- Programming

- Admin & EIM

- BI & BW

- FICO & BPC

- CRM & Sales

- Introductions

- SAP PRESS Subscription

SAP Controlling: Assigning and Checking Cost Component Structures

In SAP Controlling, a company code determines which cost component structure the standard cost estimate uses, which ensures that the same cost component structure is used for all plants and costing variants in a company code.

If you use different cost component structures in different plants, the standard cost estimate in one plant cannot access the results of standard cost estimates in another plant. You cannot transfer costing data for materials transferred from one plant to another.

For other cost estimates, the cost component structure is determined through the combination of company code , plant, and costing variant.

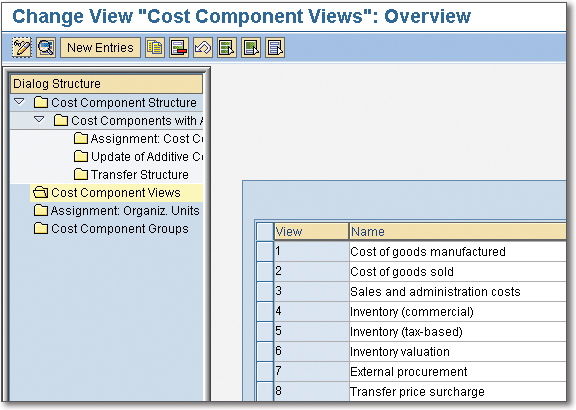

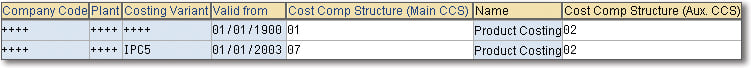

To access assignment of organizational units, double-click Assignment: Organiz. Units shown in the first figure below. Once selected, you should see the second figure display.

In this screen, you can assign cost component structures to organizational units such as Company Code , Plant , and Costing Variant . Some entries in this example employ masking. In the Plant column, both rows have the entry ++++ , which is a shorthand method of assigning cost component structures to all plants. You can employ the same technique of masking in many other screens throughout the system.

Specific entries always take priority over masked entries. Here’s an example:

In the Costing Variant column shown above, the row with the specific IPC5 entry takes priority over rows with masked entries in the same column. When you create a cost estimate for any company code with costing variant IPC5, the system will use main cost component structure 07 and auxiliary cost component structure 02. All other cost estimates for these plants will use main cost component structure 01 and auxiliary cost component structure 02.

Now that we’ve discussed assigning organizational structures in general, let’s look first at assigning the cost component structure and then checking this assignment.

Assigning Organizational Units with Cost Component Structures in SAP

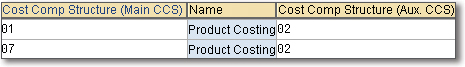

The main cost component split is the principal cost component split used by a standard cost estimate to update a standard price. The main cost component split can be for COGM or for a primary cost component split. You assign the main cost component structure in the above figure. You’ll need to widen the columns so you can see the entire text in the column headings as shown below.

You assign the main cost component structure in the first column and the auxiliary cost component structure in the last column. You don’t have to assign an auxiliary cost component structure, but you do need to assign a main cost component structure to each row you define in this screen.

You can use the auxiliary cost component structure in parallel to the main cost component structure to allow comparisons and analysis. You can use the auxiliary cost component structure to analyze costs in cost estimates and CO-PA. When viewing a cost estimate with an activated auxiliary cost component structure, you can switch between the main and auxiliary cost component structures.

You assign an auxiliary cost component structure to an organizational unit in the last column in the figure above. Follow these additional steps needed to activate the auxiliary cost component structure:

1. Create an auxiliary cost component structure.

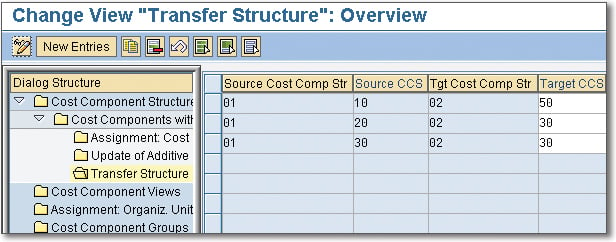

2. Create a transfer structure mapping the auxiliary cost components to the main cost components as shown below:

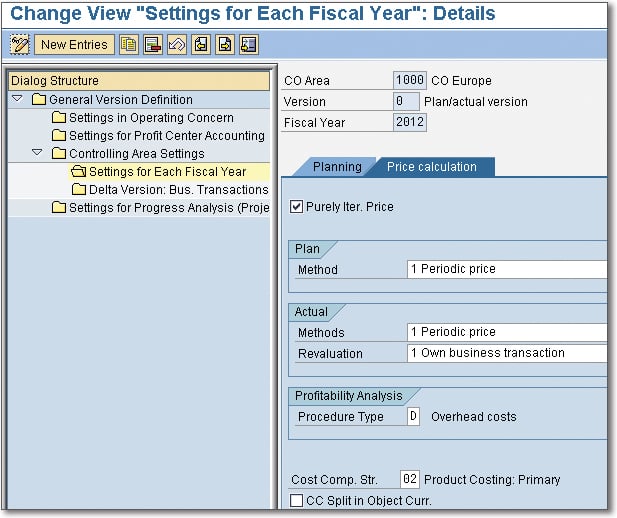

3. Assign the auxiliary cost component structure to the plan version per fiscal year in the Price calculation tab shown below.

4. Assign the auxiliary cost component structure to organizational units. See below.

5. Automatically calculate the plan activity price.

You don’t have to enter an auxiliary cost component structure. In most cases, the COGM cost component structure alone provides sufficient cost component reporting. The auxiliary cost component structure is available if you need additional reporting on primary costs, especially in some European implementations.

Next, we’ll look at a quick way to check assignment to organizational units.

Checking the Assignment to Organizational Units

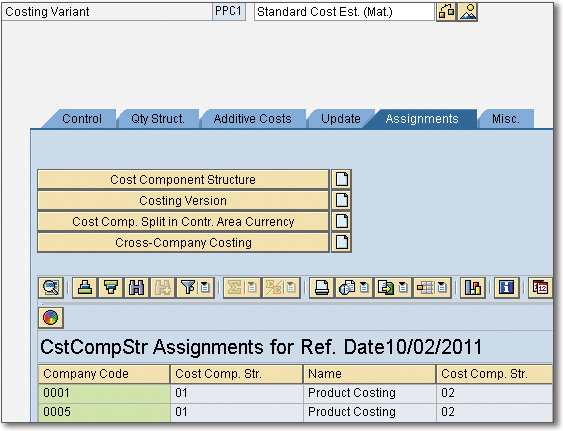

You can check the assignment of cost component structures to organizational units by inspecting the costing variant. Take costing variant PPC1 as an example. Display costing variant PPC1 with Transaction OKKN or double-click the costing variant in the Costing Data tab of a cost estimate.

Select the Assignments tab and click the Cost Component Structure button to display the screen shown below.

The main cost component structure assigned to company codes 0001 and 0005 is 01, and the auxiliary cost component structure assigned is 02.

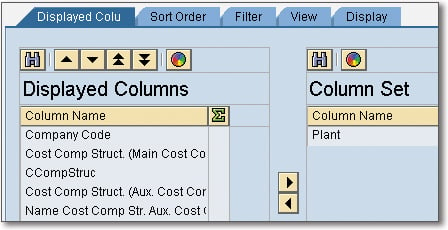

You can also assign a cost component structure to a plant. To add “Plant” as a column in the previous figure, click the down-pointing arrow to the right of the grid icon and select Change Layout to display this screen:

Double-click Plant to move it across to Displayed Columns and press (Enter) to display the screen shown below.

TIP : Click the Save icon before pressing (Enter) to save this layout.

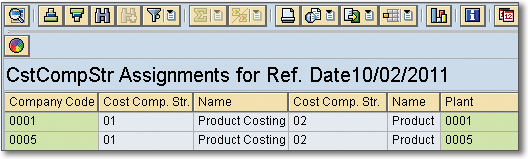

You can now see the Plant column in the cost component structure assignments for the costing variant.

Notice the SBO Explorer (circle) icon available with Enhancement Package (EHP) 5. This icon allows you direct access to SAP BusinessObjects Explorer.

This blog post summarized the process for assigning organizational units to cost component structures in SAP Controlling. After assigning these units, you learned how to check them. You also read a discussion of both the main cost component structure and the auxiliary cost component structure.

Editor’s note: This post has been adapted from a section of the book Product Cost Controlling with SAP by John Jordan.

Recommendation

Looking for a comprehensive guide to product costing in SAP (SAP CO-PC)? With this best-seller, you’ll begin with a breakdown of how to manage master data and configure settings in SAP CO. Next, you’ll learn the nitty-gritty details of integrated planning, from creating cost estimates to handling planned costs, actual costs, and final settlements. Contains coverage of SAP HANA, current trends in product cost controlling, and other new functionalities!

SAP PRESS is the world's leading SAP publisher, with books on ABAP, SAP S/4HANA, SAP CX, intelligent technologies, SAP Business Technology Platform, and more!

Latest Blog Posts

Planning and Budgeting for Investment Controlling with SAP S/4HANA

How Has Controlling Changed with SAP S/4HANA?

The official sap press blog.

As the world’s leading SAP publisher, SAP PRESS’ goal is to create resources that will help you accelerate your SAP journey. The SAP PRESS Blog is designed to provide helpful, actionable information on a variety of SAP topics, from SAP ERP to SAP S/4HANA. Explore ABAP, FICO, SAP HANA, and more!

SAP Blog Topics

- Administration

- Business Intelligence

- Human Resources

Blog curated by

- Legal Notes

- Privacy Policy

- Terms of Use

- Guest Posting

- +91-9556432150

- [email protected]

Cost Elements in SAP – Know the Types and How to Create it – An informative Guide

Published by pradeep on september 18, 2020 september 18, 2020.

Last Updated on March 27, 2023 by Pradeep

What Cost Elements in SAP ?

Cost Elements in the SAP system create a link between Finance posting with Cost Object like Cost Center, Order, Profitability Segment, etc.

In this blog, we will learn how to create Cost Elements in SAP and differentiate between the various cost element types to use them correctly.

Although Cost Element Accounting does not offer much functionality. Still, an organization must implement it for its business in order to use all the other Controlling Subcomponents .

Master Data Cost Elements

A key aspect of the Cost element is Master Data Cost Element . Here we create primary and secondary cost elements.

At the beginning of Cost Element Accounting, we first learn how to create cost elements. Further, we would discuss the difference between the cost element types and categories.

Primary and Secondary Cost Elements in SAP

Cost elements are separated into primary cost elements and secondary cost elements. Since both have their own use and importance in SAP Controlling . Thus, you should understand both of them carefully.

Primary Cost Elements

Primary cost elements are created based on expense accounts. They always have the same number as the expense account. In other words, there is a 1:1 relationship between the expense account and primary cost elements.

In SAP ERP Financial Accounting on expense accounts, we will post all the entries in Controlling on the primary cost elements.

To clarify, if a cost element exists for this expense account, we must first create it as a primary cost element so that it can reflect the postings in the controlling module.

Read Related: Interview Questions to Primary Cost Elements

Secondary Cost Elements

Secondary cost elements are created in controlling and are used for all activities that are executed in controlling.

Certainly, these Secondary Cost elements do not cause any change in any values in the Financial Accounting module.

Importantly, the balance of the secondary cost element is always zero. For example, it includes cost allocations, order settlements, and so on.

Lastly, for the secondary cost element, no General Ledger exists.

Cost Elements Categories – Primary and Secondary

We categorize the cost element by a cost element category. There are different cost element categories for primary and secondary cost elements.

Below is a list of cost element categories available for Primary and Secondary Cost Elements.

It’s essential to assign the correct cost element category to the cost elements. Hence it guarantees an integrated value chain with correct results in Controlling SAP .

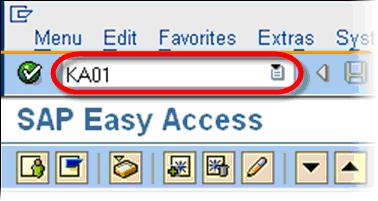

Create Primary Cost Element – KA01

Create Secondary Cost Element – KA06

Also Read:- Changes in SAP Controlling in S/4HANA

Also learn: The concept of Cost Object Controlling in SAP

Creation of Cost Elements in SAP

Depending on your process for the master data creation, you can decide whether you want to create cost elements manually or automatically.

Manual Creation of Cost Elements in SAP

If we create the cost elements manually, we need to define a process. In this process, the person who creates the expense accounts informs you about the new account before executing any posting. Otherwise, you won’t be able to see this posting in SAP Controlling.

Automatic Creation of Cost Elements in SAP

If you want to create cost elements automatically, you need to do some configuration .

So here, the first setting that we do is in the Chart of Accounts .

Further, we need to indicate those cost elements which the system creates automatically.

Use Transaction Code (TCode) – OB13

Steps to Create Cost Elements Automatically

Next IMG => Controlling => Cost Element Accounting => Master data => Cost Elements => Automatic Creation of Primary and Secondary Cost Elements => Make Default Settings

Further, we will make the default settings via the chart of accounts, which is assigned to your controlling area.

From now on, the cost element will be created automatically with the assigned cost element category. This is when we create a General Ledger account in the range of intervals.

Creation of Batch Job

SAP also enables you to create cost elements with a batch job, which means you also have to maintain the default settings.

You can enter intervals or single expense General ledger accounts . Likewise, you can enter account numbers that don’t exist as General ledger accounts and create them as secondary cost elements.

However, for this, you need to assign a cost element category for the secondary cost element category for the cost element.

Cost Elements Batch Input Session Creation TCode for – OKB3

Related: Cost Center in SAP

Cost Element Groups

You can place cost elements into cost element groups. These groups are often used in reporting to define assessment cycles, settlement profiles many more.

I recommend that you use cost element groups as much as possible in the configuration. Because in this way you can easily adjust the settings at this time, such as changing the cost element groups.

Cost Elements Groups TCode – KAH1

Reporting Options

Reporting options for Cost Element Accounting are quite limited within standard SAP. This is because we require them only for reconciliation purposes.

Cost Element Report TCode – S_SL0_21000007

Also Read: SAP CO Interview Questions

With this article, you understood the key uses of cost elements and where and how we utilize them in the SAP ERP system of a business.

The components of cost elements i.e. primary and secondary play a key role in its functioning of it and their categorization makes the job of the SAP consultant easier.

The cost elements also play a similarly important role in the SAP S/4HANA version too. It adds even more features and functionalities with the enhanced software.

However I advise if you are new to this subject, then first learn the Cost element in SAP ECC thoroughly and then upgrade further to S/4HANA Finance.

Watch the Related Video on: Cost Element Accounting in SAP FICO

Related Posts

SAP Career for Freshers- What is the right process?

How is SAP Career for Freshers? SAP Career for Freshers seems challenging initially. If you’ve recently completed SAP training, specifically in SAP finance, and you find yourself applying for various jobs without success. Or perhaps Read more…

Tax on Sale Purchase in SAP S/4HANA

SAP S/4 HANA covers the business processes like Procure-to-Pay, Order-to-Cash and record-to-report. To understand the functioning of tax on sale purchase in SAP we need to know all tax-relevant steps within the end-to-end scenarios. Additionally, Read more…

SAP New GL Activation & Migration Process

SAP New GL Activation and Migration From Classic GL During a new installation, the New G/L accounting in the standard system is set to active. While the use of classic General Ledger is theoretically also Read more…

- SAP Training Blog ›

S/4 HANA Finance - Dealing with SAP Cost Elements

.png)

by Janet Salmon

This blog post about S4HANA Cost Elements is from our friends at SAPexpert - the source for trusted SAP tutorials, tips, and training content.

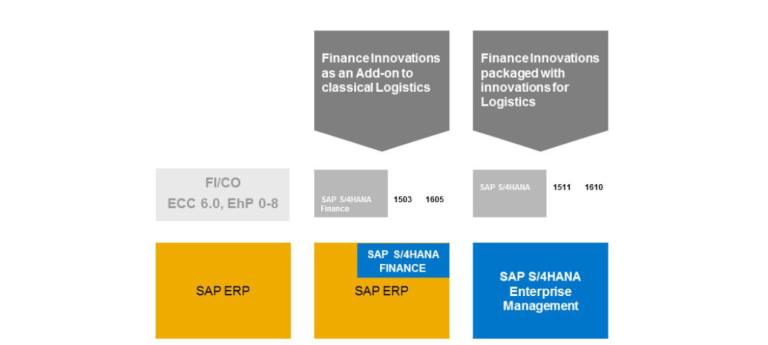

With S/4HANA Finance , the universal journal includes a single field account that covers both the general ledger (G/L) account and the cost element. As companies migrate to S/4HANA Finance, the system merges their existing G/L accounts and cost elements.

The transactions for the creation and maintenance of cost elements become obsolete, replaced by a single transaction for account maintenance. However, this technical change does not mean that the idea of a cost element has disappeared with S/4HANA Finance. Learn what changes come with S/4HANA Finance and what remains as before.

Key Concept

The cost element design within the controlling area is a vital part of setting up your controlling (CO) system. In S/4HANA Finance, as the accounts and cost elements are merged, the following changes result:

- The primary cost elements represent the profit-and-loss accounts used to classify your journal entries. In all accounting approaches, you use cost elements to represent wages and salaries, material expenses, depreciation, and many others. If you use account-based profitability analysis (CO-PA) or if you have make-to-order processes requiring results analysis and settlement, you also use cost elements for revenues or sales deductions. In S/4HANA Finance, the G/L account and the primary cost elements merge into one.

- The secondary cost elements record the value flows within CO, such as the charging of utility costs from a support cost center to an operational cost center or the charging of machine-hours to a production order. Additional examples include the charging of consulting time to a Work Breakdown Structure (WBS) element or the settlement of research and development costs to CO-PA. In S/4HANA Finance, accounts are created for every secondary cost element so that all value flows are visible in the universal journal and thus in reports such as the trial balance.

A Controlling (CO) implementation typically starts with the decision regarding which profit-and-loss (P&L) accounts require primary cost elements and which don’t. There are typically a handful of P&L accounts that do not need to be reflected in CO—either because they have no impact on the operational business or are needed for a particular purpose, such as recording work in process (WIP).

However, for the majority of P&L accounts, the implementation team creates a separate primary cost element for each account. It makes sure that the correct CO account assignment can be updated as each journal entry is posted. This approach allows capturing salary postings by cost center or material expense postings by Work Breakdown Structure (WBS) element.

All these changes with S/4HANA Finance, where the accounts and cost elements merge, and the master data settings for the cost elements become part of the general ledger (G/L) account master.

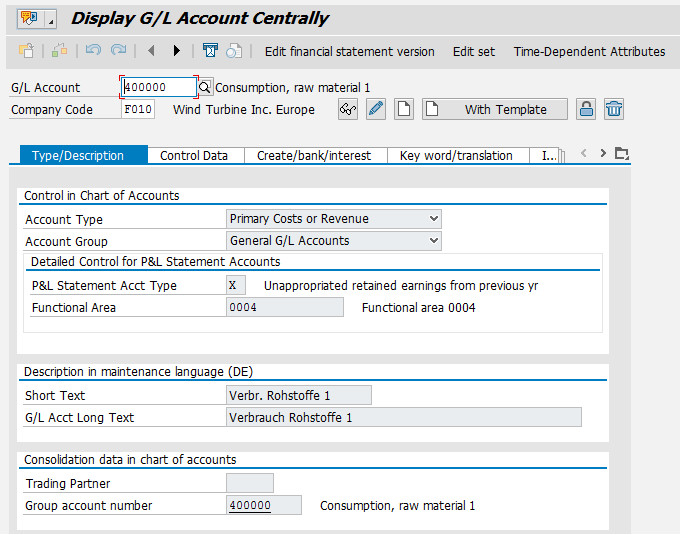

This means that where you used to create primary cost elements using transaction code KA01, you now are directed to transaction code FS00 (Display G/L Account Centrally). While this all sounds quite radical, the fundamental nature of the account does not change, and you continue to use the field status groups to control which account assignments are valid for each business transaction as before.

The merge of accounts and cost elements does have an impact on your authorization profiles. You can create accounts with no CO impact if you have authorization for G/L account maintenance (these are typically given by account, company code, and account type). However, if you want to create an account that is simultaneously a cost element, you need authorization for both the G/L account and the cost element (authorization object K_CSKB).

The combination also means that you need to keep the period locks in sync and make sure that the account types that allow postings match the CO business transactions that allow postings at any given time.

Setting Up Your Accounts in S/4 HANA Finance

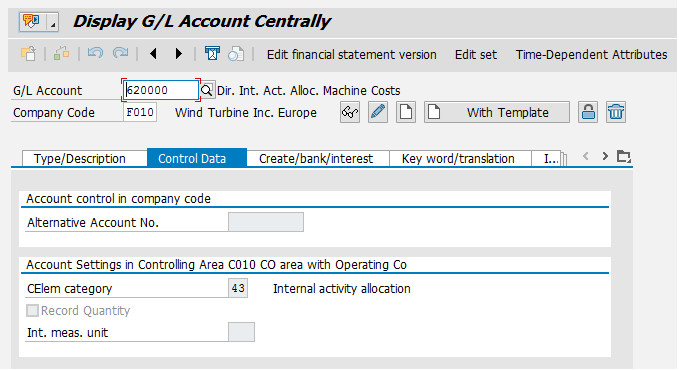

Figure 1 shows the account master data in S/4HANA Finance (transaction code FS00), which is a combination of the account maintenance and the previous cost element maintenance transactions (transaction code KA01-3).

Figure 1: G/L account showing the account type for the primary cost element

The main change to this screen is that you can choose between P&L accounts that do not require a cost assignment by selecting the account type Nonoperating Expense or Income and P&L accounts that are associated with a CO account assignment by selecting the Account Type Primary Costs or Revenue.

In my example, you have a raw material expense account, and any raw material posting to this account needs to be assigned to a CO account, such as a cost center, order, or WBS element. If you are migrating, your field status groups will already be set up to include these CO account assignments.

As you go through the screens, notice that the old Default Assignment tab in the cost element master record is gone, so the only way to set up the default account assignments is to use transaction code OKB9 or follow IMG menu path Controlling > Cost Center Accounting > Actual Postings > Manual Actual Postings > Edit Account Assignment. If you have entered default account assignments in your cost element master data, the migration process creates entries in table TKA3A for these default assignments. You can check them using transaction code OKB9.

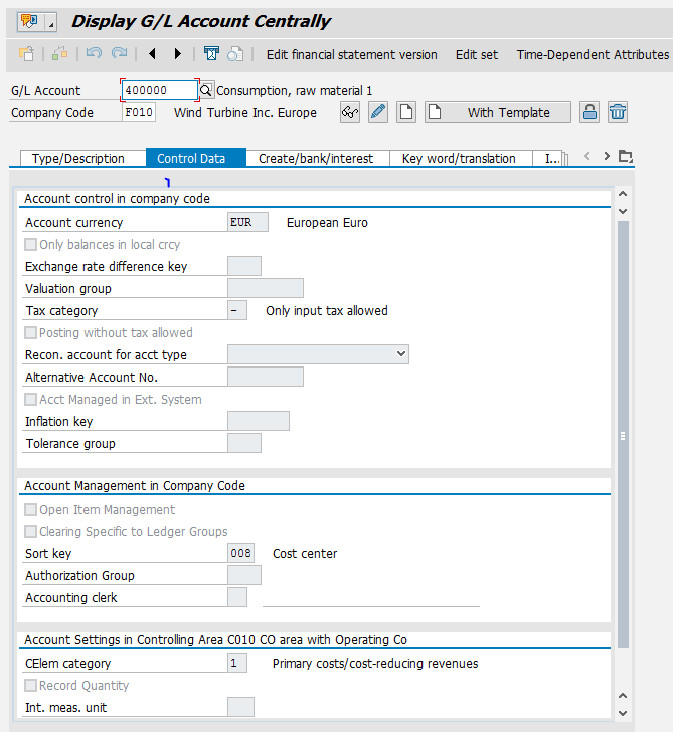

The account type alone does not define how the account is used in CO. This is done by assigning a cost element category to each account. To check the cost element category, select the Control Data tab as shown in Figure 2 .

In this tab, you see that your raw material account has the cost element category 1 (Primary costs/cost reducing revenues). (This value appears in the CElem category field.) You want similar accounts or cost elements for wages and salaries, asset depreciation, material movements, and many others.

You can also use cost elements of category 3 and 4 if you work with accrual postings. If you are using account-based profitability analysis (CO-PA), you also want cost elements of category 11 for revenue and category 12 for sales deductions.

You also use these cost element categories if you have make-to-order processes requiring results analysis, where revenue or direct costs are assigned to a project or sales order. If you have settlement processes that capitalize expenses as either asset under construction or finished goods inventory, you also want cost elements of category 22 for external settlement.

Note that the old restriction that WIP accounts must not be cost elements continue to apply (in other words, the account type for the WIP offsetting entry must be Nonoperating Expense or Income).

With the settings for the primary cost elements made to the relevant accounts, it’s time to think about the secondary cost elements. Before I go into detail here, it’s worth recalling how a primary cost element differs from a secondary cost element. A primary cost element is an extension of a P&L account, and the offsetting entry is always to a balance sheet account (so a salary expense will offset to accounts payable, a revenue posting will offset to accounts receivable, and so on).

A posting to a secondary cost element balances to zero, but under the same account. Hence, a direct activity allocation credits the cost center and debits the order under the same cost element.

The switch is in the sender (here cost center) and the receiver (the order), and this, in turn, may trigger a shift in profit centers or functional areas, all of which are captured as partner relationships in the universal journal.

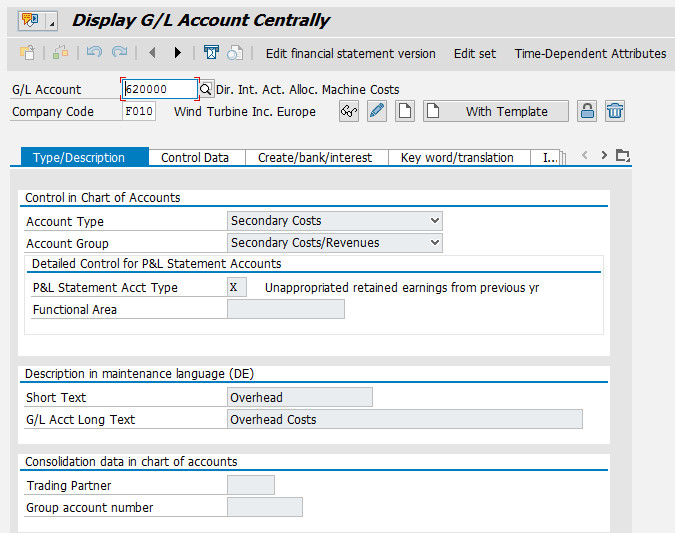

In the past, secondary cost elements were created using transaction code KA06, but in S/4HANA Finance, you again are redirected to transaction code FS00 (Display G/L Account Centrally). During migration, secondary cost elements are migrated into the G/L account tables (SKA1, SKB1, and SKAT) for all company codes assigned to the CO area. Figure 3 shows the G/L account master data for a secondary cost element for the allocation of machine costs.

Again, you can see the cost element categories by selecting the Control Data tab. Figure 4 shows that this cost element can be used for internal activity allocations (in other words, to charge machine costs from a cost center to orders or projects).

As you think about your secondary cost element categories, think about these sender-receiver relationships. These relationships give you a cost element category of 43 for internal activity allocation (as shown in Figure 4 ), 21 for internal settlement, 41 for overhead rates, and 42 for assessment. You’ll see an example of such a sender-receiver relationship and the associated value flow when I explain how a secondary cost element appears in the trial balance at the end of this article.

If you’ve been working with the classic General Ledger, these movements are recorded in the reconciliation ledger if they cross-company code boundaries and are moved to the classic General Ledger at the period close using transaction code KALC. If you’ve been working with the SAP General Ledger, you probably have set up real-time integration to create journal entries for these movements. Both these approaches are obsolete in S/4HANA Finance.

You always see such movements reflected in the universal journal so that you won’t need a reconciliation ledger. Because the secondary cost elements are now G/L accounts, you won’t need to map the CO business transactions to reconciliation accounts in FI.

The secondary cost elements appear in your financial accounts whenever you perform the transactions listed above, provided that you include the new accounts in your financial statement versions. You can find the link by clicking the Edit financial statement version button shown in the ribbon in Figure 4 .

If you are building up your financial statement version from scratch, you can still use transaction code KA23 (Cost Elements: Master Data List) to list all the cost elements and their attributes in your system. This makes grouping them for reporting purposes much easier than trying to use the F4 help.

Other secondary cost elements exist that don’t represent such sender-receiver relationships. If you work with Result Analysis, you still need cost elements of type 31 (order/project results analysis). If you are working with Project System, you still potentially need cost elements of types 50, 51, 52 (project-related incoming orders), and 61 (earned value).

Working with Accounts and Cost Elements in S/4 HANA Finance

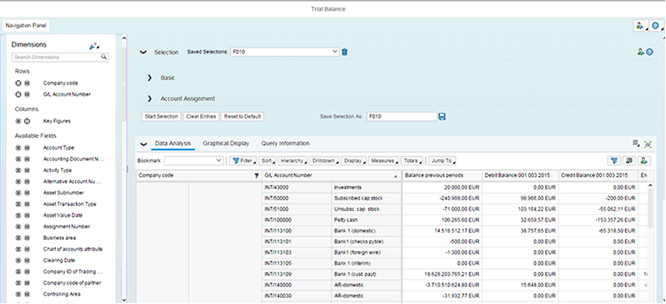

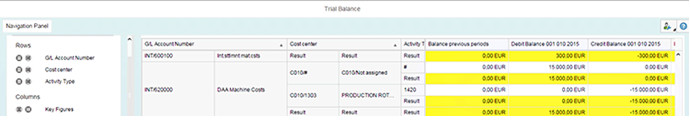

Figure 5 shows a sample trial balance in S/4HANA Finance. You see the classic view showing the balances by company code and account on the right, but also the option to drill-down by Account Type, Accounting Document, and Activity Type on the left.

This view enables you to drill down by account type (material, asset, vendor, customer) in Financial Accounting but also by activity type (for example, the machine hours that are allocated using the account or cost element shown in Figures 3 and 4 ) in CO. This same merge is available in all-new financial reports in S/4HANA Finance.

However, while the accounts and cost elements are merged in the new reports, you continue to see the term cost element on many of the screens. You find the term cost element in the assessment cycles, the settlement profiles, the costing sheets, and other areas. These configuration transactions work exactly as before.

You can use the example shown in Figures 3 and 4 to perform time recording or order confirmations via the work center. You can enter only accounts of cost element category 41 in your costing sheets and accounts of cost element category 42 in your assessment cycles, and so on.

What’s important is that your secondary cost elements provide the transparency you need for your analysis. Mainly if you’ve only worked with costing-based CO-PA in the past, there is a tendency to allocate and settle under a single cost element and rely on the value fields to give you the detail you need for reporting. You may want to create separate secondary cost elements to distinguish between marketing expenses and sales and administration expenses in your assessment cycles.

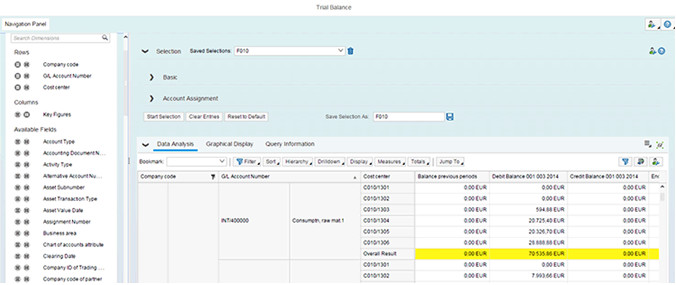

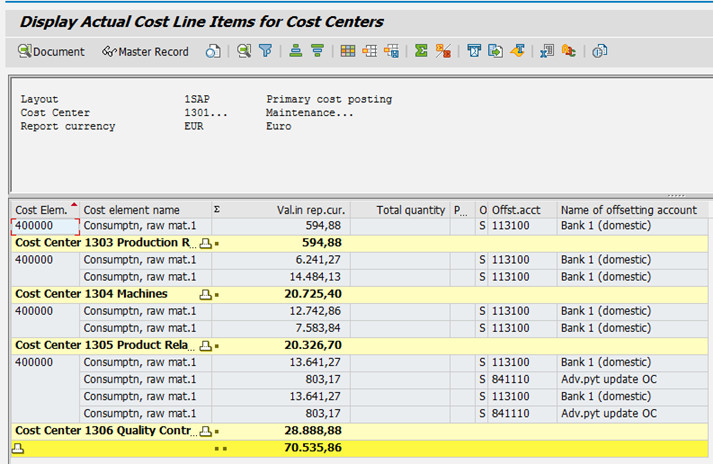

In Figure 6 , for example, select the account for raw material costs that you looked at in Figures 1 and 2 within the trial balance ( Figure 5 ) and drill down by cost center to show all the cost centers to which raw materials were posted within the selected time frame.

By comparison, in Figure 7 , a more classic approach is taken in which the cost center line-item report transaction code KSB1) is used to select all postings to the raw material cost element with these cost centers in the same time frame.

What’s happening here is that the system is using compatibility views to simulate the existence of CO line items even though the CO data has been subsumed in the universal journal. This means that you won’t need to rework your existing reports after migration to S/4HANA Finance.

Indeed, if you use the relationship browser in the CO line-item display, you find it appears to show an accounting document and a controlling document. However, both documents are views on the universal journal that display the data as if the old structures still existed. You could continue to explore the trial balance, focusing on single accounts, such as raw materials and selecting other account assignments (such as orders and projects) or looking at different accounts, such as revenue accounts and drilling down to the CO-PA characteristics.

Instead, look at the account for the secondary cost element in Figures 3 and 4 , then drill down to the sender and receiver objects that were updated during these postings.

In Figure 8 , note that you’ve drilled down to the sender cost center (1303) and the sender activity type (1420), which gives you a credit balance. The offsetting line is a debit balance. To see the account assignment, you have to pull the order number by choosing the appropriate option in the navigation panel. This is a straightforward example, but it gives you an impression of the fundamental changes available with S/4HANA Finance.

Related Blogs

The SAP Asset History Sheet Report

The SAP Asset History Sheet report (AHS) is the most pow...

Account Based COPA - S/4 HANA Finance

As a reporting tool, profitability analysis (CO-PA) is very effective ...

Finance in S/4 HANA: What, Why, How & ACDOCA

Nowadays there is a tremendous interest in S/4 HANA, especially from current...

We offer thousands of SAP courses and real-world SAP sandboxes for individuals and corporate teams.

Support: [email protected]

Sales: [email protected]

+1 (415) 360-6249

- Success Stories

- Become an Affiliate

- Become an Instructor

- Scholarships

- Search Entire Website

- SAP Transaction Codes

- SAP Error Messages

- Authenticate Certificate

Have Questions?

Get In Touch.

Training License Required

Planning Costs for WBS Elements

After completing this lesson, you will be able to:

- List methods for cost planning with a Work Breakdown Structure (WBS)

Methods of Cost Planning for WBS Elements

Planning costs in projects.

Linda, the project controller now checks the created project by James, the project planner. She discusses with him how the costs should be calculated for the project.

Different Methods of Cost Planning and Calculation

You can plan costs for a project in the SAP Project System (SAP PS) based on WBS elements and/or network activities.

The following are various ways in which you can plan costs for WBS elements:

Overall planning

This is the most basic form of cost planning, where the costs for WBS elements are entered manually. You can choose to break down your figures by fiscal year.

Detailed planning

This type of planning (of primary costs and activity inputs) is based on cost elements and periods.

Unit costing

For each WBS element, you use a scheme for entering quantities, such as materials, internal activities, external activities, variable items, and so on. This type of planning is cost element-based.

Easy Cost Planning (ECP)

ECP is a user-friendly method for performing element-based cost planning by means of a quantity structure. You can then use execution services to enter commitment and actual data relating to planned costs.

SAP Business Planning and Consolidation (BPC)

This is a method used to plan costs in SAP Analysis for Microsoft Office (for example in Microsoft Excel) and transfer the data directly to the SAP S/4HANA planning tables in the back-end system.

In addition to manual planning in the WBS, you can assign different types of orders (internal orders or maintenance orders) to WBS elements that are flagged as account assignment elements. This assignment can then be used to display the planned costs of the orders for the project. You can also assign activities to WBS elements and plan costs using these activities.

Easy Cost Planning for WBS Elements

Planning costs with easy cost planning (ecp).

Easy Cost Planning (ECP) enables you to plan costs for WBS elements. You can access ECP for projects from the Project Builder. You choose a WBS element from the structure and then create costing items for this WBS element. Cost planning with ECP is cost element-based. The cost planning periods are determined from the basic start and the basic end date of the WBS element. To enter costing items, you can also use planning forms. When you do this, characteristics, such as work in hours, are valuated. The characteristic values from the planning form are linked to quantities, values, or actions in the costing items (for example, to the quantity of an internal activity). Once you have transferred the values, the costing items appear under the relevant WBS elements in the structure.

ECP can be used to create a simple, preliminary costing for projects. The pre-planned costs are then replaced, for example, by a quantity structure of networks and activities. You can also use ECP to create planned data for the project execution phase. In this case, you can use execution services to enter commitment and actual costs for the planned costs.

How to Execute Easy Cost Planning (ECP)

Log in to track your progress & complete quizzes

- TutorialKart

- SAP Tutorials

- Salesforce Admin

- Salesforce Developer

- Visualforce

- Informatica

- Kafka Tutorial

- Spark Tutorial

- Tomcat Tutorial

- Python Tkinter

Programming

- Bash Script

- Julia Tutorial

- CouchDB Tutorial

- MongoDB Tutorial

- PostgreSQL Tutorial

- Android Compose

- Flutter Tutorial

- Kotlin Android

Web & Server

- Selenium Java

- SAP CO Tutorial

- Basic SAP CO Settings

- Maintain controlling area

- Assign Company code to controlling area

- Define number range interval for SAP co documents

- Maintain Versions

- SAP CO Cost Center Accounting

- What is SAP Cost center accounting

- Create Cost center

- What is cost element accounting

- Create primart cost elements

- Create cost element group

- Create secondary cost elements in SAP

- ADVERTISEMENT

- Activate cost center accounting

- Define cost center categories

- Define cost center standard hierarchy

- SAP CO Profit Center Accounting

- Create dummy profit center

- Define profit center group

- Maintain Profit center standard hierarchy

- SAP CO TCodes

- ❯ SAP CO Tutorial

- ❯ What is cost element accounting

What is Cost Element Accounting in SAP | SAP CO-CEL

What is sap cost element accounting.

In SAP, cost element accounting (CO-OM-CEL) deals with the collection of costs and summarizes costs within controlling and posts to reconciliation ledger account. For every profit & loss type G/L account type, corresponding cost elements are to be created in SAP R/3 system.

What are cost elements?

Cost element is an item in the chart of accounts, which is used in controlling area to record the values assigned consumption of production factors like raw material, utilities, etc. cost elements are divided in to two types i.e.

- Primary Cost / Revenue Elements

Secondary Cost Elements

Primary Cost Elements: –

Primary cost elements describes the costs that occurs outside of controlling. It links to SAP financial accounting (FI) expenses account (corresponding to G/L account required for costs). When you are creating new primary cost elements, the SAP check if a corresponding accounts are available in SAP Financial accounting .

Cost Element Categories: – You need to assign a particular cost element category when you are implementing cost element accounting in SAP.

- 01 – Primary costs / cost reducing revenues

- 11 – Revenues

- 12 – Sales deductions

It describes the costs flows that occurs only within controlling like allocations, overhead cost calculations, etc. No link to SAP FI expense accounts.

Secondary Cost element category: – Similarly you need to assign a cost element category when you are creating secondary cost elements. Some of the important secondary cost element category are

- 01 – Internal Settlements

- 31 – Order/ Project results analysis

- 41 – Overhead

- 42 – Assessment

- 43 – Internal activity allocation

SAP Cost Element Accounting (CO-CEL) Configuration

The primary configuration of cost element accounting in SAP involve maintenance of cost element master data and information system.

The important configuration steps of SAP CO-CEL are

- Creation of primary cost elements

- Creation of secondary cost elements

- Creation of cost element group

- SAP CO/FI reconciliation in company code currency

- Cost element master data reports.

Also read: what is cost center accounting in SAP .

Popular Courses by TutorialKart

App developement, web development, online tools.

How to Create a New Cost Element

Cost Element Creation in SAP

To create a New Cost Element , In the SAP transaction code box, enter transaction KA01

In the Create Cost Element Screen

- Enter the new cost element number.

- Enter the validity dates of the new cost element.

Optional – In the Reference section:

- In the Cost Element field, you can enter a reference cost element if the details are similar to the new cost element.

- In the Controlling Area field, you can enter the reference cost element’s controlling area.

Click Master Data Button

In the next SAP screen

- Enter Name & Description

- Enter a relevant CElem Category

- Click Save.

Cost Element is created

Note: Before you create a Cost Element you must create a G/L account with the same number in your SAP system .

Other Noteworthy Transactions

- Change an existing cost element – transaction KA02

- Display a cost element – transaction KA03

- How to create a new COST CENTER: SAP KS01

- All About Internal Order in SAP

- Settlement of Internal Orders Tutorial: KO02 & KO88 in SAP

- SAP Profit Center Tutorial: Create, Group, Posting & Planning

- Creation Of Profit Center using Standard Hierarchy in SAP

- How to assign Cost Centers to Profit Center in SAP

- How to assign material master to Profit Center in SAP

- SAP CO Tables: Important Tables in Controlling Module

Cost code assignment

Assignments review

Multiple cost codes assignments to single element

Cost code assignment by query, validation. Save and open query

Cost code assignment tooltip and widget

The Cost codes widget lists the cost codes from the uploaded Excel spreadsheet. It allows you to assign cost code to a selected 3D component. All child work-steps are assigned automatically and quantities are calculated for volume, area and each variables during the cost code assignment.

All assignments with calculated quantities are listed in the Reporting grid.

Assignments could be filtered by cost code, work area, property and work step type:

Volume and area could be calculated from the geometry in case element property has no property of volume or area. To use this tool select volume or area variable in Assignment grid and 'Calculate from geometry' item will be listed in menu

Existing assignments that were affected by changed cost code configuration could be easily reviewed by selecting configuration change date to compare with existing configuration. Once configuration date is selected in Assignments grid, existing assignments are filtered and only affected assignments are shown. Specific change is highlighted:

Formula's variable could be linked to element's property with additional options:

- Option 'Link property to variable name in current work step throughout all assignments' will link variable to selected property for the same work step assigned to other elements.

- Option 'Link property to variable name in all work steps in current Cost Code throughout all assignments' will link variable to selected property for other work steps where variable is the same in given cost code assignment.

Ability to assign multiple cost codes to single element.

Cost code assignment by query and validation. Save and open query Assign cost codes by defining query of 3D elements properties. Visually validate query results before assignment and quantity calculation. Save and open assignments query for quicker quantity take off.

Quickly review assignments and calculated quantities in tooltip and Cost code widget

Assigned cost codes and calculated quantities could be quickly reviewed from the tooltip and cost code widget.

Hower over 3d element in QTY front stage to get tooltip with general information about element and assigned cost code. To enable this information in the tooltip, go to Settings and set 'Show Cost Code assignments information in element tooltip'.

IMAGES

VIDEO

COMMENTS

When you create a cost element, you must assign a cost element category. This assignment determines the transactions for which you can use the cost element. For example, category 01 (general primary cost elements) is used for the standard primary postings from Financial Accounting (FI) or Materials Management (MM). ...

Cost Elements. With SAP S/4HANA, the universal journal contains the Account field that covers both G/L accounts and cost elements. Cost elements are now part of the chart of accounts. Therefore, you no longer need to maintain cost element master data separately. G/L accounts (cost elements) classify the valued consumption of production factors ...

Follow these additional steps needed to activate the auxiliary cost component structure: 1. Create an auxiliary cost component structure. 2. Create a transfer structure mapping the auxiliary cost components to the main cost components as shown below: 3. Assign the auxiliary cost component structure to the plan version per fiscal year in the ...

Cost elements are depicted in the system as a type of G/L account. You reach the functions for editing cost elements by choosing the following from the SAP menu: Accounting Financial Accounting General Ledger Master Records G/L Accounts Individual Processing Centrally (transaction FS00). Alternatively, you can use the corresponding SAP Fiori app.

Cost Element Report TCode - S_SL0_21000007. Also Read: SAP CO Interview Questions. EndNote. With this article, you understood the key uses of cost elements and where and how we utilize them in the SAP ERP system of a business.

In S/4HANA Finance, as the accounts and cost elements are merged, the following changes result: The primary cost elements represent the profit-and-loss accounts used to classify your journal entries. In all accounting approaches, you use cost elements to represent wages and salaries, material expenses, depreciation, and many others.

Most important Transaction Codes for Cost Element Assignment # TCODE Description Application; 1 : CK11N: Create Material cost Estimate CO - Product Cost Planning: 2 : OKB9: Change Automatic Account assignment: CO - Overhead Cost Controlling: 3 : KP26: Change Plan Data for Activity Types CO - Cost Center Accounting: 4 :

General Ledger Account and Cost Element. The two segments of the G/L master record from a Financial Accounting perspective are as follows: The chart of accounts segment contains a description of the account, the account type that classifies how the account can be used in FI and/or CO and, the account group that controls the company code segment ...

Easy Cost Planning (ECP) enables you to plan costs for WBS elements. You can access ECP for projects from the Project Builder. You choose a WBS element from the structure and then create costing items for this WBS element. Cost planning with ECP is cost element-based. The cost planning periods are determined from the basic start and the basic ...

Cost element is an item in the chart of accounts, which is used in controlling area to record the values assigned consumption of production factors like raw material, utilities, etc. cost elements are divided in to two types i.e. Primary Cost Elements: -. Primary cost elements describes the costs that occurs outside of controlling.

Cost and Quotation Management (SAP xCQM) (XAP-CQM) : (XAP-CQM) An element in a cost bucket. Cost elements enable you to break down the cost associated with one cost bucket into more granular entities. Cost Element in SAP - Everything you need to know about Cost Element; definition, explanation, tcodes, tables, wiki, relevant SAP documents, PDFs ...

TCODE. Description. Application. OKB9. Change Automatic Account Assignment. CO - Overhead Cost Controlling. FS00. G/L acct master record maintenance. FI - Basic Functions.

Assignment Cost Elements Transaction Codes in SAP (25 TCodes) 6 : OBYC: C FI Table T030 FI - Basic Functions: 7 : COSS Transport of C Tables PP - Production Orders

Click Master Data Button. In the next SAP screen. Enter Name & Description. Enter a relevant CElem Category. Click Save. Cost Element is created. Note: Before you create a Cost Element you must create a G/L account with the same number in your SAP system. Other Noteworthy Transactions. Change an existing cost element - transaction KA02.

Cost Element Categories; Cost Center Accounting (CO-OM-CCA) 1610 Latest * Available Versions: 1709 Latest * 1709 FPS02 (May 2018) * 1709 FPS01 (Jan 2018) * 1709 (Sep 2017) * 1610 Latest * 1610 SPS03 (Oct 2017) * * This product version is out of mainstream maintenance. The documentation is no longer regularly updated.

Cost Code Assignments. Manual Assignment To assign a Cost Code, first select the element (s) in the 3D View, then click on the link icon . Only the bottom level Cost Code can be selected for assignment, which in-turn assigns the actual Work steps. The assigned Cost Codes can be quickly reviewed either through the information Tooltip accessed by ...

SAP Transaction Codes; cost element; TCodes Related Searches # TCODE Description Application; 1 : KA02: Change cost element: CO - Overhead Cost Controlling ... CO - Overhead Cost Controlling: 3 : OKB9: Change Automatic Account Assignment CO - Overhead Cost Controlling: 4 : OBYC: C FI Table T030 FI - Basic Functions: 5 : KP06: Change CElem ...

It allows you to assign cost code to a selected 3D component. All child work-steps are assigned automatically and quantities are calculated for volume, area and each variables during the cost code assignment. All assignments with calculated quantities are listed in the Reporting grid. Assignments review. Assignments could be filtered by cost ...

SAP Transaction Codes; cost element activity input planning; TCodes Related Searches # TCODE Description Application; 1 : ... CO - Cost Center Accounting: 2 : CK11N: Create Material cost Estimate CO - Product Cost Planning: 3 : OKB9: Change Automatic Account Assignment CO - Overhead Cost Controlling: 4 : SM35: Batch input Monitoring Basis - UI ...