- Search Search Please fill out this field.

Understanding the Legal Requirements

Acquiring bookkeeping skills, creating a business plan for your bookkeeping business, marketing strategies for your bookkeeping business, managing finances in your bookkeeping business, acquiring clients for your bookkeeping business, is bookkeeping a profitable business, can you start your own bookkeeping business, how much should i charge my bookkeeping clients, the bottom line.

- Small Business

- How to Start a Business

How to Start Your Own Bookkeeping Business: Essential Tips

Understanding the legal requirements

:max_bytes(150000):strip_icc():format(webp)/20171019_172018-5a12f5cdbeba3300373b7964-3d8c34a5e28d41cdb3c4e2df355329f4.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips CURRENT ARTICLE

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

Papakon Mitsanit / Getty Images

Starting a bookkeeping business is something you might be interested in if you naturally love numbers and want to break free of the traditional nine-to-five. It’s possible to offer bookkeeping services to clients in person or remotely, which may be ideal if you would prefer a work-at-home job.

Before starting a bookkeeping business, you’ll first need to know the basics of operating legally. It’s also helpful to understand how to market your services and manage the financial side of running a business.

Key Takeaways

- A degree in accounting is not required to start a bookkeeping business, though a certification in bookkeeping can be helpful to have.

- You’ll need to choose a business structure, and register your business with the proper state authorities if required by law where you live.

- If you plan to hire employees, you may need to obtain workers’ compensation insurance in compliance with state law.

- Developing a solid marketing plan can help you build your brand and attract clients to your business.

The legal requirements for starting a bookkeeping business are similar to any other type of business. Some of the most important things you’ll need include:

- Selecting a business structure (i.e., sole proprietorship, limited liability company, etc.)

- Choosing a name for the business

- Registering your business with the proper state agencies

- Obtaining a federal Employer Identification Number (EIN) and state identification numbers, if necessary

- Applying for any necessary licenses or permits

- Opening a business bank account

- Getting business insurance , including liability coverage and/or home-based business insurance

The exact requirements for starting a small business will depend on the state in which you live. You may need to contact your secretary of state or department of revenue for more information on what paperwork you may need to complete to legally establish your bookkeeping business.

There may be additional steps required if you plan to hire employees for your business. For instance, you may need to obtain workers’ compensation insurance. The requirements for workers’ compensation vary by state. For instance, California requires workers’ compensation for all employers, regardless of the number of employees. In Alabama, on the other hand, businesses are not required to purchase workers’ compensation insurance if they have fewer than five employees.

Some states may impose steep penalties against businesses that fail to obtain workers’ compensation insurance.

Starting a bookkeeping business requires an understanding of accounting and bookkeeping practices. You may need to first complete a training program before you can launch.

For example, you might pursue any of the following:

- Bookkeeping certification

- Tax certification

- Accounting software certification

Unlike the requirements to become an accountant, the training required to become a bookkeeper is less strenuous. It’s possible to find and complete an online training program from home.

As you compare online bookkeeping courses , consider the range of topics covered, the course format, and the cost. Whether it makes sense to obtain just one bookkeeping certification or additional tax and accounting software certificates can depend on your niche and the types of services you plan to offer.

While a degree in accounting may be helpful for starting a bookkeeping business, it’s not an absolute requirement.

A business plan is a detailed overview of how you plan to launch and grow your business. There are several key elements that are typically included in a comprehensive business plan. Here’s what yours might look like as you draft a plan for your bookkeeping business.

- Executive summary : The executive summary should offer a brief overview of what your business is about, your mission, and how you’ll be successful. Your mission statement can also include information about your employees (if you plan to hire any) and your plans for growth.

- Company description : Your company description is an opportunity to provide additional details about your business, including who you plan to serve and what problems you’ll solve for your clients.

- Market analysis : Market analysis allows you to look at your competitors and identify their strengths and weaknesses. Completing this section can help you better understand what makes your bookkeeping business unique.

- Organization and management : This section should describe how your business is legally structured and who’s responsible for running it. If you’re operating as a one-person business, this part of your plan will likely be brief.

- Services : In the services section, you can expand on what types of services you plan to offer as a bookkeeper and who you expect your customers to be.

- Marketing : How you market your bookkeeping business can depend on your niche or target audience and what resources you have to invest in advertising. You’ll use this section to sketch out your marketing plans for attracting clients to your business.

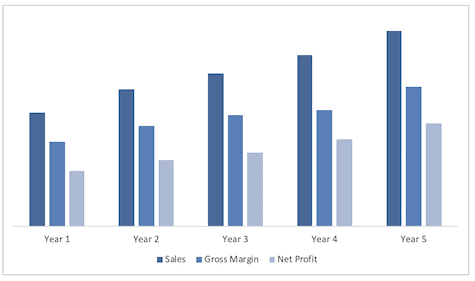

- Financial projections : This section is where you’ll outline how much revenue and profit you expect to make from the business.

Having a business plan to start a bookkeeping business isn’t a requirement, but creating one can help you get some clarity on what your goals are and how you plan to proceed with growing the business. Even if you’re just planning to offer bookkeeping services remotely as a sole proprietor , it can still be helpful to flesh out the exact steps you’ll need to take to succeed.

A business plan may be required if you plan to apply for business financing from banks or investors.

When you start any new business, you can’t expect customers or clients to magically find you. Instead, you’ll have to invest some time (and perhaps, money) in marketing your business.

If you’re specifically interested in working as a bookkeeper remotely, establishing a website and social media profiles may be a starting point for your marketing plan. Both can make it easier for potential clients to find you in online searches. You can also leverage social media to build your brand and increase your visibility.

Aside from a website and social media, there are some other options you might consider for marketing your services. They can include:

- Using LinkedIn to build out your professional network and establish credibility

- Joining a local meetup group of bookkeepers in your area

- Joining a professional business association in your area

- Participating in local small business events

- Seeking out opportunities to be a guest on podcasts in the finance niche

- Offering a seminar or workshop, either online or in person

When planning your marketing strategy , it’s important to think about the message you want to send to prospective clients. That message should be consistent across all of the channels you use to market your business, whether that includes YouTube, Facebook, TikTok, or another platform.

It’s also important to consider who your message is targeting. Your marketing content should speak to the needs and pain points of the types of customers you’re most interested in attracting to your business.

Keeping track of cash flow is essential for running any business. As you prepare to start your bookkeeping business, it’s important to keep track of your expenses, which may include:

- Website hosting

- Accounting software

- Customer relationship management (CRM) software

- Cloud storage fees

- Home office supplies (if you’ll be working remotely)

- Registration fees

- Fees for certification or training

- Marketing costs

Once your business gets under way, you can make a monthly budget to track your cash inflows and outflows. You’ll also need to give some thought to how you plan to invoice your clients for your services. That includes choosing when to send invoices , how quickly you expect them to be paid, and which payment methods you'll accept.

Running a business also means paying taxes on your earnings. That includes income tax and estimated quarterly taxes . Generally, you’re required to make estimated quarterly tax payments to the Internal Revenue Service (IRS) if:

- You expect to owe at least $1,000 in tax for the year, after subtracting withholding and refundable credits.

- You expect your withholding and refundable credits to be the smaller of 90% of the tax shown on your current year’s return or 100% of the tax shown on your prior year’s return.

If your state imposes an income tax, you’ll also be responsible for making estimated tax payments to your state agency.

Opening a business bank account can make it easier to keep track of what funds go in and out. You can open a business bank account at a traditional bank, credit union, or online bank. You’ll need to provide your personal information, along with your business details, in order to open an account. Comparing fees, features, and accessibility can help you choose the best business bank account for your needs.

You might also consider applying for a business credit card to help cover expenses until you start making money. You can apply for a business credit card using your personal credit score and income ; business credit is not a requirement. If you’re considering a business credit card , you might want to look for one that offers a generous rewards program and/or charges no annual fee.

Once you’ve covered all the legal aspects of starting your business, it’s time to start finding your first clients. There are a few ways you can go about doing this. These include:

- Looking for remote bookkeeping opportunities on freelance job boards

- Establishing profiles on sites like Fiverr or Upwork, which connect companies with freelance workers

- Reaching out to local businesses to ask if they need bookkeeping services

- Running ads on social media

- Joining local small business directories

- Offering a free consultation to local businesses

- Asking friends, family, or other business owners for referrals

Once you start getting your first clients, it’s important to focus on customer satisfaction. Clients who are happy with your services are more likely to stay loyal and continue to hire you. They also may be willing to refer you to people they know who might need a good bookkeeper.

Bookkeeping has the potential to be a profitable business if you’re able to maintain a solid roster of clients who are willing to pay competitive rates for your services. A typically remote bookkeeper’s salary is just over $63,600 a year, but it’s possible to make much more than that, depending on your clientele and the rates you charge.

It’s possible to start a bookkeeping business from scratch, even if you don’t have a professional or educational background in accounting or bookkeeping. Having a degree or certification in either area could be an advantage, but it’s possible to acquire the skills you need to become a bookkeeper online. Likewise, you don’t need to have experience running a business, but that could also prove helpful.

The amount you should charge your bookkeeping clients can depend on a number of factors, including how much experience you have, which certifications you hold, the types of services you offer, and the types of individuals or businesses you work with. Someone who’s new to the profession, for example, may start their rates at $20 an hour, while someone with several years of experience may charge $35 an hour or more. Researching average bookkeeper salaries for your area can give you an idea of what your competitors may charge.

Starting a bookkeeping business can be a great opportunity to take control of your career. Before diving in, however, it’s important to understand what’s involved to get your new business up and running. The more prepared you are before launching, the greater your chances of succeeding as an expert bookkeeper.

U.S. Small Business Administration. “ Launch Your Business .”

Insureon. “ State Laws for Workers’ Compensation .”

U.S. Small Business Administration. “ Write Your Business Plan .”

Internal Revenue Service. “ Estimated Tax .”

Glassdoor. “ Remote Bookkeeper Salaries .”

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1163568066-3e01187e658a45beb064ab64166d9e68.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

Over the past 20+ years, we have helped over 9,000 entrepreneurs create business plans to start and grow their bookkeeping companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a bookkeeping business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Bookkeeping Business Plan?

A business plan provides a snapshot of your business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Bookkeeping Business

If you’re looking to start your own bookkeeping business or grow an established business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bookkeeping business in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Bookkeeping Startups

With regards to funding, the main sources of funding for a bookkeeping business are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a bookkeeping company is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

How to write a business plan for a bookkeeping company.

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of business you are operating and the status; for example, are you a startup, do you have a bookkeeping business that you would like to grow, or are you operating a chain of bookkeeping companies.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the bookkeeping business industry. Discuss the type of business you are operating. Detail your direct competitors. Give an overview of your target market. Provide a snapshot of your marketing strategy. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of bookkeeping business you are operating.

For example, you might operate one of the following types:

- Traditional Bookkeeping and Accounting Business : the traditional bookkeeping and accounting business can provide the entire range of bookkeeping services, including maintaining journals and ledgers, balancing and reconciling accounts, preparing payroll, preparing and filing taxes, and providing billing and collection services.

- Tax Preparation Services : this type of bookkeeping business primarily prepares, reviews, and/or files tax returns and supplementary documents.

- Payroll Services : this type of bookkeeping business typically collects payroll information, processes paychecks, processes withholdings, and files reports.

- Billing Services : this type of bookkeeping business deals with sending bills and collecting payments.

In addition to explaining the type of business you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new store openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

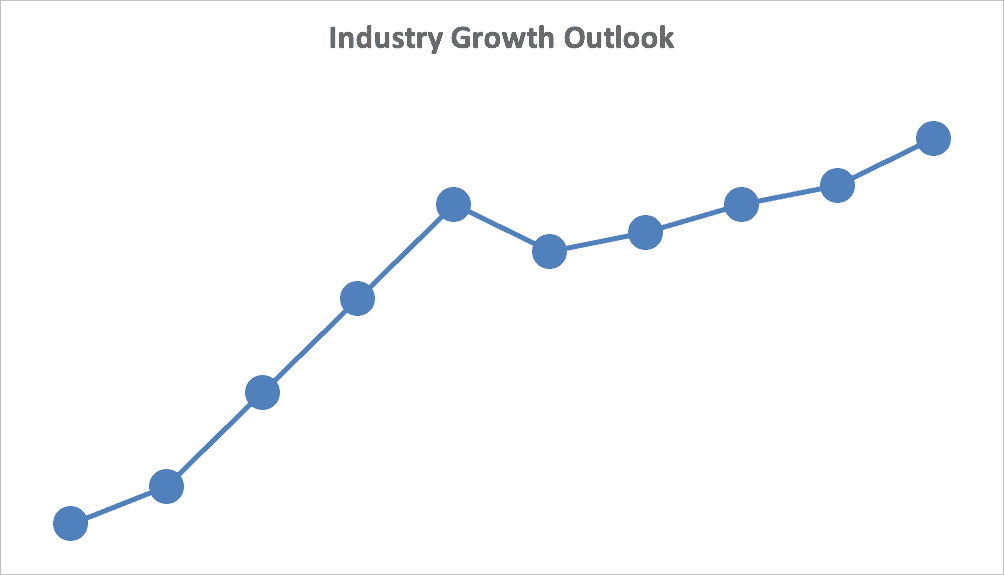

In your industry analysis, you need to provide an overview of the bookkeeping business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bookkeeping industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, it would be helpful to ensure your plan takes into account the seasonal nature of certain services such as tax preparation.

The following questions should be answered in the industry analysis section:

- How big is the bookkeeping industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your bookkeeping business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments : families, entrepreneurs, businesses, retirees, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bookkeeping business you operate. Clearly, families would want different pricing and product options and would respond to different marketing promotions than established businesses.

Try to break out your target market in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the customers you seek to serve. Because most bookkeeping companies primarily serve customers living in the same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your business clients.

Finish Your Bookkeeping Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other bookkeeping services and companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes accountants, companies’ internal accounting departments, professional employer organizations, and entrepreneurs/individuals doing their own bookkeeping. You need to mention such competition to show you understand that not everyone engages in bookkeeping services.

With regards to direct competition, you want to detail the other bookkeeping companies with which you compete. Most likely, your direct competitors will be bookkeeping companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What services do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior bookkeeping services?

- Will you provide bookkeeping services that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your services?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

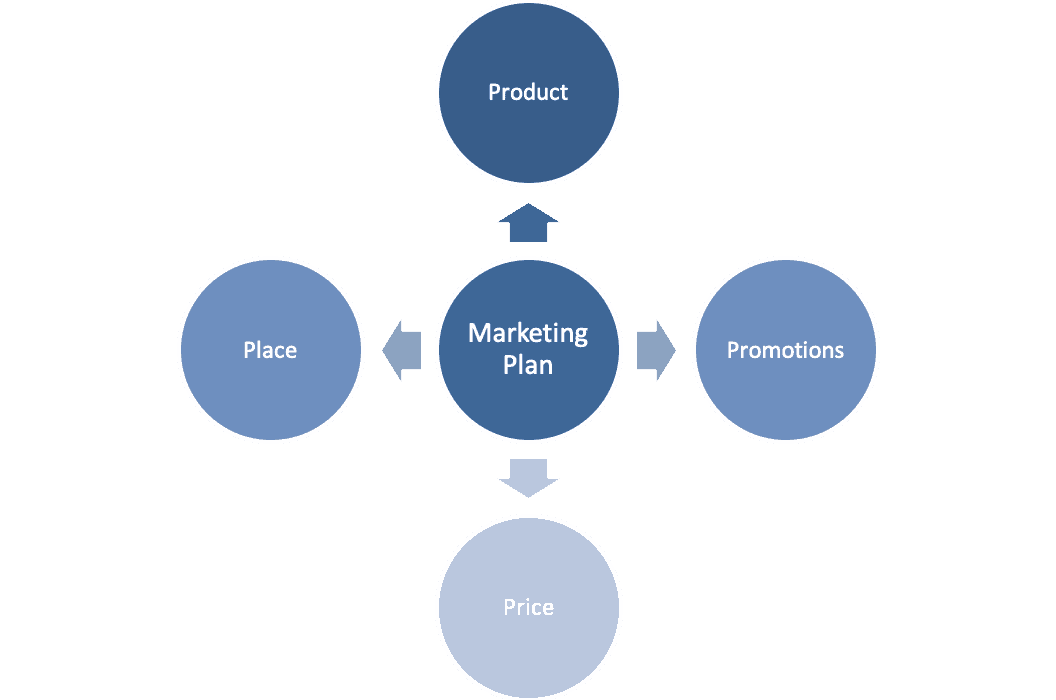

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bookkeeping business plan, you should include the following:

Product : in the product section, you should reiterate the type of business that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to account reconciliation, will you offer services such as tax preparation?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections, you are presenting the services you offer and their prices.

Place : Place refers to the location of your business. Document your location and mention how the location will impact your success. Discuss how your location might provide a steady stream of customers.

Promotions : the final part is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Email marketing to prospective clients

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Social media advertising

- Pay per click advertising

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bookkeeping business such as serving customers, procuring supplies, keeping the office clean, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to serve your 1,000th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

Management Team

To demonstrate your bookkeeping business’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in the bookkeeping or accounting business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in bookkeeping businesses and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you serve 10 customers per week or 20? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your bookkeeping business, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement Your cash flow statement will help determine how much money you need to start or grow your business and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bookkeeping or accounting business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers and software

- Cost of maintaining an adequate amount of office supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office design blueprint or location lease.

Bookkeeping Business Plan Summary

Putting together a business plan for your bookkeeping business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will have an expert bookkeeping business plan; download it to PDF to show banks and investors. You will really understand the bookkeeping business, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful bookkeeping business.

Bookkeeping Business Plan FAQs

What is the easiest way to complete my bookkeeping business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily complete your Bookkeeping Business Plan.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of bookkeeping business you are operating and the status; for example, are you a startup, do you have a bookkeeping business that you would like to grow, or are you operating a chain of bookkeeping businesses.

Don’t you wish there was a faster, easier way to finish your Bookkeeping business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

You’ve come to the right place to create your Bookkeeping business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Bookkeeping companies.

Below is a template to help you create each section of your Bookkeeping business plan.

Executive Summary

Business overview.

Pacific Bookkeeping is a new bookkeeping firm located in Seattle, Washington. The firm will focus on providing expert bookkeeping services and exceptional customer service. We will help both small businesses and individuals and provide them with tax preparation, forecasting, budgeting, and other bookkeeping/accounting services.

Pacific Bookkeeping is led by Rebecca Stone, an experienced accountant who has been managing a large bookkeeping firm in Seattle, Washington for the past ten years. She graduated from Washington State University with an accounting degree and has been working at a large payroll firm since then, starting at an entry-level position and working her way up to a management-level role. Her experience and education have fully equipped her to run her own local bookkeeping firm.

Product Offering

Pacific Bookkeeping will provide a full range of bookkeeping services for individuals and small businesses. Some of these services include:

- Recording invoices

- Tax filing and preparation

- Financial reporting

- Payroll processing

- Monitoring accounts receivable

- Documenting receipts

- Forecasting

- Customer analysis

Customer Focus

Pacific Bookkeeping will primarily serve individuals and small businesses in the Seattle, Washington area. The city is home to over four million residents and around 100,000 businesses and many of them have a need for professional bookkeeping services. We will offer a wide variety of bookkeeping services in order to serve as many customers as we can in this target market.

Management Team

Pacific Bookkeeping is led by Rebecca Stone, an experienced accountant who has been working at a large bookkeeping firm in Seattle, Washington for the past ten years. She graduated from Washington State University with an accounting degree and then began working at the firm, starting at an entry-level position and working her way up to a management-level role. Though she has never run an accounting firm of her own, her experience has given her an in-depth knowledge of the bookkeeping industry, including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

Success Factors

Pacific Bookkeeping will be able to achieve success by offering the following competitive advantages:

- Location: Pacific Bookkeeping is centrally located in the community, which provides ease of access for clients. The firm’s office will be located between the retail and business districts, making it accessible to a larger customer base.

- Competitive pricing: Pacific Bookkeeping’s pricing is more affordable than its closest competitors.

- Management: The management team has years of accounting experience that allows the company to market to and serve clients in a much more sophisticated manner than competitors.

- Relationships: Having lived in the community for over 20 years, Rebecca Stone knows all of the local leaders, newspapers, and other influencers. As such, it will be relatively easy for Pacific Bookkeeping to build brand awareness and an initial customer base.

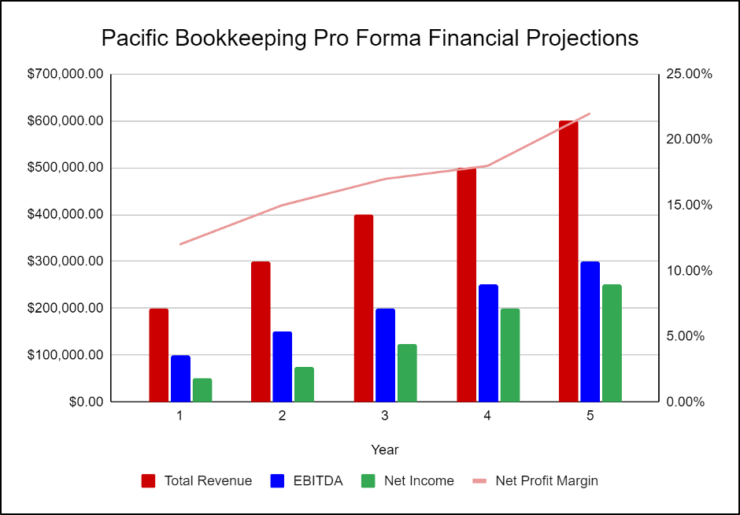

Financial Highlights

Pacific Bookkeeping is seeking a total funding of $200,000 of debt capital to open its bookkeeping firm. Funding will also be dedicated towards three months of overhead costs including the payroll of the staff, rent, and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

Company Overview

Who is pacific bookkeeping, pacific bookkeeping’s history.

Once her market analysis was complete, Rebecca Stone began surveying local office spaces for lease and identified an ideal location for the bookkeeping firm. Rebecca Stone incorporated Pacific Bookkeeping as a Limited Liability Corporation in January 2023.

Once the lease is finalized on the office space, interior design work can begin to make the office an appealing place to meet with clients.

Since incorporation, the company has achieved the following milestones:

- Located available office space for rent that is ideal for the bookkeeping firm

- Developed the company’s name, logo, and website

- Hired an interior decorating company to design and furnish the office

- Determined equipment and necessary supplies

- Began recruiting key employees

Pacific Bookkeeping’s Services

Industry analysis.

The United States Bookkeeping Industry is forecast to generate more than $66B this year. According to research reports, the largest bookkeeping firm in America generates approximately $9.5B annually. There are currently over 1.5M bookkeepers employed throughout the United States.

The top bookkeeping firms industry-wide are Automatic Data Processing (ADP) ($9.5B in annual revenue), Intuit ($7.8B in annual revenue), and Paychex ($4.0 in annual revenue). All other bookkeeping firms in the United States combined generate approximately $43.5B in annual revenue. An estimated 42% of industry revenue is generated through payroll services. Additional services such as billing, general accounting, tax preparation, and bookkeeping make up the remainder.

One of the biggest challenges for bookkeeping firms is the ability to keep up with changes in regulations. Additional hurdles include recruiting and retaining high-quality employees, keeping up with evolving technology, and acquiring new clients.

However, despite the challenges, the bookkeeping industry is expected to grow significantly throughout the rest of the decade. According to Data Intelo, the industry is expected to grow at a compound annual growth rate of 9.5% from now until 2030. This large growth shows that bookkeeping services are still in high demand, meaning that Pacific Bookkeeping has a solid chance of succeeding and maintaining a profit.

Customer Analysis

Demographic profile of target market.

Pacific Bookkeeping will serve individuals and small businesses in the community of Seattle, Washington, and its surrounding areas. Seattle has thousands of individuals and small businesses that would benefit from affordable bookkeeping services.

The precise demographics for Seattle, Washington are:

| Total | Percent | |

|---|---|---|

| Total population | 1,680,988 | 100% |

| Male | 838,675 | 49.9% |

| Female | 842,313 | 50.1% |

| 20 to 24 years | 114,872 | 6.8% |

| 25 to 34 years | 273,588 | 16.3% |

| 35 to 44 years | 235,946 | 14.0% |

| 45 to 54 years | 210,256 | 12.5% |

| 55 to 59 years | 105,057 | 6.2% |

| 60 to 64 years | 87,484 | 5.2% |

| 65 to 74 years | 116,878 | 7.0% |

| 75 to 84 years | 52,524 | 3.1% |

Customer Segmentation

Pacific Bookkeeping will primarily target the following customer profiles:

- Individuals

- Small businesses and nonprofits

- Government organizations

Competitive Analysis

Direct and indirect competitors.

Pacific Bookkeeping will face competition from other companies with similar business profiles. A description of each competitor company is below.

Young & Mitchell

Founded in the 1930s, Young & Mitchell has intentionally remained a small business so that the core group of professionals within the company could get to intimately know each one of their clients. The company is one of the leading tax firms in the Four State Region and offers financial guides and tax tools for individuals for free. Listed below is an outline of the services that the company offers according to its website:

- Tax Preparation and Planning Services

- Assurance and Advisory Services

- Estate and Trust Planning and Tax Preparation

- Bookkeeping/Write-up

- IRS Representation

- Accounting Services

- Audits, Reviews, and Compilation

- QuickBooks Accounting Help and Assistance

- Entity Selection and Restructuring

- Payroll Services

A Plus General Bookkeeping Services

A Plus General Bookkeeping Services is a bookkeeping firm that specializes in financial strategy and consulting for businesses of all sizes. The firm has been in business for over a decade and has acquired a loyal client base.

Clients may work with accountants in person, over the phone, through email, on video conferencing software, or completely through a new digital application. Although this firm has an excellent track record for service, it is also the most expensive bookkeeping company on the market.

Smith Brothers Accounting

Established in 1974, Smith Brothers Accounting is a privately held accountant practice that offers a wide variety of financial services including tax planning and preparation, payroll processing, financial planning, and small business accounting. Smith Brothers Accounting serves individuals and businesses.

Smith Brothers Accounting Services:

- Business Services

- Tax Services

- Individual Services

- Notary Services

Competitive Advantage

Pacific Bookkeeping will be able to offer the following advantages over the competition:

Marketing Plan

Brand & value proposition.

Pacific Bookkeeping will offer a unique value proposition to its clientele:

- Client-focused bookkeeping services

- Service built on long-term relationships

- Thorough knowledge of the latest regulations

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Pacific Bookkeeping is as follows:

Pacific Bookkeeping understands that the best promotion comes from satisfied customers. The company will encourage its clients to refer others by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Website/SEO

Pacific Bookkeeping will invest heavily in developing a professional website that displays all of the features and benefits of the bookkeeping company. It will also invest heavily in SEO so that the brand’s website will appear at the top of search engine results.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content and post customer reviews that will increase audience awareness and loyalty.

Special Offers

Offers and incentives are an excellent approach to assisting businesses in replenishing the churn in their customer base that they lose each year. The company will introduce special offers to attract new clients and encourage repeat business.

Pacific Bookkeeping’s pricing will be moderate so consumers feel they receive great value when purchasing the bookkeeping services. The client can expect to receive quality bookkeeping services at a more affordable price than what they pay at other accounting firms.

Operations Plan

The following will be the operations plan for Pacific Bookkeeping.

Operation Functions:

- Rebecca Stone is the Owner and CEO of Pacific Bookkeeping. She will be in charge of the executive and operations aspects of the business. She will also provide bookkeeping services for her initial clients until she hires a full staff of accountants, bookkeepers, and tax preparation professionals.

- Rebecca is joined by Rhonda Wolfe who will be the company’s Administrative Assistant. She will help Rebecca with the administrative functions of the business.

- Rebecca is also joined by Samual Wright. He will act as the Marketing Manager and manage all the marketing and advertising functions for Pacific Bookkeeping.

- As the firm grows and takes on more clients, Rebecca will hire a team of experienced accountants, bookkeepers, and tax preparation professionals to help with the company’s service functions.

Milestones:

Pacific Bookkeeping will have the following milestones completed in the next six months.

- 3/202X Finalize lease agreement

- 4/202X Design and build out Pacific Bookkeeping

- 5/202X Hire and train initial staff

- 6/202X Kickoff of promotional campaign

- 7/202X Launch Pacific Bookkeeping

- 8/202X Reach break-even

Financial Plan

Key revenue & costs.

Pacific Bookkeeping’s revenues will come primarily from its bookkeeping services. The major costs for the company will include the salaries of the staff, marketing spending, and the rent for a prime location in Seattle.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Annual rent: $50,000

- Year 3: 100

- Year 4: 125

- Year 5: 150

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Bookkeeping Business Plan FAQs

What is a bookkeeping business plan.

A bookkeeping business plan is a plan to start and/or grow your bookkeeping business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Bookkeeping business plan using our Bookkeeping Business Plan Template here .

What are the Main Types of Bookkeeping Businesses?

There are a number of different kinds of bookkeeping businesses , some examples include: Traditional Bookkeeping and Accounting Business, Tax Preparation Services, Payroll Services, and Billing Services.

How Do You Get Funding for Your Bookkeeping Business Plan?

Bookkeeping businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Bookkeeping Business?

Starting a bookkeeping business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Bookkeeping Business Plan - The first step in starting a business is to create a detailed bookkeeping business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your bookkeeping business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your bookkeeping business is in compliance with local laws.

3. Register Your Bookkeeping Business - Once you have chosen a legal structure, the next step is to register your bookkeeping business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your bookkeeping business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Bookkeeping Equipment & Supplies - In order to start your bookkeeping business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your bookkeeping business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful bookkeeping business:

- How to Start a Bookkeeping Business

Hot Summer Savings ☀️ 60% Off for 4 Months. BUY NOW & SAVE

60% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to start a bookkeeping business – a step-by-step guide.

Bookkeeping is a tasking part of any small business. Small business owners know that time management , organization, and detail-orientation all need to go into keeping a strong system of accounting afloat. If these are skills you’ve mastered, you may consider starting your own bookkeeping business.

This step-by-step guide will map out the process to get started on your own bookkeeping business. We’ll cover building a bookkeeping plan, creating a strong accounting system, marketing and gaining clients and other helpful tips to get your business set up.

Here’s What We’ll Cover:

Benefits of Starting a Bookkeeping Business

Launch a thriving bookkeeping business, more resources for bookkeepers.

Perhaps you’ve worked as a bookkeeper for a larger company or firm and you’d like to branch out and start your own business . You may be ready to be your own boss, work virtually, make your own hours, and build your own accounting software program.

There are some things you should consider when thinking about starting your own bookkeeping business. Learn the benefits of starting out on your own small business venture that will encourage you to take that leap.

You get to establish your own management style.

Different bookkeepers have different methods of accounting. Depending on your training, certification, and experience you’ll learn to navigate different strategies and dial in what will help your company succeed. Only you know what accounting style works best for you, choose a system that helps you thrive.

You can choose your hours.

As a small business owner , you get to decide how many clients you want to take on, how much money you want to make, and how many hours you want to work during the day.

You can personalize your business and grow at your own pace.

Build a marketing strategy that draws clients to your unique brand, while becoming familiar with the clients that you’re bringing in, and predict how they could support future business bookkeeping goals.

The great thing about starting your own bookkeeping business is that all of these decisions will be yours to make. You will be the one putting the work in, so creating a personalized business model will be what sets you apart from competition, and what will get you the most fulfilling feedback.

Step One: Draft a Business Plan

Take time to sit down and write out a business plan– a roadmap of what you’d like your business to look like. This can be as creative as you’d like, and include short-term and long-term goals that you have for your bookkeeping business.

Your business plan should define your purpose in wanting to start this new endeavour. Be specific in what you’re trying to accomplish– what satisfies you about accounting and how you will amplify that satisfaction to create a practice of purpose?

Another key aspect of building your business plan will be finding your target audience. Again, it’s important to detect what potential clients you will be bringing in. Are you looking to get hired by small businesses bringing in large income ? Or freelancers starting out on their own?

Step Two: Create Your Accounting System

This step may be the most important aspect of beginning a successful bookkeeping business.

When you decide to go into business for yourself, a big part of your decision may be the thought of making your own hours and working less. The only way to make that transition a reality is by time management.

The key to time management is creating an effortless bookkeeping accounting system. This step may take trial and error but you will use your skills and experience to dial in a software program that is repeatable and strategic so that each client you decide to work with will be managed in the same structured pattern.

Having an effortless accounting system will be imperative when it comes to hiring on additional help for your business– as you could familiarize them with the existing software system and they could get started right away.

Step Three: Market to Prospective Clients

A successful business needs a strong marketing strategy from the start. By learning early on what your target audience is, you will gain huge insight on what procedures you need to take to keep your bookkeeping business at the top of potential clients’ radar.

Reference your initial business plan — what type of clientele are you aiming to serve? If you’re directing your accounting services to freelance businesses, you will implement practices that will be unique to serving freelancers, and that will encourage them to hire your business over a different bookkeeper.

Another aspect of marketing is dialing in your brand, which goes hand in hand with the type of clients you want to bring in. Knowing the market and what makes you stand out from other competitors will naturally draw your potential client base to your bookkeeping services .

Figure out what bookkeeping methods you’re good at (whether it be tax returns, payroll, financial data entry, insurance, etc.) and put emphasis on those services so that when potential clients see your website, they will know they want to work with you.

Step Four: Create a Business Website

When you dial in your business structure, accounting system, brand, and target audience, you’re ready to showcase it on a professional bookkeeping website.

Having a strong website will make you stand out against your competitors, and there are key elements to consider when building your platform.

- Choose a Structure – Different website platforms have many different styles and structures to choose from. Find a clean, manageable layout that will not distract visitors from your services.

- Make a Statement – What key statement do you want potential clients to remember that will set you apart from other professional bookkeepers and make them want to hire you? Fill guests in on your experience in the industry and they want to work with your company. Clients will prefer to work with an accredited professional bookkeeper– stating your certification and training could be useful.

- Guide Your Clients – Having organized and accessible services on your website will allow you to get clients familiar with what your business has to offer. Let clients know if you provide online bookkeeping service and how you can connect virtually. Make your services, your unique brand, and your mission apparent to each client that finds your site.

- Add Contact Information – How can clients contact you for your service? State where clients can find you online, via social media (linkedin, facebook, apps) and how they can get started and schedule a consultation with you.

Step Five: Strive for Business Success

Once your bookkeeping business is underway, you will have to trust that your system will draw clients to you. Time management, experience, and consistent energy will all be factors in your business success.

Maybe you learn that you’re drawing in different clientele than you’d anticipated, or you need to hire more assistance to help with a growing workload– managing and adjusting minor details in the beginning stages of your business will help dial in your bookkeeping services.

All the while, as you navigate your new business, keep in mind the initial goals you made, and continue to feed consistent energy into bringing those goals to life as you build your professional practice.

One of the most rewarding parts of building your own business is that whatever you put into it, you will see the outcome and reap the benefits. As you move along in your business plan, you get to decide how much time, energy, and motivation you have to give to your endeavor. Business owners alike know that the more you put in, the more you’ll get out.

Whatever your motivation for starting a business of your own, if you take the steps to create a strong roadmap, build a successful accounting system, and draw in clients through an organized and professional website, soon enough you’ll have your first client and be reaching your business bookkeeping goals.

- Bookkeeping Basics for Freelancers

- Easy Bookkeeping with FreshBooks

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

Creating your business plan

It’s time to get things down on paper. Your business plan is vital to reality checking all those ideas you have.

What to do on day zero

If you already know what you want to be called, lock down the name and register the URL. Now take some time to see what’s working for other bookkeepers. Find the ones in your area and check out their websites – plus their LinkedIn and Facebook profiles – to see what makes them tick. How do they speak to the market? What services do they offer? How much do they charge? Use this research to help start the plan for your bookkeeping business.

But what if I already know the plan?

It’s great if you already know how you’re going to get started, but it’s still important to write everything down. For one thing, you’ll want to record all your golden ideas before they’re forgotten. Plus the writing process will help you interrogate those ideas.

Putting them on a timeline, costing them out, and fitting them around each other might reveal a thing or two. Perhaps some assumptions will need to be rethought, or some ideas will have to be skipped in favor of others. It’s a great way to organize your thinking.

Start with a working one-pager

The key to a business plan is to start out simple, and build on it as you go. Begin with a few headings and bullet points that map out your vision, goals, milestones and predictions.

Don’t let it get out of hand or bog you down. That’s not what a business plan is for. It’s supposed to help you get started. So set yourself a target of producing a one page plan to start.

Choose your words carefully

Decide how you’re going to talk about your business, and which words you’ll use. It’ll be helpful in settling on a value proposition and relating to clients. You can use your chosen terms in your elevator pitch, on your website, in blurbs about your business – and in your business plan.

Sections for a one-page business plan

1. Value proposition: Explain why clients will be better off with you.

2. The problem you’re solving: Describe the status quo and say why it’s not ideal.

3. Target market and competition: Profile the clients you want, and the bookkeeping solutions they use now.

4. Sales and marketing: Show how you’ll reach your target market, and what you’ll say to them.

5. Budget and sales: Work out your costs and predict how much you can earn over the first couple of years.

6. Milestones: Identify all the things that need to happen and map them against a timeline.

7. The team: Identify the people that will be involved (including consultants) and outline their roles.

8. Funding: Show how you’ll bankroll the business, especially as you wait for fees to start rolling in.

9. Contingency plan: What will you do if your cash flow isn’t what you budgeted?

You may eventually draw up a longer business plan, or you may stick with a short one. It depends on your working style, and the level of risk you’re taking on. Your plan will probably be more detailed if you’re taking on a lot of debt.

You can download a copy of our one-page or multi-page business plan template .

Staying alive

Once you’ve got your plan nailed down, remember you really don’t. You should treat your plan as a living document and keep tweaking it as things evolve. That’s another reason why it’s good to have a short plan, which you’re much more likely to update as you go. Try to be agile and open to change.

The discipline of maintaining your business plan will help you:

- discover and solve problems – putting things in black and white will show up holes in your thinking.

- get feedback from others – you can share your plan to get feedback from trusted advisors.

- go for more finance – an up-to-date business plan (and budget) means you’re always ready to apply for loans.

- guide growth – regular focus on the big picture will help you make strategic decisions rather than instinctive ones.

Have a succession plan

You will also need a succession plan. What will happen when you step away from the business? Will you sell it? Who to? A family member, a staff member, or someone on the open market?

A good succession plan will make sure the business can survive and thrive without you. That it will perform for its clients and its new owners. And it should give you the flexibility to step away from the business at short notice, if required or desired.

Learn more in our guide to succession planning.

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Starting a bookkeeping business

Work through the big decisions around accreditation, services to offer, fees to charge, and how to find clients.

You’ll need some training and certification to become a professional bookkeeper. Find out where this is available.

With a foundation of knowledge, skills and experience, take the next steps in setting up as a bookkeeper.

You need to nail down what services you’ll offer, who to, and how. Don’t promise more than you’re able to deliver.

Designing your bookkeeping business around a specific type of client or your strengths can be a successful way to go.

How do you walk the line between profitable for you and affordable for your clients? And help clients budget?

You might deliver an awesome service at a great price, but what if no one knows? Let’s look at marketing your services.

Download the bookkeeping business guide

A guide to help you work through the big decisions around starting a bookkeeping business. Fill out the form to receive the guide as a PDF.

Privacy notice .

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Included Safe and secure

- Included Cancel any time

- Included 24/7 online support

Or compare all plans

Free Accounting and Bookkeeping Sample Business Plan PDF

1 min. read

Updated February 26, 2024

Looking for a free, downloadable accounting and bookkeeping sample business plan PDF to help you create a business plan of your own? Bplans has you covered.

Keep in mind that you don’t need to find a sample business plan that exactly matches your business. Whether you’re launching a larger accounting business in a bustling city or a smaller neighborhood office, the details will be different, but the bones of the plan will be the same.

Are you writing a business plan for your accounting firm because you’re seeking a loan? Is your primary concern building a clear roadmap for growth? Either way, you’re going to want to edit and customize it so it fits your particular company.

No two accounting businesses are alike. Your strategy will be different if you’re partnering with other CPAs, rather than working independently, for example. So take the time to create your own financial forecasts and do enough market research so you have a solid plan for success.

- What should you include in an accounting and bookkeeping business plan?

Your accounting business plan doesn’t need to be hundreds of pages—keep it as short and concise as you can. You’ll probably want to include each of these sections: executive summary, company summary and funding needs, products and services, marketing plan, management team, financial plan, and appendix.

One of the things that makes an accounting business plan different than some other service-based business plans is that you might decide to only work with businesses and not with individuals.

You may offer different tiers of service to different types of clients. If that’s the case, make sure you include ideas like up-selling small businesses from hourly consultation to quarter contracts.

Download this accounting and bookkeeping sample business plan PDF for free right now, or visit Bplans’ gallery of more than 550 sample business plans if you want more options.

There are plenty of reasons accounting business owners can benefit from writing a business plan —you’ll need one if you’re seeking a loan or investment.

Even if you’re not seeking funding, the process of thinking through every aspect of your business will help you make sure you’re not overlooking anything critical as you grow.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

Related Articles

10 Min. Read

Free Wedding Venue Business Plan PDF [2024 Template + Sample Plan]

7 Min. Read

How to Write a Dog Grooming Business Plan + Free Sample Plan PDF

9 Min. Read

How to Write a Business Plan for a Service Business

How to Write a Business Plan for a Retail Clothing Boutique

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How To Write a Winning Bookkeeping Company Business Plan

Creating a business plan is essential for any business, but it can be especially helpful for bookkeeping businesses who want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every bookkeeping business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Bookkeeping Business Plan?

A bookkeeping business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Bookkeeping Business Plan?

A bookkeeping business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Bookkeeping Business Plan

The following are the key components of a successful bookkeeping business plan:

Executive Summary

The executive summary of a bookkeeping business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your bookkeeping company

- For your executive summary you should provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial statements forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your bookkeeping business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your bookkeeping firm, mention this.

Industry Analysis

The industry or market analysis is an important component of a bookkeeping business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the bookkeeping industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of a bookkeeping business may include small businesses, non-profit organizations, and individuals.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or bookkeeping services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign. Or, you may promote your bookkeeping business via word-of-mouth or by exhibiting at trade shows.

Operations Plan

This part of your bookkeeping business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.