No products in the cart.

Worksheet 11.2 Types of Contracts

- September 18, 2022

Contracts are agreements that involve two or more parties that outline the terms and conditions of their business relationship. Contracts are an essential part of conducting business as they help to define the obligations, responsibilities, and expectations of all parties involved.

In this worksheet, we will discuss the different types of contracts that are commonly used in business transactions.

1. Express Contracts

Express contracts are written or oral agreements where all terms and conditions of the contract are explicitly stated. These types of contracts are legally binding and enforceable in court.

2. Implied Contracts

Implied contracts are agreements that are not explicitly stated in writing or orally. Instead, they are inferred from the conduct or actions of the parties involved. These types of contracts are also legally binding and enforceable in court.

3. Bilateral Contracts

Bilateral contracts are agreements where both parties make a promise to each other. For example, a contract between a buyer and seller, where the buyer promises to pay for the product and the seller promises to deliver the product.

4. Unilateral Contracts

Unilateral contracts are agreements where only one party makes a promise. For example, a reward for finding a lost pet or a bonus for meeting specific performance goals.

5. Executed Contracts

Executed contracts are agreements where all parties have fulfilled their obligations under the contract. For example, a seller has delivered the product, and the buyer has paid for the product.

6. Executory Contracts

Executory contracts are agreements where one or more parties have not yet fulfilled their obligations under the contract. For example, a contract between a buyer and seller where the seller has not yet delivered the product.

7. Void Contracts

Void contracts are agreements that are not legally enforceable due to a legal defect. For example, a contract that involves illegal activities or a contract that was made under duress.

8. Voidable Contracts

Voidable contracts are agreements that can be legally challenged by one or more parties involved in the contract. For example, a contract that involves fraud or misrepresentation.

In conclusion, contracts are an essential part of conducting business, and it is essential to understand the different types of contracts that are commonly used in business transactions. This worksheet has provided an overview of the various types of contracts, which include express contracts, implied contracts, bilateral contracts, unilateral contracts, executed contracts, executory contracts, void contracts, and voidable contracts. By understanding these types of contracts, you can ensure that you are entering into legally binding and enforceable agreements that protect your interests and obligations.

8.2 Warranties and Sales Contracts

A warranty is a guarantee on the good that comes as part of the sales contract, but contract law treats warranties as an additional form of contract that binds the selling party to undertake a certain action. Typically, the selling party has an obligation to provide a product that achieves a specified task, or to deliver a service that meets certain minimal standards. Warranties are offered for a range of different goods and services, from manufactured goods to real estate to plumbing services. The warranty assures the buyer that the good or service is free from defects, and it is a legally binding commitment. In the event that the product or service fails to meet the standards set out in the warranty, then the contract provides a specific remedy, such as a replacement or repair.

According to UCC 1-203, the performance and execution of all contracts must be undertaken in good faith. Good faith means honesty in fact and the observance of reasonable commercial standards of fair dealing. If the parties in the contract are merchants, the UCC also requires that the contract be undertaken in accordance with commercial reasonableness. This requirement means that the transaction should be undertaken in a sensible and prudent way.

Express and Implied Warranties

Warranties can be express, implied, or both. Both express and implied warranties provide legal relief for the purchaser in the event of a breach of contract.

An express warranty is one in which the seller explicitly guarantees the quality of the good or service sold. Typically, the vendor provides a statement, or other binding document, as part of the sales contract. What this means in practice is that the buyer has engaged in the contract on the reasonable assumption that the quality, nature, character, purpose, performance, state, use, or capacity of the goods or services are the same as those stated by the seller. Therefore, the sales contract is based, in part, on the understanding that the goods or services being supplied by the seller will conform to the description, or any sample, that has been provided.

There are myriad ways in which the seller can make statements as to the characteristics of the goods.

Here are a few examples of express warranties:

“Wrinkle-free shirt”

“Lifetime guarantee”

“Made in the USA”

“This orange juice is not from concentrate”

There is not a specific way that words must be formed to make an express warranty valid. Importantly, the sales contract does not need to explicitly state that a warranty is being intended. It is enough that the seller asserts facts about the goods that then become part of the contract between the parties. However, the courts do apply a reasonableness test of reliance upon warranties. Puffery, or language used to bolster sales, is lawful, and the consumer is required to apply reason when evaluating such statements. For example, buyers are expected to use reason when judging seller claims such as “this sandwich is the best in the world.” Obvious sales talk cannot ordinarily be treated as a legally binding warranty.

A breach of the warranty occurs when the express warranty has been found to be false. In such circumstances, the warrantor is legally liable just as though the truth of the warranty had been guaranteed. The courts do not accept as a defense:

- Seller claims the warranty was true.

- Seller claims due care was exercised in the production or handling of the product.

- Seller claims there is not any reason to believe that the warranty was false.

Implied Warranties

In certain circumstances where no express warranty was made, the law implies a warranty. This statement means that the warranty automatically arises from the fact that a sale was made. With regard to implied warranties, the law distinguishes between casual sellers and merchant sellers, with the latter held to a higher standard, given that they are in the business of buying or selling the good or service rendered. For example, unless otherwise agreed, goods sold by merchants carry an implied warranty against claims by any third party by way of trademark infringement, patent infringement, or any other intellectual property law infringement. This type of warranty is known as the warranty against infringement. Another implied warranty provided by merchant sellers is the warranty of fitness for normal use , which means that the goods must be fit for the ordinary purposes for which they are sold.

It is important to note that if express warranties are made, this does not preclude implied warranties. If an express warranty is made, it should be consistent with implied warranties, and can be treated as cumulative, if such a construction is reasonable. If the express and implied warranties cannot be construed as consistent and cumulative , the express warranty generally prevails over the implied warranty, except in the case of the implied warranty of merchantability , or fitness for purpose.

Breaches of Warranty

If the buyer believes that there has been a breach of the implied warranty of merchantability, it is their responsibility to demonstrate that the good was defective, that this defect made the good not fit for purpose, and that this defect caused the plaintiff harm. Typical examples of defects are:

- Design defects

- Manufacturing defects

- Inadequate instructions on the use of the good

- Inadequate warning against the dangers involved in using the good.

Specific Examples of Goods Under the Warranty of Merchantability

| Type | Description |

|---|---|

| Second-hand goods | The UCC treats warranties arising for used goods in the same way as warranties arising for new goods, but second-hand products tend to be held to a lower standard on the warranty of merchantability. |

| Buyer-designed goods | The same warranties arise for mass manufactured goods as for goods that have been specified or made to order for the buyer. However, in this case, no warranty of fitness for purpose can arise since the buyer is using his or her own decisions, skill, and judgment when making the purchase. |

| Food and drink | The sale of food or drink carries the implied warranty of being fit for human consumption. |

The buyer might intend to use the goods purchased for a different purpose than that for which it was sold. In this case, the implied warranty holds only if the buyer relies on the seller’s skill or judgment to select the product, the buyer informs the seller at the time of purchase of his or her intention for the use of the good, and the buyer relies on the seller’s judgment and skill in making the final choice. If the seller is not made aware of the buyer’s true intention, or does not offer his or her skill and judgment in aiding the sale, then warranty of fitness for a particular purpose does not arise. For this reason, it is common for vendors to include provisions in the average terms and conditions of sale with regard to the true and intended purpose of use.

Warranty of Title

By the mere act of selling, the vendor implies a warranty that the title is good and that the transfer of title is lawful. In addition, the act of the sale creates a warranty that the goods shall be delivered free from any lien of which the buyer was unaware. In some circumstances, the warranty of title can be excluded from the contract documents. For instance, when the seller makes the sale in a representative capacity (e.g. as an executor of an estate), then a warranty of title will not arise.

Remedies to Buyers under the UCC

| Remedy | Description |

|---|---|

| Cancel the contract | The UCC allows buyers to cancel the contract for nonconforming goods and to seek remedies that give them the benefit of the bargain. |

| Obtain cover | Buyers are allowed to substitute goods for those due under the sales contract. However, substitutes must be reasonable, acquired without delay, and obtained in good faith. |

| Obtain specific performance | If the goods are unique or a legal remedy is inadequate, the seller may be required to deliver the goods as identified in the contract. |

| Sue | Buyers are entitled to consequential and incidental damages if there is a breach of contract. They may also be able to obtain liquidated damages (damages before the breach occurs) or punitive damages. |

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/business-law-i-essentials/pages/1-introduction

- Authors: Mirande Valbrune, Renee De Assis

- Publisher/website: OpenStax

- Book title: Business Law I Essentials

- Publication date: Sep 27, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/business-law-i-essentials/pages/1-introduction

- Section URL: https://openstax.org/books/business-law-i-essentials/pages/8-2-warranties-and-sales-contracts

© Mar 31, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

In order to continue enjoying our site, we ask that you confirm your identity as a human. Thank you very much for your cooperation.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

12.1 Writing Contracts

Learning objectives.

- Learn how to write valid contracts.

- Understand strategies for drafting contracts.

Knowing how to write legally enforceable contracts that protect their interests is a vital skill for businesses. In fact, most contracts are not written by attorneys. Individuals and businesses write contracts without legal help because they are trying to save time, money, and tension with others. However, hiring an attorney to write or review a contract to protect personal or business interests is sometimes necessary and worthwhile.

There are no magic words that a contract must have to be enforceable. Some are short and informal, while others are long and formal. No one style, format, or approach will always serve the parties’ needs. The only legal requirement that contracts must have are the elements of a contract: offer, acceptance, and consideration. This chapter offers some guidelines for business people to consider when writing their own contracts.

Counselor’s Corner It has been said that a poorly drafted contract will work if everyone gets the benefit of their bargain. This may be true, but it does not excuse sloppy drafting. Address all essential matters, clearly, succinctly, and at once. Non-essential terms, inconsistent use of defined terms, and repetition create fertile ground for disputes. You cannot control how the other party will perform. However, you put yourself in the best position possible by ensuring that the intent, obligations and rights of all parties are stated clearly and unambiguously. ~Kathy K., attorney

12.2 Structure of Contracts

Written contracts can be organized in many different ways. However, having a structure can help keep information organized, clear, and easy to find. The best contracts have clear headings that accurately describe what is contained in that section. Using emphasis, such as bold and underlining , work better than italics alone for capturing the reader’s eye.

In general, contracts often contain a structure like this:

Introduction of Parties and Purpose

Definitions of material terms, covenants and promises of performance, breach and its consequences, representations and warranties.

- Procedure to Modify Contract

- Rights of Assignment and Delegation

Alternative Dispute Resolution

Choice of law and forum, integration, severability, exculpatory clause, force majeure, attorney fees.

- Signature Block

Not all contracts will contain all these elements and provisions. The parties’ needs and the purpose of the contract drive the structure of the document.

Contracts have a title, often in bold or CAPITAL letters, at the top of the page. Titles should be as descriptive as possible. “Contract” or “Agreement” are not useful because they require the reader to read through the contract to know what it is about. The best contracts capture the nature of the document in the title. For example, “Employment Agreement Between Jane Doe and Stanford University.”

The introduction should name the parties and describe the nature of the contract. If background information is useful in explaining the parties’ interests and objectives, then it should be included here.

Most business contracts contain some definitions, unless the subject matter and parties are clear. Definitions are useful because it is an area readers can reference to ensure compliance with the contract. For example, did the seller provide the specific goods as defined by the contract?

Definitions are not necessary for every term, though. If not defined, legal terms are given their legal meaning. And ordinary words are given their common, ordinary meaning. Therefore, businesses should define the material terms of the transaction: goods, services, quantity, quality, price, etc. Definitions that are specific to the industry are also helpful to include.

A covenant is a formal promise to perform. This is the section of the contract where the parties state exactly how they will perform the contract. Buyer will pay a specific amount for the goods or service. Seller will deliver a specific item at a particular location.

To ensure clarity, the best contracts use active verbs in this section. For example, “Buyer will pay Seller ten dollars.” It is clear who will be paying whom, and how much is owed. Passive voice injects ambiguity, which can be problematic. For example, “Seller shall be paid ten dollars.” Will Buyer pay Seller the money or will someone else tender payment? If payment is not made, is Buyer in breach of contract?

As discussed in Chapter 10, conditions are things that must occur before performance is due. Usually conditions must be expressly stated in a contract to be legally enforceable. The best contracts identify any conditions and delineate a timeline for when performance is due after the condition is met. For example, if an inspection of a property is a condition precedent of purchasing it, how long after the inspection is completed must the buyer perform?

To constitute a violation of the contract, a breach must be material. A material breach is a substantial breach of contract that excuses aggrieved parties from further performance and affords them the right to sue for damages.

In contracts that require performance over a period of time, or payments in installments, it is helpful to define what constitutes a material breach. This clarifies when the non-breaching party can seek a remedy. The best contracts anticipate reasons for breach and identify consequences for them.

Acceleration Clause

An acceleration clause makes all future payments due immediately under the contract. Acceleration clauses often exists in contracts where periodic payments occur. For example, a contract to purchase a vehicle may require payment of all remaining money owed under the contract if the buyer misses a monthly payment. This allows the business that sold the vehicle or the bank that issued the loan to sue for breach of contract once, rather than filing a new lawsuit for each month.

Liquidated Damages

A liquidated damages clause allows parties to determine the amount of damages in the event of a material breach. Agreeing to the value of the contract before any breach occurs often saves time and money should the case be litigated. To be enforceable, the liquidated damages must apply to all parties equally, and be based on the value of the contract rather than act as a penalty.

Representations are statements of fact made to induce someone to enter into a contract. Common representations by businesses include:

- They are properly licensed;

- They are insured;

- Their financial statements are accurate;

- They own all relevant assets;

- They have legal authority to enter into contracts.

Warranties in a contract are express promises that guarantee something in furtherance of the contract by one of the parties. For example, a seller warrants that the object being sold is as represented or promised.

Warranties differ from representations in four ways:

- A warranty is an essential part of a contract, while a representation is usually only a collateral inducement;

- A warranty is written in a contract; while a representation may be written or oral;

- A warranty is conclusively presumed to be material, while a representation must be proven to be material by the party claiming breach; and

- A warranty must be strictly complied with, while a representation must be substantially true.

Please note that express contract warranties are different from implied warranties under the Uniform Commercial Code (UCC). A party may disavow implied warranties under the UCC through a written contract.

Modification

Often with contracts that require an extended period for performance, modification becomes a concern. What happens if prices or deadlines need to be altered? Does that require a new contract or can the existing contract be modified? Good contracts often include a procedure for how to modify a contract. This may be as informal as writing changes directly on the original contract with the parties’ initials and date. Or it could be through a formal addendum procedure.

Regardless of the chosen procedure, it is a best practice for businesses to discuss modification procedures when entering into a contract. If the procedure is clear, less friction occurs when a party seeks modification.

Assignment and Delegation

In general, parties are free to assign and delegate their rights and duties under a contract. Parties can limit those rights or they can request notice if an assignment or delegation occurs. This is a provision that is often not needed unless a party has a concern about assignment, such as in the insurance industry.

As discussed in Chapter 4, many businesses want to reduce their risk of litigation by participating in alternative dispute resolution (ADR). Mandatory arbitration clauses are common in consumer and employment contracts. Before including an ADR provision in a contract, parties should be fully comfortable with the option that they choose. If a party agrees to mediation or arbitration, a court will enforce that choice even if the parties change their mind.

Choice of law provisions determine which state’s laws will be used to interpret the contract. Choice of forum provisions determine the state in which any litigation will take place.

This provision is often unnecessary for contracts involving individuals and entities in the same state. If the parties do not select that state law or location for litigation, the courts look to:

- Where the contract was signed;

- Where the contract is performed;

- Where the parties are residents; and

- The court’s jurisdictional rules.

An integration clause is a provision stating that the contract represents the parties’ complete and final agreement and supersedes all informal understandings and oral agreements relating to the subject matter of the contract. In other words, it is the agreement.

The purpose of an integration clause is to prevent the parties from later claiming that they agreed to additional or different terms than what the contract states. This means that any statements made before the parties signed the contract are not part of the contract and they will not be used to interpret the meaning of the contract.

A severability clause is a provision that keeps the remaining provisions of a contract in force if any portion of the contract is declared unenforceable by the court. It is also known as a savings clause because it “saves” the whole contract from being declared unenforceable.

For example, if a non-compete clause in an employment contract is declared unenforceable by a court, then the rest of the employment contract remains in effect.

An exculpatory clause is a provision relieving a party from any liability resulting from a negligent or wrongful act. They are often employed when the risk of injury exists. Exculpatory clauses cannot limit liability when a party acts with gross negligence, commits an intentional tort, or when public policy or state laws prohibit them. Exculpatory clauses have been struck down by courts in some cases where parties to a contract have greatly unequal bargaining power, especially when the party with greater power acts unethically or with gross negligence.

A force majeure clause is a provision allocating risk to a certain party if performance becomes impossible as a result of an event that the parties could not have anticipated or controlled. Force majeure events are big, disruptive events such as natural disasters, war, terrorist attacks, and fires.

For example, if the subject matter of an international sales contract is destroyed by a hurricane, does the buyer or seller lose the money in the sale?

Business contracts often have an attorney fees clause that entitles a party successful in litigation over the contract to be reimbursed its attorney fees. This clause often has the effect of limiting frivolous lawsuits because it becomes more expensive for parties to litigate weaker claims. It may also give leverage to a winning party to prevent or end appeals of a court judgment.

Courts will usually enforce an attorney fees provision in a contract. However, courts review attorney fee awards for reasonableness. Therefore, the amount of fees usually must be deemed reasonable by a court or arbitrator before a party can collect under a contract.

12.3 Common Mistakes

Four of the most common mistakes when writing a contract are not understanding the content, vagueness, ambiguity, and typographical errors.

Not Understanding the Content

One common mistake is using free online resources without ensuring that they are appropriate for the circumstances. Just because it sounds official, a document generated by a computer algorithm may not be helpful. Better to read the contract and ensure that it accurately reflects the parties’ agreement.

Courts presume that parties have read a contract before signing it. Any mistakes in drafting go against the party who wrote the contract. In other words, if the contract is unclear, the party who did not write it gets the benefit of the doubt. The idea is that the party who wrote it should have done a better job, and the party who read and signed it should not be penalized as a result of someone else’s error. When writing a contract, better to keep it simple and clear.

It is also important to exclude provisions that are irrelevant to the contract. Contracts that are too long and contain irrelevant and contradictory terms are hard to understand. The best contracts are used as a reference between the parties during the period of performance. If a contract is too broad, too confusing, or contains too much irrelevant information, it hinders the effectiveness of the document.

In the context of contracts, vagueness means the language is imprecise, uncertain, and not clearly expressed. Vagueness is problematic because it could mean that the parties did not have a meeting of the minds because they were not talking about the same things.

Some business people think that keeping the contract “general” will facilitate a business transaction and that the details can be worked out later. However, if the parties are not in agreement up front, it is uncommon that things will work out smoothly later.

Another risk with vagueness is that it is not clear how a court will interpret the contract. If there are two or more reasonable interpretations, it is possible that the court will decide another interpretation is more reasonable. Again, mistakes in drafting are held against the drafter so if a court concludes that the vague term was a mistake, then it is hard to win in litigation.

In contracts, ambiguity means an uncertainty of meaning or intention. Ambiguities can be either patent or latent. A patent ambiguity is where the language of the contract itself creates uncertainty because it is contradictory. For example, a contract states two different sale prices.

A latent ambiguity exists where the uncertainty arises during the performance of the contract. For example, the contract states that goods will ship via a carrier that has a common name and could be referring to different carriers.

Typographical Errors

Typographical errors are common in contracts. Some are harmless, some are embarrassing, and others are harmful. Although some typos are easy to ignore because they do not carry legal consequences, some can be fatal to the agreement.

Minor errors are called scrivener’s errors . The scrivener’s error doctrine permits typographical errors in a written contract to be corrected when clear and convincing evidence exists that the mistake does not reflect the intent of the parties.

However, errors related to dates, price, quantity, legal names of individuals and entities, and property descriptions (such as addresses and lot numbers) may not qualify as scrivener’s errors. Such errors may be fatal to the contract or may be enforced with adverse consequences against one of the parties.

12.4 Tips for Writing a Contract

Regardless of the purpose of the contract, some tips for writing good contracts include:

Naming the Parties

Be sure to use the correct name of the business entity or individual who is a party to the contract. This may seem obvious, but people often write the name of a representative of the entity rather than the legal name of the entity.

For sole proprietorships, it is appropriate to identify the party as Ling Chen doing business as Chen Bookkeeping. If the business is a Limited Liability Company (LLC), identifying an individual in the contract by name may remove any personal liability protection that a LLC provides. Similar issues may arise with a partnership if each individual is identified as a party to the contract.

Except for sole proprietors who do not have a separate business name, use the business entity’s name and not a personal name as a party to the contract. Otherwise, parties may lose the benefit of limited liability. There may also be tax consequences.

Define the Scope of the Work

Clearly define the scope of work or service being provided, and the proposed timeline to complete the work. Be specific. For example, instead of a broad “renovate the kitchen,” provide details of the cabinet designs, counter tops, and other materials and work to be provided.

If applicable, a time frame for each phase of the project is useful, along with procedures to follow if there are delays. This is especially helpful when delays occur as a result of a supply shortage or a third party. Breach of contract may not always be the fault of the parties. Having procedures in place in the case of delay often saves business relationships when things go wrong.

Specify Time and Amounts of Payments

Entering an hourly rate and projected time for completion, or the total amount of payment for a project, may be insufficient. Depending on the nature of the goods or services, the contract should include:

- Who is paying whom;

- How much is being paid;

- The method of payment (such as check, cashier’s check or bank transfer);

- Any portion of fees to be paid upfront;

- Any fees to be paid at project milestones;

- Payment for work completed if contract is canceled;

- Any late fees; and

- Hourly/per diem rate for time due to delays caused by the other party.

Termination Clause

Few contracts go on forever, so including an end date for the agreement or procedures for a party to cancel the contract are helpful. For example, parties often want to end the agreement if the other party fails to pay or misses too many important deadlines.

Termination procedures should be as specific as possible and include how much notice needs to be given, the type of notice required, and whether there is a time period where the other party may cure the deficiency.

Termination clauses should anticipate termination by all parties and address the parties’ rights based on which party requests termination and why.

Sign and Date the Contract

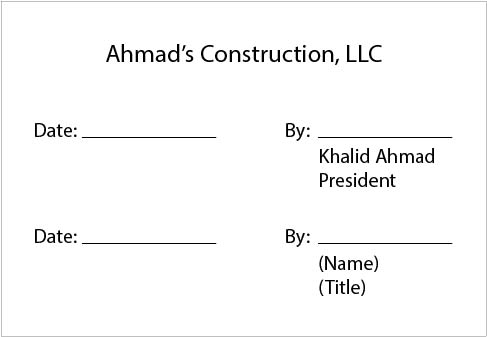

The signature block should name the business entity, then under the signature, the name and title of the person signing.

Figure 12.1 Signature Block Example

For example, Ahmad’s Construction, LLC By: __________ Khalid Ahmad, President

Each person signing the contract should date it next to his or her signature.

For partnerships, only general partners can sign a contract on the partnership’s behalf. For corporations, the president or chief executive officer is presumed to have authority to sign. For an organization or association, a board president would have authority, but it may require a vote of the governing board to approve the contract.

Minor Changes

Minor changes can be made directly to the contract. Both parties need to initial and date beside the changes to show that both parties agree to the change.

This is common when people buy property and the amount held in escrow changes (usually based on interest accrued) from the time the contract was prepared to the time it was signed.

Legal Terms

Courts interpret legal terms to have their legal meaning, regardless of the parties’ intent. Avoid using legal terminology unless all parties fully understand the legal definition and how it will be applied by the court. Again, simple and clear language is more effective than confusing legal jargon.

Allow for Flexibility

Contracts are usually the result of negotiation and the majority of them never end up in court. Contracts cannot cover every possible future situation but serve as a working document for the parties’ business relationship. When writing contracts, it is best to think of them as an agreement between parties that need some flexibility for the transaction(s) to take place. Life is dynamic and the best contracts give structure without being too rigid.

12.5 Concluding Thoughts

Writing valid contracts is an essential skill to be successful in business. Most contracts are not written by attorneys but they are critical to capturing an agreement between parties. Successful business people see contracts not just as a way to protect their interests, but also as a document that governs their business relationships with others. A well-written contract can be used throughout a transaction to guide the parties in their interactions and responsibilities.

Fundamentals of Business Law Copyright © 2020 by Melissa Randall is licensed under a Creative Commons Attribution 4.0 International License , except where otherwise noted.

Share This Book

- About This Book

- 1. Introduction to Project Management

- 1.1. Project Management Defined

- 1.2. Project Definition and Context

- 1.3. Key Skills of the Project Manager

- 1.4. Introduction to the Project Management Knowledge Areas

- 2. Project Profiling

- 2.1. Using a Project Profile

- 2.2. Project Profiling Models

- 2.3. Complex Systems and the Darnall-Preston Complexity Index

- 2.4. Darnall-Preston Complexity Index Structure

- 2.5. Using the Darnall-Preston Complexity Index to Measure Organizational Complexity

- 3. Project Phases and Organization

- 3.1. Project Phases and Organization

- 3.2. Project Phases and Organization

- 4. Understanding and Meeting Client Expectations

- 4.1. Including the Client

- 4.2. Understanding Values and Expectations

- 4.3. Dealing with Problems

- 5. Working with People on Projects

- 5.1. Working with Individuals

- 5.2. Working with Groups and Teams

- 5.3. Creating a Project Culture

- 6. Communication Technologies

- 6.1. Types of Communication

- 6.2. Selecting Software

- 7. Starting a Project

- 7.1. Project Selection

- 7.2. Project Scope

- 7.3. Project Start-Up

- 7.4. Alignment Process

- 7.5. Communications Planning

- 8. Project Time Management

- 8.1. Types of Schedules

- 8.2. Elements of Time Management

- 8.3. Critical Path and Float

- 8.4. Managing the Schedule

- 8.5. Project Scheduling Software

- 9. Costs and Procurement

- 9.1. Estimating Costs

- 9.2. Managing the Budget

- 9.3. Identifying the Need for Procuring Services

- 9.4. Procurement of Goods

- 9.5. Selecting the Type of Contract

- 9.6. Procurement Process

- 10. Managing Project Quality

- 10.1. Standards of Quality and Statistics

- 10.2. Development of Quality as a Competitive Advantage

- 10.3. Relevance of Quality Programs to Project Quality

- 10.4. Planning and Controlling Project Quality

- 10.5. Assuring Quality

- 11. Managing Project Risk

- 11.1. Defining Risk

- 11.2. Risk Management Process

- 11.3. Project Risk by Phases

- 11.4. Project Risk and the Project Complexity Profile

- 12. Project Closure

- 12.1. Project Closure

- Translations

Selecting the Type of Contract

Choose a sign-in option.

Tools and Settings

Questions and Tasks

Citation and Embed Code

LEARNING OBJECTIVES

- Identify factors that determine which type of contract to select.

- Describe the types of fixed cost contracts.

- Describe the types of cost reimbursable contracts.

- Understand progress payments and how to reduce problems in changing the contractors’ scope of work.

An agreement between the organization and an outside provider of a service or materials is a contract . To limit misunderstandings and make them more legally binding, contracts are usually written documents that describe the obligations of both parties and are signed by those with authority to represent the interests of the parties.

Because legal agreements often create risk for the parent organization, procurement activities are often guided by the policies and procedures of the parent organization. After the project management team develops an understanding of what portions of the project work will be outsourced and defines the type of relationships that are needed to support the project execution plan, the procurement team begins to develop the contracting plan . On smaller, less complex projects, the contract development and execution is typically managed through the parent company or by a part-time person assigned to the project. On larger, more complex projects, the procurement team can consist of work teams within the procurement function with special expertise in contracting. The contract plan defines the relationship between the project and the subcontractors (supplier, vendor, or partner) and also defines a process for making changes in the agreement to accommodate changes that will occur on the project. This change management process is similar to the change management process used with the project agreement with the project client.

The contracting plan of the project supports the procurement approach of the project. The following are some factors to consider when selecting the type of contract:

- The uncertainty of the scope of work needed

- The party assuming the risk of unexpected cost increases

- The importance of meeting the scheduled milestone dates

- The need for predictable project costs

There are several types of contracting approaches and each supports different project environments and project approaches. The legal contracts that support the procurement plan consist of two general types of contract: the fixed-price and the cost-reimbursable contracts, with variations on each main type.

Fixed-Price Contracts

The fixed-price contract is a legal agreement between the project organization and an entity (person or company) to provide goods or services to the project at an agreed-on price. The contract usually details the quality of the goods or services, the timing needed to support the project, and the price for delivering goods or services. There are several variations of the fixed price contract. For commodities and goods and services where the scope of work is very clear and not likely to change, the fixed price contract offers a predictable cost. The responsibility for managing the work to meet the needs of the project is focused on the contractor. The project team tracks the quality and schedule progress to assure the contractors will meet the project needs. The risks associated with fixed price contracts are the costs associated with project change. If a change occurs on the project that requires a change order from the contractor, the price of the change is typically very high. Even when the price for changes is included in the original contract, changes on a fixed-price contract will create higher total project costs than other forms of contracts because the majority of the cost risk is transferred to the contractor, and most contractors will add a contingency to the contract to cover their additional risk.

Fixed-price contracts require the availability of at least two or more suppliers that have the qualifications and performance histories that assure the needs of the project can be met. The other requirement is a scope of work that is most likely not going to change. Developing a clear scope of work based on good information, creating a list of highly qualified bidders, and developing a clear contract that reflects that scope of work are critical aspects of a good fixed-priced contract.

If the service provider is responsible for incorporating all costs, including profit, into the agreed-on price, it is a fixed-total-cost contract . The contractor assumes the risks for unexpected increases in labor and materials that are needed to provide the service or materials and in the materials and timeliness needed.

The fixed-price contract with price adjustmen t is used for unusually long projects that span years. The most common use of this type of contract is the inflation-adjusted price. In some countries, the value of its local currency can vary greatly in a few months, which affects the cost of local materials and labor. In periods of high inflation, the client assumes risk of higher costs due to inflation, and the contract price is adjusted based on an inflation index. The volatility of certain commodities can also be accounted for in a price adjustment contract. For example, if the price of oil significantly affects the costs of the project, the client can accept the oil price volatility risk and include a provision in the contract that would allow the contract price adjustment based on a change in the price of oil.

The fixed-price with incentive fee is a contract type that provides an incentive for performing on the project above the established baseline in the contract. The contract might include an incentive for completing the work on an important milestone for the project. Often contracts have a penalty clause if the work is not performed according to the contract. For example, if the new software is not completed in time to support the implementation of the training, the contract might penalize the software company a daily amount of money for every day the software is late. This type of penalty is often used when the software is critical to the project and the delay will cost the project significant money.

If the service or materials can be measured in standard units, but the amount needed is not known accurately, the price per unit can be fixed—a fixed unit price contract . The project team assumes the responsibility of estimating the number of units used. If the estimate is not accurate, the contract does not need to be changed, but the project will exceed the budgeted cost.

Figure 9.10 Table of Fixed Price Contracts and Characteristics

Cost-reimbursable contracts.

In a cost-reimbursable contract , the organization agrees to pay the contractor for the cost of performing the service or providing the goods. Cost-reimbursable contracts are also known as cost-plus contracts . Cost-reimbursable contracts are most often used when the scope of work or the costs for performing the work are not well known. The project uses a -reimbursable contract to pay the contractor for allowable expenses related to performing the work. Since the cost of the project is reimbursable, the contractor has much less risk associated with cost increases. When the costs of the work are not well known, a cost-reimbursable contract reduces the amount of money the bidders place in the bid to account for the risk associated with potential increases in costs. The contractor is also less motivated to find ways to reduce the cost of the project unless there are incentives for supporting the accomplishment of project goals.

Cost-reimbursable contracts require good documentation of the costs that occurred on the project to assure that the contractor gets paid for all the work performed and to assure that the organization is not paying for something that was not completed. The contractor is also paid an additional amount above the costs. There are several ways to compensate the contractor.

- A cost-reimbursable contract with a fixed fee provides the contractor with a fee, or profit amount, that is determined at the beginning of the contract and does not change.

- A cost-reimbursable contract with a percentage fee pays the contractor for costs plus a percentage of the costs, such as 5% of total allowable costs. The contractor is reimbursed for allowable costs and is paid a fee.

- A cost-reimbursable contract with an incentive fee is used to encourage performance in areas critical to the project. Often the contract attempts to motivate contractors to save or reduce project costs. The use of the cost reimbursable contract with an incentive fee is one way to motivate cost reduction behaviors.

- A cost-reimbursable contract with award fee reimburses the contractor for all allowable costs plus a fee that is based on performance criteria. The fee is typically based on goals or objectives that are more subjective. An amount of money is set aside for the contractor to earn through excellent performance, and the decision on how much to pay the contractor is left to the judgment of the project team. The amount is sufficient to motivate excellent performance.

On small activities that have a high uncertainty, the contractor might charge an hourly rate for labor, plus the cost of materials, plus a percentage of the total costs. This type of contract is called time and materials (T&M) . Time is usually contracted on an hourly rate basis and the contractor usually submits time sheets and receipts for items purchased on the project. The project reimburses the contractor for the time spent based on an agreed-on rate and the actual cost of the materials. The fee is typically a percentage of the total cost.

Time and materials contracts are used on projects for work that is smaller in scope and has uncertainty or risk and the project, rather than the contractor, assumes the risk. Since the contractor will most likely include contingency in the price of other types of contracts to cover the high risk, T&M contracts provide lower total cost to the project.

Figure 9.11 Table of Contract Types and Characteristics

To minimize the risk to the project, the contract typically includes a not-to-exceed amount, which means the contract can only charge up to the agreed amount. The T&M contract allows the project to make adjustments as more information is available. The final cost of the work is not known until sufficient information is available to complete a more accurate estimate.

PROGRESS PAYMENTS AND CHANGE MANAGEMENT

Vendors and suppliers usually require payments during the life of the contract. On contracts that last several months, the contractor will incur significant cost and will want the project to pay for these costs as early as possible. Rather than wait until the end of the contract, a schedule of payments is typically developed as part of the contract and is connected to the completion of a defined amount of work or project milestones. These payments made before the end of the project and based on the progress of the work are called progress payments . For example, the contract might develop a payment schedule that pays for the development of the curriculum, and payment is made when the curriculum is completed and accepted. There is a defined amount of work to be accomplished, a time frame for accomplishing that work, and a quality standard the work must achieve before the contractor is paid for the work.

Just as the project has a scope of work that defines what is included in the project and what work is outside the project, vendors and suppliers have a scope of work that defines what they will produce or supply to the company. (Partners typically share the project scope of work and may not have a separate scope of work.) Often changes occur on the project that require changes in the contractor’s scope of work. How these changes will be managed during the life of the project is typically documented in the contract. Capturing these changes early, documenting what changed and how the change impacted the contract, and developing a change order (a change to the contract) are important to maintaining the progress of the project. Conflict among team members will often arise when changes are not documented or when the team cannot agree on the change. Developing and implementing an effective change management process for contractors and key suppliers will minimize this conflict and the potential negative effect on the project.

KEY TAKEAWAYS

- Contract selection is based on uncertainty of scope, assignment of risk, need for predictable costs, and the importance of meeting milestone dates.

- Total fixed cost is a single price where the scope is well defined. A fixed price with incentive contract offers a reward for finishing early or under budget or a penalty for being late. A fixed price with adjustment allows for increases in cost of materials or changes in currency values. A fixed unit price contract sets a price per unit, but the exact number of units is not known.

- In a cost reimbursable contract, the project pays for costs. A cost plus fixed fee contract assures the contractor of a known fee. A cost plus percentage fee calculates the fee as a percentage of the costs. A cost plus incentive fee sets goals for the contractor to achieve that would result in a bonus. A cost plus award fee is similar, but the goals are more subjective. Time and materials contracts pay for costs plus an hourly rate for the contractor’s time.

- Payments to vendors and suppliers are required during the course of the project. A change management system needs to be in place when dealing with vendors and suppliers.

This content is provided to you freely by EdTech Books.

Access it online or download it at https://edtechbooks.org/pm4id/9-5-selecting-the-type-of-contract .

IMAGES

VIDEO

COMMENTS

A ___ (1)___ contract is a contract that has the necessary contractual elements: agreement, ___ (2)___ , legal capacity of the parties, and a legal purpose. A (n) ___ (3)___ contract occurs when a contract exists, but it cannot be enforced because of a legal defense. (1) valid. (2) consideration. (3) unenforceable.

If one party has the legal option not to perform a contract and to have the contract declared unenforceable, the contract is called a _____ contract. a. valid b. voidable c. void d. quasi

A (n) _____ contract occurs when a contract exists, but it cannot be enforced because of a legal defense. valid, consideration, unenforceable. Social Science. Law. Civil Law. fin 240 kaplowitz worksheet 11.2: types of contracts.

View 11.2.pdf from AA 1Assignment: Worksheet 11.2: Types of Contracts Assignment Score: 0.00% Save Questions Submit Assignment for Grading cl2bl14h.Ch11-2 Question 1 of 1 1. Check My Work 1. Match

View 11.2.pdf from AA 1Assignment: Worksheet 11.2: Types of Contracts Assignment Score:... Worksheet 10.1- An Overview of Contract Law & Elements of a Contract.docx Miami Dade College, Miami

In this worksheet, we will discuss the different types of contracts that are commonly used in business transactions. 1. Express Contracts. Express contracts are written or oral agreements where all terms and conditions of the contract are explicitly stated. These types of contracts are legally binding and enforceable in court. 2. Implied Contracts

This worksheet and quiz let you practice the following skills: Information recall - access the knowledge you've gained regarding the six elements of a contract. Distinguishing differences ...

View Homework Help - Worksheet 11.1 Contracts, Sources of Contract Law, Types of Contracts, Consumer Credit Contracts.doc from BUL 3130 at College of Central Florida, Citrus. Worksheet 11.1: ... 23092020 Assignment Print View. document. See more documents like this. Scroll to top. Company. About Us; Careers;

A contract that has been made, but one or more parties has not yet fulfilled its obligations. Unilateral contract. A contract in which one party makes a promise that the other party can accept only by actually doing something. Bilateral contract. A contract in which each party has made a promise to do something.

Warranties. A warranty is a guarantee on the good that comes as part of the sales contract, but contract law treats warranties as an additional form of contract that binds the selling party to undertake a certain action. Typically, the selling party has an obligation to provide a product that achieves a specified task, or to deliver a service ...

Define assignment of contract, the parties of assignment of contract, the types of assignment, and assignable contracts. Explore these definitions as well as examples of each. Updated: 11/21/2023

2. Contract law is necessary to ensure compliance with a promise or to entitle an innocent party to some form of relief. 4. The element of is of key importance in determining if a contract has been formed. It is determined by the theory of contracts. Hide Feedback Correct Check My Work Feedback Correct. An Overview of Contract Law 3. A contract is an agreement.

10.5 Defenses to Contracts; 10.6 Assignment, Delegation, and Third Party Beneficiaries; 10.7 Parol Evidence Rule; 10.8 Remedies; 10.9 Concluding Thoughts; 11. Sales Contracts. ... Termination procedures should be as specific as possible and include how much notice needs to be given, the type of notice required, and whether there is a time ...

may not; substantially performed. Which of the following is NOT a requirement for an implied contract? - The defendant had a chance to reject the service or property but did not do so. - The defendant had no chance to reject service or property furnished by the plaintiff. - The plaintiff expected to be paid and the defendant knew, or should ...

Chapter 20 - The Formation of Sales and Lease Contracts. The Scope of Articles 2 (Sales) and 2A (Leases) UCC Article 2 governs sales, and contracts for the sale of goods, pursuant to which a seller transfers to a buyer Title (ownership) to Goods, including Growing crops and timber to be harvested Fixtures that can be removed without harming the real property to which they are attached Oil ...

Fixed-Price Contracts. The fixed-price contract is a legal agreement between the project organization and an entity (person or company) to provide goods or services to the project at an agreed-on price. The contract usually details the quality of the goods or services, the timing needed to support the project, and the price for delivering goods ...

INTERPRETATION OF CONTRACTS NOTE This document is the Worksheet for INTERPRETATION OF CONTRACTS. The. AI Homework Help. Expert Help. Study Resources. ... Chapter 11: Interpretation of Contracts [Once we have established the types of terms and obligations present in the contract ... This question was created from ANTH 101_Check-In Assignment # 2 ...

Types of Leases Under Art 2A. o Consumer leases: o Finance leases. Formation of Sales and Lease Contracts. o Offer: at common law once a valid offer is unequivocally accepted, a binding contract is formed o UCC is more flexible and allows open pricing, payment, and delivery terms. Offer: Open Terms

fin 240 kaplowitz worksheet 11.1: an overview and elements of a contract. 14 terms. jasminrhyle. Preview. chapter 11 bus law. 17 terms. workhardplayharder3. Preview. Business Law - Chapter 14. ... While verbal agreements are often contracts, some types of contracts must be in writing to be enforceable. Legality. The contract must be for a ...

Worksheet 111 Contracts Sources of Contract Law Types of Contracts Consumer from BUL 3130 at College of Central Florida, Citrus. AI Homework Help. ... Worksheet 11.1: Contracts, Sources of Contract Law, Types of Contracts, Consumer Credit Contracts ... Assignment 4.docx. homework. 52534-Monica-BSBLED401-Re Submission 2.pdf.

16.403-1 Fixed-price incentive (firm target) contracts. Description. A fixed-price incentive (firm target) contract specifies a target cost, a target profit, a price ceiling (but not a profit ceiling or floor), and a profit adjustment formula. These elements are all negotiated at the outset.

True. Study with Quizlet and memorize flashcards containing terms like 1. A contract is a promise of performance that can be enforced by law., 2. It is difficult to determine which contracts are UCC contracts and which are common law contracts., 3. The Restatement (Second) of Contracts addresses common law contracts. and more.

Worksheet 11.2- E-Contracts 1. The basic requirements for an electronic contract are different than those for a. AI Homework Help. ... Worksheet 10.2 - Types of Contracts & Quasi Contracts & Interpretation of Contracts.docx. ... View 12.2.pdf from AA 1Assignment: Worksheet 12.2: Agreement in E-Contracts Assignment... 14.2.pdf. No School. AA 1 ...