7 Airbnb in China – before, during and after COVID-19

Yixiao Xiang , School of Management, Shandong University, China

Lan Liu , School of Management, Shandong University, China

Sara Dolnicar , Department of Tourism, UQ Business School, The University of Queensland, Australia

Please cite as: Xiang, Y., Liu, L. and Dolnicar, S. (2021) Airbnb in China – before, during and after COVID-19, in S. Dolnicar (Ed.) Airbnb before, during and after COVID-19 , University of Queensland DOI: https://doi.org/10.6084/m9.figshare.14195930

Airbnb in China before COVID-19

China represents a unique market for tourist accommodation in general, and for peer-to-peer traded accommodation in particular. Chinese residents have a strong sense that one’s home is not intended for sharing beyond family and friends ( Xiang & Dolnicar, 2018) . Chinese tourists prefer using China-specific online trading platforms operated by Chinese people, prefer to search for accommodation in the Chinese language, and trust their own social network verification processes (such as Ctrip.com) more than those of foreign companies. Not surprisingly, therefore, Chinese tourists – especially young tourists ( Xiang & Dolnicar, 2018) – have not fully embraced Airbnb as an accommodation option when travelling domestically or internationally.

Airbnb initially launched its operations in China shortly after the company was founded in 2008 (Douban Group, 2009). The Chinese population learned about this new platform in 2009, primarily via a social media platform popular with young people in China called Douban Forum. The potential economic benefits from peer-to-peer accommodation platforms such as Airbnb – additional income tax, new employment opportunities, and contribution to GDP (Cai & Li, 2016) – ensured the support of the Chinese government (Analysis, 2016). Soon, policies and regulatory frameworks were put in place to facilitate the peer-to-peer trading of space among ordinary people (Iresearch, 2017), referred to as minsu . This term originates from Taiwan and refers to a “ civil house rented for short-term accommodation ”.

Rather than embracing Airbnb as the global market leader, the Chinese tourism industry reacted by implementing its own versions of online peer-to-peer accommodation trading platforms (Cai & Li, 2016). Airizu, for example, was set up in June 2011 and operated by Chinese entrepreneurs with the financial support of Rocket Internet Ltd., a German venture capital firm. This initial attempt at copying the Airbnb model failed in 2013 because the Chinese market was not yet familiar with the concept of peer-to-peer accommodation. Renting one’s home for money felt strange and foreign to Chinese people. Buying and selling real estate was perceived as more lucrative than engaging in the short-term rental market (Lei, 2013). Consequently, Airizu was unable to attract the number of listings and guests required to make a multi-sided platform business successful (Reinhold & Dolnicar, 2018).

The Airizu failure drew the attention of online travel agents to the potential of peer-to-peer accommodation trading. They entered the market and competed directly with peer-to-peer accommodation platform facilitators (Lei, 2013). In addition, Chinese entrepreneurs – familiar with the Chinese market – set up their own online peer-to-peer accommodation trading platforms, initially without depending on international venture capital. The top ten providers in China before COVID-19 were: Airbnb, Tujia, Xiaozhu, Mayi, Muniao, Youtianxia, Meituan, Onehome, Zizaike, and Locals (CNPP, 2020).

Arguably the most successful Chinese platform provider is Tujia. Tujia was founded in 2011 and then it absorbed Mayi (Sina.com, 2016). In 2016, it purchased the short-term rental divisions of major Chinese online travel agents (Ctrip & Qunaer), leading to a powerful strategic alliance (Ifeng.com, 2016; Iresearch, 2017). In 2019, Tujia was home to over 1,400,000 listings and employed 4,000 people at 1,347 destinations globally. Of all listings, 1,200,000 were in China and 200,000 were based outside China. In comparison, Airbnb – at the same time – had over 6,000,000 listings globally, but only 150,000 in China (Qianzhan, 2019; Fastdata, 2019). To gain market share in China, Airbnb put in place several targeted initiatives ( Xiang & Dolnicar, 2018) , including the launch of a Chinese language site in 2014, a China-based Airbnb company, a partnership with Alipay targeting young travellers (Guan & Wang, 2017), and travel stories on the Airbnb webpage to facilitate the sharing of information among travellers. Airbnb also introduced a Chinese name, Ai-bi-ying (爱彼迎), which means ‘Love (enables us) to welcome you’ ( Xiang & Dolnicar, 2018) , or – as Airbnb translates it – ‘Let love embrace each other’ (Airbnb, 2017). By the end of 2019, just before COVID-19 forced the global tourism industry into hibernation, Airbnb had succeeded in increasing its Chinese domestic market share to more than 50% (Xiong et al., 2020).

In 2019, despite having substantially fewer listings in China than other platform facilitators (150,000 compared to: Tujia 1,200,000, Meituan 700,000, Mayi 350,000, and Xiaozhu 340,000; Fastdata, 2020), Airbnb topped the list of online short-term rental platform providers in China in terms of overall brand quality and reputation (Sohu News, 2019). Airbnb’s Chinese market report for the first quarter of 2019 showed a three-fold increase of its business in China. Between January and February 2019, the number of active monthly Airbnb users of its iOS and Android apps in mainland China ranked first among all such platforms in the country (Sohu News, 2019). One of the reasons for this success is that Airbnb focused strongly on marketing efforts in second and third tier cities in China.

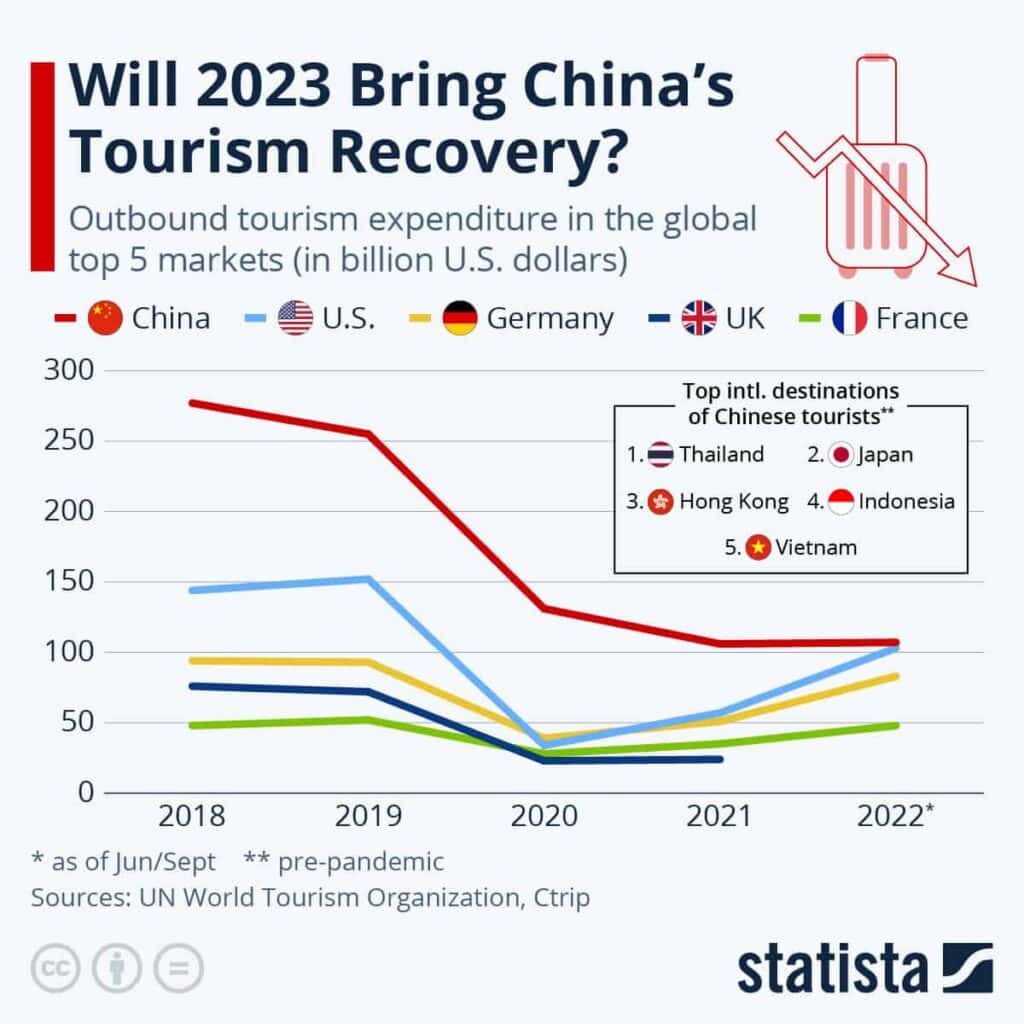

Another key opportunity for Airbnb in relation to China was outbound Chinese travellers. In 2013, 109 million Chinese tourists spent more than $100 billion on international travel. The number of Chinese people travelling outside of China had been showing continuous growth until COVID-19: 107 million in 2014, 117 million in 2015, 122 million in 2016, and 310 million in 2019 (China Tourism Academy, 2017; 2020). Airbnb bookings increased by 700% from 2012 to 2013 alone while Ctrip.com bookings increased even more (Qiu et al., 2016).

Airbnb in China during COVID-19

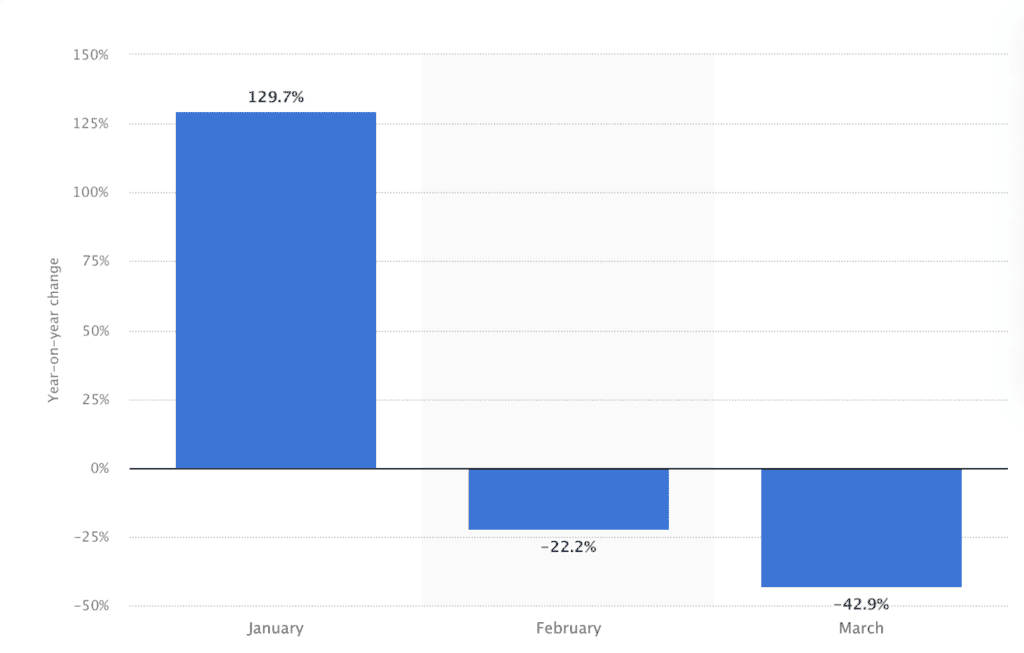

The unprecedented global travel restrictions and stay-at-home orders caused by COVID-19 resulted in a super-shock to peer-to-peer accommodation network facilitators (Dolnicar & Zare, 2020). Travel restrictions due to COVID-19 caused a drastic drop in Airbnb China’s revenue. In Wuhan, travel restrictions were in place as early as 23 January. Other provinces followed shortly thereafter, causing mobility within China to be effectively frozen. The transportation and accommodation sectors were most severely affected (Zhu & Kang, 2020). As a result, during the seven-day Chinese New Year holiday, more than 22% of minsu businesses lost RMB¥200,000-500,000. Another 8.7% lost more than RMB¥500,000 (Zhu & Kang, 2020). Airbnb was not spared. Airbnb’s revenue in Beijing dropped by 43% in March 2020 compared to March 2019 (Statista, 2020), and its occupancy rate was lower than 10%.

Hosts experienced cash-flow shortages because of the suspension of new bookings and the booking cancellation compensation policy announced by Airbnb in early February 2020. These measures complied with local regulations intended to curb the COVID-19 outbreak, and were subsequently extended in May 2020 (Fortune, 2020; The Business Times, 2020). As early as 21 January – in response to the sudden outbreak of the coronavirus pandemic – Airbnb China officially launched a special protection policy for booking cancellations to help those planning to travel to Wuhan (Travel Weekly China, 2020). Airbnb also refunded the service fee for those bookings.

To better understand the reactions of hosts, we conducted online and telephone structured interviews with 11 Chinese Airbnb hosts (between 20 July and 2 August 2020) and two unstructured face-to-face interviews with two medium-sized rural minsu owners on 19 November 2020. Details of study participants are included in the appendix. We asked the following questions: How many years have you listed your property on Airbnb? Has your perception of and preference for Airbnb changed over the years or not, and if so, in which way and why? Do you list your property on other peer-to-peer platforms such as Tujia or Xiaozhu? What advantages/disadvantages does Airbnb have over those competitors? How has COVID-19 affected your business on Airbnb over the past 6 months? How did Airbnb support you to survive? Do you have confidence in your future short-term rental business with Airbnb in the long run? How would you like to see Airbnb improve its operations?

The analysis of responses led to the following key findings:

L oss of bookings : All study participants confirmed that they experienced a dramatic loss of bookings following the official COVID-19 warning and announcements of travel restrictions. Interviewee #10 reported losing all bookings between 23 January and the middle of March. Interviewee #2 reported that her friends who also operate short-term rentals and list them on Airbnb suffered similar losses as she did, noting that revised refund policies caused a lot of confusion and communication difficulties during that period, which ruined her business performance during the 2020 Chinese New Year holiday.

Loyalty to the platform : Despite COVID-19-related challenges, none of the 11 interviewees expressed an intention to stop making their spaces available for short-term rental on Airbnb China. Interviewees #3, #4, #6, and #7 indicated that their attitude had changed towards Airbnb China; they initially felt suspicious, but over years of doing business with Airbnb they now fully trust it. Four study participants have been working with Airbnb for between two and five years – a relatively long period of time. Interviewee #1 expressed disappointment in the efficiency of Airbnb China’s customer service. 5 of the 11 study participants indicated that Airbnb is the only platform they currently use. The remaining interviewees also used other Chinese apps to list their properties.

Platform reaction and support during the C OVID -19 : 7 of the 11 participants reported having received support from Airbnb. Four benefitted from preferential policies offered by Airbnb China, such as discounted commission. The hotline for cancellation and refund enquiries was also mentioned by two participants, but they noted perceiving the hotline as inefficient and ineffective.

Confidence in the future business with Airbnb : All study participants expressed positivity about future business with Airbnb as an international booking platform. They all expressed confidence in and expectations for the forthcoming revival of the business once COVID-19 is completely under control around the world.

Suggestions for improvement : “ Improving t he quality of staff service of the platform will help the host to hold the guest a lot easier ” said Interviewee #1. Two study participants hoped for discounted commission and more platform promotions. One participant suggested that the platform should organise more activities and training for hosts. Three interviewees suggested making the booking app more user-friendly.

Overall, the key challenges for Airbnb China during the COVID-19 were shortage of cashflow, loss of listings, a low occupancy rate, booking cancellation refunds, host and guest loyalty, and maintaining confidence from both the hosts and the guests in the future of Airbnb China.

Airbnb in China after COVID-19

The substantial losses suffered by both the Airbnb platform and its hosts in China during the period of COVID-19 travel restrictions have put Airbnb under tremendous pressure to find an effective solution to secure its business in China after the pandemic. Dolnicar and Zare (2020) hypothesise that the proportion of hosts renting out space on Airbnb primarily for the reason of earning money will decline as a consequence of the business uncertainties caused by COVID-19, while the proportion of hosts making space available to travellers for other, more idealistic reasons, will increase again. This appears to describe the situation in China as well. Although no statistics have been officially released, several media articles noted that listing rates on platforms such as Airbnb, Xiaozhu, and Meituan minsu were all plummeting. People abandoning their peer-to-peer space trading operations were mainly people who rented other people’s properties to run online short-term accommodation businesses; they suffered the worst losses (Shen, 2020; Xu, 2020; ThePaper.cn, 2020).

The 11 Airbnb hosts we interviewed did not depend solely on Airbnb income, which explains why they were still listing spaces on Airbnb and were accessible to conduct interviews. Even among these hosts, their standard procedures changed because of COVID-19. Interviewee #10, for example, stopped hiring a cleaner to save costs, and cleaned the space herself instead. She explained: “ Although I know this pandemic will go away, I have to prepare to g et over the hard time s .”

On the platform side, Airbnb China saw a three-fold business increase in the first half of 2019 (year-on-year basis) and ambitious objectives for the first quarter of 2020 (Peng, 2019). COVID-19 shifted Airbnb’s original development plan in China from expansion to survival. At the time of writing, Airbnb China had taken the following steps:

Kep t losses to a minimum and protect ed brand credibility and sustainability : Airbnb cut its staff by 25% globally, affecting 85 staff at Airbnb China (CTNEWS, 2020). Airbnb also stopped all recruitment activities, halved CEO salaries, and ceased all marketing activities (Eastday.com, 2020a).

To comply with Chinese regulations regarding travel restrictions, Airbnb China announced a check-in suspension and developed a cancellation policy intended to protect the guests who booked and prepaid accommodation on Airbnb’s platform in China, the Chinese hosts listing their properties on the platform, and the platform facilitator itself.

When asked whether they encountered complaints from guests regarding cancellations or whether they made complaints to the Airbnb platform, two of the study participants (Interviewees #10 and #11) replied that with the guidelines provided by the platform they did not have a problem with cancellations. However, they noticed that there were some complaints posted online reflecting conflicts among guests, hosts, and the platform (BlackCat Complaints, 2020).

Secure d sufficient cash-flow to maintain health y operation of the platform : Budget-cutting measures were not enough to ensure sufficient cash-flow. Airbnb required cash to run its day-to-day operations, to take care of the host community, and to protect its brand reputation. Airbnb raised USD $1 billion in a new round of funding led by Silver Lake and Sixth Street Partners (Bosa & Batchelor, 2020), increasing confidence from its stakeholders and providing a lifeline for it to survive the turbulence of COVID-19, without losing too many of its listings.

Retain ed hosts and their listings : T he most impressive initiative Airbnb China took to protect their host community was to dedicate RMB 70 million to supporting Chinese hosts . Airbnb China also formulated the Ten Commitments in February 2020 during the initial coronavirus outbreak in Wuhan (Chen, 2020; Airbnb, 2020; Eastday.com, 2020 b ).

Airbnb China’s Ten Commitments to support its host community

- Refund Hubei hosts’ service fees

- Provide resource support and financial compensation

- Give priority to helping “heart-warming hosts”

- Empower landlords for long-term growth

- Strengthen various types of host training

- Reward the host community

- Extend the time for free cancellation

- Fully match employee donations

- Care for front-line pandemic professionals

- Strengthen the development of Chinese communities

Table 7.1: Airbnb China’s Ten Commitments to support its host community (source: Airbnb, 2020)

These measures demonstrate that Airbnb is acutely aware of the importance of retaining hosts and their listings. The Ten Commitments aim to protect and retain Chinese Airbnb hosts. They are summarised in Table 1 and shown in full detail in the appendix. As well as helping the host community, the Ten Commitments serve as a strategy to project a positive image of Airbnb in the Chinese market. Findings from the interview data show that Airbnb China’s efforts to retain hosts and listings have been effective: all 11 interviewees gave positive answers when asked about their overall perception of the future of Airbnb in China, eight talked positively about their hosting experience with the platform, and all expressed confidence in the future of Airbnb in China.

Based on the investigation of Airbnb China before and during the COVID-19 pandemic, we offer a few observations which have implications for the post-pandemic period:

Focus on younger travellers : Airbnb may want to consider redirecting its efforts toward the younger generation of travellers, especially those born in the 1980s and 1990s. Fastdata (2020) notes that the millennial and post-95 generations will be major forces influencing the Chinese travel market over the coming decade. Understanding their consumption behaviours and travel and accommodation needs – and catering to these needs – will strengthen Airbnb China’s competitive position. Peer-to-peer accommodation (online short-term rentals, or minsu ) is popular in this market segment, which enjoys independent travel and experiences with special value and meaning. The post-95 generation make up 20.7% of the minsu market, compared to 16.7% among post-90s and 12.3% among the post-80s. Fastdata (2020) predicts: “ Win the post-95 users, and you will win the future market ”.

Focus on the countryside : To increase post-pandemic supply, Airbnb may need to direct its efforts towards expanding its business from the cities into the countryside in China and integrating its products with rural tourism. Tujia launched its countryside minsu initiative as early as 2016 (Jiemian.com, 2016). Its countryside accommodation business grew by 300% in 2018 and another 200% in 2019, generating a revenue of RMB 500 million in 2018 and RMB 550 million in 2019 for minsu hosts (Tujia, 2019). In 2019, Tujia had 70,000 countryside minsu listings (rural lodgings), many catering to high-end customers with high turnout. The COVID-19 pandemic further fuelled market demand for accessible natural or rural destinations for weekends or short holidays, making rural accommodation the number one post-pandemic growth opportunity. Airbnb had already reached out to rural areas before the pandemic. By November 2018, 22% of all Airbnb China listings were in the countryside, with a 257% increase in listings and a 203% increase in hosts (Tang, 2018). However, considering the full picture of Airbnb’s listings in China compared to those of local Chinese platforms such as Tujia and Xiaozhu, Airbnb China still has a long way to go.

Enrich the host experience : Host community development has always been one of Airbnb China’s strengths and has helped to develop host loyalty. Our study participants described host community activities organised by the Airbnb platform as attractive and of benefit to them, and requested even more community activities in the future, such as online training, creative programs, and offline meetings and events (Interviewees #1, #3, #4, #8, #10, and #11). These requests offer an excellent opportunity for Airbnb China to further strengthen its links with hosts and, in doing so, increase the likelihood of them continuing to list their spaces on Airbnb in future.

Enrich the guest experience : Tujia and Xiaozhu introduced pick-up and drop-off services for guests at airports and train stations. Tujia also collaborated with Jingdong Express to provide an express luggage service for its guests (Sohu News, 2018, 2020). These services add substantial value to bookings for guests who are not travelling by car. During and after COVID-19 this value has further increased as these pickup services imply reduced human contact compared to taking public transport. Similar value-adding services could be introduced and maintained by Airbnb in the post-pandemic era, offering a competitive advantage, strengthening brand image, and encouraging market demand for Airbnb in China. Another alternative could be coupons or subsidies given to hosts by Airbnb to encourage them to provide pick-up and drop-off services for guests. This approach would allow Airbnb to maintain its asset-light strategy (not requiring any investment on its part) while encouraging increased host-guest interaction and enhancing host loyalty to the platform facilitator.

Collaborate : After its initial public offering and with sufficient available capital, Airbnb may wish to consider mergers and acquisitions. According to the latest unstructured interviews with two successful minsu owners in Shandong, the localisation of Airbnb in China could be facilitated by teaming up with or acquiring local players with growth potential. Although neither of the two interviewees are currently Airbnb hosts, both have previous negative hosting experiences with Airbnb China. According to them, Airbnb is favoured by hosts in first tier cities in China such as Beijing, Shanghai, Guangzhou, and Shenzhen. In second tier cities such as Qingdao and Jinan in Shandong, or even in rural areas, local platforms are much more successful in attracting domestic tourists. Airbnb could reach properties and domestic tourists by merging with and acquiring local peer-to-peer accommodation businesses, instead of competing against them. It should be noted, however, that there is a strong trend of monopolisation through mergers and acquisitions currently emerging in China, which is driven by domestic and international venture capitalists in the Chinese minsu (short-term rental) business. It is likely that this process will result in most minsu resources and businesses being acquired and controlled by a small number of large companies (similar to the process that led to the strong market position of Didi Taxi in China). Determining how to integrate local resources and strengths to gain competitiveness without straying from its original ethos – peer-to-peer accommodation offered by community members to community members – is perhaps one of the key future challenges for Airbnb in China.

Conclusions

The Chinese tourist market is unique. Airbnb learned this lesson quickly. Although Airbnb entered the Chinese market shortly after starting its operations as a peer-to-peer accommodation platform facilitator, it was not as successful there as it was in other markets around the world. The main reason for this is that local Chinese platform facilitators were quick in realising the potential of Airbnb’s business model and in successfully copying it. Chinese platform facilitators – in those early years – catered better to the needs of the Chinese tourists, giving them a competitive advantage over Airbnb (which was not as intimately familiar within this unique marketplace).

Over the years, Airbnb China learned to operate successfully in the Chinese marketplace and, before the COVID-19 pandemic hit, ranked first for perceived brand quality and reputation in China in 2019 (Sohu News, 2019). It also increased its Chinese domestic market share to more than 50% (Xiong et al., 2020).

COVID-19 significantly disrupted the business of Airbnb China and curtailed its ambitious development objectives. Key challenges for Airbnb China during COVID-19 include: a shortage of cashflow, loss of listings, a low occupancy rate, booking cancellation refunds, host and guest loyalty, and maintaining confidence from hosts in the future of Airbnb China.

For the post-pandemic era, Airbnb has a number of strategic options for rebuilding and growing its business, including: focusing on younger, educated Chinese tourists (the post-80s and post-90s generations); growing supply in the Chinese countryside and integrating their accommodation offerings with rural tourism products; further developing its host community to secure its loyalty into the future; introducing value-added services to match – or even surpass – those of its local Chinese competitors; and considering mergers and acquisitions with local peer-to-peer accommodation providers to facilitate its localisation efforts and its expansion into second and third-tier cities and rural areas.

Acknowledgements

This chapter is based on Xiang, Y. and Dolnicar, S. (2018) Chapter 13 – Networks in China, in S.Dolnicar (Ed.), Peer-to-Peer Accommodation Networks: Pushing the boundaries , Oxford: Goodfellow Publishers, 148–159.

Fieldwork was conducted by the Chinese authors of this book chapter who are from Shandong University, China. Fieldwork was approved via the human ethics approval process at Shandong University.

Airbnb (2017) Airbnb announced its latest plan for Chinese travellers, retrieved on August 21, 2017 from https://press.atairbnb.com/zh/airbnb-announces-new-plans-to-serve-chinese-travelers-zh

Airbnb (2020) Airbnb China has invested 70 million yuan as the special fund to fight the epidemic and to set up “10 Commitments” to restore confidence, retrieved on August 6, 2020 from https://news.airbnb.com/zh

Analysis (2016) The AMC model of Chinese online holiday renting market 2016, retrieved on August 21, 2017 from https://www.analysys.cn/analysis/22/detail/1000430

BlackCat Complaints (2020) Airbnb’s full refund policy during the COVID-19 is just a cover to cheat its guests, retrieved on August 6, 2020 from https://tousu.sina.com.cn/complaint/view/17349289141

Bosa, D. and Batchelor, L. (2020) Airbnb is raising $1 billion amid fallout from coronavirus, retrieved on August 6, 2020 from https://www.cnbc.com/2020/04/06/airbnb-raising-1-billion-amid-fallout-from-coronanvirus.html

Cai, D. and Li, X. (2016) Research on the development prospect of China’s hotel sharing platform, Jiangsu Review , 5, 10-12.

Chen, C. (2020) Airbnb China sets up 70-million-yuan special fund to restore confidence during Coronavirus outbreak, retrieved on August 6, 2020 from Panda daily: https://pandaily.com/airbnb-china-sets-up-70-million-yuan-special-fund-to-restore-confidence-during-coronavirus-outbreak

China Tourism Academy (2017) Tribute to the Chinese tourists – 2016 China outbound tourist large data, retrieved on August 21, 2017 from http://www.chinacloud.cn/show.aspx?id=24838&cid=6

China Tourism Academy (2020) Tribute to the Chinese tourists – 2019 China outbound tourist big data, retrieved on August 2, 2020 from http://www.ctaweb.org/html/2020-3/2020-3-10-16-48-64712.html

CNPP (2020) Top 10 short-term R&B brand names, retrieved on August 2, 2020 from https://www.cnpp.cn/china/list_6309.html

CTNEWS.com (2020) Airbnb laid off 25% of its workforce, possibly affecting 85 people in China, retrieved on August 2, 2020 from http://www.ctnews.com.cn/jdzs/content/2020-05/07/content_75134.html

Dolnicar, S. and Zare, S. (2020) COVID-19 and Airbnb – Disrupting the disruptor, Annals of Tourism Research , 102961, DOI: 10.1016/j.annals.2020.102961

Douban Group (2009) What can start-up companies learn from Airbnb? retrieved on August 21, 2017 from https://www.douban.com/group/topic/8962285

Eastday.com (2020 a ) Airbnb China invested 70 million yuan to set up a special fund and launched a green channel for free cancellation on Airbnb China, retrieved on August 6, 2020 from http://n.eastday.com/pnews/1580891764010112

Eastday.com (2020b) Airbnb has suspended recruitment and marketing due to the pandemic outbreak, retrieved on August 2, 2020 from http://n.eastday.com/pnews/1585618746019035

Fastdata (2019) Analysis Report on 2019 online minsu booking industry development in China, retrieved on August 2, 2017 from http://www.199it.com/archives/975961.html

Fastdata (2020) 2020 China online travel industry – Post 95s user data report, retrieved on August 2, 2020 from https://www.shangyexinzhi.com/article/2107954.html

Fortune (2020) Airbnb suspends all check-ins in Beijing amid the coronavirus outbreak, retrieved on August 6, 2020 from https://fortune.com/2020/02/10/airbnb-beijing-china-coronavirus

Guan, Z. and Wang, S. (2017) Can Airbnb make a breakthrough in the Chinese market by joining hands with ‘Alipay’?, retrieved on August 21, 2017 from http://www.bbtnews.com.cn/2017/0705/200384.shtml

Ifeng.com (2016) Tujia announced M&A of Mayi; Lightspeed China Partners was highly positive about ‘Internet +’, retrieved on August 21, 2017 from http://finance.ifeng.com/a/20160622/14515164_0.shtml

Iresearch (2017) Research report on the online short-term renting industry in China 2017, retrieved on August 21, 2017 from http://www.iresearch.com.cn/report/2944.html

Jiemian.com (2016) Optimistic about the rural vacation rental market, Tujia wants to go to the countryside, retrieved on August 6, 2020 from https://www.jiemian.com/article/586941.html

Lei, J. (2013) Airizu founder: Why it took two years to burn tens of millions of dollars but still go bankrupt? retrieved on August 21, 2017 from http://www.cyzone.cn/a/20131204/247502.html

Peng, T. (2019) Airbnb: The local strategy is effective, the monthly number of App users ranked first in the domestic industry in the first 8 months, retrieved on August 6 , 2020 from https://zhuhai.ihouse.ifeng.com/news/2019_09_17-52316698_0.shtml

Qianzhan (2019) Understanding the growth trend of the unicorn in 2018 China – Tujia, the biggest flow inlet of minsu (P2P accommodation), retrieved on August 2, 2017 from https://www.qianzhan.com/analyst/detail/220/190212-79a2b4b9.html

Qiu, R., Ou, S., Jiang, J. and Huang, L. (2016) The current situation and its countermeasures of Airbnb in China, Value Engineering , 31, 176-178.

Reinhold, S. and Dolnicar, S. (2018) Airbnb’s Business Model, i n S . Dol ni car (Ed.) , Peer-to-Peer Accommodation Networks: Pushing the boundaries , Oxford : Goodfellow Publishers, 27-38, DOI: 10.23912/9781911396512-3601

Shen, A. (2020) Under the epidemic, city homestays will face a major reshuffle, retrieved on August 6, 2020 from https://www.sohu.com/a/376435908_100191062

Sina.com (2016) Tujia announced M&A with Ctrip and Qunaer of their business sectors of apartment short-term rent and minsu , retrieved on August 21, 2017 from http://finance.sina.com.cn/chanjing/gsnews/2016–10–20/doc-ifxwzpsa8266027.shtml

Sohu News (2018) Tujia first launched the home stay platform airport business upgrade to ensure new travel experience, retrieved on August 6, 2020 from https://www.sohu.com/a/272442138_376259

Sohu News (2019) Three-fold increase of Airbnb business with localized “operating system”, retrieved on August 2, 2020 from https://www.sohu.com/a/308445727_202972

Sohu News (2020) Worry-free for family travel luggage w ith the help of Jingdong E xpress, Tujia minsu makes your travel and stay easy, retrieved on August 6, 2020 from https://www.sohu.com/a/366509353_100059725

Statista (2020) Year-on-year change in monthly revenue of Airbnb affected by the coronavirus COVID-19 pandemic in Beijing, China in 1st quarter 2020, retrieved on August 2, 2020 from https://www.statista.com/statistics/1110445/china-coronavirus-covid-19-pandemic-impact-on-airbnb-monthly-revenue-in-beijing

Tang, Y. (2018) Tujia rural loading is growing rapidly but still faces challenges from platforms such as Airbnb, retrieved on August 6, 2020 from https://www.chinaventure.com.cn/cmsmodel/news/detail/337048.html

The Business Times (2020) Airbnb extends Beijing suspension to May, retrieved on August 6 , 2020 from https://www.businesstimes.com.sg/technology/airbnb-extends-beijing-suspension-to-may

ThePaper.cn (2020) Airbnb: Many started to book accommodation for 1 May holiday, retrieved on August 6, 2020, from https://3g.163.com/house/article/F8Q6CFBE000782A4.html

Travel Weekly China (2020) Airbnb officially launches special protection policy for cancellation of bookings in response to the new coronavirus epidemic, retrieved on August 6, 2020 from https://www.travelweekly-china.com/81976

Tujia (2019) Tujia 2019 rural lodging data report, retrieved on August 6, 2020 from http://www.199it.com/archives/1040175.html

Xiang, Y. and Dolnicar, S. (2018) Networks in China, i n S . Dolnicar (Ed.) , Peer-to-Peer Accommodation Networks: Pushing the boundaries , Oxford : Goodfellow Publishers, 148-159, DOI: 10.23912/9781911396512 – 3611

Xiong, Y., Zhu, M. and Zhao, Y. (2020) Study on ethical risks of P2P accommodation platform -the case of Airbnb, Economy and Management , 1, 63-67.

Xu, C. (2020) Portraits of the accommodation hosts: Small entrepreneurs discouraged, while Ctrip and Airbnb struggling to saving themselves, retrieved on August 6, 2020 from https://finance.sina.cn/2020-04-03/detail-iimxyqwa4905492.d.html?from=wap

Zhu, K. and Kang, L. (2020) Research on the development of minsu business in the context of COVID-19, Journal of Beijing Vocational College of Agriculture , 34(3), 32-38.

Demographic characteristics of interviewees

| 1 | Guangdong | M | B19-35 | C Senior High | B Part-time job plus Airbnb host | B Part-time job plus Airbnb host | G 150,000+ | G 150,000+ | 5 |

| 2 | Zhejiang | M | B19-35 | C Senior High | C Full-time job plus Airbnb host | C Full-time job plus Airbnb host | G 150,000+ | G 150,000+ | 2 |

| 3 | Hainan | M | B19-35 | D Bachelor | D Full-time Airbnb host | C Full-time job plus Airbnb host | D 60,001 -100,000 | D 60,001 -100,000 | 4 |

| 4 | Guangdong | F | B19-35 | D Bachelor | C Full-time job plus Airbnb host | C Full-time job plus Airbnb host | E 100,001 -150,000 | D 60,001 -100,000 | 5 |

| 5 | Hebei | M | B19-35 | D Bachelor | D Full-time Airbnb host | D Full-time Airbnb host | G 150,000+ | E 100,001 -150,000 | 3 |

| 6 | Yunnan | M | B19-35 | D Bachelor | B Part-time job plus Airbnb host | B Part-time job plus Airbnb host | C 40,001 -60,000 | C 40,001 -60,000 | 2 |

| 7 | Jiangsu | M | B19-35 | D Bachelor | C Full-time job plus Airbnb host | C Full-time job plus Airbnb host | E 100,001 -150,000 | E 100,001 -150,000 | 4 |

| 8 | Guangdong | M | B19-35 | D Bachelor | C Full-time job plus Airbnb host | C Full-time job plus Airbnb host | E 100,001 -150,000 | D 60001 -100,000 | 0.75 |

| 9 | Fujian | F | C 36-55 | B Junior High | C Full-time job plus Airbnb host | C Full-time job plus Airbnb host | C 40,001 -60,000 | B 20,001 -40,000 | 2 |

| 10 | Shandong | F | B19-35 | D Bachelor | B Part-time job plus Airbnb host | B Part-time job plus Airbnb host | D 60,001 -100,000 | C 40,001 -60,000 | 2 |

| 11 | Shandong | M | B19-35 | D Bachelor | C Full-time job plus Airbnb host | C Full-time job plus Airbnb host | E 100,001 -150,000 | D 60001 -100,000 | 2 |

Airbnb China’s Ten Commitments to support its host community

| 1. Refund Hubei hosts’ service fees: | Promises to refund the host service fee for all Hubei listings. This policy applies to bookings made before 5 February 2020 for the check-in period 5 February 2020 – 1 May 2020. |

| 2. Provide resource support and financial compensation: | Promises to launch the “Green Channel” program, which streamlines the cancellation process for hosts and guests. This program applies to bookings made before 28 January 2020 for stays between 2 – 29 February 2020. Promises to provide hosts with more resource support and certain financial compensation for booking cancellations within the defined period. |

| 3. Give priority to helping “heart-warming hosts”: | Promises to give priority to tilting the flow of weekly and monthly rent orders to hosts identified as “heart-warming hosts” to reward their contribution to the host community. More incentives will follow for the “heart-warming hosts”. |

| 4. Empower landlords for long-term growth: | Promises to launch a landlord growth plan, including: giving high-quality hosts access to “high-quality listing” and “plus listing” badges, encouraging and helping hosts to upgrade their properties and to optimise their service capacity. |

| 5. Strengthen various types of host training: | Promises to expand the number and content of China’s host training programs to cover hosts in both urban and rural areas, to increase knowledge of safety, hygiene and operations, and to improve the host’s ability to deal with major public safety emergencies. |

| 6. Reward the host community: | Promises to put the host community at the core of its business development plan, and raise the global profile of the Chinese host community and its successes against the pandemic, through programs such as annual host awards, “host of the month” awards, community activities, and Chinese landlord incentive programs, story-sharing of Chinese host fighting against coronavirus pandemic, etc. |

| 7. Extend the time for free cancellation: | Promises to extend the “Special Circumstances Policy” until 29 February 2020 (until 1 April 2020 in Hubei Province). The booking date must be before 28 January 2020 (bookings from mainland China) or 1 February 2020 (bookings from outside China). Airbnb will continue to evaluate and adjust this policy in light of the pandemic situation. |

| 8. Fully match employee donations: | Promises to fully match donations made by the company’s global employees to the non-profit Give2Asia, for the purchase of masks, protection suits, and eye protectors for medical staff. |

| 9. Care for front-line pandemic professionals: | Promises that front-line medical workers and other professional staff who cannot complete their itineraries due to the pandemic may cancel their Airbnb bookings free of charge upon verification of relevant certification materials. Airbnb promises to provide targeted travel funds for outstanding front-line medical workers to thank them for their great contributions in the fight against the pandemic. |

| 10. Strengthen the development of Chinese communities: | Promises to increase marketing activities that are strategic to the Chinese market in the post-pandemic era, encourage more people to sign up as hosts and guests, and achieve the healthy development and sustainability of host community growth. |

Airbnb Before, During and After COVID-19 Copyright © 2021 by The University of Queensland is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Digital Object Identifier (DOI)

https://doi.org/10.6084/m9.figshare.14195930

Share This Book

Chinese Tourists Agency

Airbnb in China: Why Did The Company Fail?

Ever find yourself pondering over why Airbnb , the global giant in home-sharing services , stumbled when it came to cracking into China’s market? Trust me, you’re not alone. I too was left scratching my head and decided to do a little detective work.

My investigation shed light on an intriguing blend of culture clashes , intense competition from local rivals , and legal hurdles that majorly contributed to this unexpected misstep .

In this blog post, we’ll navigate through the complex labyrinth of challenges Airbnb faced and extract some valuable lessons from their Chinese chapter gone awry. Stay tuned!

Key Takeaways

- Airbnb faced strong competition from domestic platforms like Tujia and Xiaozhu, who had a better understanding of the Chinese market and established themselves before Airbnb could make its mark.

- Cultural differences and trust issues played a significant role in Airbnb’s failure in China, as people were hesitant to stay in strangers’ homes , preferring traditional accommodations or staying with family and friends.

- Regulatory restrictions and legal challenges posed major obstacles for Airbnb, with cities saying no to short-term rentals and potential new laws requiring data sharing outside of China. These challenges made it difficult for Airbnb to operate within the country.

- Lack of localized strategies and adaptations was another reason for Airbnb’s failure in China, as they didn’t fully understand the specific needs of Chinese travelers or adapt their branding and marketing messages effectively. This resulted in a disconnect between their offerings and what the target audience wanted .

Challenges Faced by Airbnb in China

Airbnb in China struggled with strong competition from domestic players, cultural differences that led to trust issues, and regulatory restrictions and legal challenges.

Strong competition from domestic players

Local big names like Tujia and Xiaozhu were giving Airbnb a run for its money in the domestic business. They were hard to beat . These platforms knew the Chinese market well. They took over the home-sharing space before Airbnb could make its mark.

The cut-throat rivalry didn’t help Airbnb’s cause. It became tough to stand out with so many foes in the field of vacation rentals. Domestic players had a strong grip on the market , making it rough for Airbnb to thrive or even survive in China .

Cultural differences and trust issues

China is different. Airbnb had a tough time with that. People in China do things their own way. They like to stay with the ways they know and trust. This was a big problem for Airbnb when it tried to start there.

The folks there did not understand or trust the idea of staying in strangers’ homes . They usually travel in groups and stay in luxury hotels. The idea of staying in someone’s home didn’t feel safe for them.

Tujia, a local company like Airbnb, knows these Chinese ways better. It uses them well and has done good business because of it.

Airbnb tried hard but could not win enough trust from people in China. Many people call China a low-trust country towards new ideas from outside.

This idea of sharing homes was also all-new and weird for many people in China at first, making it harder still for Airbnb to build its business there.

Regulatory restrictions and legal challenges

China has its own unique rules for Internet businesses . These rules acted like a brick wall to Airbnb. Cities in China started saying no to short-term rentals . This was a big hit to Airbnb’s business model there.

Then came potential new laws from the Chinese government. They aimed at sharing data outside of the country’s borders . The legal battles were as hard as fighting off rivals from home soil!

Lack of Localized Strategies and Adaptations

Airbnb failed in China primarily because it lacked localized strategies and adaptations that catered to the specific needs of Chinese travelers.

Failure to understand and cater to the specific needs of Chinese travelers

When Airbnb entered the Chinese market in 2013, they didn’t fully understand and cater to the specific needs of Chinese travelers . The concept of peer-to-peer accommodation was new to them, and they were more accustomed to staying in traditional hotels or with family and friends .

Additionally, Airbnb’s attempt to use disparate Chinese characters to evoke the idea of hospitality was seen as a cultural misstep . This lack of cultural understanding and adaptation made it difficult for Airbnb to gain traction in China.

They also had to comply with strict regulations by confirming and verifying real identities, which further hindered their progress.

On top of that, they forgot about offering exclusive discounts and promotional codes . Chinese people enjoy exclusive discounts often and they are used to local platforms offering them on a daily basis.

Insufficient localization efforts in terms of branding and marketing

When it comes to Airbnb’s failure in China, one of the reasons was their insufficient efforts in localizing their branding and marketing strategies. They didn’t understand the specific needs and preferences of Chinese travelers , which resulted in a disconnect between their offerings and what the target audience wanted.

Additionally, they didn’t adapt their branding and marketing messages to resonate with the local culture effectively. This lack of localization made it difficult for Airbnb to compete with domestic players who had a better understanding of the market.

To be successful in foreign markets like China, companies need to invest time and resources in conducting thorough market research , segmenting their target audience, adapting language localization, and creating localized branding campaigns that appeal directly to consumers’ preferences and behaviors.

Impact of COVID-19 Pandemic

The COVID-19 pandemic greatly impacted Airbnb’s presence in China, with travel restrictions and a decline in tourism leading to decreased demand for short-term rentals.

Travel restrictions and decline in tourism

The COVID-19 pandemic has had a big impact on tourism in China. There were travel restrictions in place and fewer people were traveling, which has led to a decline in tourism . This means that there was (and still is) less demand for accommodations , including short-term rentals like those offered by Airbnb.

The pandemic has caused a collapse of the tourism industry in China, as it’s been difficult to control the spread of COVID-19 . It’s not just happening in China – the global tourism industry has also been greatly affected by the pandemic.

Above you can see how the numbers dropped during the pandemic.

Decreased demand for short-term rentals

During the COVID-19 pandemic, there was a significant decrease in demand for short-term rentals in Airbnb China. This was due to various factors, including travel restrictions and a decline in tourism .

Here you can see a huge drop in Airbnb’s revenue in China in the first quarter of 2020, due to lockdowns and a lack in outbound travel activities among Chinese tourists:

Many people were unable or hesitant to travel during this time, leading to a lower occupancy rate for short-term rental properties . Additionally, the crisis in the short-term rental market resulted in fewer bookings overall .

Listings with shorter rental periods were particularly affected, with some being eliminated completely. As a result of the global impact of the pandemic on Airbnb booking activity, there was a low demand for short-term rentals in general.

Lessons Learned from Airbnb’s Failure in China

Airbnb’s failure in China offers valuable lessons for international companies entering new markets. Understanding the local market and adapting strategies is crucial, as cultural differences and trust issues can significantly impact success.

Moreover, building strong partnerships with local stakeholders, navigating regulatory challenges, and staying updated on laws and policies are essential to long-term viability in foreign markets.

Importance of understanding the local market and adapting strategies

To succeed in a new market like China, it is crucial to understand the local culture and preferences. This means adapting your strategies to meet the specific needs of Chinese consumers.

For example, when Airbnb decided to enter China, it faced challenges because the concept of peer-to-peer accommodation and such room service was unfamiliar to Chinese travelers . It’s important to research and familiarize yourself with the market before launching your product or service.

In addition, building trust with customers and establishing strong partnerships with local stakeholders can help you navigate regulatory challenges and stay updated on local laws and policies.

Building trust and establishing strong partnerships with local stakeholders

In order to succeed in China, it is crucial for Airbnb to build trust and establish strong partnerships with local stakeholders . This means establishing relationships with local communities, gaining the trust of local residents, collaborating with local businesses and organizations, engaging with local government and regulatory agencies, and building a strong network of local hosts and partners.

By understanding the cultural and social dynamics of the market, addressing concerns raised by stakeholders, investing in localized marketing strategies , and respecting local customs and practices, Airbnb can overcome challenges and create a positive brand image in China.

Navigating regulatory challenges and staying updated on local laws and policies

Understanding and complying with local regulations is essential for foreign companies like Airbnb to succeed in China. The country has a complex regulatory landscape , and keeping up with the changing laws and policies can be challenging.

It is important to adapt to the demanding regulatory environment by understanding the cultural context and meeting local market demands. By building strong partnerships with local stakeholders , businesses can navigate these challenges more effectively and increase their chances of success in China’s market.

Ensure Your Brand’s Success with Gentlemen Marketing Agency

The story of Airbnb’s challenges in the domestic business in China underscores the importance of understanding and adapting to the nuances of the local market. For any online travel agency or tourism-based company aspiring to flourish in China, this journey is laden with complexities that require expert navigation.

At Gentlemen Marketing Agency , here’s how we can be your guiding star:

- Deep Local Insight: We dive deep into the intricacies of Chinese consumer behavior, ensuring your brand resonates and connects with the audience effectively.

- Strategic Planning: We don’t just offer solutions; we craft strategies based on your brand’s unique strengths, and the opportunities within the Chinese market.

- Partnership and Collaboration: Our extensive network in China includes key influencers, platforms, and industry leaders. This ensures your brand isn’t just seen, but celebrated.

- Customized Marketing Campaigns: From WeChat to Douyin, our tailored campaigns are designed to garner maximum visibility and engagement for your brand.

Don’t let challenges deter you. With Gentlemen Marketing Agency by your side, craft a success story in China that others will aspire to. Reach out today and chart a course for unparalleled growth and success.

Similar Posts

This is where chinese tourists want to go in 2014.

Top destination for Chinese tourists in 2014! Which countries are among the top 3 for Chinese tourists in 2014? All countries around the world have realized that Chinese people were the new category of tourists they have to attract at all costs, all the more so as everyone know that Chinese are big spenders. That is…

New Zealand Tourism strategy to attract Chinese tourists

New Zealand has been increasing in popularity among Chinese tourists. According to the official New Zealand Tourism website, in 2015, New Zealand attracted more than 350,000 visitors. The number of tourists increased by 34% in 2015 in comparison to 2014. They are also staying longer compared the previous year with an increase of around 70% of…

Record number of Chinese tourists in Spain!

Last year, Spain became the third global holidays destination, after France and the United States. Spain received a record 65 million foreign tourists in 2014. This is the second consecutive year that Spain beats its record of of inbound tourism with 65 million visitors. That means an increase up to 7,1% in comparison with the…

Why you should choose a China based Agency?

A Chinese tourism specialist based outside of China? Hundreds of Agencies around the world present themselves as China specialists. Most of them are based in Europe, North America, Australia or even India (those cheap fake leads providers) They are close to the customer – they meet you every day, drink coffee, they are nice BUT…

Chinese tourists in India: Guide for Pro!

What tour operator and tourism professional should know about India and Chinese tourists? Boost in Tourism and Economic Impact: The reopening to Chinese tourists can lead to a significant boost in tourism for India, benefiting local economies, especially in popular tourist destinations like Goa, Rajasthan, and Kerala. The increase in tourists can help revive sectors…

Chinese tourists in Cameroon: Opportunities for Local Travel Companies

900,000 international tourists visited Cameroon in 2015 Tourism in Cameroon Tourism in Cameroon is a growing industry. Since the 1970s, the government of Cameroon has developed the tourism industry by creating a ministry of tourism and by encouraging investment by airlines, hotels, and travel agencies. “All of Africa in a single Country”, Cameroon is described…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Notify me of new posts by email.

Airbnb in China: The Impact of Sharing Economy on Chinese Tourism

- Conference paper

- First Online: 14 June 2017

- Cite this conference paper

- Yumeng Bie 17 ,

- Jieyu Wang 17 &

- Jingyu Wang 18

Part of the book series: Advances in Intelligent Systems and Computing ((AISC,volume 594))

Included in the following conference series:

- International Conference on Applied Human Factors and Ergonomics

2960 Accesses

1 Citations

Today an increasing number of young people are likely to book homestay hotels instead of traditional hotels. We find Airbnb is one of the most popular websites in China to reserve homestays for young people traveling aboard. Since the company’s headquarters is based in San Francisco, we find it is not well-known in China and little research has been done about it in China. Therefore, this paper addresses how Airbnb can influence Chinese tourism. We use mixed methods in this paper, including surveys, interviews and ethnography studies. We conduct semi-structured interviews to travelers and Airbnb employees. We carry out surveys to participants. The surveys have been posted both on the internet and in print. Ethnography studies have been conducted in order to get detailed information about customers’ usage of the website. We find that 59.05% of the participants prefer to live in starred hotels, and 49.52% of the participants prefer to stay in budget hotels and 18.1% of the participants used Airbnb. We find out that interviewees believe that the emerging of sharing economy like Airbnb does influence or will impact the traditional hotel industry. Some participants expressed their preferences about the website design and the work environment of Airbnb. Our ethnography studies also investigated four Airbnb customers’ travel experiences about using Airbnb website. They reported that Airbnb not only offered them diverse rooms, but also offered them good accommodation, lots of travel information and help from landlords. However, trust issue still is a big concern between customers and Airbnb.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or Ebook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Similar content being viewed by others

Shaping the Consumers Behavior Who Are Using Airbnb—The Case of Airbnb’s Users in Greece

When harry met sally: different approaches towards uber and airbnb—an australian and singapore perspective.

Northern Portugal Tourism Experiences Management for the Post-Covid Period: Facing Demand Changes in Tourism Products and Services

Byers, J.W., Esposito, F., Proserpio, D., Zervas, G. The hyper-local economic impact of Airbnb. In: 9th Symposium on Statistical Challenges in eCommerce Research, Lisbon, Portugal (2013)

Google Scholar

Fradkin, A., Grewal, E., Holtz, D., Pearson, M.: Bias and reciprocity in online reviews: evidence from field experiments on Airbnb. In: 18th ACM Conference Companion on Computer Supported Cooperative Work and Social Computing, pp. 219–222. ACM, New York (2015)

Lee, D., Hyun, W., Ryu, J., Lee, W.J., Rhee, W., Suh, B.: An analysis of social features associated with room sales of Airbnb. In: 16th ACM Conference on Economics and Computation, pp. 641–641. ACM, New York (2015)

Ma, X., Hancock, J.T., Mingjie, K.L., Naaman, M.: Self-disclosure and perceived trustworthiness of Airbnb host profiles. In: 20th ACM Conference on Computer Supported Cooperative Work and Social Computing, pp. 2397–2409. ACM, New York (2017)

Zervas, G., Proserpio, D., Byers, J.W.: The impact of the sharing economy on the hotel industry: evidence from Airbnb’s entry into the Texas market. In: 16th ACM Conference on Economics and Computation, pp. 637–637. ACM, New York (2015)

Download references

Acknowledgments

We thank our participants for their participation and contribution.

Author information

Authors and affiliations.

International College Beijing, University of Colorado Denver, Beijing, 100083, China

Yumeng Bie & Jieyu Wang

Haidian Huanyuan Road 5, Beijing, 100088, China

Jingyu Wang

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Jieyu Wang .

Editor information

Editors and affiliations.

Belgafik Oy, University of Vaasa, Vaasa, Finland

Jussi Ilari Kantola

University of Szeged, Szeged, Hungary

Tibor Barath

Institute of Maritime Operations, University College of Southeast Norway, Borre, Norway

Salman Nazir

Rights and permissions

Reprints and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper.

Bie, Y., Wang, J., Wang, J. (2018). Airbnb in China: The Impact of Sharing Economy on Chinese Tourism. In: Kantola, J., Barath, T., Nazir, S. (eds) Advances in Human Factors, Business Management and Leadership. AHFE 2017. Advances in Intelligent Systems and Computing, vol 594. Springer, Cham. https://doi.org/10.1007/978-3-319-60372-8_2

Download citation

DOI : https://doi.org/10.1007/978-3-319-60372-8_2

Published : 14 June 2017

Publisher Name : Springer, Cham

Print ISBN : 978-3-319-60371-1

Online ISBN : 978-3-319-60372-8

eBook Packages : Engineering Engineering (R0)

Share this paper

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Airbnb China closes domestic unit to cut costs as it bets on border reopening

Airbnb will terminate its domestic business in China, marking the partial retreat of another Western tech giant from the country.

Like most of its peers, the home sharing titan is shifting its focus to China’s outbound business. Google, Facebook, Twitter and the likes don’t offer services to Chinese consumers but they are important advertising channels for the country’s booming export-oriented e-commerce sellers.

Airbnb is closing down its domestic home and experiences segments in China this summer and pivoting to serve the country’s growing appetite for outbound tourism, according to a person familiar with the matter.

The American company had high hopes when it entered China in 2016. It was once a popular choice for foreign tourists and Western-educated Chinese traveling in the country. But that population is in the minority after all. Over the years Airbnb has faced rising competition from domestic rivals like Tujia, backed by its own investor , and experienced several management shakeups at the top.

With China’s tourism disrupted by intermittent lockdowns since 2020 “with no end in sight,” Airbnb decided to it was time to end the business. “The domestic segment is costly and complex to operate, and COVID-19 worsened these issues and heightened their impact,” the person with knowledge said.

Since 2016, Airbnb’s China listings have logged 25 million guest arrivals, but stays in China have accounted for just about 1% of the firm’s revenue for the last few years. The company will remove roughly 150,000 listings in China as part of the shutdown, reported The New York Times .

Airbnb is betting on the opportunity to meet China’s pent-up demand for outbound tourism once the country loosens travel restrictions. Nearly 155 million Chinese people traveled abroad in 2019, compared to just 48 million a decade ago, according to data compiled by World Bank.

But it might still be a long time before Airbnb gets to experiment with this new endeavor. China is one of the last countries to have stuck to strict COVID-19 border rules , limiting outbound and inbound travel. The country’s economy is also projected to slow , which could continue to hurt consumer confidence even after the borders reopen.

The long haul of Microsoft’s China localization

More TechCrunch

Get the industry’s biggest tech news, techcrunch daily news.

Every weekday and Sunday, you can get the best of TechCrunch’s coverage.

Startups Weekly

Startups are the core of TechCrunch, so get our best coverage delivered weekly.

TechCrunch Fintech

The latest Fintech news and analysis, delivered every Tuesday.

TechCrunch Mobility

TechCrunch Mobility is your destination for transportation news and insight.

Presti is using GenAI to replace costly furniture industry photo shoots

If you’ve ever bought a sofa online, have you thought about the homes you can see in the background of the product shots? When it’s time to release a new…

Google backs Indian open-source Uber rival

Google has joined investors backing Moving Tech, the parent firm of open-source ride-sharing app Namma Yatri in India that is eroding market share from Uber and Ola with its no-commission…

At last, Apple’s Messages app will support RCS and scheduling texts

These messaging features, announced at WWDC 2024, will have a significant impact on how people communicate every day.

Here are all the devices compatible with iOS 18

iOS 18 will be available in the fall as a free software update.

TikTok glitch allows Shop to appear to users under 18, despite adults-only policy

The tests indicate there are loopholes in TikTok’s ability to apply its parental controls and policies effectively in a situation where the teen user originally lied about their age, as…

Lhoopa raises $80M to spur more affordable housing in the Philippines

Lhoopa has raised $80 million to address the lack of affordable housing in Southeast Asian markets, starting with the Philippines.

Trump’s VP candidate JD Vance has long ties to Silicon Valley, and was a VC himself

Former President Donald Trump picked Ohio Senator J.D. Vance as his running mate on Monday, as he runs to reclaim the office he lost to President Joe Biden in 2020.…

TechCrunch Space: Space cowboys

Hello and welcome back to TechCrunch Space. Is it just me, or is the news cycle only accelerating this summer?!

Without Apple Intelligence, iOS 18 beta feels like a TV show that’s waiting for the finale

Apple Intelligence features are not available in the developer beta, which is out now.

Apple’s public betas for iOS 18 are here to test out

Apple released the public betas for its next generation of software on the iPhone, Mac, iPad and Apple Watch on Monday. You can now test out iOS 18 and many…

Fisker has one major objector to its Ocean SUV fire sale

One major dissenter threatens to upend Fisker’s apparent best chance at offloading its unsold EVs, a deal that would keep the startup’s bankruptcy proceeding alive and pave the way for…

Major Stripe investor Sequoia confirms $70B valuation, offers its investors a payday

Payments giant Stripe has delayed going public for so long that its major investor Sequoia Capital is getting creative to offer returns to its limited partners. The venture firm emailed…

Google’s Kurian approached Wiz, $23B deal could take a week to land, source says

Alphabet, Google’s parent company, is in advanced talks to acquire Wiz for $23 billion, a person close to the company told TechCrunch. The deal discussions were previously reported by The…

Bird Buddy’s new AI feature lets people name and identify individual birds

Name That Bird determines individual members of a species by identifying distinguishing characteristics that most humans would be hard-pressed to spot.

YouTube Music is testing an AI-generated radio feature and adding a song recognition tool

YouTube Music is introducing two new ways to boost song discovery on its platform. YouTube announced on Monday that it’s experimenting with an AI-generated conversational radio feature, and rolling out…

Elon Musk confirms Tesla ‘robotaxi’ event delayed due to design change

Tesla had internally planned to build the dedicated robotaxi and the $25,000 car, often referred to as the Model 2, on the same platform.

Moon cave! Discovery could redirect lunar colony and startup plays

What this means for the space industry is that theory has become reality: The possibility of designing a habitation within a lunar tunnel is a reasonable proposition.

Disrupt Deal Days are here: Prime savings for TechCrunch Disrupt 2024!

Get ready for a prime week of savings at TechCrunch Disrupt 2024 with the launch of Disrupt Deal Days! From now to July 19 at 11:59 p.m. PT, we’re going…

Deezer chases Spotify and Amazon Music with its own AI playlist generator

Deezer is the latest music streaming app to introduce an AI playlist feature. The company announced on Monday that a select number of paid users will be able to create…

Caliza lands $8.5 million to bring real-time money transfers to Latin America using USDC

Real-time payments are becoming commonplace for individuals and businesses, but not yet for cross-border transactions. That’s what Caliza is hoping to change, starting with Latin America. Founded in 2021 by…

Adaptive builds automation tools to speed up construction payments

Adaptive is a platform that provides tools designed to simplify payments and accounting for general construction contractors.

How VanMoof’s new owners plan to win over its old customers

When VanMoof declared bankruptcy last year, it left around 5,000 customers who had preordered e-bikes in the lurch. Now VanMoof is up and running under new management, and the company’s…

Mitti Labs aims to make rice farming less harmful to the climate, starting in India

Mitti Labs aims to transform rice farming in India and other South Asian markets by reducing methane emissions by 50% and water consumption by 30%.

How to tell if your online accounts have been hacked

This is a guide on how to check whether someone compromised your online accounts.

The AI financial results paradox

There is a general consensus today that generative AI is going to transform business in a profound way, and companies and individuals who don’t get on board will be quickly…

Google reportedly in talks to acquire cloud security company Wiz for $23B

Google’s parent company Alphabet might be on the verge of making its biggest acquisition ever. The Wall Street Journal reports that Alphabet is in advanced talks to acquire Wiz for…

Featured Article

Hank Green reckons with the power — and the powerlessness — of the creator

Hank Green has had a while to think about how social media has changed us. He started making YouTube videos in 2007 with his brother, novelist John Green, at a time when the first iPhone was in development, Myspace was still relevant and Instagram didn’t exist. Seventeen years later, posting…

Synapse’s collapse has frozen nearly $160M from fintech users — here’s how it happened

Here is a timeline of Synapse’s troubles and the ongoing impact it is having on banking consumers.

Helixx wants to bring fast-food economics and Netflix pricing to EVs

When Helixx co-founder and CEO Steve Pegg looks at Daisy — the startup’s 3D-printed prototype delivery van — he sees a second chance. And he’s pulling inspiration from McDonald’s to get there. The prototype, which made its global debut this week at the Goodwood Festival of Speed, is an interesting proof…

India clings to cheap feature phones as brands struggle to tap new smartphone buyers

India is struggling to get new smartphone buyers, as millions of Indians don’t go for an upgrade and continue to be on feature phones.

Click through the PLOS taxonomy to find articles in your field.

For more information about PLOS Subject Areas, click here .

Loading metrics

Open Access

Peer-reviewed

Research Article

Characteristics and influencing factors of Airbnb spatial distribution in China’s rapid urbanization process: A case study of Nanjing

Roles Conceptualization, Funding acquisition, Methodology, Project administration, Supervision, Writing – review & editing

* E-mail: [email protected]

Affiliation School of Architecture, Southeast University, Nanjing, Jiangsu, China

Roles Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Resources, Software, Validation, Visualization, Writing – original draft

Affiliation Jiangsu Institute of Urban Planning and Design, Nanjing, Jiangsu, China

Roles Data curation, Formal analysis, Investigation, Resources, Software, Validation, Visualization, Writing – review & editing

- Shijie Sun,

- Shengyue Zhang,

- Xingjian Wang

- Published: March 18, 2021

- https://doi.org/10.1371/journal.pone.0248647

- Reader Comments

As in other countries, short-term rentals for tourism services are growing rapidly in China’s tourist cities, which are mainly operated through Airbnb. This paper explores whether the spatial distribution of Airbnb in China’s rapid urbanization process exhibits characteristics, paths, and drivers that are different from those of cities in other countries. Airbnb is a model for the global sharing economy, but it is increasingly influenced by other functions and facilities in cities as it grows. In this paper, the zero-expansion negative binomial regression was used to study the factors affecting the spatial distribution of Airbnb in Nanjing, China. The results showed that the spatial distribution of Airbnb listings was correlated with the distribution of cultural attractions, universities, public transport accessibility, shopping centers, and business apartments. By analyzing the driving forces of Airbnb’s development in Nanjing, this paper found that a large number of business apartments developed in cities were essential providers of Airbnb listings, and affected its spatial distribution. The gap between short-term and long-term rentals was also correlated with the distribution of Airbnb. In addition, similar to the previous literature findings, the increase in the proportion of professional hosts changes the original intention of Airbnb for sharing and communication. Our empirical results applies to the current situation of Airbnb in Chinese cities, which is conducive to the government’s more intelligent management and effective promotion of the Airbnb market. Our findings also provide positive references for urban renewal policies and public participation methods in China.

Citation: Sun S, Zhang S, Wang X (2021) Characteristics and influencing factors of Airbnb spatial distribution in China’s rapid urbanization process: A case study of Nanjing. PLoS ONE 16(3): e0248647. https://doi.org/10.1371/journal.pone.0248647

Editor: Jun Yang, Northeastern University (Shenyang China), CHINA

Received: December 17, 2020; Accepted: March 3, 2021; Published: March 18, 2021

Copyright: © 2021 Sun et al. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Data Availability: All relevant data are within the manuscript and its Supporting Information files.

Funding: This work was supported by the National Natural Science Foundation of China. Grant Number:51678130. The funders had no role in study design, data collection and analysis, decision to publish, or preparation of the manuscript.

Competing interests: The authors have declared that no competing interests exist.

Introduction

The attractive concept of sharing accommodation represented by Airbnb has raised the attention of scholars. Founded in 2008, Airbnb has covered 65,000 cities worldwide by 2017, becoming the largest accommodation sharing platform in the world. Researchers analyzed the impact of Airbnb on the traditional hotel business [ 1 – 3 ] and housing [ 4 – 6 ]. Some studies believe that the rapid growth of Airbnb may bring community problems and promote gentrification of tourism [ 4 , 7 – 9 ]. Therefore they also discuss the management of Airbnb [ 7 , 10 ]. In recent years, researchers have studied the spatial distribution characteristics of some cities considering the potential economic, social, and cultural impacts that Airbnb might have on communities. These studies showed that the distribution of Airbnb listing was related to city centers, major attractions, and transport accessibility [ 11 , 12 ].

In China, the construction of transportation infrastructure over the last two decades has greatly contributed to the tourism boom [ 13 , 14 ], and the growth of shared urban accommodation has followed. According to the “Report on The Development of Shared Accommodation in China (2018)”, the transaction volume of shared accommodation in 2017 was around 14.5 billion yuan, which increased 70.6 percent compared to the previous year, and the number of domestic listings on major shared accommodation platforms was about 3 million. Airbnb officially entered the Chinese market in 2015 and expanded rapidly. In 2019, the web visits of Airbnb exceeded that of other accommodation-sharing platforms in China. In Nanjing, the selected site of this study, Airbnb has more short-term rental listings than its competitors. However, few studies discussed the correlation between it and urban elements. In particular, although Airbnb in China develops rapidly, there are gaps in the research of spatial distribution characteristics, and there is a lack of discussion on the spatial growth mechanism behind it. The above problems resulted in scholars have an insufficient understanding of the spatial growth characteristics of Airbnb in China.

Therefore, Airbnb’s spatial distribution characteristics and growth mechanism need to be better understood to deal with various related urban issues. This paper analyzes the spatial distribution characteristics of Airbnb in the central regions of Nanjing and tries to find the correlation between the distribution of listing and other characters of the city. The goal is to answer the following questions: What are the characteristics of the spatial distribution of Airbnb in Nanjing city? What factors determine the distribution and expansion of Airbnb? Answering these questions will help urban planners and policymakers deal with the problems caused by the proliferation of Airbnb in the urban renewal process.

Literature review

The influences of airbnb.

Some studies showed that the rapid growth of Airbnb might bring negative impacts on communities, including the increasing housing rental costs, social conflicts, security problems, and noise [ 6 , 7 , 15 ]. The most important one is that the rapid increase of Airbnb listings may lead to the rise in housing costs [ 16 , 17 ]. A study of Boston found that the rental price increases by 0.4% when Airbnb listings increase one standard deviation [ 6 ]. According to Gurran and Phibbs (2017) ’s study of Sydney, it is found that Airbnb may cause community problems such as noise, congestion, and reduction of long-term rentable housing [ 7 ]. Cocola-gant and Gago (2019) tracked the Alfma community in Lisbon and found that the gentrification process experienced by the residents was an unfair social process [ 18 ]. In addition, it has been shown in many studies that the negative impact of Airbnb is geographically unbalanced [ 19 ]. The study of Gutierrez et al. (2017) about the spatial distribution of shared home-stays and hotels in Barcelona illustrated that home-stays are mainly clustered in the areas of city centers or famous tourist attractions, posing new challenges to the harmonious coexistence of local communities [ 20 ].

Airbnb and rental gap