Attendance Management and Employee Performance among Selected Commercial Banks in the Kingdom of Bahrain

International Journal of Economics, Commerce and Management, 2019

14 Pages Posted: 6 Mar 2020

Mohamed Abdulla Ebrahim Jasim Bader

Ama international university, college of administrative and financial sciences, jayendira p sankar.

University of Technology Bahrain

Date Written: December 31, 2019

Attendance management is a critical factor within any organization which has employees. Information gathered through attendance management reporting style helps in determining if an organization is on the right track as well as if it moving toward a successful future. The workforce is a key resource that a business should know the way to keep track of their attendance and time. Through monitoring attendance, it is easier for a company to determine which employees arrive on time, early or constantly late. Employees from different organizations are found to involve in fake leaves that cause negative impact on the performance of the organization. As a result, organization uses different types of management techniques to maintain the performance of their employees in various business organizations as well as in banking sectors. In order to determine the correlation between the two variables: attendance management and employee performance the paper used an online survey questionnaire to collect information about the research topic under investigation. The collected data is analysed using the Statistical Package for the Social Sciences using frequency descriptive tables. To test the reliability of the collected data results a Pearson’s correlation analysis test is used. To conclude, the paper provides several recommendations regarding the strategies that commercial banks within the Kingdom of Bahrain should be put in place to improve their employee attendance management.

Keywords: Attendance Management, Performance Management, Time management, Absenteeism, Accountability, Fake leave, Punctuality, Bahrain

Suggested Citation: Suggested Citation

Jayendira P Sankar (Contact Author)

University of technology bahrain ( email ).

Salmabad Salmabad, 0321 Bahrain

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, human resource management & organizational behavior ejournal.

Subscribe to this fee journal for more curated articles on this topic

Political Economy - Development: Political Institutions eJournal

Payroll system: A bibliometric analysis of the literature

- Split-Screen

- Article contents

- Figures & tables

- Supplementary Data

- Peer Review

- Open the PDF for in another window

- Reprints and Permissions

- Cite Icon Cite

- Search Site

Fariza Hanim Rusly , Aidi Ahmi , Yurita Yakimin Abdul Talib , Khairina Rosli; Payroll system: A bibliometric analysis of the literature. AIP Conf. Proc. 26 September 2018; 2016 (1): 020124. https://doi.org/10.1063/1.5055526

Download citation file:

- Ris (Zotero)

- Reference Manager

Payroll processing is an imperative process in an organization; it involves many tasks to ensure accurate and timely payments of the workforces’ services, and to protect organization’s reputation through effective record-keeping compliance with the government authorities’ employment legislations. Despite its important function in the organization process, studies on payroll processing is quite limited, as compared to other transaction processing systems such as sales and purchase. This paper observes the trend of articles published on payroll system that has been indexed by the Google Scholar as at February 2018. This study aims to provide insights into the characteristics of the issues related to payroll system using a bibliometric analysis. Articles that matched with the keywords [allintitle: payroll system OR systems OR application OR applications OR software] in the Google Scholar has been obtained and analyzed. After conducted the cleaning process i.e. by completing the meta-data of the articles and removing some of the irrelevant and duplicate articles, 170 articles are available for further analysis. It is found that, the number of published payroll system articles are increasing in the past five years. Most of the articles has been published as journal articles, academic dissertations and conference papers. The output of this study can help researchers to understand the landscape of the global research and issues on payroll system and establish further research directions in this field.

Citing articles via

Publish with us - request a quote.

Sign up for alerts

- Online ISSN 1551-7616

- Print ISSN 0094-243X

- For Researchers

- For Librarians

- For Advertisers

- Our Publishing Partners

- Physics Today

- Conference Proceedings

- Special Topics

pubs.aip.org

- Privacy Policy

- Terms of Use

Connect with AIP Publishing

This feature is available to subscribers only.

Sign In or Create an Account

← BLOG | EMPLOYMENT LAW UPDATES | NEWS

10 Questions to Ask When Evaluating Payroll Systems

Payroll problems? You’re not alone.

If your company wrestles with the same frustrating payroll problems every single pay period, it’s time to see what else is out there. Because when it comes to payroll systems, employers have a dizzying number of options. So, where to start? These 10 questions can help you narrow the field.

1. Are Payroll Systems Cloud-based?

Surveys show that 64% of companies that have adopted cloud-based HR platforms have accomplished definable business value from their investments. Cloud-based systems free companies from the need to maintain on-premise software and servers, while greatly simplifying system updates. They also allow payroll professionals to work from anywhere, on any device—a must in today’s fluid work environment.

Consider this: many HR tech providers no longer even offer on-premise software, and there are several reasons why cloud data is even more secure than on-premise data, including security management, data encryption and more. If you’re truly looking to upgrade and simplify your HR systems, focus on cloud-based solutions.

2. Can Payroll System End Manual Workarounds?

One of the most common payroll problems that employers face is the need to make manual end runs around their payroll system because it can’t process all transactions automatically. Even if your staff is adept at jury-rigging your system, it’s a risky business. To err is human. Every manual intervention is an opportunity to make errors—and if there’s one thing you don’t want to mess up, it’s your employees’ paychecks. When evaluating new payroll systems, find out how they will help you navigate each of your particular challenges.

Want easy, accurate payroll

Schedule a call to learn how VensureHR runs payroll timely and accurately.

3. Are Payroll Systems Designed for Our Workforce?

Another common payroll roadblock is when an employer’s system can’t adequately handle the specific complexities of its labor environment. If your company deals with things like multiple Federal Employer Identification Numbers (FEINs), shift differentials, blended overtime or union dues, make sure in advance that your prospective payroll system can, too. Tip: If a payroll provider handles similarly sized companies in your industry, it probably speaks your language.

4. How Does This Payroll System Handle Taxes?

Many employers have concluded that it’s in their best interest to offload payroll tax deposits and filings to their payroll service provider. These are time-consuming, time-sensitive tasks that can commonly lead to IRS fines if completed incorrectly. Find out what a payroll service can do for you—W-2s, Form 1000s, quarterly reports—and what guarantees it is willing to make.

5. What Kind of Customer Support Do Payroll Systems Offer?

Inadequate customer support is one of the most common payroll issues by far. If your provider’s help desk staff isn’t helpful—or closes up shop before you do—that’s a problem. When it comes to payroll systems, it’s not unreasonable to expect live, 24/7 customer service. Tip: Ask your prospective payroll provider to share its customer retention rate—it will tell you a lot about what customers think of the service provided.

6. Do Payroll Systems Offer Self-Service Portals?

One payroll challenge that can be overwhelming for HR staffs is fielding questions from employees about pay stubs, paid time off (PTO) balances, withholding and more. Today, any payroll system worth its salt will include an employee self-service portal that’s easy to access and use. Employees like them; busy HR departments need them.

7. What’s a Payroll System Billing Structure?

Feeling nickeled and dimed is a common payroll headache for many employers. If you’re dinged for every report, garnishment and general ledger edit, that can add up to an unpleasant, budget-blowing surprise. Remember, some payroll providers offer all-inclusive pricing. Tip: Ask the potential provider for sample bills for groups with a similar structure to yours.

8. Are Payroll Systems Part of Integrated HCM Systems?

In recent years, it was a common trend to assemble a collection of best-of-breed systems for every facet of HR. Now, employers are moving to integrated Human Capital Management (HCM) systems that eliminate duplicate inputting and ensure records are consistent. Tip: If one of your payroll issues is being able to get prompt, complete time and attendance data over to payroll, an integrated HCM system could be your solution.

9. What Type of Analytics Do Payroll Systems Offer?

Every payroll system should offer some kind of reporting feature. When evaluating providers’ reporting capabilities, don’t be afraid to get specific. How easy is it for staff to run reports? What standard reports are included, and how do they measure up to your needs? Are custom reports an option, and if so, what is the cost? You can never ask too many questions.

10. Will Payroll Providers Give You Customization?

Several providers will offer you a demonstration, but to get the most value from it, it needs to be tailored to your business. So be ready to share all of your payroll problems and priorities with potential vendors—a truly client-centered payroll provider will want to know this information.

Learn more about VensureHR’s payroll services .

Subscribe to The Vensure Voice

Recent Posts

- Vensure Employer Solutions Acquires Apex America, a Specialist in Customer Experience (CX) and Nearshore Business Process Outsourcing

- Vensure Employer Solutions Announces Acquisition of White Label HR

- Colorado Amends Its Privacy Act to Include Biometric Data

- Reminder: Texas Data Privacy & Security Act (TDPSA) Takes Effect on July 1, 2024

- Illinois Department of Labor Published Final Regulations on Paid Leave for All Workers Act

- Quick Sitemap

Sign up for The Vensure Voice, our monthly updates newsletter.

- Human Resources

- Payroll Administration

- Employee Benefits

- Risk and Compliance

- PEO Services

- Client Center

CHAT WITH US

Sales: 800.941.8731 24/7 Live Support: 800.409.8958

Thanks for subscribing. Be on the look out for The Vensure Voice, our newsletter full of helpful resources, up-to-date info and more!

iNetTutor.com

Online Programming Lessons, Tutorials and Capstone Project guide

Automated Payroll System Thesis Project with Complete Source code

Significance of the study

The present study endeavors to assess the present payroll system employed by Company. Result of this investigation will improve the payroll system. Furthermore the study will provide benefits to the following:

By using the Automated Payroll System, the rate of efficiency and effectiveness will improve and develop by providing:

- Date Security – this system use a password to protected database that can be accessed by authorized personnel only.

- Prevent Error – support of the buck up and restores utility to minimize the lost data of employees.

- Fast and easy to use – it is time saver, minimizing manual procedure and updated program.

- Automatic appearance of pay slips of the employee – a printed papers support of updated program to compute automatically the salary deduction and give the final total of the salary

Accountant/Disbursing Officer

This study makes the operation easy, automatic and accurate. It is not time consuming for the disbursing officer to operate because it is systematic.

Data Gathering Instrument

The data gathering instrument that used in the study is questionnaire method. The questionnaire is consists of a series of questions and other prompts for the purpose of gathering information from the respondents.

The questionnaire is a way of collecting information through a given list if questions, the answer to which is recorded by respondents (dictionary.com).

The self-made questionnaire is evaluated and validated by the group of experts on research and an English teacher.

The questionnaires consist of two Parts.

Part1. refers to the identification of the present payroll system of Company

Part2. refers to the assessment of the level of preference among the employees to adopt an Automated Payroll System.

Data Gathering Procedure

A preliminary inquiry was made from the employees of the company to seek their cooperation and support in determining the necessary information needed in the study.

The researchers wrote a letter to the asked permission to study and distribute questionnaire to actual respondents. Upon approval of the letter, the researchers conducted and have an actual interview to employees and staff to validate their preference to create an Automated Payroll System.

This study aimed to develop an Automated Payroll System. The actual mode of the system automates payroll for faster, easy and accurate computation of salary and deductions.

Descriptive survey methods by administering questioner getting the percentage were used by the researchers. Self-made questionnaire was used as research instrument. Respondents were the employees of Company.

After administering the questionnaire, the data were collected, collated and tabulated with the use of tally sheet and frequency.

It was treated statistically using descriptive statistics such as frequency and percentage. Results showed that majority of the employees confirmed to develop an Automation Payroll System. One hundred percentage transactions were processed using manual. Has a total sample of one hundred (100), the data gathered were analyzed using statistical tools such as mode, frequency and percentage.

The preference of employee to adopt an Automation System in developing Automated Payroll System was found to be “Very High”. For all these, the researchers were found out that there is a need to propose an automated payroll system

Recommendation

- Manual system of payroll preparation is antiquated, tedious and error prone system, therefore it is recommended that it will be discarded.

- Since the preference level of respondents to adapt Automated Payroll System is “very high” it is therefore recommended that the institution will access soonest possible time on Automated Payroll System.

People ware Recommendation

The target user is the payroll officer, because he/she will be the one to use the automated payroll system. User should have knowledge about the system that he or she will be using, she must also understand the program itself. The user should also be a computer literate and should undergo training to understand and familiarize herself with the proposed automated payroll system.

Payroll System in Visual Basic and MS Access Complete Source code

Post navigation.

- Automated Grading System in Visual Basic and MySQL

- Thesis and Capstone Project Title Compilation for Information Technology

Similar Articles

Thesis titles and capstone projects for information technology 2018, livestreaming platform in php, laravel cms free download source code.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Payroll Management System

2013, Payroll Management with Biometric Process

Payroll management system encompasses all the tasks involved in paying an organization’s employees. It typically involves keeping track of hours worked and ensuring that employees receive the appropriate amount of pay. It also includes calculating taxes and social security, as well as ensuring that they are properly withheld and processed. Depending on the company in question, a full range of other deductions may be calculated, withheld, and processed as part of payroll administration. Additionally, the processing of contractor payments may fall under the umbrella of payroll administration.

Related Papers

Diana Cardenas

pronoti roy

Payroll is a critical operation for every organization to pay employee accurately their salary and enrollments on time.[1]The idea of taking control of employees pay calculations are quite tedious if done manually and require more effort and time mainly for big organizations. Hence if this process is automated, it would be of great benefit as it would require less time to calculate the salary of the employees. The software for payroll management system service on the cloud is provided as a solution in this paper.[2] This system provides multiple user data access. Each user like employee or HR or admin can login into the software by writing username and password which are allocated to them from the company. It involves keeping track of hours worked and is capable of keeping a record of employee data including their pay, allowances, deductions and taxes on monthly bases so that fresh definitions are reflected from the month onwards, which leaves all the past data intact.[3] The proposed payroll system is advantageous as it provides a user friendly environment and also increases security and minimizes human calculation errors.

International Journal of Computer Applications

Albert Akanferi

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Do you want to create free survey about:

Survey for Payroll Management?

Or maybe something else?

or use this template:

Survey for Payroll Management

Explore the world of payroll management with our comprehensive survey on employee satisfaction, preferences, and challenges.

Would you like to work on this survey?

Startquestion is a free survey platform which allows you to create, send and analyse survey results.

Optimizing Payroll Management: A Comprehensive Survey Analysis

In today's ever-evolving business landscape, efficient payroll management is crucial for organizational success. The 'Survey for Payroll Management' aims to gather feedback from employees regarding their satisfaction levels, preferences, and challenges related to payroll processes. The survey consists of a mix of single choice, multiple choice, and open-ended questions to provide a comprehensive understanding of the current state of payroll management. From assessing satisfaction levels with existing systems to identifying key features and improvement areas, the survey delves deep into the world of payroll management. Participants are encouraged to share their experiences, opinions, and suggestions to help shape the future of payroll processes within their organizations. We believe that the insights gained from this survey will not only benefit individual employees but also contribute to overall organizational efficiency and effectiveness. So, don't miss this opportunity to voice your thoughts and be a part of the transformation in payroll management!

All Formats

Table of Contents

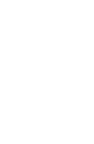

5 steps to create a payroll questionnaire, 8+ payroll questionnaire templates, 1. company payroll questionnaire, 2. sample payroll questionnaire template, 3. payroll office questionnaire in pdf, 4. payroll integration questionnaire, 5. simple payroll questionnaire template, 6. bonus payroll preparation questionnaire, 7. energy payroll questionnaire template, 8. basic payroll questionnaire in pdf, 9. payroll service questionnaire in doc, 8+ payroll questionnaire templates in pdf | doc.

A payroll questionnaire often helps in evaluating the controls in an organization’s payroll process. This payroll questionnaire is made to focus on the business activities of hiring personnel, terminating personnel, recording time, managing payroll accounting and so on. An employee payroll questionnaire includes various objectives like the additions to the payroll master files that represent valid employees, all new employees that are added to the payroll master files along with the terminated employees.

Step 1: Purpose of the Questionnaire

Step 2: ask the questions right away, step 3: ask specific questions, step 4: avoid any negative questions, step 5: pre-test the questionnaire.

More in Business

10+ Schedule Template Bundle

Bi-weekly payroll template, weekly payroll template, sales promotional schedule template, payroll calculator template, holiday and leave compliance schedule hr template, banquet event order schedule template, babysitter schedule template, event planning schedule template, dinner event schedule template.

- What is a Template?

- How to Create a Sales Plan + Templates

- 28+ Blank Check Template – DOC, PSD, PDF & Vector Formats

- 39+ Free Obituary Templates in MS Word | PDF | Apple Pages | Google Docs

- 41+ Christmas Brochures Templates – PSD, Word, Publisher, Apple Pages

- 23+ Christmas Brochure Templates

- 11+ Scholarship Profile Templates in DOC | PDF

- 4+ Hospitality Induction Templates in DOC | PDF

- 7+ Financial Plan Templates

- 10+ Operational Plan Templates

- 11+ Student SWOT Analysis Templates – PDF

- 9+ Training Plan Templates

- 7+ Production Evaluation Templates

- 5+ Shooting Schedule Template

- 5+ Budget Planner Templates

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Employment May 2024: Strong Report Dashes Rate Cut Hopes

- Nonfarm Payrolls in May exceeded expectations, growing by 272,000 jobs and surprising economists.

- The strong payroll and hourly earnings data may temper hopes for Fed rate cuts and raise concerns about inflation.

- Certain details in the report raise troubling questions.

- Successful Portfolio Strategy members get exclusive access to our real-world portfolio. See all our investments here »

Maskot/DigitalVision via Getty Images

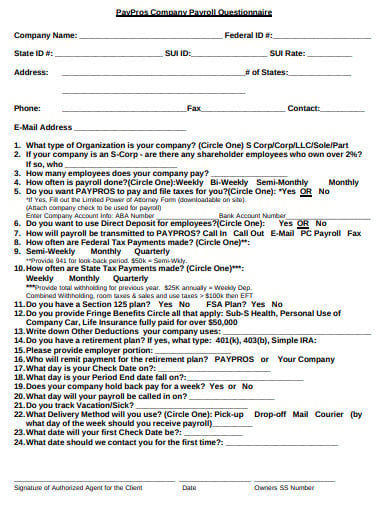

The Employment Situation Report (ESR), corresponding to labor market activity during the month of May 2024, was published by the BLS on Friday, June 7, 2024, at 8:30 AM EST. This report makes available an extraordinary amount of important labor market data derived from two separate surveys: The Establishment Survey and the Household Survey.

In this article, we will walk readers through the most important employment statistics derived from both surveys. However, we will be providing a deep breakdown of the Establishment Survey. We will also discuss the likely implication of the report for bond and equity markets.

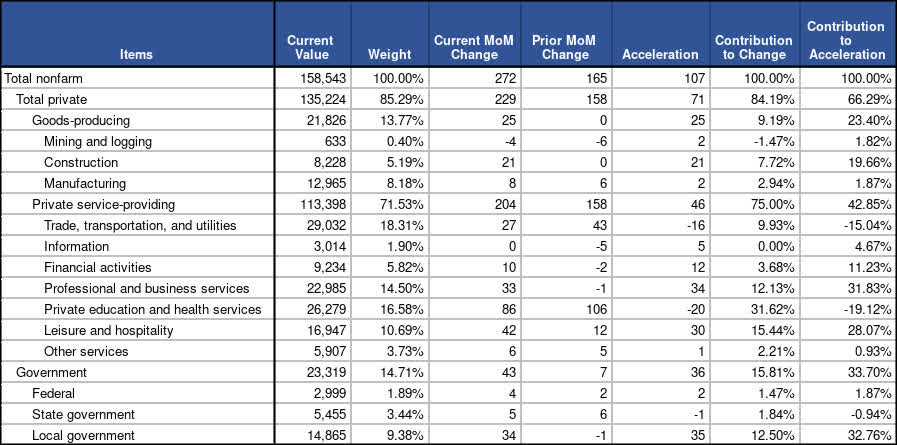

According to the BLS, Nonfarm Payrolls (NFP) in May came in at 158,543,000 payrolls and expanded by 272,000 (0.17%)— surprising significantly to the upside compared to the median forecast of professional economists which expected a 182,000 expansion in NFP.

The forecasted 3-month annualized change of NFP was +1.17% growth rate, a rate of change which ranks in the 47th percentile historically.

However, reported data (including the figures for the most recent month and revisions to prior months) indicate that NFP grew at a 3-month annualized rate of 1.91%, a rate of change which ranks in the 47th percentile historically.

The question now is: Based on a thorough analysis of the employment data, and the initial market reactions to it, should investors make any adjustments to their economic forecasts, and/or to their investment strategies?

The right answer is never an obvious one. Success in investing largely depends on finding difficult-to-obtain information and/or insights that supply an informational and/or analytical edge. This requires both diligence and skill. Our method, focused on five key questions, helps us generate an edge from analyses of just-released economic reports:

Was there any surprise?

What caused the surprise?

Did the surprise alter the macroeconomic outlook?

Is anything in this report being misunderstood or overlooked?

Has the initial market reaction given rise to any actionable opportunities?

In this article, these questions will be addressed as we walk readers through a four-step process. First, we will perform a comprehensive analysis of the just-released report. Second, we will update macroeconomic forecasts, based on this analysis. Third, we will adjust our investment assessments of major asset classes. Finally, we will deliver actionable insights that will enable readers to capitalize on our analysis.

Headline Data

We begin our examination with summary data and analytics, which we highlight in Figure 1. We recommend that readers pay particular attention to the percent rank of Month-on-Month (MoM) growth, MoM acceleration, and the surprises relative to forecasts.

Figure 1: Change, Acceleration, Expectations, and Surprise

Employment Situation Report Summary Data (BLS & Investor Acumen)

NFP expanded 272,000 total jobs this past month. This change was above the historical median, ranking in the 53rd percentile. This month’s change represented a 0.07% acceleration from the prior month. NFP surprised to the upside of median expectations by 90,000 total jobs.

Figure 1 provides similar analysis for other employment indicators. Notably, Average Hourly Earnings (AHE) accelerated and surprised to the upside. However, the unemployment rate rose, surprising to the upside.

A Deep Dive Into the Establishment Survey

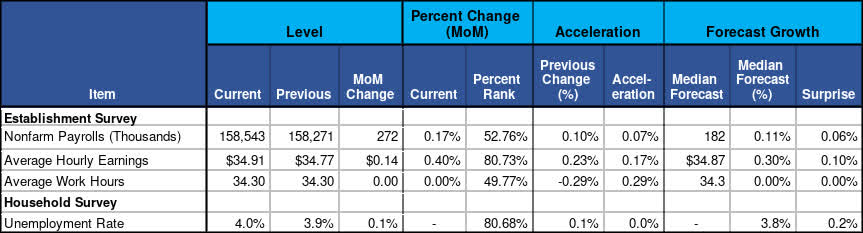

This section of our report will be devoted to analysis of data derived from the Establishment Survey. The first section tracks the rates of change of nonfarm payrolls over several time frames, broken down by industry groups. The second section presents a decomposition analysis of the contributions of various industry groups to the overall MoM change in nonfarm payrolls.

Rates of Change and Momentum of NFP Components

In this section, we break down Nonfarm Payrolls (NFP) by major industry groups, scrutinizing their annualized growth rates over various time frames (1m, 3m and 12m). The purpose of this analysis is two-fold. Our first purpose is to identify which components of NFP are exhibiting rates of change that are greater than or less than the overall aggregates. Our second purpose is to determine whether, and to what extent, the rates of change of the various components are accelerating or decelerating over various time frames. Nonfarm Payroll figures are displayed in thousands.

Figure 2: Annualized Growth Rates of Key Components

Annualized Growth of NFP (BLS & Investor Acumen)

Strength and momentum of overall growth. As can be seen in Figure 3, overall NFP, on a 3-month annualized basis (1.91%), remained below the historical median (47th percentile). However, for the month of May the 1-month growth was above expectations (53rd percentile).

Divergences in rates of change between categories. It is interesting to note the differences in the 3-month rate of change between Total Private and Government. In the Total Private sector, the 3-month annualized growth rate of payrolls (206) was historically below (44th percentile). The 3-month annualized growth rate (43) in Government payrolls during the past 3-month period was historically above (62nd percentile). This divergence also exists for the month of May, where Total Private was below the historical median (49th percentile) while Government was above the median (60th percentile).

Attribution Analysis: Change and Acceleration of NFP Components

In this section, our analysis is focused on identifying the contributions of various industry groups to the MoM Change and MoM Acceleration of the aggregate Nonfarm Payrolls statistic. Nonfarm Payroll figures are displayed in thousands.

Figure 3: Contributions to Change and Acceleration Attributable to Major Components

Contribution of Components to NFP (BLS & Investor Acumen)

As can be seen in Figure 4, the MoM rate of change in total NFP for May accelerated by 107k jobs compared to the prior month. This is attributable to a 66.29% contribution to acceleration from Total Private payrolls and a 33.70% contribution to acceleration from Government Payrolls.

Within the Private sector, Goods-producing payrolls accounted for 23.40% contribution to acceleration, while Private service-providing accounted for 42.85%.

231k jobs are attributable to the birth-death model, which estimates the net jobs created by the opening and closing of businesses. This figure will likely be significantly revised downwards.

US Economy Outlook: Implications of the PCE Data

In this section, we address the following question: Based on our comprehensive analysis of the just-released NFP data, what (if any) changes should we make to our macroeconomic forecasts and/or our overall outlook for the US economy?

Updates to US Economic Forecasts

Let’s begin with a brief review of forecasters’ expectations leading into this report. The median forecast of professional economists expected the BLS to report that Nonfarm Payrolls grew by 182k during the most recent month.

Assuming that this forecast had been completely correct, and that there were no revisions to prior data, the 3-month annualized change of NFP would have been a 1.17%, a rate of change which ranks in the 43rd percentile historically.

As it turns out, reported data (including the figures for the most recent month and revisions to prior months) indicate that NFP grew at a 3-month annualized rate of 1.91%, a rate of change which ranks in the 47th percentile historically. This will result in modest upward revisions of nowcasts.

Certain aspects of the Employment Situation Report raise important questions. For example, full-time employment was reported to be down substantially. By contrast, part-time work was up sharply and the number of people working more than one job was up to a record high. Furthermore, employment of native-born Americans is down while employment of immigrants (legal and illegal) is up sharply.

Perhaps the most salient question is regarding the estimate of net jobs created by the opening and closing of businesses (birth-death model). Numerous data points suggest that net job creation in this category is far less vigorous than the BLS is estimating, and that subsequent estimates will be severely revised.

Update of Overall Outlook for US Economy

How do these updates to our forecasts affect our overall outlook for the US economy? Currently, the overall outlook for the US economy is dominated by whether or not the US economy will achieve a “soft-landing.” How does our thorough analysis of the just-released payroll data impact the analysis of this question?

As mentioned earlier, the US economy is currently operating at very high rates of resource utilization. For example, the estimated Non-Accelerating Inflation Rate of Unemployment (NAIRU) is estimated to be approximately 4.2%, and the current unemployment rate at 4.0%. This rate of labor resource utilization, combined with above average consumer demand growth being reflected in the Personal Spending data, is not compatible with a stable (non-accelerating) rate of inflation.

Another way to describe the current situation is that BLS data suggest that growth of employment in the US economy is not “landing” in a manner that is conducive to a “landing” of the current too-high rate of inflation down to the Fed’s target rate of 2.0%. Indeed, economic conditions in the US -- if the BLS data are to be believed -- could currently be characterized as indicating a “no landing” scenario.

A no-landing scenario poses no immediate threat to the US economy. However, in the intermediate term, if the growth rate of economic activity does not slow down to a below-average pace that would enable the rate of inflation to “land” at the target rate of 2.0%, then US Fed monetary policy will remain tighter than many hope. This would raise the risk of a “hard landing” of the economy in the intermediate-term.

Fixed income markets are currently pricing in 25 basis points of Fed rate cuts by September 2024. However, the implied probability of one or two Fed rate cuts by the end of 2024 fell significantly as a result of the strong Payrolls and AHE data.

Market Outlook

As a result of the stronger-than-expected payrolls and hourly earnings data, US Treasury bond prices fell and yields rose, across the curve. The 10Y Treasury yield surged by 14 basis points as of this writing. The S&P 500 index was down by 0.20%, but had bounced from the lows.

This report runs against the grain of a slew of data during the past 40 days that suggests the economy has been slowing substantially. As a result of weak data, hopes regarding Fed rate cuts coming sooner and in greater numbers had surged in recent days; these hopes will now be substantially tempered. However, fears of a potential slowdown in earnings will also be allayed.

Going forward, both bonds and equity markets will face considerable uncertainty regarding the extent and timing of Fed rate cuts. Unless and until inflation decelerates for at least three months, the Fed is unlikely to lower rates unless there are unambiguous signs that the economy is slowing to an extent that has raised the risk of a recession substantially. Strong payroll and AHE data run contrary to any thesis regarding risk of recession and, in fact, raise the specter of upward pressures on inflation.

Without any clear direction regarding fundamentals, the equity market may continue to be dominated by technical and behavioral phenomena — as has occurred in recent days.

Concluding Thoughts

Our team at Successful Portfolio Strategy is of the view that risks will rise substantially in the second half of 2024. We are particularly concerned about the risk of an oil price shock. Indeed, we think that very unusual opportunities are going to emerge in the second half of 2024, starting sometime between June and August.

If you are really serious about improving your investment performance -- during this historic moment that is providing once-in-a-decade opportunities -- I highly recommend that you subscribe to Successful Portfolio Strategy . This service is designed to empower you to become a successful strategic manager of your investments. It has rarely been as important as it is now to have a winning portfolio strategy approach. Now is the time to be proactive and take decisive action.

This article was written by

James A. Kostohryz has 20+ years of experience as a global financial professional. He has worked as an analyst at one of the world's largest asset management firms covering emerging markets, banking, energy, construction, real estate, metals and mining. He has also served as Global Portfolio Strategist and Head of International Investments for an investment bank. He is currently managing JK Investment Consulting, a firm specializing in global portfolio strategy, macro forecasting, and quant analytics.

James is the leader of the investing group Successful Portfolio Strategy , a service designed to empower investors to achieve investment performance through implementation of a portfolio strategy system. Features include: 2 model portfolios, tactical asset allocation and mentorship for execution, analysis via video and articles, and more. Learn More .

James also contributes to the group account Investor Acumen on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. All positions are disclosed in the Successful Portfolio Strategy service.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| - | - | |

| Crude Oil Futures | ||

| - | - | |

| NASDAQ Composite Index | ||

| - | - | |

| SPDR® Dow Jones Industrial Average ETF Trust | ||

| - | - | |

| Dow Jones Industrial Average Index | ||

| - | - | |

| Invesco QQQ Trust ETF | ||

Related Analysis

Trending analysis, trending news.

IMAGES

VIDEO

COMMENTS

Sample Questionnaire for Thesis About Payroll System - Free download as PDF File (.pdf), Text File (.txt) or read online for free.

The management of employees' salaries is an extremely complex task and time-consuming job due to having a large volume of payroll data and calculations. In many developing regions and countries including the Kurdistan Region of Iraq, the accounting processes of salary are manual. This leads to low speed in the calculation processes of deductions and allowances, easy making errors, difficulty ...

resources and payroll system Thus, the broad objective of the study is: - a) Identify the HR role in Payroll system and thereby to analyze the interface level between account and H.R. department in the organization. b) Effectiveness of the software used in payroll system in an organization.

the design, implementation, and evaluation of a web-based payroll management. system (WPMS). This system can calculate the salary of every employee per month. and annum efficiently and ...

The use of a web-based employee payroll information system application is expected to provide significant assistance to companies in managing employee data, calculating salaries, and preparing ...

In order to determine the correlation between the two variables: attendance management and employee performance the paper used an online survey questionnaire to collect information about the research topic under investigation. The collected data is analysed using the Statistical Package for the Social Sciences using frequency descriptive tables.

5. PAYROLL MANAGEMENT. Payroll ma nagement system explain itself that it's an accounting package that will provide a. financial solution for a particular organization or for a par ticular ...

The research instrument were the questionnaire for payroll system. The test questionnaires have 12 questions for each indicator. The respondents will choose from excellent, very good, good, fair, and poor and put a check on the corresponding answer which will be based on the level of rating scale to our proposed Payroll system from the questions.

model. Often, HR and payroll strategies are linked due to data integration, desire for a positive employee experience and overlapping processes. Among survey respondents, 57% indicated that payroll reports to HR (to be further discussed in the Organizational structure section below). Survey respondents reported the number one priority for R

This paper observes the trend of articles published on payroll system that has been indexed by the Google Scholar as at February 2018. This study aims to provide insights into the characteristics of the issues related to payroll system using a bibliometric analysis. Articles that matched with the keywords [allintitle: payroll system OR systems ...

The objectives of this thesis are: to present a comprehensive literature review of human resource information systems (HRIS) and to explore the impact of infor- ... Surveys of HR consultants suggest that both the number of organizations adopting HRIS and the depth of applications within the organizations are continually increasing ...

Sample Thesis Payroll System - Free download as PDF File (.pdf), Text File (.txt) or read online for free. One of the primary challenges in writing a thesis on payroll systems is the complexity of the topic, as payroll systems encompass many elements such as compensation, taxes, benefits, and more. Thorough research is also essential but difficult, as it requires reviewing many sources to find ...

This paper represents the design, implementation, and evaluation of a web-based payroll management system (WPMS). This system can calculate the salary of every employee per month and annum eficiently and efectively. Moreover, it can keep the records of employees' data including their pay, allowances, and deductions on monthly bases in the ...

Because when it comes to payroll systems, employers have a dizzying number of options. So, where to start? These 10 questions can help you narrow the field. 1. Are Payroll Systems Cloud-based? Surveys show that 64% of companies that have adopted cloud-based HR platforms have accomplished definable business value from their investments. Cloud ...

August 8, 2015 inettutor.com. Automated Payroll System Thesis Project with Complete Source code. Significance of the study. The present study endeavors to assess the present payroll system employed by Company. Result of this investigation will improve the payroll system.

Payroll processing is an imperative process in an organization; it involves many tasks to ensure accurate and timely payments of the workforces' services, and to protect organization's ...

2013, Payroll Management with Biometric Process. Payroll management system encompasses all the tasks involved in paying an organization's employees. It typically involves keeping track of hours worked and ensuring that employees receive the appropriate amount of pay. It also includes calculating taxes and social security, as well as ensuring ...

The 'Survey for Payroll Management' aims to gather feedback from employees regarding their satisfaction levels, preferences, and challenges related to payroll processes. The survey consists of a mix of single choice, multiple choice, and open-ended questions to provide a comprehensive understanding of the current state of payroll management.

Size: 4.0 KB. Download Now. If you seek to create a document that will guide you to prepare a questionnaire, then this is the best place to get help from. We have got a ready-made company payroll questionnaire template that contains a payroll sheet of questions made for the employees of various companies.

Survey Questionnaire For Payroll System Thesis. The first step in making your write my essay request is filling out a 10-minute order form. Submit the instructions, desired sources, and deadline. If you want us to mimic your writing style, feel free to send us your works. In case you need assistance, reach out to our 24/7 support team.

Survey Questionnaire For Payroll System Thesis, Essays On Diets, Resume For Linux Administrator, Food Service Industry Resume Objective, Help With Calculus Research Paper, Pabsec Essay, Persuasive Essay Topics On Beowulf. 921.

In the order page to write an essay for me, once you have filled up the form and submitted it, you will be automatically redirected to the payment gateway page. There you will be required to pay the entire amount for taking up the service and writing from my experts. We will ask you to pay the entire amount before the service as that gives us ...

The strong payroll and hourly earnings data may temper hopes for Fed rate cuts and raise concerns about inflation. Certain details in the report raise troubling questions.