Request Letter Format for GST Refund – Application GST Refund Letter

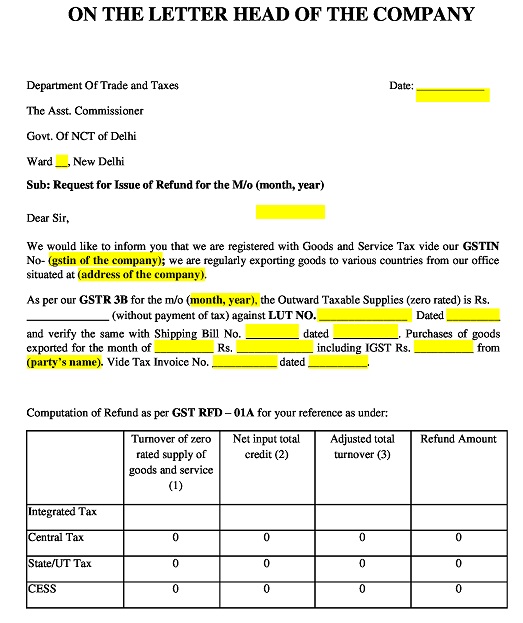

If you are entitled for GST refund then all you need is a professional GST refund letter format to submit your GST refund application with the department. This might sound a little complicated to you as it is for the first time you are submitting your request for refund. But with declaration format for GST refund, covering letter format for GST refund and undertaking format for GST refund, you can conveniently submit a formal application,

We bring to you a perfect Request Letter Format for GST refund in Word and PDF format . Use this easy to download and customize GST refund application to create a personalized letter with no hassles.

Another GST Related Format

- GST Revocation Request Letter Format

- GST Email id and Mobile Number Change Letter Format

- Calculation of GST on Purchase or Sale of Foreign Currency in Excel Format

- GST Delivery Challan Format in Excel For Transportation of Goods Without Tax Invoice

- GST Invoice Format in Excel for Job Work

- GST Payment Voucher Format in Excel for Payments Under Reverse Charge

- GST Receipt Voucher for Advance Payments under GST Format in Excel

- GST Retail Invoice Format in Excel Sheet Free Download

- Declaration for Authorised Signatory for GST in Word Format

- GST Interest and Late Fee Calculator in Excel Format

- What are the Reasons for Receiving GST Notices?

- Everything You Must Know About GST on Rent

- GST Refund Power of Attorney Letter Format

- Reply Letter Format to GST Department

- Letter of Authorization for GST Sole Proprietorship

Top File Download:

- GST refund application letter

- gst letter format

- letter issue to vendor regarding this our GST No

- letter format for gst payment reconciliation issue

- WRITE LETTER FOR GST DEPARTMENT FOR SEQURITY DEPOSIT AMOUNT

- cover letter gst return

- sample email format purchase department to account department

- request gst refund letter

- refund format

Related Files:

- Letter for GST not Applicable

- GST Debit Note Format In Excel Under GST 2018

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

- Call +918007700800

- Tally Connector

- SAP Connector

- For GST Return

- For e-Invoicing

- For E-Way Bill

- ITC Reconciliation

- GST Auditing Tool

- GST Litigation/Notice Management Tool

- GST Webinars

GST Refund Series- A Detailed Guide on Basics Of the GST Refund Process

Updated on March 11th, 2024

GST Refund Process: Most Taxpayers & Tax Practitioners struggle around this provision of the GST Regime- GST Refunds. Despite being so important it remains to be a tedious task, & requires a deep understanding of the entire concept.

GST Refund claim is vital for businesses to avoid any loss of funds through taxes.

The article covers all the details you must know before you claim a GST Refund such as types of GST Refund, Forms, Relevant time, withholding GST Refund & a lot more.

GST Refund Process | Complete Steps For Claiming GST Refund By CA Swapnil Munot

You may also interested in reading below posts:

GST Refund-How To Claim Online on Excess GST?

How to track gst refund status | gst refund process.

Get Free Bonus Report: Claim 100% ITC for your business

What is a Refund under GST?

Refund under GST is the process of reversal of taxes paid by the taxpayer, for one or the other reason. You can claim a refund of the tax that you paid if you are eligible for it, by filing a refund return form under GST.

There can be multiple cases where a taxpayer is eligible for a refund of some sort, most of these situations are specified by CBIC or the Government.

If you have paid taxes in any situation that falls under this specified category, then you can claim a refund of such GST, for example- Exports, they are kept tax-free by the Government to endorse exports by keeping it simpler. Exporting is an international activity & brings profit to the government in numerous ways.

Hence, exporting goods is tax-free, however, you may have to pay IGST, as export is also an inter-state movement of goods.

But the Government gives you an option to claim a refund of the IGST paid, as you paid taxes on a Zero-rated Supply.

Just like the above, there may be other cases where a taxpayer can claim a GST refund such as extra tax payment, tax payment on zero-rated supplies, refund by order, etc.

The Taxpayer will have to submit a relevant Refund Return Form, get it signed by an authorized person- CA & then submit it to the common GST Portal along with the supporting documents.

GST refund process is online & patterned depending upon the type of case. A taxpayer can claim the GST Refund within the defined time-frame only.

Although there are generic processes & forms, etc. in refund under GST, all cases may be different & unique on its own. In such cases, relevant details must be filled in the relevant forms depending on the situation supported by the relevant documents.

What are the Forms under GST Refund Process

In order to claim a GST refund, you must first understand the GST refund forms & know what each form signifies.

There are a total of 10 Forms under GST Refund & we have listed them down explaining each one of them-

- Form GST RFD 01- The main refund application is made through this form. You must furnish the required details & attach the supporting documents while filing this form. This form also needs to be verified by a CA before submission on the GST Portal.

- Form GST RFD 02- This form is an auto-generated acknowledgment of the GST RFD-01 form.

- Form GST RFD 03- This form can be called an error file. In case of any mistakes or deficiencies in Form GST RFD-01, this error file will be sent to the taxpayer, containing the errors or indicating deficiencies. The taxpayer can rectify these errors & try re-filing Form GST RFD 01.

- Form GST RFD 04- This form is the Provisional Refund form, mostly a provisional amount of 90% of the refund claimed is granted to the taxpayer initially within 7 days of filing the refund form.

- Form GST RFD 05- On successful validation of the refund application the authorized official will issue a final order through this form. The authorized official must do it within 60 days from the application date.

- Form GST RFD 06- This form is used to adjust the refund against the taxable amount.

- Form GST RFD 07- This form is a notice of rejection of a refund application.

- Form GST RFD 08- This is the payment advice or the Notice Form under refunds, issued by the Tax Official to the taxpayer.

- Form GST RFD 09- In case the refund is delayed from the tax official's end, then this form will serve as an order for interest on late payments to be paid to the taxpayer.

- Form GST RFD 010- This is the main refund form for UN bodies, foreign embassies, or consulate. Any foreign bodies or embassies (as per section 55 of the CGT Act) can claim their refunds through this form.

- Additionally, there is Form GST RFD-11 but it is not a refund form, it is the Letter of Undertaking or LUT form, that is filed in case of exports while exporting goods without the payment of IGST.

Application of GST Refund- Cases Of Allowable Refunds

There are certain scenarios where the taxpayer is eligible to claim a refund of GST paid.

We have listed down the most common cases where a refund can be claimed-

- Refund of excessive paid taxes.

- Refund of taxes paid for the Export of goods & services with IGST .

- Refund of taxes paid on the supplies made to SEZ Unit/SEZ Developers with IGST .

- Refunds for UNOs, of tax paid on inward supplies of goods or services by the United Nations Organization, etc. as notified under section 55.

- Refund of unutilized Input Tax Credit (ITC) on account of Exports without the payment of integrated tax.

- Refund of unutilized input tax credit (ITC) on account of goods or services supplied to SEZ Unit/ SEZ Developers without the payment of integrated taxes.

- Refund of unutilized Input Tax Credit on account of accumulation due to the inverted tax structure, where the input tax is more than outward tax liabilities.

- Refund for the supplier, of tax paid on deemed export supplies.

- Refund for the recipient, of tax paid on deemed export supplies.

- Refund of excess balance in the electronic cash ledger .

- Refund on assessment/provisional assessment/appeal/any other order.

- GST Paid by foreign tourists can also be subject to refunds.

These are the most basic & generic situations where GST Refund is applicable, but there may be other situations & special cases as well & the procedures for claiming refunds in each situation may vary.

Exceptional Scenarios under GST Refund Process

There are various other situations where the GST Refund claim may be ineligible & yet allowed.

Similarly, there may be situations where the refunds are eligible & yet not be allowed under special circumstances.

These are exceptional cases & need to be treated differently by the taxpayers.

Following are the special cases of GST Refund claim-

- Taxes paid under wrong GST Head - In case you have paid CGST & SGST for inter-state movement of goods you are eligible to claim a refund of the CGST & SGST after paying the taxes in the right GST Head.

- For Supplies not receive - If you have paid taxes on a supply that you didn't receive & for which an invoice was not generated, then you can claim a refund of such taxes.

- Tax refund order - Taxes can be refundable as a consequence of a judgment, decree, order or on the direction of an Appellate Authority, Appellate Tribunal or any court.

- No Refund on ITC in case of exports - You cannot claim ITC on taxes paid on exports that were taxable under excise duty.

- Duty Drawback - If your supplier has availed the benefit of duty drawback paid under excise duty, then you cannot claim a refund of such ITC.

What is Relevant Date & Time Limit For Claiming GST Refunds?

Claiming GST Refunds is squared into a time-frame. The refunds may best be claimed within the boundaries of this time-frame.

A GST refund may be claimed within two years from the relevant date. This means that the relevant date is the earliest date from when a taxpayer can start claiming their refunds.

Different cases of GST refunds have different Relevant Dates.

Given below is a table for you to understand the relevant dates for each case-

What is withholding of Refunds under GST & its Consequences?

Although the GST Refund process is smooth & hasslefree there may be some complications in it.

Generally, a taxpayer files the form GST RFD 01, by filing the relevant details & attaching the supporting documents, he then gets the form verified by a CA and submits the form to the relevant Tax Official.

The role of the taxpayer ends here, & the rest of the process will lie in the hand of the Tax Official, he may accept, hold, or reject your GST Refund application on authentication of the same.

Although, the Tax Officials are obliged to process your refund or at least take required actions to it within 60 days from the date of applying.

The Tax Officials cannot hold your GST Refund without informing or without generating a relevant revert form stating facts as to why is the refund being withheld.

In the case where a refund is liable to further proceedings or appeal & the Commissioner is opinioned that a refund may be a liability to the Revenue on account of false or fraud commitments & claims, then the jury may withhold such GST Refunds.

The minimum declared amount of claiming a refund is Rs. 1000, any amount less than that & no refund will be granted.

Ideally, a tax official is required to produce a deficiency memo, acknowledgment form, or a rejection form within 15 days from the date of ARN generation, & release the provisional credit within 7 days from the date of ARN generation, if the refund application is accepted.

Also, the Tax Officials are required to release the refund within 60 days from the date of ARN generation, if they fail to do so, then the Government will have to pay interest to the taxpayer at the rate of 6% per annum, calculated for the period of the delay.

The interest amount will be auto-credited to the taxpayer's bank account that he mentioned while registering.

Refund under GST is highly complicated despite being one of the most important provisions of the GST Regime. One must be aware of even its minor details to claim the refund accurately.

The GST Refund process is a variable subject & can mold differently for different situations & cases.

In fact, incorrect GST refund applications can be massive troublemakers for Businesses, especially if they are escalated to an appeal or a proceeding.

You are also likely to lose the credits due to having incomplete information about the process & other provisions of GST Refund.

To read other articles in this series, click here .

File your GST returns in minutes, not hours!

Get Live Demo and experience the simplicity by yourself.

- GSTR 1 and GSTR 9C all returns made automatically and faster

- GSTR 1 data is auto populated

- Auto-notification to your defaulting suppliers

- 1-click data preparation

About the author

Pallavi is currently associated with GSTHero as a Senior Executive-Indirect Tax. She has industry experience as a Financial Controller with a demonstrated history of working with Fin-tech industries. Her expertise includes GST Law, GST Software Development, Business Planning & Development, Corporate Finance, Accounting & Income Tax.

Join Our Newsletter

* fields are mandatory

- Submit Post

- Union Budget 2024

- Goods and Services Tax

Format of Undertaking for GST refund application

Undertaking with respect to GST Refund Application for the period : From xx/xx/xxxx to xx/xx/xxxx

1. I/We hereby declare that the goods/services exported are not subject to any export duty. No drawback has been availed / or availed at lower rate by us in respect of central tax and no refund is claimed by us in respect of the integrated tax paid on such supplies in terms of Section 54(3) of CGST/SGST Act.

2. I/We hereby declare that refund of input tax credit claimed does not include input tax credit availed on goods or services used for making Nil rated or fully exempted supplies.

3. I/We hereby declare that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person in terms of Rule 89(2)(l) of Central Goods and Services Tax (CGST) Rules, 2017 .

4. I/We hereby declare that the GST refund application has been made to one authority only.

5. I/We hereby undertake that during any period of five years immediately preceding the tax period to which the claim for refund relates, I/We have not been prosecuted for any offence under the Act or under an existing law where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

6. I/We hereby undertake to pay back to the government the amount of refund sanctioned along with interest in case it is found subsequently that the requirements of Section 16(2)(c) read with Section 42 of the CGST/SGST Act have not been complied with in respect of the amount refunded.

Authorised Signatory

- Goods And Services Tax

- « Previous Article

- Next Article »

Name: Saurabh Gupta

Qualification: ca in practice, company: gupta saurabh & co., chartered accountants, location: gurgaon, haryana, in, member since: 02 may 2018 | total posts: 1, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Channel

- Join Our Telegram Group

13 Comments

any format for declaration of deemed export input claim under inverted refund

Hi Whether this declaration will take Rs. 20 or Rs.50 or Rs.100 is mandatory. Please anyone advice???

what is the authority or legal backing–which act and rules aply for undertaking

RWA having gst exemption 7500 per month and per member. Where us RWA paying gst amount to the vendor. Will they eligible to claim refund?

SIR,MY QUERY “SHIPMENT OF EXPORT UNDER THE PAYMENT OF IGST BUT SHIPPING FILED LUT. GSTR1 WE HAVE PAID IGST PLEASE ADVISE IGST REFUND OF CUSTOM

Please help you sir

1. You have not submitted the undertaking that claim is filed only to one of the tax authorities i.e. Central or State. 2. You have not submitted declaration regarding non-prosecution for last five years under Rule 91 of CGST Rules, 2017 where the amount of tax does not exceeds than Two hundred and Fifty lacs. 3. You have not submitted the undertaking for returning the refund amount to government with interest if the requirements of clause (c) of sub-section (2) of section 16 read with sub-section 42 of CGST Act have not been compiled with.

Hi. Can someone please share the Indemnity Bond and Undertaking format for Refund of GST for excess balance in Cash Ledger?

Saurabh ji, Thank you for such a useful article. I request if you have specific format of undertaking issued by EOU`s to a DTA on supplies procured by them and EOU is not claiming refund of IGST amount charged in tax invoice. Any further clarification required shall be gladly provided as and when asked for. Thank You

Sir, the article is very useful. Thanks. If my understanding is correct, after 01.07.17, if a person is claiming ‘All Industry Rate’ of Duty Drawback, still he can claim refund of accumulated ITC on account of continuous exports. But I am not getting the relevant circular / authority under which it is allowed. Please help.

any format for Export of service refund

Thanks for the post.

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: 0b6511da740a44b99b577a9a62335ff6

Subscribe to Our Daily Newsletter

Latest posts.

Unreceived GST ASMT 10/DRC-01: HC Grants Petitioner Opportunity

GSTR-1 Turnover Reporting Error Case: HC Grants opportunity to petitioner

Interest on compensation taxable as income from other sources: Delhi HC

GST registration cannot be cancelled retrospectively for non-filing of return for some period

Stamp duty valuation on Allotment letter date should be considered for Section 56(2)(x)

HC set-aside GST Registration cancellation SCN/Order for lacking reason for retrospective cancellation

HC Quashes GST order for Failure to Seek Further Details from Petitioner

Alleged Misuse: Madras HC orders disposal of GST registration revocation application

Expert Panel for Addressing queries related to Statutory Audit

Ex-parte Order Invalid if SCN Issued Post GSTN Cancellation: Delhi HC

Featured posts.

For Tax Filing – Analyze the Old and New Tax Regime

Auto-populate HSN-wise summary from e-Invoices into Table 12 of GSTR-1

CBDT mandates electronic filing of 8 income tax forms starting April 1, 2024

Advisory on Reset and Re-filing of GSTR-3B of some taxpayers

CBDT Clarifies on Misleading Reports on HRA Claims

Financial Year end GST Checkpoints

Representation on Incorrect/Delay In Submitting Application U/S 12A(1)(ac)

Statutory and Tax Compliance Calendar for April 2024

TDS Deduction under Old vs New Tax Regime & Budget 2023 Impact

Functionalities to file commonly used ITRs enabled by CBDT on 1st April, 2024

- Toll Free 1800 309 8859 / +91 80 25638240

Home GST GST Declarations

GST Declarations

Tally Solutions | Updated on: December 28, 2021

--> published date: | updated on: --> <--, what is gst declaration form india– in context to registration.

- Who should apply

- Any prescribed format

- Manner of uploading the authorization letter

- Prerequisite before filing: GST declaration for refund

- GST declarations to be annexed in form of statement for refund processing

- It is a document usually in form of official letter

- Signed by promoters of a business, authorizing and nominating one person from the business as an Authorised Signatory

- Purpose: In GST Registration - to apply for GST registration and complete all related formalities.

- Any prescribed format? There is no prescribed format in GST law but one can download the format of letter of authorization from various sources online.

- Manner of uploading the authorization letter : The declaration for the appointment of authorized signatory is required to be uploaded in PDF or JPG. The maximum file size which the GSTIN will accept is 1MB.

GST declaration for refund

- Applicant should have filed the GST returns in GSTR-1 of the month for which the claim is made and GSTR-3B of the previous month.

- Applicant must have the list of invoices in hand against which the refund is claimed.

- Declaration in form of Annexure -1 containing statements as documentary evidences, have to be made or submitted under different types of refund claims.

- A Certificate issued by Chartered Accountant/ Cost Accountant also needs to be annexed along with the Refund application in RFD-01/RFD-01A.

Read More on GST

GST Software , GST Software for CAs , GST Software for Traders , GST Invoicing Software , GST Calculator , GST on Freight , GST on Ecommerce , GST Impact on TCS , GST Impact on TDS , GST Exempted Goods & Services , Reverse Charge Mechanism in GST

GST Rates & Charges

GST Rates , GST Rate Finder , GST Rate on Labour Charges , HSN Codes , SAC Codes , GST State Codes

Types of GST

CGST , SGST , IGST , UTGST , Difference between CGST, SGST & IGST

GST Returns

GST Returns , Types of GST Returns , New GST Returns & Forms , Sahaj GST Returns , Sugam GST Returns , GSTR 1 , GSTR 2 , GSTR 3B , GSTR 4 , GSTR 5 , GSTR 5A , GSTR 6 , GSTR 7 , GSTR 8 , GSTR 9 , GSTR 10 , GSTR 11

Tally Solutions | Nov-28-2019

- Business Guides

- ERP Software

Latest Blogs

MSME Payment Rule Changes from 1st April 2024: A Quick Guide

Are Your Suppliers Registered Under MSME (UDYAM)?

Nuts & Bolts of Tally Filesystem: Embedded Indexing

Moving to New Financial Year

How to Create and Use Barcodes for Inventory Management with TallyPrime

5 Inventory Management Best Practices

Compliance is NO MORE complex! Ease of e-invoicing & accurate GST return filing with TallyPrime!

Thanks for Applying

We will be in touch with you shortly.

- Popular Courses

- GST Live Course

- More classes

- More Courses

GST Refund Letter Format || GST ||

CA Naveen Chand

on 20 February 2018

Download Other files in GST category

Trending Downloads

- Tax Connect (With GST) - 449th Issue

Trending Online Classes

Live class on Bonus & Gratuity(with recording)

Live Class on Mastering Virtual Hearings in Faceless Assessments

GST Live Certification Course (39th Batch) - April 2024 (Weekend Batch) (With Certificate)

Popular Files

Quick links.

- Submit File

- Top Downloads

- New Downloads

- Contributors List

- Top Rated Files

- Top downloads of the month

- Top Weekly Downloads

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

10+ GST Declaration Letter Format – Tips, Examples, Email Template

- Letter Format

- February 1, 2024

- Authorization Letters , Business Letters , Confirmation Letters , Legal Letters

GST Declaration Letter Format : A GST declaration letter is a document that businesses or individuals may need to provide in order to declare their compliance with the Goods and Services Tax (GST) regulations in their respective country . This letter serves as a confirmation that the individual or business has followed all the necessary procedures and rules related to GST and has accurately calculated and paid their GST dues.

GST Declaration Letter Format Tips

Content in this article

The GST declaration letter format may vary depending on the specific requirements of the country or jurisdiction . However, there are certain elements that are generally included in a GST Declaration Letter Format. These include:

- Name and address of the business or individual : The Business letter should start with the name and address of the individual or business declaring their GST compliance.

- GST registration number : The letter should include the GST registration number assigned to the business or individual by the tax authorities.

- Declaration of compliance : The letter should clearly state that the individual or business has complied with all the rules and regulations related to GST. This declaration should also include details of the GST returns that have been filed, the tax liability that has been calculated, and the tax that has been paid.

- Date of declaration : The letter should clearly state the date on which the declaration is being made.

- Signature and designation : The letter should be signed by the authorized signatory of the business or individual, along with their name and designation.

GST Declaration Letter Format is important to ensure that the information provided in the GST Declaration Letter Format is accurate and complete to avoid any potential penalties or legal issues. By following the appropriate format and providing accurate information, businesses and individuals can demonstrate their compliance with the GST regulations and maintain a good reputation with the tax authorities.

Example 1: GST Declaration Letter Format for a Sole Proprietorship Business

Here is example for GST Declaration Letter Format for a Sole Proprietorship Business

[Name of Sole Proprietorship Business] [Address] [City, State, Pin Code] [Country]

[GST Registration Number]

Date: [Date of declaration]

To, [Name of Tax Authority] [Address] [City, State, Pin Code] [Country]

Subject: Declaration of GST Compliance

Dear Sir/Madam,

I, [Name of Authorized Signatory], proprietor of [Name of Sole Proprietorship Business], hereby declare that the business has complied with all the rules and regulations related to GST. We have filed all the necessary GST returns for the period [Insert period]. We have accurately calculated our tax liability and paid all the tax dues on time.

I confirm that all the information provided in the GST returns is correct and complete to the best of my knowledge and belief.

[Signature of Authorized Signatory] [Name of Authorized Signatory] [Designation: Proprietor]

Example 2: GST Declaration Letter Format for a Partnership Business

Here is example for GST Declaration Letter Format for a Partnership Business

[Name of Partnership Business] [Address] [City, State, Pin Code] [Country]

We, [Name of Authorized Signatories], partners of [Name of Partnership Business], hereby declare that the business has complied with all the rules and regulations related to GST. We have filed all the necessary GST returns for the period [Insert period]. We have accurately calculated our tax liability and paid all the tax dues on time.

We confirm that all the information provided in the GST returns is correct and complete to the best of our knowledge and belief.

[Signature of Authorized Signatories] [Name of Authorized Signatories] [Designation: Partners]

Example 3: GST Declaration Letter Format for an Individual

Here is example for GST Declaration Letter Format for an Individual

[Name of Individual] [Address] [City, State, Pin Code] [Country]

I, [Name of Individual], hereby declare that I have complied with all the rules and regulations related to GST. I have filed all the necessary GST returns for the period [Insert period]. I have accurately calculated my tax liability and paid all the tax dues on time.

[Signature of Individual] [Name of Individual] [Designation: Individual Taxpayer]

Example 4: Email Format about GST Declaration Letter

Here is Email Format example for GST Declaration Letter Format

Subject: GST Declaration Letter for [Name of Business]

Dear [Name of Recipient],

I am writing to provide you with the GST declaration letter for [Name of Business]. As per the GST regulations, we are required to declare our compliance with the GST rules and regulations. Please find attached the GST declaration letter, which includes all the necessary details such as our business name, address, GST registration number, a declaration of compliance, and the signature of the authorized signatory.

We confirm that we have filed all the necessary GST returns for the period [Insert period]. We have accurately calculated our tax liability and paid all the tax dues on time. We also confirm that all the information provided in the GST returns is correct and complete to the best of our knowledge and belief.

If you have any questions or require any further information, please do not hesitate to contact us.

Thank you for your time and attention.

[Your Name] [Designation] [Name of Business]

A GST declaration letter format is a standardized way of providing information about a business’s compliance with GST regulations . The GST Declaration Letter Format typically includes essential details, such as the business name, address, GST registration number, a declaration of compliance, the date of declaration, and the signature of the authorized signatory . It is important to ensure that the letter is accurate and complete to avoid any legal issues or penalties .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

28+ Assurance Letter Format – How to Start, Examples, Email Template

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

AI Summary to Minimize your effort

Filing of a Refund Application Under GST by an Unregistered Person

Updated on : Jan 10th, 2023

10 min read

In the 48th GST Council meeting, one of the decisions taken by the Council was for the government to lay down the rules for unregistered persons to file a refund application under GST. This decision was taken due to several instances taking place where an unregistered buyer had entered into a construction agreement or contract with a builder, but the said contract had been subsequently cancelled. Another situation could arise where long-term insurance policies are cancelled where the entire premium had been paid upfront.

On 27th December 2022, the CBIC released a circular prescribing the manner in which an unregistered person can file a refund application. In this article, we explain the process by which an unregistered buyer can file a refund application under GST law.

Cases where an unregistered person may claim a refund under GST

Circular No.188/20/2022-GST lists the procedure for two cases where unregistered buyers may claim a refund under GST.

- Unregistered buyers of construction services

In this case, unregistered persons have entered into an agreement with a builder for the supply of construction services for apartments/buildings, etc. The buyer has further paid the amount towards consideration for such services, fully or partially, along with the applicable taxes. However, the said contract or agreement has thereafter been cancelled due to reasons such as non-completion of the project or delay in construction activity, or any other reason.

Here, the period for issuance of a credit note as per Section 34 of the Central Goods and Service Tax (CGST) Act may have already expired by this time, i.e. earlier of 30th November of the following financial year in which the supply was made, or date of filing the annual return. Hence, while the supplier may refund an amount to the buyer in the case of cancelled contracts, this amount would be after deducting the GST portion as it would have already been paid to the government.

- Unregistered buyers of long-term insurance policies

The second case, where unregistered buyers can file a refund application, applies where the premium for the entire period of a long-term insurance policy, along with the applicable GST, has been paid upfront, and the policy is subsequently required to be terminated prematurely due to any reason. Similar to the above situation, the time period for issuing credit notes may have already expired, and the insurance company may refund only the proportionate premium without the GST amount.

To ease the hardships of unregistered buyers in the above two cases, the government has now provided a facility where such persons may file a refund application under GST.

Provisions in the GST law on refunds for unregistered persons

As per Section 54(1) of the CGST Act, any person can claim a refund of tax and interest paid by filing an application within two years from the relevant date, explained in the later section of this article.

Further, Section 54(8)(e) of the CGST Act says that where unregistered persons have borne the incidence of tax and not passed on the same to any other person, then the said refund should be paid to the unregistered person and not credited to the Consumer Welfare Fund (CWF).

Further, the government has amended Rule 89(2) of the CGST Rules and inserted Statement 8 in Form GST RFD-01 vide Notification No.26/2022-Central Tax dated 26th December 2022. This change provides for the required documents to be furnished/uploaded along with the refund application.

Hence, while the law already provides for such refunds, the government is now providing a new functionality on the GST portal. This will allow unregistered persons to take a temporary registration to apply for a refund under the category ‘Refund for unregistered person’.

Filing of a refund application by an unregistered person

The following is the procedure for an unregistered person to file a refund application under GST:

Step 1: Obtain a temporary GST registration

- The unregistered person whose construction or insurance contract has been terminated is required to obtain a temporary registration on the GST portal using their PAN.

- At the time of registration, the unregistered person should select the same state/Union Territory where their supplier, in respect of whose invoices the refund is to be claimed, is registered.

- The applicant is then required to undergo Aadhaar authentication as laid down under Rule 10B of the CGST Rules.

- They also need to provide their bank account details in which they would prefer to receive the refund amount. (Note here that the applicant is supposed to provide the bank account details, which is in their name and has been obtained on their PAN.)

Step 2: File a refund application in GST RFD-01 with supporting documents

- The applicant should file the refund application using Form GST RFD-01 on the GST portal under the category ‘Refund for unregistered person’.

- Further, they should upload Statement 8 (in PDF format) along with all the requisite documents as per Rule 89(2) of the CGST Rules. (Note that the refund amount claimed should not exceed the total tax value of the invoices in respect of which the refund is being claimed.)

- The applicant must also upload the certificate issued by the supplier as per the terms of Rule 89(2)(kb) of the CGST Rules while filing the refund application.

According to Section 89(2)(kb), a certificate is to be issued by the supplier to the effect that they have paid the tax in respect of the said invoices on which the refund is being claimed by the applicant. Further, the supplier should state that they have not adjusted the tax amount involved in these invoices against their tax liability by issuing a credit note. It should also state that the supplier has not claimed and will not claim a refund of the amount of tax involved in respect of these invoices.

If there exists any other document which proves that the applicant has paid and borne the incidence of tax and that the said amount is refundable to him, then the same must also be uploaded. For example, the invoices and receipts for making payment to the developer/builder.

Prerequisites for filing a refund claim

- For every refund claim with regard to a particular supplier, a separate application must be made on the GST portal. This also holds good if the same supplier is registered in different states or Union Territories, as a separate registration will need to be obtained in that state/UT.

- Refund claims are only to be filed where the time period for issuance of a credit note has already expired. When the time period hasn’t yet expired, the supplier is still in a position to issue the credit note and refund the GST amount, and hence there is no need to file applications for a refund in such cases.

Relevant date for filing a refund application

As per Section 54(1) of the CGST Act, unregistered persons can file a refund application within two years from the relevant date. The relevant date in cases of refund by a person other than the supplier will be the date of receipt of goods or services or both as per clause (g) of the second explanation given to Section 54 of the CGST Act.

However, if a long-term contract has been cancelled between a supplier and unregistered buyer where the payments are made in advance or in instalments, there may be no date of receipt of service to the extent the supply has not been made/rendered. In such cases, for the purpose of determining the relevant date, the date of issuance of the letter of cancellation of the agreement or contract for supply by the supplier will be the date of receipt of services by the buyer.

What happens post-filing of a refund application?

Once a refund application has been filed, the proper officer shall process the claim in a manner similar to other RFD-01 claims.

- First, the proper officer will scrutinise the application to ensure the completeness and eligibility of the refund claim.

- Next, they will issue the refund sanction order in Form GST RFD-06.

- Finally, the proper officer will upload a detailed speaking order along with the refund sanction order within 60 days from the date of receipt of the completed application.

If the amount paid back by the supplier to an unregistered buyer on the termination or cancellation of a contract is less than the amount paid by the unregistered buyer to the supplier, then only a proportionate amount of tax in such amount paid back will be refunded to the unregistered person. For example, an unregistered buyer paid a premium of Rs.1,000 for an insurance policy that later got cancelled. The supplier refunded Rs.500. Hence, a proportional amount of GST amounting to Rs.90 only will be refunded and not the total GST amount of Rs.180.

What is the minimum amount for filing a refund application?

According to Section 54(14), no refund shall be paid if the amount is less than Rs.1,000. Hence, the minimum tax amount to be refunded in a refund application is Rs.1,000.

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

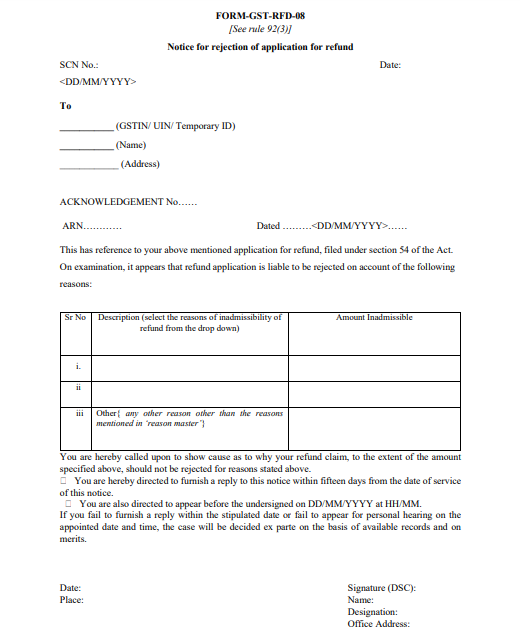

Form RFD-08 is also known as notice for rejection of the application for refund. This form provides information about the reason why form RFD-01 and RFD-01A are rejected.

The GST Refund Application is applied in RFD-01 and RFD-01A of which the acknowledgement is received in Form RFD 02 . The Form RFD 03 , which is the deficiency memo, suggests any pending/ missing status in the application. Form RFD 04 is the provisional refund order after which Form RFD 05 , the payment advice is issued. It is followed by the Final Refund Order in Form RFD 06 , while Form RFD-07 is an order for complete adjustment of sanctioned GST Refund.

Following are the details of form RFD-08:

The form starts with Show Cause No.

The body of this notice begins with the application reference number (ARN), date, acknowledgement number and date.

The reasons for inadmissibility of refund are provided in a table given in the notice.

The reasons to be entered are available in the drop-down. However, if the officer wants to enter any other reasons then he can do so by using the “Other” option.

If the applicant wants to reply to this notice then he can do so within 15 days from the date of service of this notice by using RFD-09.

It is important to note that the applicant is required to appear before the undersigned on a prefixed date and time as mentioned in the form. If the applicant fails to do so then the case will be decided ex parte on the basis of available records and on merits.

IRIS GST helps all its readers with its premium product – IRIS Sapphire which is a cloud-based GST Return Filing Software and has advanced reconciliation module with strong reconciliation rules like match invoices across FY, beyond invoice number, fuzzy logic and user-defined tolerance that helps you completely match your purchase data with GSTR 2A and maximize your ITC.

Streamline you ITC Maximization & GST Refunds with

Bhavika is Customer Success Manager for IRISGST at IRIS Business. An ICWA, Bhavika comes with approx 13 years of experience in Compliance Reporting. She has been handling clients in Indian Markets since the GST mandate and has profound expertise in product functioning, GST filing and issue resolution. During leisure time, she loves traveling and likes to explore new places.

Leave a comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Get GST Ready

GST Filing Solution | IRIS Sapphire EWay Bill Application | IRIS Topaz GST API | IRIS Zircon

Blog Newsletter GST Notifications and Circulars FAQ powered by IRISGST E-books #GSToon #WFH Positivity Dossier GST Compliance Calendar

Simplify GST Compliance

GST Reconciliation Annual GST Return Filing CaptainBiz

ISO 27001 Certified

Beyond GST Compliance

GST Data for Credit Evaluation & Monitoring | IRIS Credixo GSTIN Verification App | IRIS Peridot E-Invoicing Solution | IRIS Onyx

IRIS IRP Portal About IRIS GST About IRIS Business Contact Us

Our Partners

Arteria Grant Thornton ICICI Bank | Saral GST Logo Infosoft | CaptainBiz Moneycontrol.com | Easybiz Rama Softlink Swipez Winsoft

7th Edition TAX Strategy & Planning Summit & Awards

Smart Future of Tax and Finance Summit & Awards

16th CFO Vision and Innovation Summit & Awards

Global Fintech Fest 2023

2nd CFO Confex & Awards 2023

13th NBFC100 Tech Summit – ELETS

2nd Annual Tax Leaders India Summit

Masterclass on GST, Customs and Foreign Trade Policy

Finance Summit Bangalore 2023

10th CFO Vision and Innovation Summit – Transformance

Fintech Festival India – Constellar

12th CFO Vision-Transformance

5th Edition Tax summit – UBS

CFO Innovation Confex & Awards 2023

9th CII WR MSME Summit

Smart Future of Taxation Summit & Awards

13th CFO Vision and Innovation Summit & Awards

6th Edition Strategy Summit 2023

14th CFO Vision and Innovation Summit & Awards

Finance Forward

What is covered in the webinar?

Request A Meeting

Letter of Declaration Format for GST Refund

THE ASTT. COMISSIONER

GOODS & SERVICE TAX BIKRI KAR BHAWAN

WARD NO. 74 NEW DELHI,

REF GST NO._______________________

SUBJECT: REFUND OF GST AMT. FOR THE FIRST QUART. 2017-18

With Respect to the GST NO. _________________ and as required by you . I Raj Kumar Kushwah Partner of the above Firm herewith Submitting the following facts and undertaking in support of this

A) Cancelled Cheque

B) Copy of Bank Statement Showing Proof of Payment

C) I Declare Under Section 54(3)(iii) that refund of ITC claimed does not include ITC availed on goods and services used for making NIL rated or fully Exempt Supplies.

D) I further undertake that the amount of refund Sanctioned will be paid back to the Government with interest whenever is found subsequently that the requirement of clause ( C) of Sub Section (2) of Section 16 read with Sub Section (2) of Section 42 of the CGST/SGST have been complied with respect of amount refunded.

(E) I Certify That This Claim Of Refund Has Not Been Preferred To Central Or Any Other Authority.

That I Raj kumar kushwah Solemnly affirm and declare as under that the information given above true and correct as per Para (a) to (e) and nothing has been Concealed there from.

Ifurther declare that no Refund amount for this period received by me till the date.

For Anshul Goods Carriers

- Power of Attorney letter format for GST Refund- https://rtsprofessionalstudy.com/2019/11/10/power-of-attorney-letter-format-for-gst-refund/

2. Authorised Signatory Letter Format for GST Refund- https://rtsprofessionalstudy.com/2019/11/10/authorised-signatory-letter-format-for-gst-refund/

Popular Topics

Latest post, subscribe | newsletter.

Subscribe to our newsletter and stay latest updated on GST, Income Tax and new post.

Leave a Reply

Your email address will not be published. Required fields are marked *

You have successfully subscribed to the newsletter

There was an error while trying to send your request. Please try again.

Insert/edit link

Enter the destination URL

Or link to existing content

IMAGES

VIDEO

COMMENTS

But with declaration format for GST refund, covering letter format for GST refund and undertaking format for GST refund, you can conveniently submit a formal application, We bring to you a perfect Request Letter Format for GST refund in Word and PDF format. Use this easy to download and customize GST refund application to create a personalized ...

RFD-01 & Related Forms Guide. RFD-01 is an essential form for claiming a refund of GST for several types of refunds. The procedure laid down for applying for a refund under GST law is different under different scenarios, as explained in the refund process article. This article focuses on the RFD-01 form, contents, format, time limit to file ...

GST RFD-01 Refund Application form -Annexure 1 Details of Goods -Annexure 2 Certificate by CA 2. GST RFD-02 Acknowledgement 3. GST RFD-03 Notice of Deficiency on Application for Refund ... Refund Application Form 1. GSTIN: 2. Name : 3. Address: 4. Tax Period: From <DD/MM/YY> To <DD/MM/YY> 5. Amount of Refund Claimed : Tax Interest Penalty ...

The two steps involved in filing the GST refund pre-application form are as follows: Step 1: Log in to the GST portal, go to the 'Services' tab, click on 'Refunds' and select the 'Refund pre-application form' option. Step 2: On the page displayed called 'Refund pre-application form', fill in the details asked, and click on ...

Form GST RFD-03. Once the proper officer has reviewed the application and if any discrepancies are found, he has to issue deficiency memo to the applicant in the Form GST RFD-03 within 15 days of refund application. This Form GST RFD-03 has to be issued electronically through the common portal.

4. GST RFD-01A: A self attested refund application form. 5. Other docs: Specific documents needed to claim GST return. Steps to submit a refund pre application form. Once submitted, this application cannot be modified and does not need to be signed. Thus, the user needs to exercise caution when entering the information.

Refund pre-application Form page is displayed. 3. Select the Nature of Business from the options given. 4. Select the Date of Issue of IEC (Only for Exporters). 5. Enter the Aadhaar Number of Primary Authorized Signatory. 6. Enter the Value of Exports made in the Financial Year 2019-2020 (till date) (Only for Exporter), I ncome tax paid in ...

Filed applications can be tracked using the Track Application Status option under Refunds. Once the ARN is generated on filing of refund application in Form RFD-01, the refund application along with the documents attached while filing the form would be assigned to Refund Processing Officer for processing the refund. Tax payer can track the ...

1. Login to GST portal for filing refund application under refunds section. 2. Navigate to Services > Refunds > Application for Refund option. 3. Select the reason of Refund as 'Refund on account of excess balance in cash ledger'. File refund application in GST RFD-01. 4.

The taxpayer can rectify these errors & try re-filing Form GST RFD 01. Form GST RFD 04- This form is the Provisional Refund form, mostly a provisional amount of 90% of the refund claimed is granted to the taxpayer initially within 7 days of filing the refund form. Form GST RFD 05- On successful validation of the refund application the ...

Format of Undertaking for GST refund application. Undertaking with respect to GST Refund Application for the period: From xx/xx/xxxx to xx/xx/xxxx. 1. I/We hereby declare that the goods/services exported are not subject to any export duty. No drawback has been availed / or availed at lower rate by us in respect of central tax and no refund is ...

dear members, this file helps to draft gst refund request letter . #share #pdf. Submitted By: CA Naveen Chand. on 04 July 2018. Other files by the user. Downloaded: 1460 times. File size: 398 KB.

Application form for refund form under GST for manual processing, notified for certain cases of Refund. Applicant should have filed the GST returns in GSTR-1 of the month for which the claim is made and GSTR-3B of the previous month. Applicant must have the list of invoices in hand against which the refund is claimed.

Covering letter for GST Refund | Letter for GST Refund apply . TO, THE ASTT. COMISSIONER. GOODS & SERVICE TAX. New Delhi. REF GST NO. SUBJECT: REFUND OF GST For the Tax Period Oct 2021 to Dec 2021 . DEAR SIR, I Adv. Rajinder Kumar Sethi being authorized Signatory of the above Firm herewith Submit/upload the following supporting Document ...

GST Revocation Letter Format: The Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold in India.The GST system was introduced in July 2017, and it has been in effect ever since. However, there are instances where businesses or individuals may want to revoke their GST registration.In such cases, they must provide a GST Revocation Letter Format to the ...

GST REFUND IN CASE OF EXPORT AGAINST LUT #docx. Submitted By: CA Naveen Chand. on 20 February 2018. Other files by the user. Downloaded: 5888 times. File size: 17 KB.

An acknowledgment covered under the form RFD-02 is available on the common portal for applicants. This acknowledgment will be auto-populated on the common portal after the application of refund is filed using the form GST RFD-01. The following details are covered in the acknowledgment after you file the application for refund:

GST Declaration Letter Format: A GST declaration letter is a document that businesses or individuals may need to provide in order to declare their compliance with the Goods and Services Tax (GST) regulations in their respective country.This letter serves as a confirmation that the individual or business has followed all the necessary procedures and rules related to GST and has accurately ...

Step 2: File a refund application in GST RFD-01 with supporting documents. The applicant should file the refund application using Form GST RFD-01 on the GST portal under the category 'Refund for unregistered person'. Further, they should upload Statement 8 (in PDF format) along with all the requisite documents as per Rule 89 (2) of the CGST ...

Form RFD-08 is also known as notice for rejection of the application for refund. This form provides information about the reason why form RFD-01 and RFD-01A are rejected. The GST Refund Application is applied in RFD-01 and RFD-01A of which the acknowledgement is received in Form RFD 02. The Form RFD 03, which is the deficiency memo, suggests ...

DEAR SIR, With Respect to the GST NO. _________________ and as required by you . I Raj Kumar Kushwah Partner of the above Firm herewith Submitting the following facts and undertaking in support of this. A) Cancelled Cheque. B) Copy of Bank Statement Showing Proof of Payment. C) I Declare Under Section 54 (3) (iii) that refund of ITC claimed ...

2. Login to the GST Portal with valid credentials. 3. Click the Services > User Services > Furnish Letter of Undertaking (LUT) command. 4. Form GST RFD-11 is displayed. Select the financial year for which LUT is applied for from the LUT Applied for Financial Year drop-down list. 5. Click the Choose File button to upload the previous LUT.