An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

Topic no. 421, Scholarships, fellowship grants, and other grants

More in help.

- Interactive Tax Assistant

- Report Phishing

- Fraud/Scams

- Notices and Letters

- Frequently Asked Questions

- Accessibility

- Contact Your Local IRS Office

- Contact an International IRS Office

- Other Languages

A scholarship is generally an amount paid or allowed to a student at an educational institution for the purpose of study. A fellowship grant is generally an amount paid or allowed to an individual for the purpose of study or research. Other types of grants include need-based grants (such as Pell Grants) and Fulbright grants .

If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. Scholarships, fellowship grants, and other grants are tax-free if you meet the following conditions:

- You're a candidate for a degree at an educational institution that maintains a regular faculty and curriculum and normally has a regularly enrolled body of students in attendance at the place where it carries on its educational activities; and

- The amounts you receive are used to pay for tuition and fees required for enrollment or attendance at the educational institution, or for fees, books, supplies, and equipment required for courses at the educational institution.

You must include in gross income:

- Amounts used for incidental expenses, such as room and board, travel, and optional equipment.

- Amounts received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant. However, you don't need to include in gross income any amounts you receive for services that are required by the National Health Service Corps Scholarship Program, the Armed Forces Health Professions Scholarship and Financial Assistance Program, or a comprehensive student work-learning-service program (as defined in section 448(e) of the Higher Education Act of 1965) operated by a work college.

How to report

Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows:

- If filing Form 1040 or Form 1040-SR , include the taxable portion in the total amount reported on Line 1a of your tax return. If the taxable amount wasn't reported on Form W-2, enter it on Line 8 (attach Schedule 1 (Form 1040) PDF ).

- If filing Form 1040-NR , report the taxable amount on Line 8 (attach Schedule 1 (Form 1040)).

Estimated tax payments

If any part of your scholarship or fellowship grant is taxable, you may have to make estimated tax payments on the additional income. For additional information on estimated tax, refer to Publication 505, Tax Withholding and Estimated Tax and Am I required to make estimated tax payments?

Additional information

For more information, refer to Publication 970, Tax Benefits for Education and Do I include my scholarship, fellowship, or education grant as income on my tax return?

- Life Stages

- Tax Breaks and Money

- View all Tax Center topics

Are scholarships taxable? Are grants taxable?

Receiving a college scholarship or grant can making paying for college a lot easier and help with your overall budget. But what about your taxes? OK, we know it’s probably not the first thing on your mind. But as tax time rolls around, you may be asking yourself, “Are scholarships taxable? Are grants taxable?”

The good news is that your scholarship and grant are not taxable if the money was for study or research for a degree-seeking student who spent the funds to pay qualified expenses at an eligible educational organization.

Let’s dig into exactly what that means with a few definitions:

A degree-seeking student is one:

- Pursuing studies for an associate, bachelor’s, or higher degree at an eligible educational institute,

- Enrolled in a program accepted for full credit toward a bachelor’s or higher degree,

- Pursuing studies or conducting research to meet the requirements for a professional certification in a recognized occupation, OR

- Enrolled in a program accredited by a national recognized accreditation agency and authorized under federal or state law.

An eligible educational organization is one:

- Whose primary function is the presentation of formal instruction,

- That maintains a regular faculty and curriculum, and

- Has a regularly enrolled body of students

Qualified education expenses include:

- Tuition and fees required to enroll at or attend an eligible educational institution

- Course-related expenses required of all students in your course of instruction. Expenses include fees, books, supplies and equipment (e.g. computers).

Have other student tax filing questions? Be sure to visit our Tax Guide for College Students and find out about student forms that can be filed for free.

Are scholarships taxable income?

If all the above describes your situation, you won’t need to report your grant or scholarship as taxable income on your return.

If that’s not you exactly, then you may find that some or all your award is taxable. Here are a few scenarios where that might apply.

Scholarship or grant income is taxable in the following situations.:

- Amounts received for incidental expenses such as room and board, travel, and optional equipment

- Amounts for payments for services including teaching, researching, or other services required as a condition of receiving the scholarship

However, National Health Services Corps Scholarships and Armed Forces Health Professions Scholarship and Financial Assistance Program payments, or certain student work-learning service programs aren’t taxable.

Do you have to pay taxes on grants?

Some grants are treated the same as a tax-free scholarship, and the amounts you use to pay for qualified education expenses are tax free.

These include:

- Fulbright Grants

- Pell Grants

- Other Title IV need-based education grants

If you’ve received one of the grants mentioned above and used the money appropriately, the grant money is not taxable.

What about student loans? Any loans you take out to pay for education expenses are tax free, too. Since its money you’ll need to pay back, the amount isn’t included in income. If you’re currently paying back your student loans, you may qualify for the student loan interest deduction .

Get help with your taxable scholarships and grants

If it turns out your scholarships and grants are taxable, don’t worry about getting your taxes done right. At H&R Block, you can find the expertise you need. Whether you file on your own with H&R Block Online or with a tax pro . We’ll be there with you every step of the way.

Free tax filing for students – Did you know some students can file for free with H&R Block? It’s true! Learn more who can file for free with H&R Block Free Online .

Was this topic helpful?

Yes, loved it

Could be better

Related topics

Learn how to fill out your W-2, how to report freelance wages and other income-related questions.

Find out how real estate income like rental properties, mortgages, and timeshares affect your tax return.

How do taxes change once you’re retired? H&R Block helps you find all the answers about retirement taxes.

Find out how to report investments on your taxes, how your investments can affect income, and more.

Recommended articles

Other income

Garage Sale Money and Capital Gains: What You Should Report to the IRS

For Pro Golfers, Tough Taxes Are Par for the Course

Real estate

How Renting Out Your Extra Bedrooms Affects Your Taxes

No one offers more ways to get tax help than H&R Block.

At TFX we've been doing taxes for U.S. expats for over 25 years

Expat taxes are complicated. Seriously.

Every precaution recommended by the IRS & more

Clear, transparent process. Thorough & well-thought-out

IRS restructuring & reform act of 1998 protects taxpayers

Trusted by tens of thousands of clients worldwide

Which should you hire and why?

We stand by our work — year in, year out.

If you have years of experience with expat tax, get in touch!

Live webinar with Q&A — join & ask questions!

Many imitators, only one TFX. Ask the tough questions

Specific use cases & scenario analysis

Top notch customer service is core to TFX

We are the best at what we do and we’re here to help you

Understanding Form 5471: A guide for US taxpayers with foreign interests

The art and finesse of filing Form 8833: Exploring treaty-based return positions

Missed the April tax-filing deadline? Navigating late tax filing and penalties’ avoidance

Easy process with an expert tax preparer

No matter where you reside — you must file US tax returns

TFX helps non-US aliens or Green Card holders file returns

Discover the average cost of tax return preparation for you

Get started call with tax preparer

High-level phone consultations with experts

Scary letter from the IRS? TFX can help

Selling stocks? New job? Make educated financial decisions

Easily determine your US tax residency status

How to renounce citizenship or green card

TFX can review your prior returns for errors

We can re-file returns that need a little fixing up

TFX can call and negotiate with the IRS on your behalf

New filing requirements for foreign owners of U.S. LLC

To report ownership in Foreign Corporations

Amnesty program for those residing in the states

U.S. tax requirements of non-US e-commerce merchants

Form 1040 federal tax return package

For those with additional income sources beyond the core package.

For those who have not filed and want to become compliant with amnesty from penalties.

Frequently asked questions & tips

How to use our handy tax questionnaire

We host a daily webinar to walk through our easy process and answer questions

Every precaution recommended by the IRS. And then some

IRS Restructuring & reform act of 1998 protects taxpayers

Disclaimer ... May 10, 2024

Disclaimer ... May 06, 2024

Immediate action post-deadline For taxpayers who missed the April tax filing deadline,... Apr 30, 2024

Disclaimer ... Apr 30, 2024

TFX (Taxes for Expats) has expanded its service offering to cater to the needs of US small... Apr 29, 2024

Disclaimer ... Apr 29, 2024

Disclaimer ... Apr 26, 2024

Disclaimer ... Apr 24, 2024

The IRS has released updated guidance on ... Apr 23, 2024

The IRS has announced an extension through 2024 for the enforcement of required minimum di... Apr 18, 2024

As tax season approaches, it's crucial for taxpayers to understand the implications of filing ... Apr 17, 2024

Prior year transcripts - who to call, which forms to fill out, etc.

A common misunderstanding is that US citizens abroad do not have to file tax returns

Audits are no fun, especially when the documents are not standard US tax forms; TFX can help

How the IRS computes tax, interest, and other penalties & what you can do to avoid them

Scary IRS letters? We will help you debunk them and form an action plan to fix any issues

TFX is an authorized e-file firm and e-files tax returns for taxpayers globally

If you do have a tax bill, what are the ways you can pay the IRS?

We can amend prior filed returns to ensure you get the deductions & credits you are eligible for

In cases where E-filing is not permitted (IRS rules), we outline where and how to snail mail the returns

Short answer: Yes. Long answer: Certainly, but your tax return needs to be optimized.

The IRS can’t chase you forever; we break down the rules behind the IRS statute of limitations

What are ITINs, who needs one, how to get one, and when they expire

Recently Published Articles

Expatriate tax glossary. Commonly used terms explained

More complicated than it sounds. How ‘US Person’ is defined by the IRS and what it means to you

“Resident” can have many different meanings for the IRS.

FinCEN Form 114 and filing requirements explained. Who needs to file, when, and why?

Filing requirements, penalties, and other considerations

Financial reporting requirements explained

How is your nest egg treated by the IRS? It depends on the country and the plan

Save over $100,000 on your US tax return with this nifty exlcusion. But, it’s complicated

How to avoid double taxation

One of two ways to meet the Foreign earned income exclusion (FEIE)

Second method to meet the Foreign earned income exclusion (FEIE)

Moving overseas (inbound or outbound) midyear is not uncommon

It’s the law. But, outside of legal reasons, many taxpayers may also benefit from refunds

There are many different deadlines & possible extensions - TFX can keep you abreast.

What are the minimum thresholds that trigger tax filing requirements?

Which documents you may require in getting caught up to date on your tax returns

It depends. State taxes are one of the most misunderstood aspects of expat tax.

Thousands of tax forms exist, but which select few you really need to understand

How to understand these two terms & use them to your advantage to obtain tax refunds

Why these complex terms can mean a lot to self-employed individuals & digital nomads

US tax filing requirements & credits specific to permanent residents

Big life choice that also carries hidden tax implications & filing requirements

Will your non-US spouse be sble to receive survivor, dependent, or spousal benefits?

US citizens & Green Card holders who are living and working outside the US

TFX has partnerships with many international schools to assist their staff with tax filings

Contractor taxes contain many nuances, especially for potential state tax filing requirements

Aid workers (& other staff) of the UN, EC, WHO or WB have many tax advantages and tax complexities

Thx for keeping us safe in the sky! International pilot taxes are *almost* as complex as flying a jet

Working in war zones or stationed abroad, TFX can help understand filing requirements

Global citizens who earn a living without a permanent establishment

TFX files returns for American retirees globally & ensures their nest eggs are protected

We support entrepreneurs globally & explain how to make the most of your hard-earned earnings

Permanent residency has tax implications - we explain what you need to know

Born with a U.S. citizenship but never filed tax returns? TFX can help.

Multiple citizenship is in vogue! TFX explains your U.S. tax filing requirements

Non-US citizens and Green Card holders who have U.S income and require filing tax returns.

Non-US corporations owned by US citizens and Green Card holders. Complex form debunked.

Retirees abroad enjoy sunshine & tax advantages. Our guide explains how to plan accordingly.

Remote work is booming and so is the nomad lifestyle; understanding tax implications is a must

Contractors (especially military) have different tax treatment than normal employed expats

Non-US mutual fund investments may carry onerous tax implications

Financial reporting forms - similarities, differences, due dates, and more

Missionary tax treatment will vary based on country & presence of social security agreements

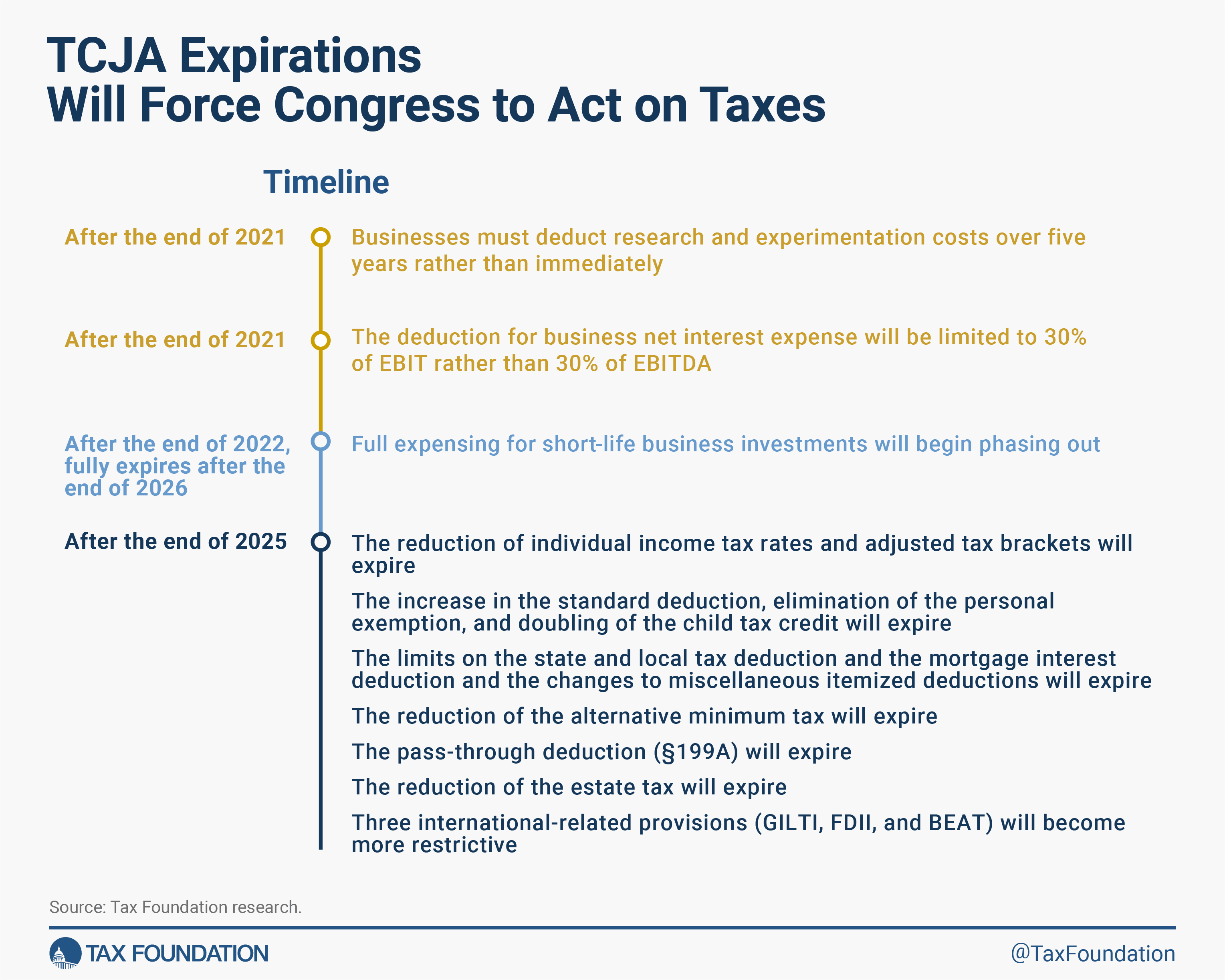

Tax reform that reshaped much of the tax code: winners, losers, and business implications

The IRS expects certain taxpayers to make payments before the deadline - learn how and why

TFX Mobile app

- Expat tax rules

Stipend vs. Scholarship vs. Research Grants - Taxation Methods

To whomever you are, firstly - thank you for contributing to research and development and pursuit of furthering our knowledge of a particular field. Without your efforts and intellectual curiosity, we would be naught for progress as a civilization, and relegated to becoming accountants. Keep up the good work..

Now - let’s examine the taxation of the various grants/monetary stimulus you can receive as a research scientist.

A stipend fully taxable and reported as wages, although W2 not issued;

Scholarship - partially taxable. Amount spent on tuition and qualified education expenses (provide link) not taxable, the remainder is taxable ordinary income. Reported on 1098-T if from USA stipend is treated as a

Scholarships

Scholarships are tax free (excludable from gross income) if you are a candidate for a degree at an eligible educational institution. These payments will not generate a W2, 1099, but if received from a US institution it will be on form 1098-T.

The payment received by the individual will be tax free if it is used for Qualified Expenses.

- Tuition & required fees

- Books/supplies/equipment required for all students in the course

Expenses that are not qualified include life expenses such as room & board and travel. The grant also cannot include payment for services such as teaching, research, or other services as a condition for receiving the scholarship.

There are exceptions to this rule -- if you receive the amount under one of these programs.

- The National Health Service Corps Scholarship Program (NHSC)

- The Armed Forces Health Professions Scholarship and Financial Assistance Program (HPSP)

Fellowship and Research Grants

Generally, research grants is non-taxable (ie - excludable from gross income) if they meet one of the following conditions:

a. The grant qualifies as a prize or award that is excludible from gross income under Internal Revenue Code section 74(b).

In non-legalese, what this means is that the individual could not have made an action to enter the contest of proceeding on their own, the individual is not required to render future services as a condition to receiving the award, and the prize/award is transferred by the payor to a governmental unit or organization.

b. The grant/prize remains non-taxable if the grant's purpose is to achieve a specific objective - ie produce a report or product, or to improve or enhance a literary, artistic, musical, scientific, teaching, or similar capacity, skill or talent of the grantee.

Non-US citizen grants

Generally, academic institutions who issue grants and fellowship payments to Nonresident Aliens (present in the US) - will issue form 1042-S, which will also contain withholding information. The amount of withholding will depend on the visa status of the recipient.

F-1, J-1, M-1, or Q-1 --- a stipend paid to a non-resident alien with these visas will be subject to federal tax withholding at a rate of 14% unless tax treaty relief is available.

Non-US persons with a B visa will have 30% of payments withheld, without provisions for reduction of withholding.

- Join Our Mailing List

Tax Guidelines for Scholarships, Fellowships, and Grants

Feb 10, 2021 | Resources

Taxes can be confusing, especially for young adults who have never had to file taxes before. Yet when beginning college, it is important to learn about and understand how scholarships impact your taxes, so that you are prepared at tax time. There are simple guidelines from the Internal Revenue Service (IRS) that help you determine if you will claim all or part of your scholarship amounts as income on your taxes, meaning you are required to pay taxes on them.

Here are the guidelines quoted directly from the IRS. ( Topic No. 421 Scholarships, Fellowship Grants, and Other Grants)

A scholarship is generally an amount paid or allowed to a student at an educational institution for the purpose of study. A fellowship grant is generally an amount paid or allowed to an individual for the purpose of study or research. Other types of grants include need-based grants (such as Pell Grants) and Fulbright grants .

Not Taxable

If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. Scholarships, fellowship grants, and other grants are tax-free if you meet the following conditions:

- You’re a candidate for a degree at an educational institution that maintains a regular faculty and curriculum and normally has a regularly enrolled body of students in attendance at the place where it carries on its educational activities; and

- The amounts you receive are used to pay for tuition and fees required for enrollment or attendance at the educational institution, or for fees, books, supplies, and equipment required for courses at the educational institution.

You must include in gross income:

- Amounts used for incidental expenses, such as room and board, travel, and optional equipment.

- Amounts received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant. However, you don’t need to include in gross income any amounts you receive for services that are required by the National Health Service Corps Scholarship Program, the Armed Forces Health Professions Scholarship and Financial Assistance Program, or a comprehensive student work-learning-service program (as defined in section 448(e) of the Higher Education Act of 1965) operated by a work college.

How to Report

Generally, you report any portion of a scholarship, a fellowship grant, or other grant that you must include in gross income as follows:

- If filing Form 1040 or Form 1040-SR , include the taxable portion in the total amount reported on the “Wages, salaries, tips” line of your tax return. If the taxable amount wasn’t reported on Form W-2, enter “SCH” along with the taxable amount in the space to the left of the “Wages, salaries, tips” line.

- If filing Form 1040-NR , report the taxable amount on the “Scholarship and fellowship grants” line.”

Now that you’ve read the IRS guidelines, you can ask yourself the questions below:

- What is the total amount I received from scholarships, fellowships and grants during the tax year I am filing (Jan-Dec)?

- Of that amount, what amount did I use for tuition and fees required for enrollment or attendance at the educational institution, or for fees, books, supplies, and equipment required for courses at the educational institution?

Example: If your class required that you purchase an I-Pad to complete the course, it could be considered a required expense, but if you bought the I-Pad for convenience and it was not required, it would be considered as taxable income.

Subtract the amount you used for required expenses (question 2) from the total amount of scholarships, fellowships, and grants you received (question 1). That is the amount that you used for incidental expenses, such as room and board, travel, and optional equipment and amounts received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant.

This amount is taxable and must be claimed as income on your taxes.

The IRS has an online assistant you can use to decide how much of your scholarships (if any) are taxable.

There also is a tax credit that may be available to students (for independent students) or your parents (for dependent students) if you got a Form 1098-T from your college. The credit is called the American Opportunity Tax Credit (AOTC). According to the IRS:

“To be eligible for AOTC, the student must:

- Be pursuing a degree or other recognized education credential

- Be enrolled at least half time for at least one academic period * beginning in the tax year

- Not have finished the first four years of higher education at the beginning of the tax year

- Not have claimed the AOTC or the former Hope credit for more than four tax years

- Not have a felony drug conviction at the end of the tax year”

To claim AOTC, you must complete the Form 8863 PDF and attach the completed form to your tax return.

We know that this is a lot of information and it can be confusing. As you begin to file your taxes, we encourage you to reach out to people in your support system and utilize the resources offered through the IRS. In addition to the resources we have referenced above, the IRS has also partnered with several organizations to help people prepare and file their federal individual income tax returns for free. Typically, you can file your taxes as early as February and they are due in April. Check the IRS website for exact filing dates for this year and if possible, file your taxes early so that you can get your refund faster.

Pin It on Pinterest

Member Login

- Get Listed Today

Understanding the Tax Implications of Grants and Fellowships

For many students, receiving a grant or fellowship can provide a welcome break from increasing student loan debt. They can assist in covering expenses, as well as rewarding a student for their hard work. However, the question may come up whether or not these grants and fellowships have any tax implications for the student who receives them. In order to determine your particular tax liability, it is important to discuss your situation with a tax professional, such as HCS, LLC in North Richland Hills , TX .

What is a Scholarship or Fellowship Grant?

A scholarship is generally a defined amount of funds are paid to the benefit of a student (either undergraduate or graduate) at a particular educational institution to aid in the pursuit of their studies. A fellowship grant, on the other hand, is generally an amount paid for the benefit of an individual to aid in the pursuit of study or research.

The amount of a scholarship or fellowship grant will also include the value of the contributed services and accommodations, the amount of tuition, matriculation and other fees, and any amount received in the nature of a family allowance. All of these items are meant to benefit the student in their pursuit of a specific field of study.

Is it Tax Free?

Before you can determine your tax liability, it is important to make sure that the assistance does not fall within the realm of being tax free. Here are the requirements for assistance to be considered tax free for the student taxpayer’s purposes. Keep in mind that a student needs to prove they are a candidate for a degree at what has been determined to be an eligible educational institution.

The fellowship grant or scholarship is tax free if it can meet the following criteria:

- It does not exceed your qualified education expenses

- It isn’t designated or earmarked for other purposes (such as room and board)

- It does not require by its terms that it can’t be used for qualified education expenses

- It does not represent payment for teaching, research or other services required as a condition for receiving the scholarship.

So who counts as a candidate for a degree? They must be in college pursing a degree and the institution is accredited and provides an acceptable degree program.

Additionally, the funds received must be used for qualified expenses. A few of these include:

- Tuition and fees required to enroll or attend an eligible educational institution

- Course related expenses, including fees, books, supplies, and equipment that are required for their courses at the eligible educational institution

Expenses that do not qualify typically include such things as room and board, travel, research, clerical help and equipment that isn’t required for enrollment in or attendance at an eligible educational institution. As a result, you can exclude from your gross income any part of the grant or fellowship used for the qualified expenses, but must include in your income the part that was used for unqualified expenses.

Keep in mind that if you are paid for services such as teaching through a grant or fellowship, those funds must be reported as part of your gross income. However, if you did the teaching with the National Health Service Corps Scholarship Program or The Armed Forces Health Professions Scholarship and Financial Assistance Program then you do not have to treat the funds received as a payment for services.

Reporting Requirements

If your grant or fellowship is tax-free and you did not have any other income to report, then you would not have to file a tax return. On the other hand, if a portion of the grant or fellowship can be deemed taxable, then you will need to file a return to report it and determine your tax liability. This income must be reported even if you did not receive a traditional W-2.

Types of Educational Assistance

Here are a few options for educational assistance, but each of these has their own requirements for eligibility.

- Fulbright Grant – a portion may be tax free based on above expenses and criteria

- Pell Grants and Need-Based Educational Grants – Tax free as long as they are used for qualified educational expenses

- Payment to Service Academy Cadets – Taxable income, will be reported to the taxpayer with a W-2

- Veterans’ Benefits – Tax free if received for education, training or subsistence

As you can see, there are many opportunities to receive educational assistance that is tax-free to pursue your education and training.

Click on the link below to contact a tax professional or accountant at HCS, LLC in North Richland Hills , TX , to discuss whether or not your grant or fellowship is part of your taxable income.

- Finding Tax Preparers and Tax Attorneys is easy by searching our trusted network of top-rated Tax Preparers and Tax Attorneys. TaxProfessionals.com 2360 Corporate Circle Suite 400 Henderson, Nevada 89074 United States

- How It Works

- List Your Company

- Browse Categories

- Browse Locations

- Password Retrieval

- Tax Preparers And Tax Attorneys - Join Our Website Today »

- Not a Registered User? Create Free User Account

- Are You a Local Business List Your Company Now

- Search Search Please fill out this field.

Are Business Grants Taxable?

How to determine if business grants are taxable.

- Financial Preparations for Taxable Grants

Finding and Applying for Business Grants

Is grant money taxable income to a business, how are cash grants taxed, are grants reported to the irs, the bottom line.

- Small Business

Most business grants are taxable

Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture.

:max_bytes(150000):strip_icc():format(webp)/smda1_crop-f0c167dd2b2144f68f352c63d17f7db5.jpg)

Most business grants are regarded as taxable income, though there are some exceptions. If you are unsure whether your business grant is taxable, you should check the grant agreement, check the Internal Revenue Service (IRS) guidelines, or contact your grant donor or a tax professional.

For most businesses, it makes sense to reserve part of a business grant for tax purposes. Rather than spending all of the grant, you should hold on to part of it to meet your tax liabilities.

Key Takeaways

- Most business grants are taxable, with only a few exceptions.

- Your business grant agreement will state whether your business grant is tax-exempt; if it doesn’t, it’s best to assume that you’ll have to pay tax on the grant.

- If you’re still unsure, you can check the IRS guidelines, or with your grant organization or a tax professional.

- It’s best to reserve a portion of your business grant when you first receive it, in order to meet your tax obligations.

The majority of business grants, including government grants , count as taxable income. This means that you’ll have to pay taxes on the money you receive from the grant, effectively reducing the total amount of grant that you receive.

There are some important exceptions to this rule, however:

- Nonprofit organizations with 501(c)(3) status are generally tax-exempt, so they don’t pay tax on their income whether this comes from a business grant or another source.

- Most of the business grants that were given out as part of the federal government’s COVID-19 relief program were tax-exempt.

- Grants received by a member of a federally recognized American Indian tribe are also tax-exempt.

It’s important to ascertain whether a business grant is taxable before you use it. That’s because if you have to pay taxes, this essentially reduces the total amount of the award. It’s best to assume that a grant is taxable, but you can then check a number of sources for information to the contrary.

1. Check the Grant Agreement

Your business grant agreement will outline the terms under which you are given the grant, and will state whether it is tax-exempt. If the grant agreement doesn’t state this, it’s best to assume that you have to pay tax on it.

2. Contact the Funding Organization

The funding organization that gave you the grant should know whether it is tax-exempt. If your grant agreement doesn’t explicitly mention your tax liabilities, you should call your funding organization to check this.

3. Review Federal and State Guidelines

You can also consult the official IRS guidelines on taxable and nontaxable income. The IRS website contains a comprehensive list of what is considered taxable, and can help you to determine your tax obligations.

You should also check your state’s guidelines on taxable and nontaxable income, because these can differ from the federal government’s rules.

4. Consult with a Tax Professional

If you are still unsure about your tax liabilities, or whether your business grant is taxable, you can seek professional help. If you don’t have a business accountant, you can find certified accountants through a number of websites: CPAverify, the Association of International Certified Public Accountants (AICPA), or the National Association of Enrolled Agents (NAEA).

Financial Preparations for Taxable Grants

In the majority of cases, any business grant you receive will be taxable. It’s wise to keep this in mind when you are applying for the grant, and definitely before you spend it. Here are some principles that can make it easier to administer the grant:

- Reserve some of the grant for taxes. You should work out in advance how much of the grant you will have to pay in tax, and then set this amount aside. This will avoid you having to find these funds from elsewhere once you’ve filed your taxes.

- Include grants in your accounts. Any grants you receive should appear on your tax return. If you exclude them, you may have to pay penalties.

- Keep good financial records. You should make sure that your business records are accurate, are up to date, and include any grants you’ve received, whether they are taxable or not.

- Research tax deductions. It may be possible to lower the amount of tax that your business pays by taking advantage of tax deductions . This can free up more of the money you’ve received in your business grant.

Many organizations give out business grants, and it can take a significant amount of research to find a grant that your business is eligible for. You should check:

- Government grants are offered by both the federal and state governments. Grants.gov is a website with a comprehensive list of federal business grants, and the websites of the U.S. Small Business Administration (SBA) and the State Business Incentives Database are also good resources.

- Corporations also give out grants, often to businesses operating in a particular sector. Finding these grants is most often a case of searching online for a grant that is available to your kind of business.

- Charities and foundations also give out grants, particularly to businesses owned by underrepresented communities.

Once you’ve found a suitable grant, you can generally apply online for it. You’ll likely have to include some documents to support your application, including a business plan that explains how the grant will help your business to develop.

Once you’ve applied, it’s a case of waiting. Sometimes, it can take months for a donor organization to make a decision on a grant application, and you might have to call them for an update.

Generally, yes. The IRS regards most types of business grants as taxable income, with only a few exceptions.

Cash grants are taxed in the same way as non-cash grants. If your business deals in cash, you should be careful to ensure that your records are accurate. Otherwise, you could be hit with tax penalties.

You need to report any business grant you receive to the IRS as part of your tax return. Failure to do this is considered tax fraud and could have serious consequences.

Most business grants are taxable, with only a few exceptions. Your business grant agreement will state whether your business grant is tax-exempt; if it doesn’t, it’s best to assume that you’ll have to pay tax on the grant.

If you’re still unsure, you can check the IRS guidelines, or with your grant organization or a tax professional. It’s best to reserve a portion of your business grant when you first receive it, in order to meet your tax obligations.

Internal Revenue Service. “ Grants to Individuals .”

Internal Revenue Service. “ Exemption Requirements—501(c)(3) Organizations .”

Thomson Reuters, Tax & Accounting. “ COVID-19 Related Aid Not Included in Income; Expense Deduction Still Allowed .”

Internal Revenue Service. “ CARES Act Coronavirus Relief Fund Frequently Asked Questions .”

Internal Revenue Service. “ Publication 525: Taxable and Nontaxable Income .”

Grants.gov. “ Search Grants .”

U.S. Small Business Administration. “ Grants .”

State Business Incentives Database. “ Homepage .”

Internal Revenue Service. “ Penalties .”

:max_bytes(150000):strip_icc():format(webp)/thinkstockphotos468741549-5bfc2e7a46e0fb0051455ee7.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Research Voyage

Research Tips and Infromation

Are Research Grants Taxable? Tax Implications you Need to Know as a Researcher

Introduction

Distinction between grants intended to cover expenses and grants intended to compensate for time and effort, examples of research grants and their tax implications, research grant tax implications in united states, research grant tax implications in united kingdom, research grant tax applicability in canada, research grant tax applicability in india, professional advice on research grant tax applicability.

Research grants are financial awards given to individuals or organizations for the purpose of conducting research. These grants can be critical for advancing scientific knowledge and improving quality of life, as they allow researchers to conduct studies and experiments that might not otherwise be possible due to lack of funding.

There are several different types of grants, including competitive grants, collaborative grants, travel grants, and equipment and materials grants. Competitive grants are awarded through a competitive application process based on merit, such as the National Science Foundation’s grants for scientific research.

Collaborative grants are awarded to teams or groups of researchers working on a project together, such as a grant for a multi-institutional research project. Travel grants are awarded to cover expenses related to travel for research purposes, such as attending conferences or conducting field research. Equipment and materials grants are awarded to cover the cost of necessary research equipment or materials, such as a grant for a new microscope or research chemicals.

Without research funds, many important scientific discoveries and advancements may never have been made. However, it’s important to understand the tax implications of research grants, as the tax laws related to these grants can be complex and vary depending on the specific circumstances and the laws of the country involved. In the following sections, we will explore the taxation of research grants in more detail and examine how tax laws related to research grants differ between countries.

In case you are not familiar with writing research grant proposals, then please visit my post on Research Grants Uncovered: A Step-by-Step Guide to Funding Your Research Projects . This post will help you in writing powerful research grant proposals in minimal time.

Taxation of Research Grants

Research grants can have different tax applications depending on a number of factors, including the country where the grant is awarded, the type of grant, and the purpose of the grant. Some research grants may be taxable, while others may not be. The taxation of research funds can be determined by several factors, including the specific laws of the country in which the grant is awarded, the terms of the grant agreement, and the purpose of the grant. Some grants may be intended to cover research expenses, such as equipment, supplies, and travel, while others may be intended to compensate for time and effort, such as salary or wages.

A key factor in determining the taxation of research funds is the distinction between grants intended to cover expenses and those intended to compensate for time and effort. Grants intended to cover expenses are generally not taxable, as they are meant to reimburse the recipient for costs incurred during the research project. Examples of expenses that may be covered by research funds include travel, equipment, and supplies.

On the other hand, grants intended to compensate for time and effort are typically taxable. These grants are intended to provide the recipient with compensation for their work on the research project, and are similar to a salary or wage. Examples of grants that may be intended to compensate for time and effort include stipends and fellowships.

The tax implications of grants can vary depending on the specific circumstances of the grant. Here are a few examples:

- Research grant to cover expenses: A researcher receives a grant to cover the cost of travel and lodging for a conference related to their research project. This grant would typically be non-taxable, as it is intended to reimburse the researcher for expenses incurred during the research project.

- Research grant to compensate for time and effort: A graduate student receives a fellowship to support their research project. The fellowship provides the student with a stipend of $25,000 per year for two years. This stipend would typically be taxable, as it is intended to compensate the student for their time and effort spent on the research project.

- Research grant to cover expenses and compensate for time and effort: A researcher receives a grant to cover the cost of equipment and supplies for their research project, as well as a stipend of $10,000 to compensate them for their time and effort. In this case, the grant would likely be partially taxable, with the stipend portion being subject to taxation while the portion intended to cover expenses would not be taxed.

Understanding the taxability of research grants is important for researchers, as failure to properly report grant income can result in penalties and legal consequences. By understanding the factors that determine the taxation of research grants and the different types of grants that may be subject to taxation, researchers can ensure that they comply with tax laws and properly report their grant income.

Tax Laws for Research Grants by Country

The taxation of research grants can vary depending on the specific tax laws of the country where the grant is awarded. Here is an overview of how research grants are taxed in different countries, as well as examples of tax laws related to research grants in the United States, United Kingdom, Canada, and India.

In the United States, research grants are generally subject to taxation unless they are specifically exempted under the tax code. Grants that are intended to cover expenses related to the research project, such as equipment, supplies, and travel, are typically non-taxable. However, grants that are intended to compensate for time and effort, such as stipends and fellowships, are usually taxable.

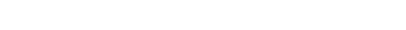

One notable exemption for grants in the US is the National Institutes of Health (NIH) Grant Policy , which exempts certain types of grants from taxation. For example, NIH grants that are used to cover research expenses, such as equipment, supplies, and travel, are typically non-taxable. However, NIH grants that provide stipends or salaries to researchers may be taxable.

In the United Kingdom, research grants are also subject to taxation unless they are specifically exempted. Grants that are intended to cover research expenses, such as equipment and supplies, are generally non-taxable. However, grants that provide stipends or salaries to researchers may be taxable.

There are also specific exemptions for research grants in the UK, such as the Research Councils UK (RCUK) Grant Policy . Under this policy, grants that are intended to cover research expenses are generally non-taxable, while grants that provide stipends or salaries to researchers may be taxable.

In Canada, research grants are generally subject to taxation unless they are specifically exempted. Grants that are intended to cover research expenses, such as equipment and supplies, are usually non-taxable. However, grants that provide stipends or salaries to researchers may be taxable.

One notable exemption for research grants in Canada is the Natural Sciences and Engineering Research Council of Canada (NSERC) Grant Policy . Under this policy, grants that are intended to cover research expenses are generally non-taxable, while grants that provide stipends or salaries to researchers may be taxable.

In India, research grants are generally subject to taxation unless they are specifically exempted. Grants that are intended to cover research expenses, such as equipment, supplies, and travel, are generally non-taxable. However, grants that provide stipends or salaries to researchers may be taxable.

The Indian government offers certain tax exemptions for research grants. For example, grants awarded by the Department of Science and Technology and the Department of Biotechnology are exempt from income tax. Additionally, grants awarded by the University Grants Commission (UGC) for research purposes are also exempt from income tax.

While the tax laws related to research grants can be complex and vary by country, it’s important for researchers to understand their tax obligations and properly report their grant income. Seeking professional advice from a tax professional or accountant can help ensure compliance with tax laws and minimize the risk of errors or omissions on tax returns.

There are a number of potential consequences of failing to properly report research grant income. For example:

- Tax Penalties: Failing to report grant income or inaccurately reporting it can result in penalties and interest charges from tax authorities. Depending on the severity of the error, these penalties can be substantial and can have a long-term impact on a researcher’s finances.

- Legal Issues: In some cases, failing to properly report grant income can lead to legal issues, including fines or even criminal charges. This can be particularly problematic for researchers who rely on grant funding to support their work.

- Loss of Funding: Researchers who fail to comply with tax laws may also face consequences from funding agencies. Some agencies may require researchers to provide proof of compliance with tax laws as a condition of funding, and failure to comply could result in loss of funding or other negative consequences.

By seeking professional advice from a tax professional or accountant, researchers can ensure that they are properly reporting their grant income and complying with tax laws. These professionals can help researchers identify any tax exemptions or deductions they may be eligible for, and can assist with the preparation of tax returns and other documentation required by tax authorities.

Explore a world of research funding opportunities with scientifyRESEARCH , the open and curated database transforming the way researchers access critical funding information. Break free from traditional paywalls and effortlessly navigate the funding landscape. Visit scientifyRESEARCH’s dynamic hub now by clicking link HERE

Research grants can be an important source of funding for researchers, but it’s important to understand the tax implications of these grants and properly report grant income. Seeking professional advice from a tax professional or accountant can help ensure compliance with tax laws and minimize the risk of errors or omissions on tax returns. This can help researchers avoid tax penalties, legal issues, and loss of funding, and can support the long-term success of their research projects.

Upcoming Events

- Visit the Upcoming International Conferences at Exotic Travel Destinations with Travel Plan

- Visit for Research Internships Worldwide

Recent Posts

- EditPad Research Title Generator: Is It Helpful to Create a Title for Your Research?

- Are Postdoctoral Fellowships Taxable? A Guide to Understanding Tax Implications

- How to Get Off-Cycle Research/Academic Internships

- How to End Your Academic/Research Internship?

- PhD or Industry Job? A Comprehensive Career Guide

- All Blog Posts

- Research Career

- Research Conference

- Research Internship

- Research Journal

- Research Tools

- Uncategorized

- Research Conferences

- Research Journals

- Research Grants

- Internships

- Research Internships

- Email Templates

- Conferences

- Blog Partners

- Privacy Policy

Copyright © 2024 Research Voyage

Design by ThemesDNA.com

Can Nonprofit Grants Be Taxed?

Reviewed by:

August 4, 2022

Last Updated:

September 6, 2022

Table of Contents

Picture this—you have just been awarded a grant! You are able to spend an entire year doing your amazing work, realizing your awesome project, and making a community impact. Congratulations!

But wait—how do you account for this grant when tax time comes? How does a grant award impact nonprofit taxes?

This article will give you all the information and tools you need to build proper allowances for taxes, including what grants are, what their tax implications are, and what that means for you and your nonprofit.

What Is a Grant?

Before we go into the fine details of grant taxation, let’s start off with the basics of what a grant is. From there, we can then explain what nonprofit grants are, and how grants impact nonprofit taxes.

A grant is defined as money, goods, or services given from a grantmaking organization to another entity without an expectation of being repaid. Grants are usually sums of money. Although they can also be “in-kind” opportunities, which means grants in the form of goods or services as opposed to “cash”.

Common categories of grants include:

- Federal grant opportunities distributed by the various departments of the federal government

- State grants which are administered through state governments

- Private foundations (also known as “foundation grants”)

- Corporate social responsibility (CSR) grants support from private businesses

While grants are given without an expectation of being paid back, they require a return on investment—or ROI—in terms of measurable benefit to the target area you will use the grant in.

To receive grant funding for programs, a nonprofit will generally need to describe how the funds will be used, the types of services to be provided, the implementation plan, the demonstrated need and impact of the program, and the anticipated outcomes or goals to be met, and the evaluation measures.

To learn more about what types of grants exist for nonprofits, take a look at our article on The Most Common Types of Nonprofit Grants .

For more information about what grants are and the overall grant writing process, check out Grant Writing for Beginners: The Ultimate Guide and What is a Grant Proposal: Grant Writing 101 .

Are Grants Considered Taxable Income?

The answer is: it depends on what sort of organization you are representing, and what type of grant you are focused on.

Note: In this article, we will be focusing on grants and tax law in the United States. International grants will have additional tax implications to consider.

There are many types of grants that are awarded for many different reasons. There are for-profit opportunities, nonprofit opportunities, grants to tribal organizations, grants to research institutions—the list goes on.

The type of grant and the type of organization that is receiving the grant impact the guidance for the tax implications.

For example, COVID-19 grants have specific guidelines that look different from foundation grant guidance, which looks different from research grants to institutions.

As another example, if you are representing yourself as an individual/sole proprietor LLC (e.g. you are the organization) and the grant is not for educational purposes, the grant funds paid to you as a payment/stipend for your grant-related work should be accounted as taxable income.

A good general rule to keep in mind is that all income, regardless of its source, is considered taxable income unless the tax law specifically states an exception.

Since a grant is considered income, it is considered taxable unless the law has provisions that state otherwise. We will explore what that looks like for nonprofit taxes shortly.

Fun fact: if a grant is for expenditures that appear in your profit and loss account and you are deferring the grant income, you most likely would not have a tax liability on the income as it will be matched (canceled out) with its designated expenditure.

For the purposes of this article, we will do a brief overview of what the general grant taxation landscape looks like, and then hone in on nonprofit grants and their specific implications for nonprofit taxes.

Need help finding more grants?

Find and win more grants for your nonprofit! See why thousands of nonprofits trust and use Instrumentl.

What Types of Grants are Tax-Free?

Here’s a snapshot overview of what grants are considered tax-free, why they are considered tax-free, and what it means for you.

Nonprofit Grants

What do we mean when we say “nonprofit” grants? We’re looking at nonprofits defined as 501(c)(3) private foundations.

Every organization that qualifies for tax exemption as a 501(c)(3) organization is considered a private foundation unless it falls into one of the categories specifically excluded from the definition of that term (referred to in section 509(a) of the IRS tax code ).

Nonprofits in the United States are exempt from federal corporate income taxes. Most are also exempt from state and local property and sales taxes.

However, nonprofits are required to pay taxes on income from activities that are unrelated to their mission.

An unrelated business activity (subject to Unrelated Business Income Tax, or “UBIT”) for a nonprofit includes the following characteristics:

- It is a trade or business

- It is regularly carried out and

- It is not substantially related to furthering the exempt purpose of the organization

If the grant is spent on equipment then the grant is not taxable but there is no capital allowance available on the equipment expenditure. A capital allowance is money directed towards long-term business growth and can be deducted each year from overall revenue by way of depreciation.

Qualified Educational Expense Grants

Grants for qualified educational expenses are treated the same as a tax-free scholarship, and the amounts you use to pay for qualified education expenses are tax-free. To be qualified for one of these grants, you must:

- Be a candidate for a degree at an eligible educational institution

- Use the grant to pay qualified educational expenses, and

- Not spend the majority of grant-funded time researching, testing, teaching, etc.

Qualified educational expense grants include Fulbright Grants, Pell Grants, and all Title IV need-based education grants.

COVID-19 Small Business Administration (SBA) Economic Injury Disaster Loan (EIDL) Grants and Grants for Shuttered Venue Operators

The 2020 COVID-19 responded Economic Injury Disaster Loan (EIDL) advance grants of $10,000 for small businesses were not considered taxable income. Additionally, grants for Shuttered Venue Operators (live venues, museums, arts organizations, etc.) were also considered to be tax-free. In some of these unique situations, Covid-19 grant opportunities are tax-deductible nonprofit grants.

Do Nonprofits Have to Issue 1099s for Grants?

The answer is NO.

When it comes to nonprofit taxes, because these funds are considered charitable grants and not designated as payment for services and/or compensation, organizations don’t need to issue 1099s for disbursed grant funds.

Some activities that nonprofits do have to issue 1099s for include:

- Payment issued for a non-employee for services performed in the course of the organization's business.

- Payment to an individual, partnership, vendor, or estate.

At this point, some of you might be asking: what if I happen to be a grantmaking organization that is also a nonprofit?

The answer to that is that a nonprofit's grants to organizations are taxable expenditures, unless:

- The recipients are public charities, and/or

- The foundation exercises expenditure responsibility with respect to the grant.

Expenditure responsibility means that the foundation exerts all reasonable efforts and establishes adequate procedures:

- To see that the grant is spent only for the purpose for which it is made,

- To obtain full and complete reports from the grantee organization on how the funds are spent, and

- To make full and detailed reports on the expenditures to the IRS.

General Rules for Nonprofit Grants and Taxes

Like we went over earlier, the general rule for nonprofit grants is that they are considered income in most situations, and therefore are exempt from federal corporate income taxes. Most are also exempt from state and local property and sales taxes, but you would want to check your specific state and municipality to make sure that you are also following local tax laws.

Each state has its own website dedicated to specific rules and regulations for nonprofit taxes, and you might also consider speaking with a certified tax professional in your area to ensure you have all the information that you need. Many firms will offer pro-bono consultation if you are representing a nonprofit organization.

For even more information about how the grants process works, for both tax structure and overall lifecycle, you can read our article How Do Government Grants Work? What You Need To Know , which provides a deep dive into common questions about government-supported grants.

Wrapping Up: Can Nonprofit Grants Be Taxed?

In this article, we explored the basics of rules and regulations for nonprofit taxes and grants. We went over general rules and delved into which categories of grants are considered to be tax-free. We also went over where you can take additional steps to learn more about grants.

Remember that you also want to check out your state and local tax regulations regarding nonprofits to make sure that you have a solid grasp of your specific situation.

Instrumentl is a great place to start as you think about how to account for your newest grant-funded endeavor. We have tons of resources, including articles and webinars, that can answer your questions and help you build your toolkit of resources for your overall grants experience. Check out our blog for more tips on how to thoroughly account for your next grant.

Need more grants to diversify your revenue?

Discover your next grant, get access to weekly advice and grant writing templates.

10k+ grant writers have already subscribed

Instrumentl team

Instrumentl is the all-in-one grant management tool for nonprofits and consultants who want to find and win more grants without the stress of juggling grant work through disparate tools and sticky notes.

Become a Stronger Grant Writer in Just 5 Minutes

17,502 open grants waiting for you.

Find grant opportunities to grow your nonprofit

10 Ready-to-Use Cold Email Templates That Break The Ice With Funders

Transform funder connections with our 10 expert-crafted cold email templates. Engage, build bonds, showcase impact, and elevate conversations effortlessly.

Related posts

7 best practices to master nonprofit financial management.

Discover seven best practices for managing your nonprofit’s finances and maintaining strong financial health. From tangible tips to expert insights and tried-and-true strategies, this article provides essential guidance to help your organization avoid costly mistakes and continue serving your community effectively. Let’s ensure your nonprofit thrives!

Why Your Board Hates Fundraising & What To Do About It

Transform your non-profit board into fundraising champions with insights from a seasoned industry expert. Discover how to overcome common hurdles and ignite enthusiasm for fundraising among board members. Learn actionable strategies to drive support for your cause effectively.

Love Thy Donor: Donor Retention in an Era of Dwindling Loyalty

Seize the opportunity in philanthropy’s surge while addressing declining individual giving. With baby boomers and the Silent Generation transferring historic wealth, now is the time to bolster donor recruitment and retention efforts. Learn how to tap into this monumental opportunity to sustain your cause’s support.

Try Instrumentl

The best tool for finding & organizing grants

128 reviews | High Performer status on g2.com

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Are Business Grants Taxable?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Grants provide free money you don't have to repay — making them a highly desirable form of business funding. However, though they don't require repayment, small-business grants may have tax implications for your business.

Here's everything you need to know.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Most business grants are taxable

A business grant is usually considered taxable income — unless the tax law calls for some exception. Suppose you're a member of a federally recognized American Indian tribe, for example, and you receive a grant from the tribe to expand your business on or near reservations. In that case, you do not have to include those funds as taxable income [0] Internal Revenue Service . Publication 525 Taxable and Nontaxable Income . Accessed Jun 8, 2022. View all sources .

Typically, however, the money you receive from a small-business grant (regardless of the source) is taxed as income on your federal tax return. In addition, although state tax laws vary, you may also have to report grant funds as income on your state tax returns.

Are COVID-19 relief grants taxable?

In general, COVID-19 relief grants are also considered taxable income for businesses [0] Internal Revenue Service . CARES Act Coronavirus Relief Fund Frequently Asked Questions . Accessed Jun 8, 2022. View all sources . Although these grants are subject to federal taxes, certain COVID-19 relief grants have been issued a tax exemption at the state level.

» MORE: How COVID grants and relief programs impact business taxes

How to determine if your business grant is taxable

If you're unsure if your business grant funding qualifies as taxable income, there are a few things you can do.

Review federal requirements

Although most business grants are subject to federal taxes, you can review federal guidelines to ensure you don't qualify for exemptions. The IRS publishes an annual guide to taxable and nontaxable income and a tax guide for small businesses on its website.

Research state laws

States have individual tax laws, so you'll want to make sure that you research the guidelines in your state to see if you'll need to pay income taxes on your grant money. Some states have economic development corporations or agencies whose websites include tax guidelines for small businesses. You might also consult your state's Department of Revenue website.

Refer to your business grant agreement

Your business grant agreement may outline your tax obligations. Therefore, you'll want to review this document thoroughly before and after receiving your grant funding. Understanding the terms and conditions of your grant agreement and your tax responsibilities can help you create a financial plan and set aside funds to cover your taxes before you spend the money.

Contact your funding organization

If your agreement doesn't include tax information, you need clarification or you have questions about the terms of your grant, you can reach out to your funding organization for assistance. A representative from this organization should be able to discuss your grant and answer any questions you may have.

Work with a business accountant or certified tax advisor

When in doubt, a business accountant or certified tax advisor can help you understand any tax liabilities associated with your grant funding. These professionals may also be able to assist you with other tax issues and general financial planning.

To find a certified business accountant or tax advisor, you can refer to professional tax organizations, such as the Association of International Certified Public Accountants or the National Association of Enrolled Agents . Nonprofits such as SCORE can also connect you with small-business experts and additional resources for free.

» MORE: How to find the right small-business tax advisor

Compare small-business loans

Our recommendations are based on the market scope and track record of lenders, the needs of business owners, and an analysis of rates and other factors so that you can make the right financing decision.

On a similar note...

- Sign in to Community

- Discuss your taxes

- News & Announcements

- Help Videos

- Event Calendar

- Life Event Hubs

- Champions Program

- Community Basics

Find answers to your questions

Work on your taxes

- Community home

- Discussions

I received a grant and have a 1099-MISC for it. Do I also include that grant in my education/scholarship section?

Do you have a turbotax online account.

We'll help you get started or pick up where you left off.

- Mark as New

- Subscribe to RSS Feed

- Report Inappropriate Content

- TurboTax Deluxe Online

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

View solution in original post

Still have questions?

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amirahm2021

If i received a letter from my school verifying that I qualify for both American opportunity and Lifetime learning tax credit, then why is TurboTax saying otherwise?

If you use TurboTax MAX benefits did they help with the return if not received?

Stock sales or dividends when not a CA resident

bryanna-j00

Is it normal to have my return “refunded”? I have yet to receive a penny of my tax return… it has been over 21 days. Anyone else experiencing this?

Did the information on this page answer your question?

Thank you for helping us improve the TurboTax Community!

Sign in to turbotax.

and start working on your taxes

File your taxes, your way

Get expert help or do it yourself.

Access additional help, including our tax experts

Post your question.

to receive guidance from our tax experts and community.

Connect with an expert

Real experts - to help or even do your taxes for you.

You are leaving TurboTax.

You have clicked a link to a site outside of the TurboTax Community. By clicking "Continue", you will leave the Community and be taken to that site instead.

REVISED APRIL 2024. This document applies to all NIH grants and cooperative agreements for budget periods beginning on or after October 1, 2023.

Ruth L. Kirschstein National Research Service Award, NRSA, institutional research training grants, training grants, stipend supplementation, compensation, other income, concurrent benefits, educational loans or GI bill, NIH loan repayment program, LRP, taxability of stipends, Form 1099

11.3.10 stipend supplementation, compensation, and other income, 11.3.10.1 stipend supplementation.

Recipients may supplement stipends A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. from non-Federal funds provided the supplementation is without any additional obligation for the trainee. An organization can determine what amount of stipend A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. supplementation, if any, will be provided according to its own formally established policies governing stipend A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. support. These policies must be consistently applied to all individuals in a similar training status regardless of the source of funds. Federal funds may not be used for stipend A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. supplementation unless specifically authorized under the terms of the program from which funds are derived. An individual may use Federal educational loan funds or VA benefits when permitted by those programs as described in Educational Loans or GI Bill below. Under no circumstances may PHS funds be used for supplementation.

11.3.10.2 Compensation

NIH recognizes that student or postdoctoral trainees may seek part-time employment coincidental to their training program to further offset their expenses. Fellows and trainees may spend on average, an additional 25% of their time (e.g., 10 hours per week) in part time research, teaching, or clinical employment, so long as those activities do not interfere with, or lengthen, the duration of their NRSA training. Funds characterized as compensation may be paid to trainees only when there is an employer-employee relationship, the payments are for services rendered, and the situation otherwise meets the conditions of the compensation of students as detailed in Cost Considerations-Allowability of Costs/Activities-Selected Items of Cost-Fringe Benefits / IHE Tuition/Tuition Remission in IIA. In addition, compensation must be in accordance with organizational policies consistently applied to both federally and non-federally supported activities and must be supported by acceptable accounting records that reflect the employer-employee relationship. Under these conditions, the funds provided as compensation (salary, fringe benefits, and/or tuition remission) for services rendered, such as teaching, laboratory assistance, or clinical duties are not considered stipend A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. supplementation; they are allowable charges to Federal grants, including PHS research grants. However, NIH expects that compensation from research grants will be for limited part-time employment apart from the normal full-time training activities.

Compensation may not be paid from a research grant that supports the same research that is part of the trainee's planned training experience as approved in the Kirschstein-NRSA institutional research training grant application.

Stipend A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. Supplementation & Compensation. Under no circumstances may the conditions of stipend A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. supplementation or the services provided for compensation interfere with, detract from, or prolong the trainee's approved Kirschstein-NRSA training program. Training PD/PIs must approve all instances of employment on research grants to verify that the circumstances will not detract from or prolong the approved training program.

11.3.10.3 Other Income: Concurrent Benefits

An individual may not receive support under a Kirschstein-NRSA institutional research training grant concurrently with another federally sponsored fellowship or similar Federal or non-Federal award that provides a stipend A payment made to an individual under a fellowship or training grant in accordance with pre-established levels to provide for the individual's living expenses during the period of training. A stipend is not considered compensation for the services expected of an employee. or otherwise duplicates provisions of the Kirschstein-NRSA award.

11.3.10.4 Other Income: Educational Loans or GI Bill

An individual may accept concurrent educational remuneration from the VA (GI Bill) and Federal educational loan funds. Such funds are not considered supplementation or compensation. In the case of the MARC-U*STAR program, funds from a Pell grant may be accepted as well.

11.3.10.5 Other Income: NIH Loan Repayment Program

Postdoctoral trainees also may be eligible to participate in the NIH Loan Repayment Program .

11.3.10.6 Taxability of Stipends