- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What to Do if Your Loan Application Is Denied

Nicole Dow is a freelance writer and editor based in Tampa Bay, Florida. Her work has been featured in The Penny Hoarder and Yahoo Finance, among other outlets. She holds a journalism degree from Hampton University.

Annie Millerbernd is an assistant assigning editor and NerdWallet authority on personal loans. Before joining NerdWallet in 2019, she worked as a news reporter in California and Texas, and as a digital content specialist at USAA. Annie's work has been cited by the Northwestern University Law Review and Harvard Kennedy School . Her work has been featured in The Associated Press, USA Today and MarketWatch. She’s also been quoted in New York magazine and appeared on NerdWallet's "Smart Money" podcast as well as local TV and radio. She is based in Austin, Texas.

Steve Nicastro is a former NerdWallet writer and authority on personal loans and small business. His work has appeared in USA Today, The New York Times and MarketWatch. He holds a bachelor’s degree in journalism from Quinnipiac University.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

6 reasons your loan application was denied and what to do next

3 ways to improve your chances of personal loan approval, how long to wait before reapplying for a personal loan, alternatives to personal loans.

Being denied for a personal loan can feel like a punch to the gut. It’s easy to get discouraged, especially if it delays plans to consolidate debt or renovate your home.

Instead of taking the rejection personally, use it as motivation to make the necessary changes to win approval the next time you apply.

According to the Equal Credit Opportunity Act, lenders must disclose why they denied your application or inform you of your right to seek out such reasons. If a lender doesn’t volunteer this information, you have 60 days to ask.

Once you know why you were denied, you can prepare for next time.

» MORE: Boost your chances of getting your loan approved

Here are six common reasons you may be denied for a personal loan and how to recover.

1. Your credit score is too low

Your credit is one of the main factors a lender considers on a personal loan application. Good or excellent credit (a score of 690 or higher) and a history of paying other loans or credit cards on time will help you qualify for a personal loan, while fair or bad credit and a history of missed payments could get your application declined.

A low credit score doesn’t automatically prevent you from getting a personal loan, but interest rates are often higher for borrowers with bad credit. Credit unions and online lenders may be more likely to consider bad-credit borrowers, while banks often require good credit.

» MORE: Best loans for bad credit

How to fix it: Check your credit report for errors that could be bringing your score down, such as payments incorrectly reported as late or accounts showing the wrong balance. You can dispute errors with any of the three major credit bureaus online, over the phone or by mail. Get free copies of your credit reports from AnnualCreditReport.com or NerdWallet .

Building credit can be a slow process, but you can start by making timely payments toward all your existing debts and keeping your credit balances low. You can also build your score by:

Getting a secured credit card and making on-time payments.

Getting a credit-builder loan and making on-time payments.

Becoming an authorized user on a credit card of someone with a strong payment history.

2. Your income is too low

Lenders check your income to ensure that you can repay a new personal loan. A low income may signal to a lender that you could default on the loan .

Minimum income requirements vary across lenders, and not all lenders set specific income requirements. In general, lenders want to see that you can make your monthly bill payments, repay your new personal loan and ideally have some money left over.

» MORE: What is a low-income loan and where can you get one?

How to fix it: If you have the time, consider picking up a side job such as freelancing, dog walking, tutoring or driving for Uber or Lyft.

When you reapply for a loan, include all sources of income on the application, which may include a spouse’s income, investment income, child support, alimony or military pay.

3. Your debt-to-income ratio is too high

Your debt-to-income ratio (DTI) helps lenders determine how much money you have left each month after all your other debt payments. To calculate yours, divide your total monthly debt payments by your monthly income and multiply it by 100 to see your DTI as a percentage.

Personal loan lenders often like to see a DTI of about 43% or lower, though some will accept a higher number.

How to fix it: You can lower your ratio by raising your income or paying off debt. To clear debt faster, scrutinize your budget for places to trim expenses and put the savings toward debt payments. Research different debt payoff strategies , like the snowball and avalanche methods, to find one that works for you.

4. You do not meet the lender's requirements

In addition to assessing your credit score, income and debt, most lenders have some basic criteria you need to meet to get a personal loan. To qualify for a personal loan, an applicant typically must:

Be a U.S. citizen or permanent resident.

Have a Social Security number or, in some cases, an individual taxpayer identification number.

Live in a state where the lender provides personal loans.

Be at least 18 years old.

Have a valid email address.

How to fix it: Personal loan requirements vary between lenders, but many publish some requirements in an FAQ or blog post. You can also reach out to the lender directly if you have questions about what’s required.

5. Incorrect information on your application

False information on your application, such as the wrong address or misstated income, could lead to a loan denial. Even typing mistakes can cause problems, especially if you’re off a digit on your Social Security number. Lenders generally won’t approve applications with unverifiable information.

How to fix it: It may sound tedious, but double-check everything on your application to avoid being denied over a small error.

6. You requested too much money

There are limits to how much you can borrow, and requesting too much money can be a reason your loan application is denied. Even if the amount is within the lender’s limits, it may be considered too high based on your income or DTI.

How to fix it: Personal loan amounts are often from $1,000 to $50,000. Check the lender’s minimum and maximum loan amounts before applying and use a personal loan calculator to see what loan amount and rate you’d need to get an affordable loan. Then, be sure to only request what you need and can afford to repay.

1. Pre-qualify

Pre-qualifying for a personal loan helps you determine if your loan application is likely to be approved. If it is, a lender will show you your potential loan amount, rate, and monthly payment before you formally apply for the loan.

Lenders conduct a soft credit check at this stage, which doesn’t affect your credit score, so you can pre-qualify with multiple lenders to compare offers and find the best deal. Lenders weigh information differently, so while you may not meet the requirements with one lender, you could qualify with another.

Once you find the best loan offer, you’ll submit a formal application and undergo a hard credit check .

2. Add a co-signer

When you add a co-signer to a loan application, the lender considers both of your credit and financial information. Adding a co-signer with better credit and income can boost your chances of personal loan approval. Consider this option carefully because your co-signer is responsible for repaying the loan if you’re not able to.

» MORE: Best personal loans with a co-signer

3. Secure the loan with collateral

Lenders may be more likely to approve a secured personal loan than an unsecured one because there’s less financial risk for them. If you default on a secured loan , the lender can take what you’ve put down as collateral — usually a vehicle or savings account — to recoup their losses.

» MORE: Best secured personal loans

It’s disappointing to see your personal loan application declined, but depending on the reason for denial, it may not be wise to try again right away.

If you were denied because of a minor issue, such as a typo, reach out to the lender immediately to address the problem.

If you need to build your credit, lower your debt or increase your income, consider waiting at least one month — but likely a few months — before reapplying. Credit histories are usually updated once a month, so changes may not be reflected in your score immediately.

Lenders perform a hard credit check each time you apply for a loan, which causes your score to temporarily dip by a few points. Too many hard credit inquiries in a short period could cause future lenders to view you as a high-risk borrower.

» MORE: Best personal loans

If you need to borrow money now and can’t wait to address the reasons your loan was denied, other options may be available.

Buy now, pay later: Many major retailers partner with “buy now, pay later” companies that allow you to split up a large purchase over several weeks, usually without interest or fees. This type of financing typically doesn’t impact your credit score.

Cash advance app: Borrow from your next paycheck with a cash advance app . Borrowing amounts are relatively low, but you can pay an express funding fee to get the money instantly. Some cash advance apps have a subscription fee or ask for an optional tip. Payments are usually due by your next payday.

401(k) loan: A 401(k) loan lets you borrow from your retirement account. Interest rates are low and there is no credit check, but borrowing from your nest egg reduces its growth potential over time, and you may face penalty fees if you leave your job before you’ve repaid the loan.

Family loan: Borrowing from family eliminates credit checks and high interest rates, but your relationship can be strained if the money isn’t repaid on time. Sign and notarize a loan agreement to eliminate any confusion about the repayment plan.

Local financial assistance programs: A charity or nonprofit in your area may offer assistance with housing, transportation or utility bills. Some organizations even provide low-interest loans to people in need. Use this list of local financial assistance programs to find resources near you.

Pawnshop loan: You can get a pawnshop loan using an item you own as collateral. The amount you can get will depend on the assessed value of the collateral, but you can get money instantly without a credit check. Be aware of high interest rates and fees and quick repayment terms. If you don’t repay the loan on time, you’ll lose your collateral.

» MORE: Best ways to borrow money

Lenders are required by law to provide loan applicants with the reasons why they were denied a loan. You’ll likely receive a notice from the lender. If not, you can request that information within 60 days of being denied the loan.

Your chances of approval are better if you have good or excellent credit (a score of 690 or higher). However, some lenders work with borrowers across all credit bands.

» MORE: What credit score do you need to get a personal loan?

When you formally apply for a personal loan, the lender will perform a hard credit check, which results in a temporary dip in your credit score. However, your score is not affected if a lender denies your application.

What credit score do you need to get a personal loan?

Need help with your finances? Work with a Certified Financial Planner™ for one of the lowest prices on the market.

Discuss your finances on a one-time call for $99 or subscribe to a full financial planning membership for just $30/month with a six-month commitment.

NerdWallet Advisory LLC

- Search Search Please fill out this field.

What to Do If Your Loan Application Is Declined

Take these steps before you re-apply for a loan that was denied

Identify the Cause of the Denial

- Regroup Before You Re-Apply

Use Short-Term Strategies

Incorporate long-term strategies, the bottom line, frequently asked questions (faqs), is it bad to apply for more than one loan at once, how does a declined loan affect your credit report, why was my loan application declined even though my credit is good.

The Balance / Bailey Mariner

If your loan application is declined, you might not know where to turn or what to do next. You can start by determining the reasons you were denied a loan, how long you need to wait before you apply again, and what steps you can take, right now and in the future, to prevent it from happening again.

Recourse is available for any type of loan, including mortgages, auto loans, credit cards, personal loans , and business loans. Whenever there is a disconnect between the loan you thought you could obtain and what your lender agreed to, it’s worth narrowing that gap to boost the odds of approval when you re-apply for the loan.

It's important to find out why your loan application was declined before you apply again. Lenders will generally be glad to give you an explanation and are required to provide certain disclosures, so you don't have to remain in the dark about the denial.

The most common reasons for being denied credit are:

- Bad (or no) credit: Lenders look at your borrowing history when you apply for a loan, which is reflected in your credit scores . They want to see a solid history of borrowing and repaying loans. However, you might not have borrowed much, or you might have experienced some challenges and even defaulted on loans in the past, in which case your loan application might be declined.

- Insufficient or unverifiable income: Lenders look at your work, investment, and other income before they approve your loan to ensure that you can make the minimum monthly loan payments. With some loans, such as home loans, lenders are required by law to calculate your ability to repay . Your loan application can be declined if a lender doesn't think you can afford to repay the loan, either because you don't earn enough or the lender can't verify your income with the information you provided.

- High debt-to-income ratio: This ratio compares how much you owe each month to how much you earn. Most lenders use your debt-to-income ratio to determine whether you can handle the payments upon approval of your loan. Your loan application may be declined if it doesn’t look like you’ll be able to take on new debt.

- Lack of collateral: When applying for small business loans, lenders often look at the business owner’s personal credit if the business isn't established enough to have built up sufficient business credit. Unless business owners are willing to personally guarantee the loan or pledge personal assets valued at the amount of the loan as collateral, the chances of getting approved for a loan without business credit are generally slim.

- Other issues: Occasionally your loan application will be declined for less obvious reasons—if you submit an incomplete application or have a length of residence that the lender deems to be too short, for example. Some mortgage loans don’t go through because an appraisal did not come in high enough to justify the size of the loan.

If you are denied credit, your lender is generally required to provide you with a notice of adverse action explaining the source of information that was used against you (credit reports or data from an outside source), the reasons for the denial (defaulted loans, for example), and information on how to obtain your credit reports and dispute inaccurate information in the reports. Reading this notice can give you a good idea of what led to the denial.

Under the Equal Credit Opportunity Act (ECOA), your loan application can't be denied on the basis of race, religion, national origin, gender, marital status, age (provided that you're old enough to sign a contract), participation in a public assistance program, or your Consumer Credit Protection Act rights.

Regroup Before You Re-Apply

Once you have reviewed any disclosures that your lender provided after your loan application was declined, save yourself time and frustration before you apply again and look at various aspects of your financial profile the way lenders do to check for and resolve red flags in your credit:

- Assess your debt and income: Evaluate your debt-to-income ratio to determine whether you have sufficient income to repay a loan. It’s worth asking your lender what they expect for your debt-to-income ratio. In general, a ratio of under 36% can boost your creditworthiness in the eyes of lenders.

- Examine your credit reports: The credit reports on file with the three credit bureaus (Equifax, Experian, and TransUnion) will show you the lenders that granted you credit, the types of credit you received, and your payment history. Review each one to identify problems like late payments that may have led your loan application to be declined.

- Fix errors in your credit reports: If you have errors in your credit report, reach out to the credit bureau that produced the problematic report. You shouldn’t be held responsible for computer errors or the actions of a fraudster. You have the right to have mistakes removed . If you're applying for a mortgage, you can get errors fixed—and your credit score updated—within a few days if you get the lender to request rapid rescoring on your behalf.

- Talk to your lender: If you're not sure whether an aspect of your financial profile will lead to a denial, ask your lender before you apply again whether they anticipate any problems. They’ll gladly explain what matters and what doesn’t, and how long you need to wait before re-applying after negative events like a foreclosure. Using a small, local institution, such as a local credit union makes it easier to speak with a lender in detail about what you need to do to prepare yourself before you fill out another loan application.

There are some actions you can take that generally have an immediate positive effect on your credit score or may even result in approval for the loan:

- Make a large down payment: A substantial down payment on a car or house (at least 20% of the purchase price of a home, for example) may help you get approved. You’ll also end up borrowing less, which means your monthly payments will be lower. Plus, lenders have less at risk with a lower loan-to-value ratio, which compares the loan amount to the appraised value of the property, so they might be willing to approve a loan even if you don't have perfect credit.

- Use collateral: If you’re applying for a personal or business loan, collateral may help you get approved. Offer to pledge something of equal or greater value than the loan amount to help secure the loan. Just be aware of the risks: You could lose your home in foreclosure, or your vehicle could be repossessed if you fail to make payments. Only take risks that make sense.

- Get a co-signer: If your income or credit were not sufficient to get approved, you might have better odds if you add someone else’s income and credit to the application, assuming they have better credentials. A co-signer applies with you and agrees to become responsible for repaying the loan. If you fail to repay, the lender will go after both you and your co-signer, and their credit will also suffer, so only use a co-signer who understands and agrees to take on that risk.

- Apply elsewhere: A denial speaks to just one lender’s opinion of your financial profile. It’s valuable information, but a different lender might have a different view and approve your loan. If you believe that your finances are as strong as you can make them, you don’t have to wait before applying again after a rejection; approach another lender and apply for a loan with them. Try a local bank or credit union, and check with online lenders . With home and auto loans, in particular, it’s best to “bunch” your loan applications into a short window of time of 30 to 45 days at the longest to minimize damage to your credit from too many hard inquiries in a short time period.

Think twice before you use a home equity loan to pay for a vacation or a luxury car. If you fail to make payments on the loan, you could lose your primary home for a non-essential purchase.

Your loan denial might be due to issues in your finances that can't be fixed overnight. If this is the case, consider making deeper changes to your financial profile over time to make it easier to borrow:

- Build credit: Borrowing will be easier in the future if you build a strong credit history . That means you’ll need to borrow and repay loans on time. Your credit will gradually improve, and you’ll likely get better interest rates and fewer rejections going forward.

- Increase income: Earning more is easier said than done, but it’s worth paying attention to your income when you need to borrow money. If you plan to make major life changes that can reduce your income, such as quitting a job or starting a new career, it’s best to pursue them after you’ve been approved for your loan and have established a plan for paying off the debt.

- Bring accounts current: If you’re behind on any of your loans, get up to date with payments so that your credit can begin to recover. That doesn’t necessarily mean paying back all of the debt you owe. Contact your creditors to work out a payment plan, and get a written agreement to remove negative information from your credit reports.

- Pay down debt: Your existing loans affect your ability to get new loans because lenders look at how much you owe relative to your income each month. Reducing debt reduces your debt-to-income ratio and can make you look more financially capable as a borrower. It will also free up more of your monthly income to repay a new loan after approval.

If your loan application is declined, don't give up. Take the above actions to improve your finances before you apply again. Some won't require much effort, such as clearing up a negative item on your credit report. Others, like building a thin credit file, will require time and patience. Ultimately, these approaches will make you a better loan candidate, which will increase the odds of getting approved in the future.

If you're worried that you may be declined for a loan, it's not a good idea to apply for several loans in the hope that you'll get approved for one. Your credit score can take a hit if you apply for more than one loan at once. In most cases, it's better to apply for one at a time. If a creditor runs a hard credit check and sees that other lenders have done so as well, it may become a concern that you're taking on too much debt at once.

A declined loan will not show up on your credit report. Potential creditors looking at your report will see that a report was pulled by the creditor that declined the loan, but they won't be able to tell that the loan was declined.

Even if you are paying your bills on time, and your credit score looks good, there could be other reason your loan was declined. It may be because you haven't been at your job for long enough, or your income is too low for the amount you are requesting, or you are using too much of your debt. You will learn the reasons why you were declined when you receive your notice of adverse action in the mail.

Experian. " How Lenders View Your Credit ."

Experian. " What Factors Do Mortgage Lenders Consider? "

Consumer Financial Protection Bureau. “ What Is the Ability-To-Repay Rule? Why Is It Important to Me? ”

Experian. “ Debt-to-Income Ratio .”

U.S. Small Business Administration. " Unsecured Business Funding for Small Business Owners Explained ."

Citizens Bank. “ How to Manage a Low Appraisal Value .”

FDIC. " Appendix C to Part 1002—Sample Notification Forms ."

Consumer Financial Protection Bureau. “ § 1002.9 Notifications .”

Federal Trade Commission. “ Disputing Errors on Credit Reports .”

TransUnion. ” How Long Does It Take for a Credit Report to Update? ”

Consumer Financial Protection Bureau. “ What Is a Loan-To-Value Ratio and How Does It Relate to My Costs? ”

Experian. " Secured vs. Unsecured Loans: What You Should Know ."

Federal Trade Commission. “ Co-signing a Loan .”

myFICO. “ Credit Checks: What Are Credit Inquiries and How Do They Affect Your FICO® Score? ”

Experian. " Does a Declined Loan Appear on Your Credit Report ?"

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

- Personal Loans

Was Your Loan Denied? Here’s What To Do

Updated: Mar 29, 2021, 4:00am

It can be a painful experience when a lender rejects your loan application—whether it’s for a mortgage , student loan or personal loan . Although you might not know what to do, you can take steps to increase your approval odds for future applications. We will walk you through what you need to do after rejection and how you can secure financing after you’ve had a loan denied.

Here are three immediate steps you can take after a rejection.

1. Identify Why Your Loan Was Denied

Before you re-apply for a loan, take time to identify why your lender denied your application. It might be because you didn’t meet the lender’s debt-to-income (DTI) ratio and minimum credit score requirements, have negative items listed on your credit report or applied for too much money. If you can’t determine the reason on your own, contact the lender.

Under the Equal Credit Opportunity Act, you have the right to ask your lender why it rejected your application, as long as you ask within 60 days. After you request an explanation, the lender must provide you with a specific reason for your denial. You can use the information it gives you to help fix any issues.

2. Remove Errors or Negative Remarks From Your Credit Report

After you identify the reason for your denial, review your credit report. Due to the pandemic, you can get a free copy of your report —from all three credit bureaus: Experian, Equifax and TransUnion—each week until April 20, 2022, through AnnualCreditReport.com ; prior to the pandemic, you could only receive one free report per bureau, per year.

If you have negative marks, such as late or delinquent accounts, this can hurt your loan eligibility. While you look over your credit report, confirm each account it lists belongs to you and is accurate.

You have a right to dispute inaccurate information shown on your credit report with all three credit bureaus. Although you can pay a credit repair company to dispute the negative items for you, you can do it yourself, too. There is no charge to dispute incomplete or inaccurate information. The Federal Trade Commission (FTC) provides sample letters for disputing errors on your credit report .

3. Improve Other Key Qualification Factors

In addition to removing errors or negative remarks from your credit report, you should consider improving two other key factors lenders consider when they review your application: your credit score and DTI.

Credit Score

Low credit scores can lead to loan application denials. Lenders use this score to assess how much risk you pose as a borrower. FICO is a common scoring model lenders use,, with scores ranging from 300 to 850. Applicants with good credit scores (at least 670) typically experience higher approval rates; applicants with lower scores may not qualify.

Debt-to-income Ratio

Lenders may also deny your loan application if your DTI ratio is too high. They look at this number to assess your ability to repay the new loan while handling your current debt load. Lenders typically prefer ratios of 36% or less; however, some may approve highly qualified applicants with a ratio up to 50%.

To calculate your DTI, the lender divides your current monthly debt burden by your monthly gross income. For example, if your current monthly debt load is $3,000 and your monthly gross income is $4,000, your DTI ratio would be 75% ($3000 / $4,000).

Short-term Strategies to Increase Approval Odds

Try these four short-term tactics to increase your approval odds if a lender denies your loan application.

1. Prequalify With Other Lenders

Since different lenders have different lending requirements , try prequalifying with other lenders. When you prequalify, the lender should outline what terms you will receive if your application is successful, including your loan amount and interest rate; there’s no impact on your credit score because lenders typically only run a soft credit check .

If you are unable to prequalify with a traditional bank or online lender, try submitting an application through a local credit union. These member-owned, not-for-profit institutions might be more willing to extend you a loan based on your complete financial picture, and not just your credit score.

2. Provide Collateral

Providing collateral —something of value that secures the loan—might improve your chances of qualifying for a loan; a loan that uses collateral is considered a secured loan . Some common examples of collateral include a cash deposit, car title or savings account. Since the lender can seize your collateral if you don’t repay your loan, it may be more willing to approve your loan.

3. Request a Lower Loan Amount

Some lenders might deny your loan because you’ve requested to borrow more money than you can afford to repay. If this is the case, ask the lender to approve you for a lower loan amount.

4. Increase Your Down Payment Amount

Another way to increase your approval odds is to use a larger down payment amount, which makes the loan less risky for the lender to take on. For example, if you’re applying for a mortgage , you might increase your chances of approval if you put down 20% of the home’s price instead of 10%. In addition, the lender might not require that you pay for mortgage insurance .

Long-term Strategies to Increase Approval Odds

If you don’t need cash immediately and want to decrease your chances of having a loan rejected in the distant future, consider these four strategies.

1. Build or Improve Credit

Although it might take some time, taking steps to build or improve your credit will help you meet lenders’ minimum credit score requirements. To do so, repay any current debts you may have on time, keep your credit utilization rate below 30% and remove any inaccurate information from your credit report.

2. Increase Income

While increasing your income is easier said than done, it may help you qualify for more loans. More income can result in a lower DTI ratio, which means you’re more likely to meet lenders’ minimum DTI requirement. To increase your income, consider picking up a lucrative side hustle or learn an in-demand skill to boost your earning potential.

3. Pay Down Debt

You can also improve your DTI if you pay down debt. Two of the most popular debt payoff methods are the debt snowball and debt avalanche methods. With the debt snowball method, you pay off your smallest debt first, while making minimum monthly payments toward the rest of your debt. The avalanche method is similar, but instead of paying your smallest debt off first, you pay your debt with the highest interest rate.

4. Increase Your Cash Reserves

Some lenders may require you to have a certain amount of cash reserves before approving your loan. To improve your chances of qualifying for a loan that has this requirement, create a long-term automatic savings plan to increase your cash reserves.

What Happens If My Loan Is Denied a Second Time?

If your loan is denied a second time, you’ll have to identify why it happened again. Ask the lender for an explanation why it denied you a loan.

Before you apply for another loan , review your credit report again to see if you can spot any errors. Check your credit score to see if it has improved. To increase your chances of approval, you might have to wait until you meet the lender’s requirements or choose another lender that better matches your financial situation.

Other Methods of Financing to Consider

If you don’t qualify for a loan, consider these other methods of financing.

Secured Credit Cards

A secured credit card requires a refundable security deposit when you apply, which serves as your credit limit. Like a traditional credit card, you borrow money on an as-needed basis. If you fail to repay your balance, however, the lender can seize your security deposit. This option could help you build your credit, making it easier to qualify for future loans.

Grants and Scholarships

If you need help financing your business, look for grant programs in your area. Check to see if your business is eligible for forgivable loans under the Paycheck Protection Program (PPP). Also, check with your local government to see if it has a small business grant fund.

If you need money for school but don’t qualify for a student loan , consider applying for grants and scholarships.

Family Loans

If you can find someone in your family who can loan you money, you can bypass traditional lending requirements. The loan agreement between you and the family member could be informal but should outline the terms. However, the downside to this option is that it could ruin your relationship with the family member if you can’t repay the loan.

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Bad Credit Loans

- Best Low-Interest Personal Loans

- Best Personal Loan Rates

- Best Debt Consolidation Loans For Bad Credit

- Best Easy Loans To Get

- Best Emergency Loans

- Best Emergency Loans For Bad Credit

- Best Personal Loans For Fair Credit

- Best Installment Loans For Bad Credit

- Fiona Personal Loans Review

- Best Egg Personal Loans Review

- Dave App Review

- LendingTree Personal Loans Review

- Upgrade Personal Loans Review

- LendingClub Personal Loans Review

- LightStream Personal Loans Review

- Upstart Personal Loans Review

- SoFi Personal Loans Review

- OneMain Financial Personal Loans Review

- Personal Loan Calculator

- Loan Comparison Calculator

- Loan Interest Calculator

- Debt Consolidation Calculator

- Pool Loan Calculator

- Simple Loan Calculator

- Boat Loan Calculator

- How Do Personal Loans Work?

- How To Apply For A Personal Loan

- Personal Loan Requirements

- Pros And Cons Of Debt Consolidation

- Personal Loan To Pay Off Credit Card Debt

- How To Find A Co-Signer For A Loan

- How To Prequalify For A Personal Loan

- Compare Personal Loan Options

Today’s Personal Loan Rates: July 2, 2024—Rates Decline

Today’s Personal Loan Rates: June 25, 2024—Rates Jump Up

How To Finance A Mobile Home

Today’s Personal Loan Rates: June 17, 2024—Rates Drop

SoFi Vs. Discover: Which Personal Loan Lender Is Right For You?

Today’s Personal Loan Rates: June 11, 2024—Rates Increase By 0.10%

Jerry Brown is a personal finance writer based in Baton Rouge, La. He's been writing about personal finance for three years. Financial products he enjoys covering include credit cards, personal loans, and mortgages.

Jordan Tarver has spent seven years covering mortgage, personal loan and business loan content for leading financial publications such as Forbes Advisor. He blends knowledge from his bachelor's degree in business finance, his experience as a top performer in the mortgage industry and his entrepreneurial success to simplify complex financial topics. Jordan aims to make mortgages and loans understandable.

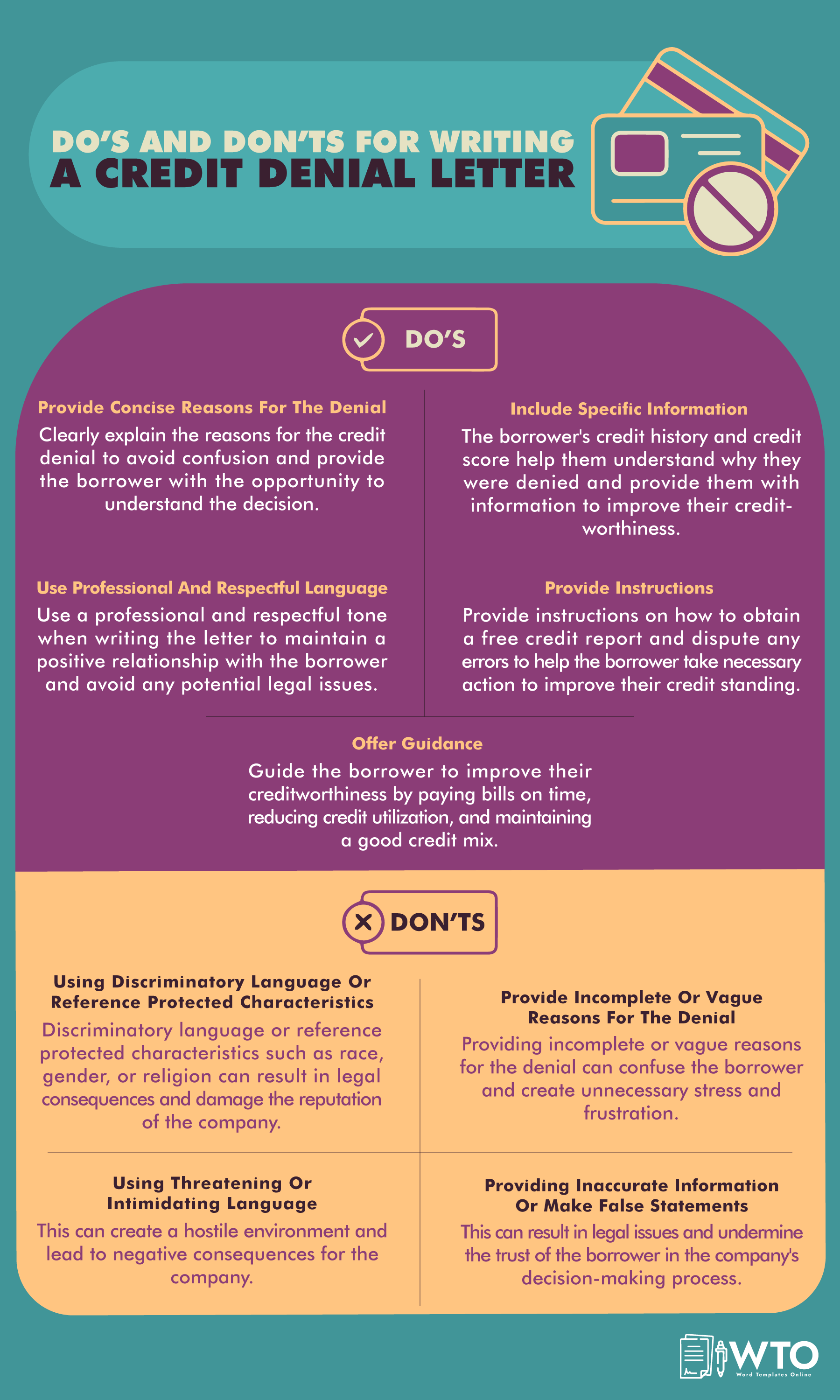

WTO / Letters and Emails / Rejection / How to Write Credit Denial Letter (Samples & Templates)

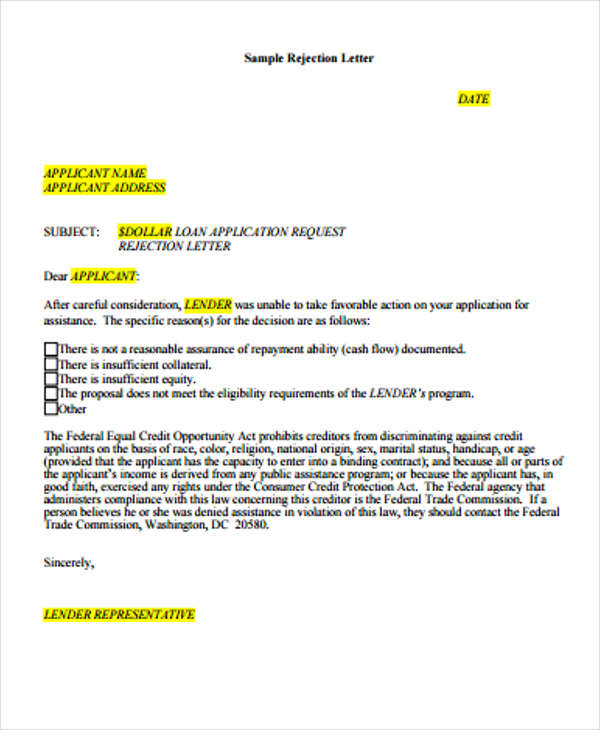

How to Write Credit Denial Letter (Samples & Templates)

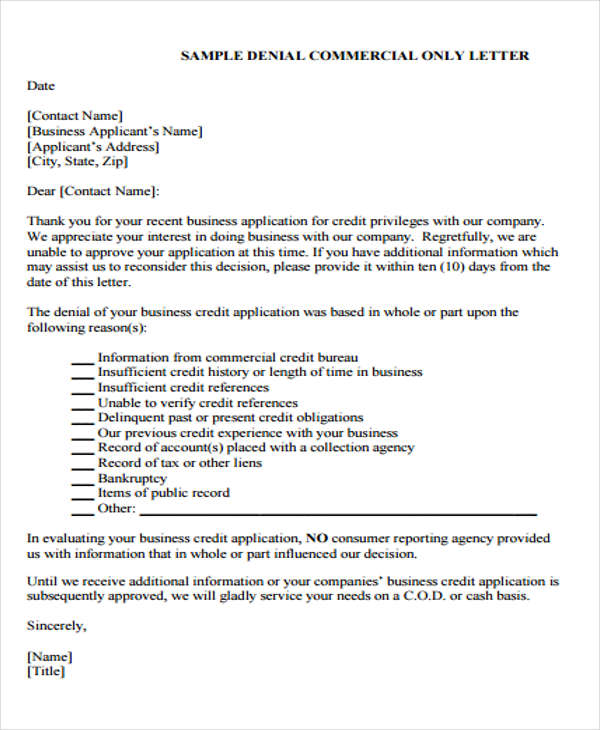

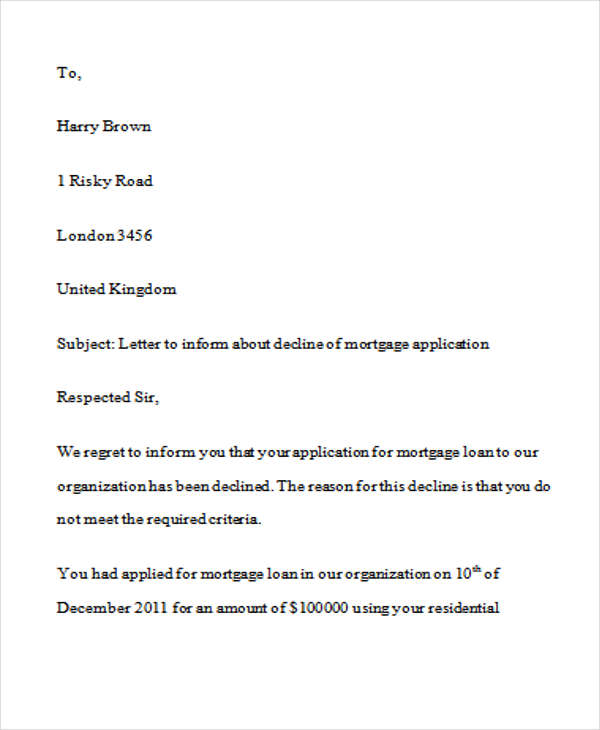

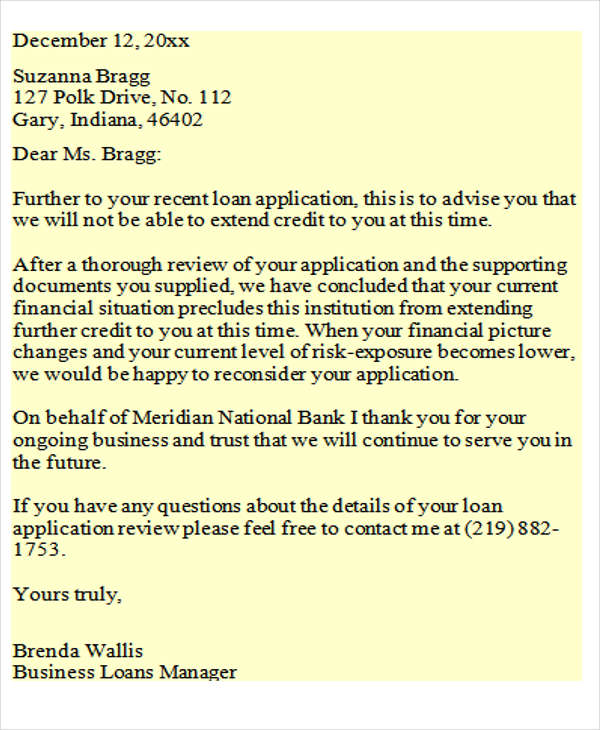

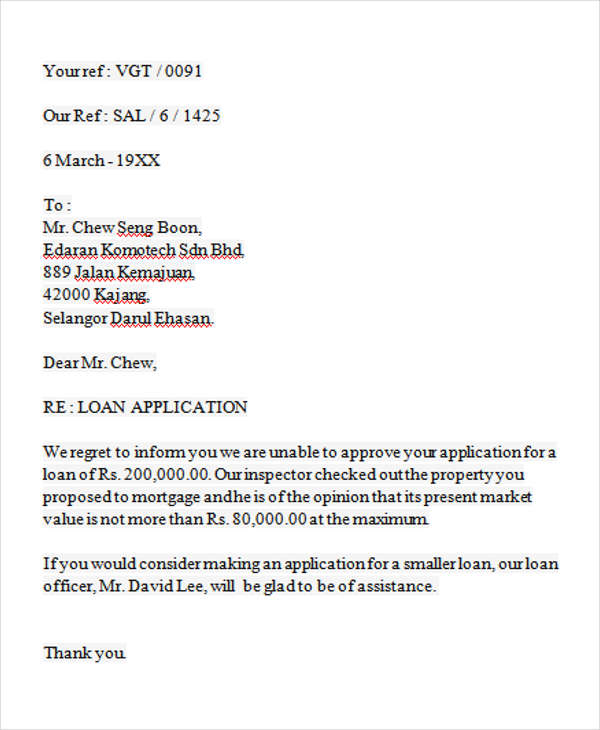

A credit denial letter is an official notification written by lenders to inform an individual or business of the rejection of their loan request.

It is usually sent for applications for loans , mortgages, credit cards, and business credit lines. It also informs the applicant why their application was rejected.

Typically, lenders will deny loan requests if the applicants are not creditworthy, which can result from multiple factors such as incomplete documents, insufficient income, bankruptcy, poor credit score, etc. The letter also communicates the applicant’s credit score, the credit reporting agency used, and the process to obtain their credit report.

Lenders can use templates that include all the information required to produce the formal letters. It is important to note that lenders are expected to reassess their decision to decline an application should the applicant object to it. They should also cite legitimate reasons, such as errors and inaccuracies in the report. Review multiple samples of such letters to understand the different reasons a lender can use to legally deny credit to their clients.

The letter is a legal requirement under the ECOA and the Fair Credit Reporting Act. It provides information to the borrower, protects the lender’s reputation, and complies with legal requirements. Also, it is professional to be transparent about the decision-making process. Online templates are practical tools that can help lenders write such letters.

This article will discuss reasons to reject credit applications and how to write a letter notifying the applicant of such a decision by providing a sample. It also educates lenders on certain legal factors they should know before sending a letter of denial to a credit application.

Reasons for Denying a Credit Request

Letters to notify applicants of refusals of their credit requests serve a valuable purpose by providing individuals with insights into the factors considered by lenders when assessing creditworthiness. By exploring the common reasons for credit denial, we can understand the criteria that financial institutions use to evaluate applicants, empowering individuals to make informed decisions and take proactive steps toward improving their credit standing.

This section discusses the key factors that can influence a credit denial decision:

Credit score

A credit score is a measure or numerical ranking of creditworthiness. Using a standardized formula, you can calculate it from credit information such as length of credit history, payment patterns, credit utilization, and outstanding debt. The higher scores indicate a lower level of risk, making it more likely for such applicants to secure loans at favorable terms. On the other hand, the lower scores may result in credit denial or less favorable loan terms, as they suggest a higher risk of defaulting on payments.

Employment history

Employment status and history are criteria used to determine an applicant’s suitability for loans because they determine their capacity to pay back the loan. So, you need to consider whether an applicant is employed, how long they have been employed, and their current and previous jobs. Having a stable job and career may indicate that they have a reliable source of income and are less likely to default. However, if their employment situation is unstable, it raises concerns about their ability to fulfill financial obligations and is a legitimate basis for refusing their loan request.

Insufficient income

One crucial factor that lending institutions carefully scrutinize when assessing loan applications is the applicant’s income. For lenders, the ability of borrowers to repay their debts is of paramount importance to mitigate the risk of defaults. Therefore, income serves as a critical indicator of an individual’s capacity to meet their financial obligations. When an applicant’s income is deemed insufficient, it can be a compelling reason for denial.

Debt-to-income ratio

The debt-to-income ratio compares an individual’s monthly debt payments to their income. If the ratio is too high, it indicates that a significant portion of income is already allocated towards existing debts, and lenders may perceive the applicant as having a higher credit risk and reject the loan request.

Payment history

Payment history is a reliable criterion for determining an applicant’s eligibility for a loan. If an applicant has a history of late payments or defaults with a specific financial institution, it can significantly impact their chances of getting approved for new credit from that institution.

Unstable housing situation

Lenders might have a negative opinion of housing instability, such as frequent moves or a lack of a permanent address. It can be an indicator of financial uncertainty and affect an applicant’s creditworthiness.

Inaccurate information on a credit report

You can reject an application if the credit report results are inaccurate. The report will indicate the borrowing history, current and previous addresses, bank accounts, employment history, etc. Incorrect information, such as accounts that do not belong to the applicant or inaccurate payment records, can be particularly detrimental.

The accuracy and reliability of this information are of utmost importance in determining an applicant’s creditworthiness. Unfortunately, mistakes or inaccuracies in the reports can occur, and they have the potential to significantly impact an individual’s credit standing. From a lender’s perspective, such errors pose risks and can be a valid reason for credit denial.

Multiple loan applications

You can deny credit to individuals or businesses that have applied too many times in a short period. This will often indicate that the applicant is struggling financially and in desperate need of money, which poses a risk of inability to repay once approved.

How to Write a Letter to Notify Rejection of Credit Application

Most applicants will be distressed by the news, so it is critical to approach the rejection professionally. Your communication must be objective and clearly explain the situation. Using a template can be helpful in properly organizing information and ensuring the decision is effectively conveyed to the client.

The information required in a letter to formally notify applicants that they are ineligible for credit is presented below:

Specify the date

The first element on the letter is the date it was written or issued. The date is needed for reference and filing purposes. A proper format should be used,

March 24, 2023.

Include borrower’s information

Secondly, it must be clear to whom the letter is addressed, i.e., the applicant. Your letter must have the borrower’s name, mailing address, account number, and application ID.

For example, this information can be presented as follows:

Jack Geller 103 City Park Road, New York City, NY 8007 Account No.: 1234 4567 7890 Application ID: JG009282NY

A subject line indicating the purpose of the letter can be included if you are sending an email. For example, RE: Credit Denial Letter for Application ID-2363. This should be followed by a formal greeting such as Dear Mr. Schumacher.

Mention the reason for the denial

Next, indicate the letter’s purpose for rejecting the application and provide a valid reason. You can begin by acknowledging the borrower’s interest in the opening statement before stating that their application is being rejected.

“Thank you for your inquiry about a credit card with B&G Platinum. We are honored by your interest in our company and our services. Unfortunately, we regret to notify you that your application was declined as your debt-to-income ratio is too high and a principal concern for our team.”

Provide credit reporting agency information

Lenders are usually obligated to inform applicants about the credit reporting agency (or agencies) they use to assess their creditworthiness. This section provides details of the agency’s name, contact information, and instructions on how to obtain a free copy of the report for further review. Note that while this information is necessary for a consumer credit application , it is not needed for a commercial application. This is because, in such situations, it is not a requirement of the FCRA.

For example, this section can be written as follows:

“After a thorough search, we determined that your total debt is above $150,000. When compared to your assets, this amount indicates that you have a credit score of 450, which is lower than the 650 required for eligible candidates.”

Specify the adverse action reasons

The letter should include a section detailing the specific adverse action reasons, which are the key factors that contributed to the denial decision.

To comply with regulatory requirements, for example:

“The decision was based specifically on the key adverse action reasons that influenced our decision: a poor credit history and insufficient income.”

Right to obtain a free report

Lenders typically highlight the recipient’s right to access a free copy of their report within a specified timeframe. This provision allows individuals to review the report for inaccuracies or discrepancies that may have impacted the credit decision.

“We understand that credit denial can be disappointing, and we encourage you to review your credit report, which you can obtain free of charge from [credit reporting agency’s name], to ensure its accuracy and address any areas that may require improvement.”

Your contact information

The letter for denial should be concluded by providing your contact information, including your name and contact details such as phone number, email address, and mailing address. This information is meant to facilitate future correspondence if the borrower has questions about the denial or future applications.

Charles MajorsJenkins Micro-Finance CompanyDownhill AvenueAugusta, Maine [email protected] (0288) 3630-8999

Free Templates

To simplify the writing process, you can use the free downloadable templates for these letters provided in this article. They can be customized to suit your needs and preferences. Also, they are professionally designed to create legible and presentable letters that protect a financial institution’s reputation.

Credit Denial Letter Template

[Your Company Name]

[Your Company Address Line 1]

[Address Line 2]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Today’s Date]

[Applicant’s Name]

[Applicant’s Address Line 1]

Dear [Applicant’s Name],

Thank you for your interest in [Credit Product/Service, e.g., credit card, loan, etc.] with [Your Company Name]. We appreciate the opportunity to review your application. After careful consideration, we regret to inform you that we are unable to approve your request at this time.

The decision to decline your application was based on the following reason(s):

- [Reason for denial, e.g., credit score below our minimum requirement, insufficient income, employment history, etc.]

- [Any additional reason(s)]

In accordance with the Fair Credit Reporting Act, you have the right to a free copy of the credit report used in our decision-making process. To obtain your report, please contact the credit reporting agency listed below within 60 days of receiving this notice:

Credit Reporting Agency Information:

[Agency Name]

[Agency Address]

[Agency Phone Number]

[Agency Website]

Furthermore, you have the right to dispute the accuracy or completeness of any information in your credit report. If you have any questions or believe this decision is based on incorrect information, please do not hesitate to contact us at [Your Phone Number] or [Your Email Address].

We understand that this may be disappointing news, and we encourage you to review your credit report and financial situation. Improving certain factors may increase your eligibility for [Credit Product/Service] in the future. For any questions about improving your creditworthiness or to discuss potential options moving forward, please feel free to reach out to our customer service team.

Thank you again for considering [Your Company Name] for your financial needs. We hope to have the opportunity to serve you under different circumstances in the future.

[Your Name]

[Your Title]

Sample Credit Denial Letter

Dear Mr. Doe,

Thank you for applying for the Sunset Credit Card with Sunset Bank. We value your interest in our products and services and appreciate the opportunity to review your application.

After a thorough review of your application and credit information, we regret to inform you that we are unable to approve your request for credit at this time. The decision is based on the following primary reason(s):

- Credit Score Below Minimum Requirement: Your current credit score of 620 falls below our minimum requirement for the Sunset Credit Card, which is set at 650. Our decision was influenced by the credit report obtained from Equifax, one of the leading credit reporting agencies.

- High Utilization of Existing Credit Lines: Our review also noted a high utilization rate on your existing credit lines, which is another factor in our decision-making process.

In accordance with the Fair Credit Reporting Act, you are entitled to a free copy of your credit report from Equifax, used in our decision-making process, if you request it within 60 days of receiving this letter. To obtain your report, please contact:

P.O. Box 740241

Atlanta, GA 30374-0241

Phone: 1-800-685-1111

Website: www.equifax.com

You also have the right to dispute any inaccuracies in the information provided by the credit reporting agency.

We encourage you to review your credit report and address the factors that have affected our decision. Improving your credit score and lowering your credit utilization may enhance your eligibility for credit in the future.

Please understand that this decision does not diminish the value we place on your interest in our services. We would be happy to review another application from you in the future, should your financial situation change.

If you have any questions or require further clarification, please do not hesitate to contact our customer service team at (555) 890-1234 or via email at [email protected].

Thank you again for considering Sunset Bank for your credit needs. We hope to have the opportunity to serve you in the future.

Credit Manager

Sunset Bank

Key Takeaways

This rejection letter from Sunset Bank regarding the credit card application is a well-structured and considerate communication. Here’s why it’s effective:

Gratitude and Politeness: The letter starts with a courteous tone, expressing gratitude for the applicant’s interest in the bank’s services, which sets a positive tone despite the disappointing news.

Clear Explanation: It provides a clear explanation for the decision, citing specific reasons such as the credit score falling below the minimum requirement and high utilization of existing credit lines. This transparency helps the applicant understand the basis of the decision.

Reference to Rights: By mentioning the Fair Credit Reporting Act, it informs the applicant of their rights to access their credit report and dispute any inaccuracies, demonstrating the bank’s commitment to regulatory compliance and consumer rights.

Encouragement for Improvement: Despite the rejection, the letter encourages the applicant to take steps to improve their creditworthiness, indicating a willingness to consider future applications if their financial situation improves. This supportive approach maintains a positive relationship with the applicant.

Openness to Future Applications: It leaves the door open for future interactions by expressing a willingness to consider another application in the future, fostering goodwill and preserving the possibility of a future relationship with the bank.

Clear Contact Information: The letter provides clear contact information for the bank’s customer service team, allowing the applicant to seek further clarification or assistance if needed, which enhances accessibility and customer support.

Closing Appreciation: It ends with a sincere expression of appreciation for the applicant’s consideration of the bank’s services, reinforcing the bank’s commitment to customer service and leaving a positive final impression.

In summary, this rejection letter effectively communicates the decision while maintaining professionalism, transparency, and a customer-centric approach, which are crucial for preserving the bank’s reputation and fostering goodwill with the applicant.

Legal Requirements for Credit Denial Letters

As previously stated, it is legally necessary for you to notify the applicant in writing of the reasons for the application’s denial.

These include:

- Fair Credit Reporting Act (FCRA): FCRA mandates you to notify applicants of any information, such as credit scores and reports, used as a basis for credit refusal. Also, it gives the applicant the right to reevaluate the credit report and appeal the decision if any inaccuracies are identified. According to the FCRA, borrowers should request the credit report within 60 days of being notified of the refusal.

- Equal Credit Opportunity Act (ECOA): ECOA prohibits discriminating against applicants based on race, gender, age, religion, marital status, or receipt of public assistance.

- Truth in Lending Act (TILA): TILA promotes transparency in lending. It requires the lenders to disclose the terms, credit terms, costs, and fees to consumers. Even though TILA regulations may not directly control credit refusal, lenders are nevertheless required to abide by other TILA provisions when providing credit to customers.

- State-Specific Regulations: Each state may have additional laws or regulations that govern the content and delivery of credit refusal letters. Lenders must familiarize themselves with state-specific requirements to ensure compliance.

You can deny credit applications as long as you have valid and lawful reasons. However, you must issue a letter to explain with clarity the reasons for the refusal. Compliance with legal requirements, such as the Fair Credit Reporting Act and Equal Credit Opportunity Act, is crucial to avoid legal issues and maintain ethical lending practices. By understanding the importance of effective communication and adherence to regulations, lenders can ensure fair treatment of applicants while protecting their institution’s reputation. The most common reasons for credit denial are a high debt-to-income ratio, a poor credit score, and a poor payment history. You can use templates to save time and effort when writing this type of letter. Consider reviewing sample letters of this type to learn the proper format and language to use when writing one.

About This Article

Was this helpful?

Great! Tell us more about your experience

Not up to par help us fix it, keep reading.

Letters and Emails

Tenant rejection letter (how to write) – free templates.

Letters and Emails , Rejection

Free Grant Rejection Letter Templates (Guide & Tips)

Rejection Letter Without an Interview (Samples)

Business Proposal Rejection Letter Samples (How to Decline)

Proposals , Rejection

Bid proposal rejection letter samples (writing tips).

College Rejection Letter Samples | How to Write (Format)

30 Best Polite Job Rejection Letter Samples

Authorization

12 free credit card authorization letter templates.

Free Eye Doctor Note Templates

Authorization Letters to Travel with Minor

Sample Landlord Reference Letters for a Tenant

Thank you for your feedback.

Your Voice, Our Progress. Your feedback matters a lot to us.

All Formats

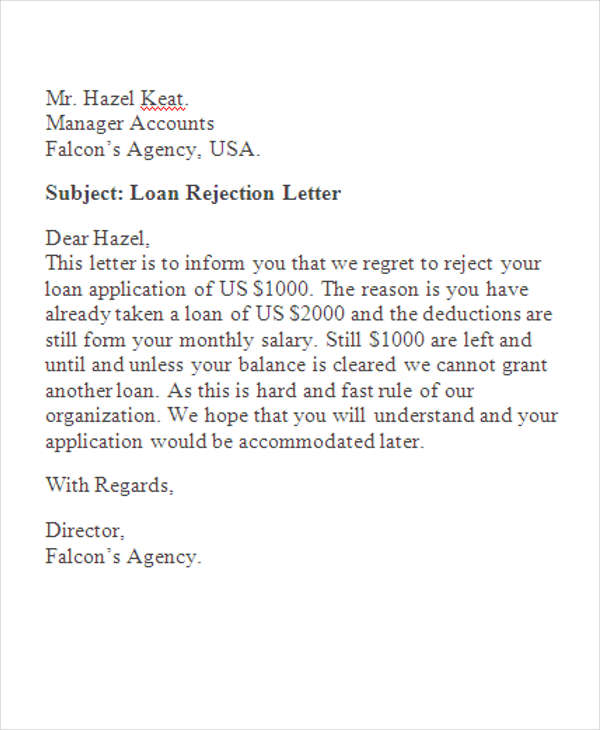

10+ Sample Loan Rejection Letters

Loan rejection letters are written and sent by entities who would like to provide details about their refusal to approve a loan application. There are many reasons why loan applications are declined and these are due to the variables that are involved in the transaction. This post is a collection of samples of loan rejection letter templates that you may use as reference for writing rejection letters.

- Rejection Letter Templates

- Rejection Letters in DOC

Customer Loan Rejection Letter

- Mirosoft Word

- Apple Pages

- Google Docs

Loan Rejection Letter from Bank

Short Loan Rejection Letter

Commercial Loan

Mortgage Loan Rejection Example

Business Loan

Reasons for Creating Loan Rejection Letters

- It is very essential to assess yourself and financial capability first. Most credit providers do background researches so they will be able to identify whether you are credible enough to be given a loan application letters approval. More so, this process will also identify whether you can repay the loan that you have applied for.

- There may be items that are questionable in terms of the credit report of the entity who is applying for a loan. It is very important to settle all your financial responsibilities and drawbacks first before applying for a loan especially if those responsibilities are also transactions from the business where you passed your loan application.

- In terms of sanctioning terms for small or medium enterprises, financial institutions make sure that businesses have sound business strategies and plans that would allow for some room to grow and thrive amid competition in new start-ups and established ones. Not only does this ensure that the financial institution will be repaid, this is also one form of investing.

Loan Application

Loan Proposal

Formal Loan Rejection Letter

Call to Actions to Get an Approved Loan Application

- Have a clean history in terms of debts. If you have a lot of debts, it can give an impression that you will not be able to repay the loan that you are applying for.

- It is highly suggested for you to have your credit report copy at hand.

- Assure that you have some savings before applying for a loan. This will enable the credit provider to have trust on your ability to pay the loan that you want to have.

More in Letters

Proposal Document Template

Formal proposal template, quotation proposal template, proposal format template, transport and logistics budget proposal template, transport and logistics loan application template, loan repayment receipt template, short proposal template, editable sample proposal template, minimal professional proposal template.

- FREE 26+ Covid-19 Letter Templates in PDF | MS Word | Google Docs

- Thank You Letter for Appreciation – 19+ Free Word, Excel, PDF Format Download!

- 69+ Resignation Letter Templates – Word, PDF, IPages

- 12+ Letter of Introduction Templates – PDF, DOC

- 14+ Nurse Resignation Letter Templates – Word, PDF

- 16+ Sample Adoption Reference Letter Templates

- 10+ Sample Work Reference Letters

- 28+ Invitation Letter Templates

- 19+ Rental Termination Letter Templates – Free Sample, Example Format Download!

- 23+ Retirement Letter Templates – Word, PDF

- 12+ Thank You Letters for Your Service – PDF, DOC

- 12+ Job Appointment Letter Templates – Google DOC, PDF, Apple Pages

- 21+ Professional Resignation Letter Templates – PDF, DOC

- 14+ Training Acknowledgement Letter Templates

- 49+ Job Application Form Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Loan Rejection Letter from Bank to Client

[Here briefly focus on sample Loan Rejection Letter from Bank to Client. You can follow this sample letter to the client for rejection of the loan request application letter from a bank. Every creditor has its rules and regulations that govern loans. The letter will make it simple for the client to realize the cause of why his or her loan request was denied and provide further information on what he or she can do. You need to modify this sample according to your needs.]

Date: DD/MM/YY

Client name…

Job/Business type…

Home/Office Address…

Sub: Rejection of Request for Loan

This letter is in reference to your loan application dated [DD/MM/YY]. It gives us the pain to describe to you that your request for the loan of (Money amount) has been rejected by the board of directors of our bank. (Describe in your words). The main reason for this rejection was found to be the short amount of salary you are earning (Or business profit), is a job holder in a private/business job. (Explain actual cause and situation). After going through your application, we are sorry to inform you that your application was rejected due to [give reasons].

As you have no source of income other than this job/business and the bank has strong reservations over your way of returning this huge amount of loan. (Cordially describe your regrets). Anyhow, we would always be obtainable to provide you with other matters. Hoping to serve you in a better way.

Job Designation…

Bank/Finance institute name…

Contact info. and Signature…

Another Format,

Client/Customer name…

Sub: Rejection of Loan Request

Respected Customer,

This letter is to inform you about the refusal of your loan request that you submitted at (Bank/Institute name). (Describe in your words). With reference to your application for loan dated (DD/MM/YY), we have to say that it is alongside the bank strategy to sanction the loan for buying a (Product Name). (Explain actual cause and situation).

I regret to say ‘no’ to your request but hope that you will appreciate that we cannot go against bank regulations. (Describe all about the situation and bank rules). Unfortunately, you were failed to fulfill the criteria that are must for the loan approval at our bank or the credentials and assets that you provided failed to be verified by our verification team. ((Cordially describe your regrets). Thanks for showing interest in our loan scheme.

You may contact the concerned branch for further queries if any.

Purchase Order Letter

No Objection (NOC) letter for Leaving Job

Offer Letter for Training

No Objection Letter from University for Tourism Visa

Iodine Dioxide – a binary inorganic compound

Dia-magnetism

Characteristics of various generations of Programming Languages

Artificial Vegetative Reproduction

Surface Tension of Liquid Property

Types of Report on the basis of Nature of Subject

Latest post.

Top QS World University Rankings 2024

Nano-oscillator Achieves Record Quality Factor

Not Only Do Opposites Attract: A New Study Demonstrates That Like-Charged Particles Can Come Together

A Breakthrough in Single-photon Integration Shows Promise for Quantum Computing and Cryptography

Could the Sun be Conscious? Enter the Unorthodox World of Panpsychism

The Brains of Conspiracy Theorists Are Different: Here’s How

What to do if you are denied a loan: Reasons for denials & ways to improve

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal loans

- • Debt consolidation

- Connect with Heidi Rivera on Twitter Twitter

- Connect with Heidi Rivera on LinkedIn Linkedin

- Get in contact with Heidi Rivera via Email Email

- • Personal finance

- Connect with Rhys Subitch on LinkedIn Linkedin

- Get in contact with Rhys Subitch via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Key takeaways

- Lenders tend to tighten credit requirements during tough economic times, making it harder to get approved for credit products, including loans.

- Credit score, income and debt-to-income ratio are the main factors lenders consider when reviewing applications.

- Paying down debts, increasing your income, applying with a co-signer or co-borrower and looking for lenders that specialize in loans within your credit band could increase your approval odds.

If you recently applied for a personal loan and got denied you’re not alone. Bankrate’s credit denials survey found that half of Americans who’ve applied for a loan or another financial product since the Fed hiked its benchmark rate in March 2022, have gotten denied.

This is likely in part due to the fact that lenders tend to tighten their credit requirements during tough economic times to mitigate risks, which in turn makes it harder to get approved for a loan. Luckily, there are a few steps you can take to improve your approval odds, even in a tough economy.

- 50% of Americans who have applied for credit products since the Fed rate hikes in March 2022 have gotten denied, according to Bankrate’s Credit Denials survey.

- 17% were denied more than one loan or financial product.

- 21% of Americans say it has gotten harder to access credit since the Fed increased interest rates, with 11% saying it has gotten much harder.

- New credit card applications, including balance transfer cards, accounted for the majority of credit denials at 19%.

- Credit card limit increase denials (at 11%) came in second, followed by personal loans (at 10%).

Why it’s been harder to get approved for a loan

Borrowers with good to excellent credit are still most likely to get approved for a loan, although the APRs (annual percentage rates) offered are likely to be much higher than they would have been last year.

The cost of borrowing has greatly increased as lenders adjust to the Federal Reserve raising the benchmark rate . What’s more, lenders have also become more selective about who qualifies for approval as the inflation rate remains stubbornly high, despite the Fed’s recent behaviors.

Reasons for personal loan rejections

There are several reasons someone may have their loan application rejected:

- Bad credit history: Bad credit history may indicate to creditors that you are having or had trouble repaying what you owe based on past transactions. Although your credit score is generally a good indicator of credit history, lenders also look at your overall financial history to establish your creditworthiness.

- High DTI: If you have a DTI — or debt-to-income — ratio of 50 percent or higher, you might have too much debt for a lender to give you a new loan. If that’s the case, it’s best to apply after reducing your overall debt, as this will increase your chances of approval.

- Incomplete application: Your loan rejection could be as simple as missing a key field or document needed for verification. If you are rejected for a loan, double-check that you fully completed the application and submitted all the proper documentation .

- Lack of proof of steady income: Consistency is key because it helps lenders understand your job landscape moving forward. Because jobs can vary depending on the line of work, lenders may look at tax returns to get a better overview.

- Loan doesn’t fit the purpose: Lenders might have certain restrictions on what you can and can’t do with loan money. The lender may be able to offer you alternative suggestions to better fit your needs.

- Unsteady employment history: Lenders like to see a steady income stream over time. If you are between jobs or have a history of unsteady employment, this could indicate to lenders that you may not be a reliable borrower.

How to improve your chances of qualifying for a loan

There are a few measures you can take to improve your approval odds when applying for a personal loan. But for any of these steps to work you must know why you got denied in the first place.

Under the Equal Credit Opportunity Act , lenders must disclose the reason for denying your loan application as long as you inquire about it within 60 days of the decision. This is known as an adverse action notice. Knowing this information is key to developing an effective strategy to get approved next time.

Review and build your credit score

Lower your dti, find ways to increase your income, compare lenders, prepare with personal loan preapproval, when to apply for a loan again after denial.

Each time you apply for a loan or credit product there is a hard inquiry that can temporarily lower your score. That’s why it’s a good idea to wait at least 30 days before you apply again. However, if you don’t need the funds urgently, experts recommend waiting at least six months.

How to get a loan with bad credit

There are a few ways you could still get approved for a personal loan, even with less-than-perfect credit.

Add a co-borrower or co-signer

Co-borrowers and co-signers are typically creditworthy family members or friends who sign the loan agreement with the primary applicant and take on equal legal responsibility for the loan. This, in turn, can boost the chances of approval of the primary applicant, plus help them secure a better rate.

The main difference between the two is that the co-borrower has access to the loan funds, while the co-signer doesn’t. Both co-borrowers and co-signers are equally responsible for payments, but co-signers typically only make payments if the borrower is at risk of defaulting on the loan.

Consider the potential relational risks before enlisting the assistance of a co-borrower or co-signer. Also make sure the monthly payment is well within your budget, both now and in the future, to avoid negatively impacting their credit as well as yours.

Consider getting a secured loan

Secured loans are those that are backed by an asset, such as a car or a savings account. Though not many, some personal loan lenders do offer these products. If you have enough equity built in your home, you may also be able to apply for a home equity loan or a home equity line of credit (HELOC) . Both are second mortgages backed by your home.

Because secured loans are guaranteed by an asset, lenders tend to be more lenient with credit requirements and offer lower rates. That said, if you default on the loan, the lender could take legal action to seize the asset. Additionally, home equity loans and HELOCs usually entail a lengthy approval process and are best suited if you need a considerable amount. Otherwise, they may not be worth the trouble or risk.

Target your search toward lenders within your credit band

If you need money quickly there are loans for bad credit borrowers that tend to have more relaxed requirements. However, be aware that your interest rates may potentially be higher than if you qualified for a good credit loan. Regardless, if you can handle the higher payments and interest, without tilting your budget, it may be a good option to explore .

The bottom line

If you have been denied a loan, take the time to review your application and see what went wrong. Then, work on improving the aspects that got you denied in the first place. For instance, if the main issue is that your DTI is too high, consider paying down debt before reapplying.

But if you’re in a crunch, there are lenders that offer loans to those with bad credit. But be sure to carefully consider the interest rates and your ability to make payments before you apply. It’s also important to wait at least one month before reapplying after getting denied and to only borrow an amount that you can comfortably repay.

What to do when your credit card application is denied

Can you get a balance transfer card with bad credit?

My Loan Was Declined, When Can I Apply Again?

Last Updated: Dec 06, 2022

Being rejected for a loan can be demoralizing.