What is the Business Planning Cycle

Planning is the most influential part of a business. Every business organization must plan their activities on a long term or short-term basis for the proper development of their organization. Lack of planning may create some loss in financial, mechanical, or in human resources management divisions. A developed company has a wing that deals with this type of business planning process and holds highly qualified and skilled workers appointed for this process.

What is business planning

A good business plan is to consider as the base of every business. Proper business planning reflects the company’s overview, and it attracts investors from different sectors. In modern times we get assistance from many online applications for planning for a startup company. Business planning should be easy to understand and have to be done in a systematic order. A graphical representation is the best way to represent planning. A good business plan should include an executive summary, marketing policies, and analysis of budget and financial planning. The business planning cycle is a diagrammatic representation of business planning, which includes eight main steps.

Business Planning Cycle

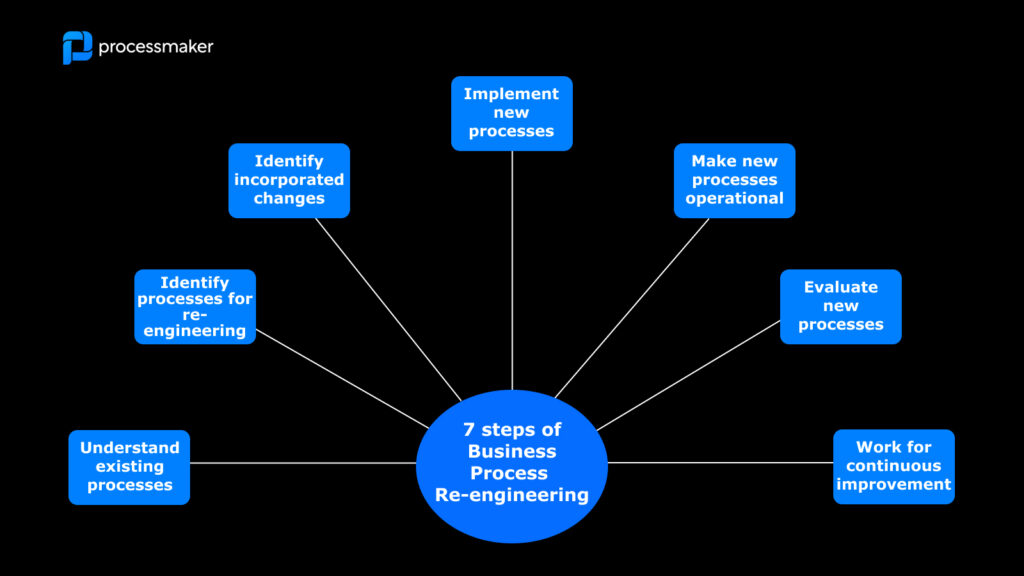

The planning cycle is a systematic process that includes eight steps. We use this planning cycle to plan any small-to-large-sized projects in action. This cycle helps you to identify your mistakes and teaches you some lessons from your previous error, and these lessons are helpful for feature planning. Project or business planning steps are

- Analyze Your Situation : You must have proper data that helps you to analyze the present situation of your organization. You must start thinking about the current situation and deciding how you can improve it. For better analyzing, you must gather as much data as possible regarding the company. We can follow some methods to analyze data in your company like:

- SWOT Analysis : SWOT ( Strengths, Weaknesses, Opportunities, and Threats) Analysis is a technique for evaluating the four main aspects of the business.

- Risk Analysis : By using this method, you can detect potential traps and defects in your organization that may affect your plan. You can identify the external risk by using this method and can neutralize or mitigate those risks.

- Simplexity Thinking : It is a powerful tool that helps to encourage creativity and helps to solve complicated problems in the organization.

- To fix a Mission or Vision statement to your plan: After analyzing the current situation of the organization, the next step is to determine an aim for our plans. First, you must fix your Vision and Mission of our organization. The vision statement of an organization means the privilege that an organization will provide to its customers, and the mission statement will explain how we can achieve the vision of your organization.

- Examine your Results or options from previous steps: After completing the first two steps, we get several options to establish our planning. We must go through every record one by one and prepare data regarding the economic and social feasibility of the plan. In this step, you can sort the available data and identify the best plans that suit your organization and help in its development.

- Identify the best plan: After examining the previous results and options, you need to find the best plan. To find out the best possible outcome, you need to calculate the cost and risk assessment work for each plan. They can use different methods like Decision Matrix Analysis and Decision Trees for the selection process. After selecting the best one, you can move to the next phase of the cycle.

- Detailed planning: You need to identify the most efficient and suitable way to execute our plans. For proper planning, you need to answer many WH questions like who, where, why, what, and when. The detailed planning helps you to identify cost controls and quality assurance of the business are in place. If some deviations occur from the actual plan, you can quickly point out those deviations in the early stage and can solve those issues. If you are working out with priorities and deadlines, the techniques like Critical Path Analysis and Gantt Charts helps to make your work easier.

- Impact of the plan: The next step is to review the impact of the plan and need to decide whether you should execute it. If it shows some negative results at this stage, you can drop this plan and continue with others before investing your funds and valuable time in it. There are different methods to calculate the impact of the plan in different circumstances.

- Quantitative Pros and Cons: By using this method, you can list the pros and cons of your plan in two different columns and allocate positive and negative points for each data accordingly. Then identify the difference between the positive and negative points to find the impact of your plan.

- Cost/Benefit Analysis: In a financial sense, you can compare all expenditures for executing this plan with the expected benefits.

- Force Field Analysis: This will give you a detailed report about the factors for and against your plan on a large platform.

- Cash Flow Forecast: The cash flow forecast deals with the cash inflow and outflow for an organization. By evaluating this cash flow statement, we can analyze the impact of our plan.

- Execute your plan: Once you complete all these steps and finalize your decision, then it’s time to execute the plan. Then you can monitor the real-time performance of the plan.

- Stop executing the Plan and Review: After completing the current cycle, you must stop running your plan. Create a review of the execution of your plan and can refer to this data for future planning.

Every organization has its own goals or targets that they should achieve shortly. To attain this goal, they need to plan their daily activities accordingly. The Business Planning Cycle helps them to implement plans in a systematic way to achieve their goal. It helps to identify the threats in the early stages of planning and allow you to modify your plans accordingly for better results. Proper Business Planning Cycle will reduce the risk in investments and attract more people to start their own business.

Artificial Intelligence and Future of Accounting

Risk and reward in entrepreneurship, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Resource Center

- Terms of Service

- Privacy Policy

- Brightflow AI

- 440 N. Barranca Ave., Suite 6084

- Covina, California 91723

- [email protected]

- We’re Hiring

Secure Login

Module 3: Planning and Mission

The planning cycle, learning outcomes.

- Explain the stages of the planning cycle.

- Explain why the planning cycle is an essential part of running a business.

Organizations have goals they want to achieve, so they must consider the best way of reaching their goals and must decide the specific steps to be taken. However, this is not a linear, step-by-step process. It is an iterative process with each step reconsidered as more information is gathered. As organizations go through the planning, they may realize that a different approach is better and go back to start again.

Remember that planning is only one of the management functions and that the functions themselves are part of a cycle. Planning, and in fact all of the management functions, is a cycle within a cycle. For most organizations, new goals are continually being made or existing goals get changed, so planning never ends. It is a continuing, iterative process.

In the following discussion, we will look at the steps in the planning cycle as a linear process. But keep in mind that at any point in the process, the planner may go back to an earlier step and start again.

Stages in the Planning Cycle

The stages in the planning cycle

Define objectives

The first, and most crucial, step in the planning process is to determine what is to be accomplished during the planning period. The vision and mission statements provide long-term, broad guidance on where the organization is going and how it will get there. The planning process should define specific goals and show how the goals support the vision and mission. Goals should be stated in measurable terms where possible. For example, a goal should be “to increase sales by 15 percent in the next quarter” not “increase sales as much as possible.”

Develop premises

Planning requires making some assumptions about the future. We know that conditions will change as plans are implemented and managers need to make forecasts about what the changes will be. These include changes in external conditions (laws and regulations, competitors’ actions, new technology being available) and internal conditions (what the budget will be, the outcome of employee training, a new building being completed). These assumptions are called the plan premises. It is important that these premises be clearly stated at the start of the planning process. Managers need to monitor conditions as the plan is implemented. If the premises are not proven accurate, the plan will likely have to be changed.

Evaluate alternatives

There may be more than one way to achieve a goal. For example, to increase sales by 12 percent, a company could hire more salespeople, lower prices, create a new marketing plan, expand into a new area, or take over a competitor. Managers need to identify possible alternatives and evaluate how difficult it would be to implement each one and how likely each one would lead to success. It is valuable for managers to seek input from different sources when identifying alternatives. Different perspectives can provide different solutions.

Identify resources

Next, managers must determine the resources needed to implement the plan. They must examine the resources the organization currently has, what new resources will be needed, when the resources will be needed, and where they will come from. The resources could include people with particular skills and experience, equipment and machinery, technology, or money. This step needs to be done in conjunction with the previous one, because each alternative requires different resources. Part of the evaluation process is determining the cost and availability of resources.

Plan and implement tasks

Management will next create a road map that takes the organization from where it is to its goal. It will define tasks at different levels in the organizations, the sequence for completing the tasks, and the interdependence of the tasks identified. Techniques such as Gantt charts and critical path planning are often used to help establish and track schedules and priorities.

Determine tracking and evaluation methods

It is very important that managers can track the progress of the plan. The plan should determine which tasks are most critical, which tasks are most likely to encounter problems, and which could cause bottlenecks that could delay the overall plan. Managers can then determine performance and schedule milestones to track progress. Regular monitoring and adjustment as the plan is implemented should be built into the process to assure things stay on track.

Practice Question

The planning cycle: essential part of running a business.

Following the planning cycle process assures the essential aspects of running a business are completed. In addition, the planning process itself can have benefits for the organization. The essential activities include the following:

- Maintaining organizational focus: Defining specific goals requires managers to consider the vision, mission, and values of the organization and how these will be operationalized. The methods and selected goals can demonstrate that the vision, mission, and values statements are working documents that are not just for show but prescribe activities.

- Encouraging diverse participation: Planning activities provide an opportunity for input from different functions, departments, and people. Some organizations establish planning committees that intentionally include people from diverse backgrounds to bring new perspectives into the planning process.

- Empowering and motivating employees: When people are involved in developing plans they will be more committed to the plans. Allowing diverse input into the planning cycle empowers people to contribute and motivates them to support the outcomes.

PRactice Question

There are several stages, or steps, in the planning process. It is not unusual to have to repeat steps as conditions change. This process is essential to a business to maintain focus, gather diverse opinions, and empower and motivate employees.

- The Planning Cycle. Authored by : John/Lynn Bruton and Lumen Learning. License : CC BY: Attribution

- Image: Stages in the Planning Cycle. Authored by : Lumen Learning. License : CC BY: Attribution

The Business Planning Process: 6 Steps To Creating a New Plan

In this article, we will define and explain the basic business planning process to help your business move in the right direction.

What is Business Planning?

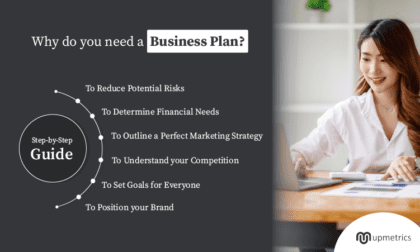

Business planning is the process whereby an organization’s leaders figure out the best roadmap for growth and document their plan for success.

The business planning process includes diagnosing the company’s internal strengths and weaknesses, improving its efficiency, working out how it will compete against rival firms in the future, and setting milestones for progress so they can be measured.

The process includes writing a new business plan. What is a business plan? It is a written document that provides an outline and resources needed to achieve success. Whether you are writing your plan from scratch, from a simple business plan template , or working with an experienced business plan consultant or writer, business planning for startups, small businesses, and existing companies is the same.

Finish Your Business Plan Today!

The best business planning process is to use our business plan template to streamline the creation of your plan: Download Growthink’s Ultimate Business Plan Template and finish your business plan & financial model in hours.

The Better Business Planning Process

The business plan process includes 6 steps as follows:

- Do Your Research

- Calculate Your Financial Forecast

- Draft Your Plan

- Revise & Proofread

- Nail the Business Plan Presentation

We’ve provided more detail for each of these key business plan steps below.

1. Do Your Research

Conduct detailed research into the industry, target market, existing customer base, competitors, and costs of the business begins the process. Consider each new step a new project that requires project planning and execution. You may ask yourself the following questions:

- What are your business goals?

- What is the current state of your business?

- What are the current industry trends?

- What is your competition doing?

There are a variety of resources needed, ranging from databases and articles to direct interviews with other entrepreneurs, potential customers, or industry experts. The information gathered during this process should be documented and organized carefully, including the source as there is a need to cite sources within your business plan.

You may also want to complete a SWOT Analysis for your own business to identify your strengths, weaknesses, opportunities, and potential risks as this will help you develop your strategies to highlight your competitive advantage.

2. Strategize

Now, you will use the research to determine the best strategy for your business. You may choose to develop new strategies or refine existing strategies that have demonstrated success in the industry. Pulling the best practices of the industry provides a foundation, but then you should expand on the different activities that focus on your competitive advantage.

This step of the planning process may include formulating a vision for the company’s future, which can be done by conducting intensive customer interviews and understanding their motivations for purchasing goods and services of interest. Dig deeper into decisions on an appropriate marketing plan, operational processes to execute your plan, and human resources required for the first five years of the company’s life.

3. Calculate Your Financial Forecast

All of the activities you choose for your strategy come at some cost and, hopefully, lead to some revenues. Sketch out the financial situation by looking at whether you can expect revenues to cover all costs and leave room for profit in the long run.

Begin to insert your financial assumptions and startup costs into a financial model which can produce a first-year cash flow statement for you, giving you the best sense of the cash you will need on hand to fund your early operations.

A full set of financial statements provides the details about the company’s operations and performance, including its expenses and profits by accounting period (quarterly or year-to-date). Financial statements also provide a snapshot of the company’s current financial position, including its assets and liabilities.

This is one of the most valued aspects of any business plan as it provides a straightforward summary of what a company does with its money, or how it grows from initial investment to become profitable.

4. Draft Your Plan

With financials more or less settled and a strategy decided, it is time to draft through the narrative of each component of your business plan . With the background work you have completed, the drafting itself should be a relatively painless process.

If you have trouble writing convincing prose, this is a time to seek the help of an experienced business plan writer who can put together the plan from this point.

5. Revise & Proofread

Revisit the entire plan to look for any ideas or wording that may be confusing, redundant, or irrelevant to the points you are making within the plan. You may want to work with other management team members in your business who are familiar with the company’s operations or marketing plan in order to fine-tune the plan.

Finally, proofread thoroughly for spelling, grammar, and formatting, enlisting the help of others to act as additional sets of eyes. You may begin to experience burnout from working on the plan for so long and have a need to set it aside for a bit to look at it again with fresh eyes.

6. Nail the Business Plan Presentation

The presentation of the business plan should succinctly highlight the key points outlined above and include additional material that would be helpful to potential investors such as financial information, resumes of key employees, or samples of marketing materials. It can also be beneficial to provide a report on past sales or financial performance and what the business has done to bring it back into positive territory.

Business Planning Process Conclusion

Every entrepreneur dreams of the day their business becomes wildly successful.

But what does that really mean? How do you know whether your idea is worth pursuing?

And how do you stay motivated when things are not going as planned? The answers to these questions can be found in your business plan. This document helps entrepreneurs make better decisions and avoid common pitfalls along the way.

Business plans are dynamic documents that can be revised and presented to different audiences throughout the course of a company’s life. For example, a business may have one plan for its initial investment proposal, another which focuses more on milestones and objectives for the first several years in existence, and yet one more which is used specifically when raising funds.

Business plans are a critical first step for any company looking to attract investors or receive grant money, as they allow a new organization to better convey its potential and business goals to those able to provide financial resources.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink business plan consultants can create your business plan for you.

Other Helpful Business Plan Articles & Templates

The 7 Steps of the Business Planning Process: A Complete Guide

In this article, we'll provide a comprehensive guide to the seven steps of the business planning process, and discuss the role of Strikingly website builder in creating a professional business plan.

Step 1: Conducting a SWOT Analysis

The first step in the business planning process is to conduct a SWOT analysis. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. This analysis will help you understand your business's internal and external environment, and it can help you identify areas of improvement and growth.

Strengths and weaknesses refer to internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

You can conduct a SWOT analysis by gathering information from various sources such as market research, financial statements, and feedback from customers and employees. You can also use tools such as a SWOT matrix to visualize your analysis.

What is a SWOT Analysis?

A SWOT analysis is a framework for analyzing a business's internal and external environment. The acronym SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Strengths and weaknesses include internal factors such as the company's resources, capabilities, and culture. Opportunities and threats are external factors such as market trends, competition, and regulations.

A SWOT analysis can help businesses identify areas of improvement and growth, assess their competitive position, and make informed decisions. It can be used for various purposes, such as business planning, product development, marketing strategy, and risk management.

Importance of Conducting a SWOT Analysis

Conducting a SWOT analysis is crucial for businesses to develop a clear understanding of their internal and external environment. It can help businesses identify their strengths and weaknesses and uncover new opportunities and potential threats. By doing so, businesses can make informed decisions about their strategies, resource allocation, and risk management.

A SWOT analysis can also help businesses identify their competitive position in the market and compare themselves to their competitors. This can help businesses differentiate themselves from their competitors and develop a unique value proposition.

Example of a SWOT Analysis

Here is an example of a SWOT analysis for a fictional business that sells handmade jewelry:

- Unique and high-quality products

- Skilled and experienced craftsmen

- Strong brand reputation and customer loyalty

- Strategic partnerships with local boutiques

- Limited production capacity

- High production costs

- Limited online presence

- Limited product variety

Opportunities

- Growing demand for handmade products

- Growing interest in sustainable and eco-friendly products

- Opportunities to expand online presence and reach new customers

- Opportunities to expand product lines

- Increasing competition from online and brick-and-mortar retailers

- Fluctuating consumer trends and preferences

- Economic downturns and uncertainty

- Increased regulations and compliance requirements

This SWOT analysis can help the business identify areas for improvement and growth. For example, the business can invest in expanding its online presence, improving its production efficiency, and diversifying its product lines. The business can also leverage its strengths, such as its skilled craftsmen and strategic partnerships, to differentiate itself from its competitors and attract more customers.

Step 2: Defining Your Business Objectives

Once you have conducted a SWOT analysis, the next step is to define your business objectives. Business objectives are specific, measurable, achievable, relevant, and time-bound (SMART) goals that align with your business's mission and vision.

Your business objectives can vary depending on your industry, target audience, and resources. Examples of business objectives include increasing sales revenue, expanding into new markets, improving customer satisfaction, and reducing costs.

You can use tools such as a goal-setting worksheet or a strategic planning framework to define your business objectives. You can also seek input from your employees and stakeholders to ensure your objectives are realistic and achievable.

What is Market Research?

Market research is an integral part of the business planning process. It gathers information about a target market or industry to make informed decisions. It involves collecting and analyzing data on consumer behavior, preferences, and buying habits, as well as competitors, industry trends, and market conditions.

Market research can help businesses identify potential customers, understand their needs and preferences, and develop effective marketing strategies. It can also help businesses identify market opportunities, assess their competitive position, and make informed product development, pricing, and distribution decisions.

Importance of Market Research in Business Planning

Market research is a crucial component of the business planning process. It can help businesses identify market trends and opportunities, assess their competitive position, and make informed decisions about their marketing strategies, product development, and business operations.

By conducting market research, businesses can gain insights into their target audience's behavior and preferences, such as their purchasing habits, brand loyalty, and decision-making process. This can help businesses develop targeted marketing campaigns and create products that meet their customers' needs.

Market research can also help businesses assess their competitive position and identify gaps in the market. Businesses can differentiate themselves by analyzing their competitors' strengths and weaknesses and developing a unique value proposition.

Different Types of Market Research Methods

Businesses can use various types of market research methods, depending on their research objectives, budget, and time frame. Here are some of the most common market research methods:

Surveys are a common market research method that involves asking questions to a sample of people about their preferences, opinions, and behaviors. Surveys can be conducted through various channels like online, phone, or in-person surveys.

- Focus Groups

Focus groups are a qualitative market research method involving a small group to discuss a specific topic or product. Focus groups can provide in-depth insights into customers' attitudes and perceptions and can help businesses understand the reasoning behind their preferences and behaviors.

Interviews are a qualitative market research method that involves one-on-one conversations between a researcher and a participant. Interviews can be conducted in person, over the phone, or through video conferencing and can provide detailed insights into a participant's experiences, perceptions, and preferences.

- Observation

Observation is a market research method that involves observing customers' behavior and interactions in a natural setting such as a store or a website. Observation can provide insights into customers' decision-making processes and behavior that may not be captured through surveys or interviews.

- Secondary Research

Secondary research involves collecting data from existing sources, like industry reports, government publications, or academic journals. Secondary research can provide a broad overview of the market and industry trends and help businesses identify potential opportunities and threats.

By combining these market research methods, businesses can comprehensively understand their target market and industry and make informed decisions about their business strategy.

Step 3: Conducting Market Research

Market research should always be a part of your strategic business planning. This step gathers information about your target audience, competitors, and industry trends. This information can help you make informed decisions about your product or service offerings, pricing strategy, and marketing campaigns.

There are various market research methods, such as surveys, focus groups, and online analytics. You can also use tools like Google Trends and social media analytics to gather data about your audience's behavior and preferences.

Market research can be time-consuming and costly, but it's crucial for making informed decisions that can impact your business's success. Strikingly website builder offers built-in analytics and SEO optimization features that can help you track your website traffic and audience engagement.

Step 4: Identifying Your Target Audience

Identifying your target audience is essential in the business planning process. Your target audience is the group of people who are most likely to buy your product or service. Understanding their needs, preferences, and behaviors can help you create effective marketing campaigns and improve customer satisfaction.

You can identify your target audience by analyzing demographic, psychographic, and behavioral data. Demographic data include age, gender, income, and education level. Psychographic data includes personality traits, values, and lifestyle. Behavioral data includes buying patterns, brand loyalty, and online engagement.

Once you have identified your target audience, you can use tools such as buyer personas and customer journey maps to create a personalized and engaging customer experience. Strikingly website builder offers customizable templates and designs to help you create a visually appealing and user-friendly website for your target audience.

What is a Target Audience?

A target audience is a group most likely to be interested in and purchase a company's products or services. A target audience can be defined based on various factors such as age, gender, location, income, education, interests, and behavior.

Identifying and understanding your target audience is crucial for developing effective marketing strategies and improving customer engagement and satisfaction. By understanding your target audience's needs, preferences, and behavior, you can create products and services that meet their needs and develop targeted marketing campaigns that resonate with them.

Importance of Identifying Your Target Audience

Identifying your target audience is essential for the success of your business. By understanding your target audience's needs and preferences, you can create products and services that meet their needs and develop targeted marketing campaigns that resonate with them.

Here are reasons why identifying your target audience is important:

- Improve customer engagement. When you understand your target audience's behavior and preferences, you can create a more personalized and engaging customer experience to improve customer loyalty and satisfaction.

- Develop effective marketing strategies. Targeting your marketing efforts to your target audience creates more effective and efficient marketing campaigns that can increase brand awareness, generate leads, and drive sales.

- Improve product development. By understanding your target audience's needs and preferences, you can develop products and services that meet their specific needs and preferences, improving customer satisfaction and retention.

- Identify market opportunities. If you identify gaps in the market or untapped market segments, you can develop products and services to meet unmet needs and gain a competitive advantage.

Examples of Target Audience Segmentation

Here are some examples of target audience segmentation based on different demographic, geographic, and psychographic factors:

- Demographic segmentation. Age, gender, income, education, occupation, and marital status.

- Geographic segmentation. Location, region, climate, and population density.

- Psychographic segmentation. Personality traits, values, interests, and lifestyle.

Step 5: Developing a Marketing Plan

A marketing plan is a strategic roadmap that outlines your marketing objectives, strategies, tactics, and budget. Your marketing plan should align with your business objectives and target audience and include a mix of online and offline marketing channels.

Marketing strategies include content marketing, social media marketing, email marketing, search engine optimization (SEO), and paid advertising. Your marketing tactics can include creating blog posts, sharing social media posts, sending newsletters, optimizing your website for search engines, and running Google Ads or Facebook Ads.

To create an effective marketing plan , research your competitors, understand your target audience's behavior, and set clear objectives and metrics. You can also seek customer and employee feedback to refine your marketing strategy.

Strikingly website builder offers a variety of marketing features such as email marketing, social media integration, and SEO optimization tools. You can also use the built-in analytics dashboard to track your website's performance and monitor your marketing campaign's effectiveness.

What is a Marketing Plan?

A marketing plan is a comprehensive document that outlines a company's marketing strategy and tactics. It typically includes an analysis of the target market, a description of the product or service, an assessment of the competition, and a detailed plan for achieving marketing objectives.

A marketing plan can help businesses identify and prioritize marketing opportunities, allocate resources effectively, and measure the success of their marketing efforts. It can also provide the marketing team with a roadmap and ensure everyone is aligned with the company's marketing goals and objectives.

Importance of a Marketing Plan in Business Planning

A marketing plan is critical to business planning. It can help businesses identify their target audience, assess their competitive position, and develop effective marketing strategies and tactics.

Here are a few reasons why a marketing plan is important in business planning:

- Provides a clear direction. A marketing plan can provide a clear direction for the marketing team and ensure everyone is aligned with the company's marketing goals and objectives.

- Helps prioritize marketing opportunities. By analyzing the target market and competition, a marketing plan can help businesses identify and prioritize marketing opportunities with the highest potential for success.

- Ensures effective resource allocation. A marketing plan can help businesses allocate resources effectively and ensure that marketing efforts are focused on the most critical and impactful activities.

- Measures success. A marketing plan can provide a framework for measuring the success of marketing efforts and making adjustments as needed.

Examples of Marketing Strategies and Tactics

Here are some examples of marketing strategies and tactics that businesses can use to achieve their marketing objectives:

- Content marketing. Creating and sharing valuable and relevant content that educates and informs the target audience about the company's products or services.

- Social media marketing. Leveraging social media platforms like Facebook, Twitter, and Instagram to engage with the target audience, build brand awareness, and drive website traffic.

- Search engine optimization (SEO). Optimizing the company's website and online content to rank higher in search engine results and drive organic traffic.

- Email marketing. Sending personalized and targeted emails to the company's email list to nurture leads, promote products or services, and drive sales.

- Influencer marketing. Partnering with influencers or industry experts to promote the company's products or services and reach a wider audience.

By using a combination of these marketing strategies and tactics, businesses can develop a comprehensive and effective marketing plan that aligns with their marketing goals and objectives.

Step 6: Creating a Financial Plan

A financial plan is a detailed document that outlines your business's financial projections, budget, and cash flow. Your financial plan should include a balance sheet, income statement, and cash flow statement, and it should be based on realistic assumptions and market trends.

To create a financial plan, you should consider your revenue streams, expenses, assets, and liabilities. You should also analyze your industry's financial benchmarks and projections and seek input from financial experts or advisors.

.jpg)Image taken from Strikingly Templates

Strikingly website builder offers a variety of payment and e-commerce features, such as online payment integration and secure checkout. You can also use the built-in analytics dashboard to monitor your revenue and expenses and track your financial performance over time.

What is a Financial Plan?

A financial plan is a comprehensive document that outlines a company's financial goals and objectives and the strategies and tactics for achieving them. It typically includes a description of the company's financial situation, an analysis of revenue and expenses, and a projection of future financial performance.

A financial plan can help businesses identify potential risks and opportunities, allocate resources effectively, and measure the success of their financial efforts. It can also provide a roadmap for the finance team and ensure everyone is aligned with the company's financial goals and objectives.

Importance of Creating a Financial Plan in Business Planning

Creating a financial plan is a critical component of the business planning process. It can help businesses identify potential financial risks and opportunities, allocate resources effectively, and measure the success of their financial efforts.

Here are some reasons why creating a financial plan is important in business planning:

- Provides a clear financial direction. A financial plan can provide a clear direction for the finance team and ensure everyone is in sync with the company's financial goals and objectives.

- Helps prioritize financial opportunities. By analyzing revenue and expenses, a financial plan can help businesses identify and prioritize financial opportunities with the highest potential for success.

- Ensures effective resource allocation. A financial plan can help businesses allocate resources effectively and ensure that financial efforts are focused on the most critical and impactful activities.

- Measures success. A financial plan can provide a framework for measuring the success of financial efforts and making adjustments as needed.

Examples of Financial Statements and Projections

Here are some examples of financial statements and projections that businesses can use in their financial plan:

- Income statement. A financial statement that shows the company's revenue and expenses over a period of time, typically monthly or annually.

- Balance sheet. A financial statement shows the company's assets, liabilities, and equity at a specific time, typically at the end of a fiscal year.

- Cash flow statement. A financial statement that shows the company's cash inflows and outflows over a period of time, typically monthly or annually.

- Financial projections. Forecasts of the company's future financial performance based on assumptions and market trends. This can include revenue, expenses, profits, and cash flow projections.

Step 7: Writing Your Business Plan

The final step in the business planning process is to write your business plan. A business plan is a comprehensive document that outlines your business's mission, vision, objectives, strategies, and financial projections.

A business plan can help you clarify your business idea, assess the feasibility of your business, and secure funding from investors or lenders. It can also provide a roadmap for your business and ensure that you stay focused on your goals and objectives.

Importance of Writing a Business Plan

Writing a business plan is an essential component of the business planning process. It can help you clarify your business idea , assess the feasibility of your business, and secure funding from investors or lenders.

Here are some reasons why writing a business plan is important:

- Clarifies your business idea. Writing a business plan can help you clarify your business idea and understand your business's goals, objectives, and strategies.

- Assesses the feasibility of your business. A business plan can help you assess the feasibility of your business and identify potential risks and opportunities.

- Secures funding. A well-written business plan can help you secure funding from investors or lenders by demonstrating the potential of your business and outlining a clear path to success.

- Provides a roadmap for your business. A business plan can provide a roadmap and ensure that you stay focused on your goals and objectives.

Tips on How to Write a Successful Business Plan

Here are some tips on how to write a business plan successfully:

- Start with an executive summary. The executive summary is a brief business plan overview and should include your business idea, target market, competitive analysis, and financial projections.

- Describe your business and industry. Provide a detailed description of your business and industry, including your products or services, target market, and competitive landscape.

- Develop a marketing strategy. Outline your marketing strategy and tactics, including your target audience, pricing strategy, promotional activities, and distribution channels.

- Provide financial projections. Provide detailed financial projections, including income statements, balance sheets, and cash flow statements, as well as assumptions and risks.

- Keep it concise and clear. Keep your business plan concise and clear, and avoid using jargon or technical terms that may confuse or intimidate readers.

Role of Strikingly Website Builder in Creating a Professional Business Plan

Strikingly website builder can play a significant role in creating a professional business plan. Strikingly provides an intuitive and user-friendly platform that allows you to create a professional-looking website and online store without coding or design skills.

Using Strikingly, you can create a visually appealing business plan and present it on your website with images, graphics, and videos to enhance the reader's experience. You can also use Strikingly's built-in templates and a drag-and-drop editor to create a customized and professional-looking business plan that reflects your brand and style.

Strikingly also provides various features and tools that can help you showcase your products or services, promote your business, and engage with your target audience. These features include e-commerce functionality, social media integration, and email marketing tools.

Let’s Sum Up!

In conclusion, the 7 steps of the business planning process are essential for starting and growing a successful business. By conducting a SWOT analysis, defining your business objectives, conducting market research, identifying your target audience, developing a marketing plan, creating a financial plan, and writing your business plan, you can set a solid foundation for your business's success.

Strikingly website builder can help you throughout the business planning process by offering a variety of features such as analytics, marketing, e-commerce , and business plan templates. With Strikingly, you can create a professional and engaging website and business plan that aligns with your business objectives and target audience.

Most Viewed

The Leading Source of Insights On Business Model Strategy & Tech Business Models

What is the planning cycle?

The planning cycle enables organizations to perform activities successfully and achieve goals across projects of various sizes. The planning cycle is most effective for small to medium-sized projects.

| Component | Description |

|---|---|

| Definition | The Planning Cycle is a strategic management process that organizations use to set goals, create action plans, implement strategies, monitor progress, and make adjustments to achieve their objectives effectively. It involves a series of structured steps for systematic planning and execution. |

| Key Elements | – Identifying specific, measurable, achievable, relevant, and time-bound (SMART) goals. – Evaluating internal and external factors that may affect goal attainment. – Developing strategies and action plans to achieve objectives. – Executing the action plans and monitoring progress. – Continuously assessing performance and making necessary adjustments to plans. |

| How It Works | – Define clear and measurable goals that align with the organization’s mission and vision. – Analyze internal strengths and weaknesses and external opportunities and threats (SWOT analysis). – Develop detailed strategies, allocate resources, and create action plans. – Execute plans, assign responsibilities, and track progress. – Regularly assess performance, compare outcomes to goals, and make adjustments as needed. |

| Process Breakdown | 1. Identifying the need for planning and gathering relevant information. 2. Defining specific, achievable objectives. 3. Assessing internal and external factors. 4. Formulating strategies and tactics. 5. Executing action plans. 6. Tracking progress and performance. 7. Assessing results against objectives. 8. Making changes based on evaluation findings. |

| Benefits | – Improved goal alignment and focus on key priorities. – Enhanced organizational performance and efficiency. – Better resource allocation and risk management. – Agility to adapt to changing circumstances. – Increased accountability and transparency. – Informed decision-making and a structured approach to problem-solving. |

| Drawbacks | – Time-consuming process, especially for complex planning cycles. – Potential resistance to change from stakeholders. – Overemphasis on planning may lead to inflexibility. – External factors beyond control may disrupt plans. – Requires ongoing commitment and resources. |

| Applications | – Business and Strategic Planning: Used by businesses to set corporate strategies and operational plans. – Project Management: Employed in project planning and execution. – Public Policy Development: Used by governments to formulate policies and programs. – Education: Applied in curriculum development and educational planning. |

| Use Cases | – A technology company using the Planning Cycle to set annual product development goals, allocate resources, and track project progress. – A city government employing the cycle to plan infrastructure improvements, assess community needs, and allocate budgets. – An educational institution using it to develop a curriculum, set learning objectives, and evaluate teaching effectiveness. |

| Examples | – A retail company employing the Planning Cycle to expand into new markets, including setting sales targets, analyzing market trends, and adjusting pricing strategies. – A healthcare organization using it to plan patient care improvements, define performance metrics, and continuously monitor healthcare outcomes. – A non-profit organization applying it to develop fundraising strategies, allocate resources, and assess the impact of social programs. |

Table of Contents

Understanding the planning cycle

The planning cycle enables organizations to plan and then implement robust, practical, cost -effective, and well-considered projects.

The planning and implementation process is iterative in the sense that insights are fed back into the cycle to be incorporated into future projects.

Alternatively, project managers may move back to an earlier stage of the cycle.

Whatever the case, project planning is a cycle within a cycle (like other management functions) since objectives are modified or new ones are created as new information comes to hand.

The planning cycle is most effective for small to medium-sized projects.

For larger, complex projects where project management becomes a technical discipline in its own right, certified frameworks such as PMBOK or PRINCE2 can be used.

The components of a planning cycle

Let’s now describe the various components of the planning cycle. Remember that the process is not linear.

At any point, the organization may choose to revisit an earlier step with new information or restart the process.

1 – Define objectives

Defining objectives is the most crucial part of the planning cycle.

While mission and vision statements provide some degree of clarity on where the company is headed, the planning cycle requires teams to develop specific goals using the SMART framework.

2 – Develop premises

Premises are assumptions the team makes about how the project may be impacted in the future by different conditions.

These may be external (competitors, laws, innovation ) or internal (management, employee training outcomes, or available budget), for example.

The SWOT analysis can be used to examine the organization ’s current position and how it may be able to respond in various situations.

Whatever method is chosen, however, premises must be defined early so that managers can monitor conditions during project implementation. If assumptions prove incorrect, the plan may need to be revised.

3 – Evaluate alternatives

In business as in life, there is more than one way to achieve the same outcome.

A company wanting to reduce office-related expenditure by 8% could move to smaller premises, enable more employees to work remotely, or find a cheaper source of toner ink.

Project managers need to evaluate each alternative in terms of its implementation difficulty and chances of success.

They should do this by seeking out diverse perspectives or expertise.

There are several methods for evaluating a plan . These include the cost /benefit analysis , force field analysis , and the six thinking hats brainstorming method.

4 – Identify resources

What are the resources required to implement the plan ? Which of these resources does the organization possess, and which must be sourced from elsewhere?

Resources may encompass technology, money, equipment, raw materials, or skills.

For each alternative from the previous step, the availability and cost of resources must be identified.

5 – Establish tasks

Tasks comprise the roadmap that enables the organization to move toward a desired future state.

They must be defined at all organizational levels and, to illustrate task completion sequences and interdependencies, many teams choose to use a Gantt chart.

6 – Determine tracking and evaluation methods

Tracking means project managers constantly monitor progress toward the intended outcomes.

They should have a detailed understanding of critical tasks as well as those most likely to encounter problems or cause project bottlenecks.

In the final evaluation, the team looks back on what it has learned. Could any aspect of planning be improved or refined?

Developing a standard post-implementation review process may also be useful if similar projects are likely to be undertaken in the future.

Above all, the review should determine whether the project solved a key problem and if so, if its benefits could potentially be enhanced.

Key takeaways:

- The planning cycle enables organizations to successfully perform activities and achieve goals across projects of various sizes.

- The planning cycle is most effective for small to medium-sized projects. For larger, more complex projects, formal frameworks such as PMBOK or PRINCE2 may be more effective.

- The planning cycle has six iterative steps where results from the evaluation stage can be fed back into similar future projects. These steps include defining objectives, developing premises, evaluating alternatives, identifying resources, establishing tasks, and determining tracking and evaluation methods.

Key Highlights

- Planning Cycle Overview : The planning cycle is a process that allows organizations to plan and implement projects effectively, ensuring they are practical, cost-effective, and well-considered. It involves iterative stages that incorporate insights and can be revisited if needed.

- Scope of Planning Cycle : The planning cycle is particularly effective for small to medium-sized projects. For larger and more complex projects, certified frameworks like PMBOK or PRINCE2 are often employed.

- Define Objectives : Clear and specific goals are set using the SMART framework, ensuring they are Specific, Measurable, Achievable, Relevant, and Time-based.

- Develop Premises : Assumptions about future project impacts are defined, both external (competition, laws) and internal (management, budget).

- Evaluate Alternatives : Different approaches to achieving goals are explored, considering feasibility, difficulty, and success probabilities. Methods like cost/benefit analysis and brainstorming are used.

- Identify Resources : Necessary resources for plan implementation are identified, including technology, money, equipment, materials, and skills.

- Establish Tasks : The roadmap of tasks to achieve the desired outcome is created, often visualized using tools like Gantt charts.

- Determine Tracking and Evaluation Methods : Progress is constantly monitored, focusing on critical tasks and potential bottlenecks. A post-implementation review process may be established for improvement.

- Iterative Nature : The planning cycle is iterative, with feedback from evaluation influencing future projects. The process is adaptable, allowing for changes based on new information.

- Final Evaluation and Review : A final evaluation is conducted, reflecting on what was learned during the process. Opportunities for improvement are identified, and the project’s problem-solving effectiveness is assessed.

| Frameworks, Models, or Concepts | Description | When to Apply |

|---|---|---|

| is a systematic process of defining an organization’s direction and making decisions to allocate resources toward achieving its objectives. Strategic planning involves assessing internal and external environments, setting goals and priorities, and developing action plans to guide organizational activities. By engaging in strategic planning, organizations can align efforts, anticipate challenges, and capitalize on opportunities effectively. | ||

| is a short-term planning process that translates strategic objectives into specific actions and initiatives to be implemented by various departments or teams within an organization. Tactical planning involves setting specific goals, defining tasks and responsibilities, and allocating resources to achieve desired outcomes within a defined timeframe. By engaging in tactical planning, organizations can operationalize strategic objectives, coordinate activities, and monitor progress effectively. | ||

| is a detailed planning process that focuses on day-to-day activities and processes within an organization to ensure efficient and effective execution of tasks. Operational planning involves setting specific targets, establishing procedures and protocols, and allocating resources to support ongoing operations. By engaging in operational planning, organizations can optimize workflows, manage risks, and deliver products or services to customers reliably. | ||

| is an approach that combines strategic, tactical, and operational planning processes to ensure alignment and coherence across different levels of an organization. Integrated planning involves coordinating activities, sharing information, and leveraging synergies to achieve organizational goals holistically. By adopting integrated planning, organizations can enhance coordination, agility, and performance across departments and functions. | ||

| is a continuous process of setting goals, monitoring progress, and providing feedback to improve individual, team, and organizational performance. Performance management involves defining performance metrics, measuring performance against targets, and identifying areas for improvement or development. By implementing performance management practices, organizations can align efforts, track progress, and drive accountability and results effectively. | ||

| is a strategic foresight technique that involves creating and analyzing alternative future scenarios to anticipate uncertainties and prepare for potential challenges or opportunities. Scenario planning helps organizations identify potential risks, explore alternative strategies, and develop contingency plans to mitigate or capitalize on future events. By engaging in scenario planning, organizations can enhance resilience, agility, and adaptability in the face of uncertainty. | ||

| The is a financial planning process that involves estimating future revenues and expenses, allocating resources, and setting financial targets for an organization. The budgeting process typically includes developing a budget proposal, reviewing and approving budgets, and monitoring actual performance against budgeted targets. By engaging in the budgeting process, organizations can optimize resource allocation, control costs, and achieve financial goals effectively. | ||

| is a structured approach to managing organizational change effectively. Change management involves assessing change impacts, engaging stakeholders, and implementing strategies to minimize resistance and maximize adoption. By applying change management principles, organizations can navigate transitions, drive transformation, and achieve desired outcomes with minimal disruption. | ||

| is a process of identifying, assessing, and mitigating risks that may impact an organization’s ability to achieve its strategic objectives. Strategic risk management involves analyzing internal and external risks, prioritizing risks based on their impact and likelihood, and developing risk mitigation strategies. By adopting strategic risk management practices, organizations can anticipate threats, capitalize on opportunities, and protect value effectively. | ||

| is an ongoing effort to enhance processes, products, or services through incremental changes and innovations. Continuous improvement involves identifying opportunities for optimization, implementing improvements, and evaluating outcomes to drive ongoing enhancements. By fostering a culture of continuous improvement, organizations can increase efficiency, quality, and customer satisfaction over time. |

Read Next: OKR , SMART Goals .

Related Team Management Frameworks

Smart Goals

Micromanagement

Delegative Leadership

Agile Leadership

Active Listening

Adaptive Leadership

RASCI Matrix

Flat Organizational Structure

Tactical Management

High-Performance Management

Scientific Management

Main Guides:

- Business Models

- Business Strategy

- Business Development

- Distribution Channels

- Marketing Strategy

- Platform Business Models

- Network Effects

More Resources

About The Author

Gennaro Cuofano

Discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- Product overview

- All features

- Latest feature release

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Capacity planning

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana AI

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Content calendars

- Marketing strategic planning

- Resource planning

- Project intake

- Product launches

- Employee onboarding

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Support Need help? Contact the Asana support team

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- Business strategy |

- What is strategic planning? A 5-step gu ...

What is strategic planning? A 5-step guide

Strategic planning is a process through which business leaders map out their vision for their organization’s growth and how they’re going to get there. In this article, we'll guide you through the strategic planning process, including why it's important, the benefits and best practices, and five steps to get you from beginning to end.

Strategic planning is a process through which business leaders map out their vision for their organization’s growth and how they’re going to get there. The strategic planning process informs your organization’s decisions, growth, and goals.

Strategic planning helps you clearly define your company’s long-term objectives—and maps how your short-term goals and work will help you achieve them. This, in turn, gives you a clear sense of where your organization is going and allows you to ensure your teams are working on projects that make the most impact. Think of it this way—if your goals and objectives are your destination on a map, your strategic plan is your navigation system.

In this article, we walk you through the 5-step strategic planning process and show you how to get started developing your own strategic plan.

How to build an organizational strategy

Get our free ebook and learn how to bridge the gap between mission, strategic goals, and work at your organization.

What is strategic planning?

Strategic planning is a business process that helps you define and share the direction your company will take in the next three to five years. During the strategic planning process, stakeholders review and define the organization’s mission and goals, conduct competitive assessments, and identify company goals and objectives. The product of the planning cycle is a strategic plan, which is shared throughout the company.

What is a strategic plan?

![what is a business planning cycle [inline illustration] Strategic plan elements (infographic)](https://assets.asana.biz/transform/7d1f14e4-b008-4ea6-9579-5af6236ce367/inline-business-strategy-strategic-planning-1-2x?io=transform:fill,width:2560&format=webp)

A strategic plan is the end result of the strategic planning process. At its most basic, it’s a tool used to define your organization’s goals and what actions you’ll take to achieve them.

Typically, your strategic plan should include:

Your company’s mission statement

Your organizational goals, including your long-term goals and short-term, yearly objectives

Any plan of action, tactics, or approaches you plan to take to meet those goals

What are the benefits of strategic planning?

Strategic planning can help with goal setting and decision-making by allowing you to map out how your company will move toward your organization’s vision and mission statements in the next three to five years. Let’s circle back to our map metaphor. If you think of your company trajectory as a line on a map, a strategic plan can help you better quantify how you’ll get from point A (where you are now) to point B (where you want to be in a few years).

When you create and share a clear strategic plan with your team, you can:

Build a strong organizational culture by clearly defining and aligning on your organization’s mission, vision, and goals.

Align everyone around a shared purpose and ensure all departments and teams are working toward a common objective.

Proactively set objectives to help you get where you want to go and achieve desired outcomes.

Promote a long-term vision for your company rather than focusing primarily on short-term gains.

Ensure resources are allocated around the most high-impact priorities.

Define long-term goals and set shorter-term goals to support them.

Assess your current situation and identify any opportunities—or threats—allowing your organization to mitigate potential risks.

Create a proactive business culture that enables your organization to respond more swiftly to emerging market changes and opportunities.

What are the 5 steps in strategic planning?

The strategic planning process involves a structured methodology that guides the organization from vision to implementation. The strategic planning process starts with assembling a small, dedicated team of key strategic planners—typically five to 10 members—who will form the strategic planning, or management, committee. This team is responsible for gathering crucial information, guiding the development of the plan, and overseeing strategy execution.

Once you’ve established your management committee, you can get to work on the planning process.

Step 1: Assess your current business strategy and business environment

Before you can define where you’re going, you first need to define where you are. Understanding the external environment, including market trends and competitive landscape, is crucial in the initial assessment phase of strategic planning.

To do this, your management committee should collect a variety of information from additional stakeholders, like employees and customers. In particular, plan to gather:

Relevant industry and market data to inform any market opportunities, as well as any potential upcoming threats in the near future.

Customer insights to understand what your customers want from your company—like product improvements or additional services.

Employee feedback that needs to be addressed—whether about the product, business practices, or the day-to-day company culture.

Consider different types of strategic planning tools and analytical techniques to gather this information, such as:

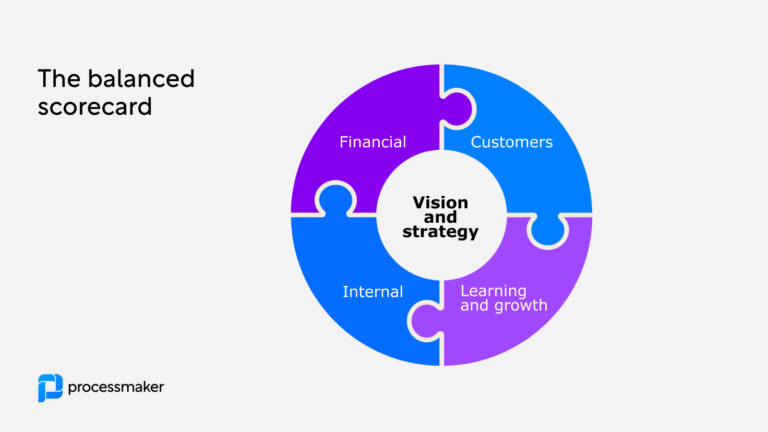

A balanced scorecard to help you evaluate four major elements of a business: learning and growth, business processes, customer satisfaction, and financial performance.

A SWOT analysis to help you assess both current and future potential for the business (you’ll return to this analysis periodically during the strategic planning process).

To fill out each letter in the SWOT acronym, your management committee will answer a series of questions:

What does your organization currently do well?

What separates you from your competitors?

What are your most valuable internal resources?

What tangible assets do you have?

What is your biggest strength?

Weaknesses:

What does your organization do poorly?

What do you currently lack (whether that’s a product, resource, or process)?

What do your competitors do better than you?

What, if any, limitations are holding your organization back?

What processes or products need improvement?

Opportunities:

What opportunities does your organization have?

How can you leverage your unique company strengths?

Are there any trends that you can take advantage of?

How can you capitalize on marketing or press opportunities?

Is there an emerging need for your product or service?

What emerging competitors should you keep an eye on?

Are there any weaknesses that expose your organization to risk?

Have you or could you experience negative press that could reduce market share?

Is there a chance of changing customer attitudes towards your company?

Step 2: Identify your company’s goals and objectives

To begin strategy development, take into account your current position, which is where you are now. Then, draw inspiration from your vision, mission, and current position to identify and define your goals—these are your final destination.

To develop your strategy, you’re essentially pulling out your compass and asking, “Where are we going next?” “What’s the ideal future state of this company?” This can help you figure out which path you need to take to get there.

During this phase of the planning process, take inspiration from important company documents, such as:

Your mission statement, to understand how you can continue moving towards your organization’s core purpose.

Your vision statement, to clarify how your strategic plan fits into your long-term vision.

Your company values, to guide you towards what matters most towards your company.

Your competitive advantages, to understand what unique benefit you offer to the market.

Your long-term goals, to track where you want to be in five or 10 years.

Your financial forecast and projection, to understand where you expect your financials to be in the next three years, what your expected cash flow is, and what new opportunities you will likely be able to invest in.

Step 3: Develop your strategic plan and determine performance metrics

Now that you understand where you are and where you want to go, it’s time to put pen to paper. Take your current business position and strategy into account, as well as your organization’s goals and objectives, and build out a strategic plan for the next three to five years. Keep in mind that even though you’re creating a long-term plan, parts of your plan should be created or revisited as the quarters and years go on.

As you build your strategic plan, you should define:

Company priorities for the next three to five years, based on your SWOT analysis and strategy.

Yearly objectives for the first year. You don’t need to define your objectives for every year of the strategic plan. As the years go on, create new yearly objectives that connect back to your overall strategic goals .

Related key results and KPIs. Some of these should be set by the management committee, and some should be set by specific teams that are closer to the work. Make sure your key results and KPIs are measurable and actionable. These KPIs will help you track progress and ensure you’re moving in the right direction.

Budget for the next year or few years. This should be based on your financial forecast as well as your direction. Do you need to spend aggressively to develop your product? Build your team? Make a dent with marketing? Clarify your most important initiatives and how you’ll budget for those.

A high-level project roadmap . A project roadmap is a tool in project management that helps you visualize the timeline of a complex initiative, but you can also create a very high-level project roadmap for your strategic plan. Outline what you expect to be working on in certain quarters or years to make the plan more actionable and understandable.

Step 4: Implement and share your plan

Now it’s time to put your plan into action. Strategy implementation involves clear communication across your entire organization to make sure everyone knows their responsibilities and how to measure the plan’s success.

Make sure your team (especially senior leadership) has access to the strategic plan, so they can understand how their work contributes to company priorities and the overall strategy map. We recommend sharing your plan in the same tool you use to manage and track work, so you can more easily connect high-level objectives to daily work. If you don’t already, consider using a work management platform .

A few tips to make sure your plan will be executed without a hitch:

Communicate clearly to your entire organization throughout the implementation process, to ensure all team members understand the strategic plan and how to implement it effectively.

Define what “success” looks like by mapping your strategic plan to key performance indicators.

Ensure that the actions outlined in the strategic plan are integrated into the daily operations of the organization, so that every team member's daily activities are aligned with the broader strategic objectives.

Utilize tools and software—like a work management platform—that can aid in implementing and tracking the progress of your plan.

Regularly monitor and share the progress of the strategic plan with the entire organization, to keep everyone informed and reinforce the importance of the plan.

Establish regular check-ins to monitor the progress of your strategic plan and make adjustments as needed.

Step 5: Revise and restructure as needed

Once you’ve created and implemented your new strategic framework, the final step of the planning process is to monitor and manage your plan.

Remember, your strategic plan isn’t set in stone. You’ll need to revisit and update the plan if your company changes directions or makes new investments. As new market opportunities and threats come up, you’ll likely want to tweak your strategic plan. Make sure to review your plan regularly—meaning quarterly and annually—to ensure it’s still aligned with your organization’s vision and goals.

Keep in mind that your plan won’t last forever, even if you do update it frequently. A successful strategic plan evolves with your company’s long-term goals. When you’ve achieved most of your strategic goals, or if your strategy has evolved significantly since you first made your plan, it might be time to create a new one.

Build a smarter strategic plan with a work management platform

To turn your company strategy into a plan—and ultimately, impact—make sure you’re proactively connecting company objectives to daily work. When you can clarify this connection, you’re giving your team members the context they need to get their best work done.

A work management platform plays a pivotal role in this process. It acts as a central hub for your strategic plan, ensuring that every task and project is directly tied to your broader company goals. This alignment is crucial for visibility and coordination, allowing team members to see how their individual efforts contribute to the company’s success.

By leveraging such a platform, you not only streamline workflow and enhance team productivity but also align every action with your strategic objectives—allowing teams to drive greater impact and helping your company move toward goals more effectively.

Strategic planning FAQs

Still have questions about strategic planning? We have answers.

Why do I need a strategic plan?

A strategic plan is one of many tools you can use to plan and hit your goals. It helps map out strategic objectives and growth metrics that will help your company be successful.

When should I create a strategic plan?

You should aim to create a strategic plan every three to five years, depending on your organization’s growth speed.

Since the point of a strategic plan is to map out your long-term goals and how you’ll get there, you should create a strategic plan when you’ve met most or all of them. You should also create a strategic plan any time you’re going to make a large pivot in your organization’s mission or enter new markets.

What is a strategic planning template?

A strategic planning template is a tool organizations can use to map out their strategic plan and track progress. Typically, a strategic planning template houses all the components needed to build out a strategic plan, including your company’s vision and mission statements, information from any competitive analyses or SWOT assessments, and relevant KPIs.

What’s the difference between a strategic plan vs. business plan?

A business plan can help you document your strategy as you’re getting started so every team member is on the same page about your core business priorities and goals. This tool can help you document and share your strategy with key investors or stakeholders as you get your business up and running.

You should create a business plan when you’re:

Just starting your business

Significantly restructuring your business

If your business is already established, you should create a strategic plan instead of a business plan. Even if you’re working at a relatively young company, your strategic plan can build on your business plan to help you move in the right direction. During the strategic planning process, you’ll draw from a lot of the fundamental business elements you built early on to establish your strategy for the next three to five years.

What’s the difference between a strategic plan vs. mission and vision statements?