BROWSE BY TOPICS

- Income Tax e-Filing

- Last Date To File ITR For 2022-23

- Income Tax Slabs FY 2023-24

- Which Is Better: Old vs New Tax Regime For Salaried Employees?

- House Property

- Business, Professional & Freelance

- Which ITR Should I File?

- Income Tax Refunds

- Paying Tax Due

- Salary Income

- Capital Gains Income

- Other income sources

- Advance Tax

- Income Tax Notices

RELATED ARTICLES

- ESI Rate 2022

Corporate Social Responsibility Under Section 135 of Companies Act 2013

Updated on : Sep 22nd, 2023

22 min read

Corporate Social Responsibility (CSR) implies a concept, whereby companies decide voluntarily to contribute to a better society and a cleaner environment – a concept, whereby the companies integrate social and other useful concerns in their business operations for the betterment of their stakeholders and society in general in a voluntary way.

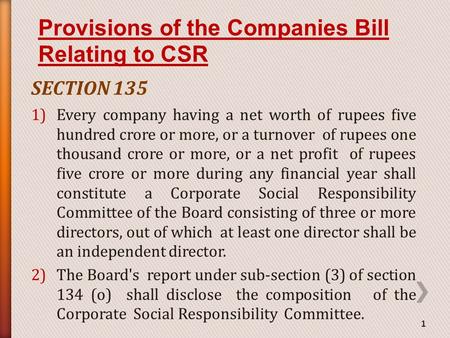

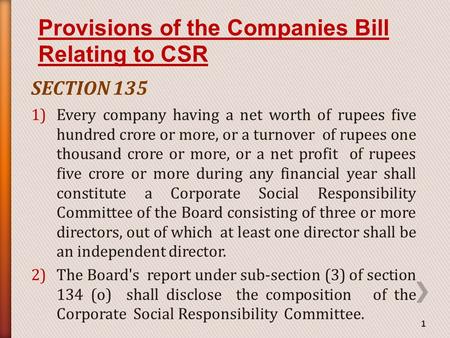

However, Section 135 of the Companies Act, 2013 ("Act") provides that certain companies must mandatorily contribute a certain amount towards CSR activities. As per the Act, 'Corporate Social Responsibility' means and includes but is not limited to:

- Projects or programs relating to activities specified in Schedule VII to The Act.

- Projects or programs relating to those activities which are undertaken by the Board of Directors of a company in ensuring the recommendation of the CSR Committee of the Board as per declared CSR Policy along with the conditions that such policy will cover subjects specified in Schedule VII of the Act.

CSR Applicability in India

The provisions of CSR applies to every company fulfiing any of the following conditions in the preceding financial year:

- Net worth of more than Rs.500 crore

- Turnover of more than Rs.1000 crore

- Net profit of more than Rs.5 crore

The Board of Directors of every company for which the CSR provisions apply must ensure that the company spends in every financial year at least 2% of its average net profits made during the i mmediately preceding three financial years as per its CSR policy. If the company has not completed three financial years since its incorporation, it must spend 2% of its average net profits made during the immediately preceding financial years as per its CSR policy.

Importance of Corporate Social Responsibility

CSR is an immense term that is used to explain the efforts of a company in order to improve society in a significant manner. Below reasons reflect why CSR is important:

- CSR improves the public image by publicising the efforts towards a better society and increasing their chance of becoming favourable in the eyes of consumers.

- CSR increases media coverage as media visibility throws a positive light on the organisation.

- CSR enhances the company’s brand value by building a socially strong relationship with customers.

- CSR helps companies to stand out from the competition when companies are involved in any kind of community.

Role of Board of Directors

The role of the Board of Directors in implementing CSR is as follows:

- After considering the recommendations made by the CSR Committee, approve the CSR policy for the Company.

- The Board must ensure only those activities must be undertaken which are mentioned in the policy.

- The Board of Directors shall make sure that the company spends in every financial year, a minimum of 2% of the average net profits made during the three immediately preceding financial years as per CSR policy.

- In case a company has not completed three financial years since its incorporation, the average net profits shall be calculated for the financial years since its incorporation.

- CSR Committee’s composition

- The contents of CSR Policy

- In case CSR spending does not meet 2% as per CSR Policy, the reasons for the unspent amount, and details of the transfer of unspent amount relating to an ongoing project to a specified fund (transfer within a period of six months from the expiry of the financial year).

Net Profit for CSR Applicability

Every company which needs to comply with the CSR provisions have to spend 2% of the average net profits made during the preceding three years as per the CSR policy. The computation of net profit for CSR is as per Section 198 of the Companies Act, 2013.

Section 198 provides that while computing the net profits of a company a credit should be given for the subsidies and bounties received from any government, or public authority constituted or authorised on this behalf.

For computing net profits , credit cannot be given for the following sums:

- Profits, by way of premium on shares, unless the company is an investment company.

- Profits on sales of forfeited shares.

- Profits of a capital nature, including profits from the sale of the undertaking or any part thereof.

- Profits from the sale of any fixed assets or immovable property of a capital nature comprised in the undertaking, unless the company business consists of buying and selling any assets or property.

- Any change in the carrying amount of an asset or of a liability recognised in equity reserves, including surplus in profit and loss accounts for the measurement of the asset or the liability at fair value.

- Any amount representing notional gains, unrealised gains or revaluation of assets

In making the computation of net profits, the following sums should be deducted:

- Every usual working charge.

- Directors’ remuneration.

- Bonus or commission payable or paid to any member of the company’s staff, technician, engineer or person engaged or employed by the company, whether on a part-time or whole-time basis.

- Any tax notified by the Central Government as a tax on abnormal or excess profits.

- Any tax on business profits imposed for special reasons or special circumstances and notified by the Central Government.

- Interest on debenture issued by the company.

- Interest on mortgages executed by the company and on advances and loans secured by a charge on its floating or fixed assets.

- Interest on unsecured advances and loans.

- Expenses on repairs, whether to movable or immovable property, provided the repairs are not of a capital nature.

- Outgoings inclusive of contributions made under section 181.

- Depreciation to the extent specified in section 123.

- Excess of expenditure over income.

- Damages or compensation to be paid for any legal liability and any sum paid by way of insurance against the risk of meeting the such liability.

- Debts considered bad and adjusted or written off during the year of account.

In making the computation of net profits, the following sums cannot be deducted:

- Income-tax and super-tax payable by the company under the Income-tax Act, 1961.

- Any damages, compensation or payments made voluntarily.

- Loss of capital nature including loss on sale of the undertaking or of any part thereof not including any excess of the written-down value of any asset which is discarded, sold, discarded, destroyed or demolished over its sale proceeds or its scrap value.

- Any change in carrying amount of an asset or of a liability recognised in equity reserves, including surplus in profit and loss accounts for the measurement of the asset or the liability at fair value.

Transfer and Use of Unspent Amount

A company can transfer unspent CSR amount to the following specified funds:

- A contribution made to the Prime Minister’s National Relief Fund.

- Any other fund is initiated by the central government concerning socio-economic development, relief and welfare of the scheduled caste, minorities, tribes, women and other backward classes.

- A contribution made to an incubator is funded either by the central government, the state government, public sector undertaking of the state or central government, or any other agency.

- Public-funded universities

- Indian Institute of Technology (IITs)

- Indian Council of Agricultural Research (ICAR)

- Council of Scientific and Industrial Research (CSIR)

- Department of Atomic Energy (DAE)

- Department of Biotechnology (DBT)

- Department of Pharmaceuticals

- Ministry of Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homoeopathy (AYUSH)

- Ministry of Electronics and Information Technology

- Indian Council of Medical Research (ICMR)

- Defence Research and Development Organisation (DRDO)

- Department of Science and Technology (DST) engaged in conducting research in technology, science, medicine, and engineering aimed at encouraging Sustainable Development Goals (SDGs).

In case of the unspent amount relating to an ongoing project under the company’s CSR policy, the company will transfer the unspent amount to an exclusive account to be opened by a company, known as ‘Unspent Corporate Social Responsibility Account’, in any scheduled bank within 30 days from the end of the financial year.

The company must use the funds in the ‘Unspent Corporate Social Responsibility Account’ towards its obligations under the CSR policy within a period of three financial years from the date of the transfer.

In a case where the company fails to utilise the funds at the end of the three financial years, the funds should be transferred to the specified fund mentioned above within a period of 30 days upon completion of the third financial year.

CSR Committee Applicability

- Every company to which CSR provision are applicable must constitute a Corporate Social Responsibility (CSR) Committee.

- The CSR Committee should consist of three or more directors, out of which at least one director must be an independent director .

- An unlisted public company or a private company shall have its CSR Committee without any independent director if an independent director is not required.

- A private company having only two directors on its Board shall constitute its CSR Committee with two directors.

- In the case of a foreign company, the CSR Committee shall comprise of at least two persons of which one person shall be a person resident in India authorised to accept on behalf of the foreign company – the services of notices and other documents. Also, the other person shall be nominated by the foreign company.

- A company having any amount in its Unspent Corporate Social Responsibility Account shall constitute a CSR Committee and comply with the CSR provisions.

Duties of the CSR Committee

- The CSR Committee will formulate and recommend a CSR policy to the Board. CSR policy shall point out the activities to be undertaken by the company as enumerated in Schedule VII of the Act.

- CSR Committee will recommend the amount of expenditure to be incurred on the CSR activities to be undertaken by the company.

- CSR Committee will monitor the CSR policy of the Company from time to time.

- The CSR Committee will establish a transparent controlling mechanism for the implementation of the CSR projects or programs or activities undertaken by the company.

CSR Reporting

With respect to CSR Reporting, the provisions are as follows :

- The Board’s Report referring to any financial year initiating on or after the 1st day of April 2014 shall include an annual report on CSR.

- In the case of a foreign company, the balance sheet filed shall contain an Annexure regarding a report on CSR.

CSR Policy elaborates the activities to be undertaken by the Company as named in Schedule VII to the Act . The activities should not be the same which are done by the company in its normal course of business. Additionally, the Act provides the follwoing in relation to CSR Policy:

- Contents of CSR Policy should be placed on the company’s website by the Board.

- The activities mentioned in the policy must be undertaken by the company.

- The company can join hands with other companies for undertaking projects or programs or CSR activities and report separately on such programs or projects.

- The CSR policy shall monitor the projects or programs.

List of Permitted CSR Activities Under Schedule VII

The Board of Directors shall ensure that the activities included by a company in its CSR Policy fall within the purview of the activities included is schedule VII of the Act. The activities specified in Schedule VII which may be included by companies in their Corporate Social Responsibility Policies are as follows:

Fines and Penalties for Non-Compliance

In case a company fails to comply with the provisions relating to CSR spending, transferring and utilising the unspent amount, the company will be punishable with a penalty of Rs.1 crore or twice the amount required to be transferred by the company to the CSR fund specified in Schedule VII of the Act or the Unspent Corporate Social Responsibility Account, whichever is less.

Further, every officer of such company who defaults in compliance will be liable to pay Rs.2 lakh or one-tenth of the amount required to be transferred by the company to CSR fund specified in Schedule VII or the Unspent Corporate Social Responsibility Account, whichever is less.

Reason for Introduction of CSR for Companies

We live a dynamic life in a world that is growing more and more complex. Global-scale environment, social, cultural and economic issues have now become part of our everyday life. Boosting profits is no longer the sole business performance indicator for the corporate and they have to play the role of responsible corporate citizens as they owe a duty towards society.

The concept of Corporate Social Responsibility (CSR), introduced through Companies Act, 2013 puts a greater responsibility on companies in India to set out a clear CSR framework.

Many corporate houses like TATA and Birla have been engaged in doing CSR voluntarily. The Act introduces the culture of corporate social responsibility (CSR) in Indian corporate requiring companies to formulate a CSR policy and spend on social upliftment activities.

CSR is all about corporate giving back to society. The Company Secretaries are expected to be known about the legal and technical requirements with respect to CSR in order to guide the management and Board.

Frequently Asked Questions

Why csr is mandatory.

The Companies Act, 2013 provides for CSR under section 135. Thus, it is mandatory for the companies covered under section 135 to comply with the CSR provisions in India. Companies are required to spend a minimum of 2% of their net profit over the preceding three years as CSR.

How much CSR is mandatory?

It is mandatory for the companies covered under section 135(1) of the Companies Act, 2013 to spend 2% of their net profit over the proceeding three years as per the CSR policy.

Whether provisions of CSR apply to a section 8 Company?

Yes, the CSR provisions apply to a company registered for a charitable purpose under Section 8 of the Companies Act, 2013. Section 135(1) of the Act states that every company having the specified net worth, turnover, or net profits must establish a CSR committee. Thus, section 8 companies must also establish a CSR committee and comply with CSR provisions when it meets the specified net worth, turnover, or net profits.

Which activities do not qualify as eligible CSR activity?

Rule 2(1)(d) of the Companies (CSR Policy) Rules, 2014 defines CSR and excludes the following activities from being considered as eligible CSR activity:

- Activities undertaken in pursuance of the normal course of business of the company.

- Activities undertaken outside India, except for training of Indian sports personnel representing any state/UT at the national level or India at the international level

- Contribution of any amount, indirectly or directly, to any political party under Section 182 of the Act

- Activities benefiting employees of the company

- Sponsorship activities for deriving marketing benefits for products/services

- Activities for fulfilling statutory obligations under any law in force in India

What is the role of the Government in monitoring CSR provision compliance?

The government monitors the CSR provisions compliance through the disclosures made by the companies on the MCA portal. The government can initiate action for any violation of CSR provisions against the non-compliant companies after due examination of records.

How is the average net profit calculated for the purpose of Section 135 of the Act?

The average net profit to determine the spending on CSR activities is to be computed as per the provisions of Section 198 of the Act and be exclusive of the items given under Rule 2(1)(h) of the Companies (CSR Policy) Rules, 2014. Section 198 of the Act specifies certain additions/deletions (adjustments) to be made while calculating a company’s net profit. It mainly excludes capital payments/receipts, income tax and set-off of past losses.

Can the excess CSR spending be set off against the CSR expenditure of the succeeding financial years?

Yes, the excess CSR spending can be set off against the required 2% CSR expenditure up to the immediately succeeding three financial years subject to compliance with the conditions mentioned under Rule 7(3) of the Companies (CSR Policy) Rules, 2014. However, the excess amount spent on CSR activities can be set off from 22 January 2021. Thus, no carry forward shall be allowed for the excess amount spent, if any, in financial years before FY 2020-21.

What is the meaning of surplus arising from CSR activities?

Surplus refers to income generated from the spend on CSR activities, e.g., revenue received from the CSR projects, interest income earned by the implementing agency on funds provided under CSR, disposal/sale of materials used in CSR projects, and other similar income sources. The surplus arising out of CSR activities shall be utilised only for CSR purposes.

Whether companies must carry out CSR only in their local areas?

Section 135(5) of the Act provides that the company should give preference to local areas around where it operates. However, with the advent of IT and the emergence of new-age businesses like process-outsourcing companies, e-commerce companies, and aggregator companies, it becomes difficult to determine the local area for various activities. Thus, the preference to the local area mentioned in the Act is only directory and not mandatory, and companies need to balance local area preference with national priorities.

Disclaimer: The materials provided herein are solely for information purposes. No attorney-client relationship is created when you access or use the site or the materials. The information presented on this site does not constitute legal or professional advice and should not be relied upon for such purposes or used as a substitute for legal advice from an attorney licensed in your state.

Related Articles:

GST on Supplies made under Corporate Social Responsibility

About the Author

Mayashree Acharya

I am an advocate by profession and have a keen interest in writing. I write articles in various categories, from legal, business, personal finance, and investments to government schemes. I put words in a simplified manner and write easy-to-understand articles. Read more

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

Companies Act 2013 on Corporate Social Responsibility (CSR)

Published by Milo Goodman Modified over 5 years ago

Similar presentations

Presentation on theme: "Companies Act 2013 on Corporate Social Responsibility (CSR)"— Presentation transcript:

Provisions of Section 135- Corporate Social Responsibility under the Companies Act 2013 The Institute of Chartered Accountants of India.

Corporate Social Responsibility Under the Companies Act 2013.

Corporate Social Responsibility CA Sameer Gogia. 2 CSR under the Companies Act 2013 Applicable on? Criteria?How much? All companies including a holding.

Corporate Social Responsibility

By Harsh To Mr Namit Khanduja

“Nurture Nourish Empower” …for those who need it most Building strong futures for young people through experiential learning in the outdoors Program Initiative.

SECTION 135 1)Every company having a net worth of rupees five hundred crore or more, or a turnover of rupees one thousand crore or more, or a net profit.

BRIEFING ON THE SADC PROTOCOL on Gender and Development By Emilia Muchawa.

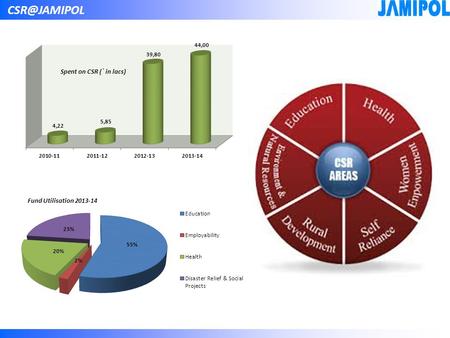

JAMIPOL, as a corporate entity, believes that supporting our stakeholders and communities is a fundamental principle of our Corporate Social.

CORPORATE SOCIAL RESPONSIBILITY An overview of the Companies Act, 2013

Corporate Social Responsibility in India Ahimsa Round Table 2015 June 23, 2015 Impact India Foundation.

Corporate Social Responsibility CS Alka Kapoor Joint Secretary.

OPTIONS AND REQUIREMENTS FOR ENGAGEMENT OF CIVIL SOCIETY IN GEF PROJECTS AND PROGRAMMES presented by Faizal Parish Regional/Central Focal Point GEF NGO.

(Companies Act 2013) By Sibani Swain Economic Advisor Ministry Of Corporate Affairs.

“DESH HME DETA HAI SB HUM BHI TOH KUCH DENA SIKHE” AT the end of our lives, we will not be judged by how many diplomas we have received,how much money.

Isabella Sassine. - Halve, between 1990 and 2015, the proportion of people whose income is less than $1 a day. - Achieve full and productive employment.

Relationship Building in the context of Corporate Social Responsibility Iytha Mallikarjuna National Convention on CSR, Rambhau.

PRESENTATION ON CORPORATE SOCIAL RESPONSIBILITY

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

- Submit Post

- Union Budget 2024

- Company Law

Corporate Social Responsibility (CSR) as Per Companies Act, 2013

Introduction:

Corporate Social Responsibility (CSR) can be defined as a Company’s sense of responsibility towards the community and environment (both ecological and social) in which it operates. Companies can fulfil this responsibility through waste and pollution reduction processes, by contributing educational and social programs, by being environmentally friendly and by undertaking activities of similar nature. CSR is not charity or mere donations. CSR is a way of conducting business, by which corporate entities visibly contribute to the social good. Socially responsible companies do not limit themselves to using resources to engage in activities that increase only their profits. They use CSR to integrate economic, environmental and social objectives with the company’s operations and growth. CSR is said to increase reputation of a company’s brand among its customers and society.

The Companies Act, 2013 has formulated Section 135, Companies (Corporate Social Responsibility) Rules, 2014 and Schedule VII which prescribes mandatory provisions for Companies to fulfil their CSR. This article aims to analyse these provisions (including all the amendments therein).

Applicability of CSR Provisions:

♥ On every Company including its holding or subsidiary having:

- Net worth of Rs. 500 Crore or more, or

- Turnover of Rs. 1000 crore or more, or

- Net Profit of Rs. 5 crore or more

♥ during the immediately preceding financial year

A foreign company having its branch office or project office in India, which fulfills the criteria specified above

However, if a company ceases to meet the above criteria for 3 consecutive financial years then it is not required to comply with CSR Provisions till such time it meets the specified criteria.

CSR Committee:

Every Company on which CSR is applicable is required to constitute a CSR Committee of the Board:

- Consisting of 3 or more directors, out of which at least one director shall be an independent director. However, if a company is not required to appoint an independent director, then it shall have in 2 or more directors in the Committee.

- Consisting of 2 directors in case of a private company having only two directors on its Board

- Consisting of at least 2 persons in case of a foreign Company of which one person shall be its authorised person resident in India and another nominated by the foreign company

Functions of CSR Committee:

The CSR Committee shall—

- Formulate and recommend to the Board, a CSR Policy which shall indicate the activities to be undertaken by the Company

- Recommend the amount of expenditure to be incurred on the activities referred to in clause (i)

- Monitor the CSR Policy of the company from time to time

- Institute a transparent monitoring mechanism for implementation of the CSR projects or programs or activities undertaken by the company.

Responsibility of Board of Directors (BoD):

The BoD of every company on which CSR is applicable shall:

- after considering the recommendations made by the CSR Committee, approve the CSR Policy for the Company and disclose contents of such Policy in Board report.

- ensure that the activities as are included in CSR Policy of the company are undertaken by the Company

- shall disclose the composition of the CSR Committee in Board Report

- ensure that the company spends, in every financial year, at least 2% of the average net profits of the company made during the 3 immediately preceding financial years, in pursuance of its CSR Policy. The CSR projects/programs/activities undertaken in India only shall amount to CSR Expenditure.

Note: The Company shall give preference to the local area and areas around it where it operates, for spending the amount earmarked for CSR activities and shall specify the reasons for not spending whole of earmarked amount (if it fails to spend some) in Board Report.

CSR Policy

The CSR Policy of the company shall, inter-alia, include the following namely :-

- A list of CSR projects or programs which a company plans to undertake specifying modalities of execution of such project or programs and implementation schedules for the same

- Monitoring process of such projects or programs

- A clause specifying that the surplus arising out of the CSR projects or programs or activities shall not form part of the business profit of the company.

CSR Activities

- The CSR activities shall be undertaken by the company, as per its CSR Policy, excluding activities undertaken in pursuance of its normal course of business.

- The BoD may decide to undertake its CSR activities approved by the CSR Committee, through

- a section 8 company or a registered trust or a registered society, established by the company, either singly or alongwith any other company, or

- a section 8 company or a registered trust or a registered society, established by the Central Government or State Government or any entity established under an Act of Parliament or a State legislature

- a section 8 company or a registered trust or a registered society, other than those specified in clauses (a) and (b) above, having an established track record of 3 years in undertaking similar programs or projects;

- collaboration with other companies,

for undertaking projects or programs or CSR activities in such a manner that the CSR Committees of respective companies are in a position to report separately on such projects or programs.

- The CSR projects or programs or activities not to be considered as CSR Activities:

- Expenses for the benefit of only the employees of the company and their families

- Contribution of any amount directly or indirectly to any political party

Display of CSR Activities on its Website

The BoD shall disclose contents of CSR policy in its report and the same shall be displayed on the company’s website, if any.

Other Important Points:

- The balance sheet of a foreign company to be filed under section 381(1)(b) of the Act shall contain an Annexure regarding report on CSR.

- The Board of Directors shall ensure that activities included by a company in its CSR Policy are related to the areas or subjects specified in Schedule VII (given below) of the Act.

Activities which may be included by companies in their Corporate Social Responsibility Policies relating to:

- Eradicating hunger, poverty and malnutrition,promoting health care including preventive health care and sanitation including contribution to the Swach Bharat Kosh set-up by the Central Government for the promotion of sanitation and making available safe drinking water.

- Promoting education, including special education and employment enhancing vocation skills especially among children, women, elderly and the differently abled and livelihood enhancement projects.

- Promoting gender equality, empowering women, setting up homes and hostels for women and orphans; setting up old age homes, day care centres and such other facilities for senior citizens and measures for reducing inequalities faced by socially and economically backward groups.

- Ensuring environmental sustainability, ecological balance, protection of flora and fauna, animal welfare, agroforestry, conservation of natural resources and maintaining quality of soil, air and waterincluding contribution to the Clean Ganga Fund set-up by the Central Government for rejuvenation of river Ganga.

- Protection of national heritage, art and culture including restoration of buildings and sites of historical importance and works of art; setting up public libraries; promotion and development of traditional art and handicrafts;

- Measures for the benefit of armed forces veterans, war widows and their dependents;

- Training to promote rural sports, nationally recognised sports, paralympic sports and olympic sports

- Contribution to the Prime Minister’s national relief fund or any other fund set up by the central govt. for socio economic development and relief and welfare of the schedule caste, tribes, other backward classes, minorities and women;

- Contributions or funds provided to technology incubators located within academic institutions which are approved by the central govt.

- Rural development projects

- Slum area development.

(The author of this article is a Practicing Company Secretary and can be reached at [email protected])

Disclaimer: The contents of this article are solely for informational purpose. It does not constitute professional advice or a formal recommendation. No part of this article should be distributed or copied without express written permission of the author.

Click Here to read more about CSR Companies Act 2013

- Companies Act

- Companies Act 2013

- corporate social responsibility

- « Previous Article

- Next Article »

Name: Ankita Singla

Qualification: cs, company: ankita singla & associates, location: new delhi, delhi, india, member since: 16 aug 2018 | total posts: 30, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Group

- Join Our Telegram Group

14 Comments

Thanks for the article. Very informative. God bless you

mam is Darpan Id or Niti Ayog registration is mandatory for the trust to accept CSR or registration is optional.

we are CSR Utility platform company ( Gramin health care ) in Preventive Health care. if any Organization want to execute CSR activities can cantact. [email protected] .

WE ARE LOOKING FOR CSR PROJECTS

We are non – profit organization implementating international health related projects. We can discuss about preventive health care systems

I am available on 8892216510

Thank you Susai

I am ready teach for underprivileged children m develop contents and materials for them

Out sourcing or can appoint teachers on contract basis who should not be employee on full time basis and preferably adult education volunteers services can be utilised for sparing teachers on subjects where pupils demand for .Apart from regular subjects like environment,moral sciences, ethics, first-aid, hobbies,art of public speaking communication skills,education on health and sanitation etc can be taken under CSR contributions from your company.

I am ready to teach in government school

Nice article

We have incorporated a Section 8 company (ABC) in which one of the Other company (Say XYZ Ltd.) holds 19% stake.

Will XYZ Ltd be in compliance if it gives its entire amount of CSR to be spent each year to ABC (Section 8 Co) which in turn spends the entire amount on education?

My company would like to sponsor teachers, to be appointed in government run schools. This is to support the school where there are vacancies. Can we undertake this as a CSR activity?

My company would like to sponsor teachers, to be appointed in government run schools. This is to support the school where there are vacancies.

THIS IS A GOOD NEWS FOR US ,WE CAN FILL IN SUBSTITUTE TEACHER IN GOVERNMENT SCHOOL IN RURAL AREAS IF YOUR COMPANY IS OFFERING. WRITE TO MY EMAIL PLEASE. THANK YOU.

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Notice: It seems you have Javascript disabled in your Browser. In order to submit a comment to this post, please write this code along with your comment: 28191f55af49ad7b82d3ddee66a7d625

Subscribe to Our Daily Newsletter

Latest posts.

Clarification regarding applicability of new tax regime and old tax regime

How to start a new financial year without becoming a financial fool?

SEBI Launches SCORES 2.0: Strengthening Investor Complaint Redressal

Amendment to IFSCA (Vault Manager) Circular, 2021 dated August 25, 2021

Master Direction on Counterfeit Notes, 2024 – Detection, Reporting & Monitoring

RBI Master Circular 2024 – Basel III Capital Regulations

RBI Master Circular 2024 on Agency Commission

RBI Master Circular 2024: Disbursement of Government Pension by Agency Banks

RBI Master Circular 2024 on SHG-Bank Linkage Programme

Master Direction on Penal Provisions in reporting of transactions/ balances at Currency Chests

Featured posts.

Section 139(8A)- Updated Return (ITR-U): FAQs

Bombay HC Dismisses Rs. 3731 Crore CGST Act Penalty Notice issued to Salaried Employee

April, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines

Guidelines for CGST Investigation: Ensuring Compliance & Ease of Business

Live Webinar: How can MSME recover payment without going to court

Pre-End of Accounting Year Checklist

TDS Rate Chart (FY 2024-25; AY 2025-26)

10 Important Actions to be taken before filing of GST returns for March 2024

CSR in context of Companies Act, 2013 - Affluence Advisory

Aug 29, 2022

50 likes | 51 Views

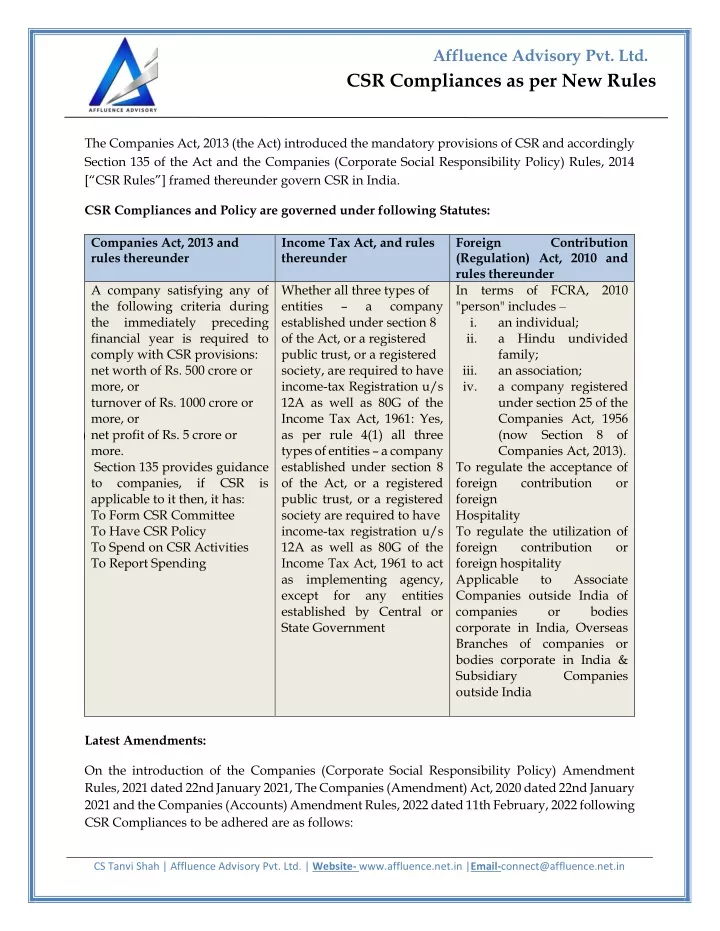

The Companies Act, 2013 (the Act) introduced the mandatory provisions of CSR and accordingly Section 135 of the Act and the Companies (Corporate Social Responsibility Policy) Rules, 2014 [u201cCSR Rulesu201d] framed thereunder govern CSR in India.

Share Presentation

Presentation Transcript

Affluence Advisory Pvt. Ltd. CSR Compliances as per New Rules The Companies Act, 2013 (the Act) introduced the mandatory provisions of CSR and accordingly Section 135 of the Act and the Companies (Corporate Social Responsibility Policy) Rules, 2014 [“CSR Rules”] framed thereunder govern CSR in India. CSR Compliances and Policy are governed under following Statutes: Companies Act, 2013 and rules thereunder thereunder Income Tax Act, and rules Foreign (Regulation) Act, 2010 and rules thereunder ➢In terms of FCRA, 2010 "person" includes ‒ i. an individual; ii. a Hindu undivided family; iii. an association; iv. a company registered under section 25 of the Companies Act, 1956 (now Section 8 of Companies Act, 2013). ➢To regulate the acceptance of foreign contribution foreign Hospitality ➢To regulate the utilization of foreign contribution foreign hospitality ➢Applicable Companies outside India of companies corporate in India, Overseas Branches of companies or bodies corporate in India & Subsidiary outside India Contribution A company satisfying any of the following criteria during the immediately financial year is required to comply with CSR provisions: net worth of Rs. 500 crore or more, or turnover of Rs. 1000 crore or more, or (iii)net profit of Rs. 5 crore or more. Section 135 provides guidance to companies, applicable to it then, it has: To Form CSR Committee To Have CSR Policy To Spend on CSR Activities To Report Spending Whether all three types of entities – established under section 8 of the Act, or a registered public trust, or a registered society, are required to have income-tax Registration u/s 12A as well as 80G of the Income Tax Act, 1961: Yes, as per rule 4(1) all three types of entities – a company established under section 8 of the Act, or a registered public trust, or a registered society are required to have income-tax registration u/s 12A as well as 80G of the Income Tax Act, 1961 to act as implementing agency, except for established by Central or State Government a company preceding if CSR is or or to Associate any entities or bodies Companies Latest Amendments: On the introduction of the Companies (Corporate Social Responsibility Policy) Amendment Rules, 2021 dated 22nd January 2021, The Companies (Amendment) Act, 2020 dated 22nd January 2021 and the Companies (Accounts) Amendment Rules, 2022 dated 11th February, 2022 following CSR Compliances to be adhered are as follows: CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website- www.affluence.net.in |[email protected]

Affluence Advisory Pvt. Ltd. CSR Compliances as per New Rules 1.Companies are required to Amend the CSR Policy in order to align it with the requirements under (CSR) Amendment Rules, 2021; 2.Companies to have Investor Tab on its official Website where disclosure of CSR Policy, CSR Committee and CSR Projects is to be updated on timely basis for public access; 3.Every Company’s CSR Committee to formulate an Annual action plan in the Month of April every year and recommend to the Board, in pursuance of its CSR Policy; 4.CSR Amendment Rules, 2021 provides for exemption from constitution of CSR Committee where the amount of CSR expenditure obligation for the relevant year does not exceed Rs. 50 Lakhs and the Board shall carry out the functions by itself. 5.From now onwards, CSR Committee to meet at least twice in a year. i. To Formulate & Approve the Annual Action Plan for the upcoming Financial Year and recommending the same to the Board for Approval ii. To review Annual action plan and Approve Allocation of CSR Expenditure Amount 6.CFO Certification: Chief Financial Officer (CFO) or the person responsible for financial management shall certify to the Board to the effect that the funds disbursed by the Board for CSR implementation have been utilized for the purposes and in the manner as approved by the Board. 7.Companies to file Form CSR-2 as an addendum to Form AOC-4/AOC-4 XBRL/AOC-4 NBFC (Ind-AS) as the case may be. (However, form CSR-2 for the F.Y.2020-21 shall be filed separately latest by 31st March 2022.) 8.Companies will now be penalized vide section 135(7) of Companies Act, 2013 where non- compliance to CSR provisions will lead to penalty of twice the amount required to be transferred to the Fund specified in Schedule VII or Rs one crore, whichever is less. Further, every officer who is in default is liable to a penalty of one-tenth of amount required to be transferred by the company to such fund specified in Schedule VII or the unspent CSR amount, or Rs two lakhs, whichever is less. Note: 1.While ascertaining the applicability of CSR provisions and for calculation of the prescribed spending, the net profit shall be calculated as per section 198 of the Act and the relevant adjustments shall be made to the same as stated under rule 2(h) of the CSR Rules; 2.Administrative Overheads should not exceed 5% of total CSR expenditure of the company for the financial year; 3.In cases of non-spending of CSR money, specify reasons for non-spending in its report under section 134 of the Act and transfer the unspent amount in following manner: i. In case of on-going projects, to transfer such unspent amount, within a period of 30 days from the end of financial year, to a special account to be opened by the company in that behalf for that financial year in any scheduled bank to be called the unspent CSR account. (In the immediate case Companies to hold CSR Committee Meeting for, “To Approve Ongoing Project & Transfer to the ‘Unspent”) CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website- www.affluence.net.in |[email protected]

Affluence Advisory Pvt. Ltd. CSR Compliances as per New Rules ii. In case there is no on-going project, it must transfer such unspent amount, within 6 months of the expiry of the financial year, to any of the funds mentioned in Schedule VII to the Act. (In the immediate case Companies to hold CSR Committee Meeting for, “To Approve Opening of a Bank A/C For Unspent CSR Amount”) In Case where Company decides to carry out CSR obligation through implementing agency. (In the immediate case Companies to hold CSR Committee Meeting, “To Identify Implementing Agencies & to Approve Allocation of CSR Amount”) 4.In case Company spends in excess of its CSR obligation, the excess amount can be carried forward and set off against CSR obligation required in subsequent three financial years. If the amount remains unutilized within subsequent three financial years, the set-off benefit lapses. iii. Every company having average CSR obligation of Rs. 10 crore or more in the three immediately preceding financial years, it shall undertake an impact assessment, through an independent agency, of their CSR projects having outlays of Rs. 1 crore or more, and which have been completed not less than one year before undertaking the impact study. Further, the impact assessment reports shall be placed before the Board and shall be annexed to the annual report on CSR. (Companies to hold CSR Committee Meeting for, “To Approve Appointment of Independent Agency for undertaking Impact Assessment”) The Exchange Portal has been developed based on recommendations of High-Level Committee on Corporate Social Responsibility 2018. An Advisory cum Technical Committee was formed for the development of the portal. The Committee was represented by different CSR Stakeholders – CSR Practitioners, Technical Experts and Civil Society Organizations. The Committee apprised of BSE Sammaan which was an initiative of MCA Think Tank: Indian Institute of Corporate Affairs, Confederation of Indian Industry and Bombay Stock Exchange which offered similar functionalities as envisaged for National CSR Exchange Portal. National CSR Exchange Portal is an initiative by Ministry of Corporate Affairs to connect corporates, beneficiaries, and Implementing Agencies. This Exchange Portal will help in building a more robust system for implementation of Corporate Social Responsibility. CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website- www.affluence.net.in |[email protected]

Affluence Advisory Pvt. Ltd. CSR Compliances as per New Rules FAQ’s on National CSR Exchange Portal 1.Who all can register on National CSR Exchange portal? A - Registered corporates and Registered Implementing Agencies can register on the portal. 2.Who are Registered Implementing Agencies? A - Registered Implementing Agencies are those Implementing Agencies which are registered on MCA21 portal and has a valid CSR Registration Number (CRN). 3.Who are Registered Corporates? A - Registered Corporates are those corporates which are registered on MCA21 portal and have a valid Corporate Identification Number (CIN). 4.I am neither a company nor Implementing Agency. Can I register? A - No. Only Corporates and Implementing Agency, can register on the portal. 5. What is Request For Proposal (RFP)? A - Request For Proposal (RFP) is a process where a registered corporate creates a request for providing available funds for the project on this portal. 6.What is Request For Fund (RFF)? A - Request For Funds (RFF) is a process where Implementing Agency creates a request for asking of funds for the project on this portal. 7.What are the charges for Registration on this Portal? A - There are no charges for registration on National CSR Exchange Portal. 8. How can I register on National CSR Exchange Portal as a Corporate? •Enter a valid Corporate Identification Number (CIN) and click on search. •Confirm the details displayed on the screen. •You will receive a One Time Password (OTP) on the registered email id. •Enter OTP in the box. •Create Username and password. •Confirm your password.Click submit. 9.Do I need to provide any document in profile building? Yes, you need to upload CSR policy document which should include following details: •Contact Person Detail •CSR Budget for the year CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website- www.affluence.net.in |[email protected]

Affluence Advisory Pvt. Ltd. CSR Compliances as per New Rules •Details of Awards (if any) 10.Why should I register on National CSR Exchange Portal? This Portal provides a platform to identify suitable Implementing Agency for the CSR Projects. You can easily manage your CSR projects through this Portal. Conclusion: This Exchange Portal will help Corporates identify suitable Implementing Agencies for successful implementation of their CSR Projects reducing their transaction cost. National CSR Exchange Portal also helps overcoming a common challenge cited by Corporates for failing to fulfil their CSR obligations “inability to find suitable projects” based on their CSR Policy. Disclaimer: This article has been carefully prepared, but it has been written in general terms and should be seen as broad guidance only. This article cannot be relied upon to cover the specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact Affluence Advisory Private Limited to discuss these matters in the context of your particular circumstances. Affluence Advisory Private Limited, Its Partners, Directors, Employees, and agents do not accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this article or for any decision based on it. CS Tanvi Shah | Affluence Advisory Pvt. Ltd. | Website- www.affluence.net.in |[email protected]

- More by User

The Companies Act, 2013

V.M. & ASSOCIATES. The Companies Act, 2013. V.M. & ASSOCIATES. Companies Act, 2013 whether lengthy or concise?. V.M. & ASSOCIATES. NCLT. Key Managerial Personnel . Corporate Social Responsibility [CSR]. Auditor Rotation . Private Placement . Women & Independent Director .

258 views • 0 slides

Companies Act - 2013

Companies Act - 2013. Accounts, Audit, Directors & Related Party Transactions. Overview – Comparative Analysis Special Features of New Act New Concepts / Definitions Formation of Companies and MOA / AOA Issue of Shares & Securities Impact on Private Limited Companies.

2.29k views • 123 slides

THE COMPANIES ACT, 2013

THE COMPANIES ACT, 2013. Overview: Definitions. By Ashwani Jaiswal. Disclaimer. The content of this presentation is meant for informational purposes only. The views expressed and the comments or statements made herein are those of the presenter.

869 views • 48 slides

COMPANIES ACT,2013

COMPANIES ACT,2013. By CA PUNKAJ JAIN. TOPICS FOR DISCUSSIONS. SHARE CAPITAL & DEBENTURES. MANAGEMENT & ADMINISTRATION. APPOINTMENT & QUALIFICATION OF DIRECTORS. MEETINGS OF BOARD AND ITS POWERS. APPOINTMENT & RENUMERATION OF MANEGERIAL PERSONNEL. SHARE CAPITAL & DEBENTURES.

5.6k views • 86 slides

COMPANIES ACT ,2013

COMPANIES ACT ,2013. TOPICS FOR DISCUSSION. MANAGEMENT & ADMINISTRATION [Sec 88-122]. MANAGEMENT & ADMINISTRATION. ANNUAL RETURN. As per Rules: Certification by PCS for Listed Company or a company with: Paid up capital Rs.10 Crore or more or Turnover of Rs.50Crore or more .

795 views • 59 slides

COMPANIES ACT,2013. CA. Amarjit Chopra. The Companies Act, 2013. Time line. CA, 2013 vs. CA, 1956. ACCOUNTS . Books of Accounts. To be prepared & kept at the registered office. Books of Accounts, Other relevant books and papers and Financial Statement For every Financial year

1.11k views • 62 slides

Companies Act, 2013

Companies Act, 2013. B K SHARMA ACA, FCS, LL.B. B K Sharma & Associates Company Secretaries Former Chairman, NIRC of ICSI [email protected] M-9314517929. Issue of Securities and other matter incidental thereto. Under the Companies Act, 2013 & Companies Rules, 2014.

662 views • 19 slides

COMPANIES ACT, 2013

PRESENTED BY:- SILPA SATAPATHY [email protected] SOBHAGYA DHIRNARENDRA [email protected]. COMPANIES ACT, 2013. Background of Companies Act,2013. Background of Companies Act,2013.(contd...). NEED OF CHANGES IN COMPANIES ACT,1956.

474 views • 19 slides

COMPANIES ACT, 2013. Presented by CS Vijay Kumar Sharma. OVERVIEW. Presented By CS Vijay Kumar Sharma. Introduction.

1.47k views • 117 slides

COMPANIES ACT ,2013. TOPICS FOR DISCUSSION. MANAGEMENT & ADMINISTRATION [Sec 88-122]. MANAGEMENT & ADMINISTRATION. ANNUAL RETURN. As per Rules: Certification by PCS for Listed Company or a company with: Paid up capital Rs.10 Crore or more or Turnover of Rs.50Crore or more.

775 views • 59 slides

Companies Act 2013

Companies Act 2013. Chapter X – Audit & Auditors (139 - 148) Companies (Audit & Auditors) Rules 2014 (1 - 14). Jomon K. George Chairman, CL Committee, SIRC. Companies Act 2013 – An Overview. An all new enactment 470 sections (282 notified) 29 chapters 7 schedules

857 views • 42 slides

COMPANIES ACT, 2013. SPECIAL FEATURES. Self Regulation. Forced Compliance. Equal Provisions for Private & Public Co(s). Harmonise with internationally accepted practice. Strict Penal Provisions. SPECIAL FEATURES. 33 new definitions inserted. 3 new schedules inserted:

477 views • 25 slides

Companies Act 2013. Why a new Companies Act ?. The existing law is over half a century old New law helps to consolidate and bring related provisions under a single roof Objective is lesser government approvals, enhanced self regulation and emphasis on corporate democracy

717 views • 49 slides

Companies Act 2013. Opportunities for Professionals CA. S. Santhanakrishnan, Chairman, Corporate Laws & Corporate Governance Committee, ICAI. “Some changes look negative on the surface but you will soon realize that space is being created in your life for something new to emerge.”

383 views • 24 slides

INCORPORATION OF COMPANIES UNDER COMPANIES ACT, 2013

INCORPORATION OF COMPANIES UNDER COMPANIES ACT, 2013. Presented By: S. DHANAPAL Sr. Partner S Dhanapal & Associates Practising Company Secretaries Chennai. Organised By: Nellore Branch of SIRC of ICAI THURSDAY, 30th April, 2014. Scheme of Presentation.

1.88k views • 42 slides

PRESENTATION ON THE COMPANIES ACT, 2013 CSR & PENALTIES

PRESENTATION ON THE COMPANIES ACT, 2013 CSR & PENALTIES. By DR. S.D. ISRANI, Advocate & Sr. Partner SD Israni Law Chambers ICAI Seminar at Kandivali, Mumbai on Sunday, 27 th April 2013. THE COMPANIES ACT, 2013.

715 views • 57 slides

The Companies Act, 2013. CS PANKAJ JAIN Partner UKCA and Partners Email: [email protected] Mobile: 844 777 8422. ADJUDICATION AUTHORITIES AND PENAL PROVISIONS. PAST PITFALLS AND LESSONS LEARNT.

455 views • 27 slides

COMPANIES ACT 2013

COMPANIES ACT 2013. FOCUS AREAS. AUDIT & AUDITORS. SCHEME OF SECTIONS UNDER COMPANIES ACT. New section. APPOINTMENT OF AUDITORS. AUDIT & AUDITORS. OVERVIEW. Section 139.

716 views • 38 slides

Companies Act 2013. Chapter-III. ICSI Study Circle 24.05.2014 Umesh Ved, PCS, Ahmedabad. Chapter III Prospectus and Allotment of Securities.

936 views • 56 slides

CSR CONTEXT

CSR CONTEXT. CSR CONTEXT What do you make/ do?. CSR CONTEXT What do you make/ do? How do you make/ do it?. CSR CONTEXT What do you make/ do? How do you make/ do it? How do you impact the environment, society and economy both direct and indirectly?. CSR CONTEXT What do you make/ do?

234 views • 11 slides

569 views • 49 slides

683 views • 56 slides

IMAGES

VIDEO

COMMENTS

The Board's report of a company for FY commencing on or after 1 April 2014 shall include an annual report on CSR containing the following: − Brief outline of the company's CSR policy − Composition of CSR Committee − Average net profit of the company for the last 3 FYs − Prescribed CSR expenditure − Details of the amount spent in ...

Companies Act, 2013. This handbook begins by building a common understanding of the concept of CSR, based on global practices, Indian tradition, and the intent and provisions of the Companies Act, 2013. It then goes on to bring out the key aspects of clause 135 of the Companies Act, 2013 and the recently released draft rules, and highlights its ...

Corporate Social Responsibility under Companies Act, 2013 Presented by: CA Diana Mathias 28th May '20. Contents Overview Applicability and Compliance ... Section 135 of Companies Act, 2013 comes in to force High Level Committee on CSR (HLC-2015) makes recommendations on the CSR framework and stakeholder concerns 2009 2014 2015

The Companies Act, 2013 provides for CSR under section 135. Thus, it is mandatory for the companies covered under section 135 to comply with the CSR provisions in India. Companies are required to spend a minimum of 2% of their net profit over the preceding three years as CSR.

The Companies Act, 2013 ('2013 Act'), enacted on 29 August 2013 on accord of Hon'ble President's assent, has the potential to be a historic milestone, as it aims to improve corporate governance, simplify regulations, enhance the interests of minority investors and for the first time legislates the role of whistle-blowers.

After much debate, discussion and consultations with various stakeholders (Government, Parliamentarians, Corporates, Civil Society and NGO's) the CSR provisions under Section 135 were added to the Companies Bill 2012, making India the first country to mandate spend on CSR activities through statutory provisions.

CORPORATE SOCIAL RESPONSIBILITY An overview of the Companies Act, 2013 Gayatri Subramaniam Indian Institute of Corporate Affairs. EVOLUTION OF CSR We are getting here Section 135 Compliance Investment in social development as part of the Business plan (NVGs) Good corporate citizenship Strategic giving linked to business interest Strategic Community investment Passive donations to charities ...

Impact assessment mandated. Impact assessment expenditure limit is 5% of the mandated CSR or INR 5Mn, whichever is less. Company with average CSR obligation of INR10 Cr. or more in immediate 3 preceding FYs shall take impact assessment through independent agency. Impact assessment to be taken for CSR projects with outlays of INR one crore of more.

CSR is said to increase reputation of a company's brand among its customers and society. The Companies Act, 2013 has formulated Section 135, Companies (Corporate Social Responsibility) Rules, 2014 and Schedule VII which prescribes mandatory provisions for Companies to fulfil their CSR. This article aims to analyse these provisions (including ...

CSR Act.pptx - Free download as Powerpoint Presentation (.ppt / .pptx), PDF File (.pdf), Text File (.txt) or view presentation slides online. Scribd is the world's largest social reading and publishing site.

Corporate Social Responsibility - IICA

Companies Act 2013: CSR in PSUs Author: Tripathi Last modified by: USER Created Date: 2/7/2016 5:42:27 PM Document presentation format: On-screen Show (4:3) ... 3 Calibri Arial Narrow Wingdings 2 Ion Horizon 1_Ion 2_Ion 3_Ion 1_Horizon 2_Horizon 3_Horizon Companies Act 2013: Corporate Social Responsibility in PSUs Opportunities Opportunities ...

CSR in context of Companies Act, 2013 - Affluence Advisory. An Image/Link below is provided (as is) to download presentation Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

The Companies Act, 2013 (the Act) introduced the mandatory provisions of CSR and accordingly Section 135 of the Act and the Companies (Corporate Social Responsibility Policy) Rules, 2014 [u201cCSR Rulesu201d] framed thereunder govern CSR in India. Slideshow 11563943 by Connect5

COVID-19 related FAQs on CSR. Amendments 1. Substituted by Notification Dated 27th February, 2014. - Original Content 2. Substituted by Notification Dated 31st March, 2014. For the words "promoting preventive health care'' read ''promoting health care including preventinve health care''. 3. Inserted by Notification Dated 7th August ...

1. Frequently Asked Questions (FAQs) on the provisions of Corporate Social Responsibility under Section 135 of the Companies Act 2013 and Rules thereon 04 2. Text of Section 135 of the Companies Act 2013 09 3. Schedule VII of the Companies Act 2013 11 4. Annotated Text of CSR Rules under Chapter IX, amended upto January, 2015 13 5.