing initiatives; Company 13 upgraded its chatbot tool so that people could make a pre-assessment of a possible infection, and the tool also proposed a possible health insurance policy in specific cases. Regarding support to human resources, many insurance companies introduced remote working to reduce the spread of the disease and protect their employees (e.g. Company 27). These initiatives were driven by a relevant technology impulse, as insurance companies were able to exploit their existing technologies to address and aggressively ‘take on’ the new needs emerging from the market, handling them in an efficient and innovative way, and possibly gaining competitive advantage.

The nature of innovation rationales

Figure 1 shows the distribution of initiatives, cluster by cluster, along the insurance value chain. Most Aggression initiatives were related to product development (10 out of 35 initiatives), generating technologically-enabled products to address new risks. Expansion initiatives were related more closely to contract administration and customer services (12 out of 26), these often being extensions of existing (and purchased) products to cover new risks. A good number of Reaction initiatives (eight out of 32) concerned claims management, where insurance companies exploited their existing technologies to continue serving their customers. Lastly, Adaptation initiatives were frequently implemented in underwriting (five out of 19), with discounts or extensions to premium payments. While several contract administration and customer services initiatives were put forward to manage people’s daily routines, we noticed something similar in product development. Therefore, market demand linked to unsatisfied customer needs potentially opens up room for new products (Maier et al. 2016 ), despite the practical difficulties that arise when insurance companies handle new risk insurance under conditions of scarce historical data and few models for measuring risks accurately (Śliwński et al. 2017 ).

Considering initiatives where technology is relevant (i.e. Reaction and Aggression ), our findings support those found in previous studies (Eling and Lehmann 2018 ; Stoeckli et al. 2018 ) on the impact of digitalisation on the insurerance value chain. For instance, digital technologies made certain marketing communication strategies possible (e.g. Company 13’s online symptom checker for COVID-19 that can, in some cases, suggest suitable health coverage), attracting prospects and eventually offering insurance products and services, or were of assistance in insurance sales (e.g. enabling online sales via the web or apps, as in the case of Company 20). They also supported a smoother interaction with agents and employees (e.g. digital touchpoints and distance working), the adoption of new systems for claims management (e.g. drones, video calls and apps), the offering of new services (e.g. telemedicine, digital tools for providing psychological support, tools for identifying available public financial aid), and the improvement of policies for actual customers (e.g. including new policies such as those for COVID-related issues). Furthermore, our research supports the claim made by Stoeckli et al. ( 2018 ) that InsurTech enables innovations coupled with an underwritten insurance product (e.g. Company 1 offered triage tools and a symptom checker to its highest risk members to collect data and assess their status and needs more efficiently), as well as those that are not coupled to an underwritten insurance product but are packaged with complementary products (e.g. Company 9 offered their customers a free online consultation service with qualified personal trainers, chefs and dieticians).

The relevance of such initiatives for society can be observed from several points of view. Many insurance companies responded to increasing health concerns. More than half the initiatives dealt specifically with health issues, from the risk of infection to lockdown-related psychological issues (see, for instance, the 24/7 hotline set up by Company 22 to help people get through the crisis). Some innovations in the health insurance sector actually produced more frequent interactions between customers and insurers. For instance, Company 8 opened a hotline for coronavirus enquiries, while Company 9 introduced its ‘heroes against loneliness’ initiative, where employees spend time on the phone with customers in high-risk groups, asking them about their well-being, and they set up a platform where people can register and connect with each other. Other initiatives responded to economic and financial issues, such as the decision taken by Company 1 to give grace periods for paying insurance premiums, which was open to both employees and individuals. The aim of several initiatives was to solve work-related issues in insurance companies, in particular by introducing remote working, and also extending coverage to risks arising from an increase in remote working within other industries. Company 2, for instance, extended existing policy guarantees to cover business clients in specific situations, such as against cyberattacks, since most of their employees were working remotely. Lastly, other initiatives were designed to ensure continuity in their customers’ daily lives, for instance, digital home inspections to assess damages (see Company 25).

Conclusions

The COVID-19 pandemic gave rise to a number of serious issues for society. Due to their socio-economic importance, insurance companies were well-placed to play an important role in addressing these problems. Many insurance companies supported the general public, for instance by making large donations to health systems (e.g. Company 8 gifted 350,000 surgical masks to hospitals) or supporting people in financial distress (e.g. Company 9 donated to the EUR 200 million insurance Federation contribution to the EUR 1 billion solidarity fund created by the French government to support small and medium enterprises, very small enterprises and self-employed workers in difficulty).

At the same time, although the insurance industry has not traditionally fully exploited its innovation potential due to its conservative approach (Nam 2018 ), we found that insurance companies are indeed innovating. With the emerging of a particularly serious new risk, insurance companies took the opportunity to rethink their value chain and develop new products and processes, exploiting their existing technology and tapping into their customers’ needs. This research offers valuable insight into the innovation initiatives undertaken by insurance companies, and its aim is to share meaningful findings and contribute to our understanding of how insurance companies respond to highly uncertain events.

By grouping the initiatives according to the relevance of technology in each case and the kind of risks covered, we extrapolated four types of rationale behind the initiatives, creating four classes. Depending on whether they made use of and/or upgraded existing technology or implemented new technologies, insurance companies were able to handle pre-existing risks, and so continue to serve their customers in an effective and efficient way ( Reaction initiatives), or tackle new risks ( Aggression initiatives). However, despite the clear impulse towards digitalisation and the ensuing wide set of potential opportunities, we also identified a broad selection of initiatives where the role of technology was negligible ( Adaptation and Expansion strategies). Some reactive innovations responded to increasing health issues, others were more strictly associated with economic and financial difficulties. Others still related to work-related matters in insurance companies, in particular remote working, but there were also instances of extending cover against risks arising from an increase in distance working within other industries. Lastly, some initiatives were designed to establish continuity in everyday life.