- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- *New* Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

Time Value of Money (TVM): A Primer

- 16 Jun 2022

Would you rather receive $1,000 today or the promise that you’ll receive it one year from now? At first glance, this may seem like a trick question; in both instances, you receive the same amount of money.

Yet, if you answered the former, you made the correct choice. Why does receiving $1,000 now provide more value than in the future?

This concept is called the time value of money (TVM), and it’s central to financial accounting and business decision-making. Here’s a primer on what TVM is, how to calculate it, and why it matters.

Access your free e-book today.

What Is the Time Value of Money?

The time value of money (TVM) is a core financial principle that states a sum of money is worth more now than in the future.

In the online course Financial Accounting , Harvard Business School Professor V.G. Narayanan presents three reasons why this is true:

- Opportunity cost: Money you have today can be invested and accrue interest, increasing its value.

- Inflation: Your money may buy less in the future than it does today.

- Uncertainty: Something could happen to the money before you’re scheduled to receive it. Until you have it, it’s not a given.

Essentially, a sum of money’s value depends on how long you must wait to use it; the sooner you can use it, the more valuable it is.

When time is the only differentiating factor, the money you receive sooner will always be more valuable. Yet, sometimes, there are other factors at play. For instance, what’s more valuable: $1,000 today or $2,000 one year from now?

TVM calculations “translate” all future cash to its present value. This way, you can directly compare its values and make financially informed decisions.

“Cash flows expressed in different time periods are analogous to cash flows expressed in different currencies,” Narayanan says in Financial Accounting. “To add or subtract cash flows of different currencies, we first have to convert them to the same currency. Likewise, cash flows of different time periods can be added and subtracted only if we convert them first into the same period.”

Related: 8 Financial Accounting Skills for Business Success

How to Calculate TVM

How you calculate TVM depends on which value you have and which you want to solve for. If you know the money’s present value (for instance, the amount you deposited into your savings account today), you can use the following formula to find its future value after accruing interest:

FV = PV x [ 1 + (i / n) ] (n x t)

Alternatively, if you know the money’s future value (for instance, a sum that’s expected three years from now), you can use the following version of the formula to solve for its present value:

PV = FV / [ 1 + (i / n) ] (n x t)

In the TVM formula:

- FV = cash’s future value

- PV = cash’s present value

- i = interest rate (when calculating future value) or discount rate (when calculating present value)

- n = number of compounding periods per year

- t = number of years

Calculating TVM Manually: An Example

Imagine you’re a key decision-maker in your organization and two projects are proposed:

- Project A is predicted to bring in $2 million in one year.

- Project B is predicted to bring in $2 million in two years.

Before running the calculation, you know that the time value of money states the $2 million brought in by Project A is worth more than the $2 million brought in by Project B, simply because Project A’s earnings are predicted to happen sooner.

To prove it, here’s the calculation to compare the present value of both projects’ predicted earnings, using an assumed four percent discount rate:

PV = 2,000,000 / [ 1 + (.04 / 1) ] (1 x 1)

PV = 2,000,000 / [ 1 + .04 ] 1

PV = 2,000,000 / 1.04

PV = $1,923,076.92

PV = 2,000,000 / [ 1 + (.04 / 1) ] (1 x 2)

PV = 2,000,000 / [ 1 + .04 ] 2

PV = 2,000,000 / 1.04 2

PV = 2,000,000 / 1.0816

PV = $1,849,112.43

In this example, the present value of Project A’s returns is greater than Project B’s because Project A’s will be received one year sooner. In that year, you could invest the $2 million in other revenue-generating activities, put it into a savings account to accrue interest, or pay expenses without risk.

Now, imagine there’s a third project to consider: Project C, which is predicted to bring in $3 million in two years. This adds another variable into the mix: When sums of money aren’t the same, how much weight does timeliness carry?

PV = 3,000,000 / [ 1 + (.04 / 1) ] (1 x 2)

PV = 3,000,000 / [ 1 + .04 ] 2

PV = 3,000,000 / 1.04 2

PV = 3,000,000 / 1.0816

PV = $2,773,668.64

In this case, Project C’s present value is greater than Project A’s, despite Project C having a longer timeline. In this case, you’d be wise to choose Project C.

Calculating TVM in Excel

While the aforementioned example was calculated manually, you can use a formula in Microsoft Excel, Google Sheets, or other data processing software to calculate TVM. Use the following formula to calculate a future sum’s present value:

=PV(rate,nper,pmt,FV,type)

In this formula:

- Rate refers to the interest rate or discount rate for the period. This is “i” in the manual formula.

- Nper refers to the number of payment periods for a given cash flow. This is “t” in the manual formula.

- Pmt or FV refers to the payment or cash flow to be discounted. This is “FV” in the manual formula. You don’t need to include values for both pmt and FV.

- Type refers to when the payment is received. If it’s received at the beginning of the period, use 0. If it’s received at the end of the period, use 1.

It’s important to note that this formula assumes payments are equal over the total number of periods (nper).

Here’s the calculation for Project A’s present value using Excel:

Why Is TVM Important?

Even if you don’t need to use the TVM formula in your daily work, understanding it can help guide decisions about which projects or initiatives to pursue.

“Applying the concept of time value of money to projections of free cash flows provides us with a way of determining what the value of a specific project or business really is,” Narayanan says in Financial Accounting.

As in the previous examples, you can use the TVM formula to calculate predicted returns’ present values for multiple projects. Those present values can then be compared to determine which will provide the most value to your organization.

Additionally, investors use TVM to assess businesses’ present values based on projected future returns, which helps them decide which investment opportunities to prioritize and pursue. If you’re an entrepreneur seeking venture capital funding, keep this in mind. The quicker you provide returns to investors, the higher cash’s present value, and the higher the likelihood they’ll choose to invest in your company over others.

You now know the basics of TVM and can use it to make financially informed decisions. If this piqued your interest, consider taking an online course like Financial Accounting to build your skills and learn more about TVM and other financial levers that impact an organization’s financial health .

Do you want to take your career to the next level? Explore Financial Accounting —one of three online courses comprising our Credential of Readiness (CORe) program —which can teach you the key financial topics you need to understand business performance and potential. Not sure which course is right for you? Download our free flowchart .

About the Author

Brought to you by:

Time Value of Money: A Home Investment Decision Dilemma

By: Arit Chaudhury, Varun Dawar, Rakesh Arrawatia

In early 2016, Naresh Jain was busy looking at various rental properties on popular real estate listing websites. Because of a sudden downturn in business conditions and an immediate need for money,…

- Length: 4 page(s)

- Publication Date: Jul 26, 2017

- Discipline: Finance

- Product #: W17453-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

- Supplements

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

In early 2016, Naresh Jain was busy looking at various rental properties on popular real estate listing websites. Because of a sudden downturn in business conditions and an immediate need for money, Jain's landlord wanted to sell the property and therefore had asked Jain to vacate the premises within 30 days. Jain had been living in the spacious, two-bedroom apartment in North West Delhi for the past five years as it was within a reasonable commuting distance to his workplace. After looking at various rental properties, Jain had come across a furnished apartment identical to his, next door, and met with a broker to discuss it. During the discussion, it came up that an identical apartment in an adjoining locality was for sale at ₹12.5 million. Jain was thus faced with a quantitative finance decision of buy versus rent to arrive at the right option for him given his current financial conditions and the potential future benefits.

The authors Arit Chaudhury and Varun Dawar are affiliated with Institute of Management Technology, Ghaziabad.

Learning Objectives

This case can be used in a corporate finance or financial management course in an undergraduate or MBA program. The case illustrates practical usage of the time value of money concept and techniques to quantitatively evaluate the classic decision of buying versus renting a home. After working through the case and assignment questions, students will be able to do the following: Understand the practical concepts and techniques of the time value of money. Understand the present and future value estimation framework. Estimate relevant cash flows, including equated monthly installments, after taking into account taxation and opportunity cost considerations. Perform quantitative evaluation, using the time value of money framework, for the proposed alternatives of buying versus renting.

Jul 26, 2017

Discipline:

Geographies:

Industries:

Real estate industry

Ivey Publishing

W17453-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Dr. Kevin Bracker; Dr. Fang Lin; and jpursley

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it. – Albert Einstein

Chapter Learning Objectives

After completing this chapter, students should be able to

- Explain the concepts of future value, present value, annuities, and discount rates

- Solve for the future value, present value, payment, interest rate or number of periods using the 5-key approach on a financial calculator

- Work with annual, semi-annual, quarterly, monthly, biweekly, weekly, or daily periods

- Solve for the present value of a perpetuity

- Solve for the present value or future value of an uneven cash flow stream

- Solve for the interest rate implied by an uneven cash flow stream

- Explain, calculate, and compare investments based on the effective annual rate

- Perform complex time value of money calculations (problems where multiple steps are required in order to reach the final solution)

The Power of Compound Interest

The quote at the start of the chapter is often attributed to Albert Einstein (despite some controversy as to the accuracy of that attribution). However, the validity of the statement itself has merit. Positive returns on investments over long periods of time are central to making money work for you as the power of compounding allows for geometric growth. Consider the following table (before long, you’ll be able to verify these calculations) of someone saving $250 per month for various times at various rates of return. Note that an individual who is 25 would have about 40 years until a standard retirement at age 65 and, assuming their employer offers a 50% match on retirement savings plans such as a 401(k), a total contribution of $250 each month would only be $2000 per year out of pocket before taxes.

Table: Future Value of $250 per month investment

Take a moment to review the table above. Note that at 5 years out, the rate of return makes some difference, but not a dramatic difference. By 15 years out, an individual would have 2.5 times as much at the 15% rate of return as the 5% rate of return. By 30 years out, the 10% rate of return is 2.7 times as much as the 5% rate of return and the 15% rate of return has accumulated 8.3 times the wealth. By 40 years out, an individual has invested $120,000 into her retirement savings (40 years at $3000 per year – with the potential for some of that $120,000 coming from the employer). The power of compounding has generated about $261,500 at 5%, nearly $1.5 million at 10%, and over $7.5 million at 15%. This example illustrates how powerful time and return are as tools for building wealth. Now it is time to show you how to do these and other time value of money calculations.

Future Value

When you put your money in a savings account (or invest it in some fashion), you earn a certain return (sometimes called interest) in order to compensate you. Because of this, a dollar today is not worth the same amount as a dollar sometime in the future. Since you earn money on the dollar invested (or saved) today, you will have more than a dollar at some later future point (making a dollar today worth more than the same dollar received later). The specific amount that you will have at the future date is referred to as a Future Value.

Consider if you had $100 today and were able to earn 12% per year by putting that money in a savings account at XYZ bank. How much would you have in one year? Two years? Three years? At first, you might think that you would have $112 in one year, $124 in two years and $136 in three years as you would earn $12 per year in interest. However, this is WRONG! It ignores the concept of compounding. After one year, you would indeed have $112. However, during the second year you earn 12% interest on the full $112 instead of only the $100 you started with. Therefore, you will earn $13.44 (=112×0.12) in interest in the second year and have $125.44 in two years. During the third year, you will earn $15.05 (=125.44×0.12) in interest and have $140.49 in three years. Therefore, the Future Value of $100 for three years at 12% is $140.49. In other words, $100 today is equivalent to $140.49 received three years from now assuming that you can earn 12% interest annually.

Solving for Future Value

We have three ways to solve for the FV: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the FV

The first is directly with a formula. Under this method, we use the following formula:

[latex]FV=PV(1+k)^n[/latex]

FV is the future value (in year n) for which we are trying to solve PV is the present value (how much we have today) k is the rate of return we are earning (also referred to as the interest rate, required return, growth rate, or discount rate) n is the number of years which we will be saving (or investing) the money.

Method 2: Using a Table to Find the FV

The second method is to use Financial Tables, in Appendix A. Financial tables are cumbersome and don’t allow us as much flexibility as other methods, so they will not be covered in this text.

Method 3: Using a Financial Calculator to Find the FV

The third method (and the method focused on here) is to use the financial calculator or spreadsheet. Each financial calculator follows the same basic ideas, but the specifics are different for each brand of calculator. The steps below are for the HP10BII, TI-BAII+ and TI-83/84. If this is the first time using your financial calculator, see the detailed instructions Setting up Your Financial Calculator , in Appendix B. Please pause here to read that and set up your financial calculator before proceeding.

Calculator Steps to Compute FV:

Note: The order of steps 1-4 is not important. The FV answer will appear as a negative number, ignore the negative sign for now. For the TI-83/84 calculators your P/Y and C/Y on the onscreen display should both be 1 for now.

Example: Finding FV using the Financial Calculator

Find the Future Value of $350 invested for 25 years at 9.5% per year.

Step 1: 25 N Step 2: 9.5 I/YR Step 3: 350 PV Step 4: 0 PMT Step 5: FV⇒

You should get a solution of $3383.93.

In other words, if we invest $350 today and let it compound at 9.5% per year for 25 years, we will have $3383.93 at the end of the 25th year.

Technically, you will get a value of -3383.93. The negative sign is an important aspect of financial calculators. The calculator is looking for the solution that balances both parties of a transaction. Here, since the $350 starting value was positive, the calculator assumes that this amount is being received today. If an individual receives $350, that individual needs to pay back $3383.93. Positive values represent cash inflows and negative values represent cash outflows. In a problem like this, it is not essential. However, later in the chapter, we will introduce problems where the cash flow direction is essential. Specifically, whenever there are nonzero values for two or three of the cash flows (PV, PMT, and/or FV), cash flow direction matters. In those cases, figure out if the cash flow is coming to you (available at that moment to spend) or the cash flow is going away from you (set aside into a savings plan). If the cash flow is coming to you, it is positive. If it is going away from you, it is negative. If we applied that logic in this example, the $350 PV would actually be -350. However, this would not change the value of the FV other than to make it positive.

Present Value

The flip side of Future Value is Present Value. Future value tells us how much a certain amount of money will be worth at some future date assuming a certain rate of return. However, what if we know how much we are supposed to get at some point in the future and want to know what it is worth to us today? Now we must find the Present Value. Assume we are offered an opportunity to receive $200 at the end of two years (call it investment A). How much is this opportunity worth to us today assuming we could earn 8% by placing our money in a savings account (that has risk similar to investment A)? To answer this, we must ask how much we would need to place in a savings account today in order to have $200 at the end of the two years.

[latex]FV=PV(1+k)^n[/latex] [latex]200=PV(1.08)^2[/latex] [latex]\frac{200}{(1.08)^2}=PV[/latex] [latex]\$171.47=PV[/latex]

If we had $171.47 today and placed it in a savings account earning 8%, we would have $200 in two years (the same as through investment A). Assuming that investment A had the same degree of risk as our savings account, then we would buy investment A if it was available for less than $171.47 and put our money in the savings account if investment A cost more than $171.47. We could say that the present value of investment A is $171.47.

Solving for Present Value

We have three ways to solve for the PV: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the PV

[latex]PV=\frac{FV}{(1+k)^n}[/latex]

FV is the future value (in year n) that we plan to receive PV is the present value (how much it is worth to us today) k is the rate of return we can earn elsewhere (also referred to as the compound rate, required return, or discount rate) n is the number of years which we will have to wait before receiving the money.

Method 2: Using a Table to Find the PV

The second method is to use financial tables and will not be covered in this text.

Method 3: Using a Financial Calculator to Find the PV

The third method is to use the financial calculator (or spreadsheet). Each financial calculator follows the same basic ideas, but the specifics are different for each brand of calculator. The steps below are for the HP10BII, TI-BAII+ and TI-83/84.

Calculator Steps to Compute PV

Note: The order of steps 1-4 is not important. The PV answer will appear as a negative number, ignore the negative sign for now.

Example: Finding PV using the Financial Calculator

Find the Present Value of $5000 received 15 years from today with a 9.5% discount rate.

Step 1: 15 N Step 2: 9.5 I/YR Step 3: 0 PMT Step 4: 5000 FV Step 5: PV⇒

You should get a solution of $1281.62

In other words, if we are offered the opportunity to receive $5000 at the end of 15 years that is equivalent to receiving $1281.62 today.

The examples previously discussed are for situations where we have a specific amount today and want to know what it is worth at some point in the future (FV) or when we plan to receive a certain amount at some point in the future and want to know what it is worth today (PV). These are referred to as lump sum situations because there is only one cash flow that we are discounting or compounding.

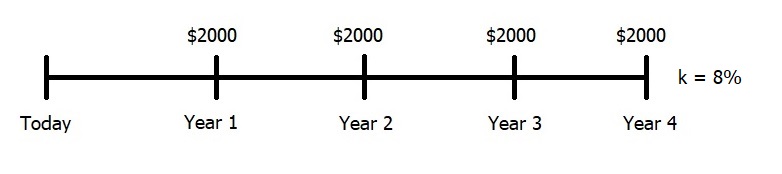

Timelines: Let us pause here for a moment to introduce an important tool used in time value of money – timelines. Timelines provide an aid that helps us better visualize what the cash flow stream looks like. Consider an annuity that pays $2000 per year for 4 years with an 8% discount rate. We can illustrate this on a timeline as follows:

Note that the hashmarks represent the end of the time increment and the space between the hashmarks represent the time increment itself. In other words, the year 1 hashmark represents the end of year 1 where the annuity makes its first $2000 payment. Some students find timelines very helpful and use them for most time value of money problems while others use them less frequently. However, when we get to the section on complex time value of money problems later in this chapter, most students will find timelines quite beneficial.

Solving for Present Value of an Annuity

We have three ways to solve for the PV of an annuity: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the PV of an Annuity

[latex]PVA=PMT\Big(\frac{1-\frac{1}{(1+k)^n}}{k}\Big)[/latex]

PVA is the present value of the anticipated cash flow stream (annuity) PMT is the annuity payment (how much we receive or save each period) k is the rate of return we can earn elsewhere (also referred to as the compound rate, required return, or discount rate) n is the number of periods which we will have to wait before receiving the money.

Method 2: Using a Table to Find the PV of an Annuity

Method 3: using a financial calculator to find the pv of an annuity.

The third method is to use the financial calculator (or spreadsheet) which is what we will focus on. Let’s walk through an example with the financial calculator. An investment that pays $100 at the end of each year for 4 years is an annuity (note that a clue for annuities is to look for the word “each’ or “every” to indicate that the same cash flow is being repeated multiple times). If we wanted to know what that investment is worth to us today and we had a 10% discount rate, we would be finding the present value of that annuity.

Calculator Steps to Compute PV of an Annuity

You should get a solution of $316.99

Solving for Future Value of an Annuity

As with the other TVM calculations we have encountered, there are 3 basic methods to solve for the FV of an annuity: formula, financial table, and financial calculator.

Method 1: Using a Formula to Find the FV of an Annuity

[latex]FVA=PMT\Big(\frac{(1+k)^n-1}{k}\Big)[/latex]

FVA is the future value that our cash flow stream will grow to at the end of n periods PMT is the annuity payment (how much we receive or save each period) k is the rate of return we can earn elsewhere (also referred to as the compound rate, required return, or discount rate) n is the number of periods which we will have to wait before receiving the money.

Method 2: Using a Table to Find the FV of an Annuity

The second method is to use financial tables . These tables are included in Appendix A and will not be covered in this text.

Method 3: Using a Financial Calculator to Find the FV of an Annuity

The third method is the financial calculator (or spreadsheet) approach. Let’s walk through an example using the financial calculator to solve for the future value of an annuity. We want to save $1000 per year (at the end of each year) for 10 years at 12%. How much will this be worth at the end of the 10th year?

Calculator Steps to Compute FV of an Annuity

Note: The order of steps 1-4 is not important. The FV answer will appear as a negative number, ignore the negative sign for now.

You should get a solution of $17,548.74

Note: Ordinary annuities (both present value and future value) assume that cash flows will arrive at the end of each period. Occasionally, you might encounter an annuity due (which means that cash flows arrive at the BEGINNING of each period). It is easy to adjust for this when using a financial calculator by changing the calculator from END of period cash flows to BEGINNING of period cash flows. This process is described in Setting up Your Financial Calculator in Appendix B (for the TI-83/84, it is just part of the onscreen display in the TVM_Solver).

Solving for PMT, I/YR, or N

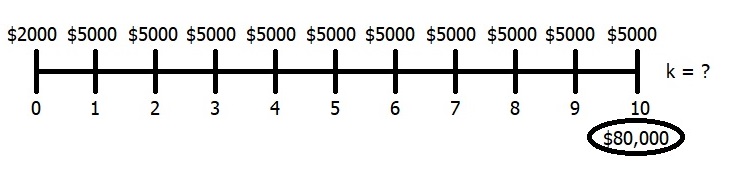

Sometimes you may need to find something other than the present value or future value. For instance, you may want to know how much you have to save per year to reach a certain future value (or how much you must earn as a rate of return or how many years it will take). If you are using a financial calculator, these are relatively easy. For example, assume you have $2000 saved already and want to save another $5000 per year to accumulate $80,000 after 10 years. What rate of return must you earn?

Calculator Steps for the Solution

Solution = 8.83%

Reminder: Either the PMT must be negative and the FV positive or the PMT positive and the FV negative. It doesn’t matter which way you do it, but one must be negative and the other positive.

Solving for N and PMT is done along similar lines.

Perpetuities

A Perpetuity is an annuity that lasts forever. While it is difficult to imagine a situation where an individual could buy a cash flow stream that will pay a fixed amount per year through infinity, perpetuities can be useful tools when dealing with long, constant cash flow streams. Consider someone wanting to fund a scholarship or plan for retirement where she is not sure how long she’ll live. A perpetuity can provide a reasonable approximation in either of those situations.

How much would a perpetuity of $100 be worth assuming a discount rate of 10%? Remember this is $100 per year forever. It would seem that this would be worth an infinite amount. However, consider what would happen if you had $1000 today and could put it in the bank to earn 10% interest. You would receive $100 per year and never touch the principal. You would essentially be buying a $100 perpetuity (assuming the bank didn’t change the interest rate). Therefore, a perpetuity has a finite value. The formula for finding the present value of a perpetuity is as follows:

[latex]PV=\frac{PMT}{k}[/latex]

Note: When using this formula, always plug in k as a decimal so that 10% is 0.10

Uneven Cash Flow Streams

Sometimes you will encounter a situation where you have more than one payment, but it is not the same each year. Remember that an annuity requires the payment to be the same each year. If you have multiple cash flows, but they are not the same, you have an uneven cash flow stream. In order to solve a problem like this, treat it as a series of single cash flows (or possibly a series of smaller annuities).

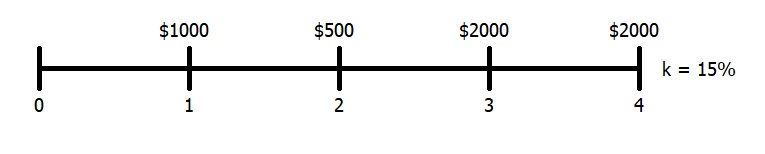

Net Present Value of an Uneven Cash Flow Stream

Consider the following example: you have an investment project that will pay the following cash flows:

Year 1 $1000 Year 2 $500 Year 3 $2000 Year 4 $2000

The discount rate is 15%. Find the Present Value.

Calculator Steps to Compute PV of an Uneven Cash Flow Stream

Solution $3706.18

Note for HP10BII+: The Nj key is used to tell the calculator the number of times that the same cash flow will be received consecutively. If the cash flow only occurs once (in a row) then we do not need to use the Nj key. However, when we have the same cash flow multiple times in a row (such as the $2000 for two years), we can use the Nj key to tell the calculator that this $2000 will occur in two consecutive years.

Note for TI-BAII+: The F screen that appears after you enter a cash flow and down arrow is used to tell the calculator the number of times we have that same cash flow consecutively. If the cash flow only occurs once (in a row) then we do not F screen and just down arrow past it. However, when we have the same cash flow multiple times in a row (such as the 2000 for two years), we use the F screen to tell this to the calculator. The calculator does not have a F screen after the initial cash flow, so we do not need the double down arrow after entering the initial CF.

The above calculator methods are referred to as your Cash Flow Register or Cash Flow Worksheet. It is essential that you always clear all/clear work before entering any cash flows. If you do not do this you will be adding cash flows to a previous problem instead of starting a new problem. The TI-83/84 does not utilize this type of register and does not need to be cleared.

Future Value of an Uneven Cash Flow Stream

The NPV function gives you the present value. You may alternatively want to know how much you will have at the END of the time period (solve for the future value). If this is the case, you start by solving for the NPV. Once you have that, use the 5-key approach to bring that present value forward to the end of the time horizon. For example, if we wanted to know what the above cash flow stream was worth at the END of the fourth year, we would start by solving for the NPV and get the same $3706.18 we calculated earlier. Then, we would go to our 5-key and solve for the future value as follows:

Step 1: 4 N Step 2: 15 I/YR Step 3: 3706.18 PV Step 4: 0 PMT Step 5: Solve for FV⇒ $6482.13

When calculating the PV of an uneven cash flow stream, it should always be less than the sum of the cash flows. When calculating the FV of an uneven cash flow stream, it should always be more than the sum of the cash flows. Also, many financial calculators allow you to solve directly for the future value of an uneven cash flow stream. To see if yours does this, consult your user manual or ask your instructor.

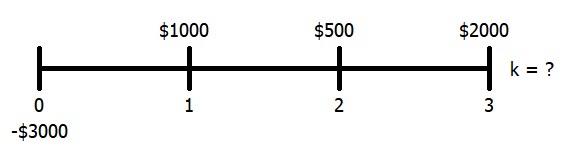

Finding the discount rate of an Uneven Cash Flow Stream

We can also find the discount rate (I/Y) if we have uneven cash flows. Consider the following example: We have an investment project that will pay the following cash flows:

Year 1 $1000 Year 2 $500 Year 3 $2000

If the present value of this investment is $3000, what is the discount rate?

Calculator Steps to Compute I/Y of an Uneven Cash Flow Stream

Solution 7.06%

Note for HP10BII+: The IRR/YR is not the same key as you used for the I/YR, but it serves a similar role — finding the discount rate (or rate of return) for a cash flow stream. The difference is that they I/YR key only works with single cash flows or annuities while the IRR/YR key works with uneven cash flows.

Note for TI-BAII+: The IRR is not the same key as you used for the I/Y, but it serves a similar role — finding the discount rate (or rate of return) for a cash flow stream. The difference is that the I/Y key only works with single cash flows or annuities while the IRR key works with uneven cash flows.

CF0 will always be negative when calculating IRR. If you end up with an error message when calculating the IRR, one of the first things you should do is make sure that your CF0 was a negative value.

Non-Annual Compounding

The more frequently interest is compounded, the greater the effective yield on our savings. Many banks use non-annual compounding periods (monthly, daily, etc). In order to make comparisons, we must find the effective annual yield. This tells us how much we are earning on an annual basis.

Using a Formula to Find the Effective Annual Yield

The formula for effective annual yield is as follows:

[latex]k_{eff}=\Big(1+\frac{k_{nom}}{m}\Big)^m-1[/latex]

k eff is the effective annual yield k nom is the nominal or stated yield m is the number of compounding periods per year

For example, what is the effective interest rate of 8% compounded daily?

[latex]k_{eff}=\Big(1+\frac{0.08}{365}\Big)^{365}-1[/latex]

Note: Be careful not to round when you take .08/365 or you will end up with significant error after compounding it 365 times.

Using a Calculator to Find the Effective Annual Yield

As an alternative, you could use your financial calculator to find the effective interest rate. Again, using 8% compounded daily.

Calculator Steps to Find the Effective Annual Yield

Solution 8.33%.

Note for HP-10BII+: You have changed your payments per year when doing this calculation. If you go back to another TVM problem, be sure to reset your payments per year to one.

Example: Solve a Problem Involving Non-Annual Compounding

We could also look at non-annual compounding with loans or investments. For example, consider a mortgage loan. You are borrowing $80,000 at an 8% rate with monthly payments for 30 years (note that non-annual annuities and lump sums work best with calculators), what is your monthly payment?

Step 1: Convert your calculator to monthly payments by entering 12 P/YR Step 2: -80000 PV Step 3: 8 I/YR Step 4: 360 N (30 years at 12 months per year) Step 5: 0 FV Step 6: PMT

Solution = $587.01 per month

Be VERY careful if you change your payments per year to change it back to 1 P/YR when you are done. Also, each calculator is slightly different in how it sets the periods per year. Be sure to review the Setting up Your Financial Calculator in Appendix B for calculator specific instructions.

Return to Future Value Tables

Remember the table of future values that we used to start the chapter? We said that the value of $250 set aside every month for 40 years at 10% would be $1,581,019.90. We also suggested that by the end of this chapter, you would be able to do that calculation on your own. Well, now you can.

Step 1: Convert your calculator to monthly payments by entering 12 P/YR Step 2: 0 PV Step 3: 10 I/YR Step 4: 480 N (40 years at 12 months per year) Step 5: 250 PMT Step 6: FV

Solution = $1,581,019.90

Complex Time Value of Money Problems

Everything above this point completes your “Time Value of Money Toolbox.” All the examples to this point have been straight-forward situations. However, sometimes we have what we refer to as complex time value of money problems where there are multiple issues that need addressed within one problem. One of the most common examples of this would be a retirement problem where you have X dollars available today, want to be able to withdraw a certain cash flow stream at retirement throughout your retirement years and want to find out how much you need to save each month until retirement between now and the day you retire to achieve your goal. In order to solve a problem like this, you need to visualize (a time line is very helpful) what information you have and what you are missing (that you need to solve for). You will often need to break this down into multiple steps.

Example: Solve a Complex Time Value of Money Problem

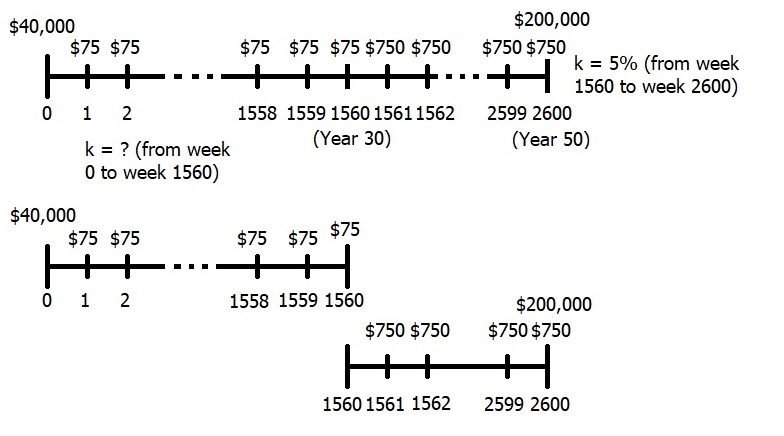

Consider a situation where you are saving for retirement. You currently have $40,000 saved and would like to save an additional $75 per week for the next 30 years. You estimate that when you retire (30 years from today), you want to be able to withdraw $750 each week for the next 20 years and have $200,000 left over at the end of the 20-year retirement period. Assuming you earn 5% during retirement, what rate of return must you earn during the next 30 years to meet your goal?

One way to approach this is to start with a timeline. Note that each period is one week and there are 52 weeks per year. This means that we will have 1560 periods until retirement (1560 = 30×52) and another 1040 periods until the end of retirement (1040 = 20×52). This provides a total of 2600 periods for the entire 50 year time (2600 = 1560 + 1040). Once we’ve created the timeline, we can split it into two timelines. Timeline one will begin today and go to retirement (period 1560) and timeline 2 will begin at retirement (also period 1560) and go to the end of the retirement time frame (period 2600). Here, the timelines help us visualize the information that we know and what we need to find out (specifically our rate of return we must earn over the first 30 years).

Now we can start the calculations. To start, you need to figure out how much you will require at the end of the 30 years. This is the amount you want to have when you retire.

Step 1: Solve for how much you need at retirement.

Set your calculator to 52 periods per year to reflect weekly withdraws during retirement

Set your N to 1040 (52 periods per year for 20 years = 1040 weekly periods)

Set your PMT to 750 (to reflect the weekly withdraw)

Set your FV to 200,000 (to reflect the amount left over)

Set your I/YR to 5 (for your rate of return during retirement)

Solve for PV ⇒$566,527.38

Note – your PMT and FV need to be the same sign. You can make them both positive or both negative, but they are both flowing in the same direction so must be the same sign.

Step 2: Now that you know how much you need when you retire ($566,527.38), you can calculate what rate of return you need to earn over the next 30 years to get there.

Keep your calculator set to 52 periods per year as you are making weekly contributions

Set your N to 1560 (52 periods per year for 30 years = 1560 weekly periods)

Set your PV to -40,000 (to reflect the initial $40,000 contribution)

Set your PMT to -75 (to reflect your weekly $75 contribution)

Set your FV to 566,527.38 (to reflect how much you need at retirement)

Solve for I/YR ⇒5.98%

Note – your PV and PMT both need to be the same sign. Again, you can make them positive or negative, but they are both flowing in the same direction. The FV needs to be the opposite sign. The easiest way to think of this is that you are giving up the $40,000 today and the $75 per week in order to get back the $566,527.38 30 years from today.

Key Takeaways

Time value of money is one of the most powerful and most important concepts in finance. It essentially is as simple as recognizing that because we can earn a return on our money, the value of money changes depending on when it is received or spent. One dollar today is worth more than one dollar received next year. The value of the dollar initially is referred to as a present value while the value of the dollar at a later point in time is referred to as the future value. Compound interest implies that money will grow exponentially over time instead of linearly. This means that relatively small increases in rates of return or time horizons have more power to increase wealth. After completing this chapter, you should be comfortable performing many calculations to see exactly how time value of money can work for you.

Explain why $1 received today is worth more than $1 received one year from today.

What do we mean when we refer to an annuity? How is an annuity different from an annuity due?

What is the relationship between present value and future value?

How do we determine the appropriate discount rate to use when finding present value?

Why is compounding on a monthly basis better for us than compounding on an annual basis?

Determine the answer to each of the following questions.

1a. Find the Future Value of $2500 invested today at 11% for 10 years. 1b. Find the Future Value of $2500 invested today at 11% for 30 years. 1c. Find the Present Value of $6000 received 10 years from today if the discount rate is 5%. 1d. Find the Present Value of $6000 received 10 years from today if the discount rate is 10%. 1e. Find the Future Value of $3000 per year (at the end of each year) invested at 6% for 30 years. 1f. Find the Future Value of $3000 per year (at the end of each year) invested at 12% for 30 years. 1g. Find the Present Value of $4000 per year (at the end of each year) if the discount rate is 15% for 20 years. 1h. Find the Present Value of $4000 per year (at the end of each year) if the discount rate is 15% for 40 years.

Find the interest rates implied by each of the following:

2a. You borrow $1500 today and promise to repay the loan by making a single payment of $2114.00 in 5 years. 2b. You invest $500 today and receive a promise of receiving back $193.50 for each of the next 4 years.

If $2000 is invested today at a 12% nominal interest rate, how much will it be worth in 15 years if interest is compounded

3a. Annually 3b. Quarterly 3c. Monthly 3d. Daily (365-days per year)

How long will it take your money to triple given the following interest rates?

4a. 5% 4b. 10% 4c. 15%

After graduating from college you make it big — all because of your success in business finance. You decide to endow a scholarship for needy finance students that will provide $5000 per year indefinitely, beginning 1 year from now. How much must be deposited today to fund the scholarship under the following conditions.

5a. The interest rate is 10% 5b. The interest rate is 10% and the first payment is made 6 years from today instead of 1 year from today.

Find the present value of the following cash flow stream if the discount rate is 12%:

Years 1-10 $4000 per year Years 11-15 $6000 per year Years 16-20 $8000 per year

Find the value of the following cash flow stream at the end of year 30 if the rate of return is 8.75%:

Years 1-5 $3000 per year Year 6 $7500 Years 7-15 $9000 per year Years 16-30 $12,000 per year

Find the effective annual rate of interest for a nominal rate of 9% compounded

8a. Annually 8b. Quarterly 8c. Monthly 8d. Daily (365 days per year)

Your firm has a retirement plan that matches all contributions on a one-to-two basis. That is, if you contribute $3000 per year, the company will add $1500 to make it $4500. The firm guarantees a 9% return on your investment. Alternatively, you can “do-it-yourself” and you think you can earn 12% on your money by doing it this way. The first contribution will be made 1 year from today. At that time, and every year thereafter, you will put $3000 into the retirement account. If you want to retire in 25 years, which way are you better off?

Jen is planning for retirement. She plans to work for 32 more years. She currently has $15,000 saved and, for the next 15 years, she can save $6,000 at the end of each year. Fifteen years from now, she wants to buy a weekend vacation home that she estimates will require her to withdraw $100,000. How much will she have to save in years 16 through 32 so that she has exactly $750,000 saved when she retires? Assume she can earn 9% throughout the 32-year period.

You are a recent college graduate and want to start saving for retirement. You plan to save $2000 per year for the next 15 years. After that you will stop contributing and just allow your savings to accumulate for another 20 years. Your twin brother would rather wait awhile before he starts saving. He is not going to put away anything for the next ten years, then he will start making contributions at the end of each year for the final 25 years. You both anticipate earning a 9.5% rate of return on your investments. How much must your brother put away at the end of each year to have the same amount of money for retirement as you?

You are considering purchasing a new home. The house you are looking at costs $120,000 and you plan to make a 10% down payment. You checked with a bank and they have two mortgage loan options for you. The first is a 15-year mortgage at 6.25%. The second is a 30-year mortgage at 6.50%.

12a. What are your monthly payments for each loan? 12b. What is the total you will pay over the life of the loan for each loan? 12c. After one year you get a job transfer and have to sell the house. What is the payoff value of your remaining loan balance (hint: find PV of remaining payments)? 12d. Over the first year, how much did you pay in principal and how much did you pay in interest?

Solutions to CH 3 Exercises

Student resources.

Table: Future Value of $250 per month investment, in Appendix B

Financial Tables, in Appendix A

Setting up Your Financial Calculator, in Appendix B

TVM 5-Key Approach Guided Tutorial with HP10BII+, in Appendix B

TVM 5-Key Approach Guided Tutorial with TI-BAII+, in Appendix B

TVM 5-Key Approach Guided Tutorial with TI-83 or TI-84, in Appendix B

Attributions

Image: Mixed from Godkänd Grön Handskrivning by Anthony Poynton is licensed under CC0 1.0

Business Finance Essentials Copyright © 2018 by Dr. Kevin Bracker; Dr. Fang Lin; and jpursley is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License , except where otherwise noted.

Share This Book

7.3 Methods for Solving Time Value of Money Problems

Learning outcomes.

By the end of this section, you will be able to:

- Explain how future dollar amounts are calculated.

- Explain how present dollar amounts are calculated.

- Describe how discount rates are calculated.

- Describe how growth rates are calculated.

- Illustrate how periods of time for specified growth are calculated.

- Use a financial calculator and Excel to solve TVM problems.

We can determine future value by using any of four methods: (1) mathematical equations, (2) calculators with financial functions, (3) spreadsheets, and (4) FVIF tables. With the advent and wide acceptance and use of financial calculators and spreadsheet software, FVIF (and other such time value of money tables and factors) have become obsolete, and we will not discuss them in this text. Nevertheless, they are often still published in other finance textbooks and are also available on the internet to use if you so choose.

Using Timelines to Organize TVM Information

A useful tool for conceptualizing present value and future value problems is a timeline. A timeline is a visual, linear representation of periods and cash flows over a set amount of time. Each timeline shows today at the left and a desired ending, or future point (maturity date), at the right.

Now, let us take an example of a future value problem that has a time frame of five years. Before we begin to solve for any answers, it would be a good approach to lay out a timeline like that shown in Table 7.1 :

The timeline provides a visual reference for us and puts the problem into perspective.

Now, let’s say that we are interested in knowing what today’s balance of $100 in our saving account, earning 5% annually, will be worth at the end of each of the next five years. Using the future value formula

that we covered earlier, we would arrive at the following values: $105 at the end of year one, $110.25 at the end of year two, $115.76 at the end of year three, $121.55 at the end of year four, and $127.63 at the end of year five.

With the numerical information, the timeline (at a 5% interest or growth rate) would look like Table 7.2 :

Using timelines to lay out TVM problems becomes more and more valuable as problems become more complex. You should get into the habit of using a timeline to set up these problems prior to using the equation, a calculator, or a spreadsheet to help minimize input errors. Now we will move on to the different methods available that will help you solve specific TVM problems. These are the financial calculator and the Excel spreadsheet.

Using a Financial Calculator to Solve TVM Problems

An extremely popular method of solving TVM problems is through the use of a financial calculator. Financial calculators such as the Texas Instruments BAII Plus™ Professional will typically have five keys that represent the critical variables used in most common TVM problems: N , I/Y , PV , FV , and PMT . These represent the following:

These are the only keys on a financial calculator that are necessary to solve TVM problems involving a single payment or lump sum .

Example 1: Future Value of a Single Payment or Lump Sum

Let’s start with a simple example that will provide you with most of the skills needed to perform TVM functions involving a single lump sum payment with a financial calculator.

Suppose that you have $1,000 and that you deposit this in a savings account earning 3% annually for a period of four years. You will naturally be interested in knowing how much money you will have in your account at the end of this four-year time period (assuming you make no other deposits and withdraw no cash).

To answer this question, you will need to work with factors of $1,000, the present value ( PV ); four periods or years, represented by N ; and the 3% interest rate, or I/Y . Make sure that the calculator register information is cleared, or you may end up with numbers from previous uses that will interfere with the solution. The register-clearing process will depend on what type of calculator you are using, but for the TI BA II Plus™ Professional calculator, clearing can be accomplished by pressing the keys 2ND and FV [ CLR TVM ].

Once you have cleared any old data, you can enter the values in the appropriate key areas: 4 for N , 3 for I/Y , and 1000 for PV . Now you have entered enough information to calculate the future value. Continue by pressing the CPT (compute) key, followed by the FV key. The answer you end up with should be displayed as 1,125.51 (see Table 7.3 ).

Important Notes for Using a Calculator and the Cash Flow Sign Convention

Please note that the PV was entered as negative $1,000 (or -$1000). This is because most financial calculators (and spreadsheets) follow something called the cash flow sign convention, which is a way for calculators and spreadsheets to keep the relative direction of the cash flow straight. Positive numbers are used to represent cash inflows, and negative numbers should always be used for cash outflows.

In this example, the $1,000 is an investment that requires a cash outflow. For this reason, -1000 is entered as the present value, as you will be essentially handing this $1,000 to a bank or to someone else to initiate the transaction. Conversely, the future value represents a cash inflow in four years’ time. This is why the calculator generates a positive 1,125.51 as the end result of this calculation.

Had you entered the present value of $1,000 as a positive number, there would have been no real concern, but the ending future value answer would have been returned expressed as a negative number. This would be correct had you borrowed $1,000 today (cash inflow) and agreed to repay $1,125.51 (cash outflow) four years from now. Also, it is important that you do not change the sign of any input value by using the - (minus) key). For example, on the TI BA II Plus™ Professional, you must use the +|- key instead of the minus key. If you enter 1000 and then hit the +|- key, you will get a negative 1,000 amount showing in the calculator display.

An important feature of most financial calculators is that it is possible to change any of the variables in a problem without needing to reenter all of the other data. For example, suppose that we wanted to find out the future value in our bank account if we left the money from our previous example invested for 20 years instead of 4. Before clearing any of the data, simply enter 20 for N and then press the CPT key and then the FV key. After this is done, all other inputs will remain the same, and you will arrive at an answer of $1,806.11.

Think It Through

How to determine future value when other variables are known.

Here’s an example of using a financial calculator to solve a common time value of money problem. You have $2,000 invested in a money market account that is expected to earn 4% annually. What will be the total value in the account after five years?

Follow the recommended financial calculator steps in Table 7.4 .

The result of this future value calculation of the invested money is $2,433.31.

Example 2: Present Value of Lump Sums

Solving for the present value (discounted value) of a lump sum is the exact opposite of solving for a future value. Once again, if we enter a negative value for the FV, then the calculated PV will be a positive amount.

Taking the reverse of what we did in our example of future value above, we can enter -1,125.51 for FV , 3 for I/Y , and 4 for N . Hit the CPT and PV keys in succession, and you should arrive at a displayed answer of 1,000.

An important constant within the time value of money framework is that the present value will always be less than the future value unless the interest rate is negative. It is important to keep this in mind because it can help you spot incorrect answers that may arise from errors with your input.

How to Determine Present Value When Other Variables Are Known

Here is another example of using a financial calculator to solve a common time value of money problem. You have just won a second-prize lottery jackpot that will pay a single total lump sum of $50,000 five years from now. How much value would this have in today’s dollars, assuming a 5% interest rate?

Follow the recommended financial calculator steps in Table 7.5 .

The present value of the lottery jackpot is $39,176.31.

Example 3: Calculating the Number of Periods

There will be times when you will know both the value of the money you have now and how much money you will need to have at some unknown point in the future. If you also know the interest rate your money will be earning for the foreseeable future, then you can solve for N, or the exact amount of time periods that it will take for the present value of your money to grow into the future value that you will require for your eventual use.

Now, suppose that you have $100 today and you would like to know how long it will take for you to be able to purchase a product that costs $133.82.

After making sure your calculator is clear, you will enter 5 for I/Y , -100 for PV , and 133.82 for FV . Now press CPT N , and you will see that it will take 5.97 years for your money to grow to the desired amount of $133.82.

Again, an important thing to note when using a financial calculator to solve TVM problems is that you must enter your numbers according to the cash flow sign convention discussed above. If you do not make either the PV or the FV a negative number (with the other being a positive number), then you will end up getting an error message on the screen instead of the answer to the problem. The reason for this is that if both numbers you enter for the PV and FV are positive, the calculator will operate under the assumption that you are receiving a financial benefit without making any cash outlay as an initial investment. If you get such an error message in your calculations, you can simply press the CE/C key. This will clear the error, and you can reenter your data correctly by changing the sign of either PV or FV (but not both of these, of course).

Determining Periods of Time

Here is an additional example of using a financial calculator to solve a common time value of money problem. You want to be able to contribute $25,000 to your child’s first year of college tuition and related expenses. You currently have $15,000 in a tuition savings account that is earning 6% interest every year. How long will it take for this account grow into the targeted amount of $25,000, assuming no additional deposits or withdrawals will be made?

Table 7.6 shows the steps you will take.

The result of this calculation is a time period of 8.7667 years for the account to reach the targeted amount.

Example 4: Solving for the Interest Rate

Solving for an interest rate is a common TVM problem that can be easily addressed with a financial calculator. Let’s return to our earlier example, but in this case, we know that we have $1,000 at the present time and that we will need to have a total of $1,125.51 four years from now. Let’s also say that the only way we can add to the current value of our savings is through interest income. We will not be able to make any further deposits in addition to our initial $1,000 account balance.

What interest rate should we be sure to get on our savings account in order to have a total savings account value of $1,125.51 four years from now?

Once again, clear the calculator, and then enter 4 for N , -1,000 for PV , and 1,125.51 for FV . Then, press the CPT and I/Y keys and you will find that you need to earn an average 3% interest per year in order to grow your savings balance to the desired amount of $1,125.51. Again, if you end up with an error message, you probably failed to follow the sign convention relating to cash inflow and outflow that we discussed earlier. To correct this, you will need to clear the calculator and reenter the information correctly.

After you believe you are done and have arrived at a final answer, always make sure you give it a quick review. You can ask yourself questions such as “Does this make any sense?” “How does this compare to other answers I have arrived at?” or “Is this logical based on everything I know about the scenario?” Knowing how to go about such a review will require you to understand the concepts you are attempting to apply and what you are trying to make the calculator do. Further, it is critical to understand the relationships among the different inputs and variables of the problem. If you do not fully understand these relationships, you may end up with an incorrect answer. In the end, it is important to realize that any calculator is simply a tool. It will only do what you direct it to do and has no idea what your objective is or what it is that you really wish to accomplish.

Determining Interest or Growth Rate

Here is another example of using a financial calculator to solve a common time value of money problem. Let’s use a similar example to the one we used when calculating periods of time to determine an interest or growth rate. You still want to help your child with their first year of college tuition and related expenses. You also still have a starting amount of $15,000, but you have not yet decided on a savings plan to use.

Instead, the information you now have is that your child is just under 10 years old and will begin college at age 18. For simplicity’s sake, let’s say that you have eight and a half years before you will need to meet your total savings target of $25,000. What rate of interest will you need to grow your saved money from $15,000 to $25,000 in this time period, again with no other deposits or withdrawals?

Follow the steps shown in Table 7.7 .

The result of this calculation is a necessary interest rate of 6.194%.

Using Excel to Solve TVM Problems

Excel spreadsheets can be excellent tools to use when solving time value of money problems. There are dozens of financial functions available in Excel, but a student who can use a few of these functions can solve almost any TVM problem. Special functions that relate to TVM calculations are as follows:

Excel also includes a function called Payment (PMT) that is used in calculations involving multiple payments or deposits (annuities). These will be covered in Time Value of Money II: Equal Multiple Payments .

Future Value (FV)

The Future Value function in Excel is also referred to as FV and can be used to calculate the value of a single lump sum amount carried to any point in the future. The FV function syntax is similar to that of the other four basic time-value functions and has the following inputs (referred to as arguments), similar to the functions listed above:

Lump sum problems do not involve payments, so the value of Pmt in such calculations is 0. Another argument, Type, refers to the timing of a payment and carries a default value of the end of the period, which is the most common timing (as opposed to the beginning of a period). This may be ignored in our current example, which means the default value of the end of the period will be used.

The spreadsheet in Figure 7.3 shows two examples of using the FV function in Excel to calculate the future value of $100 in five years at 5% interest.

In cell E1, the FV function references the values in cells B1 through B4 for each of the arguments. When a user begins to type a function into a spreadsheet, Excel provides helpful information in the form of on-screen tips showing the argument inputs that are required to complete the function. In our spreadsheet example, as the FV formula is being typed into cell E2, a banner showing the arguments necessary to complete the function appears directly below, hovering over cell E3.

Cells E1 and E2 show how the FV function appears in the spreadsheet as it is typed in with the required arguments. Cell E4 shows the calculated answer for cell E1 after hitting the enter key. Once the enter key is pressed, the hint banner hovering over cell E3 will disappear. The second example of the FV function in our example spreadsheet is in cell E6. Here, the actual numerical values are used in the FV function equation rather than cell references. The method in cell E8 is referred to as hard coding . In general, it is preferable to use the cell reference method, as this allows for copying formulas and provides the user with increased flexibility in accounting for changes to input data. This ability to accept cell references in formulas is one of the greatest strengths of Excel as a spreadsheet tool.

Download the spreadsheet file containing key Chapter 7 Excel exhibits.

Determining Future Value When Other Variables Are Known . You have $2,000 invested in a money market account that is expected to earn 4% annually. What will be the total value in the account in five years?

Note: Be sure to follow the sign conventions. In this case, the PV should be entered as a negative value.

Note: In Excel, interest and growth rates must be entered as percentages, not as whole integers. So, 4 percent must be entered as 4% or 0.04—not 4, as you would enter in a financial calculator.

Note: It is always assumed that if not specifically stated, the compounding period of any given interest rate is annual, or based on years.

Note: The Excel command used to calculate future value is as follows:

You may simply type the values for the arguments in the above formula. Another option is to use the Excel insert function option. If you decide on this second method, below are several screenshots of dialog boxes you will encounter and will be required to complete.

This dialog box allows you to either search for a function or select a function that has been used recently. In this example, you can search for FV by typing this in the search box and selecting Go, or you can simply choose FV from the list of most recently used functions (as shown here with the highlighted FV option).

Figure 7.6 shows the completed data input for the variables, referred to here as “function arguments.” Note that cell addresses are used in this example. This allows the spreadsheet to still be useful if you decide to change any of the variables. You may also type values directly into the Function Arguments dialog box, but if you do this and you have to change any of your inputs later, you will have to reenter the new information. Using cell addresses is always a preferable method of entering the function argument data.

Additional notes:

- The Pmt argument or variable can be ignored in this instance, or you can enter a placeholder value of zero. This example shows a blank or ignored entry, but either option may be used in problems such as this where the information is not relevant.

- The Type argument does not apply to this problem. Type refers to the timing of cash flows and is usually used in multiple payment or annuity problems to indicate whether payments or deposits are made at the beginning of periods or at the end. In single lump sum problems, this is not relevant information, and the Type argument box is left empty.

- When you use cell addresses as function argument inputs, the numerical values within the cells are displayed off to the right. This helps you ensure that you are identifying the correct cells in your function. The final answer generated by the function is also displayed for your preliminary review.

Once you are satisfied with the result, hit the OK button, and the dialog box will disappear, with only the final numerical result appearing in the cell where you have set up the function.

The FV of this present value has been calculated as approximately $2,433.31.

Present Value (PV)

We have covered the idea that present value is the opposite of future value. As an example, in the spreadsheet shown in Figure 7.3 , we calculated that the future value of $100 five years from now at a 5% interest rate would be $127.63. By reversing this process, we can safely state that $127.63 received five years from now with a 5% interest (or discount) rate would have a value of just $100 today. Thus, $100 is its present value. In Excel, the PV function is used to determine present value (see Figure 7.7 ).

The formula in cell E1 uses cell references in a similar fashion to our FV example spreadsheet above. Also similar to our earlier example is the hard-coded formula for this calculation, which is shown in cell E6. In both cases, the answers we arrive at using the PV function are identical, but once again, using cell references is preferred over hard coding if possible.

Determining Present Value When Other Variables Are Known

You have just won a second-prize lottery jackpot that will pay a single total lump sum of $50,000 five years from now. You are interested in knowing how much value this would have in today’s dollars, assuming a 5% interest rate.

- If you wish for the present value amount to be positive, the future value you enter here should be a negative value.

- In Excel, interest and growth rates must be entered as percentages, not as whole integers. So, 5 percent must be entered as 5% or 0.05—not 5, as you would enter in a financial calculator.

- It is always assumed that if not specifically stated, the compounding period of any given interest rate is annual, or based on years.

- The Excel command used to calculate present value is as shown here:

As with the FV formula covered in the first tab of this workbook, you may simply type the values for the arguments in the above formula. Another option is to again use the Insert Function option in Excel. Figure 7.8 , Figure 7.9 , and Figure 7.10 provide several screenshots that demonstrate the steps you’ll need to follow if you decide to enter the PV function from the Insert Function menu.

As discussed in the FV function example above, this dialog box allows you to either search for a function or select a function that has been used recently. In this example, you can search for PV by typing this into the search box and selecting Go, or you can simply choose PV from the list of the most recently used functions.

Figure 7.10 shows the completed data input for the function arguments. Note that once again, cell addresses are used in this example. This allows the spreadsheet to still be useful if you decide to change any of the variables. As in the FV function example, you may also type values directly in the Function Arguments dialog box, but if you do this and you have to change any of your input later, you will have to reenter the new information. Remember that using cell addresses is always a preferable method of entering the function argument data.

Again, similar to our FV function example, the Function Arguments dialog box shows values off to the right of the data entry area, including our final answer. The Pmt and Type boxes are again not relevant to this single lump sum example, for reasons we covered in the FV example.

Review your answer. Once you are satisfied with the result, click the OK button, and the dialog box will disappear, with only the final numerical result appearing in the cell where you have set up the function. The PV of this future value has been calculated as approximately $39,176.31.

Periods of Time

The following discussion will show you how to use Excel to determine the amount of time a given present value will need to grow into a specified future value when the interest or growth rate is known.

You want to be able to contribute $25,000 to your child’s first year of college tuition and related expenses. You currently have $15,000 in a tuition savings account that is earning 6% interest every year. How long will it take for this account grow into the targeted amount of $25,000, assuming no additional deposits or withdrawals are made?

- As with our other examples, interest and growth rates must be entered as percentages, not as whole integers. So, 6 percent must be entered as 6% or 0.06—not 6, as you would enter in a financial calculator.

- The present value needs to be entered as a negative value in accordance with the sign convention covered earlier.

- The Excel command used to calculate the amount of time, or number of periods, is this:

As with our FV and PV examples, you may simply type the values of the arguments in the above formula, or we can again use the Insert Function option in Excel. If you do so, you will need to work with the various dialog boxes after you select Insert Function.

As discussed in our previous examples on FV and PV, this menu allows you to either search for a function or select a function that has been used recently. In this example, you can search for NPER by typing this into the search box and selecting Go, or you can simply choose NPER from the list of most recently used functions.

- Once you have highlighted NPER, click the OK button, and a new dialog box will appear for you to enter the necessary details. As in our previous examples, it will look like Figure 7.12 .

Figure 7.13 shows the completed Function Arguments dialog box. Note that once again, we are using cell addresses in this example.

As in the previous function examples, values are shown off to the right of the data input area, and our final answer of approximately 8.77 is displayed at the bottom. Also, once again, the Pmt and Type boxes are not relevant to this single lump sum example.

Review your answer, and once you are satisfied with the result, click the OK button. The dialog box will disappear, with only the final numerical result appearing in the cell where you have set up the function.

The amount of time required for the desired growth to occur is calculated as approximately 8.77 years.

Interest or Growth Rate

You can also use Excel to determine the required growth rate when the present value, future value, and total number of required periods are known.

Let’s discuss a similar example to the one we used to calculate periods of time. You still want to help your child with their first year of college tuition and related expenses, and you still have a starting amount of $15,000, but you have not yet decided which savings plan to use.

Instead, the information you now have is that your child is just under 10 years old and will begin college at age 18. For simplicity’s sake, let’s say that you have eight and a half years until you will need to meet your total savings target of $25,000. What rate of interest will you need to grow your saved money from $15,000 to $25,000 in this time, again with no other deposits or withdrawals?

Note: The present value needs to be entered as a negative value.

Note: The Excel command used to calculate interest or growth rate is as follows:

As with our other TVM function examples, you may simply type the values for the arguments into the above formula. We also again have the same alternative to use the Insert Function option in Excel. If you choose this option, you will again see the Insert Function dialog box after you click the Insert Function button.

Once we complete the input, again using cell addresses for the required argument values, we will see what is shown in Figure 7.16 .

As in our other examples, cell values are shown as numerical values off to the right, and our answer of approximately 0.0619, or 6.19%, is shown at the bottom of the dialog box.

This answer also can be checked from a logic point of view because of the similar example we worked through when calculating periods of time. Our present value and future value are the same as in that example, and our time period is now 8.5 years, which is just under the result we arrived at (8.77 years) in the periods example.

So, if we are now working with a slightly shorter time frame for the savings to grow from $15,000 into $25,000, then we would expect to have a slightly greater growth rate. That is exactly how the answer turns out, as the calculated required interest rate of approximately 6.19% is just slightly greater than the growth rate of 6% used in the previous example. So, based on this, it looks like our answer here passes a simple “sanity check” review.

- 1 The specific financial calculator in these examples is the Texas Instruments BA II Plus™ Professional model, but you can use other financial calculators for these types of calculations.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Authors: Julie Dahlquist, Rainford Knight

- Publisher/website: OpenStax

- Book title: Principles of Finance

- Publication date: Mar 24, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-finance/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-finance/pages/7-3-methods-for-solving-time-value-of-money-problems

© Jan 8, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- How time value of money works

- How to calculate time value of money

- An example of using TVM

- The financial takeaway

Time value of money: The guiding principle for virtually every financial and investing decision

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate investing products to write unbiased product reviews.

- The time value of money (TVM) is the concept that a dollar today is worth more than a dollar tomorrow.

- Understanding TVM allows you to evaluate financial opportunities and risks.

- The principle underlies almost every financial and investing decision you make.