Assignment Of Debt Agreement

Jump to section, what is an assignment of debt agreement.

An assignment of debt agreement is a legal document between a debtor and creditor that outlines the repayment terms. An assignment of debt agreement can be used as an alternative to bankruptcy, but several requirements must be met for it to work.

In addition, if obligations are not met under a debt agreement, it might still be necessary to file for bankruptcy later on. Therefore, consulting with an attorney specializing in debt agreements is always recommended before entering into one of these contracts.

Assignment Of Debt Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 5 exhibit1024f10qsbmay04.htm EXHIBIT 10.24 , Viewed December 20, 2021, View Source on SEC .

Who Helps With Assignment Of Debt Agreements?

Lawyers with backgrounds working on assignment of debt agreements work with clients to help. Do you need help with an assignment of debt agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignment of debt agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Debt Agreement Lawyers

Committed to a career in advocacy as an attorney, educator, and consultant, I specialize in education, family, personal injury, and criminal law. While at John Rue & Associates LLC, I led litigation and alternative dispute resolution, handling complex class-action lawsuits involving discrimination, privacy, administrative, and education law. I also directed conflict resolution through mediation, reducing costs and securing favorable client outcomes. While in law school, I served as a law clerk at Wilson Elser, excelling in crafting answers, overseeing discovery, attending depositions, and conducting exhaustive legal research. My responsibilities extended to preparing deposition summaries, assisting in motion practice, drafting persuasive briefs, evaluating cases, and contributing to trial preparations. I thrived in managing client affairs, supporting colleagues, and ensuring compliance with relevant laws. I am eager to explore opportunities to contribute my skills and passion to impactful projects aligned with client needs. I look forward to discussing opportunities and demonstrating how my qualifications will meet client needs.

Legal professional with 10+ years of Fortune 500 in-house and AmLaw 50 law firm experience in crafting multi-pronged litigation, regulatory, and public policy strategies and negotiating pioneering, high-stakes global cloud services and digital content distribution deals.

Ido Alexander is dedicated to helping his clients identify risks and understand how to navigate the unknowns. He has a keen ability to sort through the noise to develop strategies for growth and advance clients' interests. An experienced counsel, he focuses on finding solutions for businesses, estate planning needs, helping resolve complex and strategic disputes, and at times restructuring through bankruptcy or out of court, while keeping his clients' financial health as the top priority.

Motivated and self-starting Corporate and Commercial Counsel with over 12 years of experience in providing strategic legal solutions. Exceptional analytical and negotiation skills, focusing on Cyber Security, Finance, and Software. Proven track record of success in handling complex M&A matters. Expertly led negotiations and full five M&A transactions from start to finish (over $100M), resulting in successful integration including raising capital on Reg. A and Reg. D exemptions. Drafted, reviewed and negotiated commercial agreements including, Restructure Agreements Partnership Agreements, Asset Purchase Agreements, Stock Purchase Agreements, Restructure Agreements, Loan conversion Agreements, Debt Conversion Agreements. Provided business and capital strategy, such as restructuring of companies, due diligence, and SEC filings. Proven expertise in M&A and equity debt finance, with a track record of handling diverse clients. Provided strategic guidance on corporate governance, compliance, fiduciary duties, and ethical issues

I am an attorney in Michigan. I attended Boston College for my undergraduate degree and Suffolk University Law School for my law degree. I have been practicing law for over 20 years.

Business and Real Property

I am a corporate lawyer with over 15 years of experience in litigation and in advising companies on a variety of legal issues, including mergers and acquisitions, securities regulations, and contract negotiations. I have a deep understanding of the technology industry and have represented numerous tech companies in my career.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt Agreement lawyers by city

- Austin Assignment Of Debt Agreement Lawyers

- Boston Assignment Of Debt Agreement Lawyers

- Chicago Assignment Of Debt Agreement Lawyers

- Dallas Assignment Of Debt Agreement Lawyers

- Denver Assignment Of Debt Agreement Lawyers

- Houston Assignment Of Debt Agreement Lawyers

- Los Angeles Assignment Of Debt Agreement Lawyers

- New York Assignment Of Debt Agreement Lawyers

- Phoenix Assignment Of Debt Agreement Lawyers

- San Diego Assignment Of Debt Agreement Lawyers

- Tampa Assignment Of Debt Agreement Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt . In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-540532052-018275dbb23241a185697a7081c6fb15.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

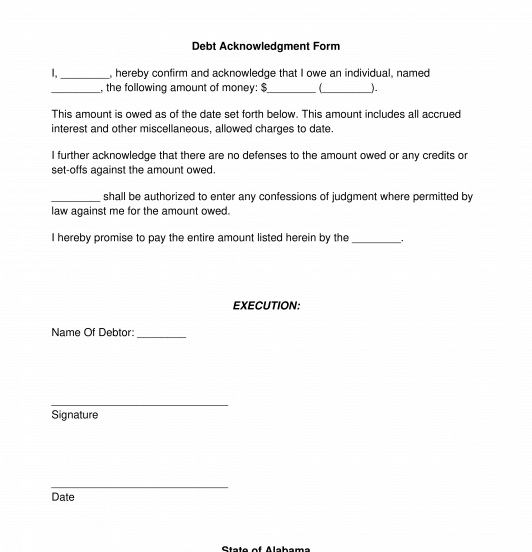

Debt Acknowledgment Form

Rating: 4.7 - 92 votes

A Debt Acknowledgment Form, also sometimes called a Debt Acknowledgment Letter, is a document signed by one primary party, the debtor, as an acknowledgment of a specific amount of money owed to another party, the creditor. A Debt Acknowledgment Form is usually quite a short document, containing only the basic and required facts about the parties' transaction and the monies owed.

A Debt Acknowledgment Form contains the names of the two parties, the amount of money owed, an acknowledgment that there are no defenses to the money owed, and a date certain by which the money will be paid back.

How to use this document

This document may be used for a debtor needing to create a signed form for a creditor, in which the debtor acknowledges that money is owed and needs to be paid back. This document may also be used for a creditor that needs a standard template for one of its debtors to fill out regarding any money owed.

Here, the party entering the information will enter the names and the details of the financial situation between the two, including money owed and whether the full amount listed in the letter is with or without interest accrued.

At the end, there is a portion for a notary to fill out after witnessing the signature of the debtor. This is a good idea, as it will ensure the debtor signature cannot be questioned, as the debtor signature is the most important one, but the notary is not strictly necessary. It is the creditor and debtor's choice whether to have the form notarized.

Applicable law

Debt acknowledgment forms are subject to state-specific laws in the United States, which cover debt acknowledgment form principles, like a necessary executed written acknowledgment, as well as general contract principles like formation and mutual understanding.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Acknowledgment of Debt, Acknowledgment of Money Oweda, Confirmation of Debt, Debtor Acknowledgment Form, Form To Acknowledge Debt

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Meeting Notice

- Other downloadable templates of legal documents

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Search our site

Understanding an assignment and assumption agreement

Need to assign your rights and duties under a contract? Learn more about the basics of an assignment and assumption agreement.

Get your assignment of agreement

by Belle Wong, J.D.

Belle Wong, is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. She ...

Read more...

Updated on: November 24, 2023 · 3 min read

The assignment and assumption agreement

The basics of assignment and assumption, filling in the assignment and assumption agreement.

While every business should try its best to meet its contractual obligations, changes in circumstance can happen that could necessitate transferring your rights and duties under a contract to another party who would be better able to meet those obligations.

If you find yourself in such a situation, and your contract provides for the possibility of assignment, an assignment and assumption agreement can be a good option for preserving your relationship with the party you initially contracted with, while at the same time enabling you to pass on your contractual rights and duties to a third party.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

In order for an assignment and assumption agreement to be valid, the following criteria need to be met:

- The initial contract must provide for the possibility of assignment by one of the initial contracting parties.

- The assignor must agree to assign their rights and duties under the contract to the assignee.

- The assignee must agree to accept, or "assume," those contractual rights and duties.

- The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

A standard assignment and assumption contract is often a good starting point if you need to enter into an assignment and assumption agreement. However, for more complex situations, such as an assignment and amendment agreement in which several of the initial contract terms will be modified, or where only some, but not all, rights and duties will be assigned, it's a good idea to retain the services of an attorney who can help you draft an agreement that will meet all your needs.

When you're ready to enter into an assignment and assumption agreement, it's a good idea to have a firm grasp of the basics of assignment:

- First, carefully read and understand the assignment and assumption provision in the initial contract. Contracts vary widely in their language on this topic, and each contract will have specific criteria that must be met in order for a valid assignment of rights to take place.

- All parties to the agreement should carefully review the document to make sure they each know what they're agreeing to, and to help ensure that all important terms and conditions have been addressed in the agreement.

- Until the agreement is signed by all the parties involved, the assignor will still be obligated for all responsibilities stated in the initial contract. If you are the assignor, you need to ensure that you continue with business as usual until the assignment and assumption agreement has been properly executed.

Unless you're dealing with a complex assignment situation, working with a template often is a good way to begin drafting an assignment and assumption agreement that will meet your needs. Generally speaking, your agreement should include the following information:

- Identification of the existing agreement, including details such as the date it was signed and the parties involved, and the parties' rights to assign under this initial agreement

- The effective date of the assignment and assumption agreement

- Identification of the party making the assignment (the assignor), and a statement of their desire to assign their rights under the initial contract

- Identification of the third party accepting the assignment (the assignee), and a statement of their acceptance of the assignment

- Identification of the other initial party to the contract, and a statement of their consent to the assignment and assumption agreement

- A section stating that the initial contract is continued; meaning, that, other than the change to the parties involved, all terms and conditions in the original contract stay the same

In addition to these sections that are specific to an assignment and assumption agreement, your contract should also include standard contract language, such as clauses about indemnification, future amendments, and governing law.

Sometimes circumstances change, and as a business owner you may find yourself needing to assign your rights and duties under a contract to another party. A properly drafted assignment and assumption agreement can help you make the transfer smoothly while, at the same time, preserving the cordiality of your initial business relationship under the original contract.

You may also like

What does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

May 20, 2024 · 11min read

How to Start an LLC in 7 Easy Steps (2024 Guide)

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

May 16, 2024 · 22min read

the Legal and Business Hub

All you need, all in one place!

The legal and business hub, powered by Farillio, is a one-stop shop for legal and business guidance and templates providing our customers with 24/7 access to the vital content and resources which every small business needs to succeed.

The hub includes videos, guides, dynamic templates, workflow tools (and more) across a range of topics important to every small business.

Health & safety

Business compliance

Finance, tax & debt

Commercial landlord & tenant

Marketing & branding

Business models & planning

Cyber & data security

Contractors & freelancers

Handling disagreements

Our solution empowers our customers - at whatever stage or size their business is - and enables them to manage their risks, be compliant, and avoid common legal concerns (such as employment tribunals and health and safety fines).

Free Business self-assessment tool

Our customers can take the pulse of their business and check they've got everything in place to ensure their success, from cyber security, data compliance, fitness to manage staff and more

Over 400 Legal Templates

Customers can save time and money using our dynamic online document system to quickly and easily prepare complex, legally binding contracts and policies at any time of the day

Over 500 business and legal guides; over 1,500 videos

Written in plain English in conjunction with lawyers and subject-matter experts, customers can find the answers they need across a wide range of topics to help them thrive and survive, 24/7/365

Safe storage of legal and HR contracts and policies

Customers can safely create or upload documents and store, edit, duplicate and share these online; furthermore they can be reassured that templates are always up-to-date

Workflow tools

Our task-based tools allows customers to achieve their core objectives at their own pace, delegate tasks to team members and keep track of their progress

What is an Assignment of Debt?

By Vanessa Swain Senior Lawyer

Updated on February 22, 2023 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

Perfecting Assignment

- Enforcing an Assigned Debt

Recovery of an Assigned Debt

- Other Considerations

Key Takeaways

Frequently asked questions.

I t is common for creditors, such as banks and other financiers, to assign their debt to a third party. Usually, an assig nment of debt is done in an effort to minimise the costs of recovery where a debtor has been delinquent for some time. This article looks at:

- what it means to ‘assign a debt’;

- the legal requirements to perfecting an assignment; and

- common problems with enforcing an assigned debt.

Whether you’re a small business owner or the Chief Financial Officer of an ASX-listed company, one fact remains: your customers need to pay you.

This manual aims to help business owners, financial controllers and credit managers best manage and recover their debt.

An assignment of debt, in simple terms, is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt.

Once a debt is properly assigned, all rights and responsibilities of the original creditor (the assignor ) transfer to the new owner (the assignee ). Once an assignment of debt has been perfected, the assignee can collect the full amount of the debt owed . This includes interest recoverable under the original contract, as if they were the original creditor. A debtor is still responsible for paying the outstanding debt after an assignment. However, now, the debt or must pay the debt to the assignee rather than the original creditor.

Purchasing debt can be a lucrative business. Creditors will generally sell debt at a loss, for example, 20c for each dollar owed. Although, the amount paid will vary depending on factors such as the age of the debt and the likelihood of recovery. This can be a tax write off for the assignor, while the assignee can take steps to recover 100% of the debt owed.

In New South Wales, the requirements for a legally binding assignment of debt are set out in the Conveyancing Act :

- the assignment must be in writing. You do this in the form of a deed (deed of assignment) and both the assignor and assignee sign it; and

- the assignor must provide notice to the debtor. The requirement for notice must be express and must be in writing. The assignor must notify the debtor advising them of the debt’ s assign ment and to who it has been assigned. The assignee will send a separate notice to the debtor, putting them on notice that the debt is due and payable. They will also provide them with the necessary information to make payment.

The assignor must send the notices to the debtor’s last known address.

Debtor as a Joined Party

In some circumstances, a debtor will be joined as a party to the deed of assignment . There can be a great benefit in this approach . This is because the debtor can provide warranties that the debt is owed and has clear notice of the assignment. However, it is not always practical to do so for a few reasons:

- a debtor may not be on speaking terms with the assignor;

- a debtor may not be prepared to co-operate or provide appropriate warranties; and

- the assignor or the assignee may not want the debtor to be made aware of the sale price . This occurs particularly where the sale price is at a significant discount.

If the debtor is not a party to the deed of assignment, proper notice of the assignment must be provided.

An assignment of debt that has not been properly perfected will not constitute a legal debt owing to the assignee. Rather, the legal right to recover the debt will remain with the assignor. Only an equitable interest in the debt will transfer to the assignee.

Enforcing an Assigned Debt

After validly assigning a debt (in writing and notice has been provided to the debtor’s last known place of residence), the assignee is entitled to take any legal steps available to them to recover the outstanding debt. These recovery options include:

- commencing court proceedings;

- obtaining a judgment; and

- enforcement of that judgment.

Suppose court proceedings have been commenced or judgment already entered in favour of the assignor. In that case, the assignee must take steps to have the proceedings or judgment formally changed into the assignee’s name.

In our experience, recovery of an assigned debt can be problematic because:

- debtors often do not understand the concept of debt assignment and may not be aware that their credit contract contains an assignment of debt clause;

- disputes can arise as to whether a lawful assignment of debt has arisen. A debtor may claim that the assignor did not provide them with the requisite notice of the assignment, or in some cases, a contract will specifically exclude the creditor from legally assigning a debt;

- proper records of the notice of assignment provided to the debtor must be maintained. If proper records have not been kept, it may be difficult to prove that notice has been properly given, which may invalidate the legal assignment; and

- the debtor has the right to make an offsetting claim in defence to any recovery action taken by the assignee. A debtor may raise an offsetting claim which has arisen out of a previous arrangement with the assignor (which the assignee may not be aware of). For example, the debtor may have entered into an agreement with the assignor whereby the assignor agreed to accept a lesser amount of the debt owed by way of settlement. Because the assignee acquires the same rights and obligations of the assignor, the terms of that previous settlement agreement will bind the assignee. The court may find that there is no debt owing by the debtor. In this case, the assignee will have been assigned nothing of value.

Other Considerations

When assigning a debt, it is essential that the assignee, in particular, considers relevant statutory limitation periods for commencing proceedings or enforcing a judgment debt . In New South Wales, the time limit:

- to file legal proceedings to recover debts is six years from the date of last payment or when the debtor admitted in writing that they owed the debt; and

- for enforcing a judgment debt is 12 years from the date of judgment.

An assignment of a debt does not extend these limitation periods.

While there can be benefits to both the assignor and the assignee, an assignment of debt will be unenforceable if done incorrectly. Therefore, if you are considering assigning or being assigned a debt, it is important to seek legal advice. If you need help with drafting or reviewing a deed of assignment or wish to recover a debt that has been assigned to you, contact LegalVision’s debt recovery lawyers on 1300 544 755 or fill out the form on this page.

An assignment of debt is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt.

Once the assignee has validly assigned a debt, they are entitled to take any legal steps available to them to recover the outstanding debt. This includes commencing court proceedings, obtaining a judgment and enforcement of that judgment.

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

Sponsoring overseas workers for your hospitality business, safeguarding vulnerable clients: mandatory ndis & in-home aged care reporting, tips for sponsoring overseas workers for ndis and aged care, engaging contractors: latest employment law changes, contact us now.

Fill out the form and we will contact you within one business day

Related articles

Dealing With Proceedings in the Small Claims Division of the NSW Local Court

What Are the Pros and Cons of a Writ for Levy of Property?

I’m a Judgment Debtor. What are the Next Steps?

How Can I Enforce a Judgment Debt in New South Wales?

We’re an award-winning law firm

2023 Fast Firms - Australasian Lawyer

2022 Law Firm of the Year - Australasian Law Awards

2021 Law Firm of the Year - Australasian Law Awards

2020 Excellence in Technology & Innovation Finalist - Australasian Law Awards

2020 Employer of Choice Winner - Australasian Lawyer

Assignment of Debt – What You Need to Know

By aqila zulaiqha zulkifli ~ 23 june 2023.

Share this article:

Aqila Zulaiqha Zulkifli

Email Me | View Profile

Occasionally, to ensure liquidity and to reduce financial risk, a creditor may assign its rights to a debt repayment to another party. Such an arrangement is known as the assignment of debt.

An assignment generally means the transfer of contractual rights and liabilities to a third party without the concurrence of the other party to the contract. [1] The assigning party is known as the assignor, whereas the recipient party is known as the assignee.

Once an assignment occurs, the assignee stands in the exact position as the assignor and has the legal right to a debt, other remedies therein, and even the power to discharge the debt. The debtor must then, make all payments to the assignee, and not the assignor. In fact, if the debtor pays the assignor without the consent of the assignee, the debtor may risk having to pay the assignee all over again. [2]

An assignment of debt is governed by Section 4(3) of the Civil Law Act 1956 (the “Act”) (cited with approval in the Federal Court case of UMW Industries Sdn Bhd v Ah Fook [3] , in which, the elements of a statutory assignment of debt can be summarized as follows:

- the assignment must be in writing under the hand of the assignor (and not, i.e the agent of the assignor);

- the assignment must be absolute and not by way of charge only; and

- the express notice in writing must have been given to the person liable to the assignor (i.e the debtor).

The effect of a statutory assignment is that the assignee possesses the legal right to the debt and the right to sue the debtor in respect of the debt without needing to join the assignor. [4]

However, rest assured, an assignment that is not in compliance with Section 4(3) of the Act is not automatically invalid. A non-statutory assignment could still be valid in equity [5] , though the assignee would have to join the assignor in the proceeding, either as a plaintiff or defendant [6] . This is to ensure a just disposal of the action, by ensuring that all relevant parties are before the Court so that the assignor would not make a claim against the debtor in respect of the same debt.

As such, in conclusion, before accepting an assignment of debt, it is prudent for an assignee to ensure that the elements in Section 4(3) of the Act abovementioned are fulfilled. If the assignment is meant to be absolute, such terms should be clearly reflected in the deed of assignment, or the assignee runs the risk of being crippled in a legal proceeding to recover the debt in the absence of the assignor.

[1] United General Insurance Co Sdn Bhd v Progress Credit Sdn Bhd [1988] 2 MLJ 297

[2] malayawata steel berhad v government of malaysia & anor [1980] 2 mlj 103, [3] [1996] 1 mlj 365, [4] mbf factors sdn bhd v tay hing ju (t/a new general trading) [2002] 5 mlj 536, [5] khaw poh chhuan v ng gaik peng & ors [1996] 1 mlj 761 (fc), [6] chan min swee v melawangi sdn bhd [2000] 7 clj 1.

RESOURCES /

- Recent Reported Cases

- Talks by Thomas Philip

- TP Legal Clinic

What is an Assignment of Debt?

By Sej Lamba

Updated on 26 February 2024 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

When Could an Assignment of Debt Happen?

Key issues on assignment of debt, drafting the correct documentation, giving notice, key takeaways.

Debts are increasingly common in today’s financial climate, and unfortunately, many people struggle to repay what they owe. Debts owed can be sold to third parties and a lot of companies in the UK purchase debts. However, this can be complicated as specific legal formalities apply when assigning debts. This article will explain some of the critical issues around the assignment of debt.

Debt collection can be a complex process. There are various reasons as to why debt is assigned. For example, a company owed debt may want to avoid putting in time and effort to chase it or want to take legal action to recover it.

To picture a scenario, imagine this:

- Joe Bloggs gets a brand-new shiny credit card. Joe purchases lots of nice things for his family with the credit card. Usually, he can keep up with payments as he keeps track of them and earns enough to pay them back;

- suddenly, Joe has an injury and cannot work anymore. He has to give up his job and now can’t afford to pay the credit card company back;

- Joe ignores various letters chasing the debt and hopes the problem will disappear. Ultimately, after months, the credit card company gives up and sells Joe’s debt to a debt collection agency.

So, in summary – after the debt sale, Joe now owes money to a different company.

In practice, debt assignments can be complex, and the parties must follow the relevant legal rules and draft the correct documentation.

An assignment of debt essentially transfers the debt from one party (the assignor) to a third party (an assignee).

In practice, this will mean the original debtor (e.g. Joe Bloggs) will now owe the debt to a new third-party creditor (e.g. the debt collection business). Therefore, in the scenario above, Joe must now repay the debt to the third-party debt collection business.

This process can be complex. There have been several legal cases in the courts where this process has given rise to disputes.

There are two different types of assignment of debt – a legal assignment of debt and an equitable assignment of debt.

In simple terms:

- a legal assignment of debt will transfer the right for enforcement of the debt; and

- an equitable assignment of debt will transfer only the benefit of the debt without the right to enforce it.

Let us explore each type below.

Legal Assignment of Debt

If the assignment complies with specific legal requirements under the Law of Property Act 1925, it will be a ‘legal assignment’. This means that the assignee will be the new owner of the debt.

A legal assignment requires various formalities to be effective. For example, it must:

- be in writing and signed by the assignor;

- the debtor must be given written notice of the assignment;

- be absolute with no conditions attached to it;

- relate to the whole of the debt and not just part of it; and

- not be a charge.

After the transfer of the debt, the assignor can sue the debtor in its own name.

Equitable Assignment of Debt

It is also possible to have an equitable debt transfer – the requirements for this are much less strict. For example, this can be done informally by the assignor informing the assignee that the rights are transferred to them.

Download this free Commercial Contracts Checklist to ensure your contracts will meet your business’ needs.

For an equitable assignment, giving notice is not essential, but still always highly advisable.

Where an equitable assignment is made, the assignee won’t have the right to pursue court action for the debt. In this case, the assignee will have to join forces with the assignor to sue for the debt to sue for the debt.

The debtor should receive notice of any debt transfer so they know to whom the money is owed. Following notice, the new debt owner can pursue the debt owed.

A legal assignment is the best option for an assignee of debt – this will give them full rights to enforce the debt.

Assignments of debts can be very complex. For a legal assignment of debt, you need to follow various formalities. Otherwise, it may be unenforceable and lead to disputes. If you need help executing a debt assignment correctly, you should seek legal advice from an experienced lawyer.

If you need help with an assignment of debt, LegalVision’s experienced business lawyers can assist as part of our LegalVision membership. You will have unlimited access to lawyers to answer your questions and draft and review your documents for a low monthly fee. Call us today on 0808 196 8584 or visit our membership page .

We appreciate your feedback – your submission has been successfully received.

Register for our free webinars

Understanding your business’ new employment law obligations, a roadmap to business success: how to franchise in the uk, contact us now.

Fill out the form and we will contact you within one business day

Related articles

3 Key Considerations to Manage Contract Risks

3 Business Benefits of Working With a Specialist Commercial Contracts Lawyer

What Are the Risks of a Verbal Contract With Your Customers?

3 Points Your Business Should Consider to Minimise Risk Before Signing a New Contract

We’re an award-winning law firm

2023 Economic Innovator of the Year Finalist - The Spectator

2023 Law Company of the Year Finalist - The Lawyer Awards

2023 Future of Legal Services Innovation - Legal Innovation Awards

2021 Fastest Growing Law Firm in APAC - Financial Times

- My View My View

- Following Following

- Saved Saved

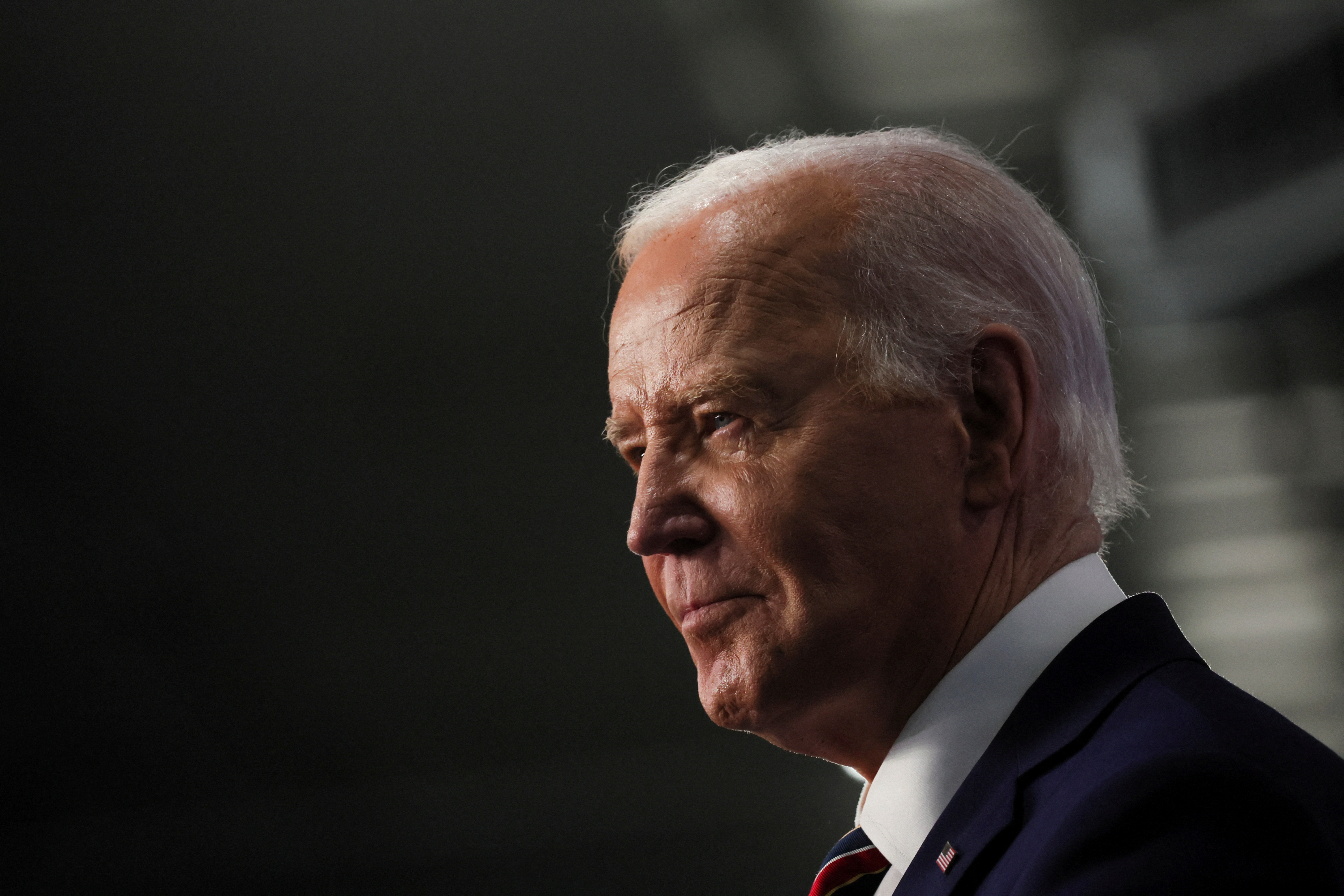

Biden cancels $7.7 bln more in student debt for 160,000 borrowers

- Medium Text

Sign up here.

Reporting by Andrea Shalal; Editing by Leslie Adler

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

World Chevron

Boosted by Gaza war, South African Muslim party open to deal with ANC

South Africa's small Muslim political party Al Jama-ah is gaining support due to the conflict in Gaza and sees itself as a potential coalition partner for the African National Congress after next week's vote, its leader said on Wednesday.

A member of Bangladesh's ruling party was found murdered in the Indian city of Kolkata on Wednesday morning, more than a week after he went missing, Bangladeshi Home Minister Asaduzzaman Khan said.

- Share full article

Advertisement

Managing Your Debt

How to make a plan for tackling your debt, improving your credit score and feel like the money you owe isn’t controlling you.

By Tara Siegel Bernard

Financial Boot Camp for 20-Somethings: Day 4 of 5

It’s time to get your money in order.

Many of us make one of the most consequential financial decisions of our lives before we even hit the legal drinking age: borrowing money for college.

The college acceptance letter is followed by the financial aid package (“aid,” lol), which is really just a nicer way of stating how much debt you’ll need to amass to pay for your degree.

It’s at that moment that Americans — teenagers! — have their first encounter with the debt culture that’s ingrained in how we pay for just about everything. It’s always there, for the taking, to buy cars, homes, Lululemon leggings and more. U.S. households carry more than $17 trillion , for all of it, including credit cards.

So while we’ve normalized indebtedness in this country, we’ve also moralized it : If you have debt that you can’t afford to pay back, you must have done something very wrong .

Yet we know that’s often the furthest thing from the truth. Many people accumulate debt, not because of lattes, nice sweaters and exotic vacations, but because of circumstances beyond their control, from health issues to job loss.

Then there are the structural reasons that most people borrow, like wages not keeping pace with education costs and a societal decision to push more of the burden onto individuals. We should all be asking big, basic questions about how we landed here — where college degrees often feel like luxury products and medical debts often drive bankruptcies — and what it would take to change the status quo.

For now, we’re going to focus on the microeconomy that is you: How to improve your credit standing, avoid debt where you can and manage the debt you have so it doesn’t feel like it’s controlling you.

Spending Awareness

The first part of debt management is simply becoming more aware of where your money goes and spending with intention, just as Ron discussed in the third boot camp session .

In an increasingly cashless society, it’s become easier to lose track of our spending because there’s little friction — you don’t even need to pull out a piece of plastic from a wallet, you can just tap your phone, and some money is charged to your credit card or siphoned from your bank account.

Buy now-pay later apps, which enable you to pay for just about everything with a no-interest installment loan, instantaneously underwritten from somewhere deep inside your mobile phone, can be similarly pernicious .

Understanding Your Credit Profile

Look at debt as a tool that you have to use carefully. It can also help improve your credit profile — and may have already.

In fact, people with debt who make timely payments may already have solid credit scores , the three-digit number that lenders use to judge you when deciding whether to make you a loan (and how much interest to charge for it). Landlords often use them when considering rental applications.

But having too much debt can drag down your score, which generally ranges from 300 to 850 — the higher, the better. (At FICO , a score of more than 740 is considered “very good.”)

The bottom line: Paying down debt regularly will help strengthen solid scores and improve less-than-perfect scores, which can lead to better interest rates later. (We’ll provide more information on how to find your scores in the action items section below.)

Got Debt? Make a Plan

There are several different approaches to tackling credit card debt :

Don’t forget one of the oldest tricks: ye olde balance transfer offer , where you transfer your debt to a credit card with an introductory rate of zero percent. With interest rates on the rise, these deals are harder to find, but it’s worth a shot. Be sure to evaluate the transfer fees (which have risen) and how much you would need to pay each month to be debt-free once the introductory rate expires.

Consolidating your debts into a personal loan is another option. The interest rates are nearly as high as those for credit cards, but there is some variability across lenders, so it pays to shop around. You may get lucky, especially if you have a strong credit score.

For people with debt on multiple credit cards, the so-called avalanche method is the most practical — you focus on paying down your highest-cost debt first. Pay the monthly minimums on all of your card debts (to avoid any late fees). Then, throw the money you have left over toward your credit-card balance with the highest interest rate. Once that is zapped, put the extra money toward the next highest-cost debt.

The second strategy, known as the snowball method, may be more psychologically rewarding for people who want a quicker win. Here too, you pay the monthly minimums on all of your debts, but put the extra money toward your smallest-balance debt first. The logic here? You knock out debts more quickly, which can be highly motivating and spur you to keep going.

Some people like to combine the two — snowball first, for a quick victory, then follow with avalanche.

If at any point you feel stuck, there are professionals who can help. They may even be able to negotiate a repayment plan with your credit card companies (but beware of scam artists who make promises that sound too good to be true ). Your safest bet is to find a nonprofit credit counseling agency through the National Foundation for Credit Counseling .

Medical Debt

Medical debt is a bit different from other consumer debts. After you’ve made sure that the bill is accurate and your insurance (if you have it) paid every last cent that it should, ask your medical provider to reduce the bill to a more manageable amount, and then work out a payment plan. Even if collectors are hounding you, don’t put the debt on your credit card. Here’s why: Once you do, it will look just like any other consumer debt.

Why is that important? The big credit reporting agencies have begun to view medical debts a bit less punitively. (Read a piece by my colleague Ann Carrns for more information.)

Managing Your Student Loans

If you’ve already amassed some credit card debt but also have student loans, you’re probably wondering how to balance the two. Even though federal student loan rates have risen, they’re still far less than most credit cards, which now carry insanely high rates of 22 percent, on average. The same rules apply here: You want to stay current on your student loans while also attacking your highest-rate debt first.

If you’re overwhelmed with other consumer debts, there may be a way to safely reduce your student loan payment while you focus on the former. Run your numbers on Studentaid.gov ’s loan simulator , which will calculate your monthly payments under different repayment plans, along with how much you will pay in interest over the life of the loan.

But that’s a step that all student borrowers should take to ensure you’re in the best repayment plan, given your circumstances.

For people struggling to make ends meet, income-driven repayment, or I.D.R., plans may be the most affordable option: They base your monthly payment on your discretionary income and household size. After you make payments for a set period, somewhere between 10 and 20 years, the remaining debt is cancelled.

The Biden administration’s new I.D.R. plan, called SAVE , is the most generous version (which is why it’s being challenged by more than a dozen Republican-led states). Anyone working in public service or at a nonprofit should also consider the Public Service Loan Forgiveness program, which may provide an even faster path to eradicating your federal student debts.

If you also have private student loans through commercial lenders, there are a few things you should bear in mind. Federal student loans have embedded protections that private loans do not — I.D.R. programs may not require you to pay anything at all if your income is wiped out or you’re making a minimum wage, for example, and tools like forbearance allow you to temporarily hit the pause button on payments. If you ever consider refinancing your federal student debt with a commercial lender, you give all of that up.

It’s a lot to take in. If you’d like some hand-holding, there are experts at organizations like TISLA who can assist.

The journey through your 20s is a time of self-discovery, including your financial personality. You may make suboptimal decisions that you may not even necessarily regret, but those choices will teach you. As long as the lesson isn’t lost, you will have gained something.

Action items:

Your family background has probably influenced your outlook on debt. Did your family save for big purchases? Borrow constantly for financial emergencies? Or perhaps they were financially comfortable, but still managed to overextend themselves? Think about how your life experience thus far may have shaped your approach toward debt as an adult.

Make a list of all of your debts, along with the interest rate you are paying on each. Can you optimize in any way?

Everyone has a credit file at each of the three major credit reporting companies ( Equifax , Experian and TransUnion ). Pull each of yours (using this website only, where you receive a free report from each bureau weekly) and scan it for errors. You can dispute any errors online.

Do you know your credit score? There are several places to look.

Don’t have debt? Reacquaint yourself with the reward terms and interest rate on your credit card — can you do better?

Have a question about money?

Ask us here .

Did you miss Day 1? Catch up here. Day 2 is here , Day 3 is here , Day 4 is here and Day 5 is here .

Tara Siegel Bernard writes about personal finance, from saving for college to paying for retirement and everything in between. More about Tara Siegel Bernard

A Guide to Making Better Financial Moves

Making sense of your finances can be complicated. the tips below can help..

Inheriting money after the death of a loved one while also grieving can be an emotional minefield, particularly for younger adults. Experts share ways to handle it wisely .

Either by choice or because they are priced out of the market, many people plan to never stop renting. Building wealth without home equity requires a different mind-set.

You may feel richer as you pay your mortgage down and home values go up. As a result, some homeowners end up with a lot of home equity but low retirement savings. Here’s the problem with that situation.

Can your investment portfolio reflect your values? If you want it to, it is becoming easier with each passing year .

The way advisers handle your retirement money is about to change: More investment professionals will be required to act in their customers’ best interest when providing advice about their retirement money.

The I.R.S. estimates that 940,000 people who didn’t file their tax returns in 2020 are due back money. The deadline for filing to get it is May 17.

'Plan B' $750B student debt transfer to taxpayers draws bicameral rejection

(The Center Square) – Transferring student debt to taxpayers in a “Plan B” costing $750 billion has drawn a bicameral rejection letter authored by a North Carolina congresswoman and Louisiana senator and sent to the head of the Department of Education.

Signed by 130 Republican members of Congress, Secretary Miguel Cardona is told the latest rule-making proposal should be withdrawn and in no way could be the intent of the 1965 Federal Loan Insurance Program or its 2008 reauthorization. The letter led by U.S. Rep. Virginia Foxx, R-N.C., and Sen. Bill Cassidy, R-La., said the Education Department is making an even broader attempt to send the debt of 28 million borrowers, some with annual income exceeding $300,000, to taxpayers in a “backdoor attempt to enact ‘free’ college.”

In part, the letter reads , “The Supreme Court has made it abundantly clear that there is zero authority to write-off federal student loans en masse last June when the Department’s ‘Plan A’ was ruled unconstitutional.”

Foxx, seeking her 11th two-year term in November, is chairwoman of the Committee on Education and the Workforce in the House of Representatives. Cassidy, a gastroenterologist before entering politics, is ranking member of the Committee on Health, Education, Labor and Pensions in the Senate.

The Department of Education on April 17 filed a Notice of Proposed Rule Making , also known as NPRM, describing “targeted relief.” The letter reads in part, “The Department notes that the long-anticipated regulation to ‘cancel’ loans for borrowers facing ‘hardship’ – a broad term defined under the NPRM to grant the Department full authority to cancel any loan it pleases – is still forthcoming. According to budget experts, those additional changes would bring the total cost of the Department’s ‘Plan B’ to nearly $750 billion, at almost double the cost of ‘Plan A.’”

The letter further criticized Cardona and his department for putting “resources to draft this proposal to benefit those who already were able to attend college” while “simultaneously” failing to “competently implement the Free Application for Federal Student Aid.” FAFSA helps needy prospective college applicants and their families afford higher education.

“We already know,” the letter says, “as of March 29, FAFSA completion for seniors in high school is down 40%. Those who do not file will likely not attend college next year and maybe never will.”

Thom Tillis and Ted Budd, North Carolina’s two Republican U.S. senators, were among the signers. In addition to Foxx, the other House members from North Carolina signing were Reps. Richard Hudson and Chuck Edwards.

160,500 more student-loan borrowers are getting $7.7 billion in 'much needed' debt cancellation

- Biden announced another $7.7 billion in student-debt cancellation for 160,500 borrowers.

- It's a result of fixes to PSLF and income-driven repayment plans, including the SAVE plan.

- This means that one out of every 10 federal borrowers have now gotten debt relief.

Another batch of student-loan borrowers has been approved for debt relief .

On Wednesday, President Joe Biden's Education Department announced that it approved $7.7 billion in debt cancellation for 160,500 borrowers on Public Service Loan Forgiveness — which forgives student debt for government and nonprofit workers after 10 years of qualifying payments — or income-driven repayment plans.

Specifically, according to the announcement, 66,900 borrowers are receiving relief through fixes to PSLF, 54,300 borrowers are receiving relief through the SAVE income-driven repayment plan , and 39,200 borrowers are receiving relief through one-time account adjustments to bring payments on income-driven repayment plans up to date.

Related stories

The relief through SAVE is a result of a new provision the Education Department implemented earlier this year. This provision forgives student debt for borrowers who originally took out $12,000 or less in student loans and made as few as 10 years of payments.

"Another 160,000 borrowers and their families will get some much-needed relief thanks to the continued efforts [of] the Biden-Harris Administration to fix the broken student loan system," Undersecretary of Education James Kvaal said in a statement. "We congratulate those borrowers on their due forgiveness and we will continue to work to deliver relief to others."

According to the department, this relief now means that more than one out of every 10 federal borrowers has been approved for debt cancellation.

Some impacted borrowers have already started receiving emails informing them of the relief, which, per the department, will be processed in the coming weeks.

There's still time for borrowers to benefit from some of the provisions that made this latest relief possible. The Education Department recently extended the deadline for borrowers to consolidate their loans to benefit from the one-time account adjustment, giving borrowers two extra months to take action before the adjustments are set to be completed in September.

In addition, the Education Department is in the process of implementing its broader student-loan forgiveness plan after the Supreme Court struck down the first one. It just concluded its public comment period , and the department said it will work to move quickly, with a goal to begin implementing the relief this fall.

While legal challenges are likely to arise — there have already been threats — Biden's administration has remained confident in its authority to continue relieving borrowers.

"From day one of my Administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity," Biden said in a statement. "I will never stop working to cancel student debt — no matter how many times Republican elected officials try to stop us."

Watch: Biden announces who can have $10,000 erased in student loans

- Main content

IMAGES

VIDEO

COMMENTS

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

This agreement must clearly establish the calendar date when the assignment of the debt to the Assuming Party becomes active. (2) Debtor Name And Mailing Address. The current Holder of the debt should be identified as the Debtor in this agreement. To this end, record the Debtor's name and address. (3) Assuming Party.

Assignment of debt is an agreement that transfer debt, rights, and obligations from a creditor to a third party. Assignment of debt agreements are commonly found when a creditor issues past due debt to a debt collection agency. The original lender will be relieved of all obligations and the agency will become the new owner of the debt.

Under the FDCPA, if you send the bill collector a letter that disputes the debt and/or requests verification of the debt within 30 days of receiving the initial written notice of the debt, called a "dunning letter," then that bill collector must: ... If the creditor or collector suing you fails to produce proof of the assignment, then you can ...

An assignment of debt agreement is a legal document between a debtor and creditor that outlines the repayment terms. An assignment of debt agreement can be used as an alternative to bankruptcy, but several requirements must be met for it to work. In addition, if obligations are not met under a debt agreement, it might still be necessary to file ...

Debt Assignment: A transfer of debt, and all the rights and obligations associated with it, from a creditor to a third party . Debt assignment may occur with both individual debts and business ...

II. ASSIGNMENT OF DEBT. It is known that the Debtor is indebted to the Creditor, under a separate agreement, for the current principal sum of $150,000.00, plus any interest ("Debt"). Under this Agreement, the Assuming Party agrees to assume: (choose one) ☒ - All of the Debt. ☐ - Portion of the Debt. The Assuming Party agrees to assume ...

Assignment and debt collection agencies. Sometimes, the purchasing company will employ a debt collection agency to act on their behalf or the debt will be purchased by an agency themselves. They will take over the full rights to the debt and attempt to collect it from you in full. As such, they will contact you by letter, phone calls, texts or ...

A letter of assignment of debt is a written document that legally transfers the rights to collect a debt from one party to another. It is also known as a deed of assignment of debt. The original creditor sends a copy of this letter to the assignee, informing them of the debt's transfer and providing all necessary details, including the new ...

A Debt Acknowledgment Form, also sometimes called a Debt Acknowledgment Letter, is a document signed by one primary party, the debtor, as an acknowledgment of a specific amount of money owed to another party, the creditor. A Debt Acknowledgment Form is usually quite a short document, containing only the basic and required facts about the parties' transaction and the monies owed.

Assigning debts and other contractual claims - not as easy as first thought. Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt).

Assignment Agreement Template. Use our assignment agreement to transfer contractual obligations. An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the "assignor") to another (the "assignee"). You can use it to reassign debt, real estate, intellectual property, leases ...

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

The notice informs the remaining original party to the contract or the original debtee, that this assignment to you has taken place. It can only be used where the assigning party already has the legal right to assign its rights in the debt or the contract to someone else. If it does not have that right, it will have to seek consent and ...

An assignment of debt, in simple terms, is an agreement that transfers a debt owed to one entity, to another. A creditor does not need the consent of the debtor to assign a debt. Once a debt is properly assigned, all rights and responsibilities of the original creditor (the assignor) transfer to the new owner (the assignee).

The Letter begins with a traditional letter structure, which clearly sets out the sender and the recipient of the Letter (ie the assignor and the assignee), their addresses, and the date of the Letter. The reference number or code that the parties can use to identify this Letter is also set out here. Re: Assignment of the rights under the ...

As such, in conclusion, before accepting an assignment of debt, it is prudent for an assignee to ensure that the elements in Section 4(3) of the Act abovementioned are fulfilled. If the assignment is meant to be absolute, such terms should be clearly reflected in the deed of assignment, or the assignee runs the risk of being crippled in a legal ...

- Assignment of Debt. Use Lawlive's Deeds of Assignment of Debt (Loans) to assign a debt as between companies and individuals or between each. The deeds assign rights and accordingly it is important to consider the requirements to assign a debt and the risks of doing so. Some advantages of assigning a debt are that no consideration is required ...

An assignment of debt essentially transfers the debt from one party (the assignor) to a third party (an assignee). In practice, this will mean the original debtor (e.g. Joe Bloggs) will now owe the debt to a new third-party creditor (e.g. the debt collection business). Therefore, in the scenario above, Joe must now repay the debt to the third ...

4. Sign. Use our Deed of Assignment of Debt template in order to transfer (or sell) the right to recover a debt. To transfer a debt legally between parties, it is necessary to enter into a written transfer document. Once the transfer document has been signed by the Assignee (the party transferring the debt) and the Assignee (the party receiving ...

assignor hereby acknowledges), the said assignor, as beneficial owner, does hereby transfer, sell and assign unto and to the use of the said assignee, all the several said debts, and sums of money specified in the said Schedule which are now due and owing to the assignor to have and to receive them for his absolute use and benefit with absolute ...

Overall household debt grew by 1.1% during the first quarter to $17.69 trillion, according to data that is not adjusted for inflation. The quarterly increase was driven largely by mortgage balances.

U.S. President Joe Biden on Wednesday announced the cancellation of another $7.7 billion in student debt for 160,000 borrowers, bringing the total number of people to benefit from his debt relief ...

For people with debt on multiple credit cards, the so-called avalanche method is the most practical — you focus on paying down your highest-cost debt first. Pay the monthly minimums on all of ...

Today, my Administration is canceling student debt for 160,000 more people, bringing the total number of Americans who have benefitted from our debt relief actions to 4.75 million. Each of those ...

The letter led by U.S. Rep. Virginia Foxx, R-N.C., and Sen. Bill Cassidy, R-La., said the Education Department is making an even broader attempt to send the debt of 28 million borrowers, some with ...

Biden announced another $7.7 billion in student-debt cancellation for 160,500 borrowers. It's a result of fixes to PSLF and income-driven repayment plans, including the SAVE plan. This means that ...

Discharging debt for borrowers who have been in repayment for over two decades on a rolling basis, so no borrower has to delay or forego retirement because of their student loan debt. Student loan debt should never be a life sentence. Providing relief to borrowers who have been victims of servicing errors or misconduct.